Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION - RED METAL RESOURCES, LTD. | ex5-1.htm |

| EX-23.1 - CONSENT - RED METAL RESOURCES, LTD. | ex23-1.htm |

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 13, 2011

REGISTRATION NO. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Red Metal Resources Ltd.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

20-2138504

|

||

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or

organization)

|

Classification Code Number)

|

Identification No.)

|

195 Park Avenue

Thunder Bay

Ontario, Canada P7B 1B9

(Address and telephone number of principal executive offices)

Caitlin Jeffs

Chief Executive Officer

195 Park Avenue

Thunder Bay

Ontario, Canada P7B 1B9

(807) 345-7384

(Name, address and telephone number of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Marcelle S. Balcombe, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, New York 10006

(212) 930-9700

(212) 930-9725 (fax)

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

(COVER CONTINUES ON FOLLOWING PAGE)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

¨ Large accelerated filer

¨ Accelerated filer

¨ Non-accelerated filer

x Smaller reporting company

CALCULATION OF REGISTRATION FEE

|

Title of Class of Securities to be Registered

|

Amount To

be Registered (1)

|

Proposed

Maximum

Aggregate

Price

Per Share (2)

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

||||||||||||

|

Common Stock, $0.001 par value per share

|

9,442,999 | $ | 0.46 | $ | 4,343,780 | $ | 504.31 | |||||||||

(1) Represents outstanding shares of common stock of Red Metal Resources Ltd and shares underlying warrants offered by the selling stockholders.

(2) Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on the Over the Counter Bulletin Board on May 4, 2011, which was $0.46 per share.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED MAY 13, 2011

RED METAL RESOURCES LTD

This prospectus relates to the public offering of up to 9,442,999 shares of common stock, par value $0.001 per share (the “Common Stock”) , of Red Metal Resources Ltd. by the selling stockholders. The total amount of shares consists of 4,623,333 shares of Common Stock, and 4,819,666 of Common Stock underlying warrants.

We will not receive any of the proceeds from the sale of Common Stock by the selling stockholder. However, we will receive proceeds from any exercise of the warrants into and up to 4,819,666 shares of our Common Stock, which are presently offered under this prospectus. We intend to use any proceeds received from the exercise, as the case may be, for working capital and other general corporate purposes. We, however, cannot assure you that any of the warrants will be exercised.

Our Common Stock is traded on the Over the Counter Bulletin Board (OTCBB) under the ticker symbol “RMES”. The last reported sales price was $0.46 on May 13, 2011.

We will pay the expenses of registering these shares.

Investment in the Common Stock involves a high degree of risk. You should consider carefully the risk factors beginning on page 4 of this prospectus before purchasing any of the shares offered by this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

RED METAL RESOURCES LTD.

TABLE OF CONTENTS

| Page | ||||||||

|

PART I – INFORMATION REQUIRED IN PROSPECTUS

|

||||||||

|

Prospectus Summary

|

1

|

|||||||

|

Risk Factors

|

4

|

|||||||

|

Forward-Looking Statements

|

7

|

|||||||

|

Use of Proceeds

|

8

|

|||||||

| Selling Security Holders | 8 | |||||||

|

Plan of Distribution

|

10

|

|||||||

|

Description of Securities to be Registered

|

11

|

|||||||

|

Interests of Named Experts and Counsel

|

11

|

|||||||

|

Description of Business

|

11

|

|||||||

|

Description of Property

|

26

|

|||||||

|

Legal Proceedings

|

26

|

|||||||

|

Management’s Discussion and Analysis or Plan of Operation

|

27

|

|||||||

|

Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

32

|

|||||||

|

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure

|

33

|

|||||||

|

Directors, Executive Officers, Promoters and Control Persons

|

34

|

|||||||

|

Executive Compensation

|

36

|

|||||||

|

Security Ownership of Certain Beneficial Owners and Management

|

37

|

|||||||

|

Certain Relationships and Related Transactions, and Corporate Governance

|

38

|

|||||||

|

Additional Information

|

39

|

|||||||

|

Disclosure Of Commission Position On Indemnification For Securities Act Liabilities

|

40

|

|||||||

|

Legal Matters

|

41

|

|||||||

|

Experts

|

41

|

|||||||

|

Financial Statements

|

42

|

|||||||

|

PART II—INFORMATION NOT REQUIRED IN PROSPECTUS

|

||||||||

|

Other Expenses of Issuance and Distribution

|

II-1

|

|||||||

|

Indemnification of Directors and Officers

|

II-1

|

|||||||

|

Recent Sales of Unregistered Securities

|

II-2

|

|||||||

|

Exhibits

|

II-3

|

|||||||

|

Undertakings

|

II-4

|

|||||||

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling stockholders are offering to sell and seeking offers to buy shares of our Common Stock, including shares they acquire upon exercise of their warrants, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the selling stockholders, the securities or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or any selling stockholder. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

Prospectus Summary

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including, the section entitled "Risk Factors" before deciding to invest in our Common Stock.

About Us

We are a start-up exploration stage company without operations. We are in the business of acquiring and exploring mineral claims. All of our claims are located in the III Region of Atacama, Chile. We have not determined whether our claims contain mineral reserves that are economically recoverable. We have not produced revenues from our principal business and are considered an exploration stage company as defined by “Accounting and Reporting by Development Stage Enterprises.”

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. To the best of our knowledge, and after consultation with an attorney knowledgeable in the practice of mining, we believe that we have taken the steps necessary to ensure that we have good title to our mineral claims. We have had our contracts and deeds notarized, recorded in the registry of mines and published in the mining bulletin and we review the mining bulletin regularly to determine whether other parties have staked claims over our ground. We have discovered no such claims.

Chile’s mining and land tenure policies were established to secure the property rights of both domestic and foreign investors to stimulate development of mining in Chile. The government of Chile owns all mineral resources, but exploration and exploitation of these resources are permitted through exploration and mining concessions. A mineral concession must pass through three stages to become a permanent mining concession, namely, pedimento, manifestacion and mensura.

A pedimento is an initial exploration claim. It can be placed on any area, whereas the survey to establish a permanent mensura claim can only be completed on free areas where no other mensuras exist. A pedimento is valid for a maximum of two years. At the end of this period it may either be reduced in size by at least 50% and renewed for an additional two years or entered into the manifestacion process to establish a permanent mensura claim. New pedimentos can overlap existing pedimentos, but the pedimento with the earliest filing date takes precedence providing the claim holder maintains the pedimento in accordance with the mining code and the applicable regulations.

Manifestacion is the process by which a pedimento is converted to a permanent mining claim. At any stage during its two-year life, the holder of a pedimento can submit a manifestacion application, which is valid for 220 days. To begin the manifestacion process, the owner must request a survey (mensura) within 220 days. After the survey request is accepted, the owner has approximately 12 months to have the claim surveyed by a government-licensed surveyor, inspected and approved by the national mining service, and affirmed as a mensura (equivalent to a patented claim) by a judge. Thereafter, an abstract describing the claim is published in Chile’s official mining bulletin (published weekly) and 30 days later the claim is inscribed in the appropriate mining registry.

A mensura is a permanent property right that does not expire so long as the annual fees (patentes) are paid in a timely manner. Failure to pay the patentes for an extended period can result in the claim being listed for sale at auction, where a third party can acquire a claim for the payment of the back taxes owed and a penalty.

In Chile, we have both pedimento and mensura claims. We cannot guarantee that any of our pedimento claims will convert to mensura claims. Some of our pedimentos are still in the registration process and some are in the manifestacion stage. We may decide, for geologic, economic or other reasons, not to complete a registration or manifestacion or to abandon a claim after it is registered. Some of our pedimentos may have been staked over other owners’ claims as permitted by the Chilean mining code. Our pedimento rights in these claims will not crystallize unless the owners of the underlying claims fail to pay their taxes or otherwise forfeit their interests in their claims. Our purpose in over-staking is to claim free ground around others’ claims and to have the first right to forfeited claims if we want them. Over-staking is easier and less costly than staking available ground around claims and ensures that all available ground is covered that might otherwise be missed.

We have a close working relationship with Minera Farellon Limitada, a Chilean company owned equally by Kevin Mitchell, Polymet’s legal representative in Chile, and Richard Jeffs, the father of our president who holds more than 5% of our shares of Common Stock. Minera Farellon investigates potential claims and often ties them up by staking new claims, optioning existing claims, or buying others’ claims, all at its cost. This gives us an opportunity to review the claims to decide whether they are of interest to us. If we are interested, then we either proceed to acquire an interest in the property directly from the owner, or, if Minera Farellon has already obtained an interest, we take an option to acquire its interest. Minera Farellon, which is located in the city of Vallenar, also provides all of our logistical support in Vallenar under month-to-month contracts, which enables us to limit our operating expenses to those needed from time to time.

1

Corporate History

Red Metal Resources Ltd. was incorporated in Nevada on January 10, 2005 as Red Lake Exploration, Inc. We changed our name to Red Metal Resources Ltd. on August 27, 2008.

On August 21, 2007, we formed Minera Polymet Limitada, a limited liability company, under the laws of the Republic of Chile. We own 99% of Polymet, which holds our Chilean mineral property interests. Under Chilean law, a resident of Chile must be a shareholder in a limitada. To meet this requirement, 1% of Polymet is owned by a Chilean resident, an experienced manager who has organized an office and other resources for us to use and is Polymet’s legal representative in Chile. Polymet’s office is located in Vallenar, III Region of Atacama, Chile.

Our resident agent’s office is at 711 S. Carson Street, Suite 4, Carson City, Nevada, 89701. Our business office is at 195 Park Avenue, Thunder Bay, Ontario, Canada, P7B 1B9. Our telephone number is (807) 345-7384; our email address is info@redmetalresources.com; and our web address is www.redmetalresources.com. Information on our web site is not a part of this registration statement.

Our shares of common stock are traded on the Over the Counter Bulletin Board under the ticker symbol “RMES”

As used in this prospectus and the registration statement of which it forms a part, the terms the “Company”, “we”, “us”, or “our” refer to Red Metal Resources Ltd. and its subsidiaries, unless the context indicates otherwise.

About This Offering

This prospectus includes 9,442,999 shares of Common Stock offered by the selling stockholders identified in the Selling Security Holders section of this registration statement on Form S-1.

On April 7, 2011, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with certain investors for the sale of 6,723,333 units at a price of $.30 per unit (the “Units”) (the “Offering”) for gross proceeds of $2,017,000. Each Unit consists of one share of Common Stock (the “Shares”) and one warrant to purchase one share of Common Stock (the “Warrants”). The Warrants have an exercise price of $0.50 per share and are exercisable for a period of two years. The Warrants contain a call provision, which allows the Company to call the warrants upon the occurrence of certain conditions.

If, after the effective date of a registration statement providing for the resale of the Warrants, (i) the Volume Weighted Average Price (as defined in the Warrant), for each of 20 consecutive business days (“Measurement Period”) exceeds $0.75, (ii) the average daily volume during the Measurement Period exceeds $50,000 per business day; and (iii) the holder of the Warrant is not in possession of any information that constitutes, or might constitute, material non-public information which was provided by the Company, then the Company may, within 5 business days of the end of such Measurement Period, call for cancellation of all or any portion of the Warrants for consideration equal to $0.001 per share.

Pursuant to the terms of the Registration Rights Agreement entered into with certain of the investors on April 7, 2011, the Company agreed to prepare and file a registration statement with the Securities and Exchange Commission registering the resale of the shares of Common Stock and the shares underlying the Warrants on or prior to 60 days following the closing date and to use its best efforts to have such registration statement declared effective by the 120th day after filing.

The net proceeds to the Company from the Offering, after deducting placement agent fees and estimated offering expenses, are approximately $1,862,462. The Offering closed on April 7, 2011.

Brimberg & Co. served as a placement agent for the Offering and received a cash commission of $58,900 and a warrant to purchase 196,333 shares of Common Stock calculated based upon the purchasers introduced to the Company by Brimberg.

The Company relied upon an exemption from registration afforded by Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 of Regulation D promulgated under the Securities Act or Rule 903 of Regulation S promulgated under the Securities Act.

The foregoing summaries of the terms of the Securities Purchase Agreement, the Registration Rights Agreement and the Warrants, are subject to, and qualified in their entirety by, such documents attached hereto as Exhibits 10.30, 10.31 and 10.32, respectively, and are incorporated herein by reference.

2

Summary of the Shares offered by the Selling Stockholder

The following is a summary of the shares being offered by the selling stockholder:

|

Common Stock offered by the selling stockholder

|

Up to 9,442,999 shares of Common Stock.

|

|

Common Stock outstanding prior to the Offering

|

16,939,634 (1)

|

|

Common Stock to be outstanding after the Offering

|

21,759,301(2)

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the Common Stock hereunder. However, we will receive proceeds from any exercise or conversion of the warrants into and up to 4,819,666 shares of our Common Stock, which are presently offered under this prospectus. We intend to use any proceeds received from the exercise or conversion, as the case may be, for working capital and other general corporate purposes. We, however, cannot assure you that any of the warrants will be exercised or converted.

|

|

|

(1)

|

Based upon the total number of issued and outstanding shares as of May 13, 2011.

|

|

|

(2)

|

The total amount of Common Stock assuming all shares of Common Stock underlying the Warrants offered under this prospectus are exercised and issued.

|

3

RISK FACTORS

In addition to the factors discussed elsewhere in this registration statement, the following risks and uncertainties could materially adversely affect our business, financial condition and results of operations. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and financial condition.

Risks Related to Our Business

During the fiscal years ended January 31, 2010 and 2011 we earned no royalty revenue while our operating expenses totalled $710,745 and $672,618, respectively. If we do not find sources of financing as and when we need them, we may be required to cease our operations.

Mineral exploration and development are very expensive. During the fiscal year that ended on January 31, 2010, we earned no royalty revenue while our operating expenses totalled $710,745. During the fiscal year that ended on January 31, 2011 we earned no royalty revenue while our operating expenses totalled $672,618. This resulted in a total accumulated loss of $3,056,819 since inception. As of January 31, 2011 we had cash of $8,655. Since our inception we have sold our securities and borrowed money to fund our operations. Our ability to continue our operations, including exploring and developing our properties, will depend on our ability to generate operating revenue, obtain additional financing, or enter into joint venture agreements. We raised $2,017,000 in gross proceeds through a PIPE financing in April 2011. We anticipate that these funds will allow us to continue the current development of our Farellon and Mateo projects for the next 12 months. We have signed a joint venture earn-in agreement with Revonergy Inc. on our Perth property that requires Revonergy Inc. to pay for exploration programs on the Perth property for the next three years. We are continually reviewing potential properties to add to our portfolio. Suitable acquisitions and project development will require additional financing. Until we earn enough revenue to support our operations, which may never happen, we will continue to be dependent on loans and sales of our equity or debt securities to continue our development and exploration activities. If we do not find sources of financing as and when we need them, we may be required to severely curtail, or even to cease, our operations.

Our auditors have expressed substantial doubt about our ability to continue as a going concern; as a result we could have difficulty finding additional financing.

Our financial statements have been prepared assuming that we will continue as a going concern. Except for approximately $16,000 of royalty income that we received in the 2009 fiscal year from Minera Farellón, we have not generated any revenue since inception and have accumulated losses. As a result, our auditors have expressed substantial doubt about our ability to continue as a going concern. Our ability to continue our operations depends on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that could result from the outcome of this uncertainty.

Unfavorable economic conditions may have a material adverse effect on us since raising capital to continue our operations could be more difficult.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets and a general decline in the value of real property, have created a difficult operating environment for our businesses and other companies in our industry. Depending upon the ultimate severity and duration of any economic downturn, the resulting effects on Red Metal could be materially adverse if it is unable to raise the working capital required to carry out its business plan.

Our business was formed in January 2005 and our operations, to date, have earned only minimal revenues. Due to the high costs of acquiring and exploring claims, we may never be profitable. We expect to continue to incur operating losses during the next 12 months.

We were incorporated on January 10, 2005 and to date have been involved primarily in organizational activities, acquiring and exploring mineral claims and obtaining financing. We have earned minimal revenues and we are not profitable. Whether we will be successful as a mining company must be considered in light of the costs, difficulties, complications and delays associated with our proposed exploration programs. These potential problems include, but are not limited to, finding claims with mineral deposits that can be cost-effectively mined, the costs associated with acquiring the properties and the unavailability of human or equipment resources. We have a very short history and had no more than minimal operations until April 25, 2008 when we acquired the mining claims known as Farellon Alto 1 – 8 in Chile. We cannot assure you that we will ever generate significant revenue from our operations or realize a profit. We expect to continue to incur operating losses during the next 12 months.

Our joint development and operating arrangements may not be successful.

We have in the past, and may in the future, enter into joint venture arrangements in order to share the risks and costs of developing and operating properties. In a typical joint venture arrangement, the partners own a proportionate share of the assets, are entitled to indemnification from each other and are only responsible for any future liabilities in proportion to their interest in the joint venture. If a party fails to perform its obligations under a joint venture agreement, we could incur liabilities and losses in excess of our pro-rata share of the joint venture. We make investments in exploration and development projects that may have to be written off in the event we do not proceed to a commercially viable mining operation.

4

On March 14, 2011, our subsidiary, Minera Polymet, granted the right to earn a 50% joint venture interest in the Perth Property to Revonergy Inc. For more information on the terms of the agreement, see Perth property joint venture earn-in agreement in the discussion in this Registration Statement titled “Business”.

In some instances members of the board of directors or an officer may be liable for losses incurred by holders of our common stock. If a shareholder were to prevail in such an action in the U.S., it may be difficult for the shareholder to enforce the judgment against any of our directors or officers, who are not U.S. residents.

In certain instances, such as trading securities based on material non-public information, a director may incur liability to shareholders for losses sustained by the shareholders as a result of the director’s or officer’s illegal or negligent activity. However, all of our directors and officers live and maintain a substantial portion of their assets outside the U.S. As a result it may be difficult or impossible to effect service of process within the U.S. upon these directors and officers or to enforce in the courts any judgment obtained here against them predicated upon any civil liability provisions of the U.S. federal securities laws.

Foreign courts may not entertain original actions predicated solely upon U.S. federal securities laws against these directors; and judgments predicated upon any civil liability provisions of the U.S. federal securities laws may not be directly enforceable in foreign countries.

As a result of the foregoing, it may be difficult or impossible for a shareholder to recover from any of these directors or officers if, in fact, the shareholder is damaged as a result of the negligent or illegal activity of an officer or director.

Mineral exploration is highly speculative and risky: we might not find mineral deposits that can be extracted cost effectively on our claims.

Exploration for mineral deposits is a speculative venture involving substantial risk. Problems such as unusual and unexpected rock formations often result in unsuccessful exploration efforts. We cannot assure you that our claims contain mineral deposits that can be extracted cost effectively.

Mineral exploration is hazardous. We could incur liability or damages as we conduct our business due to the dangers inherent in mineral exploration.

The search for minerals is hazardous. We could become liable for hazards such as pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We have no insurance for these kinds of hazards, nor do we expect to get such insurance for the foreseeable future. If we were to suffer from such a hazard, the costs of rectifying it could exceed our asset value and require that we liquidate our assets.

In the future we may be required to comply with government regulations affecting mineral exploration and exploitation, which could adversely affect our business, the results of our operations and our financial condition.

The mining business is subject to various levels of government control and regulation, which are supplemented and revised from time to time. We cannot predict what legislation or revisions might be proposed that could affect our business or when any such proposals, if enacted, might become effective. Our exploration activities are subject to laws and regulations governing worker safety, and, if we explore within the national park that is part of our Farellon property, protection of endangered and other special status species. The cost of complying with these regulations has not been burdensome to date, but if we mine our properties and process more than 5,000 tonnes of ore monthly on our properties, we will be required to submit an environmental impact study for review and approval by the federal environmental agency. We anticipate that the cost of such a study will be significant. If the study were to show too great an adverse impact on the environment, we might be unable to develop the property or we might have to engage in expensive remedial measures during or after developing the property, which could make production unprofitable. This requirement could materially adversely affect our business, the results of our operations and our financial condition if we were to proceed to mine a property or process ore on the property. We have no immediate or intermediate plans to process ore on any of our properties.

If we do not comply with applicable environmental and health and safety laws and regulations, we could be fined, enjoined from continuing our operations, and suffer other penalties. Although we make every attempt to comply with these laws and regulations, we cannot assure you that we have fully complied or will always fully comply with them.

We might not be able to market any minerals that we find on our mineral claims due to market factors that are beyond our control.

Even if we discover minerals that can be extracted cost-effectively, we may not be able to find a ready market for our minerals. Many factors beyond our control affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting minerals and environmental protection. We cannot accurately predict the effect of these factors, but any combination of these factors could result in an inadequate return on invested capital.

5

We are not certain that we can successfully compete in the mineral exploration business. We do not represent a significant presence in this industry.

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are one of the smallest exploration companies and we do not represent a significant presence in the mineral exploration business. Being a junior mineral exploration company, we compete with other similar companies for financing and joint venture partners, and for resources such as professional geologists, camp staff, helicopters and mineral exploration contractors and supplies. We may not have the means to compete successfully for these resources.

We conduct operations in a foreign jurisdiction, and are subject to certain risks that may limit or disrupt our business operations.

Our head office is in Canada; and our mining operations are in Chile. Mining investments are subject to the risks normally associated with the conduct of any business in foreign countries including uncertain political and economic environments; wars, terrorism and civil disturbances; changes in laws or policies, including those relating to imports, exports, duties and currency; cancellation or renegotiation of contracts; royalty and tax increases or other claims by government entities, including retroactive claims; risk of expropriation and nationalization; delays in obtaining or the inability to obtain or maintain necessary governmental permits; currency fluctuations; restrictions on the ability of local operating companies to sell gold, copper or other minerals offshore for U.S. dollars, and on the ability of such companies to hold U.S. dollars or other foreign currencies in offshore bank accounts; import and export regulations, including restrictions on the export of gold, copper or other minerals; limitations on the repatriation of earnings; and increased financing costs.

These risks could limit or disrupt our exploration programs, cause us to lose our interests in our mineral claims, restrict the movement of funds, cause us to spend more than we expected, deprive us of contract rights or result in our operations being nationalized or expropriated without fair compensation, and could materially adversely affect our financial position or the results of our operations. If a dispute arises from our activities in Chile, we could be subject to the exclusive jurisdiction of courts outside North America, which could adversely affect the outcome of the dispute.

While we take the steps we believe are necessary to maintain legal ownership of our claims, title to mineral claims may be invalidated for a number of reasons, including errors in the transfer history or our acquisition of a claim we believed, after appropriate due diligence investigation, to be valid, but in fact, was not. If ownership of our claims was ultimately determined to be invalid, our business and prospects would likely be materially and adversely affected.

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. We take a number of steps to protect the legal ownership of our claims, including having our contracts and deeds notarized, recording these documents with the registry of mines and publishing them in the mining bulletin. We also review the mining bulletin regularly to determine whether other parties have staked claims over our ground. However, none of these steps guarantees that another party could not challenge our right to a claim. Any such challenge could be costly to defend and, if we lost our claim, our business and prospects would likely be materially and adversely affected.

We cannot guarantee that any of our pedimento claims will convert to mensura claims.

Some of our exploration claims (pedimentos) are still in the registration process. We cannot guarantee that any of our pedimento claims will convert to mining claims (mensuras). Some of our Mateo pedimentos may have been staked over other owners’ claims, as permitted by the Chilean mining code. The pedimento with the earliest filing date takes precedence providing the claim holder maintains its claim in accordance with the mining code and the applicable regulations. Our pedimento rights in these claims will not crystallize unless the owners of the underlying claims fail to pay their taxes or otherwise forfeit their interests in their claims. We will exercise any right that we acquire through forfeiture only if the ground remains of interest to us.

We sometimes hold a significant portion of our cash in United States dollars, which could weaken our purchasing power in other currencies and limit our ability to conduct our exploration programs.

Currency fluctuations could affect the costs of our operations and affect our operating results and cash flows. Gold and copper are sold throughout the world based principally on the U.S. dollar price, but most of our operating expenses are incurred in local currencies, such as the Canadian dollar and the Chilean peso. The appreciation of other currencies against the U.S. dollar can increase the costs of our operations.

We sometimes hold a significant portion of our cash in U.S. dollars. Currency exchange rate fluctuations can result in conversion gains and losses and diminish the value of our U.S. dollars. If the U.S. dollar declined significantly against the Canadian dollar or the Chilean peso, our U.S.-dollar purchasing power in Canadian dollars and Chilean pesos would also significantly decline and we would not be able to afford to conduct our mineral exploration programs. We have not entered into derivative instruments to offset the impact of foreign exchange fluctuations.

6

Risks Related to Our Common Stock

Because our directors are not independent they can make and control corporate decisions that may be disadvantageous to other common shareholders.

Our securities are not listed on a national securities exchange or quoted on an inter-dealer quotation system that requires that directors be independent. Using the definition of “independent” in Section 803 of the Rules of the NYSE Amex, we have determined that none of our directors are independent. Our directors have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations, and the sale of all or substantially all of our assets. They also have the power to prevent or cause a change in control. The interests of our directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

Our Common Stock is quoted on the OTC Bulletin Board, which may have an unfavorable impact on our stock price and liquidity.

Our Common Stock is quoted on the OTC Bulletin Board. The OTC Bulletin Board is a significantly more limited market than the New York Stock Exchange or NASDAQ stock markets. The quotation of our shares on the OTC Bulletin Board means there is a less liquid market available for existing and potential stockholders to trade shares of our Common Stock. The limited liquidity could depress the trading price of our Common Stock and could have a long-term adverse impact on our ability to raise capital in the future.

We do not expect to declare or pay dividends in the foreseeable future.

We have never paid cash dividends on our common stock and have no plans to do so in the foreseeable future. We intend to retain any earnings to develop, carry on, and expand our business.

You may be diluted if we issue additional equity securities.

We anticipate issuing additional equity securities in the future. There can be no assurance that the pricing of any such additional securities will not be lower than the price at which you purchased your securities in this Offering. If and when we issue additional securities, it is possible that your percentage interest in us will be diluted further.

“Penny stock” rules may make buying or selling our common stock difficult, and severely limit its marketability and liquidity.

Trading in shares of our common stock is subject to regulations adopted by the SEC commonly known as the “penny stock” rules. The additional burdens imposed upon broker-dealers by the penny stock rules could discourage broker-dealers from participating in transactions involving shares of our common stock, which could severely limit its marketability and liquidity. Under the penny stock rules, broker-dealers participating in penny-stock transactions must first deliver to their customer a risk disclosure document describing the risks associated with penny stocks, the broker-dealer’s duties in selling the stock, the customer’s rights and remedies, and certain market and other information. The broker-dealer must determine the customer’s suitability for penny- stock transactions based on the customer’s financial situation, investment experience and objectives. Broker-dealers must also disclose these restrictions in writing to the customer, obtain specific written consent from the customer, and provide monthly account statements to the customer. The effect of these restrictions can decrease broker-dealers’ willingness to make a market in our shares of common stock, decrease the liquidity of our common stock, and increase transaction costs for sales and purchases of our common stock as compared to other securities.

FORWARD-LOOKING STATEMENTS

Statements in this prospectus may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this prospectus, including the risks described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus and in other documents which we file with the Securities and Exchange Commission. In addition, such statements could be affected by risks and uncertainties related to our ability to raise any financing which we may require for our operations, competition, government regulations and requirements, pricing and development difficulties, our ability to make acquisitions and successfully integrate those acquisitions with our business, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this prospectus, except as may be required under applicable securities laws.

7

USE OF PROCEEDS

We will receive no proceeds from the sale of shares of Common Stock offered by the selling stockholders. However, we will receive proceeds from any exercise or conversion of the warrants into and up to 4,819,666 shares of our Common Stock, which are presently offered under this prospectus. We intend to use any proceeds received from the exercise or conversion, as the case may be, for working capital and other general corporate purposes. We, however, cannot assure you that any of the warrants will be exercised or converted.

SELLING SECURITY HOLDERS

This prospectus includes 9,442,999 shares of Common Stock offered by the selling stockholders, consisting of 4,623,333 shares of Common Stock and 4,819,666 shares of Common Stock underlying Warrants.

The following table details the names of the selling stockholders, the number of shares owned by the selling stockholders, and the number of shares that may be offered by the selling stockholders for resale under this prospectus. The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the selling stockholder has sole or shared voting power or investment power and also any shares, which the selling stockholder has the right to acquire within 60 days. Applicable percentage ownership is based on 16,939,634 shares of Common Stock outstanding as of May 13, 2011, together with securities exercisable or convertible into shares of Common Stock within 60 days of such date for the stockholder. Number and percentage owned after the Offering assumes the sale of all shares offered under this prospectus. All shares of common stock offered under this prospectus are currently issued and outstanding. Other than Brimberg & Co., a registered broker-dealer, and Theodore Marolda, an affiliate of a registered broker-dealer, the selling stockholders are not broker-dealers or affiliates of broker-dealers. The selling stockholders may sell up to 9,442,999 shares of our Common Stock from time to time in one or more offerings under this prospectus. Because the selling stockholders may offer all, some or none of the shares they hold, and because, based upon information provided to us, there are currently no agreements, arrangements, or understandings with respect to the sale of any of the shares, no definitive estimate as to the number of shares that will be held by the selling stockholders after the Offering can be provided. The following table has been prepared on the assumption that all shares offered under this prospectus will be sold to parties unaffiliated with the selling stockholders.

|

Table 1: Selling Security Holders

|

||||||||||||||||

|

Name of Selling

Stockholder

|

Beneficial

Ownership (1)

Prior to

the

Offering

|

Shares of

Common

Stock

Included in

Prospectus

|

Beneficial

Ownership

After the

Offering(2)

|

Percentage

Owned

After the

Offering

|

||||||||||||

|

Robert Andjelic

|

0 | 5,000,000 | (3) | 0 | 0 | |||||||||||

|

Lawrence J. Manolda

|

0 | 66,666 | (4) | 0 | 0 | |||||||||||

|

John R. Low-Beer

|

0 | 60,000 | (5) | 0 | 0 | |||||||||||

|

John F. Kohn

|

0 | 200,000 | (6) | 0 | 0 | |||||||||||

|

Douglas Thunen

|

0 | 300,000 | (7) | 0 | 0 | |||||||||||

|

Christopher G. Thunen

|

0 | 200,000 | (8) | 0 | 0 | |||||||||||

|

Cynthia A. Kohn

|

0 | 300,000 | (9) | 0 | 0 | |||||||||||

|

The Thunen Family Trust

|

0 | 400,000 | (10) | 0 | 0 | |||||||||||

|

ALB Private Investments, LLC

|

0 | 800,000 | (11) | 0 | 0 | |||||||||||

|

Phyllis Esposito

|

0 | 600,000 | (12) | 0 | 0 | |||||||||||

|

Anthony Low-Beer

|

0 | 1,000,000 | (13) | 0 | 0 | |||||||||||

|

Fred Rabiner

|

45,000 | 60,000 | (14) | 45,000 | 0.26 | |||||||||||

|

Amir Vahabzadeh

|

0 | 40,000 | (15) | 0 | 0 | |||||||||||

|

Jonathan Davidson

|

40,000 | 133,334 | (16) | 40,000 | 0.24 | |||||||||||

|

David Donaldson

|

0 | 66,666 | (17) | 0 | 0 | |||||||||||

|

Adam Rabiner

|

25,120 | 20,000 | (18) | 25,120 | 0.15 | |||||||||||

|

Theodore Marolda

|

0 | 98,167 | (19) | 0 | 0 | |||||||||||

|

Brimberg & Co.

|

0 | 98,166 | (20) | 0 | 0 | |||||||||||

|

Total

|

110,120 | 9,442,999 | 110,120 | 0.65 | ||||||||||||

8

|

(1)

|

Under applicable SEC rules, a person is deemed to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner” of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the security, in each case, irrespective of the person’s economic interest in the security. Each listed selling stockholder has the sole investment and voting power with respect to all shares of Common Stock shown as beneficially owned by such selling stockholder, except as otherwise indicated in these footnotes.

|

|

(2)

|

As of May 13, 2011, there were 16,939,634 shares of our Common Stock issued and outstanding. In determining the percent of Common Stock beneficially owned by a selling shareholder as of May 13, 2011, (a) the numerator is the number of shares of Common Stock beneficially owned by such selling shareholder (including the shares that he has the right to acquire within 60 days of May 13, 2011), and (b) the denominator is the sum of (i) the 16,939,634 shares of Common Stock outstanding on May 13, 2011 and (ii) the number of shares of Common Stock which such selling shareholder has the right to acquire within 60 days of May 13, 2011.

|

|

(3)

|

Represents (a) 2,500,000 shares of common stock and (b) 2,500,000 shares of common stock issuable upon exercise of warrants.

|

|

(4)

|

Represents (a) 33,333 shares of common stock and (b) 33,333 shares of common stock issuable upon exercise of warrants.

|

|

(5)

|

Represents (a) 30,000 shares of common stock and (b) 30,000 shares of common stock issuable upon exercise of warrants.

|

|

(6)

|

Represents (a) 100,000 shares of common stock and (b) 100,000 shares of common stock issuable upon exercise of warrants.

|

|

(7)

|

Represents (a) 150,000 shares of common stock and (b) 150,000 shares of common stock issuable upon exercise of warrants.

|

|

(8)

|

Represents (a) 100,000 shares of common stock and (b) 100,000 shares of common stock issuable upon exercise of warrants.

|

|

(9)

|

Represents (a) 150,000 shares of common stock and (b) 150,000 shares of common stock issuable upon exercise of warrants.

|

|

(10)

|

Represents (a) 200,000 shares of common stock and (b) 200,000 shares of common stock issuable upon exercise of warrants. Garret G. Thunen and Carol Thunen, as trustees of the Thunen Family Trust, have the voting and dispositive power over the securities held for the account of this selling security holder.

|

|

(11)

|

Represents (a) 400,000 shares of common stock and (b) 400,000 shares of common stock issuable upon exercise of warrants. Francis A. Mlynarczyk, Jr. has the sole voting and dispositive power over the securities held for the account of this selling security holder.

|

|

(12)

|

Represents (a) 300,000 shares of common stock and (b) 300,000 shares of common stock issuable upon exercise of warrants.

|

|

(13)

|

Represents (a) 500,000 shares of common stock and (b) 500,000 shares of common stock issuable upon exercise of warrants. Anthony Low-Beer is a member of Scarsdale Equities LLC, a FINRA member firm.

|

|

(14)

|

Represents (a) 30,000 shares of common stock and (b) 30,000 shares of common stock issuable upon exercise of warrants.

|

|

(15)

|

Represents (a) 20,000 shares of common stock and (b) 20,000 shares of common stock issuable upon exercise of warrants.

|

|

(16)

|

Represents (a) 66,667 shares of common stock and (b) 66,667 shares of common stock issuable upon exercise of warrants.

|

|

(17)

|

Represents (a) 33,333 shares of common stock and (b) 33,333 shares of common stock issuable upon exercise of warrants.

|

|

(18)

|

Represents (a) 10,000 shares of common stock and (b) 10,000 shares of common stock issuable upon exercise of warrants.

|

|

(19)

|

Represents 98,167 shares of common stock issuable upon exercise of placement agent warrants. Mr. Marolda is a registered representative of Brimberg & Co., a registered broker-dealer. The placement agent warrants were received as compensation for placement agent services.

|

|

(20)

|

Represents 98,166 shares of common stock issuable upon exercise of placement agent warrants. The warrants were issued as part of the consideration for placement agent services to the Company. Brimberg and Co. is a registered broker-dealer. Jack Brimberg has the sole voting and dispositive power over the securities held for the account of this selling security holder.

|

9

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. We have not been advised of any arrangements by the selling stockholders for the sale of any of the common stock owned by them.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

•

|

crosses, where the same broker acts as an agent on both sides of the trade;

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

•

|

privately negotiated transactions;

|

|

•

|

short sales;

|

|

•

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

•

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

•

|

a combination of any such methods of sale; and

|

|

•

|

any other method permitted pursuant to applicable law.

|

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus; provided, however, that prior to any such transfer the following information (or such other information as may be required by the federal securities laws from time to time) with respect to each such selling beneficial owner must be added to the prospectus by way of a prospectus supplement or post-effective amendment, as appropriate: (1) the name of the selling beneficial owner; (2) any material relationship the selling beneficial owner has had within the past three years with us or any of our predecessors or affiliates; (3) the amount of securities of the class owned by such security beneficial owner before the transfer; (4) the amount to be offered for the security beneficial owner’s account; and (5) the amount and (if one percent or more) the percentage of the class to be owned by such security beneficial owner after the transfer is complete.

10

DESCRIPTION OF SECURITIES TO BE REGISTERED

This prospectus includes 9,442,999 shares of our Common Stock offered by the selling stockholders. The following description of our Common Stock is only a summary. You should also refer to our certificate of incorporation and bylaws, which have been filed as exhibits to the registration statement of which this prospectus forms a part.

Our authorized capital stock consists of 500,000,000 shares of common stock at a par value of $0.001 per share.

Common stock

As at May 13, 2011, 16,939,634 shares of common stock were issued and outstanding and held by 74 shareholders of record.

Holders of our Common Stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of Common Stock do not have cumulative voting rights. Holders of a majority of the shares of Common Stock voting for the election of directors can elect all of the directors. Holders of three percent of our shares of Common Stock issued and outstanding, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to make certain fundamental corporate changes such as a liquidation, a merger or an amendment to our Articles of Incorporation.

Holders of Common Stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the Common Stock. Holders of our Common Stock have no preemptive rights, no conversion rights and there are no redemption provisions applicable to our Common Stock.

Section 2.3 of article 2 of our bylaws states that a special meeting of our stockholders may be called at any time only by the president or the secretary, by the resolution of the board of directors, or on the written request of stockholders owning a majority of our issued and outstanding voting shares. This provision could prevent stockholders from calling a special meeting because, unless certain significant stockholders were to join with them, they might not obtain the majority necessary to request the meeting. Therefore, stockholders holding less than a majority of the issued and outstanding common stock, without the assistance of management, may be unable to propose a vote on any transaction that would delay, defer or prevent a change of control, even if the transaction were in the best interests of our stockholders.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis or had, or is to receive, in connection with the Offering, any interest, directly or indirectly, in the registrant or any of its parents or subsidiaries.

DESCRIPTION OF BUSINESS

General

We are a start-up exploration stage company without operations. We are in the business of acquiring and exploring mineral claims. All of our claims are located in the III Region of Atacama, Chile. We have not determined whether our claims contain mineral reserves that are economically recoverable. We have not produced revenues from our principal business and are considered an exploration stage company as defined by “Accounting and Reporting by Development Stage Enterprises.”

Our ability to realize a return on our investment in mineral claims depends upon whether we maintain the legal ownership of the claims. Title to mineral claims involves risks inherent in the process of determining the validity of claims and the ambiguous transfer history characteristic of many mineral claims. To the best of our knowledge, and after consultation with an attorney knowledgeable in the practice of mining, we believe that we have taken the steps necessary to ensure that we have good title to our mineral claims. We have had our contracts and deeds notarized, recorded in the registry of mines and published in the mining bulletin and we review the mining bulletin regularly to determine whether other parties have staked claims over our ground. We have discovered no such claims.

Chile’s mining and land tenure policies were established to secure the property rights of both domestic and foreign investors to stimulate development of mining in Chile. The government of Chile owns all mineral resources, but exploration and exploitation of these resources are permitted through exploration and mining concessions. A mineral concession must pass through three stages to become a permanent mining concession, namely, pedimento, manifestacion and mensura.

A pedimento is an initial exploration claim. It can be placed on any area, whereas the survey to establish a permanent mensura claim can only be completed on free areas where no other mensuras exist. A pedimento is valid for a maximum of two years. At the end of this period it may either be reduced in size by at least 50% and renewed for an additional two years or entered into the manifestacion process to establish a permanent mensura claim. New pedimentos can overlap existing pedimentos, but the pedimento with the earliest filing date takes precedence providing the claim holder maintains the pedimento in accordance with the mining code and the applicable regulations.

11

Manifestacion is the process by which a pedimento is converted to a permanent mining claim. At any stage during its two-year life, the holder of a pedimento can submit a manifestacion application, which is valid for 220 days. To begin the manifestacion process, the owner must request a survey (mensura) within 220 days. After the survey request is accepted, the owner has approximately 12 months to have the claim surveyed by a government-licensed surveyor, inspected and approved by the national mining service, and affirmed as a mensura (equivalent to a patented claim) by a judge. Thereafter, an abstract describing the claim is published in Chile’s official mining bulletin (published weekly) and 30 days later the claim is inscribed in the appropriate mining registry.

A mensura is a permanent property right that does not expire so long as the annual fees (patentes) are paid in a timely manner. Failure to pay the patentes for an extended period can result in the claim being listed for sale at auction, where a third party can acquire a claim for the payment of the back taxes owed and a penalty.

In Chile, we have both pedimento and mensura claims. We cannot guarantee that any of our pedimento claims will convert to mensura claims. Some of our pedimentos are still in the registration process and some are in the manifestacion stage. We may decide, for geologic, economic or other reasons, not to complete a registration or manifestacion or to abandon a claim after it is registered. Some of our pedimentos may have been staked over other owners’ claims as permitted by the Chilean mining code. Our pedimento rights in these claims will not crystallize unless the owners of the underlying claims fail to pay their taxes or otherwise forfeit their interests in their claims. Our purpose in over-staking is to claim free ground around others’ claims and to have the first right to forfeited claims if we want them. Over-staking is easier and less costly than staking available ground around claims and ensures that all available ground is covered that might otherwise be missed.

We have a close working relationship with Minera Farellon Limitada, a Chilean company owned equally by Kevin Mitchell, Polymet’s legal representative in Chile, and Richard Jeffs, the father of our president, who holds more than 5% of our shares of Common Stock. Minera Farellon investigates potential claims and often ties them up, either by staking new claims or optioning or buying others’ claims, all at its cost. This gives us an opportunity to review the claims to decide whether they are of interest to us. If we are interested, then we either proceed to acquire an interest in the property directly from the owner, or, if Minera Farellon has already obtained an interest, we take an option to acquire its interest. Minera Farellon, which is located in the city of Vallenar, also provides all of our logistical support in Vallenar under month-to-month contracts, which enables us to limit our operating expenses to those needed from time to time.

Unproved mineral properties

We have three active properties—the Farellon, Mateo, and Perth—consisting of both mining claims and exploration claims that we have assembled since the beginning of 2007.

12

Active properties

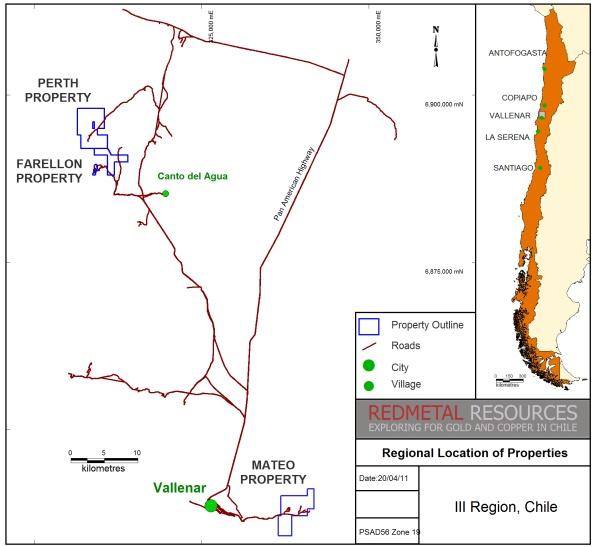

Our active properties as of the date of this filing are set out in Table 2. These properties are accessible by road from Vallenar as illustrated in Figure 1.

|

Table 2: Active properties

|

|||||

|

Property

|

Percentage, type of claim

|

Hectares

|

|||

|

Gross area

|

Net Area (a)

|

||||

|

Farellon

|

|||||

|

Farellon 1 – 8 claim

|

100%, mensura

|

66

|

|||

|

Farellon 3 claim

|

100%, pedimento

|

300

|

|||

|

Cecil 1 – 49 claim

|

100%, mensura

|

230

|

|||

|

Cecil 1 – 40 and Burghley 1 – 60 claims

|

100%, manifestacion

|

500

|

|||

|

1,096

|

1,096

|

||||

|

Mateo

|

|||||

|

Margarita claim

|

100%, mensura

|

56

|

|||

|

Che 1 & 2 claims

|

100%, mensura

|

76

|

|||

|

Irene & Irene II claims

|

100% (b), mensura

|

60

|

|||

|

Mateo 1, 2, 3, 12, 13, 14 claims

|

100%, manifestacion

|

1,500

|

|||

|

Mateo 4 and 5 claims

|

100%, pedimento

|

600

|

|||

|

2,292

|

|||||

|

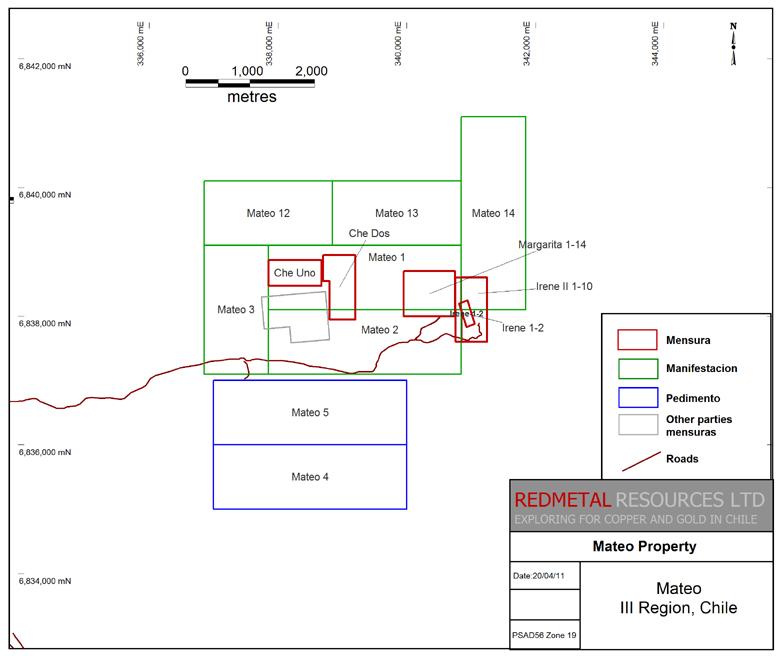

Overlapped claims (see Figure 3)

|

(170)

|

2,122

|

|||

|

Perth

|

|||||

|

Perth 1 al 36 claim

|

100%, mensura

|

109

|

|||

|

Lancelot I 1 al 30 claim

|

100%, mensura in process

|

300

|

|||

|

Lancelot II 1 al 20 claim

|

100%, mensura in process

|

200

|

|||

|

Rey Arturo 1 al 30 claim

|

100%, mensura in process

|

300

|

|||

|

Merlin I 1 al 10 claim

|

100%, mensura in process

|

60

|

|||

|

Merlin I 1 al 24 claim

|

100%, mensura in process

|

240

|

|||

|

Galahad I 1 al 10 claim

|

100%, manifestacion

|

50

|

|||

|

Galahad I 1 al 46 claim

|

100%, manifestacion

|

230

|

|||

|

Percival III 1 al 30 claim

|

100%, manifestacion

|

300

|

|||

|

Tristan II 1 al 30 claim

|

100%, manifestacion

|

300

|

|||

|

Tristan IIA 1 al 5 claim

|

100%, manifestacion

|

15

|

|||

|

Camelot claim

|

100%, pedimento

|

300

|

|||

|

2,404

|

|||||

|

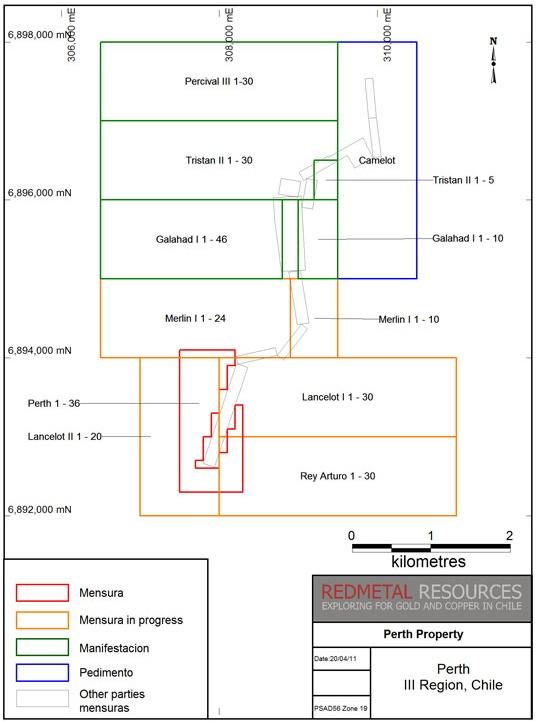

Overlapped claims (see Figure 4)

|

(124)

|

2,280

|

|||

|

5,498

|

|||||

|

(a) Some pedimentos and manifestacions overlap other claims. The net area is the total of the hectares we have in each property (i.e. net of our overlapped claims).

(b) We have agreed to complete the purchase of this property in May, 2011.

|

|||||

13

|

Figure 1: Location and access to active properties

|

14

farellon property

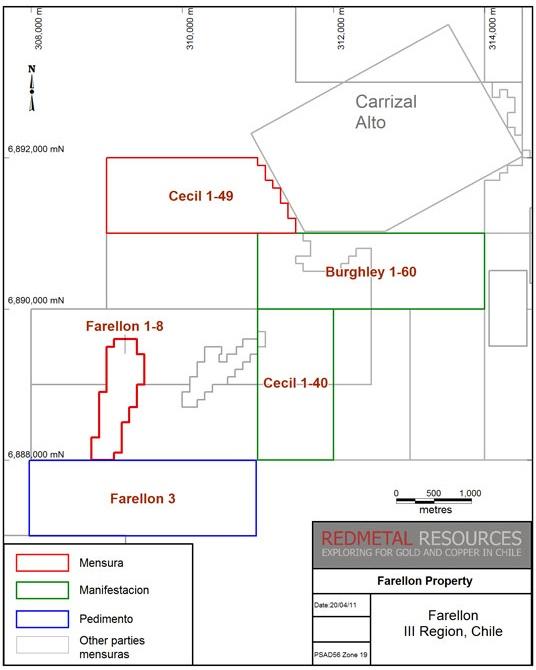

The Farellon property consists of two groups of claims—the Farellon claim and the Cecil and Burghley claims—which are not contiguous but lie within the historical Carrizal Alto mining district southwest of the Carrizal Alto mine. Table 3 describes the claims and Figure 2 illustrates them.

|

Table 3: Farellon property

|

|||

|

Claim

|

Type

|

||

|

Mensura

(ha)

|

Manifestacion

(ha)

|

Pedimento

(ha)

|

|

|

Farellon 1 – 8

|

66

|

||

|

Cecil 1 – 49

|

230

|

||

|

Cecil 1 – 40

|

200

|

||

|

Burghley 1 – 60

|

300

|

||

|

Farellon 3

|

300

|

||

|

296

|

500

|

300

|

|

Figure 2: Farellon property

15

The Farellon 1 – 8 is the first mineral claim that we acquired in Chile. It covers 66 hectares and is centered about 309,150 east and 6,888,800 south UTM PSAD56 Zone 19 in Province of Huasco, Commune of Huasco, III Region of Atacama, Chile.

We acquired the claim on April 25, 2008 for $550,000. We owe a royalty equal to 1.5% of the net proceeds that we receive from the processor to a maximum of $600,000, payable monthly and subject to a monthly minimum of $1,000 when we start exploiting the minerals we extract from the claim. We can pay any unpaid balance of the royalty at any time. We have not yet exploited the claim.

On September 17, 2008, we bought the Cecil 1 – 49, Cecil 1 – 40 and Burghley 1 – 60 claims for $27,676. The Cecil and Burghley claims cover 730 hectares and are centered at 311,500 east and 6,890,000 south UTM PSAD56 Zone 19 and lie approximately 1.7 kilometers north of the Farellon 1 – 8 border. The claims cover a 1.8-kilometre strike length of a mineralized vein interpreted to be part of the same mineralizing system as the Farellon 1 – 8 vein. An investigation completed during the Farellon 1 – 8 acquisition uncovered a broad regional reconnaissance sampling program completed in 1996 showing results from the areas covered by the Cecil and Burghley claims. Results from the 1996 sampling show copper and gold grades similar to grades returned from the Farellon vein, indicating that the Cecil and Burghley claims could have similar mineralized bodies. On December 1, 2009, we initiated the manifestacion process when we applied to convert the Cecil 1 – 40 and Burghley 1 – 60 exploration (pedimento) claims to mining (mensura) claims.

On July 1, 2010 we registered a pedimento, Farellon 3, at a cost of $305 to cover 300 hectares of ground directly south of our Farellon 1 – 8 claim. The Farellon 3 claim covers a further 1,000 metres of potential strike extent of the known mineralized zone on the Farellon 1 – 8 claim.

Location and means of access. The Farellon property is approximately 40 kilometers west of the Pan-American Highway, about 1 hour and 15 minutes by vehicle from the town of Vallenar which has a population of 40,000 and modern facilities. High-tension power lines and a fiber-optic communications line run along the highway and both power and rail are connected to the Cerro Colorado iron ore mine only 20 kilometers from the Farellon property. The area is serviced from Copiapó, a city of 70,000 with daily air and bus services to Santiago and other centers.

The Farellon property can be accessed by driving approximately 20 kilometers north on the Pan-American Highway from Vallenar then turning northwest towards Canto del Agua. From Canto del Agua, the Farellon property is approximately 10 kilometers along a well-maintained gravel road. There are numerous gravel roads in the area, so a guide is necessary to access the property the first time. All of the roads are well maintained and can support large machinery necessary to transport drills, backhoes and bulldozers. Water is readily available in Canto del Agua and could probably be found on the Farellon property where all of the historic drill holes intersected water.

Exploration history .The Farellon property is in the Carrizal Alto mining district and lies 5 kilometers along strike south of the center of the historic Carrizal Alto copper-gold mine. Veins of the Farellon property were exploited as part of the Carrizal Alto mines. We have located no hard data summarizing all of the past mining activity, but tailings, slag dumps and the size of the shafts and some of the shallow surface workings are evidence of extensive historical mining.

Mine workings of various sizes are all along the Farellon property, but only one modern exploration program has been completed. In 1996, the Farellon and two other veins, the Fortuna and the Theresa, were explored by an Australian junior mining company under the name Minera Stamford S.A. Their exploration included a large mapping and surface sampling program followed by a 34-hole RC drilling program. Of these 34 drill holes, 23 were drilled on the Farellon 1 – 8 claim. The RC drilling program on the Farellon claim consistently intersected oxide and sulphide facies mineralization along a 2 kilometer-long zone covering the Farellon claim and strike extents to the south. Mineralization is 2 to 35 meters wide with an average width of 5 meters. The mineralized zone consists of one or more discrete veins and, in places, stockwork veining and mineralization. While drilling covered the length of the property, gaps up to 350 meters are untested and infill drilling is required to confirm an economic ore body. Table 4 presents the significant intersections from the 23 holes drilled on the Farellon claim in the 1996 drilling.

16

|

Table 4: Farellon historic significant intersections (1996)

|

||||||||

|

Drill hole

|

Significant intervals (m)

|

Assay results

|

||||||

|

FAR–96

|

From

|

To

|

Length

|

Gold (g/t)

|

Copper (%)

|

Cobalt (%)

|

||

|

06

|

49

|

54

|

5

|

0.15

|

0.73

|

0.01

|

||

|

07

|

25

|

34

|

9

|