Attached files

EXHIBIT 10.5

OFFICE LEASE AGREEMENT

THIS Office Lease Agreement (the “Lease”) is made and entered into on this the 10th day of December 2007, between CALIBER INVESTMENT GROUP LLC, a Delaware limited liability company, having an office at 2936 Via Esperanza, Suite A, Edmond, Oklahoma 73013 (the “Landlord”), and GREAT WHITE ENERGY SERVICES LLC, a Delaware limited liability company, having a notice and mailing address at 14201 Caliber Drive, Suite 300, Oklahoma City, OK 73134 (the “Tenant”). Unless otherwise separately defined, the capitalized terms used herein are defined at Section 1 hereof.

W I T N E S S E T H

1 Construction and Definitions Unless otherwise herein defined, the terms used in this Lease have the meanings indicated in this Section 1 and shall include the plural as well as the singular. The word “including” shall be construed to be followed by the words “without limitation” or “but not limited to.” The words “herein,” “hereof,” “hereunder,” “hereafter,” and other words of similar import shall refer to this Lease as a whole and not to any particular Section or other subdivision. All references to Exhibits or other attachments shall refer to the Exhibits, diagrams, and other special provisions attached to this Lease, all of which are incorporated by reference herein for all purposes.

1.1 Actual Operating Costs All costs incurred or to be incurred by Landlord for any given calendar year in connection with the management, operation, safety, security, replacement, and maintenance of the Building, the Land, the Common Areas, and all other improvements on the Land; as more fully defined in Exhibit C attached hereto.

1.2 Additional Rent Tenant’s Pro Rata Share of Actual Operating Costs and any other sums (exclusive of Base Rent) that are required to be paid to Landlord by Tenant hereunder, which sums are deemed to be Additional Rent under this Lease.

1.3 Base Rent The aggregate amount determined in accordance with Section 5 hereof. The Base Rent for the first month during the Lease Term (as defined herein) shall be paid by Tenant to Landlord contemporaneously with Tenant’s execution hereof.

1.4 Base Year 2007.

1.5 Building The structure located at 14201 Caliber Drive, Oklahoma City, County of Oklahoma, State of Oklahoma, commonly known as the Diamondback Building owned by Landlord, together with the adjacent parking areas designated for the Building’s use and a reasonable amount of landscaped area around the Building.

1.6 Building Regulations The rules and regulations adopted from time to time by Landlord for the convenience, peace, safety, and welfare of the tenants of the Building and to govern the Building use and the distribution of services which are applicable to all tenants of the Building. The current Building Regulations are set out at Exhibit B attached hereto. Any modification to the Building Regulations shall bind Tenant upon delivery of a copy thereof to Tenant. Landlord shall not be responsible to Tenant for the nonperformance of any portion of the Building Regulations by any other tenants, occupants, or invitees of the Building.

1.7 Building Standard The type, brand, quality and/or quantity of materials Landlord designates from time-to-time to be the minimum quality and/or quantity to be used in the Building or the exclusive type, grade, quality and/or quantity of material to be used in the Building.

1.8 Business Hours The hours of operation for the Building will be 8:00 a.m. until 6:00 p.m. every Monday through Friday, and 8:00 a.m. to 1:00 p.m. on Saturdays, exclusive of the normal business holidays of New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day (“Holidays”). Landlord, from time to time during the Lease Term, shall have the right to designate, in the Building Regulations, additional Holidays, provided such additional Holidays are commonly recognized by other office buildings in the area where the Building is located.

1.9 Commencement Date The date upon which the Lease Term (as defined herein) commences as specified in Section 3 hereof, which may or may not be the date projected therein.

1.10 Common Areas Those areas, as designated by Landlord from time to time, located within the Building, or on the Property, intended for non-exclusive common use by the public and other tenants of the Building, including, corridors, elevator foyers, mail rooms, restrooms, mechanical rooms, elevator mechanical rooms, stairways, janitorial closets, electrical and telephone closets, vending areas, lobby areas (whether at ground level or otherwise), entrances, exits, sidewalks, plaza areas, driveways, parking areas and landscaped areas and other similar facilities.

1.11 Effective Date The date inserted on the first page of this Lease following execution by the last party signing the counterparts of this Lease.

Page 1 of 30

Landlord: Tenant:

1.12 Encumbrance(s) All mortgages, security agreements, collateral assignments, and other encumbrances, and all ground leases or master leases which might now or hereafter affect any portion of Landlord’s interest in this Lease, the Building, and/or the Land, and all renewals, modifications, consolidations, replacements, and extensions thereof.

1.13 Estimated Operating Cost Landlord’s good faith estimate of the operating cost to be incurred in any given calendar year.

1.14 Expiration Date The date when the Lease Term expires as specified at Section 3 hereof, or such earlier date as specifically provided herein.

1.15 Governmental Authorities All federal, state, county, and municipal governmental bodies and agencies or instrumentalities thereof, including all judicial, quasi-judicial, and administrative bodies, having jurisdiction over the Land and Building, Landlord’s ownership and operation thereof, and Tenant’s business and use and occupancy of the Leased Premises and Building.

1.16 Guarantor Any Person executing a full or partial guaranty of payment or performance of any one or more of Tenant’s obligations under this Lease.

1.17 Hazardous Material Any hazardous or toxic substance, material, or waste, including but not limited to those substances, materials, and wastes listed now or in the future in the United States Department of Transportation Hazardous Materials Table or by the Environmental Protection Agency as hazardous substances, or such substances, materials, and wastes that are or become regulated under any applicable Law.

1.18 Holder The mortgagee, secured party, or lessor under any Encumbrance and such party’s successors and assigns.

1.19 Improvement Allowance The credit to Tenant against the Construction Cost, and used to determine Tenant’s Construction Cost to be incurred in the renovation and redecoration of the Leasehold Improvements.

1.20 Landlord Caliber Investment Group LLC, a Delaware Limited Liability Company, and its successors and assigns.

1.21 Laws All laws, statutes, regulations, rules, ordinances, and orders of any Governmental Authority, including common law and rulings, decisions, and interpretations of all judicial, quasi-judicial, and administrative bodies.

1.22 Lease This lease agreement and all subsequent amendments and modifications, together with all schedules, exhibits, diagrams, and other special provisions attached hereto or subsequently attached hereto or thereto, and to any amendments or modifications thereof.

1.23 Lease Term The period of time designated at Section 3 hereof, as the same might be modified from time to time by the written agreement of Landlord and Tenant.

1.24 Leased Premises The space in the Building leased to Tenant hereunder, as more fully described in Section 2 hereof, and depicted in Exhibit A attached hereto and the Leasehold Improvements related thereto.

1.25 Lease Year Twelve (12) complete months following the Commencement Date and each successive twelve (12) month period thereafter during the Lease Term.

1.26 Leasehold Improvements All improvements located within the Leased Premises on the Commencement Date together with all renovations and redecorating as constructed or installed pursuant to the Final Working Drawings, and all subsequent alterations and additions thereto, all of which are a part of the Building and the property of Landlord from the time of installation and shall be surrendered by Tenant to Landlord upon the Expiration Date or earlier termination of this Lease.

1.27 Net Rentable Area of Leased Premises The area contained within the demising walls of the Leased Premises and any other area designated for the exclusive use of Tenant plus an allocation of the Tenant’s pro rata share of the square footage of the Common Areas (as defined herein). For purposes of the Lease it is agreed and stipulated by both Landlord and Tenant that the Net Rentable Area of the Leased Premises is 14,311 square feet.

1.28 Net Rentable Area of the Building 41,970 square feet.

1.29 Person A natural person or a corporation, partnership, limited liability company, or any other legal entity, or a Governmental Authority, as the case may be.

1.30 Permitted Use General office use and no other use or purpose, as further defined in Section 7 hereof.

1.31 Property The Building together with the parcel(s) of land on which it is located, other improvements located on such land, adjacent parcels of land that Landlord operates jointly with the Building, and other buildings and improvements located on such adjacent parcels of land.

Page 2 of 30

Landlord: Tenant:

1.32 Rent The collective sums to be paid by Tenant to Landlord as Base Rent and Additional Rent as provided for herein, and all such other amounts as required to be paid by Tenant to Landlord pursuant to the terms hereof.

1.33 Substantial Completion The completion of the renovation and redecorating of the Leasehold Improvements to the extent that the same can be occupied by Tenant for the conduct of Tenant’s business. The completion of minor construction deficiencies or completion of punch list items will not delay Substantial Completion.

1.34 Taxes All (i) real and personal property and ad valorem taxes or other tax levied in lieu of real property taxes; (ii) municipal taxes, special assessments, or similar charges; and (iii) all other taxes, assessments, and governmental charges (including taxes on rents or services), levied or assessed against the Building, the Land, or any other improvements, fixtures, or personal property owned by Landlord and located on or incorporated into the Building. If any special assessments are payable over a period of years, only that portion required to be paid during a calendar year, together with interest thereon, shall be treated as a Tax allocable to such year.

1.35 Tenant Great White Energy Services LLC and its permitted affiliates, successors and assigns.

1.36 Tenant’s Construction Cost That portion of the final Construction Cost of the renovation and redecorating of the Leasehold Improvements to be paid by Tenant as provided for herein, being an amount equal to the Construction Cost minus the Improvement Allowance, if applicable.

1.37 Tenant’s Share A fraction having as the numerator the Net Rentable Area of the Leased Premises and as the denominator the Net Rentable Area of the Building. Tenant’s Share is agreed by Landlord and Tenant to be 14,311/ 41,970 or 34%.

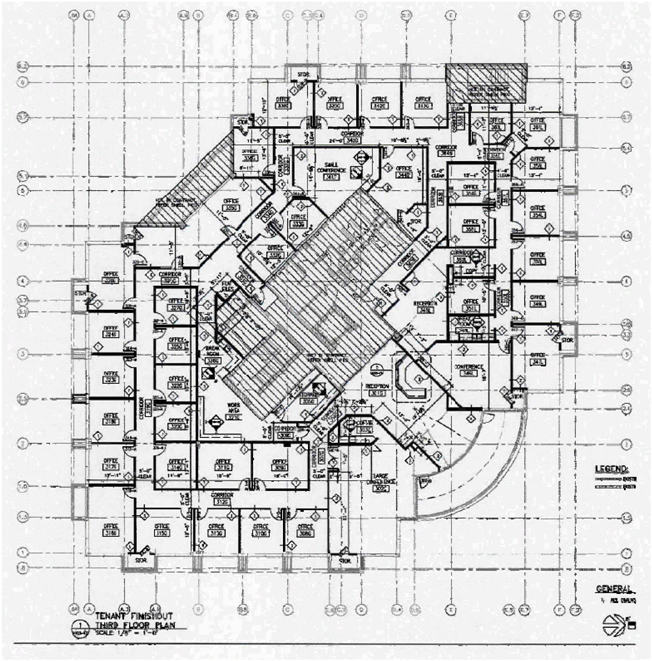

2 Leased Premises Landlord hereby leases the Leased Premises, together with the right, in common with others, to use the Common Areas, to Tenant and Tenant hereby leases the same from Landlord. As depicted in Exhibit A attached hereto, the Leased Premises are comprised of 12,590 square feet of Net Rentable Area on the third (3rd) floor of the Building, commonly known as Suite 300; plus an allocation of 1,721 square feet of the Common Areas (as defined herein).

3 Term The Lease Term is ten (10) years having a Commencement Date on December 10, 2007. If the Commencement Date occurs on the first day of a month, the Expiration Date will be ten (10) years from the last day of the preceding month. If the Commencement Date occurs on a date other than the first day of the month, the Expiration Date will be ten (10) years from the last day of the month in which the Commencement Date occurs, unless extended as hereafter provided.

3.1 Early Occupancy If Tenant takes possession of the Leased Premises prior to the Commencement Date, such possession shall be subject to all the terms and conditions hereof and Tenant shall pay Base Rent and Additional Rent, as provided in Section 5 hereof, to Landlord for each day of occupancy prior to the Commencement Date. Notwithstanding the foregoing, if Tenant, with Landlord’s prior approval, takes possession of the Leased Premises prior to the Commencement Date for the sole purpose of performing any Landlord-approved improvements therein or installing furniture, equipment or other personal property of Tenant, such possession shall be subject to all of the terms and conditions of the Lease, except that Tenant shall not be required to pay Rent with respect to the period of time prior to the Commencement Date during which Tenant performs such work. Tenant shall, however, be liable for the cost of any services (e.g. electricity, HVAC, freight elevators) that are provided to Tenant or the Leased Premises during the period of Tenant’s possession prior to the Commencement Date. Nothing herein shall be construed as granting Tenant the right to take possession of the Leased Premises prior to the Commencement Date, whether for construction, fixturing or any other purpose, without the prior consent of Landlord.

3.2 Late Occupancy If for any reason the Leased Premises are not a available to Tenant for occupancy by the Commencement Date identified in Section 3 hereof, (the “Projected Commencement Date”), this Lease will nevertheless continue in effect.

3.2.1 Tenant’s Causation If the failure to occupy the Leased Premises arises from any default, delay, or omission by Tenant or anyone acting under or for Tenant, the payment of Rent will commence on the Projected Commencement Date in accordance with Section 3 hereof, and the Lease Term will not be modified. For the purposes of this Section 3.2.1, default, delay or omission by the Tenant shall include, but is not limited to the following: (i) Tenant’s failure to furnish information in accordance with the Work Letter Agreement or to respond to any request by Landlord for any approval of information within any time period prescribed, or if no time period is prescribed, then within two (2) Business Days of such request; (ii)Tenant’s insistence on materials, finishes or installations that have long lead times after having first been informed by Landlord that such materials, finishes or installations will cause a Delay; (iii) Changes in any plans and specifications requested by Tenant; (iv) The performance or nonperformance by a person or entity employed by on or behalf of Tenant in the completion of any work in the Premises (all such work and such persons or entities being subject to prior approval of Landlord); (v) Any request by Tenant that Landlord delay the completion of any of the Landlord’s Work; (vi) Any breach or default by Tenant in the performance of Tenant’s obligations under this Lease; (vii) Any delay resulting from Tenant’s having taken possession of the Premises for any reason prior to substantial completion of the Landlord’s Work; or (viii) Any other delay chargeable to Tenant, its agents, employees or independent contractors.

3.2.2 Other Causation If the failure to occupy the Leased Premises by the Projected Commencement Date arises through no fault of Tenant, Rent will abate and not commence until the date the Leased Premises are delivered to Tenant, vacant and ready for occupancy; and the Lease Term will be extended by the period of time which elapses between the Projected Commencement Date and the date of such occupancy.

Page 3 of 30

Landlord: Tenant:

3.2.3 Outside Date If through no fault of Tenant, the Leased Premises have not been delivered to Tenant within sixty (60) calendar days from the Commencement Date, Tenant may terminate this Lease and neither party shall have any obligation to the other party for any action taken prior to the termination. The abatement of Rent or termination as provided herein will constitute full settlement of all claims which Tenant might otherwise have against Landlord by reason of any delay in occupancy of the Leased Premises.

4 Adjustment of Commencement Date The adjustment of the Commencement Date and, accordingly, the postponement of Tenant’s obligation to pay Base Rent and other sums due hereunder shall be Tenant’s sole remedy and shall constitute full settlement of all claims that Tenant might otherwise have against Landlord by reason of the Leased Premises not being ready for occupancy by Tenant on the Projected Commencement Date. Promptly after the determination of the Commencement Date, Landlord and Tenant shall enter into a letter agreement (the “Tenant Estoppel”) on the form attached hereto as Exhibit E setting forth the Commencement Date, the Termination Date and any other dates that are affected by the adjustment of the Commencement Date. Notwithstanding anything herein to the contrary, Landlord may elect, by written notice to Tenant, not to adjust the Commencement Date as provided above if such adjustment would cause Landlord to be in violation of the existing rights granted to any other tenant of the Building. If Landlord elects not to adjust the Commencement Date, the Commencement Date shall be the Projected Commencement Date, provided that Base Rent and Additional Rent shall not commence until the date that the Leased Premises are delivered to Tenant, vacant and ready for occupancy.

5 Rent Tenant covenants and agrees to pay to Landlord during the Lease Term, without any setoff or deduction except as otherwise expressly provided herein, the full amount of all Base Rent and Additional Rent due hereunder and the full amount of all such other sums of money as shall become due under this Lease (including, without limitation, any charges for replacement of electric lamps and any other services, goods or materials furnished by Landlord at Tenant’s request).Tenant shall pay Rent to be mailed or delivered to Landlord at 3817 N.W. Expressway, Suite 1000, Oklahoma City, OK 73112/23. No payment by Tenant or receipt or acceptance by Landlord of a lesser amount than the correct installment of Rent due under this Lease shall be deemed to be other than a payment on account of the earliest Rent due hereunder, nor shall any endorsement or statement on any check or any letter accompanying any check or payment be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance or pursue any other available remedy. The acceptance by Landlord of an installment of Rent on a date after the due date of such payment shall not be construed to be a waiver of Landlord’s right to declare a Default for any other late payment. All amounts received by Landlord from Tenant hereunder shall be applied first to the earliest accrued and unpaid Rent then outstanding. Tenant’s covenant to pay Rent shall be independent of every other covenant set forth in this Lease.

5.1 Base Rent Base Rate is payable on the first day of each month, in advance and without prior notice or demand, in monthly installments beginning on the Commencement Date, or such other date as provided herein and continuing on the first day of each month thereafter through the Expiration Date. During the Lease Term (subject to the proration provisions of Section 5.3 hereof), Tenant shall pay monthly Base Rent to Landlord as follows:

| Base Rent Schedule |

||||

| Monthly Rent Schedule |

Monthly Base Rent | |||

| December 5, 2007 through November 31, 2012 |

$ | 27,429.42 | ||

| December 1, 2012 through November 31, 2017 |

$ | 29,814.58 | ||

The Base Rent amount was calculated based upon the agreed rate of $23.00 per square foot per year of Net Rentable Area in the Leased Premises. In the event the size of the Leased Premises should be increased through Tenant change orders or a revision to the original size of the Leased Premises, the Base Rent shall be upwardly adjusted pro rata to accommodate any such increase.

5.2 Additional Rent Tenant agrees to pay Landlord on the first day of each month following receipt of a statement therefore and monthly thereafter an amount which is equal to monthly amount attributable to Tenant’s Share of the Estimated Operating Costs for the Building. In addition Tenant shall pay and be liable for all rent, sales and use taxes or other similar taxes, if any, levied or imposed by any city, state, county or other governmental body having authority, such payments to be in addition to all other payments required to be paid to Landlord by Tenant under the terms and conditions of this Lease. Any such payments shall be paid concurrently with the payments of the Rent on which the tax is based. The Additional Rent payable hereunder shall be adjusted from time-to-time in accordance with the provisions of Exhibit C attached hereto and incorporated herein for all purposes.

5.3 Prorations If the Commencement Date is a date other than the first day of a month, or if the Expiration Date is a date other than the last day of a month, the installment of Base Rent for the month in which the Commencement Date occurs will be prorated based on a thirty (30) day month. If any assessment for Additional Rent is computed for a term beginning before the Commencement Date or extending beyond the Expiration Date, the assessment will be prorated based on a three hundred sixty five (365) day year.

5.4 Late Charges Tenant shall pay all Rent at the times and in the manner herein provided. Tenant’s obligation to pay Rent is an independent covenant and no act or circumstance whatsoever (whether constituting a default by Landlord or not) will release Tenant from the obligation to pay Rent timely or give rise to a counterclaim, offset, or deduction unless specifically otherwise provided herein. Time is of the

Page 4 of 30

Landlord: Tenant:

essence in the performance of each of Tenant’s obligations hereunder. To the extent allowed by law, in the event Tenant fails to make timely payment of Rent or any other amount due and owing hereunder and the amount remains unpaid for a period of ten (10) calendar days from such due date, in addition to any and all other sums due and owing herein, Landlord may collect from Tenant as Additional Rent an administrative service fee in an amount equal to three percent (3%) of the amount of the payment then due.

6 Security Deposit Tenant herewith deposits with Landlord an amount equal to one (1) month’s Base Rent. Such deposit will be held by Landlord throughout the Lease Term without liability for interest and as security for the performance by Tenant of Tenant’s covenants and obligations hereunder. It is expressly understood, the Security Deposit will not be considered an advance payment of Rent or a measure of Landlord’s damages for any Default by Tenant. Landlord shall have no fiduciary responsibilities or trust obligations whatsoever with regard to the Security Deposit and shall not assume the duties of a trustee for the Security Deposit. Landlord may commingle the deposit with Landlord’s other funds and may, from time to time, without prejudice to any other remedy, use the deposit to satisfy any arrearages of Rent or any other obligation of Tenant hereunder. Following any such application of the deposit, Tenant, on demand, shall restore the deposit to its original amount and Tenant’s failure to do so within ten (10) calendar days of written notice from Landlord shall be a Default hereunder. If Tenant is not in Default at the termination of this Lease, the balance of any such deposit remaining after any such application will be returned to Tenant. If Landlord transfers Landlord’s interest in the Building during the Lease Term, Landlord shall assign the deposit to the transferee, and thereafter the transferor will have no further liability with respect to any such deposit so assigned. Tenant agrees to look solely to such transferee or assignee or successor thereof for the return of the Security Deposit. Landlord and its successors and assigns shall not be bound by any actual or attempted assignment or encumbrance of the Security Deposit by Tenant.

7 Use Tenant will occupy the Leased Premises continuously and in entirety and will not use or permit any portion of the Leased Premises to be used for any purpose other than for general office space and related administrative activities. Tenant may not use the Leased Premises for any purpose which is unlawful, disreputable, dangerous to life, limb or property, adversely affects Landlord’s leasing of the Building, or which, in Landlord’s sole judgment, creates a nuisance, or increases the risk of casualty or the rate of fire or casualty insurance covering the Building or its contents. In the event that any act of Tenant results in any increase in the cost of insurance covering the Building or its contents, Tenant agrees to pay to Landlord the amount of such increased cost as Additional Rent. Tenant will conduct Tenant’s business and will control Tenant’s agents, employees, licensees, and invitees in such a manner as not to create any nuisance or interfere with, annoy, or disturb other tenants of the Building. Tenant will maintain the Leased Premises in a clean and healthful condition. Tenant, at Tenant’s expense, shall comply and shall cause Tenant’s agents, employees, licensees, and invitees to comply fully with: (i) the Building Regulations attached hereto as Exhibit B; (ii) all Laws pertaining to Tenant’s use of the Leased Premises; (iii) all other Legal Requirements, including all applicable Laws pertaining to air and water quality, hazardous materials, waste disposal, all emissions and other environmental matters; and (iv) all zoning and other land use matters, and any directive of any Governmental Authority, pursuant to Law, which shall impose any duty upon Landlord or Tenant with respect to the use or occupancy of the Leased Premises. In the event Tenant receives any notice with respect to a violation or alleged violation of any of the aforementioned legal requirements, Tenant, within ten (10) days after the receipt thereof, shall provide Landlord with copies of such notices.

7.1 Compliance With Declaration of Protective Covenants for Quail Springs Office Park Tenant’s use of the Premises and Common Areas shall be subject to and in full compliance with the Declaration of Protective Covenants of Quail Springs Office Park and any current or subsequent amendments thereto, including the Declaration of Protective Covenants dated as of April 27, 1983, and recorded in Book 4997 at Page 999, in the office of the County Clerk of Oklahoma County, Oklahoma (“Oklahoma County Clerk”), as amended by that certain Amendment to Declaration of Protective Covenants dated as of September 20, 1984, and recorded with the Oklahoma County Clerk in Book 5230 at Page 44, as further amended by that certain Second Amendment to Declaration of Protective Covenants dated as of March 17, 1998 and recorded with the Oklahoma County Clerk in book 7269 at Page 735, as further amended by that certain Third Amendment to Declaration of Protective Covenants dated as of September 30, 2005 and recorded with the Oklahoma County Clerk in book 9875 at Page 560 (collectively the “Declaration”), all of which subject the Building to the terms, conditions, restrictions and provisions therein contained and as said Declaration is amended from time to time. It is expressly understood and agreed that the terms of the Declaration may vary from the terms of this Lease.

7.2 Americans with Disabilities Act Requirements Landlord is responsible for and will maintain the Common Areas of the Building in substantial compliance with the public accommodations provisions of Title III of the Americans with Disabilities Act of 1990, as amended (the “ADA”). Landlord shall bear the cost of any improvements, repairs, renovations, or modifications to the Common Areas that may from time to time be required to bring the Building into compliance or maintain the Building’s compliance with Title III of the ADA. Tenant shall indemnify and hold Landlord harmless from and against any losses, costs, damages, or claims of whatever nature, arising out of or in connection with the compliance requirements set forth in the ADA, as amended, relating to the use and occupancy of the Leased Premises and/or alteration and/or renovation of the Leasehold Improvements, including, but not limited to, any changes necessitated because of the specific needs of Tenant’s employees.

8 Landlord’s Services and Other Obligations Landlord agrees to furnish Tenant the following services:

8.1 Standard Services So long as Tenant is not in Default, and subject to the limitations prescribed by the Building Regulations, Landlord agrees to furnish to Tenant during the Business Hours the following services: (i) access to running water at the points of supply generally provided in the Building and in reasonable quantities consistent with customary office usage; (ii) heated and refrigerated air conditioning at such times, temperatures, and in such amounts as are considered by Landlord, in its reasonable judgment, to be standard for buildings of similar class, size, age and location, or as required by governmental authorities (specifically excluding, however, service, if necessary, for the operation of Tenant’s supplemental heating, ventilation, and air conditioning system for Tenant’s computer equipment or similar high electricity

Page 5 of 30

Landlord: Tenant:

consumption equipment, if any, all of which is considered excess service and will be provided at additional cost to Tenant as hereinafter provided); (iii) elevator service in common with other tenants of the Building; (iv) access to electrical power in accordance with and subject to the terms and conditions of Section 9 hereof; (v) janitorial services as Landlord regularly provides to other tenants of the Building; provided, however, if Tenant’s floor covering or other improvements require special treatment, Tenant shall pay the additional cleaning cost attributable thereto as Additional Rent upon presentation of a statement therefor by Landlord; (vi) ordinary maintenance services, to the extent reasonably deemed by Landlord to be standard for buildings of similar class, age and location, required to maintain the exterior and mechanical systems of the Building and the Common Areas; (vii) electric lighting for the Common Areas in the manner and to the extent deemed by Landlord to be reasonably required; and (viii) main telephone service to the Building, such service to be made available in a telecommunications equipment area located on same floor of the Building as the Leased Premises or at such other location in the Building as Landlord may designate and provide.

8.2 Excess Services To the extent Tenant requests, uses, or requires any other utilities or building services in addition to those identified herein, above the utilities or building services in frequency, scope, quality or quantities substantially greater than the standards set by Landlord for the Building, then Landlord shall use reasonable efforts to attempt to furnish Tenant with such additional utilities or building services. Tenant agrees to pay to Landlord as Additional Rent such charges as Landlord might from time to time prescribe for such additional services. Unless previously included, installed, and paid pursuant to the Final Working Drawings, Tenant shall pay the cost of installing, servicing, and maintaining any special or additional lines, risers, or other equipment that may be required for Tenant’s computer, electro-data processing, or other equipment requiring high electrical consumption, all of which will be installed under Landlord’s supervision.

8.3 Landlord’s Repairs Landlord shall make all inspections and repairs to the mechanical, electrical, plumbing and HVAC systems within the Building or providing service to the Leased Premises as customarily required for such equipment to be functional for their intended purposes. Landlord will promptly endeavor to repair any malfunction of such equipment when required, following any notice of malfunction from Tenant, but the failure to any extent to furnish, or any stoppage or interruption of the foregoing services will not render Landlord liable in any respect for damages to Tenant or any other Person or be construed as an eviction of Tenant or entitle Tenant to any abatement of Rent or relieve Tenant from performing any obligation contained herein. Tenant will promptly notify Landlord of any damage or malfunction of such systems of which Tenant has knowledge. Any such repairs made necessary by the act, neglect, fault, or omission of Tenant or Tenant’s agents, employees, invitees, or visitors shall be made by Landlord at Tenant’s expense; and Tenant shall remit promptly such cost to Landlord as Additional Rent upon written demand therefor.

8.4 Landlord’s Reservation Notwithstanding the foregoing, Landlord reserves the right, without any liability to Tenant and without being in breach of any covenant or agreement of this Lease, to temporarily interrupt or discontinue all or any portion of Landlord’s services hereunder at such times, and for so long as may be necessary in Landlord’s reasonable judgment, by reason of accident, unavailability of employees, strikes, riots, acts of God, or other events beyond the control of Landlord. Reasonable advance notice shall be given to Tenant for any anticipated interruption.

9 Use of Electrical Services by Tenant All electricity used by Tenant in the Leased Premises shall be paid for by Tenant through inclusion in Base Rent and Additional Rent (except as provided for in this Section 9 with respect to excess usage). Landlord shall have the right at any time and from time-to-time during the Lease Term to contract for electricity service from such providers of such services as Landlord shall elect (each being an “Electric Service Provider”). Tenant shall cooperate with Landlord, and the applicable Electric Service Provider, at all times and, as reasonably necessary, shall allow Landlord and such Electric Service Provider reasonable access to the Building’s electric lines, feeders, risers, wiring, and any other machinery within the Leased Premises. Landlord shall in no way be liable or responsible for any loss, damage, or expense that Tenant may sustain or incur by reason of any change, failure, interference, disruption, or defect in the supply or character of the electric energy furnished to the Leased Premises, or if the quantity or character of the electric energy supplied by the Electric Service Provider is no longer available or suitable for Tenant’s requirements, and no such change, failure, defect, unavailability, or unsuitability shall constitute an actual or constructive eviction, in whole or in part, or entitle Tenant to any abatement or diminution of rent, or relieve Tenant from any of its obligations under the Lease. Tenant’s use of electrical services furnished by Landlord shall not exceed in voltage, rated capacity, or overall load that which is standard for the Building. In the event Tenant shall request that it be allowed to consume electrical services in excess of Building Standard, Landlord may refuse to consent to such usage or may consent upon such conditions as Landlord reasonably elects (including the installation of utility service upgrades, submeters, air handlers or cooling units), and all such additional usage (to the extent permitted by law), installation and maintenance thereof shall be paid for by Tenant as Additional Rent. Landlord, at any time during the Lease Term, shall have the right to separately meter electrical usage for the Leased Premises or to measure electrical usage by survey or any other method that Landlord, in its reasonable judgment, deems appropriate.

10 Maintenance Landlord and Tenant agree as follows:

10.1 Landlord’s Responsibilities Subject to the provisions herein regarding damage by fire or other casualty, Landlord shall, at its expense (except as included in Actual Operating Costs) keep and maintain in good repair and working order and make all repairs to and perform necessary maintenance upon: (i) all structural elements of the Building; (ii) all mechanical, electrical and plumbing systems that serve the Building in general; and (iii) the Building facilities common to all tenants including but not limited to, the ceilings, walls and floors in the Common Areas. Landlord shall not be liable to Tenant for any damage or inconvenience and Tenant shall not be entitled to any abatement or reduction of Rent by reason of any repairs, alterations, or additions made by Landlord.

Page 6 of 30

Landlord: Tenant:

10.2 Tenant’s Maintenance Obligations Tenant will, at Tenant’s expense, maintain the Leased Premises in good order, condition and repair throughout the entire Lease Term, ordinary wear and tear excepted. Tenant agrees to keep the areas visible from outside the Leased Premises in a neat, clean and attractive condition at all times. Tenant shall be responsible for all repairs, replacements and alterations in and to the Leased Premises, Building and Property and the facilities and systems thereof, the need for which arises out of (i) Tenant’s use or occupancy of the Leased Premises, (ii) the installation, removal, use or operation of Tenant’s property, (iii) the moving of Tenant’s Property into or out of the Building, or (iv) the act, omission, misuse or negligence of Tenant, its agents, contractors, employees or invitees. All such repairs, replacements or alterations shall be performed in accordance with Section 11 hereof, and the rules, policies and procedures reasonably enacted by Landlord from time to time for the performance of work in the Building. If Tenant fails to maintain the Leased Premises in good order, condition and repair, Landlord shall give Tenant notice to perform such acts as are reasonably required to so maintain the Leased Premises. If Tenant fails to promptly commence such work and diligently pursue it to its completion, then Landlord may, at is option, make such repairs, and Tenant shall pay the cost thereof to Landlord on demand as Additional Rent, together with an administration charge in an amount equal to ten percent (10%) of the cost of such repairs.

11 Alteration of Leasehold Improvements Tenant shall not make or allow to be made any alterations, additions or improvements to the Leased Premises, without first obtaining the written consent of Landlord in each such instance, which consent may be refused or given on such conditions as Landlord may elect. Prior to commencing any such work and as a condition to obtaining Landlord’s consent, Tenant must furnish Landlord with plans and specifications acceptable to Landlord; names and addresses of contractors reasonably acceptable to Landlord; copies of contracts; necessary permits and approvals; evidence of contractor’s and subcontractor’s insurance; and a payment bond or other security, all in form and amount satisfactory to Landlord. Tenant shall be responsible for insuring that all such persons procure and maintain insurance coverage against such risks, in such amounts and with such companies as Landlord may require, including, but not limited to, Builder’s Risk and Worker’s Compensation insurance. All such improvements, alterations or additions shall be constructed in a good and workmanlike manner using Building Standard materials or other new materials of equal or greater quantity. Landlord, to the extent reasonably necessary to avoid any disruption to the tenants and occupants of the Building, shall have the right to designate the time when any such alterations, additions and improvements may be performed and to otherwise designate reasonable rules, regulations and procedures for the performance of work in the Building. Upon completion, Tenant shall furnish “as-built” plans, contractors’ affidavits and full and final waivers of lien and receipted bills covering all labor and materials. All improvements, alterations and additions shall comply with the insurance requirements, codes, ordinances, laws and regulations, including without limitation, the Americans with Disabilities Act. Tenant shall reimburse Landlord upon demand for all sums, if any, expended by Landlord for third party examination of the architectural, mechanical, electrical and plumbing plans for any alterations, additions or improvements. In addition, if Landlord so requests, Landlord shall be entitled to oversee the construction of any alterations, additions or improvements that may affect the structure of the Building or any of the mechanical, electrical, plumbing or life safety systems of the Building. In the event Landlord elects to oversee such work, Landlord shall be entitled to receive a fee for such oversight in an amount equal to ten percent (10%) of the cost of such alterations, additions or improvements. Landlord’s approval of Tenant’s plans and specifications for any work performed for or on behalf of Tenant shall not be deemed to be representation by Landlord that such plans and specifications comply with applicable insurance requirements, building codes, ordinances, laws or regulations or that the alterations, additions and improvements constructed in accordance with such plans and specifications will be adequate for Tenant’s use.

11.1 Fixtures and Personalty All fixtures (including trade fixtures attached to the Leased Premises), equipment, improvements, and appurtenances attached to or built into the Leased Premises, as reflected in the Final Working Drawings or subsequently installed pursuant to any other provisions hereof, whether by Landlord at Landlord’s expense or at Tenant’s expense, or by the Tenant, shall be and remain part of the Leased Premises and shall not be removed by Tenant at the expiration of the Lease Term, unless otherwise expressly provided herein.

11.1.1 Fixtures The following shall be deemed fixtures that comprise a part of the Leased Premises, except as otherwise specifically provided herein: all electric ceiling and lighting fixtures and outlets, plumbing, heating, sprinkling, telephone, telegraph, and built-in communication systems; partitions, railings, doors, paneling, molding, cabinetry, shelving, flooring, and floor and wall coverings; and all ventilating, silencing, air conditioning, cooling, and heating equipment, where installed within or to interior walls, floors, and ceilings.

11.1.2 Movable Items Where not built into the Leased Premises or attached to interior walls, floors, and ceilings, and if furnished by or at Tenant’s expense without credit by the Improvement Allowance, all readily removable electric fixtures, non-attached carpets or rugs, electric fans, water coolers, kitchen appliances, furniture, furnishings, movable trade fixtures, and equipment shall not be deemed fixtures and a part of the Leased Premises, and may be removed by Tenant upon the condition that such removal does not damage the Leased Premises and upon condition also that Tenant shall pay the cost of repairing any damage to the Leased Premises arising from any such removal.

11.2 Mechanic’s Liens Tenant will not permit any mechanic’s liens or other liens to be placed upon the Premises, the Building, or the Property and nothing in this Lease shall be deemed or construed in any way as constituting the consent or request of Landlord, express or implied, by inference or otherwise, to any person for the performance of any labor or the furnishing of any materials to the Leased Premises, the Building, or the Property or any part thereof, nor as giving Tenant any right, power, or authority to contract for or permit the rendering of any services or the furnishing of any materials that would give rise to any mechanic’s or other liens against the Leased Premises, the Building, or the Property. In the event any such lien is attached to the Leased Premises, the Building, or the Property, then, in addition to any other right or remedy of Landlord, Landlord may, but shall not be obligated to, discharge the same. Any amount paid by Landlord for any of the aforesaid purposes including, but not limited to, reasonable attorneys’ fees, shall be paid by Tenant to Landlord promptly on demand as Additional Rent. Tenant shall within ten (10) days of

Page 7 of 30

Landlord: Tenant:

receiving such notice of lien or claim (a) have such lien or claim released or (b) deliver to Landlord a bond in form, content, amount and issued by surety, satisfactory to Landlord, indemnifying, protecting, defending and holding harmless the Indemnities against all costs and liabilities resulting from such lien or claim and the foreclosure or attempted foreclosure thereof. Tenant’s failure to comply with the provisions of the foregoing sentence shall be deemed an Event of Default under Section 22 hereof entitling Landlord to exercise all of its remedies therefor without the requirement of any additional notice or cure period.

12 Assignment; Subletting Except as permitted hereunder in this Section 12, Tenant will not assign, sublease, transfer or encumber this Lease or any interest herein or in whole or in part (collectively or individually, a “Transfer”), without the prior written consent of Landlord, which consent shall not be unreasonably withheld. Without limitation, it is agreed that Landlord’s consent shall not be considered unreasonably withheld if: (i) the proposed transferee’s financial condition does not meet the criteria Landlord uses to select Building tenants having similar leasehold obligations; (ii) the proposed transferee’s business is not suitable for the Building considering the business of the other tenants and the Building’s prestige, or would result in a violation of another tenant’s rights; (iii) the proposed transferee is a governmental agency or occupant of the Building; (iv) Tenant is in default beyond any applicable notice and cure period; or (v) any portion of the Building or the Premises would likely become subject to additional or different laws as a consequence of the proposed Transfer.

12.1 Landlord’s Election If Tenant requests Landlord’s consent to a Transfer, Tenant shall submit to Landlord written notice of such request, together with the name of the proposed assignee, the proposed effective date, financial statements for the proposed transferee, a complete copy of the proposed assignment, sublease; together with any and all other information as Landlord may reasonably request, at least thirty (30) calendar days prior to the date of the proposed Transfer. Landlord will have the option for a period of thirty (30) calendar days after receipt of such notice to either: (i) permit Tenant to assign, encumber, or sublet the Leased Premises; or (ii) refuse any consent and continue this Lease in effect. The failure by Landlord to exercise either of the foregoing options within the time provided will be deemed a refusal and election to keep this Lease in full force and effect. Consent by Landlord to one or more Transfer(s) shall not operate as a waiver of Landlord’s rights to approve any subsequent Transfer(s). In no event shall any Transfer release or relieve Tenant from any obligation under this Lease or any liability hereunder. Tenant shall reimburse Landlord for all costs associated with Landlord’s review of any Transfer or requested Transfer. In addition, Tenant shall reimburse Landlord for its actual reasonable costs and expenses (including without limitation reasonable attorney’s fees) incurred by Landlord in connection with Landlord’s review of such requested Transfer.

12.2 Proceeds In the event Landlord consents to a requested Transfer, Tenant shall pay to Landlord fifty percent (50%) of all cash and other consideration which Tenant receives as a result of a Transfer that is in excess of the rent payable to Landlord hereunder for the portion of the Leased Premises and Term covered by the Transfer within ten (10) days following receipt thereof by Tenant. If Tenant is in Monetary Default (defined in Section 20 hereof), Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of any payments received (less Landlord’s share of any excess).

12.3 Permitted Transfer to Commonly Controlled Entity Tenant may assign its entire interest under this Lease or sublet the Leased Premises to any entity controlling or controlled by or under common control with Tenant or to any successor to Tenant by purchase, merger, consolidation or reorganization (hereinafter, collectively, referred to as “Permitted Transfer”) without the consent of Landlord, provided: (i) Tenant is not in default under this Lease; (ii) such proposed transferee shall have a net worth which is at least equal to the greater of Tenant’s net worth at the date of this Lease or Tenant’s net worth as of the day prior to the proposed purchase, merger, consolidation or reorganization as evidenced to Landlord’s reasonable satisfaction; (iii) such proposed transferee operates the business in the Leased Premises for the Permitted Use and no other purpose; and (iv) Tenant shall give Landlord written notice at least thirty (30) days prior to the effective date of the proposed purchase, merger, consolidation or reorganization.

12.4 Perpetual Nature of Lease Notwithstanding any consent granted by Landlord, Tenant and each assignee, mortgagee, and sublessee will at all times remain fully liable for the payment of Rent and for the performance of Tenant’s obligations hereunder. No consent granted by Landlord will constitute a waiver of the provisions of this Section 12 except as to the specific instance covered thereby. Any attempted Transfer in violation of this Section 12 shall, exercisable in Landlord’s sole and absolute discretion, be voidable. Tenant agrees that in the event Landlord withholds its consent to any Transfer contrary to the provisions of this Section 12, Tenant’s sole remedy shall be to seek an injunction in equity or compel performance by Landlord to give its consent and Tenant expressly waives any right to damages in the event of such withholding by Landlord of its consent.

13 Signage Tenant will be provided, at Landlord’s expense, one building standard strip on the lobby directory. Landlord will also provide, at Landlord’s expense, one suite identification sign adjacent to or on the main entry door of the Leased Premises. Tenant will pay Landlord’s reasonable charges for changing such building directory and identification sign at Tenant’s request. No other signage shall be used or permitted on the Leased Premises without Landlord’s prior written consent.

14 Entry by Landlord Tenant shall permit Landlord or its agents or representatives to enter into and upon any part of the Leased Premises at all reasonable hours (or, in any emergency, at any hour), to inspect, clean, or make repairs, alterations, or additions thereto, including any work that Landlord deems necessary for the safety, protection or preservation of the Building or any occupants thereof, or to facilitate repairs, alterations or additions to the Building or any other tenant’s premises. Landlord may also enter the Leased Premises to conduct an economic appraisal of the Building or to show the Leased Premises to prospective purchasers, mortgagees, and tenants.

Page 8 of 30

Landlord: Tenant:

14.1 Notice of Entry Except for any entry by Landlord in an emergency situation or to provide normal cleaning and janitorial service, Landlord shall provide Tenant with reasonable prior notice of any entry into the Leased Premises, which notice may be given verbally.

14.2 Effect of Entry Landlord and Landlord’s agents, employees, and contractors will have the absolute right to enter the Leased Premises and Tenant will not be entitled to any abatement or reduction of Rent by reason thereby, nor shall any such entry for such purposes constitute an actual or constructive eviction of Tenant.

15 Insurance Tenant and Landlord shall each maintain during the Lease Term, at their respective expense, the following insurance coverages provided in this Section 15:

15.1 Landlord’s Insurance Landlord will maintain the following policy or policies of insurance: (i) fire and extended coverage insurance covering the Building and the Common Areas (other than on Tenant’s Property or on any additional improvements constructed in the Leased Premises by Tenant) for the full insurable value thereof; and (ii) commercial general liability insurance insuring injury to or death of any person occasioned by or arising out of or in connection with the ownership, maintenance, management, leasing, and operation of the Building, the limits of such policy or policies to be in an amount of not less than $1,000,000.00 with respect to injuries to or death of any one person and in an amount of not less than $500,000.00 with respect to any one occurrence. The cost of such insurance shall be included as a part of the Actual Operating Costs, and payments for losses thereunder shall be made solely to Landlord or the mortgagees of Landlord as their interests shall appear.

15.2 Tenant’s Insurance Tenant will maintain the following policy or policies of insurance, at its expense, insuring Tenant and naming Landlord as an additional insured: (i) special form (formerly known as all risk) property insurance on all of its personal property, including removable trade fixtures and leasehold and tenant improvements, and Tenant’s Property located in the Leased Premises and in such additional amounts as are required to meet Tenant’s obligations hereunder and with deductibles in an amount for the full replacement cost thereof; and (ii) commercial general liability insurance (including endorsement or separate policy for owned or non-owned automobile liability) with respect to its activities in the Building and on the Property, with the premiums thereon fully paid on or before the due date, in an amount of not less than $2,000,000 per occurrence per person coverage for bodily injury, property damage, personal injury or combination thereof (the term “personal injury” as used herein means, without limitation, false arrest, detention or imprisonment, malicious prosecution, wrongful entry, liable and slander), provided that if only single limit coverage is available it shall be for at least $2,000,000 per occurrence with an umbrella policy of at least $5,000,000 combined single limit per occurrence. Tenant’s insurance policies shall name Landlord as an additional insured and shall include coverage for the contractual liability of Tenant to indemnify Landlord hereunder and shall have deductibles in an amount reasonably satisfactory to Landlord. Prior to Tenant’s taking possession of the Premises, Tenant shall furnish evidence satisfactory to Landlord of the maintenance and timely renewal of such insurance, and Tenant shall obtain and deliver to Landlord a written obligation on the part of each insurer to notify Landlord at least thirty (30) days prior to the modification, cancellation or expiration of such insurance policies. In the event Tenant shall not have delivered to Landlord a policy or certificate evidencing such insurance at least thirty (30) days prior to the expiration date of each expiring policy, Landlord may obtain such insurance as Landlord may reasonably require to protect Landlord’s interest (which obtaining of insurance shall not be deemed to be a waiver of Tenant’s default hereunder). The cost to Landlord of obtaining such policies, plus an administrative fee in the amount of fifteen percent (15%) of the cost of such policies shall be paid by Tenant to Landlord as Additional Rent upon demand.

15.2.1 Evidence of Coverage Tenant will furnish to Landlord on or before the Commencement Date, a certificate of insurance satisfactory to Landlord, confirming the maintenance of such insurance and the payment of all premiums. Renewal certificates or copies of renewal policies will be delivered to Landlord at least thirty (30) calendar days prior to the expiration of any policy. OK

12.2.2 Carriers All insurance required under this Section 15 shall be issued by an insurance company with a rating of no less than A-VIII in the current Best’s Insurance Guide, or A- in the current Standard & Poor Insurance Solvency Review, or that is otherwise acceptable to Landlord, and admitted to engage in the business of insurance in the State of Oklahoma.

15.3 Waiver of Certain Claims Each of the parties hereby releases the other from all liability for damage due to any act or neglect of the other (except as hereinafter provided) occasioned to property owned by said parties, which is or might be incident to or the result of any casualty for which either of the parties is now carrying, is required by this Lease to carry, or may hereafter carry insurance; provided, however, that the releases herein contained shall not apply to any loss or damage occasioned by the deliberate, harmful, or negligent act of either of the parties hereto or their agents, employees, or other Persons acting on their behalf. Since this mutual waiver will preclude the assignment of any such claim by subrogation (or otherwise) to an insurance company (or any other person), Landlord and Tenant each agree to give each insurance company which has issued, or on the future may issue, policies of insurance, with respect to the items covered by this waiver, written notice of the terms of this mutual waiver, and to have such insurance policies properly endorsed, if necessary, to prevent the invalidation of any of the coverage provided by such insurance policies by reason of such mutual waiver. Upon request by either party, Tenant or Landlord shall provide the other with proof of insurance containing evidence of the insurer’s acknowledgement of the provisions of this Section 15.3.

15.4 Waiver of Subrogation Landlord and Tenant hereby waive any and all rights of recovery against the other, their officers, agents, and employees, to the extent the same is insured against under any insurance policy that covers the Building, the Leased Premises, or any assets thereon and/or any business conducted thereon, occurring out of the use and occupancy of the Leased Premises for loss or damage to their respective real and/or personal property arising as a result of a casualty or condemnation contemplated by

Page 9 of 30

Landlord: Tenant:

this Lease, regardless of whether the negligence of the other party caused any such loss. Each of the parties shall, upon obtaining the policies of insurance required by this Lease, notify the insurance carrier that the foregoing waiver is contained in this Lease and shall require such carrier to include an appropriate waiver of subrogation provision in the policies. For the purpose of the foregoing waiver, the amount of any deductible applicable to any loss or damage shall be deemed covered by, and recoverable by the insured under the insurance policy to which such deductible relates. In the event that Tenant is permitted to and self-insures any risk for which insurance is required to be carried under this Lease, or if Tenant fails to carry any insurance required to be carried by Tenant pursuant to this Lease, then all loss or damage to Tenant, its leasehold interest, its business, its property, the Premises or any additions or improvements thereto or contents thereof shall be deemed covered by and recoverable by Tenant under valid and collectible policies of insurance. Notwithstanding anything to the contrary herein, Landlord shall not be liable to the Tenant or any insurance company (by way of subrogation or otherwise) insuring the Tenant for any loss or damage to any property, or bodily injury or personal injury or any resulting loss of income or losses from worker’s compensation laws and benefits, even though such loss or damage might have been occasioned by the negligence of Landlord, its agents or employees, or Building Manager, if any such loss or damage was required to be covered by insurance pursuant to this Lease.

The insurance requirements set forth in this Section 15 are independent of the waiver, indemnification, and other obligations under this Lease and will not be construed or interpreted in any way to restrict, limit or modify the waiver, indemnification and other obligations or to in any way limit any party’s liability under this Lease.

16 Indemnity. To the extent not expressly prohibited by law, Landlord nor any of its respective officers, directors, employees, members, managers, or agents shall be liable to Tenant, or to Tenant’s agents, servants, employees, customers, licensees, or invitees for any injury to person or damage to property caused by any act, omission, or neglect of Tenant, its agents, servants, employees, customers, invitees, licensees or by any other person entering the Building or upon the Property under the invitation of Tenant or arising out of the use of the Property, Building or Leased Premises by Tenant and the conduct of its business or out of a default by Tenant in the performance of its obligations hereunder. Tenant hereby indemnifies and holds Landlord and its officers, directors, employees, members, managers and agents (“Indemnitees”), harmless from all liability and claims for any property damage, or bodily injury or death of, or personal injury to, a person in or on the Leased Premises, , including the Property or the Building and this indemnity shall be enforceable to the full extent whether or not such liability and claims are the result of the sole, joint or concurrent acts, negligent or intentional, or otherwise, of Tenant, or its employees, agents, servants, customers, invitees or licensees. Such indemnity for the benefit of Indemnitees shall be enforceable even if Indemnitees, or any one or more of them have or has caused or participated in causing such liability and claims by their joint or concurrent acts, negligent or intentional, or otherwise. Additionally, Landlord shall not be liable to Tenant or Tenant’s employees, contractors, agents, invitees or customers, for any injury to person or damage to property sustained by Tenant or any such party or any other person claiming through Tenant resulting from any accident or occurrence in the Leased Premises or any other portion of the Building caused by the Leased Premises or any other portion of the Building becoming out of repair or by defect in or failure of equipment, pipes, or wiring, or by broken glass, or by the backing up of drains, or by gas, water, steam, electricity, or oil leaking, escaping or flowing into the Leased Premises (except where due to Landlord’s willful failure to make repairs required to be made pursuant to other provisions of this Lease, after the expiration of a reasonable time after written notice to Landlord of the need for such repairs), nor shall Landlord be liable to Tenant for any loss or damage that may be occasioned by or through the acts or omissions of other tenants of the Building or of any other persons whomsoever, including, but not limited to riot, strike, insurrection, war, court order, requisition, order of any governmental body or authority, acts of God, fire or theft. Notwithstanding the terms of this Lease to the contrary, the terms of this Section 16 shall survive the expiration or earlier termination of this Lease.

17 Casualty The following provisions shall apply to damage or destruction to the Building or the Leased Premises:

17.1 Damage to Leased Premises If the Leased Premises or any part thereof shall be damaged by fire or other casualty, Tenant shall give prompt written notice thereof to Landlord. In case the Building shall be so damaged that substantial alteration or reconstruction of the Building shall, in Landlord’s sole opinion, be required (whether or not the Leased Premises shall have been damaged by such casualty) or in the event there is less than two (2) years of the Lease Term remaining or in the event Landlord’s mortgagee should require that the insurance proceeds payable as a result of a casualty be applied to the payment of the mortgage debt or in the event of any material uninsured loss to the Building, Landlord may, at its option, terminate this Lease by notifying Tenant in writing of such termination within ninety (90) days after the date of such casualty. If Landlord does not thus elect to terminate this Lease, Landlord shall commence and proceed with reasonable diligence to restore the Building, and the improvements located within the Leased Premises, if any, for which Landlord had financial responsibility pursuant to the Work Letter Agreement attached hereto as Exhibit D; to substantially the same condition in which it was immediately prior to the happening of the casualty. Notwithstanding the foregoing, Landlord’s obligation to restore the Building, and the improvements located within the Leased Premises, if any, for which Landlord had financial responsibility pursuant to the Work Letter Agreement, shall not require Landlord to expend for such repair and restoration work more than the insurance proceeds actually received by the Landlord as a result of the casualty and Landlord’s obligation to restore shall be further limited so that Landlord shall not be required to expend for the repair and restoration of the improvements located within the Leased Premises, if any, for which Landlord had financial responsibility pursuant to the Work Letter Agreement, more than the dollar amount of the Allowance, if any, described in the Work Letter Agreement. When the repairs described in the preceding two sentences have been completed by Landlord, Tenant shall complete the restoration of all improvements, including furniture, fixtures and equipment, which are necessary to permit Tenant’s reoccupancy of the Leased Premises. Except as set forth above, all cost and expense of reconstructing the Leased Premises shall be borne by Tenant, and Tenant shall present Landlord with evidence satisfactory to Landlord of Tenant’s ability to pay such costs prior to Landlord’s commencement of repair and restoration of the Leased Premises. Landlord shall not be liable for any inconvenience or annoyance to Tenant or injury to the

Page 10 of 30

Landlord: Tenant:

business of Tenant resulting in any way from such damage or the repair thereof, except that, subject to the provisions of the next sentence, Landlord shall allow Tenant a fair diminution of Rent during the time and to the extent the Leased Premises are unfit for occupancy. If the Leased Premises or any other portion of the Property is damaged by fire or other casualty resulting from the fault or negligence of Tenant or any of Tenant’s agents, employees, or invitees, the Rent hereunder shall not be diminished during the repair of such damage and Tenant shall be liable to Landlord for the cost of the repair and restoration of the Property caused thereby to the extent such cost and expense is not covered by insurance proceeds.

17.2 Damage to Building If the Building, but not the Leased Premises, shall be so damaged by casualty that substantial alteration or reconstruction of the Building shall, in Landlord’s sole judgment, be required or in the event of any material uninsured loss to the Building, Landlord may, at Landlord’s option, terminate this Lease by notifying Tenant in writing of such termination within sixty (60) calendar days after the date of casualty. On such termination Tenant will pay Rent and all other obligations of Tenant apportioned to the date of termination and Tenant will immediately surrender the Leased Premises to Landlord. If Landlord does not exercise the option to terminate this Lease within such period, Landlord will repair and restore the Building and the Common Areas pursuant to this Lease. Rent will not be abated or reduced during such restoration or repair so long as Tenant’s continued occupancy of the Leased Premises is not materially interrupted. If the Building is damaged by any casualty resulting from the fault or negligence of Tenant or any of Tenant’s agents, employees, or invitees, the Rent hereunder shall not abate and Tenant shall be liable to Landlord for the cost of repair and restoration of the Building to the extent such cost and expenses are not covered by insurance proceeds.

17.3 No Liability Landlord shall not be liable to Tenant for any inconvenience or annoyance to Tenant or injury to the business of Tenant resulting in any way from such damage or Landlord’s restoration work, other than abatement of Rent, as and when applicable in accordance with this Section 17.

17.4. Holder’s Requirements. Any provisions of this Section 17 to the contrary notwithstanding, Tenant hereby acknowledges that in the event any Holder under any Encumbrance should require that proceeds of insurance be used to retire the indebtedness secured thereby in accordance with the provisions of such Encumbrance, Landlord shall have no obligation to rebuild or restore the Building, and this Lease shall terminate on sixty (60) calendar days written notice to Tenant.

18 Condemnation If the whole or any substantial part of the Leased Premises or if the Building or any portion thereof which would leave the remainder of the Building unsuitable for use as an office building comparable to its use on the Commencement Date, or if the land on which the Building is located or any material portion thereof, is taken or condemned in whole or part for any public use or purpose by right of eminent domain, or is transferred by agreement in connection with, in lieu of, or under threat of condemnation, then Landlord may, at its option, terminate this Lease and the Rent shall be abated during the unexpired portion of this Lease, effective as of the date title vests in the condemner or transferee. Landlord will receive the entire award from such taking (or the entire compensation paid on account of any transfer by agreement). Tenant, however, shall be entitled to claim, prove, and receive in any condemnation proceeding such awards as may be allowed under applicable Laws for fixtures and other equipment installed by Tenant, but only if such award shall be made by the court in addition to (and shall in no manner whatsoever reduce) the award made by the court to Landlord for the Land and Building. For purposes of this Section 18 only, the term “Building” shall not include parking facilities, driveways, or non-paved landscaped exteriors.

19 Hazardous Materials Tenant hereby represents and covenants to Landlord the following: No toxic or hazardous substances or wastes, pollutants or contaminants (including, without limitation, asbestos, urea formaldehyde, the group of organic compounds known as polychlorinated biphenyls, petroleum products including gasoline, fuel oil, crude oil and various constituents of such products, radon, and any hazardous substance as defined in the Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. 9601-9657, as amended (“CERCLA”) (collectively, “Hazardous Materials”) other than customary office supplies and cleaning supplies stored and handled within the Leased Premises in accordance with all applicable laws, will be generated, treated, stored, released or disposed of, or otherwise placed, deposited in or located on the Property, and no activity shall be taken on the Property, by Tenant, its agents, employees, invitees or contractors, that would cause or contribute to (i) the Property or any part thereof to become a generation, treatment, storage or disposal facility within the meaning of or otherwise bring the Property within the ambit of the Resource Conservation and Recovery Act of 1976 (“RCRA”), 42 U.S.C. 5901 et. seq., or any similar state law or local ordinance, (ii) a release or threatened release of toxic or hazardous wastes or substances, pollutants or contaminants, from the Property or any part thereof within the meaning of, or otherwise result in liability in connection with the Property within the ambit of CERCLA, or any similar state law or local ordinance, or (iii) the discharge of pollutants or effluents into any water source or system, the dredging or filling of any waters, or the discharge into the air of any emissions, that would require a permit under the Federal Water Pollution Control Act, 33 U.S.C. 1251 et. seq., or the Clean Air Act, 42 U.S.C. 7401 et. seq., or any similar state law or local ordinance.

19.1 Disclosure Tenant shall immediately notify Landlord in writing of any release or threatened release of Hazardous Materials of which Tenant has knowledge, whether or not the release is in quantities that would require, under law, the reporting of such release to a governmental or regulatory agency. Tenant shall also immediately notify Landlord in writing of, and shall contemporaneously provide Landlord with a copy of: (i) any written notice of release of Hazardous Materials on the Property that is provided by Tenant or any subtenant or other occupant if the Premises to a governmental or regulatory agency; (ii) any notice of a violation, or a potential or alleged violation, of any Environmental Law (hereinafter defined) that is received by Tenant or any subtenant or other occupant of the Premises from any governmental or regulatory agency; (iii) any inquiry, investigation, enforcement, cleanup, removal, or other action that is instituted or threatened by a governmental or regulatory agency against Tenant or any subtenant or other occupant of the Premises and that relates to the release or discharge of Hazardous Materials on or from the Property; (iv) any claim that is instituted or threatened by any third-party against Tenant or any subtenant or other occupant of the Premises and that relates to any release or discharge of Hazardous Materials on or from the Property; and (v) any notice of the loss of any environmental operating permit by Tenant or any subtenant or other occupant of the Premises.

Page 11 of 30

Landlord: Tenant:

19.2 Inspection Landlord and its agents shall have the right, but not the duty, to inspect the Leased Premises at any time to determine Tenant’s compliance with this Section 19. Landlord shall have the right to immediately enter upon the Leased Premises to remedy any Discharge caused by Tenant’s failure to comply and Tenant shall reimburse Landlord for all costs and expenses incurred by Landlord. Landlord shall use reasonable efforts to minimize interference with Tenant’s business, but shall not be liable for any interference caused thereby.

19.3 Indemnification If Tenant breaches the obligations of this Section 19 or if the presence of Hazardous Material within the Building or the Leased Premises caused or permitted by Tenant, results in contamination of the Leased Premises or the Building by Hazardous Material otherwise for which Tenant is legally liable, then Tenant shall indemnify, defend, and hold Landlord harmless from any and all claims, judgments, damages, penalties, fines, costs, liabilities, or losses incurred by Landlord (including diminution in value of the Leased Premises, damages for the loss or restriction on use of rentable or usable space or of any amenity of the Leased Premises, damages arising from any adverse impact on marketing of space, and sums paid in settlement of claims, attorney fees, consultant fees, and expert fees) which arise during or after the Lease Term as a result of such contamination. This indemnification includes costs incurred by Landlord in connection with any investigation of site conditions and any action to remedy any contamination of the Land, Building, or Leased Premises (a “Discharge”), including any clean-up, remedial, removal, or restoration work required by any Governmental Authority because of Hazardous Material present in the soil or ground water on or under the Land. If the presence of any Hazardous Material within the Building or the Leased Premises caused or permitted by Tenant results in Discharge, Tenant shall promptly take all actions at its sole expense as are necessary to return the Land, Building, or Leased Premises to the condition existing prior to the Discharge, provided, that Landlord’s approval of such actions shall first be obtained. The foregoing indemnity shall survive the Expiration Date or earlier termination of this Lease.

As used in this Section 19 “Environmental Laws” mean all present and future federal, state and municipal laws, ordinances, rules and regulations applicable to environmental and ecological conditions, and the rules and regulations of the U.S. Environmental Protection Agency, and any other federal, state or municipal agency, or governmental board or entity relating to environmental matters.

20 Default The following events shall be deemed to be events of default by Tenant hereunder (“Tenant Defaults” or “Default”) if not cured within the applicable cure period:

20.1 Monetary Default Tenant shall fail to pay when due any Base Rent, Additional Rent or other amount payable by Tenant to Landlord under this Lease within ten (10) calendar days after written notice thereof to Tenant.

20.2 Non-Monetary Defaults Tenant’s failure to cure any of the following events within thirty (30) calendar days after written notice thereof to Tenant:

| (i) | Any failure by Tenant (other than a Monetary Default) to comply with any term, provision or covenant of this Lease, or the Building Regulations, however, that if the term, condition, covenant or obligation to be performed by Tenant is of such nature that the same cannot reasonably be performed within such thirty-day period, such default shall be deemed to have been cured if Tenant commences such performance within said thirty-day period and thereafter diligently undertakes to complete the same, and in fact, completes same within sixty (60) days after notice; or |

| (ii) | Failure by Tenant to continue to occupy all of the Leased Premises and to conduct and operate Tenant’s business within the Leased Premises during the Business Hours of the Building for a period of more than thirty (30) consecutive calendar days; or |

| (iii) | Tenant or any Guarantor shall (a) become insolvent, (b) make a transfer in fraud of creditors (c) make an assignment for the benefit of creditors, (d) admit in writing its inability to pay its debts as they become due, or (e) file a petition under any section or chapter of the United States Bankruptcy Code, as amended, pertaining to bankruptcy, or under any similar law or statute of the United States or any State thereof; or |