Attached files

| file | filename |

|---|---|

| 8-K - COPANO ENERGY, L.L.C. FORM 8-K - Copano Energy, L.L.C. | form8-k.htm |

May 2011 Investor Presentation

NASDAQ: CPNO

Disclaimer

This presentation includes “forward-looking statements,” as defined in the federal securities laws.

Statements that address activities or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Statements that address activities or events that Copano believes will or may occur in the future are

forward-looking statements. These statements include, but are not limited to, statements about future

producer activity and Copano’s total distributable cash flow and distribution coverage. These statements

are based on management’s experience and perception of historical trends, current conditions, expected

future developments and other factors management believes are reasonable.

Important factors that could cause actual results to differ materially from those in the forward-looking

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production, producers’ ability to drill and successfully complete and attach new natural

gas supplies and the availability of downstream transportation systems and other facilities for natural

gas and NGLs; higher construction costs or project delays due to inflation, limited availability of required

resources, or the effects of environmental, legal or other uncertainties; general economic conditions;

the effects of government regulations and policies; and other financial, operational and legal risks and

uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with the

Securities and Exchange Commission.

statements include the following risks and uncertainties, many of which are beyond Copano’s control:

the volatility of prices and market demand for natural gas and natural gas liquids; Copano’s ability to

continue to obtain new sources of natural gas supply and retain its key customers; the impact on

volumes and resulting cash flow of technological, economic and other uncertainties inherent in

estimating future production, producers’ ability to drill and successfully complete and attach new natural

gas supplies and the availability of downstream transportation systems and other facilities for natural

gas and NGLs; higher construction costs or project delays due to inflation, limited availability of required

resources, or the effects of environmental, legal or other uncertainties; general economic conditions;

the effects of government regulations and policies; and other financial, operational and legal risks and

uncertainties detailed from time to time in Copano’s quarterly and annual reports filed with the

Securities and Exchange Commission.

Copano undertakes no obligation to update any forward-looking statements, whether as a result of new

information or future events.

information or future events.

2

Introduction to Copano

Independent midstream company founded in 1992

■ Producer focused

■ Entrepreneurial approach

■ Focus on long-term accretive growth

■ Publicly traded LLC

● No general partner or incentive distribution rights

● Tax benefits similar to MLPs, but with corporate governance of a C-corp

Provides midstream services in multiple producing areas through

three operating segments

three operating segments

■ Texas

● Conventional, Eagle Ford Shale and North Barnett Shale Combo play

■ Oklahoma

● Conventional, Hunton dewatering play and Woodford Shale

■ Rocky Mountains

● Powder River Basin

3

Key Metrics

Service throughput volumes approximate 1,500,000 MMBtu/d of

natural gas(1)

natural gas(1)

Approximately 6,700 miles of active pipelines

10 natural gas processing plants with over 1.2 Bcf/d of combined

processing capacity

processing capacity

One NGL fractionation facility with total capacity of 22,000 Bbls/d

■ Expansion underway to increase total capacity to 44,000 Bbls/d in 3Q 2011

Equity market cap: $2.1 billion(2)

Enterprise value: $3.0 billion(3)

4

Based on 1Q 2011 results. Includes unconsolidated affiliates.

As of May 12, 2011.

As of May 12, 2011. Includes $300 million of convertible preferred equity issued July 2010.

Business Strategy

To build a diversified midstream company with scale and

stability of cash flows, above-average returns on invested

capital and “investment-grade quality” distributions

stability of cash flows, above-average returns on invested

capital and “investment-grade quality” distributions

Key tenets of business strategy:

■ Executing on organic growth opportunities and bolt-on acquisitions

■ Reducing sensitivity to commodity prices

■ Expanding through greenfield opportunities and strategic acquisitions

■ Pursuing growth judiciously

■ Developing and exploiting flexibility in our operations

■ Maintaining a strong balance sheet and access to liquidity

■ Maintaining an approach to business founded on a culture of integrity, service

and creativity

and creativity

5

Agenda

6

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Eagle Ford Shale Landscape

Eagle Ford Shale is currently the best-situated U.S. shale play

■ Regulatory environment familiar with industry

■ Land owners are more industry-friendly

■ Some existing infrastructure

■ Proximity to large consuming market, industrial load and petrochemical

markets

markets

Significant producer activity with large upstream representation

■ Over 160 rigs currently running in the Eagle Ford Shale

■ Significant investment by offshore firms encouraging activity

■ Lack of completion crews and liquids-handling capabilities partially restricting

near-term growth

near-term growth

Many competitors in midstream space, but early-movers and those

with existing infrastructure are advantaged

with existing infrastructure are advantaged

■ Producers fostering competition (i.e. multiple midstream providers desired)

■ Midstream providers with full-service capabilities lead the pack

● Producers require both natural gas and liquids solutions

7

Copano’s Eagle Ford Shale Strategy

Utilize existing assets as a platform to provide additional

midstream solutions for rich Eagle Ford Shale production in

excess of 1 Bcf/d of gas and just under 100,000 Bbls/d of NGLs

midstream solutions for rich Eagle Ford Shale production in

excess of 1 Bcf/d of gas and just under 100,000 Bbls/d of NGLs

Leverage existing assets

■ Gathering

■ Processing

■ Fractionation

■ NGL transportation

Execution of this strategy is well underway

8

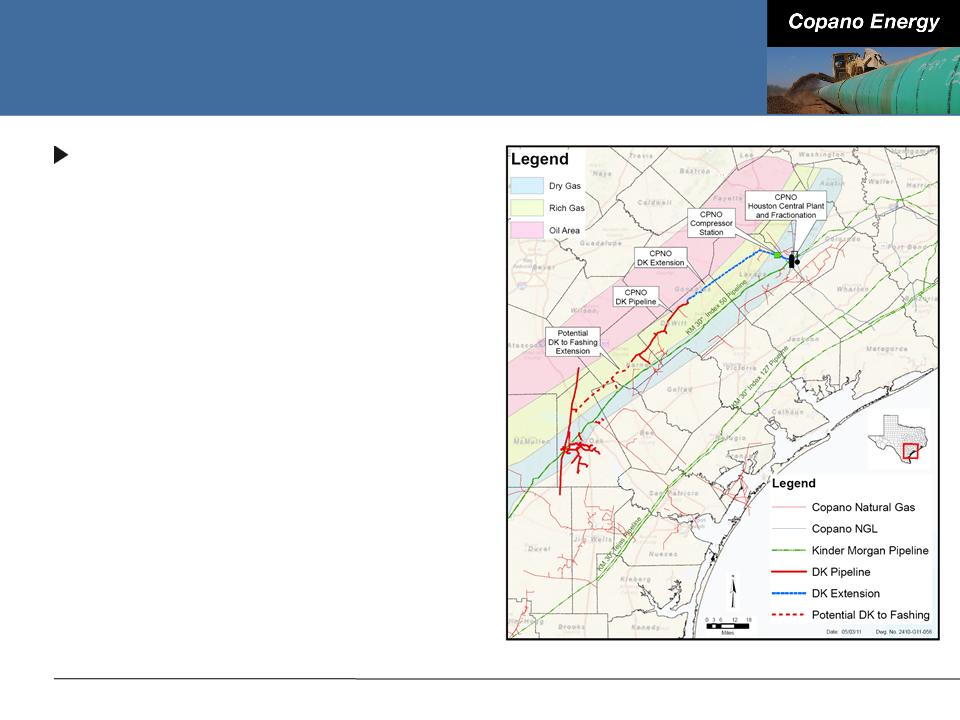

Northern Eagle Ford Shale

DK pipeline

■ Existing pipeline - 38 miles of 24”

pipe placed into full service October

2010

pipe placed into full service October

2010

■ February 2011 - announced

extension of existing pipeline back

to Houston Central complex

extension of existing pipeline back

to Houston Central complex

● Additional 58 miles of 24” pipe

● Expected completion in 4Q 2011

■ Current capacity of 225,000

MMBtu/d; extension to Houston

Central complex will increase

capacity to 350,000 MMBtu/d

MMBtu/d; extension to Houston

Central complex will increase

capacity to 350,000 MMBtu/d

■ Extension south to Live Oak Fashing

under consideration

under consideration

9

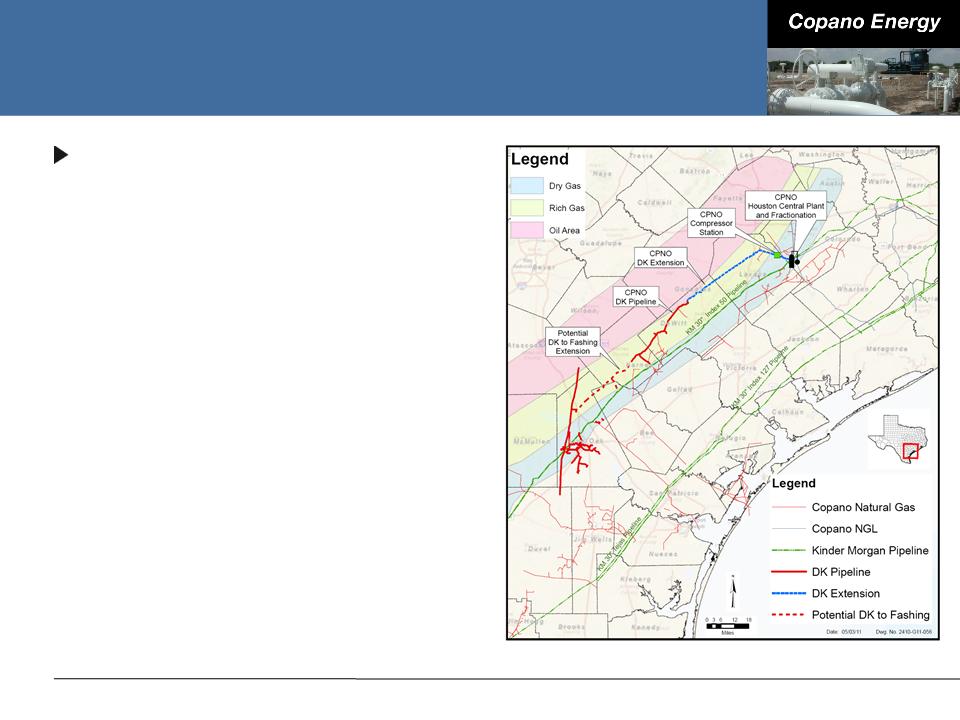

Northern Eagle Ford Shale

DK pipeline

■ Services the most prolific rich gas

window in the Eagle Ford Shale

window in the Eagle Ford Shale

■ Loops Kinder Morgan Index 50

pipeline, effectively boosting

pipeline capacity to Houston Central

pipeline, effectively boosting

pipeline capacity to Houston Central

■ Key producer contracts with

Abraxas, GeoSouthern, Petrohawk,

Pioneer, Riley and others

Abraxas, GeoSouthern, Petrohawk,

Pioneer, Riley and others

■ Existing pipeline capital investment

of $48 million

of $48 million

■ DK extension additional capital

investment of $100 million

investment of $100 million

■ Potential DK to Fashing project

under consideration - estimated

additional capital investment of $50

million

under consideration - estimated

additional capital investment of $50

million

10

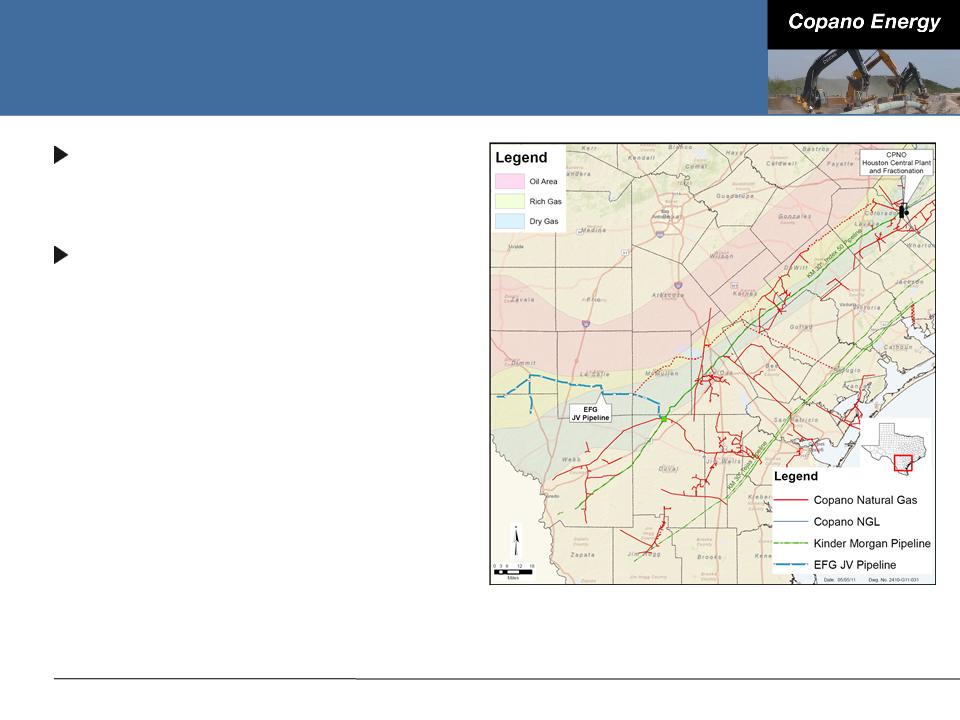

Southern Eagle Ford Shale

Eagle Ford Gathering (EFG)

■ 50/50 JV with Kinder Morgan

EFG pipeline

■ 114 miles of 30” and 24” pipe -

currently under construction

currently under construction

■ Expected completion 3Q 2011

■ Nominal capacity of 600,000

MMBtu/d

MMBtu/d

■ Long-term, fee-based contracts with

aggregate volume commitments

approaching 500,000 MMBtu/d

aggregate volume commitments

approaching 500,000 MMBtu/d

● SM Energy - July 2010

● Chesapeake - November 2010

● Anadarko - February 2011

■ Net capital investment of $87.5

million

million

11

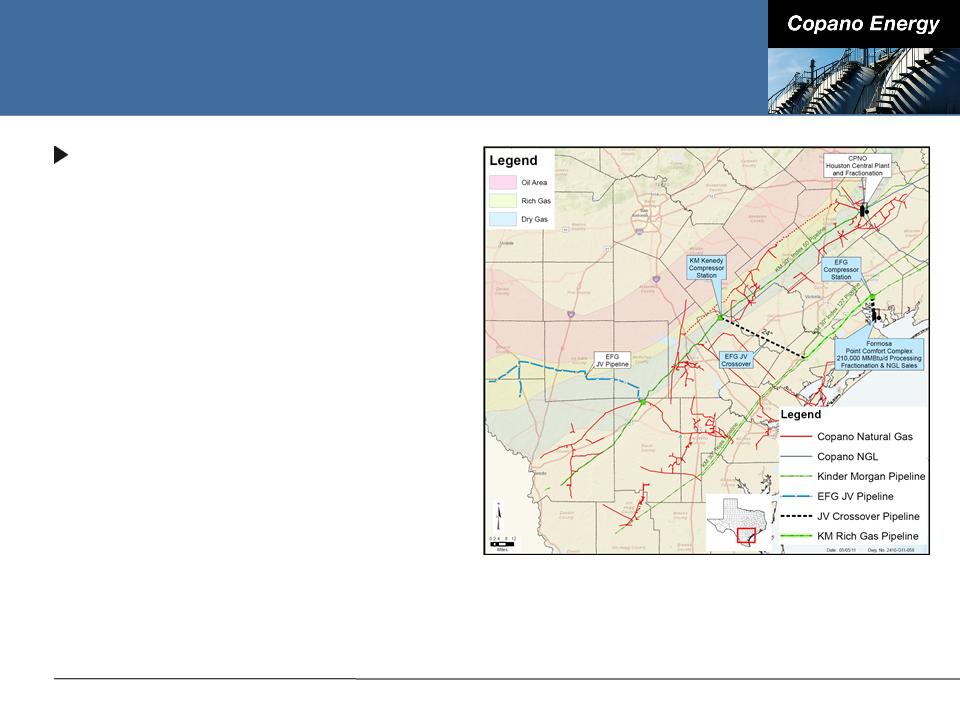

Eagle Ford Gathering Crossover Project

Crossover project

■ 66 miles of 24” and 20” pipe

connecting Kinder Morgan’s Index

50 and Tejas 30” pipelines to

Formosa

connecting Kinder Morgan’s Index

50 and Tejas 30” pipelines to

Formosa

● Nominal pipeline capacity of

400,000 MMBtu/d

400,000 MMBtu/d

● Expected completion 4Q 2011

■ Allows an incremental 210,000

MMBtu/d of gas to flow on Eagle

Ford Gathering 30” pipeline

MMBtu/d of gas to flow on Eagle

Ford Gathering 30” pipeline

■ Processing, fractionation and

product sales at Formosa’s Point

Comfort complex

product sales at Formosa’s Point

Comfort complex

■ Net capital investment of $50

million

million

12

Houston Central Complex

Current capacity of 700 MMcf/d

■ 500 MMcf/d of lean oil processing

■ 200 MMcf/d of cryogenic processing

Multiple residue interconnects

■ Anticipated additional connection - Tres Palacios storage and header system

Cryogenic processing expansion of 400 MMcf/d in process

■ Improves NGL recoveries

■ Allows base loading of cryogenic plants with spillover to lean oil plant

■ Total capital investment of $145 million

13

Houston Central Complex

Fractionation expansion

■ Responding to increased producer demand,

liquids handling capacity will double at

Houston Central complex

liquids handling capacity will double at

Houston Central complex

■ Fractionation expansion from 22,000 Bbls/d

to 44,000 Bbls/d

to 44,000 Bbls/d

● All ethane and propane will move to Dow

through Copano purity pipelines

through Copano purity pipelines

■ Total capital investment of $66 million

● Includes fractionation facilities and related

plant upgrades and product pipeline

expansions

plant upgrades and product pipeline

expansions

● Expected completion 3Q 2011

14

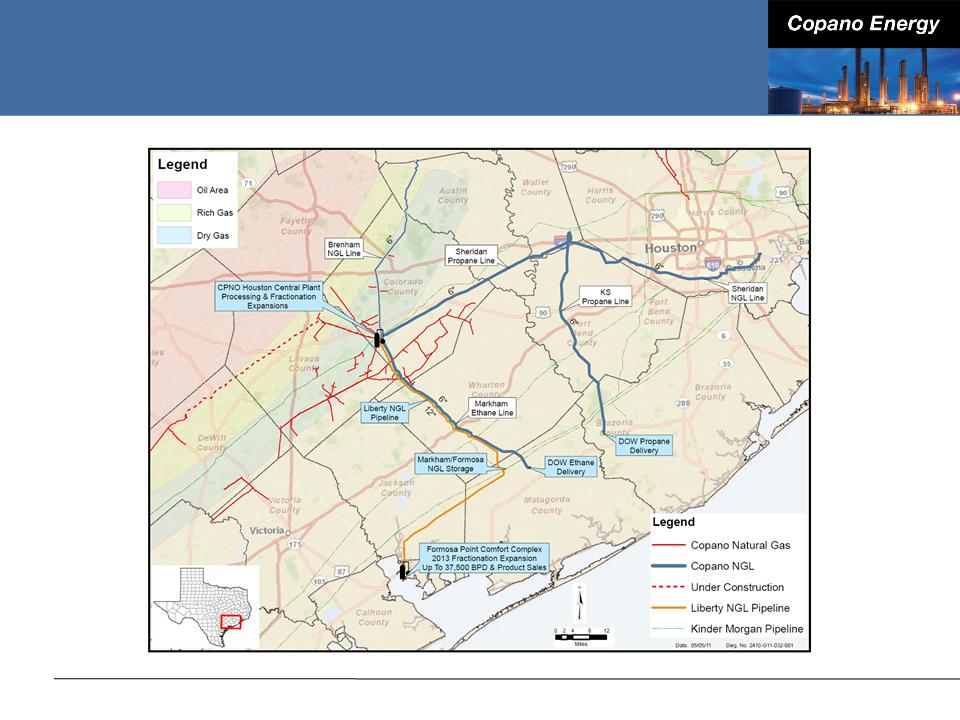

Liberty NGL Pipeline

83-mile, 12” NGL pipeline extending from the Houston Central

complex to Markham NGL storage and Formosa’s Point Comfort

complex

complex to Markham NGL storage and Formosa’s Point Comfort

complex

■ Total capacity of 75,000 Bbls/d

■ Constructed through 50/50 JV with Energy Transfer

■ Expected completion early 3Q 2011

Long-term fractionation and product sales agreement with Formosa

on favorable terms

on favorable terms

■ Initial access to a minimum of 5,000 Bbls/d - 7,000 Bbls/d following Liberty

NGL pipeline completion

NGL pipeline completion

■ Upon completion of Formosa’s fractionation expansion, will have up to 37,500

Bbls/d of firm capacity starting 1Q 2013 for a 15-year term

Bbls/d of firm capacity starting 1Q 2013 for a 15-year term

Net capital investment of $26 million

15

Houston Central NGL Infrastructure

16

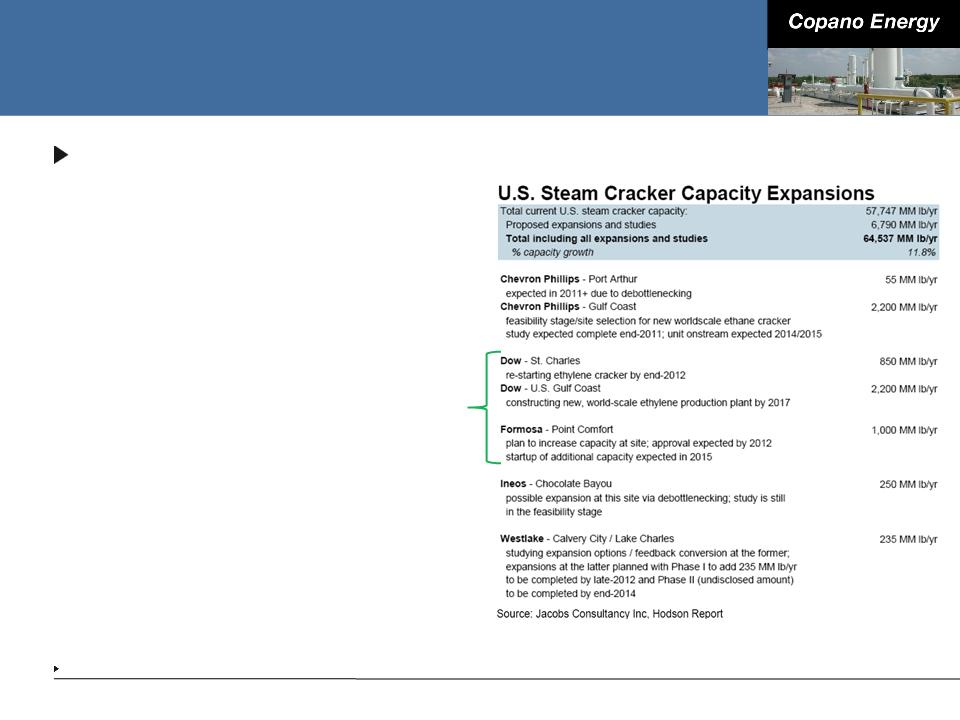

Gulf Coast Petrochemical Market Access

Copano has access to Dow

and, upon completion of

the Liberty NGL pipeline,

Formosa

and, upon completion of

the Liberty NGL pipeline,

Formosa

■ Among the largest end users

of NGLs in the U.S.

of NGLs in the U.S.

■ Taking into account

announced expansions, Dow

and Formosa’s combined

steam cracker capacity is

approximately 19% of total

U.S. capacity(1)

announced expansions, Dow

and Formosa’s combined

steam cracker capacity is

approximately 19% of total

U.S. capacity(1)

17

Source: Hodson Report.

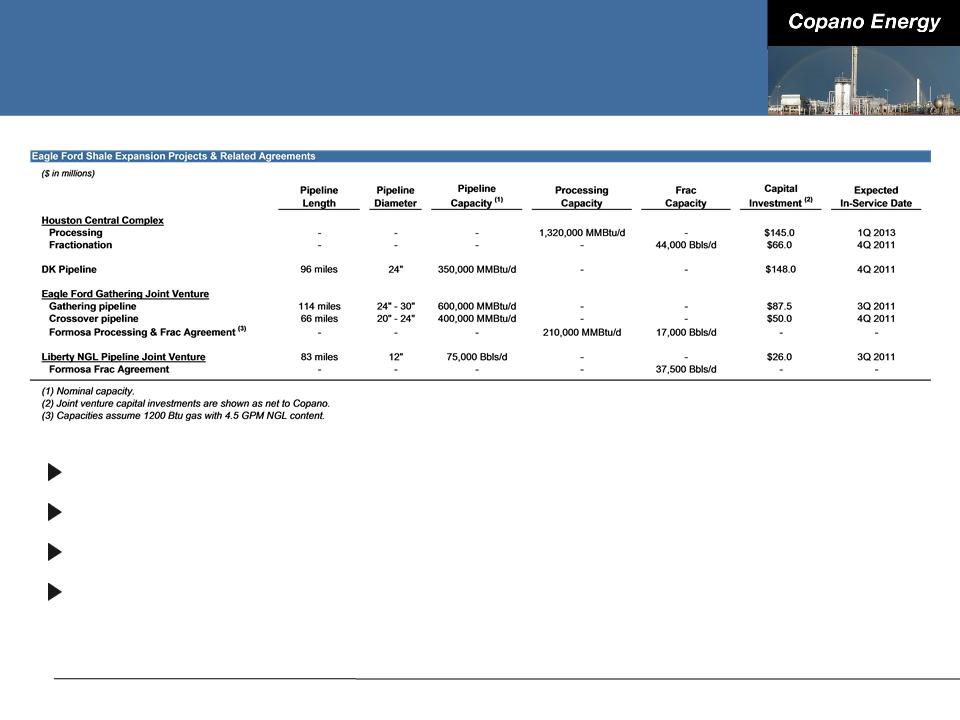

Summary of Eagle Ford Shale

Infrastructure

Infrastructure

18

Total capital investment of over $500 million

In excess of 1 Bcf/d of pipeline and processing capacity

Approaching 100,000 Bbls/d of fractionation capacity

Access to multiple markets for residue gas and NGLs

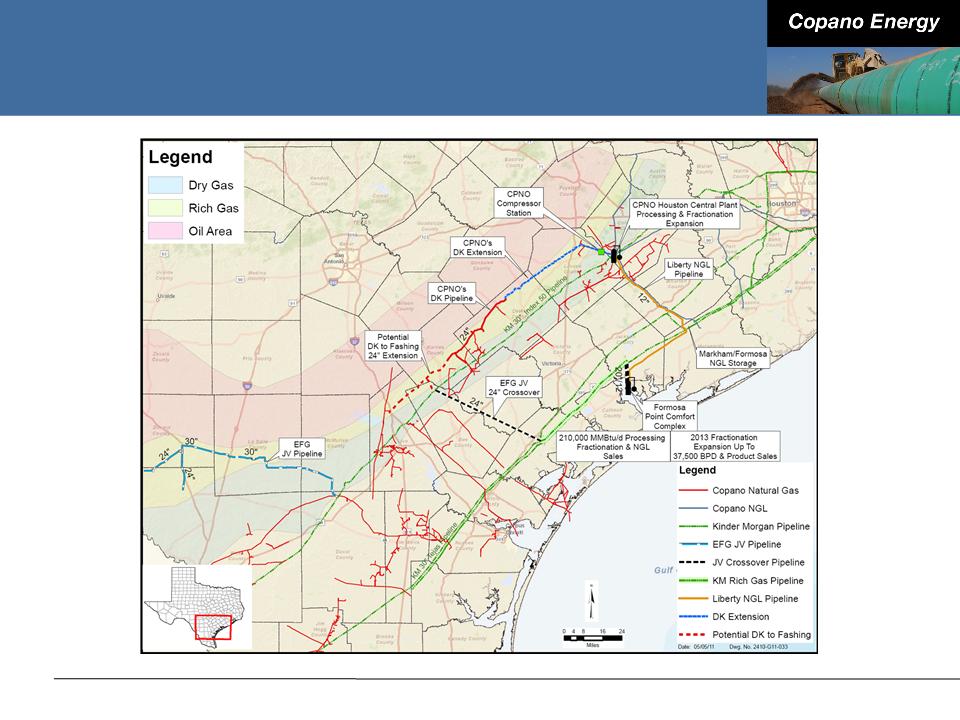

Combined Eagle Ford Shale Map

19

Business Segment Outlook

20

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Texas Recent Developments

Saint Jo system

■ Primarily long-term gathering, treating and processing fee-for-service

business

business

■ Plant fully committed under contracts

■ System volumes have been averaging approximately 62,000 MMBtu/d

Eagle Ford Shale

■ Houston Central complex processing expansion

● Permitting underway with expected in-service date in 1Q 2013

■ Producers running over 30 rigs in areas served by Copano pipelines

■ Total Eagle Ford Shale volumes have been averaging approximately 115,000

MMBtu/d

MMBtu/d

● DK pipeline volumes - approximately 90,000 MMBtu/d

21

Texas Outlook

Saint Jo system

■ 16 rigs running in the area

● Still on track to connect approximately 150 wells in 2011

● Leasing activity continues

■ Based on producer discussions, expect activity to remain high

Eagle Ford Shale

■ Potential addition of interruptible volumes on Eagle Ford Gathering 30” pipeline

by mid-summer

by mid-summer

■ Expect to see further volume increases on both wholly owned and joint venture

assets in the second half of 2011 and beyond

assets in the second half of 2011 and beyond

Assuming current prices continue and the current outlook on

volumes, expect slightly higher segment gross margin in 2Q 2011

volumes, expect slightly higher segment gross margin in 2Q 2011

22

Oklahoma Recent Developments

Significant drilling activity in the

Woodford Shale around the

Cyclone Mountain system

Woodford Shale around the

Cyclone Mountain system

■ Average 1Q 2011 volumes of

approximately 75,000 MMBtu/d vs.

average 4Q 2010 of approximately

59,000 MMBtu/d

approximately 75,000 MMBtu/d vs.

average 4Q 2010 of approximately

59,000 MMBtu/d

Current system capacity

approximately 120 MMcf/d

approximately 120 MMcf/d

■ System expansion likely in 2H 2012

based on producer expectations

based on producer expectations

23

Oklahoma Outlook

Rich gas (primarily Hunton dewatering play)

■ Drilling activity has increased slightly in 2Q 2011 compared to 1Q 2011

■ 3 rigs currently running in the Hunton and 13 rigs in other rich gas areas

■ Attractive processing upgrade and low geologic risk

■ 2Q 2011 volumes expected to be slightly higher vs. 1Q 2011

● Increased volumes resulting from acquisition of Harrah plant

Lean gas (primarily Woodford Shale)

■ Drilling activity remains steady in 2Q 2011 compared to 1Q 2011

■ 3 rigs currently running

■ 2Q 2011 volumes expected to be slightly higher than 1Q 2011

At current commodity prices, expect Oklahoma gross margin to be

slightly higher in 2Q 2011

slightly higher in 2Q 2011

24

Rocky Mountains Outlook

Drilling and dewatering will be driven by commodity prices and

producer economics

producer economics

2Q 2011 volumes for Bighorn expected to be slightly lower vs. 1Q

2011

2011

2Q 2011 volumes for Fort Union expected to be lower vs. 1Q 2011

due to the start-up of Bison pipeline

due to the start-up of Bison pipeline

■ Do not expect material impact to Copano Adjusted EBITDA due to long-term

contractual commitments through 2017

contractual commitments through 2017

2011 Adjusted EBITDA expected to be slightly lower vs. 2010

25

Financing and Commodity Price

Sensitivity

Sensitivity

26

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Liquidity and Capitalization

At March 31, 2011:

■ $69 million cash

■ $550 million revolving credit facility

● Approximately $310 million available

● Matures October 2012

■ $583 million senior notes

● $332.7 million 8.125% senior notes due 2016 (fully redeemed in 2Q 2011)

● $249.5 million 7.75% senior notes due 2018

■ Total debt to trailing 12-months Consolidated EBITDA(1) ratio of 3.44x

■ Total debt to total capitalization(2) ratio of 38%

On April 5, 2011, issued $360 million of 7.125% senior notes due

2021

2021

■ Proceeds used primarily to tender for existing 2016 notes (2016 notes fully

redeemed on May 6, 2011) - expect annual interest savings of approximately

$1.4 million for the next five years

redeemed on May 6, 2011) - expect annual interest savings of approximately

$1.4 million for the next five years

27

See Appendix for reconciliation of “Consolidated EBITDA” as defined in our credit agreement.

Defined as total debt plus total members’ capital.

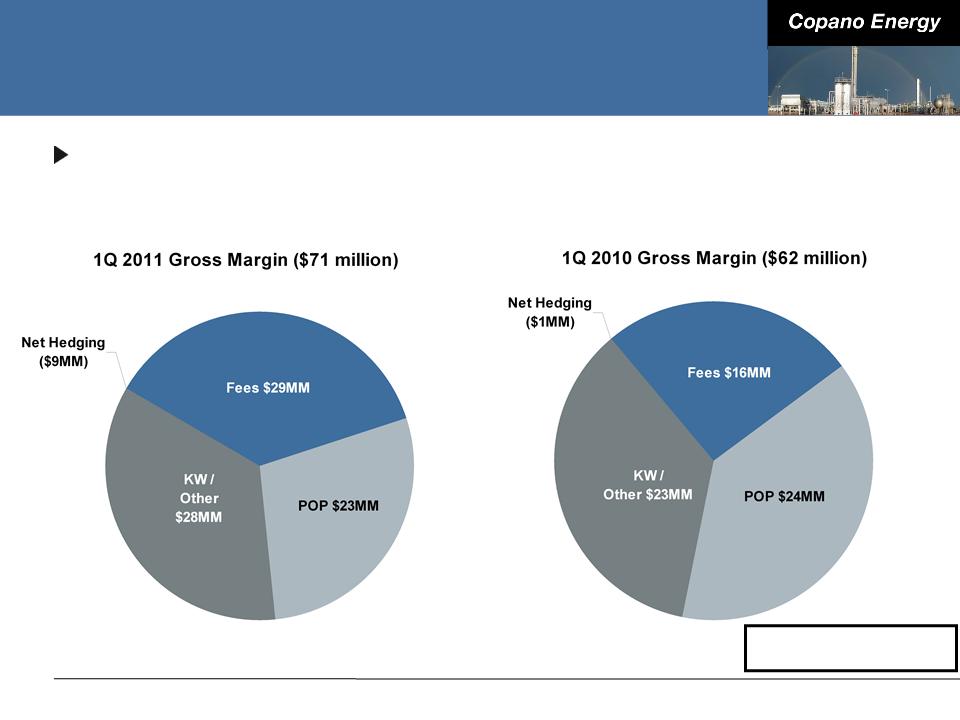

Commodity Price Exposure

As Eagle Ford Shale and North Barnett Shale Combo volumes grow,

transition to more fee-based volumes will continue to reduce direct

commodity price exposure

transition to more fee-based volumes will continue to reduce direct

commodity price exposure

Note: Includes Copano’s share of gross margin from unconsolidated affiliates. Approximate percentages based on Copano

internal financial planning models.

internal financial planning models.

28

41%

27%

32%

39%

-12%

-2%

37%

39%

KW: Keep-whole

POP: Percentage of Proceeds

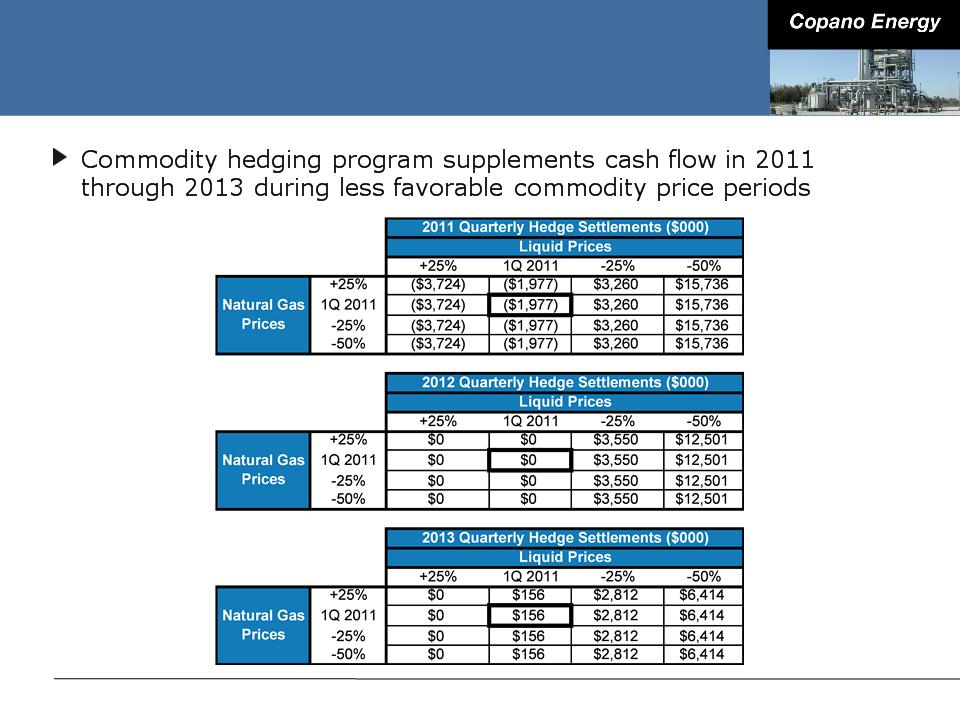

Hedging Strategy

Option-based, product-specific

2011 hedged at or near policy limits

■ Approximately 70% of ethane, propane, butane, natural gasoline and

condensate price exposure is hedged

condensate price exposure is hedged

Will continue adding to 2013 hedging positions during 2011

29

Conclusions

30

|

Eagle Ford Shale

Growth Projects |

Business Segment

Outlook |

|

Financing and

Commodity Price Sensitivity |

Conclusions

|

Conclusions

Focused on execution in the Eagle Ford Shale

Strong producer activity in north Texas continues

Focused on growth opportunities in the Woodford Shale in

Oklahoma

Oklahoma

Continue to evaluate strategic M&A opportunities

Shift to predominately fee-based contract mix underway

Ample liquidity and access to capital to support growth initiatives

31

Appendix

32

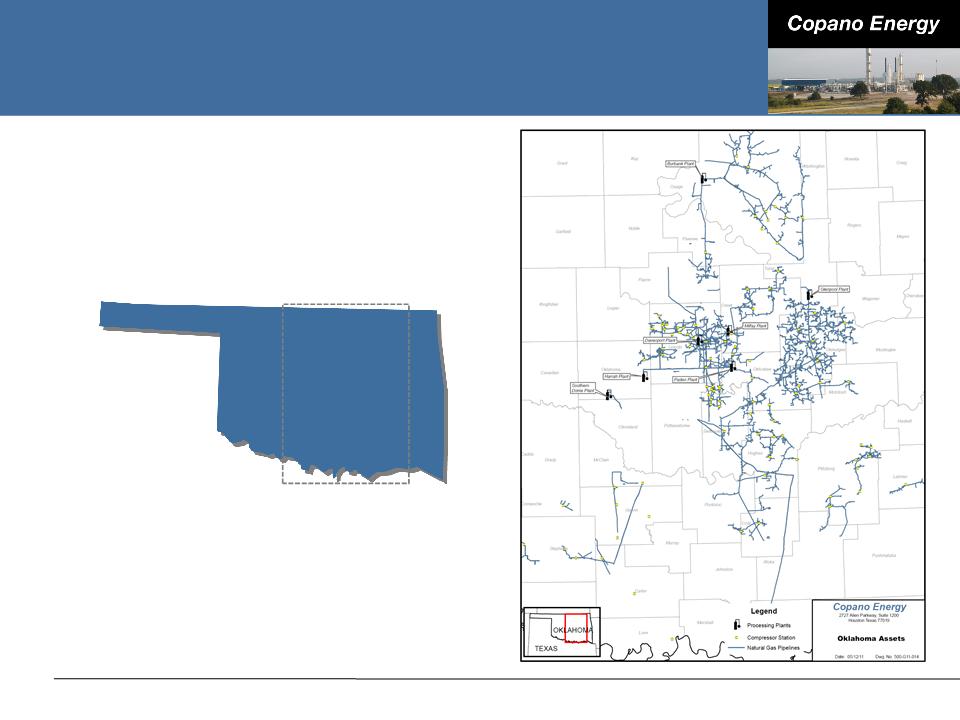

Oklahoma Assets

33

OKLAHOMA

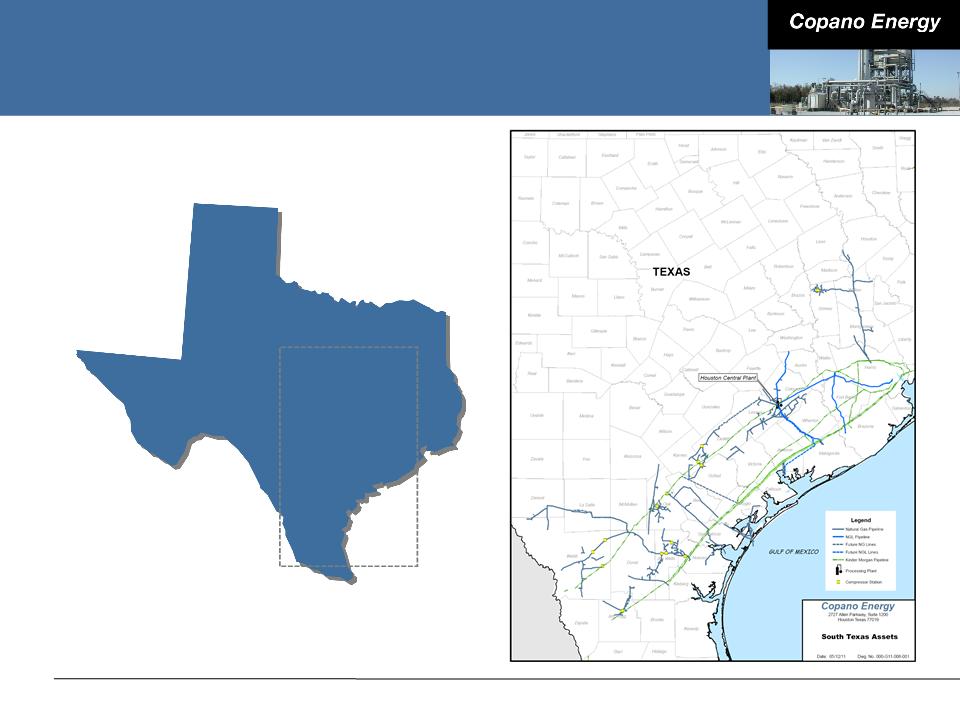

South Texas Assets

34

TEXAS

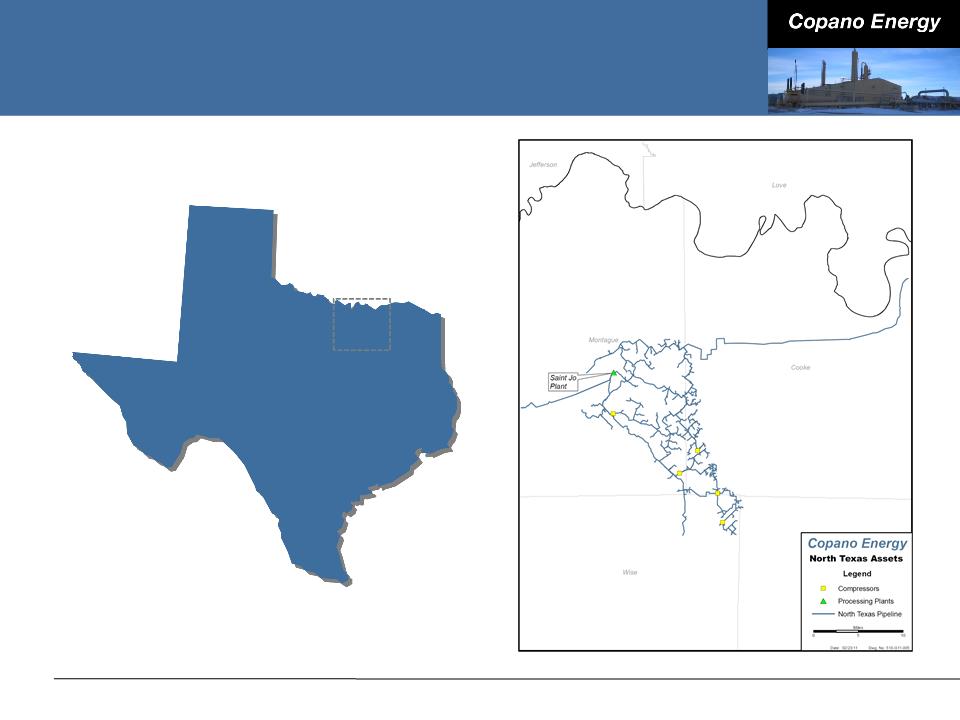

North Texas Assets

35

TEXAS

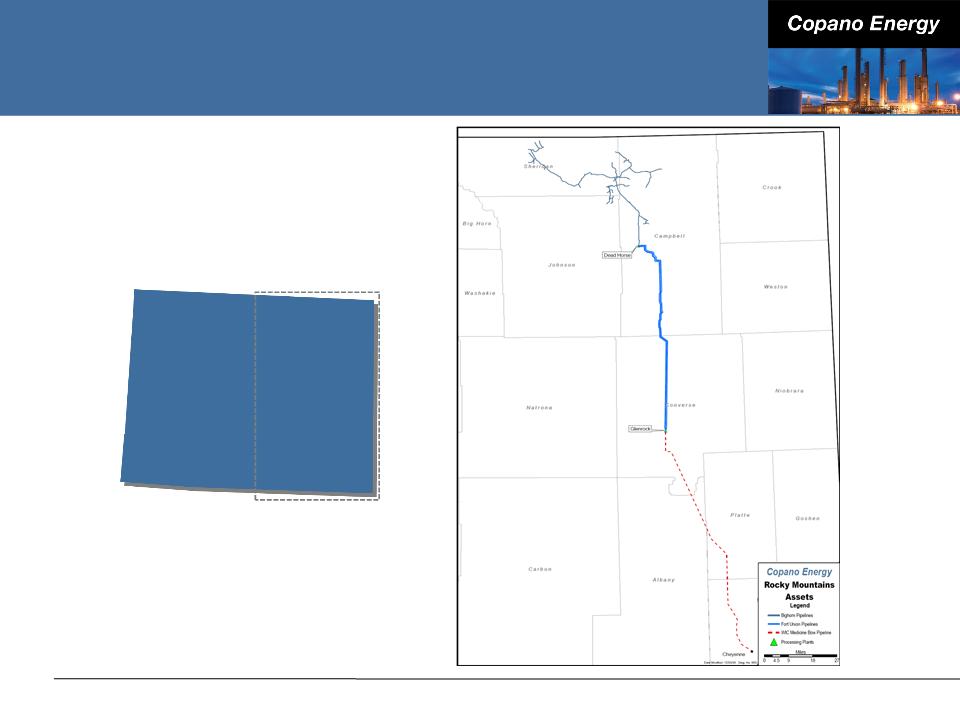

Rocky Mountains Assets

36

WYOMING

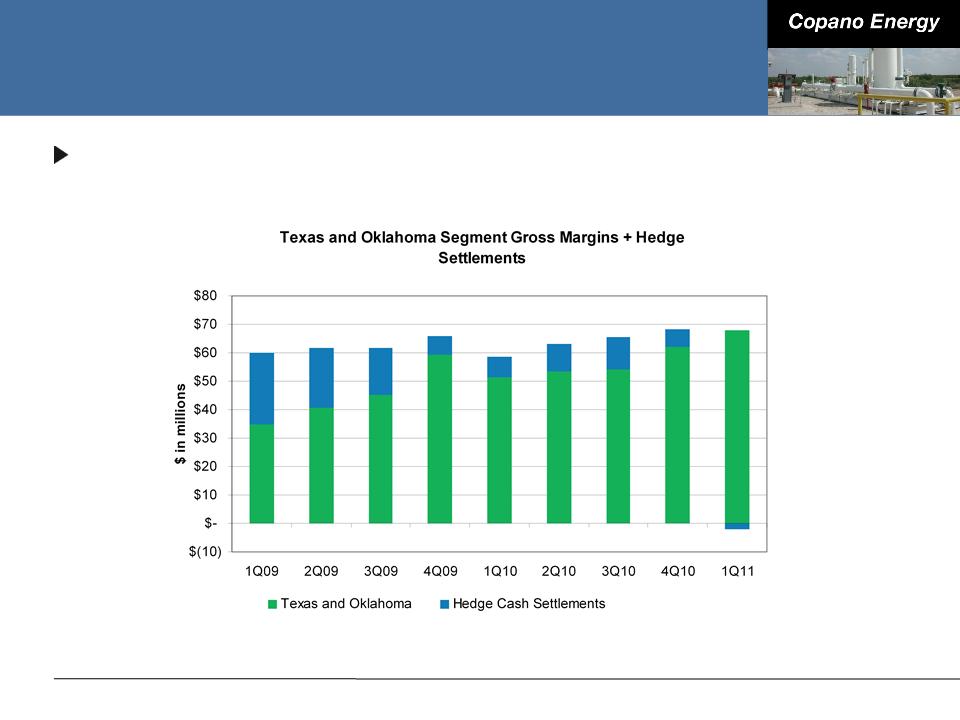

Combined Commodity-Sensitive Segment

Margins and Hedging Settlements

Margins and Hedging Settlements

Copano’s hedge portfolio supports cash flow stability

37

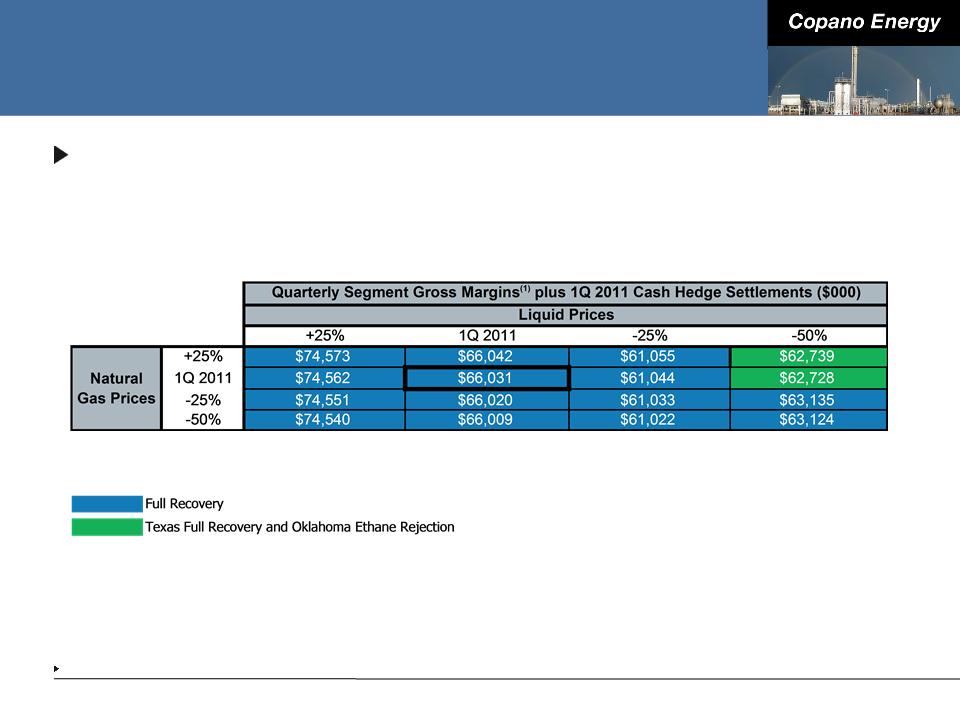

Commodity-Related Margin Sensitivities

Matrix reflects 1Q 2011 wellhead and plant inlet volumes, adjusted

using Copano’s 2011 planning model

using Copano’s 2011 planning model

38

Consists of Texas and Oklahoma Segment gross margins.

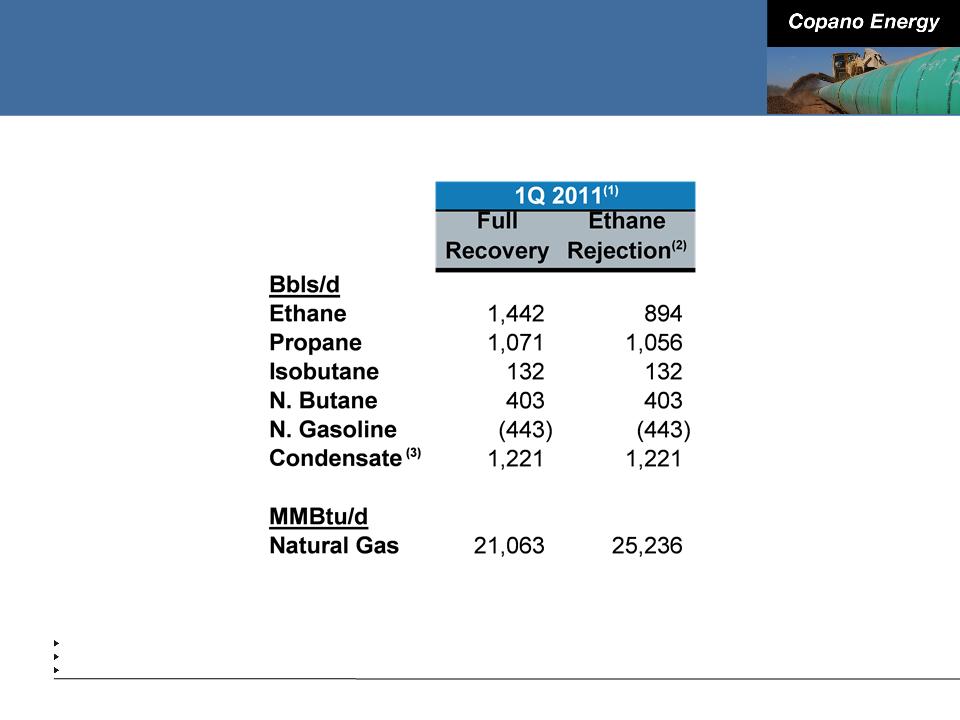

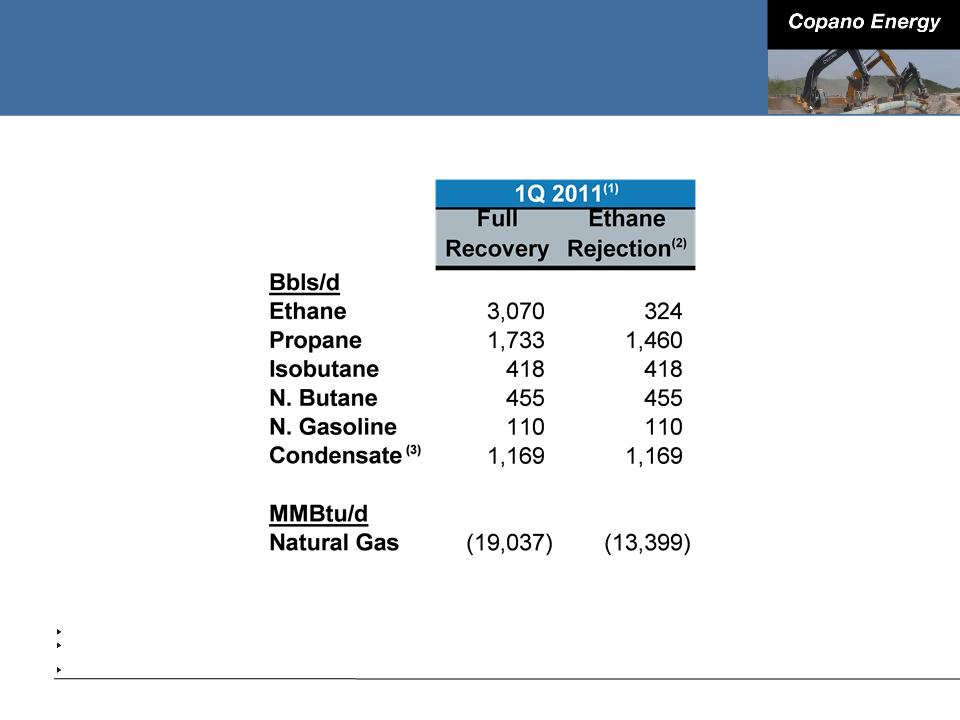

Oklahoma Net Commodity Exposure

39

Note: See explanation of processing modes in this Appendix. Values reflect rounding.

Source: Copano Energy internal financial planning models.

Ethane rejection at Paden plant is limited by nitrogen rejection facilities.

Reflects impact of producer delivery point allocations, offset by field condensate collection and stabilization.

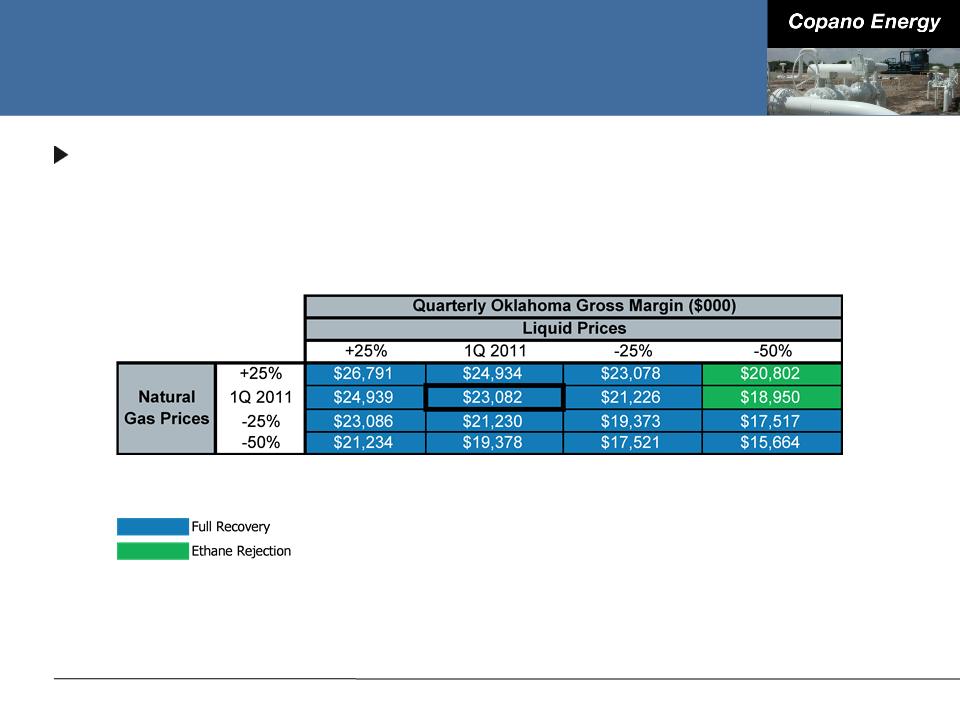

Oklahoma Commodity Price Sensitivities

Oklahoma segment gross margins excluding hedge settlements

■ Matrix reflects 1Q 2011 volumes, adjusted using Copano’s 2011 planning

model

model

40

Note: Please see this Appendix for definitions of processing modes and additional details.

Texas Net Commodity Exposure

41

Note: See explanation of processing modes in this Appendix.

Source: Copano Energy internal financial planning models. Based on 1Q 2011 daily wellhead/plant inlet volumes.

Fractionation at Houston Central complex permits significant reductions in ethane recoveries in ethane rejection mode. To optimize profitability, plant

operations can also be adjusted to partial recovery mode.

operations can also be adjusted to partial recovery mode.

At the Houston Central complex, pentanes+ may be sold as condensate.

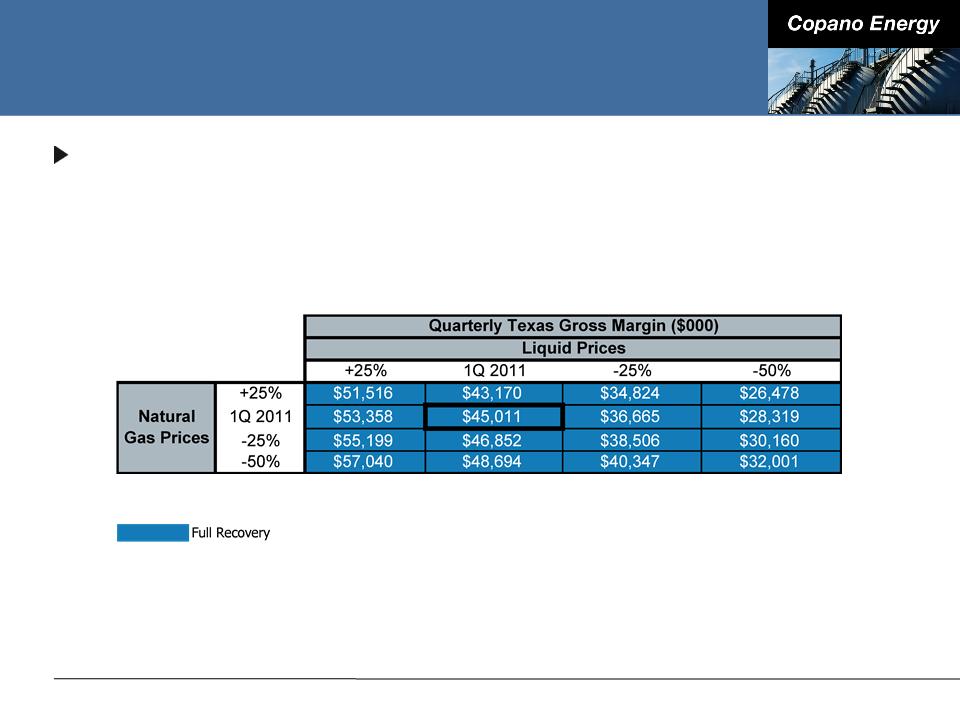

Texas Commodity Price Sensitivities

Texas segment gross margins excluding hedge settlements

■ Matrix reflects 1Q 2011 volumes and operating conditions, adjusted using

Copano’s 2011 planning model

Copano’s 2011 planning model

42

Note: Please see this Appendix for definitions of processing modes and additional details.

Rocky Mountains Sensitivities

1Q 2011 Adjusted EBITDA volume sensitivity (positive or negative

impact)

impact)

■ Bighorn: 10,000 MMBtu/d = $255,000(1)

■ Fort Union: 10,000 MMBtu/d = immaterial impact until physical volumes

exceed long-term contractual volume commitments

exceed long-term contractual volume commitments

● 1Q 2011 pipeline throughput: 434,744 MMBtu/d

● 1Q 2011 revenue based on 723,710 MMBtu/d of volume commitments

43

Note: See this Appendix for reconciliation of Adjusted EBITDA. Values reflect rounding.

Impact on Adjusted EBITDA based on Copano’s interest in the unconsolidated affiliate.

Hedging Impact of Commodity Price

Sensitivities

Sensitivities

44

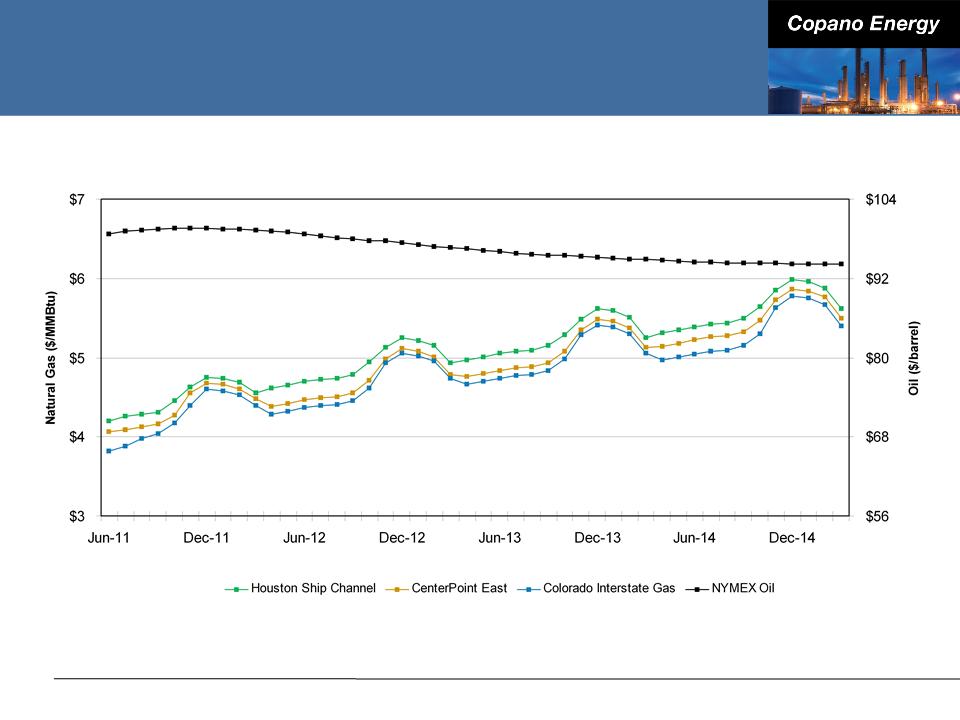

Historical Commodity Prices

45

Note: NGL prices for Jan-09 through Mar-11 are calculated based on the weighted-average product mix for the period indicated.

NGL prices for Apr-11 through May-11 are calculated based on the first quarter 2011 product mix.

Forward Commodity Prices

46

Note: Forward prices as of May 10, 2011

Processing Modes

47

|

Full Recovery

|

|

|

|

Texas and Oklahoma - If the value of

recovered NGLs exceeds the fuel and gas shrinkage costs of recovering NGLs |

|

Ethane Rejection

|

|

|

|

Texas and Oklahoma - If the value of ethane

is less than the fuel and shrinkage costs to recover ethane (in Oklahoma, ethane rejection at Paden plant is limited by nitrogen rejection facilities) |

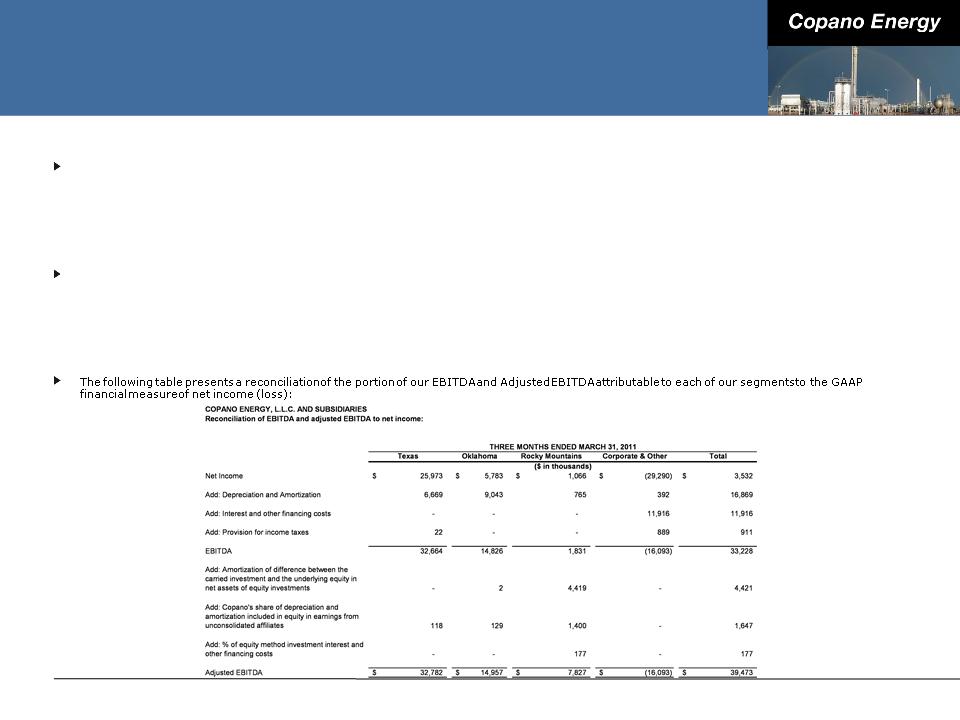

Reconciliation of Non-GAAP Financial

Measures

Measures

Adjusted EBITDA

We define EBITDA as net income (loss) plus interest expense, provision for income taxes and depreciation and amortization expense. Because a portion

of our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and

Southern Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in

earnings (loss) from unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization

expense attributable to the difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii)

the portion of each unconsolidated affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that

unconsolidated affiliate and (iii) the portion of each unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership

interest in that unconsolidated affiliate.

of our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and

Southern Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in

earnings (loss) from unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization

expense attributable to the difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii)

the portion of each unconsolidated affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that

unconsolidated affiliate and (iii) the portion of each unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership

interest in that unconsolidated affiliate.

External users of our financial statements such as investors, commercial banks and research analysts use EBITDA or Adjusted EBITDA, and our

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

■ The financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

■ The ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness;

■ Our operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to financing or capital

structure; and

structure; and

■ The viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities.

48

Reconciliation of Non-GAAP Financial

Measures

Measures

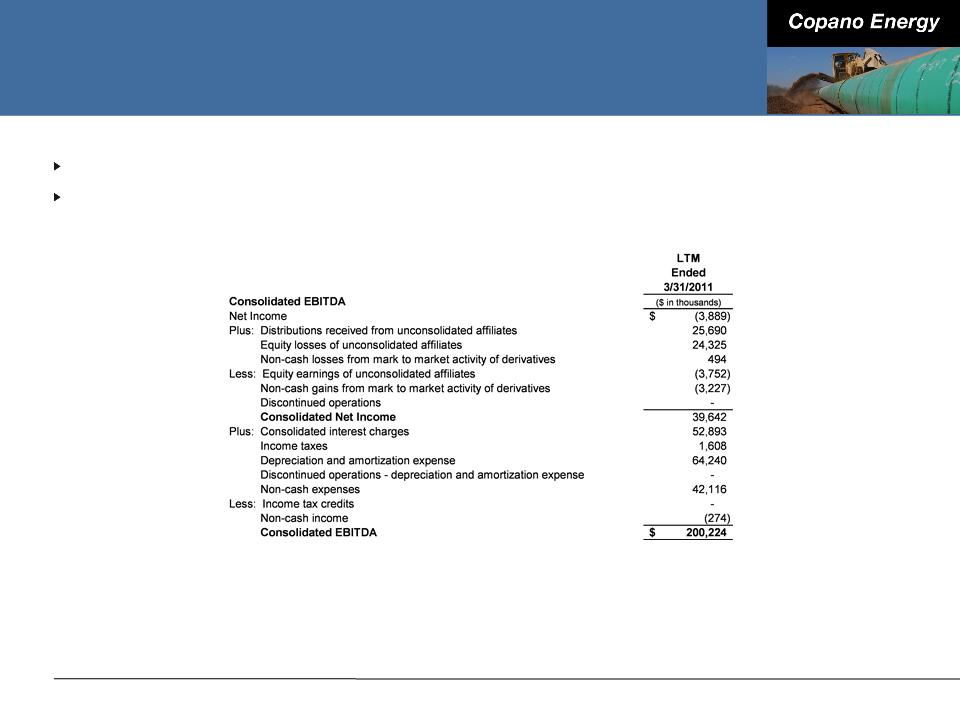

Consolidated EBITDA

EBITDA is also a financial measure that, with negotiated pro forma adjustments relating to acquisitions completed during the period, is reported to our

lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior secured revolving credit facility.

lenders as Consolidated EBITDA and is used to compute our financial covenants under our senior secured revolving credit facility.

The following table presents a reconciliation of the non-GAAP financial measure of Consolidated EBITDA to the GAAP financial measure of net income

(loss):

(loss):

49

Definitions of Non-GAAP Financial

Measures

Measures

Total Distributable Cash Flow

We define total distributable cash flow as net income plus: (i) depreciation, amortization and impairment expense

(including amortization expense relating to the option component of our risk management portfolio); (ii) cash

distributions received from investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates;

(iii) provision for deferred income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of

equity in earnings from unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other

miscellaneous non-cash amounts affecting net income for the period, such as equity-based compensation, mark-to-

market changes in derivative instruments, and our line fill contributions to third-party pipelines and gas imbalances.

Maintenance capital expenditures are capital expenditures employed to replace partially or fully depreciated assets to

maintain the existing operating capacity of our assets and to extend their useful lives, or other capital expenditures that

are incurred in maintaining existing system volumes and related cash flows.

(including amortization expense relating to the option component of our risk management portfolio); (ii) cash

distributions received from investments in unconsolidated affiliates and equity losses from such unconsolidated affiliates;

(iii) provision for deferred income taxes; (iv) the subtraction of maintenance capital expenditures; (v) the subtraction of

equity in earnings from unconsolidated affiliates and (vi) the addition of losses or subtraction of gains relating to other

miscellaneous non-cash amounts affecting net income for the period, such as equity-based compensation, mark-to-

market changes in derivative instruments, and our line fill contributions to third-party pipelines and gas imbalances.

Maintenance capital expenditures are capital expenditures employed to replace partially or fully depreciated assets to

maintain the existing operating capacity of our assets and to extend their useful lives, or other capital expenditures that

are incurred in maintaining existing system volumes and related cash flows.

Total distributable cash flow is a significant performance metric used by senior management to compare basic cash flows

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash

distributions we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants.

Using total distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to

planned cash distributions. Total distributable cash flow is also an important non-GAAP financial measure for our

unitholders because it serves as an indicator of our success in providing a cash return on investment — specifically,

whether or not we are generating cash flow at a level that can sustain or support an increase in our quarterly distribution

rates. Total distributable cash flow is also used by industry analysts with respect to publicly traded partnerships and

limited liability companies because the market value of such entities’ equity securities is significantly influenced by the

amount of cash they can distribute to unitholders.

generated by us (prior to the establishment of any retained cash reserves by our Board of Directors) to the cash

distributions we expect to pay our unitholders, and it also correlates with the metrics of our existing debt covenants.

Using total distributable cash flow, management can quickly compute the coverage ratio of estimated cash flows to

planned cash distributions. Total distributable cash flow is also an important non-GAAP financial measure for our

unitholders because it serves as an indicator of our success in providing a cash return on investment — specifically,

whether or not we are generating cash flow at a level that can sustain or support an increase in our quarterly distribution

rates. Total distributable cash flow is also used by industry analysts with respect to publicly traded partnerships and

limited liability companies because the market value of such entities’ equity securities is significantly influenced by the

amount of cash they can distribute to unitholders.

50