Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LAKE SHORE BANCORP, INC. | lakeshore-8k_051811.htm |

Lake Shore Bancorp, Inc. Copyright 2011 1 May 18, 2011 Annual Meeting of Shareholders

Lake Shore Bancorp, Inc. Copyright 2011 2 Safe Harbor Statement This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward - looking statements to be covered by the Safe Harbor Provision and are including this statement for purpose of such Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Such forward - looking statements include, but are not limited to, statements concerning future business, revenue and earnings. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward - looking statements. Information on factors that could affect the Company's business and results is discussed in the Company's periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise.

Lake Shore Bancorp, Inc. Copyright 2011 3 Lake Shore Bancorp Inc. Stock Profile Market Data (as of May 13, 2011) – (Source - NASDAQ) » Ticker Symbol LSBK » 52 – week Range $ 7.52 - $ 14.00 » Current Price $10.88 » Market Capitalization $25.68 million » Minority Shares Outst . 2.4 M shares » 50 Day Avg. Trading Vol. 6,797 shares » Annual Cash Dividend $0.28 per share » Dividend Yield 2.59% » Ownership □ Mutual Holding Company (Lake Shore, MHC) 61.24% □ Insiders (including directors, 8.02% executives, and ESOP plan) □ Institutional 13.56% □ Other 17.18%

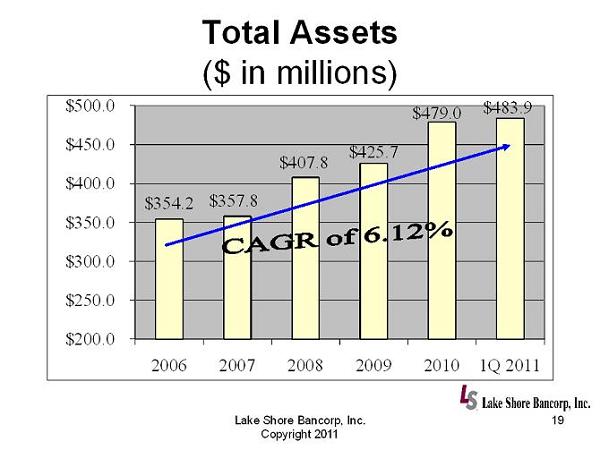

Lake Shore Bancorp, Inc. Copyright 2011 4 Corporate Profile: » Lake Shore Savings has been in business for over 120 years » As of March 31, 2011 we had: □ Total Assets - $483.9 million □ Total Loans Receivable, net - $266.2 million □ Total Deposits - $376.8 million

Corporate Profile (continued): » 10 Branch Locations in Chautauqua and Erie County Lake Shore Bancorp, Inc. Copyright 2011 5 Chautauqua Erie Dunkirk Depew Fredonia East Amherst Jamestown Kenmore - Tonawanda West Ellicott Hamburg Westfield Orchard Park

Corporate Profile (continued): » Strong management team. 22 Officers have an average of 19 years of experience in banking industry. » 101 full - time employees and 23 part – time employees as of April 30, 2011. Lake Shore Bancorp, Inc. Copyright 2011 6

Economic Environment National Economy » Housing Market » Gas Prices » Unemployment Rate Lake Shore Bancorp, Inc. Copyright 2011 7

Economic Environment (continued) Local Economy: » Stable Housing Market » Unemployment rate - below national rate In spite of the current economic environment, our overall performance was strong during 2010. Lake Shore Bancorp, Inc. Copyright 2011 8

Strong 2010 Loan Originations » Loan originations in 2010 met our strategic goals. 2010 New Loans ($’s in millions) Residential Mortgage – New & Modified $ 34.91 Commercial Mortgage – New & Modified 11.31 Commercial Loans 4.36 Home Equity Loans 7.17 Total New Loans in 2010 $ 57.75 milli on Lake Shore Bancorp, Inc. Copyright 2011 9

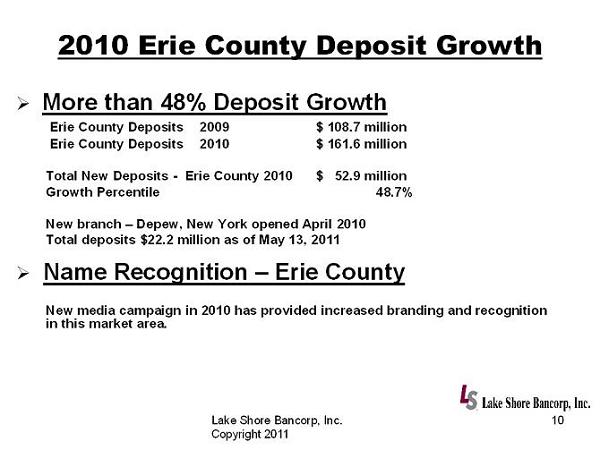

Lake Shore Bancorp, Inc. Copyright 2011 10 2010 Erie County Deposit Growth » More than 48% Deposit Growth Erie County Deposits 2009 $ 108.7 million Erie County Deposits 2010 $ 161.6 million Total New Deposits - Erie County 2010 $ 52.9 million Growth Percentile 48.7% New branch – Depew, New York opened April 2010 Total deposits $22.2 million as of May 13, 2011 » Name Recognition – Erie County New media campaign in 2010 has provided increased branding and recognition in this market area.

2010 Facilities & Technology Upgrades » Renovation of 31 East Fourth Street location into state - of - the - art administrative offices. » Board Room - Implementation of digital technology and “going green” □ Web Based Board Materials » Relocation of the Information Technology function from the second floor of our Dunkirk, New York branch to the former location of the administrative offices. » Administrative area of the Orchard Park branch was remodeled with offices and a conference room. Lake Shore Bancorp, Inc. Copyright 2011 11

2010 Commercial Lending Review » Experiencing the benefits of the realignment of our Commercial Lending activities. □ Being recognized as a primary lender, first look at deals. □ Primarily commercial real estate backed. » Branch Manager Business Lending Training » BlueBridge Small Equipment Lending Initiative □ Geared towards meeting the equipment financing needs of small businesses. Financing equipment essential to producing income for small businesses. □ Initiated program June 2010. □ Current bookings are approximately $2 Million, with board authorization to attain a total portfolio of $3 million. Lake Shore Bancorp, Inc. Copyright 2011 12

Lake Shore Bancorp, Inc. Copyright 2011 13 2011 CEO Transition » Daniel P. Reininga - promoted to President and Chief Executive Officer on January 28, 2011. » Served as Chief Operating Officer with Lake Shore since January 4, 2010, overseeing the loan department and bank operations. » A member of the Lake Shore Savings Bank Board of Directors for 14 years, serving in various capacities, including: □ Vice Chairman of the Board □ Chairman of the Asset/Liability Committee □ Member of Audit, Loan and Executive Committees » ABA Stonier National Graduate School of Banking graduate. » Former President and CEO, David C. Mancuso, remains a member of the Board of Directors and will be the Asset - Liability Committee (ALCO) Chairperson.

Strategic Review » Continue to service traditional customer base by providing cost effective banking solutions. » QuickBooks and Quicken download features recently added to Lake Shore on line banking. » Senior Staff training. □ An intensive week is planned facilitated by Jamestown Community College. Lake Shore Bancorp, Inc. Copyright 2011 14

Strategic Review (continued) » The Impact of Dodd - Frank legislation □ Projected to be in excess of 200 new regulations implemented over the next several years. » Transition from the Office of Thrift Supervision (OTS) to the Office of the Comptroller of the Currency (OCC) as the Bank’s Primary Regulator. The MHC and Bancorp regulators will be the Federal Reserve. □ July 21, 2011 » Risk Identification, Measurement, Monitor and Control » Implementation of Interest Rate Risk modeling software » Facade improvements - Orchard Park, Summer 2011 » Restructuring of our entire approach to disaster recovery Lake Shore Bancorp, Inc. Copyright 2011 15

Strategic Review (continued) Branch Growth » New Branch every 12 - 18 months » Market area in Erie County provides great potential for future growth opportunities. Lake Shore Bancorp, Inc. Copyright 2011 16

Strategic Review (continued) Operationally, LSBK is positioned to continue to achieve results aimed at managing overall risk while enhancing shareholder value. Lake Shore Bancorp, Inc. Copyright 2011 17

Lake Shore Bancorp, Inc. Copyright 2011 18 » Financial Presentation – Rachel Foley, Chief Financial Officer

Lake Shore Bancorp, Inc. Copyright 2011 19 Total Assets ($ in millions) $354.2 $357.8 $407.8 $425.7 $479.0 $483.9 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 2006 2007 2008 2009 2010 1Q 2011

Lake Shore Bancorp, Inc. Copyright 2011 20 Loans, net ($ in millions) $205.7 $218.7 $240.5 $259.2 $263.0 $266.2 $100.0 $150.0 $200.0 $250.0 $300.0 2006 2007 2008 2009 2010 1Q 2011

Lake Shore Bancorp, Inc. Copyright 2011 21 Loan Composition (as of December 31, 2010) One - to four - family 70.32% Commercial real estate 12.92% Construction loans 0.24% Home equity 11.71% Commercial loans 3.96% Consumer loans 0.85%

Lake Shore Bancorp, Inc. Copyright 2011 22 Non - performing Loans as a percentage of Gross Loans 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2006 2007 2008 2009 2010 0.64% 0.75% 0.69% 0.65% 0.89%

Lake Shore Bancorp, Inc. Copyright 2011 23 Loan Loss Reserves as a percentage of Loans 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2006 2007 2008 2009 2010 0.61% 0.56% 0.61% 0.60% 0.36%

Lake Shore Bancorp, Inc. Copyright 2011 24 Total Deposits ($ in millions) $249.6 $240.8 $293.2 $318.4 $375.8 $376.8 $ - $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 2006 2007 2008 2009 2010 1Q 2011

Lake Shore Bancorp, Inc. Copyright 2011 25 Deposit Composition (as of December 31, 2010) Savings 8.55% Money Market Accts 12.72% Interest - Bearing Demand 11.17% Noninterest - Bearing Demand 6.12% Time Deposits > $100,000 21.19% Time Deposits < $100,000 40.25%

Net Interest Income ($ in millions) Lake Shore Bancorp, Inc. Copyright 2011 26 $9.7 $9.5 $11.2 $11.80 $13.60 $ - $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 2006 2007 2008 2009 2010

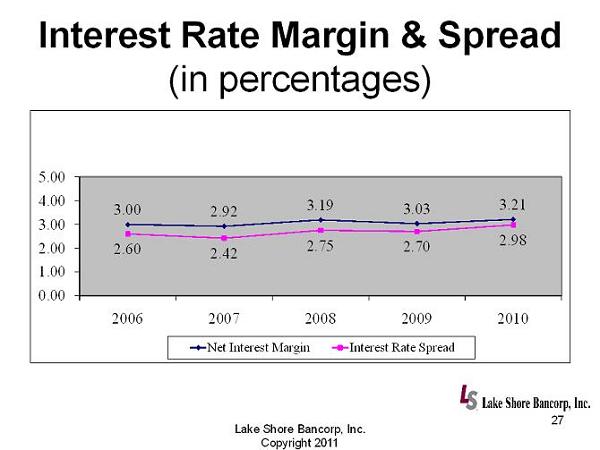

Interest Rate Margin & Spread (in percentages) Lake Shore Bancorp, Inc. Copyright 2011 27 3.00 2.92 3.19 3.03 3.21 2.60 2.42 2.75 2.70 2.98 0.00 1.00 2.00 3.00 4.00 5.00 2006 2007 2008 2009 2010 Net Interest Margin Interest Rate Spread

Treasury Yield Lake Shore Bancorp, Inc. Copyright 2011 28 0.02 0.03 0.07 0.19 0.59 1.03 1.91 2.57 3.23 4.07 4.34 0.13 0.16 0.22 0.39 0.87 1.4 2.27 2.98 3.57 4.23 4.41 0 1 2 3 4 5 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr Percentage Treasury Maturities 5/10/2011 5/10/2010

Lake Shore Bancorp, Inc. Copyright 2011 29 Net Income ($ in millions) $ - $1.0 $2.0 $3.0 2006 2007 2008 2009 2010 $1.8 $1.8 $1.5 $2.2 $3.0

Lake Shore Bancorp, Inc. Copyright 2011 30 Return on Average Assets (in percentages) 0.52% 0.52% 0.39% 0.52% 0.67% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2006 2007 2008 2009 2010

Return on Average Equity (in percentages) Lake Shore Bancorp, Inc. Copyright 2011 31 4.05% 3.39% 2.76% 3.93% 5.32% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2006 2007 2008 2009 2010

Lake Shore Bancorp, Inc. Copyright 2011 32 Regulatory Capital Requirements To be Well Capitalized under Prompt Corrective Action Provisions Actual Actual Action Provisions Amount Ratio Amount Ratio (Dollars in Thousands) As of December 31, 2010: Total capital (to risk - weighted assets) $49,862 20.44% $ 24,397 10.0% Tier 1 capital (to adjusted total assets) 48,915 10.28 23,789 5.0 Tangible equity (to tangible assets) 48,915 10.28 N/A N/A Tier 1 capital (to risk - weighted assets) 48,915 20.05 14,638 6.0

Lake Shore Bancorp, Inc. Copyright 2011 33 1 st Quarter 2011 Balances Vs. 2010 Year End Balances » Total Assets up $4.9 million □ Loans, net up $3.2 million □ Investments up $9.1 million □ Cash and Cash Equivalents down $6.3 million » Total Deposits up $1.0 million » Increases in Loans, net and Investments primarily funded through the use of excess cash.

Lake Shore Bancorp, Inc. Copyright 2011 34 1 st Quarter 2011 vs. 1 st Quarter 2010 Results » $950,000 net income in 1 st quarter of 2011 compared to $721,000 in 1 st quarter of 2010, a 31.8% increase. □ $188,000 increase in interest income due to an increase in investment purchases since March 31, 2010 □ $44,000 decrease in interest expense due to low interest rates □ $30,000 decrease in provision for loan losses □ $34,000 increase in non - interest income □ $81,000 increase in non - interest expenses

Lake Shore Bancorp, Inc. Copyright 2011 35 Dividends Paid per Share $ - $0.01 $0.02 $0.03 $0.04 $0.05 $0.06 $0.07 $0.08 Q4 '06 Q1 '07 Q2 '07 Q3 '07 Q4 '07 Q1 '08 Q2 '08 Q3 '08 Q4 '08 Q1 '09 Q2 '09 Q3 '09 Q4 '09 Q1 '10 Q2 '10 Q3 '10 Q4 '10 Q1 '11

LSBK Closing Stock Price December 31, 2006 thru May 13, 2011 Lake Shore Bancorp, Inc. Copyright 2011 36 $12.56 $12.72 $12.00 $10.30 $8.61 $9.30 $8.57 $9.50 $7.00 $6.89 $7.25 $8.25 $7.86 $8.20 $7.90 $8.03 $9.23 $10.21 $10.88 $ - $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00