Attached files

| file | filename |

|---|---|

| EX-32 - RULE 13A-14(B) CERTIFICATION - Smooth Global (China) Holdings, Inc. | smgh10k20101231ex32.htm |

| EX-31.2 - RULE 13A-14(A) CERTIFICATION - CFO - Smooth Global (China) Holdings, Inc. | smgh10k20101231ex31-2.htm |

| EX-31.1 - RULE 13A-14(A) CERTIFICATION - CEO - Smooth Global (China) Holdings, Inc. | smgh10k20101231ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | |

|

( X )

|

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

|

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

|

|

|

( )

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

|

|

For the transition period from _________ to __________

|

|

Commission File Number 0-25707

SMOOTH GLOBAL (CHINA) HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

NEVADA

|

91-1948355

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

Room 618, +17 Anyuan Road, Chaoyang District, Beijing, P.R. China 100029

(Address of principal executive offices)

(011)- 86-10-6498-7788

(Issuer's telephone number)

Securities Registered Pursuant to Section 12(b) of the Exchange Act: NONE

Securities Registered Pursuant to Section 12(g) of the Exchange Act:

COMMON STOCK, $.0001 PAR VALUE

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes __ No √

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No √

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes √ No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ___ No _____

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer ___ Accelerated filer ___ Non-accelerated filer ___ Smaller reporting company X

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No √

As of June 30, 2010 (the last business day of the most recently completed second fiscal quarter) the aggregate market value of the common stock held by non-affiliates was approximately $1,167,693, based upon the closing sale price of $.07 per share.

As of May 18, 2011, there were 38,381,375 shares of common stock outstanding.

Documents incorporated by reference: NONE

PART I

FORWARD-LOOKING STATEMENTS: NO ASSURANCES INTENDED

In addition to historical information, this Annual Report contains forward-looking statements, which are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements represent Management’s belief as to the future of Smooth Global (China) Holdings, Inc. Whether those beliefs become reality will depend on many factors that are not under Management’s control. Many risks and uncertainties exist that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the section entitled “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements.

|

ITEM 1.

|

BUSINESS

|

The Company is engaged in the business of manufacturing and distributing rechargeable polymer lithium-ion (“PLI”) batteries in the People’s Republic of China (the “PRC”). PLI batteries produce a relatively high average of 3.8 volts per cell, which makes them attractive for their light weight and high volume. These cells can be configured in almost any prismatic shape and in a wide variety of sizes, which make them particularly useful in consumer products.

The Company offers over 300 products, and a single battery can have power capacity of between 30 and 20,000 milliamp-hours. Our manufacturing facility has the capacity to produce on a daily basis batteries with an aggregate production of 20,000 amp-hours. Our products can be grouped into four major categories: electronic systems for mining companies; batteries for mining equipment; higher voltage and higher capacity batteries for use in the automotive industry; and batteries for power tools and portable consumer products, such as cellular phones, digital cameras and laptop computers.

Our PLI batteries can be built to satisfy the capacity requirements for such diverse products as mining lights, electronic automobiles, and cellular phones. We can also design products to meet a client’s specifications.

The Company’s production management and quality control have received approval from an international accreditation organization and certification from the European Community. Our manganese and lithium iron phosphate batteries, types of PLI batteries, have received the PRC National Security certification for use in mining lights.

We have obtained four patents from the PRC in order to protect our technology. The company does not use any intellectual property owned by third parties.

We are a member of the National Electric Vehicle Industry Association and the committee of experts convened to draft standards for batteries used in mining lights. Both these groups were formed, and are managed, by the PRC governmental departments. The Company has obtained all the required licenses and approvals from the PRC.

1

The demand for PLI batteries has rapidly increased over the last decade and currently accounts for the largest share of the market for small sized, secondary batteries. According to an analysis by the Singapore Stock Exchange, the global market for small sized PLI batteries in 2010 was approximately $52.6 billion. It anticipates that this market will grow by 15% per year over the next 5 years, reaching $106.9 million in 2015.

Sales of packs of PLI batteries for use in electric automobiles constitute a huge potential market for the Company. (Packs of small PLI batteries wired in a parallel circuit are more efficient in powering large devices, such as electric cars, than a single large battery.) According to the Japan Automobile Manufacturers Association, electronic automobiles will account for 13% of global automobile sales in 2013. This percentage of the market is projected to increase to 20% by 2020. In the PRC, the government intends to increase the market share attributable to electronic vehicles to 10%, or 1 million autos, by 2012 through use of consumer subsidies. At the prevailing average price of $7,625 for each pack of PLI batteries, this suggests an aggregate market of $7.625 billion.

Marketing and sales for the Company is done by our employees and takes place only within the PRC. Third party representatives or distributors are not used. To date, most of our sales have been to manufacturers of mining facilities and equipment. While sales to the electric automobile industry have not yet been initiated, we anticipate our research and development efforts will enable us to take a share of this new market. We spent approximately $70,000 on research and development in 2010 and $31,000 in 2009.

Following the commencement of operations in January of 2009, the Company purchased PLI batteries manufactured by Beijing Tian Rui Chi Energy Technology Co. (“Tian Rui Chi”) and resold them to customers. In 2010, we began manufacturing our own PLI batteries. Currently, we sell both PLI batteries we produce and those purchased from Tian Rui Chi.

Tian Rui Chi is also the main supplier for the raw materials (aluminum and plastic film, septem, kapton tape, terminating tape, methylprolidone, copper foil, aluminum foil, polyvinylidene, lithium cobalt dioxide, lithium manganate, carbon powder, electrolyte) that we use in manufacturing our own batteries. For the years ended December 31, 2010 and December 31, 2009, Tian Rui Chi accounted for 76.6% and 99%, respectively, of the Company’s total purchases for the period. We believe that Tian Rui Chi’s batteries and raw materials are attractively priced, and we have strong, long-term relations with their personnel. However, we believe that if this relationship were to be terminated for any reason, we could obtain these batteries and materials in the market at acceptable prices.

The market for PLI batteries is characterized by intense completion from both domestic and multi-national enterprises. Many of these competitors are significantly larger than we are and have substantially greater financial resources that allow them to be in a better position to withstand changes in the industry. However, we believe that our products are attractively priced and that our technology gives us an advantage versus the competition.

2

Our development strategy for the near future is to continue sales of PLI batteries to the mining industry in the PRC and to produce packs of PLI batteries for use in underground mine chambers, motorized bicycles, and electric automobiles.

We currently have 50 employees, all on a full-time basis. None of our employees belongs to a collective bargaining unit. Our relationships with our employees are good.

|

ITEM 1A

|

RISK FACTORS

|

You should carefully consider the risks described below before buying our common stock. If any of the risks described below actually occurs, that event could cause the trading price of our common stock to decline, and you could lose all or part of your investment.

We may be unable to gain a substantial share of the market for batteries.

Our business operations are based on the marketing of rechargeable polymer lithium-ion batteries. There are many companies, large and small, involved in the market for rechargeable batteries. Some of our existing and potential competitors have longer operating histories and significantly greater financial, technical, marketing and other resources. It will be difficult for us to establish a reputation in the market so that manufacturers chose to use our batteries rather than those of our competitors. Unless we are able to expand our sales volume significantly, we will not be able to improve the efficiency of our operation.

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future success depends on our ability to attract and retain highly skilled engineers, technical, marketing and customer service personnel, especially qualified personnel for our operations in China. Qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. Therefore we may not be able to successfully attract or retain the personnel we need to succeed.

We may have difficulty establishing adequate management and financial controls in China and in complying with U.S. corporate governance and accounting requirements.

The People’s Republic of China has only recently begun to adopt the management and financial reporting concepts and practices that investors in the United States are familiar with. We may have difficulty in hiring and retaining employees in China who have the experience necessary to implement the kind of management and financial controls that are expected of a United States public company. If we cannot establish such controls, we may experience difficulty in collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards.

We may be required to raise additional financing by issuing new securities with terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock.

We will require additional financing to fund future operations, develop and exploit existing and new products and to expand into new markets. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current shareholders will be reduced, and the holders of the new equity securities may have rights superior to those of the holders of shares of common stock, which could adversely affect the market price and the voting power of shares of our common stock. If we raise additional funds by issuing debt securities, the holders of these debt securities would similarly have some rights senior to those of the holders of shares of common stock, and the terms of these debt securities could impose restrictions on operations and create a significant interest expense for us.

3

Currency conversion and exchange rate volatility could adversely affect our financial condition and the value of our common stock.

The PRC government imposes control over the conversion of Renminbi, or RMB, into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of RMB into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in China. Conversion of RMB into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in China, including FIEs, which require foreign exchange for transactions relating to current account items, if within a certain limited amount may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs. Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

Between 1994 and 2004, the exchange rate for RMB against the U.S. dollar remained relatively stable, most of the time in the region of approximately RMB8.28 to US$1.00. However, in 2005, the Chinese government announced that it would begin pegging the exchange rate of the RMB against a number of currencies, rather than just the U.S. dollar. As our operations are primarily in China, any significant revaluation of the RMB may materially and adversely affect our cash flows, revenues, financial condition and the value of our common stock. For example, to the extent that we need to convert U.S. dollars into RMB for our operations, appreciation of this currency against the U.S. dollar could have a material adverse effect on our business, financial condition, results of operations and the value of our common stock. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the RMB, the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

4

We rely principally on dividends and other distributions on equity paid by our operating subsidiary to fund our cash and financing requirements, but such dividends and other distributions are subject to restrictions under PRC law. Limitations on the ability of our operating subsidiary to pay dividends or other distributions to us could have a material adverse effect on our ability to grow, make investments or acquisitions, pay dividends to you, and otherwise fund and conduct our business.

We are a holding company and conduct substantially all of our business through our operating subsidiary, which is a limited liability company established in China. We will rely on dividends paid by our Chinese subsidiary for our cash needs, including the funds necessary to pay dividends and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. The payment of dividends by entities organized in China is subject to regulations that will permit our Chinese subsidiary to pay dividends to us only out of accumulated profits as determined in accordance with PRC accounting standards and regulations. Our Chinese subsidiary is also required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its general reserves until the cumulative amount of such reserves reaches 50% of its registered capital. These reserves are not distributable as cash dividends. In addition, our Chinese subsidiary is required to allocate a portion of its after-tax profit to its enterprise expansion fund and the staff welfare and bonus fund at the discretion of its board of directors. Any limitations on the ability of our Chinese subsidiary to pay dividends or other distributions to us could have a material adverse effect on our ability to grow, make investments or acquisitions, pay dividends to you, and otherwise fund or conduct our business.

The scope of our business license in China is limited, and we may not expand or continue our business without government approval and renewal, respectively.

Our principal operating subsidiary is a limited liability company under PRC law. A PRC limited liability company can only conduct business within its approved business scope, which ultimately appears on its business license. In order for us to expand our business beyond the scope of our license, we would be required to enter into a negotiation with the authorities for the approval to expand the scope of our business. We cannot assure you that we would be able to obtain the necessary government approval for any change or expansion of our business scope. As a result, if there were adverse events affecting our battery business, our flexibility in crafting a corporate response would be limited.

We may be classified as a “resident enterprise” for PRC enterprise income tax purposes, which could result in unfavorable tax consequences to us and our non-PRC shareholders.

The Enterprise Income Tax Law provides that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” and are generally subject to the uniform 25% enterprise income tax rate on their worldwide income. In addition, a recent circular issued by the State Administration of Taxation regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises and established outside of China as “resident enterprises” clarified that dividends and other income paid by such “resident enterprises” will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC shareholders. This circular also subjects such “resident enterprises” to various reporting requirements with the PRC tax authorities. Under the implementation regulations to the enterprise income tax, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and treasury, and acquisition and disposition of properties and other assets of an enterprise. In addition, the circular mentioned above details that certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese group enterprises will be classified as “resident enterprises” if the following are located or resident in China: senior management personnel and departments that are responsible for daily production, operation and management; financial and personnel decision making bodies; key properties, accounting books, company seal, and minutes of board meetings and shareholders’ meetings; and half or more of the directors with voting rights or senior management. If the PRC tax authorities determine that we are a “resident enterprise,” we may be subject to enterprise income tax at a rate of 25% on our worldwide income and dividends paid by us to our non-PRC shareholders as well as capital gains recognized by them with respect to the sale of our stock may be subject to a PRC withholding tax. This will have an impact on our effective tax rate, a material adverse effect on our net income and results of operations, and may require us to withhold tax on our non-PRC shareholders.

5

We may be subject to fines and legal or administrative sanctions if we or our PRC citizen employees fail to comply with PRC regulations with respect to the registration of such employees’ share options and stock grants.

Pursuant to the Implementation Rules of the Administration Measure for Individual Foreign Exchange, issued in January 2007 by SAFE and the relevant guidance issued by SAFE in March 2007, PRC domestic individuals who have been granted shares or share options by an overseas listed company according to its employee share option or share incentive plan are required, through the PRC subsidiary of such overseas-listed company or other qualified PRC agents, to register with SAFE and complete certain other procedures related to the share option or other share incentive plan. Accordingly, our employees who are PRC nationals resident in China to whom we grant shares or share options will be subject to these rules. In addition, we, our PRC subsidiaries or other qualified PRC agent are required to appoint an asset manager or administrator and a custodian bank, as well as to open a foreign currency account to handle transactions relating to the share option or other share incentive plan. If we or our PRC option holders fail to comply with these rules, we may be subject to fines up to RMB300,000 and other legal or administrative sanctions.

We may have difficulty defending our intellectual property rights from infringement which may undermine our competitive position.

We have been designing and developing new technology. We rely on a combination of patents, trade secret laws, and restrictions on disclosure to protect our intellectual property rights. Unauthorized use of our technology could damage our ability to compete effectively. We regard our service marks, trademarks, trade secrets, patents and similar intellectual property as critical to our success. Our trade secrets may become known or be independently discovered by our competitors. Policing the unauthorized use of proprietary technology can be difficult and expensive. Also, litigation may be necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. The outcome of such potential litigation may not be in our favor and any success in litigation may not be able to adequately protect our rights. Such litigation may be costly and divert management attention away from our business. An adverse determination in any such litigation would impair our intellectual property rights and may harm our business, prospects and reputation. Enforcement of judgments in China is uncertain and even if we are successful in such litigation it may not provide us with an effective remedy. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations. In addition, there can be no assurance that we will be able to obtain licenses from third-parties that we may need to conduct our business or that such licenses can be obtained at a reasonable cost.

6

Capital outflow policies in China may hamper our ability to pay dividends to shareholders in the United States.

The People’s Republic of China has adopted currency and capital transfer regulations. These regulations require that we comply with complex regulations for the movement of capital. Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange. We may be unable to obtain all of the required conversion approvals for our operations, and Chinese regulatory authorities may impose greater restrictions on the convertibility of the RMB in the future. Because most of our future revenues will be in RMB, any inability to obtain the requisite approvals or any future restrictions on currency exchanges will limit our ability to pay dividends to our shareholders.

Currency fluctuations may adversely affect our operating results.

Beijing GRT generates revenues and incurs expenses and liabilities in Renminbi, the currency of the People’s Republic of China. However, as a subsidiary of Smooth Global (China) Holdings, it will report its financial results in the United States in U.S. Dollars. As a result, our financial results will be subject to the effects of exchange rate fluctuations between these currencies. From time to time, the government of China may take action to stimulate the Chinese economy that will have the effect of reducing the value of Renminbi. In addition, international currency markets may cause significant adjustments to occur in the value of the Renminbi. Any such events that result in a devaluation of the Renminbi versus the U.S. Dollar will have an adverse effect on our reported results. We have not entered into agreements or purchased instruments to hedge our exchange rate risks.

We have limited business insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products, and do not, to our knowledge, offer business liability insurance. As a result, we do not have any business liability insurance coverage for our operations. Moreover, while business disruption insurance is available, we have determined that the risks of disruption and cost of the insurance are such that we do not require it at this time. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

7

Smooth Global (China) Holdings is not likely to hold annual shareholder meetings in the next few years.

Management does not expect to hold annual meetings of shareholders in the next few years, due to the expense involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, the shareholders of Smooth Global (China) Holdings will have no effective means of exercising control over the operations of Smooth Global (China) Holdings.

Your ability to bring an action against us or against our directors, or to enforce a judgment against us or them, will be limited because we conduct all of our operations in China and because most of our management resides outside of the United States.

We conduct all of our operations in China through our wholly-owned subsidiary. All of our directors and officers reside in China and all of the assets of those Chinese residents are located outside of the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in the United States in the event that you believe that your rights have been infringed under the securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the United States and of China may render you unable to enforce a judgment against our assets or the assets of our directors.

|

ITEM 1B

|

UNRESOLVED STAFF COMMENTS

|

|

Not Applicable.

|

|

|

ITEM 2.

|

DESCRIPTION OF PROPERTY

|

Our headquarters and manufacturing facility are located in the Yongle Economic/Technical Development Zone in the Tongzhou District of Beijing. We utilize a 67,000 square meter factory with 6,000 square meters dedicated to production. The Company rents the production facility from an unrelated third party under a lease that terminates on December 31, 2012. The minimum annual lease payments are $231,674.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

None.

|

|

|

ITEM 4.

|

RESERVED

|

8

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

(a) Market Information

The Company’s common stock is quoted on the Pink Sheets under the symbol “SMGH.” Until February 2011 the common stock was quoted on the OTC Bulletin Board. Set forth below are the high and low bid prices for each of the quarters between January 1, 2009 and December 31, 2010. The reported bid quotations reflect inter-dealer prices without retail markup, markdown or commissions, and may not necessarily represent actual transactions.

|

Bid

|

||||||||

|

Quarter Ending

|

High

|

Low

|

||||||

|

March 31, 2009

|

$ | 0.02 | $ | 0.02 | ||||

|

June 30, 2009

|

$ | 0.03 | $ | 0.02 | ||||

|

September 30, 2009

|

$ | 0.03 | $ | 0.03 | ||||

|

December 31, 2009

|

$ | 0.03 | $ | 0.02 | ||||

|

March 31, 2010

|

$ | 0.04 | $ | 0.02 | ||||

|

June 30, 2010

|

$ | 0.07 | $ | 0.04 | ||||

|

September 30, 2010

|

$ | 0.07 | $ | 0.01 | ||||

|

December 31, 2010

|

$ | 0.01 | $ | 0.01 | ||||

(b) Shareholders

Our shareholders list contains the names of 80 registered stockholders of record of the Company’s Common Stock.

(c) Dividends

The Company has not paid or declared any cash dividends on its Common Stock within the past three years and does not foresee doing so in the foreseeable future. The Company intends to retain any future earnings for the operation and expansion of the business. Any decision as to future payment of dividends will depend on the available earnings, the capital requirements of the Company, its general financial condition and other factors deemed pertinent by the Board of Directors.

(d) Securities Authorized for Issuance Under Equity Compensation Plans.

The information set forth in the table below regarding equity compensation plans (which include individual compensation arrangements) was determined as of

December 31, 2010.

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans

|

|

|

Equity compensation plans approved by security holders

|

0

|

--

|

0

|

|

Equity compensation plans not approved by security holders

|

0

|

--

|

0

|

|

Total

|

0

|

--

|

0

|

9

(e) Sale of Unregistered Securities

The Company did not sell any unregistered securities during the 4th quarter of 2010.

(f) Repurchase of Equity Securities

The Company did not repurchase any of its equity securities that were registered under Section 12 of the Securities Act during the 4th quarter of 2010.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

Not applicable.

|

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

|

In the fall of 2010 a subsidiary of the Company acquired the registered equity of Beijing Yupeng Hengli Technology Ltd. (“BJHL”) in exchange for twenty million (20,000,000) shares of Company common stock. For accounting purposes, this is a capital transaction treated for financial reporting purposes as a reverse merger. It is accounted for as a recapitalization of the accounting acquirer (BJHL) and a reorganization of the accounting acquiree (Beijing Telecom, the subsidiary that made the acquisition). Accordingly, the comparison below is done using the historical statements of BJHL for the period prior to the merger.

Year Ended December 31, 2010 Compared to Year Ended December 31, 2009

Revenue for the year ended December 31, 2010 was $4,164,057, an increase of $3,634,425 or 686% over the year ended December 31, 2009. This rapid growth is a result of the continued development of our sales and marketing effort and strengthened relations with clients in the mining industry. The large percentage increase in 2010 is also a reflection of the low base in 2009, as one would expect as start-up activities ramp up.

The Company generally recognizes revenue when products are shipped to unaffiliated customers or picked up by unaffiliated customers from the company’s warehouse, title and risk of loss have been transferred, collectability is reasonably assured and pricing is fixed and determinable. We warrant our products in the event of defect for a period of one year from the date of shipment. For the two years ended December 31, 2010, no returns have occurred. Accordingly, no allowances or product reserve was considered necessary.

As revenues increased significantly, the cost of goods sold for the year ended December 31, 2010 was $3,261,160 versus $475,010 for the year ended December 31, 2009, an increase of $2,786,150 or 586%.

10

The Company’s gross profit was $902,897 for the year ended December 31, 2010 as opposed to $54,622 for the year ended December 31, 2009. This represents an increase of $848,275 and reflects the expanded and intensified sales and marketing activities. The overall gross profit rate rose by 11.4 percentage points in 2010 from 2009, increasing from 10.3% in the year ended December 31, 2009 to 21.7% in the year ended December 31, 2010. The margin expansion reflects the initiation of original manufacturing of PLI batteries as opposed to resales and scale efficiencies in distribution.

Net income for the year ended December 31, 2010 was $487,979 compared to a loss of $15,001 for the year ended December 31, 2009. This improvement was achieved in spite of a meaningful increase of operating expenses, from $69,782 in 2009 to $272,790. This expense growth is consistent with an intensified sales effort and the initiation of manufacturing activities. The fourth quarter of 2010 also reflected higher professional fees relating to the acquisition.

Net income as a percentage of sales was 11.7% for the year ended December 31, 2010. We anticipate that this percentage will improve in future periods as the business mix shifts in favor of sales of PLI batteries that we manufacture as opposed to resales.

Our business operates entirely in Chinese Renminbi, but we report our results in our SEC filings in U.S. Dollars. The conversion of our accounts from RMB to Dollars results in translation adjustments. While our net income is included in the retained earnings on our balance sheet, the translation adjustments are included in a line item on our balance sheet labeled “accumulated other comprehensive income,” since it is more reflective of changes in the relative values of U.S. and Chinese currencies than of the success of our business. During the year ended December 31, 2010, the effect of converting our financial results from RMB to U.S. Dollars was to increase our accumulated other comprehensive income by $52,683. During the year ended December 31, 2009, the effect of converting our financial results from RMB to U.S. Dollars was to increase our accumulated other comprehensive income by $172.

Liquidity and Capital Resources

To date, the Company has been financed by paid-in capital from the company founders, cash generated from operations, and a $106,808 non-interest bearing note from an individual who had been a shareholder at the time when the credit was extended. As a result of these factors, we had working capital of $1,681,860 at December 31, 2010, consisting primarily of accounts receivable, inventories and cash on hand. The allowance for doubtful accounts netted against the total accounts receivable is $1,856, a relatively low level of .16%, reflecting our confidence, in light of all the circumstances, that we will be paid by our customers. Our bad debt expenses were $745 in the year ended December 31, 2009 and zero in the ended December 31, 2010. Consistent with ramped up sales activities and the start of manufacturing operations, our inventories of finished goods, work-in-progress and raw materials increased from $32,410 on December 31, 2009 to $312,996 on December 31, 2010. Cash on hand rose from $35,447 on December 31, 2009 to $95,261 on December 31, 2010.

The Company has no long term liabilities. Therefore, we believe that we can continue to fund operations at the current level of activity. However, in order to finance the Company’s continuing growth and construction of a new manufacturing facility, we will need to develop alternative sources of funds. The Company is currently negotiating with investment bankers and seeking loans from commercial banks. However, no financing agreements are yet in place.

11

Critical Accounting Policies and Estimates

We made no material changes to our critical accounting policies in connection with the preparation of financial statements for 2010.

Impact of Accounting Pronouncements

There were no recent accounting pronouncements that have had a material effect on the Company’s financial position or results of operations.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition or results of operations.

|

ITEM 7A

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

|

Not Applicable.

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

12

INDEX TO FINANCIAL STATEMENTS

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

14

|

|

Consolidated Balance Sheets as of December 31, 2010 and 2009

|

15

|

|

Consolidated Statements of Operations and Other Comprehensive Income

|

|

|

for the Years Ended December 31, 2010 and 2009

|

16

|

|

Consolidated Statements of Changes in Stockholders’ Equity/(Deficit)

|

|

|

for the Years Ended December 31, 2010 and 2009

|

17

|

|

Consolidated Statements of Cash Flows for the Years Ended

|

|

|

December 31, 2010 and 2009

|

18

|

|

Notes to Consolidated Financial Statements

|

19

|

13

|

KEITH K. ZHEN, CPA

|

|

CERTIFIED PUBLIC ACCOUNTANT

|

|

2070 WEST 6TH STREET - BROOKLYN, NY 11223 - TEL (347) 408-0693 - FAX (347) 602-4868 - EMAIL :KEITHZHEN@GMAIL.COM

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

Board of Directors

|

|

Smooth Global (China) Holdings, Inc.

|

|

We have audited the accompanying consolidated balance sheets of Smooth Global (China) Holdings, Inc. and subsidiaries as of December 31, 2010 and 2009, and the related statements of income, stockholders' equity and comprehensive income, and cash flows for each of the years in the two-year period ended December 31, 2010. Smooth Global (China) Holdings, Inc.'s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audit.

|

|

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

|

|

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Smooth Global (China) Holdings, Inc. and subsidiaries as of December 31, 2010 and 2009, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2010 in conformity with accounting principles generally accepted in the United States of America.

|

|

|

/s/Keith K. Zhen, CPA

|

|

Keith K. Zhen, CPA

|

|

Brooklyn, New York

|

|

April 15, 2011

|

14

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

December 31,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 95,261 | $ | 35,447 | ||||

|

Notes receivable

|

75,621 | - | ||||||

|

Accounts receivable, net (Note 4)

|

1,176,039 | 112,408 | ||||||

|

Advance to suppliers

|

21,943 | 549 | ||||||

|

Inventories (Note 5)

|

312,996 | 32,410 | ||||||

|

Total current assets

|

1,681,860 | 180,814 | ||||||

|

Property, Plant, and Equipment, net (Note 6)

|

102,770 | 13,997 | ||||||

|

Lease Security Deposit

|

15,835 | 687 | ||||||

|

Total Assets

|

$ | 1,800,465 | $ | 195,498 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

517,255 | 71,256 | ||||||

|

Accrued expenses

|

88,640 | 1,540 | ||||||

|

Advance from customers

|

39,035 | 66,660 | ||||||

|

VAT and other taxes payable

|

413,334 | (622 | ) | |||||

|

Corporate taxes payable

|

165,116 | - | ||||||

|

Due to a related party (Note 10)

|

106,807 | - | ||||||

|

Total Current Liabilities

|

1,330,187 | 138,834 | ||||||

|

Commitments and Contingencies (Note 11)

|

- | - | ||||||

|

Stockholders' Equity:

|

||||||||

|

Common stock, $0.001 par value, 200,000,000 shares authorized;

|

||||||||

|

38,381,375 shares issued and outstanding as of December 31, 2010

|

||||||||

|

20,000,000 shares issued and outstanding as of December 31, 2009

|

38,381 | 20,000 | ||||||

|

Additional paid-in capital

|

(92,631 | ) | 52,948 | |||||

|

Retained earnings

|

471,545 | (16,434 | ) | |||||

|

Accumulated other comprehensive income

|

52,983 | 150 | ||||||

|

Stockholders' Equity

|

470,278 | 56,664 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 1,800,465 | $ | 195,498 | ||||

See Notes to Consolidated Financial Statements

15

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE INCOME

|

||||||||

|

For the Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Revenues

|

||||||||

|

Sales

|

4,164,057 | 529,632 | ||||||

|

Costs of Sales

|

3,261,160 | 475,010 | ||||||

|

Gross Profit

|

902,897 | 54,622 | ||||||

|

QTC Consultancy Income

|

18,747 | - | ||||||

|

Operating Expenses

|

||||||||

|

Selling expenses

|

70,193 | 31,024 | ||||||

|

Payroll

|

44,969 | 15,700 | ||||||

|

Pension and employee benefit

|

82,619 | 3,787 | ||||||

|

Depreciation expenses

|

7,702 | 2,295 | ||||||

|

Office rent

|

9,342 | 8,245 | ||||||

|

Office expenses

|

57,965 | 8,731 | ||||||

|

Total Operating Expenses

|

272,790 | 69,782 | ||||||

|

Income (Loss) from Operations

|

648,854 | (15,160 | ) | |||||

|

Other Income

|

||||||||

|

Interest income

|

174 | 159 | ||||||

|

Total other income

|

174 | 159 | ||||||

|

Income (Loss) before provision

|

||||||||

|

for Income Tax

|

649,028 | (15,001 | ) | |||||

|

Provision for Income Tax

|

(161,049 | ) | - | |||||

|

Net Income (Loss)

|

487,979 | (15,001 | ) | |||||

|

Other Comprehensive Income (Loss)

|

||||||||

|

Effects of Foreign Currency Conversion

|

52,683 | 172 | ||||||

|

Comprehensive Income (Loss)

|

$ | 540,662 | $ | (14,829 | ) | |||

|

Basic and fully diluted earnings (loss) per share

|

$ | 0.01 | $ | (0.00 | ) | |||

|

Weighted average shares outstanding

|

38,381,375 | 20,000,000 | ||||||

See Notes to Consolidated Financial Statements

16

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

||||||||||||||||||||||||

|

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY (DEFICIT)

|

||||||||||||||||||||||||

|

FOR THE YEARS ENDED DECEMBER 31, 2010 AND 2009

|

||||||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||||||

|

Common Stock

|

Additional

|

Other

|

Total

|

|||||||||||||||||||||

|

$0.001 Par Value

|

Paid-in

|

Retained

|

Comprehensive

|

Owners'

|

||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Earnings

|

Income

|

Equity

|

|||||||||||||||||||

|

Balances at

|

||||||||||||||||||||||||

|

December 31, 2008

|

1,000 | $ | 1,000 | $ | 71,948 | $ | (1,433 | ) | $ | (22 | ) | $ | 71,493 | |||||||||||

|

Common stock issued for

|

||||||||||||||||||||||||

|

acquisition of Smooth Global

|

||||||||||||||||||||||||

|

(reverse merger)

|

20,000,000 | 20,000 | (20,000 | ) | - | - | - | |||||||||||||||||

|

Smooth Global share exchange

|

(1,000 | ) | (1,000 | ) | 1,000 | - | - | - | ||||||||||||||||

|

Net Income (Loss)

|

- | - | - | (15,001 | ) | - | (15,001 | ) | ||||||||||||||||

|

Other comprehensive income-

|

||||||||||||||||||||||||

|

effects of exchange rates

|

- | - | - | - | 172 | 172 | ||||||||||||||||||

|

Balances at

|

||||||||||||||||||||||||

|

December 31, 2009

|

20,000,000 | $ | 20,000 | $ | 52,948 | $ | (16,434 | ) | $ | 150 | $ | 56,664 | ||||||||||||

|

Reverse merger adjustment*

|

18,381,375 | 18,381 | (145,579 | ) | - | - | (127,198 | ) | ||||||||||||||||

|

Net Income (Loss)

|

- | - | - | 487,979 | - | 487,979 | ||||||||||||||||||

|

Other comprehensive income-

|

||||||||||||||||||||||||

|

effects of exchange rates

|

- | - | - | - | 52,833 | 52,833 | ||||||||||||||||||

|

Balances at

|

||||||||||||||||||||||||

|

December 31, 2010

|

38,381,375 | $ | 38,381 | $ | (92,631 | ) | $ | 471,545 | $ | 52,983 | $ | 470,278 | ||||||||||||

* The reverse merger adjustment represents the recording of the minority shareholders’ shares outstanding at the time of the reverse merger.

See Notes to Consolidated Financial Statements

17

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||||||

|

For the Year Ended

|

||||||||

|

December 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Operating Activities

|

||||||||

|

Net income (loss)

|

$ | 487,979 | $ | (15,001 | ) | |||

|

Adjustments to reconcile net income (loss) to

|

||||||||

|

net cash provided (used) by operating activities:

|

||||||||

|

Depreciation

|

7,702 | 2,295 | ||||||

|

Reverse merger effect

|

(127,198 | ) | - | |||||

|

Changes in operating assets and liabilities:

|

||||||||

|

(Increase)/Decrease in accounts receivable

|

(1,051,966 | ) | (112,348 | ) | ||||

|

(Increase)/notes receivable

|

(75,062 | ) | - | |||||

|

(Increase)/Decrease in advance to suppliers

|

(21,217 | ) | (549 | ) | ||||

|

(Increase)/Decrease in inventories

|

(277,415 | ) | (32,393 | ) | ||||

|

(Increase)/Decrease in contract security deposit

|

(15,013 | ) | (687 | ) | ||||

|

Increase/(Decrease) in accounts payable

|

440,291 | 71,219 | ||||||

|

Increase/(Decrease) in accrued expenses

|

87,166 | - | ||||||

|

Increase/(Decrease) in advance from customers

|

(30,440 | ) | 66,705 | |||||

|

Increase/(Decrease) in VAT and other taxes payable

|

410,918 | (622 | ) | |||||

|

Increase/(Decrease) in corporate taxes payable

|

163,896 | - | ||||||

|

Net cash provided (used) by operating activities

|

(359 | ) | (21,381 | ) | ||||

|

Investing Activities

|

||||||||

|

Purchase of fixed assets

|

(87,925 | ) | (16,283 | ) | ||||

|

Net cash provided (used) by investing activities

|

(87,925 | ) | (16,283 | ) | ||||

|

Financing Activities

|

||||||||

|

Proceeds from related parties

|

106,018 | - | ||||||

|

Net cash provided (used) by financing activities

|

106,018 | - | ||||||

|

Increase (decrease) in cash

|

17,734 | (37,664 | ) | |||||

|

Effects of exchange rates on cash

|

42,080 | 163 | ||||||

|

Cash at beginning of the period

|

35,447 | 72,948 | ||||||

|

Cash at end of the period

|

$ | 95,261 | $ | 35,447 | ||||

|

Supplemental Disclosures of Cash Flow Information:

|

||||||||

|

Cash paid (received) during year for:

|

||||||||

|

Interest

|

$ | - | $ | - | ||||

|

Income taxes

|

$ | - | $ | - | ||||

See Notes to Consolidated Financial Statements

18

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 1-

|

ORGANIZATION AND OPERATIONS

|

|

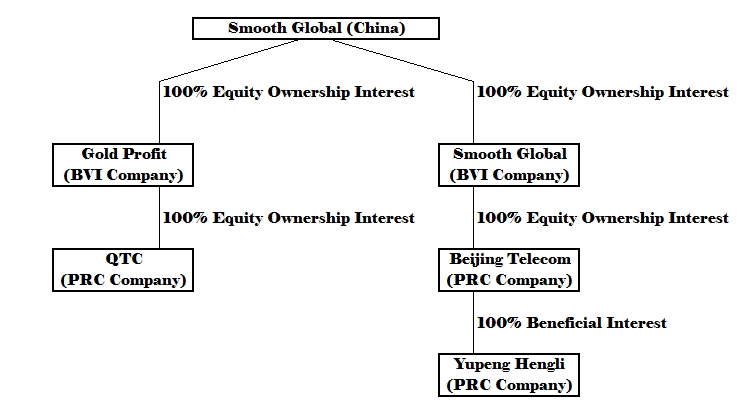

Smooth Global (China) Holdings, Inc. ("Smooth Global (China)" or the "Company") was incorporated under the laws of the State of Nevada on December 2, 1998 with authorized common stock of 200,000,000 shares at $0.001 par value. Currently, the Company principally engages in the business of design, manufacture and distribution of rechargeable polymer lithium-ion batteries in the People's Republic of China ("PRC'), through its wholly-owned subsidiaries, Smooth Global Services Limited ("Smooth Global"), a limited liability company incorporated on January 25, 2006 in the British Virgin Island ("BVI") .

|

|

|

On October 24, 2007 Smooth Global (China) completed the acquisition of all the registered capital stock of Smooth Global. In exchange for the capital stock of Smooth Global, Smooth Global (China) issued 33,000,000 shares of its common stock to the prior owners of Smooth Global. The prior registered owners were Christina Nelson and Shannon Lee Alsop. They held the shares, however, as nominees for nine residents of PRC. Accordingly, upon closing of the acquisition, Ms. Nelson and Ms. Alsop assigned the 33,000,000 shares to those nine beneficiaries. 20,000,000 of the shares were assigned to Ms. Zheng Shuying. Ms. Zheng is the Chief Executive Officer of Smooth Global (China). Also, Smooth Global became a wholly-owned subsidiary of Smooth Global (China) upon completion of the acquisition.

|

|

|

On June 28, 2007, Smooth Global established a wholly owned subsidiary, Smooth Global (Beijing) Telecom Science Limited ("Beijing Telecom") in the Beijing City, PRC. Beijing Telecom was incorporated under the Company Law of PRC as a limited liability company with registered capital of $100,000. Beijing Telecom was formed for the purpose of seeking and consummating a merger or acquisition with a business entity organized in PRC.

|

|

|

On September 20, 2007, Ms. Yianfang Jin and Ms. Yianxia Wang (collectively the "Trustees"), both of whom are citizens of PRC and own a 100% equity ownership interest in Beijing GRT Information Services Limited ( "GRT" ), executed Trust and Indemnity Agreements ("Agreements") with Beijing Telecom, pursuant to which the Trustees assigned to Beijing Telecom all of the beneficial interest in the Trustee's equity ownership interest in GRT. The Agreements provided for effective control of GRT to be transferred to Beijing Telecom at September 20, 2007.

|

|

|

On December 16, 2010, the Trustees terminated the Agreements with Beijing Telecom, and accordingly, Beijing Telecom lost its effective control over GRT. Therefore, the consolidated financial statements of Smooth Global and its wholly owned subsidiary, Beijing Telecom, do not include the financial statements of GRT. In connection with the termination of the Agreements, Ms. Zheng Shuying transferred and surrendered 20,000,000 shares of the Company's common stock to the Company as treasury stock.

|

19

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 1-

|

ORGANIZATION AND OPERATIONS (continued)

|

|

On December 16, 2010, Beijing Telecom finished the acquisition of 100% of the registered capital of Beijing Yupeng Hengli Technology Co., Ltd. ("Yupeng Hengli"). In connection with the acquisition, the Company issued 20,000,000 shares of its treasury stock to the two prior registered owners of Yupeng hengli, Mr. Wang, Xiaoping and Mr. Zhu, Chenyu, and their assignees, all of them are PRC citizen. Upon completion of this transaction, Yupeng Hengli became a wholly-owned subsidiary of Beijing Telecom.

|

|

|

The acquisition of Yupeng Hengli resulted in a capital transaction accounted for as a reverse merger. The transaction was treated for accounting purposes as a recapitalization of the accounting acquirer (Yupeng Hengli) and a reorganization of the accounting acquiree (Beijing Telecom). Accordingly, the historical financial statements presented prior to the merger are the historical financial statements of Yupeng Hengli.

|

|

|

Under the Company Law of PRC, Yupeng Hengli was incorporated on December 23, 2008 in Beijing City, PRC , as a limited liability company with a registered capital of RMB 500,000 (equivalent to US$72,948). Yupeng Hengli started its operation with distribution of rechargeable polymer lithium-ion batteries in PRC in 2009. Beginning from January 2010, Beijing Yupeng is engaged in the business of design, manufacture, and distribution of rechargeable polymer lithium-ion batteries in PRC.

|

|

|

Smooth Global (China) also wholly own Gold Profit (Asia) Group Limited ("Gold Profit"), a limited liability company incorporated in the BVI on July 28, 2006, which in turn wholly own Beijing Quan Tong Chang Information Service Limited a/k/a Beijing Smooth Global Information Services Ltd. (”QTC”), a limited liability company incorporated in Beijing City, PRC on August 2, 2003. Currently, QTC is engaged to provide business information consultant services.

|

|

|

Yupeng Hengli and QTC are the two of these affiliated companies that are engaged in business operations. Smooth Global (China), Gold Profit, Smooth Global, and Beijing Telecom are all holding companies, whose business is to hold an equity ownership interest in Yupeng Hengli and QTC. All these affiliated companies are hereafter referred to as the "Company", whose structure is outlined as following:

|

20

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 1-

|

ORGANIZATION AND OPERATIONS (continued)

|

21

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 2-

|

CONTROL BY PRINCIPAL STOCKHOLDERS

|

|

The chief executive officer owns beneficially and in the aggregate, the majority of the voting power of the Company. Accordingly, the chief executive officer has the ability to control the approval of most corporate actions, including approving significant expenses, increasing the authorized capital stock and the dissolution, merger or sale of the Company's assets.

|

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES

|

|

Basis of Consolidation

|

|

|

The consolidated financial statements include the accounts of the Company and all its majority-owned subsidiaries which require consolidation. Inter-company transactions have been eliminated in consolidation.

|

|

|

The consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP"). This basis of accounting differs from that used in the statutory accounts of the Company, which are prepared in accordance with the "Accounting Principles of China " ("PRC GAAP"). Certain accounting principles, which are stipulated by US GAAP, are not applicable in the PRC GAAP. The difference between PRC GAAP accounts of the Company and its US GAAP financial statements is immaterial.

|

|

|

Certain amounts in the prior year's consolidated financial statements and notes have been revised to conform to the current year presentation.

|

|

|

Subsequent Events

|

|

|

The Company evaluated subsequent events through the date of issuance of these financial statements. We are not aware of any significant events that occurred subsequent to the balance sheet date but prior to the filing of this report that would have a material impact on our financial statements, or all such material events have been fully disclosed.

|

|

|

Use of Estimates

|

|

|

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the years reported. Actual results may differ from these estimates.

|

22

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

Foreign Currencies Translation

|

|

|

The Company maintains its books and accounting records in PRC currency "Renminbi" ("RMB"), which is determined as the functional currency. Transactions denominated in currencies other than RMB are translated into RMB at the exchange rates quoted by the People’s Bank of China (“PBOC”) prevailing at the date of the transactions. Monetary assets and liabilities denominated in currencies other than RMB are translated into RMB using the applicable exchange rates quoted by the PBOC at the balance sheet dates. Exchange differences are included in the statements of changes in owners' equity. Gain and losses resulting from foreign currency transactions are included in operations.

|

|

|

The Company’s financial statements are translated into the reporting currency, the United States Dollar (“US$”). Assets and liabilities of the Company are translated at the prevailing exchange rate at each reporting period end. Contributed capital accounts are translated using the historical rate of exchange when capital is injected. Income and expense accounts are translated at the average rate of exchange during the reporting period. Translation adjustments resulting from translation of these financial statements are reflected as accumulated other comprehensive income (loss) in the owners’ equity.

|

|

|

The exchange rates used for foreign currency translation were as follows (USD$1 = RMB):

|

|

Period Covered

|

Balance Sheet

Date Rates

|

Average Rates

|

|||

|

Year ended December 31, 2010

|

6.61180

|

6.661031434

|

|||

|

Year ended December 31, 2009

|

6.83720

|

6.84088

|

|||

|

Statement of Cash Flows

|

|

|

In accordance with ASC 830-230, “Statement of Cash Flows”, cash flows from the Company’s operations is calculated based upon the functional currency. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily agree with changes in the corresponding balances on the balance sheet.

|

|

|

Cash and Cash Equivalents

|

|

|

Cash and cash equivalents include cash on hand, deposits in banks with maturities of three months or less, and all highly liquid investments which are unrestricted as to withdrawal or use, and which have original maturities of three months or less at the time of purchase.

|

23

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

|

Fair Value of Measurements

|

||

|

The Company applies the provisions of ASC Subtopic 820-10, Fair Value Measurements, for fair value measurements of financial assets and financial liabilities and for fair value measurements of nonfinancial items that are recognized or disclosed at fair value in the financial statements. ASC Subtopic 820-10 also establishes a framework for measuring fair value and expands disclosures about fair value measurements.

|

||

|

ASC Subtopic 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market participants would use when pricing the asset or liability.

|

||

|

ASC Subtopic 820-10 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC Subtopic 820-10 establishes three levels of inputs that may be used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are as follows:

|

||

|

Level 1:

|

Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

|

|

|

Level 2:

|

Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

|

|

|

Level 3:

|

Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

|

|

|

The level in the fair value hierarchy within which a fair value measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety.

|

||

|

The carrying amounts reported in the balance sheets for cash and cash equivalents, accounts receivable, loan receivables, other receivables, advance to suppliers, short-term loan, accounts payable, advance from customers, other payables and accrued expenses, approximate their fair market value based on the short-term maturity of these instruments. The Company did not identify any assets or liabilities that are required to be measured at fair value on a recurring basis on the consolidated balance sheets in accordance with ASC 820.

|

||

24

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

Revenue Recognition

|

|

|

The Company recognizes its revenues net of sales taxes and sales-related taxes. In accordance with FASB ASC 605, "Revenue Recognition", the Company recognizes revenue when the earnings process is complete. This generally occurs when services have been rendered and accepted or products are shipped to unaffiliated customers or picked up by unaffiliated customers in the Company's warehouse, title and risk of loss have been transferred, collectability is reasonably assured and pricing is fixed or determinable. The corresponding shipping and handling costs are included in the selling expenses.

|

|

|

The Company warrants the product only in the event of defects for one year from the date of shipment. Historically, the Company has not experienced significant defects, and replacements for defects have been minimal. For the years ended December 31, 2010 and 2009, no such returns and allowances have been recorded. Should returns increase in the future it would be necessary to adjust estimates, in which case recognition of revenues could be delayed. Payments received prior to satisfying the Company’s revenue recognition criteria are recorded as advance from customers.

|

|

|

Product warranty

|

|

|

The Company provides product warranties to its customers that all equipment manufactured by it will be free from defects in materials and workmanship under normal use for a period of one year from the date of shipment. The Company's costs and expenses in connection with such warranties has been immaterial and during the two-year period ended December 31 2010, no product warranty reserve was considered necessary.

|

|

|

Accounts Receivable

|

|

|

Accounts receivable are recorded at the invoiced amount and do not bear interest. Any allowance for doubtful accounts is established based on the management’s assessment of the recoverability of accounts and other receivables. Management regularly reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the collectability of accounts receivable and the adequacy of the allowance. In circumstances in which we receive payment for accounts receivable which have previously been written off, we reverse the allowance and bad debt expenses.

|

|

|

Inventory

|

|

|

Inventories are stated at the lower of cost, as determined on a weighted average basis, or market. Costs of inventories include purchase and related costs incurred in bringing the products to their present location and condition. Market value is determined by reference to selling prices after the balance sheet date or to management’s estimates based on prevailing market conditions. Management writes down the inventories to market value if they are below cost. Management regularly evaluates the composition of the Company’s inventories to identify slow-moving and obsolete inventories to determine if a valuation allowance is required.

|

25

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

Property, Plant and Equipment

|

|

|

Property, plant and equipment are stated at cost less accumulated depreciation and amortization. Maintenance, repairs and betterments, including replacement of minor items, are charged to expense; major additions to physical properties are capitalized. Depreciation and amortization are provided using the straight-line method (after taking into account their respective estimated residual values) over the estimated useful lives of the assets as follows:

|

|

Building and warehouses

|

20 years

|

|

|

Machinery and equipment

|

7 to 10 years

|

|

|

Office equipment and furniture

|

5 years

|

|

|

Motor vehicles

|

5 years

|

|

Valuation of Long-Lived assets

|

|

|

In accordance with Impairment or Disposal of Long-Lived Assets Subsections of ASC Subtopic 360-10, Property, Plant, and Equipment - Overall, long-lived assets, such as property, plant and equipment, and purchased intangible asset subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset or asset group be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary. No impairment of long-lived assets was recognized for the years ended December 31, 2010 and 2009, respectively.

|

|

|

Research and Development Costs

|

|

|

The Company charges research and development costs to expense when incurred in accordance with the FASB ASC 730, “Research and Development”. Research and development costs were immaterial for the years ended December 31, 2010 and 2009, respectively.

|

|

|

Advertising Costs

|

|

|

The Company expenses advertising costs as incurred or the first time the advertising takes place, whichever is earlier, in accordance with the FASB ASC 720-35, “Advertising Costs”. Advertising expenses were included in selling expenses. Advertising expenses were immaterial for the years ended December 31, 2010 and 2009, respectively.

|

26

|

SMOOTH GLOBAL (CHINA) HOLDINGS, INC. AND SUBSIDIARIES

|

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

Note 3-

|

SIGNIFICANT ACCOUNTING POLICIES (continued)

|

|

Value-added Tax ("VAT") and other taxes

|

|

|

Sales revenue represents the invoiced value of goods, net of a value-added tax (VAT). The VAT collected on sales is netted against the taxes paid for purchases of cost of goods sold to determine the amounts payable and refundable. The Company presents VAT on a net basis.

|

|

|

The Company is subject to various taxes such as City Development Tax, and Education tax to the local government tax authorities. The City Development Tax and Education Tax are generally collected on a certain percentage of VAT.

|

|

|

Comprehensive Income

|

|

|

ASC 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated comprehensive income, as presented in the accompanying statement of changes in shareholders' equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

|

|

|

Segment Reporting

|

|

|