Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Discover Financial Services | d8k.htm |

Barclays Capital Americas Select Conference

Harit Talwar

President, U.S. Cards

May 24, 2011

Exhibit 99.1 |

2

Notice

www.discoverfinancial.com.

Certain

reconciliations

are

also

included

at

the

end

of

this

presentation.

The following slides are part of a presentation by Discover Financial Services (the "Company")

and are intended to be viewed as part of that presentation. No representation is made that the

information in these slides is complete.

The information provided herein may include certain non-GAAP financial measures. The

reconciliations of such measures to the comparable GAAP figures are included in the

Company’s Annual Report on Form 10-K for the year ended November 30, 2010 and the

Company’s Current Report on Form 8-K dated March 22, 2011, each of which are on file

with the SEC and available on the Company’s website at

The presentation contains forward-looking statements. You are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the date on which they are

made, which reflect management’s estimates, projections, expectations or beliefs at that

time and which are subject to risks and uncertainties that may cause actual results to differ

materially. For a discussion of certain risks and uncertainties that may affect the future

results of the Company, please see "Special Note Regarding Forward- Looking

Statements," "Risk Factors," "Business – Competition," "Business – Supervision and Regulation" and

"Management’s Discussion and Analysis of Financial Condition and Results of Operations"

in the Company’s Annual Report on Form 10-K for the year ended November 30, 2010 and

"Management’s Discussion and Analysis of Financial Condition and Results of

Operations" in the Company’s Form 10-Q for the quarter ended February 28, 2011,

which are on file with the SEC.

Certain historical financial information about the Company that we have included in this presentation

has been derived from Morgan Stanley’s consolidated financial statements and does not

necessarily reflect what our financial condition, results of operations or cash flows would

have been had we operated as a separate, stand-alone company during the periods presented. We own or have rights to use the

trademarks, trade names and service marks that we use in conjunction with

the

operation

of

our

business,

including,

but

not

limited

to:

Discover

®

,

PULSE

®

,

Cashback

Bonus

®

,

Discover

®

Network

and

Diners

Club

International

®

.

All

other

trademarks,

trade

names

and

service

marks

included

in

this

presentation are the property of their respective owners.

|

Leverage our Direct Banking and Payments assets to

deliver profitable growth

CONSUMER

DEPOSITS

DISCOVER

CARD

CONSUMER

LOANS

PULSE

DEBIT

NETWORK

DINERS

CLUB

INTERNATIONAL

DISCOVER

NETWORK |

4

Unique collection of well positioned assets

Note: Balances as of February 28, 2011; volume based on the trailing four

quarters ending 1Q11 •

$44Bn in receivables

•

Leading cash rewards

program

•

1 in 4 U.S. households

•

$22Bn consumer deposits

•

$7.3Bn personal and student

loans

Deposits and Other Lending

Deposits and Other Lending

U.S. Card Issuing

U.S. Card Issuing

•

$125Bn volume

•

4,400+ issuers

•

$104Bn volume

•

30+ issuers

•

$28Bn volume

•

50+ franchises

•

185 countries /

territories |

5

Profitable long-term growth model

Asset Growth

EPS Growth /

Contribution

Card

2 - 4%

3 - 4%

Other Consumer Lending

20 - 25%

3 - 4%

Payments

NA

2%+/-

Organic Growth

5 - 6%

8 - 10%

Capital Management /

Acquisitions

0 - 4%

2 - 5%

Total Growth

5 - 10%

10 - 15%

Targets:

TCE / TA

(1)

~8%

ROE

15% +

Note(s)

1.

Defined as tangible common equity to tangible assets |

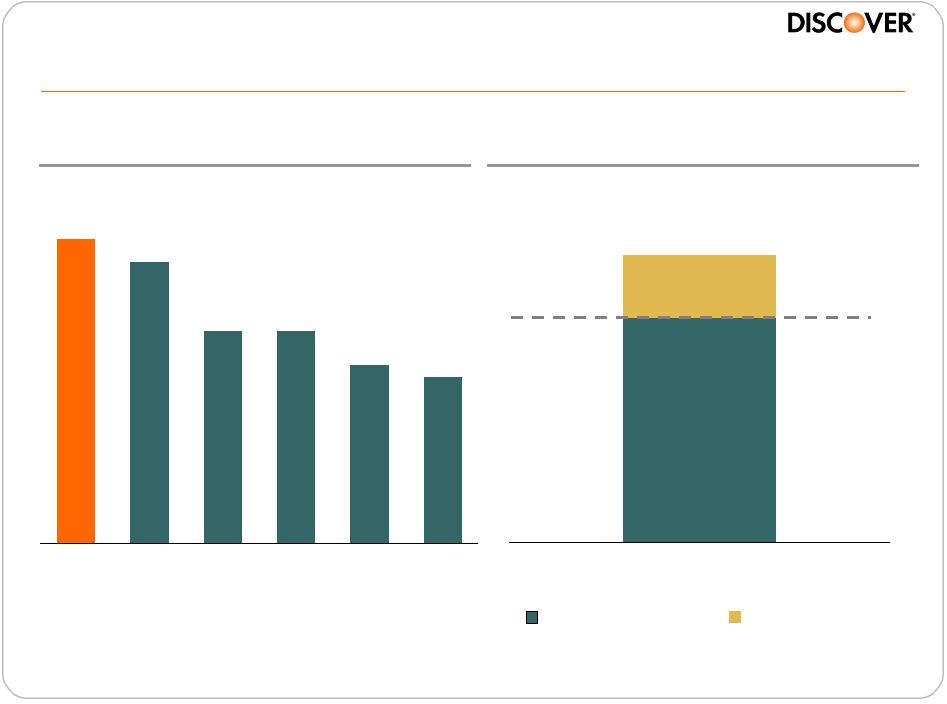

6

Discover Card -

well positioned for profitable growth

•

Our business is positioned to generate a pre-tax ROA of 2.5%+ and

an ROE of 15%+ on a sustainable basis

•

Outperforming large general purpose card issuers over the last two

years (1Q09-1Q11)

Note(s)

1.

Comparison based on “managed basis”

receivables at March 31, 2009

2.

Calendar year data for sales and receivables

3.

Includes BAC, C, COF, and JPM

Source

Internal data and company filings

•

Strong growth in new accounts

•

Increasing usage and wallet share with existing customers

Sales

Receivables

(1)

1Q11

NCO Rate

Discover

(2)

+14%

-10%

5.96%

Peer Average

(3)

+8%

-20%

7.25% |

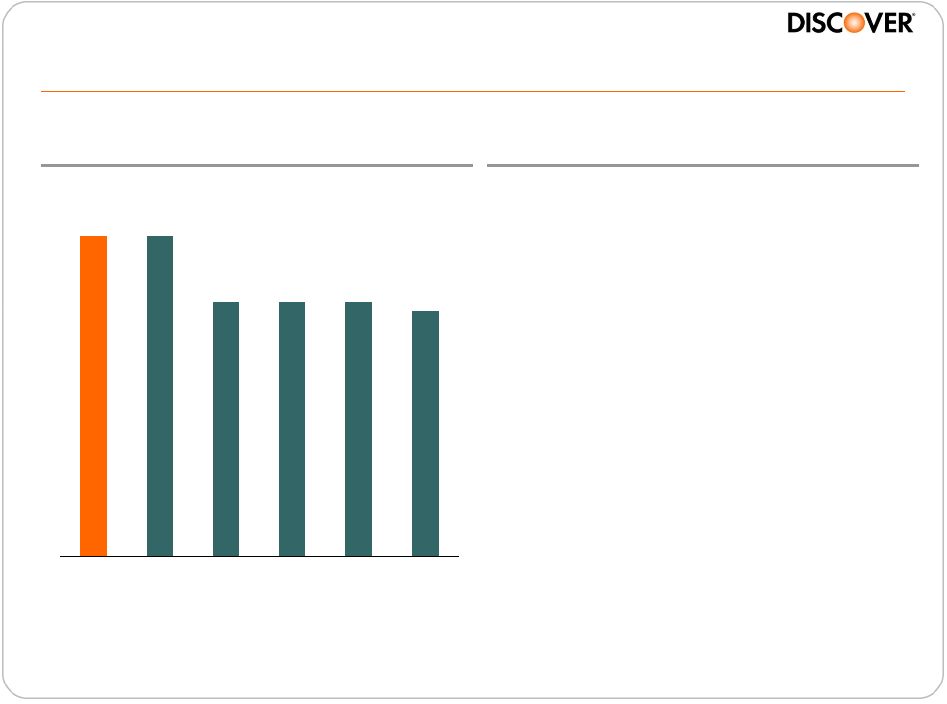

7

79%

79%

72%

72%

72%

71%

DFS

AXP

JPM

C

BAC

COF

Recommend to a Friend

(1)

Source

4Q ‘10 Brand Tracker study, Millward

Brown

Note(s)

1.

% of survey participants who strongly / somewhat agree with the statement “I

would recommend to a friend”; among cardholders who say they use that

brand’s card most often to make purchases

Discover brand resonates strongly with attractive

customer base

Customer Base & Target Profile

Large, seasoned customer base

Large, seasoned customer base

•

Highest average tenure in industry

•

Balanced customer base

–

~40% revolver / 60% transactor

•

Geographically diverse

•

Avg. age 44; avg. HHI $108K

•

75% married

•

74% attended college

•

85%+ own their home |

8

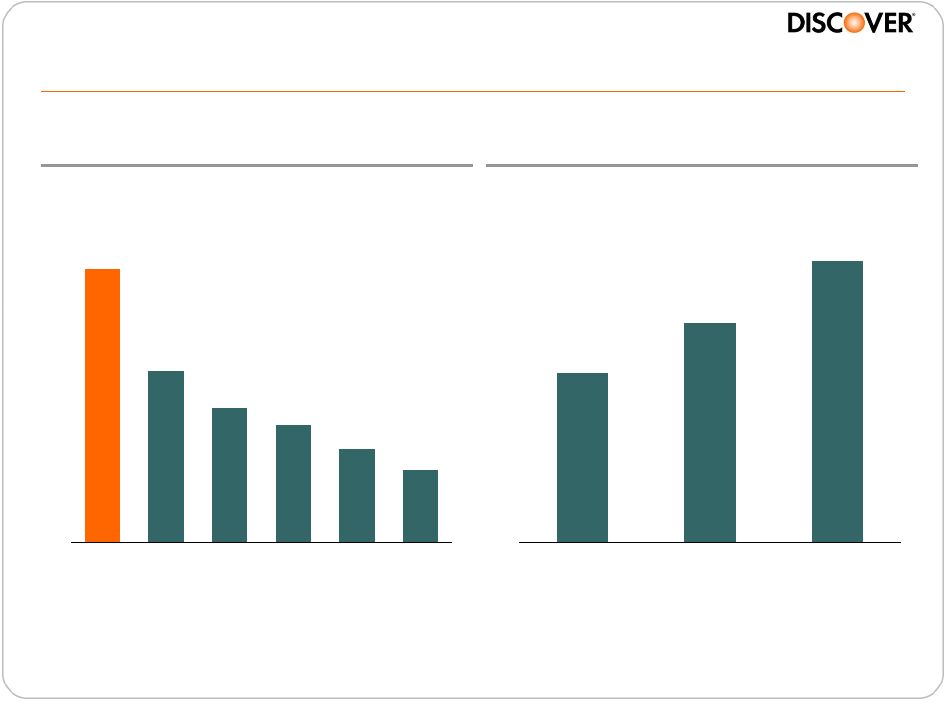

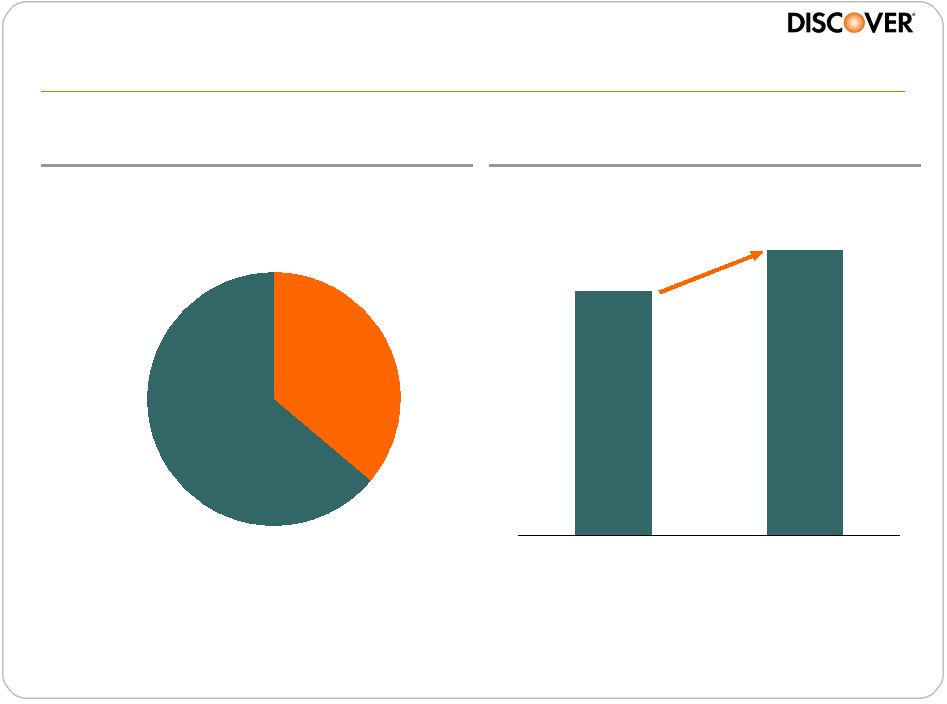

Leading rewards programs driving record levels

of customer engagement

67%

42%

33%

29%

23%

18%

DFS

JPM

AXP

C

COF

BAC

Best Cash Rewards

(1)

Rewards Program

Enrollment (MM)

Source

4Q 2010 Brand Tracker study, Millward Brown

Note(s)

1.

% of unaided cardmembers who identify the brand with the statement “best cash

rewards”; among cardholders who say they use that brand’s card most often to make purchases

14

18

23

2008

2009

2010 |

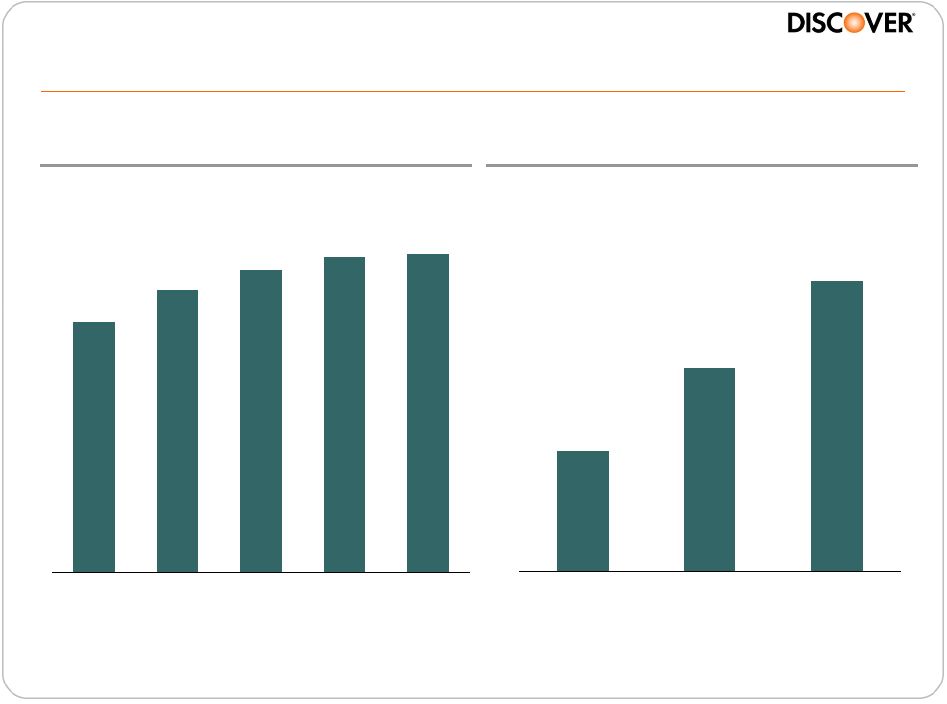

9

Acceptance and marketing programs driving usage and sales

Sales Impact ($Bn)

(2)

$3.4

$2.4

$1.4

2008

2009

2010

Source

Internal data

Note(s)

1.

U.S. points of sale enabled for Discover acceptance based on internal

analysis 2.

Estimation based upon previously non-accepting and accelerated sign-up of

new merchants

Merchant Outlet Coverage

(1)

76%

86%

92%

96%

97%

2006

2007

2008

2009

2010 |

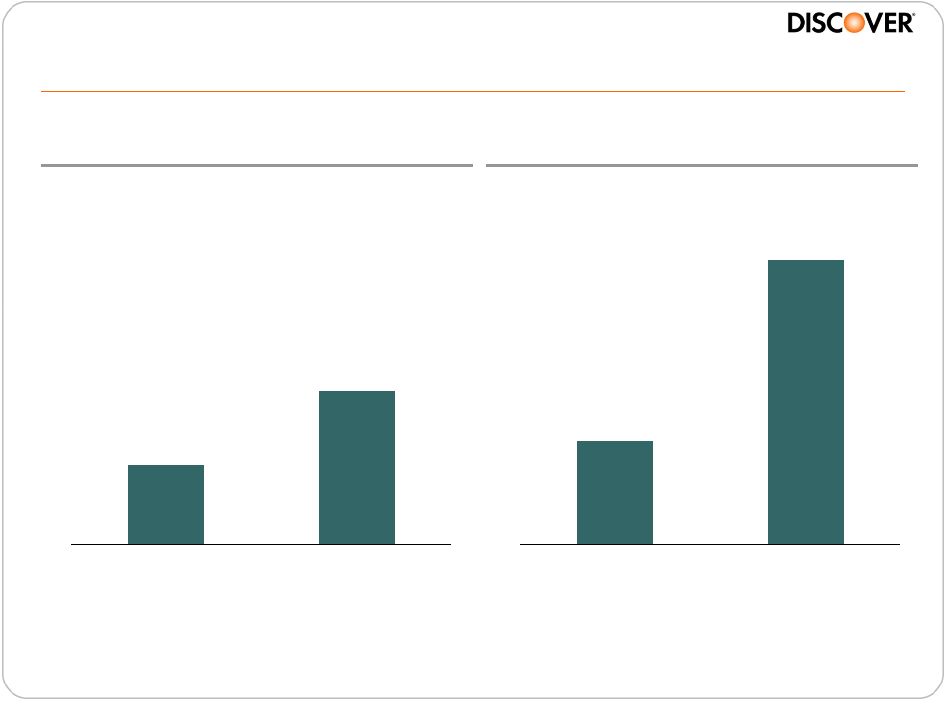

10

Significantly increasing brand presence

6%

11%

Historical

2010

7%

20%

Historical

2010

Share of

Media Spend

(1)

Share of

Voice

(2)

Source

Nielsen

Note(s)

1.

Share

of

Spend

=

Discover

media

spend

vs.

AXP,

BAC,

C,

COF,

JPM,

V,

MA

2.

Share of Voice = Total Discover media impressions vs. AXP, BAC, C, COF, JPM, V,

MA 3.

Average of 2005-2009

(3)

(3) |

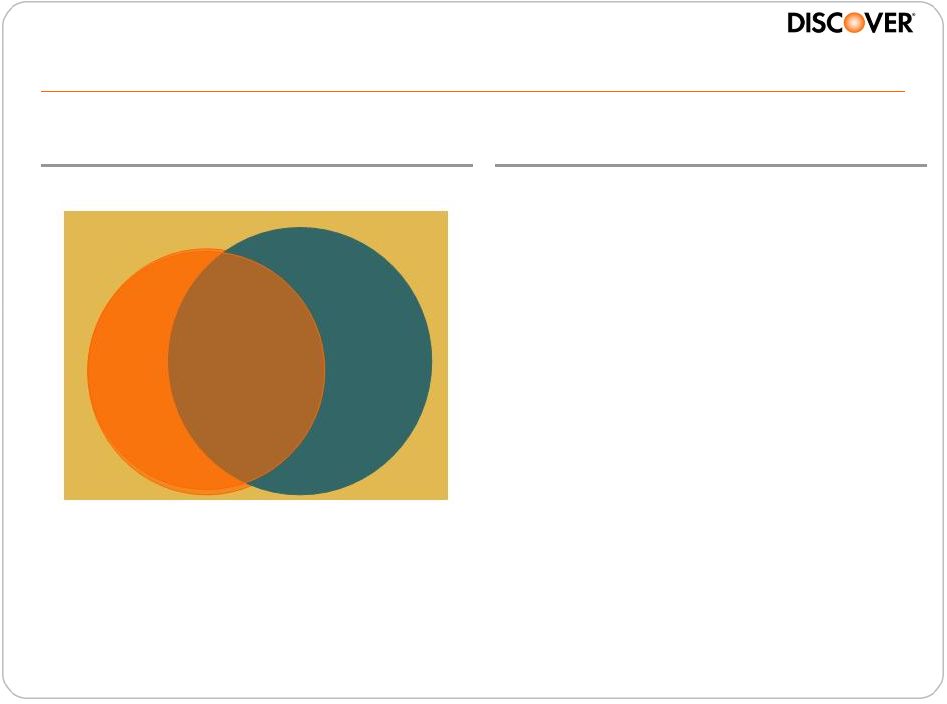

11

Off-Us

On-Us

Loans

Discover

Opportunity for growth and proven ability to take wallet share

2008

2010

Wallet Share of Loans

16%

Sources

Internal calendar year data and public company data

Note(s)

Loans –

Credit bureau data and internal modeling

“On-Us”

represents

activity with Discover Card; “Off-Us”

represents activity by Discover

Cardmembers

with

other competitors

Wallet Share is the amount of customer loans with Discover vs. other cards in the

wallet; share based upon credit bureau data and internal modeling |

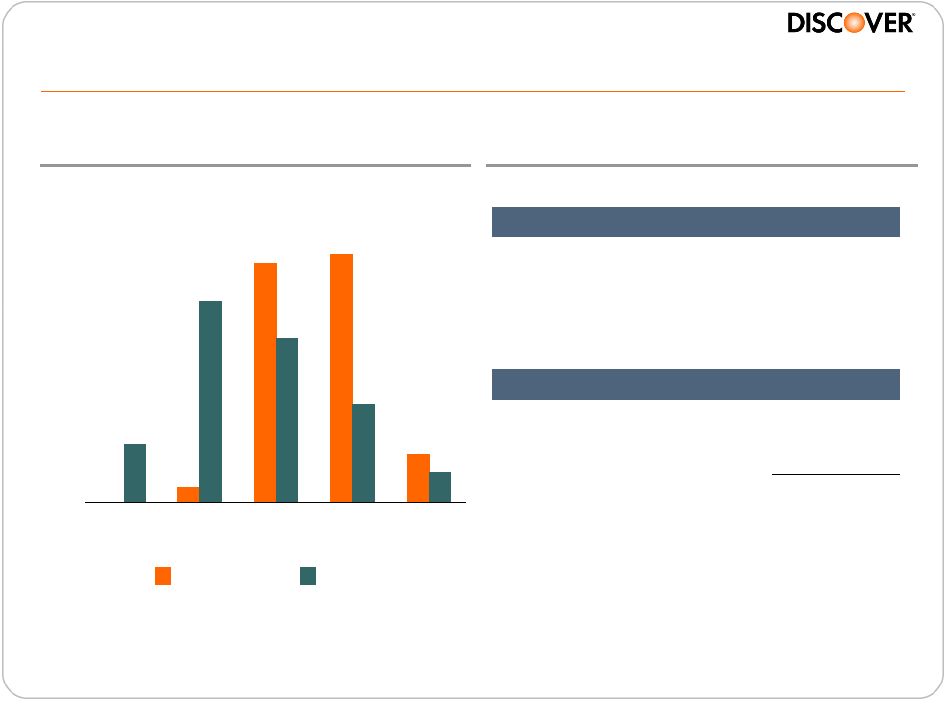

12

Personal Loans –

natural adjacency with attractive returns

Origination by Credit Score

Industry

Discover

0%

10%

20%

30%

40%

50%

501-

600

601-

700

701-

800

801-

900

901-

990

Source

Industry -

credit bureau data (Vantage); Discover based on analysis of 2010

originations Select 1Q11 Stats

Personal Loans, ending

$2.0Bn

Growth (YOY)

40%

Loan Size, avg.

$16k

% with Discover Card

~75%

Targeted Returns

Net Interest Income

9%

Loss Provision

(4%)

Operating Expenses

(2%)

Target ROA

3%

Overview |

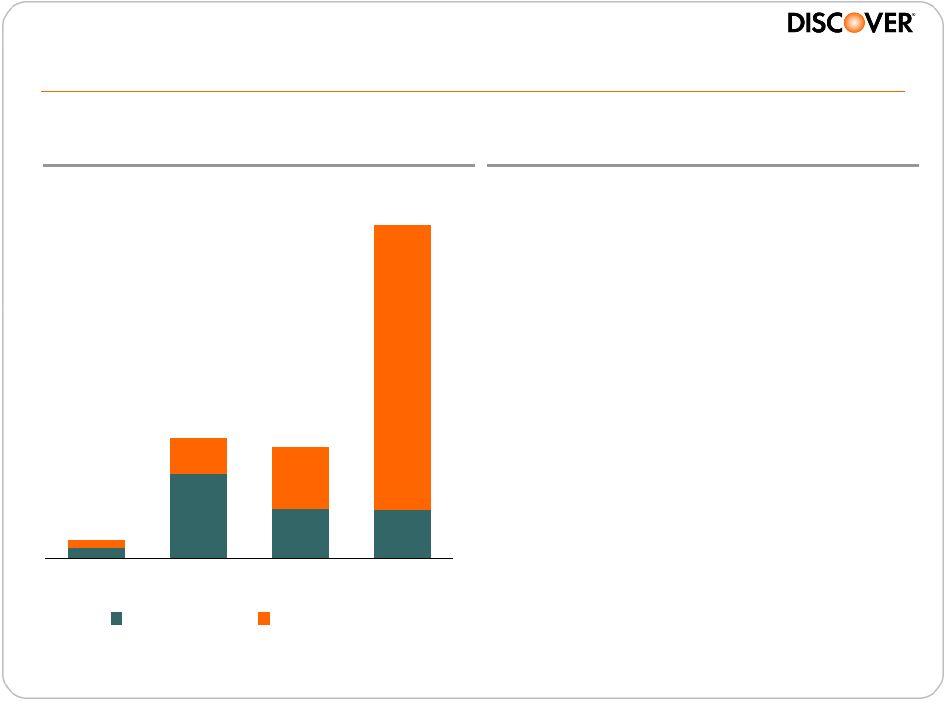

13

Overview

Private Student Loans –

strong growth in an

attractive business

Note(s)

1.

Federal student loan portfolio is held-for-sale as of 11/30/10 and

thereafter 2.

Includes The Student Loan Corporation purchased credit impaired loans and 1Q11

disbursements Student Loan Growth ($Bn)

0.6

1.0

4.5

$0.3

$1.9

$1.8

$5.3

0.8

0.8

1.3

0.2

0.1

2008

2009

2010

1Q11

Federal

Private

•

Asset class with long duration

and relatively low credit losses

•

Conservative underwriting

approach with high co-signer

rate and FICO

•

Acquisition of SLC diversified

total company portfolio

•

Expect to be top 3 originator of

private student loans in 2011

•

Students are an upwardly mobile

customer base offering important

cross-sell opportunity

(1)

(2) |

14

Acquisition expanded penetration among target schools

SLC

350

Discover is on Preferred Lender List

at 1150 of 1350 Target Schools

Target Schools

200

DSL

250

550

Top School Penetration

(1)

•

83% of top 100 colleges

•

91% of top 50 Business schools

•

90% of top 50 Law schools

•

87% of top 50 Medical schools

Note(s)

1. Incorporates

U.S.

News

&

World

Report

-

Best

Rankings

for

2010 |

15

Private student loans are on track to deliver targeted returns

Net Interest Income

Loss Provision

Operating Expenses

Target ROA

5%

(1%)

(1.5%)

2.5%

Targeted Returns

•

Integration of The Student Loan

Corporation is on track

•

Targeting net receivable growth of

$1Bn+ in 2011

•

Strong pipeline of repeat business

•

Competitive product set with

opportunities for expansion

•

Increased marketing to Card

customer base and new affinity

partnerships |

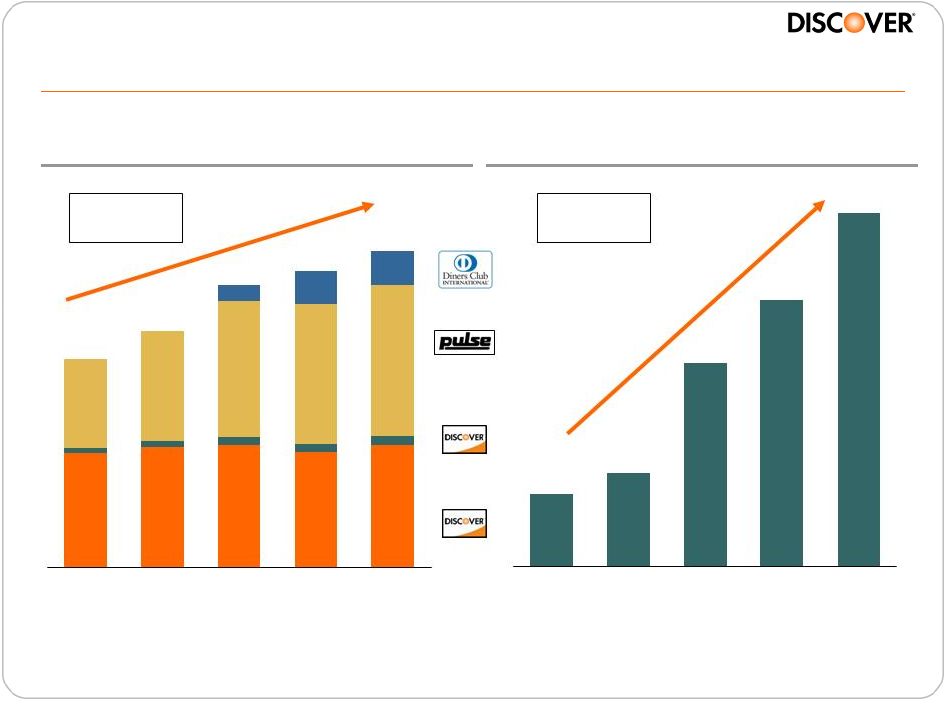

16

Payment Services –

double-digit volume and profit growth

Volume Growth ($Bn)

Pre-tax Profit ($MM)

Partner

Issuance

Proprietary

2006 –

2010

CAGR: 48%

2006 –

2010

CAGR: 11%

91

96

70

86

106

109

118

13

$163

$186

$221

$232

$248

90

94

96

7

6

6

5

3

26

27

2006

2007

2008

2009

2010

$141

$107

$81

$37

$29

2006

2007

2008

2009

2010 |

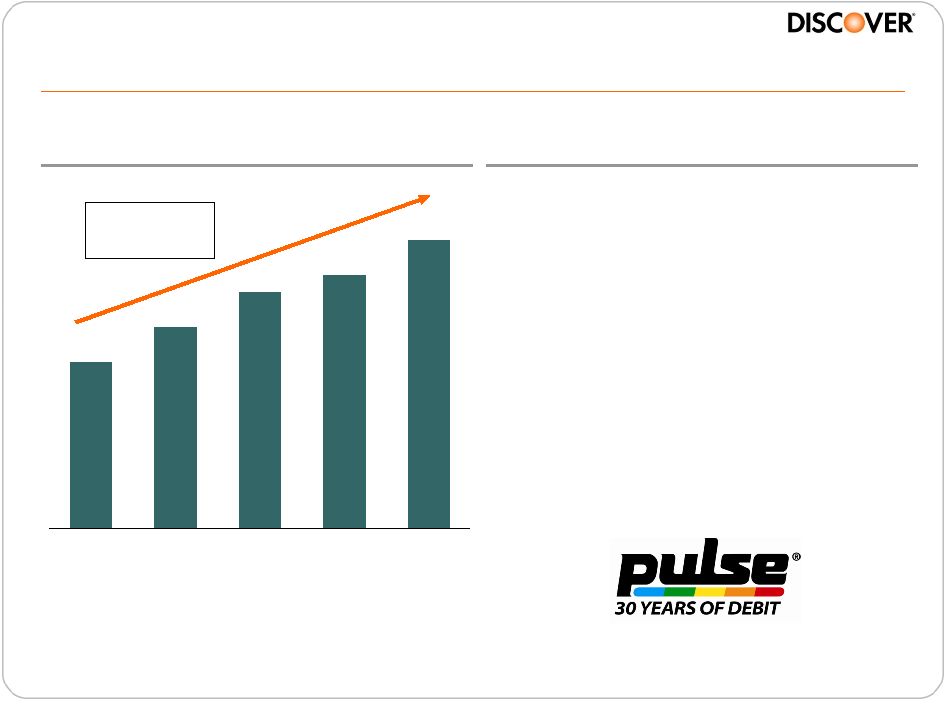

17

PULSE –

large player and gaining share

3.3

2.9

2.7

2.3

1.9

2006

2007

2008

2009

2010

Transactions (Bn)

2006 –

2010

CAGR: 15%

Overview

•

#3 market share in PIN debit

(1)

•

Strong transaction and volume

growth

•

Expanding international and

domestic ATM acceptance

•

Durbin

-

changes

in

network

participation requirements may

result in redistribution of PIN

debit volume

Note(s)

1.

Based

on

internal

analysis

which

used

the

following

sources:

EFT

Data

Book,

Federal

Reserve

and

SEC

Filings |

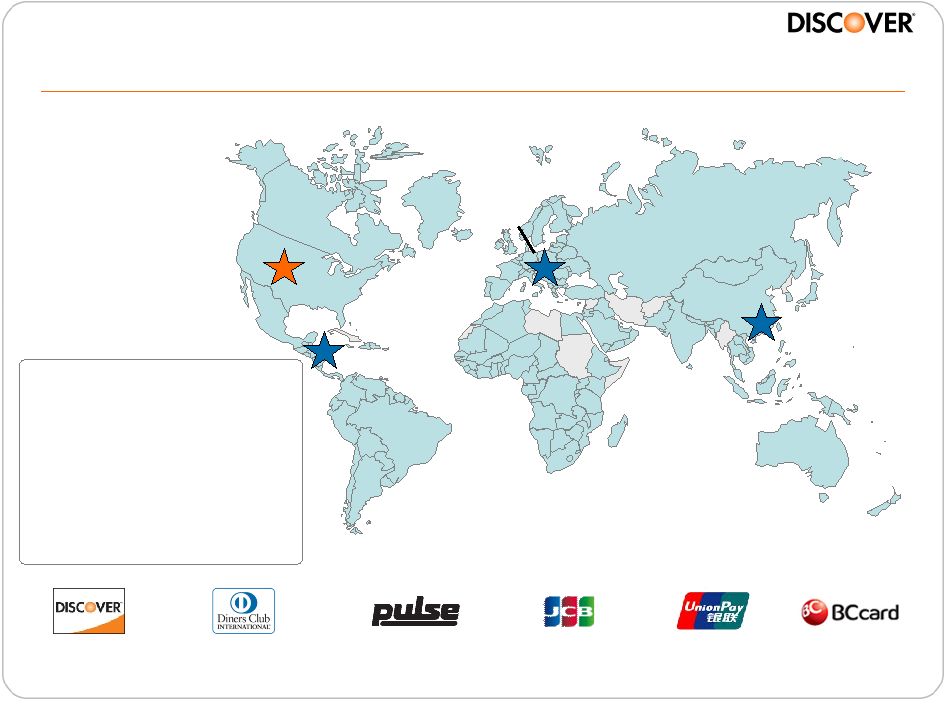

18

•

Complementary networks

with strong global presence

•

Expanding merchant

coverage

•

Operates in over 185

countries / territories

•

Over 780,000 ATMs in more

than 80 countries

Global acceptance footprint

Note(s)

1.

North

America

includes

U.S.,

Canada,

Mexico

&

Caribbean

North America

North America

(1)

(1)

8.1 MM

8.1 MM

EMEA

EMEA

2.0 MM

2.0 MM

Latin America

Latin America

2.3 MM

2.3 MM

Asia Pacific

Asia Pacific

6.2 MM

6.2 MM |

19

Global relationships are a competitive advantage

Merchants

Acquirers

Networks

Issuers |

20

Financial performance

($ MM, except per share data)

1Q11

1Q10

Net Interest Income

$1,170

$1,145

$25

Other Operating Revenue

563

546

17

Total Revenue

$1,733

$1,691

$42

Provision for Loan Loss

418

1,387

(969)

Total Operating Expense

595

475

120

Pretax Income

$720

($171)

$891

Net Income (Loss)

$465

($104)

$569

ROE

28%

-6%

NM

Total Average Receivables

$51,488

$51,555

($68)

Net Interest Margin

9.22%

9.01%

21bps

YOY

Change |

21

Capital position provides flexibility

Note(s)

1.

Tangible common equity to tangible assets; see appendix for Discover

reconciliation 2.

See appendix for reconciliation

$5.1

$1.4

3/31/11

Illustrative Target

Excess Capital

Tangible Common Equity

(2)

(Bn)

8%+/-

Target

10.2%

1Q11 TCE / TA Ratio

(1)

10.2%

9.4%

7.2%

7.1%

6.0%

5.6%

DFS

AXP

C

COF

BAC

JPM

Source

SNL, Regulatory Reports dated 3/31/11 |

22

Concluding themes

•

Card business generating strong profitability

–

Credit trends provide flexibility to invest for growth

–

Leveraging brand, acceptance and risk management capabilities to

increase wallet share

•

Have continued to diversify our portfolio with the acquisition of The

Student Loan Corporation and expansion of personal loans

–

Other consumer lending receivables are now ~15% of total receivables

–

Leveraging unsecured lending and marketing capabilities to drive

more

rapid asset growth at attractive returns

•

Focused on increasing acceptance globally and exploiting opportunities

in debit and mobile

–

Targeting Payment Services long-term profit growth of 15-20% with 10%+

volume CAGR

•

We continue to generate excess capital and were one of the first

U.S.

financial services companies to restore the dividend

–

Excess capital provides significant flexibility |

Using our Direct Banking and Payments assets to deliver

profitable growth

CONSUMER

DEPOSITS

DISCOVER

CARD

CONSUMER

LOANS

PULSE

DEBIT

NETWORK

DINERS

CLUB

INTERNATIONAL

DISCOVER

NETWORK

Harit Talwar

President, U.S. Cards

May 24, 2011 |

24

Reconciliations

($MM)

3/31/11

Tangible Common Equity Ratio Calculation:

Total Common Equity (TCE)

$7,002

Less: Goodwill and Intangibles

(448)

Tangible Common Equity

$6,554

Total Assets

$64,405

Less: Goodwill and Intangibles

(448)

Tangible Assets (TA)

$63,957

TCE/TA Ratio

10.2%

Note(s)

Tangible common equity ("TCE"), a non-GAAP financial measure, represents common equity

less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial

measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so

we advise users of this information to exercise caution in comparing TCE of different companies.

TCE is included because management believes that common equity excluding goodwill and

intangibles is a more meaningful valuation to investors of the true net asset value of the company. |