Attached files

| file | filename |

|---|---|

| 8-K - TRUSTCO BANK CORP N Y 8-K 5-19-2011 - TRUSTCO BANK CORP N Y | form8k.htm |

Exhibit 99(a)

Welcome to the

2011 Annual Meeting

Shareholder Assembly Agenda

•State of the Industry / Economy

•Financial Performance

•Performance vs. Peers & Stock Performance

•Dividend Record and Capital

•Future Plans

•Things to be Proud Of

•Questions and Answers

•Economic Conditions - Unemployment Level

- Housing Market

•Increasing Regulation

•Government Intervention - Unwinding

•Large Deficits / Low Interest Rates / Rising

Inflation / Rising Taxes

Inflation / Rising Taxes

•Asset Quality

State of the Industry

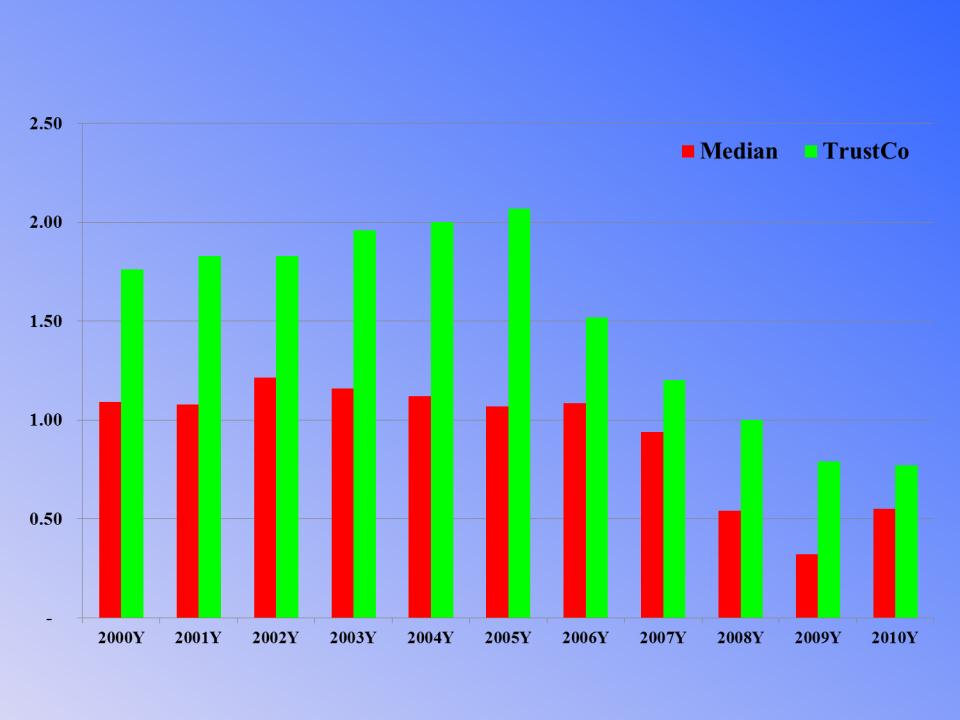

Return on Average Assets (%)

Return on Average Equity (%)

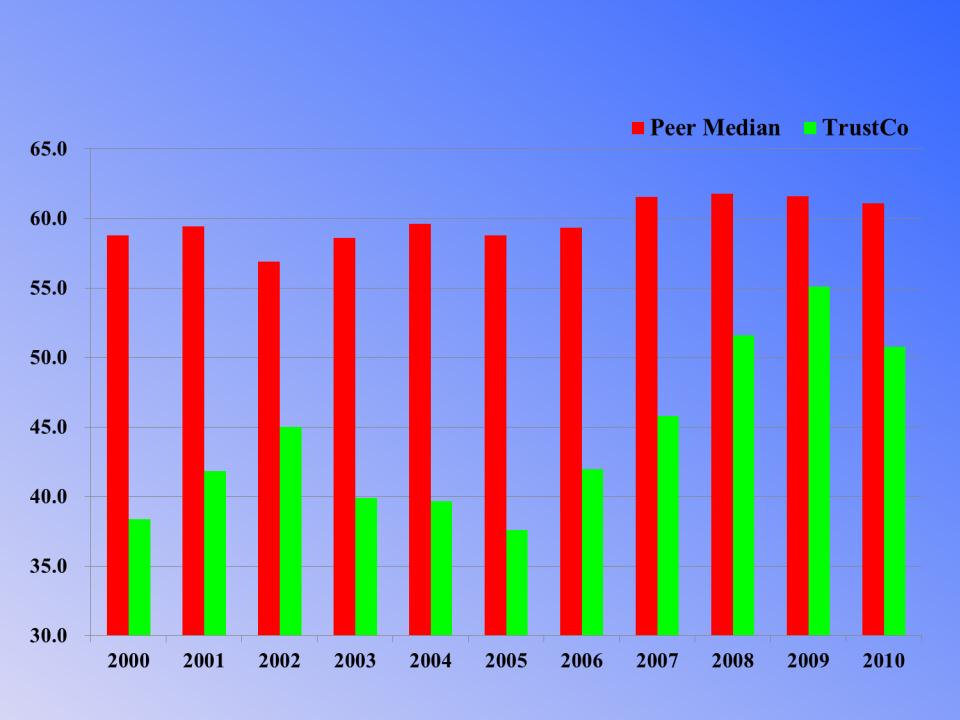

Efficiency Ratio (%)

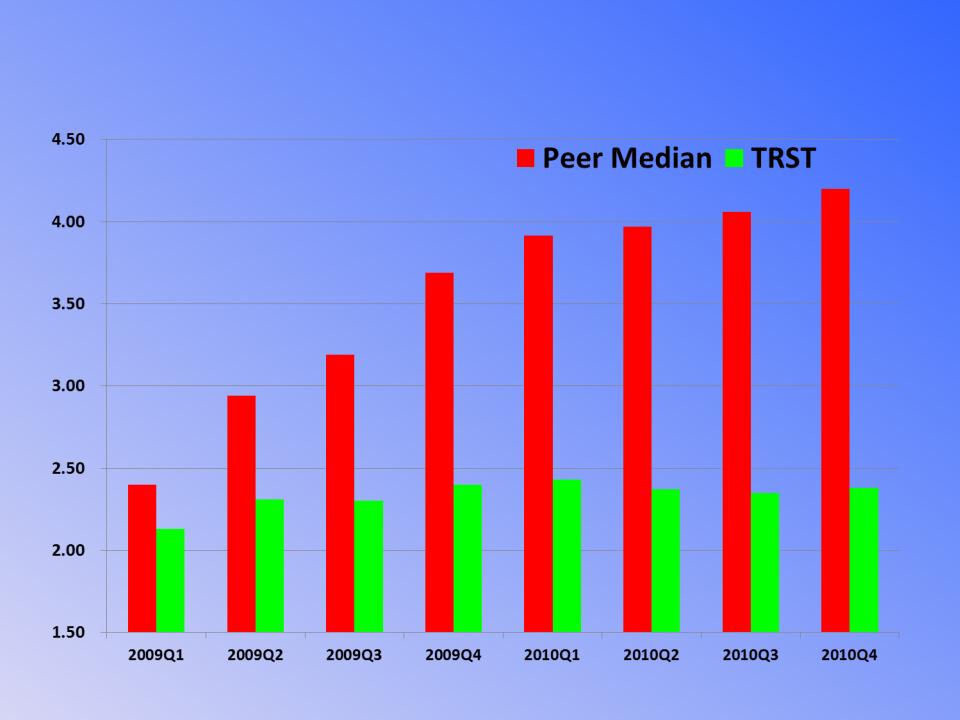

Non-performing Assets Ratio (%)

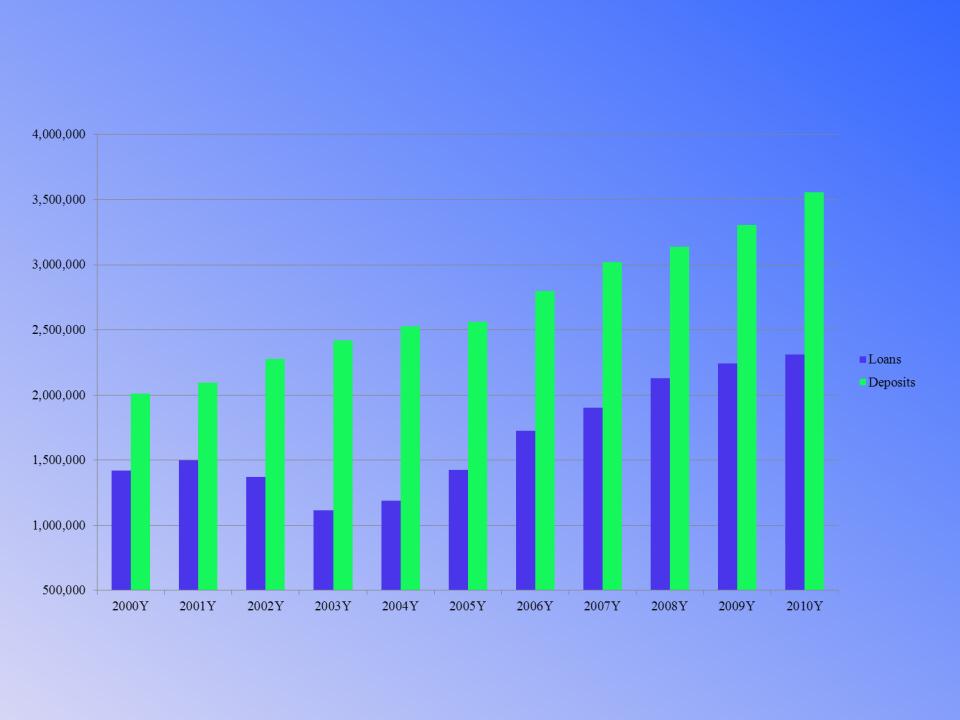

Loan and Deposit Growth ($000)

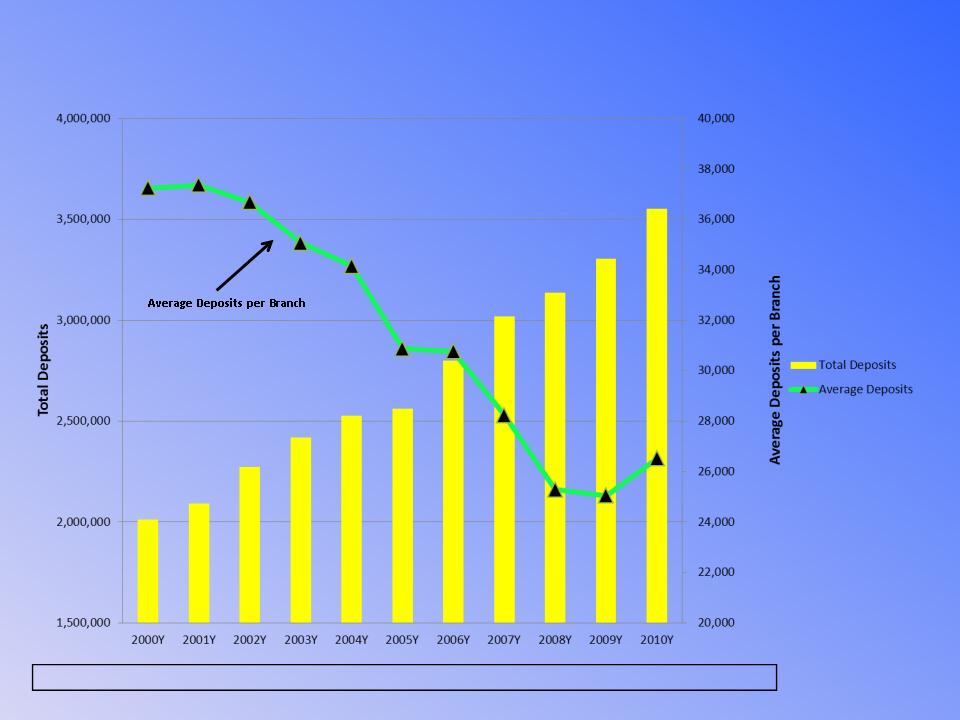

# of Branches 54 56 62 69 74 83 91 107 124 132 134

Branches and Deposits ($000)

TrustCo vs. Peers in 2010

|

|

TrustCo

|

Peers*

|

|

Return on Average Equity

|

11.48%

|

4.72%

|

|

Return on Average Assets

|

0.77%

|

0.55%

|

|

Efficiency Ratio

|

50.77%

|

61.41%

|

*All banking institutions covered by SNL Financial with assets of $2 to $10 billion as of December 31, 2010

Ratios reflect the full year 2010

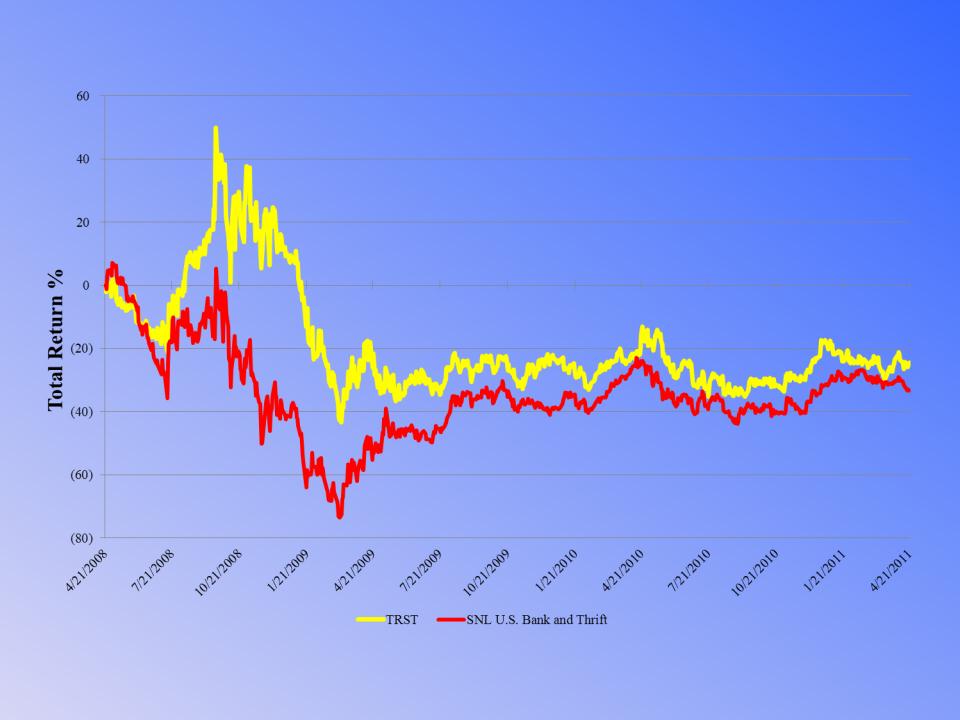

3-Year Stock Performance

*Through April 21, 2011

Cash Dividends Paid: 2000 to 2010

|

|

TrustCo

|

Peers*

|

|

Dividend Payout Ratio

|

88.9%

|

39.6%

|

|

Cash Dividends Paid

|

$425.5 Million

|

$86.4 Million

|

*All banking institutions covered by SNL Financial with assets of $2 to $10 billion as of December 31, 2010

Capital Planning

• Regulatory Landscape

• Dodd-Frank, Basel III, Bank Regulators driving higher capital

requirements

requirements

• Goal - 8% capital level

• Asset Growth

• Branch expansion program

• Capital to support growth

• Shelf Registration

• Filed with SEC today

• Raise capital as needed

• Variety of capital instruments - including common equity

• Facilitates Increasing Capital

• Flexibility

Community Relations / Contributions

• We provide both significant employee involvement and financial

contributions to many worthy organizations in our market area

contributions to many worthy organizations in our market area

• In 2010 we provided 278 organizations with cash contributions

• Total contributions in 2010 were over $430,000

• We examine what types of need are most pressing and focus much of

our giving in those areas

our giving in those areas

• Health care and education were among the areas we focused on

during 2010

during 2010

• “Banking’s Top Performers” - ABA Banking Journal

• 12th out of 129 banks with over $3 billion of assets for 2010

• Top 30 of “Top 150 Performers” - Bank Director Magazine,

2008-2010

2008-2010

• Top 20 of “Top 100 Thrifts” - SNL Thrift Investor, 2005-

2010 .

2010 .

• Top 10 of “Top 200 Mid Tier Banks” - US Banker

Magazine, 2007-2009

Magazine, 2007-2009

Things to be Proud Of

2011 Annual Meeting

Questions and Answers

2011 Annual Meeting

Thank You for Attending