Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[ X ]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended February 26, 2011

OR

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________________ to ____________________

Commission file number 1-4141

THE GREAT ATLANTIC & PACIFIC TEA COMPANY, INC.

(Exact name of registrant as specified in its charter)

Maryland 13-1890974

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

2 Paragon Drive

Montvale, New Jersey 07645

(Address of principal executive offices)

Registrant’s telephone number, including area code: 201-573-9700

_________________________________

Securities registered pursuant to Section 12 (b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock - $1 par value OTC Markets, Inc.

9.375% Notes, due August 1, 2039 OTC Markets, Inc.

Securities registered pursuant to Section 12 (g) of the Act: None

_________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ________ Accelerated filer X Non-accelerated filer _________ Smaller reporting company__________

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes [ ] No [ X ]

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes [ ] No [ ]

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of the close of business on September 11, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $23,170,101.

The number of shares of common stock outstanding as of the close of business on April 29, 2011 was 53,852,470.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III, Items 10, 11, 12, 13, and 14, and Part IV, Item 15 are incorporated by reference in an amendment to this Annual Report on Form 10-K, which will be filed by the registrant within 120 days after the close of its 2010 fiscal year.

PART I

ITEM 1 – Business

General

The Great Atlantic & Pacific Tea Company, Inc. (“A&P”, “we”, “our”, “us” or “our Company”) is engaged in the retail food business. We operated 393 stores averaging approximately 42,000 square feet per store as of February 26, 2011.

Operating under the trade names A&P®, SuperFresh®, Waldbaum’s®, Super Foodmart®, Food Basics®, The Food Emporium®, Best Cellars®, Best Cellars at A&P®, Pathmark® and Pathmark Sav-A-Center®, we sell groceries, meat, fresh produce and other items commonly offered in supermarkets and wine, beer and spirits in our Best Cellars® and Best Cellars at A&P® locations. In addition, many of our stores offer bakeries, delicatessens, pharmacies, floral departments, fresh seafood and cheese departments and on-site banking. National, regional and local brands are sold as well as a selection of our private label brands. In support of our retail operations, we sell private label products in our stores under other brand names of our Company which include, without limitation, America’s Choice®, America’s Choice Gold®, America’s Choice Healthy Kids®, Hartford Reserve®, Smart Price®, Green Way®, Via Roma®, and Live Better Wellness®.

Building upon a broad base of supermarkets, our Company has historically expanded and diversified within the retail food business through the acquisition of other supermarket chains and the development of several alternative store types. We now operate our stores with merchandise, pricing and identities tailored to appeal to different segments of the market, including buyers seeking gourmet and ethnic foods, a wide variety of premium quality private label goods and health and beauty aids along with the array of traditional grocery products.

Our Internet address is www.aptea.com. We make available free of charge through our Internet website our annual reports as soon as reasonably practicable after we electronically file such material with, or furnish them to, the Securities and Exchange Commission. All of such materials are located at the “Investors” page. We also provide through our Internet website a hyperlink to the Securities and Exchange Commission (“SEC”) website, where the Company’s quarterly reports on Form 10-Q, current reports on Form 8-K, and Forms 3, 4 and 5 filed with respect to our equity securities under Section 16(a) of the Securities Exchange Act of 1934, as amended, may be accessed electronically. The information found on our website shall not be deemed incorporated by reference by any general statement incorporating by reference this report into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended (collectively, the ”Acts”), and shall not otherwise be deemed filed under the Acts.

Bankruptcy Filing

On December 12, 2010 (the "Petition Date"), our Company and all of our U.S. subsidiaries (the “Debtors”) filed voluntary petitions for relief (the “Bankruptcy Filing”) under chapter 11 of title 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York in White Plains (the “Bankruptcy Court”), case number 10-24549. Management's decision to make the Bankruptcy Filing was in response to, among other things, our Company’s deteriorating liquidity and management's conclusion that the challenges of successfully implementing additional financing initiatives and of obtaining necessary cost concessions from our Company’s business and labor partners, was negatively impacting our Company’s ability to implement our previously announced turnaround strategy. Our Company’s non-U.S. subsidiaries, which are immaterial on a consolidated basis and have no retail operations, were not part of the Bankruptcy Filing.

Our Company was required to apply the FASB’s provisions of Reorganizations effective on the Petition Date, which is applicable to companies in chapter 11, which generally does not change the manner in which financial statements are prepared. However, it does require that the financial statements for periods subsequent to the filing of the Bankruptcy Filing petition distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. The balance sheet must distinguish prepetition liabilities subject to compromise from both those prepetition liabilities that are not subject to compromise and from post-petition liabilities. As discussed in Note 9 to our Consolidated Financial Statements - Indebtedness and Other Financial Liabilities, currently the Superpriority Debtor-in-Possession Credit Agreement is senior to all debt. The Senior Secured Notes totaling $260.0 million have priority over the unsecured creditors of our Company. Based upon the uncertainty surrounding the ultimate treatment of the Notes in our reorganization plan, including the potential that these Notes may be impaired, these notes are classified as Liabilities subject to compromise on our Consolidated Balance Sheets. Our Company continues to evaluate creditors' claims for other claims that may also have priority over unsecured creditors. Liabilities that may be affected by a plan of reorganization must be reported at the amounts expected to be approved by the Bankruptcy Court, even if they may be settled for lesser amounts as a result of the plan or reorganization. In addition, cash provided by reorganization items must be disclosed separately in the Consolidated Statements of Cash Flows. Lastly, these accompanying consolidated financial statements do not reflect any adjustments of the carrying value of assets and liabilities which may result from any plan of reorganization adopted by our Company.

Reporting Requirements

As a result of the Bankruptcy Filing, our Company is now required to file various documents with, and provide certain information to, the Bankruptcy Court and various third parties, including statements of financial affairs, schedules of assets and liabilities, and monthly operating reports in forms prescribed by federal bankruptcy law, as well as certain financial information on an unconsolidated basis. Such materials will be prepared according to requirements of federal bankruptcy law. Although such materials accurately provide then-current information required under federal bankruptcy law, they are nonetheless unconsolidated, unaudited, and are prepared in a format different from that used in our Company's consolidated financial statements filed under the securities laws. Accordingly, our Company believes that the substance and format do not allow meaningful comparison with its regular publicly disclosed consolidated financial statements. Moreover, the materials filed with the Bankruptcy Court are not prepared for the purpose of providing a basis for an investment decision relating to our Company's securities, or for comparison with other financial information filed with the SEC.

Notifications

Shortly after the Petition Date, our Company began notifying current or potential creditors of the Bankruptcy Filing. Subject to certain exceptions under the Bankruptcy Code, the Bankruptcy Filing automatically enjoined, or stayed, the continuation of any judicial or administrative proceedings or other actions against our Company or their property to recover on, collect or secure a claim arising prior to the Petition Date. Thus, for example, most creditor actions to obtain possession of property from our Company, or to create, perfect or enforce any lien against the property of our Company, or to collect on monies owed or otherwise exercise rights or remedies with respect to a claim arising prior to the Petition Date are enjoined unless and until the Bankruptcy Court lifts the automatic stay. Vendors are being paid for goods furnished and services provided after the Petition Date in the ordinary course of business. Certain creditors and other parties in interest have filed motions for relief from the automatic stay with the Bankruptcy Court, although no such motions have been granted (or resolved consensually with our Company) on a basis that would have a material effect on our Company’s businesses. Nonetheless, there can be no assurance that the Bankruptcy Court will not at some future date grant relief from the automatic stay, or other similar creditor relief, that would have a material, adverse effect on our Company’s businesses.

Creditors' Committee

As required by the Bankruptcy Code, the United States trustee for the Southern District of New York appointed the Creditors' Committee. The Creditors' Committee and its legal representatives have a right to be heard on all matters that come before the Bankruptcy Court with respect to our Company. There can be no assurance that the Creditors' Committee will support our Company’s positions on matters to be presented to the Bankruptcy Court in the future or on any plan of reorganization, and the Creditors' Committee in fact has taken positions adverse to our Company in proceedings related to the Chapter 11 Filing. Disagreements between the Company and the Creditors' Committee could protract the court proceedings, negatively impact our Company’s ability to operate and delay the Company’s emergence from Chapter 11.

Executory Contracts — Section 365

Under section 365 and other relevant sections of the Bankruptcy Code, our Company may assume, assume and assign, or reject certain executory contracts and unexpired leases, including, without limitation, leases of real property, subject to the approval of the Bankruptcy Court and certain other conditions. Any description of an executory contract or unexpired lease in this Form 10-K, including, where applicable, our Company’s express termination rights or a quantification of our obligations, must be read in conjunction with, and is qualified by, any overriding rejection rights our Company have under section 365 of the Bankruptcy Code. Claims may arise as a result of rejecting any executory contract. At this time, we are unable to estimate precisely the rejection damages that may result from rejecting any leases or other executory contracts.

Plan of Reorganization

In order to emerge successfully from bankruptcy, our Company will need to propose and obtain confirmation by the Bankruptcy Court of a plan of reorganization that satisfies the requirements of the Bankruptcy Code. A plan of reorganization would, among other things, resolve our Company obligations arising prior to the Petition Date, set forth the revised capital structure of the newly reorganized entities and establish the framework for corporate governance subsequent to exit from bankruptcy.

Automatically, upon commencing the Chapter 11 Filing, our Company under the Bankruptcy Code had the exclusive right for 120 days after the Petition Date to file a plan of reorganization. Our Company has since obtained court approval extending this exclusivity through August 31, 2011. If we do file a plan, our Company will be entitled to 60 additional days to obtain necessary acceptances of our plan.

In addition to being voted on by holders of impaired claims and equity interests, a plan of reorganization must satisfy certain requirements of the Bankruptcy Code and must be approved, or confirmed, by the Bankruptcy Court in order to become effective.

A plan of reorganization will be deemed accepted by holders of claims against and equity interests in our Company if (1) at least one-half in number and two-thirds in dollar amount of claims actually voting in each impaired class of claims have voted to accept the plan, and (2) at least two-thirds in amount of equity interests actually voting in each impaired class of equity interests has voted to accept the plan. Under certain circumstances, however, the Bankruptcy Court may confirm a plan even if such plan has not been accepted by all impaired classes of claims and equity interests. A class of claims or equity interests that does not receive or retain any property under the plan on account of such claims or interests is deemed to have voted to reject the plan. The precise requirements and evidentiary showing for confirming a plan, notwithstanding its rejection by one or more impaired classes of claims or equity interests, depends upon a number of factors including without limitation, the status and seniority of the claims or equity interests in the rejecting class (i.e., secured claims or unsecured claims, subordinated or senior claims, preferred or common stock). Generally, with respect to a class of claim holders, a plan may be "crammed down" even if such class receives no recovery if the proponent of the plan demonstrates that (1) no class junior to such class is receiving or retaining property under the plan, and (2) no class of claims or interests senior to the "crammed down" class is being paid more than in full.

Reorganization Costs

Revenues, expenses, realized gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the business must be reported separately as reorganization items in the Consolidated Statements of Operations beginning in the year ended February 26, 2011. We have incurred and will continue to incur significant costs associated with the reorganization. The amount of these costs, which are being expensed as incurred, are expected to significantly affect our results of operations.

Risks and Uncertainties

The ability of our Company, both during and after the Bankruptcy Court proceedings, to continue as a going concern, is dependent upon, among other things, (i) the ability of our Company to maintain adequate liquidity, including the generation of cash from operations, and (ii) the ability of our Company to confirm a plan of reorganization under the Bankruptcy Code. Uncertainty as to the outcome of these factors raises substantial doubt about our Company’s ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments to reflect or provide for the consequences of the bankruptcy proceedings, except for unsecured claims allowed by the Bankruptcy Court. In particular, such financial statements do not purport to show (a) as to assets, their realization value on a liquidation basis or their availability to satisfy liabilities, (b) as to liabilities arising prior to the Petition Date, the amounts that may be allowed for claims or contingencies, or the status and priority thereof, (c) as to stockholder accounts, the effect of any changes that may be made in the capitalization of our Company, or (d) as to operations, the effects of any changes that may be made in the underlying business. A plan of reorganization would likely cause material changes to the amounts currently disclosed in the consolidated financial statements.

Negative events associated with the Bankruptcy Filing could adversely affect revenues and our Company’s relationship with customers, as well as with vendors and employees, which in turn could adversely affect our Company’s operations and financial condition, particularly if the Bankruptcy Court proceedings become more protracted. Also, transactions outside of the ordinary course of business are subject to the prior approval of the Bankruptcy Court, which may limit our Company’s ability to respond timely to certain events or take advantage of certain opportunities. Because of the risks and uncertainties associated with the Bankruptcy Court proceedings, the ultimate impact that events that occur during these proceedings will have on our Company’s business, financial condition and results of operations cannot be predicted or quantified accurately, and until such issues are resolved, there remains substantial doubt about our Company’s ability to continue as a going concern.

As a result of the Bankruptcy Filing, realization of assets and liquidation of liabilities are subject to uncertainty. While operating as a debtor-in-possession under the protection of Bankruptcy Code and subject to Bankruptcy Court approval or otherwise as permitted in the normal course of business, our Company may sell or otherwise dispose of assets and liquidate or settle liabilities for amounts other than those reflected in the consolidated financial statements. Further, a plan of reorganization could materially change the amounts and classifications reported in the consolidated historical financial statements, which do not give effect to any adjustments to the carrying value of assets or amounts of liabilities that might be necessary as a consequence of confirmation of a plan of reorganization.

Under the priority scheme established by the Bankruptcy Code, certain post-petition liabilities and pre-petition liabilities need to be satisfied before shareholders are entitled to receive any distribution. The ultimate recovery to creditors, convertible preferred securities holders and/or common shareholders, if any will not be determined until confirmation of a plan or plans of reorganization. No assurance can be given as to what values, if any, will be ascribed in the bankruptcy proceedings to each of these constituencies. A plan of reorganization could also result in holders of preferred and common stock receiving no value for their interests. Because of such possibilities, the value of the common stock is highly speculative. Accordingly, the Company urges that appropriate caution be exercised with respect to existing and future investments in any of these liabilities and/or securities. Amounts reflected in our Consolidated Financial Statements relative to these constituencies are not intended to represent the fair value or redemption values that will be realized by these constituencies under the bankruptcy proceedings.

Fresh Start Accounting

As required by the FASB’s provisions of Reorganizations, we will adopt fresh start accounting upon the conclusion of the Bankruptcy Filing. The consolidated financial statements for the periods ended February 26, 2011 and prior do not include the effect of any changes in our capital structure or changes in the fair value of assets and liabilities as a result of fresh start accounting.

Sources of Supply

Our Company currently acquires a majority of our saleable inventory from one supplier, C&S Wholesale Grocers, Inc. (“C&S”). Under our March 7, 2008 agreement with C&S, C&S provides warehousing, logistics, procurement and purchasing services (the “Services”) in support of our Company's entire supply chain. This agreement expires on September 29, 2018. The agreement defines the parties' respective responsibilities for the procurement and purchase of merchandise intended for use or resale at our Company's stores, as well as the parties' respective remuneration for warehousing and procurement/purchasing activities. In consideration for its services, C&S is paid an annual fee and has incentive income opportunities based upon our cost savings and increases in retail sales volume. The agreement also provides that we will purchase virtually our entire warehoused inventory from C&S. We are rebidding the Services to ensure that the structure and cost and costs of our entire supply chain are more closely aligned with the needs of our business. The rebidding of the Services may result in a rejection or termination of our agreement with C&S in Bankruptcy Court. We anticipate that the rebidding process will result in significant cost savings in fiscal 2011 and beyond, but there can be no assurance that these efforts will be successful or will result in any savings or improvements.

Licenses and Trademarks

Our stores require a variety of licenses and permits that are renewed on an annual basis. Payment of a fee is generally the only condition to maintaining such licenses and permits. We maintain registered trademarks for nearly all of our store banner trade names and private label brand names. Trademarks are generally renewable on a 10 year cycle. We consider trademarks an important way to establish and protect our Company brands in a competitive environment.

Employees

As of February 26, 2011, we had approximately 39,000 employees, of which 68% were employed on a part-time basis. Approximately 92% of our employees are covered by union contracts. We believe that we have good relationships with our labor union partners.

Competition

The supermarket business is highly competitive throughout the marketing areas served by our Company and is generally characterized by low profit margins on sales with earnings primarily dependent upon rapid inventory turnover, effective cost controls and the ability to achieve high sales volume. We compete for sales and store locations with a number of national and regional chains, as well as with many independent and cooperative stores and markets.

Segment Information

The segment information required is contained within Item 8 under the caption “Note 20 – Segments” in the Notes to Consolidated Financial Statement and is herein incorporated by reference.

ITEM 1A – Risk Factors

Our future performance is subject to uncertainties and other risk factors that could have a negative impact on our business and cause actual results to differ materially from our expectations. Various factors could have a negative effect on our Company’s financial position and results of operations. These risk factors include, among others, the following:

|

·

|

Failure to execute on our turnaround plan could adversely affect our Company’s liquidity, financial condition and results of operations.

|

We are currently operating pursuant to the Bankruptcy Filing and continuation of our Company as a going-concern is contingent upon, among other things, the Debtors’ ability (i) to comply with the terms and conditions of the Debtor-In-Possession Credit Agreement (“DIP Credit Agreement”) described in Note 9 to our Consolidated Financial Statements – Indebtedness and Other Financial Liabilities; (ii) to develop a plan of reorganization and obtain confirmation under the Bankruptcy Code; (iii) to reduce debt and other liabilities through the bankruptcy process; (iv) to return to profitability, including necessary near-term cost concession from our business and labor partners beginning as early as June 2011 with the benefits reflected in our results shortly thereafter; (v) to generate sufficient cash flow from operations; and (vi) to obtain financing sources to meet our future obligations. The uncertainty regarding these matters raises substantial doubt about our ability to continue as a going concern.

|

·

|

As a result of the Bankruptcy Filing, our historical financial information may not be indicative of our future financial performance.

|

Our capital structure will likely be significantly altered under any plan of reorganization ultimately confirmed by the Bankruptcy Court. Under fresh-start reporting rules that may apply to the Debtor upon the effective date of a plan of reorganization, our assets and liabilities would be adjusted to fair values and our accumulated deficit would be restated to zero. Accordingly, if fresh-start reporting rules apply, our financial condition and results of operations following our emergence from the Bankruptcy Filing would not be comparable to the financial condition and results of operations reflected in our historical financial statements. In connection with the Bankruptcy Filing and the development of a plan of reorganization, it is also possible that additional restructuring and related charges may be identified and recorded in future periods. Such charges could be material to our consolidated financial position and results of operations in any given period.

|

·

|

Operating during the Bankruptcy Filing may restrict our ability to pursue our strategic and operational initiatives.

|

Under the Bankruptcy Filing, transactions outside the ordinary course of business are subject to the prior approval of the Bankruptcy Court, which may limit our ability to respond in a timely manner to certain events or take advantage of certain opportunities. Additionally, the terms of the DIP Credit Agreement limit our ability to undertake certain business initiatives. These limitations include, among other things, our ability to:

|

·

|

incur indebtedness;

|

||

|

|

·

|

incur or create liens;

|

|

|

|

·

|

dispose of assets;

|

|

|

·

|

prepay certain indebtedness and make other restricted payments;

|

||

|

·

|

enter into sale and leaseback transactions; and

|

||

|

·

|

modify the terms of certain indebtedness and certain material contracts.

|

|

·

|

The pursuit of the Bankruptcy Filing may have an adverse effect on our business and results of operations.

|

The requirements of the Bankruptcy Filing have consumed and will continue to consume a substantial portion of our corporate management’s time and attention and leave them with less time to devote to the operation of our business. This diversion of attention may materially and adversely affect the conduct of our business, and, as a result, on our financial condition and results of operations, particularly if the Bankruptcy Filing is protracted.

Furthermore, we have incurred and will continue to incur during the pendency of the Bankruptcy Filing substantial costs for professional fees and other expenses associated with the administration of the Bankruptcy Filing. A prolonged continuation of the Bankruptcy Filing may also require us to seek additional financing. If we require additional financing during the pendency of the Bankruptcy Filing and we are unable to obtain the financing on favorable terms or at all, our chances of successfully reorganizing our businesses may be seriously jeopardized, and as a result, any securities in our Company could become devalued or become worthless.

|

·

|

We may not be able to remain in compliance with the requirements of the DIP Credit Agreement therefore the lending commitments under the DIP Credit Agreement may be terminated by the DIP Lender.

|

The DIP Credit Agreement also contains certain financial covenants, including a minimum excess availability covenant of $100.0 million, minimum liquidity covenant of $100.0 million and minimum cumulative EBITDA covenant as defined in the DIP Credit Agreement. Minimum cumulative EBITDA measured beginning on April 24, 2011 is as follows (in millions):

|

Date

|

Minimum Cumulative EBITDA

|

|

August 13, 2011

|

$ -

|

|

September 10, 2011

|

10.0

|

|

October 8, 2011

|

20.0

|

|

November 5, 2011

|

35.0

|

|

December 3, 2011

|

50.0

|

|

December 31, 2011

|

65.0

|

|

January 28, 2012

|

90.0

|

|

February 25, 2012

|

100.0

|

|

March 24, 2012

|

110.0

|

|

April 21, 2012

|

125.0

|

|

May 19, 2012

|

150.0

|

|

June 16, 2012

|

175.0

|

We are currently in compliance with all covenants. Meeting our EBITDA covenant requires increasing levels of performance throughout the year. Achieving this improving performance will require our Company to successfully implement our business improvement initiatives beginning as early as June 2011 with the benefits reflected in our results shortly thereafter. The DIP Credit Agreement matures upon the earliest to occur of (a) June 14, 2012, (b) the acceleration of the loans and the termination of the commitment thereunder, and (c) the substantial consummation (as defined in Section 1101(2) of the Bankruptcy Code, which for purposes hereof shall be no later than the effective date thereof) of a plan of reorganization that is confirmed pursuant to an order entered by the Bankruptcy Court. The Bankruptcy Court entered a final order approving the DIP Credit Agreement on January 11, 2011.

If, as a result of our breach of the terms thereof, the DIP Credit Agreement is terminated or our access to funding thereunder is restricted or terminated, we may not have sufficient cash availability to meet our operating needs or satisfy our obligations as they fall due, in which instance we could be required to seek a sale of our Company or certain of its material assets pursuant to Section 363 of the Bankruptcy Code, or to convert the Bankruptcy Filing into a liquidation under Chapter 7 of the Bankruptcy Code.

|

·

|

If we are unable to implement a plan of reorganization or if sufficient debtor-in-possession financing is not available we could be required to seek a sale of our Company or certain of its material assets pursuant to Section 363 of the Bankruptcy Code, or liquidate under Chapter 7 of the Bankruptcy Code.

|

There can be no assurance that the Bankruptcy Court will approve a proposed plan or that the DIP Credit Agreement will not be terminated by the DIP Lender for our breach thereof. If either of these events were to occur we could be forced to liquidate under Chapter 7 of the Bankruptcy Code.

|

·

|

As a result of approval and implementation of a proposed plan, should such occur, certain changes in ownership of our Company could occur, which could adversely affect our ability to utilize our significant net operating loss carry-forwards upon our emergence from the Bankruptcy Filing.

|

There are certain tax attributes, such as net operating loss carry-forwards, that may be limited or lost altogether in the event of an ownership change as defined under Section 382 of the Internal Revenue Code. If a change of ownership were to occur as a result of the implementation of the proposed plan, upon our emergence from the Bankruptcy Filing there could be significant valuation allowances placed on deferred tax assets.

|

·

|

We may experience increased levels of employee attrition.

|

During the pendency of the Bankruptcy Filing, we may experience increased levels of employee attrition, and our employees are facing considerable distraction and uncertainty. A loss of key personnel or material erosion of employee morale, at the corporate, field and store levels, could have a materially adverse affect on our ability to meet customer, trade partner and strategic partner expectations, thereby adversely affecting our business and results of operations. Our ability to engage, motivate and retain key employees or take other measures intended to motivate and incent key employees to remain with us through the pendency of the Bankruptcy Filing is limited during the Bankruptcy Filing by restrictions on implementation of retention programs.

|

·

|

Trading in our securities during the pendency of the Bankruptcy Filing is highly speculative and poses substantial risks. Our common stock may be cancelled and holders of such common stock may not receive any distribution with respect to, or be able to recover any portion of, their investments.

|

It is unclear at this stage of the Bankruptcy Filing if any plan of reorganization would allow for distributions with respect to our common stock. It is likely that these equity interests will be cancelled and extinguished in connection with confirmation of a plan of reorganization by the Bankruptcy Court and the holders thereof would not be entitled to receive, and would not receive or retain, any property or interest in property on account of such equity interests. In the event of cancellation of these equity interests, amounts invested by such holders in our outstanding equity securities will not be recoverable. As a result, our currently outstanding common stock would have no value. Trading prices for our common stock may bear little or no relationship to the actual recovery, if any, by the holders thereof in the Bankruptcy Filing. Accordingly, we urge extreme caution with respect to existing and future investments in our equity securities and any of our other securities.

|

·

|

Our common stock and 9 3/8% senior quarterly interest bonds are no longer listed on a national securities exchange and are quoted only on the Pink Sheets, which could negatively affect our stock price, bond price and marketplace liquidity.

|

As of December 13, 2010, our common stock and 9 3/8% senior quarterly interest bonds (“9 3/8% bonds”) trade exclusively on the Pink OTCQB market (the “Pink Sheets”) and are currently traded under the symbols GAPTQ and GAJTQ, respectively. The Pink Sheets is a significantly more limited market than the NYSE, and the quotation of our common stock and 9 3/8% bonds on the Pink Sheets may result in a less liquid market available for existing and potential stockholders and bondholders, respectively, to trade in our common stock and 9 3/8% bonds. This could further depress the trading price of our common stock and 9 3/8% bonds.

|

·

|

Various operating factors and general economic conditions affecting the food industry may affect our business and may adversely affect our operating results.

|

The retail food and food distribution industries and the operation of our business, specifically in the New York, New Jersey and Philadelphia regions, are sensitive to a number of economic conditions and other factors such as: (i) food price deflation or inflation, (ii) softness in local and national economies, (iii) the availability of favorable credit and trade terms, (iv) changes in business plans, operations, results and prospects, and (v) other economic conditions that may affect consumer buying habits. Any one or more of these economic conditions can affect our retail sales, the demand for products we distribute to our retail customers, our operating costs and other aspects of our business. Failure to achieve sufficient levels of cash flow at reporting units could also result in additional impairment charges on goodwill, intangible assets and/or long-lived assets.

Changes in the general business and economic conditions in our markets, including the rate of inflation, population growth, the fluctuating prices of oil and gas, the nature and extent of continued consolidation in the food industry and the unemployment rate in the markets in which we operate, may negatively affect earnings and sales growth. General economic changes may also affect the shopping habits and buying patterns of our customers, which could affect sales and earnings.

Our ability to achieve profitability will be affected by, among other things: (i) our success in executing our category management and purchasing programs, which are designed to improve our gross margins and reduce product costs, (ii) the effectiveness of efforts to improve our value proposition for our customers through our merchandising and marketing programs and to enhance customers’ experience in our stores, (iii) our ability to achieve productivity improvements and reduce shrink in our stores, (iv) our success in generating efficiencies in our supporting activities, (v) our ability to eliminate or maintain a minimum level of supply and/or quality control problems with our vendors, (vi) the rebidding of our warehousing, logistics, procurement, and purchasing services; and (vii) the results of negotiations with our union partners to alter existing collective bargaining agreements.

|

·

|

We face a high level of competition, including the threat of further consolidation in the food industry, which could adversely affect our sales and future profits.

|

The retail food business is extremely competitive and is characterized by high inventory turnover and narrow profit margins. The retail food business is subject to competitive practices that may affect the prices at which we are able to sell products at our retail locations, sales volume, and our ability to attract and retain customers. In addition, the nature and extent of consolidation in the retail food industry could affect our competitive position in the markets we serve.

Our retail food business and the grocery retailing industry continue to experience aggressive competition from mass merchandisers, warehouse clubs, drug stores, convenience stores, discount merchandisers, dollar stores, restaurants, other retail chains, nontraditional competitors and emerging alternative formats in the markets where we have retail operations. Competition with these outlets is based on price, store location, advertising and promotion, product mix, quality and service. Some of these competitors may have greater financial resources, lower merchandise acquisition costs and lower operating expenses than we do, and we may be unable to compete successfully in the future. Increasingly competitive markets have made it difficult generally for grocery store operators to achieve comparable store sales gains. Because sales growth has been difficult to attain, our competitors have attempted to maintain market share through increased levels of promotional activities and discount pricing, creating a more difficult environment in which to consistently increase year-over-year sales. Price-based competition has also, from time to time, adversely affected our operating margins. Competitors’ greater financial strengths enable them to participate in aggressive pricing strategies such as selling inventory below costs to drive overall increased sales. Our continued success is dependent upon our ability to effectively compete in this industry and to reduce operating expenses, including managing health care and pension costs contained in our collective bargaining agreements. The competitive practices and pricing in the food industry generally and particularly in our principal markets may cause us to reduce our prices in order to gain or maintain our market share of sales, thus reducing margins.

Our in-store pharmacy business is also subject to intense competition. In particular, an adverse trend for drug retailing has been the significant growth in mail-order and Internet-based prescription processors, including importation from Canada and other countries. Due to the rapid rise in drug costs experienced in recent years, mail-order prescription distribution methods are perceived by employers and insurers as being less costly than traditional distribution methods and are being mandated by an increasing number of third party pharmacy benefit managers, many of which also own and manage mail-order distribution operations. As a result, some labor unions and employers are requiring, and others may encourage, that their members or employees obtain medications from mail-order pharmacies which offer drug prescriptions at prices that are lower than we are able to offer. In addition to these forms of mail-order distribution, there has also been increasing competition from a number of Internet-based prescription distributors, which specialize in offering certain high demand lifestyle drugs at deeply discounted prices, and importers from Canada and other foreign countries. These alternate distribution channels have acted to restrain the rate of sales growth for traditional chain drug retailers in the last few years. There can be no assurance that our efforts to offset the effects of alternate distribution channels and eligibility changes will be successful.

|

·

|

We are concentrated in the New York, New Jersey and Philadelphia metropolitan areas and, as a result, our business is significantly influenced by the economic conditions and other characteristics of these areas.

|

We are vulnerable to economic downturns in the New York, New Jersey and Philadelphia metropolitan areas, in addition to those that may affect the country as a whole, as well as other factors that may impact that region, such as the regulatory environment, the cost of real estate, insurance, taxes and rent, reliance on the financial industry, increasing unemployment, weather and natural catastrophes, demographics, the availability of labor, and geopolitical factors.

We cannot predict economic conditions in this region, and factors such as interest rates, energy costs and unemployment rates may adversely affect our sales which may lead to higher losses. Any unforeseen events or circumstances that affect the area could also materially adversely affect our revenues and profitability. Further, since we are concentrated in densely populated metropolitan areas, opportunities for future store expansion may be limited, which may adversely affect our business and results of operations.

|

·

|

Our vendors may shorten our payment terms, which would impair our ability to effectively manage our cash flow.

|

We have negotiated payment terms with most of our vendors. However, there can be no assurance that we will be able to maintain such terms in the future.

|

·

|

We rely on C&S for a substantial amount of our products.

|

Pursuant to the terms of a long-term supply agreement that expires on September 29, 2018, we currently acquire most of our saleable inventory, including groceries and perishables, from one supplier, C&S. During fiscal 2010, products supplied from C&S accounted for approximately 74% of our Company’s supermarket inventory purchases. Recently, we have experienced some difficulty in the supply of isolated products to certain stores and supply interruptions by C&S could occur in the future. Any significant interruption in this supply chain, either as a result of disruptions at C&S or if our supply agreement with C&S were terminated for any reason, could have a material adverse effect on our business and results of operations. We are therefore subject to the risks of C&S’s business, including potential labor disruptions at C&S facilities, increased regulatory obligations and distribution problems which may affect C&S’s ability to obtain products. While we believe that other suppliers could provide similar products on reasonable terms, they are limited in number. In addition, a change in suppliers could cause a delay in distribution and a possible loss of sales, which would affect operating results adversely.

We are rebidding the Services to ensure that the structure and cost and costs of our entire supply chain are more closely aligned with the needs of our business. The rebidding of the Services may result in a rejection or termination of our agreement with C&S in Bankruptcy Court. We anticipate that the rebidding process will result in significant cost savings in fiscal 2011 and beyond, but there can be no assurance that these efforts will be successful or will result in any savings or improvements.

|

·

|

We may be adversely affected by unexpected changes in the insurance market or changes in factors affecting our self-insurance reserve estimates.

|

We use a combination of self-insurance and insurance coverage to provide for the potential liabilities for general liability, property losses, fleet liability, workers’ compensation, employee benefits and directors and officers. There is no assurance that we will be able to continue to maintain our insurance coverage or obtain comparable coverage at a reasonable cost. Self-insurance reserves are determined based on actual claims experience and actuarially estimated claims incurred but not reported. Actuarial projections are subject to a high degree of variability, due to fluctuations in future interest and inflation rates, future economic conditions, litigation trends, benefit level changes, changes in state regulations, and changes in other factors. An increase in the frequency of claims, cost of claims or changes in actuarial assumptions could adversely affect our results of operations and financial condition.

|

·

|

We may be adversely affected by rising utility and fuel costs.

|

Rising fuel costs may adversely affect our operating costs since we incur the cost of fuel in connection with the transportation of goods from our warehouse and distribution facilities to our stores. In addition, operations at our stores are sensitive to rising utility fuel costs due to the amount of electricity and gas required to operate our stores. In the event of rising fuel costs, we may not be able to recover rising utility and fuel costs through increased prices charged to our customers. Oil prices directly affect our product transportation costs and fuel costs due to the amount of electricity and gas required to operate our stores as well as our utility and petroleum-based supply costs, including plastic bags.

|

·

|

Current economic conditions have been, and may continue to be volatile.

|

Many financial institutions have in the past reduced and, in some cases, ceased to provide funding to borrowers. Based on information available to us, we have no indication that the financial institutions acting as lenders under our credit facility would be unable to fulfill their commitments. Continued turbulence in the global credit markets and U.S. economy may adversely affect our results of operations, financial condition and liquidity.

|

·

|

We have certain substantial equity holders that may support strategies that are opposed to your interests or with which you disagree.

|

Tengelmann, our Company’s former majority stockholder, owns beneficially and of record a substantial percentage of our common stock on a fully diluted basis. As a result of this equity ownership and our stockholder agreement with Tengelmann, Tengelmann has the power to significantly influence the results of stockholder votes and the election of our board of directors, as well as transactions involving a potential change of control of our Company. Tengelmann may support strategies and directions for our Company which are in its best interests but which are opposed to other stakeholders. So long as Tengelmann retains sufficient ownership of our Company’s voting power, Tengelmann has rights to board representation, as well as consent rights in connection with certain major Company actions including changes to Company policies and organizational documents, dispositions and financing activity.

Yucaipa is a significant holder of our common stock on a fully diluted basis. According to the stockholder’s agreement with Yucaipa, as long as Yucaipa retains sufficient ownership of our Company’s voting power, Yucaipa has rights to board representation, as well as consent rights in connection with certain major Company actions including changes to Company policies and organizational documents, dispositions and financing activity. Yucaipa may support strategies and directions for our Company which are in its best interests but which are opposed to other stakeholders.

|

·

|

We could be affected if consumers lose confidence in the food supply chain or the quality and safety of our products.

|

We could be adversely affected if consumers lose confidence in the safety and quality of the food supply chain. Adverse publicity about these concerns, whether or not ultimately based on fact, and whether or not involving products sold at our stores, could discourage consumers from buying our products. The real or perceived sale of contaminated food products by us could result in a loss of consumer confidence and product liability claims, which could have a material adverse effect on our sales and operations.

To the extent that we are unable to maintain appropriate sanitation and quality standards in our stores, food safety and quality issues could involve expense and damage to our various brand names. Additionally, concerns about the safety or effectiveness of certain drugs or negative publicity surrounding certain categories of drugs may have a negative impact on our pharmacy sales.

|

·

|

Threats or potential threats to security of food and drug safety may adversely affect our business.

|

Acts or threats of war or terror or other criminal activity directed at the grocery or drug store industry, the transportation industry, or computer or communications systems, whether or not directly involving our stores, could increase our security costs, adversely affect our operations, or impact general consumer behavior and spending as well as customer orders and our supply chain. Other events that give rise to actual or potential food contamination, drug contamination, or food-borne illnesses could have an adverse effect on our operating results.

|

·

|

Various aspects of our business are subject to federal, state and local laws and regulations. Our compliance with these regulations may require additional expenditures and could adversely affect our ability to conduct our business as planned. Changes in these laws and regulations could increase our compliance costs.

|

We are subject to federal, state and local laws and regulations relating to zoning, land use, environmental protection, work place safety, public health, community right-to-know, beer and wine sales, pharmaceutical sales and gasoline station operations. A number of states and local jurisdictions regulate the licensing of supermarkets, including beer and wine license grants. In addition, under certain local regulations, we are prohibited from selling beer and wine in certain of our stores. Employers are also subject to laws governing their relationship with employees, including minimum wage requirements, overtime, working conditions, disabled access and work permit requirements. Compliance with these laws could reduce the revenue and profitability of our supermarkets and could otherwise adversely affect our business, financial condition or results of operations. In addition, any changes in these laws or regulations could significantly increase our compliance costs and adversely affect our results of operations, financial condition and liquidity.

A number of federal, state and local laws exist that impose burdens or restrictions on owners with respect to access by disabled persons. Our compliance with these laws may result in modifications to our properties, or prevent us from performing certain further renovations.

Our pharmacy business is subject to certain government laws and regulations, including those administered and enforced by Medicare, Medicaid, the Drug Enforcement Administration (“DEA”), Consumer Product Safety Commission, U.S. Federal Trade Commission and Food and Drug Administration. For example, the conversion of various prescription drugs to over-the-counter medications may reduce our pharmacy sales, and if the rate at which new prescription drugs become available slows or if new prescription drugs that are introduced into the market fail to achieve popularity, our pharmacy sales may be adversely affected. The withdrawal of certain drugs from the market may also adversely affect our pharmacy business. Changes in third party reimbursement levels for prescription drugs, including changes in Medicare Part D or state Medicaid programs, could also reduce our margins and have a material adverse effect on our business. In order to dispense controlled substances, we are required to register our pharmacies with the DEA and to comply with security, recordkeeping, inventory control and labeling standards.

In addition, our pharmacy business is subject to local regulations in the states where our pharmacies are located, applicable Medicare and Medicaid regulations and state and federal prohibitions against certain payments intended to induce referrals of patients or other health care business. Failure to properly adhere to these and other applicable regulations could result in the imposition of civil, administrative and criminal penalties including suspension of payments from government programs; loss of required government certifications; loss of authorizations to participate in, or exclusion from, government reimbursement programs such as Medicare and Medicaid; loss of licenses; significant fines or monetary penalties for anti-kickback law violations, submission of false claims or other failures to meet reimbursement program requirements and could adversely affect the continued operation of our business. Our pharmacy business is also subject to the Health Insurance Portability and Accountability Act, including its obligations to protect the confidentiality of certain patient information and other obligations. Failure to properly adhere to these requirements could result in the imposition of civil as well as criminal penalties.

|

·

|

Certain risks are inherent in providing pharmacy services, and our insurance may not be adequate to cover any claims against us.

|

Pharmacies are exposed to risks inherent in the packaging and distribution of pharmaceuticals and other healthcare products, such as risks of liability for products which cause harm to consumers. Although we maintain professional liability insurance and errors and omissions liability insurance, we cannot assure you that the coverage limits under our insurance programs will be adequate to protect us against future claims, or that we will be able to maintain this insurance on acceptable terms in the future. Our results of operations, financial condition or cash flows may be adversely affected if in the future our insurance coverage proves to be inadequate or unavailable, or there is an increase in liability for which we self-insure, or we suffer harm to our reputation as a result of an error or omission.

|

·

|

Litigation, legal or administrative proceedings and other claims could expose us to significant liabilities and thus negatively affect our financial results.

|

We are, from time to time, subject to various claims, administrative proceedings and litigation, which if determined adversely to us could negatively affect our financial results. We have estimated our exposure to claims, administrative proceedings and litigation and believe we have made adequate provisions for them, where appropriate. Unexpected outcomes in both the costs and effects of these matters could result in an adverse effect on our business and our results of operation and earnings.

|

·

|

We are affected by increasing labor, benefit and other operating costs and a competitive labor market and are subject to the risk of workforce disruptions.

|

Our financial performance is greatly influenced by increasing wage and benefit costs, including pension and health care costs, a competitive labor market and the risk of labor disruption of our highly unionized workforce.

We have approximately 39,000 employees, of which approximately 68% are employed on a part-time basis. Over the last few years, increased benefit costs have caused our Company’s labor costs to increase. We cannot assure you that our labor costs will not continue to increase, or that any such increases would be offset through increased prices of products in our stores. Any significant failure to attract and retain qualified employees, to control our labor costs or to recover any increased labor costs through increased prices charged to customers could have a material adverse effect on our results of operations.

As of February 26, 2011, approximately 92% of our employees were represented by unions and covered by collective bargaining or similar agreements that are subject to periodic renegotiations. Although we believe that we will successfully negotiate new collective bargaining agreements, these negotiations may not prove successful, may result in a significant increase in the cost of labor or may result in the disruption of our operations.

We believe that we have good relationships with our union partners. To reorganize as a viable business, our Company believes it needs to secure cost savings in multiple areas, including obligations arising under our collective bargaining agreements. Our Company is currently seeking to negotiate with its union partners to obtain consensual modifications to its collective bargaining agreements that are necessary for our Company’s successful reorganization. Our Company’s goal is to consensually modify its collective bargaining obligations by agreement with each of its union partners, although our Company cannot guaranty whether such outcome can be achieved.

If our Company is unable to obtain cost savings from its labor partners on a consensual basis, our Company may need to avail itself of certain rights and remedies under the Bankruptcy Code with regard to its collective bargaining obligations. In particular, Section 1113(c) of the Bankruptcy Code permits our Company to reject its collective bargaining agreements if our Company first satisfies a number of substantive and procedural requirements and the Bankruptcy Court determines, among other things, that the “balance of the equities clearly favors rejection.” Our Company has not sought to reject any of its collective bargaining agreements at this time.

There can be no assurance that our Company will succeed in obtaining necessary labor cost savings or that work stoppages or labor disturbances will not occur as a result of this process.

|

·

|

We participate in various multi-employer pension plans for substantially all employees represented by unions.

|

We will be required to make contributions to these multi-employer pension plans in amounts established under collective bargaining agreements. Pension expenses for these plans, which are recognized as contributions, are currently funded. Benefits generally are based on a fixed amount for each year of service. We contributed $56.6 million, $62.3 million and $48.2 million to multi-employer pension plans in fiscal 2010, fiscal 2009 and fiscal 2008, respectively. We could, under certain circumstances, be liable for unfunded vested benefits or other expenses of jointly administered union/management plans, which benefits could be significant and material for us. To date, we have not established any liabilities for future withdrawals because such withdrawals from these plans are not probable and the amount cannot be estimated. As a result, we expect that contributions to these plans may increase. Additionally, the benefit levels and related items will be issues in the negotiation of future collective bargaining agreements. Under current law, an employer that withdraws or partially withdraws from a multi-employer pension plan may incur withdrawal liability to the plan, which represents the portion of the plan’s underfunding that is allocable to the withdrawing employer under complex actuarial and allocation rules. The amount of any increase or decrease in our required contributions to these multi-employer pension plans will depend upon the outcome of collective bargaining, actions taken by trustees who manage the plans affecting the costs of future service benefits, government regulations and the actual return on assets held in the plans, among other factors.

|

·

|

We face the risk of being held liable for environmental damages that have or may occur.

|

Our operations subject us to various laws and regulations relating to the protection of the environment, including those governing the management and disposal of hazardous materials and the cleanup of contaminated sites. Under some environmental laws, such as the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, also known as CERCLA or the Superfund law, and similar state statutes, responsibility for the entire cost of cleanup of a contaminated site can be imposed upon any current or former site owners or operators, or upon any party who sent waste to the site, regardless of the lawfulness of the original activities that led to the contamination. From time to time we have been named as one of many potentially responsible parties at Superfund sites, although our share of liability has typically been de minimis. Although we believe that we are currently in substantial compliance with applicable environmental requirements, future developments such as more aggressive enforcement policies, new laws or discoveries of unknown conditions may require expenditures that may have a material adverse effect on our business and financial condition.

|

·

|

The loss of key personnel could negatively affect our business.

|

We are dependent upon a number of key personnel and members of management. If we were to lose the services of a significant number of key personnel or management within a short period of time, this could have a material adverse effect on our operations. We do not maintain key person insurance on any personnel or management. Our continued success is also dependent upon our ability to attract and retain qualified personnel to meet our future growth needs. We face intense competition for qualified personnel, many of whom are subject to offers from competing employers. We may not be able to attract and retain necessary team members to operate our business.

|

·

|

Any difficulties we experience with respect to our information technology systems could lead to significant costs or losses.

|

We have large, complex information technology systems that are important to our business operations. We could encounter difficulties developing new systems or maintaining and upgrading existing systems. Such difficulties could lead to significant expenses or losses due to disruption in our business operations.

Despite our considerable efforts to secure and maintain our computer network, security could be compromised, confidential information could be misappropriated, or system disruptions could occur. This could lead to disruption of operations, loss of sales or profits or cause us to incur significant costs to reimburse third parties for damages.

|

·

|

Our substantial indebtedness could impair our financial condition and our ability to fulfill our debt obligations, including our obligations under the notes.

|

We have substantial indebtedness. As of February 26, 2011, we had total indebtedness of $1,376.5 million, consisting of approximately $350.0 million outstanding under our debtor-in-possession financing, $260.0 million of senior secured notes – subject to compromise, $645.4 million of other outstanding notes – subject to compromise, approximately $121.1 million outstanding under capital lease obligations – subject to compromise. Our indebtedness could have important consequences to you. For example, it could: (i) make it more difficult for us to satisfy our obligations with respect to the notes and our other indebtedness, which could in turn result in an event of default on the notes or such other indebtedness, (ii) require us to dedicate a substantial portion of our cash flow from operations to debt service payments, thereby reducing the availability of cash for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iii) impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes, (iv) diminish our ability to withstand a downturn in our business, the industry in which we operate or the economy generally, (v) limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate, and (vi) place us at a competitive disadvantage compared to certain competitors that have proportionately less debt.

ITEM 1B – Unresolved Staff Comments

None.

ITEM 2 – Properties

At February 26, 2011, we owned 51 properties consisting of the following:

|

Stores, Not Including Stores in Owned Shopping Centers

|

|

|

Land and building owned

|

6

|

|

Building owned and land leased

|

22

|

|

Total stores

|

28

|

|

Shopping Centers

|

|

|

Land and building owned

|

4

|

|

Building owned and land leased

|

1

|

|

Total stores

|

5

|

|

Administrative and Other Properties

|

|

|

Land and building owned

|

6

|

|

Undeveloped land

|

12

|

|

Total other properties

|

18

|

|

Total Properties

|

51

|

Seventeen of these properties are pledged under our Company’s Amended and Restated Superpriority Debtor-In-Possession Credit agreement and six of these properties are pledged under our 11.375% Senior Secured Notes, which are subject to compromise.

At February 26, 2011, we operated 393 retail stores, of which 10 were owned and 383 were leased. These stores are geographically located as follows:

|

Company Stores:

|

|

|

Connecticut

|

16

|

|

District of Columbia

|

1

|

|

Delaware

|

13

|

|

Maryland

|

25

|

|

New Jersey

|

136

|

|

New York

|

164

|

|

Pennsylvania

|

37

|

|

Virginia

|

1

|

|

Total Stores

|

393

|

The total area of all of our operated retail stores is 16.5 million square feet averaging approximately 42,000 square feet per store. Excluding our Wine, Beer and Spirits stores and The Food Emporiumâ stores, which are generally smaller in size, the average store size is approximately 45,000 square feet. With the exception of our Wine, Beer and Spirits stores, our stores built over the past several years and those planned in the future generally range in size from 40,000 to 60,000 square feet. The selling area of new stores ranges from approximately 60% to 75% of the total square footage.

Our Company considers our stores, warehouses, and other facilities adequate for our operations.

ITEM 3 – Legal Proceedings

The information required is contained within Item 8 under the caption “Note 22 – Commitments and Contingencies” in the Notes to Consolidated Financial Statements and is herein incorporated by reference.

ITEM 4 – [Removed and Reserved]

PART II

ITEM 5 – Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The information required is contained within Item 6 – Selected Financial Data and under Item 12 - Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters of this Annual Report on Form 10-K and is herein incorporated by reference.

The high and low market price of our Company’s stock by quarter for fiscal 2010 and 2009 are as follows:

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||

|

Fiscal Year 2010

|

||||||||

|

High

|

$8.86

|

$4.74

|

$4.36

|

$3.32

|

||||

|

Low

|

$4.04

|

$2.61

|

$2.86

|

$0.16

|

||||

|

Fiscal Year 2009

|

||||||||

|

High

|

$7.47

|

$7.02

|

$12.31

|

$12.89

|

||||

|

Low

|

$3.02

|

$3.63

|

$6.35

|

$7.27

|

As of December 13, 2010, our common stock trades exclusively on the Pink OTCQB market (the “Pink Sheets”) and are currently traded under the symbol GAPTQ. The Pink Sheets is a significantly more limited market than the New York Stock Exchange, and the quotation of our common stock on the Pink Sheets may result in a less liquid market available for existing and potential stockholders to trade in our common stock. This could further depress the trading price of our common stock.

Stock Performance Graph

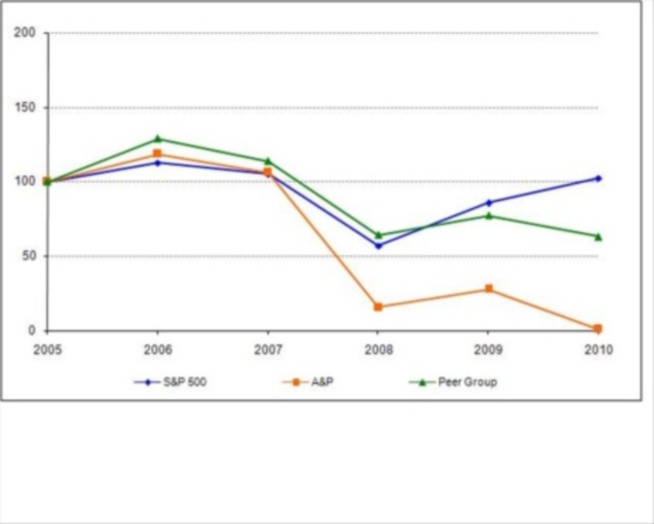

The following performance graph compares the five-year cumulative total stockholder return (assuming reinvestment of dividends) of the Company's Common Stock to the Standard & Poor's 500 Index and the Company's Peer Group which consists of the Company, Supervalu Inc., Safeway, Inc. and The Kroger Co. The “Peer Group” for the purposes of the Stock Performance Graph is a subset of, and should not be confused for, the peer group list of companies used to benchmark executive compensation as will be discussed in an amendment to this Annual Report on Form 10-K that will be filed within 120 days after the close of our Company’s 2010 fiscal year. The performance graph assumes $100 is invested in the Company's Common Stock, the Standard & Poor's 500 Index and the Company's Peer Group on February 24, 2006, and that dividends paid during the period were reinvested to purchase additional shares. The Company’s fiscal year ends the last Saturday in February.

|

Last Business Day of Fiscal Year

|

S&P 500

|

A&P

|

Peer Group

|

|

$

|

$

|

$

|

|

|

02/24/06

|

100

|

100

|

100

|

|

02/23/07

|

113

|

118

|

129

|

|

02/22/08

|

105

|

106

|

114

|

|

02/28/09

|

57

|

15

|

64

|

|

02/27/10

|

86

|

28

|

77

|

|

02/26/11

|

102

|

1

|

63

|

The performance graph above is being furnished solely to accompany this Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, and is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not to be incorporated by reference into any filing of our Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

ITEM 6 – Selected Financial Data

Five Year Summary of Selected Financial Data

| Fiscal 2007 | ||||||||||||||||||||

|

Fiscal 2010(j)

|

Fiscal 2009(j)

|

Fiscal 2008(h)

|

(a)(b)(c)(h)

|

Fiscal 2006

|

||||||||||||||||

|

(52 Weeks)

|

(52 Weeks)

|

(53 Weeks)

|

(52 Weeks)

|

(52 Weeks)

|

||||||||||||||||

|

(Dollars in thousands, except per share amounts)

|

||||||||||||||||||||

|

Operating Results

|

||||||||||||||||||||

|

Sales

|

$ | 8,078,455 | $ | 8,813,568 | $ | 9,516,186 | $ | 6,401,130 | $ | 5,369,203 | ||||||||||

|

Loss from operations

|

(450,621 | ) | (600,574 | ) | (75,063 | ) | (39,240 | ) | (27,170 | ) | ||||||||||

|

Depreciation and amortization

|

(218,398 | ) | (245,460 | ) | (260,991 | ) | (178,152 | ) | (148,762 | ) | ||||||||||

|

Loss on sale of Canadian operations

|

- | - | - | (436 | ) | (1,299 | ) | |||||||||||||

|

Gain on sale of Metro, Inc.

|

- | - | - | 184,451 | - | |||||||||||||||

|

Interest expense (d)

|

(218,409 | ) | (193,058 | ) | (157,591 | ) | (112,218 | ) | (65,884 | ) | ||||||||||

|

(Loss) income from continuing operations

|

(673,400 | ) | (780,650 | ) | (117,882 | ) | 86,578 | 12,751 | ||||||||||||

|

Income (loss) from discontinued operations

|

74,825 | (95,848 | ) | (53,730 | ) | (247,660 | ) | 14,142 | ||||||||||||

|

Net (loss) income

|

(598,575 | ) | (876,498 | ) | (171,612 | ) | (161,082 | ) | 26,893 | |||||||||||

|

Per Share Data

|

||||||||||||||||||||

|

(Loss) income from continuing operations – basic

|

(12.84 | ) | (14.79 | ) | (2.31 | ) | 1.99 | 0.31 | ||||||||||||

|

Income (loss) from discontinued operations – basic

|

1.39 | (1.80 | ) | (1.05 | ) | (5.69 | ) | 0.34 | ||||||||||||

|

Net (loss) income – basic

|

(11.45 | ) | (16.59 | ) | (3.36 | ) | (3.70 | ) | 0.65 | |||||||||||

|

(Loss) income from continuing operations – diluted

|

(277.17 | ) | (26.12 | ) | (4.90 | ) | 1.36 | 0.30 | ||||||||||||

|

Income (loss) from discontinued operations – diluted

|

29.48 | (3.22 | ) | (1.06 | ) | (5.59 | ) | 0.34 | ||||||||||||

|

Net (loss) income – diluted

|

(247.69 | ) | (29.34 | ) | (5.96 | ) | (4.23 | ) | 0.64 | |||||||||||

|

Cash dividends – common stock (g)

|

- | - | - | - | 7.25 | |||||||||||||||

|

Book value per share (e)

|

(21.19 | ) | (9.47 | ) | 5.03 | 7.78 | 10.36 | |||||||||||||

| Fiscal 2007 | ||||||||||||||||||||

|

Fiscal 2010

|

Fiscal 2009

|

Fiscal 2008(h)

|

(a)(b)(c)(h)

|

Fiscal 2006

|

||||||||||||||||

|

(52 Weeks)

|

(52 Weeks)

|

(53 Weeks)

|

(52 Weeks)

|

(52 Weeks)

|

||||||||||||||||

|

(Dollars in thousands, except per share amounts)

|

||||||||||||||||||||

|

Financial Position

|

||||||||||||||||||||

|

Current assets

|

$ | 1,041,593 | $ | 940,706 | $ | 918,522 | $ | 886,245 | $ | 748,908 | ||||||||||

|

Current liabilities

|

343,618 | 729,845 | 746,535 | 771,815 | 558,391 | |||||||||||||||

|

Working capital (e)

|

697,975 | 210,861 | 171,987 | 114,430 | 190,517 | |||||||||||||||

|

Current ratio (e)

|

3.03 | 1.29 | 1.23 | 1.15 | 1.34 | |||||||||||||||

|

Expenditures for property

|

71,070 | 86,378 | 115,994 | 122,850 | 208,159 | |||||||||||||||

|

Total assets

|

2,644,849 | 2,836,760 | 3,526,697 | 3,622,633 | 2,111,623 | |||||||||||||||

|

Current portion of long-term debt (f)

|

- | 191 | 5,283 | 11,875 | 32,069 | |||||||||||||||

|

Current portion of capital lease obligations

|