Attached files

| file | filename |

|---|---|

| S-1/A - CROSSROADS SYSTEMS INC | v222043_s1a.htm |

| EX-10.11 - CROSSROADS SYSTEMS INC | v222043_ex10-11.htm |

| EX-10.12.2 - CROSSROADS SYSTEMS INC | v222043_ex10-12x2.htm |

| EX-23.2 - CROSSROADS SYSTEMS INC | v222043_ex23-2.htm |

Exhibit 10.12.1

COMMERCIAL INDUSTRIAL LEASE AGREEMENT

PRINCIPAL LIFE INSURANCE COMPANY, AN IOWA CORPORATION, LANDLORD

AND

TABLE OF CONTENTS

|

28.

|

TENANT’S ACKNOWLEDGEMENTS

|

30 | ||||

|

RIDER

|

33 | |||||

|

EXHIBIT A

|

38 | |||||

|

EXHIBIT A-1

|

39 | |||||

|

EXHIBIT B

|

40 | |||||

|

EXHIBIT C

|

46 | |||||

|

EXHIBIT D

|

47 | |||||

|

EXHIBIT E

|

49 | |||||

|

EXHIBIT F

|

50 | |||||

LIST OF DEFINED TERMS

|

Page No.

|

||||

|

Additional Rent

|

3 | |||

|

Affiliate

|

24 | |||

|

Building’s Structure

|

7 | |||

|

Claimant

|

22 | |||

|

Collateral

|

30 | |||

|

Construction Management Fee

|

11 | |||

|

Environmental Laws

|

28 | |||

|

Event of Default

|

20 | |||

|

Final Calendar Year

|

5 | |||

|

Hazardous or Toxic Materials

|

28 | |||

|

HVAC System

|

9 | |||

|

Indemnified Parties

|

24 | |||

|

Landlord’s Mortgagee

|

23 | |||

|

Law

|

24 | |||

|

Laws

|

24 | |||

|

Loss

|

15 | |||

|

Mortgage

|

23 | |||

|

Operating Expenses

|

3 | |||

|

Parking Areas

|

16 | |||

|

Primary Lease

|

23 | |||

|

Repair Period

|

14 | |||

|

Reserved Right

|

17 | |||

|

Rules and Regulations

|

16 | |||

|

Sign Requirements

|

11 | |||

|

Taking

|

19 | |||

|

Taxes

|

7 | |||

|

Tenant Parties

|

24 | |||

|

Tenant Party

|

24 | |||

|

Transfer

|

17 | |||

|

UCC

|

30 | |||

|

Vacation Date

|

17 | |||

|

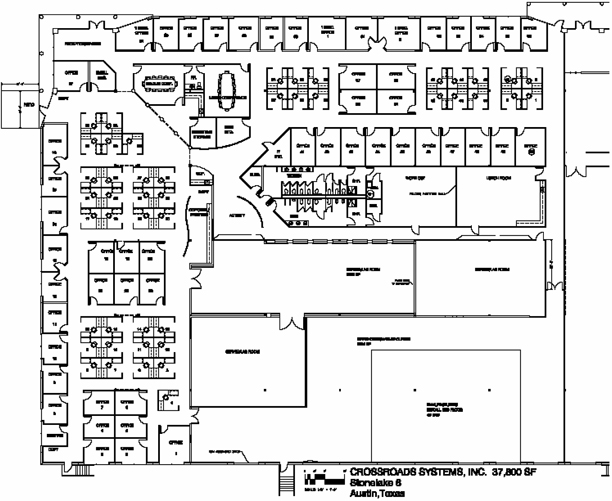

Square Feet

|

37,800

|

|

Address:

|

Stonelake 6

|

|

11000 North Mopac Expressway

|

|

|

Suite 100

|

|

|

Austin, TX 78749

|

LEASE AGREEMENT

This Lease Agreement (this “Lease”) is entered into by PRINCIPAL LIFE INSURANCE COMPANY, an Iowa corporation (“Landlord”), and CROSSROADS SYSTEMS, INC., a Delaware corporation (“Tenant”). The terms referenced in the Basic Lease Information above are hereby incorporated herein by this reference.

BASIC LEASE INFORMATION

|

Effective Date:

|

October 31, 2005

|

|

Tenant:

|

Crossroads Systems, Inc., a Delaware corporation

|

|

Tenant’s Address:

|

Crossroads Systems, Inc.

|

|

11000 North Mopac Expressway, Suite 100

|

|

|

Austin, TX 78759

|

|

|

Tenant’s Contact:

|

John King email/Telephone: jking@crossroads.com /512-928-7100

|

|

Landlord:

|

|

|

Landlord’s Address:

|

PRINCIPAL LIFE INSURANCE COMPANY

|

|

801 Grand Ave.

|

|

|

Des Moines, Iowa 50392-1370

|

|

|

Attn: Commercial Real Estate Equities, Central States Region

|

|

|

With a copy to:

|

|

|

Trammell Crow Company

|

|

|

P.O. Box 2176

|

|

|

Austin, Texas 78768-2176

|

|

|

Attn: Property Manager of 4030 West Braker Lane

|

|

|

Payments:

|

All Rent payments shall be sent to:

|

|

Principal Life Insurance Co.

|

|

|

Property 009010

|

|

|

Lockbox 90030111

|

|

|

PO Box 301111

|

|

|

Los Angeles, CA 90030-1111

|

|

|

Building:

|

The “Building” shall mean the building and improvements located at 11000 North Mopac Expressway in Austin, Travis County, Texas, comprising approximately 108,000 net rentable square feet as described in Exhibit “A” attached to this lease.

|

|

Premises:

|

Approximately 37,800 net rentable square feet as outlined on the plan attached to this Lease as Exhibit “A” and whose street address is 11000 North Mopac Expressway, Suite 100, Austin, TX 78749.

|

1

|

Original Term:

|

Sixty-six (66) full calendar months (and any partial month, if applicable), commencing on the Commencement Date (as defined below) and ending on the Expiration Date (as defined below) subject to adjustment and earlier termination as provided in the Lease.

|

|

Commencement Date:

|

The EARLIER of (i) March 1, 2006 (“Outside Date”), (ii) the Date of Substantial Completion as set forth in Exhibit B, or (iii) ninety (90) days following the date of the initial local approvals permitting initial construction are issued. Following the date of the full execution of this Lease and prior to the Commencement Date, provided that Tenant has supplied evidence of Tenant’s insurance to Landlord, Tenant may access the Premises for any reason. During any such early entry, all provisions of this Lease, except the payment of rental, shall apply. During any such early entry, Tenant shall coordinate construction efforts with Landlord so as not to interfere with any construction efforts of Landlord. Under no circumstances shall the Outside Date be delayed due to a delay in Tenant’s initial build out of the Premises. Notwithstanding the foregoing, the Outside Date may be extended if a delay is the result of Landlord’s delays (e.g., Landlord’s failure to timely approve drawings, failure to permit access or provide necessary information) and Landlord has received notice of any potential delay from Tenant.

|

|

Expiration Date:

|

The last day of the sixty-sixth (66th) full calendar month following the Commencement Date.

|

|

Security Deposit:

|

Forty Three Thousand Ninety Two and 00/100ths Dollars ($43,092.00).

|

|

Base Rent:

|

|

Base Rent

|

||||||||

|

Months

|

PSF/Mo.

|

Monthly Base Rent

|

||||||

|

Commencement Date – Month 6

|

$ | 0.00 | $ | 0.00 | ||||

|

Months 7 - 18

|

$ | 0.70 | $ | 26,460.00 | ||||

|

Months 19 - 42

|

$ | 0.80 | $ | 30,240.00 | ||||

|

Months 43 – 66

|

$ | 0.90 | $ | 34,020.00 | ||||

|

For purposes of clarification, “Month 6” means the end of the first six full calendar months of the Original Term.

|

|

Amount Due on Lease Execution

|

Initial Monthly Base Rent

|

$

|

0.00

|

|

|

Initial Monthly Escrows (subject to adjustment)

|

$

|

9,072.00

|

||

|

Security Deposit

|

$

|

43,092.00

|

||

|

Total Initial Monthly Payment

|

$

|

52,164.00

|

|

Permitted Use:

|

Only for general office uses and, to the extent allowable under local zoning ordinances, light manufacturing, assembly, integration, staging and testing of electronic parts in the course of Tenant’s business in keeping with the first-class office/industrial nature of the Building and for no other purpose without Landlord’s prior written consent. The Premises shall not be used for any use which is disreputable. No retail sales may be made from the Premises.

|

|

Tenant’s Proportionate Share:

|

The percentage obtained by dividing the net rentable square feet in the Premises by the rentable square feet in the Building, or 35%.

|

|

Guarantor:

|

None.

|

2

1. PREMISES, TERM, INITIAL IMPROVEMENTS, ACCEPTANCE OF PREMISES.

1.1 Premises. Landlord leases to Tenant, and Tenant leases from Landlord, the Premises as more fully depicted on the floor plan attached as Exhibit A-1, subject to the terms and conditions in this Lease (“Premises”). The Premises are part of the Building located on the real property described on Exhibit A (the “Land”). All references to “Building” shall individually and collectively refer to all buildings and Parking Areas (herein defined) on the Land, now and during the lease Term (defined below), unless the context otherwise requires. “Common Areas” will mean all areas, space, facilities, and equipment (whether or not located within the Building) made available by Landlord for the common and joint use of Landlord, Tenant, and others designated by Landlord using or occupying space in the Building or on the Land to the extent that the Common Areas are not expressly made a part of the Premises, and are made available for the use of all tenants in the Building. Landlord hereby grants Tenant a non-exclusive right to use the Common Areas during the lease Term in common with others designed by Landlord, subject to the terms and conditions of this Lease, including, without limitation, the restrictions on intended use and the Rules and Regulations (defined below).

1.2 Term. The lease Term shall begin on the Commencement Date, and end on the Expiration Date (“Original Term”). The Original Term, together with any renewals and extensions, shall be referred to collectively as the “Term.” Following the Commencement Date, Landlord and Tenant shall execute an instrument specifying the Commencement Date and the Expiration Date of the Original Term.

1.3 Initial Improvements. If an Exhibit B is attached to this Lease, Tenant shall construct in the Premises the improvements (the “Initial Improvements” as defined in Exhibit B) described on the plans and specifications referenced on Exhibit B.

1.4 Tenant’s Acceptance of Premises. By occupying the Premises, Tenant accepts the Premises in its “AS-IS, WHERE IS”, subject to any latent defects of which Tenant notifies Landlord within one year after the Commencement Date with all faults condition as of the date of Tenant’s occupancy; provided that Landlord represents and warrants that as of the Effective Date all existing mechanical, electrical, life safety, plumbing and sprinkler systems (connected to the core) (“Building Systems”) are in good working condition and repair, and in compliance with local building code and other governmental agency requirements including ADA requirements (prior to Tenant’s construction), and except with respect to Landlord’s obligation to perform or pay for any repair or other work as set forth in this Lease. As of the date of Landlord’s execution of this Lease, Landlord has not received written notice from any governmental entity that the Building or Common Areas are not currently in compliance with any applicable laws.

1.5 Option to Extend. See Section 2 of the Rider to Lease.

2. RENT AND SECURITY DEPOSIT.

2.1 Rent; No Right of Offset. The Base Rent, the Additional Rent and all other payments and reimbursements required to be made by Tenant under this Lease, including any sums due under the attached Exhibit B, shall constitute “Rent.” Tenant shall make each payment of the following items of Rent when due, without prior notice, demand, deduction or offset (except as expressly set forth herein)

2.2 Base Rent. The first monthly installment of Base Rent, plus the other monthly charges set forth in Section 2.3, shall be due on the date Tenant signs the Lease. Monthly installments of Base Rent shall then be due within five days after the first day of each calendar month following the Commencement Date. If the Term begins on a day other than the first day of a month or ends on a day other than the last day of a month, the Base Rent and Additional Rent for each partial month shall be prorated.

2.3 Additional Rent. On the same day that Base Rent is due, Tenant shall pay as “Additional Rent” Tenant’s Proportionate Share of all costs incurred in operating and maintaining the Land, Building and Common Areas (collectively “Operating Expenses“). Tenant also shall pay as “Additional Rent“ Tenant’s Proportionate Share of Taxes (defined in Section 3) and all late fees incurred by Tenant.

3

2.3.1 Operating Expenses.

2.3.1.1 Operating Expenses Inclusions. Operating Expenses shall include all expenses and disbursements of every kind which Landlord incurs, pays or becomes obligated to pay in connection with the ownership, operation and maintenance of the Building (including the associated Parking Areas as herein defined) and Land (subject to the exclusions from Operating Expenses set forth in Section 2.3.1.2 below) determined in accordance with GAAP fairly and consistently applied, including, but not limited to, the following: (1) Taxes (defined below) and the cost of any tax consultant employed to assist Landlord in determining the fair tax valuation of the Building and Land; (2) the cost of all utilities which are not billed separately to a tenant of the Building for above-building standard utility consumption; (3) the cost of insurance; (4) the cost of repairs, replacement, property management fees and expenses, landscape maintenance and replacement, security service (if provided), sewer service (if provided), trash service (if provided); (5) the cost of dues, assessments, and other charges applicable to the Land payable to any property or community owner association under restrictive covenants or deed restrictions to which the Premises are subject; (6) the cost of any labor-saving or energy-saving device or other equipment installed in the Building or on the Land (which device or equipment is not primarily for the benefit of any particular tenant), amortized over a period together with an amount equal to interest at an amortization rate on the unamortized balance (provided that the annual amortization does not exceed the actual annual cost savings realized), as determined using GAAP consistently applied; (7) alterations, additions, and improvements made by Landlord to comply with Law (defined below), which, if considered to be capital improvements using GAAP consistently applied, shall be amortized over a period together with an amount equal to interest at an amortization rate on the unamortized balance, as determined using GAAP; and (8) wages and salaries of personnel up to and including the level of Property Manager. Any Operating Expenses which are included in expenses for other areas of Landlord’s business park or properties shall be equitably prorated.

For the purpose of determining Tenant’s Proportionate Share of Operating Expenses, “controllable” Operating Expenses shall not increase by more than five percent (5%) per year on a cumulative and compounded basis (for example, if controllable Operating Expenses are $1.00 / rsf in year one, then they shall not exceed $1.05 in year two, $1.10 in year three, $1.16 in year four and so on). It is understood and agreed that controllable Operating Expenses shall not include trash removal, utility expenses, taxes, insurance premiums and any other cost beyond the reasonable control of Landlord. Management fees shall not exceed five percent (5%) of gross revenue.

2.3.1.2 Operating Expense Exclusions. Operating Expenses shall not include the following (1) any financing transactions, refinancing fees and loan costs for interest, fees, amortization, or other payments (including late payment penalties) on loans to Landlord; (2) expenses incurred in leasing or procuring tenants, including but not limited to commissions and brokerage fees (including rental fees); (3) any in-house legal or accounting fees and any legal expenses other than those incurred for the general benefit of the Building’s tenants; (4) allowances, concessions, and other costs of renovating or otherwise improving space for occupants of the Building or vacant space in the Building; (5) federal income taxes imposed on or measured by the income of Landlord from the operation of the Building; (6) rents due under ground leases; (7) costs incurred in selling, syndicating, financing, mortgaging, or hypothecating any of Landlord’s interests in the Building; (8) expenses for repairs, restoration or other work occasioned by fire, wind, the elements or other casualty or any other costs to the extent covered by insurance; (9) any depreciation allowance or expense; (10) any utilities or other expenses which are separately metered or calculated and charged to Tenant or any other tenant in the Building; (11) costs incurred by Landlord for alterations which are considered new capital improvements or capital replacements (such as a roof replacement) under Generally Accepted Accounting Principles consistently applied, except for items in clauses (6) and (7) in Section 2.3.1.1 above (12) any costs, fines and penalties incurred due to violations by Landlord of any governmental rule or authority in existence on the date of the execution hereof; (13) expenses for the replacement of any item to the extent covered under warranty; (14) cost of repairs necessitated by the Landlord’s negligence or willful misconduct, or of correcting any latent defects or original design defects in the Building construction, materials or equipment, (15) wages and salaries of personnel above the level of Property Manager, (16) costs incurred by Landlord due to the violation by Landlord or any other tenant of the terms and conditions of any lease of space in the Building, (17) tax penalties incurred as a result of Landlord’s negligence, inability or unwillingness to make payments and/or to file any tax or informational returns when due, (18) any and all costs arising from the presence of hazardous materials or substances (as defined by applicable laws in effect on the date this lease is executed) in or about the Premises, the Building or the Land, existing prior to the Commencement Date or otherwise caused by the negligence or willful misconduct of Landlord, (19) costs arising from Landlord’s charitable or political contributions, (20) costs for the acquisition of sculpture, paintings or other objects of art, (21) any Operating Expenses not billed to Tenant within two (2) years after the expiration of the Operating Year in which such Operating Expenses were incurred, (22) charges for any services provided for the benefit of a tenant of the Building, (23) marketing and advertising expenses incurred with leasing of the Building, (24) cost incurred in connection with upgrading the Building to comply with the current interpretation of disability, life, fire and safety codes, ordinances, statutes or other laws in effect prior to the Commencement Date, including without limitation, the ADA, including penalties or damages incurred due to such non-compliance; (24) off-site overhead, (25) all amounts paid to Affiliates of Landlord for services on or to the Building which are materially in excess of competitive costs for such services; and (26) property management fees in excess of five percent (5%) of gross revenues.

4

2.3.1.3 Operating Expense Calculation and Notices. The initial monthly payments for Operating Expenses shall be calculated by taking 1/12 of Landlord’s estimate of Tenant’s Proportionate Share of Operating Expenses for a particular calendar year (or any portion of a year as determined by Landlord). The initial monthly payments are estimates only, and shall be increased or decreased annually to reflect the projected actual Operating Expenses for a particular year. If Landlord fails to give Tenant notice of its estimate of Tenant’s Proportionate Share of Operating Expenses in accordance with this subsection for any calendar year, then Tenant shall continue making Additional Rent payments in accordance with the estimate for the previous calendar year until a new estimate is provided by Landlord. If during any year Landlord determines in good faith that, because of an unexpected increase in Operating Expenses with evidence provided to Tenant, Landlord’s estimate of Operating Expenses was too low, then Landlord shall have the right, no more than once in a calendar year, to give a new statement of the estimated Proportionate Share of Operating Expenses due from Tenant for the applicable calendar year or the balance of the estimated amount and to bill Tenant for any deficiencies which have accrued during the calendar year or any portion of the year, and Tenant shall then make monthly payments based on the new statement. Any estimate deficiencies shall be amortized over the remaining monthly payments for such year. Within a reasonable time after the end of each calendar year and the Expiration Date, Landlord shall prepare and deliver to Tenant a statement certified by an agent of Landlord to be correct to their knowledge (“Final Statement”) showing Tenant’s actual Proportionate Share of Operating Expenses for the applicable calendar year, provided that with respect to the calendar year in which the Expiration Date occurs, (1) that the calendar year shall be deemed to have commenced on January 1 of that year and ended on the Expiration Date (the “Final Calendar Year“) and (2) Landlord shall have the right to estimate the actual Operating Expenses allocable to the Final Calendar Year. Unless Tenant makes written exception to any item within three hundred sixty five (365) days after Landlord furnishes its annual statement of Tenant’s Additional Rent, the statement shall be considered as final and accepted by Tenant. If Tenant’s total monthly payments of its Proportionate Share for the applicable calendar year are more than Tenant’s actual Proportionate Share of Operating Expenses, then Landlord shall retain the excess and credit the amount in full against Tenant’s future Additional Rent payments as such Additional Rent obligations are incurred. With respect to the Final Calendar Year, Landlord shall pay to Tenant the amount of all excess payments, less any additional amounts then owed to Landlord within thirty (30) days following the date on which Landlord furnishes a statement of Tenant’s Additional Rent. If Tenant’s total monthly payments of its Proportionate Share of Operating Expenses for any year are less than Tenant’s actual Proportionate Share of Operating Expenses for that year, Tenant shall pay the difference to Landlord within thirty (30) days after Landlord’s written request for payment accompanied by the statement. There shall be no duplication of costs for reimbursements in calculating Operating Expenses. In the event Landlord receives a refund or credit of Operating Expenses subsequent to the year in which such expense was paid and charged to Operating Expenses, Landlord shall promptly pay to Tenant the amount of such refund or credit to the extent Tenant directly or indirectly was charged for such Operating Expenses during a prior year. Tenant shall not be required to pay any Operating Expenses prior to the Commencement Date.

5

Tenant shall have the right to conduct a Tenant's Review, as hereinafter defined, at Tenant's sole cost and expense (including, without limitation, photocopy and delivery charges), upon thirty (30) days' prior written notice to Landlord. “Tenant's Review” shall mean a review of Landlord's books and records relating to (and only relating to) the Operating Expenses payable by Tenant hereunder for the most recently completed calendar year (as reflected on Landlord's Final Statement) by Tenant or third party auditor (“Third Party Auditor”) provided that as a condition precedent to any such inspection by a Third Party Auditor, Tenant shall deliver to Landlord a copy of Tenant’s written agreement with such Third Party Auditor, which agreement shall include provisions which state that (i) such Third Party Auditor will not in any manner solicit or agre to represent any other tenant of the Building with respect to an audit or other review of Landlord’s accounting records for the Building, and (ii) such Third Party Auditor shall maintain in strict confidence any and all information obtained in connection with the Tenant Review and shall not disclose such information to any person or entity other than to the management personnel of Tenant. Tenant must elect to perform a Tenant's Review by written notice of such election received by Landlord within two hundred seventy (270) days following Tenant's receipt of Landlord's Final Statement for the most recently completed calendar year. In the event that Tenant fails to make such election in the required time and manner required or fails to diligently perform such Tenant's Review to completion, then Landlord's calculation of Operating Expenses shall be final and binding on Tenant. Tenant hereby acknowledges and agrees that even if it has elected to conduct a Tenant's Review, Tenant shall nonetheless pay all Tax Operating Expense and Expense Operating Expense payments to Landlord, subject to readjustment. Tenant further acknowledges that Landlord's books and records relating to the Building may not be copied in any manner, are confidential, and may only be reviewed at a location reasonably designated by Landlord; but Landlord will make such records available within the metropolitan area in which the Premises is located. Tenant shall provide to Landlord a copy of Tenant's Review as soon as reasonably possible after the date of such Review. If Tenant's Review reflects a reimbursement owing to Tenant by Landlord, and if Landlord disagrees with Tenant's Review, then Tenant and Landlord shall jointly appoint an auditor to conduct a review (“Independent Review”), which Independent Review shall be deemed binding and conclusive on both Landlord and Tenant, provided that such Independent Review must address all issues raised by the Tenant’s Review. If the Independent Review results in a reimbursement owing to Tenant equal to five percent (5%) or more of the amounts reflected in the Final Statement, the costs of the Tenant’s Review and Independent Review shall be paid by Landlord, but otherwise Tenant shall pay the costs of Tenant's Review and the Independent Review. Under no circumstances shall Tenant conduct a review of Landlord's books and records whereby the auditor operates on a contingency fee or similar payment arrangement. Any such reviewer must sign a commercially reasonable non-disclosure, non-solicitation, and confidentiality agreement. Landlord will promptly pay to Tenant any overpayment disclosed by the Tenant’s Review, or, if disputed, by the subsequent Independent Review.

2.3.1.4 Grossed-Up Operating Expenses. If during any year the Building is less than one hundred percent (100%) occupied, then, for purposes of calculating Tenant’s Proportionate Share of Operating Expenses for that year, the amount of Operating expenses that fluctuates with Building occupancy shall be “grossed-up” to the amount which, in Landlord’s reasonable estimation, it would have been had the Building been one hundred percent (100%) occupied for that entire year. In the event that Landlord, in calculating the Operating Expenses of the Building, “grosses-up” the Operating Expenses that fluctuate with Building occupancy incurred during the year in question, then Landlord agrees that the “gross-up” of Expenses shall be limited to Operating Expenses that fluctuate with Building occupancy and the following items of Operating Expenses shall not be adjusted in the “gross-up” calculation: (1) Taxes, (2) amortized capital improvements costs, (3) insurance premiums, (4) landscaping expenses, and (5) any other fixed-cost items that are not subject to fluctuation based on occupancy. Notwithstanding the foregoing, Landlord shall not recover as Operating Expenses more than 100% of the Operating Expenses actually paid by Landlord.

2.3.2 Late Fee. If any Rent or other payment required of Tenant under this Lease is not paid within five (5) days of when due, Landlord may charge Tenant, and Tenant shall pay upon demand, a fee equal to five percent of the delinquent payment to reimburse Landlord for its cost and inconvenience incurred as a consequence of Tenant’s delinquency; provided, however, Tenant shall be entitled to written notice and a five (5) day cure period on one (1) occasion during any twelve (12) month period before such late fee is assessed. All such fees shall be Additional Rent.

2.4 Initial Monthly Rent. The amounts of the initial monthly Base Rent and Additional Rent for Tenant’s Proportionate Share of Operating Expenses and Taxes are set forth in the Summary of Lease Terms.

6

2.5 Security Deposit. Tenant shall deposit the Security Deposit with Landlord on the date this Lease is executed by Tenant, which shall be held by Landlord to secure Tenant’s obligations under this Lease. The Security Deposit is not an advance rental deposit or a measure of Landlord’s damages for an Event of Default (defined below). Landlord may use any portion of the Security Deposit to satisfy Tenant’s unperformed obligations under this Lease, to reimburse Landlord for performing any such obligations or to compensate Landlord for its damages arising from Tenant's failure to perform its obligations, without prejudice to any of Landlord’s other remedies. If so used, Tenant shall, upon request, pay Landlord an amount that will restore the Security Deposit to its original amount. Landlord also may require Tenant to provide Landlord with an additional amount to be held as part of the Security Deposit if Tenant exercises its expansion option hereunder. The Security Deposit shall be Landlord’s property. Tenant shall not be entitled to interest on any security deposit amount and Landlord may commingle such Security Deposit with any other of its funds. Tenant agrees that it will not assign or encumber or attempt to assign or encumber the monies deposited with Landlord as the Security Deposit and that Landlord and its successors and assigns shall not be bound by any such actual or attempted assignment or encumbrance. The unused portion of the Security Deposit, along with a list of deductions, will be returned to Tenant within forty-five (45) days after the Expiration Date, provided that Tenant has fully and timely performed its obligations under this Lease or cured any deficiencies at that time.

3. TAXES

3.1 Real Property Taxes. The term “Taxes“ shall include all taxes, assessments and governmental charges that accrue against the Premises, the Land, and the Building, whether federal, state, county, or municipal, and whether imposed by taxing or management districts or authorities presently existing or hereafter created. Landlord shall pay the Taxes, and Tenant shall pay Landlord for Tenant's Proportionate Share of the Taxes. If, during the Term, there is levied, assessed or imposed on Landlord a capital levy or other tax directly on the Rent; or a franchise tax, assessment, levy or charge measured by or based, in whole or in part, upon the Rent; then all such taxes, assessments, levies or charges, or any part so measured or based, shall be included within the term “Taxes.” If the Building is occupied by more than one tenant and the cost of any improvements constructed in the Premises for Tenant is disproportionately higher than the cost of improvements constructed in the premises of other tenants of the Building, then Landlord may require that Tenant pay the amount of additional Taxes directly attributable to such improvements (but only as evidenced by correspondence or other documentation with the taxing authority attributing additional Taxes to Tenant’s improvements, which evidence shall be provided to Tenant) in addition to its Proportionate Share of other Taxes. In determining whether the cost of any improvements constructed in the Premises for Tenant is disproportionately higher than the cost of improvements constructed in the premises of other tenants of the Building, factors shall consist of the following: (1) percentage of office finish of the Premises, (2) levels of office finish, (3) parking, (4) and other differing and distinguishing factors between the improvements constructed in the Tenant's Premises and the improvements constructed in the premises of other tenants.

3.2 Personal Property Taxes. Tenant shall before delinquency pay all taxes and assessments levied or assessed against any personal property, trade fixtures or alterations placed in or about the Premises; and upon Landlord's request, deliver to it receipts from the applicable taxing authority or other evidence acceptable to Landlord to verify that the taxes have been paid. If any such taxes are levied or assessed against Landlord or its property, and (1) Landlord pays them or (2) the assessed value of Landlord’s property is increased and Landlord pays the increased taxes, then Tenant shall pay to Landlord the amount of all such taxes within ten (10) days after Landlord’s request for payment. All such amounts shall bear interest from the date paid by Landlord to the applicable taxing authority until reimbursed by Tenant at the rate set forth in Section 24.13.

4. LANDLORD’S MAINTENANCE AND REPAIR OBLIGATIONS. This Lease is intended to be a net lease; accordingly, Landlord’s maintenance obligations during the Term as may be extended shall consist of only the replacement and repair of the Building’s roof, maintenance and repair of the foundation, any common areas, including but not limited to the elevators, lobbies and restrooms, maintenance of the Land (including but not limited to the maintenance and replacement of landscaping, Parking Areas, and sidewalks), portions of systems servicing the Building to the extent not exclusively servicing the Premises, and maintenance of the structural members of the exterior walls (collectively the “Building’s Structure and Common Areas“) and shall operate the Building consistent with similar first class office/industrial buildings within a ten (10) mile radius of the Building. Landlord shall be responsible for ensuring that the Building’s Structure and Common Areas comply with local building code and other governmental agency requirements including ADA requirements (unless caused to be out of compliance by the initial or any subsequent Tenant alterations). Landlord shall not be responsible for: (1) any non-routine or latent maintenance until Tenant delivers to Landlord written notice of the need for maintenance, (2) such alterations to the Building’s Structure and Common Areas required by Law because of Tenant’s particular use of all or a portion of the Premises as opposed to use for normal and customary business office or assembly operations (all alterations shall be performed by Tenant), or (3) repairs to skylights, windows, glass or plate glass, doors, special storefronts or office entries, all of which shall be maintained by Tenant. Except for maintaining the Building's Structure and Common Areas, Landlord shall not be required to maintain or repair at Landlord's expense any other portion of the Premises. LANDLORD’S LIABILITY FOR ANY DEFECTS, REPAIRS, REPLACEMENT OR MAINTENANCE FOR WHICH LANDLORD IS RESPONSIBLE UNDER THIS LEASE SHALL BE LIMITED TO THE COST OF PERFORMING SUCH WORK. Tenant shall give Landlord notice of any repairs as may be required hereunder and Landlord shall proceed to promptly make such repairs, subject to weather conditions and other reasonable factors.

7

Subject to the provisions contained herein relating to force majeure, condemnation, and casualty, and provided further that Tenant is not then if default, Tenant shall have the following self help rights to perform Landlord’s duties under the Lease:

(a) Emergency. If there is an emergency that threatens person or property and requires immediate intervention to prevent further loss, then Tenant may only take such measures as are reasonably necessary to prevent further loss and stabilize the emergency. Tenant shall use commercially reasonable efforts to inform Landlord of such emergency as soon as possible. If so directed by Landlord during the emergency situation, Tenant shall cease its self help activities, provided that Landlord promptly takes curative action to prevent further loss.

(b) Non-Emergency. In the event that Landlord fails to make any repairs to the Building or Premises or otherwise fails to comply with any other obligation under this Lease, and such failure materially and adversely affects Tenant’s ability to do business from the Premises, Tenant shall provide written notice to Landlord, specifying the failure and required action. Landlord shall cure such default within ten (10) business days after receipt of such notice (provided that if such failure cannot be cured within ten (10) business days, then such longer period as may reasonably be required provided that Landlord proceeds diligently to cure such failure). In the event that Landlord fails to make the applicable repairs in the specified time period, then Tenant shall provide a second written notice to Landlord, which notice shall describe the work that Tenant intends to undertake and the estimated cost of such work, to the extent practical. In the event that Landlord fails to commence applicable repairs within five (5) business days following receipt of the second notice, Tenant may proceed to make the repairs that Landlord failed to make. Notwithstanding the foregoing, Tenant shall not make any such repairs in the event that prior to any such repairs Landlord gives to Tenant written notice of the legitimate business reasons (other than lack of funds) as to why Landlord is not willing to make such repairs in the time requested by Tenant, provided that such failure does not materially and adversely affect Tenant’s ability to do business from the Premises or the first class office/industrial appearance of the Building and Common Areas. By way of example and not by limitation, it may be more effective for Landlord to make certain non-emergency repairs during warmer months of the year.

(c) Standard. All repairs by Tenant shall be made in a good and workmanlike manner, and otherwise in accordance with the terms and conditions of this Lease (except for provisions requiring Landlord’s consent).

(d) Reimbursement. Landlord shall reimburse to Tenant the reasonable (taking into consideration the exigencies of the activity) cost of such activities within thirty (30) days following the date of Landlord’s receipt of fully paid invoices, lien waivers (if applicable) and such other information and documentation as Landlord may reasonably require,at Landlord’s expense. In the event Landlord fails to timely reimburse Tenant for such properly documented cost, then Tenant may deduct such amounts from Rent next due.

(e) Exclusive Remedy. Tenant’s self help rights set forth this section are Tenant’s sole and exclusive remedy and in lieu of any other rights or remedies that may be available to Tenant under this Lease, at law or in equity.

5. TENANT’S MAINTENANCE AND REPAIR OBLIGATIONS

5.1 Tenant’s Maintenance of the Premises. Tenant shall maintain all parts of the Premises except for maintenance work for which Landlord is expressly responsible for under Section 4 in good condition and shall promptly make all necessary repairs and replacements to the Premises, unless delayed by Landlord pursuant to Section 6. All repairs and replacements performed by or on behalf of Tenant shall be performed in a good and workmanlike manner acceptable in all respects to Landlord, and in accordance with Landlord's standards applicable to alterations or improvements performed by Tenant. Notwithstanding anything in this Lease to the contrary, Tenant shall not be required to make any repair to, modification of, or addition to the Building Structure and Common Areas and/or the Building Systems except and to the extent required because of Tenant’s use of all or a portion of the Premises for other than normal and customary business office operations and/or to the extent required because of Tenant’s installation of improvements or alterations which do not constitute customary business office improvements.

8

5.2 Tenant’s Repair. Tenant shall repair and pay for any damage caused by a Tenant Party (defined below) or caused by any failure by Tenant to perform obligations under this Lease, unless delayed by Landlord pursuant to Section 6. Tenant and any Tenant Party shall use commercially reasonable efforts not do anything in performing any repairs that would inhibit or prevent other tenants' use and enjoyment of the Common Areas.

5.3 HVAC System. Landlord shall deliver the HVAC System, as hereinafter defined, as well as the Building Systems servicing the Premises, to Tenant in good working order and repair, and Landlord shall pay for any costs over Five Hundred Dollars ($500.00) per occurrence, of all parts and labor for repairs to the HVAC System and replacements thereof necessitated by ordinary wear and tear for a period of twelve (12) months following the Commencement Date (provided that (i) Landlord pre-approves in writing any applicable repair or replacement, which approval shall not be unreasonably withheld or delayed, and (ii) to the extent the repair or replacement was not necessitated by Tenant’s failure to maintain or negligence). After the initial twelve (12) month period, Tenant shall be responsible for the cost of any repairs to the HVAC system and Tenant shall maintain, the heating, air conditioning, and ventilation equipment and system and the hot water equipment (collectively the “HVAC System“) in good repair and condition and in accordance with Law and with the equipment manufacturers’ suggested operation/maintenance service program. Such obligation shall include the replacement of all equipment necessary to maintain the HVAC System servicing the Premises in good working order. Within thirty (30) days after the Commencement Date, Tenant shall deliver to Landlord copies of contracts entered into by Tenant for regularly scheduled preventive maintenance and service contracts for the HVAC System, each contract in a form and substance and with a contractor reasonably acceptable to Landlord. At least fourteen (14) days before the Expiration Date, the earlier termination of this Lease, or the termination of Tenant's right to possess the Premises, Tenant shall deliver to Landlord a certificate from an engineer reasonably acceptable to Landlord certifying that the HVAC System is then in good repair and working order. Landlord shall provide Tenant with reasonable access to the HVAC System 24X7X365 so that Tenant may control and use the HVAC as desired at all times. The HVAC System shall be dedicated to Tenant and not shared with any other tenant in the Building.

Notwithstanding the foregoing to the contrary, provided Tenant enters into a regularly scheduled preventative maintenance and service contract for the HVAC System with a reputable HVAC contractor pursuant to the provisions of this Section 5.3, if at any time during the Term the HVAC unit serving the Premises requires replacement or a repair in excess of $3,000 for the repair project (as recommended by the contractor approved by Landlord and Tenant) and such need for replacement or applicable repair is due to ordinary wear and tear (and not to the extent due to any misuse or abuse of the unit by Tenant or failure of Tenant to properly maintain the unit), then the cost of such replacement or applicable repair shall be amortized over the useful life of the unit in accordance with GAAP and Tenant shall only be required to pay that portion of the cost applicable to the Term (as may be extended). Landlord must pre-approve, in writing, any such replacement, repair or improvement, which such approval shall not be unreasonably withheld or delayed. Except as set forth above, Tenant shall be liable for any additional or other repairs or replacements of the HVAC System during the Term.

5.4 Landlord’s Optional Performance of Tenant’s Obligations. Landlord has the right, but not the obligation, to perform or provide any maintenance, repairs or replacements to be performed by Tenant under Section 5 and to provide any utility service that Tenant is required to provide under Section 8 below, upon ten (10) days prior written notice to Tenant. If Tenant fails to perform or provide any maintenance, repairs or replacements to be performed by Tenant under Section 5 or to provide any utility service which Tenant is required to provide under Section 8 below and such failure is not attributable to Landlord under Section 6, and should Landlord elect to do so after the notice period set forth in the preceding sentence, then Tenant shall reimburse Landlord for all out of pocket expenses and costs incurred by Landlord in performing Tenant's obligations plus an additional five percent of such amount to compensate Landlord for the overhead and administrative costs relating to the performance of all such obligations. All such amounts owing pursuant to this Section 5 shall be deemed Rent under this Lease, which Tenant shall pay Landlord within ten (10) days after Landlord's request for payment.

9

6. ALTERATIONS BY TENANT.

6.1 No Tenant Alterations. Tenant shall not make any changes, modifications, alterations, additions or improvements to the Premises, or install any heat or cold generating equipment, or other equipment, machinery or devices in the Premises or any other part of the Building without the prior written consent of Landlord. Notwithstanding the foregoing, Tenant may install heat generating equipment, environmental chambers, machinery and related devices as part of its assembly, integration, testing, staging and light manufacturing of electronics, as well as one or more microwaves, a refrigerator, gas grill (on the exterior deck/patio to be approved as part of the Space Plans) and related items in the Premises, provided that Tenant removes the same upon the expiration or sooner termination of this Lease and repairs any damage caused by installation, use or removal. In addition to foregoing, provided that (i) Tenant is not then in default beyond any applicable notice and grace period, (ii) Tenant’s provides prior written notice to Landlord of the proposed work, (iii) Tenant complies with all laws, insurance requirements and lien covenants, (iv) the proposed work does not adversely affect the Building’s structure or the electrical, mechanical, plumbing, or life/safety systems of the Building, and (v) no building permit (or similar permit) is required, and (vi) the aggregate (per project) cost of such work does not exceed $25,000.00, then Landlord’s consent shall not be required.

6.2 Requirements for Landlord’s Written Consent. If Landlord’s consent is required hereunder, Landlord shall not be required to notify Tenant of whether it consents to any Tenant alterations until it has received plans and specifications (if required) which are reasonably detailed to allow construction of the work depicted in them to be performed in a good and workmanlike manner, and Landlord has had a reasonable opportunity to review them, which shall not exceed ten (10) days. If Landlord disapproves any alterations, Landlord shall provide Landlord’s reasons for disapproval. Without in any way limiting Landlord's rights to refuse its consent to Tenant's proposed alterations, if Landlord consents in writing to Tenant's proposed alterations, then Landlord's consent shall be conditioned without limitation on all of the following: (1) Landlord's reasonable approval of the contractor making the alterations and approving each contractor's insurance coverage provided in connection with the alterations, (2) Landlord's supervision of the installation, (3) Landlord's reasonable approval of final plans and specifications for the alterations, (4) the appropriate governmental agency, if any, having final and complete plans and specifications for such work, and (5) whether any alterations to the Premises, or installations of any equipment would do any of the following: (i) adversely affect structural or load bearing portions of the Premises or the Building, (ii) result in a material increase of electrical usage above the normal type of amount of electrical current to be provided by Landlord, (iii) result in a material increase of Tenant's use of heating or air conditioning, (iv) impact mechanical, electrical or plumbing systems in the Premises or the Building, (v) affect the exterior appearance of the Building, or (vi), violate any provision in Sections 13 or 26 of this Lease or Exhibit B, attached hereto. If the alterations will affect the Building’s Structure and Common Areas, HVAC System, or mechanical, electrical, or plumbing systems, then the plans and specifications must be prepared by a licensed engineer. Landlord’s approval of any plans and specifications shall not be a representation that the plans or the work depicted in them will comply with any applicable Law (defined below) or be adequate for any purpose, but shall merely be Landlord’s consent to Tenant's installation of the alterations. Landlord shall have the right, but not the obligation, to periodically inspect the work in the Premises and may require changes in the method or quality of the work if Tenant has not complied with the provisions hereof. If Landlord's consent is granted, any such Alterations shall be made at Tenant's sole cost and expense.

6.3 Tenant’s Obligations. Upon completion of any Alteration, Tenant shall deliver to Landlord accurate, reproducible “as-built” plans. If Tenant has not delivered to Landlord the as-built drawings within thirty (30) days of completion of the alterations, Landlord may contract for production of as-built drawings at Tenant's sole cost and expense by providing Tenant five (5) days written notice of Landlord’s intent to contract for such drawings. Tenant shall reimburse Landlord for such costs within ten (10) days of Landlord's request for payment. All work performed by Tenant in the Premises, including work relating to the alterations or their repair, shall be performed in a good and workmanlike manner in accordance with Law (defined below) and with Landlord's and Landlord's insurance carriers' specifications and requirements as provided to Tenant.

10

6.4 Ownership of Alterations. Upon the Expiration Date or earlier termination of this Lease, Tenant shall return the Premises to Landlord clean and in good order and condition, except for: (1) ordinary wear and tear, (2) damage that Landlord has the obligation to repair under the terms of this Lease, (3) all changes, modifications, alterations, additions or improvements that Tenant does not have the obligation to remove under the terms of this Section 6.4, and (4) damage by casualty. Except as provided below, all changes, modifications, alterations, additions or improvements and property at the Premises (including wall to wall carpeting, paneling or other wall covering and any other surface material attached to or affixed to the floor, wall or ceiling of the Premises) will remain in and be surrendered with the Premises upon the Expiration Date or earlier termination of this Lease, and Tenant waives all rights to any payment, reimbursement or compensation for the property that must remain at the Premises in accordance with this subsection. Tenant must, however, remove from the Premises prior to the Expiration Date or earlier termination of this Lease any changes, modifications, alterations, additions or improvements that Landlord has designated for removal at the time of Landlord's written approval of such changes, modifications, alterations, additions or improvements. Subject to the foregoing, Landlord shall notify Tenant of any items that will need to be removed prior to or immediately following the Joint Inspection set forth in Section 17.1 below. Notwithstanding the foregoing, Landlord shall only be able to require removal of Tenant alterations which would materially add to Landlord’s demolition costs of usual office tenant improvements. Tenant shall not be required to remove from the Premises any of the changes, modifications, alterations, additions or improvements that are contemplated in Exhibit “B” or those that do not require Landlord's approval. Tenant must promptly repair any damage to the Premises caused by its removal of personal property, changes, modifications, alterations, additions or improvements.

6.5 Trade Fixtures. Tenant may erect shelves, bins, partitions, movable fixtures, machinery, communications equipment, manufacturing devices, environmental chambers, and other trade fixtures provided that such items (1) do not alter the basic character of the Premises or the Building; (2) do not overload or damage the same; and (3) may be removed without damage to the Premises. Such items shall remain the property of Tenant. Unless Landlord specifies in writing otherwise, all alterations, additions, and improvements shall be Landlord’s property when installed and remaining in the Premises on the Expiration Date.

6.6 Construction Management Fee. In connection with any such Alteration requiring Landlord approval above, Tenant shall pay to Landlord a “Construction Management Fee“ of five percent of all costs incurred for such work.

6.7 Existing Furniture. Landlord shall convey via a quit claim bill of sale any rights that Landlord has in any furniture within the Premises as of the Commencement Date. Landlord shall use commercially reasonable efforts to obtain the furniture from the existing tenant within the Premises.

7. SIGNS

7.1 Premises’ Exterior. Tenant shall not without Landlord's prior written consent (1) make any changes to the exterior of the Premises or the Building, (2) install any exterior lights, decorations, balloons, flags, pennants, banners or paintings, (3) erect or install any signs, windows, blinds, draperies, window treatments, bars, security installations, or door lettering, decals, window or glass-front stickers, placards, decorations or advertising media of any type that is visible from the exterior of the Premises. As to (3) only, such consent shall not be unreasonably withheld, delayed or conditioned. Subject to Tenant complying with all applicable Laws, Landlord hereby consents to the exterior door and exterior deck area to be built as described in the Space Plan referenced in the Work Letter attached hereto.

7.2 Requirements for Landlord’s Written Consent. Landlord shall not be required to notify Tenant in writing of whether it consents to any sign until Landlord (1) has received detailed, to-scale drawings specifying the design, material composition, color scheme, and method of installation, and (2) has had a reasonable opportunity to review them. Notwithstanding the foregoing, Landlord shall not unreasonably withhold its consent.

7.3 Sign Requirements. Landlord’s signs and lettering requirements are reflected in Exhibit E, if applicable. Tenant shall erect any signs in accordance with the plans and specifications, in a good and workmanlike manner, in accordance with all Laws and architectural guidelines in effect for the area in which the Building is located and will obtain all requisite governmental approvals (the “Sign Requirements“), and in a manner so as not to unreasonably interfere with the use of the Building grounds while such construction is taking place; thereafter, Tenant shall maintain the sign in a good, clean, and safe condition in accordance with the Sign Requirements.

11

7.4 Sign Removal. After the Expiration Date or earlier termination of this Lease or after Tenant's right to possess the Premises has been terminated pursuant to Section 20, Landlord may require that Tenant remove the sign by delivering to Tenant written notice within thirty (30) days after the termination of the Lease. If Landlord so requests, Tenant shall within ten (10) days after Tenant's receipt of the notice remove the sign, repair all damage caused by the sign and its installation and removal, and restore the Building to its condition before the installation of the sign including, but not limited to, making the following restoration and repair work: hole punching, electrical work, and repair of Building exterior discoloration or fading made noticeable by removal of the signage. If Tenant fails timely to remove the sign and perform the repair work, Landlord may, without compensation to Tenant, (1) use the sign, or (2) at Tenant's expense, remove the sign, perform the related restoration and repair work, and dispose of the sign in any manner Landlord deems appropriate.

8. SERVICES AND UTILITIES. Landlord shall provide roving attendant service for the entire business park of which the Building is a part, such attendant shall be on duty generally during evening and early morning hours. Landlord shall provide a controlled access system for the Building which enables 24X7X365 access to the Premises by Tenant, subject to reasonable rules and regulations for after hours entry. Tenant shall obtain and pay for all water, gas, electricity, heat, telephone, sewer, sprinkler charges and other utilities and services used at the Premises, together with any taxes, penalties, surcharges, maintenance charges, and similar charges pertaining to Tenant’s use of the Premises. Tenant shall heat the Premises as necessary to prevent any freeze damage to the Premises or any portion. Tenant's use of electric current shall at no time exceed the capacity of the feeders or lines to the Building or the risers or wiring installation of the Building or the Premises. Landlord may, at Tenant’s expense, separately meter and bill Tenant directly for its use of any such utility service, in which case the amount separately billed to Tenant for Building standard utility service shall not be duplicated in Tenant’s obligation to pay Additional Rent under Section 2.3. Landlord shall not be liable for any interruption or failure of utility service to the Premises, and Tenant shall not be entitled to any abatement or reduction of Rent by reason of any interruption or failure of utilities or other services to the Premises except as set forth below. Any interruption or failure in any utility or service shall not be construed as an eviction, constructive or actual of Tenant or as a breach of the implied warranty of suitability, and shall not relieve Tenant from the obligation to perform any covenant or agreement under this Lease. In no event shall Landlord be liable for damage to persons or property, including, without limitation, business interruption, damages, or shall Landlord be in default under this Lease, as a result of any such interruption or failure. All amounts due from Tenant under this Section 8 shall be payable within ten (10) days after Landlord’s request for payment. Notwithstanding the foregoing, in the event such interruption of services described in this Section 8 (and results from causes within Landlord’s reasonable control, and is not due to Tenant’s negligence, the act of a third party not acting on behalf of Landlord, or force majuere) and continues for more than five (5) consecutive days following written notice to Landlord, and results in the denial or otherwise renders impractical the intended use of substantially all of the Premises (such as loss of electricity or high speed data access) then Tenant shall receive a Base Rent abatement for each day thereafter until the service is restored, unless and to the extent Tenant is able to collect insurance proceeds for such interruption. In the event of damage from casualty, Section 11 below shall apply.

9. INSURANCE . Tenant shall, during the Lease Term, procure at its expense and keep in force the following insurance:

9.1 Commercial General Liability Insurance. Commercial general liability insurance naming the Landlord, Landlord's Mortgagee (defined below), and Property Manager as additional insureds and loss payees against any and all claims for bodily and property damage occurring in or about the Premises arising from or in connection with Tenant’s use or occupancy of the Premises. The insurance policy or policies shall have a combined single limit of not less than One Million Dollars ($1,000,000) per occurrence with a Two Million Dollar ($2,000,000) aggregate limit and excess umbrella liability insurance in the amount of Two Million Dollars ($2,000,000). If Tenant has other locations that it owns or leases, the policy shall include an aggregate limit per location endorsement. The liability insurance shall be primary and not “contributing to” any insurance available to Landlord, and Landlord’s insurance shall be in excess of all of Tenant's insurance. In no event shall the limits of Tenant's insurance limit its liability under this Lease. Tenant shall also keep in force business interruption and/or business income insurance covering, among other things, the payment of Tenant’s continuing rental expenses for a period of up to twelve (12) months that may occur as a result of loss or damage to the Building caused by an insured peril; this policy or policies must name Tenant as insured and must also name Landlord, Property Manager and Landlord's Mortgagees (defined below) as additional insureds (endorsement form CG 2026 1185, or its equivalent) and loss payees, and must contain a mortgagee clause in favor of Landlord's designated mortgagees. Tenant shall also keep in force all other insurance that Landlord deems necessary and prudent or that is required by Landlord’s beneficiaries or mortgagees of any deed of trust or mortgage encumbering the Premises, the Building, or the Land, provided that in no event shall Tenant be required to keep in force any other insurance which similarly situated tenants are not generally required to keep in force.

12

9.2 Property Insurance. Property insurance insuring: 1) all fixtures, alterations, additions, partitions, improvements and equipment installed in the Premises, 2) trade fixtures, 3) inventory, and 4) personal property located on or in the Premises for perils covered by the causes of loss - special form (all risk), including coverage for flood, earthquake and damages from any boiler and machinery, if applicable. The insurance shall be written on a replacement cost basis in an amount equal to one hundred percent of the full replacement value of the aggregate of the foregoing.

9.3 Workers’ Compensation Insurance. Workers’ compensation insurance in accordance with the Laws of the State of Texas and employer’s liability insurance in an amount not less than Five Hundred Thousand Dollars ($500,000.00). The worker’s compensation insurance must include an all-states endorsement.

9.4 Standard of Tenant’s Insurance. Each policy required to be maintained by Tenant shall be with companies rated A-VIII or better in the most current issue of Best’s Insurance Reports and will contain endorsements that (1) such insurance may not lapse with respect to Landlord or its Property Manager or be canceled or amended with respect to Landlord or its Property Manager without the insurance company's giving Landlord and its Property Manager at least thirty (30) days prior written notice of every cancellation or amendment, (2) Tenant shall be solely responsible for payment of premiums, (3) in the event of payment of any loss covered by any policy, Landlord or Landlord's designees shall be paid first by the insurance company for Landlord's loss and Tenant's insurance shall be primary in the event of overlapping coverage with insurance which may be carried by Landlord. Insurers shall be licensed to do business in the state in which the Premises are located and domiciled in the United States. Any deductible amounts under any required insurance policies shall not exceed $10,000. Tenant shall deliver to Landlord duplicate originals of certificates of insurance, and certified copies of the policies when requested by Landlord. Tenant shall have the right to provide insurance in a “blanket” policy, if the required blanket policy expressly provides coverage to the Premises and to Landlord as required by this Lease.

9.5 Landlord’s Rights. In the event Tenant does not purchase the insurance required by this Lease or keep any required insurance in full force and effect, Landlord may, but shall not be obligated to, purchase the necessary insurance and pay the premium. Tenant shall repay to Landlord, as Additional Rent, the amount so paid promptly upon demand. In addition, Landlord may recover from Tenant and Tenant agrees to pay, as Additional Rent, any and all expenses, including attorneys’ fees, litigation expenses, and damages which Landlord may sustain by reason of the failure of Tenant to obtain and maintain any insurance.

9.6 Nature of Tenant’s Obligation. Tenant’s insurance obligations under this Section 9 are freestanding obligations which are not dependent on any other conditions or obligations under this Lease.

10. SUBROGATION OF RIGHTS OF RECOVERY. LANDLORD AND TENANT MUTUALLY WAIVE THEIR RESPECTIVE RIGHTS OF RECOVERY AGAINST EACH OTHER FOR ANY LOSS OF, OR DAMAGE TO, EITHER PARTY’S PROPERTY, TO THE EXTENT THAT THE LOSS OR DAMAGE IS INSURED UNDER AN INSURANCE POLICY REQUIRED UNDER THIS LEASE TO BE IN EFFECT AT THE TIME OF THE LOSS OR DAMAGE. Each party shall obtain any special endorsements, if required by its insurer, under which the insurer shall waive its rights of subrogation against the other party. The provisions of this Section 10 shall not apply in those instances in which waiver of subrogation would cause either party’s insurance coverage to be voided or otherwise made uncollectible. Notwithstanding the foregoing, a party’s waiver of liability under this Section 10 shall not apply to its right to seek compensation from the other Party for any deductible amounts under its insurance.

13

11. CASUALTY DAMAGE.

11.1 Excessive Damage and Destruction. Tenant immediately shall give written notice to Landlord of any material damage to the Premises, the Building, or the Land of which Tenant is aware. If the Premises, the Building, or the Land are totally destroyed by an insured peril, or so damaged by an insured peril that, in Landlord’s reasonable estimation, rebuilding or repairs cannot be substantially completed with reasonable diligence (exclusive of leasehold improvements Tenant makes) within one hundred eighty (180) days after the date of Landlord’s actual knowledge of the damage, then Landlord may terminate this Lease by delivering to Tenant written notice of termination within thirty (30) days after the damage. If the Premises, the Building, or the Land are totally destroyed by an insured peril, or so damaged by an insured peril that, in Landlord's reasonable estimation, rebuilding or repairs cannot be substantially completed (exclusive of leasehold improvements Tenant makes) within one hundred eighty (180) days after the date of Landlord's actual knowledge of the damage, and a Tenant Party did not cause such damage through Tenant’s negligence or willful misconduct, then Tenant may terminate this Lease by delivering to Landlord written notice of termination within thirty (30) days following the date of such damage or destruction. In either event, the Rent shall be abated during the unexpired portion of this Lease, effective upon the date the damage occurred. Time is of the essence with respect to the delivery of all notices of damage and termination. Notwithstanding the foregoing, Tenant may not terminate the Lease if a Tenant Party caused the damage through Tenant’s gross negligence or willful misconduct. Notwithstanding the foregoing, the Rent shall not be abated if a Tenant Party caused the damage through Tenant’s negligence or willful misconduct or if Tenant fails to keep in force the insurance described in Section 9.4 above, except to the extent that Landlord actually receives proceeds from rental interruption insurance applicable to this Lease.

11.2 Restoration of Premises. Subject to Section 11.3, if this Lease is not terminated under Section 11.1, (or if the Building or the Premises are damaged but not totally destroyed by any insured peril, and in Landlord's reasonable estimation, rebuilding or repairs can be substantially completed within one hundred eighty (180) days after the date of Landlord's actual knowledge of such damage, this Lease shall not terminate), then Landlord shall diligently repair and restore the Premises to substantially its previous condition within such one hundred and eighty (180) period, except that Landlord shall not be required to rebuild, repair or replace any part of the Premises alterations, other improvements, or personal property required to be covered by Tenant’s insurance under Section 9. If the damages occurs during the last year of the Lease, and the damage causes major and substantial interference with the operation of Tenant’s business for more than sixty (60) days, Tenant, may in its sole discretion, terminate this Lease in written notice to Landlord. If the Premises are untenantable (i.e., business is impractical to be conducted on the Premises), in whole or in part, during the period beginning on the date the damage occurred and ending on the date of substantial completion of Landlord’s repair or restoration work in any event not to exceed one hundred and eighty (180) days following the date the damage occurred (the “Repair Period“), then the Rent for that period shall be reduced to such extent as may be fair and reasonable under the circumstances and the Term shall be extended by the number of days in the Repair Period. Notwithstanding the foregoing, the Rent shall not be abated if a Tenant Party caused the damage through Tenant’s negligence or willful misconduct, or if Tenant fails to keep in force the insurance described in Section 9.1 above, except to the extent that Landlord actually receives proceeds from rental interruption insurance applicable to this Lease.

11.3 Insurance. If the Premises are destroyed or substantially damaged by any peril not covered by the insurance maintained by Landlord (and Landlord has maintained the property insurance required to be maintained hereunder), or any Landlord’s Mortgagee (defined below) requires that insurance proceeds be applied to the indebtedness secured by its Mortgage (defined below) or to the Primary Lease (defined below) obligations, or the insurance proceeds available to Landlord to restore the building are insufficient in Landlord's reasonable opinion, then Landlord may terminate this Lease by delivering written notice of termination to Tenant within thirty (30) days of the later of the date upon which any destruction or damage incurred, or the date upon which Landlord learns there are not enough insurance proceeds, or Landlord learns of any such requirement by any Landlord’s Mortgagee, as applicable. In the event Landlord terminates the Lease, all rights and obligations hereunder shall cease and terminate, except for any liabilities which accrued before the Lease terminates.

14

12. LIABILITY, INDEMNIFICATION, AND NEGLIGENCE.

12.1 TENANT’S INDEMNITY OF LANDLORD. SUBJECT TO SECTION 12.2 AND 12.3, TENANT SHALL DEFEND, AND HOLD HARMLESS THE INDEMNIFIED PARTIES (AS DEFINED IN SECTION 24.1) FROM AND AGAINST ALL FINES, SUITS, LOSSES, COSTS, LIABILITIES, CLAIMS, DEMANDS, ACTIONS AND JUDGMENTS OF EVERY KIND OR CHARACTER, TO THE EXTENT SUCH CLAIMS, (1) ARISE FROM TENANT’S FAILURE TO PERFORM ITS COVENANTS UNDER THIS LEASE, (2) ARE ASSERTED AGAINST ANY OF THE INDEMNIFIED PARTIES ON ACCOUNT OF ANY LOSS (DEFINED BELOW IN SECTION 12.2) TO THE EXTENT THAT ANY SUCH LOSS MAY BE INCIDENT TO, ARISE OUT OF, OR BE CAUSED, EITHER PROXIMATELY OR REMOTELY, WHOLLY OR IN PART, BY A TENANT PARTY (DEFINED BELOW IN SECTION 24.1) OR ANY OTHER PERSON ENTERING UPON THE PREMISES UNDER OR WITH A TENANT PARTY’S EXPRESS OR IMPLIED INVITATION OR PERMISSION, (3) ARISE FROM OR OUT OF THE OCCUPANCY OR USE OF THE PREMISES BY A TENANT PARTY OR (4) ARISE FROM OR OUT OF ANY OCCURRENCE IN THE PREMISES, HOWEVER CAUSED, OR SUFFERED BY, RECOVERED FROM OR ASSERTED AGAINST ANY INDEMNIFIED PARTIES BY A TENANT PARTY, PROVIDED THAT LANDLORD: (A) PROMPTLY NOTIFIES TENANT IN WRITING OF ANY CLAIM; AND (B) PROVIDES TENANT WITH ALL ASSISTANCE, INFORMATION REQUIRED AND SOLE AUTHORITY FOR THE DEFENSE AND SETTLEMENT OF THE CLAIM. INDEMNIFICATION OF THE INDEMNIFIED PARTIES BY TENANT SHALL NOT APPLY TO THE EXTENT SUCH LOSS, DAMAGE, OR INJURY IS CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY OF THE INDEMNIFIED PARTIES OR THE BREACH OF THIS LEASE BY LANDLORD.

12.2 LIABILITY. NEITHER PARTY SHALL BE LIABLE TO THE THE OTHER PARTY FOR ANY INJURY TO OR DEATH OF ANY PERSON OR PERSONS OR THE DAMAGE TO OR THEFT, DESTRUCTION, LOSS, OR LOSS OF USE OF ANY PROPERTY OR INCONVENIENCE (COLLECTIVELY AND INDIVIDUALLY A “LOSS“) CAUSED BY CASUALTY, THEFT, FIRE, THIRD PARTIES, REPAIR, OR FAILURE TO REPAIR, OR ALTERATION OF ANY PART OF THIS BUILDING, OR ANY OTHER CAUSE, UNLESS DUE TO THE NEGLIGENCE OR WILLFUL MISCONDUCT OF SUCH PARTY, IN WHOLE OR IN PART.

12.3 LANDLORD’S INDEMNIFICATION. SUBJECT TO RELEASES BY TENANT, WAIVER OF SUBROGATION AND LIMITATIONS ON LANDLORD’S LIABILITY, LANDLORD AGREES TO INDEMNIFY, DEFEND AND HOLD TENANT AND ITS OFFICERS, DIRECTORS, PARTNERS AND EMPLOYEES HARMLESS FROM AND AGAINST ALL LIABILITIES, LOSSES, DEMANDS, ACTIONS, EXPENSES OR CLAIMS, INCLUDING REASONABLE ATTORNEYS' FEES AND COURT COSTS BUT EXCLUDING CONSEQUENTIAL DAMAGES, FOR INJURY TO OR DEATH OF ANY PERSON OR FOR DAMAGE TO ANY PROPERTY TO THE EXTENT SUCH ARE DETERMINED TO BE CAUSED BY EITHER (I) THE NEGLIGENCE OR WILLFUL MISCONDUCT OF LANDLORD, ITS AGENTS, EMPLOYEES, OR CONTRACTORS IN OR ABOUT THE PREMISES OR BUILDING, OR (II) THE BREACH BY LANDLORD OF THIS LEASE.

12.4 Survival. The provisions of this Section 12 shall survive the expiration or earlier termination of this Lease.

15

13. USE; COMPLIANCE WITH LAWS; PARKING.

13.1 Permitted Use. The Premises shall, subject to the remaining provisions of this Section, be used only for the Permitted Use and for no other purpose without Landlord’s prior written consent, which consent shall not be unreasonably withheld, delayed or conditioned. No retail sales may be made from the Premises. The Premises shall not be used for any use which is disreputable, and no part of the Premises shall be used as an escort service, a massage parlor or spa, blood bank, abortion clinic, or for the sale, distribution or display (electronically or otherwise) of materials or merchandise of a pornographic nature or merchandise generally sold in an adult book or adult videotape store (which are defined as stores in which any portion of the inventory is not available for sale or rental to children under 18 years old because such inventory explicitly details with or depicts human sexuality). Tenant shall not sell, display, transmit or distribute (electronically or otherwise) materials or merchandise of a pornographic nature or merchandise generally sold in an adult book or adult video tape store (as defined above). Tenant shall not use the Premises as living or sleeping quarters or a residence. Tenant shall not use the Premises to receive, store or handle any product, material or merchandise that is explosive or highly inflammable or hazardous or would violate any provision in Section 26. Outside storage, including without limitation, storage in non-operative or stationary trucks, trailers and other vehicles, and vehicle maintenance or repair is prohibited without Landlord's prior written consent. Tenant shall keep the Premises neat and clean at all times. Tenant shall not permit any objectionable or unpleasant odors, smoke, dust, gas, light, noise or vibrations to emanate from the Premises; nor commit, suffer or permit any waste in or upon the Premises; nor at any time sell, purchase or give away or permit the sale, purchase or gift of food in any form by or to any of Tenant's agents or employees or other parties in the Premises except through vending machines in employees' lunch or rest areas within the Premises for use by Tenant's employees only; nor take any other action that would constitute a public or private nuisance or would disturb the quiet enjoyment of any other tenant of the Building, or unreasonably interfere with, or endanger Landlord or any other person; nor permit the Premises to be used for any purpose or in any manner that would (1) void the insurance thereon, (2) increase the insurance risk, (3) violate any Law (defined below) including, but not limited to, any zoning ordinance, or (4) be dangerous to life, limb or property. Tenant shall pay to Landlord on demand any increase in the cost of any insurance on the Premises or the Building incurred by Landlord, which is caused by Tenant’s particular use of the Premises (as opposed to general office or light manufacturing use) or because Tenant vacates the Premises, and acceptance of such payment shall not constitute a waiver of any of Landlord's other rights or remedies nor a waiver of Tenant's duty to comply herewith.

13.2 Compliance with Laws. Tenant shall be solely responsible for satisfying itself and Landlord that the Permitted Use will comply with all applicable Laws. Tenant shall, at its sole cost and expense, be responsible for complying with all Laws (defined below) and Rules and Regulations (defined below) applicable to the use, occupancy, and condition of the Premises. Tenant shall promptly correct any violation of a Law, or Rules or Regulations with respect to the Premises. Tenant shall comply with any direction of any governmental authority having jurisdiction which imposes any duty upon Tenant or Landlord with respect to the Premises, or with respect to the occupancy or use thereof. Landlord shall be responsible for the Common Areas, Building (including rest rooms) and Land in complying with Laws.