Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INTEL CORP | form8k.htm |

INVESTOR MEETING 2011

Santa Clara, California

May 17, 2011

Exhibit 99.1

INVESTOR MEETING 2011

Financial Update

Stacy Smith

Senior Vice President

Chief Financial Officer

Senior Vice President

Chief Financial Officer

INVESTOR MEETING 2011

3

Key Messages

• Design capability and manufacturing advantage enabling

leadership products, resulting in record financial results

leadership products, resulting in record financial results

• Significant and growing businesses across the

compute continuum

compute continuum

• Benefitting from the explosion of devices computing and

connecting to the internet and the growth of emerging markets

connecting to the internet and the growth of emerging markets

• Using record levels of free cash flow to invest in our business and

generate returns for our shareholders

generate returns for our shareholders

INVESTOR MEETING 2011

4

Financial Performance

Segments of our Business

Return of Cash to Shareholders

INVESTOR MEETING 2011

5

We are growing

2008-2011:

35% CAGR

Source: Intel and ThomsonOne

*2009 earnings per share excludes EC fine and AMD settlement of $2.6B. See Non-GAAP recon in Appendix A

** Not an Intel forecast :2011 Consensus EPS of $2.28 and Revenue of $53.2B from ThomsonOne as of 5/11/11

2008-2011:

12% CAGR

Billion

INVESTOR MEETING 2011

6

Revenue vs. Benchmarks

2000-2011*

2000-2011*

Source: Intel , FactSet and ThomsonOne

* Not an Intel forecast :Consensus 2011 revenue forecast of $53.2B from ThomsonOne as of 5/11/11

**Benchmark for the Dow 30 and S&P 100 measured on median revenue CAGRs pulled from FactSet as of 5/11/11

INVESTOR MEETING 2011

7

Intel Gross Margin Model

Forecast

63% in 2011 represents the midpoint of the 2011 full year outlook range

Forecast range is based on current expectations and is subject to change without notice

Source: Intel

55%-65%

Gross Margin Range

INVESTOR MEETING 2011

8

Spending* % of Revenue

* MG&A + R&D spending. 2000 through 2005 adjusted to include stock based

compensation expense. See Non-GAAP recon in Appendix B.

compensation expense. See Non-GAAP recon in Appendix B.

** Not an Intel forecast. Consensus Revenue of $53.2B from 5/11/11 and

$15.7B for R&D + MG&A (the midpoint of Intel Outlook)

$15.7B for R&D + MG&A (the midpoint of Intel Outlook)

Source: Intel

Forecast

INVESTOR MEETING 2011

9

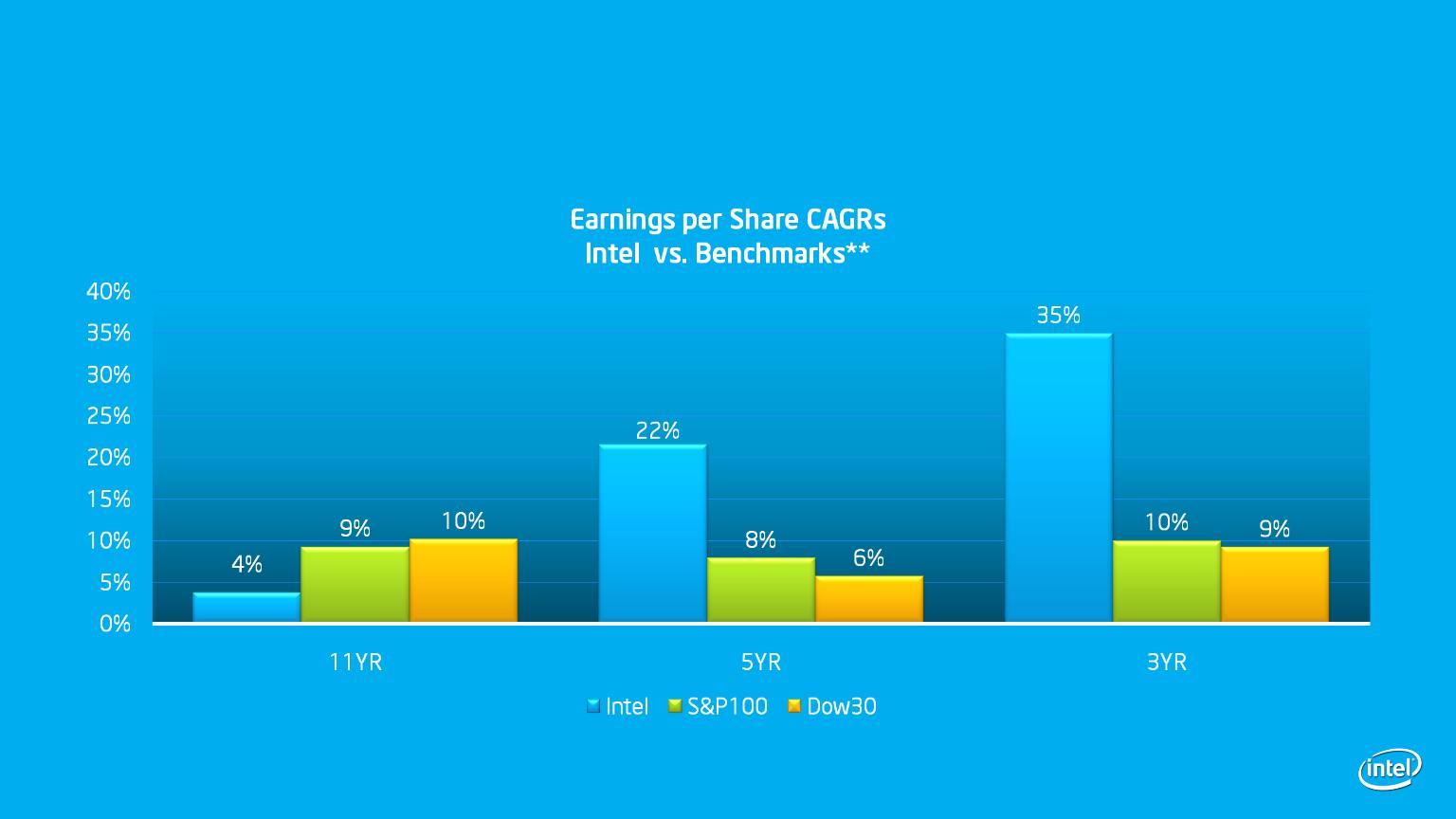

EPS vs. Benchmarks

2000-2011*

2000-2011*

Source: Intel , FactSet and ThomsonOne

* Not an Intel forecast :Consensus 2011 Earnings per share forecast of $2.28 from ThomsonOne as of 5/11/11

**Benchmark for the Dow 30 and S&P 100 measured on median CAGRs pulled from FactSet as of 5/11/11

INVESTOR MEETING 2011

10

ROIC Progress Report

ROIC includes cash and goodwill. 2000-2005 excludes stock-based compensation.

See Appendix B for Intel ROIC reconciliation to GAAP.

* 2011 Annualized figure of ROIC is Q1 2011 ROIC multiplied by four

S&P 500 contains 497 companies; Excludes:

Allegheny Energy Inc & McAfee Inc due to acquisitions

Motorola Inc due to split

Source: Intel

Long-term Goal to Rank Among Top ROIC Performers

Forecast

Intel

Top 20%

S&P 500

INVESTOR MEETING 2011

11

Financial Performance

Segments of our Business

Return of Cash to Shareholders

INVESTOR MEETING 2011

12

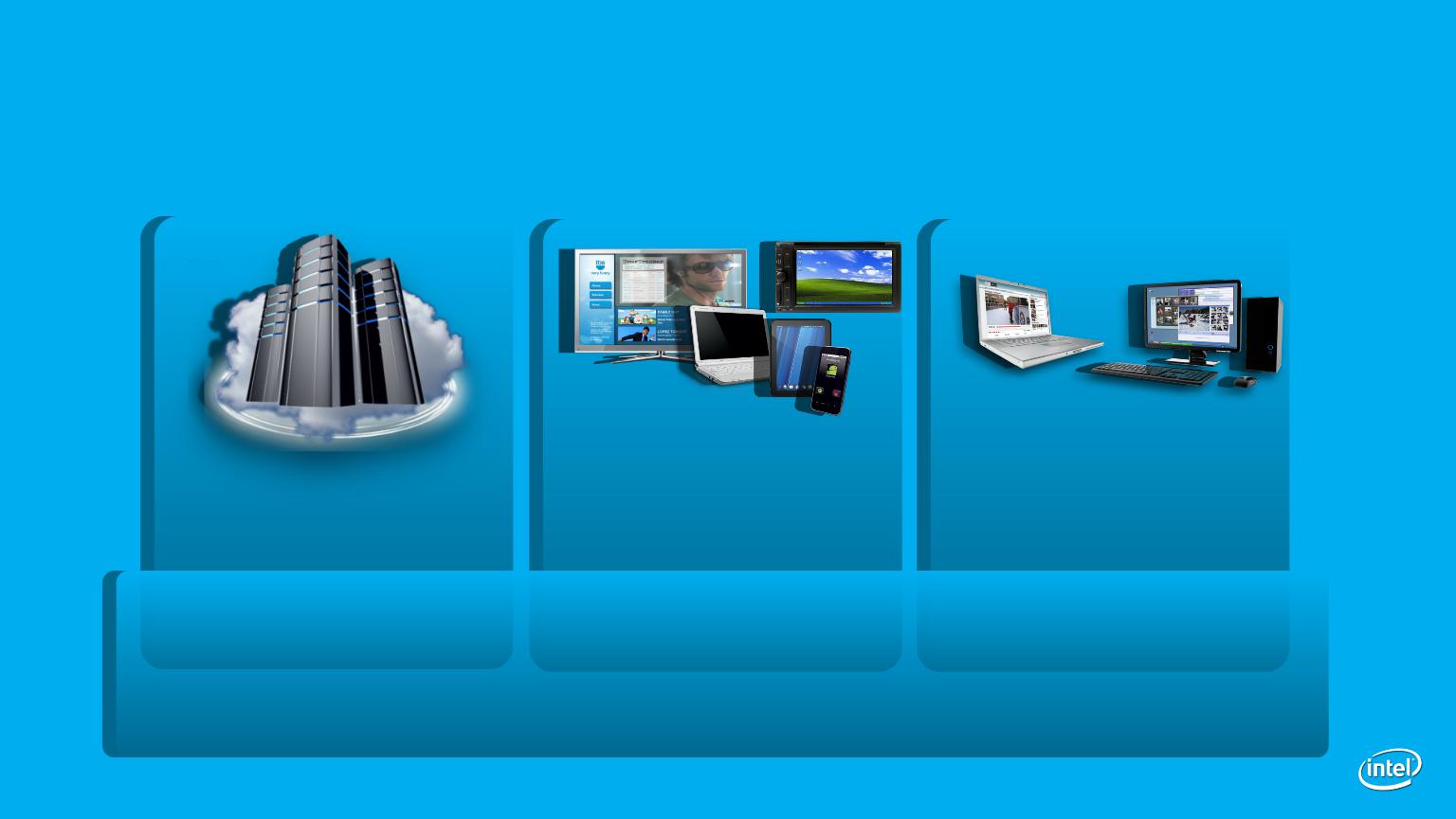

Data Center Group

Strong Businesses Across the Continuum

PC Client Group

Intel Arch. Other

2010 Rev/OM

$8.7B/$4.4B

$8.7B/$4.4B

2010 Rev/OM

$3.1B/$0.3B

$3.1B/$0.3B

2010 Rev/OM

$30.3B/$13.0B

$30.3B/$13.0B

Software and Services Group

2011* Rev/OM

$1.9B/($0.1B)

$1.9B/($0.1B)

*Forecast is based on current expectations and is subject to change without notice

Source: Intel

INVESTOR MEETING 2011

13

Strong Businesses Across the Continuum

2010 Rev/OM

$3.1B/$0.3B

$3.1B/$0.3B

2010 Rev/OM

$30.3B/$13.0B

$30.3B/$13.0B

Software and Services Group

2011* Rev/OM

$1.9B/($0.1B)

$1.9B/($0.1B)

*Forecast is based on current expectations and is subject to change without notice

Source: Intel

Data Center Group

PC Client Group

Intel Arch. Other

INVESTOR MEETING 2011

14

Data Center Group

2008 vs. 2010

2008 vs. 2010

32%

50%

Source: Intel

2008-2010:

43% CAGR

2008-2010:

Billion

Billion

INVESTOR MEETING 2011

15

Mission Critical

Infrastructure

Small Scale

Workstation

Cloud

Network

Storage

Storage

2015

1995

2000

2005

Traditional Server

Forecast is based on current expectations and is subject to change without notice

Source: Intel

Data Center Group

Processor Growth Forecast*

Processor Growth Forecast*

2010

INVESTOR MEETING 2011

16

Data Center Group

Looking Forward

Looking Forward

Benefitting from four trends

1. Build-out of the cloud

2. Expanding into networking and communications infrastructure, and storage

3. Voracious demand for high-performance computing

4. Technology leadership = high ROI for enterprise upgrades

$8.7B of revenue and $4.4B of operating profit in 2010

Expect 15% revenue growth CAGR through 2013 with operating

margins at ~50%

Forward looking statements specified are preliminary based on current expectations, and are subject to

change without notice

change without notice

Source: Intel

INVESTOR MEETING 2011

17

Strong Businesses Across the Continuum

PC Client Group

Intel Arch. Other

2010 Rev/OM

$3.1B/$0.3B

$3.1B/$0.3B

2010 Rev/OM

$30.3B/$13.0B

$30.3B/$13.0B

Software and Services Group

2011* Rev/OM

$1.9B/($0.1B)

$1.9B/($0.1B)

*Forecast is based on current expectations and is subject to change without notice

Source: Intel

INVESTOR MEETING 2011

18

Other Intel Architecture Group

2008 vs. 2010

2008 vs. 2010

2008-2010:

16% CAGR

Million

Billion

Source: Intel

INVESTOR MEETING 2011

19

Embedded iA Business

Momentum and Market Opportunity

Momentum and Market Opportunity

11%

8%

8%

19%

13%

8%

52%

CAGRs

Source: IDC and Intel

Forecast

Forecast

Billion

2010-2013:

11% CAGR

INVESTOR MEETING 2011

20

Other Intel Architecture Group

Looking Forward

Looking Forward

Embedded Intel architecture

• 2010 Revenue of $1.5B and operating profit of ~$450M

•Expect revenues to grow at a 25% CAGR through 2013 and operating

margin to be greater than $1B in 2013

margin to be greater than $1B in 2013

Making significant investments in SOC, tablet, and smartphone R&D

We expect market segment share gains and growing businesses in

tablets, smartphones (application and baseband processors), and

connected CE devices

tablets, smartphones (application and baseband processors), and

connected CE devices

Forward looking statements specified are preliminary based on current expectations, and are

subject to change without notice

subject to change without notice

Source: Intel

INVESTOR MEETING 2011

21

Strong Businesses Across the Continuum

PC Client Group

Intel Arch. Other

2010 Rev/OM

$3.1B/$0.3B

$3.1B/$0.3B

2010 Rev/OM

$30.3B/$13.0B

$30.3B/$13.0B

Software and Services Group

2011* Rev/OM

$1.9B/($0.1B)

$1.9B/($0.1B)

*Forecast is based on current expectations and is subject to change without notice

Source: Intel

INVESTOR MEETING 2011

22

PC Client Group

2008 vs. 2010

2008 vs. 2010

43%

2008-2010:

17% CAGR

Billion

Billion

Source: Intel

INVESTOR MEETING 2011

23

Segmentation Drives ASP Benefit

Source: Intel

*Platform includes both CPU and chipset

$

Up 6pts

Core Mix %

Core Mix %

’09 to ’10

0

INVESTOR MEETING 2011

24

Cost Declining Across Segments

Platform Costs*

Platform Costs*

Performance

Mainstream

Value

Atom™

*Platform includes both CPU and Chipset components

Forecast is based on current expectations and is subject to change without notice

Source: Intel

Forecast

Forecast

Forecast

Forecast

INVESTOR MEETING 2011

25

Market Drivers

Looking Forward

Looking Forward

~2 of every 3 PCs will be sold to emerging markets

~2 of every 3 PCs will be sold into the consumer segment

~2 of every 3 PCs sold will be notebooks

Forward looking statements specified are preliminary based on current expectations, and are

subject to change without notice

subject to change without notice

Source: Intel long range forecast through 2015

INVESTOR MEETING 2011

26

Blue shading notes SPP < 8 weeks of income

Income measured as mean income

Income measured as mean income

Blue shading notes SPP < 8 weeks of income

Income measured as mean income

Income measured as mean income

Emerging Market Affordability

Falling Prices, Rising Incomes

Falling Prices, Rising Incomes

Sources:

WOI to buy NB PC - Intel

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

27

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

28

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

29

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

30

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

31

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Emerging Markets 2010

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

INVESTOR MEETING 2011

32

Penetration Accelerates at 4-8 WOI to Buy a PC

Weeks of Income to Purchase a Notebook

Emerging Markets 2015

Sources:

WOI to buy NB PC - Intel

Installed PCs - IDC PC Tracker

Population by GEO - Economist Intelligence Unit (EIU)

META

India

Brazil

China

E. Europe

INVESTOR MEETING 2011

33

You will see a rapid increase in PC penetration rates in

China, Latin America and Eastern Europe.

China, Latin America and Eastern Europe.

Sources: Population - Economist Intelligence Unit (EIU)

Forward looking statements specified are preliminary based on current expectations, and are subject to change without

notice

notice

INVESTOR MEETING 2011

34

You will see a rapid increase in PC penetration rates in

China, Latin America and Eastern Europe.

China, Latin America and Eastern Europe.

Population: 2.5 billion people.

Sources: Population - Economist Intelligence Unit (EIU)

Forward looking statements specified are preliminary based on current expectations, and are subject to change without

notice

notice

INVESTOR MEETING 2011

35

PC TAM Growth

Over the last decade the PC TAM in emerging markets grew

at a 17% CAGR, and mature markets grew at a 5% CAGR

at a 17% CAGR, and mature markets grew at a 5% CAGR

Those growth rates equate to ~11% TAM CAGR from

2010 to 2013

2010 to 2013

Acceleration of the emerging market CAGR by 5 points drives

PC TAM CAGR of 14% from 2010 to 2013

PC TAM CAGR of 14% from 2010 to 2013

Source: Intel

INVESTOR MEETING 2011

36

Hold on there, Tex!

Won’t they all buy tablets?

INVESTOR MEETING 2011

37

Bear Case

100 million tablets in 2013 @ 33% cannibalization

TAM CAGR = 11% with cannibalization

Source: Intel

Caveat: We don’t believe this case

INVESTOR MEETING 2011

38

PC Client Group

Looking Forward

Looking Forward

Emerging Markets, Consumers, Notebooks will drive solid

revenue growth for several years

revenue growth for several years

Technology leadership, cost improvements, and

segmentation expected to maintain the

operating margin % through 2012

segmentation expected to maintain the

operating margin % through 2012

Forward looking statements specified are preliminary based on current expectations, and are subject to

change without notice

change without notice

Source: Intel

INVESTOR MEETING 2011

39

Intel Gross Margin Model

Forecast

63% in 2011 represents the midpoint of the 2011 full year outlook range

Forecast range is based on current expectations and is subject to change without notice

Source: Intel

55%-65%

Gross Margin Range

INVESTOR MEETING 2011

40

Strong Businesses Across the Continuum

PC Client Group

Intel Arch. Other

2010 Rev/OM

$3.1B/$0.3B

$3.1B/$0.3B

2010 Rev/OM

$30.3B/$13.0B

$30.3B/$13.0B

Software and Services Group

2011* Rev/OM

$1.9B/($0.1B)

$1.9B/($0.1B)

*Forecast is based on current expectations and is subject to change without notice

Source: Intel

INVESTOR MEETING 2011

41

• Rapidly growing software capabilities

• $300M of revenue in 2010 expected to grow to

over $3B in 2013

over $3B in 2013

– McAfee slightly accretive on a non-GAAP basis in

2011, on a GAAP basis in 2012

2011, on a GAAP basis in 2012

• Operating margin improves from ~($200M) in

2010 to ~$700M in 2013

2010 to ~$700M in 2013

• Upside opportunity as we embed additional

security features into hardware and software

security features into hardware and software

Forecast is based on current expectations and is subject to change without notice

Source: Intel

INVESTOR MEETING 2011

42

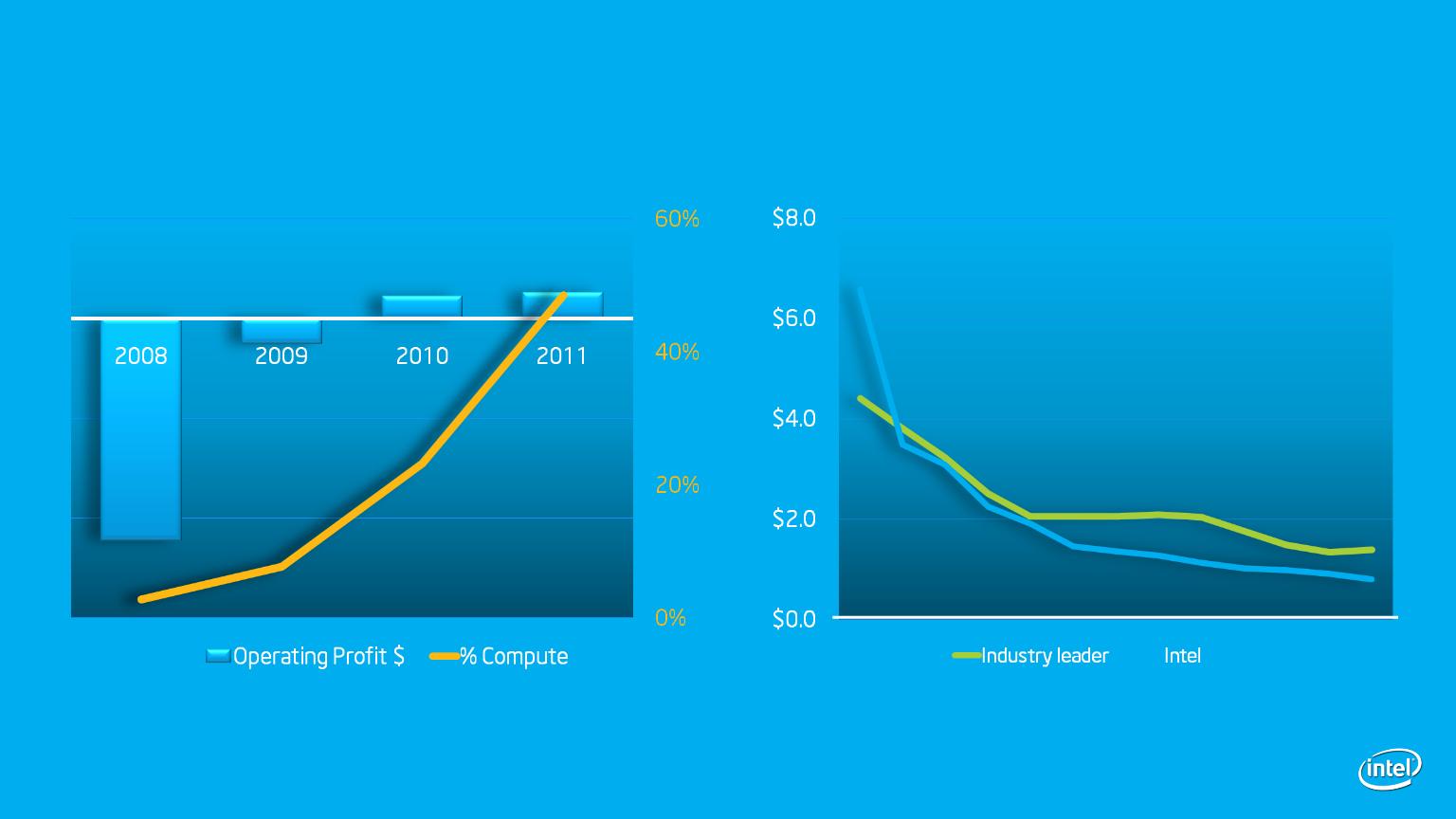

NAND Solutions Group*

Cost/GB

Q4 07

Q4 08

Q4 09

Q4 10

$0

Sources:

Operating Profit $ and Compute % - Intel

Cost/GB - iSuppli - Flash Q1 2011 Market Tracker

Forecast is based on current expectations and is subject to change without notice

*NAND solutions group is the same as Non-Volatile Memory Solutions Group and is part of the “All Other” segment

Forecast

INVESTOR MEETING 2011

43

Financial Performance

Segments of our Business

Return of Cash to Shareholders

INVESTOR MEETING 2011

44

Strong Cash Generation

Cash from Operations

$Billion

Sources:

2001-2010 Cash from Operation - Intel

*Not an Intel forecast - Consensus cash flow from ThomsonOne as of 5/11/11

INVESTOR MEETING 2011

45

Strong Cash Generation

$Billion

Sources:

2001-2010 Cash from Operation - Intel

*Not an Intel forecast - Consensus cash flow from ThomsonOne as of 5/11/11

INVESTOR MEETING 2011

46

Uses of Cash

Capital Spending, Acquisitions, Dividends, and Share Repurchases

Source: Intel

*2010 includes the $8.1B of acquisitions for McAfee and Infineon announced in 2010 but closed in Q1 2011

Capital Allocation Philosophy:

•Invest in our business

•Generate returns for shareholders

via an increasing dividend

via an increasing dividend

•Use share purchases as an additional

way to return cash to shareholders

way to return cash to shareholders

(Net of Cash)

INVESTOR MEETING 2011

47

Steadily Increasing Dividend

•16% increase announced last week

brings dividend up to $.84 annualized

brings dividend up to $.84 annualized

•Target allocation for the dividend is

~40% of free cash flow

~40% of free cash flow

•Plan to increase dividend roughly in line

with EPS growth rate

with EPS growth rate

•Dividend Yield = 3.3%*^

*2011 Annualized figure for dividend is not an Intel forecast but represents the Q1 payment, plus the Q2 declaration,

plus the May 11th announced Q3 dividend , and assuming the fourth quarter is equal to the third quarter

plus the May 11th announced Q3 dividend , and assuming the fourth quarter is equal to the third quarter

^ represents $23.49 Intel stock price close on 5/4/2011

Source: Intel

2003-2011:

33% CAGR

33% CAGR

INVESTOR MEETING 2011

48

Share Repurchases

We have bought back $5.5B from Q4’10 through Q1’11

Have reduced shares outstanding by 1.4B* shares since 2000,

including ~250M shares since November of ‘10

including ~250M shares since November of ‘10

*Repurchased under the common stock repurchase program, net of shares issued through employee equity incentive plans

Source: Intel

INVESTOR MEETING 2011

49

Strong cash generation

Dividend $ now targeting ~40% of FCF

$5.5 B share repurchases from Q4’10 to Q1’11

Source: Intel

INVESTOR MEETING 2011

50

Preview of the Rest of the Day

• Explosion of devices that compute and connect to the internet

driving data center growth

driving data center growth

• Another historic change to the PC roadmap

• Low power and SOC capability

• Software is a competitive advantage

• Combination of software and hardware capabilities enable new

levels of security

levels of security

• Process technology continues to differentiate Intel

INVESTOR MEETING 2011

52

Risk Factors

The above statements and any others in this document that refer to plans and expectations for the second quarter, the year and the future are forward-looking statements that involve

a number of risks and uncertainties. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” and their variations identify forward-

looking statements. Statements that refer to or are based on projections, uncertain events or assumptions also identify forward-looking statements. Many factors could affect Intel’s

actual results, and variances from Intel’s current expectations regarding such factors could cause actual results to differ materially from those expressed in these forward-looking

statements. Intel presently considers the following to be the important factors that could cause actual results to differ materially from the company’s expectations. Demand could be

different from Intel's expectations due to factors including changes in business and economic conditions, including supply constraints and other disruptions affecting customers; customer

acceptance of Intel’s and competitors’ products; changes in customer order patterns including order cancellations; and changes in the level of inventory at customers. Potential

disruptions in the high technology supply chain resulting from the recent disaster in Japan could cause customer demand to be different from Intel’s expectations. Intel operates in

intensely competitive industries that are characterized by a high percentage of costs that are fixed or difficult to reduce in the short term and product demand that is highly variable and

difficult to forecast. Revenue and the gross margin percentage are affected by the timing of Intel product introductions and the demand for and market acceptance of Intel's products;

actions taken by Intel's competitors, including product offerings and introductions, marketing programs and pricing pressures and Intel’s response to such actions; and Intel’s ability to

respond quickly to technological developments and to incorporate new features into its products. The gross margin percentage could vary significantly from expectations based on

capacity utilization; variations in inventory valuation, including variations related to the timing of qualifying products for sale; changes in revenue levels; product mix and pricing; the

timing and execution of the manufacturing ramp and associated costs; start-up costs; excess or obsolete inventory; changes in unit costs; defects or disruptions in the supply of materials

or resources; product manufacturing quality/yields; and impairments of long-lived assets, including manufacturing, assembly/test and intangible assets. Expenses, particularly certain

marketing and compensation expenses, as well as restructuring and asset impairment charges, vary depending on the level of demand for Intel's products and the level of revenue and

profits. The tax rate expectation is based on current tax law and current expected income. The tax rate may be affected by the jurisdictions in which profits are determined to be earned

and taxed; changes in the estimates of credits, benefits and deductions; the resolution of issues arising from tax audits with various tax authorities, including payment of interest and

penalties; and the ability to realize deferred tax assets. Gains or losses from equity securities and interest and other could vary from expectations depending on gains or losses on the

sale, exchange, change in the fair value or impairments of debt and equity investments; interest rates; cash balances; and changes in fair value of derivative instruments. The majority of

Intel’s non-marketable equity investment portfolio balance is concentrated in companies in the flash memory market segment, and declines in this market segment or changes in

management’s plans with respect to Intel’s investments in this market segment could result in significant impairment charges, impacting restructuring charges as well as gains/losses on

equity investments and interest and other. Intel's results could be affected by adverse economic, social, political and physical/infrastructure conditions in countries where Intel, its

customers or its suppliers operate, including military conflict and other security risks, natural disasters, infrastructure disruptions, health concerns and fluctuations in currency exchange

rates. Intel’s results could be affected by the timing of closing of acquisitions and divestitures. Intel's results could be affected by adverse effects associated with product defects and

errata (deviations from published specifications), and by litigation or regulatory matters involving intellectual property, stockholder, consumer, antitrust and other issues, such as the

litigation and regulatory matters described in Intel's SEC reports. An unfavorable ruling could include monetary damages or an injunction prohibiting us from manufacturing or selling one

or more products, precluding particular business practices, impacting Intel’s ability to design its products, or requiring other remedies such as compulsory licensing of intellectual property.

A detailed discussion of these and other factors that could affect Intel’s results is included in Intel’s SEC filings, including the report on Form 10-Q for the quarter ended April 2, 2011.

a number of risks and uncertainties. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” and their variations identify forward-

looking statements. Statements that refer to or are based on projections, uncertain events or assumptions also identify forward-looking statements. Many factors could affect Intel’s

actual results, and variances from Intel’s current expectations regarding such factors could cause actual results to differ materially from those expressed in these forward-looking

statements. Intel presently considers the following to be the important factors that could cause actual results to differ materially from the company’s expectations. Demand could be

different from Intel's expectations due to factors including changes in business and economic conditions, including supply constraints and other disruptions affecting customers; customer

acceptance of Intel’s and competitors’ products; changes in customer order patterns including order cancellations; and changes in the level of inventory at customers. Potential

disruptions in the high technology supply chain resulting from the recent disaster in Japan could cause customer demand to be different from Intel’s expectations. Intel operates in

intensely competitive industries that are characterized by a high percentage of costs that are fixed or difficult to reduce in the short term and product demand that is highly variable and

difficult to forecast. Revenue and the gross margin percentage are affected by the timing of Intel product introductions and the demand for and market acceptance of Intel's products;

actions taken by Intel's competitors, including product offerings and introductions, marketing programs and pricing pressures and Intel’s response to such actions; and Intel’s ability to

respond quickly to technological developments and to incorporate new features into its products. The gross margin percentage could vary significantly from expectations based on

capacity utilization; variations in inventory valuation, including variations related to the timing of qualifying products for sale; changes in revenue levels; product mix and pricing; the

timing and execution of the manufacturing ramp and associated costs; start-up costs; excess or obsolete inventory; changes in unit costs; defects or disruptions in the supply of materials

or resources; product manufacturing quality/yields; and impairments of long-lived assets, including manufacturing, assembly/test and intangible assets. Expenses, particularly certain

marketing and compensation expenses, as well as restructuring and asset impairment charges, vary depending on the level of demand for Intel's products and the level of revenue and

profits. The tax rate expectation is based on current tax law and current expected income. The tax rate may be affected by the jurisdictions in which profits are determined to be earned

and taxed; changes in the estimates of credits, benefits and deductions; the resolution of issues arising from tax audits with various tax authorities, including payment of interest and

penalties; and the ability to realize deferred tax assets. Gains or losses from equity securities and interest and other could vary from expectations depending on gains or losses on the

sale, exchange, change in the fair value or impairments of debt and equity investments; interest rates; cash balances; and changes in fair value of derivative instruments. The majority of

Intel’s non-marketable equity investment portfolio balance is concentrated in companies in the flash memory market segment, and declines in this market segment or changes in

management’s plans with respect to Intel’s investments in this market segment could result in significant impairment charges, impacting restructuring charges as well as gains/losses on

equity investments and interest and other. Intel's results could be affected by adverse economic, social, political and physical/infrastructure conditions in countries where Intel, its

customers or its suppliers operate, including military conflict and other security risks, natural disasters, infrastructure disruptions, health concerns and fluctuations in currency exchange

rates. Intel’s results could be affected by the timing of closing of acquisitions and divestitures. Intel's results could be affected by adverse effects associated with product defects and

errata (deviations from published specifications), and by litigation or regulatory matters involving intellectual property, stockholder, consumer, antitrust and other issues, such as the

litigation and regulatory matters described in Intel's SEC reports. An unfavorable ruling could include monetary damages or an injunction prohibiting us from manufacturing or selling one

or more products, precluding particular business practices, impacting Intel’s ability to design its products, or requiring other remedies such as compulsory licensing of intellectual property.

A detailed discussion of these and other factors that could affect Intel’s results is included in Intel’s SEC filings, including the report on Form 10-Q for the quarter ended April 2, 2011.

INVESTOR MEETING 2011

53

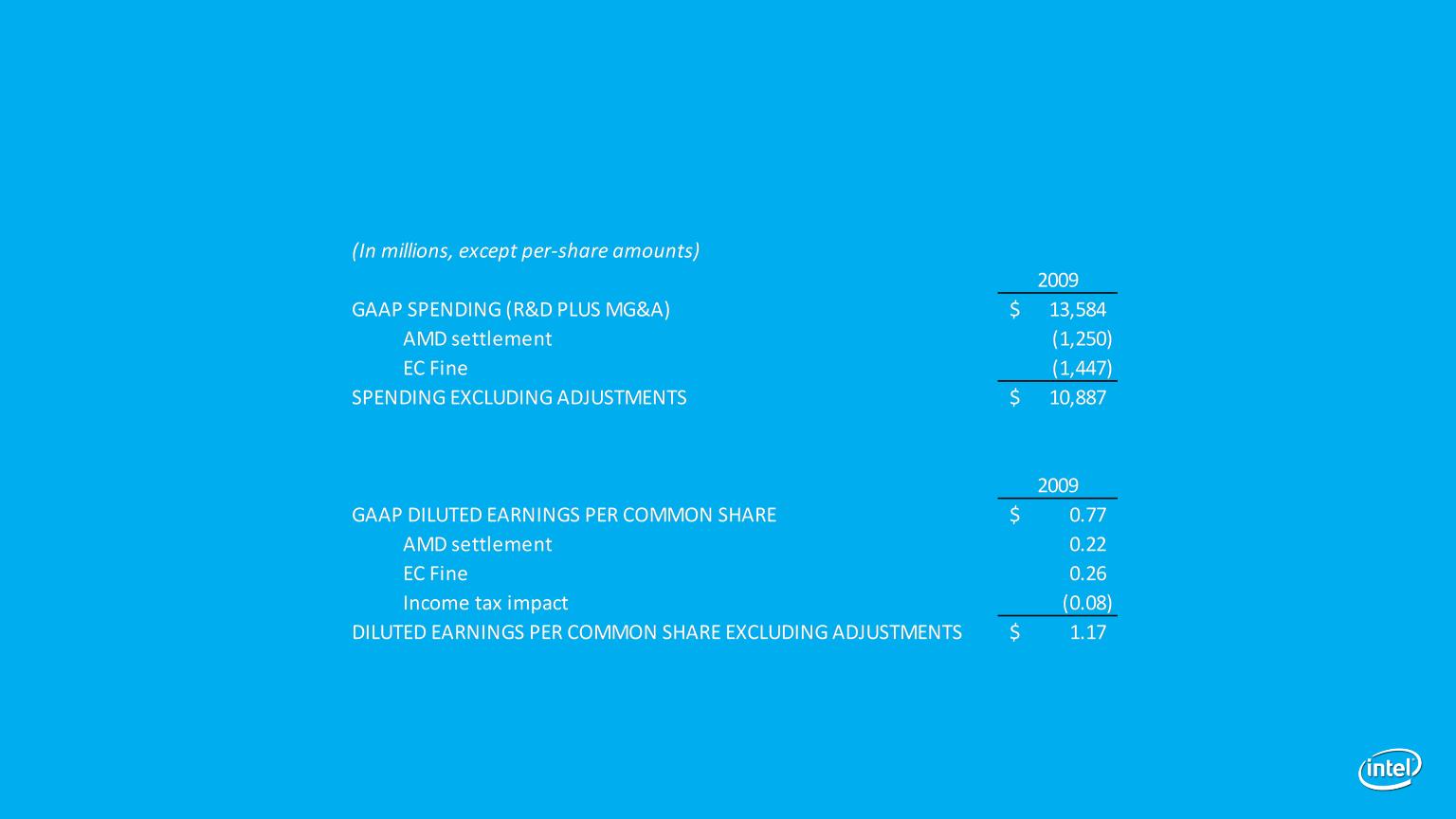

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix A: AMD Settlement/EC Fine

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix A: AMD Settlement/EC Fine

• In addition to disclosing financial results calculated in accordance with United States (U.S.) generally

accepted accounting principles (GAAP), this presentation contains non-GAAP financial measures that

exclude the charge incurred in the fourth quarter of 2009 as a result of the settlement agreement with

Advanced Micro Devices, Inc. (AMD) in the amount of $1.25 billion, and a charge incurred in the second

quarter of 2009 as a result of the European Commission (EC) fine in the amount of €1.06 billion, or about

$1.45 billion. These non-GAAP measures also exclude the associated impacts of the AMD settlement on

our tax provision. The EC fine did not impact the income tax provision because it was not tax deductible.

accepted accounting principles (GAAP), this presentation contains non-GAAP financial measures that

exclude the charge incurred in the fourth quarter of 2009 as a result of the settlement agreement with

Advanced Micro Devices, Inc. (AMD) in the amount of $1.25 billion, and a charge incurred in the second

quarter of 2009 as a result of the European Commission (EC) fine in the amount of €1.06 billion, or about

$1.45 billion. These non-GAAP measures also exclude the associated impacts of the AMD settlement on

our tax provision. The EC fine did not impact the income tax provision because it was not tax deductible.

• The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or

superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations from these results should be carefully evaluated. Management

believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show

the reader, how our performance compares to other periods. Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP financial measures.

superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations from these results should be carefully evaluated. Management

believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show

the reader, how our performance compares to other periods. Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP financial measures.

Source: Intel

INVESTOR MEETING 2011

54

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix A: AMD Settlement/EC Fine (Continued)

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix A: AMD Settlement/EC Fine (Continued)

Source: Intel

INVESTOR MEETING 2011

55

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix B: Share-Based Compensation

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix B: Share-Based Compensation

• In addition to disclosing financial results calculated in accordance with United States (U.S.) generally

accepted accounting principles (GAAP), this presentation contains non-GAAP financial measures that

include share-based compensation charges as if we had applied the fair value recognition provisions under

current GAAP to periods prior to fiscal year 2006, for options granted under the company's equity

incentive plans and rights to acquire stock granted under the company's stock purchase plan.

accepted accounting principles (GAAP), this presentation contains non-GAAP financial measures that

include share-based compensation charges as if we had applied the fair value recognition provisions under

current GAAP to periods prior to fiscal year 2006, for options granted under the company's equity

incentive plans and rights to acquire stock granted under the company's stock purchase plan.

• The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or

superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations from these results should be carefully evaluated. Management

believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show

the reader, how our performance compares to other periods. Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP financial measures.

superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in

accordance with GAAP and reconciliations from these results should be carefully evaluated. Management

believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show

the reader, how our performance compares to other periods. Set forth below are reconciliations of the

non-GAAP financial measures to the most directly comparable GAAP financial measures.

Source: Intel

INVESTOR MEETING 2011

56

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix B: Share-Based Compensation (Continued)

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix B: Share-Based Compensation (Continued)

Source: Intel

INVESTOR MEETING 2011

57

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC

• We define Return on Invested Capital (ROIC) as adjusted net operating profit

after taxes divided by beginning invested capital. Management believes that

ROIC provides greater visibility into how effectively Intel deploys capital.

Management uses ROIC as a high level target to help ensure that overall

performance is understood and acceptable. ROIC is not a measure of financial

performance under accounting principles generally accepted in the United States

(GAAP), and may not be defined and calculated by other companies in the same

manner as Intel does. ROIC should not be considered in isolation or as an

alternative to net income as an indicator of company performance.

after taxes divided by beginning invested capital. Management believes that

ROIC provides greater visibility into how effectively Intel deploys capital.

Management uses ROIC as a high level target to help ensure that overall

performance is understood and acceptable. ROIC is not a measure of financial

performance under accounting principles generally accepted in the United States

(GAAP), and may not be defined and calculated by other companies in the same

manner as Intel does. ROIC should not be considered in isolation or as an

alternative to net income as an indicator of company performance.

INVESTOR MEETING 2011

58

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC (Continued)

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC (Continued)

|

($m)

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Net income (GAAP)

|

$ 1,291

|

$ 3,117

|

$ 5,641

|

$ 7,516

|

$ 8,664

|

|

Interest expense

|

56

|

84

|

62

|

50

|

19

|

|

Income tax adjustment (1)

|

(23)

|

(22)

|

(15)

|

(14)

|

(6)

|

|

Adjusted net operating profit after taxes

|

$ 1,324

|

$ 3,179

|

$ 5,688

|

$ 7,552

|

$ 8,677

|

|

|

|

|

|

|

|

|

|

2000

|

2001

|

2002

|

2003

|

2004

|

|

Total assets (GAAP) (2)

|

$ 47,945

|

$ 44,395

|

$ 44,224

|

$ 47,143

|

$ 48,143

|

|

Current liabilities

|

(8,650)

|

(6,570)

|

(6,595)

|

(6,879)

|

(8,006)

|

|

Invested capital

|

$ 39,295

|

$ 37,825

|

$ 37,629

|

$ 40,264

|

$ 40,137

|

|

|

|

|

|

|

|

|

|

2001

|

2002

|

2003

|

2004

|

2005

|

|

Return on invested capital (Adjusted net operating profit after

taxes / prior year end invested capital) |

3.4%

|

8.4%

|

15.1%

|

18.8%

|

21.6%

|

|

|

|

|

|

|

|

|

Net income/ prior year end total assets

|

2.7%

|

7.0%

|

12.8%

|

15.9%

|

18.0%

|

|

|

|

|

|

|

|

|

(1) Assumed tax effect of interest expense based on the effective tax

rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) 2005-2008 Total assets has been adjusted due to changes to the

accounting for convertible debt instruments |

|

|

|

|

|

INVESTOR MEETING 2011

59

INTEL CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC (Continued)

RECONCILIATIONS OF GAAP TO NON-GAAP RESULTS

Appendix C: Historic ROIC (Continued)

|

($m)

|

2006

|

2007

|

2008

|

2009

|

2010

|

|

|

Net income (GAAP)

|

$ 5,044

|

$ 6,976

|

$ 5,292

|

$ 4,369

|

$ 11,464

|

|

|

Interest expense

|

24

|

15

|

8

|

1

|

0

|

|

|

Income tax adjustment (1)

|

(7)

|

(4)

|

(2)

|

(0)

|

0

|

|

|

Adjusted net operating profit after taxes

|

$ 5,061

|

$ 6,987

|

$ 5,298

|

$ 4,370

|

$ 11,464

|

|

|

|

|

|

|

|

|

|

|

|

2005

|

2006

|

2007

|

2008

|

2009

|

|

|

Total assets (GAAP) (2)

|

$ 48,309

|

$ 48,372

|

$ 55,664

|

$ 50,472

|

$ 53,095

|

|

|

Current liabilities

|

(9,234)

|

(8,514)

|

(8,571)

|

(7,818)

|

(7,591)

|

|

|

Invested capital

|

$ 39,075

|

$ 39,858

|

$ 47,093

|

$ 42,654

|

$ 45,504

|

|

|

|

|

|

|

|

|

|

|

|

2006

|

2007

|

2008

|

2009

|

2010

|

10 YR AVG

|

|

Return on invested capital (Adjusted net operating profit

after taxes / prior year end invested capital) |

13.0%

|

17.5%

|

11.3%

|

10.2%

|

25.2%

|

14.4%

|

|

|

|

|

|

|

|

|

|

Net income/ prior year end total assets

|

10.4%

|

14.4%

|

9.5%

|

8.7%

|

21.6%

|

12.1%

|

|

|

|

|

|

|

|

|

|

(1) Assumed tax effect of interest expense based on the

effective tax rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) 2005-2008 Total assets has been adjusted due to changes

to the accounting for convertible debt instruments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|