Attached files

| file | filename |

|---|---|

| EX-3.3 - EX-3.3 - Annec Green Refractories Corp | v220889_ex3-3.htm |

| EX-99.1 - EX-99.1 - Annec Green Refractories Corp | v220889_ex99-1.htm |

| EX-99.2 - EX-99.2 - Annec Green Refractories Corp | v220889_ex99-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2011 (February 9, 2011)

ANNEC GREEN REFRACTORIES CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-54117

|

27-2951584

|

||

|

(State or Other Jurisdiction of

|

(Commission File Number)

|

(IRS Employer

|

||

|

Incorporation)

|

Identification No.)

|

|

No. 5 West Section, Xidajie Street, Xinmi City,

Henan Provinc e, P.R. China

|

452370

(Zip Code)

|

|

|

(Address of Principal Executive Offices)

|

86-371- 69999012

(Registrant’s telephone number, including area code)

E-BAND MEDIA, INC.

(Former Name or Former Address, if changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

EXPLANATORY NOTE

On February 14, 2011, Annec Green Refractories Corporation, formerly E-Band Media, Inc., a Delaware corporation (“Company” or “E-Band Media”), filed a Current Report on Form 8-K (the “Original Filing”) reporting the closing of a share exchange transaction with China Green Refractories Limited, a BVI corporation (“China Green”) and its shareholders that resulted in China Green becoming a wholly owned subsidiary and new operating business of the Company on February 11, 2011. The share exchange transaction was accounted for as a reverse acquisition and recapitalization and, as a result, the consolidated financial statements of the Company (the legal acquirer) will, in substance, be those of China Green (the accounting acquirer), with the assets and liabilities, and revenues and expenses, of China Green being included effective from the date of the share exchange transaction.

In connection with the share exchange transaction, the Company’s board of directors approved a change of the Company’s fiscal year end to December 31, the fiscal year end of the operating company. In reliance of Section IIIF of the Securities and Exchange Commission’s Division of Corporate Finance: Frequently Requested Accounting and Financial Reporting Interpretations and Guidelines dated March 31, 2001, this Current Report on Form 8-K/A (“Form 8-K/A”) is being filed to furnish the consolidated financial statements of China Green’s operating subsidiary and its variable interest entity, as of December 31, 2010 and 2009. Additionally, we are amending certain disclosures under(a) Item 2.01 Completion of Acquisition or Disposition of Assets to update certain information relating to (i) the business operations of China Green as of December 31, 2010, (ii) our executive officers and directors, and (iii) beneficial ownership of our common stock, and (b) Item 9.01 Financial Statements and Exhibits.

This Form 8-K/A is limited in scope to the revisions described above and reflected in this Form 8-K/A and does not amend, update, or change any other items or disclosures contained in the Original Filing. Accordingly, all other items that remain unaffected are omitted in this Form 8-K/A. The filing of this Form 8-K/A shall not be deemed an admission that the Original Filing, when filed, intentionally included any known untrue statement of material fact or knowingly omitted to state a material fact necessary to make a statement not misleading.

2

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

|

|

Ÿ

|

our anticipated growth strategies and our ability to manage the expansion of our business operations effectively;

|

|

|

Ÿ

|

our ability to maintain or increase our market share in the competitive markets in which we do business;

|

|

|

Ÿ

|

our ability to keep up with rapidly changing technologies and evolving industry standards, including our ability to achieve technological advances;

|

|

|

Ÿ

|

our dependence on the growth in demand for our products;

|

|

|

Ÿ

|

our ability to diversify our product offerings and capture new market opportunities;

|

|

|

Ÿ

|

our ability to source our needs for skilled labor, machinery and raw materials economically;

|

|

|

Ÿ

|

the loss of key members of our senior management; and

|

|

|

Ÿ

|

uncertainties with respect to the PRC legal and regulatory environment.

|

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and file as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Use of Certain Defined Terms

Except where the context otherwise requires and for the purposes of this report only:

|

|

Ÿ

|

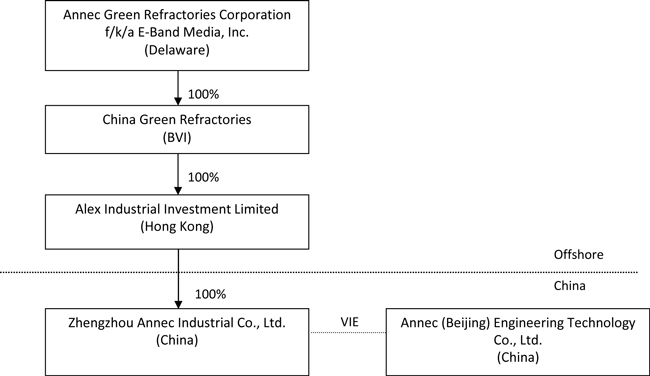

the “Company,” “we,” “us,” and “our” refer to the combined business of Annec Green Refractories Corporation, formerly E-Band Media, Inc., a Delaware corporation, and its subsidiaries, China Green Refractories (“China Green”), a BVI limited company, Alex Industrial Investment Limited (“Alex Industrial”), a Hong Kong limited company, Zhengzhou Annec Industrial Co., Ltd. (“Zhengzhou Annec”), a PRC wholly-Foreign Owned Enterprise, and Zhengzhou Annec’s variable interest entity, through its contractual arrangement with Annec (Beijing) Engineering Technology Co., Ltd. (“Beijing Annec”), a PRC limited company;

|

3

|

|

Ÿ

|

“BVI” refers to the British Virgin Islands;

|

|

|

Ÿ

|

“Exchange Act” refers the Securities Exchange Act of 1934, as amended;

|

|

|

Ÿ

|

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People's Republic of China;

|

|

|

Ÿ

|

“PRC,” “China,” and “Chinese,” refer to the People's Republic of China;

|

|

|

Ÿ

|

“Renminbi” and “RMB” refer to the legal currency of China;

|

|

|

Ÿ

|

“SEC” refers to the Securities and Exchange Commission;

|

|

|

Ÿ

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

|

Ÿ

|

“U.S. dollars,” “dollars”, “USD” and “$” refer to the legal currency of the United States.

|

|

|

Ÿ

|

All currency amounts are in USD unless otherwise stated. Foreign currency translation in this Form 8-K (excluding financial statements or amounts from the financial statements) is based on the conversion of $1.00 = RMB 6.5910 as of December 31, 2010 for balance sheet numbers and a weighted-average exchange rate during 2010 of $1.00= RMB 6.7599 for revenue and expense numbers.

|

The foregoing description of the terms of the Share Exchange Agreement is qualified in its entirety by reference to the provisions of the agreements filed as Exhibit 2.1 to the Original Filing, which are incorporated by reference herein.

Item 2.01 Completion Of Acquisition Or Disposition Of Assets

On February 11, 2011, Annec Green Refractories Corporation, formerly E-Band Media, Inc. ("E-Band Media") entered and closed a Share Exchange Agreement (“Share Exchange Agreement”), with certain shareholders and warrant holders, Dean Konstantine, Muzeyyen Balaban, Bernieta Masters, and Linda Masters, and with China Green Refractories Limited , a BVI corporation ("China Green"), and its shareholders, New-Source Group Limited, a BVI company, High-Sky Assets Management Limited, a BVI company, Joint Rise Investments Limited, a BVI company, Giant Harvest Investment Limited, a BVI company, and Mr. QIAN Yun Ting (collectively the “China Green Shareholders”), pursuant to which E-Band Media acquired 100% of the issued and outstanding capital stock of China Green in exchange for 19,220 shares of E-Band Media's Series A Convertible Preferred Stock ("Series A Preferred Stock"). Pursuant to the terms of the Share Exchange Agreement, E-Band Media agreed to effect a 1-for-14.375 reverse stock split ("Reverse Split") of its outstanding common stock. The Reverse Stock Split was effected on April 18, 2011. In addition, pursuant to the Share Exchange Agreement, the China Green Shareholders acquired all 10,000,000 shares of E-Band Media's common stock from Dean Konstantine ("Controlled Shares") and all outstanding warrants of E-Band Media from Muzeyyen Balaban, Bernieta Masters, and Linda Masters, representing warrants to purchase up to 5,000,000 shares of our common stock (“Warrants”) for an aggregate purchase price of $250,000 and 100 shares of Series A Preferred Stock held by China Green Shareholders. The Warrants were cancelled by the China Green Shareholders pursuant to the Share Exchange Agreement. As a result of the Share Exchange Agreement, the China Green Shareholders will own 98% of our issued and outstanding common stock on an as-converted common stock basis as of and immediately after the effectiveness of the Reverse Split as contemplated by the Share Exchange Agreement.

4

The acquisition was accounted for as a recapitalization effected by a share exchange, wherein China Green is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

As a result the share exchange, we indirectly control (i) through our subsidiary, Zhengzhou Annec Industrial Co., Ltd., which is engaged in the business of design, manufacturing of and selling of medium and high level refractory materials for top combustion type, internal combustion type, and external combustion type hot blast stoves, and (ii) through a contractual agreement , between Zhengzhou Annec and Annec (Beijing) Engineering Technology Co., Ltd. (“Beijing Annec”), our variable interest entity (“VIE”) Beijing Annec, which provides turnkey service for large hot blast stove projects, integrating the structural design, equipment purchase, construction, refractory production/sale and after-sale service of hot blast stoves.

Form 10 Disclosure

As disclosed elsewhere in this report, on February 11, 2011, we acquired China Green in a reverse acquisition transaction. Item 2.01(f) of Form 8-K states that if the registrant was a shell company, as we were immediately before the reverse acquisition transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form registration of securities on Form 10.

Accordingly, we are providing information that would be included in a Form 10 had we been required to file such form. Please note that the information provided below relates to the combined entity after the acquisition of China Green, except that information relating to periods prior to the date of the Share Exchange Agreement only relate to China Green unless otherwise specifically noted.

Description of Business

Overview

We are a competitive refractory enterprise in China. Through Zhengzhou Annec and our VIE, Beijing Annec, we provide integrated stove design, turnkey contracting, refractory production and sales.

History

History of E-Band Media, Inc.

E-Band Media, Inc. was incorporated under the laws of the State of Delaware on April 28, 2010 as part of the implementation of the Chapter 11 plan of reorganization of AP Corporate Services, Inc. ("AP"). On April 18, 2011, we changed our name to Annec Green Refractories Corporation.

AP was incorporated in the State of Nevada in 1997 and was formed to provide a variety of services to small, entrepreneurial businesses. These services included business planning, market research, accounting advice, incorporation and resident agent services. Between 1997 and 1999 AP's business focus changed. In addition to providing business services, AP began to own and develop businesses related to the medical professions. In 1999 AP organized E-Band Media.com with the intent of offering live "chat" consultations via the internet with nurses and physicians. A website was developed but it was unable to generate significant revenues and the site was terminated prior to AP's bankruptcy filing in 2008.

5

AP filed for Chapter 11 Bankruptcy in September 2008 in the U.S. Bankruptcy Court for the Central District of California. AP's plan of reorganization was confirmed by the Court on December 24, 2009 and became effective on January 4, 2010. This plan of reorganization provided, among other things, for the incorporation of E-Band Media and the distribution of 1,085,000 shares in it to AP's bankruptcy creditors. The shares were distributed pursuant to section 1145 of the U.S. Bankruptcy Code. The plan also provided for the transfer to E-Band Media of any interest which AP and/or E-Band Media.com had in the development of a medical "chat" website. However, no assets existed at the time of reorganization.

As stated in the Plan of Reorganization ordered by the Court, these shares were issued "to enhance the distribution to creditors," i.e. to enhance their opportunity to recover the losses they sustained in the AP bankruptcy. To this end, AP, by and through its president, agreed "to use its best efforts to have the shares... publicly traded on the Over-The-Counter market in order to provide an opportunity for liquidity to the creditors" (from the Court approved "Disclosure Statement" describing the Plan of Reorganization). The present filing is a result of this commitment. Subsequent to the effectiveness of the plan of reorganization the Company issued 10,000,000 restricted shares to its President, Dean Konstantine, at par value ($0.0001) for services rendered and costs advanced totaling $1,000.

On September 14, 2010, E-Band Media filed a Registration Statement on Form 10SB (File No.: 000-54117) with the SEC to register its common stock under Section 12(g) of the Exchange Act. The Registration Statement went effective by operation of law on November 13, 2010, at which point we became a reporting company under the Exchange Act.

As a result of our acquisition of China Green, we are no longer a shell company and active business operations were revived.

History of China Green Refractories Limited

China Green and its wholly-owned subsidiary Alex Industrial Investment Limited (“Alex Industrial”) were created for the sole purpose of conducting a reverse merger transaction with a U.S. public shell company. China Green was incorporated in the British Virgin Islands as a BVI Business Company on March 12, 2010. Under China Green’s Memorandum of Association, it is authorized to issue up to 50,000 shares of one class of stock with a par value of $1.00. Prior to the Share Exchange, there were a total of 102 shares of China Green stock, which was held by five shareholders. Each share was purchased for $1.00.

Alex Industrial was incorporated in Hong Kong on April 1, 2010 by China Green to acquire Zhengzhou Annec Industrial Co., Ltd. (“Zhengzhou Annec”) and Zhengzhou Annec’s subsidiary Annec (Beijing) Engineering Technology Co., Ltd. (Beijing Annec). Under Alex Industrial’s Memorandum of Association, the capital of Alex Industrial is divided into 10,000 shares at $1.00 each. On March 26, 2010 China Green purchased 100 founder shares in the amount of $100. On January 14, 2011 China Green purchased all of the outstanding shares of Zhengzhou for the total consideration of $2,980,998. As a result of this transaction, the controlling equity holders of Zhengzhou Annec continued to hold 98% of the outstanding equity of Zhengzhou Annec through their direct or beneficial ownership of China Green. Accordingly, this transaction was accounted for as an exchange among related parties and all assets and liabilities were transferred at their net book value.

6

Zhengzhou Annec was established in 2003, a Company Limited registered in Xinmi city Henan province in the People’s Republic of China (PRC or China) with initial registered capital of $730 thousand. On October 8, 2003, the shareholders of Zhengzhou Annec reached a resolution to increase the registered capital of Zhengzhou Annec from $730 thousand to $3.0 million. On January 14, 2011 Zhengzhou became the wholly owned subsidiary of Alex Industrial and accordingly became a wholly-foreign owned enterprise (“WFOE”) under Chinese law.

Beijing Annec was established in January 2008 in Xuanwu district Beijing as a Company Limited, registered in Beijing, PRC, with approximately $900 thousand as its initial registered capital. In 2010, Beijing Annec’s registered capital was increased from $900 thousand to approximately $2.8 million. 100% of Beijing Annec’s equity is owned or controlled through assignment by Fuchao Li. On January 16, 2011, Beijing Annec entered into a contractual agreement, or the VIE agreement, with Zhengzhou Annec. The VIE Agreement includes the following arrangements:

(1) Exclusive Business Cooperation Agreement (“Cooperation Agreement”), where Zhengzhou Annec, in general, becomes Beijing Annec’s exclusive services provider to provide Beijing Annec with business support and technical and consulting services in exchange for annual service fee equal to all of Beijing Annec’s audited total net income for such year;

(2) Equity Interest Pledge Agreement (“Pledge Agreement”) under which Fuchao Li the 100% owner of all of the equity interest in Beijing Annec, has pledged all of his equity interest in Beijing Annec to Zhengzhou Annec as a guarantee of Beijing Annec’s performance of its obligations under the Cooperation Agreement;

(3) Exclusive Option Agreement (“Option Agreement”) under which Fuchao Li grants Zhengzhou Annec an irrevocable right and option to acquire any and all of Mr. Li’s equity interest in Beijing Annec, as and when permitted by PRC laws, for an exercise price equal to the actual capital contributions paid in the registered capital of Beijing Annec by Mr. Li unless an appraisal is required by applicable PRC laws; and

(4) Power of Attorney (“POA”) under which Mr. Li grants Zhengzhou Annec the right to (i) attend shareholders meetings of Beijing Annec, (ii) exercise all of Mr. Li shareholder’s rights and shareholder’s voting rights in Beijing Annec, including, but not limited to the sale or transfer or pledge or disposition of his stock in whole or in part, and (iii) designate and appoint on Mr. Li’s behalf the legal representative, the executive director and/or director, supervisor, the chief executive officer and other senior management of Beijing Annec.

As a result of the foregoing structure, we control 100% of Beijing Annec and have rights to all of Beijing Annec's audited total net income for such year revenues. In addition to the VIE agreement, 96.3% of the equity ownership, as of December 31, 2010, of Beijing Annec was controlled by shareholders nominated by Zhengzhou Annec. The remaining 3.7% of the equity is owned by Mr. Li Fuchao. Thus, Beijing Annec is treated as a 100% owned subsidiary for accounting purposes.

7

The foregoing description of the terms of the Cooperation Agreement, the Pledge Agreement, the Option Agreement, and the POA is qualified in its entirety by the agreements filed as Exhibits 10.1, 10.2, 10.3, 10.4, and 10.5 to the Original Filing.

Reverse Acquisition of China Green

Pursuant to the Share Exchange Agreement, we acquired 100% of the issued and outstanding capital stock of China Green in exchange for 19,220 shares of our Series A Preferred Stock which will constitute 98% of our issued and outstanding common stock on an as-converted common stock basis as of and immediately after the effectiveness of the Reverse Split as contemplated by the Share Exchange Agreement.

As a result of the reverse acquisition, we have assumed the business and operations of China Green and its subsidiaries, and its VIE, Beijing Annec.

For accounting purposes, the reverse acquisition with China Green was treated as a reverse acquisition, with China Green as the acquirer and E-Band Media as the acquired party. Unless the context suggest otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of China Green.

Our Corporate Structure

All of our current business operations are conducted through our wholly-foreign owned Chinese subsidiary, Zhengzhou Annec, and our VIE, Beijing Annec.

8

Our principal executive office is located at No. 5 West Section, Xidajie Street, Xinmi City, Henan Province, 452370. The telephone number at our principal executive office is (86-371- 69999012).

Industry

In general, refractory materials are inorganic, non-metallic, materials that can withstand temperatures of more than 1,580°C, with specific high temperature mechanical properties and high stability. Refractory materials are an important supporting material for iron and steel thermodynamic equipment, non-ferrous metals, and building materials, and are used in the chemical and electrical power industries. According to Luoyang Institute of Refractories, 70% of the world's refractories are used for smelting of iron and steel, 17% for building materials, 4% for chemical industry, 3% for non-ferrous metals industry, and 6% for other industry. In China, the consumption of refractories for the iron and steel industry is approximately 65%.

Historically, the European refractory industry has led the development and output of the world refractory industry. However, the refractory industry has been gradually shifting to China because of China’s abundant resources in refractory raw materials and rapid growth of the iron, steel and cements markets. According to Luoyang Institute of Refractories, as of 2009 the total refractory output of China is more than 70% of the total refractory output of the world, making China the largest refractory producing country in the world.

Industry Trends in China

The China refractory industry is a large, highly fragmented and competitive industry whose overall performance is closely tied to the performance of other industries, such as the iron and steel industry. According to the data from refractory institute of Henan, there are more than 1,000 refractory companies in Henan. As such, we believe that the following trends in the iron and steel industry will have an effect on the refractory industry in China:

|

|

Ÿ

|

Demand for Green Refractory . The high temperature iron and steel industry is continuously making progress to increase efficiency, lower energy consumption and develop new technologies that rely heavily on high quality of refractory products. As such, the refractory industry must continually develop and improve its refractory products to keep pace with the iron and steel industry. We are now seeing a demand for “green refractory” which are refractory materials that meet certain performance levels, are environmentally friendly, and have the following characteristics: high quality, low consumption of resources and energy, environmentally friendly during production and use, and meets national environment policy and high temperature industrial standards. We intend to focus our research and development in green refractory to take advantage of this growing trend.

|

|

|

Ÿ

|

Total Solutions . Traditionally, most refractory enterprises have focused on the production of refractory products, with less emphasis on services. However, that trend is changing. The iron and steel industry, in order to reduce refractory costs and meet new requirements for iron and steel smelting technologies, is now demanding total solutions where one or more refractory companies are responsible for the supply of refractory, masonry, operation and maintenance, and dismantling of the lining after the useful life of the refractory. Through Beijing Annec, we believe that we are well positioned to take advantage of this trend.

|

9

In addition, even though China is the largest refractory producing country in the world, we believe that most of China’s refractory enterprises are small-scale with low industrial centralization and market shares. We are seeing a trend towards industry consolidation and restructuring. We believe that given our market leadership position, we are well positioned to acquire smaller refractory companies to expand our market share and customer base.

Products and Services

We are a refractory that designs, develops, produces, and markets refractory products. In addition, through our VIE, Beijing Annec, we provide integrated stove design, turnkey contracting, refractory production and sales.

Refractory Products

We offer a broad range of refractory products primarily marketed to the iron and steel industry. Our sales for refractory products were $60,236,785 and $29,171,923 for the years ended on December 31, 2010 and 2009, respectively. We produce our refractory products through our three factories in the Henan Province: Fuliang, Fuhua and Fugang.

Fuliang and Fuhua are mainly responsible for design and production of medium and high level refractory materials for top combustion type, internal combustion type, and external combustion type hot blast stoves. Since 2008, we have focused our resources and production on the design and production of our patented 37 holes checker brick and burner for hot blast stove.

Fugang is responsible for a low temperature sintering production line for special steel smelting, consumables for production of shaped and non-shaped steels, with excellent slag resistance, thermal shock resistance and stability. Currently, the sales of consumables has been limited by the scale of our production line and we are only providing the consumables to small steel factories, such as Wuhan Iron and Steel Company, Xinjiang Iron and Steel Company, Anyang Iron and Steel Company and one foreign client, India Diangang. We believe that the demand for consumable will increase and we intend to increase our sales and production capacity of consumables by expanding our production facility.

The below table is an illustration of our product category in 2010:

|

Product

|

Percent of variety

structure

|

|||

|

High-alumina brick

|

48.40 | % | ||

|

Clay brick

|

38.55 | % | ||

|

Silica brick

|

2.46 | % | ||

|

Carbonic brick

|

5.09 | % | ||

|

Non-shaped material

|

5.50 | % | ||

|

Total

|

100 | % | ||

Marketing and Sales

The Company's principal market for its refractory products is the iron and steel industry in China. We sell and market our products mainly through the following channels:

10

|

|

State-owned large–scale design institutes that design hot blast stoves. Currently there are five main iron and steel design institutes in China and we have established good long-term strategic relationships with three of those institutes: MCC Jingcheng, MCC Nanfang and MCC CISDI.

|

|

|

Ÿ

|

Direct customer sales developed through our own marketing channels and through Beijing Annec.

|

Currently most of our marketing efforts and sales are focused in China. However, our bricks have been used to a large-scale steel work project in India and we are seeking and negotiating with potential clients in Korea, Japan, Taiwan and Poland for sale of our refractory products.

The following are our top ten refractory clients for fiscal year ended December 31, 2010:

|

Clients

|

Sales (US $)*

|

% of Total Revenue

|

||||||

|

Sinosteel Equipment & Engineering (Cangzhou project)

|

6,359,776.48 | 13.10 | % | |||||

|

MCC Jingcheng (ZhongFa project)

|

3,794,185.75 | 7.81 | % | |||||

|

Liyang pengcheng steel Construction Co., Ltd

|

2,402,301.24 | 4.95 | % | |||||

|

Hebei Add Steel stainless steel Co.,Ltd

|

2,371,430.04 | 4.88 | % | |||||

|

Xinjiang Gaoyi smelt Co.,Ltd

|

1,896,553.62 | 3.91 | % | |||||

|

Beijing Mingcheng environmental protection technology Co., Ltd

|

1,819,353.67 | 3.75 | % | |||||

|

Guangxi Shenglong metallurgy Co., Ltd

|

1,719,541.95 | 3.54 | % | |||||

|

Jincheng Fusheng Steel Co., Ltd

|

1,599,426.89 | 3.29 | % | |||||

|

MCC Nanfang Engineering Technology Co., Ltd - Shanxi steel project

|

1,487,319.58 | 3.06 | % | |||||

|

Sinosteel Equipment & Engineering - Shijiazhuang subsidiary

|

1,386,118.02 | 2.85 | % | |||||

|

Total

|

24,836,007.24 | 51.14 | % | |||||

* Based on 2010 average exchange rate of 1.00 = RMB 6.76

Production process

The raw materials for our refractory products consist primarily of ores, clay, and certain additives. Upon receipt of these raw materials at our facilities, we sort and classify these materials according to various specifications. Next, these materials are conveyed to a crusher for crushing. After being crushed, the raw materials are weighed and conveyed to our electronic blender which is computer-controlled where they are mixed and fully agitated into the various mixtures required for the production of different products. The use of our electronic mixture ensures the accuracy of our mixtures which improves product quality. After being mixed, the materials are conveyed to the forming workshop where the mixtures are formed into bricks – we have the ability to form bricks according to specifications submitted to us by our customers. The shaped bricks are then sent to sintering workshop for sintering after being dried, and formed into the finished products, which are then sorted according to the relevant standards. All finished products are promptly stored and packed for deliver to our customers. All rejected products are recovered and reworked.

11

We have five (5) special production lines of refractory for hot blast stove and steel and iron smelting consumables, including two silica product production lines, two alumina product production lines, and one consumables production line. We also have more than 1,000 sets of modern processing equipment and four (4) high temperature tunnel kilns. One of our high temperature tunnel kilns is 313 meter long and is the longest one in Asia. Clean energy-coal seam gas is used as source of energy, and the raw material is pulverized through cone and Raymond mill. The forming equipments are 400 ton, and 600 ton pneumatic brick press. In addition, in 2010, we rented a 1,000 ton brick press and blast furnace tunnel kiln.

Suppliers

We procure raw materials and chemicals to manufacture into our end products. All of our suppliers are in China and we believe that there are an ample numbers of suppliers and raw materials to meet our current needs. For 2010, our principal raw materials and our suppliers for our products are:

|

Materials

|

Supplier

|

Percent of

Total Supply

|

||||

|

Aluminite

|

Xiaoyi dongrun refractory Co., Ltd

|

19 | % | |||

|

Andalusite

|

Yinge Ciyi andalusite Co., Ltd

|

77 | % | |||

|

Sillimanite

|

Jixi Tiansheng Nonmetallic Mining Co., Ltd

|

61 | % | |||

|

Bituminite

|

A local private coal mine

|

98 | % | |||

|

Coalbed Methane

|

Shanxi yigao CBM Co., Ltd.

|

95 | % | |||

In recent years, the domestic demand for raw materials has been steadily increasing due to China’s rapid growth. As a result, the prices of raw materials have increased from 2008 to 2010 as set forth below. This increase in cost has affected our profits. The following table shows the price change of some raw materials:

|

Raw material

|

Price in

2008

($/ton)

|

Price in

2009

($/ton)

|

Increased %

from

2008 to 2009

|

Price in

2010

($/ton)

|

Increased %

from

2009 to 2010

|

Increased %

from

2008 to 2010

|

||||||||||||||||||

|

Magnesium

|

215.38 | 372.23 | 73 | % | 276.15 | -26 | % | 22 | % | |||||||||||||||

|

Mullite

|

417.65 | 413.63 | -1 | % | 468.11 | 13 | % | 11 | % | |||||||||||||||

|

Carborundum

|

504.45 | 566.00 | 12 | % | 663.87 | 17 | % | 24 | % | |||||||||||||||

Moreover, the grades of many raw materials have been declining due to gradual exploitation, resulting in a certain risk to our product quality and production cost. To control the quality, supply and price of our main raw materials, we may acquire mines in the future to ensure our supply of raw materials and reduce pricing volatility.

However, at this present time, we typically do not enter into supplier agreements. When we do, they are usually long term contracts and do not impose minimum purchase requirements. We enter into supplier agreement not to ensure availability of the raw material but to ensure the quality of the raw material. The cost of raw materials purchased during the term of a supplier agreement usually is the market price for the raw materials at the time of purchase. We generally do not engage in speculative raw material commodity contracts. Rather, we attempt to reflect raw material price changes in the sale price of our products.

12

Design and Engineering Services

In keeping pace with the demands from the iron and steel industry, through our VIE, Beijing Annec, we provide design and engineering services for hot blast stoves and blast furnace. Our design and engineering services often entails equipment specification and refractory optimization, project construction, and follow up services. In addition, as part of our services, we also supply the refractory materials for our projects.

The table below summarizes the large refractory turnkey projects Zhengzhou Annec contracted in 2010:

|

Client

|

Stove body

|

Total

contract

|

Started

date

|

Expected

complete

date

|

|||||

|

Tangshan Changcheng Iron and Steel Group Songting Iron and Steel Co., Ltd #6 blast furnace

|

1780m3 blast furnace and refractory for matching hot blast stove, and stove pipe

|

$ | 7,322,594 |

Jun/1/2011

|

Nov/1/2011

|

||||

|

Tangshan Changcheng Iron and Steel Group Songting Iron and Steel Co., Ltd #7 blast furnace

|

1780m3 blast furnace and refractory for matching hot blast stove, and stove pipe

|

$ | 7,322,594 |

Jul/1/2011

|

Nov/1/2011

|

||||

|

Tianjin Tiangang Joint Iron and Steel Co., Ltd

|

Turnkey service of refractory for 3×1080m3 blast furnace project

|

$ | 8,003,077 |

Aug/1/2010

|

Jun/1/2011

|

||||

|

Changzhou Zhongfa Iron-smelting Co., Ltd

|

850m3, 2×1580m3 phase II blast furnace and general contract service of refractory for matching hot blast stove

|

$ | 14,096,132 |

Feb/1/2011

|

Oct/1/2011

|

||||

|

Xinjiang County Gaoyi Smelting Co., Ltd

|

General contract service of refractory for hot blast stove system of 630m3 blast furnace

|

$ | 2,707,141 |

Aug/1/2010

|

Dec/1/2010

|

||||

|

Total

|

$ | 39,451,538 | |||||||

13

Research and Development

The development of new products and new technology is important to our success. Accordingly, we devote significant resources to research and development. We have a 40 person research and development team, which includes nine professionals and professors. Our research and development team operates our central laboratory in Fuliang factory, which facilitates chemical examination of raw material, accessory material and our final product to ensure the chemical and structural composition of our bricks are in accordance with the contract between us and our customer.

In addition, the team operates the new product research and development office in Fuliang factory, which is responsible for researching and developing our new products and improving existing products. They focus on developing different shapes and holes bricks which have better performance and improving the existing products. We have 5 patents of bricks and 1 patent in hot blast stove burner. Currently, our team is working on developing our MgO-C brick, which has improved thermal shock resistance and thermal stability.

We also have established long term relationships with some of China’s top iron and steel design institutes. For example, with MCC JingCheng Engineering Technology Company, we developed a top combustion swirl type stove that can generate 1400°C air temperature, 100°C higher than ordinary type stoves. We got patent on this technology in 2005 and it is used widely in our business. This improvement reduces the consumption of coke to or by 20kg/t iron which has the effect of reducing the cost per ton iron by approximately $4.43. The cost price per ton of iron is $354-$443. At an annual output of 0.50 million tons of iron, the cost savings associated with our development amount to approximately $2.21 million per year. This new top combustion stove has promoted our research and development abilities and effectively expand our sales. This service is mainly applicable for the current new-built stove and reforming of old stoves.

Competition

The refractory manufacturing business is extremely competitive in China. According to the data from Henan refractory institute, in 2008, there are more than 1000 refractory companies in Henan province in 2008. We are continuing to explore ways to increase our market share in China including, but not limited to, acquiring our competitors.

Our main competitors in China include Yuxing Refractory Co., Xinmi Zhengtai Refractory Co., Ltd, Wunai Group, and Luoyang Refractory. Yuxing Refractory mainly produces the ceramic burner, combination brick on hot blast stove, checker brick, and refractory ball. Yuxing Refractory has an license agreement with MCC CISDI where all of the stoves designed by MCC CISDI using Yuxing Refractory patented technology shall use the refractory from Yuxing Refractory. Xinmi Zhengtai Refractory Co., Ltd. has three production lines, one 198m high temperature tunnel kiln and 400t and 600t presses. Wunai Group has one 200m high temperature tunnel kiln, and has engaged Lin Binyin, professor, a senior engineer from Wuhan University of Science and Technology, as its chief engineer.

Growth Strategy

Our growth strategy is as follows:

14

|

|

•

|

Product Development and Enhancement. We continue to develop our refractory products for blast furnaces and improve non-shaped material products. Furthermore, we, intend to seek and target international companies for opportunities to work with them on projects to produce high-tech carbon bricks.

|

|

|

•

|

Pursue Sales Opportunities in New Markets. We are actively pursuing additional market channels outside of China in order to increase our international market share. We are seeking and negotiating with new Clients in Korea, Japan, Taiwan and Poland for sale of our refractory products.

|

|

|

•

|

Promote Refractory Contract Service Model. We continuously and vigorously promote our refractory contract service model to generate additional significant and continuous revenue stream.

|

|

|

•

|

Strategic Acquisitions. We intend to expand our market share by pursuing strategic acquisitions of our competitors and other companies in related industries that will expand our product line and manufacturing efficiency.

|

|

|

•

|

Research and Development Investment. We will continue to invest in research and development to further develop unique and quality products to further our position as a market leader.

|

Intellectual Property

We take precaution to protect our products and our technical and proprietary know-how. In addition, we own several patents and trademarks described below.

The PRC’s intellectual property protection regime is consistent with those of other modern industrialized countries. The PRC has domestic laws for the protection of rights in copyrights, patents, trademarks and trade secrets.

We have five independently developed patents, and one patent jointly developed patent with MCC Jingcheng. See table below for a summary of patents in China:

|

Patent Name

|

Patent No.

|

Owned by

|

Validity period

|

|||

|

19 holes cell-type checker brick

|

ZL200520031144.X

|

Zhengzhou Annec

|

Apr. 11, 2007 -

Apr. 11, 2017

|

|||

|

31 holes cell-type checker brick

|

ZL200620008222.9

|

Zhengzhou Annec

|

Jun. 27, 2007 -

Jun 27, 2017

|

|||

|

37 holes cell-type checker brick

|

ZL200620113567.X

|

Zhengzhou Annec

|

Apr. 11, 2007 -

Apr. 11, 2017

|

|||

|

61 holes cell-type checker brick

|

ZL200720142954.1

|

Zhengzhou Annec

|

May 14, 2008 -

May 14, 2018

|

|||

|

Perforated wave-shaped cell-type checker brick

|

ZL200720148139.6

|

Zhengzhou Annec

|

May 8, 2008 -

May 8, 2018

|

|||

|

Swirl type top combustion hot blast stove burner

|

ZL200420008906.X

|

Zhengzhou Annec and MCC Jingcheng

|

Sept. 28, 2005 -

Sept. 28, 2015

|

15

We also have several trademarks as follows:

|

Trademark

|

Registration No.

|

Country

|

||

|

3977113 |

P.R.China

|

||

|

6802049 |

P.R.China

|

||

|

ANNEC

|

6769885 |

P.R.China

|

Competitive Strengths

|

|

Ÿ

|

Technical superiority. We employ experts known for their research and development skills and innovation and we observe and utilize the advanced technology of international business leaders in our industry.

|

|

|

Ÿ

|

Product advantage. We have a variety of high quality patented products available in the refractory and hot-blast stove fields.

|

|

|

Ÿ

|

Marketing advantage. We maintain excellent relationships with our customers who include many large and medium size companies in China, and we have a marketing network all over China. Further, we have received high praise for the quality of our products, our post-sale service and its delivery time.

|

|

|

Ÿ

|

Brand advantage. Our brands are well known in the hot stove and refractory fields and have received a number of awards.

|

|

|

Ÿ

|

Environmentally friendly and energy efficient. Our products are in compliance with the PRC’s requirements related to efficiency and environmental protection.

|

|

|

Ÿ

|

Recurring revenue stream. We have developed a series of patented refractory products which we use in our hot-blast furnace designs and other refractory products. These products require our customers to engage us to maintain and repair our proprietary products and, accordingly, provide us a recurring revenue stream.

|

PRC Government Regulations

Business license

Zhengzhou Annec was established on July 30, 2003 with a registered capital of approximately $0.73 million. On October 8, 2003, the shareholders of Zhengzhou Annec reached a resolution of increasing the registered capital of Zhengzhou Annec from approximately $0.73 million to $3.0 million. This increase of registered capital was evidenced by amendment to the articles of association, capital assessment report, and registration of alteration filed with Zhengzhou AIC. According to the business license of Zhengzhou Annec issued on April 29, 2005, the registered capital of Zhengzhou Annec was increased to approximately $3.0 million. Any company that conducts business in the PRC must have a business license that covers a particular type of work. Zhengzhou Annec obtained a business license from the Zhengzhou Administration for Industry and Commerce on January 14, 2011, which identifies the business scope of Zhengzhou Annec as “production, sale and after-sale support of refractory and electrofusion products”.

16

Beijing Annec was established on January 16, 2008 with a registered capital of approximately $0.87 million. Beijing Annec obtained a business license from the Beijing Administration for Industry and Commerce on August 25, 2010, which demonstrates that the registered capital of Beijing Annec has been increased to approximately $2.8 million and identifies the business scope of Beijing Annec as “technology development, technology transfer, technology support, image-text design and production, project technology consultation, sale of construction materials, computer, software and auxiliary equipment, mechanical equipment, chemical products (not include dangerous chemical materials), import and export agency, import and export”. Prior to expanding our business beyond that of our business licenses, we may be required to apply and receive approval from the relevant PRC government authorities and we cannot assure you that we will be able to obtain the necessary government approval for any change or expansion of our business.

Environmental Regulations

We are subject to various PRC laws and regulations on environmental protection, water pollution, occupational disease, air pollution, solid waste pollution, and noise pollution and labor contracts. We are complying with these various laws and regulations and we have the license of pollution discharge. As the relevant law in China might be changed, we will regularly monitor and review our operations and procedures to ensure the compliance.

Taxation

On March 16, 2007, the National People's Congress of China passed a new Enterprise Income Tax Law, or New EIT Law, and on December 6, 2007, the State Council of China passed its implementing rules, which took effect on January 1, 2008. Before the implementation of the New EIT Law, foreign invested enterprises, or FIEs, established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The New EIT Law and its implementing rules impose a unified EIT of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions. Despite these changes, the New EIT Law gives FIEs established before March 16, 2007, or Old FIEs, a five-year transition period since January 1, 2008, during which time the tax rate will be increased step by step to the 25% unified tax rate set out in the New EIT Law. From January 1, 2008, for the enterprises whose applicable tax rate was 15% before the promulgation of the New EIT Law , the tax rate will be increased to 18% for year 2008, 20% for year 2009, 22% for year 2010, 24% for year 2011, 25% for year 2012. For the enterprises whose applicable tax rate was 24%, the tax rate will be changed to 25% from January 1, 2008. The discontinuation of any such special or preferential tax treatment or other incentives would have an adverse effect on any organization's business, fiscal condition and current operations in China.

In addition to the changes to the current tax structure, under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization's global income will be subject to PRC income tax of 25%. For detailed discussion of PRC tax issues related to resident enterprise status, see “Risk Factors – Risks Related to Our Business – Under the Enterprise Income Tax Law, we may be classified as a ‘resident enterprise' of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.”

17

The New EIT Law provides that an income tax rate of 20% may be applicable to dividends payable to non-PRC investors that are “non-resident enterprises”. Non-resident enterprises refer to enterprises which do not have an establishment or place of business in the PRC, or which have such establishment or place of business in the PRC but the relevant income is not effectively connected with the establishment or place of business, to the extent such dividends are derived from sources within the PRC. The income tax for non-resident enterprises shall be subject to withholding at the income source, with the payor acting as the obligatory withholder under the New EIT Law, and therefore such income taxes generally called withholding tax in practice. The State Council of the PRC has reduced the withholding tax rate from 20% to 10% through the Implementation Rules of the New EIT Law. It is currently unclear in what circumstances a source will be considered as located within the PRC. We are a U.S. holding company and substantially all of our income is derived from dividends we receive from our subsidiaries located in the PRC. Thus, if we are considered a “non-resident enterprise” under the New EIT Law and the dividends paid to us by our subsidiary in the PRC are considered income sourced within the PRC, such dividends may be subject to a 10% withholding tax. Zhengzhou Annec is considered a FIE and is directly held by our subsidiary in Hong Kong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong which directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Alex Industrial by Zhengzhou Annec, but this treatment will depend on our status as a non-resident enterprise.

Pursuant to the Provisional Regulation of China on Value Added Tax and its implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay value added tax, or VAT, at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Further, when exporting goods, the exporter is entitled to some or all of the refund of VAT that it has already paid or borne.

Pursuant to the New EIT Law, designated hi-tech corporation may be accorded a tax preference at the rate of 15%. Zhengzhou Annec qualified as a hi-tech corporation and was accorded certain tax incentives for said designation. Accordingly, Zhengzhou Annec was subject to tax at a statutory rate of 15% for the years ended December 31 2010 and 2009. Zhengzhou Annec will continue to be subject to a 15% tax rate for the years ending December 31, 2010, 2011, and 2012, and expects that thereafter will become subject to a rate of 25% unless Zhengzhou Annec applies for and receives a further tax preference for the succeeding five years.

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including: wage and hour requirements, working and safety conditions, and social insurance, housing funds and other welfare. These include local labor laws and regulations, which may require substantial resources for compliance.

18

China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permits workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract. The National Labor Contract Law has enhanced rights for the nation’s workers. The legislation requires employers to provide written contracts to their workers, restricts the use of temporary labor and makes it harder for employers to lay off employees. It also requires that employees with fixed-term contracts be entitled to an indefinite-term contract after a fixed-term contract is renewed twice or the employee has worked for the employer for a consecutive ten-year period.

Foreign Currency Exchange

Foreign currency exchange in the PRC is governed by a series of regulations, including the Foreign Currency Administrative Rules (1996), as amended, and the Administrative Regulations Regarding Settlement, Sale and Payment of Foreign Exchange (1996), as amended. Under these regulations, the Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. FIEs established in the PRC may only buy, sell and remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by FIEs outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission. We currently do not hedge our exposure to fluctuations in currency exchange rates.

Dividend Distributions

The principal laws and regulations in the PRC governing distribution of dividends by FIEs include:

|

|

Ÿ

|

The Sino-foreign Equity Joint Venture Law (1979), as amended, and the Regulations for the Implementation of the Sino-foreign Equity Joint Venture Law (1983), as amended;

|

|

|

Ÿ

|

The Sino-foreign Cooperative Enterprise Law (1988), as amended, and the Detailed Rules for the Implementation of the Sino-foreign Cooperative Enterprise Law (1995), as amended; and

|

|

|

Ÿ

|

The Foreign Investment Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended.

|

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its general reserve fund until the accumulative amount of such reserve fund reaches 50% of its registered capital. The general reserve fund is not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

19

Employees

As of April 15, 2011, we employed approximately 1,325 employees as follows, 65 in management, 1,094 in production, 135 in R&D team and department, and 31 in marketing.

We maintain a satisfactory working relationship with our employees, and we have not experienced any significant labor disputes or any difficulty in recruiting employees for our operations. None of our employees are represented by a labor union.

Our employees are all in China and participate in the state pension plan organized by the Chinese municipal and provincial government. We are required by Chinese law to cover employees in China with various types of social insurance. We believe that we are in material compliance with the relevant PRC laws.

Property

All land in China is owned by the State. Individuals and companies are permitted to acquire rights to use land or land use rights for specific purposes. In the case of land used for industrial purposes, the land use rights are generally granted for a period of 50 years. Granted land use rights are transferable and may be used as security for borrowings and other obligations.

All of our three factories are located in Xinmi, Henan Province. We own the land of Fuliang and Fugang factory, the land certificate of Fugang is processing now. Fu Gang is rented entirely from an unrelated third party for $215, 445 per year for 4 years. The detail information is showed in below in square feet:

|

Factories

|

Office

|

Workshops

|

Dining Halls

|

Dormitory

|

Total

|

|||||||||||||||

|

Fuliang (own)

|

2,411 | 983,674 | 6,061 | 30,425 | 1,022,571 | |||||||||||||||

|

Fuhua (own)

|

21,356 | 270,597 | 4,758 | 28,270 | 324,981 | |||||||||||||||

|

Fugang (lease)

|

16,404 | 138,241 | 3,440 | 6,889 | 164,974 | |||||||||||||||

|

Total

|

40,171 | 1,392,512 | 14,259 | 65,584 | 1,512,526 | |||||||||||||||

We believe that our facilities, which are of varying ages and are of different construction types, have been satisfactorily maintained. They are in good conditions and are suitable for our operations and generally provide sufficient capacity to meet our production and operational requirements.

Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties and an adverse result in these or other matters may arise from time to time that may harm our business.

20

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occur, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this report.

Risks Related To Our Overall Business Operations

Current economic conditions may adversely affect consumer spending and the overall general health of our retail customers, which, in turn, may adversely affect our financial condition, results of operations and cash resources.

Uncertainty about the current and future global economic conditions may cause our customers to defer purchases or cancel purchase orders for our products in response to tighter credit, decreased cash availability and weakened consumer confidence. Our financial success is sensitive to changes in general economic conditions, both globally and nationally. Recessionary economic cycles, higher interest borrowing rates, higher fuel and other energy costs, inflation, increases in commodity prices, higher levels of unemployment, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect consumer spending or buying habits could continue to adversely affect the demand for our products. In addition, a number of our customers may be impacted by the significant decrease in available credit that has resulted from the current financial crisis. If credit pressures or other financial difficulties result in insolvency for our customers it could adversely impact our financial results. There can be no assurances that government and consumer responses to the disruptions in the financial markets will restore consumer confidence.

We may be unable to successfully execute our long-term growth strategy or maintain our current revenue levels.

Our ability to maintain our revenue levels or to grow in the future depends upon, among other things, the continued success of our efforts to maintain our brand image and bring new products to market and our ability to expand within our current distribution channels. For year ended 2009, we experienced a decrease in our revenues. There can be no assurances that we will be able to maintain or grow our revenues, or successfully execute our long-term growth strategy.

A downturn or negative changes in the highly volatile steel and iron industry will harm our business and profitability.

Our main customers consist largely of iron and steel companies. Accordingly, our business performance is closely tied to the performance of the steel industry. The sector as a whole is cyclical and its profitability can be volatile as a result of general economic conditions, labor costs, competition, import duties, tariffs and currency exchange rates. These factors have historically resulted in wide fluctuations in the Chinese and the global economies in which steel companies sell their products. In the event that these fluctuations occur, a resulting decreased demand for steel products could negatively impact our sales, margins and profits.

21

Industry growth rate for refractory products may decelerate and may affect our future revenue growth.

As a result of the growth of the Chinese steel industry, the production of refractory materials in China has experienced tremendous growth in recent years. If the steel industry growth rate slows, it will likely negatively impact our growth rate.

Our inability to overcome fierce competition in the highly competitive Chinese refractory market could reduce our revenue and net income.

We compete with many other refractory manufacturers in China and, if we are successful in expanding our market reach, we will have international competitors as well. Remaining competitive requires a variety of things – market share and customer growth, continued success in technology development, access to reasonable priced raw materials and other supplies, etc. Much of our future success will be dependent on our ability to secure and retain adequate financing of our current operations and research and development. If we are unable to secure financing, or if any other market factor makes it difficult to remain competitive, our revenue and net income will be adversely affected.

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We have a limited operating history because we have only been in operation since 2003. This limited operating history makes it difficult for investors to evaluate our businesses and predict future operating results. An investor in our securities must consider the risks, uncertainties and difficulties frequently encountered by companies in new and rapidly evolving markets. The risks and difficulties we face include challenges in accurate financial planning as a result of limited historical data and the uncertainties resulting from having had a relatively limited time period in which to implement and evaluate our business strategies as compared to older companies with longer operating histories.

Our ability to obtain additional financing may be limited, which could delay or prevent the completion of one or more of our strategies.

We have, to date, financed our working capital and capital expenditure needs primarily from capital contributions of shareholders of our operating entities, bank loans provided by local banking institutions and operating cash flows. We expect our working capital needs and our capital expenditure needs to increase in the future as we continue to expand and enhance our production facilities, increase our design, research and development capabilities and as we continue to implement our other strategies. Our ability to raise additional capital will depend on the financial success of our current business and the successful implementation of our key strategic initiatives, as well as financial, economic and market conditions and other factors, some of which are beyond our control. We may not be successful in raising any required capital on reasonable terms and at required times, or at all. Further, equity financings may have a further dilutive effect on our stockholders. If we require additional debt financing, the lenders may require us to agree on restrictive covenants that could limit our flexibility in conducting future business activities, and the debt service payments may be a significant drain on our free capital allocated for research and other activities. If we are unsuccessful in raising additional capital or if new capital funding costs are higher than our prior capital funding costs, our business operations and our development programs may be materially and adversely impacted, with similar effects on our results of operations and financial condition.

22

Our production capacity might not be able to meet with growing market demand or changing market conditions.

We cannot give assurance that our production capacity will be able to meet our obligations and the growing market demand for our products in the future. Furthermore, we may not be able to expand our production capacity in response to the changing market conditions. If we fail to meet demand from our customers, we may lose our market share.

We may not be able to develop new products or expand into new markets.

We intend to develop and produce new refractory products. The launch and development of new products involve considerable time and commitment which may exert a substantial strain on our ability to manage our existing business and operations. We cannot ensure our research and development capacity and capability is sufficient to develop any marketable new products or that any income will be generated from such new products. If we are not able to develop and introduce new products successfully, or if our new products fail to generate sufficient revenues to offset our research and development costs, our business, financial condition and operating results could be adversely affected. Failure of such could lead to wasted resources. An element of our strategy for growth also envisages us selling existing or new products into new markets other than the PRC market. There is no guarantee that we will be successful in executing our growth strategy and if we should fail to execute our growth strategy successfully, it may have a material and adverse affect on our future revenue and profitability.

We manufacture our products in a single location, and any material disruption of our operations could adversely affect our business.

Our operations are subject to uncertainties and contingencies beyond our control that could result in material disruptions in our operations and adversely affect our business. These include industrial accidents, fires, floods, droughts, storms, earthquakes, natural disasters and other catastrophes, equipment failures or other operational problems, strikes or other labor difficulties.

All of our products are manufactured in our production facilities in the PRC. If there is any damage to our production facilities, we may not be able to remedy such situations in a timely and proper manner, and our production could be materially and adversely affected. Any breakdown or malfunction of any of our equipment could cause a material disruption of our operations. Any such disruption in our operations could cause us to reduce or halt our production, prevent us from meeting customer orders, adversely affect our business reputation, increase our costs of production or require us to make unplanned capital expenditures, any one of which could materially and adversely affect our business, financial condition and results of operations.

The prices for the raw materials and the costs for labor may increase.

Any decrease in the availability, or increase in the cost, of raw materials and energy could materially increase our costs and jeopardize our current profit margins and profitability. Our ability to achieve our sales target depends on our ability to maintain what we believe to be adequate inventories of raw materials to meet reasonably anticipated orders from our customers.

23

Further, if our existing suppliers are unable or unwilling to deliver our raw materials requirements on time to meet our production schedules, we may be unable to produce certain products, which could result in a decrease in revenues and profitability, a loss of good will with our customers, and could tarnish our reputation as a reliable supplier in our industry. In the event that our raw material and energy costs increase, we may not be able to pass these higher costs on to our customers in full or at all due to contractual agreements or pricing pressures in the refractory market. Any increase in the prices for raw materials or energy resources could materially increase our costs and therefore lower our earnings and profitability.

The manufacturing industry is labor intensive. Labor costs in the PRC have been increasing over the past few years, and we cannot assure you that the cost of labor in the PRC will not continue to increase in the future or that we will be able to increase the prices of our products to offset such increases. If we are unable to identify and employ other appropriate means to reduce our costs of production or to pass on the increased labor and other costs of production to our customers by selling our products at higher prices, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Our insurance coverage may not be sufficient to cover all losses.

Although we have obtained insurance coverage for the operation of our business that we believe is customary in the PRC refractory industry, covering risks such as loss as a result of fire, theft or occurrence of certain natural disasters, the insurance may not cover all types of loss. If we incur substantial losses or liabilities that are not covered or compensated by our insurance coverage fully or at all, our business, financial condition and results of operations may be materially and adversely affected.

We may not be able to comply with all applicable government regulations.

We are subject to extensive governmental regulation by the central, regional and local authorities in the PRC, where our business operations take place. We believe that we are currently in substantial compliance with all laws and governmental regulations and that we have all material permits and licenses required for our operations. Nevertheless, we cannot assure investors that we will continue to be in substantial compliance with current laws and regulations, or that we will be able to comply with any future laws and regulations. To the extent that new regulations are adopted, we will be required to conform our activities in order to comply with such regulations. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on its business, operations and finances.

Actions by the Chinese government could drive up our material costs and could have a negative impact on our profitability.

In the past years, the Chinese government has shut down some outdated mineral mines in China. These shutdowns have decreased the overall supply of raw materials needed to produce refractory products. As a result, the materials costs for our products have increased. If the Chinese government shuts down more mineral mines, we could experience further supply shortages and price increases that could have a negative impact on our profitability.

Approximately 51% of our sales revenues were derived from our ten largest customers, and any reduction in revenues from any of these customers would reduce our revenues and net income.

While we have numerous customers, approximately 51% of our sales revenue came from our top ten customers in 2010. If we cease to do business at or above current levels with any one of our large customers which contribute significantly to our sales revenues, and we are unable to generate additional sales revenues with new and existing customers that purchase a similar amount of our products, then our revenues and net income would decline considerably.

24

A significant interruption or casualty loss at any of our facilities could increase our production costs and reduce our sales and earnings.

Our manufacturing process requires large industrial facilities for crushing, smashing, batching, molding and baking raw materials. After the refractory products come off the production line, we need additional facilities to inspect, package, and store the finished goods. Our facilities may experience interruptions or major accidents and may be subject to unplanned events such as explosions, fires, accidents and other events. Any shutdown or interruption of any facility would reduce the output from that facility, which could substantially impair our ability to meet sales targets. Interruptions in production capabilities will inevitably increase production costs and reduce our sales and earnings. In addition to the revenue losses, longer-term business disruption could result in the loss of goodwill with our customers. To the extent these events are not covered by insurance, our revenues, margins and cash flows may be adversely impacted by events of this type.

Compliance with environmental regulations can be expensive, and noncompliance with these regulations may result in adverse publicity and potentially significant monetary damages and fines.