Attached files

| file | filename |

|---|---|

| 8-K - THE LACLEDE GROUP 8-K 5-13-2011 - SPIRE MISSOURI INC | form8k.htm |

Exhibit 99.1

Investor Presentation

AGA Financial Forum

May 2011

AGA Financial Forum

May 2011

AGA Financial Forum

May 2011

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by

words such as, but not limited to, “estimates,” “expects,” “anticipates,” “intends,” and similar

expressions. Although our forward-looking statements are based on our reasonable

assumptions, future performance or results may be different than those currently anticipated.

Our forward-looking statements in this presentation speak only as of today, and we assume no

duty to update them. Factors that could cause actual results to differ materially from those

expressed or implied are discussed in our most recent annual report on Form 10-K and other

filings with the Securities and Exchange Commission in the “Risk Factors” section as well as

under the “Forward-Looking Statements” heading.

Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by

words such as, but not limited to, “estimates,” “expects,” “anticipates,” “intends,” and similar

expressions. Although our forward-looking statements are based on our reasonable

assumptions, future performance or results may be different than those currently anticipated.

Our forward-looking statements in this presentation speak only as of today, and we assume no

duty to update them. Factors that could cause actual results to differ materially from those

expressed or implied are discussed in our most recent annual report on Form 10-K and other

filings with the Securities and Exchange Commission in the “Risk Factors” section as well as

under the “Forward-Looking Statements” heading.

3

www.thelacledegroup.com

§ Company established in 1857

§ Public utility holding company

formed 2001

formed 2001

§ Consistent earnings performance

paired with a strong balance sheet

and credit rating

paired with a strong balance sheet

and credit rating

§ Rewarding shareholders with a

continuous and growing dividend

continuous and growing dividend

§ Listed on the NYSE (LG) for over

120 years

120 years

§ S&P Small Cap 600 Company

4

§ Pipeline transport of

petroleum products

petroleum products

§ Non-regulated activities

including propane sales

and storage

including propane sales

and storage

§ Potential growth platform

for related investments

for related investments

§ Core natural gas utility

§ Stable, primarily

residential customer

base

residential customer

base

§ Investing to improve

customer service and

operating efficiency

customer service and

operating efficiency

§ Established mix of

wholesale and retail

customers

wholesale and retail

customers

§ Leverages expertise in

the natural gas market

the natural gas market

§ Opportunities to

expand

expand

See Appendix for further discussion of non-GAAP measures

2,830

$56.1

Laclede Group at a Glance

5

Strategic Objectives

§ Build on success of the core regulated utility

business

business

§ Leverage LER’s competencies and strengths

§ Pursue logical growth opportunities

§ Enhance our financial strength

7

Our System and Strengths

§ Largest LDC in Missouri

• ~630,000 customers

• 16,000+ miles of pipe

• 2010 revenues of $875 million

• 2010 net economic earnings of $39.7

million

million

§ Diversified gas supply

• 28 suppliers

• Access to conventional and shale supplies

• Transportation on 7 interstate pipelines,

providing access to all major producing

regions

§ Significant operating storage capacity

• In-market storage

– ~4 Bcf natural gas

– ~3 Bcfe liquid propane (~1 Bcfe

dedicated for peak shaving)

dedicated for peak shaving)

• Upstream contracted storage: 23 Bcf

Diversified Gas Supply

9

Customer Base

§ Stable customer base

§ Diverse commercial and industrial market with minimal by-pass threat

Therms sold and transported exclude fiscal 2010 off-system sales.

10

Continuous Improvement § Customer care • Organizational alignment focused on continuous service improvements § Strategic technology upgrades • Mobile computing platforms • Core system upgrades • GPS § Strategic sourcing • Better pricing, contractual performance from vendors § Employee engagement and development programs

11

Regulatory Strategy

§ Long-standing focus on customer service, safety and reliability • Pipeline integrity – Company and state programs more stringent than federal requirements –Active partner with AGA in legislative and regulatory proceedings § Rate mechanisms support stable earnings • Largely de-coupled rate design – Recovery through customer charge and first block usage – Mitigates exposure to weather and customer conservation • Infrastructure System Replacement Surcharge (ISRS) – Provides timely recovery of mandated safety, relocation and replacement costs between rate cases – Requires general rate case at least every 3 years •Purchased Gas Adjustment clause to ensure recovery of gas costs Consistent recovery of operating costs and reasonable returns on ongoing investments in rate base

12

Recent Rate Activity

§ Latest general rate case became effective September 1, 2010

• Increased base rates by a net $20.5 million after factoring in current ISRS

revenues

revenues

• Continued weather mitigation rate design

• Improved pension cost recovery

§ ISRS

• $2.5 million annualized increase effective January 7, 2011

• Filed May 2, 2011 for additional $2.4 million increase

13

Consumer Awareness

Creates partnership between

customer and business objectives

customer and business objectives

§ Promotes energy efficiency

§ Identifies additional uses for natural gas

Enhances customer awareness

§ Educates customer on environmental advantages of

natural gas

§ Provides practical ways of reducing carbon footprint

Incorporates all customer touch points

§ Advertising

§ Newsletters

§ Websites/online presence

§ Direct marketing

§ Collateral materials

www.OriginalGreenEnergy.com

15

Laclede Energy Resources - Profile

§ Non-regulated natural gas marketer

§ Operates primarily in the central United States on 12

interstate pipelines

interstate pipelines

§ Transactions normally settled with the physical

delivery of gas

delivery of gas

§ Offers combination of firm and interruptible pipeline

services and flexible pricing alternatives

services and flexible pricing alternatives

§ Experienced management team

16

Diverse Customer and Supplier Base

§ Long-term relationships with high-quality

counterparties

counterparties

§ ~250 large-volume end users and wholesale

customers, including

customers, including

• Utilities, municipalities and power generators

• Marketing affiliates of utilities and producers

• Diverse group of large Midwestern end-users

• Small independent producers with varying needs

§ ~80 different onshore suppliers

• Top 5 Suppliers (by volume)

- Shell Energy North America - Chesapeake Energy

- ConocoPhillips - PetroQuest Energy

- Newfield Exploration

17

Henry Hub

Barnett

Fayetteville

Woodford

Marcellus

Eagleford

Active supply centers

Shale supplies

St. Louis

Supply Shift

§ Shale supplies represent a more cost-effective and plentiful on-shore alternative § Spurred significant new pipeline development, especially from the Midcontinent and Midwest to the East

18

Henry Hub

Columbia Gas Transmission

(TCO)

(TCO)

Existing Markets

Expansion Focus

§ Geographic expansion leveraging existing relationships

§ Targeting gas-fired electric generation opportunities and asset management

arrangements

arrangements

§ Focus on margin quality, not volume quantity

Customer Growth Strategy

19

Operating Strategy

§ Long-term revenue and margin growth

§ Optimize operations

• Portfolio of upstream assets

• Long-term supply arrangements

• Pursue market-based park and loans and physical storage

• Renegotiate transportation service contracts at renewal

• Maintain focus on profitability and target higher margin transactions

§ Manage risks closely

• Formal price and business risk management policy with strong oversight

• Daily monitoring of key risk metrics (value at risk, mark-to-market, etc.)

• Manage credit exposure via master netting arrangements, letters of credit

and prepayments

and prepayments

• Ongoing review of counterparty limits and liquidity requirements

Opportunities

Natural Gas Industry

22

Rational, disciplined approach

Current Focus

§ Growth investment potential in

• Complementary upstream market opportunities

• Other distribution properties

• Leveraging existing assets/expertise, including

– Laclede Pipeline

– Propane and storage

§ Capital capacity, including available cash reserves

§ Managing a strategic balance of regulated and non-

regulated businesses

regulated businesses

Financial Overview

24

Financial Profile

§ Solid core operating earnings

§ Strong balance sheet and stable free cash flow

§ Top-tier credit rating

§ Sustainable dividend provides additional return

25

See Appendix for further discussion of non-GAAP measures

§ Earnings decline reflected

higher utility earnings offset

by lower, market-driven LER

results

higher utility earnings offset

by lower, market-driven LER

results

§ Laclede Gas earnings driven

by

by

• Non-regulated propane

transaction

transaction

• Controlling operating costs

• Increased ISRS recovery

• General rate increase effective

September 1, 2010

September 1, 2010

§ LER earnings declined due to

• Industry-wide narrowing of

regional basis spreads

regional basis spreads

• Partially offset by park and loan

transactions and higher volumes

transactions and higher volumes

• Remained solidly profitable

FY 2010 Earnings

26

See Appendix for further discussion of non-GAAP measures

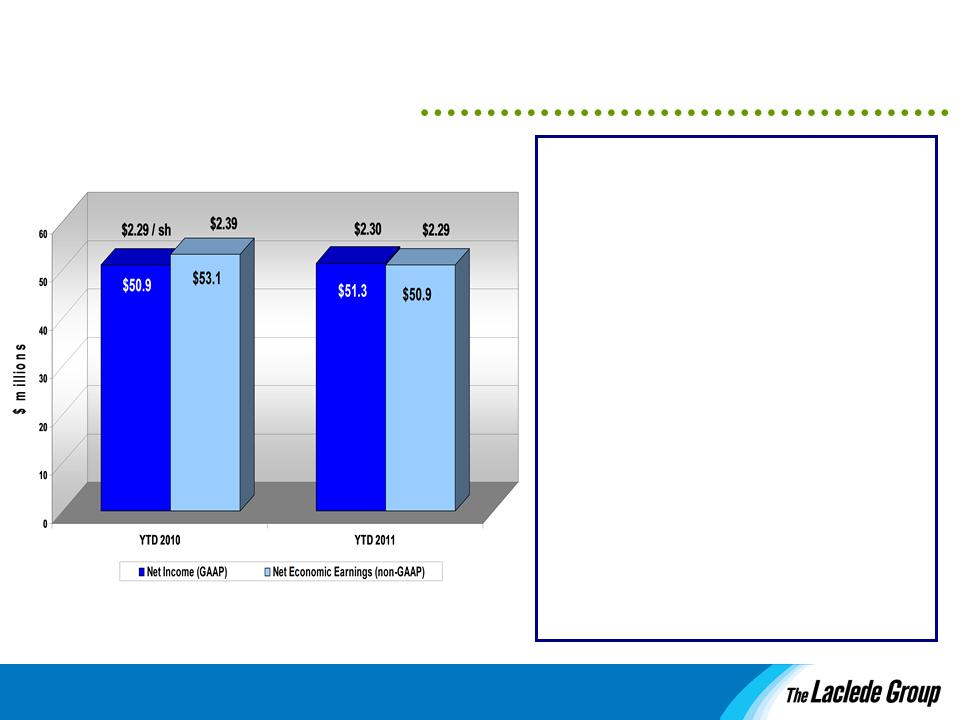

Six months ended March 31

§ Utility earnings continued to

improve

improve

§ Laclede Gas earnings were 7%

higher as a result of

higher as a result of

• General rate increase

• Lower operating costs

• Partially offset by Q1 2010

propane transaction

propane transaction

§ LER earnings were lower due

to market conditions

to market conditions

• Lower margins and volumes reflect

narrow regional basis differentials

and seasonal spreads

narrow regional basis differentials

and seasonal spreads

First Half FY 2011 Earnings

r il April propane sale to be

r il April propane sale to be reflected in Q3 2011 results

• ~$6.1 million in net earnings

27

§ Cash flow continues to support business requirements

§ Capital spending is marginally higher, reflecting prudent

investment in utility infrastructure

investment in utility infrastructure

All amounts shown are from continuing operations and exclude working capital; see Appendix for discussion

of non-GAAP measures

of non-GAAP measures

Cash Flow

28

§ Dividend paid continuously since 1946

§ Quarterly dividend increased to $.405 per share in FY 2011; eighth consecutive annual increase

§ Dividend Yield: 4.2%

* FY 2008 payout ratio calculation excludes the gain on disposal of SM&P and related disposal costs

63%

62%

53%

Payout Ratio

65%

Dividends

29

§ Strong credit ratings

§ Ample credit facilities to finance short-term needs

• Renewals in process ahead of expirations later in 2011

– Laclede Group: $ 50 million

– Laclede Gas: $320 million

• No external short-term borrowing at March 31, 2011 (despite LTD

retirement of $25 million in November 2010)

§ Next long-term debt maturity of $25 million due October 2012

|

|

Laclede Group

|

Laclede Gas

FMB

|

Laclede Gas

CP

|

|

S & P

|

A

|

A

|

A-1

|

|

Moody’s

|

|

A2

|

P-2

|

|

Fitch

|

A-

|

A+

|

F1

|

Liquidity and Financial Capacity

30

2,830

$56.1

Laclede Group - Key Takeaways

§ Solid core regulated utility business

§ Financial strength and strong cash flow

§ Leveraging knowledge and expertise to capitalize on market

opportunities

opportunities

§ Seeking logical organic and acquisitive long-term growth

opportunities

opportunities

Appendix

32

(1) Amounts presented net of income taxes. Income taxes are calculated by applying federal, state, and local income tax rates applicable to

ordinary income to the amounts of unrealized gain (loss) on energy-related derivative contracts. For the six months ended March 31, 2011

and 2010, the amount of income tax benefit included in the reconciling items above are $0.3 million and $(1.4) million. For fiscal years

ended September 30, 2010 and 2009, the amount of income tax expense (benefit) included in the reconciling items above are ($1.3)

million and $2.2 million, respectively.

ordinary income to the amounts of unrealized gain (loss) on energy-related derivative contracts. For the six months ended March 31, 2011

and 2010, the amount of income tax benefit included in the reconciling items above are $0.3 million and $(1.4) million. For fiscal years

ended September 30, 2010 and 2009, the amount of income tax expense (benefit) included in the reconciling items above are ($1.3)

million and $2.2 million, respectively.

This presentation includes the non-GAAP financial measure of “net economic earnings.” The Laclede Group’s non-regulated subsidiary

(LER) and, to a lesser extent, Laclede Gas account for certain transactions through fair value measurements. As a result, management

also uses this non-GAAP measure internally when evaluating the Company’s performance. Net economic earnings exclude from net

income the after-tax impacts of net unrealized gains and losses on energy-related derivatives resulting from the current changes in the

fair value of financial and physical transactions prior to their completion and settlement. Management believes that excluding these

timing differences provides a useful representation of the economic impact of only the actual settled transactions and their effects on

results of operations. This internal non-GAAP operating metric should not be considered as an alternative to, or more meaningful than,

GAAP measures such as net income. The schedule below provides a reconciliation of this non-GAAP measure to the most directly

comparable GAAP measure:

(LER) and, to a lesser extent, Laclede Gas account for certain transactions through fair value measurements. As a result, management

also uses this non-GAAP measure internally when evaluating the Company’s performance. Net economic earnings exclude from net

income the after-tax impacts of net unrealized gains and losses on energy-related derivatives resulting from the current changes in the

fair value of financial and physical transactions prior to their completion and settlement. Management believes that excluding these

timing differences provides a useful representation of the economic impact of only the actual settled transactions and their effects on

results of operations. This internal non-GAAP operating metric should not be considered as an alternative to, or more meaningful than,

GAAP measures such as net income. The schedule below provides a reconciliation of this non-GAAP measure to the most directly

comparable GAAP measure:

Net Economic Earnings Reconciliation

33

This presentation includes the non-GAAP measures of “free cash flow” and “operating cash flow from continuing operations (excluding working capital).”

Management uses these non-GAAP measures when evaluating the Company’s performance. Operating cash flow from continuing operations (excluding working

capital) is calculated as income from continuing operations plus depreciation, amortization, and accretion expense (from continuing operations), plus certain non-

cash charges (credits) to income (which are reflected in the “Other-net” line of the Statement of Cash Flows), minus certain tax-related benefits recorded pursuant

to FIN 48 (as codified in ASC 740). Free cash flow is operating cash flow from continuing operations (excluding working capital) reduced for capital expenditures

from continuing operations and dividends paid. Management believes that these measures provide a useful representation of the cash flows from continuing

operations generated by the Company because they exclude temporary working capital and other changes, which are primarily attributable to variations in the

timing of the collections of Laclede Gas’ gas cost and the utilization of its gas inventories. Further, by reflecting cash requirements for capital expenditures and

dividends, management believes that free cash flow provides an additional useful measure of the Company’s cash flow performance. These internal non-GAAP

measures should not be considered as an alternative to, or more meaningful than, GAAP measures such as net cash provided by (used in) operating activities. The

schedule above provides a reconciliation of these non-GAAP measures to the most directly comparable GAAP measure.

Management uses these non-GAAP measures when evaluating the Company’s performance. Operating cash flow from continuing operations (excluding working

capital) is calculated as income from continuing operations plus depreciation, amortization, and accretion expense (from continuing operations), plus certain non-

cash charges (credits) to income (which are reflected in the “Other-net” line of the Statement of Cash Flows), minus certain tax-related benefits recorded pursuant

to FIN 48 (as codified in ASC 740). Free cash flow is operating cash flow from continuing operations (excluding working capital) reduced for capital expenditures

from continuing operations and dividends paid. Management believes that these measures provide a useful representation of the cash flows from continuing

operations generated by the Company because they exclude temporary working capital and other changes, which are primarily attributable to variations in the

timing of the collections of Laclede Gas’ gas cost and the utilization of its gas inventories. Further, by reflecting cash requirements for capital expenditures and

dividends, management believes that free cash flow provides an additional useful measure of the Company’s cash flow performance. These internal non-GAAP

measures should not be considered as an alternative to, or more meaningful than, GAAP measures such as net cash provided by (used in) operating activities. The

schedule above provides a reconciliation of these non-GAAP measures to the most directly comparable GAAP measure.

Cash Flow Reconciliation