Attached files

| file | filename |

|---|---|

| EX-5.1 - Be Active Holdings, Inc. | v223803_ex5-1.htm |

| EX-3.2 - Be Active Holdings, Inc. | v223803_ex3-2.htm |

| EX-3.1 - Be Active Holdings, Inc. | v223803_ex3-1.htm |

| EX-23.1 - Be Active Holdings, Inc. | v223803_ex23-1.htm |

An Exhibit List can be found on page 42.

Registration No. _____________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SUPER LIGHT INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

2340

|

68-0678429

|

||

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

|

Classification Code)

|

|

Identification No.)

|

23A HaMe’eri St.

Givatayim, 53332

Israel

Tel: (972)54-659-6370

(Address and telephone number of Registrant's principal executive offices)

National Corporate Research, Ltd.

615 South Dupont Highway

Dover, Delaware, 19901

(800)253-5177

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all Correspondence to:

SRK Law Offices

7 Oppenheimer St.

Rabin Science Park

Rehovot, Israel

Telephone No.: (718) 360-5351

Facsimile No.: (011) (972) 8-936-6000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filed,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Calculation of Registration Fee

|

Title of Class of

Securities to be

Registered

|

Amount to be

Registered (1)

|

Proposed

Maximum

Aggregate Price

Per Share

|

Proposed

Maximum

Aggregate

Offering Priced (2)

|

Amount of

Registration Fee

|

||||||||||||

|

Common Stock, $0.0001 per share

|

1,775,000

|

$

|

0.02

|

$

|

35,500

|

$

|

3.02

|

|||||||||

|

Total

|

1,775,000

|

$

|

0.02

|

$

|

35,500

|

$

|

3.02

|

|||||||||

|

(1)

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 23, 2011

PROSPECTUS

Super Light, Inc.

A MAXIMUM OF 1,775,000 SHARES OF COMMON STOCK

OFFERING PRICE $0.02 PER SHARE

The selling stockholders named in this prospectus are offering for resale 1,775,000 shares of our common stock. The selling stockholders have advised us that they will sell the shares of common stock from time to time after this prospectus is declared effective and they have set an offering price for these securities of $0.02 per share of common stock offered through this prospectus until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses incurred in this offering. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR COMMON STOCK WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING "RISK FACTORS" BEGINNING ON PAGE _ BEFORE INVESTING IN OUR COMMON STOCK.

Prior to this offering, there has been no public market for our common stock and we have not applied for listing or quotation on any public market. The initial public offering price will be $0.02 per share. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that an active trading market for our shares will develop, or, if developed, that it will be sustained.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be amended. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

No underwriter or other person has been engaged to facilitate the sale of shares of common stock in this offering. The Selling Stockholders may be deemed underwriters of the shares of common stock that they are offering.

The date of this prospectus is _______ __ , 2011

TABLE OF CONTENTS

|

Page

|

||

|

Part I

|

||

|

SUMMARY INFORMATION

|

5

|

|

|

RISK FACTORS

|

6

|

|

|

Risks Relating to Our Business

|

7

|

|

|

Risks Relating to Our Strategy and Industry

|

9

|

|

|

Risks Relating to this Offering

|

11

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

13

|

|

|

USE OF PROCEEDS

|

14

|

|

|

DIVIDEND POLICY

|

14

|

|

|

DETERMINATION OF THE OFFERING PRICE

|

14

|

|

|

DILUTION

|

14

|

|

|

MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

|

17

|

|

|

SELLING STOCKHOLDERS

|

15

|

|

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

17

|

|

|

BUSINESS

|

21

|

|

|

LEGAL PROCEEDINGS

|

31

|

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

31

|

|

|

EXECUTIVE COMPENSATION

|

33

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENFICIAL OWNERS AND MANAGEMENT

|

34

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS PERSONS

|

35

|

|

|

DESCRIPTION OF SECURITIES

|

35

|

|

|

PLAN OF DISTRIBUTION

|

37

|

|

|

EXPERTS

|

40

|

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

40

|

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE EXPERTS

|

40

|

|

|

ADDITIONAL INFORMATION

|

40

|

|

|

INDEX TO FINANCIAL STATEMENTS

|

F-1

|

2

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from the information contained in this prospectus.

We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of when this prospectus is delivered or when any sale of our common stock occurs.

3

DEALER PROSPECTUS DELIVERY OBLIGATION

Until ____________ _ (90 days after the effective date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

4

SUMMARY INFORMATION

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes, and especially the risks described under "Risk Factors" beginning on page 6. All references to "we," "us," "our," "Super Light," "Company," ”Registrant” or similar terms used in this prospectus refer to Super Light, Inc.

Corporate Background

We were incorporated on December 27, 2007. We are a development stage company that has not generated any revenues to date. Since inception we have conducted a market analysis on diaper usage in our target market, researched governmental regulations for the importing of such products, and negotiated pricing with possible suppliers. We are focused on marketing and offering private label diapers under the brand name “Super Light” at an affordable price, initially to the Israeli marketplace and thereafter we envision that our private label disposable diapers may be sold in Eastern European markets. We plan to market and distribute our private label diapers through direct sales to retailers and chain stores in addition to sales through distributers.

Our offices are currently located at 23A HaMe’eri St., Givatayim 53332, Israel. Our telephone number is (972)54-659-6370. We have secured a domain name (www.superlightinc.com) but do not currently have an operating website. The website references (URL’s) in this Registration Statement are inactive textual references only and are not active hyperlinks. The contents of these websites are not part of this prospectus, and you should not consider the contents of these websites in making an investment decision with respect to our common stock. Our fiscal year end is December 31.

Our auditors have issued an audit opinion which includes a statement describing their doubts about whether we will continue as a going concern. In addition, our financial status creates substantial doubt whether we will continue as a going concern.

The Offering

|

Shares of common stock being offered by the selling stockholders

|

1,775,000 shares of our common stock.

|

|

|

Offering price

|

$0.02 per share of common stock.

|

|

|

Number of shares outstanding before the offering

|

6,225,000

|

|

|

Number of shares outstanding after the offering if all the shares are sold

|

6,225,000

|

|

|

Our executive officers and Directors hold approximately 72.49% of our shares, and, as a result, they retain control over our direction.

|

||

|

There is no public market for our common stock. After the effective date of the registration statement, we intend to have a market maker file an application on our behalf with the NASD to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. In addition, we do not intend to register or qualify our common stock for secondary trading in any state. Since many states restrict the resale of securities that have not been registered or qualified for resale, the potential secondary market for our common stock will be limited.

|

||

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares by the selling stockholders.

|

|

|

Risk Factors

|

See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

|

5

Summary Financial Data

The following summary financial information for the period from December 27, 2007 (date of inception) through March 31, 2011, includes statement of operations and balance sheet data from our audited financial statements. The information contained in this table should be read in conjunction with "Management's Discussion and Analysis of Financial Condition or Plan of Operation" and the financial statements and accompanying notes included in this prospectus.

|

Three

Months Ended

March 31,

2011

|

Year Ended

December 31,

2010

|

Cumulative

from Inception

(December 27,

2007) Through

March 31,

2011

|

||||||||||

|

Revenues

|

$ | - | $ | - | $ | - | ||||||

|

Operating Expenses

|

$ | 12,015 | $ | 15,306 | $ | 27,324 | ||||||

|

(Loss) from Operations

|

$ | (12,015 | ) | $ | (15,306 | ) | $ | (27,324 | ) | |||

|

Other Income (expense)

|

$ | 600 | $ | 1,404 | $ | 1,932 | ||||||

|

Net (Loss)

|

$ | (11,415 | ) | $ | (13,902 | ) | $ | (25,392 | ) | |||

|

(Loss) Per Common Share

|

$ | (0.00 | ) | $ | (0.00 | ) | $ | |||||

|

Weighted Average Number of Common Shares Outstanding – Basic and Diluted

|

6,225,000 | 5,438,630 | ||||||||||

|

|

As of

March

31,

2011

|

As of

December

31,

2010

|

||||||

|

Total Current Assets

|

$ | 31,508 | $ | 30,922 | ||||

|

Total Assets

|

$ | 31,508 | $ | 30,922 | ||||

|

Total Current Liabilities

|

$ | 12,000 | $ | - | ||||

|

Total Liabilities

|

$ | 12,000 | $ | - | ||||

|

Total Stockholders’ Equity (Deficit)

|

$ | 19,508 | $ | 30,922 | ||||

|

Total Liabilities and Stockholders’ Equity (Deficit)

|

$ | 31,508 | $ | 30,922 | ||||

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in us. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risks Relating to Our Lack of Operating History

1. We have a going concern opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

We have incurred net losses of $27,324 for the period from December 27, 2007 (date of inception) through March 31, 2010. We anticipate generating losses for the next 12 months. We do not anticipate generating revenues before December 2011. Therefore, we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities which could result should we be unable to continue as a going concern. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in us.

6

In addition, our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. As a result, we may not be able to obtain additional necessary funding. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations are unproven, and the lack of operating history makes it difficult to evaluate the future prospects of our business.

2. We are a development stage company and may never be able to execute our business plan.

We were incorporated on December 27, 2007. We currently have no agreements to purchase private label diapers, nor any customers or revenues. Although we have begun initial planning for the marketing and reselling of disposable baby diapers with our private label, we may not be able to execute our business plan unless and until we are successful in raising additional funds. We anticipate that we will require additional financing of approximately $45,000, in addition to the $44,900 that has been invested by our current shareholders, to continue our operations and to remain operational during the next twelve months. Such financing, if required, may not be forthcoming. Even if additional financing is available, it may not be available on terms we find favorable. Failure to secure the needed additional financing will have a serious effect on our company's ability to survive. At this time, there are no anticipated additional sources of funds in place.

3. Our business plan may be unsuccessful.

The success of our business plan is dependent on our having a valid agreement with one or more disposable baby diaper manufacturers for the supply of baby diapers at wholesale prices, and on our marketing and sale of these disposable baby diapers with our intended brand name. Our ability to develop this market and sell our private label products is unproven, and the lack of operating history makes it difficult to validate our business plan. As a brand-based company, marketing and sales will be driven through the marketing of our private label diapers through the use of conventional marketing techniques such as newspaper advertisements, billboards, and direct mail. In addition, the success of our business plan is dependent upon the market acceptance of, and our intended competitive pricing for, our private label disposable diapers. Should the target market not be as responsive as we anticipate, we will not have in place alternate services or products that we can offer to ensure our continuation as a going concern.

4. We have no operating history and have maintained losses since inception, which we expect to continue in the future.

Management believes that an additional investment of $45,000 will be sufficient to enable us to commence our market development and sale activities, and to continue our planned activities for approximately 12 months after the offering. We also expect to continue to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the marketing and sale of our private label disposable diapers. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Risks Relating to Our Business

5. Our executive officers and Directors have significant voting power and may take different actions from actions sought by our other stockholders.

Our officers and Directors own approximately 72.49% of the outstanding shares of our common stock.

These stockholders will be able to exercise significant influence over all matters requiring stockholder approval. This influence over our affairs might be adverse to the interest of our other stockholders. In addition, this concentration of ownership could delay or prevent a change in control and might have an adverse effect on the market price of our common stock.

7

6. Since our officers and Directors may work or consult for other companies, their other activities could slow down our operations.

Our officers and Directors are not required to work exclusively for us and do not devote all of their time to our operations. Presently, our officers and Directors allocate only a portion of their time to the operation of our business. Since our officers and Directors are currently employed full-time elsewhere, they are each able to commit to us only up to 5-10 hours a week. Therefore, it is possible that their pursuit of other activities may slow our operations and reduce our financial results because of the slow-down in operations.

7. Our officers and Directors are located in Israel and our assets may also be held from time to time outside of the United States.

Since all of our officers and Directors are located in Israel, any attempt to enforce liabilities upon such individuals under the U.S. securities and bankruptcy laws may be difficult.

In accordance with the Israeli Law on Enforcement of Foreign Judgments, 5718-1958, and subject to certain time limitations (the application to enforce the judgment must be made within five years of the date of judgment or such other period as might be agreed between Israel and the United States), an Israeli court may declare a foreign civil judgment enforceable if it finds that:

|

|

•

|

the judgment was rendered by a court which was, according to the laws of the State in which the court is located, competent to render the judgment;

|

|

|

•

|

the judgment may no longer be appealed;

|

|

|

•

|

the obligation imposed by the judgment is enforceable according to the rules relating to the enforceability of judgments in Israel and the substance of the judgment is not contrary to public policy; and;

|

|

|

•

|

the judgment is executory in the State in which it was given.

|

An Israeli court will not declare a foreign judgment enforceable if:

|

|

•

|

the judgment was obtained by fraud;

|

|

|

•

|

there is a finding of lack of due process;

|

|

|

•

|

the judgment was rendered by a court not competent to render it according to the laws of private international law in Israel;

|

|

|

•

|

the judgment is in conflict with another judgment that was given in the same matter between the same parties and that is still valid; or

|

|

|

•

|

the time the action was instituted in the foreign court, a suit in the same matter and between the same parties was pending before a court or tribunal in Israel.

|

In general, an obligation imposed by the judgment of a United States court is enforceable according to the rules relating to the enforceability of judgments in Israel, and a United States court is considered competent to render judgments according to the laws of private international law in Israel.

Furthermore, Israeli courts may not adjudicate a claim based on a violation of U.S. securities laws if the court determines that Israel is not the most appropriate forum in which to bring such a claim. Even if an Israeli court agrees to hear such a claim, it may determine that Israeli law, not U.S. law, is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proven as a fact, which can be a time-consuming and costly process.

Since our Directors and executive officers do not reside in the United States it may be difficult for courts in the United States to obtain jurisdiction over our foreign assets or persons, and, as a result, it may be difficult or impossible for you to enforce judgments rendered against us or our Directors or executive officers in United States courts. Thus, investing in us may pose a greater risk because should any situation arise in the future in which you have a cause of action against these persons or us, you may face potential difficulties in bringing lawsuits or, if successful, in collecting judgments against these persons or us.

8. Our officers have no experience in operating a disposable diaper product business.

Since our officers and Directors have no experience in operating a disposal diaper product business or in the marketing of disposable diapers, they may make inexperienced or uninformed decisions regarding the operation of our business or the marketing of our products, which could harm our business and result in our having to suspend or cease operations, which could cause investors to lose their entire investment.

8

9. We may not have effective internal controls.

In connection with Section 404 of the Sarbanes-Oxley Act of 2002, we need to assess the adequacy of our internal control, remediate any weaknesses that may be identified, validate that controls are functioning as documented and implement a continuous reporting and improvement process for internal controls. We may discover deficiencies that require us to improve our procedures, processes and systems in order to ensure that our internal controls are adequate and effective and that we are in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act. If the deficiencies are not adequately addressed, or if we are unable to complete all of our testing and any remediation in time for compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and the SEC rules under it, we would be unable to conclude that our internal controls over financial reporting are designed and operating effectively, which could adversely affect investor confidence in our internal controls over financial reporting.

Risks Relating to Our Strategy and Industry

10. Our success depends on independent contractors to manufacture and supply us with disposable diapers, and to label, package, and ship these private label products.

We intend to purchase disposable diapers from third party manufacturers/suppliers in China and to affix our private label on such diapers. We will be relying on independent contractors for the supply of the disposable diapers and for the labeling, packaging, and shipping of these private label products. We may not be successful in developing relationships with these independent contractors. In addition, these third party contractors may not dedicate sufficient resources or give sufficient priority to satisfying our requirements or needs. There is no history upon which to base any assumption as to the likelihood that we will prove successful in selecting qualified third party independent contractors or in negotiating any agreements with them. If we are unsuccessful in addressing these risks, our business will most likely fail.

11. We do not have commitments from potential suppliers and other independent contractors.

Our success is dependent on our ability to timely provide our customers with our private label disposable diapers. Although we intend to directly market these products, we will be dependent on our suppliers for the manufacturing and packaging of our disposable diapers and will be dependent on other independent contractors for the shipment of these private label products. Even though we have held discussions with potential suppliers of goods and services, we have not yet entered into any agreements with independent contractors for the supply of disposable diapers, nor for the provision of logistics services. No assurance can be given that we will enter into agreements with suppliers for the supply of disposable diapers at acceptable levels of quality and price, or with other independent contractors who will provide us with logistics services at acceptable levels of quality and price. While we anticipate having good relationships with our potential suppliers and other independent contractors, if we are unable to secure dependable sources of supply or logistics services from one or more independent contractors on a timely basis and on acceptable terms, our results of operations could be adversely affected.

12. The reselling of disposable diapers is subject to current governmental regulations.

The marketing, distribution and sale of the private label disposable diapers that we propose to sell are subject to the requirements of Israeli law. In particular, disposable diapers sold in Israel are required to conform to the requirements of the Standards Institute of Israel - Standards Document SI 818- Part 2, which regulates disposable diapers. Prior to importing the first shipment of disposable baby diapers into Israel, the products must be tested by the Israel Standards Institute to ensure that the products conform to the standards adopted by the State of Israel with regard to absorbency, leakage, pulp contents, and presence of hazardous ingredients. While we intend to have our disposable diapers satisfy these requirements, any non-compliance may result in a prohibition on future sales our product or the recall of products previously sold, which, in either event, could negatively impact our proposed business.

13. We face intense competition and many of our competitors have substantially greater resources than we do.

We will operate in a highly competitive environment since there are two main manufacturers that dominate 93% of the Israeli market. In addition, the competition in the market for disposable diapers may intensify. The current competitors are affiliates of well-established companies based in the United States with longer operating histories, significantly greater resources and name recognition, and a larger base of distributors and retailers. As a result, these competitors have greater credibility with our potential customers. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion, and sale of their products. These competitors may make it difficult for us to market and sell our products and compete in the disposable diaper market, which could harm our business.

9

14. Failure to meet customers’ expectations or deliver expected performance could result in losses and negative publicity, which would harm our business.

If the disposable diapers which we plan to resell fail to perform in the manner expected by our customers, then our revenues may be delayed or lost due to adverse customer reaction. In addition, negative publicity about us and our private label products could adversely affect our ability to attract or retain customers. Furthermore, disappointed customers may initiate claims for damages against us, regardless of our responsibility for their disappointment.

15. We need to retain key personnel to support our services and ongoing operations.

The marketing and sale of our private label disposable diapers will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officers and the hiring of key employees and contractors who have critical industry experience and relationships that we rely on to implement our business plan. The loss of the services of any of our officers or the lack of availability of other skilled personnel would negatively impact our ability to market and sell the private label disposable diapers, which could adversely affect our financial results and impair our growth.

16. Currency exchange rate fluctuations in the world markets in which we intend to conduct our business could have a material adverse affect on our business, results of operations and financial condition.

Our financial statements are stated in U.S. dollars. However, we expect that a substantial portion of our revenues and expenses will be incurred in other currencies, particularly the New Israeli Shekel and possibly the Chinese Yuan. Therefore, fluctuations in the value of the currencies in which we do business relative to the U.S. dollar may have a material adverse effect on our business, results of operations and financial condition, by decreasing the U.S. dollar value of assets held in other currencies and increasing the U.S. dollar amount of liabilities payable in other currencies, or by decreasing the U.S. dollar value of our revenues in other currencies and increasing the U.S. dollar amount of our expenses in other currencies. Even if we use derivatives or other instruments to hedge part or all of our exposures from time to time, they may not effectively eliminate such risk, if at all.

17. We may be unable to protect our brand name.

Brand recognition is critical in attracting consumers to our product. We have researched the availability of the trademark “Super Light” in Israel and have not found any inherent obstacle to registering the trademark with the Israeli patent and trademark office. Nevertheless, if we are unable to trademark our brand name or to adequately protect our trade name against infringement or misappropriation, our competitive position in the disposable diaper market may be undermined, which could lead to a significant decrease in the volume of private label products that we resell. Such a result would materially and adversely affect our results of operations.

18. We may incur losses as a result of claims that may be brought against us due to defective products or as a result of product recalls.

While we are not aware of any claims having been brought in connection with the disposable diapers we plan to resell, we may be liable if a defect in the design or manufacture of the private label products we resell causes injury, illness, or death. We also may be required to withdraw or recall some of our private label products if they become contaminated or are damaged or mislabeled. The most common complaints that diaper manufacturers face relate to defects such as missing or skewed tapes, frontal tape positioning, skewed elastic-waste foam, pad integrity issues, bad cut leg trims, and leg cuff placement. If the products that we sell suffer from any such defects, we could face product liability exposure. In addition, a widespread product withdrawal or recall could have a material adverse effect on our business and financial condition.

10

19. Political, economic and military conditions in Israel and in the Middle East as a whole could negatively impact our business.

Political, economic and military conditions in Israel may have a direct influence on us because our executive officers are located there. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors. A state of hostility, varying in degree and intensity, has led to security and economic problems for Israel. Any major hostilities involving Israel, acts of terrorism or the interruption or curtailment of trade between Israel and its present trading partners could adversely affect our operations. We cannot assure you that ongoing hostilities related to Israel such as those exhibited in the Gaza incursion in 2008-2009 and the current altercations in connection with the maritime blockade on Gaza will not have a material adverse effect on our business or on our share price. Several Arab countries still restrict business with Israeli companies and these restrictions may have an adverse impact on our operating results, financial condition or the expansion of our business. Any on-going or future violence between Israel and the Palestinians, armed conflicts, terrorist activities, tension along the Israeli-Lebanese or the Israeli-Syrian borders, or political instability in the region would likely disrupt international trading activities in Israel and may materially and negatively affect our business conditions and could harm our results of operations. Certain countries, as well as certain companies and organizations, continue to participate in a boycott of Israeli firms and others doing business with Israel and Israeli companies. Thus, there may be business opportunities in the future from which we will be precluded. In addition, such boycott policies or practices may change over time and we cannot predict whether certain companies and organizations, will be subject thereto. The boycott policies or practices directed towards Israel or Israeli businesses could, individually or in the aggregate, have a material adverse affect on our business in the future.

20. Our lack of business diversification could result in the loss of your investment if revenues from our primary products decrease.

Currently, our business is focused on the marketing and sale of disposable diapers that we will purchase from third party manufacturers. We do not have any other lines of business or other sources of revenue if we are unable to successfully implement our business plan. Our lack of business diversification could cause you to lose all or some of your investment if we are unable to generate revenues by the sale of disposable diapers we do not have any other lines of business or alternative revenue sources.

21. An unsuccessful material strategic transaction or relationship could result in operating difficulties and other harmful consequences to our business.

We expect to evaluate a wide array of potential strategic transactions and relationships with third parties. From time to time, we may engage in discussions regarding potential acquisitions or joint ventures. Any of these transactions could be material to our financial condition and results of operations, and the failure of any of these material relationships and transactions may have a negative financial impact on our business.

Risks Relating to this Offering

22. NASD sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the "penny stock" rules described below, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

23. There is no public market for the securities and even if a market is created, the market price of our common stock will be subject to volatility.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, our common stock will be eligible for quotation on the OTC Bulletin Board. If, for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

11

24. The price of our shares in this offering was arbitrarily determined by us and may not reflect the actual market price for the securities.

The initial public offering price of the common stock was determined by us arbitrarily. The price is not based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market. The price may not be indicative of the market price, if any, for the common stock in the trading market after this offering. The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management's attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

25. State securities laws may limit secondary trading, which may restrict the states in which you may sell the shares offered by this prospectus.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. Thirty-three states have what is commonly referred to as a “manual exemption” for secondary trading of securities such as those to be resold by selling stockholders under this registration statement. In these states, so long as the issuer obtains and maintains a listing in Mergent, Inc. or Standard and Poor’s Corporate Manual, secondary trading of common stock can occur without any filing, review or approval by state regulatory authorities in these states. These states are: Alaska, Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Florida, Hawaii, Idaho, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Texas, Utah, Washington, West Virginia, and Wyoming. Ten states provide for an exemption for non-issuer transactions in outstanding securities effected through a registered broker-dealer when the securities are subject to registration under Section 12 of the Securities Exchange Act of 1934 for at least 90 days (180 days in Alabama). These states are: Alabama, Colorado, District of Columbia, Illinois, Kansas, Missouri, New Jersey, New Mexico, Oklahoma, and Rhode Island.

We currently do not intend to register or qualify our stock in any state or seek coverage in one of the recognized securities manuals. Because the shares of our common stock registered hereunder have not been registered for resale under the blue sky laws of any state, and we have no current plans to register or qualify our shares in any state, the holders of such shares and persons who desire to purchase such shares in any trading market that might develop in the future should be aware that there may be significant state blue sky restrictions upon the ability of investors to purchase and sell such shares. In this regard, each state's statutes and regulations must be reviewed before engaging in any securities sales activities in a state to determine what is permitted, or not permitted, in a particular state. Nevertheless, we do intend to file a Form 8-A promptly after this registration statement becomes effective, thereby subjecting our stock registered hereunder to registration under Section 12 of the Securities Exchange Act of 1934. Furthermore, even in those states that do not require registration or qualification for the resale of registered securities, such states may require the filing of notices or place additional conditions on the availability of exemptions. Accordingly, since many states continue to restrict the resale of securities that have not been qualified for resale, investors should consider any potential secondary market for our securities to be a limited one.

26. Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations, which may limit a stockholder's ability to buy and sell our stock.

If a trading market does develop for our stock, it is likely we will be subject to the regulations applicable to "Penny Stock," the regulations of the SEC promulgated under the Exchange Act that require additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The SEC regulations define penny stocks to be any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Unless an exception is available, those regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a standardized risk disclosure schedule prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the purchaser’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that becomes subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage market investor interest in and limit the marketability of our common stock.

12

27. Should our stock become listed on the OTC Bulletin Board, if we fail to remain current on our reporting requirements, we could be removed from the OTC Bulletin Board which would limit the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market.

Companies trading on the Over-The-Counter Bulletin Board, one of which we are seeking to become, must be reporting issuers under Section 12 of the Securities Exchange Act of 1934, as amended, and must be current in their reports under Section 13, in order to maintain price quotation privileges on the OTC Bulletin Board. Currently we have sufficient resources to comply with our future reporting requirements; however, the lack of resources to prepare and file our reports, including the inability to pay our auditor, could result in our failure to remain current on our reporting requirements, which could result in our being removed from the OTC Bulletin Board. As a result, the market liquidity for our securities could be severely adversely affected by limiting the ability of broker-dealers to sell our securities and the ability of stockholders to sell their securities in the secondary market. In addition, we may be unable to get re-listed on the OTC Bulletin Board, which may have an adverse material effect on our company

28. We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant.

29. Efforts to comply with recently enacted changes in securities laws and regulations will increase our costs and require additional management resources, and we still may fail to comply.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring public companies to include a report of management on our internal controls over financial reporting in their annual reports on Form 10-K. In addition, the public accounting firm auditing our financial statements must attest to and report on management’s assessment of the effectiveness of our internal controls over financial reporting. These requirements are not presently applicable to us but we will become subject to these requirements subsequent to the effective date of this prospectus. If and when these regulations become applicable to us, and if we are unable to conclude that we have effective internal controls over financial reporting or if our independent auditors are unable to provide us with an unqualified report as to the effectiveness of our internal controls over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in the value of our securities. We have not yet begun a formal process to evaluate our internal controls over financial reporting. Given the status of our efforts, coupled with the fact that guidance from regulatory authorities in the area of internal controls continues to evolve, substantial uncertainty exists regarding our ability to comply by applicable deadlines.

30. We have not yet engaged the services of a transfer agent which may affect our stockholders’ ability to transfer their shares in the Company.

We have not yet engaged the services of a transfer agent, and until a transfer agent is retained, Super Light will act as its own transfer agent. The absence of a professional transfer agent may result in delays in the recordation of share transfers and the issuance of new stock certificates, which has the potential to disrupt the orderly transfer of stock from one stockholder to another.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this prospectus may contain forward-looking statements that involve risks and uncertainties. These statements relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this prospectus. Forward-looking statements are often identified by words like: "believe," "expect," "estimate," "anticipate," "intend," "project" and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as "may," "will," "should," "plans," "predicts," "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled Risk Factors beginning on page 8, that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the Business section beginning on page 28, the Management's Discussion and Analysis or Plan of Operation section beginning on page 22, and as well as those discussed elsewhere in this prospectus.

13

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with accounting principles generally accepted in the United States.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock by the Selling Stockholders pursuant to this prospectus. Please read “Selling Stockholders” for a list of the persons that will receive proceeds from the sale of common stock owned by them pursuant to this prospectus.

DIVIDEND POLICY

We have not declared or paid any dividend since inception on our common stock. We do not anticipate that we will declare or pay dividends in the foreseeable future on our common stock.

DETERMINATION OF THE OFFERING PRICE

There has been no public market for our common shares. The price of the shares we are offering was arbitrarily determined at $0.02 per share. We believe that this price reflects the amount that a potential investor would be willing to pay to invest in our company at this initial stage of our development. Because we have no significant operating history and have not generated any revenues to date, the price of our common stock is not based on past earnings, nor is the price of our common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business and potential business expansion.

We arbitrarily determined the price and it bears no relationship whatsoever to our business plan, the price paid for our shares by our founders, our assets, earnings, book value or any other criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities, which is likely to fluctuate.

DILUTION

None of the proceeds from the sale by the Selling Stockholders will be delivered to the Company, and therefore the proposed public offering will not include a public contribution. Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price.

The historical net tangible book value as of March 31, 2011, was $19,508 or $0.0031 per share. Historical net tangible book value per share of common stock is equal to our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding as of March 31, 2011. This represents an immediate increase of $0.0030 per share to our officers for shares held since 2009 and a substantial dilution of $0.0169 per share, or approximately 84.33%, to new investors purchasing our securities in this offering. Dilution in pro forma net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in the private placement offering and the pro forma net tangible book value per share of our common stock immediately following this offering.

14

MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

Market Information

There is no public market for our common stock.

We have issued 6,225,000 common shares since our inception in December 27, 2007, all of which are restricted shares. See the section titled "Certain Relationships and Related Transactions" below. There are no outstanding options or warrants or securities that are convertible into shares of common stock.

Holders

We had 43 holders of record for our common shares as of May 23, 2011.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any compensation plan under which equity securities are authorized for issuance.

SELLING SECURITY HOLDERS

The selling stockholders named in this prospectus are offering all of the 1,775,000 shares of common stock offered through this prospectus. The selling stockholders are non U.S. persons who acquired the 1,775,000 shares of common stock offered through this prospectus from us in a series of private placement transactions that occurred between December 2009 and April 2010 at a price per share of $0.02 and for an aggregate investment of $35,500. The private placement transactions were pursuant to Regulation S, thus exempting these private placements from the registration requirements of the United States Securities Act of 1933.

The following table provides as of May 23, 2011, information regarding the beneficial ownership of our common stock held by each of the selling stockholders, including:

|

1.

|

The number of shares beneficially owned by each prior to this offering;

|

|

2.

|

The total number of shares that are to be offered by each;

|

|

3.

|

The total number of shares that will be beneficially owned by each upon completion of the offering; and

|

|

4.

|

The percentage owned by each upon completion of the offering.

|

15

|

Beneficial Ownership

Before Offering(¹)

|

Number of

Shares

|

Beneficial Ownership

After Offering(¹)

|

||||||||||||||||||

|

Name of Selling Stockholder(¹)

|

Number of

Shares

|

Percent(²)

|

Being

Offered

|

Number of

Shares

|

Percent(²)

|

|||||||||||||||

|

Pinhas Zvi Brim

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Elhanan Ben Sosan

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Shlomo Breska

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Mordechai Frankel

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Michael Dov Glick

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Shlomo Gobi

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Azriel Menachem Goldblatt

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Naftali Yaacov Goldblatt

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Reisel Goodwin

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Uriel Moshe Goodwin

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Israel Gura

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Sara Rachel Heinrich

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Karina Hlebnikova

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Andrejs Hromisevs

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Aryeh Jacobson

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Meir Kazan

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Keren Leumi Rubin

|

200,000 | 3.2 | 200,000 | 0 | 0 | |||||||||||||||

|

Rolands Liepins

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Marina Mincenoka

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Oleg Mincenoks

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Jelena Mitjurina

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Avraham Paskus

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Natlija Petuhova

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Sergejs Petuhovs

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Andrejs Petuhovs

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Shlomo Raphael Raphaelov

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Margarita Redkina

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Kristians Rukuts

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Igors Semjonovs

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Inga Trumpe-Kalnina

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Aleksandrs Turlisovs

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

Moshe Vizel

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Israel Waserman

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Meir Waserman

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Nava Waserman

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Moshe Winberger

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Moshe Chai Yona

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Yaier Yousef

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Hanoch Zilberferb

|

50,000 | * | 50,000 | 0 | 0 | |||||||||||||||

|

Evita Zvarte

|

25,000 | * | 25,000 | 0 | 0 | |||||||||||||||

|

TOTAL

|

1,775,000 |

NIL

|

NIL

|

|||||||||||||||||

* Represents less than one percent of the total number of shares of common stock outstanding as of the date of this filing.

|

(¹)

|

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling stockholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

|

|

(²)

|

Applicable percentage of ownership is based on 6,225,000 shares of common stock outstanding as of May 23, 2011.

|

Except as disclosed above, none of the selling stockholders:

|

(i)

|

has had a material relationship with us or any of our affiliates other than as a stockholder at any time within the past three years; nor

|

|

(ii)

|

has ever been one of our officers or Directors.

|

16

MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

The following discussion of our plan of operation should be read in conjunction with the financial statements and related notes that appear elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed in “Risk Factors” beginning on page 6 of this prospectus. All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

Overview

We are a development stage company with limited operations and no revenues from our business operations. Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months. We do not anticipate that we will generate significant revenues until we are able to market and sell the private label disposable baby diapers and generate customers. Accordingly, we must raise cash from sources other than our operations in order to implement our marketing plan.

In our management’s opinion, even though the Israeli market for disposable diapers is concentrated and dominated by two main manufacturers they believe that there is a market for reasonably priced disposable diapers, especially among Orthodox Jewish customers whom have an above average number of children.

We believe that we will need to raise an additional $45,000 in order to allow us to begin our market development and sales activities and to remain in business for twelve months. We do not expect to begin to generate revenues prior to July 2012. If we raise the necessary funds, but are unable to generate revenues within twelve months of the effectiveness of this Registration Statement for any reason, or if we are unable to make a reasonable profit within twelve months of the effectiveness of this Registration Statement, we may have to suspend or cease operations. At the present time, we have not made any arrangements to raise additional cash to finance our operations. We may seek to obtain additional funds through a second public offering, a private placement of securities, or loans. Other than as described in this paragraph, we have no financing plans at this time.

Plan of Operation

Our specific goal is to provide disposable baby diapers at a competitive and affordable price. Assuming we raise the additional funds necessary for us to operate our business, our plan of operation is as follows:

Initially we are seeking to market the Super Light brand exclusively in Israel. Eventually we envision selling our products in Eastern Europe as well. We intend to market our products primarily on the basis of price – our products will be offered to consumers at the lower end of the retail price point for disposable diapers. We expect manufacturing of our products to take place in China. We have taken into consideration the 12% import duty imposed by Israeli customs on goods of this type manufactured in China.

Purchasing Strategy

We intend to purchase privately labeled disposable diapers from one or more manufacturers in China. We have not yet entered into a supply agreement with a manufacturer.

We have contacted the seven Chinese manufacturers listed below and have received initial price quotations from each of them.

|

|

·

|

Jinjian Anting Sanitary Products Co. Ltd.

|

|

|

·

|

Rockbrook Industrial Co. Ltd.

|

|

|

·

|

Baron Co. Ltd.

|

|

|

·

|

B&W Paper Products Co. Ltd.

|

|

|

·

|

Dongguan White Swan Paper Products Co. Ltd.

|

|

|

·

|

Guangzhou Suide Commodity Co., Ltd.

|

|

|

·

|

Nan’an Hengyuan Women and Children Products Co., Ltd.

|

17

Based on the initial price quotations that we have received, we believe that our initial costs will be as follows:

|

A.

|

Cost of Diapers FOB CHINA

|

|

Costs FOB CHINA

|

|||||||

|

Size

|

Diapers per pack

|

Cost/FOB

|

|||||

| 2 | 52 | $ | 3.48 | ||||

| 3 | 44 | $ | 3.48 | ||||

| 4 | 40 | $ | 3.56 | ||||

| 5 | 36 | $ | 3.53 | ||||

|

B.

|

Other Costs

|

Inspection and Verification– We expect to incur costs in the range of $1,000 per 40’ container for inspection and verification of goods. Inspection will include:

|

|

·

|

Verification of quantity

|

|

|

·

|

Load/Item Integrity (inspect for damage)

|

|

|

·

|

Item Verification (actual item to item label)

|

|

|

·

|

Packaging Verification

|

|

|

·

|

Shipping document verification

|

Regulator Testing – We expect to incur costs in the range of $500 per container for regulatory testing in Israel.

Import Costs – Importing the diapers into Israel will incur the following costs, which costs we plan to pass along to the customer.

|

Import Costs Per Pack Per 40' Container

|

|||||||||||||||||||||||||||||||||

|

Sizes

|

Shipping

|

IT

|

Testing

|

Surcharges

|

Import Duty

|

VAT

|

Inspection and

Verification

|

Total Costs

|

|||||||||||||||||||||||||

| 2 | $ | 0.42 | $ | 0.0097 | $ | 0.0812 | $ | 0.0443 | $ | 0.42 | $ | 0.56 | $ | 0.16 | $ | 1.70 | |||||||||||||||||

| 3 | $ | 0.36 | $ | 0.0082 | $ | 0.0687 | $ | 0.0427 | $ | 0.42 | $ | 0.56 | $ | 0.14 | $ | 1.59 | |||||||||||||||||

| 4 | $ | 0.33 | $ | 0.0075 | $ | 0.0625 | $ | 0.0429 | $ | 0.43 | $ | 0.57 | $ | 0.13 | $ | 1.56 | |||||||||||||||||

| 5 | $ | 0.29 | $ | 0.0067 | $ | 0.0562 | $ | 0.0418 | $ | 0.42 | $ | 0.56 | $ | 0.11 | $ | 1.50 | |||||||||||||||||

Sales Strategy

We have been in direct contact with numerous stores and distributors over the last year. All have expressed different levels of interest in our product, but we have not entered into any agreements with any of these potential customers and distributors.

We plan to sell our private label disposable diapers via the following methods:

|

|

·

|

Sales directly to retail chain stores located within the Orthodox Jewish community in Israel, such as Shefa Shuk, Yesh, Bar Kol, Hachi Kedai, Osher Ad Kolel Stores, Baby Michelle, and Co-op Israel.

|

|

|

·

|

Utilization of distributors such as Amot Shivuk, Gal Hafatze, and Netiv Hachesed that distribute to mom and pop shops throughout Israel.

|

18

We currently envision two methods for selling our private label disposable diapers.

|

|

·

|

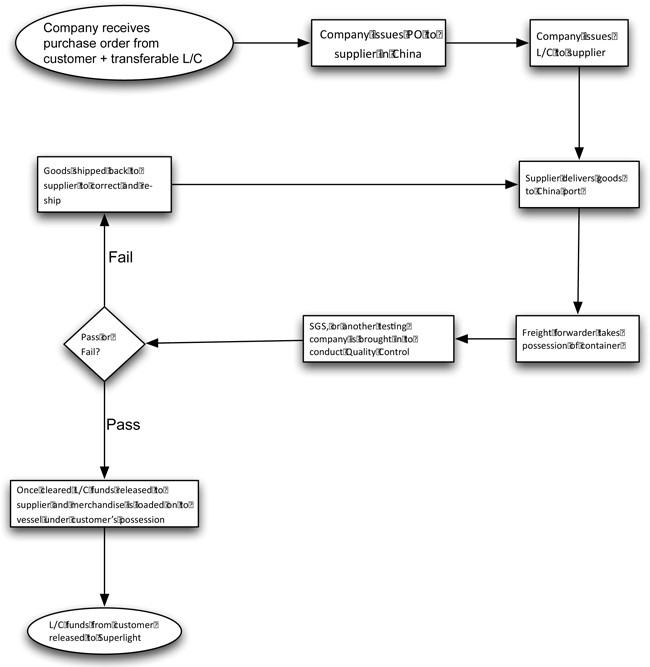

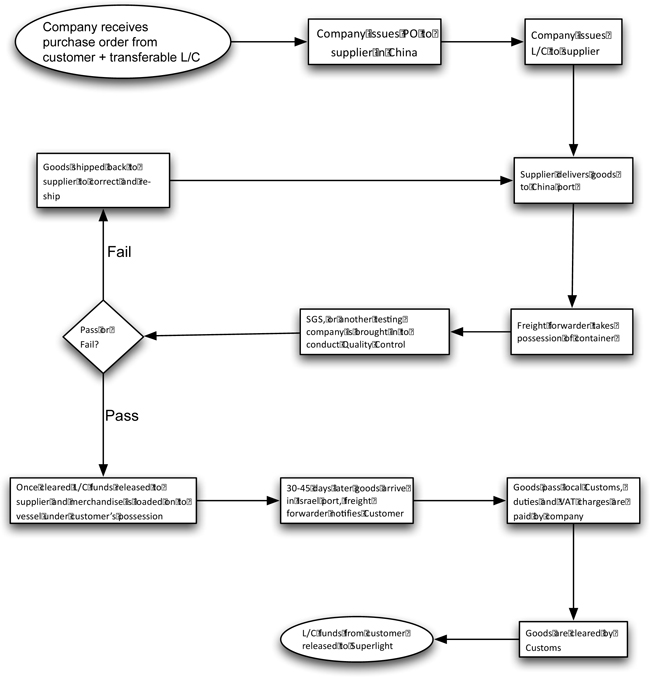

Method 1: Sell directly to retail chain stores. In this case, we would seek to sell the products on a FOB (freight on board) basis from the country of origin (on a container full load basis -either a 20 or 40 foot container). We would seek to be paid via a letter of credit, so that we would have guaranteed payment when paying the manufacturer for the disposable diapers. The customer will be responsible for costs relating shipping, duties, VAT and customs.

|

|

|

·

|

Method 2: Sell our disposable diapers to chain stores via distributors who would offer us a guarantee for payment upon the arrival of the goods in Israel. In this method, we would sell the goods on a landed costs basis, meaning that we would pay for costs relating to shipping, duties, VAT and customs. Under this method, we would have to seek bank financing to pay our manufacturer, and the bank would have to be satisfied with the retail chain store/distributor guarantee. We cannot provide any assurances that we will be able to obtain such financing.

|

Inspection/Verification and Regulatory Testing

We intend to hire a company, such as SGS, SA, a global inspection, verification, testing, and certification company, to inspect the goods at the port of export in China. SGS would inspect random samples and test for product defects. We expect to incur costs in the range of $1,000 per 40’ container for inspecting and verification of goods. Inspection will include:

|

|

·

|

Verification of quantity

|

|

|

·

|

Load/Item Integrity (inspect for damage)

|

|

|

·

|

Item Verification (actual item to item label)

|

|

|

·

|

Packaging Verification

|

|

|

·

|

Shipping document verification

|

In addition, regulatory testing costs in Israel are estimated to be $500 per container, each time a container arrives in the Israeli Port, with such regulatory testing to be performed by the Israeli Standards Institute.

Marketing/Advertising Strategy

We plan to advertise our private label disposable diapers via conventional marketing techniques. We intend to hire an advertising agency that specializes in marketing to our initial target market, which will be the Orthodox Jewish community in Israel, a market comprised of large families that are price conscious. Although we have not held any preliminary discussions with any advertising agency, our officers have conducted market research into the adverting costs associated with this strategy.

Since a majority of Orthodox Jewish households do not have TVs or Internet access, our advertising will be focused on outdoor billboards and on newspaper advertisements in newspapers that serve the Orthodox Jewish community, such as Ha’Modia (daily newspaper), Makor Rishon (weekly newspaper), and Mishpacha (weekly magazine).

The following are the advertising rates for print advertisements:

Ha’Modia

½ Weekend Page - $1708 (advertise 5 get one free)

Whole weekend page – $2617 (advertise 5 get one free)

½ Weekday Page – $1322 (advertise 5 get one free)

Whole Weekday Page – $1928 (advertise 5 get one free)

Makor Rishon

½ Weekend Page (Weekend Magazine “Dyokan”) - $2480.

Whole weekend page (Weekend Magazine “Dyokan”) – $3500.

Mishpacha

½ Page - $2480 (advertise 4 get one free)

Whole weekend page – $745 (advertise 4 get one free)

We anticipate our advertising budget to be as follows:

|

|

•

|

$10,000 in the first 2 months after receiving our first order.

|

19

|

|

•

|

$24,000 over the next 10 months as necessary (based on arrival of merchandise in supermarkets)

|

Budget of $5000 a month for 2 months:

|

Newspaper

|

No. of Ads

|

Price per Ad

|

No. of weeks

|

Total

|

|||||||

|

Ha’Modia

|

2 ½ Weekday Pages

|

$ | 1322 |

2 advertisements in total, with 1 advertisement running every month.

|

$ | 2,644 | |||||

|

Makor Rishon

|

2 ½ Weekend Pages

|

$ | 2480 |

2 advertisements in total, with 1 advertisement running every month

|

$ | 4,960 | |||||

|

Mishpacha

|

4 Whole weekend pages

|

$ | 745 |

4 advertisements +1 free one from magazine.

3 advertisements will run in the first month and 2 advertisements in the second month

|

$ | 2,980 | |||||

|

Total

|

$ | 10,584 | |||||||||

Budget of $2,200 a month for 10 months:

|

Newspaper

|

No. of Ads

|

Price per Ad

|

No. of weeks

|

Total

|

|||||||

|

Ha’Modia

|

10*½ Weekday Page

|

$ | 1,322 |

10 advertisements + 2 free bonus advertisements from newspaper.

2 advertisements will run every month in months 3 and 4 and thereafter from month 5-10, one advertisement per month.

|

$ | 13,220 | |||||

|

Mishpacha

|

8* Whole weekend page

|

$ | 745 |

8 advertisements + 2 free bonus advertisements from magazine.

One advertisement every month

|

$ | 5960 | |||||

|

Total

|

$ | 19,180 | |||||||||

Activities to Date

We were incorporated under the laws of the State of Delaware on December 27, 2007. We are a development stage company. We currently have no employees. From our inception to date, we have not generated any revenues, and our operations have been limited to organizational and start-up activities.

We have conducted market research into the disposable diaper market in Israel, and the costs related to purchasing private label disposable diapers from manufactures in China, and selling such products in Israel. Our research covered:

|

|

·

|

the different types and brands of disposable diapers currently available on the local market;

|

|

|

·

|

the costs of using manufacturers in China;

|

|

|

·

|

the costs of shipping, warehousing, and distributing goods in Israel;

|

|

|

·

|