Attached files

| file | filename |

|---|---|

| EX-31.1 - NEDAK ETHANOL, LLC | form10qex311_051011.htm |

| EX-32.2 - NEDAK ETHANOL, LLC | form10qex322_051011.htm |

| EX-31.2 - NEDAK ETHANOL, LLC | form10qex312_051011.htm |

| EX-32.1 - NEDAK ETHANOL, LLC | form10qex321_051011.htm |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|||

|

Form 10-Q

|

|||

|

(Mark one)

|

|||

|

R

|

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the quarterly period ended March 31, 2011

|

|||

|

£

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

||

|

For the transition period from _________ to __________

|

|||

|

Commission file number 000-52597

|

|||

|

NEDAK ETHANOL, LLC

|

|||

|

(Exact name of registrant as specified in its charter)

|

|||

|

Nebraska

|

20-0568230

|

||

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

||

|

87590 Hillcrest Road, P.O. Box 391, Atkinson, Nebraska 68713

|

|||

|

(Address of principal executive offices)

|

|||

|

(402) 925-5570

|

|||

|

(Registrant’s telephone number, including area code)

|

|||

|

__________________________________________________________________

|

|||

|

(Former name, former address and former fiscal year, of changed since last report)

|

|||

|

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

|

|||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the proceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes £ No £

|

|||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|||

|

Large accelerated filer £ Accelerated filer £ Non-accelerated filer £ Smaller reporting company R

|

|||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No R

|

|||

|

As of May 10, 2011, the issuer had 5,233 Common and 185.5 Class A Preferred Membership Units issued and outstanding.

|

|||

TABLE OF CONTENTS

|

PART I—FINANCIAL INFORMATION

|

|||

|

Item Number

|

Item Matter

|

Page Number

|

|

|

Item 1.

|

Condensed Unaudited Financial Statements.

|

1

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

13

|

|

|

Item 4

|

Controls and Procedures.

|

24

|

|

|

PART II—OTHER INFORMATION

|

|||

|

Item 1.

|

Legal Proceedings.

|

24

|

|

|

Item 1A

|

Risk Factors

|

24

|

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds.

|

24

|

|

|

Item 3.

|

Defaults Upon Senior Securities.

|

24

|

|

|

Item 5.

|

Other Information.

|

25

|

|

|

Item 6.

|

Exhibits.

|

25

|

|

|

Signatures

|

26

|

||

i

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

|

NEDAK ETHANOL, LLC

|

|||||||

|

Condensed Unaudited Balance Sheets

|

|||||||

|

March 31,

2011

|

December 31,

2010

|

||||||

|

ASSETS (Note 7)

|

|||||||

|

Current Assets

|

|||||||

|

Cash and equivalents

|

$

|

809,186

|

$

|

1,618,244

|

|||

|

Restricted short term investment (Note 6)

|

1,163,581

|

1,163,581

|

|||||

|

Restricted cash (Notes 7, 8 and 10)

|

1,025,998

|

1,043,173

|

|||||

|

Accounts receivable

|

2,103,615

|

2,813,133

|

|||||

|

Inventory (Note 3)

|

4,678,358

|

5,267,330

|

|||||

|

Prepaid expenses and other

|

445,796

|

208,190

|

|||||

|

Total current assets

|

10,226,534

|

12,113,561

|

|||||

|

Property and Equipment, net (Note 4)

|

73,644,621

|

75,160,322

|

|||||

|

Deposits

|

550,000

|

550,000

|

|||||

|

Debt Issuance Costs, net of accumulated amortization of $752,729 and $696,175 as of March 31, 2011 and December 31, 2010, respectively

|

1,008,506

|

1,065,060

|

|||||

|

Total other assets

|

1,558,506

|

1,615,060

|

|||||

|

Total Assets

|

$

|

85,429,661

|

$

|

88,889,033

|

|||

|

LIABILITIES AND MEMBERS’ EQUITY

|

|||||||

|

Current Liabilities

|

|||||||

|

Current maturities of long-term debt (Notes 2, 7 and 8)

|

$

|

6,472,784

|

$

|

6,025,417

|

|||

|

Accounts payable

|

|||||||

|

Trade

|

1,101,486

|

1,244,868

|

|||||

|

Corn

|

1,841,478

|

5,322,868

|

|||||

|

Accrued liabilities (Note 2)

|

4,976,783

|

4,164,646

|

|||||

|

Reclassification of long-term debt to current (Notes 2, 7 and 8)

|

37,237,800

|

38,579,904

|

|||||

|

Total current liabilities

|

51,630,331

|

55,337,703

|

|||||

|

Long-Term Debt, net of Current Maturities (Notes 2, 7 and 8)

|

18,750

|

18,750

|

|||||

|

Commitments and Contingencies (Notes 2, 5, 6 and 10)

|

|||||||

|

Members’ Equity (Note 5)

|

|||||||

|

Preferred Units, 185.5 units issued and outstanding as of March 31, 2011 and December 31, 2010

|

1,854,503

|

1,854,503

|

|||||

|

Common Units, net of offering costs, 5,233 units issued and outstanding

|

49,839,281

|

49,839,281

|

|||||

|

Accumulated deficit

|

(17,913,204)

|

(18,161,204)

|

|||||

|

Total members’ equity

|

33,780,580

|

33,532,580

|

|||||

|

Total Liabilities and Members’ Equity

|

$

|

85,429,661

|

$

|

88,889,033

|

|||

|

See Notes to Condensed Unaudited Financial Statements.

|

|||||||

1

|

NEDAK ETHANOL, LLC

|

||||

|

Condensed Unaudited Statements of Operations

|

||||

|

Three Months Ended March 31,

|

||||

|

2011

|

2010

|

|||

|

Revenues

|

$

|

35,088,344

|

$

|

20,931,245

|

|

Cost of Goods Sold

|

33,397,952

|

20,905,110

|

||

|

Gross Profit

|

1,690,392

|

26,135

|

||

|

General and Administrative Expenses

|

573,013

|

456,898

|

||

|

Operating Income (Loss)

|

1,117,379

|

(430,763)

|

||

|

Other Income (Expense)

|

||||

|

Gain from litigation settlement (Note 10)

|

-

|

3,000,000

|

||

|

Loss on sale of asset

|

(3,471)

|

-

|

||

|

Interest income

|

7,246

|

8,468

|

||

|

Interest expense

|

(874,482)

|

(850,999)

|

||

|

Other income

|

1,328

|

261

|

||

|

Total other income (expense)

|

(869,379)

|

2,157,730

|

||

|

Net Income

|

$

|

248,000

|

$

|

1,726,967

|

|

Net Income Per Common Unit—Basic & Diluted (Note 5)

|

$

|

38.65

|

$

|

321.27

|

|

See Notes to Condensed Unaudited Financial Statements.

|

||||

2

|

NEDAK ETHANOL, LLC

|

||||||||

|

Condensed Unaudited Statements of Cash Flows

|

||||||||

|

Three Months Ended March 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash Flows from Operating Activities

|

||||||||

|

Net income

|

$

|

248,000

|

$

|

1,726,967

|

||||

|

Adjustments to reconcile net income to net cash provided by operations:

|

||||||||

|

Depreciation and amortization

|

1,565,534

|

1,572,863

|

||||||

|

Loss on sale of assets

|

3,471

|

-

|

||||||

|

Change in fair value of derivative financial instruments

|

-

|

(441,112)

|

||||||

|

Change in operating assets and liabilities:

|

||||||||

|

Receivables

|

709,518

|

(361,781)

|

||||||

|

Inventory

|

588,972

|

123,920

|

||||||

|

Prepaid expenses and other

|

(237,606)

|

219,250

|

||||||

|

Accounts payable

|

(3,624,772)

|

1,171,680

|

||||||

|

Accrued liabilities

|

812,137

|

452,479

|

||||||

|

Net cash provided by operating activities

|

65,254

|

4,464,266

|

||||||

|

Cash Flows from Investing Activities

|

||||||||

|

Purchases of property and equipment

|

-

|

(10,744)

|

||||||

|

Cash proceeds from sale of fixed assets

|

3,250

|

-

|

||||||

|

Net change in restricted cash and investments

|

17,175

|

(2,991,815)

|

||||||

|

Net cash provided by (used in) investing activities

|

20,425

|

(3,002,559)

|

||||||

|

Cash Flows from Financing Activities

|

||||||||

|

Payment on construction loan

|

(894,737)

|

-

|

||||||

|

Sale of Preferred Units

|

-

|

(100,000)

|

||||||

|

Net cash used in financing activities

|

(894,737)

|

(100,000)

|

||||||

|

Increase (Decrease) in Cash and Equivalents

|

(809,058)

|

1,361,707

|

||||||

|

Cash and Equivalents—Beginning of Period

|

1,618,244

|

1,853,959

|

||||||

|

Cash and Equivalents—End of Period

|

$

|

809,186

|

$

|

3,215,666

|

||||

|

See Notes to Condensed Unaudited Financial Statements.

|

||||||||

3

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The unaudited interim condensed financial statements of NEDAK Ethanol, LLC (the “Company”) reflect all adjustments consisting only of normal recurring adjustments that are, in the opinion of management, necessary for fair presentation of financial position, results of operations and cash flows. The results for the three month period ended March 31, 2011 is not necessarily indicative of the results that may be expected for a full fiscal year. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) are condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), although the Company believes that the disclosures made are adequate to make the information not misleading. The accompanying balance sheet as of December 31, 2010 is derived from the audited financial statements as of that date. These condensed unaudited financial statements should be read in conjunction with the Company’s audited financial statements and notes thereto included in the annual report for the year December 31, 2010, filed as an exhibit to the Form 10-K filed with the SEC.

Nature of Business

The Company operates a 44 million gallon per year ethanol plant in Atkinson, Nebraska, and produces and sells fuel ethanol and distiller’s grains, a co-product of the ethanol production process. Sales of ethanol and distiller’s grains began in January 2009.

Accounting Estimates

Management uses estimates and assumptions in preparing these financial statements in accordance with GAAP. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. The Company uses estimates and assumptions in accounting for the following significant matters, among others: the allowance for doubtful accounts, useful lives of property and equipment, the valuation of inventory and inventory purchase commitments and long-lived asset impairments including the assumptions used to estimate future cash flows, the ability to raise capital, and the ability to comply with certain provisions within the Company’s credit agreements. Actual results may differ from estimated amounts, and such differences may be material to the Company’s financial statements. The Company periodically reviews estimates and assumptions, and the effects of revisions are reflected in the period in which the revisions are made.

2. LIQUIDITY AND MARKET UNCERTAINTIES

The Company has certain risks and uncertainties that it experiences during volatile market conditions such as what the ethanol industry experienced during 2008 and which continued through 2009 and 2010. These volatilities can have a severe impact on operations.

As a commodity processor, the Company’s profitability is primarily driven by the relationship between the cost of corn and the price at which the Company can sell its end-products, ethanol and wet distiller’s grains (“WDG”). The price of ethanol is influenced by factors such as supply and demand, the weather, government policies and programs, unleaded gasoline prices and the petroleum markets as a whole. Excess ethanol supply in the market, in particular, puts downward pressure on the price of ethanol. The Company’s largest cost of production is corn. The Company’s cost of corn is generally impacted by factors such as supply and demand, the weather, government policies and programs, and risk management techniques used to protect against the price volatility. The Company is subject to significant risk that its operating margins may be reduced or eliminated due to the relative movements in the market prices of its products and major manufacturing inputs. As a result, market fluctuations in the price of or demand for these commodities can have a significant adverse effect on the Company’s operations and profitability. Due to the current conditions of these commodity markets, the Company may again produce negative margins.

4

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

As of March 31, 2011, the Company was in default of its Credit Agreement and its Tax Increment Financing, as further discussed in Notes 7 and 8. For this reason, the Company has reclassified amounts owing under these loans as current liabilities. Such treatment of the Company’s long term debt will continue, as required by GAAP, until such defaults are cured.

Because of these events and market conditions, there is an increased level of uncertainty with respect to the Company’s ability to obtain sufficient cash flows from operations or debt or equity financing sufficient to cover the liquidity needed for ongoing operations. The Company has continued discussions with its lenders to resolve defaults under the Credit Agreement and Tax Increment Financing, which may include entering into a tolling agreement and obtaining additional capital. A final resolution to the defaults and amortization of the loans will require approval of the lenders and may include requirements for additional capital. The Company has also engaged a firm to undertake a more systematic approach to potential capital sources.

The Company continues to work with its lenders and others to identify the means by which it can improve its capital position. Improved capitalization would better enable the Company to hedge and better manage its market risk in the commodity markets, among other things. Improving its capitalization will likely involve restructuring its debt so that both the debt level and the associated covenants are more compatible with current market conditions, and may also involve the Company issuing equity.

Exclusive of the reclassification of the majority of the Company’s long term debt to current liabilities, the Company would have had negative working capital of $4,165,997, which includes restricted cash and investments of $2,189,579, and which includes only current maturities of long term debt that represent normal amortization of principal, as of March 31, 2011. As reported in the balance sheet, including the reclassification of long term debt to current liabilities, working capital was a negative $41,403,798 as of March 31, 2011.

Accrued liabilities include accrued board compensation of $1,013,500 and $741,750 as of March 31, 2011 and 2010, respectively, and accounts payable include amounts due to the Company’s grain procurement agent totaling approximately $560,907 and $777,334 as of March 31, 2011 and 2010, respectively, which have had favorable payment terms. If these favorable payment terms cease, more cash may be required.

These financial statements have been prepared assuming the Company will continue as a going concern. Until the Company is able to obtain additional working capital from the above options, for which no assurance can be given, or from operations, and in addition, modify the Credit Agreement covenants or refinance the construction loan, there is substantial doubt as to whether the Company can continue to operate as a going concern.

3. INVENTORY

Inventory consists of the following:

|

March 31, 2011

|

December 31, 2010

|

|||

|

Finished goods

|

$

|

2,846,533

|

$

|

3,478,089

|

|

Work in process

|

1,101,144

|

912,104

|

||

|

Raw materials

|

730,681

|

877,137

|

||

|

Total

|

$

|

4,678,358

|

$

|

5,267,330

|

5

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

4. PROPERTY AND EQUIPMENT

Property and equipment consisted of the following as of March 31, 2011 and December 31, 2010:

|

March 31, 2011

|

December 31, 2010

|

||

|

Land and improvements

|

$ 4,408,272

|

$ 4,408,272

|

|

|

Buildings

|

9,121,024

|

9,121,024

|

|

|

Plant equipment

|

73,209,117

|

73,216,667

|

|

|

Office equipment

|

200,575

|

200,575

|

|

|

Vehicles

|

560,383

|

560,383

|

|

|

87,499,371

|

87,506,623

|

||

|

Less accumulated depreciation

|

(13,854,750)

|

(12,346,599)

|

|

|

Net property and equipment

|

$ 73,644,621

|

$ 75,160,322

|

Depreciation expense for the periods ended March 31, 2011 and 2010 was $1,508,980 and $1,504,947, respectively.

5. MEMBERS’ EQUITY

As of March 31, 2011, there were 185.5 preferred membership units (“Preferred Units”). The Preferred Units entitle the holders thereof, among other things, to receive a preferred cumulative distribution of 10% (“Preferred Return”) before holders of common membership units receive distributions. Following the third anniversary of the issuance of the Preferred Units, the Company may redeem Preferred Units for the original purchase price plus any accrued but unpaid distributions. The accumulated undeclared Preferred Return as of March 31, 2011 was $364,627, and the total liquidation preference of the Preferred Units as of March 31, 2011 was $2,219,130. Losses are generally allocated to all units based upon their respective percentage of units held, except that losses are not allocated to Preferred Units if the Preferred Return has not been achieved.

A reconciliation of net income applicable to common units used in the calculation of net income per common unit for the three months ended March 31, 2011 and 2010 is as follows:

|

Three Months Ended March 31,

|

||||||

|

2011

|

2010

|

|||||

|

Net income

|

$ 248,000

|

$ 1,726,967

|

||||

|

Preferred Return on Preferred Units

|

(45,727)

|

(45,737)

|

||||

|

Net income applicable to Common Units

|

$ 202,273

|

$ 1,681,230

|

||||

|

Weighted average Common Units Outstanding -

|

||||||

|

Basic and Diluted

|

5,233

|

5,233

|

||||

|

Net income per Common Unit - Basic and Diluted

|

$ 38.65

|

$ 321.27

|

||||

6. LINE OF CREDIT

In March 2006, the Company entered into a line of credit agreement in favor of its natural gas transporter (see Note 10) to reserve pipeline space. The natural gas transporter may draw up to $150,000 until maturity in May 2011. Interest is payable upon the lender’s demand or in May 2011 at a rate of 3.35%. In August 2007, the Company

6

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

entered into a line of credit agreement in favor of its natural gas transporter for the service of transporting gas. The natural gas transporter may draw up to $923,828. Interest is payable upon the lender’s demand at a rate of 3.75%. These agreements are secured by restricted short term investments totaling $1,163,581 as of March 31, 2011 and December 31, 2010. As of March 31, 2011 and December 31, 2010, there were no borrowings outstanding on the lines of credit. All restricted short term investments and lines of credit are automatically renewed upon expiration.

7. LONG-TERM DEBT

|

March 31, 2011

|

December 31, 2010

|

|||

|

Construction loan under Credit Agreement

|

$

|

37,131,584

|

$

|

38,026,321

|

|

Members’ notes payable

|

18,750

|

18,750

|

||

|

Tax increment financing note (Note 8)

|

6,579,000

|

6,579,000

|

||

|

43,729,334

|

44,624,071

|

|||

|

Less current maturities

|

(6,472,784)

|

(6,025,417)

|

||

|

Less debt previously classified as long-term

|

(37,237,800)

|

(38,579,904)

|

||

|

$

|

18,750

|

$

|

18,750

|

The maturities of long term debt as of March 31, 2011, are as follows:

|

2011

|

$ 43,710,584

|

||

|

2012

|

18,750

|

||

|

Total long-term debt

|

$ 43,729,334

|

||

Construction Loan under Credit Agreement

In February 2007, the Company entered into a senior credit facility (“Credit Agreement”) with AgCountry Farm Credit Services, FLCA (“Lender”) for a multiple advance construction loan totaling $42,500,000. The Company was required to make interest payments during the construction phase at the thirty-day LIBOR plus 3.4%, but not less than 6.0%. The interest rate was 6.0% as of March 31, 2011. The performance test of the plant was completed in June 2009, but three significant equipment deficiencies prevented final acceptance at that time. The Credit Agreement provides that the construction loan is to be converted at final acceptance to a permanent ten year term loan of $32,500,000 and a $10,000,000 revolving term loan, which has not occurred as of March 31, 2011. As of March 31, 2011 and December 31, 2010, the Company had $37,131,584 and $38,026,321 outstanding on the construction loan, respectively.

Under the current terms of the Credit Agreement, the Company is required to make level monthly principal and interest payments of approximately $447,368 through February 1, 2018.

The Credit Agreement requires the Company to maintain certain financial covenants, including minimum working capital of $6,000,000, minimum current ratio of 1.20:1.00, minimum tangible net worth of $41,000,000, minimum owners’ equity ratio of 50%, and a minimum fixed charge coverage ratio of 1.25:1.00, and also includes restrictions on distributions and capital expenditures. As of March 31, 2011, the Company was in violation of the working capital and current ratio covenants (working capital was $(4,165,997) and the current ratio was 0.71:1.00, both exclusive of the debt reclassification), the tangible net worth requirement (tangible net worth was $39,286,998) and the fixed charge coverage ratio (intended to be an annual measure, but using year to date measures and three months of principal payment that ratio is 1.06:1.00). The Credit Agreement contains certain prepayment fees in the first four years of the scheduled payments, and the loan is secured by substantially all the Company’s assets.

On August 6¸ 2010, the Company executed a Sixth Supplement and Forbearance Agreement to the Master Credit Agreement (the “Sixth Supplement”), under which the Company agreed that Lender could apply the $3,945,087 it held as collateral under the Credit Agreement to the Company’s current obligations under the Credit Agreement, including monthly payments, penalties and interest. In exchange for the foregoing among other terms, Lender

7

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

agreed to refrain from exercising its rights under the Credit Agreement until the earlier of October 1, 2010 or the date of any default under the Sixth Supplement. The TIF Lender (defined in Note 8) filed a suit alleging a breach of the TIF Loan, which constituted a breach under the Sixth Amendment, but the Lender has not taken any actions directly related to the breach.

The Company and the Lender remain in discussions to revise the Credit Agreement covenants and resolve outstanding defaults under the Credit Agreement. In light of continuing poor margins in the ethanol industry, the Lender has indicated the Company should focus on mitigation of risk and obtaining additional capital.

Effective February 1, 2011, the Company entered into a Seventh Supplement and Forbearance Agreement with the Lender (the “Seventh Supplement”), under which the Lender agreed to forbearance from exercising its enforcement rights under the Loan Agreements until the earliest to occur of June 30, 2011 and the occurrence of an “event of default” under the Seventh Supplement. In addition, the Company agreed that the Lender may apply the proceeds of a letter of credit issued in connection with the Fifth Supplement and Forbearance Agreement dated September 30, 2009 against any amounts due under the Loan Agreement, at the Lender’s sole discretion. In addition, the Company agreed to deliver a comprehensive strategic financial plan, or update the plan previously delivered, to the Lender by March 31, 2011. Furthermore, the Company has also committed to raise additional capital prior to expiration of the forbearance period provided in the Seventh Supplement, and the Company is obligated to provide certain financial statements, books, records and budgets to lender on a periodic basis as set forth in the Seventh Supplement.

Note Payable to Members

In May 2004, each of the initial 15 members loaned the Company $1,000. The unsecured loans bore interest at 5% per annum with principal and interest due on April 8, 2009. On April 8, 2009, the notes were amended and restated to add accrued interest in the amount of $3,750 to the principal. The unsecured notes, which are classified as long-term debt as of March 31, 2011, continue to bear interest at 5% per annum with principal and interest due on April 8, 2012.

8. TAX INCREMENT FINANCING

In September 2007, the City of Atkinson, Nebraska, (“Issuer”) issued a tax increment financing Note (the “TIF Note”), the net proceeds of which in the amount of $4,939,925 were paid to the Company through a loan (the “TIF Loan”) to reimburse the Company for certain infrastructure improvements relating to the plant. Repayment of the Loan is secured by the Company’s pledge to the lender of the TIF Note (“TIF Lender”) and other obligations relating to the TIF Note. The original amount of the TIF Note was $6,864,000 and bears interest of 9.5%.

In connection with the issuance of the Note, the Issuer and the Company entered into a Redevelopment Contract (“Contract”). Under the Contract, the Note proceeds were used for project costs, for the establishment of special funds held by the Note trustee for interest and principal payments and reserves (the “Capitalized Interest Fund” and the “Debt Service Reserve Fund”), and for debt issuance costs. As of March 31, 2011 and December 31, 2010, the Capitalized Interest Fund was approximately $6,500 and is included in restricted cash on the balance sheet.

Payments on the Note are due in semi-annual increments which commenced at $139,000 on June 1, 2009 and increase to $444,000, with a final maturity in December 2021. Interest on the Note is payable semi-annually on September 1 and December 1. The interest rate resets on September 1, 2012 and September 1, 2017 to a rate equal to the 5-year U.S. Treasury Constant Maturity index plus 4.75% for the applicable five-year period and the remainder of the term of the TIF Loan, respectively. The Company has the option to redeem or purchase the Note in whole or in part. As of March 31, 2011 and December 31, 2010, the Company had $6,579,000 outstanding on the TIF Loan.

On July 6, 2009, the TIF Lender notified the Company that the Debt Service Reserve Fund was deficient, constituting a default under the TIF Loan. The Company and the TIF Lender entered into a Forbearance Agreement dated December 31, 2009 (the “TIF Forbearance”). The Company and the TIF Lender failed to extend the TIF

8

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

Forbearance or reach other arrangements containing similar forbearance obligations by May 15, 2010, and the Company received a Notice of Default dated June 30, 2010 from the TIF Lender indicating that the Company was in default under the TIF Note due to nonpayment of $464,768 owing on June 1, 2010, and that the Debt Service Reserve Fund remained deficient by an amount of $588,553. Because of these defaults, the TIF Lender reserved the right to (i) charge the Company an interest rate of 4% over the interest rate the Lender would otherwise be able to charge the Company, (ii) charge the Company a late charge of 5% for payments which are more than 10 days overdue, (iii) accelerate the entire amount of principal outstanding under the TIF Loan (which was $6,579,000 as of June 30, 2010) and (iv) exercise any other rights available to it under TIF Forbearance or at law. Due to these defaults, the TIF Loan is classified as a current liability.

On August 12, 2010, the TIF Lender filed a lawsuit against the Company in the District Court of Douglas County, Nebraska alleging that the Company failed to make certain payments due under the TIF Note and failed to maintain the required debt service reserve fund. In addition, the lawsuit stated that the TIF Lender accelerated the maturity of the TIF Note. The TIF Lender sought in the lawsuit repayment of $7,039,126 due as of August 9, 2010, plus such additional amounts as become due and owing under the TIF Note, with interest accruing after August 9, 2010 at the rate of 9.5% until the judgment is paid. On April 20, 2011, the court granted a partial summary judgment motion filed by the TIF Lender, subject to a hearing to determine costs and interest. The matter is still pending subject to final disposition.

Under the terms of the Contract, a portion of the real estate taxes paid by the Company would be used to make principal and interest payments on the TIF Note. However, the Company is not in compliance with the Contract due to nonpayment of real estate taxes. The Company has accrued the full amounts of 2009 and 2010 real estate taxes due as of March 31, 2011 and December 31, 2010 in accrued expenses on the balance sheet.

9. FAIR VALUE MEASUREMENTS

Accounting standards establish a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of the fair value hierarchy are described below:

Level 1: Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access.

Level 2: Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3: Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

There were no assets or liabilities measured at fair value on a recurring or nonrecurring basis as of March 31, 2011 or December 31, 2010.

The carrying values of cash and cash equivalents, restricted cash, restricted short-term investments, accounts receivable, and accounts payable are recorded at or approximate fair value. Management determined it is not practicable to estimate the fair value of the notes payable and long-term debt since these agreements contain unique terms, conditions, and restrictions, which were negotiated at arm’s length, and there was no readily determinable similar instrument on which to base an estimate of fair value.

9

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

10. COMMITMENTS AND CONTINGENCIES

Construction Contract

The Company entered into an Engineering, Procurement and Construction Services Fixed Price Contract dated August 9, 2006 (the “Delta-T Contract”) with Delta-T Corporation (“Delta-T”). Following a dispute, the parties amended the Delta-T Contract on September 1, 2009, which provided that, among other things: (i) Delta-T relinquished letter of credit proceeds of $3,995,000 held by Lender, and (ii) a $5,000,000 promissory note in Delta-T’s favor was extinguished. The extinguishment of the $5,000,000 promissory note and other contract liabilities were recorded as reductions to property and equipment. The relinquishment of the $3,995,000 letter of credit proceeds, less $228,431 for costs expected to be incurred, was recognized as gain in other income during the fourth quarter of 2009.

On March 19, 2010, the Company, Delta-T, Delta-T’s parent, Bateman Litwin NV (“Bateman”) and Bateman Engineering Inc. (“Bateman Engineering”) entered into a Settlement Agreement and Mutual Release (the “Settlement Agreement”), under which, among other things, Delta-T and Bateman authorized the Company to draw $3,000,000 from a letter of credit. The receipt of the $3,000,000 was recognized as a gain in other income in the first quarter of 2010, and held as restricted cash by the Company. Under the Sixth Supplement, various withdrawals were made from restricted cash to satisfy certain amounts due the Lender under the Credit Agreement, leaving $1,019,498 in restricted cash as of March 31, 2011.

Plant Management Agreement

In July 2007, the Company entered into an agreement with an unrelated party for the operation and management of the Company’s plant. The Company pays a fixed monthly payment of approximately $120,434 for such services, which will be adjusted annually. The unrelated party also supplies process chemicals, which the Company is currently paying for at a fixed rate per denatured gallon of ethanol produced. The existing contract allows for potential future payments in an incentive program intended to be based on operational improvements and company profitability. The agreement will terminate on December 31, 2014 unless terminated by either party giving 180 days prior written notice. The Company incurred approximately $381,000 for these services for the period ended March 31, 2011 and $365,000 for these services for the period ended March 31, 2010.

Utility Contracts

The Company has entered into a consulting service contract for management of the various facets of the demand for natural gas for use in plant operations. The three services of natural gas procurement required to operate the plant are transport, distribution and supply. The physical supply of natural gas to operate the plant is purchased from various companies based on bids established by the Company’s Risk Management Committee with the advice of the management services company. The gas is transported by Kinder Morgan pursuant to various contracts with the Company, and delivered to the local gas company, Source Gas, which distributes the gas to the plant.

Transportation Agreement

In July 2007, the Company entered into an agreement with a fuel carrier for the transportation of ethanol from the plant to the load out facility. The Company pays a base fee per gallon unloaded plus a surcharge if above the diesel fuel base. The agreement has a three year term which commenced July 2007 and will automatically renew for additional one-year terms unless terminated by either party by written notice no less than 180 days prior to the ending date of the initial three-year term or of any renewal term. No notice was issued by either party and the term of the agreement was automatically extended for one year through July 2011.

10

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

Marketing Agreements

Ethanol

In November 2006, the Company entered into a marketing agreement with an unrelated party for the sale of its ethanol, which arrangement terminated in December 2010. The Company paid the marketer a fixed rate fee of $0.01 per net gallon of denatured ethanol for the services provided.

The Company has lease agreements for 137 rail cars with this marketer. There are 29 cars under leases that expire before the end of 2011 and carry an average monthly rental cost of $400. The remaining 108 cars have expiration dates between May 31, 2017 and August 31, 2020, with average monthly rental cost of $658.

Since the arrangement with the former marketer terminated in December 2010, the Company has sold ethanol on the spot market through an arrangement with Tenaska BioFuels, LLC (“Tenaska”), which arrangement is terminable by either party at will. Under this arrangement, the Company pays Tenaska $0.02 per gallon of ethanol sold. As of March 31, 2011 the Company has forward contracted sales of ethanol with Tenaska for 1,247,000 gallons of ethanol at an average fixed price of $2.44 per gallon, for delivery in April 2011.

Revenues from ethanol sales to Tenaska in the quarter ended March 31, 2011 and to the former marketer in the quarter ended March 31, 2010 were $28,364,996 and $17,131,473 respectively. Accounts receivable from Tenaska as of March 31, 2011 and from the former marketer as of March 31, 2010 were $ 1,015,000 and $1,187,518, respectively.

Distiller’s Grains

In January 2007, the Company entered into a marketing agreement with an unrelated party to purchase all of the Company’s wet distiller’s grains with soluble (“WDGS”). The marketer paid the Company the selling price, less a marketing fee equal to $1.50 per ton of WDGS sold at $50 a ton or less or 3.0% of the price of WDGS sold over $50 a ton. Revenue from this marketer was approximately $5,781,000 and $2,436,000 for the three months ended March 31, 2011 and 2010, respectively. Accounts receivable from this marketer were $89,981 and $712,614 for the periods ended March 31, 2011 and December 31, 2010, respectively. The agreement was terminated on February 29, 2011. The Company has since sold its distiller’s grains directly to its purchasers without third party assistance.

Grain Procurement

In the years 2009 and 2010, the Company utilized the services of an unrelated party on an at-will basis to supply its corn. The agent was paid a service fee of $0.04 per bushel of grain delivered, and the Company also executes some contracts directly with producers (which include directors) for some of its corn. Purchases directly from the agent totaled approximately $6,570,667 and $901,751 for the three months ended March 31, 2011 and 2010, respectively. The Company has engaged Tenaska on an at-will basis to assist it with grain procurement, under which the Company’s corn cost is netted against its receivable for ethanol sold through Tenaska. No purchases have yet been made from Tenaska. The net amount of corn purchases have been from the various local producers.

In the ordinary course of business, the Company will enter into forward purchase contracts for its corn purchases. Management considers these forward contracts to be normal purchases since the corn will be delivered in quantities expected to be used by the Company over a reasonable period in the normal course of business. As of March 31, 2011, the Company had commitments on forward purchase contracts to purchase 1,165,369 bushels of corn at an average price of $6.06 per bushel totaling $7,067,000 for delivery between April 1, 2011 and July 31, 2011.

Environmental Liabilities

The Company’s operations are subject to environmental laws and regulations adopted by various governmental entities in the jurisdiction in which it operates. These laws require the Company to investigate and remediate the

11

NEDAK ETHANOL, LLC

Notes to Condensed Unaudited Financial Statements

March 31, 2011

effects of the release or disposal of materials at its location. Accordingly, the Company has adopted policies, practices, and procedures in the areas of pollution control, occupational health, and the production, handling, storage, and use of hazardous materials to prevent material environmental or other damage, and to limit the financial liability which could result from such events. Environmental liabilities are recorded when the liability is probable and the costs can be reasonably estimated.

Dryer Damage

On March 22, 2011, a fire caused approximately $1,200,000 of damage to a dryer. The Company expects its insurer to pay for the damage, less the $50,000 deductible.

12

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Forward Looking Statements

This quarterly report on Form 10-Q of NEDAK Ethanol, LLC (the “Company,” “we” or “us”) contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases you can identify forward-looking statements by the use of words such as “may,” “should,” “anticipate,” “believe,” “expect,” “plan,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the following factors:

|

|

·

|

Overcapacity in the ethanol industry;

|

|

|

·

|

Fluctuations in the price and market for ethanol and distiller’s grains;

|

|

|

·

|

Availability and costs of products and raw materials, particularly corn and natural gas;

|

|

|

·

|

Our ability to obtain the debt and equity financing necessary to operate our plant and our ability to meet the associated covenants;

|

|

|

·

|

Changes in our business strategy, capital improvements or development plans;

|

|

|

·

|

Mechanical difficulties in operation of the plant;

|

|

|

·

|

Changes in the environmental regulations that apply to our plant site and operations and our ability to comply with environmental regulations;

|

|

|

·

|

Our ability to hire and retain key employees for the operation of the plant;

|

|

|

·

|

Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agricultural, oil or automobile industries;

|

|

|

·

|

Changes in the weather and economic conditions impacting the availability and price of corn and natural gas;

|

|

|

·

|

Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives);

|

|

|

·

|

Changes and advances in ethanol production technology; and competition from alternative fuel additives;

|

|

|

·

|

Lack of transport, storage and blending infrastructure preventing ethanol from reaching high demand markets;

|

|

|

·

|

Our ability to generate free cash flow to invest in our business and service our debt;

|

|

|

·

|

Volatile commodity and financial markets;

|

|

|

·

|

Changes in interest rates and lending conditions; and

|

|

|

·

|

Results of our hedging strategies.

|

Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in this report. We are not under any duty to update the forward-looking statements contained in this report. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements.

Overview, Status and Recent Developments

We completed full startup of our ethanol plant in June 2009, and have the capacity to annually process approximately 17 million bushels of corn, through a dry milling process, into approximately 44 million gallons of ethanol per year. We also produce approximately 340,000 tons of wet distiller’s grains (“WDG”) annually. We are currently operating at approximately 114% capacity.

Our plant needs approximately 47,000 bushels of corn per day as the feedstock for its dry milling process. The grain supply for our plant is obtained primarily from local markets. The price and availability of corn are subject

13

to significant fluctuations depending upon a number of factors that affect commodity prices in general, including crop conditions, weather, governmental programs and foreign purchases. As a commodity processor, our profitability is primarily driven by the relationship between the cost of corn and the price at which we can sell our end-products, ethanol and WDG. Since we have been operational, the price of ethanol has usually tracked closely with the cost of corn.

Although the corn-ethanol Crush Margin—the difference between the cost of corn in each gallon and the price of ethanol—has varied from time to time, revenues from sales of ethanol have usually covered our variable costs of operations, leaving our fixed costs to be covered by our WDG revenues. As of May 5, 2011, corn for July 2011 delivery was $7.10 per bushel and the corresponding ethanol sales prices was $2.55 per gallon on the Chicago Board of Trade (“CBOT”), resulting in a negative gross Crush Margin of $0.01 per gallon.

Because of the way our costs have been covered during our first year and a half of operations, our profitability has tended to improve with higher corn costs. Cattle feeders compare our WDG prices to the price they would otherwise pay for feed corn, which means that generally speaking throughout our operations, higher corn prices have tended to increase our WDG revenues. So long as the price of ethanol covers our variable costs with a sufficient Crush Margin and our fixed costs are covered by WDG prices, higher corn costs support higher WDG prices and increase our profitability. Since these commodity price relationships are complex and not necessarily correlated, these trends could change at any time, and our profitability could be hindered by higher corn prices. At some point, increased corn costs will decrease the Crush Margin to the point where WDG prices cannot compensate and our profitability would correspondingly decrease.

As described below under “Liquidity and Capital Resources—Credit Facility,” we have been actively working with our lenders to resolve defaults under our credit agreements, change the way we manage our commodity risk and identify sources of additional capital to meet our working capital needs. In connection with that process, we have modified or terminated several of our pre-existing contracts for the sale of ethanol and WDG and the purchase of corn and natural gas. Currently, we are considering entering into a substitute marketing agreement or toll processing agreement, which we believe will allow us to more effectively manage risk and will reduce our working capital needs. While those discussions are on-going, we have established a relationship with Tenaska Biofuels, LLC (“Tenaska”). Although we have not entered into any long-term agreement with Tenaska, we are working closely with Tenaska for the purchase of corn and have been selling all of our ethanol through Tenaska. We have also entered into a master netting agreement to facilitate payments with Tenaska and more efficiently use our working capital. The agreement is terminable by either party at will.

WDG Revenues

As noted above, WDG sales are a key revenue stream driving our profitability. Generally, because distiller’s grains compete with other protein-based animal feed products, the price of distiller’s grains may decrease when the prices of competing feed products decrease. Downward pressure on commodity prices, such as soybeans and corn, will generally cause the price of competing animal feed products to decline, resulting in downward pressure on the price of WDG, which will decrease our revenues.

Our WDG revenue improved signficantly in the first quarter of 2011 over the first quarter of 2010. Late in 2009 and through the summer of 2010, a large local ethanol facility increased the amount of WDG available in the marketplace. Additionally, a local feedlot closed, which decreased local demand for distiller’s grains. In the fall of 2010, the local feedlot resumed operations and our competitor’s WDG production was converted to dried distiller’s grain production for the export market. This resulted in increased WDG sales in the first quarter of 2011 to 169% over the first quarter of 2010.

We currently anticipate a continued increase in revenues from the sale of WDG in 2011 over 2010 because of increasing corn prices, which topped $7.00 per bushel on February 25, 2011 on the Chicago Mercantile Exchange ending the day at $7.12 per bushel. Our first quarter 2011 WDG pricing has been based on the December 2010 cost of corn under our verbal agreements with local cattle feeders, and we expect it to fluctuate throughout 2011. Furthermore, we believe our WDG revenues will increase in 2011 as plant productivity continues to increase through improved operating processes, systems and formulation.

14

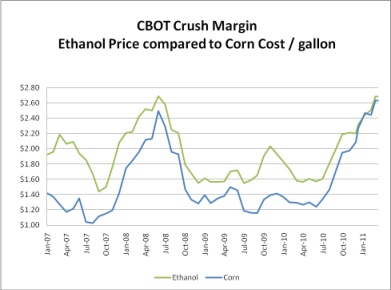

In the following graph, the relationship between the CBOT cost of corn and the price of ethanol since January, 2007 is demonstrated. It is clear that the industry margins began to deteriorate in the third quarter of 2007, which were exacerbated with the global economic distress of 2008. Some stability returned to the corn market in the third quarter of 2009, but continued distress in the general economy kept the Crush Margin tight until the end of 2009. In the fourth quarter of 2009, the Crush Margin improved for a short time as the fuel blenders ran low of ethanol inventories and some recovery in the larger economy pushed demand up, and around Thanksgiving it peaked around $0.65 and it continued strong clear into February 2010. This high Crush Margin in the first quarter of 2010 is remarkable because the Crush Margin is historically the lowest at this time of year in the ethanol industry. That annual trend for the first quarter is greatly exaggerated in the first quarter of 2011 when much of the quarter CBOT spot prices drove the cost of corn to prices that were greater than the price that could be recovered from selling the ethanol that would be produced.

|

Ethanol Market Factors

The price of ethanol is largely driven by supply and demand on the national markets, as well as regulatory requirements born by fuel blenders. Annual U.S. ethanol production capacity grew continually from 1980 through the middle of 2009. According to the Renewable Fuels Association (“RFA”), in 2002, annual U.S. ethanol production surpassed two billion gallons, by 2007, production further increased to 6.5 billion gallons, and in 2009 it topped ten billion gallons. Due to general economic difficulties and commodity prices in the last half of 2008, approximately two billion gallons of additional capacity that was planned or already under construction was put on hold, but the RFA indicates that total U.S. ethanol production capacity is now approximately 13 billion gallons.

The Renewable Fuels Standard (“RFS”), which was created by the Energy Policy Act of 2005 (the “2005 Act”), established the RFS2 standard for blending renewable fuels into automobile fuel in 2011 at 13.95 billion gallons, of which 2.56 billion gallons must come from non-corn based ethanol, leaving a maximum requirement of 11.4 billion gallons of corn based ethanol to be blended in 2011. As of December 2010, the RFA reported that nation-wide there were 191 operating ethanol refineries with a nameplate capacity of 13.1 billion gallons, another 21 non-operating facilities with 654 million gallons of capacity and 11 more plants under construction with additional capacity of 840 million gallons. Total capacity from these 223 facilities would be 14.6 billion gallons at nameplate, and at 110% of nameplate could produce over 16 billion gallons of ethanol per year. This means that compared to the RFS2 standard for 2011, there is nearly five billion gallons of potential corn based ethanol

15

oversupply in the U.S. Therefore, the ethanol industry must continue to generate demand for ethanol beyond the minimum floor set by the RFS in order to support current ethanol prices.

In response to a request by Growth Energy, an ethanol industry trade association, under section 211(f)(4) of the Clean Air Act, the Environmental Protection Agency (“EPA”) has granted a partial waiver to allow fuel and fuel additive manufacturers to introduce gasoline that contains more than 10 volume percent (vol%) ethanol and up to 15 vol% ethanol (“E15”) for use in model year (“MY”) 2001 and newer light duty motor vehicles, subject to several conditions. On October 13, 2010, the EPA granted a partial waiver for E15 for use in MY2007 and newer “light-duty vehicles.” “Light-duty vehicles” include cars, light-duty trucks and medium-duty passenger vehicles. On January 21, 2011, the EPA granted a partial waiver for E15 for use in MY2001-2006 “light-duty vehicles.” These decisions were based on test results provided by the U.S. Department of Energy (“DOE”) and other information regarding the potential effect of E15 on vehicle emissions. Taken together, the two actions allow, but do not require, E15 to be introduced into commerce for use in MY2001 and newer light-duty vehicles if conditions for mitigating, misfueling and ensuring fuel quality are met. The EPA is in the process of completing work on regulations that would provide a more practical means of meeting the conditions.

The Volumetric Ethanol Excise Tax Credit (“VEETC”) currently provides ethanol blenders with a tax credit of $0.45 per gallon of ethanol blended into gasoline. The VEETC is set to expire on December 31, 2011, but we are hopeful that Congress will approve an extension, at least in a reduced amount. Even if the VEETC is not extended prior to its expiration, Congress may renew the tax credit after its expiration. Unfortunately, any lapse in or change to the VEETC may lead to uncertainty within the ethanol industry and will likely lower ethanol prices during early 2012.

As shown in the graph above, throughout the last four years ethanol and corn prices rose and fell together with a high level of correlation. We have no reason to expect this to change in the foreseeable future. On a macro basis, we also believe that both product delivery infrastructure and demand for ethanol must increase in order to increase ethanol profit margins over both the near and long term.

We believe that since the beginning of the global recession in mid 2009, the fluctuating U.S. demand for ethanol has been primarily driven by two variables: (1) the level of on-hand inventory of ethanol in the domestic blender pipeline and storage, and to a lesser extent, (2) the sale of ethanol to South America as the weather and economies affect the sugar crop and the production of sugar-based ethanol there. The Crush Margin tends to increase in the short term (week to week) when shortages in blender inventories cause immediate demand pressure. Less dramatically, we believe that the net export of U.S. ethanol to Brazil as a result of the Brazilian sugar crop shortages caused longer term (month to month) increases in the 2010 average Crush Margins.

We believe these short and medium term fluctuations in the Crush Margin will continue to cover our variable ethanol production costs, and until the domestic ethanol distribution infrastructure grows and domestic demand for ethanol increases, the Crush Margin will have a muted impact on our profitability.

Risk Management

Because our financial performance is primarily based on commodity prices, one of the most important facets of our industry is risk management, focused on maintaining balance in the sale of ethanol and the purchase of corn. Historically, and to the extent we had available working capital, we have used commodity forward-contract marketing. The preferred position is to purchase corn and sell a matching amount of ethanol for future delivery when the margins are profitable. When corn is forward-contracted and ethanol cannot be sold to balance, we face the risk that corn prices will fall, followed by ethanol, leaving the plant with excessive expenses in corn purchases, pushing the cost of ethanol above the market price. Even if the decision is made to shut down the plant, rather than operate at a loss, the purchase and resale of that corn will also result in a loss. Alternatively, we sometimes purchase corn for future delivery and buy corn futures contracts as a hedge against adverse price changes, but this requires us to pay margin calls on the futures contracts. However, our ability to hedge has been limited because of our limited working capital. As a result we have been limited to using nearby spot purchases of corn and sales of ethanol for prompt delivery. We are continuing to explore other marketing arrangements and possibly a toll processing agreement to reduce our exposure to commodity price risk and more efficiently manage our working capital.

16

Production Matters

In the first quarter of 2010, we were forced to run the plant at reduced rates due to poor quality corn and increased foreign material in the corn fines. The plant production staff closely monitored the beer column (part of the ethanol manufacturing process) and made adjustments to the process, which minimized the impact on production rates. We reduced the solids content in the mash going to the beer column, adjusted the beer column temperature, and retuned process controllers for temperature and level control. Throughout 2010, we gradually increased the steady-state rates up to and past 100% of our plant’s name-plate capacity. By year end, the plant was frequently topping daily production rates above 110% of nameplate, and through the first quarter of 2011, we have generated average production volume above 112%, which daily rates have often gone above 116% of nameplate since March 31, 2010. We hope to continue to improve equipment and processes until we achieve daily production rates that require an application to the Nebraska Department of Environmental Quality to increase our Air Quality Permit production limit beyond our current 117% of nameplate.

Results of Operations

Throughout the first three months of 2011, we experienced significant improvements in production rates and consistency of throughput, as compared to the same period of 2010. These improvements were the result of many operational improvement initiatives, including fermentation formulation, and recipe changes, temperature controls, processing rates, implementation of process standard operating procedures and balancing of run rates.

Comparison year-to-year First Quarter Production

|

Production Quantities

|

First Quarter 2011

|

First Quarter 2010

|

Variance

better / (worse)

|

|

Ethanol (000’s gallons)

|

12,559

|

11,134

|

1,425

|

|

Distiller’s Grain (000’s tons)

|

97

|

80

|

17

|

|

Corn (000’s bushels ground)

|

4,431

|

4,008

|

423

|

|

Yield (Undenatured gal/BU)

|

2.83

|

2.78

|

0.05

|

Monthly summary of first quarter operations:

|

Ethanol Gallons Produced (000’s)

|

Corn Bushels Ground (000’s)

|

Denatured Yield (Gallons / Bushel)

|

Tons of Wet DGs Sold (000’s)

|

Tons of Dry DGs Sold (000’s)

|

||||||||||

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

|||||

|

January

|

4,320

|

3,446

|

1,545

|

1,240

|

2.80

|

2.78

|

34

|

25

|

0

|

0

|

||||

|

February

|

3,939

|

3,563

|

1,367

|

1,278

|

2.88

|

2.79

|

31

|

26

|

0

|

0

|

||||

|

March

|

4,300

|

4,125

|

1,519

|

1,490

|

2.83

|

2.77

|

32

|

26

|

0

|

2

|

||||

|

Total

|

12,559

|

11,134

|

4,431

|

4,008

|

2.83

|

2.78

|

97

|

77

|

0

|

2

|

||||

The chart above shows improvements in the first quarter of 2011 over the first quarter of 2010. Corn quality and process improvements contributed to the improved yield. Steady throughput and improved distribution of WDG also contributed to the increase over 2010. In the first quarter of 2010, 3,000 tons of distiller’s grain sales were dried. If those distiller’s grains had remained fully hydrated total sales of distiller’s grains in the first quarter of 2010 would have been 88,000 tons.

17

Revenues, Cost of Goods Sold, General & Administrative Costs

Comparison of our first quarter 2011 and 2010 Statement of Operations Items:

|

First quarter

2011

|

First Quarter 2011 Percentage

|

First Quarter 2010

|

First Quarter 2010 Percentage

|

||||||

|

Revenues

|

$

|

35,088,344

|

100%

|

$

|

20,931,245

|

100%

|

|||

|

Cost of Goods Sold

|

33,397,952

|

95%

|

20,905,110

|

100%

|

|||||

|

Gross Profit

|

1,690,392

|

5%

|

26,135

|

0%

|

|||||

|

General & Admin. Expenses

|

573,013

|

2%

|

456,898

|

2%

|

|||||

|

Operating Income (Loss)

|

1,117,379

|

3%

|

(430,763)

|

(2%)

|

|||||

|

Other Income (Expense) net

|

(869,379)

|

(2%)

|

2,157,730

|

10%

|

|||||

|

Net Income

|

$

|

248,000

|

1%

|

$

|

1,726,967

|

8%

|

|||

The predominant reason for the net income for the first quarter of 2010 was a $3,000,000 cash settlement received from Delta-T, our construction contractor, described below in “Construction Contact,” in the first quarter of 2010.

Revenues

Our revenues from operations come from two primary sources: sales of ethanol and distiller’s grains. In the first three months of 2011, our revenue from the sale of ethanol was approximately 84% of our total revenues, with the sale of distiller’s grains constituting 16%. First quarter 2011 revenues per gallon of ethanol was $2.28, as compared to $1.69, in the same period of 2010. We sold approximately 13 million gallons of ethanol in the first quarter of 2011 and 10.5 million gallons in the first quarter of 2010.

Pricing strategies for WDG in the first quarters of 2010 and 2011 were very different. In 2010, we were in a depressed market with both a supply glut and weak demand with a very large manufacturer nearby that was unable to dry the product coming out of a new facility and a very large local feedlot that was temporarily shut down. In the first quarter, the average revenue for WDG was $59.35 and $27.47 per ton in 2011 and 2010, respectively – more than double in 2011. This generated approximately $3,621,000 more revenue in 2011 over 2010, a 169% increase.

There are two price/cost relationships that must improve for us to remain profitable. Those two relationships are (i) the Crush Margin and (ii) the price of distiller’s grain compared to our costs other than the cost of corn. These two relationships are inherently the largest numbers in our statement of operations which in descending order are (i) ethanol sales, (ii) corn purchases, and (iii) distiller’s grains revenue. Because these relationships are primarily driven by market prices throughout, we believe the only way we can improve them is to increase our working capital to better hedge and forward contract, as discussed elsewhere in this report.

Cost of Goods Sold

|

First Quarter 2011

|

First Quarter 2010

|

||||||||

|

Amount

|

Percentage

|

Amount

|

Percentage

|

||||||

|

Revenues

|

$

|

35,088,344

|

100%

|

$

|

20,931,245

|

100%

|

|||

|

Cost of Goods Items:

|

|||||||||

|

Corn

|

26,740,705

|

76%

|

13,165,692

|

63%

|

|||||

|

Denaturant and Chemicals

|

1,620,764

|

5%

|

1,270,459

|

6%

|

|||||

|

Ethanol Freight Costs

|

491,139

|

1%

|

1,438,606

|

7%

|

|||||

|

Natural Gas and Electricity

|

1,815,284

|

5%

|

2,440,825

|

12%

|

|||||

|

Production Labor

|

684,557

|

2%

|

631,687

|

3%

|

|||||

|

Supplies and Maintenance

|

300,705

|

1%

|

172,078

|

1%

|

|||||

|

Property Tax

|

240,000

|

1%

|

285,000

|

2%

|

|||||

|

Depreciation

|

1,504,799

|

4%

|

1,500,763

|

7%

|

|||||

|

Total Cost of Goods Sold

|

$

|

33,397,952

|

95%

|

$

|

20,905,110

|

100%

|

|||

18

Our cost of goods sold in the first quarter of 2011 as a percentage of revenues was 95%, compared to 100% in the first quarter of 2010.

Corn is the largest component of our cost structure. Even though the cost of corn as a percentage of sales rose in the first quarter of 2011 year over year, total cost of goods sold improved dramatically. Yield and volumes increased; both of which partially mitigated the higher cost of corn per bushel. Corn cost in the first quarter was $5.88 and $3.48 in 2011 and 2010, respectively. Also mitigating the higher cost of corn was a higher ethanol price. Thus, a constant margin on ethanol and corn provided increasing benefit as corn costs rose, since the price of WDG rose with the cost of corn.

The price of natural gas in the first quarter of 2011 also improved over the previous year. Per MMBTU, the average cost of gas was $4.24 and $6.98 in the first quarter of 2011 and 2010, respectively. This difference was the result of a change in suppliers, and using a managing consultant beginning in April 2010.

The significant decrease in ethanol freight costs was not related to an operational change. As required by GAAP, any freight costs we paid and charged to customers need to be reported in both revenues and cost of goods sold. At the end of 2010, we changed our marketing arrangements for ethanol as described above, and accordingly, we no longer directly pay for the costs for rail shipping of our ethanol from our load-out facility in O’Neill, Nebraska to the customer’s destination. Thus, the 6% reduction in cost of goods sold for Ethanol Freight Costs is directly and proportionately offset by a reduction in net revenues.

General and Administrative Expenses

|

First Quarter 2011

|

First Quarter 2010

|

||||||||

|

Amount

|

Percentage

|

Amount

|

Percentage

|

||||||

|

Revenues

|

$

|

35,088,344

|

100%

|

$

|

20,931,245

|

100%

|

|||

|

Administrative Human Resources Costs

|

240,041

|

0.7%

|

219,360

|

1.1%

|

|||||

|

Professional Fees

|

227,936

|

0.7%

|

124,198

|

0.6%

|

|||||

|

Insurance

|

81,958

|

0.2%

|

88,327

|

0.4%

|

|||||

|

Other

|

23,078

|

0.1%

|

25,013

|

0.1%

|

|||||

|

Total General and Administrative Expenses

|

$

|

573,013

|

1.7%

|

$

|

456,898

|

2.2%

|

|||

General and administrative expenses as a percentage of revenues have been reduced from 2010 to 2011. While actual health insurance, payroll taxes, and miscellaneous administrative human resources costs increased as we moved to full production levels in 2010, our aggregate general and administrative cost in the first quarter decreased as a percentage of total revenues from 2.2% in 2010 to 1.7% in 2011 because of the increase in our revenues.

Professional fees increased in the first quarter of 2011 compared to the first quarter of 2010, primarily because of the TIF lawsuit discussed below and our negotiation of forbearance agreements.

Environmental Compliance

We are subject to regulations on emissions from the U.S. Environmental Protection Agency (“EPA”) and the Nebraska Department of Environmental Quality (“NDEQ”). The EPA’s and NDEQ’s environmental regulations are subject to change and often such changes are not favorable to industry. Consequently, even if we have the proper permits now, we may be required to invest or spend considerable resources to comply with future environmental regulations.

Environmental laws and regulations require us to investigate and remediate the effects of the release or disposal of materials. As previously reported, we received Notices of Violation (“NOV”) from the NDEQ arising from failures of emission equipment designed and installed by our construction contractor. While we believe that we have resolved all of the operational shortfalls cited in the NOVs, it is possible the NDEQ or the Nebraska Office

19

of the Attorney General could assess fines against us as a result of having operated the plant with the equipment before it was operating in compliance. As a result of subsequent negotiations and problem solving in cooperation with the NDEQ, we believe that the chance that any material penalties being assessed is remote.

Construction Contract