Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cooper-Standard Holdings Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Cooper-Standard Holdings Inc. | dex991.htm |

Cooper Standard 1Q 2011

First Quarter 2011 Earnings Call

May 11, 2011

Exhibit 99.2 |

cooperstandard

Introduction & Agenda

•

Introduction:

Glenn

Dong,

Treasurer

•

Executive

Overview:

Jim

McElya,

CEO

•

Business

Highlights:

Keith

Stephenson,

COO

•

Financial

Review

&

Updated

Guidance:

Allen

Campbell,

CFO

•

Questions

&

Answers

2 |

cooperstandard

Safe Harbor

3

In addition to historical information, certain statements contained herein are

forward-looking statements within the meaning of federal securities

laws, and Cooper Standard Automotive (Cooper Standard) intends that such forward-

looking statements be subject to the safe-harbor created thereby. These

forward-looking statements include statements concerning the

company’s plans, objectives, goals, strategies, future events, future revenue or

performance, capital expenditures, financing needs, plans or intentions relating to

acquisitions, business trends, the impact of

“fresh-start” accounting, the impact of the company’s

bankruptcy on its future performance and other information

that

is

not

historical

information.

When

used

herein,

the

words

“estimates,”

“expects,”

“anticipates,”

“projects,”

“plans,”

“intends,”

“believes,”

“forecasts,”

or

future

or

conditional

verbs,

such

as

“will,”

“should,”

“could,”

or “may,”

and variations of such words or similar expressions are intended to identify

forward-looking statements. All forward-looking statements,

including, without limitation, management’s examination of historical operating

trends and data, are based upon Cooper Standard’s current expectations and

various assumptions. Cooper Standard’s expectations, beliefs and

projections are expressed in good faith, and Cooper Standard believes there

is a reasonable basis for them. However, no assurances can be made that these

expectations, beliefs and projections will be achieved. Forward-looking

statements are not guarantees of future performance and are subject to

significant risks and uncertainties that may cause actual results or achievements to be materially different from

the future results or achievements expressed or implied by the forward-looking

statements. |

cooperstandard

Safe Harbor

4

This presentation includes forward-looking statements, reflecting current

analysis and expectations, based on what are believed to be reasonable

assumptions. Forward-looking statements may involve known and unknown risks,

uncertainties and other factors, which may cause the actual results to differ

materially from those projected, stated or implied, depending on many

factors, including, without limitation: the inability to compare the company’s financial

condition

or

results

historically

due

to

fresh

start

accounting;

the

company’s

emergence

from

bankruptcy

will

reduce

or eliminate certain tax benefits; the company’s emergence from bankruptcy may

adversely affect its operations going forward; the company’s dependence

on the automotive industry; the company’s dependence on certain major

customers;

the

company's

ability

to

generate

cash

to

service

its

indebtedness

and

dividend

obligations

of

preferred

shares; availability

and

cost

of

raw

materials;

the

uncertainty

of

the

company’s

ability

to

meet

significant increases

in demand; competition in the industry; sovereign and other risks related to the

company conducting operations outside the United

States;

natural

disasters;

the

uncertainty

of

the

company’s

ability

to

achieve

expected cost

reduction savings; the company’s exposure to product liability and warranty

claims; labor conditions; escalating pricing pressures

from

our

customers;

the

company’s

ability

to

meet

customers’

needs

for

new and improved

products in a

timely

manner;

potential

conflicts

of

interests

between

certain

shareholders

and the company; the

company’s legal rights to its intellectual property portfolio; the

company’s underfunded pension plans; the actual return on pension

assets; environmental and other regulations; the possibility that the company’s acquisition

strategy will not be successful; and the possibility of impairment charges relating

to goodwill and long-lived assets. There may be other factors that may

cause the company’s actual results to differ materially from the forward-looking

statement. Accordingly, there can be no assurance that Cooper Standard will meet

future results, performance or achievements expressed or implied by such

forward-looking statements. This paragraph is included to provide a safe

harbor for forward-looking statements, which are not generally required to be publicly revised as circumstances

change and which Cooper Standard does not intend to update.

There may be other factors that may cause the company’s actual results to

differ materially from the forward-looking statements. Cooper Standard

undertakes no obligation to update or revise forward-looking statements to reflect

events or circumstances that arise after the date made or to reflect the occurrence

of unanticipated events. |

Jim

McElya Chairman & CEO

Executive Overview

1Q 2011 |

cooperstandard

Executive Overview: First Quarter 2011 Review

•

Strong top and bottom-line results:

–

Sales growth of 15.5%, up across all regions

–

Adjusted EBITDA margin of 13.3%

•

Demonstrating the value of our:

–

Global and diversified customer base

–

Advantageous business model

–

Cost discipline

–

Focus on quality

6 |

cooperstandard

Executive Overview: First Quarter 2011 Review

•

Strategic progress:

–

High quality wins consistent with global and diverse

customer positioning

–

Recent opportunistic transactions support revenue

growth strategies

»

FMEA / Barre-Thomas and Nishikawa: Global

platforms, emerging markets

»

USi: Technology

7 |

Executive Overview:

FMEA

/

Barre-Thomas

Transaction

•

Material strategic and financial benefits, minimal cash

investment

•

51% ownership of joint venture with FMEA combining

our French body sealing operations with the operations

of Barre-Thomas

•

Strategic benefits:

–

Expands leadership position in body sealing

–

Establishes AVS and hose capability in Europe

8

All of Cooper Standard’s product lines are now highly

competitive for global platform awards.

cooperstandard |

cooperstandard

9

Executive Overview: Industry Trends

•

Vehicle mix changes

•

Raw material costs increase

•

Increased demand for new technology

•

Strong demand for engineers

•

Japanese earthquake impact affecting

production schedules |

Business Highlights

1Q 2011

Keith Stephenson

Chief Operating Officer |

cooperstandard

11

Business Highlights 1

st

Quarter

•

Sales improvement due to recovering volumes and

favorable mix

•

Increased sales across all regions

•

Several important new business wins

•

Barre-Thomas deal helping to drive additional

business opportunities |

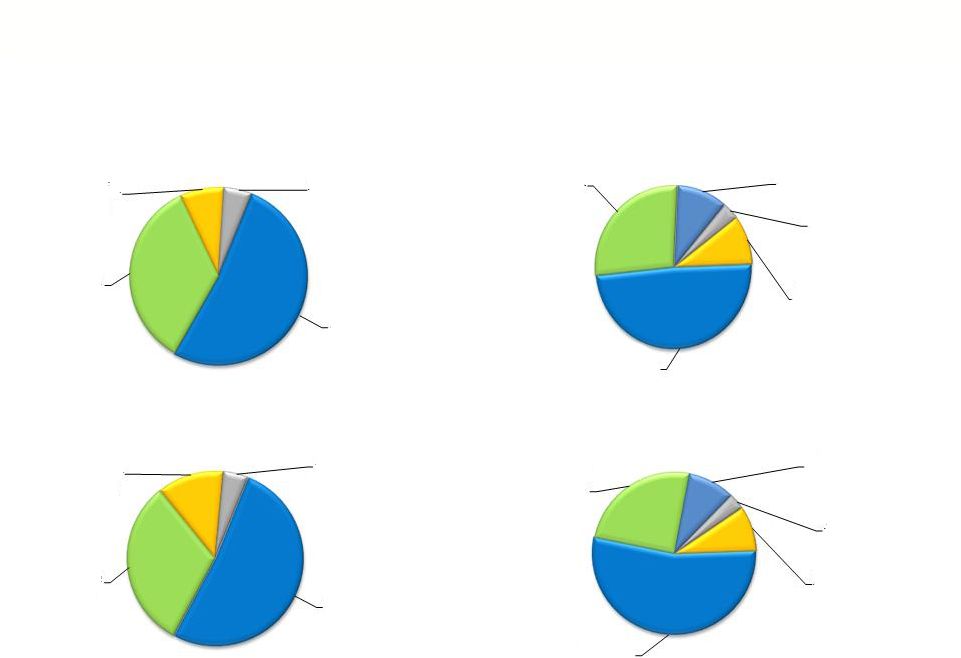

Sales

By Region & Product Groups Q1 2011 = $688.8 Million

Unconsolidated JV’s –

HASCO and NISCO

Sales By Product As Reported

Sales By Product Unconsolidated JVs

Sales By Region With Unconsolidated JVs

Sales By Region As Reported

North

America

52%

Europe

35%

Asia

Pacific

8%

South

America

5%

Sealing

49%

Fuel, Brake &

Emissions

27%

Thermal

Management

10%

Specialty

Markets

4%

Anti-Vibration

Systems

10%

North

America

52%

Europe

31%

Asia

Pacific

12%

South

America

5%

Sealing

54%

Fuel, Brake

& Emissions

25%

Thermal

Management

9%

Specialty

Markets

3%

Anti-

Vibration

Systems

9%

cooperstandard

12 |

cooperstandard

Cooper Standard’s Top 20 Platforms Q1 2011

13

#5 GM

LaCrosse

#2 Ford

Tribute/Escape

#20 Peugeot

308

#1 Ford

F-150

#7 GM

Silverado/Sierra

#9 Ford

Fusion / Edge

#13 Fiat

Linea/Punto/Stilo/Bravo

#8 Ford

Explorer

#14 VW

Passat

#3 GM

Tahoe/Yukon/

Escalade

#4 Ford

Fiesta/Fusion

#10 GM

Impala

#6 Ford

Mondeo/Freelander/

V50/V70

#11 Ford

Ecosport

#12 Dodge

200 / Challenger

#19 GM

Traverse/Acadia

#15 Ford

F-Series Super Duty

#18 GM

Cruze

#17 Chrysler

Doger Ram

#16 BMW

3 Series

Cooper

Standard

products are

consistently

on the top

selling

global

platforms

Broad customer mix across multiple vehicle segments |

cooperstandard

Vehicle

Launches

1

st

Quarter

2011

14

–

Ford F-150

Thermal Management

–

Ford Focus

Sealing

–

GM Chevrolet Camaro

Convertible Sealing

–

Honda Civic

Sealing

–

Nissan Altima

Thermal Management

–

Nissan Leaf

Thermal Management

–

Nissan Commercial Van

Thermal Management

Sealing

–

Renault 3008

Thermal Management

–

Volkswagen Golf Cabriolet

Sealing

Renault 3008

VW Golf

Nissan Altima

Honda Civic

GM Chevrolet Camaro

Ford Focus

Note: Photos are representative and may not reflect final production models

|

USi

Transaction •

Proprietary technology

•

Acquisition of USi, Inc., from Ikuyo Co. Ltd. of Japan

•

Unique coating for surface and a full-range of bright

trim sealing assemblies that are quickly gaining

popularity

Plan to extend technology and capabilities to

European and Brazil businesses

cooperstandard

15 |

Financial Overview

1Q 2011

Allen Campbell

Chief Financial Officer |

cooperstandard

17

Opportunistic Transactions: Immediate benefits

•

In addition to strategic benefits:

•

FMEA / Barre-Thomas: French supplier consolidation

•

Adds three European facilities and Indian JV

•

JV self-funds incremental restructuring expense

•

Minimal incremental cash investment

•

USi: Unique technology

•

Adds one facility

•

$6 to $8 million in 2011 sales

•

Nishikawa: Long-term partner, utilized asset exchanges

•

Will bring capability for Thailand production

•

Recorded a $11.4 million gain in Q1 |

cooperstandard

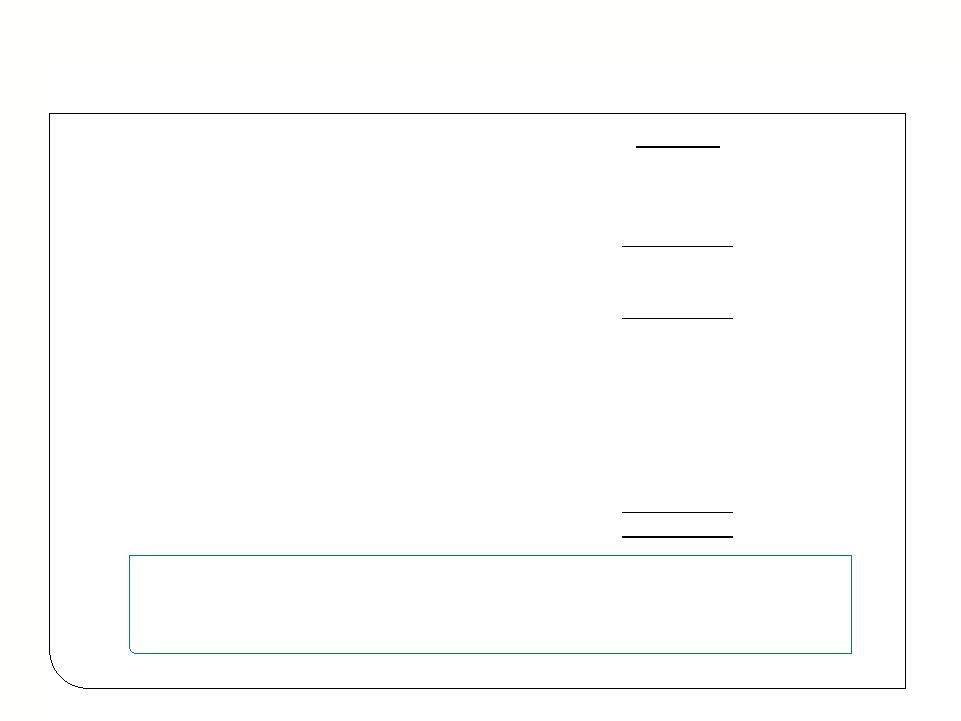

Q1 2011 Performance

18

$ Millions

Net Sales

Operating Profit

Gross Profit

Q1 2011

Q1 2010

$ 688.8

$ 596.3

$ 51.4

$ 51.0

$ 120.8

$ 104.5

Net Income

$ 44.9

$ 3.4

Adjusted EBITDA

(excluding qtr. one times)

$ 91.9

$ 74.2

% Margin

13.3%

12.4%

SGA

$ 60.9

$ 53.1 |

cooperstandard

EBITDA and Adjusted EBITDA Reconciliation

19

$ USD Millions

2010

2011

Net Income

$3.4

$ 44.9

Provision for income tax expense

7.3

EBITDA

$43.7

$ 96.0

Restructuring

0.3

4.6

Adjusted EBITDA

$ 74.2

$ 91.9

12.3

3 Months Ended March 31st

Net interest expense

11.8

9.9

Depreciation and amortization

21.2

28.9

Unrealized FX loss

23.3

Stock-based compensation

--

EDITDA and Adjusted EBITDA are Non-GAAP measures. Reference comments on slide

24 Joint venture adjustment

--

Reorganization costs

--

2.7

0.4

Net gain on partial sale of joint venture

0.2

-

Other

6.3

--

--

(11.4) |

cooperstandard

Cash Flow 1Q 2011

20

Cash Balance as of December 31

294.5

$

Cash used

(34.8)

Cash Balance as of March 31

259.7

$

($ in Millions)

Q1 - 2011

Cash from business

66.3

$

Pension funding

(25.6)

Changes in operating assets & liabilities

(62.3)

Cash used in Operations

(21.6)

$

Capital Expenditures

(16.2)

Cash used in Operations less CAPEX

(37.8)

$

Proceeds from partial sale of joint venture

16.0

Acquisition of business, net of cash acquired

(6.4)

Proceeds from sale of assets

0.3

Financing activities

(4.2)

Foreign exchange/other

(2.7)

Net Cash used in Q1

(34.8)

$ |

cooperstandard

21

Revised Guidance*

•

Sales: $2.7 billion -

$2.8 billion

•

Capital

expenditures:

$95

million

-

$105

million

•

Cash restructuring: $30 million -

$40 million

•

Cash taxes: $25 million -

$30 million

* Forecast is based on Cooper Standard estimates for North American production of

13.3. million, and Europe (including Russia) production of 19.2

million. |

cooperstandard

Non-GAAP Financial Measures

22

EBITDA and adjusted EBITDA are measures not recognized under Generally

Accepted Accounting Principles (GAAP) which exclude certain non-cash and

non- recurring items.

When analyzing the company’s operating performance, investors should use

EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net

income (loss), operating income, or any other performance measure derived in

accordance with GAAP, or as an alternative to cash flow from operating

activities as a measure of the company’s performance. EBITDA and

adjusted EBITDA have limitations as analytical

tools

and

should

not

be

considered

in

isolation

or

as

substitutes

for

analysis of the company’s results of operations as reported under GAAP. Other

companies may report EBITDA and adjusted EBITDA differently and therefore

Cooper Standard’s results may not be comparable to other similarly

titled measures of other companies.

A table setting forth a reconciliation of EBITDA and Adjusted EBITDA to net income,

which is the most directly comparable financial measure in accordance with

U.S. GAAP, is found in the Company’s press release dated May 11, 2011

with respect to first

quarter

2011

earnings

results.

A

copy

of

the

press

release

is

available

on

the

Company’s website at cooperstandard.com. |

Questions & Answers |

Q1

2011 Summary •

Effectively executing on our business plan

•

New business: global platforms, emerging markets, premier

brands

•

Smart acquisitions fill strategic needs and complements organic

growth

•

Effectively managing impact of raw material pricing and sourcing

issues

•

All while maintaining quality

24

Ready to Thrive in the New Competitive Landscape

and Drive Shareholder Value

cooperstandard |