Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - US ECOLOGY, INC. | usecology_8k-051911.htm |

Exhibit 99.1

May 2011

1

During the course of this presentation the Company will be making forward-looking statements (as

such term is defined in the Private Securities Litigation Reform Act of 1995) that are based on our

current expectations, beliefs and assumptions about the industry and markets in which US

Ecology, Inc. and its subsidiaries operate. Because such statements include risks and

uncertainties, actual results may differ materially from what is expressed herein and no assurance

can be given that the Company will meet its 2011 earnings estimates, successfully execute its

growth strategy, or declare or pay future dividends. For information on other factors that could

cause actual results to differ materially from expectations, please refer to US Ecology, Inc.’s

December 31, 2010 Annual Report on Form 10-K and other reports filed with the Securities and

Exchange Commission. Many of the factors that will determine the Company’s future results are

beyond the ability of management to control or predict. Participants should not place undue

reliance on forward-looking statements, reflect management’s views only as of the date hereof.

The Company undertakes no obligation to revise or update any forward-looking statements, or to

make any other forward-looking statements, whether as a result of new information, future events

or otherwise.

such term is defined in the Private Securities Litigation Reform Act of 1995) that are based on our

current expectations, beliefs and assumptions about the industry and markets in which US

Ecology, Inc. and its subsidiaries operate. Because such statements include risks and

uncertainties, actual results may differ materially from what is expressed herein and no assurance

can be given that the Company will meet its 2011 earnings estimates, successfully execute its

growth strategy, or declare or pay future dividends. For information on other factors that could

cause actual results to differ materially from expectations, please refer to US Ecology, Inc.’s

December 31, 2010 Annual Report on Form 10-K and other reports filed with the Securities and

Exchange Commission. Many of the factors that will determine the Company’s future results are

beyond the ability of management to control or predict. Participants should not place undue

reliance on forward-looking statements, reflect management’s views only as of the date hereof.

The Company undertakes no obligation to revise or update any forward-looking statements, or to

make any other forward-looking statements, whether as a result of new information, future events

or otherwise.

Important assumptions and other important factors that could cause actual results to differ

materially from those set forth in the forward-looking information include a loss of a major

customer, successful integration of Stablex Canada Inc., exposure to unknown liabilities resulting

from the Stablex Canada Inc. acquisition, compliance with and changes to applicable laws, rules,

or regulations, access to cost effective transportation services, access to insurance, surety bonds

and other financial assurances, loss of key personnel, lawsuits, labor disputes, adverse economic

conditions, government funding or competitive pressures, incidents or adverse weather conditions

that could limit or suspend specific operations, implementation of new technologies, market

conditions, average selling prices for recycled materials, our ability to replace business from

recently completed large projects, our ability to perform under required contracts, our ability to

permit and contract for timely construction of new or expanded disposal cells, our willingness or

ability to pay dividends and our ability to effectively close and integrate future acquisitions.

materially from those set forth in the forward-looking information include a loss of a major

customer, successful integration of Stablex Canada Inc., exposure to unknown liabilities resulting

from the Stablex Canada Inc. acquisition, compliance with and changes to applicable laws, rules,

or regulations, access to cost effective transportation services, access to insurance, surety bonds

and other financial assurances, loss of key personnel, lawsuits, labor disputes, adverse economic

conditions, government funding or competitive pressures, incidents or adverse weather conditions

that could limit or suspend specific operations, implementation of new technologies, market

conditions, average selling prices for recycled materials, our ability to replace business from

recently completed large projects, our ability to perform under required contracts, our ability to

permit and contract for timely construction of new or expanded disposal cells, our willingness or

ability to pay dividends and our ability to effectively close and integrate future acquisitions.

2

} Industry Overview

} US Ecology

◦ Who we are

◦ What do we do

} Review of our Sites

} Our Performance

} General Market Trends

} Growth Strategy and Business Outlook

3

Agenda

} Estimated $5 billion per year market

} Landfill revenue represents

14% or $700 million of market

14% or $700 million of market

} Historically ~3.5M tons/year disposed

} Key Drivers

◦ Regulatory

◦ Commercial

◦ Government

} Provide safe, secure &

cost-effective hazardous

and radioactive materials

solutions

cost-effective hazardous

and radioactive materials

solutions

} Own & operate hazardous

and radioactive waste

landfills

and radioactive waste

landfills

} Large, loyal customers

} Serving industry and

government for over 50

years

government for over 50

years

5

6

7

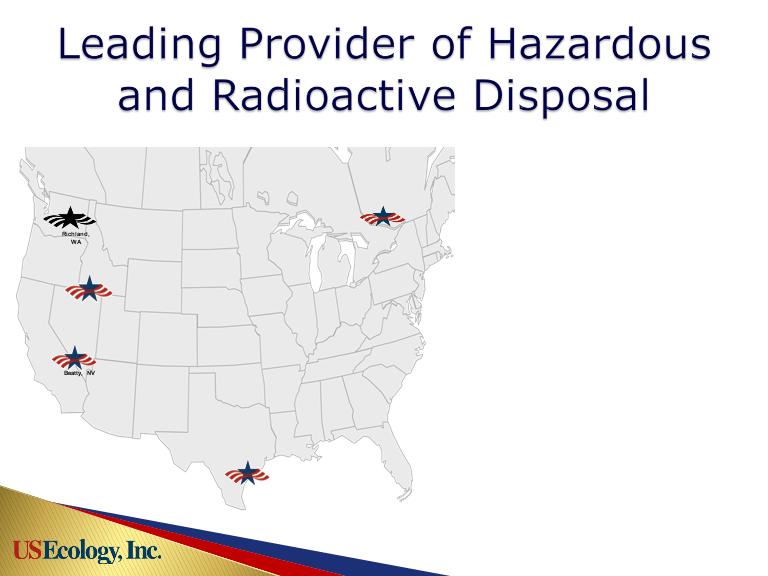

Grand View, ID

Robstown, TX

Blainville, QC

} 29% Share of North

American Hazardous

Waste Market

American Hazardous

Waste Market

◦ Operate 4 of 20 sites

} Monopoly

Radioactive Waste

Disposal Site for 11

Northwest States

Radioactive Waste

Disposal Site for 11

Northwest States

◦ Operate 1 of only 3

active commercial

radioactive sites in

country

active commercial

radioactive sites in

country

} “Hybrid” site accepts low-activity

radioactive and hazardous waste

radioactive and hazardous waste

} Specializes in high volume

treatment or direct disposal

projects

treatment or direct disposal

projects

} Rail and truck served

} Decades of permitted capacity

} Well situated in large Gulf

Coast oil and gas market

Coast oil and gas market

} Specializes in difficult to treat

waste streams

waste streams

} Added significant waste

handling infrastructure in 2010

handling infrastructure in 2010

} Rail and truck served

} 10+ years of permitted

capacity

capacity

} Recycles refinery tank

bottoms, cracking catalyst &

other oil bearing wastes

bottoms, cracking catalyst &

other oil bearing wastes

◦ Industrial reuse of catalyst

◦ Used oil resold into market

} Key advantage: Internalize

costs of recycling residuals:

ash & liquids

costs of recycling residuals:

ash & liquids

} Constructing new catalyst

handling system

handling system

} Great desert location serving

large CA/AZ market

large CA/AZ market

} Specializing in containers and

difficult to treat waste streams

difficult to treat waste streams

} State-of-the-art treatment

building with high capacity

drum handling capability

building with high capacity

drum handling capability

} New disposal space

constructed - March of 2011

constructed - March of 2011

} 10+ years of permitted

capacity

capacity

} Regulated monopoly for low-

level radioactive waste in 11

western states

level radioactive waste in 11

western states

} Market pricing for certain

naturally occurring radioactive

material

naturally occurring radioactive

material

} Generates strong cash flow,

limited growth potential

limited growth potential

} Acquired October 2010

} Provides access to NE U.S.

and Canada markets

and Canada markets

} Superb natural conditions

for disposal

for disposal

} High proportion of Base

business

business

} State-of-the-art treatment

building and proprietary

process

building and proprietary

process

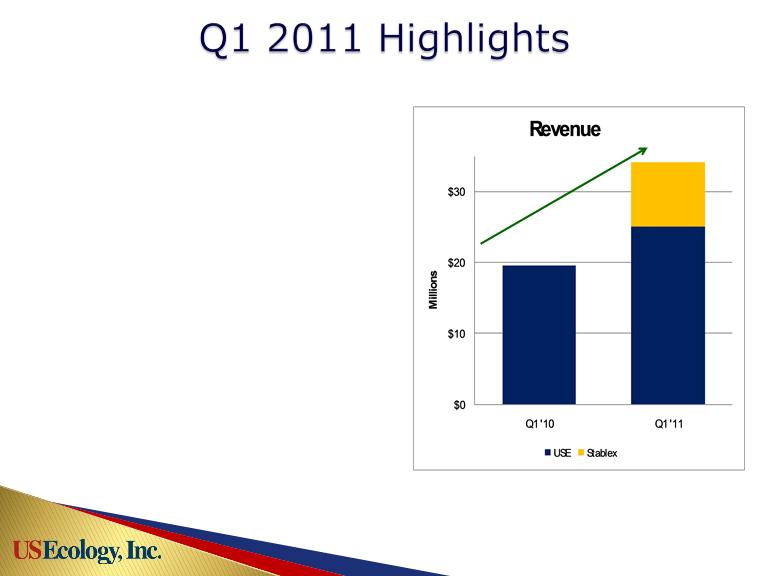

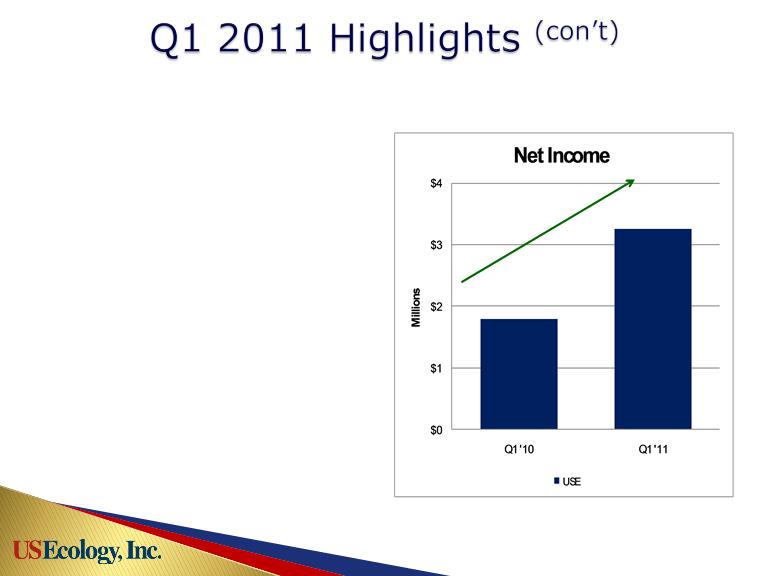

} Q1 net income increased 82%

◦ $3.3 million, $0.18 per share

◦ EPS includes ~$0.04 in foreign currency gains

◦ Compares to $1.8 million, $0.10 in Q1 2010

} Total revenue increased 75% (29% ex-Stablex)

◦ $34.1 million ($9.0 million provided by Stablex)

◦ Compares to $19.5 million in Q1 2010

◦ Average selling prices increased 2%

} Waste volumes disposed increased 67% (28% ex-Stablex)

◦ 199,000 tons vs. 119,000 tons

} Stablex integration continuing

◦ Slight negative impact to earnings with further integration activities

} Strong performance across U.S. Operations, notably:

◦ Gulf Coast Oil & Gas Markets - Thermal Recycling services

◦ Government business

◦ So. California industrial markets

14

} Quarterly Revenue

◦ Total revenue up 75%; 29% increase

excluding Stablex

excluding Stablex

◦ Base business up 69% from Q1

2010, up 19% excluding Stablex

2010, up 19% excluding Stablex

◦ Event business up 48% from Q1

2010, 15% excluding Stablex

2010, 15% excluding Stablex

◦ Volumes up 67%; Up 28% without

Stablex

Stablex

◦ Average Selling price up 2%

15

*Includes transportation services

} Quarterly Earnings

◦ Operating earnings up 54%

◦ Net income up 82%

– Included $1.25 million gain on foreign

currency

currency

◦ Earnings per share up 80%

– Up 40% without foreign currency gain

16

} Commercial projects - optimistic 2011

} Recurring “Base Business” market - modest growth

and general improvement in industrial output

and general improvement in industrial output

} “Event Business” opportunities are increasing -

large clean-up opportunities exist

large clean-up opportunities exist

} Thermal markets are improving

17

General Market Trends

18

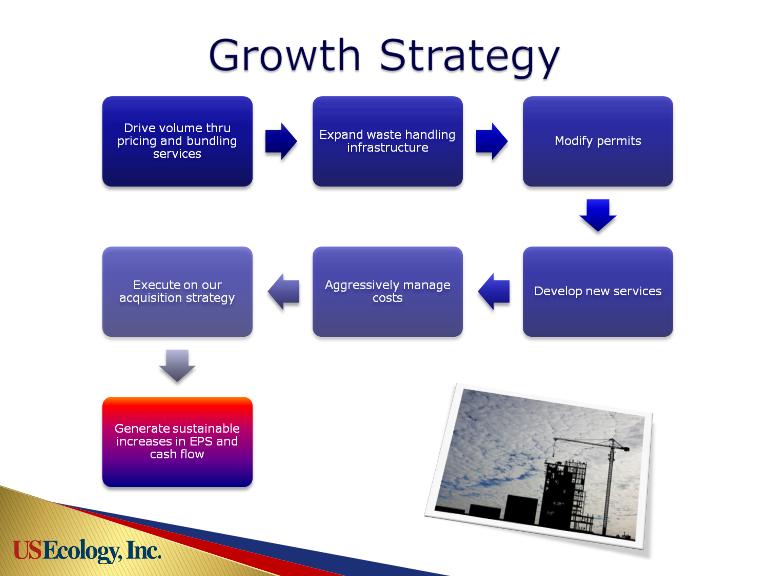

} Expect 2011 earnings from $0.75 to $0.85 per

share, excluding any FX gains/losses

share, excluding any FX gains/losses

◦ Growth of 9% to 23% over 2010 reported results of

$0.69 per share

$0.69 per share

◦ Expect 2nd half of 2011 to be stronger than 1st half in all

sectors

sectors

◦ Stablex expected to contribute to full year earnings

19

Business Outlook

} Industry leader with almost 1/3 of total disposal market

} Markets for our services are improving

} Unique and irreplaceable set of disposal assets with high

barriers to entry

barriers to entry

} High operating leverage creates significant earnings

upside as volumes increase

upside as volumes increase

} Return on invested capital: 11.9% ttm

} Attractive dividend yield of nearly 4.0%

} Acquisitions part of future growth strategy

20