Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - People's United Financial, Inc. | d8k.htm |

2

nd

Quarter 2011 Investor Presentation

May 17, 2011

*

*

*

*

*

*

*

Exhibit 99.1

*

*

*

*

*

*

*

*

*

*

*

*

* |

1

Corporate Overview

Snapshot, as of March 31, 2011

1842

Founded:

518

ATMs:

341

Branches:

$18.1 billion

Deposits:

$17.5 billion

Loans:

$25.0 billion

Assets:

$4.7 billion

Market Capitalization (5/16/11)

NASDAQ (PBCT)

People’s United Financial, Inc. |

2

Primary Objectives

Optimize the existing business

+

Deploy capital in high risk-adjusted return initiatives

Return the franchise to >1.25% Operating ROAA |

3

The Northeast Region is Best Commercial Banking Market

in the United States

Population density

Limited amount of land available for development

Construction entitlements are difficult to win

Deep educational and healthcare sectors provide long-lasting infrastructure,

attract talented young people, consistently spawn new businesses

Significant “quiet wealth”

which adds credit strength to the region

Mega bank acquisitions of mid-size banks have left a void of

relationship- based, service focused banks |

4

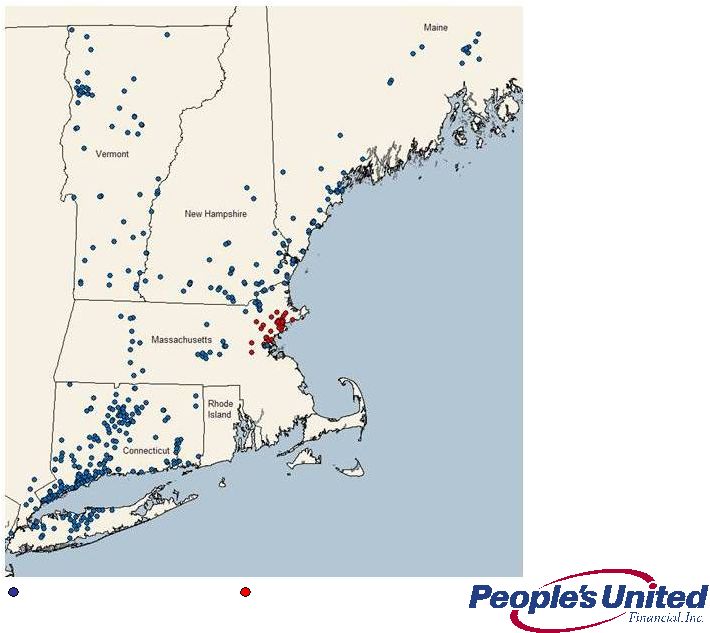

Deepening Presence in NYC Metro and Boston MSA

People’s United (PBCT)

Danvers Bancorp (DNBK) |

5

Strong Pro Forma Deposit Market Position

Connecticut

Branches

$BN

%

1

B of A

166

20.7

21.7

2

Webster

136

11.5

12.1

3

People's United

162

9.7

10.1

4

Wells Fargo

76

8.3

8.6

5

TD Bank

80

5.2

5.5

6

First Niagara

74

4.9

5.1

7

JPM Chase

49

3.9

4.0

8

Liberty

42

2.7

2.8

9

RBS

51

2.6

2.8

10

Citi

20

2.2

2.3

Massachusetts

Vermont

New York

New Hampshire

Maine

Branches

$BN

%

1

B of A

280

44.2

24.2

2

RBS

257

24.5

13.4

3

Santander

230

13.6

7.4

4

TD Bank

159

8.7

4.8

5

Eastern

96

6.2

3.4

6

Independent

70

3.7

2.0

7

People's United

59

3.6

2.0

8

Middlesex

33

3.6

2.0

9

Boston Private

9

2.4

1.3

10

Berkshire Hills

37

2.0

1.2

Branches

$BN

%

1

People's United

46

2.6

24.3

2

TD Bank

37

2.0

18.5

3

Merchants

34

1.0

9.8

4

RBS

24

0.8

8.0

5

KeyCorp

13

0.8

7.7

6

Northfield

13

0.5

4.4

7

Community

14

0.4

3.6

8

Union

13

0.3

3.3

9

Passumpsic

7

0.3

3.1

10

Berkshire Hills

7

0.3

2.8

Branches

$BN

%

1

JPM Chase

811

287.4

34.3

2

Citi

261

66.6

7.9

3

HSBC

377

65.9

7.9

4

B of A

380

55.2

6.6

5

Capital One

290

32.6

3.9

6

M&T

278

23.5

2.8

7

Wells Fargo

87

20.4

2.4

8

TD Bank

203

18.9

2.3

9

KeyCorp

229

15.2

1.8

10

Astoria

85

11.2

1.3

37

People's United

38

2.2

0.3

Branches

$BN

%

1

RBS

82

6.9

26.3

2

TD Bank

74

4.8

18.2

3

B of A

35

4.6

17.5

4

People's United

33

1.4

5.2

5

LSB Financial

20

0.8

3.2

6

Santander

20

0.8

3.1

7

Northway

19

0.6

2.5

8

New Hamp. Thrift

19

0.6

2.3

9

Centrix

6

0.5

2.1

10

Meredith Village

11

0.5

1.8

Branches

$BN

%

1

TD Bank

57

3.2

15.0

2

KeyCorp

61

2.7

12.7

3

B of A

35

1.7

8.0

4

Bangor Bancorp

57

1.7

7.9

5

Camden National

38

1.6

7.3

6

First Bancorp

14

0.9

4.5

7

Machias

13

0.8

3.9

8

People's United

31

0.8

3.9

9

Norway

21

0.7

3.3

10

Bar Harbor

13

0.7

3.1

Deposits of $20.2BN

#1 in Fairfield County, CT, 64 branches, $5.4BN, 17.8% market share

#2 in Essex County, MA, 24 branches, $2.0BN, 12.3% market share

Source: SNL Financial |

6

6

Low Cost of Deposits

Publicly Traded Northeast Banks, $5BN < Assets <$100BN

Source: SNL Financial

Total

Cost of

Assets ($BN)

Deposits (%)

Company Name

City

State

2011Q1

2011Q1

1

M&T Bank Corporation

Buffalo

NY

67.9

0.31

2

First Niagara Financial Group, Inc.

Buffalo

NY

21.4

0.48

3

Boston Private Financial Holdings, Inc.

Boston

MA

6.0

0.58

4

People's United Financial, Inc.

Bridgeport

CT

25.0

0.59

5

NBT Bancorp Inc.

Norwich

NY

5.5

0.60

6

Community Bank System, Inc.

De Witt

NY

5.5

0.60

7

Webster Financial Corporation

Waterbury

CT

18.0

0.65

8

Valley National Bancorp

Wayne

NJ

14.4

0.71

9

Fulton Financial Corporation

Lancaster

PA

16.0

0.75

10

National Penn Bancshares, Inc.

Boyertown

PA

8.5

0.77

11

New York Community Bancorp, Inc.

Westbury

NY

41.0

0.78

12

F.N.B. Corporation

Hermitage

PA

9.8

0.80

13

Provident Financial Services, Inc.

Iselin

NJ

6.8

0.81

14

First Commonwealth Financial Corporation

Indiana

PA

5.8

0.83

15

Signature Bank

New York

NY

12.4

0.89

16

Susquehanna Bancshares, Inc.

Lititz

PA

14.0

0.91

17

Northwest Bancshares, Inc.

Warren

PA

8.1

1.11

18

CapitalSource Inc.

Chevy Chase

MD

9.3

1.15

19

Investors Bancorp, Inc. (MHC)

Short Hills

NJ

9.8

1.18

20

Astoria Financial Corporation

Lake Success

NY

17.7

1.29

21

Hudson City Bancorp, Inc.

Paramus

NJ

52.4

1.33 |

7

< 20 Employees

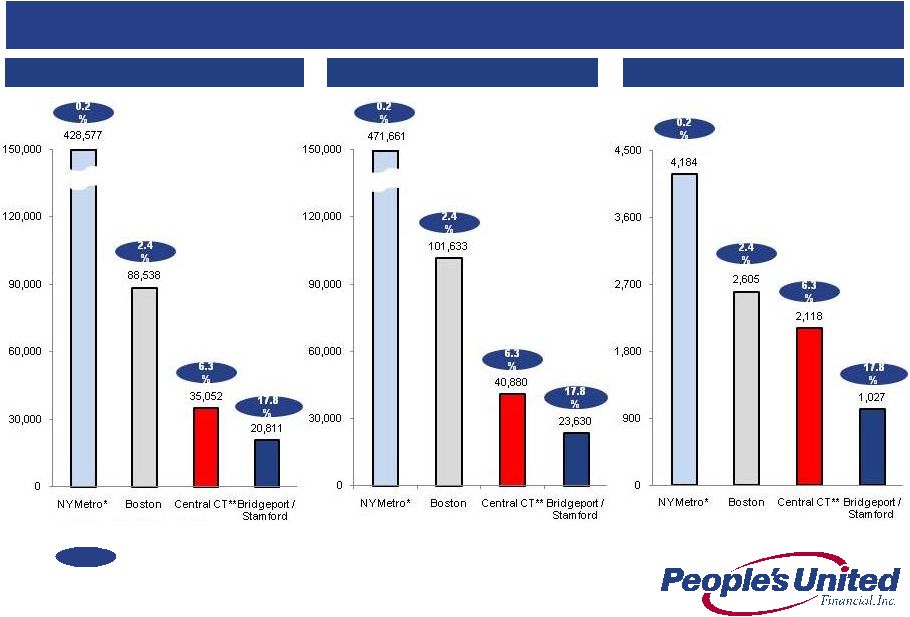

Commercial Market Opportunity by MSA

Source: SBA firms and employment by MSA 2007

*

NY

Metro

area

includes

New

York,

Northern

New

Jersey,

and

Long

Island

MSA

** Central Connecticut includes New Haven and Hartford MSAs

> 500 Employees

< 500 Employees

Pro Forma Deposit Market Share Overall within identified MSA

Number of firms by size

People’s United is growing in NYC Metro and Boston Metro,

areas rich with potential commercial, non-commodity relationships

|

8

Capital Deployment

Primary

focus

is

to

deploy

capital

via

organic

growth

–

“new

markets,

new

products, cross-sell”

Announced

an

increase

to

our

dividend

(19th

consecutive

annual

dividend

increase),

our

pro

forma dividend yield is ~4.9%

Repurchased $191MM of stock in 2010 at a weighted average price of $13.35

Repurchased an additional $61MM of stock in 1Q11 at an average price of $13.09

Prohibited from repurchasing shares until the Danvers Bancorp deal closes

Acquisitions

Closed 4 deals in 2010: Financial Federal, Butler Bank, RiverBank, Smithtown

Danvers

Bancorp

shareholders

approved

the

merger

with

People’s

United

on

May

13

th

Building

relationships

with

banks

$1BN

-

$20BN

in

asset

size

Maintaining price discipline in light of challenging industry conditions

|

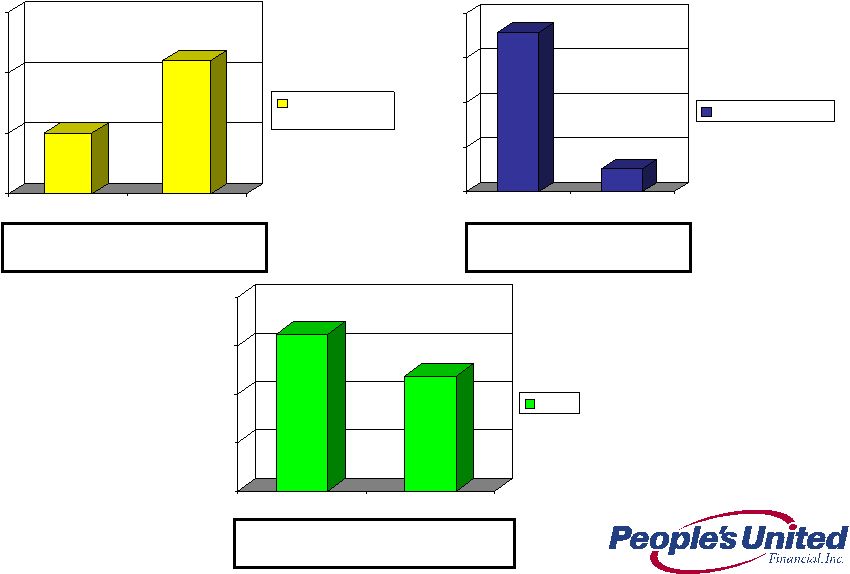

9

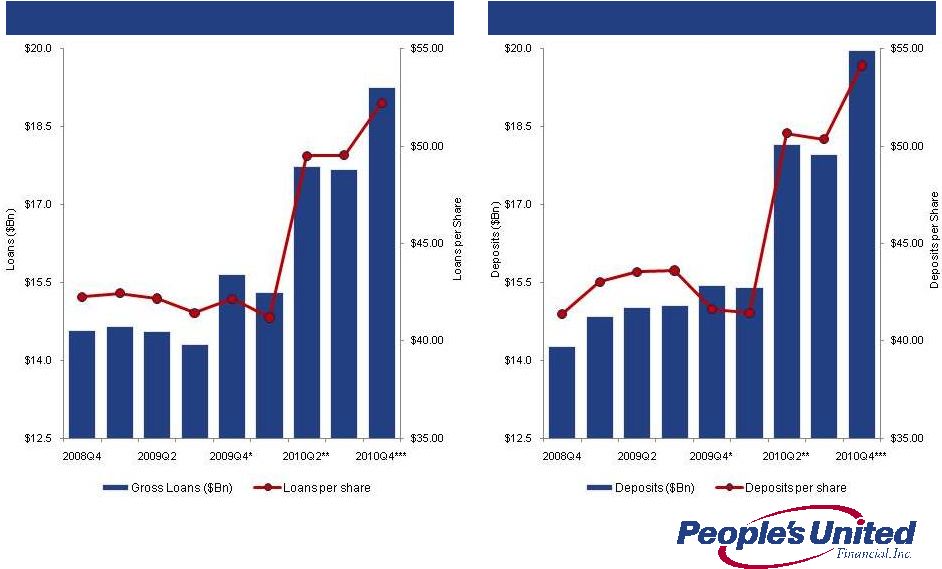

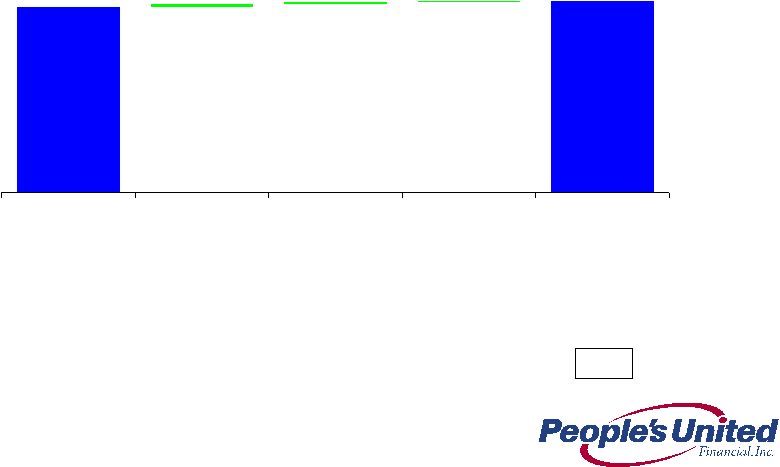

Loans

Deposits

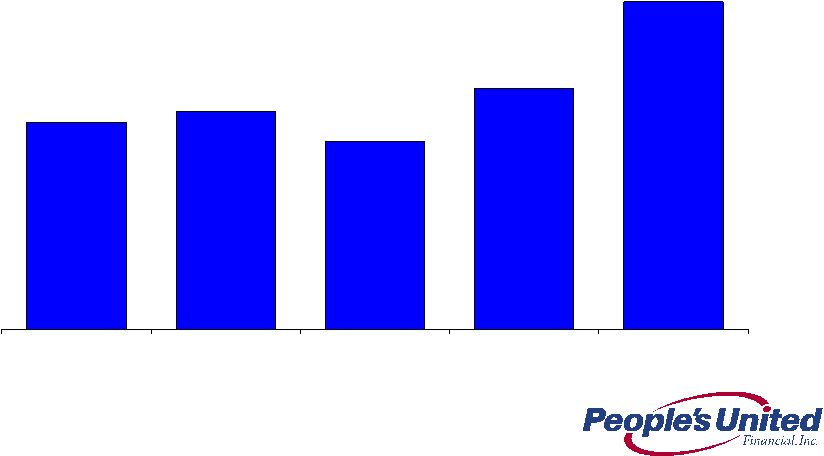

Growing Future Earnings Per Share

Loans and Deposits per Share

* Pro forma for FIF acquisition

* *Pro forma for SMTB & LSBX acquisitions

**

*Pro

forma

for

DNBK

acquisition |

10

Operating earnings of $53.8 million, or $0.15 per share

Net interest margin of 4.16%; up 29 bps from Q4 2010

Total loan growth of $195MM or 4.5% linked-quarter annualized

Deposit growth of $177MM or 3.9% linked-quarter annualized

Strong non-interest income –

wealth management income improvement

of 9% linked-quarter annualized

Efficiency ratio improved to 66.2%

NPAs

as a percentage of originated loans, REO and repossessed assets

fell to 1.96% from 2.09% as of Q4 2010

First Quarter 2011 Results

Overview |

11

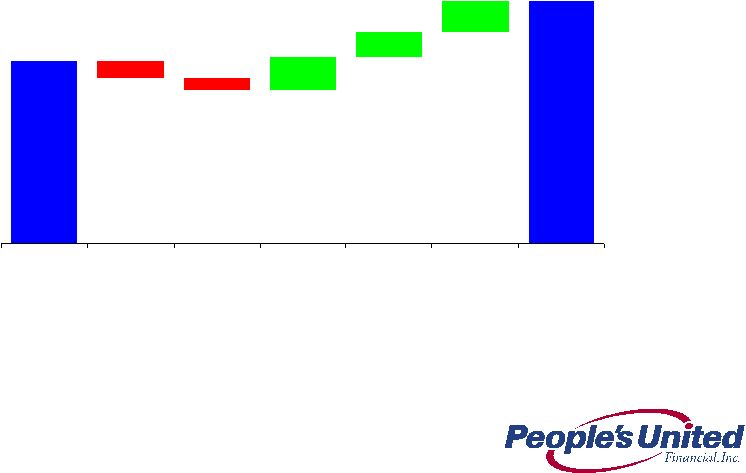

Net Interest Margin

Linked Quarter Change

11

3.87%

4.16%

-0.08%

-0.06%

0.16%

0.12%

0.15%

Q4 2010

Margin

Hedge Income

Decrease

Calendar Days

PUEF

Accretion

Adjustment

Investment Mix

& Yield

Full Quarter

Smithtown &

River

Q1 2011

Margin |

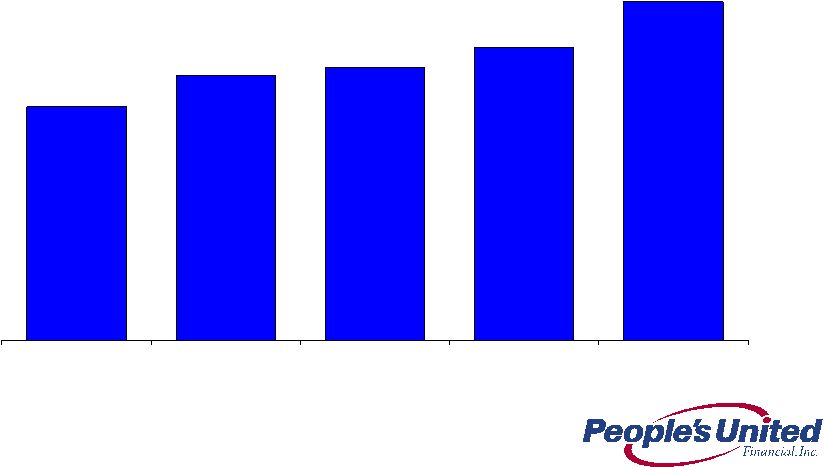

12

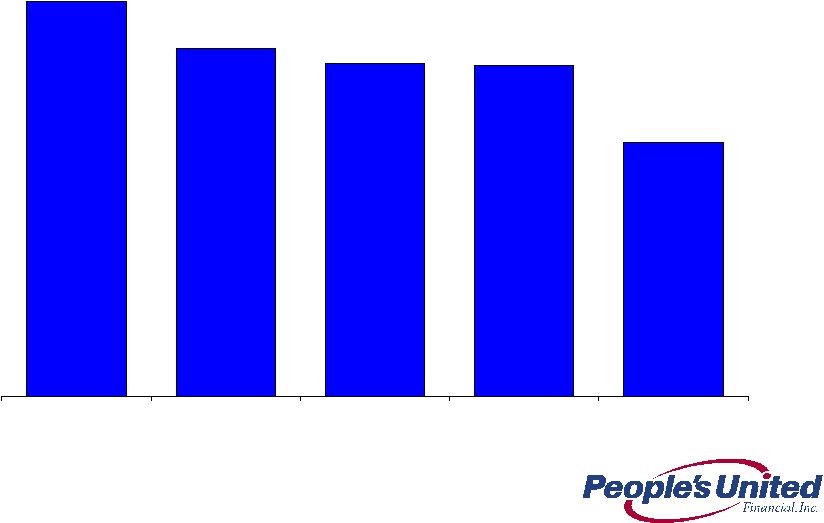

Net Interest Margin

Last Five Quarters

12

3.49%

3.69%

3.74%

3.87%

4.16%

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011 |

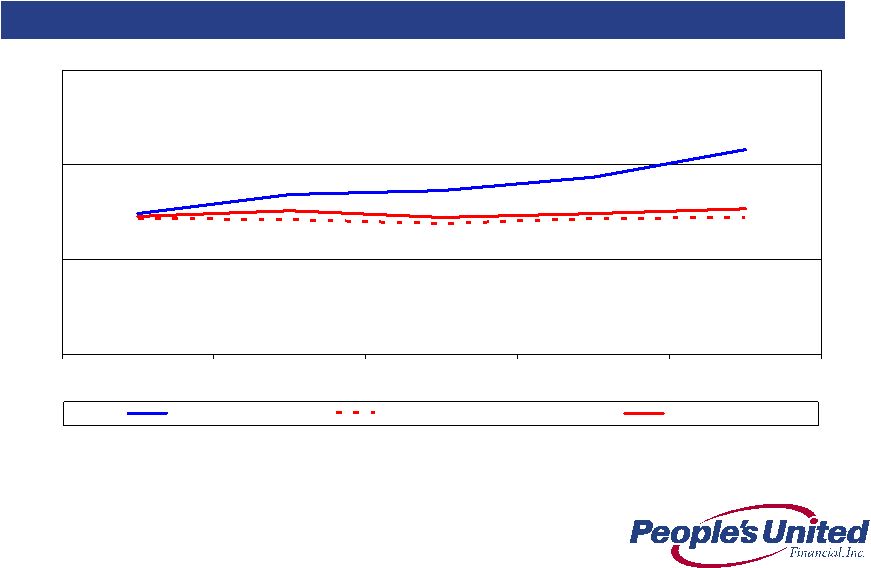

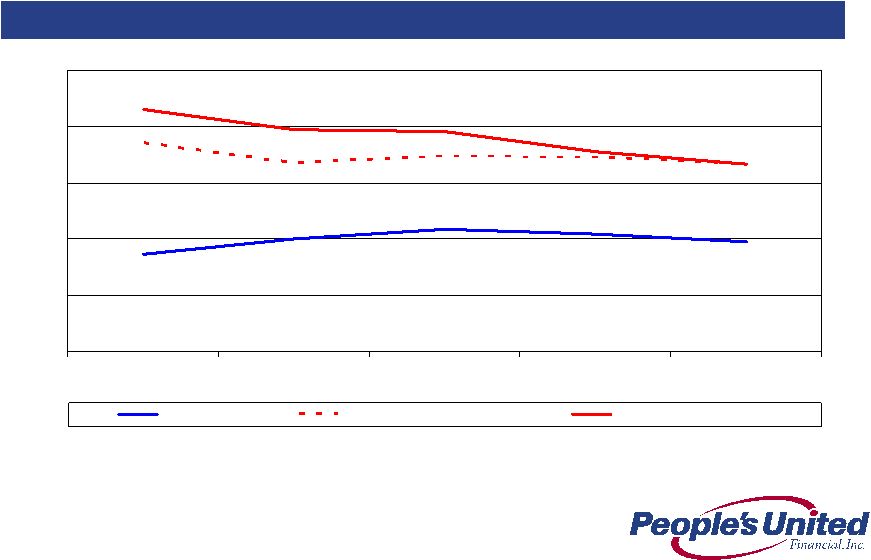

13

Last Five Quarters

4.16

3.43

3.54

2.00

3.00

4.00

5.00

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

PBCT

Peer Group Mean

Top 50 Banks

Net Interest Margin

Compared to Peers and Top 50 Banks

Source: SNL Financial and Company filings |

14

We do not expect short-term interest rates to rise in 2011, however, we do expect

Fed tightening to begin in 2012

Given short-term interest rates are very low and are expected to remain low for

the near term, we have continued to accumulate securities

For

Q1

2011

we

were

4.5x

–

5.0x

as

asset

sensitive

as

the

estimated

median

of

our

peers depending

on scenario

For an immediate parallel increase of 100bps, our net interest income is projected to

increase by ~$40MM on an annualized basis

Yield curve twist scenarios confirm that we are reasonably well protected from bull

flattener and benefit considerably from bear flattener environments

Notes:

1.

Analysis is as of 3/31/11 filings

2.

Data as of 3/31/11 SEC filings, where exact +100bps shock up scenario data was not

provided PBCT interpolated based on data disclosed 3.

Data as of 3/31/11 filings, where exact +200bps shock up scenario data was

not provided PBCT interpolated based on data disclosed Current Asset

Sensitivity Net Interest Income at Risk ¹

Analysis involves PBCT estimates, see notes below

Change in Net Interest Income

Scenario

Lowest

Amongst Peers

Highest

Amongst Peers

Peer Median

PBCT Multiple to

Peer Median

Shock Up

100bps ²

-0.6%

5.6%

0.9%

5.0x

Shock Up

200bps ³

-0.1%

11.2%

2.5%

4.5x |

15

Loans

Linked Quarter Change

(in $ millions)

15

Annualized

Linked Quarter Change:

11.0%

12.3%

(30.3%)

Originated Annualized

Linked Quarter Change:

11.4%

Total Annualized

Linked Quarter Change:

4.5%

17,328

277

136

(218)

17,523

Dec 31, 2010

Commercial

Banking

Retail & Business

Banking

Acquired

Mar 31, 2011 |

16

Deposits

Linked Quarter Change

(in $ millions)

16

Annualized

Linked Quarter Change:

2.1%

64.9%

5.9%

Total Annualized

Linked Quarter Change:

3.9%

17,933

18,110

34

63

80

Dec 31, 2010

Legacy

De Novo

Acquired

Mar 31, 2011 |

17

(1.1)

0.3

0.3

0.3

1.0

5.5

0.2

74.6

68.1

4Q 2010

Gain on

Smithtown

Loan Sales

Insurance

Investment

Management

Brokerage

Bank Service

Charges

Gain on

Residential

Loan Sales

Other

1Q 2011

Non-interest income

Linked Quarter Change

(in $ millions)

17

Includes a $5.5MM gain on sale of non-performing Smithtown loans

|

18

Non-interest expense

Linked Quarter Change

(in $ millions)

18

199.1

202.8

(2.8)

(1.7)

( 3.9)

5.0

7.1

4Q 2010

Compensation &

Benefits

Occupancy &

Equipment

Professional &

Outside Svc

Merger-related

expenses

Other

1Q 2011

Expenses essentially flat despite full quarter impact of Smithtown and

RiverBank |

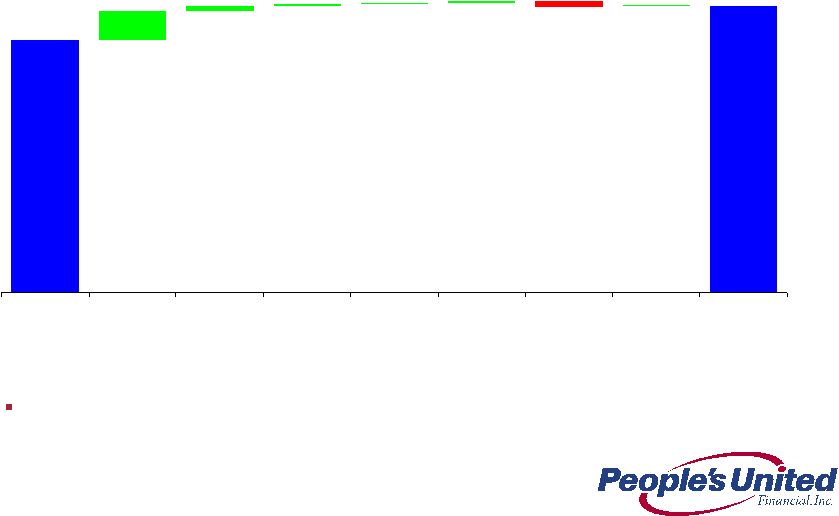

19

Efficiency Ratio

Historical Trend

75%

72%

71%

71%

66%

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011 |

20

Last Five Quarters

1.96

3.33

3.33

0.00

1.00

2.00

3.00

4.00

5.00

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

PBCT

Peer Group Median

Top 50 Banks by Assets

Asset Quality

NPAs / Loans & REO* (%)

*

Non-performing

assets

(excluding

acquired

non-performing

loans)

as

a

percentage

of

originated

loans

plus

all

REO

and

repossessed

assets;

acquired

non-performing

loans

excluded

as

risk

of

loss

has

been

considered

by

virtue

of

our

estimate

of

acquisition-date fair value and/or the existence of an FDIC loss sharing

agreement Source: SNL Financial and Company filings

|

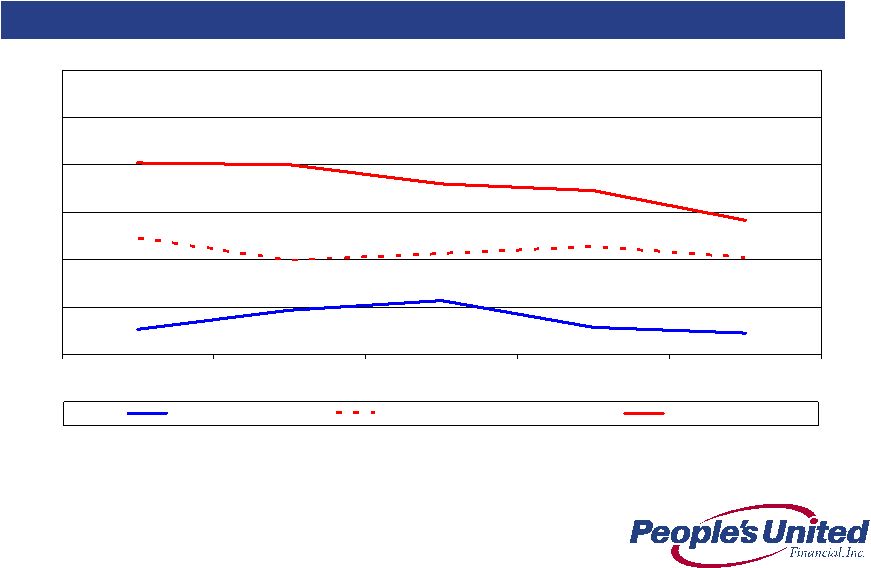

21

Last Five Quarters

0.22

1.02

1.41

0.00

0.50

1.00

1.50

2.00

2.50

3.00

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

PBCT

Peer Group Mean

Top 50 Banks

Asset Quality

Net Charge-Offs / Avg. Loans (%)

Source: SNL Financial and Company filings |

22

Allowance for Loan Losses

Coverage Detail

(in $ millions)

1.50%

1.55%

1.60%

1.65%

NPLs:Loans

ALLL:Loans

Commercial

Banking

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Retail Banking

Commercial ALLL -

$165.7 million

104% of Commercial NPLs

Retail ALLL -

$11.8 million

15% of Retail NPLs

Total ALLL -

$177.5 million

74% of Total NPLs

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:NPLs

Total |

23

Acquired Loan Portfolio

Actual Credit Experience vs. Expectations

Acquired loans initially recorded at fair value (inclusive of related credit mark)

without carryover of historical ALLL

Accounting model is cash-flow based:

Contractual

cash

flows

(principal

&

interest)

less

Expected

cash

flows

(principal

&

interest)

=

non-accretable

difference

(utilized

to

absorb

actual

portfolio

losses)

Expected

cash

flows

(principal

&

interest)

less

fair

value

=

accretable

yield

Cash flows are both acquisition and pool specific

Expected cash flows are regularly reassessed and compared to actual cash

collections Better

than

expected

credit

experience

results

in

reclass

of

non-accretable

difference

to

accretable yield (prospective yield adjustment over the life of the loans)

As of 3/31/2011

(in $ millions)

Carrying

Amount

NPLs

a

Remaining

Non-Accretable

Difference

Remaining

Non-Accretable

Difference:NPLs

Charge-offs

Incurred Since

Acquisition

FinFed (2/18/10)

$ 574.6

$ 59.2

$ 28.2

47.6%

$ 8.5

Butler (4/16/10)

99.9

14.3

35.3

246.9%

2.9

RiverBank (11/30/10)

484.3

8.3

16.8

202.4%

-

Smithtown (11/30/10)

b

1,516.1

242.6

329.1

135.7%

48.6

Total

$2,674.9

$324.4

$409.4

(a)

Represent

contractual

amounts;

loans

meet

People’s

United

Financial’s

definition

of

a

non-performing

loan but are not subject to classification as non-accrual in the same manner

as originated loans. Rather, these loans are considered to be accruing

loans because their interest income relates to the accretable yield

recognized at the pool level and not to contractual interest payments at the loan level.

(b)

Smithtown charge-offs include $17.7M incurred upon Q1 2011 sale of

non-performing loans. |

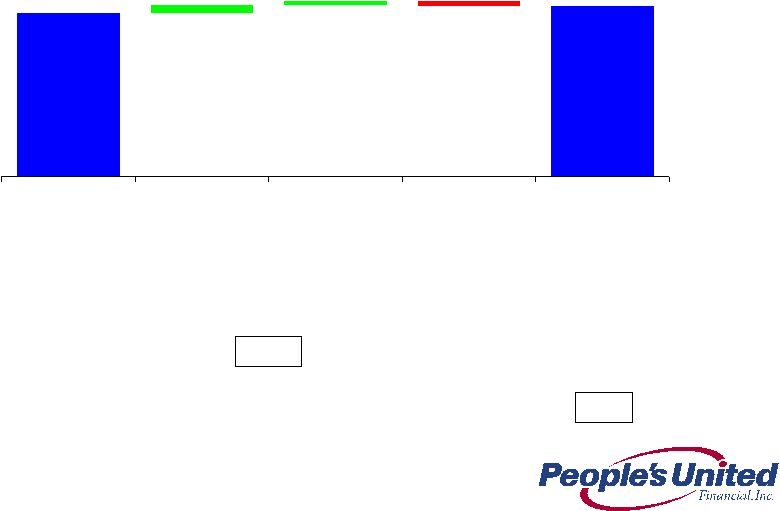

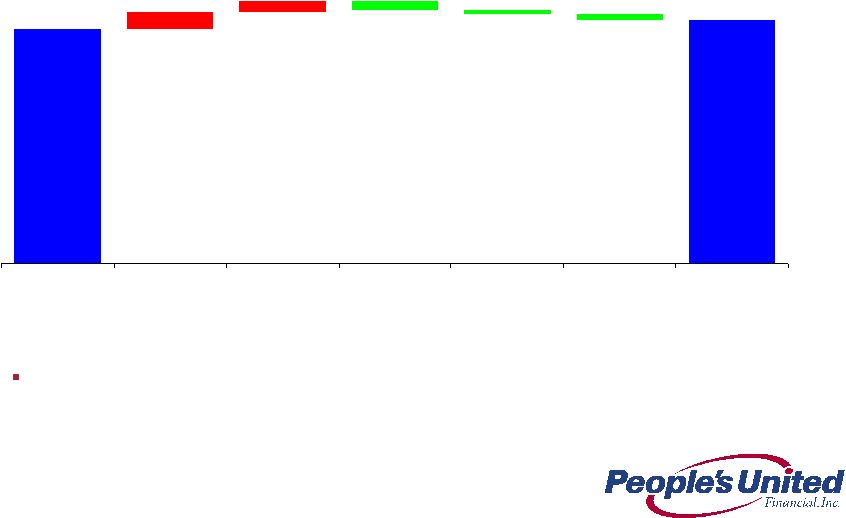

24

Operating ROAA Progress

Last Five Quarters

0.55%

0.58%

0.50%

0.64%

0.87%

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011 |

25

Summary

Premium brand built over 169 years

High quality Northeast footprint characterized by wealth, density and commercial

activity

Strengthened leadership team

Low cost of deposits

Strong net interest margin

Superior asset quality

Focus on non-commodity/relationship based lending

Growing

loans

and

deposits

within

footprint

-

in

two

of

the

largest

MSAs

in the

country (New York City, #1 and Boston, #10)

Efficiently growing loans and deposits per share

Significantly more asset sensitive than peers

Pro forma tangible common equity ratio of ~12%

Sustainable Competitive Advantage |

| Appendix

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |

27

Peer Group

Company Name

Ticker

State

1

Associated Banc-Corp

ASBC

WI

2

Astoria Financial Corporation

AF

NY

3

BOK Financial Corporation

BOKF

OK

4

City National Corporation

CYN

CA

5

Comerica Incorporated

CMA

TX

6

Commerce Bancshares, Inc.

CBSH

MO

7

Cullen/Frost Bankers, Inc.

CFR

TX

8

First Horizon National Corporation

FHN

TN

9

Flagstar Bancorp, Inc.

FBC

MI

10

Fulton Financial Corporation

FULT

PA

11

Hudson City Bancorp, Inc.

HCBK

NJ

12

M&T Bank Corporation

MTB

NY

13

Marshall & Ilsley Corporation

MI

WI

14

New York Community Bancorp, Inc.

NYB

NY

15

Synovus Financial Corp.

SNV

GA

16

TCF Financial Corporation

TCB

MN

17

Valley National Bancorp

VLY

NJ

18

Webster Financial Corporation

WBS

CT

19

Zions Bancorporation

ZION

UT |

For

more information, investors may contact: Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

*

* |