Attached files

| file | filename |

|---|---|

| 8-K - DIGITAL SYSTEMS 8-K - Digital Systems, Inc. | digitalsystems8k.htm |

Exhibit 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF KANSAS

KANSAS CITY DIVISION

| IN RE: ) | |||

| ) | Case No. 11-20140-11-rdb | ||

| ICOP DIGITAL, INC. ) | Chapter 11 | ||

| Debtor. ) | |||

| ) |

DEBTOR'S STANDARD MONTHLY OPERATING REPORT (BUSINESS)

FOR THE PERIOD

FROM April 1 2011 TO April 30 2011

Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines established by the United States Trustee and FRBP 2015.

|

/s/ Joanne B. Stutz

|

|

|

Attorney for Debtor’s Signature

|

|

|

|

|

|

Debtor's Address

|

Attorney's Address

|

|

and Phone Number:

|

and Phone Number:

|

| 16801 West 116th Street | 7225 Renner Road, Suite 200 |

|

Lenexa, KS 66219

|

Shawnee, KS 66217 |

|

(913) 962-8700; (913) 962-8701 (FAX)

|

Note: The original Monthly Operating Report is to be filed with the court and a copy simultaneously provided to the United States Trustee Office. Monthly Operating Reports must be filed by the 21st day of the following month.

For assistance in preparing the Monthly Operating Report, refer to the following resources on the United States Trustee Program Website, http://www.justice.gov/ust/r20/index.htm.

|

1)

|

Instructions for Preparations of Debtor’s Chapter 11 Monthly Operating Report

|

|

2)

|

Initial Filing Requirements

|

|

3)

|

Frequently Asked Questions (FAQs)http://www.usdoj.gov/ust/

|

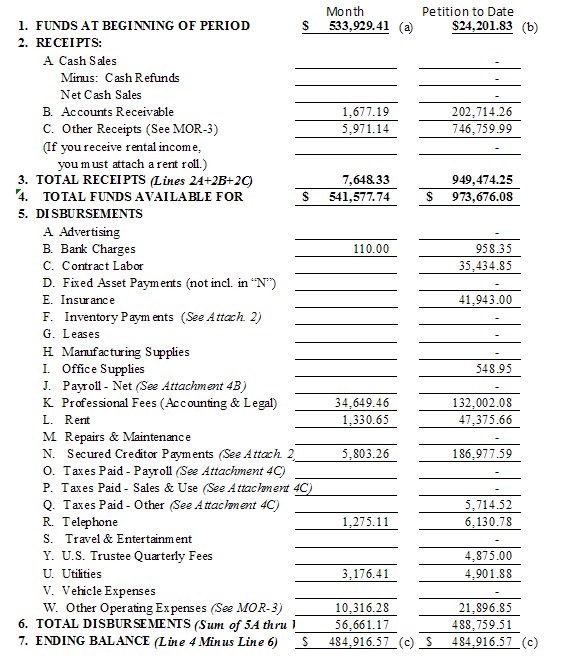

MOR-1

SCHEDULE OF RECEIPTS AND DISBURSEMENTS

FOR THE PERIOD BEGINNING April 1 2011 AND ENDING April 30 2011

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Date of Petition: January 21, 2011

I declare under penalty of perjury that this statement and the accompanying documents and reports are true and correct to the best of my knowledge and belief.

|

This 18th day of May, 2011.

|

/s/ David C. Owen

|

|

|

By: David C. Owen, Chairman/CEO

|

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This figure will not change from month to month. It is always the amount of funds on hand as of the date of the petition.

(c)These two amounts will always be the same if form is completed correctly.

Month Petition to Date

1- FUNDS AT BEGINNING OF PERIOD $ 533,929.41 (a) $24,201.83 (b) 2. RECEIPTS: A Cash Sales

Minus: Cash Refunds

A Net Cash Sales -

R Accounts Receivable 1,677.19 202,71426

C. Other Receipts (See MOR-3) 5,971.14 746,759.99

(If you receive rental income, you must attach a rent roll)

TOTAL RECEIPTS (Lines 2A+2B+2C) 7,648.33 949,474.25

TOTAL FUNDS AVAILABLE FOR $541,577.74 $973,676.08

DISBURSEMENTS

A Advertising -

R Bank Charges 110.00 958.35

C. Contract Labor 35,434.15

D. Fnted Asset Payments (not incl. in "N") -

E Insurance 41,943.00

F Inventory Payments (See Attach. 2)

G. Leases

H Manufacturing Supplies -

I Office Supplies 548.95

J. Payroll - Net (See Attachment 4B) -

K Professional Fees (Accounting & Legal) 34,649.46 132,002.08

L Rent 1,330.65 47,375.66

M Repairs & Maintenance -

N Secured Credit Payments (See Attach. 2 5,TO3.26 186,977.59

O. Taxes Paid - Payroll (See Attachment 4C)

P. Taxes Paid- Sales & Use (See Attachment 4C) -

Q Taxes Paid - Other (See Attachment 4C) 5,714.52

R Telephone 1,275.11 6,130.71

S. Travel & Entertainment -

Y. U.S. Trustee Quarterly Fees 4,175.00

U. Utilities 3,176.41 4,901.88

V. Vehicle Expenses -

W Other Operating Expenses (See MOR-3) 10,316.28 21,196.15

TOTAL DISBURSEMENTS (Sum of 5A thru 56,661.17 488,759.51

ENDING BALANCE (Line 4 Minus Line 6) $ 484,916.57 (c) $ 414,916.57 (c)

MOR-2

MONTHLY SCHEDULE OF RECEIPTS AND DISBURSEMENTS (cont’d)

Detail of Other Receipts and Other Disbursements

OTHER RECEIPTS:

Describe Each Item of Other Receipt and List Amount of Receipt. Write totals on Page MOR-2, Line 2C.

|

Description

|

Current Month

|

Cumulative

Petition to Date

|

|

|

TOTAL OTHER RECEIPTS

|

Refunds

|

5,971.14

|

“Other Receipts” includes Loans from Insiders and other sources (i.e. Officer/Owner, related parties directors, related corporations, etc.). Please describe below:

|

Loan Amount

|

Source

of Funds

|

Purpose

|

Repayment Schedule

|

|||

OTHER DISBURSEMENTS:

Describe Each Item of Other Disbursement and List Amount of Disbursement. Write totals on Page MOR-2, Line 5W.

|

Description

|

Current Month

|

Cumulative

Petition to Date

|

|||

|

TOTAL OTHER DISBURSEMENTS

|

|||||

NOTE: Attach a current Balance Sheet and Income (Profit & Loss) Statement.

MOR-3

ATTACHMENT 1

MONTHLY ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

ACCOUNTS RECEIVABLE AT PETITION DATE:

ACCOUNTS RECEIVABLE RECONCILIATION

(Include all accounts receivable, pre-petition and post-petition, including charge card sales which have not been received):

| Beginning of Month Balance | $ 177,817(a) |

| PLUS: Current Month New Billings | |

| MINUS: Collection During the Month | $ (b) |

| PLUS/MINUS: Adjustments or Writeoffs | $ 1,677.19* |

| End of Month Balance | $ 176,140(c) |

*For any adjustments or Write-offs provide explanation and supporting documentation, if applicable:

Customer receipts paid to FCG offset against interest and penalty fees

Adjustment made to refund overpayment on account.

POST PETITION ACCOUNTS RECEIVABLE AGING

(Show the total for each aging category for all accounts receivable)

|

|

0-30 Days

|

31-60 Days

|

61-90 Days

|

Over 90Days

|

Total

|

|

Current

|

1 - 30

|

31 - 60

|

61 - 90

|

> 90

|

TOTAL

|

|||||||

|

TOTAL

|

0.00

|

0.00

|

(199,359.28)

|

(2,500.00)

|

377,999.08

|

176,139.80

|

||||||

For any receivables in the “Over 90 Days” category, please provide the following:

|

Customer

|

Receivable

Date

|

Status (Collection efforts taken, estimate of collectibility, write-off, disputed account, etc.)

|

||

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This must equal the number reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 2B).

(c)These two amounts must equal.

MOR-4

ATTACHMENT 2

MONTHLY ACCOUNTS PAYABLE AND SECURED PAYMENTS REPORT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

In the space below list all invoices or bills incurred and not paid since the filing of the petition. Do not include amounts owed prior to filing the petition. In the alternative, a computer generated list of payables may be attached provided all information requested below is included.

POST-PETITION ACCOUNTS PAYABLE

|

Date

Incurred

|

Days

Outstanding

|

Vendor

|

Description

|

Amount

|

||||

| See attached | ||||||||

|

TOTAL AMOUNT

|

(b) |

X Check here if pre-petition debts have been paid. Attach an explanation and copies of supporting

documentation.

ACCOUNTS PAYABLE RECONCILIATION (Post Petition Unsecured Debt Only)

|

Opening Balance

|

$ 4,941.02 (a)

|

| PLUS: New Indebtedness Incurred This Month | $ |

|

MINUS: Amount Paid on Post Petition,

Accounts Payable This Month

|

$

|

| PLUS/MINUS: Adjustments |

$ *

|

| Ending Month Balance | $ 4,941.02 (c) |

*For any adjustments provide explanation and supporting documentation, if applicable.

MOR-5

SECURED PAYMENTS REPORT

List the status of Payments to Secured Creditors and Lessors (Post Petition Only). If you have entered into a modification agreement with a secured creditor/lessor, consult with your attorney and the United States Trustee Program prior to completing this section).

|

Secured

Creditor/

Lessor

|

Date

Payment

Due This

Month

|

Amount

Paid This

Month

|

Number

of Post

Petition

Payments

Delinquent

|

Total

Amount of

Post Petition

Payments

Delinquent

|

||||

|

TOTAL

|

(d) |

(a)This number is carried forward from last month’s report. For the first report only, this number will be zero.

(b, c)The total of line (b) must equal line (c).

(d)This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5N).

MOR-6

ATTACHMENT 3

INVENTORY AND FIXED ASSETS REPORT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

INVENTORY REPORT

| INVENTORY BALANCE AT PETITION DATE: | $ |

| INVENTORY RECONCILIATION: | |

| Inventory Balance at Beginning of Month | $ 0.00(a) |

| PLUS: Inventory Purchased During Month | |

| MINUS: Inventory Used or Sold | $ |

| PLUS/MINUS: Adjustments or Write-downs | $ * |

|

Inventory on Hand at End of Month

|

$ 0.00 |

| METHOD OF COSTING INVENTORY: FIFO |

*For any adjustments or write-downs provide explanation and supporting documentation, if applicable.

Sale of Assets March 2011.

INVENTORY AGING

|

Less than 6

months old

|

6 months to

2 years old

|

Greater than

2 years old

|

Considered

Obsolete

|

Total Inventory

|

|

%

|

100.00 %

|

%

|

% = |

100%*

|

* Aging Percentages must equal 100%.

o Check here if inventory contains perishable items.

Description of Obsolete Inventory:

FIXED ASSET REPORT

|

FIXED ASSETS FAIR MARKET VALUE AT PETITION DATE:

|

$ 1.219.241.95(b)

|

|

(Includes Property, Plant and Equipment)

|

|

| BRIEF DESCRIPTION (First Report Only): | |

| FIXED ASSETS RECONCILIATION: | |

| Fixed Asset Book Value at Beginning of Month | $ 1,000,259.41 (a)(b) |

| MINUS: Depreciation Expense | $ |

| PLUS: New Purchases | $ |

| PLUS/MINUS: Adjustments or Write-downs | $ * |

|

Ending Monthly Balance

|

$ 1,000,259.41

|

*For any adjustments or write-downs, provide explanation and supporting documentation, if applicable.

Asset Sale March 2011.

BRIEF DESCRIPTION OF FIXED ASSETS PURCHASED OR DISPOSED OF DURING THE REPORTING PERIOD:

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)Fair Market Value is the amount at which fixed assets could be sold under current economic conditions. Book Value is the cost of the fixed assets minus accumulated depreciation and other adjustments.

MOR-7

ATTACHMENT 4A

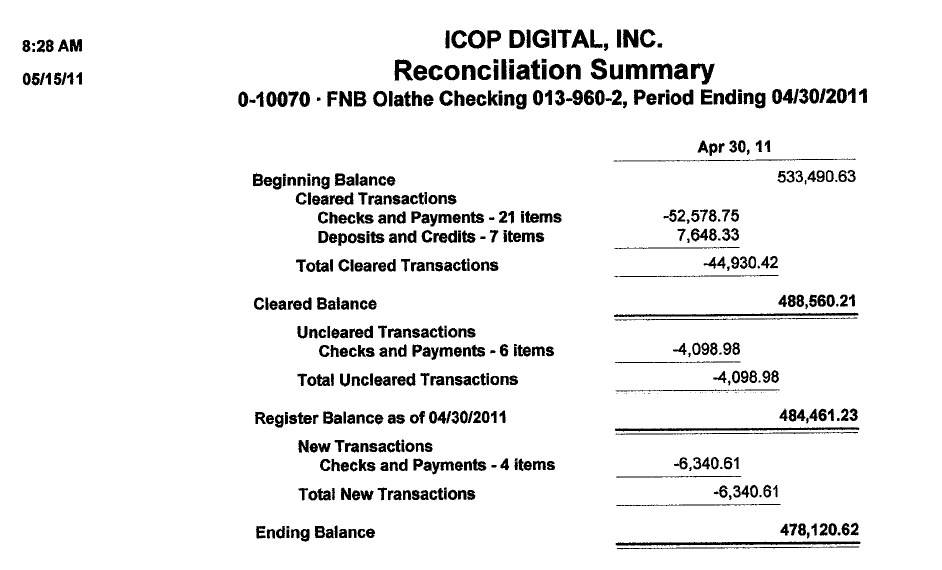

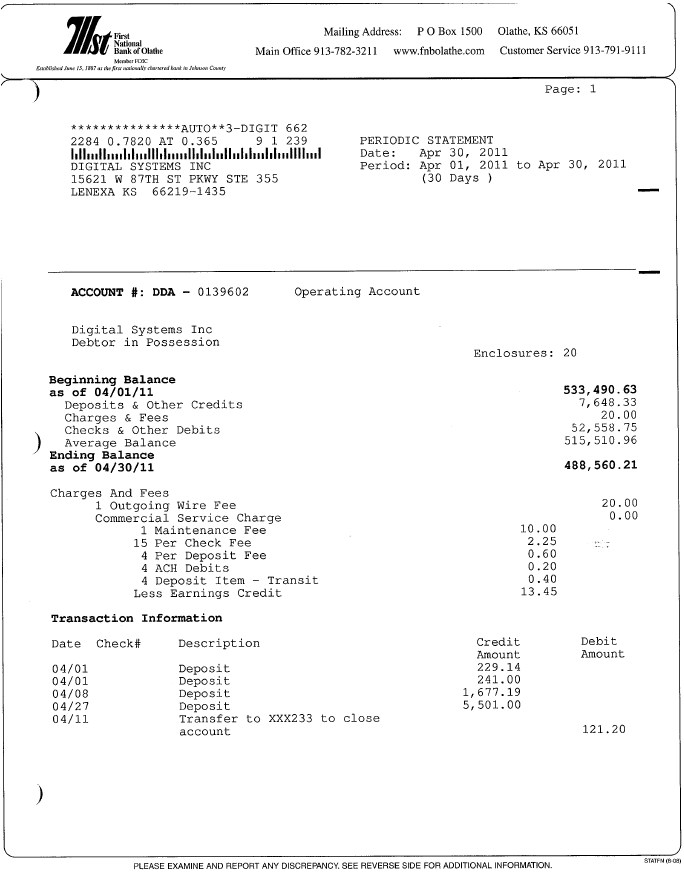

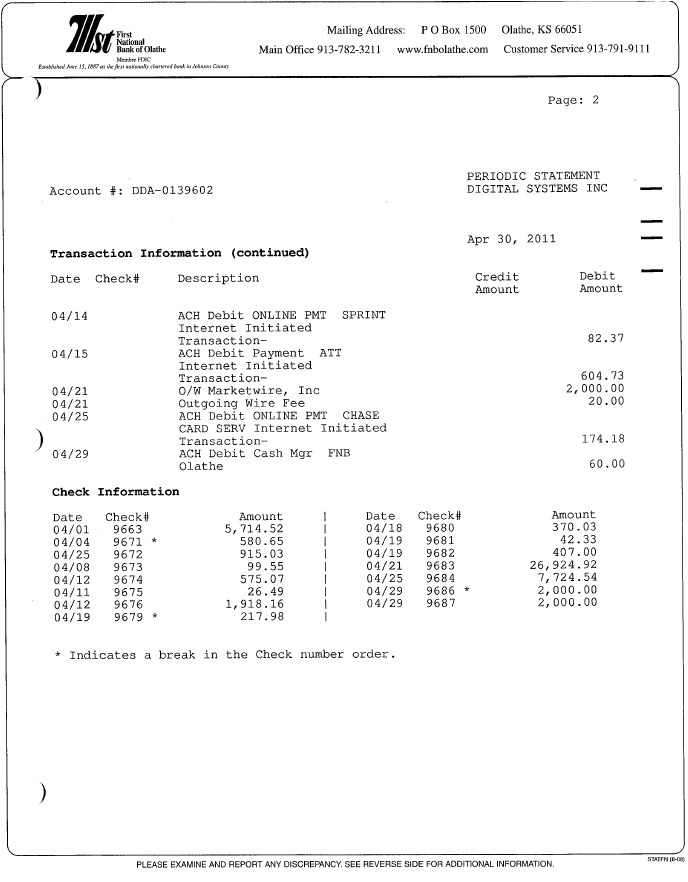

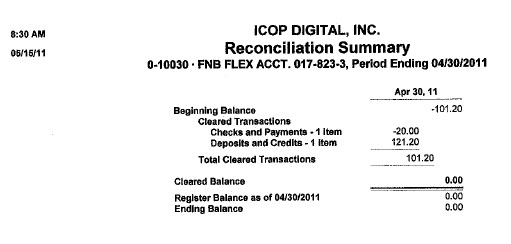

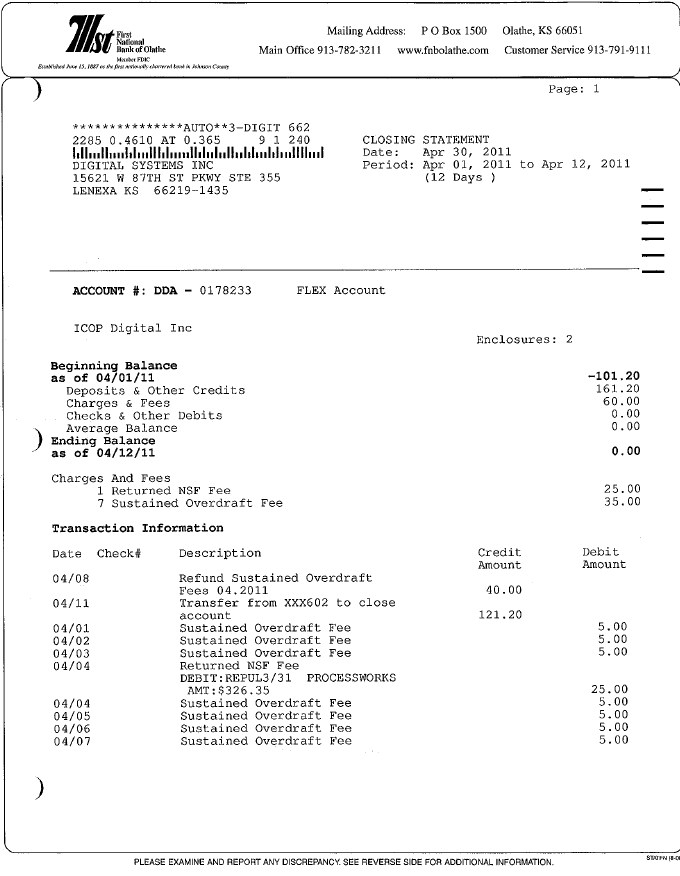

MONTHLY SUMMARY OF BANK ACTIVITY - OPERATING ACCOUNT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm. If bank accounts other than the three required by the United States Trustee Program are necessary, permission must be obtained from the United States Trustee prior to opening the accounts. Additionally, use of less than the three required bank accounts must be approved by the United States Trustee.

| NAME OF BANK: FNB Olathe BRANCH: | |

| ACCOUNT NAME: Operating Account ACCOUNT NUMBER: 0139602 | |

| PURPOSE OF ACCOUNT: OPERATING | |

|

Ending Balance per Bank Statement

|

$ 488,560.21 |

| Plus Total Amount of Outstanding Deposits | $ |

|

Minus Total Amount of Outstanding Checks and other debits

|

$ 4,098.98* |

|

Minus Service Charges

|

$ |

| Ending Balance per Check Register | $ 484,461.23**(a) |

*Debit cards are used by

**If Closing Balance is negative, provide explanation:

The following disbursements were paid in Cash (do not includes items reported as Petty Cash on Attachment 4D: ( ☐ Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee | Purpose | Reason for Cash Disbursement |

TRANSFERS BETWEEN DEBTOR IN POSSESSION ACCOUNTS

“Total Amount of Outstanding Checks and other debits”, listed above, includes:

$________________Transferred to Payroll Account

$________________Transferred to Tax Account

(a) The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-8

ATTACHMENT 5A

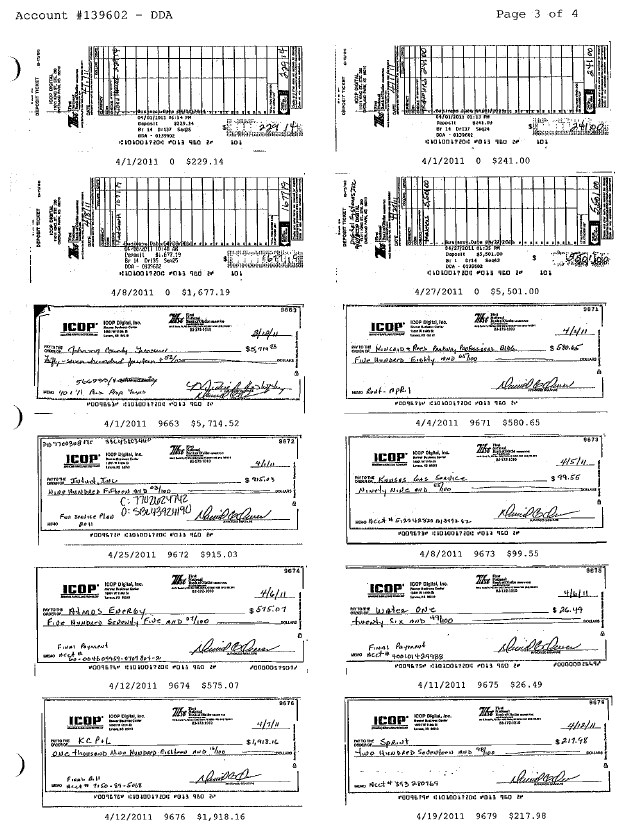

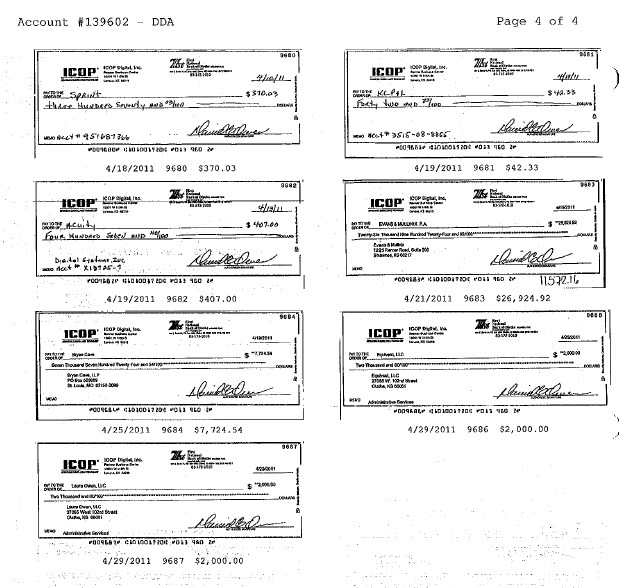

CHECK REGISTER - OPERATING ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: OPERATING

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

|||

| TOTAL | $ |

MOR-9

ATTACHMENT 4B

MONTHLY SUMMARY OF BANK ACTIVITY - PAYROLL ACCOUNT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: FNB Olathe BRANCH:

ACCOUNT NAME: Payroll Account ACCOUNT NUMBER: 0149527

PURPOSE OF ACCOUNT: PAYROLL

| Ending Balance per Bank Statement | $465.34 |

| Plus Total Amount of Outstanding Deposits | $ |

| Minus Total Amount of Outstanding Checks and other debits | $ * |

| Minus Service Charges | $ |

| Ending Balance per Check Register | $ 465.34**(a) |

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( o Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee |

Purpose

|

Reason for Cash Disbursement | |||

|

The following non-payroll disbursements were made from this account:

|

|||||||

| Date | Amount | Payee | Purpose | Reason for disbursement from this account | |||

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-10

ATTACHMENT 5B

CHECK REGISTER - PAYROLL ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME:

ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: PAYROLL

Account for all disbursements, including voids, lost payments, stop payment, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

|||

| TOTAL | $ |

MOR-11

ATTACHMENT 4C

MONTHLY SUMMARY OF BANK ACTIVITY - TAX ACCOUNT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found on the United States Trustee website, http://www.justice.gov/ust/r20/index.htm.

NAME OF BANK: BRANCH:

ACCOUNT NAME: ACCOUNT NUMBER:

PURPOSE OF ACCOUNT: TAX

|

Ending Balance per Bank Statement

|

$ |

| Plus Total Amount of Outstanding Deposits | $ |

| Minus Total Amount of Outstanding Checks and other debits | $ * |

| Minus Service Charges | $ |

| Ending Balance per Check Register | $ **(a) |

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation:

The following disbursements were paid by Cash: ( o Check here if cash disbursements were authorized by United States Trustee)

| Date | Amount | Payee |

Purpose

|

Reason for Cash Disbursement | ||||

|

The following non-tax disbursements were made from this account:

|

||||||||

| Date | Amount | Payee | Purpose | Reason for disbursement from this account | ||||

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-12

ATTACHMENT 5C

CHECK REGISTER - TAX ACCOUNT

Name of Debtor: Case Number:

Reporting Period beginning Period ending

NAME OF BANK: BRANCH:

ACCOUNT NAME: ACCOUNT #

PURPOSE OF ACCOUNT: TAX

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer-generated check register can be attached to this report, provided all the information requested below is included.

http://www.usdoj.gov/ust.

|

DATE

|

CHECK

NUMBER

|

PAYEE

|

PURPOSE

|

AMOUNT

|

|||||

| TOTAL | (d) |

SUMMARY OF TAXES PAID

|

Payroll Taxes Paid

|

(a) |

|

Sales & Use Taxes Paid

|

(b) |

|

Other Taxes Paid

|

(c) |

|

TOTAL

|

(d) |

(a) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5O).

(b) This number is reported in the “Current Month” column of Schedule or Receipts and Disbursements (Page MOR-2, Line 5P).

(c) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5Q).

(d) These two lines must be equal.

MOR-13

ATTACHMENT 4D

INVESTMENT ACCOUNTS AND PETTY CASH REPORT

INVESTMENT ACCOUNTS

Each savings and investment account, i.e. certificates of deposits, money market accounts, stocks and bonds, etc., should be listed separately. Attach copies of account statements.

Type of Negotiable

|

Instrument

|

Face Value

|

Purchase Price

|

Date of Purchase

|

Current

Market Value

|

|||||

| TOTAL | (a) |

PETTY CASH REPORT

The following Petty Cash Drawers/Accounts are maintained:

| (Column 2) | (Column 3) |

(Column 4)

|

||||

|

Location of

Box/Account

|

Maximum

Amount of Cash

in Drawer/Acct.

|

Amount of Petty

Cash On Hand

At End of Month

|

Difference between

(Column 2) and

(Column 3)

|

|||

|

TOTAL

|

$ | (b) |

For any Petty Cash Disbursements over $100 per transaction, attach copies of receipts. If there are no receipts, provide an explanation

TOTAL INVESTMENT ACCOUNTS AND PETTY CASH(a + b) $ (c)

(c)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

MOR-14

ATTACHMENT 6

MONTHLY TAX REPORT

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

TAXES OWED AND DUE

Report all unpaid post-petition taxes including Federal and State withholding FICA, State sales tax, property tax, unemployment tax, State workmen's compensation, etc.

|

Name of

Taxing

Authority

|

Date

Payment

Due

|

Description

|

Amount

|

Date Last

Tax Return

Filed

|

Tax Return

Period

|

|||||

|

|

||||||||||

|

|

||||||||||

|

|

||||||||||

|

|

||||||||||

|

|

||||||||||

| TOTAL | $ |

MOR-15

ATTACHMENT 7

SUMMARY OF OFFICER OR OWNER COMPENSATION

SUMMARY OF PERSONNEL AND INSURANCE COVERAGES

Name of Debtor: ICOP Digital, Inc. Case Number: 11-20140-11-rdb

Reporting Period beginning April 1 2011 Period ending April 30 2011

Report all forms of compensation received by or paid on behalf of the Officer or Owner during the month. Include car allowances, payments to retirement plans, loan repayments, payments of Officer/Owner’s personal expenses, insurance premium payments, etc. Do not include reimbursement for business expenses Officer or Owner incurred and for which detailed receipts are maintained in the accounting records.

| Name of Officer or Owner | Title |

Payment

Description

|

Amount Paid

|

||

PERSONNEL REPORT

| Full Time | Part Time | |

| Number of employees at beginning of period | 0 | 0 |

|

Number hired during the period

|

||

| Number terminated or resigned during period | ||

| Number of employees on payroll at end of period | 0 | 0 |

CONFIRMATION OF INSURANCE

List all policies of insurance in effect, including but not limited to workers' compensation, liability, fire, theft, comprehensive, vehicle, health and life. For the first report, attach a copy of the declaration sheet for each type of insurance. For subsequent reports, attach a certificate of insurance for any policy in which a change occurs during the month (new carrier, increased policy limits, renewal, etc.).

|

Agent

and/or

Carrier

|

Phone

Number

|

Policy

Number

|

Coverage

Type

|

Expiration

Date

|

Date

Premium

Due

|

|

CBIZ Insurance, Kathy Beamis, 913-234-1918

|

|||||

| Travelers Property | TT06303657 | General Liab | 1/1/2012 | 1/1/2011 | |

| Travelers Indemnity | BA3885P20611TEC | Auto Liab | 1/1/2012 | 1/1/2011 | |

| Travelers Property | TT06303658 | Umbrella Liab | 1/1/2012 | 1/1/2011 | |

| Standard Fire Ins Co | HCUB3751P66A11 | Work Comp | 1/1/2012 | 1/1/2011 | |

| D&O | |||||

The following lapse in insurance coverage occurred this month:

|

Policy

Type

|

Date

Lapsed

|

Date

Reinstated

|

Reason for Lapse

|

|

G

|

Check here if U. S. Trustee has been listed as Certificate Holder for all insurance policies.

|

MOR-16

ATTACHMENT 8

SIGNIFICANT DEVELOPMENTS DURING REPORTING PERIOD

Information to be provided on this page, includes, but is not limited to: (1) financial transactions that are not reported on this report, such as the sale of real estate (attach closing statement); (2) non-financial transactions, such as the substitution of assets or collateral; (3) modifications to loan agreements; (4) change in senior management, etc. Attach any relevant documents.

We anticipate filing a Plan of Liquidation and Disclosure Statement as soon as possible after liquidation of the assets.

MOR-17

|

Apr 30, 11

|

Mar 31, 11

|

||||||||

|

ASSETS

|

|||||||||

|

Current Assets

|

|||||||||

|

Checking/Savings

|

|||||||||

|

Cash Accounts

|

|||||||||

|

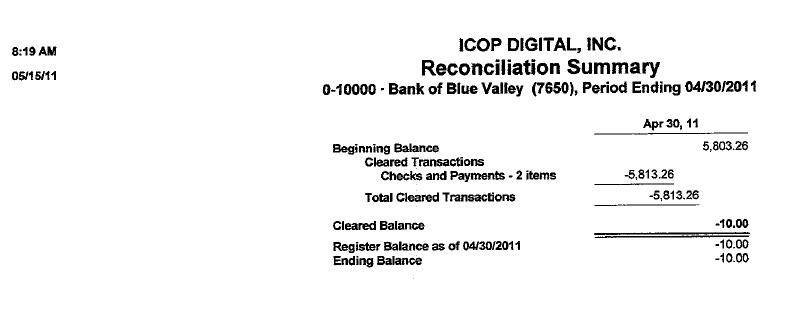

0-10000 · Bank of Blue Valley (7650)

|

(10.00)

|

5,803.26

|

|||||||

|

0-10030 · FNB FLEX ACCT. 017-823-3

|

0.00

|

(101.20)

|

|||||||

|

0-10070 · FNB Olathe Checking 013-960-2

|

484,461.23

|

527,762.02

|

|||||||

|

0-10080 · FNB Payroll Acct. 014-952-7

|

465.34

|

465.34

|

|||||||

|

Total Cash Accounts

|

484,916.57

|

533,929.42

|

|||||||

|

Foreign Cash Accounts

|

|||||||||

|

0-10200 · YEN Bank of America 11407006

|

(3,465.15)

|

(3,465.15)

|

|||||||

|

0-10210 · Yen Currency Fluctuation

|

3,465.15

|

3,465.15

|

|||||||

|

Total Foreign Cash Accounts

|

0.00

|

0.00

|

|||||||

|

Total Checking/Savings

|

484,916.57

|

533,929.42

|

|||||||

|

Accounts Receivable

|

|||||||||

|

Accounts Receivable

|

|||||||||

|

0-11000 · Accounts Receivable - Trade

|

252,876.73

|

254,553.92

|

|||||||

|

0-11010 · Accounts Receivable - Dealers

|

23,719.75

|

23,719.75

|

|||||||

|

0-11100 · Allowance for Doubtful Accounts

|

(100,456.68)

|

(100,456.68)

|

|||||||

|

Total Accounts Receivable

|

176,139.80

|

177,816.99

|

|||||||

|

Total Accounts Receivable

|

176,139.80

|

177,816.99

|

|||||||

|

Other Current Assets

|

|||||||||

|

Other Current Assets

|

|||||||||

|

0-14110 · Employee Benefits - FLEX WH

|

(787.62)

|

(787.62)

|

|||||||

|

0-14120 · Employee Benefits - Guardian

|

866.56

|

866.56

|

|||||||

|

0-14130 · Employee Benefits - UHC

|

149.74

|

149.74

|

|||||||

|

0-14140 · Employee Benefits - Aflac

|

75.21

|

75.21

|

|||||||

|

Total Other Current Assets

|

303.89

|

303.89

|

|||||||

|

Total Other Current Assets

|

303.89

|

303.89

|

|||||||

|

Total Current Assets

|

661,360.26

|

712,050.30

|

|||||||

|

Fixed Assets

|

|||||||||

|

Property Plant & Equipment, Net

|

|||||||||

|

Property Plant and Equipment

|

|||||||||

|

0-15500 · Land

|

1,000,259.41

|

1,000,259.41

|

|||||||

|

Total Property Plant and Equipment

|

1,000,259.41

|

1,000,259.41

|

|||||||

|

Total Property Plant & Equipment, Net

|

1,000,259.41

|

1,000,259.41

|

|||||||

|

Total Fixed Assets

|

1,000,259.41

|

1,000,259.41

|

|||||||

|

Other Assets

|

|||||||||

|

Long Term Assets

|

|||||||||

|

0-18100 · Security Deposit on Lease

|

17,500.00

|

17,500.00

|

|||||||

|

Total Long Term Assets

|

17,500.00

|

17,500.00

|

|||||||

|

Total Other Assets

|

17,500.00

|

17,500.00

|

|||||||

|

TOTAL ASSETS

|

1,679,119.67

|

1,729,809.71

|

|||||||

|

LIABILITIES & EQUITY

|

|||||||||

|

Liabilities

|

|||||||||

|

Current Liabilities

|

|||||||||

|

Accounts Payable

|

|||||||||

|

Accounts Payable

|

|||||||||

|

0-20000 · Accounts Payable

|

1,187,056.11

|

1,187,056.11

|

|||||||

|

0-20100 · Accounts Payable - Chpt 11

|

4,941.02

|

4,941.02

|

|||||||

|

Total Accounts Payable

|

1,191,997.13

|

1,191,997.13

|

|||||||

|

Total Accounts Payable

|

1,191,997.13

|

1,191,997.13

|

|||||||

|

Other Current Liabilities

|

|||||||||

|

Accrued Liabilities

|

|||||||||

|

Accrued Expenses

|

|||||||||

|

0-21000 · Accrued Expenses - Other

|

52,257.40

|

52,257.40

|

|||||||

|

0-21010 · Accrued Property Taxes

|

26,686.29

|

26,686.29

|

|||||||

|

0-21020 · Accrued Sales Tax

|

3,366.29

|

3,366.29

|

|||||||

|

Total Accrued Expenses

|

82,309.98

|

82,309.98

|

|||||||

|

Accrued Payroll

|

|||||||||

|

0-21100 · Accrued Vacation pay

|

198,707.02

|

198,707.02

|

|||||||

|

0-21120 · Accrued Commissions

|

18,234.00

|

18,234.00

|

|||||||

|

0-21130 · Accrued Payroll

|

37,041.80

|

37,041.80

|

|||||||

|

Total Accrued Payroll

|

253,982.82

|

253,982.82

|

|||||||

|

Accrued Benefits

|

|||||||||

|

0-21410 · ESPP Withheld

|

104.71

|

104.71

|

|||||||

|

Total Accrued Benefits

|

104.71

|

104.71

|

|||||||

|

Total Accrued Liabilities

|

336,397.51

|

336,397.51

|

|||||||

|

Notes Payable

|

|||||||||

|

0-22000 · N/P - Bank of Blue Valley

|

479,984.97

|

479,984.97

|

|||||||

|

Total Notes Payable

|

479,984.97

|

479,984.97

|

|||||||

|

Total Other Current Liabilities

|

816,382.48

|

816,382.48

|

|||||||

|

Total Current Liabilities

|

2,008,379.61

|

2,008,379.61

|

|||||||

|

Total Liabilities

|

2,008,379.61

|

2,008,379.61

|

|||||||

|

Equity

|

|||||||||

|

Shareholders' Equity - CS

|

|||||||||

|

0-30000 · Bridge Warrant 2005 Proceeds

|

164,991.75

|

164,991.75

|

|||||||

|

0-30010 · Stock Option Proceeds

|

52,650.00

|

52,650.00

|

|||||||

|

0-30020 · Public Warrant Proceeds

|

769,171.09

|

769,171.09

|

|||||||

|

0-30040 · Common Stock

|

36,343,227.14

|

36,343,227.14

|

|||||||

|

0-30050 · Common Stock Restricted

|

1,560,000.00

|

1,560,000.00

|

|||||||

|

0-30060 · Options Outstanding

|

2,076,270.47

|

2,076,270.47

|

|||||||

|

0-30065 · Warrants

|

88,660.94

|

88,660.94

|

|||||||

|

0-30070 · Offering Costs

|

(2,250,025.22)

|

(2,250,025.22)

|

|||||||

|

Total Shareholders' Equity - CS

|

38,804,946.17

|

38,804,946.17

|

|||||||

|

Other Comprehensive Income

|

|||||||||

|

0-31000 · Deferred currency exchange

|

3,465.15

|

3,465.15

|

|||||||

|

Total Other Comprehensive Income

|

3,465.15

|

3,465.15

|

|||||||

|

0-32000 · Retained Deficit

|

(36,493,467.90)

|

(36,493,467.90)

|

|||||||

|

Net Income

|

(2,644,203.36)

|

(2,593,513.32)

|

|||||||

|

Total Equity

|

(329,259.94)

|

(278,569.90)

|

|||||||

|

TOTAL LIABILITIES & EQUITY

|

1,679,119.67

|

1,729,809.71

|

|||||||

| Apr 11 | |||||

|

Ordinary Income/Expense

|

|||||

|

Expense

|

|||||

|

0-60400 · Professional & Contract Service

|

41,376.50 | ||||

|

0-60500 · Facilities & Maintenance Costs

|

4,100.06 | ||||

|

0-60700 · Business Insurance

|

-5,335.00 | ||||

|

0-60800 · Telecommunications

|

1,275.11 | ||||

|

0-61200 · IT Infrastructure/Software/Sys

|

915.03 | ||||

|

0-61900 · Other Office Expenses

|

2,000.00 | ||||

|

0-62100 · Bank and Loan Charges

|

555.08 | ||||

|

0-99999 · Clearing Account

|

0.00 | ||||

|

Total Expense

|

44,886.78 | ||||

|

Net Ordinary Income

|

-44,886.78

|

||||

|

Other Income/Expense

|

|||||

|

Other Expense

|

|||||

|

0-75000 · Interest Expense

|

5,803.26 | ||||

|

Total Other Expense

|

5,803.26 | ||||

|

Net Other Income

|

-5,803.26

|

||||

|

Net Income

|

-50,690.04

|

||||

|

Type

|

Date

|

Num

|

Name

|

Memo

|

Debit

|

Credit

|

Balance

|

||||||||||||

|

Cash Accounts

|

533,929.42

|

||||||||||||||||||

|

0-10000 · Bank of Blue Valley (7650)

|

5,803.26

|

||||||||||||||||||

|

General Journal

|

04/30/2011

|

21280

|

10.00

|

5,793.26

|

|||||||||||||||

|

General Journal

|

04/30/2011

|

21280

|

5,803.26

|

-10.00

|

|||||||||||||||

|

Total 0-10000 · Bank of Blue Valley (7650)

|

0.00

|

5,813.26

|

-10.00

|

||||||||||||||||

|

0-10030 · FNB FLEX ACCT. 017-823-3

|

-101.20

|

||||||||||||||||||

|

Transfer

|

04/11/2011

|

Funds Transfer

|

121.20

|

20.00

|

|||||||||||||||

|

General Journal

|

04/30/2011

|

21280

|

20.00

|

0.00

|

|||||||||||||||

|

Total 0-10030 · FNB FLEX ACCT. 017-823-3

|

121.20

|

20.00

|

0.00

|

||||||||||||||||

|

0-10070 · FNB Olathe Checking 013-960-2

|

527,762.02

|

||||||||||||||||||

|

Check

|

04/02/2011

|

9671

|

Rees & Kincaid

|

580.65

|

527,181.37

|

||||||||||||||

|

Check

|

04/02/2011

|

9672

|

INTUIT

|

915.03

|

526,266.34

|

||||||||||||||

|

Check

|

04/05/2011

|

9673

|

Kansas Gas Service

|

99.55

|

526,166.79

|

||||||||||||||

|

Check

|

04/06/2011

|

9674

|

ATMOS ENERGY

|

Pay Online

|

575.07

|

525,591.72

|

|||||||||||||

|

Check

|

04/06/2011

|

9675

|

Water District No. 1

|

26.49

|

525,565.23

|

||||||||||||||

|

Check

|

04/06/2011

|

9676

|

Kansas City Power & Light

|

Pay Online

|

1,918.16

|

523,647.07

|

|||||||||||||

|

Check

|

04/06/2011

|

Wire

|

Marketwire Inc.

|

ACH Filing Fees

|

2,000.00

|

521,647.07

|

|||||||||||||

|

Payment

|

04/08/2011

|

Tulelake Police Department

|

66.96

|

521,714.03

|

|||||||||||||||

|

Payment

|

04/08/2011

|

Dana Safety Supply

|

1,610.23

|

523,324.26

|

|||||||||||||||

|

Deposit

|

04/09/2011

|

Deposit

|

241.00

|

523,565.26

|

|||||||||||||||

|

Deposit

|

04/09/2011

|

Deposit

|

229.14

|

523,794.40

|

|||||||||||||||

|

Check

|

04/09/2011

|

9677

|

Last IT

|

2,500.00

|

521,294.40

|

||||||||||||||

|

Check

|

04/09/2011

|

9678

|

Safety Vision

|

445.08

|

520,849.32

|

||||||||||||||

|

Transfer

|

04/11/2011

|

Funds Transfer

|

121.20

|

520,728.12

|

|||||||||||||||

|

Check

|

04/12/2011

|

9679

|

SPRINT

|

ACH

|

217.98

|

520,510.14

|

|||||||||||||

|

Check

|

04/12/2011

|

9680

|

SPRINT

|

ACH

|

370.03

|

520,140.11

|

|||||||||||||

|

Check

|

04/13/2011

|

9681

|

Kansas City Power & Light

|

8726 Bourgade

|

42.33

|

520,097.78

|

|||||||||||||

|

Check

|

04/13/2011

|

9682

|

Acuity

|

8726 Bourgade

|

407.00

|

519,690.78

|

|||||||||||||

|

Check

|

04/14/2011

|

OL

|

AT&T

|

8726 Bourgade

|

604.73

|

519,086.05

|

|||||||||||||

|

Check

|

04/14/2011

|

SPRINT

|

ACH

|

82.37

|

519,003.68

|

||||||||||||||

|

Check

|

04/19/2011

|

9683

|

EVANS & MULLINIX P.A.

|

26,924.92

|

492,078.76

|

||||||||||||||

|

Check

|

04/19/2011

|

9684

|

Bryan Cave, LLP

|

7,724.54

|

484,354.22

|

||||||||||||||

|

Check

|

04/25/2011

|

Chase

|

174.18

|

484,180.04

|

|||||||||||||||

|

Deposit

|

04/27/2011

|

Deposit-Travelers

|

5,501.00

|

489,681.04

|

|||||||||||||||

|

Check

|

04/28/2011

|

9685

|

John Hancock

|

401-K Plan Expense

|

282.00

|

489,399.04

|

|||||||||||||

|

Check

|

04/29/2011

|

9686

|

Equivest, LLC

|

Administrative Services

|

2,000.00

|

487,399.04

|

|||||||||||||

|

Check

|

04/29/2011

|

9687

|

Laura Owen, LLC

|

Administrative Services

|

2,000.00

|

485,399.04

|

|||||||||||||

|

Check

|

04/29/2011

|

9688

|

Kincaid & Rees Parkway Prof. Bldg.

|

Rent-May

|

750.00

|

484,649.04

|

|||||||||||||

|

Check

|

04/29/2011

|

9689

|

Kansas Gas Service

|

107.81

|

484,541.23

|

||||||||||||||

|

General Journal

|

04/30/2011

|

21280

|

Bank Charges

|

80.00

|

484,461.23

|

||||||||||||||

|

Total 0-10070 · FNB Olathe Checking 013-960-2

|

7,648.33

|

50,949.12

|

484,461.23

|

||||||||||||||||

|

0-10080 · FNB Payroll Acct. 014-952-7

|

465.34

|

||||||||||||||||||

|

Total 0-10080 · FNB Payroll Acct. 014-952-7

|

465.34

|

||||||||||||||||||

|

Total Cash Accounts

|

7,769.53

|

56,782.38

|

484,916.57

|

||||||||||||||||

|

TOTAL

|

7,769.53

|

56,782.38

|

484,916.57

|

||||||||||||||||

|

Current

|

1 - 30

|

31 - 60

|

61 - 90

|

> 90

|

TOTAL

|

|||||||

|

902 CONS/LGCB -FA3089

|

0.00

|

0.00

|

0.00

|

0.00

|

650.00

|

650.00

|

||||||

|

AB Mobile Com

|

0.00

|

0.00

|

0.00

|

0.00

|

4,519.80

|

4,519.80

|

||||||

|

Aberdeen Township Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

4,482.80

|

4,482.80

|

||||||

|

Accounts Receivable Entry

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Advanced Radio Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

111.77

|

111.77

|

||||||

|

Alaska Safety

|

0.00

|

0.00

|

0.00

|

0.00

|

(358.13)

|

(358.13)

|

||||||

|

All-Pro Safety Supply & Installations, In

|

0.00

|

0.00

|

0.00

|

0.00

|

612.97

|

612.97

|

||||||

|

Andrews Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(192.50)

|

(192.50)

|

||||||

|

Appleton Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.60

|

0.60

|

||||||

|

Arkansas City Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(876.00)

|

(876.00)

|

||||||

|

B-K Electric, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

B & C Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

4,100.55

|

4,100.55

|

||||||

|

B&G Electronics

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

B&L Comm., Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

6,301.12

|

6,301.12

|

||||||

|

Banks County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

4,755.78

|

4,755.78

|

||||||

|

Belleville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(854.00)

|

(854.00)

|

||||||

|

Beltronics, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Blytheville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(42.37)

|

(42.37)

|

||||||

|

Bob Caldwell CJD

|

0.00

|

0.00

|

0.00

|

0.00

|

9,991.65

|

9,991.65

|

||||||

|

Borough of Woodbury Heights Police Depart

|

0.00

|

0.00

|

0.00

|

0.00

|

36,248.14

|

36,248.14

|

||||||

|

Brownwood Police

|

0.00

|

0.00

|

0.00

|

0.00

|

(286.63)

|

(286.63)

|

||||||

|

Cartersville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(300.00)

|

(300.00)

|

||||||

|

Cedar Rapids Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

105.50

|

105.50

|

||||||

|

Charleston Light & Siren Emergency

|

0.00

|

0.00

|

0.00

|

0.00

|

18,467.72

|

18,467.72

|

||||||

|

Chattahoochee Hill Country

|

0.00

|

0.00

|

0.00

|

0.00

|

512.65

|

512.65

|

||||||

|

CNY Public Safety Supply Inc

|

0.00

|

0.00

|

0.00

|

0.00

|

398.78

|

398.78

|

||||||

|

Communications & Emergency Products, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

1,061.87

|

1,061.87

|

||||||

|

Complete Emergency Vehicles

|

0.00

|

0.00

|

0.00

|

0.00

|

9,773.36

|

9,773.36

|

||||||

|

ComputerShare, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Connect Wireless Solutions

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Custom Command Vehicles

|

0.00

|

0.00

|

0.00

|

0.00

|

43,263.86

|

43,263.86

|

||||||

|

Dana Safety Supply

|

0.00

|

0.00

|

0.00

|

0.00

|

701.76

|

701.76

|

||||||

|

Demarest Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

63.00

|

63.00

|

||||||

|

Developed Dimension Information Technolog

|

0.00

|

0.00

|

0.00

|

0.00

|

23.00

|

23.00

|

||||||

|

Diboll Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(50.00)

|

(50.00)

|

||||||

|

Dorchester County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(112.72)

|

(112.72)

|

||||||

|

Dover Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(632.90)

|

(632.90)

|

||||||

|

DSC Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

10,190.57

|

10,190.57

|

||||||

|

Dunne Communications, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Dunnellon Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

4,791.62

|

4,791.62

|

||||||

|

Durango Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

5,920.00

|

5,920.00

|

||||||

|

East Providence Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(300.00)

|

(300.00)

|

||||||

|

Eastchester Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(170.00)

|

(170.00)

|

||||||

|

Ellensburg Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Empire Energy Corporation

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

ERS

|

0.00

|

0.00

|

0.00

|

0.00

|

7,731.92

|

7,731.92

|

||||||

|

Extreme 911

|

0.00

|

0.00

|

0.00

|

0.00

|

412.58

|

412.58

|

||||||

|

Falls Church Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

515.00

|

515.00

|

||||||

|

Fayette County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(836.36)

|

(836.36)

|

||||||

|

Fleet Auto Supply

|

0.00

|

0.00

|

0.00

|

0.00

|

25,450.66

|

25,450.66

|

||||||

|

Forest Park Police Department (GA)

|

0.00

|

0.00

|

0.00

|

0.00

|

(1,234.95)

|

(1,234.95)

|

||||||

|

Fort Dodge Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Franklin County Sheriff's Office (OH)

|

0.00

|

0.00

|

0.00

|

0.00

|

34.65

|

34.65

|

||||||

|

Fremont County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(1,674.80)

|

(1,674.80)

|

||||||

|

Fruitland Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Ft. Hamilton Provost Marshall Office

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Ft. Polk Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Gaithersburg Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(30.00)

|

(30.00)

|

||||||

|

Garden City Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

General Ledger Entry - AR

|

0.00

|

0.00

|

(199,292.32)

|

0.00

|

25,041.77

|

(174,250.55)

|

||||||

|

Georgetown Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

39.98

|

39.98

|

||||||

|

Gillespie County Sheriff's Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

57.50

|

57.50

|

||||||

|

Glen Canyon NRA

|

0.00

|

0.00

|

0.00

|

0.00

|

340.03

|

340.03

|

||||||

|

Golden Gate NRA

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Goodhue County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Grants Pass Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(30.00)

|

(30.00)

|

||||||

|

Granville Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(312.58)

|

(312.58)

|

||||||

|

Graybill Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

190.50

|

190.50

|

||||||

|

Green River Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(260.00)

|

(260.00)

|

||||||

|

Guernsey County Sheriff

|

0.00

|

0.00

|

0.00

|

0.00

|

502.25

|

502.25

|

||||||

|

Habersham County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(500.00)

|

(500.00)

|

||||||

|

Hammond Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

68,351.14

|

68,351.14

|

||||||

|

Hapeville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(600.00)

|

(600.00)

|

||||||

|

Harper Woods Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(35.00)

|

(35.00)

|

||||||

|

Hawthorn Woods Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

2.96

|

2.96

|

||||||

|

Haywood County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(78.22)

|

(78.22)

|

||||||

|

Hendersonville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

15.00

|

15.00

|

||||||

|

Herculaneum Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(240.00)

|

(240.00)

|

||||||

|

HES, Inc. (c)

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Highlands Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(90.00)

|

(90.00)

|

||||||

|

Hodgkins Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(50.00)

|

(50.00)

|

||||||

|

Holcomb Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Homewood Police Department-AL

|

0.00

|

0.00

|

0.00

|

0.00

|

285.00

|

285.00

|

||||||

|

Industrial Communiations Sales & Services

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Industrial Communications-MT

|

0.00

|

0.00

|

0.00

|

0.00

|

385.70

|

385.70

|

||||||

|

Integrated Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

4,519.80

|

4,519.80

|

||||||

|

Iredell County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(930.55)

|

(930.55)

|

||||||

|

J & S Communications LLC

|

0.00

|

0.00

|

0.00

|

0.00

|

4,931.80

|

4,931.80

|

||||||

|

Jasper Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(50.00)

|

(50.00)

|

||||||

|

Jefferson County AR SO

|

0.00

|

0.00

|

0.00

|

0.00

|

760.66

|

760.66

|

||||||

|

Kalamazoo County Sheriff's Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(50.00)

|

(50.00)

|

||||||

|

Ketchum Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Key West Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

197.50

|

197.50

|

||||||

|

Kingsland Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(908.65)

|

(908.65)

|

||||||

|

Lake Mead NRA

|

0.00

|

0.00

|

0.00

|

0.00

|

(87.00)

|

(87.00)

|

||||||

|

Lake Winnebago Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(72.29)

|

(72.29)

|

||||||

|

Lansing Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(207.58)

|

(207.58)

|

||||||

|

Laprade Government Sales

|

0.00

|

0.00

|

0.00

|

0.00

|

13,040.43

|

13,040.43

|

||||||

|

Laurel Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

5,085.00

|

5,085.00

|

||||||

|

Lincoln County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(1,741.15)

|

(1,741.15)

|

||||||

|

Linden Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

108.12

|

108.12

|

||||||

|

Livonia Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(462.11)

|

(462.11)

|

||||||

|

Lower Merion Twp Police Dept.

|

0.00

|

0.00

|

0.00

|

0.00

|

(31.00)

|

(31.00)

|

||||||

|

Lusk Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

5,642.99

|

5,642.99

|

||||||

|

Lyon County Sheriffs Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Macon County Sheriff's Dept.

|

0.00

|

0.00

|

0.00

|

0.00

|

(23.94)

|

(23.94)

|

||||||

|

Marion Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

13.00

|

13.00

|

||||||

|

Marshfield Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

3,876.09

|

3,876.09

|

||||||

|

Matsu Emergency Safety and Supply

|

0.00

|

0.00

|

0.00

|

0.00

|

577.28

|

577.28

|

||||||

|

Mercer Island Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Milton Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Minnestoa Sheriff's Association

|

0.00

|

0.00

|

0.00

|

0.00

|

0.01

|

0.01

|

||||||

|

Mitchell Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Mobile Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

2,668.30

|

2,668.30

|

||||||

|

Moncks Corner Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

4,549.49

|

4,549.49

|

||||||

|

Monroe Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

30.00

|

30.00

|

||||||

|

Morton County Sheriffs Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Nalcom Wireless, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Natchez Trace Parkway NPS

|

0.00

|

0.00

|

0.00

|

0.00

|

(200.00)

|

(200.00)

|

||||||

|

New Melle Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(37.00)

|

(37.00)

|

||||||

|

Northfield Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

57,622.88

|

57,622.88

|

||||||

|

Northwestern State University

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

NYPD Highway Patrol

|

0.00

|

0.00

|

0.00

|

0.00

|

4,405.39

|

4,405.39

|

||||||

|

NYPD HWY PATROL UNIT 5

|

0.00

|

0.00

|

0.00

|

0.00

|

280.00

|

280.00

|

||||||

|

Olmos Park Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

6,362.50

|

6,362.50

|

||||||

|

Osceola County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

OSP - Gold Beach

|

0.00

|

0.00

|

0.00

|

0.00

|

(48.00)

|

(48.00)

|

||||||

|

Ottawa Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Oviedo Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(60.00)

|

(60.00)

|

||||||

|

Ozaukee County Sheriff's Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(50.00)

|

(50.00)

|

||||||

|

Panama City Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Park Forest Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(283.50)

|

(283.50)

|

||||||

|

Plainfield Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

PMC Associates, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

(1,860.00)

|

(1,860.00)

|

||||||

|

Powder Springs Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

50.00

|

50.00

|

||||||

|

Premier Vehicle Installation, Inc

|

0.00

|

0.00

|

0.00

|

0.00

|

(1,048.74)

|

(1,048.74)

|

||||||

|

Priority One Emergency

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Procom Corporation

|

0.00

|

0.00

|

0.00

|

0.00

|

1,000.00

|

1,000.00

|

||||||

|

PSEI

|

0.00

|

0.00

|

0.00

|

0.00

|

3,022.94

|

3,022.94

|

||||||

|

Radioland Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Randolph AFB - Fire

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Raytheon-JPS Communications Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

420.00

|

420.00

|

||||||

|

RCS Wireless Technology

|

0.00

|

0.00

|

0.00

|

0.00

|

171.72

|

171.72

|

||||||

|

Red Lodge Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

924.05

|

924.05

|

||||||

|

REM Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

716.00

|

716.00

|

||||||

|

Reserve for losses

|

0.00

|

0.00

|

0.00

|

0.00

|

(100,456.68)

|

(100,456.68)

|

||||||

|

RF Marketing Sales

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Rocky Boy Tribal Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Roman Forest Police Department

|

0.00

|

0.00

|

0.00

|

(2,500.00)

|

0.00

|

(2,500.00)

|

||||||

|

Roselle Park Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

180.00

|

180.00

|

||||||

|

Saint Peter Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

13.75

|

13.75

|

||||||

|

Saukville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(63.00)

|

(63.00)

|

||||||

|

Shipman Communications

|

0.00

|

0.00

|

0.00

|

0.00

|

4,931.80

|

4,931.80

|

||||||

|

South Haven Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

South Portland Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

7,150.00

|

7,150.00

|

||||||

|

South Rockwood Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(415.00)

|

(415.00)

|

||||||

|

State of Alaska Department of Transportat

|

0.00

|

0.00

|

0.00

|

0.00

|

85.13

|

85.13

|

||||||

|

Stratford Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

39,321.64

|

39,321.64

|

||||||

|

Sumter County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

222.34

|

222.34

|

||||||

|

Sweetwater Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

||||||

|

Telecomunicaciones y Servicios del Norte

|

0.00

|

0.00

|

0.00

|

0.00

|

28,401.29

|

28,401.29

|

||||||

|

Tieton Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(64.45)

|

(64.45)

|

||||||

|

Tinton Falls Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

222.63

|

222.63

|

||||||

|

Titusville Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

409.50

|

409.50

|

||||||

|

Tulelake Police Department

|

0.00

|

0.00

|

(66.96)

|

0.00

|

0.00

|

(66.96)

|

||||||

|

Ukiah Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

5,447.74

|

5,447.74

|

||||||

|

University of Kentucky

|

0.00

|

0.00

|

0.00

|

0.00

|

(3,600.00)

|

(3,600.00)

|

||||||

|

University of Texas San Antonio

|

0.00

|

0.00

|

0.00

|

0.00

|

(268.05)

|

(268.05)

|

||||||

|

University of Wyoming

|

0.00

|

0.00

|

0.00

|

0.00

|

(568.67)

|

(568.67)

|

||||||

|

University Park Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

Vernonia Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(90.03)

|

(90.03)

|

||||||

|

Veterans Affairs Hospital Police Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

98.08

|

98.08

|

||||||

|

Wabasha County Sheriff's Dept

|

0.00

|

0.00

|

0.00

|

0.00

|

242.45

|

242.45

|

||||||

|

Wabaunsee County Sheriff's Office

|

0.00

|

0.00

|

0.00

|

0.00

|

245.28

|

245.28

|

||||||

|

Warr Acres Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

600.00

|

600.00

|

||||||

|

Watec, Inc.

|

0.00

|

0.00

|

0.00

|

0.00

|

15.00

|

15.00

|

||||||

|

Wellington Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

100.00

|

100.00

|

||||||

|

West Chester Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

(100.00)

|

(100.00)

|

||||||

|

West Jordan Police Department

|

0.00

|

0.00

|

0.00

|

0.00

|

100.00

|

100.00

|

||||||

|

Western Carolina Communication Systems

|

0.00

|

0.00

|