Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CENTERLINE HOLDING CO | exhibit99-1.htm |

| 8-K - FORM 8-K MAIN BODY - CENTERLINE HOLDING CO | f8k_march2011-clnh.htm |

CENTERLINE HOLDING

COMPANY

COMPANY

Financial Overview

1Q11 | March 31, 2011

CENTERLINE CAPITAL GROUP

Table of Contents

Centerline Corporate Overview pg 3

Equity Ownership Summary pg 7

Supplemental Financial Information pg 9

Glossary pg 24

Corporate Office

625 Madison Avenue

New York, NY 10022

Phone: 212-317-5700

Fax: 212-751-3550

www.centerline.com

OTC Symbol: CLNH

Investor Contacts

Rob Levy

President, CFO and COO

212-317-5700

Denise Bernstein

Investor Relations

212-521-6451

Centerline Corporate Overview pg 3

Equity Ownership Summary pg 7

Supplemental Financial Information pg 9

Glossary pg 24

Corporate Office

625 Madison Avenue

New York, NY 10022

Phone: 212-317-5700

Fax: 212-751-3550

www.centerline.com

OTC Symbol: CLNH

Investor Contacts

Rob Levy

President, CFO and COO

212-317-5700

Denise Bernstein

Investor Relations

212-521-6451

This presentation contains forward-looking statements about

Centerline Holding Company. Certain statements in this document

may constitute forward-looking statements within the meaning of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. Except for historical information, the matters

discussed in this presentation are forward-looking statements

subject to certain risks and uncertainties. These statements are

based on management's current expectations and beliefs and are

subject to a number of factors and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These risks and uncertainties are

detailed in Centerline Holding Company's most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q for

the first, second and third quarters of 2010 filed with the

Securities and Exchange Commission, and include, among

others, business limitations caused by adverse changes in real

estate and credit markets and general economic and business

conditions; our ability to generate new income sources, raise

capital for investment funds and maintain business relationships

with providers and users of capital; changes in applicable laws

and regulations; our tax treatment, the tax treatment of our

subsidiaries and the tax treatment of our investments; risk of

allocations of income to our shareholders without corresponding

cash distributions; possible adverse effects of a future issuance of

shares or a reverse share split; possible deterioration in cash

flows generated by material investments, such as the Freddie

Mac B-Certificate; competition with other companies; risk of loss

under mortgage banking loss sharing agreements; and risks

associated with providing credit intermediation. Words such as

"anticipates", "expects", "intends", "plans", "believes", "seeks",

"estimates" and similar expressions are intended to identify

forward-looking statements. Such forward-looking statements

speak only as of the date of this document. Centerline Holding

Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Centerline

Holding Company's expectations with regard thereto or change in

events, conditions, or circumstances on which any such statement

is based.

Centerline Holding Company. Certain statements in this document

may constitute forward-looking statements within the meaning of

the "safe harbor" provisions of the Private Securities Litigation

Reform Act of 1995. Except for historical information, the matters

discussed in this presentation are forward-looking statements

subject to certain risks and uncertainties. These statements are

based on management's current expectations and beliefs and are

subject to a number of factors and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These risks and uncertainties are

detailed in Centerline Holding Company's most recent Annual

Report on Form 10-K and the Quarterly Reports on Form 10-Q for

the first, second and third quarters of 2010 filed with the

Securities and Exchange Commission, and include, among

others, business limitations caused by adverse changes in real

estate and credit markets and general economic and business

conditions; our ability to generate new income sources, raise

capital for investment funds and maintain business relationships

with providers and users of capital; changes in applicable laws

and regulations; our tax treatment, the tax treatment of our

subsidiaries and the tax treatment of our investments; risk of

allocations of income to our shareholders without corresponding

cash distributions; possible adverse effects of a future issuance of

shares or a reverse share split; possible deterioration in cash

flows generated by material investments, such as the Freddie

Mac B-Certificate; competition with other companies; risk of loss

under mortgage banking loss sharing agreements; and risks

associated with providing credit intermediation. Words such as

"anticipates", "expects", "intends", "plans", "believes", "seeks",

"estimates" and similar expressions are intended to identify

forward-looking statements. Such forward-looking statements

speak only as of the date of this document. Centerline Holding

Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in Centerline

Holding Company's expectations with regard thereto or change in

events, conditions, or circumstances on which any such statement

is based.

CENTERLINE CAPITAL GROUP

Centerline Corporate Overview

4

Corporate Overview

5

Business Groups

6

Competitive Advantages

CENTERLINE CAPITAL GROUP

Equity Ownership Summary

8

Equity Ownership as of March 31, 2011

(1)

(4)

(4)

(4)

(4)

|

(1)

|

On October 6, 2010, Centerline shareholders approved the amendment to the Company’s trust agreement that increased the number of shares authorized for issuance from 160 million shares to 800 million shares. At that time, 19.3 million of the Special Series A Shares automatically were converted into 289.9 million of common shares at 1:15 ratio.

|

|

(2)

|

Excludes common shares owned by The Related Companies as they are shown separately.

|

|

(3)

|

The FDIC, in its capacity as Receiver, is the record owner of common shares on behalf of the following entities: California National Bank, California Savings Bank, San Diego National Bank, Indy Mac Bank, F.S.B., North Houston Bank, and Community Bank & Trust.

|

|

(4)

|

Shareholders are subject to Lock-Up Agreements pursuant to which they may not offer, sell, offer to sell, contract to sell, grant and option to purchase or otherwise sell or dispose of any of their Centerline equity interests.

|

CENTERLINE CAPITAL GROUP

Supplemental Financial Statements

The accompanying “As Adjusted” balance sheets and statements of operations are not in accordance with GAAP, are

presented for the purpose of enhancing the understanding of the economics of our business, and may not be

comparable to figures reported by other companies.

presented for the purpose of enhancing the understanding of the economics of our business, and may not be

comparable to figures reported by other companies.

11

As Adjusted Balance Sheet

Asset Detail

12

As Adjusted Balance Sheet (cont.)

Liability Detail

13

Capital Summary

|

*

|

All values and balances are as of March 31, 2011

|

|

(1)

|

Excludes Centerline Financial Holdings and Centerline Financial LLC credit facilities

|

|

(2)

|

Credit Capacity includes the $12.0M in letters of credit which was issued under the Revolving Credit Facility (once these letters of credit are terminated these amounts can not be redrawn).

|

14

15

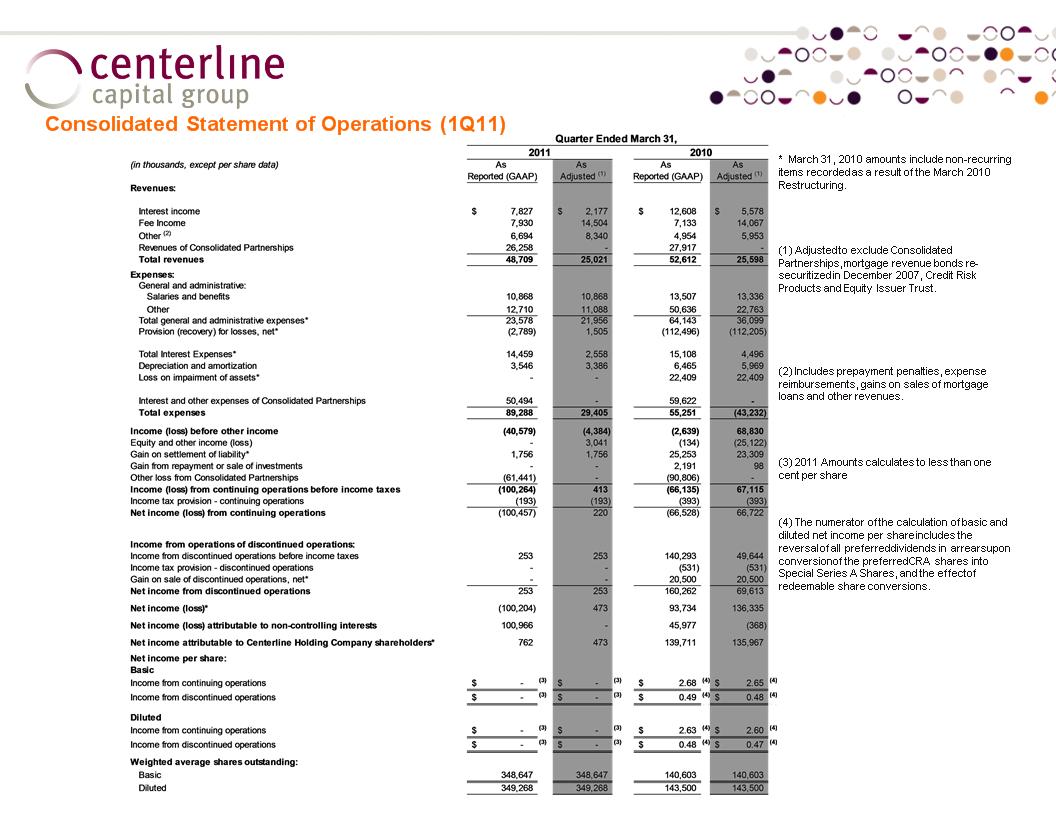

Q1 2011 As Adjusted Income Statement

Revenue & Equity Income Detail

Key Revenue Drivers:

Investment management income

Investment income

Transactional income

16

Q1 2011 Detailed As Adjusted Balance Sheet

17

Q4 2010 Detailed As Adjusted Balance Sheet

18

Q1 2011 Detailed As Adjusted Income Statement

|

|

|

(1) Refer to page

20 for further details. |

|

(2) Includes

prepayment penalties, expense reimbursements, gains on sales of mortgage loans and other revenues. (3) 2011 Amounts

calculates to less than one cent per share. |

|

|

19

|

* Year ended

December 31, 2010 amounts include non- recurring items recorded as a result of the March 2010 Restructuring. |

|

(1) Refer to pages 23

and 24 for further details. |

|

(2) Includes prepayment

penalties, expense reimbursements, gains on sales of mortgage loans and other revenues. |

|

(3) The numerator of the

calculation of basic and diluted net income per share includes the dividends in arrears for 2009 and for 2010 a reversal of all preferred dividends in arrears upon conversion of the preferred CRA shares into Special Series A Shares, and the effect of redeemable share conversions. |

20

P&L Adjustments - Details

Consolidated Partnerships

Centerline’s operating results include the results of Tax Credit Fund Partnerships that are required to be consolidated pursuant to various accounting pronouncements, as well as

other Tax Credit Fund Partnerships and Property Partnerships that Centerline controls but in which it has little or no equity interest. As Centerline has virtually no economic interest

in these partnerships, the net losses they generated were allocated almost entirely to the Partnerships' investors. The consolidation, therefore, has an insignificant impact on net

income (loss), although certain Centerline operating results are eliminated in consolidation, and operating results of the consolidated partnerships are reflected in the income

statement.

other Tax Credit Fund Partnerships and Property Partnerships that Centerline controls but in which it has little or no equity interest. As Centerline has virtually no economic interest

in these partnerships, the net losses they generated were allocated almost entirely to the Partnerships' investors. The consolidation, therefore, has an insignificant impact on net

income (loss), although certain Centerline operating results are eliminated in consolidation, and operating results of the consolidated partnerships are reflected in the income

statement.

Given the above, the Company is presenting its operating results adjusted to exclude the impact of such partnerships’ consolidation.

Mortgage Revenue Bonds

For GAAP reporting purposes, consummation of the December 2007 Re-Securitization with Freddie Mac constituted a sale of the mortgage revenue bond investments, with the

exception of certain bonds for which our continuing involvement precluded sale treatment. The Company is presenting its operating results adjusted to reflect all mortgage

revenue bonds included in the December 2007 Re-Securitization as sold.

exception of certain bonds for which our continuing involvement precluded sale treatment. The Company is presenting its operating results adjusted to reflect all mortgage

revenue bonds included in the December 2007 Re-Securitization as sold.

ØThe balance sheet adjustments primarily relate to cash and deposits receivable which collateralize credit intermediation agreements, outstanding under a senior credit facility

with no recourse to Centerline, loss reserves for credit intermediation agreements, deferred income, and fees payable for the restructuring of certain credit intermediation

agreements.

with no recourse to Centerline, loss reserves for credit intermediation agreements, deferred income, and fees payable for the restructuring of certain credit intermediation

agreements.

ØThe income statement adjustments primarily relate to fee income on credit intermediation agreements, provision for losses on credit intermediation agreements, fee expense

relating to certain restructured credit intermediation agreements and equity income on the investment in Credit Risk Product subsidiaries.

relating to certain restructured credit intermediation agreements and equity income on the investment in Credit Risk Product subsidiaries.

Centerline Equity Issuer Trust (“EIT”)

Centerline’s operating results include the income related to Series A-1 Freddie Mac Certificates, and expenses related to preferred shares issued by EIT, a special purpose

entity. Such preferred shares are secured by EIT’s assets, are non-recourse to Centerline and shares are fully defeased in principle and maturity by the Freddie Mac A-1

certificates. Accordingly, the Company is presenting its operating results adjusted to exclude the impact of EIT’s consolidation.

entity. Such preferred shares are secured by EIT’s assets, are non-recourse to Centerline and shares are fully defeased in principle and maturity by the Freddie Mac A-1

certificates. Accordingly, the Company is presenting its operating results adjusted to exclude the impact of EIT’s consolidation.

ØThe balance sheet adjustments primarily relate to the removal of the Freddie Mac A-1 certificates, redeemable and non-redeemable preferred shares. The related

investment in the Equity Issuer Trust subsidiary reflects equity pick-ups calculated on a GAAP basis.

investment in the Equity Issuer Trust subsidiary reflects equity pick-ups calculated on a GAAP basis.

ØThe income statement adjustments primarily relate to interest income on the Freddie Mac A-1 certificates and interest expense and equity distributions related to

preferred shareholders.

preferred shareholders.

Credit Risk Products

In connection with the March 2010 Restructuring, a series of transactions were entered into whereby the Company’s and its Centerline Capital Group Inc. subsidiary’s obligations

under back to back credit default swaps issued to two counterparties where assigned and assumed by certain isolated special purpose entities, relieving the Company’s assets

from exposure to potential contingent liabilities. While the credit default counterparties have significant consent rights with respect to key activities of the isolated special purpose

entities, the Company consolidates the isolated special purpose entities for GAAP purposes. The Company has adjusted its operating results to reflect such isolated special

purpose entities as if they were equity method investments.

under back to back credit default swaps issued to two counterparties where assigned and assumed by certain isolated special purpose entities, relieving the Company’s assets

from exposure to potential contingent liabilities. While the credit default counterparties have significant consent rights with respect to key activities of the isolated special purpose

entities, the Company consolidates the isolated special purpose entities for GAAP purposes. The Company has adjusted its operating results to reflect such isolated special

purpose entities as if they were equity method investments.

21

Glossary