Attached files

| file | filename |

|---|---|

| EX-10.1 - Tanke Biosciences Corp | e608449_ex10-1.htm |

| EX-23.2 - Tanke Biosciences Corp | e608449_ex23-2.htm |

| EX-23.1 - Tanke Biosciences Corp | e608449_ex23-1.htm |

| EX-99.3 - Tanke Biosciences Corp | e608449_ex99-3.htm |

As filed with the Securities and Exchange Commission on May 13, 2011

Registration No. 333-172240

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TANKE BIOSCIENCES CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

0200

|

26-3853855

|

||

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Room 2801, East Tower of Hui Hao Building, No. 519 Machang Road

Pearl River New City, Guangzhou, People’s Republic of China 510627

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Guixiong Qiu

Chief Executive Officer

c/o Guangzhou Tanke Industry Co., Ltd.

Room 2801, East Tower of Hui Hao Building, No. 519 Machang Road

Pearl River New City, Guangzhou, People’s Republic of China 510627

+86-20-3885-9025

CT Corporation

111 Eighth Avenue, 13th Floor

New York, New York 10011

(Name, Address Including Zip Code and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Evan L. Greebel, Esq.

Howard S. Jacobs, Esq.

Yue Cao, Esq.

Katten Muchin Rosenman LLP

575 Madison Avenue

New York, New York 10022

(212) 940-8800

Approximate date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer (Do not check if a smaller reporting company) ¨

|

Smaller reporting company x

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities

to be registered

|

Amount to be

registered(1)

|

Proposed

maximum

offering

price per

unit (2)

|

Proposed

maximum

aggregate

offering

price

|

Amount of

registration fee

|

|||||||||||

|

common stock, par value $0.001 per share, offered by selling stockholders

|

2,166,913 shares

|

|

$

|

1.15

|

|

$

|

2,491,949.95

|

$

|

289.32

|

|

|||||

|

common stock, par value $0.001 per share, underlying the principal of convertible notes held by selling stockholders (1)

|

6,669,627 shares

|

(3)

|

$

|

1.15

|

|

$

|

7,670,071.05

|

$

|

890.50

|

|

|||||

|

common stock, par value $0.001 per share, underlying the interest of convertible notes held by selling stockholders (1)

|

800,413 shares

|

(4)

|

$

|

1.15

|

$

|

920,474.95

|

$

|

106.87

|

|

||||||

|

common stock, par value $0.001 per share, underlying warrants held by selling stockholders (1)

|

6,669,627 shares

|

(5)

|

$

|

1.40

|

$

|

9,337,477.80

|

$

|

1,084.08

|

|||||||

|

TOTAL

|

16,306,580 shares

|

$

|

20,419,973.75

|

$

|

2,370.77

|

||||||||||

|

(1)

|

Pursuant to Rule 416 of the Securities Act of 1933, also registered hereby are such additional and indeterminable number of shares as may be issuable due to adjustments for changes resulting from stock dividends, stock splits and similar changes.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(g) of the Securities Act of 1933.

|

|

(3)

|

The 6,669,627 shares of common stock are being registered for resale by certain selling stockholders named in this registration statement, which shares are issuable by the registrant upon the conversion of the registrant’s 8% Convertible Notes due February 9, 2013.

|

|

(4)

|

The 800,413 shares of common stock are being registered for resale by certain selling stockholders named in this registration statement, which shares are potentially issuable by the registrant upon the conversion of the interest accrued under the registrant’s 8% Convertible Notes due February 9, 2013.

|

|

(5)

|

The 6,669,627 shares of common stock are being registered for resale by certain selling stockholders named in this registration statement, which shares are issuable by the registrant upon the exercise of the registrant’s common stock purchase warrants issued on February 9, 2011.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell, nor does it seek an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

|

Preliminary Prospectus

|

Subject to Completion, Dated April __, 2011

|

Tanke Biosciences Corporation

16,306,580 Shares of

Common Stock

This prospectus relates to the sale of up to a total of 16,306,580 shares of common stock of Tanke Biosciences Corporation, a Nevada corporation, that may be sold from time to time by the selling stockholders named in this prospectus and their successors and assigns. The shares of common stock subject to this prospectus include: (i) 2,166,913 shares issued to certain selling stockholders pursuant to a contractual arrangement with us, (ii) 6,669,627 shares issuable upon conversion by certain selling stockholders of the principal underlying our 8% Convertible Notes due February 9, 2013, which we refer to herein as the Notes; (iii) 800,413 shares potentially issuable upon conversion by certain selling stockholders of interest accrued under the Notes; and (iv) 6,669,627 shares issuable upon the exercise by certain selling stockholders of our common stock purchase warrants issued on February 9, 2011, which we refer to herein as the Warrants. The securities offered for resale hereby were issued to the applicable selling stockholders in a private placement transaction completed prior to the filing of the registration statement of which this prospectus is a part.

The selling stockholders may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. Information regarding the selling stockholders and the times and manner in which they may offer and sell the shares under this prospectus is provided under “Selling Stockholders” and “Plan of Distribution” in this prospectus. We have agreed to pay all the costs and expenses of this registration.

We will not receive any of the proceeds from the sale of shares by the selling stockholders. We may receive proceeds upon conversion of the Notes and exercise of the Warrants, and any proceeds we receive will be used for general corporate purposes and for working capital.

Our common stock is listed for quotation on the Over-the-Counter Bulletin Board, or OTCBB, under the symbol “TNBI” (formerly “GHND”). There is very limited trading in our common stock. On July 22, 2010, the most recent day that our stock traded, the last reported price per share of our common stock was $0.10. You are urged to obtain current market quotations of our common stock before purchasing any of the shares being offered for sale pursuant to this prospectus.

An investment in our securities is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011.

TABLE OF CONTENTS

|

1

|

|

|

7

|

|

|

24

|

|

|

25

|

|

|

25

|

|

|

26

|

|

|

35

|

|

|

53

|

|

|

53

|

|

|

53

|

|

|

54

|

|

|

55

|

|

|

56

|

|

|

58

|

|

|

69

|

|

|

70

|

|

|

71

|

|

|

72

|

|

|

73

|

|

|

73

|

|

|

73

|

|

|

F-1

|

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”). You should rely only on the information provided in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. The selling stockholders are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted.

Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. The rules of the SEC may require us to update this prospectus in the future.

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this prospectus. In this prospectus, unless the context requires otherwise, the terms “we”, “our”, “us” and the “Company” refer to Tanke Biosciences Corporation, a Nevada corporation formerly known as Greyhound Commissary, Inc. (“Greyhound”), as well as our direct and indirect subsidiaries, and our principal operating business, Guangzhou Tanke Industry Co., Ltd. (“Guangzhou Tanke”), a company organized under the laws of the People’s Republic of China (“China” or the “PRC”), which we control via a series of variable interest entity contractual agreements (the “VIE Agreements”) more fully described below.

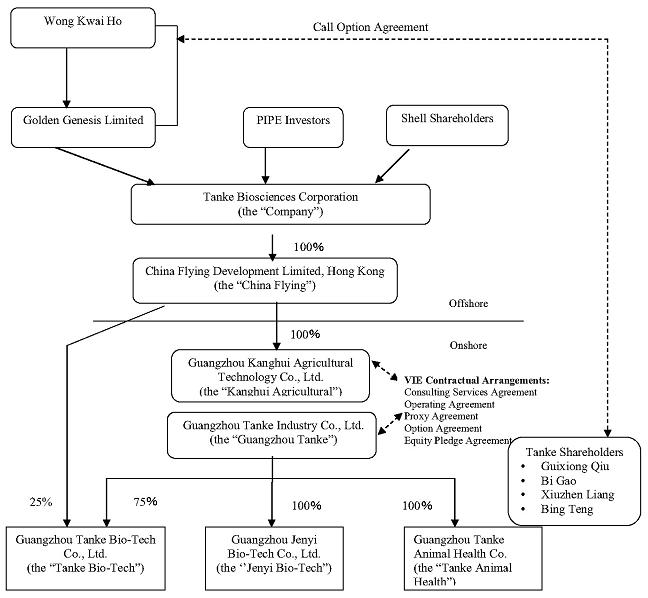

We conduct our business through our subsidiaries, principally our wholly-owned subsidiary China Flying Development Limited (“China Flying”), a Hong Kong incorporated company, and its wholly-owned subsidiary Guangzhou Kanghui Agricultural Technology Co., Ltd. (“Kanghui Agricultural” or the “WFOE”), a wholly foreign owned enterprise incorporated as a limited liability company under the laws of the PRC. The Company operates and controls Guangzhou Tanke through Kanghui Agricultural and China Flying and in connection with the VIE Agreements.

“RMB” and “Renminbi” refer to the legal currency of China and “$”, “US dollar” and “US$” refer to the legal currency of the United States.

Overview of Our Business

Through Guangzhou Tanke, our principal operating business, we are one of the leading animal nutrition and innovative feed additive providers in China. Our products are distinguished from traditional artificial feed additives in that they are environmentally-friendly and are designed to optimize the growth and health of livestock such as pigs and cattle, as well as farmed fish. One of our most popular products is an organic trace mineral additive that we believe is one of the few Chinese-developed organic products in the trace mineral market.

Our target customers are mid-to-large sized feed product factories and large scale producers. The market for our products is significant and growing, as China seeks to meet the demand of its over 1.3 billion citizens for safe and reasonably priced food. With feed additives used in China at less than half the rate of that of the United States and Europe, we are seeking to capitalize on a significant market opportunity as Chinese feed producers modernize and expand the use of modern and more effective additives.

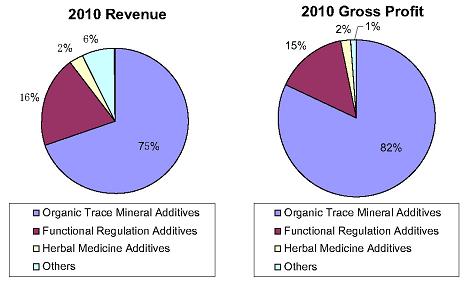

The Company currently produces 21 branded feed additives, with each brand available in seven different mixes that correspond to different stages of an animal’s life cycle. Our major products address most key market categories within China’s animal feed additive industry including: Organic Trace Mineral Additives, which in 2009 accounted for approximately 70% of our revenue, Feed Acidifiers and Flavor Enhancers, which accounted for approximately 20% of our revenue, and Herbal Medicine Additives, which accounted for approximately 3% of our revenue. Our extensive distribution network reaches China’s top 10 feed producers and the 500 largest animal farming operations. While the majority of our sales are domestic in the PRC, international sales, mainly in Southeast Asia, Latin American and other developing countries, currently account for approximately 5% of our total sales.

Background and Key Events

Greyhound, our predecessor corporation, was organized on May 24, 1989 under the laws of the State of Idaho and was re-incorporated under the laws of the State of Nevada on November 1, 2007. Greyhound was initially created to provide a variety of services related to the operation of a nearby greyhound dog-racing track. Following inception, Greyhound raised funds to assist it in providing food, shelter, healthcare and other services to animals used in the greyhound racing. Subsequently the track was closed and the business was curtailed. Beginning in 1995, Greyhound engaged in an ongoing search for suitable business opportunities, including a potential merger.

On February 9, 2011, Greyhound closed (i) a share exchange transaction (the “Share Exchange”), pursuant to which (among other things) we became the sole stockholder of China Flying and changed our name to “Tanke Biosciences Corporation”, and (ii) a private placement (the “Private Placement”) of $7,670,071.50 for 6,669,627 units (the “Units”), with each Unit consisting of a $1.15 principal amount 8% Senior Convertible Note (each, a “Note”) and a Common Stock Purchase Warrant (each, a “Warrant”) to purchase one share of our common stock, with an exercise price of $1.40 per share. The Share Exchange and the Private Placement are more fully described below.

Our principal offices are located at East Tower of Hui Hao Building, No. 519 Machang Road, Pearl River New City, Guangzhou, China. Our telephone number is +86-20-3885-9025.

VIE Agreements and Call Option Agreement

On January 3, 2011, Kanghui Agricultural entered into the VIE Agreements, which included a Consulting Services Agreement, Operating Agreement, Voting Rights Proxy Agreement, Equity Pledge Agreement and an Option Agreement, with Guangzhou Tanke and the shareholders of Guangzhou Tanke, namely Mr. Guixiong Qiu (“Mr. Qiu”), Mr. Bi Gao (“Mr. Gao”), Ms. Xiuzhen Liang (“Ms. Liang”) and Mr. Bing Teng (“Mr. Teng”) (collectively referred to as the “Tanke Shareholders”), who are all PRC citizens. Pursuant to the VIE Agreements, Kanghui Agricultural effectively assumed management of the business activities of Guangzhou Tanke and has the right to appoint all executives and senior management and the members of the board of directors of Guangzhou Tanke.

In addition, on January 3, 2011, the Tanke Shareholders each entered into a call option agreement (the “Call Option Agreement”) with Golden Genesis Limited (“Golden Genesis”), a British Virgin Islands company, and Wong Kwai Ho (“Ms. Wong”), a Hong Kong resident owning 100% of the issued and outstanding shares of Golden Genesis. Under the terms of the Call Option Agreement, which became effective upon the closing of the Share Exchange, Golden Genesis shall transfer up to 100% of the shares of common stock that it received in the Share Exchange within the next 3 years to the Tanke Shareholders for consideration of $0.01 per share, resulting in the Tanke Shareholders owning a majority of the outstanding shares of our common stock. The Call Option Agreement provides that Golden Genesis shall not dispose of the respective portion of the shares of common stock without the Tanke Shareholders’ prior written consent.

Pursuant to the VIE Agreements, Kanghui Agricultural has the right to advise, consult, manage and operate Guangzhou Tanke for an annual fee in the amount of Guangzhou Tanke’s yearly net profits after tax. Additionally, the Tanke Shareholders pledged their rights, titles and equity interest in Guangzhou Tanke as security for Kanghui Agricultural to collect consulting and services fees provided to Guangzhou Tanke through an Equity Pledge Agreement. In order to further reinforce Kanghui Agricultural’s rights to control and operate Guangzhou Tanke, the Tanke Shareholders granted Kanghui Agricultural an exclusive right and option to acquire all of their equity interests in Guangzhou Tanke through the Option Agreement.

Pursuant to the Call Option Agreement, Golden Genesis shall transfer up to 100% of the shares of the Company’s common stock to the Tanke Shareholders over the next three years. Upon the completion of such transfers the Tanke Shareholders will be stockholders of the Company and Golden Genesis will no longer be a stockholder of the Company.

Share Exchange

On February 9, 2011, pursuant to a Share Exchange Agreement, dated January 3, 2011 (the “Share Exchange Agreement”), between Greyhound, Golden Genesis and China Flying, the Company closed the Share Exchange and acquired all of the outstanding equity securities of China Flying from Golden Genesis, which was the sole shareholder of China Flying immediately prior to the closing of the Share Exchange. In exchange, we issued to Golden Genesis 10,758,000 newly issued shares of our common stock. In addition, pursuant to the terms of the Share Exchange Agreement, the Company effected a 1 for 8.512 reverse stock split to modify the Company’s capital structure to accommodate the transactions contemplated by the Share Exchange and the Private Placement and to put in place an appropriate capital structure for the Company following the closing of the Share Exchange and the Private Placement. Such securities were not registered under the Securities Act of 1933, as amended (the “Securities Act”). These securities qualified for exemption under Section 4(2) of the Securities Act since the issuance of securities by us did not involve a public offering. All references to number of shares and per share amounts included in this prospectus give effect to the 1 for 8.512 reverse stock split.

We consummated the Share Exchange in order to acquire China Flying and Kanghui Agricultural. Pursuant to the terms of the VIE Agreements, the Share Exchange also resulted in us acquiring control of the business and operations of Guangzhou Tanke.

Private Placement

On February 9, 2011, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with certain accredited investors who are selling stockholders in this offering (each, including their respective successors and assigns, an “Investor” and collectively, the “Investors”) and, with respect to certain sections of the Securities Purchaser Agreement, Euro Pacific Capital, Inc. (“Euro Pacific”) and Newbridge Securities Corporation, relating to the Private Placement of 6,669,627 Units at a purchase price of $1.15 per Unit. Each Unit consisted of a $1.15 principal amount 8% Senior Convertible Note and a Common Stock Purchase Warrant to purchase one share of the Company’s common stock, with an exercise price of $1.40 per share. We sold 6,669,627 Units in the Private Placement, for gross proceeds of $7,670,071.50. In addition, in connection with the Private Placement, we also issued to certain affiliates of Euro Pacific, our lead placement agent in the Private Placement, three-year warrants (the “Agent Warrants”) to purchase an aggregate of 666,963 shares of our common stock at an exercise price of $1.15 per share. The Private Placement met the requirements to qualify for exemption under Regulation D promulgated under the Securities Act.

The Notes are convertible into shares of our common stock at a price of $1.15 per share (subject to customary weighted average and stock based anti-dilution protection) and are payable 24 months from the date of their issuance with an interest rate of 8% per annum payable semiannually in arrears. Each three-year Warrant entitles the holder to purchase one share of our common stock, with an exercise price of $1.40 per share (subject to customary weighted average and stock based anti-dilution protection). We also issued to certain affiliates of Euro Pacific, our lead placement agent in the Private Placement, three-year Agent Warrants to purchase an aggregate of 666,963 shares of common stock at an exercise price of $1.15 per share. The Agent Warrants also contain a cashless exercise option. The issuance of the Notes and the Warrants was not registered under the Securities Act as such issuance was exempt from registration under Section 4(2) of the Securities Act and Regulation D. The issuance of the Agent Warrants was exempt from registration under Section 4(2) of the Securities Act.

In connection with the closing of the Private Placement, we also entered into the following additional agreements:

|

|

·

|

Registration Rights Agreement. We entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors which sets forth the rights of the Investors to have the shares of common stock underlying the Notes and Warrants registered with the SEC for public resale. The filing of the registration statement of which this prospectus is a part is intended to satisfy certain of our obligations under the terms of the Registration Rights Agreement. We also entered into a Registration Rights Agreement with the Investors.

|

|

|

·

|

Pursuant to the Registration Rights Agreement, we agreed to file, no later than April 11, 2011, a registration statement to register the shares underlying the Notes and the Warrants and to have such registration statement effective no later than September 18, 2011. If the registration statement is not effective by September 18, 2011 (the “Effectiveness Failure”) or if, after the effective date, sales of securities included in the registration statement cannot be made (including, without limitation, because of a failure to keep the registration statement effective, to disclose such information as is necessary for sales to be made pursuant to the registration statement, to register a sufficient number of shares of Common Stock or to maintain the listing of the Common Stock) (a “Maintenance Failure”) then, as liquidated damages (and in complete satisfaction and to the exclusion of any claims or remedies inuring to any holder of the securities) the Company is required to pay an amount in cash equal to 1% of the aggregate purchase price paid by the Investors on each of the following dates: (i) 20 days following the date of a Filing Failure; (ii) 30 days following the initial day of a Maintenance Failure; (iii) on every thirtieth day thereafter (pro-rated for periods totaling less than thirty days) until such failure is cured; (iv) on every thirtieth day after the day of an Effectiveness Failure and thereafter (pro rated for periods totaling less than thirty days) until such Effectiveness Failure is cured; (v) on every thirtieth day after the initial day of a Maintenance Failure and thereafter (pro rated for periods totaling less than thirty days) until such Maintenance Failure is cured. The payments to be made by the Company are limited to a maximum of 6% of the aggregate amount paid by the Investors ($460,204.29). As of May 8, 2011, the Company does not expect to incur any registration delay payments and has not accrued any such payments.

|

|

|

·

|

Interest Escrow Agreement. We entered into an Escrow Agreement (the “Interest Escrow Agreement”) with Euro Pacific and Escrow, LLC (the “Escrow Agent”), as escrow agent, pursuant to which the Company deposited into escrow an amount of proceeds of the Private Placement equal to one semi-annual interest payment on the Notes to secure prompt interest payments under the Notes. Until such time as 75% of the Notes are converted into shares of common stock, if such escrow is depleted in order to make interest payments, the Company has agreed to promptly replenish such escrow amount.

|

|

|

·

|

Securities Escrow Agreement. We entered into a Securities Escrow Agreement (the “Securities Escrow Agreement”) with Euro Pacific, as representative of the Investors, Golden Genesis and the Escrow Agent, as escrow agent, pursuant to which Golden Genesis placed in escrow 2,000,000 shares of common stock, to be disbursed to either the Investors on a pro rata basis or to Golden Genesis based on the financial performance of Guangzhou Tanke, our principal operating business, for the fiscal years ending December 31, 2011 and 2012.

|

Corporate Name Change

On February 8, 2011, in connection with the closing of the Share Exchange and Private Placement, we filed a Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada to change our corporate name from “Greyhound Commissary, Inc.” to “Tanke Biosciences Corporation”, a name that more accurately reflects the business operations of the Company following the closing of the Share Exchange. The name change was effective as of February 10, 2011.

Our Organizational Structure

Our organization structure after the Share Exchange and Private Placement is illustrated below:

Mr. Guixiong Qiu is the sole director of the Company and Golden Genesis, the Company’s largest stockholder. Other than Mr. Qiu, Golden Genesis does not have other stockholders or officers. Ms. Wong Kwai Ho is the sole director of China Flying. Ms. Wu Chun Rui is the sole director of Kanghui Agricultural and the legal representative who is authorized to sign corporate documents on behalf of Kanghui Agricultural. Mr. Guixiong Qiu, Mr. Bi Gao, Mr. Xugang Shu, and Ms. Xiuzhen Liang are the directors and officers of Guangzhou Tanke and its subsidiaries, Guangzhou Tanke Bio-Tech Co., Ltd., Guangzhou Jenyi Bio-Tech Co., Ltd., and Guangzhou Tanke Animal Health Co.

The Offering

|

Common stock outstanding immediately before this offering:

|

13,324,093 shares

|

|

Common stock offered by the selling stockholders:

|

Up to 16,306,580 shares underlying securities held by the selling stockholders.

|

|

Common stock outstanding immediately after this offering:

|

Up to 26,663,347 shares, assuming full conversion of the principal on the Notes and exercise of the Warrants, but no conversion of any interest accrued on the Notes.

|

|

OTCBB Symbol:

|

TNBI (formerly GHND). No active market for our common stock presently exists.

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of the common stock offered hereby. However, we may receive up to a maximum of $17,007,548.85 of proceeds from the conversion of Notes and exercise of Warrants by certain selling stockholders, which proceeds we would expect to use for general working capital. No assurances can be given, however, that all or any portion of such warrants will ever be exercised.

|

|

Risk Factors:

|

Investing in our securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the section of this prospectus entitled “Risk Factors.”

|

RISK FACTORS

Our business, as well as our common stock, are highly speculative in nature and involve a high degree of risk. Our securities should be purchased only by persons who can afford to lose their entire investment. Accordingly, prospective investors should carefully consider, along with other matters referred to herein, the following risk factors in evaluating our business before purchasing any of our common stock..

Risks Related to Our Business

We may not possess all the licenses required to operate our business, or may fail to maintain the licenses we currently hold. This could subject us to fines and other penalties, which could have a material adverse effect on our results of operations.

We are required to hold a variety of permits, licenses and certificates to conduct our business in China and we may not possess all of the permits, licenses and certificates required for our business. We entered into a Land Lease Agreement valid from May 20, 2006 to May 20, 2021 with the government of Huaqiao Town, Huadu District, Guangzhou under which the Government of Huaqiao Town granted us a land use right covering the land where our manufacturing facility currently stands. This lease will be superseded by a Land Use Right Certificate and will be automatically terminated once we obtain such certificate. Due to changes in the relevant PRC regulations, we have not been granted such certificate for this land. Therefore, pursuant to applicable PRC law, we are not permitted to operate our manufacturing facility without such certificate and as a result, there is a risk that the PRC government may declare our Land Lease Agreement invalid.

We are currently negotiating with the local government to obtain a Land Use Right Certificate, which would permit us to operate our business as it is currently conducted. Without the Land Use Right Certificate, we are unable to apply for a Property Ownership Certificate for our manufacturing facilities. Until we obtain the Land Use Right Certificate, the PRC government may evict our personnel from the premises and remove our manufacturing facilities that we built on the premises. Such action would have a very significant and negative impact on our operations and business.

In addition, there may be other circumstances under which the approvals, permits, licenses or certificates granted by the governmental agencies are subject to change without substantial advance notice, and it is possible that we could fail to obtain the approvals, permits, licenses or certificates that are required to expand our business as we intend. If we fail to obtain or to maintain such permits, licenses or certificates, or renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products that we would be able to offer. As a result, our business, result of operations and financial condition could be materially and adversely affected.

Concerns with the safety and quality of agricultural feed additive products could cause customers to avoid our products.

We could be adversely affected if our customers and the ultimate consumers of our feed additive products lose confidence in the safety and quality of various feed additive products. Adverse publicity about these types of concerns may discourage our customers from buying our products or cause production and delivery disruptions. Any negative change in customer perceptions about the safety and quality of our feed additive products could adversely affect our business and financial condition.

If our feed additive products become adulterated or misbranded, we would need to recall those items and may experience product liability claims if consumers are injured as a result.

Animal feed products occasionally contain contaminants due to inherent defects in those products or improper storage or handling. Under adverse circumstances, animal feed manufacturers may need to recall some of their products if they become adulterated or misbranded, and may also be liable if the consumption of any of their products causes injury. A widespread product recall could result in changes to one or more of our business processes, product shortages, loss of customer confidence in our products or other adverse effects on our business. If we are required to defend against a product liability claim, whether or not we are found liable under the claim, we could incur substantial costs, our reputation could suffer and our customers might substantially reduce their existing or future orders from us.

We face significant competition in the sales of our agricultural feed additive products.

Competition in the feed additive industry, especially with companies with greater resources, may make us unable to compete successfully, which could adversely affect our business.

In general, the competitive factors in the feed additive industry in China include:

|

·

|

price;

|

|

·

|

product quality;

|

|

·

|

brand identification;

|

|

·

|

breadth of product line; and

|

|

·

|

customer service.

|

To the extent that our products and services do not exhibit these qualities, our ability to compete will be hindered.

The markets in which we operate are highly competitive and fragmented and we may not be able to maintain market share.

We operate in highly competitive markets and compete with numerous local Chinese feed additive manufacturers. We expect competition to persist and intensify in the future. Our domestic competitors are mainly leaders in the feed additive markets in China. Our small local competitors may have better access in certain local markets to customers and prospects, an enhanced ability to customize products to a particular region or locality and more established local distribution channels within a small region. We also compete with large Chinese national and multi-national competitors who may have competitive advantages over us in certain areas such as access to capital, technology, product quality, economies of scale and brand recognition and may also be better positioned than us to develop superior product features and technological innovations and to exploit and adapt to market trends. Due to the lack of publicly available information about our competitors and industry, we may not be able to conduct in-depth research and analysis on our current or new markets. Therefore, we may not be able to determine our direct competitors, such competitors' revenues or market share.

In addition, China’s entry into the World Trade Organization may lead to increased foreign competition for us. International producers and traders import products into China that generally are of higher quality than those produced in the local Chinese market. We may face additional competition if these products are considered to be better than the type of feed additives we produce. If we are not successful in our marketing and advertising efforts to increase awareness of our brands, our revenues could decline, which could have a material adverse effect on our business, financial condition, results of operations and share price. We may not be able to compete successfully against existing or new competition in our markets.

We may not be able to fully implement our current business strategy if we are unable to acquire and develop a second manufacturing facility.

As part of our current business strategy, we intend to continue to increase our production volume in order to gain additional market share. In connection with that strategy, we plan to build a second manufacturing facility that would double our organic trace mineral production capacity. There is a risk that we may be unable to acquire the land use rights for this facility or to commence or finish construction of the new facility, or operate it at a profit. If we are unable to achieve any or all of the foregoing it could have a material adverse effect on our business and results of operations.

We cannot be certain that our feed additive product innovations and marketing achievements to date will continue.

We believe that our past performance has been based on, and our future prospects will depend upon, in large part, our ability to continue to improve our existing feed additive products or develop new feed products. We may not be successful in introducing, marketing and producing any new feed products or feed additive product innovations, or that we will develop and introduce, in a timely manner, innovations to our existing products which satisfy customer needs or achieve market acceptance. Our failure to develop new feed additive products and introduce them successfully and in a timely manner could harm our ability to grow our business and could have a material adverse effect on our business, results of operations and financial condition.

We purchase many commodities that we use for raw materials and packaging; price changes for such commodities may adversely affect our profitability.

The raw materials used in our feed additive business are largely commodities that experience price fluctuations caused by external conditions and changes in governmental agricultural programs that we cannot control. As a result, we try to recover our commodity cost increases by increasing prices, promoting a higher-margin product mix and creating additional operating efficiencies. Substantial increases in the prices of packaging materials, such as corrugated cardboard, aluminum products, films and plastics, or higher prices of our raw materials could adversely affect our operating performance and financial results. Any substantial fluctuation in the prices of raw materials, if not offset by increases in our sales prices, could adversely affect our profitability.

Outbreaks of livestock disease can adversely affect sales of our products.

Outbreaks of livestock diseases can significantly affect demand for our feed additive products and could result in governmental restrictions on the sale of livestock products to or from customers, or require our customers to destroy their feeds. This could result in the cancellation of orders of feed additive products by our customers and create adverse publicity that may have a material adverse effect on the agricultural products industry and our ability to market our products successfully.

We do not typically have long-term sales contracts with our customers and our customers could at any time reduce purchases of, or entirely cease purchasing, our products, harming our operating results and business.

We typically do not have long-term volume sales contracts with our customers. Accordingly, our customers could reduce their purchases from us or cease purchasing our products altogether when a particular contract expires. A variety of factors, including economic, health, regulatory, political and social instability, could contribute to a slowdown in the demand or a reduction in the market price for our products because poultry demand and pricing is highly correlated with general economic activities. If any of our customers experience serious financial difficulties, it may lead to a decline in sales and write-offs of accounts receivable, which could harm our results of operations.

The cessation of tax exemptions and deductions by the Chinese government may affect our profitability.

On March 16, 2007, the National People’s Congress of China enacted a new tax law, or the New Tax Law, whereby both foreign investment enterprises, or FIEs, and domestic companies will be subject to a uniform income tax rate of 25%. On November 28 2007, the State Council of China promulgated the Implementation Rules of the New Tax Law, the “Implementation Rules”. Both the New Tax Law and the Implementation Rules have become effective on January 1, 2008. Both the New Tax Law and the Implementation Rules provide tax exemption treatment for enterprises engaged in agricultural industries, such as farming, foresting, fishing and animal husbandry. We have been informed that certain of our Chinese subsidiaries are eligible for relevant preferential tax treatment, including tax reduction and exemption, and certain of our products are exempted from value added tax. In the future, if the relevant tax authorities determine that Guangzhou Tanke, our principal operating business, is not eligible for tax exemption treatment it may materially and adversely affect our profits, business and financial performance.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

As a manufacturer, we are subject to various Chinese environmental laws and regulations on air emission, waste water discharge, solid wastes and noise. The Environmental Protection Bureau of Huadu District, Guangzhou issued the Opinion on the Environmental Impact Statement regarding the Construction Project of Tanke Group on February 16, 2004. To date, we have not obtained any documentation of environment appraisal and acceptance inspection with respect to the completion of projects of the factory buildings and the production lines, because we have not obtained a Land Use Right Certificate for such site nor have we been granted Property Ownership Certificate. We are in the process of applying for a Land Use Right Certificate, which will enable us to obtain an environmental appraisal and acceptance inspection with respect to our facilities. Following our receipt of a Land Use Right Certificate, we anticipate that we will be able to obtain the necessary environmental approvals, but there can be no assurance in this regard. We may not be able to comply with environmental regulations at all times as the Chinese environmental legal regime is evolving and becoming more stringent. Therefore, if the Chinese government imposes more stringent regulations in future, we may have to incur additional and potentially substantial costs and expenses in order to comply with new regulations, which may negatively affect our results of operations. Furthermore, no assurance can be given that all potential environmental liabilities have been identified or properly quantified or that any prior owner, operator, or tenant has not created an environmental condition unknown to us. If we fail to obtain our Land Use Right Certificate or to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and be subject to claims for damages that may require us to pay substantial fines or have our operations suspended or even be forced to cease operations.

We do not presently maintain business disruption insurance and any disruption of the operations in our production facility would damage our business.

All of our feed additive products are currently manufactured in our production facility in the Huadu Economic Development Zone near the capital city of Guangzhou in the province of Guangdong, China. Our operations could be interrupted by fire, flood, earthquake and other events beyond our control. Any disruption of the operations in our production facility would have a significant negative impact on our ability to manufacture and deliver products as we would likely be unable to outsource our production on terms favorable to us, if at all. Failure to replace any lost production capability would cause a potential reduction in sales, the cancellation of orders, loss of valuable employees, damage to our reputation and potential lawsuits.

Our products and processes can expose us to product liability claims.

Product liability claims or product recalls can adversely affect our business reputation and expose us to increased scrutiny by local, provincial, and central governmental regulators. The packaging, marketing and distribution of agricultural feed additive products entail an inherent risk of product liability and product recall and the resultant adverse publicity. We may be subject to significant liability if the consumption of any of our products causes injury, illness or death of livestock, other animals or humans. We could be required to recall certain of our feed additive products in the event of contamination or damage to the products. In addition to the risks of product liability or product recall due to deficiencies caused by our production or processing operations, we may encounter the same risks if any third party tampers with our feed additive products. We may be required to perform product recalls, or that product liability claims will be asserted against us in the future. Any claims that may be made may create adverse publicity that would have a material adverse effect on our ability to market our feed additive products successfully or on our business, reputation, prospects, financial condition and results of operations. A successful product liability claim in excess of our insurance coverage could have a material adverse effect on us and could prevent us from obtaining adequate product liability insurance in the future on commercially reasonable terms.

Our current and future operations substantially depend on our management team and other key personnel, the loss of any of whom could disrupt our business operations.

Our business does and will depend in substantial part on the continued service of our senior management and founder, including but not limited to Guixiong Qiu, Xugang Shu and Bo Jun. The loss of the services of one or more of our key personnel could impede implementation and execution of our business strategy and result in the failure to reach our goals. We do not carry key person life insurance for any of our officers or employees. Our future success will also depend on the continued ability to attract, retain and motivate highly qualified personnel in the diverse areas required for continuing our operations. The rapid growth of the economy in China has caused intense competition for qualified personnel. We may not be able to retain our key personnel or that we will be able to attract, train or retain qualified personnel in the future.

Volatile energy prices could adversely affect our operating results.

In the last few years, energy prices have risen dramatically and are now volatile, which has resulted in increased and unpredictable increases for our raw materials costs. Continued or volatile increases in energy prices could adversely affect demand for our feed products and increase our operating costs, both of which would reduce our operating income.

If we need additional financing, we may not be available to find such financing on satisfactory terms or at all. The cost of obtaining additional financing may adversely affect our stockholders or the financial interests of the Company.

Our capital requirements may be accelerated as a result of many factors, including the growth and timing of our business development activities, budget shortfalls, unanticipated expenses or capital expenditures, future product opportunities, future licensing opportunities and future business combinations. Consequently, we may need to seek additional debt or equity financing, which may not be available on favorable terms, if at all, and which may be dilutive to our stockholders.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Any provider of debt financing would also be superior position to our stockholders’ interest in the event of a bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

We face risks associated with currency exchange rate fluctuations; any adverse fluctuation may adversely affect our operating margins

Almost all of our revenues are denominated in Renminbi. Conducting business in currencies other than US dollars subjects us to fluctuations in currency exchange rates that could have a negative impact on our reported operating results. Fluctuations in the value of the US dollar relative to other currencies impact our revenues, cost of revenues and operating margins and result in foreign currency translation gains and losses. If the exchange rate of the Renminbi is affected by lowering its value as against the US dollar, our reported profitability when stated in US dollars will decrease. Historically, we have not engaged in exchange rate hedging activities and have no current intention of doing so.

We may not be able to adequately protect and maintain our intellectual property, trademark, and brand names.

Our business has and will depend on our ability to continue to develop and market feed additive products. We currently own two patents and have entered into an exclusive licensing agreement with respect to two other patents covering aspects of the manufacturing and production of feed additives. We have filed applications for five additional patents. Our inability to protect our rights to this intellectual property may adversely affect our ability to prevent competitors from using our products and developments.

Intellectual property rights in China are still developing, and there are uncertainties involved in the protection and the enforcement of such rights. We will need to pay special attention to protecting our intellectual property and trade secrets. Failure to do so could lead to the loss of a competitive advantage that could not be compensated by our damages award.

Risks Related to Our Corporate Structure

The Chinese government may determine that the VIE Agreements which we utilize to operate Guangzhou Tanke are not in compliance with applicable Chinese laws, rules and regulations and that they are therefore unenforceable.

In China it is widely understood that foreign investment enterprises, or FIEs, are forbidden or restricted from engaging in certain businesses or industries which are sensitive to the economy. As we intend to centralize our management and operation in China without being restricted to conduct certain business activities which are important for our current or future business but are restricted or might be restricted in the future, we believe our VIE Agreements will be essential for our business operation. Pursuant to the terms of the VIE Agreement, almost all of our business activities in China are managed and operated by China Flying though Kanghui Agricultural, and almost all economic benefits and risks arising from the business of Guangzhou Tanke are transferred to China Flying and Kanghui Agricultural.

There are risks involved with the operation of Guangzhou Tanke under the VIE Agreements. We received an opinion, dated January 4, 2011, from Martin Hu & Partners, our PRC legal counsel, that if the Chinese government determines the VIE Agreement used to control the operating company to be unenforceable as they circumvent the Chinese restrictions relating to foreign investment restrictions, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

·

|

imposing economic penalties;

|

|

|

·

|

discontinuing or restricting the operations of China Flying, Kanghui Agricultural or Guangzhou Tanke;

|

|

|

·

|

imposing conditions or requirements in respect of the VIE Agreements with which Kanghui Agricultural or Guangzhou Tanke may not be able to comply;

|

|

|

·

|

requiring us to restructure the relevant ownership structure or operations;

|

|

|

·

|

taking other regulatory or enforcement actions that could adversely affect our business; and

|

|

|

·

|

revoking the business license and/or the licenses or certificates of China Flying or Kanghui Agricultural, Guangzhou Tanke, and/or voiding the VIE Agreements.

|

Any of these actions could have a material adverse impact on our business, financial condition and results of operations.

We depend upon the VIE Agreements in conducting our operations in China, which may not be as effective as direct ownership .

We conduct our business through our Chinese operating subsidiaries and generate the revenues through the VIE Agreements. The VIE Agreements may not be as effective in providing us with control over Guangzhou Tanke as direct ownership. The VIE Agreements are governed by Chinese laws and provide for the resolution of disputes through arbitration proceedings pursuant to Chinese laws. Accordingly, the VIE Agreements will be interpreted in accordance with Chinese laws. If Guangzhou Tanke or its shareholders fail to perform the obligations under the VIE Agreements, we may have to rely on legal remedies under Chinese laws, including seeking specific performance or injunctive relief, and claiming damages, and there is a risk that we may be unable to obtain these remedies. The legal environment in China is not as developed as in other jurisdictions. As a result, uncertainties in the Chinese legal system could limit our ability to enforce the VIE Agreements.

The pricing arrangement under the VIE Agreements may be challenged by Chinese tax authorities.

We could face adverse tax consequences if Chinese tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. If the Chinese tax authorities determine that the VIE Agreements were not entered into on an arm’s length basis, they may adjust the income and expenses of our company for Chinese tax purposes which could result in higher tax liability.

Any deterioration of the relationship between Kanghui Agriculture and Guangzhou Tanke could materially and adversely affect the overall business operation of our company.

Our relationship with Guangzhou Tanke is governed by the VIE Agreements, which are intended to provide us, through our ownership of China Flying and indirect ownership of Kanghui Agricultural, with effective control over the business operations of Guangzhou Tanke. Guangzhou Tanke could violate the VIE Agreements, go bankrupt, suffer from difficulties in its business, fail to renew necessary permits and certifications or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputation, business and stock price could be severely harmed.

If Kanghui Agricultural exercises the purchase options over Guangzhou Tanke’s equity pursuant to the VIE Agreements, the payment of purchase prices could materially and adversely affect our financial position.

Under the VIE Agreements, China Flying, through its ownership of Kanghui Agricultural, holds an option to purchase all or a portion of the equity of Guangzhou Tanke at a price, pro rata in case of not all, based on the capital paid in by the Tanke Shareholders ($1,147,704 or 9.5 million RMB). If applicable Chinese laws and regulations require an appraisal of the equity interest or provide other restrictions on the purchase price, the purchase price shall be the lowest price permitted under the applicable Chinese laws and regulations. As Guangzhou Tanke is already a contractually controlled affiliate to our company, Kanghui Agricultural’s purchase of Guangzhou Tanke’s equity would not bring immediate benefits to us. Due to the existence of the VIE Agreements, we currently receive all of the revenue of Guangzhou Tanke, after the payment of taxes. Therefore, even if we own Guangzhou Tanke, we will not have a stronger claim to its revenue. In addition, payment of the option price would significantly decrease our cash and this reduction of cash would have a material adverse impact on our financial position.

If the consulting service agreement between Kanghui Agricultural and Guangzhou Tanke is terminated, it could materially and adversely affect the business operation of our company.

Either Guangzhou Tanke or Kanghui Agricultural may terminate the consulting service agreement entered into by and between them as part of the VIE agreements if circumstances arise that could materially and adversely affect the performance of the objectives of this agreement. We may close our control over the operations of Guangzhou Tanke if the consulting service agreement is terminated.

Risks Associated With Doing Business in China

If Guangzhou Tanke’s land use rights are revoked, we would have no operational capabilities.

Under Chinese law, land is owned by the state or rural collective economic organizations. The rural collective economic organizations issue to tenants the rights to use rural land. Use rights can be revoked and the tenants forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. We rely heavily on Guangzhou Tanke’s land use rights for our operations, and the loss of such rights would have a material adverse effect on our business.

We entered into a Land Use Right Grant Agreement with the government of Huaqiao Town, Huadu District, Guangzhou under which the Government of Huaqiao Town granted us certain land use rights for an area of approximately 60 mu where our manufacturing facility is built. The land use right of such parcel of land is owned collectively by local farmers. However, we currently do not maintain a Land Use Right Certificate for such parcel of land. Having no use right certificate of our land would have a material adverse effect on us as we would be required to relocate our facilities and obtain new land use rights, and there is a risk that we would not be able to accomplish such a relocation with reasonable cost or at all.

In addition, we currently do not maintain a building ownership certificate for our manufacturing facility. Because Guangzhou Tanke does not have land use right certificate on this parcel of land, it neither applied for nor will be granted a building ownership certificate for the manufacturing facility it built on this parcel of land. We may not be able to eventually obtain the building ownership certificate for the foresaid land with reasonable cost.

Economic, political and social conditions in China are subject to significant uncertainty and could affect our business.

All of our operations are located in China and our business is subject to political and economic uncertainties in China. The economy of China differs from the economies of most developed countries in many respects, including the level of government involvement, the level of development, control of foreign exchange, and methods for allocating resources. A substantial portion of productive assets in China are owned by the Chinese government. Changes in Chinese policies, laws and regulations, or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on imports, restrictions or prohibitions on dividend payments to stockholders, devaluations of currency or the nationalization or other expropriation of private enterprises may occur from time to time without notice and could have a material adverse effect on our business. Nationalization or expropriation could result in the total loss of our investment in China. We have no control over most of these risks and may be unable to anticipate changes in Chinese economic and political conditions.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. The Chinese central or local governments may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

Future inflation in China may inhibit our ability to conduct business in China. In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

If relations between the United States and China worsen, our share price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Any political or trade controversies between the United States and China in the future could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

In the fiscal year ended December 31, 2010, we derived approximately 99% of our sales in China. A slowdown or other adverse developments in China’s economy may materially and adversely affect our customers, demand for our products and our business.

During the fiscal year ended December 31, 2009, we generated 95% of our sales in China. We anticipate that sales of our products in China will continue to represent a significant majority of our total sales in the near future. The significant growth of China’s economy in recent years may not continue. The industry which we are involved in China is relatively new and growing, but we do not know how sensitive we are to a slowdown in economic growth or other adverse changes in the Chinese economy which may affect demand for our products. In addition, the Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Efforts by the Chinese government to slow the pace of growth of the Chinese economy could result in reduced demand for our products. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in China may materially reduce the demand for our products and materially and adversely affect our business.

We may have limited legal recourse under Chinese laws if disputes arise under our contracts with third parties.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under Chinese laws, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. In addition, the inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital and could have a material adverse impact on our operations business and financial condition.

Because our principal assets are located outside of the United States and our sole director and officer and all of our key employees reside in China, outside of the United States, it may be difficult for you to enforce your rights based on the United States federal securities laws against us and our officers and directors in the United States or to enforce judgments of United States courts against us or them in China.

Our sole director and officer and all of our key employees reside in China, outside of the United States. In addition, our principal operating business is located in China and all of our assets are located outside of the United States. China does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States federal securities laws against us in the courts of either the United States or China and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in Chinese courts. Further, it is unclear if extradition treaties now in effect between the United States and Chinese would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States federal securities laws or otherwise.

We may have difficulty establishing adequate management, legal and financial controls in China, which could impair our planning processes and make it difficult to provide accurate reports of our operating results.

China historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees familiar with these concepts, practices and systems to work in China. As a result of these factors, and especially given that we expect to be a publicly listed company in the U.S. and subject to regulation as such, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in China.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing our revenue in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in China use their local currency as their functional currency. Substantially all of our revenue and expenses are in Chinese Renminbi. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. However, on July 21, 2005, the Chinese government changed its policy of pegging the value of Chinese Renminbi to the U.S. dollar. Under the new policy, Chinese Renminbi may fluctuate within a narrow and managed band against a basket of certain foreign currencies. It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of Chinese Renminbi against the U.S. dollar. We can offer no assurance that Chinese Renminbi will be stable against the U.S. dollar or any other foreign currency.

Our financial statements are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign consolidated subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign consolidated subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks. The availability and effectiveness of any hedging transaction may be limited and we may not be able to hedge our exchange rate risks.

The application of Chinese regulations relating to the overseas listing of Chinese domestic companies is uncertain, we may be subject to penalties for failing to request approval of the Chinese authorities prior to listing our shares in the U.S. and we may be subject to additional approval requirements for Kanghui Agricultural’s acquisition of Guangzhou Tanke.

On August 8, 2006, six Chinese government agencies, namely, the Ministry of Commerce, or MOFCOM, the State Administration for Industry and Commerce, or SAIC, the China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, the State Assets Supervision and Administration Commission, or SASAC, and the State Administration for Taxation, or SAT, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which we refer to as the “New M&A Rules”, which became effective on September 8, 2006. The New M&A Rules purport, among other things, to require offshore “special purpose vehicles,” that are (1) formed for the purpose of overseas listing of the equity interests of Chinese companies via acquisition and (2) are controlled directly or indirectly by Chinese companies and/or Chinese individuals, to obtain the approval of the CSRC prior to the listing and trading of their securities on overseas stock exchanges.

There are substantial uncertainties regarding the interpretation, application and enforcement of the New M&A Rules and CSRC has yet to promulgate any written provisions or formally declare or state whether the overseas listing of a China-related company structured similar to ours is subject to the approval of CSRC. Any violation of these rules could result in fines and other penalties on our operations in China, restrictions or limitations on remitting dividends outside of China, and other forms of sanctions that may cause a material and adverse effect to our business, operations and financial conditions.

The new mergers and acquisitions regulations also established additional procedures and requirements that are expected to make merger and acquisition activities by foreign investors more time-consuming and complex, including requirements in some instances that the Ministry of Commerce be notified in advance of any change-of-control transaction in which a foreign investor takes control of a Chinese domestic enterprise that owns well-known trademarks or China’s traditional brands. We may grow our business in part by acquiring other businesses. If within two years, the relevant PRC authority determines that Kanghui Agricultural lacks a business in the ordinary course, Kanghui Agricultural may be considered as a wholly foreign owned holding company and therefore Kanghui Agricultural’s acquisition of Guangzhou Tanke may be subject to additional approvals that are required under the new M&A Rule. Complying with the requirements of the new mergers and acquisitions regulations in completing this type of transactions could be time-consuming, and any required approval processes, including CSRC approval, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

Recent Chinese regulations relating to the establishment of offshore special purpose companies by Chinese residents may subject our Chinese resident shareholders or our Chinese subsidiaries to penalties, limit our ability to distribute capital to our Chinese subsidiaries, limit our Chinese subsidiaries’ ability to distribute funds to us, or otherwise adversely affect us.

The SAFE issued a public notice in October 2005, or the SAFE Circular No. 75, requiring Chinese residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing with assets or equities of Chinese companies, referred to in the SAFE Circular No. 75 as special purpose vehicles, or SPVs. Chinese residents who are shareholders of SPVs established before November 1, 2005 were required to register with the local SAFE branch before June 30, 2006. Further, Chinese residents are required to file amendments to their registrations with the local SAFE branch if their SPVs undergo a material event involving changes in capital, such as changes in share capital, mergers and acquisitions, share transfers or exchanges, spin-off transactions or long-term equity or debt investments.