Attached files

| file | filename |

|---|---|

| EX-3.4 - EXHIBIT 3.4 - iDcentrix, Inc. | v220421_ex3-4.htm |

| EX-32.1 - EXHIBIT 32.1 - iDcentrix, Inc. | v220421_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - iDcentrix, Inc. | v220421_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x Annual Report Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended: December 31, 2010

£ Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______ to_______

Commission File No. 000-51263

North China Horticulture, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

20-4650531

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification Number)

|

|

LongSheng Village, Tangshan Town, Zhengan District

|

|

Dandong City, Liaoning, P.R.China

|

|

(Address of Principal Executive Offices)

|

86-0415-8176321

Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.00001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

|

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Registrant’s voting and non-voting common equity held by non-affiliates as of June 30, 2010 was $1,456,455, based on 75,660 shares of common stock held by non-affiliates valued at $19.25 per share, the last known sale price of the Registrant’s common stock.

As of March 31, 2011, the registrant had 50,000,139 shares of common stock outstanding.

INDEX

|

Page

|

||||

|

PART I – FINANCIAL INFORMATION

|

||||

|

ITEM 1.

|

Business

|

4 | ||

|

ITEM 1A.

|

Risk Factors

|

14 | ||

|

ITEM 2.

|

Properties

|

25 | ||

|

ITEM 3.

|

Legal Proceedings

|

25 | ||

|

ITEM 4.

|

(Removed and Reserved)

|

25 | ||

|

PART II – OTHER INFORMATION

|

||||

|

ITEM 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

26 | ||

|

ITEM 6.

|

Selected Financial Data

|

27 | ||

|

ITEM 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

27 | ||

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

34 | ||

|

ITEM 8.

|

Financial Statements and Supplementary Data

|

34 | ||

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosures

|

34 | ||

|

ITEM 9A

|

Controls and Procedures

|

34 | ||

|

ITEM 9B.

|

Other Information

|

35 | ||

|

PART III

|

||||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance

|

35 | ||

|

ITEM 11.

|

Executive Compensation

|

36 | ||

|

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

37 | ||

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

40 | ||

|

ITEM 14.

|

Principal Accountant Fees and Services

|

42 | ||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

43 | ||

|

Signatures

|

45 | |||

|

Financial Statements pages

|

46 | |||

2

PRELIMINARY NOTES

Special Note Regarding Forward Looking Statements

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

|

|

·

|

Continued growth of the Chinese economy;

|

|

|

·

|

Chinese consumers’ continued movement up the value chain to consume higher-end agricultural products, namely blueberries;

|

|

|

·

|

Our ability to obtain additional capital in future years to fund our planned expansion;

|

|

|

·

|

Negative changes in the industries in which our products are sold;

|

|

|

·

|

Decrease in the availability, or increase in the cost, of raw materials and energy;

|

|

|

·

|

Economic, political, regulatory, legal and foreign exchange risks associated with our operations; or

|

|

|

·

|

The loss of key members of our senior management and our qualified sales personnel.

|

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

|

|

·

|

the “Company,” “we,” “us,” and “our” refer to the combined business of (i) North China Horticulture, Inc. or “North China” a Nevada corporation, (ii) Honour Bond Limited, or “Honour Bond,” a Hong Kong limited company and wholly-owned subsidiary of North China, (iii) Shengzheng Zhihao Dongbo Technology Ltd., or “Dongbo Consulting,” a Chinese limited company and wholly-owned subsidiary of Honour Bond, and (iv) Dandong LongSheng Horticulture Technology Co., Ltd., or “Dandong LongSheng,” a Chinese limited company which is effectively and substantially controlled by Dongbo Consulting through a series of captive agreements, as the case may be;

|

|

|

·

|

“BVI” refers to the British Virgin Islands;

|

|

|

·

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

|

·

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

|

|

|

·

|

“PRC,” “China,” and “Chinese,” refer to the People’s Republic of China (excluding Hong Kong and Taiwan);

|

3

|

|

·

|

“Renminbi” and “RMB” refer to the legal currency of China;

|

|

|

·

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

|

·

|

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

|

In this annual report we are relying on and we refer to information and statistics regarding the agricultural sector and economy in China and that we have obtained from various cited government and institute research publications. Much of this information is publicly available for free and has not been specifically prepared for us for use or incorporation in this annual report on Form 10-K or otherwise. We have not independently verified such information, and you should not unduly rely upon it.

PART I

ITEM 1. BUSINESS.

Overview and Corporate Background

North China Horticulture, Inc. (formerly known as iDcentrix, Inc.) was incorporated in the State of Nevada on January 26, 2004 under the name “iDcentrix, Inc.” The Company was previously engaged in the acquisition and exploration of mineral properties. This business was in the early exploration stage and was focused on the mineral exploration of a certain mining claim which was subsequently abandoned.

On January 31, 2008, iDcentrix consummated a share exchange (the “IDCX Share Exchange”) with all of the shareholders of iDcentrix, Inc., a Delaware corporation (“IDCX”), pursuant to a Share Exchange Agreement, dated January 16, 2008. Pursuant to the IDCX Share Exchange Agreement, the issued and outstanding common shares of IDCX were exchanged on a one-for-one basis for common shares of iDcentrix. iDcentrix issued 18,762,000 shares of its Common Stock to the former shareholders of IDCX upon consummation of the IDCX Share Exchange. As a result of the IDCX Share Exchange, IDCX became a wholly-owned subsidiary of iDcentrix, and iDcentrix continued its existence as the surviving corporation. Further, under the terms of the IDCX Share Exchange Agreement, the Company’s current director and management prior to the IDCX Share Exchange resigned and were replaced with IDCX’s directors and new management. The acquisition was accounted for as a reverse merger (recapitalization) with IDCX deemed to be the accounting acquirer and iDcentrix deemed to be the legal acquirer. Following the IDCX Share Exchange, iDcentrix’s new Board of Directors and management adopted the plan of operation of IDCX and abandoned its previous plan of operation regarding the acquisition and exploration of mineral properties. Following the IDCX Share Exchange, the Company changed its name from “Sterling Gold Corp.” to “iDcentrix, Inc.” and IDCX changed its name to “IDCX Co.”

On October 23, 2009, iDcentrix entered into a stock purchase agreement (the “Belmont Stock Purchase Agreement”) with Belmont Partners, LLC (“Belmont”), whereby Belmont purchased a controlling interest of the Company’s common stock (the “Belmont Purchase Transaction”). Pursuant to the Belmont Stock Purchase Agreement, Joseph Meuse, a managing member of Belmont, was appointed as a member of the Company’s Board of Directors and to the offices of President and Secretary and all other Directors and officers of the Company resigned. The Company changed its plan of business from the development and marketing of high-end security identification cards to seeking to acquire or merge with a revenue-producing company or a company with technology assets.

On April 5, 2010, the Company entered into a Common Stock Purchase Agreement (the “Tsoi Stock Purchase Agreement”) by and among Tsoi Tik Man, our former President, Secretary and a director, Belmont and the Company. Pursuant to the terms of the Tsoi Stock Purchase Agreement, on April 5, 2010, Tsoi Tik Man acquired from Belmont a controlling interest in the Company’s Common Stock. Pursuant to the terms of the Tsoi Stock Purchase Agreement, Joseph J. Meuse resigned and Tsoi Tik Man was named as the sole officer and director of the Company.

4

Acquisition of Honour Bond Limited

On July 16, 2010, we completed a reverse acquisition transaction through a share exchange with Honour Bond and its shareholders, or the Shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Honour Bond in exchange for 49,870,814 shares of our Common Stock which constituted 99.74% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Honour Bond became our wholly-owned subsidiary and the former shareholders of Honour Bond became our controlling stockholders. The amount of consideration received by the shareholders of Honour Bond was determined on the basis of arm’s-length negotiations between Honour Bond and iDcentrix. The share exchange transaction with Honour Bond and the Shareholders was treated as a reverse acquisition, with Honour Bond as the acquirer and North China as the acquired party.

Upon the closing of the reverse acquisition, TsoiTik Man, our former President, Secretary and a director, submitted a resignation letter pursuant to which he resigned from all offices that he held effective immediately and from his position as our director that became effective on August 7, 2010. In addition, our board of directors on July 16, 2010, appointed Guang Zhao to fill the vacancy created by such resignation, which appointment became effective on August 7, 2010. In addition, our executive officer was replaced by Guang Zhao upon the closing of the reverse acquisition.

From its inception until its reverse acquisition of Honour Bond, iDcentrix did not generate any revenue and was a development stage business with limited operations. As a result of our reverse acquisition of Honour Bond, we are no longer a shell company and active business operations were revived.

Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Honour Bond and its consolidated subsidiaries.

As a result of our acquisition of Honour Bond, we now own all of the issued and outstanding capital stock of Honour Bond, which in turn owns all of the issued and outstanding capital stock of Shengzheng Zhihao Dongbo Technology Ltd. (“Dongbo Consulting”). In addition, we effectively and substantially control Dandong LongSheng through a series of captive agreements with Dongbo Consulting. Dandong LongSheng is principally engaged in the production of blueberry seedlings in the PRC.

Honour Bond was established in Hong Kong on January 5, 2010 to serve as an intermediate holding company. Dongbo Consulting was established in the PRC on March 4, 2010. Dandong LongSheng, our operating affiliate, was established in the PRC on March 13, 2008. On March 2, 2010, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Dongbo Consulting by Honour Bond, a Hong Kong entity.

Contractual Arrangements with our Controlled Affiliate and its Shareholder

On March 10, 2010, prior to the reverse acquisition transaction, Dongbo Consulting and Dandong LongSheng and its sole shareholder Guang Zhao entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Dandong LongSheng became Dongbo Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

|

|

(1)

|

an Exclusive Technical Consulting and Service Agreement between Dongbo Consulting and Dandong LongSheng pursuant to which Dongbo Consulting is to provide technical support and consulting services to Dandong LongSheng in exchange for all of the net income after taxes of Dandong LongSheng.

|

|

|

(2)

|

a Call Option and Cooperation Agreement among Guang Zhao, Dandong LongSheng and Dongbo Consulting under which the sole shareholder of Dandong LongSheng has granted to Dongbo Consulting the irrevocable right and option to acquire all of his equity interests in Dandong LongSheng to the extent permitted by PRC law. If PRC law limits the percentage of Dandong LongSheng that Dongbo Consulting may purchase at any time, then Dongbo Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is the net asset value of Dandong LongSheng at the time of exercise, or the percentage of such net asset value which corresponds to any incremental exercise of the option, or any higher price required by PRC law. Any such difference between such net asset value and such higher price required by PRC law is, subject to all applicable laws and regulations, to be paid over to Dandong LongSheng. Dandong LongSheng and its owner agree to refrain from taking certain actions which might harm the value of Dandong LongSheng or Dongbo Consulting’s option, and Dongbo Consulting undertakes to offer necessary financial support to Dandong LongSheng with respect to any losses or capital requirements to the extent permitted by law;

|

5

|

|

(3)

|

a Power of Attorney by Guang Zhao pursuant to which Mr. Zhao authorizes Dongbo Consulting to designate someone to exercise all of his shareholder decision rights with respect to Dandong LongSheng, provided that Dandong LongSheng consents to such authorization; and

|

|

|

(4)

|

an Equity Pledge Agreement between Guang Zhao and Dongbo Consulting under which the sole shareholder of Dandong LongSheng has pledged all of his equity in Dandong LongSheng to Dongbo Consulting to guarantee Dandong LongSheng’s and Guang Zhao’s performance of their obligations under the Exclusive Technical Consulting and Service Agreement, the Call Option and Cooperation Agreement and the Equity Pledge Agreement.

|

The VIE Agreements with our Chinese affiliate and its shareholder, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. Furthermore, our failure to perform our obligations under the VIE Agreements could give Dandong LongSheng the right to cease performance under or terminate the VIE Agreements and thereby deprive us of the economic benefit of the VIE Agreements from which we derive all of our revenues. See “Risk Factors - Risks Relating to the VIE Agreements.”

The foregoing description of the terms of the Exclusive Technical Consulting and Service Agreement, the Call Option and Cooperation Agreement, the Power of Attorney and the Equity Pledge Agreement is qualified in its entirety by reference to the provisions of the agreements incorporated by reference as Exhibits 10.5, 10.6, 10.12 and 10.7 to this report, respectively, which are incorporated by reference herein.

See “Item 13. Certain Relationships and Related Transactions, and Director Independence” for further information on our contractual arrangements with these parties.

Name Change

On August 25, 2010, the Company amended its articles of incorporation to change its name to “North China Horticulture, Inc.”

Our Corporate Structure

All of our business operations are conducted through our Hong Kong and Chinese subsidiaries and controlled affiliate. The chart below presents our corporate structure:

6

Our Industry:

The following industry information has been obtained from various market research reports and publicly available sources. We believe this information to be current and reliable. However, we have not independently verified such information, and you should not unduly rely upon it.

Blueberries are flowering plants of the genus Vaccinium. Blueberries are either consumed fresh, frozen or processed into food products. China has historically not been a major producer or consumer of blueberries. In recent years, Chinese farmers have begun to cultivate blueberries in earnest due to the high price that can be commanded in the market. Research demonstrating the health benefits associated with blueberry consumption has been followed by increasing global demand and production.

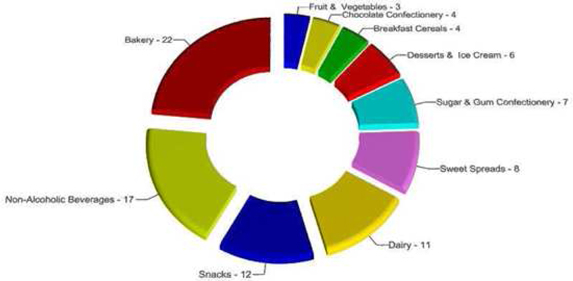

In the U.S. market, the two largest uses for blueberries are baked goods and non-alcoholic beverages. The following table provides a breakdown of U.S. blueberry processing usage:

There are more than 400 varieties of blueberries in the world with over 200 in China. Concurrent with increased awareness of health benefits of blueberry consumption, global production has recently increased rapidly driven by robust demand. In 2008, global production reached roughly 0.33 million tons. Worldwide blueberry acreage has more than doubled in the past twelve years, from 62,800 acres in 1997 to approximately 145,000 acres in 2009. The majority of that growth came from the western hemisphere, with 50,200 additional acres in South America and 32,000 more acres in North America, primarily in the U.S. and British Columbia.

Total Global Production:

Increased planted acreage has resulted in increased output. It is anticipated that global blueberry production will nearly quadruple from 2005 levels to over 1.2B lbs by 2012. North and South America will be major drivers, and production in China is also anticipated to see explosive growth.

7

Demand:

Blueberry consumption has been increasing over the past 10 years. In the United States market, consumption has increased 47% from 13 ounces per capita in 1995, to 19 ounces in 2008. It is estimated that that the global demand for blueberries in 2010 may be as high as 450,000 MMT. Japan is Asia’s largest importer of blueberries, and currently only produces 7% of its yearly consumption. Japan currently imports 10 to 14 million tons of U.S.-grown blueberries annually and is expected to become the largest importer of Chinese blueberries in the near future.

The China Blueberry Market:

China’s domestic blueberry industry is in an early stage of development. There were an estimated 400 to 600 hectares of blueberry fields under cultivation in 2007, located primarily in Jilin, Liaoning and Shandong Provinces. Due to foreign and domestic investment in blueberry production and government promotion of the industry, the area under cultivation is expected to reach 17,200 hectares by the end of 2010.

Prior to 2004, the Chinese blueberry export market was almost nonexistent. In 2003, the U.S. imported no blueberries from China. By 2008, the U.S. was importing 265,000 pounds of Chinese-grown blueberries. This figure is expected to increase as China continues to increase production of processed blueberries.

8

The following table provides a breakdown of the blueberry varieties currently produced in China:

Currently the vast majority of China’s blueberries are exported in either frozen or fresh form. In 2007, domestic consumption accounted for 10% of China’s blueberry production. As production costs are reduced and supply increases, China can be expected to dramatically increase its domestic consumption of blueberries.

PRC Macroeconomic Drivers:

China’s economic development has been rapid over the past decade:

Along with GDP growth, both urban and rural disposable income per capita have also increased:

9

As Chinese citizens grow wealthier, we believe they will be more likely to increase their purchases of healthy foods such as blueberries and blueberry products. With approximately a quarter of the world’s population, China represents a key growth driver for the global fruit food market. Although China is the largest producer of apples, third largest producer of oranges, and one of the top producers of pears and peaches in the world, per capita fruit juice consumption in China is currently well below that of major developed countries. We believe that improved living standards and growing household disposable income have led to greater health awareness among the population.

Our Competitive Advantages

We believe that our success to date and potential for future growth can be attributed to the following factors:

|

|

High-Value Plants and Superior Varietals - We produce premium specialty seedlings that yield fruit with high nutrient concentration, potential health benefits and a delicious flavor. Our blueberries are positioned in the high-end market as a premium healthy food. We specialize in several varietals bred in particular for their high yields, hardiness and quality fruit.

|

|

|

·

|

Modern Horticulture Techniques – Our technical know-how allows us to produce blueberry seedlings at greater efficiencies than most of our competitors. Our seedling survival to maturity rate is higher than that of most of our competitors and we are able to cultivate seedlings to saleable maturity in four months, more than a year and a half faster than local farmers. Our cooperation with the Agriculture Department of Dalian University allows us excellent access to the latest and best growing technology.

|

|

|

·

|

Geographic Advantage – We are located in Northern China, where the colder climate and soil conditions are well-suited to the high-end varietals of blueberries we cultivate.

|

|

|

·

|

Experienced Management – Our management team has significant experience in the agriculture, food and beverage industries.

|

As a premium specialty agricultural products company in China, we believe we are well positioned to capitalize on future industry growth in China. We are dedicated to providing seedlings that produce healthy and nutritional premium blueberries. We will implement the following strategies to take advantage of growth opportunities:

10

|

|

·

|

Increase production capacity: Production of seedlings is a scalable business. We intend to increase production capacity of seedlings to meet the increasing global and local demand for blueberries.

|

|

|

·

|

Produce downstream products: We believe there is ample opportunity for us to cultivate blueberry plants to fruition. We plan on expanding into the fresh and frozen blueberry business. Our management has experience in the processed food and beverage industries and plans to leverage that experience in the future to produce lines of blueberry beverages and food products.

|

|

|

·

|

Further expand our distribution network to increase the presence of our products throughout the PRC. Our current sales depend heavily on our regional distribution. To support our rapid growth in sales, we plan to further expand our distribution network.

|

Our Products:

Our products consist of blueberry seedlings of sizes ranging from 2 inches to 8 inches tall. We sell a variety of blueberry seedlings, including the following varietals: Vaccinium, V. ugilinosum and V. vitis-idaea. The images below show the cultivation of blueberry seedlings in our greenhouse facilities.

Raw Materials

The principal raw material used in our production is the blueberry seedlings, but our raw materials also include the supplementary materials applied to facilitate seedling growth such as fertilizer. The majority of our raw materials are purchased in our local area. The table below details our major raw material suppliers in 2010:

|

Percentage

|

||||||||

|

of seedlings

|

||||||||

|

Top Suppliers

|

Amount ($)

|

Purchased

|

||||||

|

Dandong Beilin Trading Co., Ltd

|

1,214,208 | 59 | % | |||||

|

Dandong Shengyuan Agricultural Co., Ltd

|

435,613 | 21 | % | |||||

|

Changchun Senyuan Fertilizer Co. ,Ltd

|

191,839 | 9 | % | |||||

|

Total

|

1,841,660 | 89 | % | |||||

We have a sales staff dedicated to generating sales as well as attending sales fairs and trade shows. Our sales staff is compensated on a salary plus commission basis. Our customers often seek us out directly as we are well known in the industry as a high quality provider of blueberry seedlings. Customers are responsible for all costs associated with product pickup and transport arrangements. In 2008, we sold all of our products to a related party, Yichun Lindu Shanyeguo Development Company, but we have since made efforts to diversify our sales channels. In 2010, our top six customers accounted for 78% of our total sales. The table below details our top customers in 2010:

11

|

Customer

|

Amount ($)

|

Percentage

|

||||||

|

Nanjing Forestry University Science and technology Development Co., Ltd

|

1,163,375 | 17 | % | |||||

|

Qingan County Qingan Town Ji’an Committee

|

1,173,357 | 17 | % | |||||

|

Qingan County Qinlao Town Qinpu Committee

|

912,006 | 13 | % | |||||

|

Qingan County Qinlao Town Qinlao Committee

|

733,832 | 11 | % | |||||

|

Qingan County Qinlao Town Qinfa Committee

|

715,539 | 10 | % | |||||

|

Qingan County Qinlao Town Qinfu Committee

|

695,726 | 10 | % | |||||

| 5,393,835 | 78 | % | ||||||

Employees

We currently employ a staff of approximately 208 employees. We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities for our operations in the PRC. According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees and to pay them no less than the local minimum wage.

|

Department

|

Staff

|

||

|

Management

|

5

|

||

|

Administration

|

13

|

||

|

Accounting

|

7

|

||

|

Sales

|

3

|

||

|

Greenhouse Farmers

|

180

|

||

|

Total

|

208

|

Intellectual Property Rights

We protect our intellectual property primarily by maintaining strict control over our production processes. In addition, for each project, only the personnel associated with the project have access to the related intellectual property. Access to proprietary data is limited to authorized personnel to prevent unintended disclosure or otherwise using our intellectual property without proper authorization. We will continue to take steps to protect our intellectual property rights.

Competition

Competition in the industry is fierce and we face both domestic and international competition. We compete with several growers in Northeast China including at least one other publicly-listed Chinese blueberry producer and distributor with production facilities in Jilin province. We also face export competition from well-established companies located in major blueberry-exporting countries such as Canada, the United States, and Chile. Many of these companies have larger organizations and are substantially better capitalized than the Company.

Regulation

Because our principal operating affiliate, Dandong LongSheng, is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

The PRC government has decreed that agricultural entities in China are not required to pay income tax. While Dandong LongSheng should not be subject to enterprise income tax because of the nature of its business operations, Dongbo Consulting will be required to pay enterprise income tax with respect to its consulting fees received from Dandong LongSheng.

12

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.]

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On April 16, 2007, the National People’s Congress of China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Before the implementation of the New EIT Law, FIEs established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The New EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

In addition to the changes to the current tax structure, under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Risks Related to Doing Business in China – Under the New EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.”

As all of our operations are conducted in China, according to the PRC’s new Enterprise Income Tax, we are exempt from paying income taxes because we operate our business in the agriculture industry, which the government encourages and offers special incentives. We benefited from the tax exemption in both 2010 and 2009.

13

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The New EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Dongbo Consulting is considered a FIE and is directly held by our subsidiary Honour Bond in Hong Kong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by a FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Honour Bond by Dongbo Consulting, but this treatment will depend on our status as a non-resident enterprise.

Our greenhouse facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Insurance

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business as summarized under “Risk Factors – Risks Related to Our Business – We do not carry business interruption or other insurance, so we have to bear losses ourselves.”

How to Obtain Our SEC Filings

We file annual, quarterly, and special reports, proxy statements, and other information with the Securities Exchange Commission (SEC). Reports, proxy statements and other information filed with the SEC can be inspected and copied at the public reference facilities of the SEC at 100 F Street N.E., Washington, DC 20549. Such material may also be accessed electronically by means of the SEC's website at www.sec.gov

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

14

RISKS RELATED TO OUR BUSINESS

We were founded in March 2008. We may not succeed in implementing our business plan successfully because of competition from domestic and foreign market entrants, failure of the market to accept our products, or other reasons. Therefore, you should not place undue reliance on our past performance as it may not be indicative of our future results.

We face risks related to general domestic and global economic conditions and to the current credit crisis.

Our current operating cash flows currently provide us with stable funding capacity. However, the current uncertainty arising out of domestic and global economic conditions, including the recent disruption in credit markets, poses a risk to the PRC economy, and may impact our ability to manage normal relationships with our customers, suppliers and creditors. If the current situation deteriorates significantly, our business could be materially negatively impacted, as demand for our products and services may decrease from a slow-down in the general economy, or supplier or customer disruptions may result from tighter credit markets.

Our business is subject to the health of the PRC economy and our growth may be inhibited by the inability of potential customers to fund purchases of our products.

Our products are dependent on the continued growth of agriculture in the PRC. There is no guarantee that the PRC will continue to invest in agriculture.

In order to grow at the pace expected by management, we will require additional capital to support our long-term growth strategies. If we are unable to obtain additional capital in future years, we may be unable to proceed with our plans and we may be forced to curtail our operations.

We will require additional working capital to support our long-term growth strategies, which includes identifying suitable points of market entry for expansion growing the number of points of sale for our products, so as to enhance our product offerings and benefit from economies of scale. Our working capital requirements and the cash flow provided by future operating activities, if any, may vary greatly from quarter to quarter, depending on the volume of business during the period. We may not be able to obtain adequate levels of additional financing, whether through equity financing, debt financing or other sources. Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities. In addition, we may grant registration rights to investors purchasing our equity or debt securities in the future. If we are unable to raise additional financing, we may be unable to implement our long-term growth strategies, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis.

We sometimes extend credit to our customers. Failure to collect the trade receivables or untimely collection could affect our liquidity.

We extend credit to some of our customers while generally requiring no collateral. Generally, our customers will pay within the credit period. Sometimes, due to liquidity of customers, a small portion of the payment will be paid in the extended credit period. We perform ongoing credit evaluations of our customers’ financial condition and generally have no difficulties in collecting our payments. However, if we encounter future problems collecting amounts due from our clients or if we experience delays in the collection of amounts due from our clients, our liquidity could be negatively affected. We believe that we will be able to collect current amounts due from our customers.

If the suppliers from whom we source our raw materials fail to perform their contractual obligations, our ability to provide products to our customers, as well as our ability to obtain future business, may be harmed.

We have concentration risk in our supply chain as we have recently sourced 59% of our raw materials from one supplier in the year ended December 31, 2010. Should we encounter problems with the quality of products or their availability we may be forced to source seedlings and other raw materials from other suppliers, which could adversely affect our profit margins.

If we are unable to attract and retain senior management and qualified technical and sales personnel, our operations, financial condition and prospects will be materially adversely affected.

Our future success depends in part on the contributions of our management team and key technical and sales personnel and our ability to attract and retain qualified new personnel. In particular, our success depends on the continuing employment of our Chief Executive Officer, Mr. Guang Zhao. There is significant competition in our industry for qualified managerial, technical and sales personnel and we cannot assure you that we will be able to retain our key senior managerial, technical and sales personnel or that we will be able to attract, integrate and retain other such personnel that we may require in the future. If we are unable to attract and retain key personnel in the future, our business, operations, financial condition, results of operations and prospects could be materially adversely affected.

15

We are subject to risk inherent to our business, including equipment failure, theft, natural disasters, industrial accidents, labor disturbances, business interruptions, property damage, product liability, personal injury and death. We do not carry any business interruption insurance or third-party liability insurance or other insurance to cover risks associated with our business. As a result, if we suffer losses, damages or liabilities, including those caused by natural disasters or other events beyond our control and we are unable to make a claim again a third party, we will be required to bear all such losses from our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

Our quarterly operating results are likely to fluctuate, which may affect our stock price.

Our quarterly revenues, expenses, operating results and gross profit margins vary from quarter to quarter. As a result, our operating results may fall below the expectations of securities analysts and investors in some quarters, which could result in a decrease in the market price of our common stock. The reasons our quarterly results may fluctuate include:

|

|

·

|

variations in the price of blueberry seedlings;

|

|

|

·

|

changes in the general competitive and economic conditions; and

|

|

|

·

|

delays in, or uneven timing in the delivery of, customer orders.

|

Period to period comparisons of our results should not be relied on as indications of future performance.

Our limited ability to protect our intellectual property, and the possibility that our technology could inadvertently infringe technology owned by others, may adversely affect our ability to compete.

We rely on a combination of trade secret laws and confidentiality procedures to protect the technological know-how that comprise much of our intellectual property. We protect our technological know-how pursuant to non-disclosure and non-competition provisions contained in our employment agreements, and agreements with them to keep confidential all information relating to our customers, methods, business and trade secrets during and after their employment with us. Our employees are also required to acknowledge and recognize that all inventions, trade secrets, works of authorship, developments and other processes made by them during their employment are our property.

A successful challenge to the ownership of our intellectual property could materially damage our business prospects. Our competitors may assert that our technologies or products infringe on their patents or proprietary rights. We may be required to obtain from others licenses that may not be available on commercially reasonable terms, if at all. Problems with intellectual property rights could increase the cost of our products or delay or preclude our new product development and commercialization. If infringement claims against us are deemed valid, we may not be able to obtain appropriate licenses on acceptable terms or at all. Litigation could be costly and time-consuming but may be necessary to defend against infringement claims.

Our business may be subject to seasonal and cyclical fluctuations in sales.

We may experience seasonal fluctuations in our revenue in the PRC. Moreover, our revenues are usually higher in the second and third fiscal quarters due to seasonal purchases.

Adverse weather conditions could damage our seedlings, which could have a negative effect on our revenues.

Blueberry seedlings are affected by natural disasters such as floods, drought, hail, tornadoes and earthquakes. If seedlings are damaged from adverse weather conditions, this would have a negative effect on our revenues. We may experience floods occasionally since Dandong (where our production base located) is located beside the Yalu River. A serious flood raged in North-East China in the third quarter of 2010 destroying hundreds of thousands of people’s homes and led to the destruction of millions of dollars’ worth of crops. During the flood, the Company lost thousands of products raised in greenhouses and farm chemicals kept in storehouses which amounted to $449,702.

16

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

We are subject to reporting obligations under the U.S. securities laws. The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, as amended, adopted rules requiring every public company to include a management report on such company's internal controls over financial reporting in its annual report, which contains management's assessment of the effectiveness of our internal controls over financial reporting. We reported certain material weaknesses involving control activities, specifically:

Although we have hired additional accounting and operations personnel, we are still in the progress of developing proper financial reporting procedures and policies for (i) accounting for complex and non-routine transactions, (ii) closing our financial statements at the end of a period, (iii) disclosure requirements and processes for SEC reporting.

RISKS RELATING TO THE VIE AGREEMENTS

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

Dongbo Consulting provides support and consulting service to Dandong LongSheng pursuant to the VIE Agreements. Almost all economic benefits and risks arising from Dandong LongSheng’s operations are transferred to Dongbo Consulting under these agreements. Details of the VIE Agreements are set out in “Item 1. BUSINESS – Contractual Arrangements with our Controlled Affiliate and its Shareholder” above.

There are risks involved with the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. Our PRC counsel has provided a legal opinion that the VIE Agreements are binding and enforceable under PRC law, but has further advised that if the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

|

|

·

|

imposing economic penalties;

|

|

|

·

|

discontinuing or restricting the operations of Dandong LongSheng or Dongbo Consulting;

|

|

|

·

|

imposing conditions or requirements in respect of the VIE Agreements with which Dandong LongSheng or Dongbo Consulting may not be able to comply;

|

|

|

·

|

requiring our company to restructure the relevant ownership structure or operations;

|

|

|

·

|

taking other regulatory or enforcement actions that could adversely affect our company’s business; and

|

|

|

·

|

revoking the business licenses and/or the licenses or certificates of Dongbo Consulting, and/or voiding the VIE Agreements.

|

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Dandong LongSheng, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to control Dandong LongSheng under the VIE Agreements may not be as effective as direct ownership.

We conduct our blueberry horticulture business in the PRC and generate virtually all of our revenues through the VIE Agreements. Our plans for future growth are based substantially on growing the operations of Dandong LongSheng. However, the VIE Agreements may not be as effective in providing us with control over Dandong LongSheng as direct ownership. The VIE Agreements do not provide us with day-to-day control over the operations of Dandong LongSheng. Under the current VIE arrangements, as a legal matter, if Dandong LongSheng fails to perform its obligations under these contractual arrangements, we may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we are unable to effectively control Dandong LongSheng, it may have an adverse effect on our ability to achieve our business objectives and grow our revenues.

17

Our failure to perform our obligations under the VIE Agreements could give Dandong LongSheng the right to cease performance under or terminate the VIE Agreements and thereby deprive us of the economic benefit of the VIE Agreements.

Under the terms of the VIE Agreements, our subsidiary Dongbo Consulting is required to provide extensive technical support and consulting services to Dandong LongSheng, and to offer necessary financial support to Dandong LongSheng with respect to any losses or capital requirements to the extent permitted by law. If we are unable to, or for any other reason fail to perform our obligations as required under the VIE Agreements, Dandong LongSheng may have the legal right to cease performance under or terminate the VIE Agreements. In such case, we may no longer be entitled to payment of Dandong LongSheng’s net income after taxes and we could lose the entire economic benefit derived from our controlled affiliate Dandong LongSheng from which we derive all of our revenues.

As the VIE Agreements are governed by PRC law, we would be required to rely on PRC law to enforce our rights and remedies under them; PRC law may not provide us with the same rights and remedies as are available in contractual disputes governed by the law of other jurisdictions.

The VIE Agreements are governed by PRC law and provide for the resolution of disputes through the jurisdiction of courts in the PRC. If Dandong LongSheng or its shareholder fail to perform the obligations under the VIE Agreements, we would be required to resort to legal remedies available under PRC law, including seeking specific performance or injunctive relief, or claiming damages. We cannot be sure that such remedies would provide us with effective means of causing Dandong LongSheng or its shareholder to meet their obligations, or recovering any losses or damages as a result of non-performance. Further, the legal environment in China is not as developed as in other jurisdictions. Uncertainties in the application of various laws, rules, regulations or policies in PRC legal system could limit our liability to enforce the VIE Agreements and protect our interests.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through the payments we receive pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability, or cause other adverse financial consequences.

Our Shareholders have potential conflicts of interest with our company which may adversely affect our business.

Guang Zhao is our Chief Executive Officer, Chief Financial Officer and Chairman nominee, and is also the sole shareholder of Dandong LongSheng. There could be conflicts that arise from time to time between our interests and the interests of Mr. Zhao. There could also be conflicts that arise between us and Dandong LongSheng that would require our shareholders and Dandong LongSheng’s shareholder to vote on corporate actions necessary to resolve the conflict. There can be no assurance in any such circumstances that Mr. Zhao will vote his shares in our best interest or otherwise act in the best interests of our company. If Mr. Zhao fails to act in our best interests, our operating performance and future growth could be adversely affected.

We rely on the approval certificates and business license held by Dongbo Consulting and any deterioration of the relationship between Dongbo Consulting and Dandong LongSheng could materially and adversely affect our business operations.

We operate our blueberry horticulture business in China on the basis of the approval certificates, business license and other requisite licenses held by Dongbo Consulting and Dandong LongSheng. There is no assurance that Dongbo Consulting and Dandong LongSheng will be able to renew their licenses or certificates when their terms expire with substantially similar terms as the ones they currently hold.

18

Further, our relationship with Dandong LongSheng is governed by the VIE Agreements that are intended to provide us with effective control over the business operations of Dandong LongSheng. However, the VIE Agreements may not be effective in providing control over the application for and maintenance of the licenses required for our business operations. Dandong LongSheng could violate the VIE Agreements, go bankrupt, suffer from difficulties in its business or otherwise become unable to perform its obligations under the VIE Agreements and, as a result, our operations, reputations and business could be severely harmed.

If Dongbo Consulting exercises the purchase option it holds over Dandong LongSheng’s share capital pursuant to the VIE Agreements, the payment of the purchase price could materially and adversely affect our financial position.

Under the VIE Agreements, Dandong LongSheng’s shareholder has granted Dongbo Consulting an option for the maximum period of time permitted by law to purchase all of the equity interest in Dandong LongSheng at a price equal to its net asset value at the time of purchase, unless applicable PRC laws and regulations require an appraisal of the equity interest or stipulate other restrictions regarding the purchase price of the equity interest. Dandong LongSheng’s shareholder also undertook under the VIE Agreements to confer on Dandong LongSheng all the gains from the transfer price after deducting the net asset value corresponding to such equity interest. As Dandong LongSheng is already our contractually controlled affiliate, Dongbo Consulting’s exercising of the option would not bring immediate benefits to our company, and payment of the purchase prices could adversely affect our financial position.

RISKS RELATED TO DOING BUSINESS IN CHINA

Changes in China's political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

|

|

·

|

Level of government involvement in the economy;

|

|

|

·

|

Control of foreign exchange;

|

|

|

·

|

Methods of allocating resources;

|

|

|

·

|

Balance of payments position;

|

|

|

·

|

International trade restrictions; and

|

|

|

·

|

International conflict.

|

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy and weak corporate governance and a lack of flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary and affiliate in the PRC. Our principal operating subsidiary and affiliate, Dongbo Consulting and Dandong LongSheng, respectively, are subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involves uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to effect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations, subsidiary and affiliate.

19

You may have difficulty enforcing judgments against us.

We are a Nevada holding company, but Honour Bond is a Hong Kong company, and our principal operating affiliate and subsidiary, Dandong LongSheng and Dongbo Consulting, respectively, are located in the PRC. Most of our assets are located outside the United States and most of our current operations are conducted in the PRC. In addition, all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments predicated on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. The recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenues will be settled in RMB and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

20

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary’s ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by Dongbo Consulting, our PRC subsidiary. PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary or affiliate, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; covering the use of existing offshore entities for offshore financings; (3) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (4) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. In the case of an SPV which was established, and which acquired a related domestic company or assets, before the implementation date of Circular 75, a retroactive SAFE registration was required to have been completed before March 31, 2006; this date was subsequently extended indefinitely by Notice 106, which also required that the registrant establish that all foreign exchange transactions undertaken by the SPV and its affiliates were in compliance with applicable laws and regulations. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

21