Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Encompass Health Corp | form8k_05102011.htm |

| EX-99.1 - EXHIBIT 99.1 - Encompass Health Corp | exhibit99_1.htm |

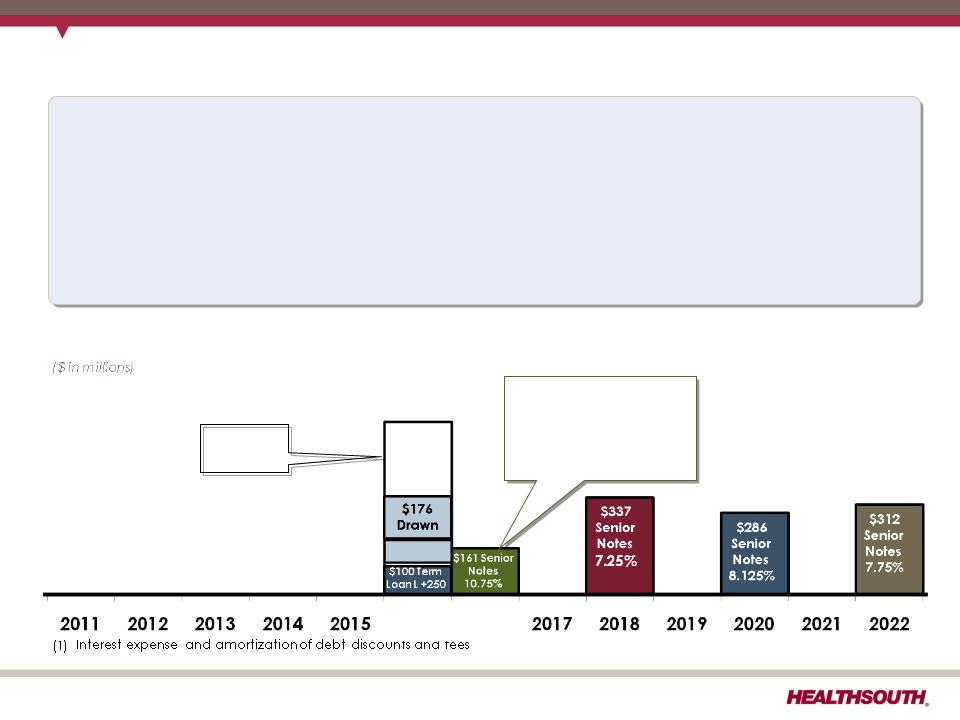

Credit Facility Amendment

ü Added $100 million Term Loan A with 2016 maturity

― Initial rate: LIBOR + 250; no LIBOR floor

― Amortizes 5%, 5%, 7.5% and 10% per annum

ü Revolver spread reduced 100 bps

― Maturity extended to 2016

― Initial rate: LIBOR +250; no LIBOR floor

ü No other material changes to terms or covenants

1

Exhibit 99.2

(2) Does not include $387.4 million of convertible perpetual preferred stock and capital leases and other note payables.

Increasing Initial Call of the 10.75% Senior Notes

2

Call schedule:

June 15, 2011 (price 105.375);

June 15, 2012 (price 103.583);

June 15, 2013 (price 101.792);

June 15, 2014 and thereafter

(price 100.000)

(price 100.000)

$500

Revolver

L+250

§Updated plan to call $335 million in principal on June 15, 2011 (cash use approx. $353 million)

• $100 million term loan, $77 million cash on hand resulting from the $120 million senior

note offering in March 2011, and borrowings under the $500 million revolver

note offering in March 2011, and borrowings under the $500 million revolver

• Loss on early extinguishment of debt is expected to be approx. $26 million.

§The Company now expects interest expense(1) to be approx. $70 million in first half of 2011

and approx. $57 million in the second half of 2011.

and approx. $57 million in the second half of 2011.

Proforma June 30, 2011 Debt Maturity Profile (2)

$49 LC

$275

Undrawn

Undrawn

2016

Exhibit 99.2