Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERITAGE FINANCIAL CORP /WA/ | d8k.htm |

Exhibit 99.1 |

Forward Looking

Statements 2

“Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995:

This presentation contains forward-looking statements that are subject to risks and

uncertainties, including, but not limited to: the credit risks of lending activities,

including changes in the level and trend of loan delinquencies and write-offs and changes in our

allowance for loan losses and provision for loan losses that may be impacted by deterioration

in the housing and commercial real estate markets; changes in general economic

conditions, either nationally or in our market areas; changes in the levels of general

interest rates, and the relative differences between short and long term interest rates, deposit

interest rates, our net interest margin and funding sources; fluctuations in the demand for

loans, the number of unsold homes and other properties and fluctuations in real estate

values in our market areas; results of examinations of us by the Board of Governors of the

Federal Reserve System (the “Federal Reserve Board”) and of our bank subsidiaries by

the Federal Deposit Insurance Corporation (the “FDIC”), the Washington State

Department of Financial Institutions, Division of Banks (the “Washington DFI”) or other regulatory

authorities, including the possibility that any such regulatory authority may, among other

things, require us to increase our reserve for loan losses, write-down assets, change our

regulatory capital position or affect our ability to borrow funds or maintain or increase

deposits, which could adversely affect our liquidity and earnings; legislative or regulatory

changes that adversely affect our business including changes in regulatory policies and

principles, including the interpretation of regulatory capital or other rules, the

interpretation of regulatory capital or other rules including changes from the Dodd-Frank

Act and regulations that have been or will be promulgated thereunder; our ability to

control operating costs and expenses; the use of estimates in determining fair value of

certain of our assets, which estimates may prove to be incorrect and result in significant

declines in valuation; difficulties in reducing risk associated with the loans on our balance

sheet; staffing fluctuations in response to product demand or the implementation of

corporate strategies that affect our workforce and potential associated charges; computer

systems on which we depend could fail or experience a security breach; our ability to

retain key members of our senior management team; costs and effects of litigation, including

settlements and judgments; our ability to implement our branch expansion strategy; our

ability to implement our expansion strategy; our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we have acquired

including the Cowlitz Bank and Pierce Commercial Bank transactions or may in the future

acquire into our operations and our ability to realize related revenue synergies and cost

savings within expected time frames and any goodwill charges related thereto; or may in the

future acquire into our operations and our ability to realize related revenue synergies

and cost savings within expected time frames and any goodwill charges related thereto; risks relating to acquiring assets or entering markets in which we have not

previously operated and may not be familiar, changes in consumer spending, borrowing and

savings habits; the availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; adverse changes in the securities markets;

inability of key third-party providers to perform their obligations to us; changes in

accounting policies and practices, as may be adopted by the financial institution regulatory

agencies or the Financial Accounting Standards Board, including additional guidance and

interpretation on accounting issues and details of the implementation of new accounting methods; other economic, competitive, governmental, regulatory, and technological

factors affecting our operations, pricing, products and services; and other risks detailed

from time to time in our filings with the Securities and Exchange Commission.

The Company cautions readers not to place undue reliance on any forward-looking

statements. Moreover, you should treat these statements as speaking only as of the date they

are made and based only on information then actually known to the Company. The Company does

not undertake and specifically disclaims any obligation to revise any forward-

looking statements to reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. These risks could cause our actual results

for 2011 and beyond to differ materially from those expressed in any forward-looking

statements by, or on behalf of, us, and could negatively affect the Company’s operating and

stock price performance. |

Overview

Company & Economic Information

Recent Achievements

Financial Performance

Peer Group Analysis

Continuing Strategies

3 |

4

|

Corporate

Structure Total assets: $1.17 billion

Branches: 26

Total assets: $160.0 million

Branches: 6

Financial Highlights

Total Assets

$1.34 billion

Net Loans

$965 million

Total Deposits

$1.1 billion

Tangible Common Equity

$188.5 million

Loan/Deposit Ratio

87.8%

Coverage Ratio (1)

83.2%

Core Deposit Ratio (2)

81.6%

Net Interest Margin

5.08% (Q1’11) 4.78% (FY2010)

Cost of Funds

0.82% (Q1’11) 1.02% (FY2010)

PTPP ROAA (3)

1.63% (Q1’11) 2.76% (FY2010)

(1) Allowance for loan loss/nonperforming loans (originated loans only)

(2) All deposits less brokered CDs and CDs over $100,000

(3) Pre-tax, pre-provision return on average assets

Note: Numbers rounded for presentation purposes only

Financial data as of March 31, 2011 unless otherwise indicated

5 |

Economic

Outlook We have not yet achieved measurable and

sustainable economic growth in the Pacific

Northwest

Our local economy will continue to struggle

until unemployment and real estate values

improve

However, we are beginning to see signs of

improvement in some areas

6 |

|

Award

Recognition 8

Washington Best Workplaces –

Bronze Award -

2010

(Puget Sound Business

Journal)

Silver Award -

2009

Top Places to Work –

Large Company and Equity Award -

2009

(Business Examiner)

Best Bank in the South Sound –

2008, 2010

(The Olympian)

Best of the Northwest for 2009

Top 20 Companies of the Decade

Publically

Traded

PNW

Companies

-

Debt

Free

for

2009

(The Seattle Times)

Washington State Financial Services Champion of the Year –

2009, 2010

(Seattle District of the US Small Business Administration)

The 100

Best

Companies

to

Work

For

–

2

nd

Midsized

Companies

-

2010

(Seattle Business Magazine) |

Raised $54

million in net proceeds from December 2010 public offering

Redeemed $24 million TARP preferred

securities in December 2010

Capital

9 |

Where We Were

(June 30, 2010) Where We Are Now

(Existing Branches) -

Total Branches 20

20 Legacy Heritage / Central

Valley branches

2 Organic de novo branches

in Pierce County

9 Acquired Cowlitz branches

1 Acquired Pierce

Commercial branch

Acquisition strategy –

continue to execute on our strategic growth goals

Due to continuing Pacific Northwest market turmoil we expected opportunities like these would

be coming, and have been preparing accordingly:

Evaluating and prioritizing targets

Scaling infrastructure to support growth

Sharpening operating focus, execution, and integration

To date we have completed two FDIC-assisted acquisitions

Positioned for further growth in two of the largest markets in the Pacific Northwest (Seattle

and Portland) Recently announced Kent branch acquisition expected to be completed

in June 2011 Expanding our Markets

(New Branches) -

Total Branches 32

10 |

11

FDIC-Assisted Acquisitions

Cowlitz Bank / Bay Bank

Pierce Commercial Bank

Date of acquisition -

July 30, 2010

Date of acquisition -

November 5, 2010

Nine branches

One branch

Entered into two largest markets in the Pacific

NW: Seattle/Bellevue & Portland/Vancouver

Increased market position in Pierce County

(Tacoma) to the 2

nd

largest community bank

(based on deposits)

Acquired $145 million in loans & $166 million in

deposits (excluding wholesale CDs) at fair value

Acquired $143 million in loans & $125 million in

deposits (excluding wholesale CDs) at fair value

Modified whole bank with loss share structure

(excluded NPAs as of bid valuation date)

Whole bank without loss share

$8.8 million negative asset bid with a 1% deposit

premium resulting in an after-tax gain on

acquisition of $285,000

$41.2 million negative asset bid with a 1% deposit

premium resulting in an after-tax gain on

acquisition of $7.4 million

Systems conversion completed in November

Systems conversion completed in March |

De Novo

Branching Opened Sumner Branch in 2008

Opened Puyallup, WA branch in September 2010

Opened Gig Harbor, WA in February 2011

Plan to acquire/build 1-2 branches per year in strategic growth locations

2010/2011 Talent Recruitment

Since September we have hired 9 new lenders

A team of 3 lenders in Pierce County (Puyallup)

3 new lenders for King Co. (Seattle/Bellevue/Kent)

2 new lenders for Vancouver WA/Portland OR

1 new lender for Olympia

Continue to seek first-class seasoned C&I bankers to join our team

12

Organic Growth |

Largest State

Banks Source: Puget Sound Business Journal: April 1 –

7, 2011

The largest banks based in Washington State are ranked by total

assets as of Dec. 31, 2010

* Announced Sale

13 |

|

Loan and Deposit

Growth 15 |

16

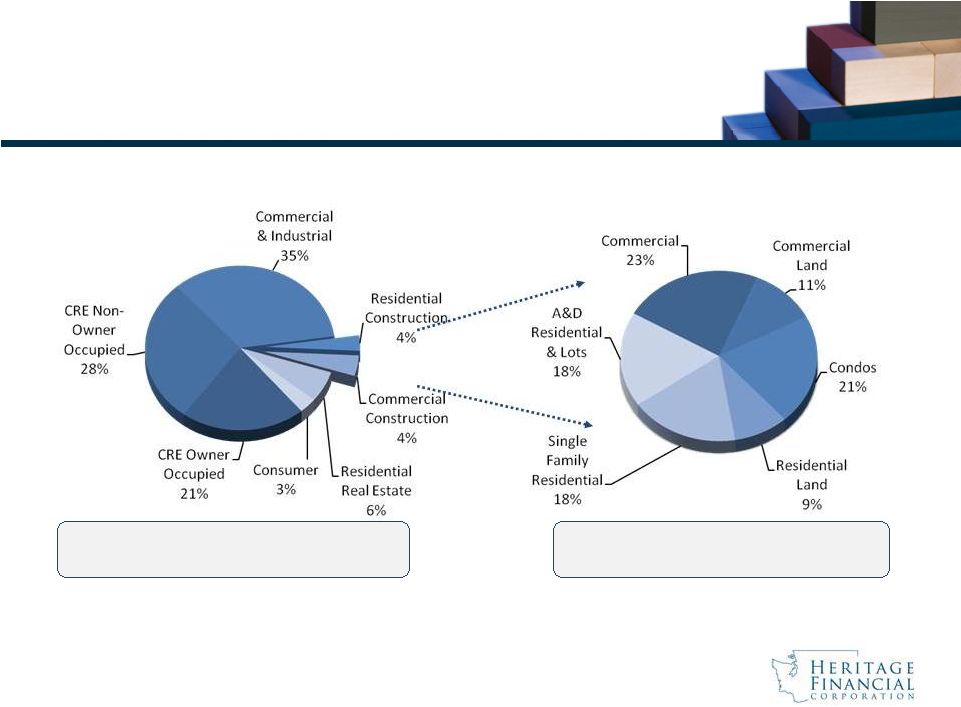

Originated Loan Portfolio

Construction Portfolio

Financial data as of March 31, 2011 and does not include loans purchased in the

Cowlitz Bank and Pierce Commercial Bank acquisitions.

Total Originated Loans: $755 million

Total Construction Loans: $60 million

Diversified Loan Portfolio |

Deposit Composition (June 30, 2010)

Attractive Deposit Base

Deposit Composition (December 31, 2010)

Financial Data as of March 31, 2011

–

Total Deposits

$1.1 billion

–

Total Non-Maturity Deposits

$741 million

–

Non-Maturity Deposits / Total Dep.

67.4%

–

Non-Int. Bearing Dep. / Total Dep.

17.2%

–

Cost of Int. Bear. Deposits

0.82%

–

Cost of Deposits

0.68%

17 |

Quarterly

Earnings Annual Earnings

Annual Earnings

18 |

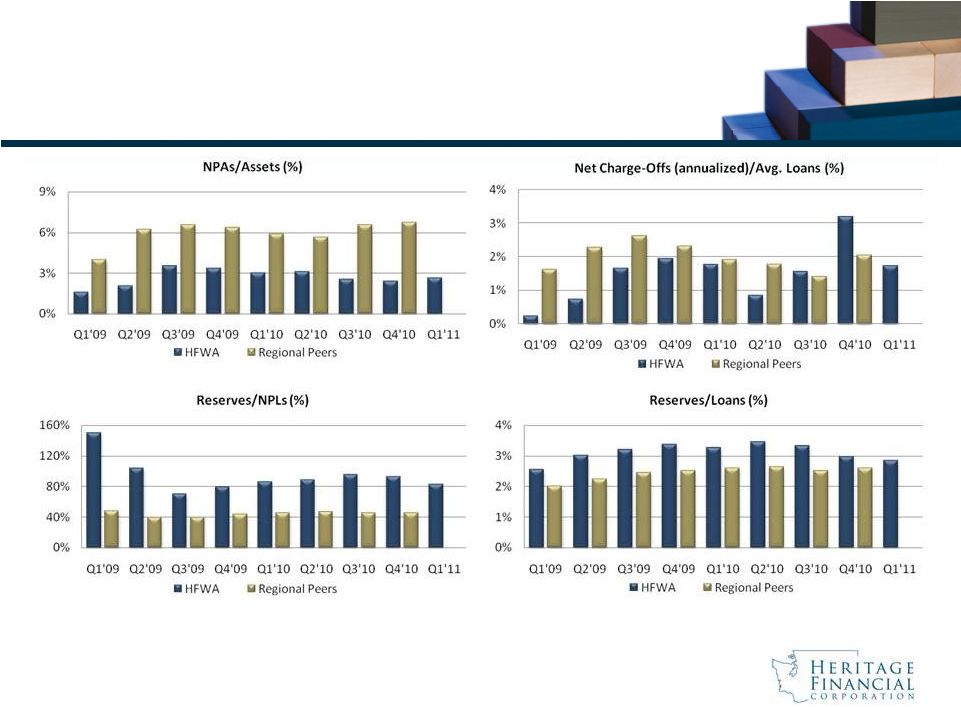

Peer Source:

SNL Financial Regional Peer Group (13): Ticker Symbols –

BANR, CACB, CASB, COLB, FFNW, HOME, NRIM, PCBK, PRWT,

RVSB, TSBK, WBCO, WCBO.

Loan Provisioning

19 |

Equity

Growth 2008 –

Issued $24 million preferred securities in TARP

2009 –

Raised $47 million in common equity

2010 –

Raised $54 million in common equity and re-purchased TARP

20 |

Strong Capital

Levels 21

Peer Source: SNL Financial

Regional Peer Group (13)

All Ratios as of December 31, 2010 |

Dividend

Announcement The Board has approved a $0.03 dividend for

shareholders of record on May 13, 2011 and

payable on May 27, 2011

22 |

|

Peer Group

Analysis 24

Peer Source: SNL Financial

*Stock pricing as of 4/29/2011

Heritage Financial

(3/31/11)

Heritage Financial

(12/31/10)

Peer Group Median

(12/31/10)

TCE Ratio (%)

14.3

13.8

8.8

NPLs/Loans (%)

3.4

3.2

5.4

Reserves/NPLs (%)

83.2

93.2

46.7

ROAA (%)

0.23

1.16

(0.34)

Price/Tangible Book (%)*

122.4

119.4

92.7 |

|

26

Growth Strategy

We believe in a three pronged approach to our growth strategy.

Our Approach

Open Bank Acquisitions

Will Opportunistically Review

Organic Growth

De Novo Branching

Capitalizing On Market

Dislocations

Increase market share

Attract new talent

FDIC-Assisted Acquisitions

Experienced and Disciplined

Bidder

Two winning bids

Multiple deals in which we

bid we were not the winning

bidder

Decided not to bid on

multiple deals after

conducting due diligence |

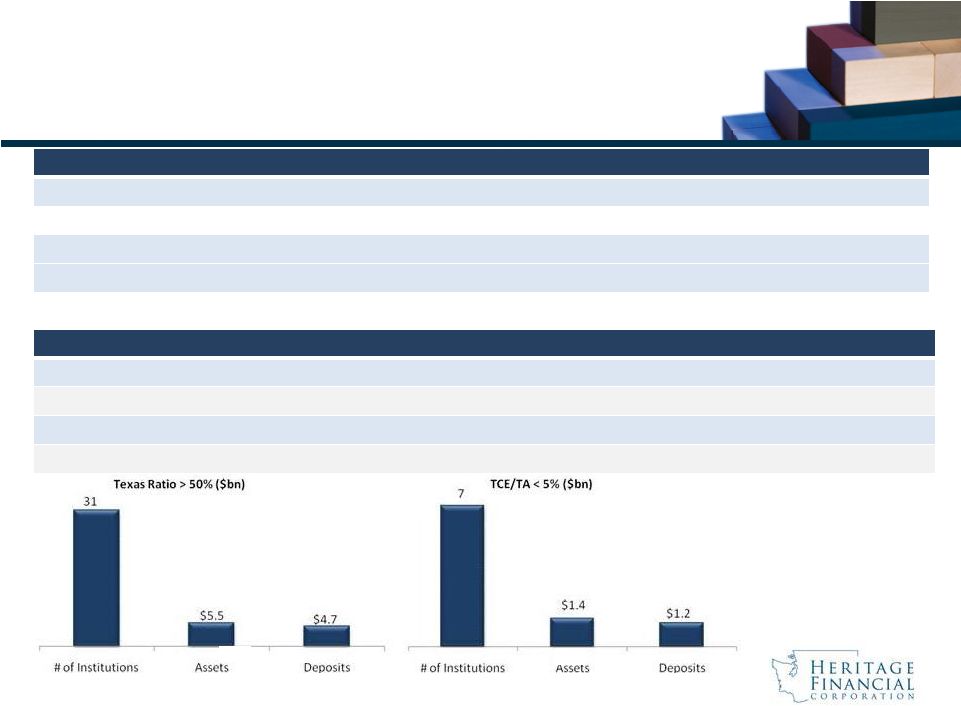

27

Acquisition Considerations

Fill in or expand geographic footprint

Opportunity to take advantage of FDIC loss share agreements

Strengthen market share

Potential to significantly grow our company

Source: SNL Financial data as of December 31, 2010. Data from charts above is

from WA & OR banks and thrifts with a Texas Ratio* greater than 50%

and assets under $500 million *(Non performing loans + Real Estate Owned)

divided by the sum of tangible common equity capital and loan loss reserves Potential

Acquisitions Summary of Analysis

18

Washington & Oregon banks and thrifts with a Texas Ratio* greater than

100% 14 Washington & Oregon banks and thrifts with a Texas Ratio*

greater than 100% and assets under $500 million 31 Washington & Oregon

banks and thrifts with a Texas Ratio* greater than 50% and assets under $500 million

28 Washington & Oregon banks and thrifts with a Texas Ratio* greater than

50% and assets under $300 million 7 Washington & Oregon banks and

thrifts with TCE / TA less than 5% and assets under $500 million |

Experienced

management team with a proven track record

Building long-term franchise value while positioning

the Company for sustainable profitability

Legacy franchise remains intact with favorable

financial performance trends; allows us to continue

to play offense

Well positioned for continued growth in the Pacific

Northwest markets

Summary

28 |

|