Attached files

| file | filename |

|---|---|

| 8-K - Avantair, Inc | v224016_8k.htm |

SAFE HARBOR

This document contains forward ] looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, including,

without limitation, statements regarding Avantair’s financial position, business strategy, plans, and

Avantair’s management’s objectives and its future operations, and industry conditions, are forward ]

looking statements. Although Avantair believes that the expectations reflected in such forward ]

looking statements are reasonable, Avantair can give no assurance that such expectations will prove to be correct.

Important factors that could cause actual results to differ materially from Avantair’s expectations (“Cautionary Statements”)

as described in Avantair’s public filings include, without limitation, the effect of existing and future laws and governmental

regulations, the results of futurefinancing efforts, and the political and economic climate of the United States. All subsequent

written and oral forward ] looking statements attributable to Avantair, or persons acting on Avantair’s behalf, are expressly

qualified in their entirety by the Cautionary Statements.

2

INVESTMENT OVERVIEW

•Industry leader in the Light Jet category

•Exclusive provider of fractional and time card programs in the Piaggio Avanti

•One plane model leads to lower operating costs

INVESTMENT OVERVIEW

•Industry leader in the Light Jet category

•Exclusive provider of fractional and time card programs in the Piaggio Avanti

•One plane model leads to lower operating costs

•The Piaggio has far lower fuel consumption than the competition, leading to lower costs

•Recurring revenue stream via fractional share and Axis Lease Program sales

•Best positioned to capture entry level market additions

3

•Focused the consumer on the inherent value of flying with Avantair

• Focused advertising on low fuel consumption and reduced carbon output

GROWTH IN CHALLENGING ECONOMY

•Market share gains by adding card business to attract new customers •Went from 17 cards perquarter in FY08Q4 to 102 cards per quarter in FY11Q3

•Focused the consumer on the inherent value of flying with Avantair

• Focused advertising on low fuel consumption and reduced carbon output

•Paid down $9.2M of short and long term debt in FY2011 YTD

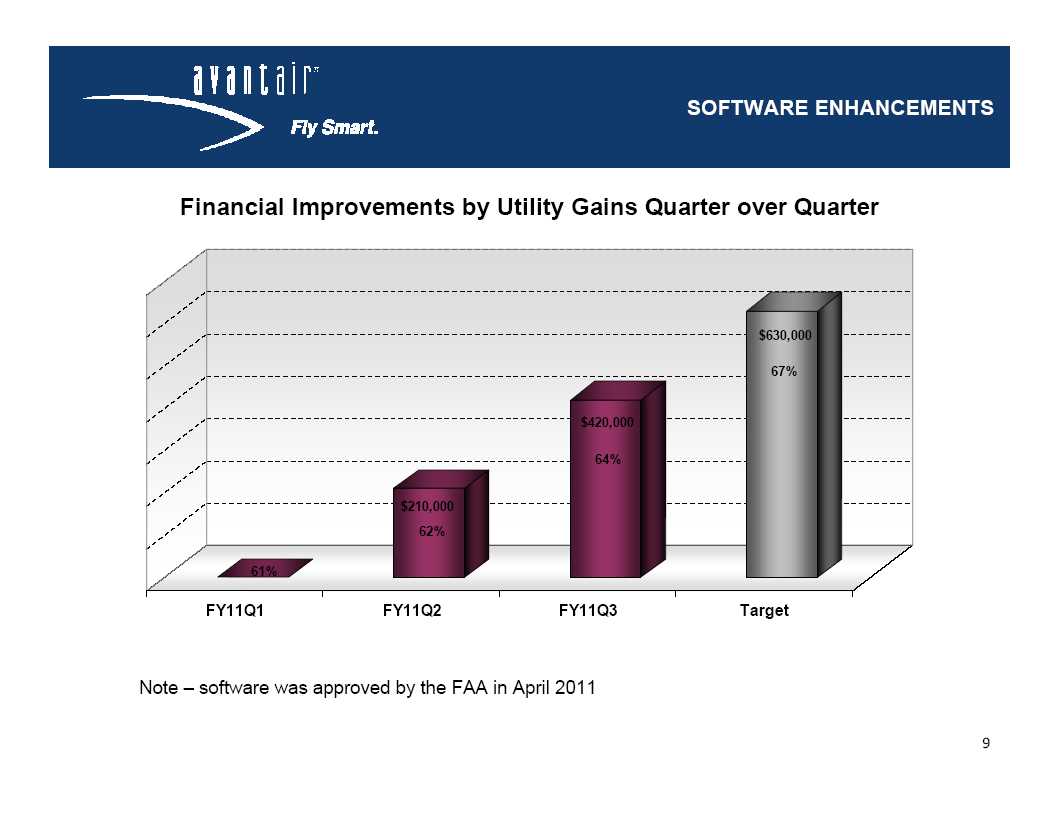

•Focused on technology by adding software to increase operational efficiency •This softwareprovides flight scheduling optimization •Received FAA approval April 2011

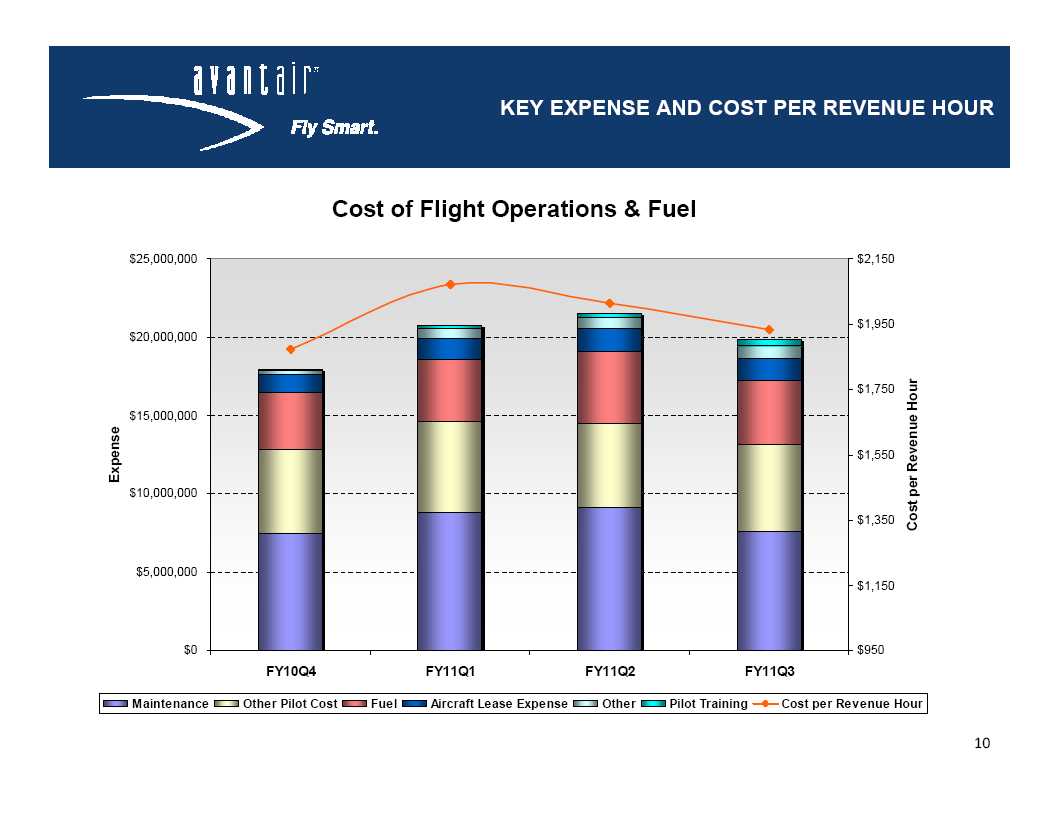

•Operating costs per hour decrease as a result of new aircraft deliveries which will decrease the frequency of engine, gear and airframe expense

4

BUSINESS MODEL: AWARD WINNING PROGRAMS

Includes FET 5

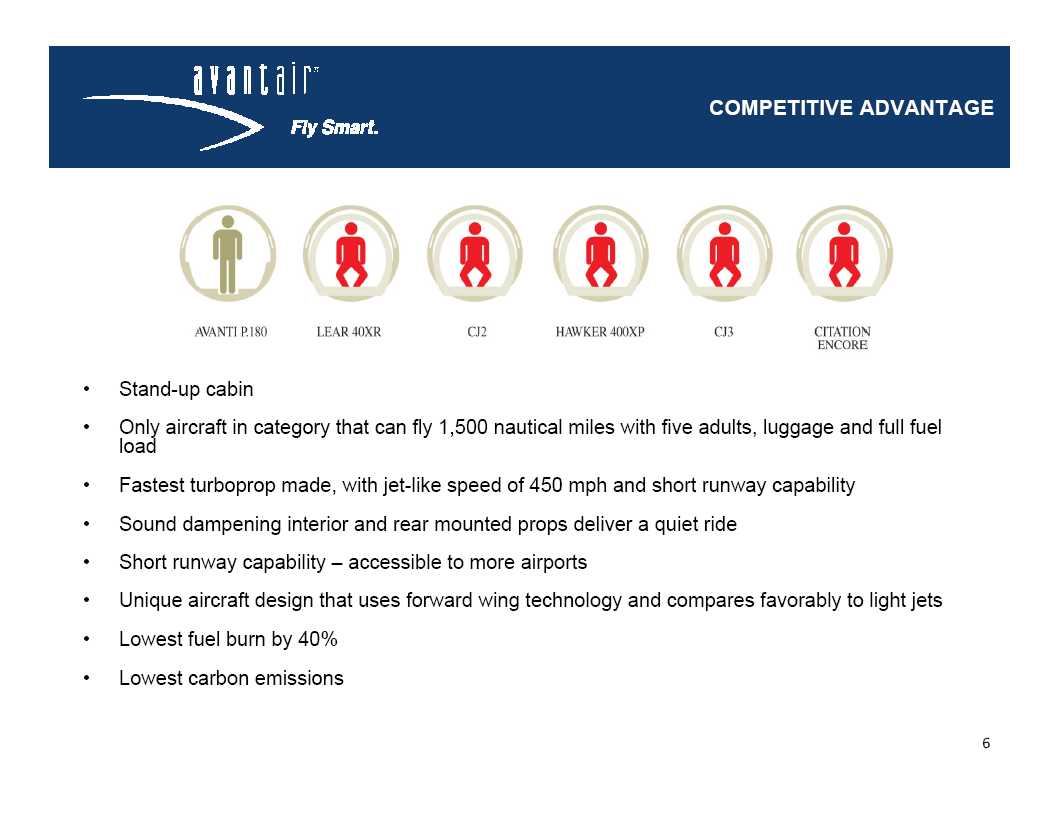

Stand-up cabin

Only aircraft in category that can fly 1,500 nautical miles with five adults, luggage and full fuel load

Fastest turboprop made, with jet-like speed of 450 mph and short runway capability

Sound dampening interior and rear mounted props deliver a quiet ride

Short runway capability – accessible to more airports

Unique aircraft design that uses forward wing technology and compares favorably to light jets

Lowest fuel burn by 40%

Lowest carbon emissions

6

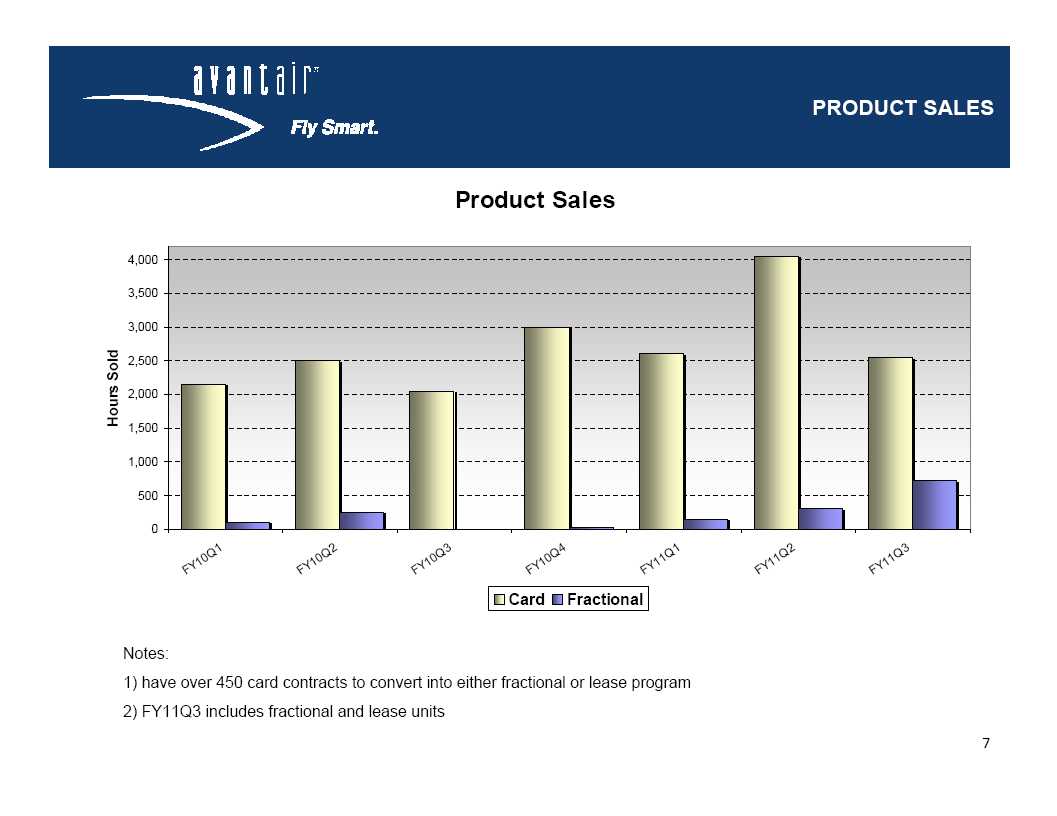

Notes:

1) have over 450 card contracts to convert into either fractional or lease program

2) FY11Q3 includes fractional and lease units

7

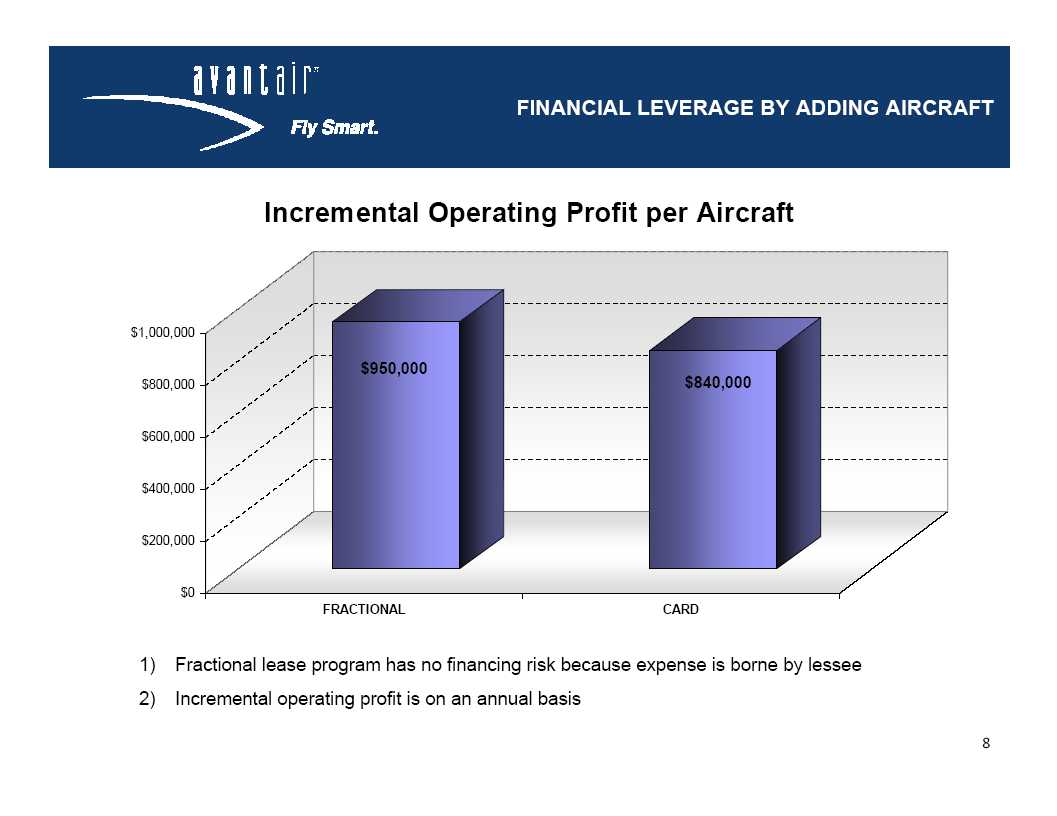

FINANCIAL LEVERAGE BY ADDING AIRCRAFT

Incremental Operating Profit per Aircraft

1) Fractional lease program has no financing risk because expense is borne by lessee

2) Incremental operating profit is on an annual basis

8LEVERAGE BY

Note – software was approved by the FAA in April 2011

9

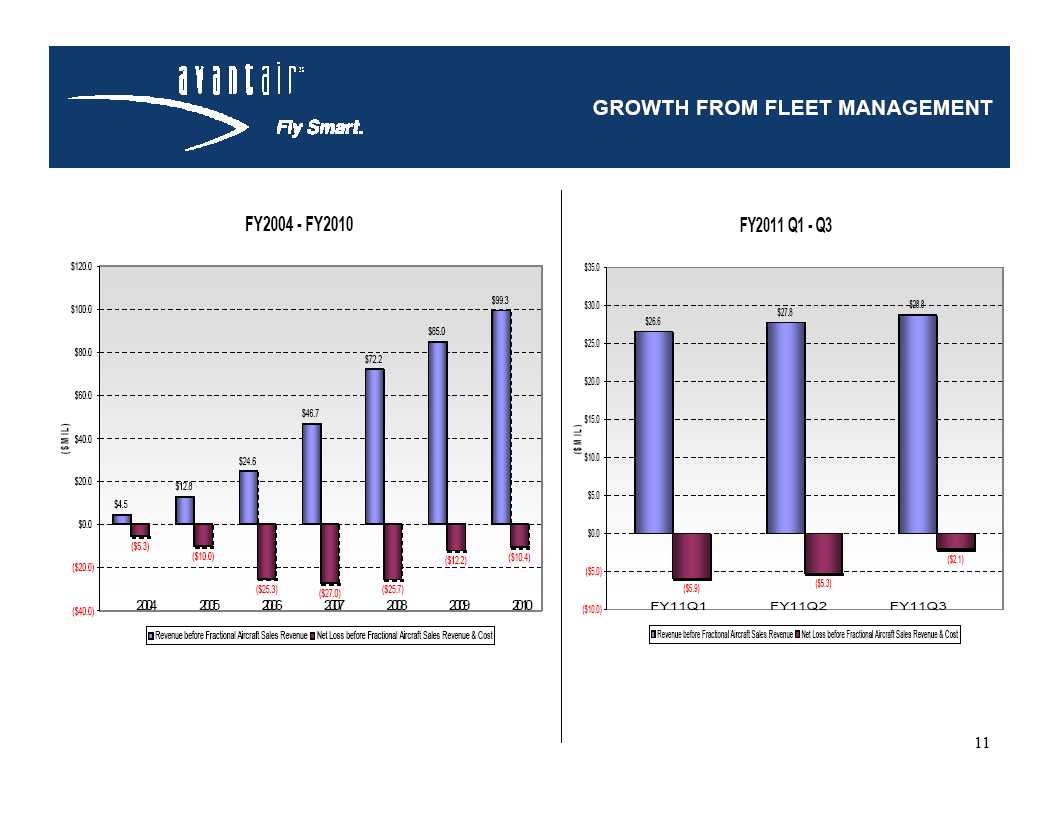

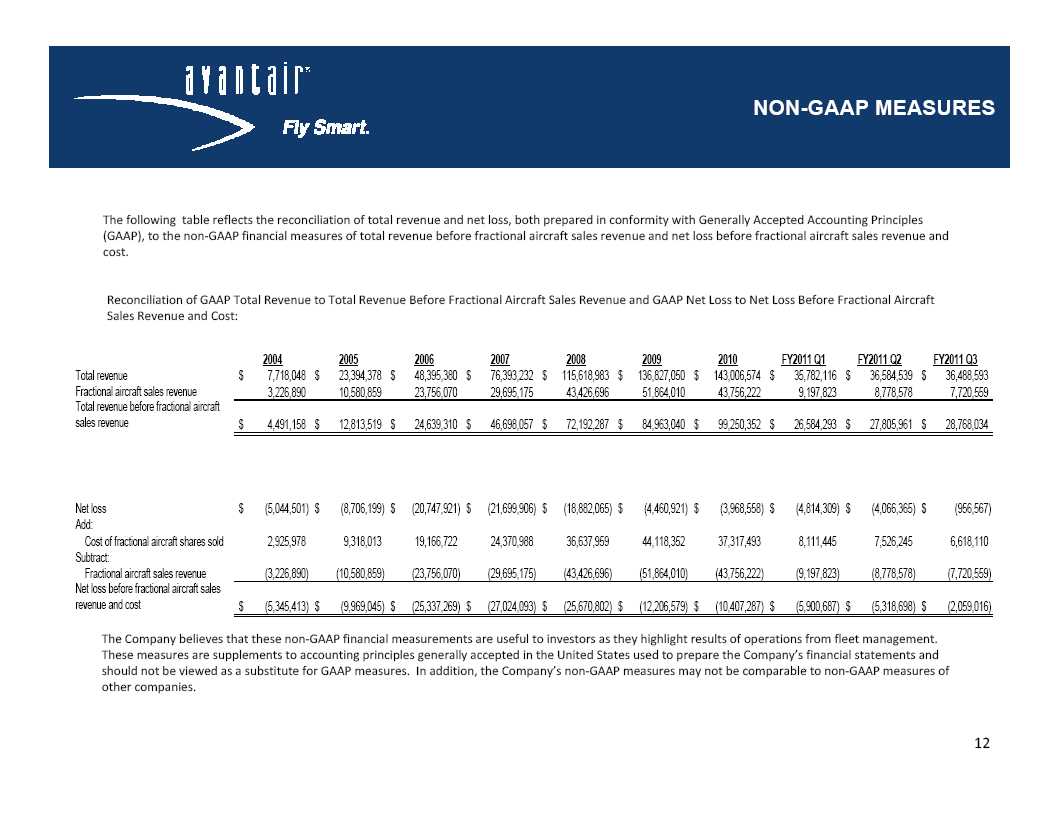

NON-GAAP MEASURES

The following table reflects the reconciliation of total revenue and net loss, both prepared in conformity with Generally

Accepted Accounting Principles (GAAP), to the non] GAAPfinancial measures of total revenue before fractional

aircraft sales revenue and net loss before fractional aircraft sales revenue and cost.

Reconciliation of GAAP Total Revenue to Total Revenue Before Fractional Aircraft Sales Revenue and GAAP Net

Loss to Net Loss Before Fractional Aircraft Sales Revenue and Cost:

2004 2005 2006 2007 2008 2009 2010 FY2011 Q1 FY2011 Q2 FY2011 Q3

Total revenue $ 7,718,048 $ 23,394,378 $ 48,395,380 $ 76,393,232 $ 115,618,983 $ 136,827,050 $ 143,006,574 $ 35,782,116 $ 36,584,539 $ 36,488,593

Fractional aircraft sales revenue 3,226,890 10,580,859 23,756,070 29,695,175 43,426,696 51,864,010 43,756,222 9,197,823 8,778,578 7,720,559

Total revenue before fractional aircraft

sales revenue $ 4,491,158 $ 12,813,519 $ 24,639,310 $ 46,698,057 $ 72,192,287 $ 84,963,040 $ 99,250,352 $ 26,584,293 $ 27,805,961 $ 28,768,034

Net loss $ (5,044,501) $ (8,706,199) $ (20,747,921) $ (21,699,906) $ (18,882,065) $ (4,460,921) $ (3,968,558) $ (4,814,309) $ (4,066,365) $ (956,567)

Add:

Cost of fractional aircraft shares sold 2,925,978 9,318,013 19,166,722 24,370,988 36,637,959 44,118,352 37,317,493 8,111,445 7,526,245 6,618,110

Subtract:

Fractional aircraft sales revenue (3,226,890) (10,580,859)

(23,756,070) (29,695,175) (43,426,696) (51,864,010) (43,756,222) (9,197,823) (8,778,578) (7,720,559)

Net loss before fractional aircraft sales

revenue and cost $ (5,345,413) $ (9,969,045) $ (25,337,269) $ (27,024,093) $ (25,670,802) $ (12,206,579) $ (10,407,287) $ (5,900,687) $ (5,318,698) $ (2,059,016)

The Company believes that these non] GAAP financial measurements are useful to investors as they highlight results of

operations from fleet management. These measures aresupplements to accounting principles generally accepted in the

United States used to prepare the Company’s financial statements and should not be viewed as a substitute for GAAP measures. In addition, the

Company’s non] GAAP measures may not be comparable to non] GAAP measures of other companies.

12

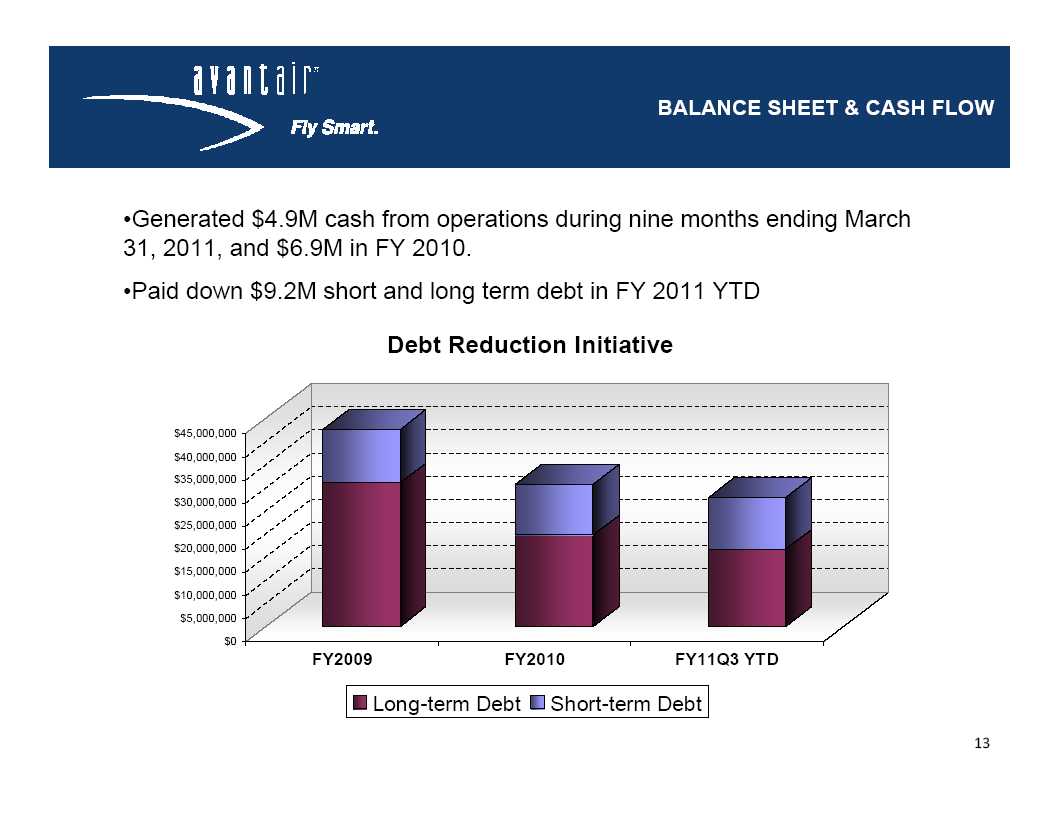

BALANCE SHEET & CASH FLOW

•Generated $4.9M cash from operations during nine months ending March 31, 2011, and $6.9M in FY 2010.

•Paid down $9.2M short and long term debt in FY 2011 YTD

Debt Reduction Initiative

13

GOING FORWARD

•Market share growth opportunities - 1,500 contracts at competitors up for renewal this year

•Pursuing new users. Currently 25% of our sales.

•Maintain high renewal rates - currently at 90%

•Continuously adding new initiatives to protect best in class reputation.

•Leveraging and increasing efficiencies via business model and cutting edge optimization software

•Add strategically located maintenance facilities to lower aircraft flight repositioning, 3rd party vendor costs and complement 4 current facilities.

14