Attached files

| file | filename |

|---|---|

| EX-5 - Cell MedX Corp. | v223533_ex5.htm |

| EX-23.1 - Cell MedX Corp. | v223533_ex23-1.htm |

| EX-23.2 - Cell MedX Corp. | v223533_ex23-2.htm |

As filed with the Commission on May 20, 2011.

File No. 333-168079

United States Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 3 to

Form S-1

Registration Statement under the Securities Act of 1933

PLANDEL RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

|||

|

State or other jurisdiction of

|

Primary Standard Industrial

|

I.R.S. Employee Identification

|

||

|

incorporation or organization

|

|

Classification Code Number

|

|

Number

|

2432 M. Dela Cruz, Pasay City, Philippines, 1300

Telephone: (702) 973-1853

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

American Corporate Enterprises

123 W Nye Lane, Ste 129, Carson City, NV, 89706

Toll Free: (888) 274-1130 Telephone: (775) 884-9380 Fax: (775) 884-9383

(Name, address, including zip code, and telephone number, including area code, of agent for service)

D. Roger Glenn

Glenn & Glenn

124 Main Street, Ste 8

New Paltz NY 12561

Telephone: (845) 256-8031 Fax (845) 255-1814

(Copies to the above address)

As soon as practicable after this Registration Statement becomes effective

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement of the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8 (a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8 (a), may determine.

Subject to Completion, Dated May 20, 2011

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. The Selling Security Holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective.

PLANDEL RESOURCES, INC.

15,000,000 Shares of Common Stock

$0.002 Offering Price per Share

$30,000 Aggregate Offering Price

We have prepared this Prospectus to allow the Selling Security Holders to sell up to 15,000,000 shares of Plandel Resources, Inc. (“Plandel”, “we”, “us”, “our”, “the Company” or similar terms) that they have acquired from private placement for resale. We will not receive any of the proceeds from the sale of these shares.

The Selling Security Holders identified in this prospectus are registering 15,000,000 shares of common stock for resale at a fixed price of $0.002 per share. The Selling Security Holders have arbitrarily set the $0.002 price per share; the price does not reflect net worth, total asset value, or any other objective accounting measure. It is our intention to find a market maker who will make an application to the FINRA to have our shares accepted for trading on the OTCBB once this registration statement becomes effective. There is no assurance that our application to the FINRA will be approved. The Selling Security Holders are underwriters, within the meaning of Section 2(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an "underwriter" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act.

Our common stock is not presently traded on any market or securities exchange.

Investing in our common stock is extremely risky and may result in a complete loss. Potential investors should carefully consider the “Risk Factors” on page 7.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Proceeds to the Selling Security Holders do not include offering costs, including filing fees, printing costs, legal fees, accounting fees, and transfer agent fees estimated at $16,302. We will pay these expenses.

Dealer Prospectus Delivery Obligation

Until _________ (90 th day after the later of (1) the effective date of the registration statement or (2) the first date on which the securities are offered publicly), all dealers that effect in transactions in these securities, whether or no participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this Prospectus is _____, 2011.

2

|

Item

|

Page

|

|

|

Forward-Looking Statements

|

3

|

|

|

Item 3. Prospectus Summary and Risk Factors

|

5

|

|

|

Item 4. Use of Proceeds

|

12

|

|

|

Item 5. Determination of the Offering Price

|

12

|

|

|

Item 6. Dilution

|

12

|

|

|

Item 7. Selling Security Holders

|

12

|

|

|

Item 8. Plan of Distribution

|

13

|

|

|

Item 9. Description of Securities to be Registered

|

14

|

|

|

Item 10. Interests of Named Experts and Counsel

|

15

|

|

|

Item 11. Information with Respect to the Registrant

|

15

|

|

|

· Description of Business

|

15

|

|

|

· Description of Property

|

17

|

|

|

· Glossary of Mining Terms

|

21

|

|

|

· Legal Proceedings

|

27

|

|

|

· Market for Common Equity, Dividends and Related Stockholder Matters

|

28

|

|

|

· Financial Statements

|

32

|

|

|

· Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

51

|

|

|

· Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

55

|

|

|

· Directors and Executive Officers

|

56

|

|

|

· Executive Compensation

|

58

|

|

|

· Corporate Governance

|

58

|

|

|

· Principal Shareholders and Security Ownership of Certain Beneficial Owners and Management

|

59

|

|

|

· Transactions with Related Persons, Promoters and Certain Control Persons

|

60

|

|

|

Item 11A. Material Changes

|

60

|

|

|

Item 12. Incorporation of Certain Information by Reference

|

60

|

|

|

Item 12A. Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

61

|

Forward- Looking Statements

This prospectus attached hereto contains "forward-looking statements,” which concern the Company's planned exploration and development of its property, anticipated results of future operations, and other business plans and matters that may occur in the future.

3

Actual results may vary from those expected. Undue reliance should not be placed on any forward-looking statements, which are appropriate only for the date made. We do not plan to subsequently revise these forward-looking statements to reflect current circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

4

Prospectus Summary

Plandel Resources, Inc.

This summary does not contain all the information that should be considered before making an investment in Plandel Resources, Inc.’s common stock. The entire prospectus should be read including the “Risk Factors” on page 9 and financial statements before deciding to invest in our common stock.

The Offering

|

Common Stock Outstanding Prior to the Offering

|

30,000,000 shares

|

|

|

Common Stock to be Outstanding Following the Offering

|

30,000,000 shares

|

|

|

Common Stock Offered

|

15,000,000 shares

|

|

|

Offering Price

|

$0.002 per share

|

|

|

Aggregate Offering Price

|

$30,000

|

|

|

Selling Security Holders

|

Two (2)

|

|

|

Use of Proceeds

|

We will not receive any of the proceeds of the shares offered by the Selling Security Holders. Plandel will pay all the expenses of this offering estimated at $16,302.

|

|

|

Underwriters

|

The Selling Security Holders are underwriters, within the meaning of Section 2(11) of the Securities Act.

|

|

|

Plan of Distribution

|

The Selling Security Holders named in the Prospectus are making this offering and may sell at market or privately negotiated prices.

|

|

|

Lack of Liquidity [No Public Market]

|

Our common stock is not currently quoted or traded on any securities exchange or automated quotation system. No application for such has yet been made. Thus, no assurance can be given that there will ever be an established public trading market for our common stock.

|

5

|

Carefully consider all the information, especially the “Risk Factors”, contained within the Prospectus before deciding whether to invest in common shares of our company.

|

||

|

Legal Proceedings

|

None pending or anticipated.

|

|

|

Dividend Policy

|

We intend to retain any future earnings to fund development and growth of our business and do not anticipate paying cash dividends.

|

Our Business

Plandel Resources, Inc. (“Plandel”, “we”, “us”, “our”, “the Company” or similar terms) was formed under the laws of the State of Nevada on March 19, 2010.

Plandel Resources Inc. offices are located at 2432 M. Dela Cruz, Pasay City, Philippines and can be reached at (702) 973-1853.

We are a start-up, pre-exploration mining company formed to explore mineral properties for gold. We have purchased a 100% interest in a 9 unit claim block (“Plandel Gold Claim”) containing 98.5 hectares that is recorded with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of the Philippines. Before we were formed, the claim was purchased on July 2, 2009 by our president Mario Gregorio from Rojas Ventures Ltd. (an unrelated company and duly incorporated body, which has its offices in Manila, Philippines) for the sum of $5,000. It was conveyed by him to us upon our formation on March 19, 2010. However, we do not currently have the necessary funds to undergo exploration of this property and will need to raise capital in order to do so. If we cannot, we may have to go out of business. The proposed two phase exploration plan will cost approximately $39,319. There has been no production to date. There are no full-time employees and management is able to spend only a small amount of time with respect to these affairs. Plandel has no other assets.

In July 2009, we hired a mining consultant, Roberto Noga, to study and propose exploration plans for the Plandel Gold Claim. The proposal can be found further into the prospectus under, “Description of Property” on page 18.

From our inception March 19, 2010 through February 28, 2011, we raised $30,000 in capital in private placements by issuing 30,000,000 shares of common stock at the price of $0.001 per share.

We have no subsidiaries.

Metric Conversion Table

For ease of reference, the following conversion factors are provided:

|

Metric Unit

|

U.S. Measure

|

U.S. Measure

|

Metric Unit

|

|||

|

1 hectare

|

2.471 acres

|

1 acre

|

0.4047 hectares

|

|||

|

1 metre

|

3.2881 feet

|

1 foot

|

0.3048 metres

|

|||

|

1 kilometre

|

0.621 miles

|

1 mile

|

1.609 kilometres

|

|||

|

1 gram

|

0.032 troy oz.

|

1 troy ounce

|

31.1 grams

|

6

Financial Information and Accounting Principles

All “$” or “dollars” refer to the U.S. dollar unless otherwise specified. All references to PHP refer to the Philippine Peso. All financial statements refer to GAAP in the United States and are reported in U.S. dollars.

Exchange Rate Information

One PHP is approximately $0.02. Inversely, $1 is 46.53 PHP as of May 14, 2010. A five-year low conversion strength for the US dollar was around January 2008 where $1 was roughly 40 PHP and 5 year high around December 2005 where $1 was roughly 56 PHP. For the purposes of this prospectus $1 equates to 44 PHP.

Summary of Financial Data

The financial information below should be read in conjunction with the financial statements found later in the prospectus.

|

Since

Inception to

February 28,

2011

|

||||

|

Statement of Expenses Information:

|

||||

|

Revenue

|

$

|

-

|

||

|

Net Losses

|

34,938

|

|||

|

Total Operating Expenses

|

34,938

|

|||

|

Impairment loss on mineral claims

|

5,000

|

|||

|

General and Administrative

|

29,938

|

|||

|

As at

February 28,

2011

|

||||

|

Balance Sheet Information:

|

||||

|

Cash

|

$

|

12,887

|

||

|

Total Assets

|

18,887

|

|||

|

Total Liabilities

|

14,925

|

|||

|

Stockholder Equity

|

(2,038

|

) | ||

Risk Factors

There is a high degree of risk associated with buying our common stock. Prospective investors should carefully read this prospectus and consider the following risk factors when deciding whether to purchase our shares. These are speculative stocks and should be purchased by only those who can afford to lose their entire investment.

The risk factors outlined below are all the known, substantial, material and potential risks that could adversely affect our business, financial condition, operating results and common share value.

We cannot assure that we will successfully address these or any unknown risks and a failure to do so can have a negative impact on your investment.

Risks Associated with our Company and our Industry

We are governed by only two people, Mario Gregorio and Rizalina Raneses, which may lead to faulty corporate governance.

7

Our sole director and executive officers will own a substantial amount of common stock and will have substantial influence over our operations denying an investor an effective voice.

Before this offering, our director, Mario Gregorio, has control of our company with 67% of the outstanding common shares (20,000,000). Rizalina Raneses has 33% or 10,000,000 of the 30,000,000 outstanding shares. Should the entire offering be sold, they will still own 50% of the outstanding shares (33% and 17% respectively). If less than all the shares are sold, they will have more than 50% and complete control. This means that investors cannot buy an effective voice in the company.

Our director and officers are not residents of the United States making the enforcement of liabilities against them difficult.

The director and executive officers reside outside the United States in the Republic of the Philippines. If a shareholder had a desire to sue them for damages, the shareholder would have to serve a summons and complaint. Even if personal service is accomplished and a judgement is entered against that person, the shareholder would then have to locate the assets of that person, and register the judgement in the foreign jurisdiction where the assets are located.

Our executive officers have other business interests which may limit the amount of time they can devote to our Company and create conflicts of interest.

Our executive officers have other business interests, meaning they may not have enough time to devote to our business operations. This could cause business failure. They have been devoting and in the future plan to devote only 10 hours per month to company affairs which may lead to sporadic exploration activities and periodic interruptions of business operations. Unforeseen events may cause this amount of time to become even less. Our officers may also have conflicts of interest as a result of their relationships with other companies. See”Directors and Executive Officers.”

We must attract and maintain key personnel or our business will fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the mining industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

We are recently formed, lack an operating history and have yet to make any revenues. If we cannot generate any profits, you may lose your entire investment.

We are a recently formed company and have yet to generate any revenues. No profits have been made to date and if we fail to make any then we may fail as a business and an investment in our common stock will be worth nothing. We have no operating history and thus no way for you to measure progress or potential future success. Success has yet to be proved. Currently, there are no operations in place to produce revenue. We are pre-exploration and have yet to find or produce sellable product. Financial losses should be expected to continue in the near future and at least until such time that we enter the production stage. As a new business we face all the risks of a ‘start-up’ venture including unforeseen costs, expenses, problems, and management limitations and difficulties. Since inception, we have a loss of approximately $34,938. There is no guarantee, unfortunately, that we may ever be able to turn a profit or locate additional opportunities, hire additional management and other personnel.

8

We must obtain additional capital or our business will fail. In order to explore the claim and eventually establish operations, we must secure more funds. Currently, we have very limited resources and have already accumulated a net loss. Without operations, we will make no money which may result in complete loss of your investment. Financing is also needed to bring product to market. Financing may be subject to numerous factors including investor sentiment, acceptance of mining claims and so on. We currently have no arrangements for additional financing. We may also have to borrow large sums of money that require substantial capital and interest payments. We must perform mineral explorations on the Plandel Gold Claim to determine if any ore reserves are present and to keep the property in good standing.

The probability of a mineral claim having profitable reserves is very rare and our claim, even with large investments, may never generate a profit.

We are dependent upon our mining property for success. All anticipated future revenues would come directly from the Plandel Gold Claim. Should we fail to extract and sell gold from this property, our business will fail. Mineral deposit estimates are imprecise and subject to error, and resource calculations when made may prove unreliable. Assumptions made regarding the supporting data may prove inaccurate and unforeseen events may lead to further inaccuracies. Sample variability, mining and processing adjustments, environmental changes, metal price fluctuations, and law and regulation changes are all factors that could lead to deviances from the original estimations. No assurances can be given that any mineral deposit estimate will ever be reclassified as a reserve. We have no known ore reserves. Despite future investment in exploration activities, there is no guarantee we will locate a commercially viable ore reserve. Most exploration projects do no result in discovery of commercially mineable deposits. With little capital available, we will have to limit our exploration which decreases the chances of finding a commercially viable ore body. Even if gold is identified, the Plandel Gold Claim may not be put into production due to high extraction costs, low gold prices, or inadequate amount and reduced recovery rates. If the exploration activities do not suggest a commercially successful prospect then we may altogether abandon plans to develop the property.

The exploration and prospecting of minerals is speculative and extremely competitive which may make success difficult.

We face strong competition from other mining companies for the acquisition of new properties. New properties increase the probability of discovering a profitable reserve. Most companies have greater financial and managerial resources than we do and can acquire and explore attractive new mining properties. We will face similar difficulties raising new capital to expand operations against the larger, better capitalized competitors. Limited supply and unforeseen demand from larger, more competitive companies may make secure all necessary equipment and materials difficult and may result in periodic interruptions or even business failure. Success depends on a combination of many factors including but not limited to: the quality of management, technical (geological) expertise, quality of land available for exploration and the capital available for exploration.

International operations in the Philippines are subject to inherent risks.

Political instability, uncertainty of the economic climate, currency fluctuations, exchange controls and taxation laws may be significant. Access to all of the equipment, supplies and materials necessary to begin exploration may not be available and delay such activity. We have not yet attempted to locate or negotiate with any suppliers of products, equipment or materials but plan to do so when exploration begins. Exchange rate changes between the PHP and the U.S. Dollar may also adversely affect success.

9

Environmental regulations may negatively affect the progression of operations and these regulations may become stricter in the future. In the Philippines, all mining is regulated by Federal and Provincial level government agencies. Obtaining licenses and permits from these agencies as well as an environmental impact study for each mining property must be completed before starting mining activities. These are expensive and affect the timing of operations. Pollution can be anticipated with mining activities. If we are unable to comply with current or future regulations, this may expose us to fines, penalties and litigation that could cause our business to fail.

We are subject to inherent mining hazards and risks that may result in future financial obligations.

Risks and hazards associated with the mining industry may adversely affect our operations such as but not limited to: political and country risks, industrial accidents, labor disputes, inability to retain necessary personnel or equipment, environmental hazards, unexpected geologic formations, cave-ins, landslides, flooding and monsoons, fires, explosions, power outages, processing problems. Personal injury and death could result as well as property damage, delays in mining, environmental damage, legal liability and monetary loss. We may not be able to obtain insurance to cover these risks at economically reasonable premiums. We do not carry any sort of insurance and may have difficulties obtaining such once operations start as insurance is generally sparse and cost prohibitive.

Risks related to this offering and our stock

We may not be able to raise additional capital through the offering of more shares but doing so will dilute those shares issued and outstanding.

Raising additional capital through future offerings of common stock may be necessary for our company to continue going, but there is no guarantee that this will be possible. Doing so will, however, dilute the total share number issued and outstanding. Financing may be achieved by issuing more shares which will increase the number of common shares outstanding. This may decrease the percentage interest held by each of our shareholders. Obtaining financing through the sale of our common stock will dilute other shareholders’ interests. As the total number of outstanding common shares will increase, the equity attached to any individual share will decrease causing a dilution of shareholder ownership over the company. With little other access to funds currently, we may have to rely on this method substantially to raise additional capital.

10

Our common stock currently has no market limiting shareholders’ ability to resell them or use them as collateral. Thus, the shareholder must sell their shares privately which may prove very difficult. The shares are not currently listed on any exchange or quotation system. Private sales are more difficult and often give lower than anticipated prices.

Should a public market develop for our stock, future sales of shares may negatively affect their market price.

Even if a market develops, the shares may be sparsely traded and have wide share price fluctuations. If we succeed in receiving a quotation, the liquidity of the stock may be low despite there being a market making it difficult to get a return on the investment. The price also depends on potential investor’s feelings regarding the results of our operations, the competition of other companies’ shares, mineral prices, our ability to generate future revenues, and market perception about future mineral exploration.

Because our stock is a “penny stock”, trading of it may be restricted and limit a shareholder’s ability to buy and sell shares.

As our stock is a penny stock, there are restrictions imposed by the United States Securities and Exchange Commission’s penny stock regulations and the FINRA’s sales practice requirements. This might limit a shareholder’s ability to buy and sell their shares as broker-dealers may be less likely to engage in transactions of our common shares. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Our common stock is expected to trade well below that mark. Rules 15g-1 through 15g-9 under the Exchange Act impose sale practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock”.

We have not paid nor anticipate paying cash dividends on our common stock.

Cash dividends are not currently paid on our common stock shares nor are they expected to be paid in the near future. We intend to retain our cash for the continued development of our business. Thus, you will not be able to derive any dividend income and your return on investment will solely be based on your ability to sell your shares in a secondary market.

11

This prospectus relates to our common stock shares that will be offered on a continuous basis by the Selling Security Holders beginning immediately after the registration statement effective date, which is included in this prospectus, and may continue for a period in excess of thirty (30) days from this effective date. We are completing this registration statement to allow the Selling Security Holders to sell their shares. We, the issuer, will not acquire any proceeds from the common stock sale by the Selling Security Holders in this offering. Plandel will pay all expenses of this offering estimated at $16,302 (see PART II. Item 13)

Item 5. Determination of Offering Price

The offering price can be considered arbitrary as it bears no relationship to Plandel’s earnings, assets, book value or any other recognized criteria of value. It should not be associated with the actual value of Plandel as it was not based on this. It should also not be considered an indicator of the future market price of the shares. Currently there is no established public market for the common stock being registered. The factors used to generate the offering price were the general condition of the stock markets, Plandel’s financial condition, and Plandel’s lack of operating history.

The Selling Security Holders are expected to sell their shares at $0.002 until they are quoted on the OTCBB at which time they can sell them at market price. We will pay all expenses of the Selling Security Holders, except for any broker-dealer or underwriter commissions which will be paid by the security holder. At this time, the Selling Security Holders have not entered into any agreements, arrangements or understandings with any broker-dealers or underwriters. See Itrem 8 – Plan of Distribution for a description of the methods by which the shares may be sold.

Item 6. Dilution

The common stock to be sold by the Selling Security Holders is common stock that is currently issued and outstanding so there will be no dilution to the existing shares outstanding.

Item 7. Selling Security Holders

This prospectus covers the offering of up to 15,000,000 shares of our common stock. The shares issued to the Selling Security Holders are restricted under applicable federal and state security laws and are being registered to give them the opportunity to sell their shares.

The Selling Security Holders are residents and citizens of the Republic of the Philippines. They’re offering for sale a total of 15,000,000 shares of common stock of Plandel. This comprises 50 percent of the total outstanding shares. To the best of our knowledge, the Selling Security Holders have sole voting and investment power and rights over all their shares and are the beneficial owners. They have given all information regarding share ownership. The shares being offered are being registered to permit public secondary trading and the Selling Security Holders may offer all or part of his shares from time to time but is under no obligation to immediately sell them pursuant to this prospectus. Thus, Plandel cannot guarantee that any shares will be sold after this registration statement is effective.

12

|

Owner

|

Shares prior

to

offering

|

Shares to be

offered

|

Shares after

offering

|

Ownership

percentage

prior to

offering

|

Ownership

after offering

|

|||||||||||||||

|

Mario S. Gregorio

|

20,000,000

|

10,000,000

|

10,000,000

|

67

|

%

|

33

|

%

|

|||||||||||||

|

Rizalina Raneses

|

10,000,000

|

5,000,000

|

5,000,000

|

33

|

%

|

17

|

%

|

|||||||||||||

There have been no transactions between shareholders.

Item 8. Plan of Distribution

15,000,000 common stock shares are being registered on behalf of the Selling Security Holders. They may, from time to time, sell all or a portion of these shares in privately negotiated transactions or otherwise. The sales will be at fixed prices of $0.002 per share until amendments are made to this prospectus or the shares are quoted on the Over-the-Counter Bulletin Board (OTCBB) at which point they may be sold at the market price. The shares may be sold in a lawful manner using any one or more of the following methods: private transaction; ordinary brokerage transactions; transactions in which the broker-dealer solicits purchasers; broker-dealer as principal purchasers and resale by the broker-dealer for its own account; block trades in which the broker-dealer will attempt to sell the shares as an agent, but may position and resell a portion of the block as principal to facilitate the transaction; broker-dealer agreements with the selling shareholder to sell a specified number of such shares at a stipulated price per share; exchange distribution following the rules of the applicable exchange; short sales that are not violations of the laws and regulations of any state of the United States; through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; or through a combination of any such methods or other lawful means.

The Selling Security Holders are underwriters, within the meaning of Section 2(11) of the Securities Act. Any broker-dealers or agents that participate in the sale of the common stock or interests therein may also be deemed to be an "underwriter" within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit earned on any resale of the shares may be underwriting discounts and commissions under the Securities Act. The Selling Security Holders, who are "underwriters" within the meaning of Section 2(11) of the Securities Act, are subject to the prospectus delivery requirements of the Securities Act.

The Brokers or dealers may receive commissions or discounts from the Selling Security Holders, if any of the broker-dealer acts as an agent for the purchaser of said shares, from the purchaser in the amount to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with the Selling Security Holders to sell a specified number of the shares of common stock at a stipulated price per share. In connection with such re-sales, the broker-dealer may pay to or receive from the purchasers of the shares, commissions as described above. Any broker or dealer participating in any distribution of the shares may be required to deliver a copy of this prospectus, including any prospectus supplement, to any individual who purchases any shares from or through such broker-dealer.

13

The Selling Security Holders may also elect to sell their common shares in accordance with Rule 144 under the Securities Act of 1933, rather than pursuant to this prospectus. After the sale of the shares offered by this prospectus the Selling Security Holders will have 15,000,000 common shares. The sale of these shares could have an adverse impact on the price of our shares or on any trading market that may develop.

We have not registered or qualified offers and sales of shares of common stock under the laws of any country, other than the United States. To comply with certain states’ securities laws, if applicable, the Selling Security Holders will offer and sell their shares of common stock in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the Selling Security Holders may not offer or sell shares of common stock unless we have registered or qualified such shares for sale in such states or we have complied with an available exemption from registration or qualification.

All expenses of this registration statement, estimated to be $16,302 (see “Use of Proceeds” page 12), including but not limited to legal, accounting, printing and mailing fees will, be paid by Plandel. However, any selling costs or brokerage commissions incurred by each Selling Security Holder relating to the sale of their shares will be paid by them.

Item 9. Description of Securities to be Registered

Our authorized capital stock is 300,000,000 shares of common stock, par value 0.001 per share, of which 30,000,000 shares of common stock are issued and outstanding. No other class or series of shares are currently authorized under Plandel’s Articles of Incorporation.

Common Shares

Holders of common stock are entitled to one vote per share on all matters subject to stockholder vote. Holders of our shares of common stock do not have cumulative voting rights, which means that the shareholders of more than 50% of such outstanding shares, voting for the election of Directors, can elect all of the Directors to be elected, if they so choose. In such event, the holders of the remaining shares will not be able to elect any of our Directors.

The common stock has no pre-emptive or other subscription rights. All of the presently outstanding shares of common stock are fully paid and non assessable. If the corporation is liquidated or dissolved, holders of shares of common stock will be entitled to share prices relating to asset values remaining after subtraction of liabilities and subject to the rights, if any, of the holders of preferred stock.

As of the date of this prospectus we have not paid any cash dividends to stockholders. The declaration of any future cash dividends will be at the discretion of the Board of Directors and will depend on our earnings, if any, capital requirements and financial position, general economic conditions and other pertinent conditions. It is our present intention not to pay any cash dividends in the near future. The holders of the common stock are entitled to receive dividends when and as declared by the Board of Directors, out of funds legally available therefore. The corporation has not paid cash dividends with respect to its common stock in the past. No share of common stock of the corporation which is fully paid is liable to calls or assessment by the corporation.

14

No experts named in this prospectus have an interest in the company and thus there exist no conflicts of interest in this respect

Experts

Our financial statements have been audited by Madsen & Associates, Inc., Unit #3 – 684 East Vine Street, Murray, Utah, 84107 as set forth in their report included elsewhere in this prospectus (see page 32).

The geological report on the Plandel Gold Claim dated July 10, 2009 titled "Summary of Exploration on the Plandel Property, Baguiao, Philippines”, was authored by Roberto Noga, P. Geol., Manila, Republic of the Philippines and has been incorporated into the “Description of Property” on page 17. The report is exhibit 99 to the registration statement of which this prospectus is a part.

Legal Matters

The law firm of Glenn & Glenn has rendered a legal opinion regarding the validity of the shares of common stock offered by the Selling Security Holders. It is exhibit 5 to the registration statement of which this prospectus is a part.

. Item 11. Information with Respect to the Registrant

Description of business

Introduction

We are a start-up pre-exploration mining company with one mineral claim (the Plandel Gold claim) in the Republic of the Philippines. Our goal is to generate revenues through the sale of gold found and extracted from this claim. We have a specific business plan to complete exploration work on this claim and have no reason to alter this plan within the next twelve months. The company has no subsidiaries, affiliates or joint venture partners. We do not intend to enter into a merger or acquisition, have not been involved in any large purchases other than that of the Plandel Gold Claim and have not been involved in any reclassification, bankruptcy or receivership since inception.

Background

Plandel Resources, Inc. was established as a private company by Mario S. Gregario and Rizalina Raneses to acquire and develop gold properties while world gold prices are strong.

We raised $30,000 in initial capital in order to identify and purchase a promising mineral property claim. Pursuant to Regulation S of the Securities Act of 1933, Plandel sold 30,000,000 shares of its common stock in a private placement for the $30,000.

Prior to our actual incorporation, our president Mario Gregorio acquired the Plandel Gold Claim from Rojas Ventures Ltd., an unrelated company, on July 2, 2009 for the sum of $5000. This is our only mineral claim. It was conveyed by him to us upon our formation on March 19, 2010.

In July 2009, we engaged a mining consultant, Roberto Noga, to develop a preliminary scoping study for the development of the Plandel Claim. Previous exploration work was reviewed and recommendations for an exploration program made. His report is the basis for the “Description of Property” on page 15.

15

Assuming we can raise the necessary capital, we intend to carry out the exploration program proposed on the Plandel Claim. There is the distinct possibility that we will not only fail to raise the capital but fail to find a commercially viable ore body. There is no guarantee that gold of significant value will be found. We currently do not have any ore body, products or revenues.

Executive Offices

We lease our principal executive offices at 2432 M. Dela Cruz, Pasay City, Philippines.

Our telephone number is (702) 973-1853.

Mining Property, Facilities and Operations

The company has a single mineral claim, the Plandel Gold Claim located in the Republic of the Philippines. A mining geologist has proposed a two phase exploration program of this property but no exploration has yet been carried out. There are no operations underway, no facilities other than the principal executive offices and no employees other than the two executive officers. Further information can be found in the following sections.

Exploration and Production

We are a pre-exploration company with no production (of gold and gold related products). No exploration has been conducted to date either. We hope to explore our sole mineral claim in the near future.

Products and Gold

Plandel does not have any products including gold. .

Gold Prices

Gold prices have risen steadily over the last few years. In 2000, gold traded between $260 and $315 USD per ounce based on London PM Fix Price. In 2005, this was between $440 and $540. In 2010, gold trades at roughly $1000 per ounce.

Other Minerals

We are planning to search for gold but will consider extracting other minerals if found in significant value on the Plandel Gold Claim.

Employees

At present, we have no employees other than our executive officers. We anticipate that we will be conducting most of our business through agreements and third parties. No such agreements have yet been made and will not be made until we near exploration. Our two executive officers only devote approximately 10 hours per month of their time to the affairs of the company. See “Directors and Executive Officers.” At present, we have no employment agreements with them. We also do not have any health plans, benefits, profit sharing, annuity, insurance, or pension plans.

Competitive Factors

There are numerous larger and better capitalized mining companies in competition with us for properties, personnel, equipment and market share. We are one of the smallest companies and right at the beginning of our journey. We lack the resources that our competitors have. Our success depends on raising the capital, obtaining the personnel and equipment and finding a commercially viable ore body on our mineral claim. None has yet been found, but we are the only entity entitled to explore this claim.

16

The Company will be conducting exploration activities in the Republic of the Philippines. If the U.S. dollar loses strength to the PHP this may adversely affected the Company’s operations.

Purchases of Equity Securities by the Small Business Issuer and Affiliates

There were no purchases of our equity securities by us from inception to February 28, 2011.

Regulation of Mining Activity- Republic of Philippines Mining Laws

Government and environmental regulations exist in the Philippines and our exploration plans are subject to these various laws. The rules are dynamic and are generally becoming more demanding. Our plans aim to safeguard public and environmental health. We are currently in compliance with all material mining, health, safety, and environmental statutes of the Republic of the Philippines.

Legislation

Changes to current laws in the jurisdiction in which we operate may require additional costs and financing. These changes are unpredictable and the additional requirements may render certain exploration activities uneconomical and lead to business failure.

Description of Property

Information in this section of the prospectus is based upon the geological report on the Plandel Gold Claim dated July 10, 2009 titled "Summary of Exploration on the Plandel Property, Baguiao, Philippines”, which was authored by Roberto Noga, P. Geol., Manila, Republic of the Philippines (the “Report”). The Report is exhibit 99 to the registration statement of which this prospectus is a part.

Property Location and Description

Plandel Gold Claim consists of one (1) unpatented mineral claim, located 30 kilometres northwest of the city of Baliuag at UTM co-ordinates Latitude 14 88’148”N and Longitude 120 86’712”E. The mineral claim was assigned to Plandel Resources, Inc. by Rojas Ventures Ltd. (an unrelated company) and the said assignment was filed with the Mineral Resources Department of the Ministry of Energy and Mineral Resources of the Government of the Republic of the Philippines. We own 100% of this claim with no encumbrance.

There are no known environmental concerns or parks designated for any area contained within the claims. The property has no encumbrances. As advanced exploration proceeds there may be bonding requirements for reclamation.

Plandel Resources, Inc. has purchased a 100% interest in the property.

The primary identifying information of the Plandel Gold Claim is a Parcel Identifier as registered with the Department of Environmental and Natural Resources – Mines and Geosciences. The parcel Identifier with the Plandel Gold Claim is 1322-544-221 as recorded both with the above authority and the Plandel Titles Office. The area of the claim is 98.5 hectares. In order to obtain a mining license in the Philippines, an applicant company must apply with the Department of Environment and natural Resources – Mines and Geosciences. The above authority then conducts a search of the local titles office and its own records to verify that the applicant company is the owner and rights holder of the claim. Once that has been verified, the department of Environment and Natural Resources – Mines and Geosciences issues a License and permit for Mining and Exploration. The license usually takes seven to ten business days to obtain and is valid for one year. Bonding requirements are strictly the responsibility of the Mining Company engaged to undertake operation on behalf of Plandel Resources Inc.

The Plandel Gold Claim is an exploration claim and the claims are Federal and under the jurisdiction of the Department of Environment and natural Resources – Mines and Geosciences of the Philippines. A renewal of the mining license must be made thirty days prior to the expiration of the existing license. Failure to do so will result in our being unable to undertake any further exploration activities on the Plandel Gold Claim. With obtaining of the license, we must abide by the Environmental and Safety requirements set forth by the Department of Environment and Natural Resources – Mines and Geosciences of the Philippines. Environmental terms and conditions affiliated with a mining license are sections 69 and 70 respectively of Philippine Mining Law. Prior to exploration commencing, an environmental protection and enhancement program must be drafted and approved by the Government of the Philippines. This is usually done by the exploration company engaged by the company to conduct exploration activities. Furthermore, section 70 states that there must be an Environmental Impact Assessment undertaken by the Federal Government in conjunction with the local government unit and other concerned bodies to ensure that the company contracted to undertake mining activities observes all of the requirements of environmental protection.

Fees for the license must be paid at the time of the renewal application and usually amount to approximately $1000.00 including all agents’ fees and solely the responsibility of the owner of the claim, in this case, Plandel Resources Inc. The license expires on September 15, 2011.

17

Except as described above, there are no material terms of the land or mineral rights securing agreements with respect to the Plandel Gold Claim.

The mining license described above is the only permit in order to explore or mine the Plandel Gold Claim.

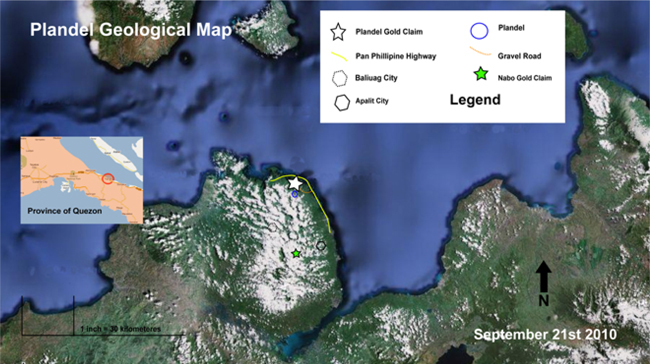

A map of the Plandel Gold claim is set forth below:

Royalty Obligations and Other Underlying Agreenments

None.

Accessibility, Climate, Local Resources, Infrastructure, and Topography

18

The Philippines is situated between 5 and 22 degrees North Latitude. This means the country falls within the so-called tropical climate zone, a zone characterized by high temperatures the whole year round, relatively high rainfall and lush vegetation. Rainfall on the city can occur in every month, but the wettest months are October, November and December. Annual rainfall is approximately 1.5 metres. Due to the steep, deforested mountains, around 60 percent of the rainwater runs quickly to the sea. The remaining 40 percent partly evaporates and partly seeps through to the island’s underground water aquifer.

Plandel Gold Claim’s area has an experienced work force and will provide all the necessary services needed for an exploration and development operation, including police, hospitals, groceries, fuel, helicopter services, hardware and other necessary items. Drilling companies and assay facilities are present in Baliuag.

History

Deposits of shell and eroded sand formed the basis for the limestone, which makes up most of the Philippines. This limestone was, over the ages, pushed upwards making it possible to find today sea fossils high in the country’s mountains. This pushing up continues today. It is caused by the fact that the Philippine Plate, on which most of the country lies, is slowly diving under the Eurasian Plate of the mainland Asia.

The Philippines are characterized by steep mountains without any substantial forest cover. Highest peaks reach over 1,000 meters. The island is 300 km long and 35 km wide. Erosion is a problem as there is a lack of forest cover on the high, steep mountains.

The island has vast copper, gold and coal reserves which are mined mainly in the central part.

During the 1990’s several properties south of Plandel Gold Claim were drilled by junior mineral exploration companies.

Plandel Resources, Inc. is preparing to conduct preliminary exploration work on the property.

Geological setting

Regional Geology of the Area

The hilly terrains and the middle level plain contain crystalline hard rocks such as charnockites, granite gneiss, khondalites, leptynites, metamorphic gneisses with detached occurrences of crystalline limestone, iron ore, quartzo-feldspathic veins and basic intrusive such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in the most of the districts except the coastal area.

19

The principal bedded rocks for the area of Plandel Gold Claim (and for most of the Philippines) are Precambrian rocks which are exposed along a wide axial zone of a broad complex.

Gold at the Nabo Gold Mine (which, as stated above, is in close proximity to the Plandel Gold Claim) is generally concentrated within extrusive volcanic rocks in the walls of large volcanic caldera.

Intrusive

In general, the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulphides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

Gold belts in sheared gneissic rocks is found in three sub-parallel auriferous load zones where some blocks having 300 to 600 meter length and 2 to 3.5 meter width could be identified as most promising ones.

Structure

Depositional Environment / Geological Setting: Veins form in high-grade, dynamothermal metamorphic environment where metasedimentary belts are invaded by igneous rocks.

Host / Associated Rock Types: Hosted by paragneisses, quartzites, clinopyroxenites, wollastonite-rich rocks, pegmatites. Other associated rocks are charnockites, granitic and intermediate intrusive rocks, quartz-mica schists, granulites, aplites, marbles, amphibolites, magnetite-graphite iron formations and anorthosites.

Tectonic Setting(s): Katazone (relatively deep, high-grade metamorphic environments associated with igneous activity; conditions that are common in the shield areas).

Deposit Types

Deposits are from a few millimetres to over a metre thick in places. Individual veins display a variety of forms, including saddle-, pod- or lens-shaped, tabular or irregular bodies; frequently forming anastomosing or stockwork patterns.

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of 4 km and are mostly within 600 m of the surface. Lodes occur in three main structural settings:

(i) Steeply dipping northwest-striking shears;

(ii) Flat-dipping fractures (flatmakes); and

(iii) Shatter blocks between shears.

Most of the gold occurs in tellurides and there are also significant quantities of gold in pyrite.

Mineralization

No mineralization has been reported for the area of the property but structures and shear zones affiliated with mineralization on adjacent properties pass through it.

20

Records indicate that no detailed exploration has been completed on the property.

Property Geology

To the south of the property is intrusive consisting of rocks such as tonalite, monzonite, and gabbro while the property itself is underlain by sediments and volcanic rock. The intrusive also consist of a large mass of granodiorite towards the western most point of the property.

The area consists of interlayered chert, argillite and massive andesitic to basaltic volcanic. The volcanic are hornfelsed, commonly contain minor pyrite, pyrrhotite.

Drilling Summary

No drilling is reported on the Plandel Gold Claim.

Sampling Method, Sample Preparation, Data Verification

All the exploration will be conducted according to generally accepted exploration procedures with methods and preparation that are consistent with generally accepted exploration practices. No samples have been taken.

No other procedures of quality control will be employed and no opinion on their absence is expressed.

Report Recommendations

A two phase exploration program to further delineate the mineralized system currently recognized on Plandel Gold Claim is recommended.

The program would consist of air photo interpretation of the structures, geological mapping, both regionally and detailed on the area of the main showings, geophysical survey using both magnetic and electromagnetic instrumentation in detail over the area of the showings and in a regional reconnaissance survey and geochemical soil sample surveying regionally to identify other areas on the claim that are mineralized and in detail on the known areas of mineralization. The effort of this exploration work is to define and enable interpretation of a follow-up diamond drill program, so that the known mineralization and the whole property can be thoroughly evaluated with the most up-to-date exploration techniques.

21

The proposed budget for the recommended work in PHP is 1,829,500 (or $39,319 USD) as follows:

Phase I

|

· Geological Mapping

|

PHP

|

315,000

|

$

|

6,770

|

||

|

· Geophysical Surveying

|

PHP

|

276,000

|

5,932

|

|||

|

Total

|

PHP

|

591,000

|

$

|

12, 702

|

Phase II

· Geochemical surveying and surface sampling (includes sample collection and assaying)

|

PHP

|

1,238,500

|

$

|

26,617

|

|||

|

Total

|

PHP

|

1,238,500

|

26,617

|

|||

|

Grand Total Exploration

|

PHP

|

1,829,500

|

$

|

39,319 USD

|

Glossary of Mining Terms

|

Amphibolite

|

a class of metamorphic rock composed mainly of amphibole with some quartz

|

|

Andesite

|

a class of fine-grained rock, of volcanic origin, containing mostly plagioclase and feldspar

|

|

Anorthosite

|

a phaneritic, intrusive igneous rock characterized by a predominance of plagioclase feldspar

|

|

Aplite

|

a fine-grained granitic rock composed mostly of quartz and feldspars

|

|

Aquifer

|

an underground layer of water-bearing porous stone, earth, or gravel

|

|

Argile

|

clay

|

|

Argillite

|

a rock derived either from siltstone, claystone or shale that has undergone a somewhat higher degree of induration than is present in those rocks.

|

|

Assaying

|

laboratory examination that determines the content or proportion of a specific metal contained within a sample.

|

|

Auriferous

|

refers to gold (AU) or gold equivalents (AUEQ).

|

|

Basalt

|

a hard rock of varied mineral content; volcanic in origin, it makes up much of the Earth's crust

|

|

Bauxite

|

the principal ore of aluminium; a clay-like mineral, being a mixture of hydrated oxides and hydroxides.

|

|

Caldera

|

a large circular volcanic depression often originating due to collapse

|

22

|

any orthopyroxene-bearing granite, composed mainly of quartz, perthite or antiperthite and orthopyroxene (usually hypersthene), as an end-member of the charnockite series [1] .

|

|

|

Chert

|

massive, dull-colored and opaque quartzite, hornstone, impure chalcedony or other flint-like mineral. By general usage in mineralogy and geology, a chert does not have a conchoidal fracture. In North American archeology the term chert occasionally is still used for various siliceous minerals (including flint) that have a conchoidal fracture; this leads to confusion between the terms flint and chert in some archeology texts.

|

|

Clay

|

a mineral substance made up of small crystals of silica and alumina, that is ductile when moist; the material of pre-fired ceramics; an earth material with ductile qualities

|

|

Clinopyroxene

|

any pyroxene that has a monoclinic crystal structure

|

|

Coal

|

a readily combustible black or brownish-black sedimentary rock normally occurring in rock strata in layers or veins called coal beds. The harder forms, such as anthracite coal, can be regarded as metamorphic rock because of later exposure to elevated temperature and pressure. Coal is composed primarily of carbon along with variable quantities of other elements, chiefly sulfur, hydrogen, oxygen and nitrogen.

|

|

Copper

|

a chemical element with the symbol Cu (Latin: cuprum) and atomic number 29. It is a ductile metal with very high thermal and electrical conductivity. Pure copper is rather soft and malleable, and a freshly-exposed surface has a pinkish or peachy color.

|

|

Cretaceous age

|

a geological period and system from 145 to 65 million years ago.

|

|

a solid material, whose constituent atoms, molecules, or ions are arranged in an orderly repeating pattern extending in all three spatial dimensions; ie. crystals.

|

|

|

Dolerite

|

A fine-grained basaltic rock

|

|

Dynamothermal

|

rock formed at variable temperatures

|

|

Extrusive

|

the mode of igneous volcanic rock formation in which hot magma from inside the Earth flows out (extrudes) onto the surface as lava or explodes violently into the atmosphere to fall back as pyroclastics or tuff. This is opposed to intrusive rock formation, in which magma does not reach the surface. The main effect of extrusion is that the magma can cool much more quickly in the open air or under seawater, and there is little time for the growth of crystals. Often, a residual portion of the matrix fails to crystallize at all, instead becoming an interstitial natural glass or obsidian.

|

|

Fault

|

a break in the continuity of a body of rock. It is accompanied by a movement on one side of the break or the other so that what were once parts of one continuous rock stratum or vein are now separated. The amount of displacement of the parts may range from a few inches to thousands of feet.

|

|

Feldspar

|

any of a large group of rock-forming minerals that, together, make up about 60% of the earth's outer crust. The feldspars are all aluminum silicates of the alkali metals sodium, potassium, calcium and barium. Feldspars are the principal constituents of igneous and plutonic rocks.

|

|

Flatmake

|

flat-dipping fractures

|

23

|

Fold

|

a curve or bend of a planar structure such as rock stata, bedding planes, foliation, or cleavage.

|

|

Foliation

|

A general term for a planar arrangement of textural or structural features in any type of rock; esp., the planar structure that results from flattening of the constituent grains of a metamorphic rock.

|

|

Formation

|

a distinct layer of sedimentary rock of similar composition.

|

|

Gabbro

|

a group of dark-colored, basic intrusive igneous rocks composed principally of basic plagioclase (commonly labradorite or bytownite) and clinopyroxene (augite), with or without olivine and orthopyroxene; also, any member of that group. It is the approximate intrusive equivalent of basalt. Apatite and magnetite or ilmenite are common accessory minerals.

|

|

Geochemistry

|

the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

|

|

Geophysicist

|

one who studies the earth; in particular the physics of the solid earth, the earth’s magnetosphere, and the atmosphere.

|

|

Geotechnical

|

the study of ground stability

|

|

Gneiss

|

a foliated rock formed by regional metamorphism, in which bands or lens-shaped strata or bodies of rock of granular minerals alternate with bands or lens-shaped strata or bodies or rock in which minerals having flaky or elongate prismatic habits predominate

|

|

Gold

|

chemical element with the symbol Au (from Latin: aurum, "shining dawn") and an atomic number of 79. It has been a highly sought-after precious metal for coinage, jewelry, and other arts since the beginning of recorded history. The metal occurs as nuggets or grains in rocks, in veins and in alluvial deposits. Gold is dense, soft, shiny and the most malleable and ductile pure metal known. Pure gold has a bright yellow color and luster traditionally considered attractive, which it maintains without oxidizing in air or water. Gold is one of the coinage metals and has served as a symbol of wealth and a store of value throughout history. Gold standards have provided a basis for monetary policies. It also has been linked to a variety of symbolisms and ideologies.

|

|

Granite

|

highly felsic igneous plutonic rock, typically light in color; rough plutonic equivalent of rhyolite. Granite is actually quite rare in the U.S.; often the term is applied to any quartz-bearing plutonic rock.

|

|

Granodiorite

|

a group of coarse-grained plutonic rocks intermediate in composition between quartz diorite and quartz monzonite, and potassium feldspar, with biotite, hornblende, or more rarely, pyroxene, as the mafic component.

|

|

Granulite

|

fine to medium–grained metamorphic rocks that have experienced high temperatures of metamorphism, composed mainly of feldspars sometimes associated with quartz and anhydrous ferromagnesian minerals, with granoblastic texture and gneissose to massive structure. They are of particular interest to geologists because many granulites represent samples of the deep continental crust. Some granulites experienced decompression from deep in the Earth to shallower crustal levels at high temperature; others cooled while remaining at depth in the Earth.

|

24

|

Graphite

|

one of the allotropes of carbon. Unlike diamond (another carbon allotrope), graphite is an electrical conductor, a semimetal, and can be used, for instance, in the electrodes of an arc lamp. Graphite holds the distinction of being the most stable form of carbon under standard conditions.

|

|

Gypsum

|

a mineral consisting of the hydrated calcium sulphate. When calcined, it forms plaster of Paris.

|

|

Heavy mineral sands ore deposits a class of ore deposit which is an important source of zirconium, titanium, thorium, tungsten, rare earth elements, the industrial minerals diamond, sapphire, garnet, and occasionally precious metals or gemstones. Heavy mineral sands are placer deposits formed most usually in beach environments by concentration due to the specific gravity of the mineral grains. It is equally likely that some concentrations of heavy minerals (aside from the usual gold placers) exist within streambeds, but most are of a low grade and are relatively small.

|

|

Hydrothermal

|

creation of rock with fluid at high temperatures

|

|

resulting from, or produced by, the action of great heat; with rocks, it could also mean formed from lava/magma; granite and basalt are igneous rocks

|

|

|

Intrusions

|

masses of igneous rock that, while molten, were forced into other rocks.

|

|

Iron

|

chemical element with the symbol Fe (Latin: ferrum) and atomic number 26. It is a metal in the first transition series. Like other group 8 elements, it exists in a wide range of oxidation states. Iron and iron alloys (steels) are by far the most common metals and the most common ferromagnetic materials in everyday use. Fresh iron surfaces appear lustrous silvery-gray, but oxidize in air. Iron is the most common element in the earth, albeit the fourth most common one in the earth's crust.

|

|

Khondalite

|

a granulite-facies metasedimentary rock.

|

|

Laterite

|

a red hard or gravel-like soil or subsoil formed in the tropics that has been leached of soluble minerals leaving insoluble iron and aluminium oxides and hydroxides; used to make bricks and roads.

|

|

Leptynite

|

a granulite.

|

|

Lignite

|

a low-grade, brownish-black coal

|

|

Limestone

|

An abundant rock of marine and fresh-water sediments; primarily composed of calcite (calcium carbonate); it occurs in a variety of forms, both crystalline and amorphous.

|

|

Marble

|

a non foliated metamorphic rock composed mostly of calcite, a crystalline form of calcium carbonate. It is formed from carbonate rocks, often limestone. It is extensively used for sculpture and as a building material.

|

|

Magnetite

|

a ferrimagnetic mineral with chemical formula Fe 3 O 4 , one of several iron oxides and a member of the spinel group.

|

|

Metamorphic

|

the mineralogical, chemical, and structural adjustment of solid rocks to physical and chemical conditions that have generally been imposed at depth below the surface zones of weathering and cementation, and that differ from the conditions under which the rocks in question originated.

|

|

Metasediment

|

a metamorphosed sedimentary rock

|

25

|

Mica

|

the name of a group of hydrous aluminosilicate minerals characterized by highly perfect cleavage, so that they readily separate into very thin leaves, more or less elastic.

|

|

Monzonite

|

an intermediate igneous intrusive rock composed of approximately equal amounts of sodic to intermediate plagioclase and orthoclase feldspars with minor amounts of hornblende, biotite and other minerals.

|

|

Ore

|

the natural occurring mineral from which a mineral or minerals of economic value can be extracted profitable or to satisfy social or political objectives.

|

|

Oxides

|

a chemical compound containing at least one oxygen atom as well as at least one other element. Most of the Earth's crust consists of oxides. Oxides result when elements are oxidized by oxygen in air.

|

|

Paragneisses

|

a gneiss from sedimentary rock

|

|

Peat

|

an accumulation of partially decayed vegetation matter. Peat forms in wetland bogs, moors, muskegs, pocosins, mires, and peat swamp forests. Peat is harvested as an important source of fuel in certain parts of the world.

|

|

Pegmatite

|

a very coarse-grained, intrusive igneous rock composed of interlocking grains usually larger than 2.5 cm in size; such rocks are referred to as pegmatitic. Most pegmatites are composed of quartz, feldspar and mica; in essence a granite. Rarer intermediate composition and mafic pegmatites containing amphibole, Ca-plagioclase feldspar, pyroxene and other minerals are known, found in recrystallised zones and apophyses associated with large layered intrusions.

|

Phosphatic nodules black to brown, rounded mass, variable in size from a few millimeters to 30 or more centimeters. Usually consists of coprolites, corals, shells, and bones, more or less enveloped in crusts of collophane. Found in many horizons of marine origin. Also covering the ocean floors at manylocations around the world

|

Placers

|

an accumulation of valuable minerals formed by deposition of dense mineral phases in a trap site.

|

|

a rare, naturally occurring metallic chemical element of high economic value, which is not radioactive (excluding natural polonium, radium, actinium and protactinium). Chemically, the precious metals are less reactive than most elements, have high lustre, are softer or more ductile, and have higher melting points than other metals. Historically, precious metals were important as currency, but are now regarded mainly as investment and industrial commodities. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

|

|

|

Production

|

a “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

|

|

Pyrite

|

a yellow iron sulphide mineral of little value and referred to as ‘fool’s gold’.

|

|

Pyrrhotite

|

a bronze-colored, magnetic iron sulphide mineral

|

|

Quartz

|

a common rock-forming mineral consisting of silicon and oxygen

|

|

Quartzite

|

a hard metamorphic rock which was originally sandstone. Sandstone is converted into quartzite through heating and pressure usually related to tectonic compression within orogenic belts. Pure quartzite is usually white to grey, though quartzites often occur in various shades of pink and red due to varying amounts of iron oxide. Other colors, such as yellow and orange, are due to other mineral impurities.

|

26

|

Reserve

|

the term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined.

|

|

Schist

|

any crystalline rock having a foliated structure and hence admitting of ready division into slabs or slates.

|

|

Seismic

|

referring to earthquakes

|

|

Shear

|

a form of strain resulting from stresses that cause or tend to cause contiguous parts of a body of rock to slide relatively to each other in a direction parallel to their plane of contact.

|

|

Silica

|

the chemical compound silicon dioxide, also known as silica (from the Latin silex), is an oxide of silicon with a chemical formula of SiO 2 and has been known for its hardness since antiquity. Silica is most commonly found in nature as sand or quartz, as well as in the cell walls of diatoms. Silica is the most abundant mineral in the Earth's crust.

|

|

Stockwork

|

a complex system of structurally controlled or randomly oriented veins. Stockworks are common in many ore deposit types and especially notable in greisens. They are also referred to as stringer zones.

|

|

Stratum

|

one of several parallel horizontal layers of material arranged one on top of another. A layer of sedimentary rock having approximately the same composition throughout

|

|

Sulphides

|

an anion of sulfur in its lowest oxidation number of −2. Sulfide is also a slightly archaic term for thioethers, a common type of organosulfur compound that are well known for their bad odors.

|

|

Telluride

|

a compound of a metal with tellurium; metal salts of tellurane. Any organic compound of general formula R 2 Te (R not = H), the tellurium analogues of ethers. Another name for sylvanite.

|

|

Tonalite

|

an igneous, plutonic (intrusive) rock, of felsic composition, with phaneritic texture. Feldspar is present as plagioclase (typically oligoclase or andesine) with 10% or less alkali feldspar. Quartz is present as more than 20% of the rock. Amphiboles and pyroxenes are common accessory minerals.

|

|

UTM

|