Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF PRICEWATERHOUSE COOPERS LLP - SRAM International Corp | dex232.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 12, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SRAM International Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 3751 | 80-0712932 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1333 N. Kingsbury Street, 4th Floor

Chicago, Illinois 60642

(312) 664-8800

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Stanley R. Day, Jr.

President and Chief Executive Officer

SRAM International Corporation

1333 N. Kingsbury Street, 4th Floor

Chicago, Illinois 60642

(312) 664-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Christopher D. Lueking Mark D. Gerstein Latham & Watkins LLP 233 South Wacker Drive, Suite 5800 Chicago, Illinois 60606 (312) 876-7700 |

Leland E. Hutchinson Winston & Strawn LLP 35 West Wacker Drive Chicago, Illinois 60601 (312) 558-5600 |

Approximate date of commencement of the proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Class A common stock, par value $0.01 per share |

$300,000,000 | $34,830.00 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes additional shares that the underwriters have the option to purchase. See “Underwriting.” |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 12, 2011.

shares

Class A common stock

This is an initial public offering of shares of Class A common stock of SRAM International Corporation.

We are offering shares of our Class A common stock, and the selling stockholders identified in this prospectus are offering an additional shares of our Class A common stock. We will not retain any of the net proceeds from the sale of the shares of Class A common stock by the selling stockholders. The estimated initial public offering price per share is expected to be between $ and $ .

We intend to list our Class A common stock on the New York Stock Exchange or Nasdaq Stock Market under the symbol “SRAM.”

We will be a holding company, and our only business will be the operation and control of the business and affairs of SRAM, LLC and its subsidiaries.

Following this offering, we will have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting. The Class A common stock is entitled to one vote per share and the Class B common stock is entitled to ten votes per share. Therefore, immediately following this offering, the holders of Class A common stock will hold % of our total voting power, assuming no exercise of the underwriters’ option to purchase additional shares. Each share of Class B common stock is convertible at any time into one share of Class A common stock.

| Per Share | Total | |||

| Initial public offering price |

$ | $ | ||

| Underwriting discounts and commissions |

$ | $ | ||

| Proceeds to SRAM International Corporation, before expenses |

$ | $ | ||

| Proceeds to the selling stockholders, before expenses |

$ | $ | ||

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase additional shares of Class A common stock. We will not receive any proceeds from the sale of these shares by the selling stockholders.

Investing in our Class A common stock involves a high degree of risk. See “Risk factors” beginning on page 10.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| J.P. Morgan | BofA Merrill Lynch | Morgan Stanley | ||

| Baird | Lazard Capital Markets | |||

| Piper Jaffray | Stifel Nicolaus Weisel | |||

, 2011.

Table of Contents

[INSIDE FRONT COVER GRAPHICS]

Table of Contents

| Page | ||||

| 1 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 26 | ||||

| 27 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 37 | ||||

| 45 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

47 | |||

| 67 | ||||

| 82 | ||||

| 87 | ||||

| 93 | ||||

| 97 | ||||

| 99 | ||||

| 104 | ||||

| Material U.S. federal income tax consequences to non-U.S. holders of our Class A common stock |

106 | |||

| 110 | ||||

| 115 | ||||

| 116 | ||||

| 117 | ||||

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We are offering to sell, and seeking offers to buy, our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our Class A common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk factors,” “Unaudited pro forma condensed consolidated financial data” and “Management’s discussion and analysis of financial condition and results of operations.” Unless the context requires otherwise, the words “SRAM International Corporation,” “SRAM,” “we,” “company,” “us” and “our” refer to SRAM International Corporation, a newly formed Delaware corporation, and its subsidiaries, including SRAM Holdings, LLC and SRAM, LLC.

Overview

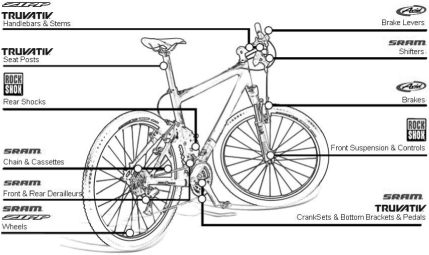

We are a leading global designer, manufacturer and marketer of premium bicycle components. Consumers recognize our brands for differentiated design and innovation. Our portfolio of premium brands includes SRAM, RockShox, Zipp, Avid and Truvativ. Our products include drivetrain systems, suspension, brakes, internal gear hubs and wheelsets, all of which are essential components used on road bikes, mountain bikes and pavement bikes. Many of the world’s elite cyclists use our components, including the last two Tour de France winners, the 2010 Ironman World Championship winner and the winners of all six 2010 World Cup mountain bike races. We believe the success of elite cyclists using our products at the highest levels of competition creates aspirational demand for our components and drives demand from a broad consumer base of cyclists across all skill levels.

We are the second largest supplier of bicycle components in the world. We focus primarily on the independent bicycle retailer market, which sells mid to high-end bikes, ranging in price from $300 to over $10,000 in the United States, Europe and other developed markets. We believe this is the highest margin segment of the bicycle component market. The consumer in this market is generally the cycling enthusiast, who seeks higher performance premium branded bikes and components. Our products, which prominently display our brands, are used on all of the major premium brands produced by our bicycle company customers, including Trek, Specialized, Cannondale, Giant, Raleigh and Schwinn.

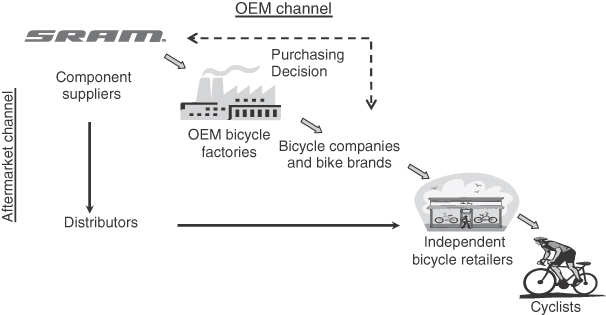

To reach the independent bicycle retailer market, we operate through two distribution channels: the OEM channel and the aftermarket channel. In the OEM channel, we market our products to bicycle companies as original equipment components for new bikes that they sell to consumers through independent bicycle retailers. In the aftermarket channel, we sell products through distributors to independent bicycle retailers and sell a limited number of premium aftermarket products directly to independent bicycle retailers in the United States, who in turn sell them to consumers for replacements, upgrades or custom bike builds. For the year ended December 31, 2010, we generated 67% of our net sales from the sale of components in the OEM channel and 33% of our net sales from the sale of components in the aftermarket channel.

We believe our premium brands, technological innovation, product development and leading market positions have been key drivers of our strong financial performance. We grew our net sales from $283.8 million in 2006 to $524.2 million in 2010, representing a compound annual growth rate, or CAGR, of 16.6%. Over the same period, our operating income increased from $23.7 million to $99.6 million, representing a CAGR of 43.2% and an increase in operating margin from 8.3% to 19.0%. Our net earnings also increased from $11.6 million in 2006 to $50.0 million in 2010, representing a CAGR of 44.1%.

1

Table of Contents

Market overview and opportunity

Bicycle industry overview

The National Bicycle Dealers Association estimates annual worldwide bike production in 2009 was 108 million units, of which approximately 46 million were sold in developed markets. There are two primary retail channels for the sale of bikes in developed markets: the independent bicycle retailer market (primarily independent bicycle retailers and to a lesser extent sporting good chains) and mass market retailers (e.g., Wal-Mart and Target). We estimate that in 2010 there were 18 million new bikes sold in the independent bicycle retailer market globally, representing $9.2 billion in retail sales, with an average retail price of approximately $500 per bike. Of these 18 million new bikes sold, we believe approximately 90% were sold in the United States, Europe and Japan.

Bicycle component market

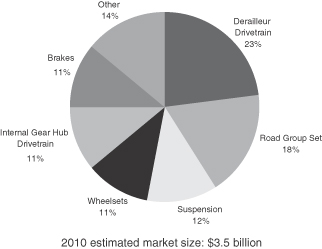

Branded bicycle components are key to the performance of mid to high-end bikes and strongly influence the buying decisions of cycling enthusiasts. Strong demand for branded components enables component suppliers to realize premium price positioning and gross margins that we believe are higher than other participants in the bicycle industry supply chain. We estimate the size of the independent bicycle retailer market for bicycle components to be approximately $3.5 billion, as measured in component suppliers’ sales.

Outlook

We expect the bicycle component market to continue to grow due to a variety of factors that impact the cycling industry, including:

| • | continuing growth in the number of cycling enthusiasts; |

| • | increasing average retail selling prices driven by better-performing product designs and technologies; |

| • | growing participation in road racing, mountain bike racing, organized weekend rides and charity cycling events, as well as cycling related sports, such as triathlons and cyclo-cross; |

| • | improving cycling infrastructure, such as cycling lanes in urban areas; |

| • | increasing consumer focus on healthier lifestyle trends; |

| • | growing focus on the environment; and |

| • | increasing adoption of mid to high-end bikes in emerging markets. |

Our strengths

We attribute our success to the following competitive strengths:

Premium brand portfolio. We have five premium brands under the SRAM umbrella: SRAM (drivetrain systems), RockShox (suspension), Zipp (wheelsets), Avid (brakes) and Truvativ (cranks). Our brands are prominently displayed on all of our products and are associated with innovation and performance by our customers, consumers and elite athletes.

Relentless innovation and product development. Our ability to develop innovative products has been a key driver of our success and growth as a company. We generated over 50% of our 2010 model year (July 1

2

Table of Contents

through June 30) net sales from products that were less than three years old. We currently have more than 280 employees dedicated to product development, and we also have an intellectual property portfolio of over 550 patents. We currently have approximately 70 ongoing product development projects and to date have launched over 40 new products for our 2011 model year.

Leader in growing independent bicycle retailer market. We are the second largest supplier of bicycle components in the world. We believe we have a 15% share of the approximately $3.5 billion of annual sales in the independent bicycle retailer market for bicycle components, as measured in component suppliers’ sales.

Highly defensible business model. Over the past 24 years, we have developed global design, production and distribution capabilities and established longstanding customer relationships that we believe are difficult to replicate. We are one of only two suppliers offering a full-line of mid to high-end components to bicycle companies for use on their bikes. We differentiate our company by offering leading customer service and warranty support to independent bicycle retailers.

Committed management team with deep-rooted corporate culture. Our senior management team has an average tenure with SRAM of approximately 18 years and has transformed SRAM from a single product company in 1987 to a full-line bicycle component supplier with approximately 2,200 employees in nine countries around the world today.

Our strategy

Key elements of our growth strategy are:

Extend our technological and product leadership. We intend to continue to develop and market products that incorporate innovative design, advanced features and improved performance that differentiate us in the bicycle component market. These efforts will include enhancing our existing products, introducing next generation technologies and developing new product offerings that leverage our existing product platforms in order to maintain our position as an industry leader.

Continue to increase our share of components on new bikes. We are favorably positioned to increase our share of components on new bikes by building on the strength of our brands, the diversity of our product portfolio and our innovation pipeline. We will focus on key decision-makers who influence component specifications for new bikes, including the bike brand product managers at bicycle companies, independent bicycle retailers, cycling industry media and competitive cyclists, including amateur racers and triathletes.

Increase aftermarket penetration. We intend to increase our sales of aftermarket components by strengthening our relationships with independent bicycle retailers and increasing brand awareness at the consumer level. We also intend to enhance our aftermarket product offerings by increasing differentiation of our aftermarket channel components from our OEM channel components and, where appropriate, expanding into product areas adjacent to our current product lines.

Grow the industry while strengthening our leadership profile. We will continue to focus on a number of initiatives aimed at growing our industry and reinforcing our leadership position within it by continuing product innovation, strengthening our independent retailer network through training and marketing programs and promoting cycling advocacy.

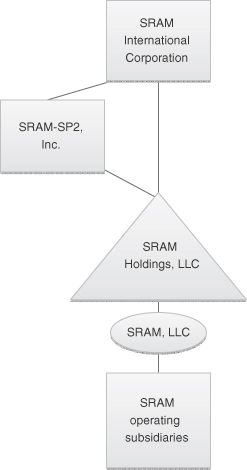

History

SRAM International Corporation was incorporated on April 29, 2011 for the purpose of becoming the holding company of SRAM Holdings, LLC and SRAM, LLC immediately prior to the consummation of this offering. SRAM was originally founded in 1987 as SRAM Corporation, an Illinois corporation, to design, manufacture and market bicycle shifters. In 1995, after becoming a market leader in shifters, we began our transformation into a

3

Table of Contents

full-line, mid to high-end component supplier. We have grown through internal product development and a series of strategic acquisitions, including the acquisition of the bicycle division of Mannesman Sachs AG (1997), RockShox, Inc. (2002), the bicycle business of Avid, LLC (2004), Truvativ International Co., Ltd. (2004) and Compositech, Inc. (Zipp) (2007). One of our founders, Stanley R. Day, Jr., is our President, Chief Executive Officer and Chairman of the Board. On September 30, 2008, we completed a recapitalization in which Trilantic Capital Partners and certain affiliates and co-investors purchased a $234.8 million equity interest in SRAM. We refer to this investment and recapitalization as the 2008 recapitalization. See “Certain relationships and related person transactions—Trilantic 2008 investment and recapitalization” for information on the 2008 recapitalization.

The refinancing and reorganization

Refinancing

Prior to the reorganization described below and this offering, SRAM, LLC intends to enter into new credit facilities consisting of a first-lien term facility, a second-lien term facility and a revolving facility. The aggregate proceeds from the new credit facilities will be approximately $ million. The proceeds from the new credit facilities will be used to repay all outstanding amounts under our existing credit facilities, which as of , 2011 was $ million, to directly or indirectly acquire all of the equity interests in SRAM Holdings, LLC held by Trilantic and its co-investors for $ million and to pay fees and expenses related to the refinancing. In connection with these transactions, SRAM Holdings, LLC will amend and restate its operating agreement to create a single class of common units and eliminate the corporate governance and liquidity rights of Trilantic and its co-investors. We refer to the entering into of our new credit facilities, the use of proceeds therefrom and the related amendment to the SRAM Holdings, LLC operating agreement as the refinancing. Following the refinancing, Trilantic and its co-investors will have no remaining ownership of SRAM Holdings, LLC. See “The refinancing and reorganization” for additional information.

Reorganization

Immediately prior to the consummation of this offering, the remaining equity holders of SRAM Holdings, LLC, after giving effect to the refinancing described above, will enter into a reorganization pursuant to which SRAM International Corporation, will acquire 100% of the equity interests of SRAM Holdings, LLC, either directly or through one or more wholly-owned subsidiaries, and the equity holders of SRAM Holdings, LLC will exchange their direct or indirect equity interests in SRAM Holdings, LLC for shares of common stock of SRAM International Corporation. The remaining equity holders will include the Day family, SRAM management and current and former directors and employees. A portion of the shares of common stock issued to the remaining equity holders will be sold in the secondary portion of this offering. SRAM Holdings, LLC will continue to hold 100% of the equity interests of our operating company, SRAM, LLC. Immediately prior to this offering, SRAM Holdings, LLC will make $ million of distributions to its remaining equity holders with respect to the estimated federal and state income taxes on their allocable shares of SRAM Holdings, LLC’s estimated taxable income from January 1, 2011 through the closing date of this offering. We refer to the series of transactions described in this paragraph as the reorganization. See “The refinancing and reorganization” for additional information.

Corporate information

Our principal executive offices are located at 1333 North Kingsbury Street, 4th Floor, Chicago, Illinois 60642. Our telephone number is (312) 664-8800. Our website address is www.sram.com. Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

4

Table of Contents

SRAM®, RockShox®, Zipp®, Avid®, TRUVATIV®, Grip Shift®, DoubleTap®, ZeroLoss™ and other trademarks or service marks of SRAM appearing in this prospectus are the property of SRAM. Trade names, trademarks and service marks of other companies appearing in this prospectus are the property of the respective holders.

Risk factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk factors” immediately following this prospectus summary, that primarily represent challenges we face in connection with the successful implementation of our strategy and the growth of our business. We expect a number of factors may cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance. Such factors include our ability to introduce new products into the market, changes in the competitive landscape for bicycle components, unfavorable economic conditions, a weakening of our brand image, a disruption in the operations of our manufacturing facilities, loss of our senior management, changes in the popularity of cycling or the number of cycling enthusiasts and other risks described under “Risk factors.”

Industry and market data

Market data and industry statistics and forecasts used throughout this prospectus are based on independent industry publications, reports by market research firms and other published independent sources. Some data and other information are also based on our good faith estimates, which are derived from our review of internal surveys and data and independent sources. Although we believe these sources are credible, we have not independently verified the data or information obtained from external sources.

Presentation of financial information

SRAM International Corporation was incorporated in Delaware on April 29, 2011. The historical financial information presented in this prospectus is that of SRAM Holdings, LLC, which will become a subsidiary of SRAM International Corporation prior to the consummation of this offering, for the period from October 1, 2008 through December 31, 2010 and SRAM Corporation, the predecessor to SRAM Holdings, LLC, for periods prior to October 1, 2008. For the purposes of the financial statements and information presented in this prospectus, we refer to SRAM Holdings, LLC and SRAM Corporation as our predecessor companies for these respective periods.

Terms used in this prospectus

As used in this prospectus, the term “Day family” means (1) Stanley R. Day, Jr. and Frederick K. W. Day and their spouses, parents, children, siblings, cousins, mothers and fathers-in-law, sons and daughters-in-law and brothers and sisters-in-law and (2) various trusts for the benefit of the individuals described in clause (1) and the trustees thereof.

As used in this prospectus, the term “Trilantic and its co-investors ” refers to Trilantic Capital Partners (f/k/a Lehman Brothers Merchant Banking) and certain of its affiliates (Trilantic) and GE Capital Equity Holdings Inc., Gleacher Mezzanine Fund II, L.P., GMF SRAM Holdings Corp., Southern Farm Bureau Life Insurance Company and JPM Mezzanine Capital, LLC (its co-investors), which prior to the refinancing collectively own 100% of the Class A units of SRAM Holdings, LLC.

References in this prospectus to our “stock” or our “common stock” mean shares of SRAM International Corporation’s Class A common stock, shares of SRAM International Corporation’s Class B common stock, or both, as the context requires.

5

Table of Contents

Common stock offered

| Class A common stock being offered by SRAM International Corporation |

shares. |

| Class A common stock being offered by the selling stockholders |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Class A common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Class B common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise in full their option to purchase additional shares). |

| Voting rights |

Each share of our Class A common stock will entitle its holder to one vote per share on all matters to be voted on by stockholders generally. Each share of our Class B common stock will entitle its holder to ten votes per share on all matters to be voted on by stockholders generally. Immediately following this offering, the holders of Class A common Stock will hold % of our total voting power. |

| Use of proceeds |

We estimate that the net proceeds to us from the sale of shares of our Class A common stock by us in this offering will be approximately $ million after deducting assumed underwriting discounts and commissions payable by us, based on an offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus. We intend to use $ million of the proceeds to us to repay $ million of indebtedness under the new credit facilities, which we intend to enter into prior to this offering, and $ million to pay fees and expenses related to this offering. |

| We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of proceeds.” |

| Risk factors |

See “Risk factors” beginning on page 10 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our Class A common stock. |

| Directed share program |

The underwriters have reserved for sale, at the initial public offering price, up to shares of our Class A common stock being offered for sale to certain parties. The number of shares available for sale to the general public in this offering will be reduced to the extent these persons purchase reserved shares. Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares. |

6

Table of Contents

| Proposed NYSE or Nasdaq symbol |

“SRAM” |

The number of shares of our common stock outstanding after this offering excludes:

| • | an aggregate of shares of Class A common stock reserved for issuance under the SRAM International Corporation 2011 Incentive Award Plan that we will adopt prior to the consummation of this offering. |

Except as otherwise indicated, information in this prospectus reflects or assumes the following:

| • | the refinancing has been consummated; |

| • | the reorganization has been consummated, including the filing of our amended and restated certificate of incorporation, which provides for, among other things, the authorization of shares of Class A common stock and shares of Class B common stock; and |

| • | no exercise of the underwriters’ option to purchase up to additional shares of our Class A common stock. |

7

Table of Contents

Summary consolidated and pro forma financial data

The following summary consolidated and pro forma financial data of our predecessor companies should be read together with “The refinancing and reorganization,” “Use of proceeds,” “Unaudited pro forma condensed consolidated financial data,” “Selected consolidated financial data,” “Management’s discussion and analysis of financial condition and results of operations” and the historical financial statements and related notes included elsewhere in this prospectus. The consolidated financial statements of our predecessor companies, SRAM Holdings, LLC and SRAM Corporation, will be our historical financial statements following this offering.

We derived the summary consolidated statement of operations data for our predecessor companies for each of the years ended December 31, 2008, 2009 and 2010 and the summary consolidated balance sheet data for our predecessor companies as of December 31, 2010 from the audited consolidated financial statements of SRAM Holdings, LLC, which are included elsewhere in this prospectus.

The unaudited pro forma condensed consolidated statement of operations data for the year ended December 31, 2010 presents our consolidated results of operations, and the unaudited pro forma condensed consolidated balance sheet data as of December 31, 2010 presents our consolidated financial position, after giving effect to the refinancing and reorganization described under “The refinancing and reorganization,” this offering and the use of the estimated net proceeds from this offering described under “Use of proceeds,” as if such transactions occurred on January 1, 2010, for the unaudited pro forma condensed consolidated statement of operations, and, as if such transactions occurred on December 31, 2010, for the unaudited pro forma condensed consolidated balance sheet.

| Predecessor(1) | Successor(1) | |||||||||||||||||||||||

| Actual | Pro forma as 2010 |

|||||||||||||||||||||||

| Year ended December 31, (in thousands, except per share/unit data) |

2008 | 2009 | 2010 | |||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||

| Net sales |

$ | 478,354 | $ | 399,581 | $ | 524,187 | $ | |||||||||||||||||

| Cost of sales |

310,725 | 239,448 | 312,954 | |||||||||||||||||||||

| Gross profit |

167,629 | 160,133 | 211,233 | |||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||

| General and administrative expense |

77,846 | 29,042 | 33,913 | |||||||||||||||||||||

| Sales and marketing expense |

49,480 | 27,934 | 40,579 | |||||||||||||||||||||

| Product development expense |

46,506 | 27,799 | 37,179 | |||||||||||||||||||||

| Recapitalization costs(2) |

8,952 | — | — | |||||||||||||||||||||

| 182,784 | 84,775 | 111,671 | ||||||||||||||||||||||

| Income (loss) from operations |

(15,155 | ) | 75,358 | 99,562 | ||||||||||||||||||||

| Other income (expense) |

||||||||||||||||||||||||

| Interest expense, net |

(21,703 | ) | (36,245 | ) | (32,634 | ) | ||||||||||||||||||

| Foreign currency exchange gain (loss) |

4,072 | (3,221 | ) | 237 | ||||||||||||||||||||

| Other expense, net |

(17,631 | ) | (39,466 | ) | (32,397 | ) | ||||||||||||||||||

| Income (loss) before income taxes |

(32,786 | ) | 35,892 | 67,165 | ||||||||||||||||||||

| Income tax expense |

15,838 | 14,373 | 17,193 | |||||||||||||||||||||

| Net income (loss)(3) |

$ | (48,624 | ) | $ | 21,519 | $ | 49,972 | $ | ||||||||||||||||

8

Table of Contents

| Predecessor(1) | Successor(1) | |||||||||||||||||||||||

| Actual | Pro forma as 2010 |

|||||||||||||||||||||||

| Year ended December 31, (in thousands, except per share/unit data) |

2008 | 2009 | 2010 | |||||||||||||||||||||

| Net income (loss) attributable to members, after Class A preferred return and tax distributions to Class A and Class B members |

$ | (54,494 | ) | $ | (6,228 | ) | $ | 15,432 | $ | |||||||||||||||

| Class B members |

||||||||||||||||||||||||

| Net income (loss) attributable to Class B members |

$ | (54,494 | ) | $ | (5,979 | ) | $ | 13,231 | ||||||||||||||||

| Weighted average units outstanding—basic and diluted(4) |

5,460,000 | 5,460,000 | 5,460,000 | |||||||||||||||||||||

| Earnings (loss) per unit—basic and diluted(4) |

$ | (9.98 | ) | $ | (1.10 | ) | $ | 2.42 | ||||||||||||||||

| Pro forma as adjusted weighted average common shares outstanding—basic and diluted |

||||||||||||||||||||||||

| Pro forma as adjusted earnings per common share—basic and diluted |

$ | |||||||||||||||||||||||

| Predecessor(1) | Successor(1) | |||||||||||

| As of December 31, 2010 (in thousands) |

Actual | Pro forma as adjusted |

||||||||||

| Balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 19,409 | $ | |||||||||

| Total assets |

249,275 | |||||||||||

| Loans and borrowings (including short-term borrowings)(5) |

227,103 | |||||||||||

| Total liabilities |

373,185 | |||||||||||

| Total members’ (deficit) equity |

(123,910 | ) | ||||||||||

| Total stockholders’ (deficit) equity |

— | |||||||||||

| (1) | Prior to this offering, the proceeds from the refinancing will be used to directly or indirectly acquire all of the equity interests in SRAM Holdings, LLC held by Trilantic and its co-investors. This transaction will be accounted for under the purchase method of accounting, which will require our net assets to be recognized at fair value upon acquisition. Our historical financial statements for periods prior to the date of this offering (our predecessor periods) were prepared on the historical cost basis of accounting, which was utilized prior to the refinancing. Our historical financial statements for periods subsequent to the date of this offering (our successor periods) and our unaudited pro forma condensed consolidated financial statements will be prepared on a new basis of accounting, that is, fair value. As a result, our results for the successor periods are not necessarily comparable to the predecessor periods. |

| (2) | Recapitalization costs relate to the 2008 recapitalization in which Trilantic and its co-investors purchased a $234.8 million equity interest in SRAM. See “Certain relationships and related person transactions–Trilantic 2008 investment and recapitalization” for a description of the 2008 recapitalization. |

| (3) | Net loss for 2008 includes expenses related to our 2008 recapitalization, including share-based compensation expense of $88.5 million in accordance with Accounting Standards Codification, or ASC, 718, Compensation—Stock Compensation. This expense was primarily due to the immediate vesting, exercise and repurchase of awards, triggered by the 2008 recapitalization, which was allocated across our cost of sales, general and administrative expense, sales and marketing expense and product development expense for the year. Net income for 2009 and 2010 includes share-based compensation expense of $3.7 million and $12.4 million, respectively, similarly allocated. |

| (4) | For purposes of determining the weighted average units outstanding used in the earnings per unit calculation, we have retroactively reflected the impact of the 2008 recapitalization on our capital structure as if it had occurred on January 1, 2008. |

| (5) | Loans and borrowings (including short-term borrowings) are defined as (i) the current portion of long-term debt plus (ii) long-term borrowings. |

9

Table of Contents

An investment in our Class A common stock involves a high degree of risk. You should consider carefully the risks described below together with the financial and other information contained in this prospectus, before you decide to buy our Class A common stock. If any of the events contemplated by the following risks should occur, our business, financial condition and results of operations could be negatively affected. As a result, the market price of our Class A common stock could decline and you could lose all or part of your investment in our Class A common stock.

Risks related to our business

Successfully managing the frequent introduction of new products that satisfy changing consumer preferences is key to our success.

In order to meet the demands of the marketplace, we are focused on product innovation and continual product evolution. We introduce numerous new products each model year. Over 50% of our 2010 model year (July 1 through June 30) net sales were generated from products that were less than three years old. In order for us to continue to successfully introduce new products, we must properly anticipate the preferences of bicycle companies, independent bicycle retailers and consumers and invest in product development to design innovative products that meet those preferences. If we are unable to meet these demands, our products may not win specifications on new bike models or have success in the aftermarket, in which case our sales, margins and brand image could suffer. Furthermore, in order for new products to generate equivalent or greater revenues than their predecessors, they must either maintain the same or higher sales levels with the same or higher pricing, or exceed the performance of their predecessors in one or both of those areas. If our new products are unable to achieve sufficient pricing levels or we are unable to increase our sales volume to compensate, our profitability could decrease.

The bicycle component industry is highly competitive and we are subject to risks relating to competition that may adversely affect our performance.

The bicycle component industry is highly competitive. We compete with a number of other manufacturers that produce and sell bicycle components. We believe our products primarily compete on the basis of product design, innovation, customer service, manufacturing and distribution capabilities, product quality and price. Our continued success depends on our ability to continue to compete effectively against our numerous competitors, at least one of which has significantly greater financial, marketing and other resources than we have. In the future, our competitors may be able to maintain and grow brand strength and market share more effectively or quickly than we do by anticipating the course of market developments more accurately than we do, developing products that are superior to our products, creating manufacturing or distribution capabilities that are superior to ours, producing similar products at a lower cost than we can, or adapting more quickly than we do to new technologies or evolving regulatory, industry or customer requirements, among other things. As a result, our products may not be able to compete successfully with our competitors’ products, which could negatively affect our business, financial condition or results of operations. For example, one of our competitors has developed and offers an electronic drivetrain system. We currently do not offer an electronic drivetrain system to our customers. If the electronic drivetrain system gains industry acceptance among cycling enthusiasts, our business, financial condition or results of operations could be negatively affected.

In addition, we may encounter increased competition if our current competitors broaden their product offerings by beginning to produce additional types of components or through consolidation. Currently, we are one of only

10

Table of Contents

two suppliers offering bicycle companies a full-line of mid to high-end components used on their bikes, which we believe provides us an advantage with these customers. Our primary competitors generally compete with us in one or two of our product types. Our business, financial condition or results of operations may suffer if additional competitors are able to offer a full-line of components.

Unfavorable economic conditions could have a negative effect on our business, financial condition or results of operations.

Our business depends substantially on global economic and market conditions. For the year ended December 31, 2010, 67% of our net sales was generated from the OEM channel. A high percentage of these sales are recreational in nature and are discretionary purchases for consumers. Consumers are generally more willing to make discretionary purchases during periods of favorable general economic conditions and high consumer confidence. Discretionary spending may also be affected by many other factors, including interest rates, the availability of consumer credit, taxes and consumer confidence in future economic conditions. During periods of unfavorable economic conditions, or periods when other of these factors exist, consumer discretionary spending could be reduced, which in turn could reduce our product sales and have a negative effect on our business, financial condition or results of operations.

In addition, there could also be a number of secondary effects resulting from an economic downturn, such as: insolvency of our suppliers resulting in product delays, an inability of our customers to obtain credit to finance purchases of our products or a desire of our customers to delay payment to us for the purchase of our products. Any of these effects could negatively affect our business, financial condition or results of operations.

If we are unable to maintain our strong brand image, our business may suffer.

Our bicycle components are selected by brands at bicycle companies and by consumers in large part because of our brand reputation. Therefore, our success depends on our ability to maintain and build our brand image. We have focused on building our brands through strong relationships with the major bicycle companies and independent bicycle retailers and through marketing programs aimed at cycling enthusiasts in various media and other channels. For example, we invest significant amounts in sponsorships of elite cyclists in order to reach cycling enthusiasts. We currently sponsor over 15 professional teams and over 40 individuals in competitive cycling. In order to continue to enhance our brand image, we will need to continue to invest in sponsorships, marketing and public relations. In addition, maintaining and enhancing our brand image will depend largely on our ability to be a leader in the bicycle component industry and to continue to provide high quality products and services, which may require us to make substantial investments in areas such as product development and employee training.

There can be no assurance, however, that we will be able to maintain or enhance the strength of our brands in the future. Our brands could be adversely impacted by, among other things:

| • | internal product quality control issues with our components; |

| • | product quality issues on the bikes on which our components are installed; |

| • | product recalls; |

| • | high profile component failures (such as a component failure during a race on a bike ridden by an athlete that we sponsor); and |

| • | negative publicity regarding our sponsored athletes. |

Any adverse impact on our brands could in turn negatively affect our business, financial condition or results of operations.

11

Table of Contents

A significant disruption in the operations of our manufacturing facilities could have a negative effect on our business, financial condition or results of operations.

We have manufacturing facilities located in the United States, Europe and Asia. Equipment failures, delays in deliveries or catastrophic loss at any of our facilities could lead to production or service disruptions, curtailments or shutdowns. In the event of a stoppage in production, or a slow down in production due to high employee turn-over or a labor dispute at any of our facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. For example, the products manufactured at our Shen Kang, Taiwan facility accounted for 64% of our net sales in 2010. If there was a manufacturing disruption in our Shen Kang facility, we may be unable to meet product delivery requirements and our business, financial condition or results of operations could be negatively affected, even if the disruption was covered in whole or in part by our business interruption insurance. Any significant delay in deliveries to our customers could lead to increased returns or cancellations, expose us to damage claims from our customers or damage our brand and, in turn, negatively affect our business, financial condition or results of operations.

Our business depends substantially on the continuing efforts of our senior management, and our business may be severely disrupted if we lose their services.

We are heavily dependent upon the contributions, talent and leadership of our senior management team, particularly our President and Chief Executive Officer, Mr. Stanley R. Day, Jr. Our senior management team, which has an average tenure with us of approximately 18 years, is key to establishing our focus and executing our corporate strategies and has extensive experience in our industry and knowledge of our systems and processes.

All of our senior management are at-will employees. Given our senior management team’s extensive knowledge of the bicycle component industry and the limited number of direct competitors in the industry, we believe that it could be difficult to find replacements should any of our senior management team leave. Our inability to find suitable replacements for any of the members of our senior management team, even if the loss of service is covered in whole or in part by our key person insurance, could negatively affect our business, financial condition or results of operations.

If we cannot maintain our corporate culture, we could lose the innovation, teamwork and focus that we believe are important to our success.

We believe that an important component of our success is our corporate culture, which we believe fosters innovation, encourages teamwork, cultivates creativity and innovation and promotes focus on execution. We have invested substantial time, energy and resources in building a highly collaborative team that works together effectively in an environment designed to promote openness, honesty, mutual respect and the pursuit of common goals. As we develop the infrastructure of a public company and continue to grow, we may find it difficult to maintain these valuable aspects of our corporate culture. Any failure to preserve our culture could negatively impact our future success, including our ability to attract and retain employees, encourage innovation and teamwork and effectively focus on and pursue our corporate strategy.

We may not be able to sustain our past growth or successfully implement our growth strategy, which may have a negative effect on our business, financial condition or results of operations.

We have experienced rapid growth since our founding over 24 years ago. We grew our net sales from $283.8 million in 2006 to $524.2 million in 2010, and we believe that we are well positioned to grow our business in the future. However, our future growth will depend upon various factors, including the strength of our brand image, our ability to continue to produce innovative, state-of-the art bicycle components, consumer acceptance of our

12

Table of Contents

current and future bicycle components, competitive conditions in the marketplace and the continued growth of the bicycle industry as a whole. If we are unable to sustain our past growth or successfully implement our growth strategy, our business, financial condition or results of operations could be negatively affected.

We are and may become subject to intellectual property suits that could cause us to incur significant costs or pay significant damages or that could prohibit us from selling our products.

As we develop new products, we seek to avoid infringing the valid patents and other intellectual property rights of our competitors. However, from time to time, third parties have claimed, or may claim in the future, that our products infringe upon their proprietary rights. We will evaluate any such claim and, where appropriate, may obtain or seek to obtain licenses or other business arrangements. To date, there have been no significant interruptions in our business as a result of any claims of infringement. We do not currently hold patent infringement insurance. Any claim, regardless of its merit, could be expensive and time consuming to defend. Moreover, if our products are found to infringe third-party intellectual property rights, we may be unable to obtain a license to use such technology, and we could incur substantial costs to redesign our products or to defend legal actions, and such costs could negatively affect our business, financial condition or results of operations.

If we are unable to enforce our intellectual property rights, our reputation and sales could be adversely affected.

Intellectual property is an important component of our business. We currently hold over 550 patents and have obtained an average of over 50 new patents per year since 2002. When appropriate, we assert our rights against those who infringe on our patents, trademarks and trade dress. However, these legal efforts may not be successful in reducing sales of bicycle components by those infringing. Additionally, intellectual property protection may be unavailable or limited in some foreign countries where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States, and it may be more difficult for us to successfully challenge the use of our proprietary rights by other parties in these countries. Furthermore, other bicycle component manufacturers may be able to successfully produce bicycle components which imitate our designs without infringing upon any of our patents, trademarks or trade dress. The failure to prevent or limit infringements and imitations could have a permanent negative impact on the pricing of our products or reduce our product sales, even if we are ultimately successful in limiting the distribution of a product that infringes on us, which in turn may affect our business, financial condition or results of operations.

A reduction or lack of continued growth in the popularity of cycling or the number of cycling enthusiasts could adversely affect our product sales and profits.

We generate all of our revenues from the sale of bicycle components. We attribute our historic growth in part to an increase in the number of cycling enthusiasts purchasing bikes with mid to high-end components. We expect the bicycle component market to continue to grow due to a variety of factors that impact the cycling industry, including continued growth in the number of cycling enthusiasts, increasing average retail selling prices driven by better-performing product designs and technologies, growing participation in cycling events and cycling related sports, improving cycling infrastructure, increasing consumer focus on healthier lifestyle trends, growing focus on the environment and increasing adoption of mid to high-end bicycles in emerging markets. However, if the popularity of cycling or the number of cycling enthusiasts does not increase, or declines, we may fail to achieve future growth and our business, financial condition or results of operations could be negatively affected.

13

Table of Contents

We have significant international operations, and are therefore exposed to currency exchange rate fluctuations.

We maintain fifteen facilities located in the United States, Australia and seven other European and Asian countries and conduct business in U.S. dollars, Euros, Renminbi (RMB), Australian dollars and New Taiwan dollars. Manufacturing and conducting business in the currencies of foreign countries exposes us to fluctuations in foreign currency exchange rates relative to the U.S. dollar.

Foreign currency fluctuations can also affect the prices at which our products are sold in our international markets. Significant unanticipated changes in foreign currency exchange rates make it more difficult for us to manage pricing in our international markets. If we are unable to adjust our pricing in a timely manner to counteract the effects of foreign currency fluctuations, our pricing may not be competitive in the marketplace.

Our financial results are reported in U.S. dollars. As a result, transactions conducted in foreign currencies must be translated into U.S. dollars for reporting purposes based upon the applicable foreign currency exchange rates. Fluctuations in these foreign currency exchange rates can therefore significantly affect period-over-period comparisons.

Our international operations are exposed to risks associated with doing business globally.

As a result of our international presence, we are exposed to increased risks inherent in conducting business outside of the United States. In addition to foreign currency risks, these risks include:

| • | increased difficulty in protecting our intellectual property rights and trade secrets; |

| • | changes in tax laws and the interpretation of those laws; |

| • | exposure to local economic conditions; |

| • | unexpected government action or changes in legal or regulatory requirements; |

| • | geopolitical regional conflicts, terrorist activity, political unrest, civil strife, acts of war, and other political uncertainty; |

| • | changes in tariffs, quotas, trade barriers and other similar restrictions on sales; |

| • | the effects of any anti-American sentiments on our brands or sales of our products; |

| • | increased difficulty in ensuring compliance by employees, agents and contractors with our policies as well as with the laws of multiple jurisdictions, including but not limited to the U.S. Foreign Corrupt Practices Act, local international environmental, health and safety laws, and increasingly complex regulations relating to the conduct of international commerce; |

| • | increased difficulty in controlling and monitoring foreign operations from the United States, including increased difficulty in identifying and recruiting qualified personnel for our foreign operations; and |

| • | increased difficulty in staffing and managing foreign operations or international sales. |

An adverse change in any of these conditions could have a negative effect upon our business, financial condition or results of operations.

If we inaccurately forecast demand for our products, we may manufacture either insufficient or excess quantities, which, in either case, could adversely affect our business.

We plan our manufacturing capacity based upon the forecasted demand for our products. In the OEM channel, our forecasts are based in large part on the number of our component specifications on new bikes and on

14

Table of Contents

projections from the bicycle companies. In the aftermarket channel, our forecasts are based on discussions with our distributors. If actual demand for our products exceeds forecasted demand, we may not be able to produce sufficient quantities of new products in time to fulfill actual demand, which could limit our sales. While we generally manufacture our products upon receipt of customer orders, if actual demand is less than the forecasted demand for our products and we have already manufactured the products, which could result in excess inventories. Either excess or insufficient production could have a negative effect on our business, financial condition or results of operations.

Our new credit facilities will place operating restrictions on us and our subsidiaries, reducing operational flexibility and creating default risks.

Prior to this offering, we intend to enter into our new credit facilities, consisting of a $ million first-lien term credit facility, a $ million second-lien term credit facility and a $ million revolving credit facility, which we expect will be undrawn at the time of the refinancing. The new credit facilities will contain covenants that place restrictions on us and our subsidiaries’ operating activities. We expect that these covenants, among other things, would limit our ability and the ability of our subsidiaries to:

| • | incur additional debt; |

| • | pay dividends and make distributions; |

| • | issue equity interests of subsidiaries; |

| • | make certain investments; |

| • | repurchase stock; |

| • | create liens; |

| • | enter into affiliate transactions; |

| • | merge or consolidate; and |

| • | transfer and sell assets. |

We expect our new revolving credit facility may also require us to maintain compliance with specified financial covenants. Our ability to comply with these financial covenants may be affected by events beyond our control.

If we are unable to comply with the covenants contained in our new credit facilities, it could constitute an event of default under our new credit facilities and our lenders could declare all borrowings outstanding, together with accrued and unpaid interest, to be immediately due and payable. If we are unable to repay or otherwise refinance these borrowings when due, our lenders could sell the collateral securing our credit facilities, which constitutes substantially all of our and our subsidiaries’ assets.

We have substantial leverage, and despite our substantial leverage, we and our subsidiaries may incur additional indebtedness.

As of December 31, 2010, as adjusted for the refinancing and the use of proceeds from this offering, our total indebtedness would have been approximately $ million. Our substantial level of indebtedness could have material negative consequences to us, including:

| • | making it difficult to satisfy our obligations with respect to our indebtedness, which could ultimately cause our lenders to accelerate all amounts under our new credit facilities; |

| • | making it difficult to obtain financing in the future for working capital, capital expenditures, acquisitions or other purposes on commercially reasonable terms or at all; |

15

Table of Contents

| • | increasing our vulnerability to general economic downturns and adverse industry conditions; |

| • | reducing our ability to further access the credit markets; |

| • | placing us at a competitive disadvantage compared to our competitors that have less indebtedness; and |

| • | limiting our flexibility in planning for, or reacting to, changes in our business and industry, including our ability to invest in product development. |

As of December 31, 2010, as adjusted for the refinancing, our new revolving credit facility would have provided for additional borrowings of $ million. In addition, although our new credit facilities will contain restrictions on the incurrence of other additional indebtedness, such restrictions are subject to a number of qualifications and exceptions, and under certain circumstances indebtedness incurred in compliance with such restrictions could be substantial. To the extent new indebtedness is added to our current debt levels, the risks described in the paragraph above would increase.

An increase in interest rates would increase the interest costs on our new credit facilities and any additional variable rate indebtedness we may incur and could adversely impact our ability to refinance our indebtedness.

Borrowings under our new credit facilities will be based on floating rates. An increase in interest rates would increase our debt service obligations and therefore reduce cash flow available for other corporate purposes. Further, rising interest rates could limit our ability to refinance our existing indebtedness when it matures and increase interest costs on any indebtedness that is refinanced. We may from time to time enter into agreements such as interest rate swaps or other interest rate hedging contracts. While these agreements may lessen the impact of rising interest rates, there can be no assurance that any hedging transactions will fully protect us from interest rate risk.

We are subject to certain safety and labor risks in our manufacturing facilities.

We employ approximately 2,200 employees worldwide, a large percentage of which work at our manufacturing facilities. Our business involves complex manufacturing processes that can be dangerous to our employees. Although we employ safety procedures in the design and operation of our facilities, there is a risk that an accident or death could occur in one of our facilities. Any accident could result in manufacturing delays, which could negatively affect our business, financial condition or results of operations. Also, the costs to defend any action or the potential liability resulting from any such accident or death, to the extent not covered by insurance, and any negative publicity associated therewith, could have a negative effect on our business, financial condition or results of operations. In addition, we have unionized workers in some of our European locations. Any strike, prolonged work stoppage or failure by us to reach a new agreement upon expiration of other union contracts could also have a negative effect on our business, financial condition or results of operations.

We are and may in the future be subject to product liability claims, recalls or warranty claims, which could be expensive or damage our reputation and result in a diversion of management resources.

We are and in the future may be subject to product liability claims and other claims relating to bodily injury, property damage or other losses that result, or allegedly result, from the failure of our products to perform as expected. We may incur losses resulting from these claims or the defense of these claims. Currently we maintain product liability coverage, but there is a risk that any claims or liabilities will exceed our insurance coverage or otherwise be limited. We also cannot guarantee that we will be able to maintain product liability coverage in the future.

In the past, some of our products have been subject to recalls and in the future we may be required to or voluntarily participate in recalls involving our bicycle components if any prove to be defective. In addition to the

16

Table of Contents

direct costs of any claim or product recall, any such claim or recall could adversely affect our brand image and have a negative effect on our business, financial condition or results of operations.

We are involved from time to time in various legal and regulatory proceedings and claims, which may have a negative effect on business or financial condition or results of operations.

We are involved in various legal and regulatory proceedings and claims that, from time to time, may be significant. These are typically claims that arise in the normal course of business including, without limitation, commercial or contractual disputes, including disputes with our customers, suppliers or competitors, intellectual property matters, personal injury claims, environmental matters, tax matters and employment matters. These proceedings and claims could negatively affect our business, financial condition or results of operations.

We rely on increasingly complex information systems for management of our manufacturing, distribution, sales and other functions. If our information systems fail to perform these functions adequately or if we experience an interruption in our operations, our business could suffer.

All of our major operations, including manufacturing, distribution, sales and accounting, are dependent upon our complex information systems. Our information systems are vulnerable to damage or interruption from, among other things:

| • | earthquake, fire, flood, hurricane and other natural disasters; |

| • | power loss, computer systems failure, internet and telecommunications or data network failure; and |

| • | hackers, computer viruses, software bugs or glitches. |

Any damage or significant disruption in the operation of such systems or the failure of our information systems to perform as expected could disrupt our operations, reduce our efficiency, delay our fulfillment of customer orders or require significant unanticipated expenditures to correct, and thereby have a negative effect on our business, financial condition or results of operations.

We depend on a limited number of suppliers for some of our products, and the loss of any of these suppliers or an increase in cost of raw materials could harm our business.

Because we dual or multi source most materials required for our products, we do not believe we are dependent on any single supplier. If, however, our current suppliers, in particular the minority of those which are single-source suppliers, are unable to fulfill orders, or if we are required to transition to other suppliers, we could experience significant production delays or disruption to our business.

In addition, we purchase various raw materials and component parts in order to manufacture our products. The main commodity items purchased for production include steel, aluminum, carbon fiber and plastic. Historically, price fluctuations for these raw materials and component parts have not had a material impact on our business. In the future, however, if we experience material increases in the price of raw materials or component parts and are unable to pass on those increases to our customers, or there are shortages in the availability of such raw materials or component parts, it could negatively affect our business, financial condition or results of operations. In addition, some of our raw materials are sourced from Japan, including a significant portion of our carbon fiber. Although the recent earthquake and tsunami in Japan have not had a negative impact on our business or supply of raw materials, we continue to monitor this matter.

17

Table of Contents

Changes in equipment standards promulgated by major cycling associations could negatively affect us.

We believe that we have products that conform to all equipment standards promulgated by major cycling associations, such as the Union Cycliste Internationale or the USA Triathlon. However, our future products may not satisfy these standards, or existing standards may be altered in ways that adversely affect the sales of our current or future products. If a change in rule were adopted and we did not have, or were unable to manufacture, a conforming product, we may be unable to sponsor athletes in various competitions, and our business, financial condition or results of operations could be negatively affected.

New laws, regulations or rules or changes in existing laws, regulations or rules could negatively affect our business.

We are subject to a variety of federal, state, local and foreign laws and regulations. Governmental regulations also affect taxes and levies, capital markets, healthcare costs, energy usage, international trade, immigration and other labor issues, all of which may have a direct or indirect negative effect on our business and our customers’ and suppliers’ businesses. We cannot predict the substance or impact of pending or future legislation, regulations or rules, or the application thereof. Changes in these laws, regulations or rules, the interpretation thereof or the introduction of new laws, regulations and rules could increase the costs of doing business for us or our customers or suppliers or restrict our actions, and therefore negatively affect our business, financial condition or results of operations.

We are subject to environmental laws and regulation and potential exposure for environmental costs and liabilities.

Our operations, facilities and properties are subject to a variety of foreign, federal, state and local laws and regulations relating to health, safety and the protection of the environment. These environmental laws and regulations include those relating to the use, generation, storage, handling, transportation, treatment and disposal of solid and hazardous materials and wastes, emissions to air, discharges to waters and the investigation and remediation of contamination. Failure to comply with such laws and regulations can result in significant fines, penalties, costs, liabilities or restrictions on operations that could negatively affect our business, financial condition or results of operations.

Our manufacturing operations involve the handling of materials and wastes, some of which are or may be regulated as hazardous substances. We could be subject to requirements related to the remediation of, or the liability for, substances that have been or are released to the environment at properties currently or formerly owned or operated by us, at or from adjacent properties, or at properties to which we send substances for treatment or disposal. Such remediation requirements and liability may be imposed without regard to fault and damage from releases can be substantial.

We believe that our operations are in substantial compliance with applicable environmental laws and regulations. Our compliance with such laws and regulations has not had, nor is it expected to have, a material impact on our capital expenditures, earnings or competitive position. However, additional environmental issues relating to presently known or unknown matters could give rise to currently unanticipated investigation, assessment or expenditures. Furthermore, through acquisitions over the years, we have acquired a number of facilities, and we could incur material costs and liabilities relating to activities that predate our ownership. In addition, future events, such as changes in existing laws and regulations or their interpretation could give rise to additional compliance costs, capital expenditures or liabilities. Compliance with more stringent laws or regulations as well as different interpretations of existing laws, more vigorous enforcement by regulators or unanticipated events could require additional expenditures that may materially affect our business, financial condition or results of operations.

18

Table of Contents

We may not be able to effectively integrate businesses we acquire or we may not be able to identify or consummate any future acquisitions on favorable terms, or at all.

Since 1995, we have achieved growth due in part to our ability to successfully acquire and integrate complementary businesses. Our acquisitions include the bicycle division of Mannesman Sachs AG (1997), RockShox, Inc. (2002), the bicycle business of Avid, LLC (2004), Truvativ International Co., Ltd. (2004) and Compositech, Inc. (Zipp) (2007). Acquisitions may continue to play a role in our future growth. Any future acquisitions that we might make, however, are subject to various risks and uncertainties, including:

| • | the inability to integrate effectively the operations, products, technologies and personnel of the acquired companies (some of which may be spread out in different geographic regions); |

| • | the potential disruption of existing business and diversion of management’s attention from day-to-day operations; |

| • | the inability to maintain uniform standards, controls, procedures and policies or correct deficient standards, controls, procedures and policies, including internal controls and procedures, sufficient to satisfy regulatory requirements of a public company in the United States; |

| • | the incurrence of contingent obligations that were not anticipated at the time of the acquisitions; |

| • | the need or obligation to divest portions of the acquired companies; and |

| • | the potential impairment of relationships with customers. |

Also, the integration of any newly acquired businesses may not achieve any anticipated cost savings or operating synergies, or we may not be able to effectively manage our operations at an increased scale of operations resulting from such acquisitions.

In addition, we may not be able to identify or consummate any future acquisitions on favorable terms, or at all. We may have limited opportunities to acquire businesses that we believe will enhance our product lines or our business.

Changes in our effective tax rate and our provision for income taxes could negatively affect our business, financial condition or results of operations.

Due to the global nature of our operations, we are subject to federal and state income taxes in the United States and various foreign jurisdictions. Our effective tax rate and our provision for income taxes is affected by changes in the mix of earnings and losses in jurisdictions with differing statutory tax rates, certain non-tax deductible expenses, including those arising from the requirement to expense stock options, changes in the valuation of our deferred tax assets and liabilities, and changes in accounting principles. Our tax liabilities are also impacted by the amounts we record in intercompany transactions for services, licenses, funding, and other items, which may be challenged by the tax authorities in the jurisdictions in which we operate. In addition, changes to tax laws in the jurisdictions in which we operate, such as an increase in tax rates or an adverse change in the treatment of an item of income or expense, could result in a material increase in our tax expense.

Currently, our foreign subsidiaries are treated as disregarded or transparent entities for U.S. federal income tax purposes, with the result that income generated by our foreign subsidiaries is subject to U.S. federal income tax on a current basis to the members of SRAM Holdings, LLC, in addition to the taxes imposed by the foreign jurisdictions in which the income is earned. In addition, distributions of earnings and other payments to us from our foreign subsidiaries may be subject to foreign withholding taxes. In general, a U.S. taxpayer may claim a foreign tax credit against its U.S. federal income tax liability for foreign income and withholding taxes paid on

19

Table of Contents

its foreign-source income. However, the amount of foreign tax credit that we may claim against our U.S. federal income tax liability is subject to many limitations that may significantly restrict our ability to claim a credit for all of the foreign taxes we pay, and we may incur incremental tax costs as a result of these limitations.

The loss of one or more of our top customers could have a significant negative impact on our business, financial condition or results of operations.

The customer base for our products is limited, as there are a limited number of bicycle companies who produce new, fully-assembled bicycles and a limited number of independent bicycle retailers and distributors who sell aftermarket and accessory components. Accordingly, we invest significant time and resources in building strong relationships with each of our customers. No bicycle company represented 10% or more of our total net sales and no distributor or retailer represented more than 4.5% of our total net sales for the year ended December 31, 2010. During this same period, our top 10 bicycle company customers accounted for approximately 37% of our total net sales and our top 10 distributors accounted for approximately 16% of our total net sales. We do not generally enter into long-term contracts with our customers and, as a result, one or more of such customers could elect not to continue doing business with us at any time. A loss of one or more customers could have a negative effect on our business, financial condition or results of operations.

Risks related to our corporate structure