Attached files

| file | filename |

|---|---|

| 8-K - VVC VUHI 8K - VECTREN CORP | vvc_vuhi8k.htm |

| EX-99.2 - EXHIBIT 99.2 - VECTREN CORP | ex99_2.htm |

Exhibit 99.1

AGA Financial Forum

Investor Presentation

May 15-17, 2011

2

Forward-Looking Statements

All statements other than statements of historical fact are forward-looking statements made

in good faith by the company and are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. Such statements are

based on management’s beliefs, as well as assumptions made by and information currently

available to management and include such words as “believe”, “anticipate”, ”endeavor”,

“estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar

expressions intended to identify forward-looking statements.

in good faith by the company and are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. Such statements are

based on management’s beliefs, as well as assumptions made by and information currently

available to management and include such words as “believe”, “anticipate”, ”endeavor”,

“estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar

expressions intended to identify forward-looking statements.

Vectren cautions readers that the assumptions forming the basis for forward-looking

statements include many factors that are beyond Vectren’s ability to control or estimate

precisely and actual results could differ materially from those contained in this document.

Forward-looking statements speak only as of the date on which our statement is made, and

we assume no duty to update them. More detailed information about these factors is set

forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s

2010 annual report on Form 10-K filed on February 17, 2011.

statements include many factors that are beyond Vectren’s ability to control or estimate

precisely and actual results could differ materially from those contained in this document.

Forward-looking statements speak only as of the date on which our statement is made, and

we assume no duty to update them. More detailed information about these factors is set

forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s

2010 annual report on Form 10-K filed on February 17, 2011.

Robert L. Goocher, Treasurer and VP - Investor Relations

rgoocher@vectren.com

812-491-4080

3

Management Representatives at AGA

Ø Carl Chapman - Chairman, President and CEO

Ø Jerry Benkert - Executive Vice President and CFO

Ø Robert Goocher - Treasurer & Vice President - Investor Relations

Ø Aaron Musgrave - Manager - Investor Relations

Ø NYSE Symbol: VVC

Ø 8-10% target annual total

shareholder return

shareholder return

• Annual dividends paid increased

51st consecutive year in Dec. 2010

to annualized rate of $1.38 per

share

51st consecutive year in Dec. 2010

to annualized rate of $1.38 per

share

Ø Over 1.1 million utility customers

in Indiana and Ohio

in Indiana and Ohio

• Operate in constructive regulatory

environments with revenue

stabilization mechanisms

environments with revenue

stabilization mechanisms

Ø Well diversified nonutility portfolio

linked to core utility

linked to core utility

Ø ~$4.8 billion in assets

Ø ~$2.1 billion in revenues

Ø ~$2.3 billion market cap

Ø S&P: A-, Moody’s: A3

Stable outlook for both

Stable outlook for both

Utility Net Income

Consolidated Net Income*

Three Year Average (’08-’10)

Utility

84%

Nonutility

16%

Electric

50%

Gas

50%

4

* Excludes the 2009 Liberty charge of $11.9 million.

Vectren Corporation Overview

5

Vectren at a Glance

Vectren

Utility

Vectren

Nonutility

Vectren North

Indiana Gas

Vectren South

SIGECO -

Electric

Electric

Vectren South

SIGECO - Gas

Vectren Ohio

VEDO

Infrastructure

Services

Services

Energy

Services

Services

Coal Mining

Energy

Marketing

Marketing

Miller Pipeline

Energy

Systems Group

Prosperity Mine

Oaktown Mine 1

Oaktown Mine 2

(under development)

ProLiance

Energy **

Vectren

Source

Minnesota

Limited *

** Jointly owned with a

subsidiary of Citizens Energy

Group

subsidiary of Citizens Energy

Group

* Acquired on 3/31/2011

6

Looking Ahead - Strategies for 2011 and Beyond

Utility

Ø Execute strategies to consistently achieve annual utility earnings growth target of 3%

• Earn allowed returns in gas and electric utilities

– Implement new electric rates from 4/27/11 base rate Order

– Aggressively manage costs through performance management and strategic sourcing

– Seek continued support for alternative regulatory solutions that encourage customer

conservation and also reduce the size and frequency of traditional base rate cases

conservation and also reduce the size and frequency of traditional base rate cases

• Disciplined allocation of capital to operate at cash flow neutral

– Reinvest earnings to support necessary rate base growth

– Reduce external financing requirements

Nonutility

Ø Continued growth and profitability of existing portfolio of nonutility businesses

• Increase investments in Infrastructure and Energy Services businesses to drive longer term

earnings growth

earnings growth

– Including Infrastructure Services’ acquisition of Minnesota Limited on March 31, 2011

• As demand continues to recover, open Oaktown #2 coal mine in 2012 and ramp up to full

production

production

• Focus on dramatically improving ProLiance’s profitability prospects through customer growth and

significant reductions in fixed cost structure

significant reductions in fixed cost structure

7

Early 2011 Highlights

Ø 1st Quarter 2011 earnings of $44.6 million, or $0.55 per share, compared to $63.2 million,

or $0.78 per share in 2010

or $0.78 per share in 2010

• Consolidated results on plan for the quarter; Consolidated 2011 guidance affirmed

• Utility results were as expected with solid large customer margins tempered by higher operating

expenses from planned maintenance of electric generating units

expenses from planned maintenance of electric generating units

• Lower nonutility earnings reflecting lower contributions from ProLiance as expected

– All nonutility businesses remain on track to meet 2011 expectations

Ø Order for $28.6 million annualized base rate increase received in electric rate case on April

27, 2011

27, 2011

Ø Successfully priced $150 million of utility related long-term debt in March 2011 at weighted

average interest rate of 5.12%

average interest rate of 5.12%

• Eliminates refinancing risk for 6.625% December 2011 $250 million maturity

• Remainder to be retired with short-term debt

• Delayed draw feature matches timing of retirement

Ø Acquisition of Minnesota Limited on 3/31/2011 enhances growth opportunities for

Infrastructure Services segment

Infrastructure Services segment

• Expected to add $0.02-$0.04 to 2011 EPS

Ø Indiana Senate Bill 251 signed by the Governor on 5/10/11; allows for cost recovery outside

a base rate proceeding for federally mandated projects and provides for a voluntary clean

energy portfolio standard

a base rate proceeding for federally mandated projects and provides for a voluntary clean

energy portfolio standard

• Applies to the integrity, safety, and reliable operation of natural gas pipelines and facilities as well as

environmental costs incurred due to EPA rules for both our gas and electric utilities

environmental costs incurred due to EPA rules for both our gas and electric utilities

8

Electric Base Rate Case - Order on April 27, 2011

Ø Annualized rate increase of $28.6 million based on 10.4% ROE; new rates effective 5/2/11

• Consistent with 2011 guidance expectation of ~$15-20 million of rate relief, which assumed a partial-

year impact

year impact

Ø Decoupling rate design denied

• However, separate settlement in place provides opportunity for subsequent filing for lost margin

recovery from implementation of energy efficiency programs

recovery from implementation of energy efficiency programs

Ø Coal contracts remain effective

• Going forward a Commission review process for future coal procurement will be initiated

Ø Continuation of 50/50 Wholesale Power Marketing sharing above & below the annual base

rate level of $7.5 million

rate level of $7.5 million

• Previous base level was $10.5 million

Ø Approved deferred depreciation and continued AFUDC accrual on Dense Pack projects (~$35

million investment thru 2013)

million investment thru 2013)

9

Transaction Highlights - Minnesota Limited Acquisition

Ø Consistent with plan to target infrastructure services growth through geographic

and market expansion opportunities

and market expansion opportunities

• Net purchase price of $83 million; Closed 3/31/2011

• Expected to add $0.02-$0.04 to Vectren’s EPS in 2011

• Provides underground transmission pipeline construction and repair services for natural gas

and petroleum companies

and petroleum companies

– Complements Miller’s other existing market segments for natural gas, water and wastewater

construction, primarily focused on distribution; limited overlap of customers and geography

construction, primarily focused on distribution; limited overlap of customers and geography

– Positions combined company to take advantage of the pipeline construction impacts from shale

– Brings expanded construction capabilities to Miller’s existing customer base in the

Marcellus shale basin

Marcellus shale basin

– Minnesota’s location positions them for growth in the Bakken shale basin in North

Dakota

Dakota

• Synergies from the combination expected to result in revenue growth opportunities and

efficiencies

efficiencies

– Combined resources provides ability to compete for larger projects; sharing of equipment and

facilities

facilities

• Minnesota’s experienced and well respected management team remains in place (Big Lake,

MN)

MN)

• See Appendix for additional information on the transaction

10

2011 EPS Guidance Affirmed

Consolidated: $1.60 to $1.85 per share

Utility: $1.45 to $1.55 per share

Nonutility, excl. ProLiance: $0.32 to $0.42 per share

ProLiance: $(0.20) to $(0.10) per share

Ø Consolidated 2011 EPS guidance midpoint remains at $1.87, excluding ProLiance

11

Generation Portfolio

Ø 5 Coal-fired base units - 1,000 MW

• 100% scrubbed for SO2

• 90% controlled for NOx

• Combination of pollution controls,

including fabric filter technology, have the

co-benefit of removing substantial levels

of mercury and particulate matter

including fabric filter technology, have the

co-benefit of removing substantial levels

of mercury and particulate matter

• Vectren’s generation fleet investments

over the past decade have positioned the

company well to comply with the new EPA

rules without significant additional

investment; Indiana SB251 is supportive if

future investments are necessary

over the past decade have positioned the

company well to comply with the new EPA

rules without significant additional

investment; Indiana SB251 is supportive if

future investments are necessary

Ø 6 Gas-fired peak-use turbines - 295 MW

Ø Purchased capacity - 100 MW thru 2012

Ø Renewable energy ~ 5%

• Land-fill gas generation facility - 3 MW

• Wind energy - up to 80 MW via purchased

power agreements of ~20 years

power agreements of ~20 years

The Utility Group

Utility Service Territories

OH

IN

Vectren Utility Holdings, Inc.

Vectren Energy Delivery of Indiana - North

570,000 Gas Customers

Vectren Energy Delivery of Indiana - South

142,000 Electric Customers

111,000 Gas Customers

Vectren Energy Delivery of Ohio

314,000 Gas Customers

12

Constructive Utility Regulation - Mitigating Risk

Ø Gas Utilities’ Rate Base: ~$1.2 billion

• ~$0.9 billion Indiana

• ~$0.3 billion Ohio

• ~10.2% Total Gas Allowed ROE

(1) Settlement pending which provides for a mechanism to recover margins lost from the company's large

commercial and industrial customers associated with implementation of energy efficiency programs. The settlement

also provides that margins lost from residential and commercial customers due to energy efficiency programs may

be deferred for future recovery under a rate mechanism to be proposed by the company.

commercial and industrial customers associated with implementation of energy efficiency programs. The settlement

also provides that margins lost from residential and commercial customers due to energy efficiency programs may

be deferred for future recovery under a rate mechanism to be proposed by the company.

Ø Electric Utility Rate Base: ~$1.3 billion

• All Indiana; Excludes FERC Transmission

• 10.4% Allowed ROE

Ø FERC Electric Transmission Rate Base: ~$0.1 billion

• 12.38% Allowed ROE

13

Utility Investments and Cash Flow

Ø Targeting free cash flow neutral in 2011-2013, similar to 2010

• Depreciation & amortization expense of $190 to $200 million expected through 2013

Ø Favorable regulatory support in recovering capital spend on significant utility expenditures

• Annual incremental margins expected each year from regulatory mechanisms for current recovery of Ohio bare

steel/cast iron (BS/CI) expenditures, and favorable BS/CI accounting treatment in IN

steel/cast iron (BS/CI) expenditures, and favorable BS/CI accounting treatment in IN

• Total investment of ~$90 million in high voltage electric transmission line, timely recovered at FERC-approved

equity return of 12.38%, with completion in 2012; 2011 earnings to reflect a return on ~$75 million of the total

equity return of 12.38%, with completion in 2012; 2011 earnings to reflect a return on ~$75 million of the total

Ø Utilize cash generated from bonus depreciation to reduce external financing requirements and

accelerate funding of pension plans in 2011 ($25 million)

accelerate funding of pension plans in 2011 ($25 million)

• Estimate will generate ~$100 million of incremental cash in 2011-2013

Infrastructure Services - Miller Pipeline and Minnesota

Limited

Limited

Ø Provides underground pipeline construction and

repair services for natural gas, water and

wastewater companies

repair services for natural gas, water and

wastewater companies

Ø 2010 gross revenues of ~$235 million

($30 million from transmission construction)

Ø Over 1,700 employees

Ø Over 55 years in construction business

Ø Headquartered in Indianapolis, IN

Ø Operates primarily in Midwest, Mid-Atlantic and

Southern regions

Southern regions

Ø Major customers are regional utilities, such as

Vectren, NiSource, Duke, LG&E, Alagasco and

Citizens

Vectren, NiSource, Duke, LG&E, Alagasco and

Citizens

Ø Acquired 5 small regional pipeline construction

companies over past 4 years, expanding location

and scope of operation

companies over past 4 years, expanding location

and scope of operation

Ø Provides underground pipeline construction

and repair services for natural gas and

petroleum transmission companies

and repair services for natural gas and

petroleum transmission companies

Ø 2010 gross revenues of ~$110 million

Ø Nearly 500 employees

Ø Over 45 years in construction business

Ø Headquartered in Big Lake, MN

Ø Operates primarily in Minnesota and

surrounding states

surrounding states

Ø Major customers include Northern Natural,

Consumers Energy, Enbridge Energy and

Minnesota Pipe Line

Consumers Energy, Enbridge Energy and

Minnesota Pipe Line

Ø Management team will remain in place

• Strong, multi-year retention incentive in

place for Minnesota’s President

place for Minnesota’s President

14

15

Infrastructure Services - cont.

Ø Significant drivers for future growth include:

• New and existing customers - more projects as economy continues rebound; availability of bonus

depreciation

depreciation

– Bare steel/cast iron replacement programs, along with waste water and sewer rehabilitation

projects

projects

– Increased emphasis on growing gas transmission construction business, building off successful

2010 projects

2010 projects

– Competing for growing number of new shale gas pipeline infrastructure projects

– Significant work expected related to gas pipeline infrastructure integrity assessments resulting

from San Bruno and other recent incidents

from San Bruno and other recent incidents

• Utilization of technology and other workforce improvement measures to drive improved

productivity, efficiency and control costs

productivity, efficiency and control costs

• Infrastructure is a focused growth area for Vectren

16

Energy Services - Energy Systems Group (ESG)

Ø Performance contracting and renewable

energy project group

energy project group

• 2010 revenues of $147 million

• Record backlog of $122 million at 3/31/11

• Approx. 235 employees at 3/31/11 and currently

ramping up hiring to set the stage for future

growth

ramping up hiring to set the stage for future

growth

Ø Operates primarily in the Midwest, Mid-

Atlantic and Southern regions, recently

expanding its territorial reach including Texas,

Colorado, New Mexico and U.S. Virgin Islands

Atlantic and Southern regions, recently

expanding its territorial reach including Texas,

Colorado, New Mexico and U.S. Virgin Islands

• Major customers include hospitals, universities,

governments and schools (HUGS)

governments and schools (HUGS)

Ø Provides energy-saving performance

contracting

contracting

• Design facility improvements that pay for

themselves from energy savings and

operational improvements

themselves from energy savings and

operational improvements

Ø Designs, constructs, manages and owns

renewable energy projects

renewable energy projects

• Successfully completed three landfill gas projects

• Near-term opportunities include landfill and

anaerobic digester projects

anaerobic digester projects

Ø ESG is partnering with eight gas/electric

utilities as conservation and renewable

energy contractor

utilities as conservation and renewable

energy contractor

• Subcontractor under the federal “area

wide” contractor mechanism to develop

energy efficiency conservation projects to

federal installations

wide” contractor mechanism to develop

energy efficiency conservation projects to

federal installations

Ø Energy Efficient Commercial Building

federal income tax deductions (Revenue

Code 179D) available through 2013

federal income tax deductions (Revenue

Code 179D) available through 2013

17

Coal Mining

Ø Mines and sells Indiana coal to Vectren’s utility

operations and other third parties

operations and other third parties

• 2010 revenues of $210 million

• 750 contract mining jobs with completion of Oaktown

mines

mines

Ø Competitive location - 13 power plants within 50

mile radius of underground mines

mile radius of underground mines

Ø 2011 sales estimated at 5.1 million tons compared

to 3.7 million in 2010

to 3.7 million in 2010

• 90% contracted and priced

• Reduced costs at Oaktown 1 due to additional volumes

• ~1.9 million tons to Vectren, incl. 200k deferred

Ø Approximately 40% and 15%, respectively, of

2012 and 2013 expected production already

contracted and priced

2012 and 2013 expected production already

contracted and priced

Ø As 2nd Oaktown mine comes online in 2012,

production costs per ton expected to decline

production costs per ton expected to decline

• Will enable cost sharing of investments already

made in wash plant, rail spur, etc., plus other

operating efficiencies

made in wash plant, rail spur, etc., plus other

operating efficiencies

Ø Long-term Illinois Basin coal demand expected to

continue increasing as economy improves,

inventory levels reduced, scrubbers are installed,

and as Appalachian production declines

continue increasing as economy improves,

inventory levels reduced, scrubbers are installed,

and as Appalachian production declines

Ø Prosperity Mine

• 32 million tons of reserves

• 4.0 lbs SO2 - 11,300 BTU

• Est. max annual production up to 3 million

tons

tons

• Mine reconfiguration was completed 1st

quarter 2011, driving cost reductions

quarter 2011, driving cost reductions

Ø Oaktown Mines 1 & 2

• 104 million tons of reserves

• Less than 6.0 lbs SO2 - 11,200 BTU

• Est. max annual production

– Oaktown #1 up to 3 million tons

– Oaktown #2 up to 2 million tons

– Ramp up in production dependent on

contracts, negotiations continue

contracts, negotiations continue

• Through December 2010, $185 million in

development costs already incurred of

expected $205 million total for both mines

development costs already incurred of

expected $205 million total for both mines

18

Energy Marketing - ProLiance

Ø Energy marketing affiliate with Vectren (61%)

and Citizens Energy Group (39%) - equity

accounting

and Citizens Energy Group (39%) - equity

accounting

• 2010 revenues of $1.5 billion

• ~100 employees

• Operates throughout the Midwest & Southeast

• 46 Bcf of natural gas storage and diverse

pipeline transportation network under contract

pipeline transportation network under contract

• Balanced book approach - VaR capped at $2.5

million

million

Ø Provides bundled gas services, including base

load, peaking sales, risk management, and

other ancillary services

load, peaking sales, risk management, and

other ancillary services

• Retail services to over 1,700 Commercial and

industrial customers

industrial customers

• Wholesale services to utilities, municipals,

power generators

power generators

• Ranked #2 out of 32 gas marketers in 2010

Mastio customer satisfaction survey; in top 4

each of the past 5 years

Mastio customer satisfaction survey; in top 4

each of the past 5 years

Ø Indiana regulatory approval received in March 2011 for ProLiance’s continued provision of gas supply

services to Vectren’s & Citizens’ utilities for an additional five years, through March 2016

services to Vectren’s & Citizens’ utilities for an additional five years, through March 2016

Ø Restructuring of transportation and storage contracts

• $7 million of annualized fixed demand costs will be dropped in 2011 starting in the second quarter

• $25 million or one-third of contracts expire over next 3 years, $40 million or half over next 5 years

Ø Growth in commercial and industrial (C&I) customers

• C&I customer count is up 15% in Q1 2011 vs. Q1 2010

• C&I and power generation customers’ volumes up 40% in Q1 2011 vs. Q1 2010

Ø Reductions in G&A costs - reductions of over 10% realized in Q1 2011 vs. 2010 (annualized)

19

Energy Marketing - Vectren Source

Ø Source provides natural gas and other

related products and services to retail

customers in the Midwest and Northeast

related products and services to retail

customers in the Midwest and Northeast

• 2010 revenues of $143 million

• Current staffing of over 50 employees

• Operates in 7 LDC territories in 3 states -

Ohio, Indiana and New York, with highest

customer concentration in Ohio

Ohio, Indiana and New York, with highest

customer concentration in Ohio

• Considering expanding footprint to markets

in additional states

in additional states

Ø 4/1/11 customer count of ~255,000, an

increase of 60,000 year over year

increase of 60,000 year over year

Ø Focus on customer retention with a

contract renewal rate above 90%

contract renewal rate above 90%

Ø Conservative risk management practices

• Good mix of fixed and variable price

customers

customers

Ø Ohio is transitioning to a fully deregulated

market, providing growth opportunities as

energy delivery companies exit the

merchant function of buying natural gas for

its customers

market, providing growth opportunities as

energy delivery companies exit the

merchant function of buying natural gas for

its customers

Ø Developing a residential energy efficiency

service with a pilot offering available in

Cleveland under GreenStreet Solutions SM

service with a pilot offering available in

Cleveland under GreenStreet Solutions SM

• General contractor role in home energy audits

and complete service to implement

recommendations

and complete service to implement

recommendations

• Positioned to take advantage of Home Star

program if approved by Congress

program if approved by Congress

• Will be expanding into Cincinnati/Dayton

market in 2011

market in 2011

20

Summary - Investment Fundamentals

Ø Attractive total shareholder return targeted at 8-10% annually

Ø Over 1.1 million utility customers in Indiana and Ohio

• Operate in constructive regulatory environments with numerous revenue stabilization mechanisms

• Utility growth driven by reinvestment of earnings in recoverable infrastructure improvements, increasing large

customer demand and implementation of new electric base rates

customer demand and implementation of new electric base rates

• Disciplined management of cap ex and operating expenses

• Resulting in more predictable earnings growth opportunities and strong cash flow

Ø Well diversified nonutility portfolio linked to core utility

• Upside earnings opportunity on top of solid utility earnings prospects

• Long-term growth primarily focused on significant growth in infrastructure and energy services businesses, along

with ramp up of coal mines to full production

with ramp up of coal mines to full production

• Executing on strategies to grow the Source customer base and return ProLiance to profitability

Ø Stable ‘A’ rated company (both Moody’s & S&P) with strong balance sheet, liquidity, and cash flows

Ø Experienced management team

Ø Attractive dividend

• 51 consecutive years of increasing annual dividends paid

• Attractive dividend yield

21

Appendix

Appendix

22

Consolidated 1st Quarter Results

Appendix

23

Nonutility Metrics - Infrastructure Services

Appendix

24

Nonutility Metrics - Energy Services

Appendix

25

Nonutility Metrics - Coal Mining

Appendix

26

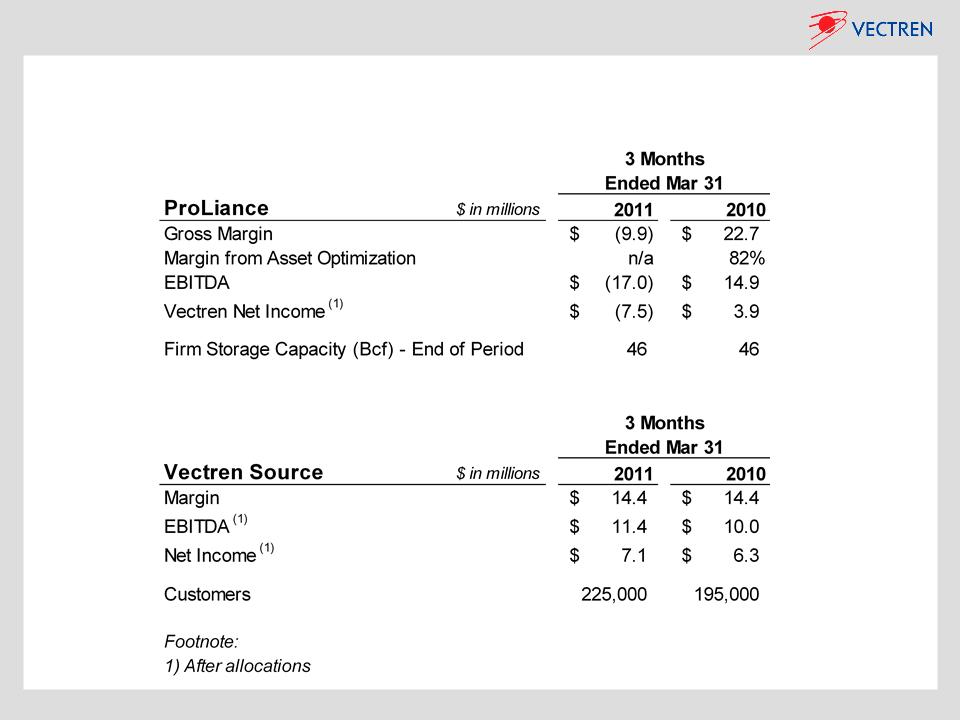

Nonutility Metrics - Energy Marketing

27

Appendix

Vectren’s Acquisition of Minnesota Limited, Inc.

Ø Transaction Highlights

• On March 31, 2011, Vectren announced that it had acquired Minnesota Limited, Inc. a large

diameter natural gas and petroleum transmission pipeline construction contracting business

diameter natural gas and petroleum transmission pipeline construction contracting business

– Expected to add $.02 - $.04 to Vectren’s EPS in 2011, net of incremental interest costs

– Provides additional support for EPS within previously issued range for

2011 earnings guidance

2011 earnings guidance

– Synergies from the combination expected to result in efficiencies, cost savings and revenue

growth opportunities

growth opportunities

– Sharing of equipment and facilities; combined resources provides ability

to compete for larger projects; potential consolidation of “back office”

functions

to compete for larger projects; potential consolidation of “back office”

functions

– Combined companies expected to generate ~$345 million in revenues and have ~2200

employees

employees

Ø Management

• Combined Vectren Infrastructure Services organization led by Miller’s Doug Banning as CEO

• Minnesota’s management team remains in place, headquartered in Big Lake, MN

• Both management teams have extensive experience and are respected leaders in the industry

– Chris Leines of Minnesota Limited is incoming president of Pipe Line Contractors Association

– Kevin Miller of Miller Pipeline is outgoing president of Distribution Contractors Association

28

Appendix

Vectren’s Acquisition of Minnesota Limited, Inc. (Cont.)

Ø Strategic Rationale for the Acquisition

• Consistent with Vectren’s plans to target infrastructure services growth through geographic and

market expansion opportunities

market expansion opportunities

– Complements Miller’s other existing market segments for natural gas, water and wastewater

construction

construction

– Provides access to new customer base and geographic territories for both Miller and

Minnesota Limited

Minnesota Limited

– Significantly enhances market opportunities for installation of large diameter gas and

petroleum pipes and related infrastructure

petroleum pipes and related infrastructure

– Capitalizes on Minnesota Limited’s strong brand equity, proven management team and great

reputation in the transmission pipeline construction industry

reputation in the transmission pipeline construction industry

• Anticipated growth in demand for gas transmission construction

– Driven by increasing onshore drilling and gathering of natural gas and oil as shale basins are

developed, with a particular focus on the Marcellus and Bakken basins

developed, with a particular focus on the Marcellus and Bakken basins

– Expected additional natural gas pipeline regulations creating increased demand for pipeline

infrastructure assessment and system upgrades

infrastructure assessment and system upgrades

• Capture synergies and leverage operational excellence to accelerate performance throughout the

combined business units

combined business units

– Minnesota’s equipment resources can be more effectively utilized as part of a larger

combined entity

combined entity

– Will facilitate standardization and capture of synergies for key functional areas across all

business units (Accounting, IT, Human Resources, Purchasing, etc.)

business units (Accounting, IT, Human Resources, Purchasing, etc.)

Miller Pipeline

current

transmission

territory

current

transmission

territory

Minnesota

Limited current

transmission

territory

Limited current

transmission

territory

29

Appendix

Jointly Capitalizing on Development of Natural Gas and Oil in Shale Basins

Ø Limited overlap of territories

Ø Positioned well to take advantage of the pipeline construction impacts from shale

Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other

are presented herein and are non-GAAP measures. Such per share amounts are based on the

earnings contribution of each group included in Vectren’s consolidated results divided by

Vectren’s basic average shares outstanding during the period. The earnings per share of the

groups do not represent a direct legal interest in the assets and liabilities allocated to the

groups, but rather represent a direct equity interest in Vectren Corporation's assets and

liabilities as a whole. These non-GAAP measures are used by management to evaluate the

performance of individual businesses. In addition, other items giving rise to period over period

variances, such as weather, are presented on an after tax and per share basis. These amounts

are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding

during the period. Accordingly, management believes these measures are useful to investors in

understanding each business’ contribution to consolidated earnings per share and in analyzing

consolidated period to period changes and the potential for earnings per share contributions in

future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP

measure of consolidated earnings per share are included throughout the presentation

presented. The non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures calculated in accordance with

GAAP, and the financial results calculated in accordance with GAAP.

are presented herein and are non-GAAP measures. Such per share amounts are based on the

earnings contribution of each group included in Vectren’s consolidated results divided by

Vectren’s basic average shares outstanding during the period. The earnings per share of the

groups do not represent a direct legal interest in the assets and liabilities allocated to the

groups, but rather represent a direct equity interest in Vectren Corporation's assets and

liabilities as a whole. These non-GAAP measures are used by management to evaluate the

performance of individual businesses. In addition, other items giving rise to period over period

variances, such as weather, are presented on an after tax and per share basis. These amounts

are calculated at a statutory tax rate divided by Vectren’s basic average shares outstanding

during the period. Accordingly, management believes these measures are useful to investors in

understanding each business’ contribution to consolidated earnings per share and in analyzing

consolidated period to period changes and the potential for earnings per share contributions in

future periods. Reconciliations of the non-GAAP measures to their most closely related GAAP

measure of consolidated earnings per share are included throughout the presentation

presented. The non-GAAP financial measures disclosed by the Company should not be

considered a substitute for, or superior to, financial measures calculated in accordance with

GAAP, and the financial results calculated in accordance with GAAP.

Appendix

30

Use of Non-GAAP Performance Measures and Per Share Measures