Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NEWTEK BUSINESS SERVICES, INC. | d8k.htm |

| EX-99.1 - PRESS RELEASE - NEWTEK BUSINESS SERVICES, INC. | dex991.htm |

Newtek Business Services, Inc.

NASDAQ: NEWT

First Quarter 2011

Financial Results Conference Call

May 11, 2011 4:15 PM

Hosted By:

Barry Sloane, CEO and Chairman

Seth A. Cohen, CFO

Public Relations Contact:

Liz Petrova

Rubenstein Public Relations, Inc.

(212) 843-9335

lpetrova@rubensteinpr.com

Exhibit 99.2 |

Safe

Harbor Statement The statements in this slide presentation including

statements regarding anticipated future financial performance, Newtek's

beliefs, expectations, intentions or strategies for the future, may be

"forward-looking statements" under the Private Securities Litigation Reform Act of 1995. All

forward-looking statements involve a number of risks and uncertainties that

could cause actual results to differ materially from the plans, intentions

and expectations reflected in or suggested by the forward-looking

statements. Such risks and uncertainties include, among others, intensified

competition,

operating

problems

and

their

impact

on

revenues

and

profit

margins,

anticipated

future business strategies and financial performance, anticipated future number of

customers, business prospects, legislative developments and similar matters.

Risk factors, cautionary statements and other conditions which could cause

Newtek’s actual results to differ from management's current

expectations are contained in Newtek’s filings with the Securities and

Exchange

Commission

and

available

through

http://www.sec.gov

Our

Capcos

operate

under

a

different

set

of

rules

in

each

of

the

7

jurisdictions

and

that

these

place varying requirements on the structure of our investments. In some cases,

particularly in Louisiana or in certain situations in New York, we do not

control the equity or management of a qualified business, but that cannot

always be presented orally or in written presentations. 2

|

First Quarter 2011 Highlights

Announce consolidated net income of $509 thousand for the quarter ended

March 31, 2011

Versus consolidated net loss of $(467) thousand for the quarter ended

March 31, 2010

Announce consolidated pretax income of $834 thousand for the quarter

ended March 31, 2011

Versus consolidated pretax loss of $(874) thousand for the quarter

ended March 31, 2010

Reaffirming 2011 annual guidance of:

$119.6 million to $125.3 million for consolidated revenue range

$1.2 million to $4.3 million for consolidated pretax income range

3 |

First Quarter 2011 Highlights

Announce Q1 2011 consolidated revenue of $30.5 million

18% growth vs. Q1 2010 of $25.9 million

Primary Q1 2011 revenue trends in EPP and Managed Technology

Solutions exceed Q1 2010 comparisons

Combined EPP and Managed Technology Solutions revenue for Q1

2011 is $24.9 million

•

Versus Q1 2010 of $23.6 million

•

6% growth

Small Business Finance segment posts pretax income of $1.3

million

for

Q1

2011

vs.

a

pretax

loss

of

$(110)

thousand

for Q1

2010

4 |

First Quarter 2011 Conference Call Agenda

Q1 2011 financial performance, cash position, balance sheet,

commentary, business trends, and 2011 guidance

Strategic mission as The Small Business Authority

New

website

launched:

www.thesba.com

(January

2011)

5 |

First

Quarter

2011

Financial

Results

Q1 2011 vs. Q1 2010 core operating segment revenue:

Electronic Payment Processing:

$20.1 million -

up 7% from Q1 2010

Managed Technology Solutions:

$4.8 million -

up 1% from Q1 2010

Small Business Finance:

$5.1 million –

up 282% from Q1 2010

Q1 2011 vs. Q1 2010 core operating segment pretax net income:

Electronic Payment Processing:

$1.2 million -

up 11% from Q1 2010

Managed Technology Solutions:

$1.2 million -

up 32% from Q1 2010

Small Business Finance:

$1.3 million -

a $1.4 million improvement from

the pretax loss in Q1 2010 of $(110) thousand

6 |

Cash

Position $25.6 million in cash and cash equivalents, restricted

cash, and broker receivable at March 31, 2011, down from

$33.2 million at December 31, 2010.

Equates to $0.39 cash per share.

Equates to $0.72 cash per share when including restricted

cash and the broker receivable, which we received in April

2011.

$2.8 million of net cash provided by operating activities for

Q1 2011 versus $1.7 million of net cash used in operating

activities for Q1 2010 2009.

•

Primarily reflects the operations of the SBA lender in Q1 2011.

7 |

Developments in EPP

Q1 2011 EPP revenue up 7% over Q1 2010

Q1 2011 EPP pretax income up 11% over Q1 2010

Cash flow positive business

Significant operating leverage

Q1 2011 EPP segment EBITDA of $1.6 million

versus Q1 2010 of $1.5 million

EPP segment does not have any debt

eCommerce : Single most important corporate initiative and identifier

NewtPay

“Meet or Beat”

campaign launch

8 |

Managed Technology Solutions Initiatives

Q1 2011 versus Q1 2010:

Revenue up 1%

Pre-tax income up 32%

Continue to evaluate expenditures versus productivity, particularly in

marketing, seeking additional cost savings where applicable

Continued growth despite challenging market

Continue to invest in Managed Technology Solutions segment to support

future growth

Currently above 50% real estate capacity in our data center

Q1 2011 Managed Technology Solutions segment EBITDA of $1.6 million

versus Q1 2010 of $1.4 million

Great

marketing

channel

to

target

IT

partners

and

web

developers

–

TechExec

Competitive at lower-end of the market

9 |

Cloud

Computing

What is it?

Outsourcing of hardware, software, personnel, storage, data

security and responsibility and accountability for IT in whole or

part.

Why is it relevant?

Cost containment and efficiencies

Better service and management of resources

More security

More functionality

10 |

Cloud

Computing

Competition

Amazon

Microsoft

Other hosting companies and IT providers like Rackspace

Hosting (RAX)

Thesba has real U.S. based cloud authority personnel to service and

talk to the customer

Thesba has a pay for what you use at the Cloud Authority

Bandwith

Storage

CPU

11 |

Cloud

Computing

Why is this market important and why are we

good at it?

12 |

Small Business Finance

We have very good lending infrastructure (origination, underwriting, funding,

servicing, and collection)

This infrastructure is valuable more so today

This sector offers the best opportunity for Newtek shareholders

109 to 114 pricing on governments

FDIC contract

We are an S&P rated commercial servicer

Closed S&P AA rated securitization for note issuance of $16 million in

December 2010 Closed Capital One Bank $12 million line of credit to fund

portions of loans guaranteed by the SBA

Closed a $10 million line with Sterling National Bank to fund accounts receivable

finance business in February 2011

Obtained

Letter

of

Intent

on

an

additional

$15

million

warehouse

line

from

Capital

One

Bank to fund unguaranteed portions of SBA 7(a) loans until next

securitization. 13 |

14

Small Business Finance

Servicing Portfolio (in thousands):

3/31/2011

12/31/2010

Increase

Servicing for our loans

$190,731

$ 179,894

$ 10,837

Servicing for others

$ 75,365

$ 73,062

$ 2,303

Total servicing portfolio

$ 266,096

$ 252,956

$ 13,140

We expect future growth in this business area. |

Reduced Effect of Capco

on Consolidated Results

Balance sheet illusionary leverage

Management time

Accounting cost

Other miscellaneous costs

15 |

Balance Sheet Items to Discuss

SBA loans transferred, subject to premium recourse

$16.9 million

Credits in lieu of cash

$29.0 million

Total assets

$144.2 million

Liability on SBA loans transferred, subject to premium recourse

$16.5 million

Notes payable in credits in lieu of cash

$29.0 million

Total liabilities

$88.2 million

16 |

Future Year End

Balance of Tax Credits 17

$-

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

2011

2012

2013

2014

(in millions) |

Reduction of Capco Effect

Reduction of balance sheet

Credits in lieu of cash

Notes payable in credits in lieu of cash

Current percentage investment threshold and amount needed to reach 100%

Alabama reached 100% investment threshold in December 2010

18

Capco

% Investment

threshold

$ Investments needed

to reach 100%

DC

60%

5,059,000

TX

74%

6,047,000

LA2

50%

1,808,457

LA4

95%

315,205

AL

100%

-

|

What

is our Growth Strategy Going Forward?

The Small Business Authority brand through

www.thesba.com (launched January 2011)

Emphasize cross-selling and cross-marketing into the customer base

which we are now doing

Continue to grow alliance channels as outsourcing of our services is

attractive to banks, credit unions and other affinity groups

Outbound campaign with direct focus on small businesses through

television and radio

19 |

Our

Strategy & Mission We are a thought leader and destination for

independent owner operators of small businesses. The Small Business

Authority provides products, services, and data to small and medium size

businesses across the United States to grow their sales, reduce

their expenses, reduce their risk and offer state of the art efficient

business strategies, structures, and content to run their businesses.

20 |

Small Business Authority

Branding Achievements

We anticipate Forbes publishing daily Small Business Authority

Blog

We anticipate Forbes publishing monthly Small Business

Authority Index

We anticipate Forbes publishing monthly Small Business

Authority Market Sentiment Survey

21 |

Small Business Authority

Branding Achievements

Small Business Authority Hour

All shows podcast on thesba.com and wabcradio.com

2/5/11 –

Show on Business Entrepreneurship

3/5/11 –

Show on Healthcare and Health Insurance effects on

small businesses

4/2/11 –

Show on Small Business Lending

5/7/11 –

Show on eCommerce

6/4/11 –

Show on Cloud Computing

22 |

77 WABC Radio

“Reporting Live from The Small Business Authority Studios”

over 400 mentions per month

Over 250 sixty second radio commercials per month. Hear our

spots on www.thesba.com

click on community, then click on radio spots to hear our personalities, like

Imus, Hannity, Levin, Kudlow, Batchelor and McIntyre broadcast our spots

The Small Business Authority Hour

The first Saturday of every month on 77 WABC and WABCradio.com (click

listen live)

Our show for independent business owners and operators

Go

to

our

website

www.thesba.com,

click

on

community

and

then

radio

spots

to

listen to the podcasts

23 |

WABC Radio

“The Imus in the Morning Show”

–

broadcast Monday through

Friday, 6am EST to 9:20am EST on 77 WABC and Fox

Business News

See Warner Wolfe broadcast sports from the SBAS several

times each morning

See

Bernard

McGirk

broadcast

his

“Bernie

Briefing”

from

the

SBAS

several

times

each

morning

Backdrop

Microphone flags

Testing for future growth for Thesba brand and direct-to-market

distribution

SBAS –

Small Business Authority Studios

24 |

SB

Authority Index Financial barometer for small business economy

Made up of eight primary business and economic components

of the small business economy

SB Authority Index released at beginning of every month

Available in our newsletter with over 50,000 in distribution

Available

on

our

website

now

at

www.thesba.com

25 |

SB

Authority Market Sentiment Survey On a monthly basis, delivers the pulse of

the small business economy by polling our client base on topical issues

like health care, the lending environment and other important issues

effecting small businesses

Usually poll in excess of 1,200 respondents

Released once per month

Results are available in our newsletter with over 50,000 in

distribution

Available to all to participate and view results on our website at

www.thesba.com

26 |

Small Business Authority Hour

Live radio for small business on the first Saturday of every

month broadcasting from The Small Business Authority Studios

on 77 WABC or nationally at WABCRadio.com

Produced and directed by Newtek for independent business

owners and operators

Discussing key small business issues like health care and the

business lending environment

Special guests, small business news and call-ins each and

every month

27 |

Marketing Focus |

Strategic Alliance Partner Channel

Still our workhorse for distribution, clientele and relationships

Driven by Newtracker™

which has a patent pending

Referral volume continues to grow on a consolidated basis

CUNA

Latino Coalition

Pershing

Morgan Stanley Smith Barney

Chartis

New York Community Bank

The Company Corporation

Humana Insurance Company

29 |

Small Business Authority Channel

Grow internet web based direct business

through search

through branding on TV, radio, print and public relations

Increased recognition as the authority on business issues for

small businesses

Grow as the destination spot for independent owner/operator

businesses

Become recognized as best of breed in each area of:

Lending

Electronic payment processing

Insurance brokerage

Outsourced technology managed services

Business information

Payroll

Data storage

Health insurance

30 |

In Conclusion

31 |

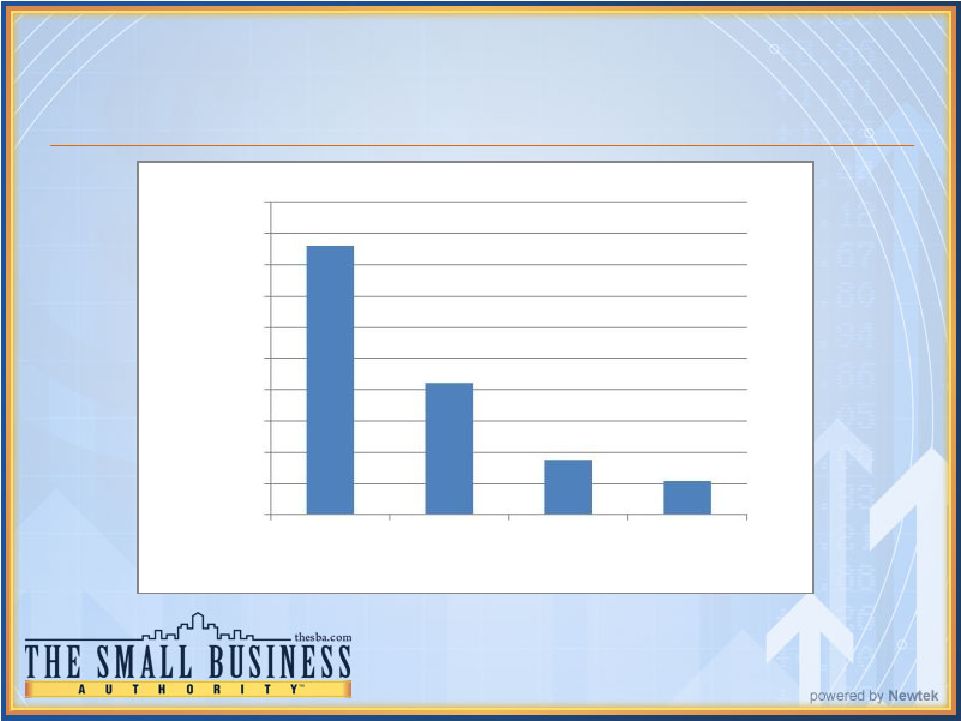

Annual Pretax Income (Loss) Trend

-$18

-$12

-$6

$0

$6

2007

Actual

2008

Actual

2009

Actual

2010

Actual

2011

Forecast

Midpoint

32

Pretax Income

(Loss)

$(17.5)

$(13.1)

$(4.0)

$0.9

in millions

$2.8 |

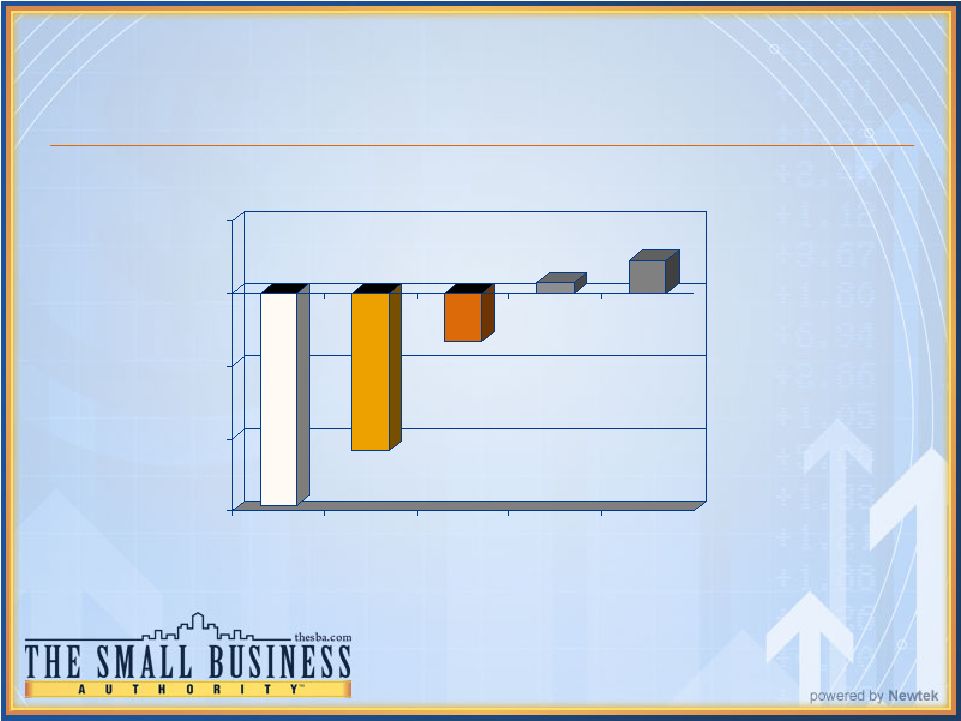

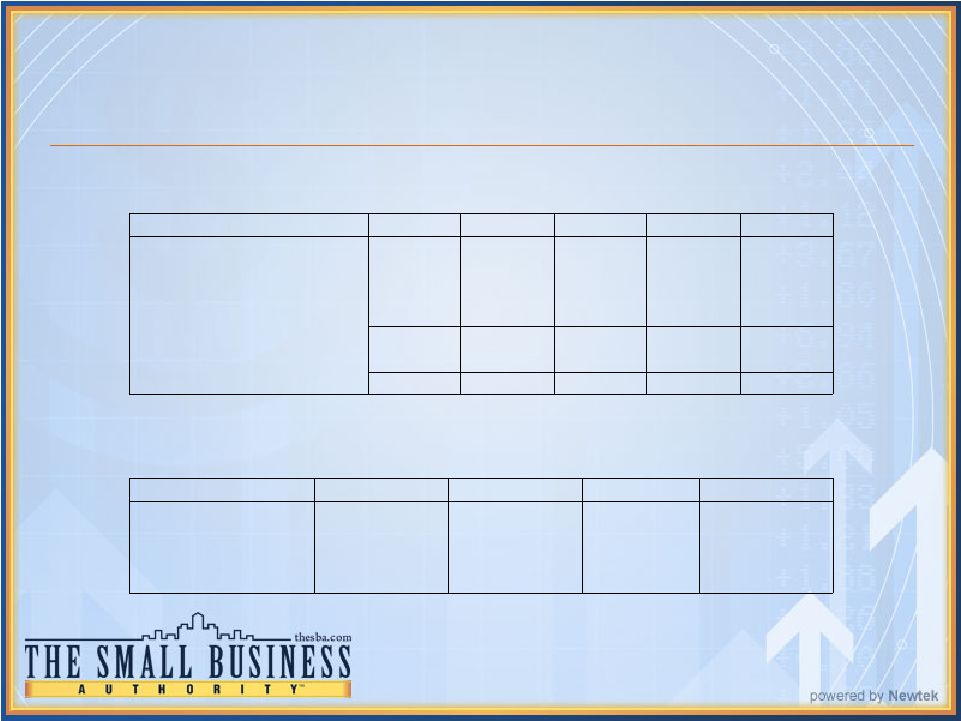

2011 Current Segment

Guidance 33

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Managed

Small

Payment

Technology

Business

All

Corporate

Processing

Solutions

Finance

Other

Activities

Low

High

Low

High

Low

High

Low

High

Low

High

2011 Full Year

Revenue

79.1

82.5

19.9

20.7

17.1

18.5

1.6

1.8

1.0

1.0

Pretax Net Income (Loss)

5.8

6.3

4.7

5.3

3.4

4.8

(1.2)

(1.0)

(9.7)

(9.3)

Interest Expense

-

-

0.1

0.1

1.5

1.7

-

-

-

-

Depreciation and Amortization

1.4

1.4

1.7

1.7

1.0

1.0

0.1

0.1

0.3

0.3

EBITDA

7.2

7.7

6.5

7.1

5.9

7.5

(1.1)

(0.9)

(9.3)

(8.9)

Total

Business

CAPCO

Intercompany

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

2011 Full Year

Revenue

118.7

124.4

2.5

2.5

(1.6)

119.6

125.3

Pretax Net Income (Loss)

3.0

6.1

(1.8)

(1.8)

-

1.2

4.3 |

Consolidated Annual Pretax Income (Loss)

Year

Amount (in millions)

2007

$(17.5)

2008

$(13.1)

2009

$(4.0)

2010

$0.9

2011 (Forecast range midpoint)

$2.8

34 |

Financial Review

Seth A. Cohen -

CFO |

Non-GAAP Financial Measures

In

evaluating

its

business,

Newtek

considers

and

uses

EBITDA

as

a

supplemental

measure

of

its

operating performance. The Company defines EBITDA as earnings before interest

expense, taxes,

depreciation

and

amortization.

Newtek

uses

EBITDA

as

a

supplemental

measure

to

review

and

assess

its

operating

performance.

The

Company

also

presents

EBITDA

because

it

believes it

is frequently used by securities analysts, investors and other interested parties

as a measure of financial performance.

The term EBITDA is not defined under U.S. generally accepted accounting principles,

or U.S. GAAP, and is not a measure of operating income(loss), operating

performance or liquidity presented in accordance with U.S. GAAP.

EBITDA has limitations as a analytical tool and, when assessing the

Company’s operating performance, investors should not consider EBITDA in

isolation, or as a substitute for net income (loss) or other consolidated income

statement data prepared in accordance with U.S. GAAP. Among other

things, EBITDA does not reflect the Company’s actual cash

expenditures. Other companies may calculate similar measures

differently

than

Newtek,

limiting

their

usefulness

as

comparative

tools.

Newtek

compensates

for

these limitations by relying primarily on its GAAP results and using EBITDA only

supplementally. 36 |

Selected Balance Sheet Items

Balance at

March 31, 2011

Balance at

December 31, 2010

Cash and cash equivalents

$13,851

$10,382

Restricted cash

$7,686

$10,747

Broker receivable

$4,081

$12,058

SBA loans held for sale, at fair value

$5,559

$1,014

Total short term liquidity

$31,177

$34,201

Notes payable

$28,001

$28,053

37

In thousands of dollars |

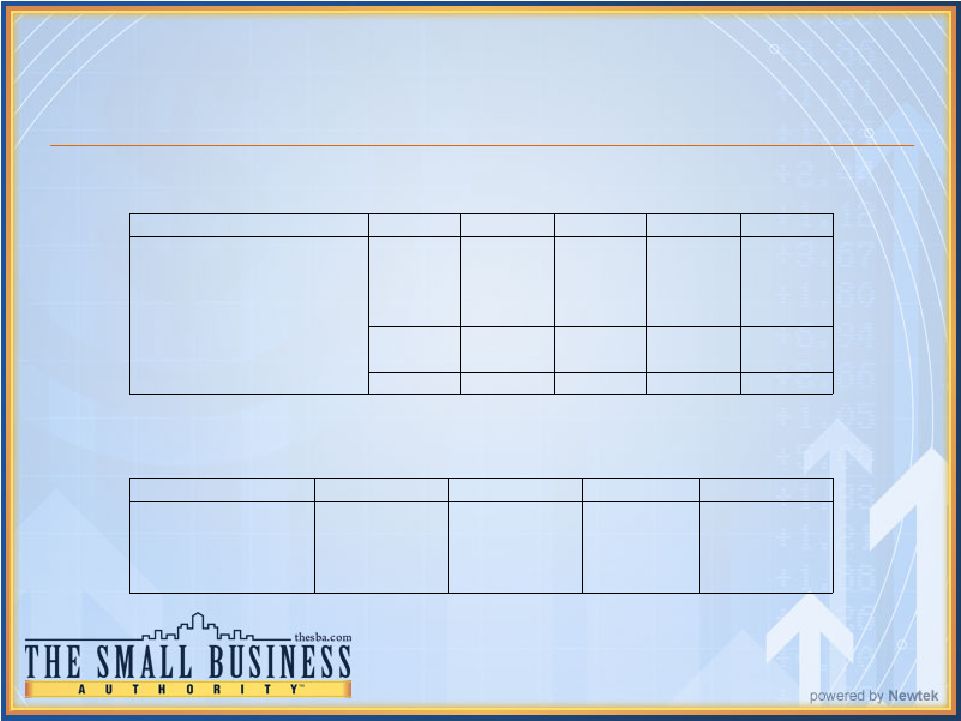

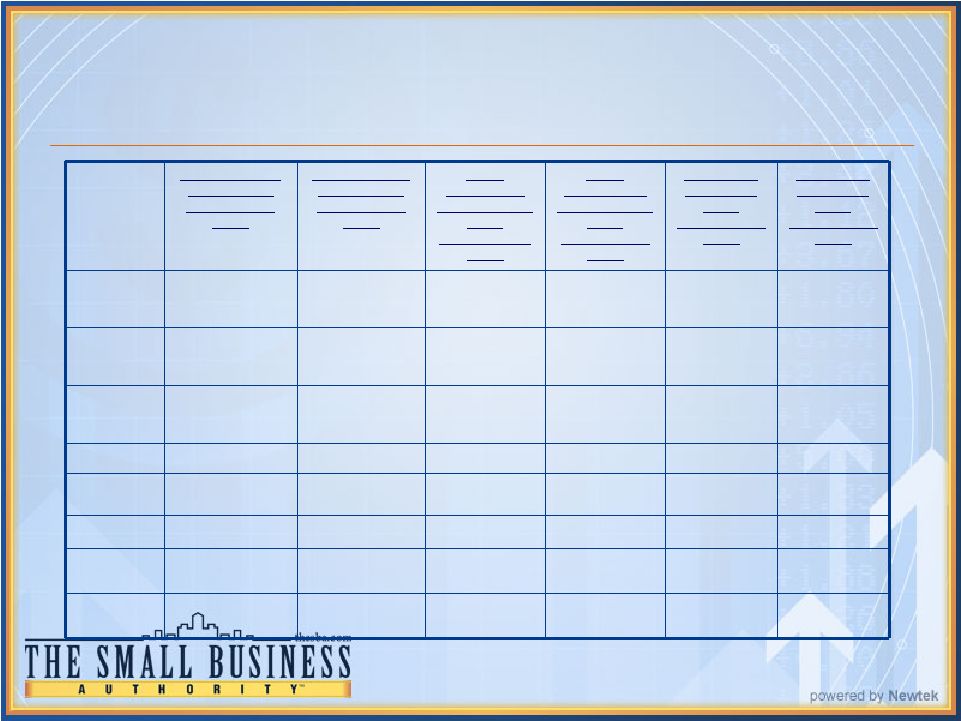

Q1 2011 Actual vs. Q1

2010 Actual 38

In millions of dollars

Revenue

For The

Quarter Ended

March

31, 2011

Actual

Revenue For The

Quarter Ended

March 31, 2010

Actual

Pretax

Income (Loss)

For The Quarter

Ended

March 31, 2011

Actual

Pretax

Income (Loss)

For The Quarter

Ended

March 31, 2010

Actual

EBITDA For

The Quarter

Ended

March 31, 2011

Actual

EBITDA

For

The Quarter

Ended

March 31, 2010

Actual

Electronic

Payment

Processing

20.089

18.763

1.204

1.084

1.585

1.500

Managed

Technology

Solutions

4.829

4.790

1.231

0.932

1.634

1.440

Small

Business

Finance

5.053

1.322

1.271

(0.110)

2.093

0.435

All Other

0.354

0.337

(0.296)

(0.348)

(0.275)

(0.303)

Corporate

Activities

0.335

0.708

(1.965)

(1.531)

(1.907)

(1.441)

CAPCO

0.340

0.780

(0.611)

(0.901)

Interco

Eliminations

(0.477)

(0.847)

Total

30.523

25.853

0.834

(0.874) |

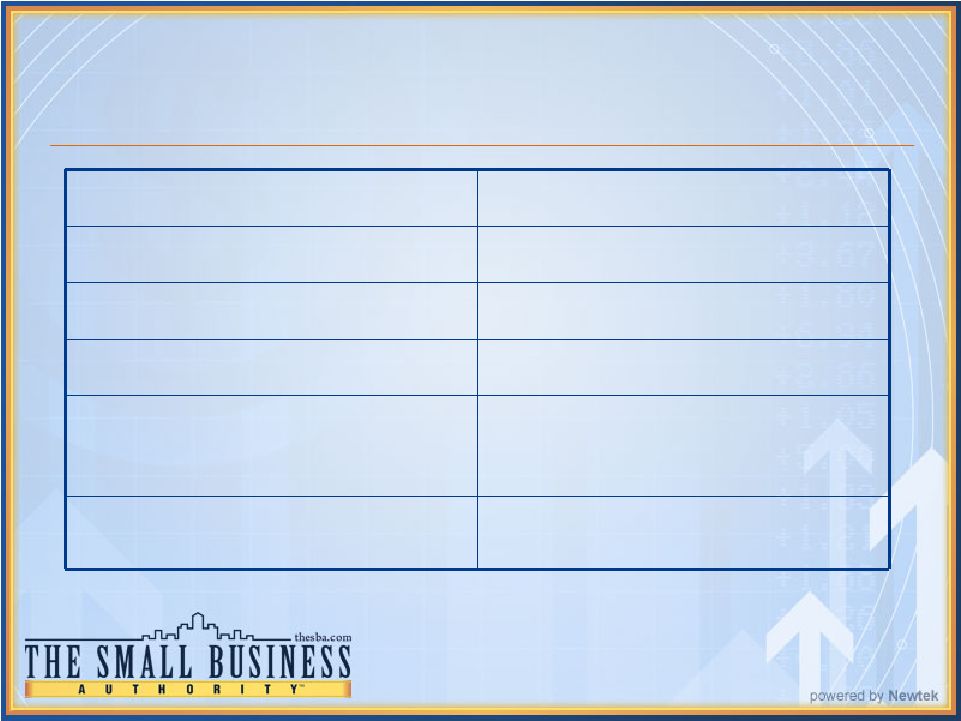

2011

Current Segment Guidance 39

*Note: totals may not add due to rounding

In millions of dollars

Electronic

Managed

Small

Payment

Technology

Business

All

Corporate

Processing

Solutions

Finance

Other

Activities

Low

High

Low

High

Low

High

Low

High

Low

High

2011 Full Year

Revenue

79.1

82.5

19.9

20.7

17.1

18.5

1.6

1.8

1.0

1.0

Pretax Income (Loss)

5.8

6.3

4.7

5.3

3.4

4.8

(1.2)

(1.0)

(9.7)

(9.3)

Interest Expense

-

-

0.1

0.1

1.5

1.7

-

-

-

-

Depreciation and Amortization

1.4

1.4

1.7

1.7

1.0

1.0

0.1

0.1

0.3

0.3

EBITDA

7.2

7.7

6.5

7.1

5.9

7.5

(1.1)

(0.9)

(9.3)

(8.9)

Total

Business

CAPCO

Intercompany

Segments

Segment

Eliminations

Total

Low

High

Low

High

Low

High

2011 Full Year

Revenue

118.7

124.4

2.5

2.5

(1.6)

119.6

125.3

Pretax Income (Loss)

3.0

6.1

(1.8)

(1.8)

-

1.2

4.3 |

Going Forward: 2011

Barry Sloane -

CEO |

Questions & Answers |

Addendum |

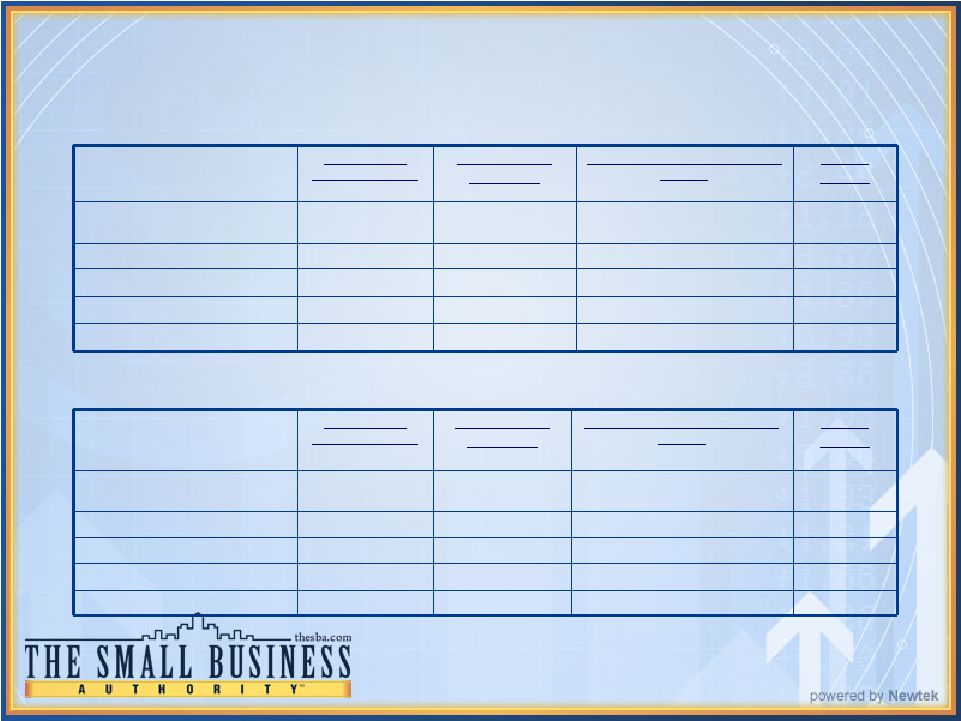

43

Pretax Income

(Loss) for Q1 2011

Interest Expense

for Q1 2011

Depreciation

and

amortization for

Q1 2011

Q1 2011

EBITDA

Electronic Payment Processing

1.204

-

0.381

1.585

Managed Technology Solutions

1.231

0.028

0.375

1.634

Small Business Finance

1.271

0.630

0.192

2.093

All Other

(0.296)

-

0.021

(0.275)

Corporate Activities

(1.965)

-

0.058

(1.907)

Pretax Income

(Loss) for Q1 2010

Interest

Expense

for Q1 2010

Depreciation

and

amortization for

Q1 2010

Q1 2010

EBITDA

Electronic Payment Processing

1.084

-

0.416

1.500

Managed Technology Solutions

0.932

0.018

0.490

1.440

Small Business Finance

(0.110)

0.333

0.212

0.435

All Other

(0.348)

-

0.045

(0.303)

Corporate Activities

(1.531)

-

0.090

(1.441)

EBITDA Reconciliation

EBITDA Reconciliation from Net Income (Loss)

For the three months ended March 31, 2011

In millions of dollars

EBITDA Reconciliation from Net Income (Loss)

For the three months ended March 31, 2010

In millions of dollars |