Attached files

| file | filename |

|---|---|

| EX-23.2 - ECOTALITY, INC. | v220447_ex23-2.htm |

| EX-23.1 - ECOTALITY, INC. | v220447_ex23-1.htm |

As filed with the Securities and Exchange Commission on May 10, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

ECOTALITY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

3621

|

|

68-0515422

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

Four Embarcadero Center, Suite 3720

San Francisco, California 94111

(415) 992-3000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jonathan R. Read, Chief Executive Officer

ECOtality, Inc.

Four Embarcadero Center, Suite 3720

San Francisco, California 94111

(415) 992-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Samuel C. Dibble, Esq.

Farella Braun + Martel LLP

235 Montgomery Street

San Francisco, California 94104

Telephone: (415) 954-4400

Facsimile: (415) 954-4480

|

Ellen S. Bancroft, Esq.

Joo Ryung Kang, Esq.

Dorsey & Whitney LLP

38 Technology Drive, Suite 100

Irvine, California 92618

Telephone: (949) 932-3600

Facsimile: (949) 932-3601

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer,” “accelerated filed,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Proposed Maximum Offering

Price(1)(2)

|

Amount of

Registration Fee

|

||

|

Common Stock, par value $0.001 per share

|

$30,000,000

|

$3,483

|

|

(1)

|

Includes the offering price attributable to shares that the underwriters have the option to purchase solely to cover over-allotments, if any.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold until the registration statement becomes effective. This preliminary prospectus is not an offer to sell and it is not soliciting an offer to buy the securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED MAY 10, 2011

PROSPECTUS

ECOtality, Inc.

We are offering _______ shares of common stock, par value $0.001 per share.

Our common stock is listed on the Nasdaq Capital Market under the symbol “ECTY.” On May 9, 2011, the closing sales price of our common stock was $3.74 per share.

You should carefully consider the risks associated with investing in our common stock. Before making an investment in our common stock, please read the “Risk Factors” section of this prospectus, which begins on page 6.

|

|

Price to

Public

|

Underwriting

Discounts and

Commissions(1)

|

Proceeds, Before

Expenses, to

ECOtality, Inc.

|

|||||||||

|

Per Share

|

$ | $ | $ | |||||||||

|

Total

|

$ | $ | $ | |||||||||

|

|

(1)

|

See “Underwriting” beginning on page 68 for additional information regarding compensation payable to the underwriters by us.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The selling stockholders identified in this prospectus have granted the underwriter an option to purchase up to an additional _______ shares of our common stock at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus to cover over-allotments, if any. We will not receive any of the proceeds from the sale of common stock by the selling stockholders.

The underwriter expects to deliver the shares of common stock to purchasers on or about ______, 2011.

Roth Capital Partners

|

ThinkEquity LLC

|

Craig-Hallum Capital Group

|

The date of this prospectus is ______, 2011.

TABLE OF CONTENTS

|

|

Page

|

|

|

Prospectus Summary

|

1 | |

|

Risk Factors

|

6 | |

|

Cautionary Note Regarding Forward-Looking Statements

|

14 | |

|

Use of Proceeds

|

16 | |

|

Market For Common Equity and Related Stockholder Matters

|

17 | |

|

Dividend Policy

|

17 | |

|

Capitalization

|

18 | |

|

Dilution

|

19 | |

|

Selected Consolidated Financial Data

|

20 | |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

21 | |

|

Business

|

33 | |

|

Management

|

49 | |

|

Executive Compensation

|

54 | |

|

Certain Relationships and Related Transactions

|

60 | |

|

Security Ownership of Management and Principal and Selling Stockholders

|

61 | |

|

Description of Securities

|

65 | |

|

Underwriting

|

68 | |

|

Legal Matters

|

70 | |

|

Experts

|

70 | |

|

Where You Can Find More Information

|

70 | |

|

Index to Consolidated Financial Statements

|

71 |

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We and the selling stockholders (solely to the extent the over-allotment option is exercised) are not making an offer to sell or seeking offers to buy shares of our common stock in jurisdictions where the offer or sale is not permitted.

The information contained in this prospectus is accurate only as of the date of this prospectus, and the information contained in any document incorporated or deemed to be incorporated by reference is accurate only as of the date of such document. Our business, financial condition, results of operations and prospects may have changed since that date. You should read carefully this prospectus together with the additional information described under the heading “Where You Can Find More Information” before making your investment decision.

PROSPECTUS SUMMARY

This summary highlights certain information described in greater detail elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including “Risk Factors,” together with the additional information described under the heading “Where You Can Find More Information.”

ECOtality

ECOtality is a leader in advanced electric vehicle (“EV”) charging and storage systems with 20 years of experience in designing, manufacturing, testing and commercializing these technologies. Leveraging that experience, we are currently building the largest EV smart charging network in the U.S. Our cloud-based smart charging network, branded as the Blink Network, is initially supporting the adoption of EVs in 18 major U.S. metropolitan markets. Through innovation and strategic partnerships, with companies such as ABB Inc. (“ABB”) and Cisco, we are establishing and monetizing the Blink Network, which is expected to reach 14,000 chargers across the U.S. by year-end. Initial commercial customers hosting our chargers include Best Buy, BP/ARCO, Cracker Barrel, Fred Meyer/Kroger, and Macy’s. In January 2011, we entered into a strategic partnership with ABB, a global leader in power and automation technologies. Under this partnership, ABB Technology Ventures Ltd, an affiliate of ABB, committed $10 million of capital, and ABB entered into a North American manufacturing and sales distribution agreement with us.

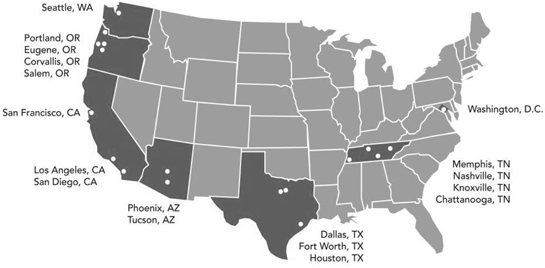

With concerns mounting over the cost of, and the U.S.’s growing dependence on, foreign sources of oil, in combination with recent advances in EV technologies, we believe the market for EVs and EV supply equipment (“EVSE”) will grow substantially over the next decade. To help jump-start the industry, we have been awarded several government grants to support and manage the build out of the largest EV charging infrastructure in U.S. history. As a leader in the EVSE industry, we are managing a $100.2 million1 cost reimbursable contract from the U.S. Department of Energy, or DOE, known as “The EV Project.” This project spans across six U.S. states and the District of Columbia to include 18 major metropolitan areas and is designed to support the deployment of 5,700 Nissan LEAF and 2,600 Chevy Volt EVs. As the sole project manager of The EV Project, we believe we are uniquely positioned to capture significant share of the domestic market for EV charging solutions.

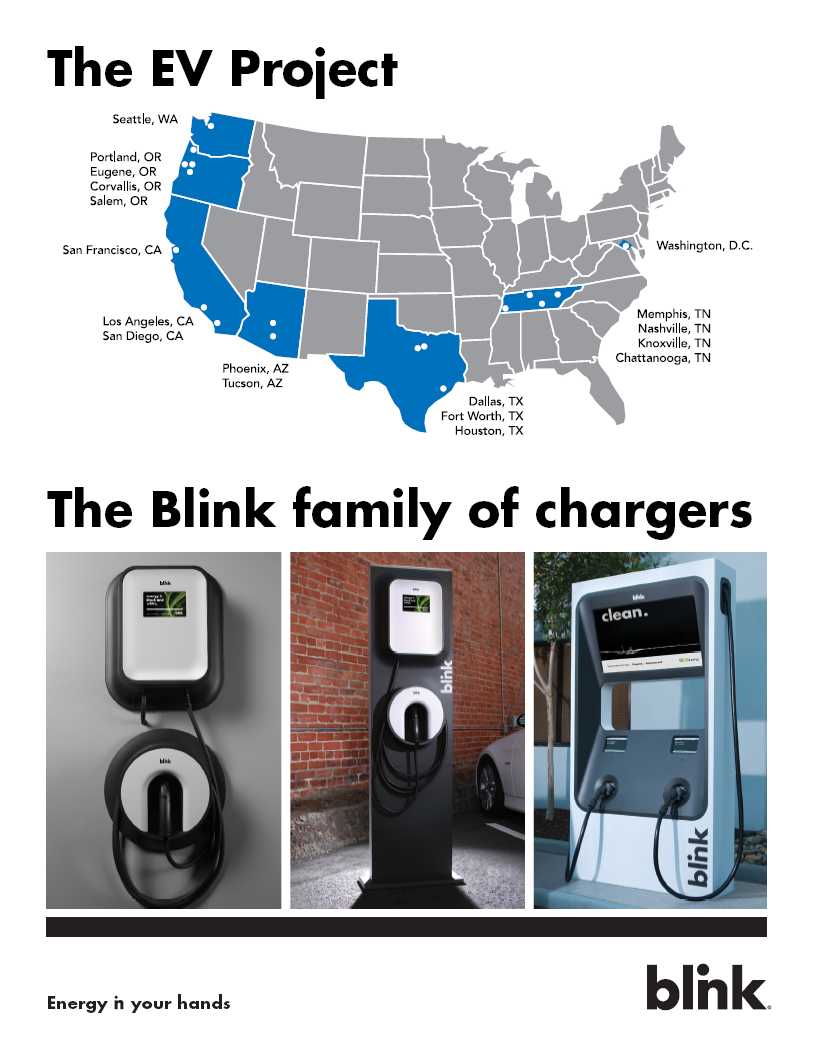

Our primary product offerings are the Blink line of EVSE or “charging stations” for on-road vehicular applications, which include our Blink Level 2 residential and commercial chargers and DC Fast Charger. Our product offerings also include the Minit-Charger line of advanced fast-charge systems for off-road industrial applications. We also offer testing and consulting services to utilities and government agencies worldwide, including the Advanced Vehicle Testing Activities for the DOE and the EV Micro-Climate Program for utilities and government agencies.

Through April 30, 2011, we have installed 830 Level 2 residential chargers and have plans to install 1,000 or more chargers per month through the remainder of 2011. With approximately 14,000 Blink chargers planned to be installed by the end of 2011, through The EV Project and our initial commercial sales channels, we believe the Blink Network will be the largest EV smart charging infrastructure network in the world and will become a well recognized and trusted brand within the U.S. and international EV industry.

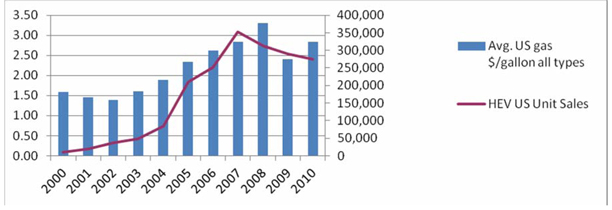

Industry

Based on the announced planned introductions of EVs, and the initial success of the LEAF and Volt, we expect strong and sustained demand for our Blink Network system beyond that contracted under The EV Project. With the recent attention surrounding the introduction of EVs, a variety of industry estimates are available regarding the rate of adoption of EVs and, subsequently, EVSE. Recent analysis by Pike Research estimates that more than 3.1 million EVs, including plug-in hybrid EVs (“PHEVs”), will be sold across the globe between 2010 and 2015, with nearly 300,000 EVs sold in the U.S. in 2015 alone. The DOE forecasts that EV production will grow to 170,000 units in 2012 and over 355,000 units in 2015. To support these EVs, Pike Research estimates that roughly 1.2 EVSE is needed for every EV, with between 45% (in 2011) and 33% (in 2015) of these chargers in non-residential locations, with broad industry consensus that the vast majority of charging will be done at the vehicle owner’s place of residence. Based on this analysis and Pike Research’s estimate of approximately one million EVSE sold in North America from 2011 to 2015, Pike Research is forecasting that the EVSE market could exceed $400 million in 2015, with the global market approaching $2 billion in sales annually.

1 The EV Project cost reimbursable contract amount of $100.2 million includes $86.4 million awarded under the initial grant in September 2009 and $13.8 million awarded via a subsequent grant in June 2010. See “Business – The EV Project and Supporting Grants” for more information.

1

Competitive Strengths

We believe the following business strengths position us well to remain a market leader and grow our business:

|

·

|

Sole Project Manager of the Largest EVSE Deployment in U.S. History. We are overseeing the three-year EV Project infrastructure rollout. Upon completion of The EV Project, we expect to have the largest EV charging station footprint in the U.S. with over 14,000 combined residential and commercial charging stations. Connecting these charging stations to the grid, EV owners and commercial retailers will be our cloud-based Blink Network, which will serve as a long-term source of recurring revenue. Additionally, if successful, this project should provide us with an extremely valuable marketing tool to support future EVSE infrastructure projects both domestically and internationally.

|

|

|

·

|

Blink Network. The Blink Network of charging stations will provide all EV drivers the freedom to travel wherever they choose and charge at commercial locations conveniently identified along the way. The Blink Network is a cloud-based operating system that provides device management and provisioning, location pricing customization, transaction processing, payment gateways, historical data collection, content management, and reservation capabilities. In addition, Blink charging stations will integrate with utility smart grid services, including home area networks, home energy management systems, and load management and demand response programs. We will generate revenue within the Blink Network through membership and charger usage fees, advertising, and utility-based programs.

|

|

|

·

|

Strategic Partnerships. We have established several key strategic partnerships to support product development, manufacturing, and deployment of our Blink Network. On the product development and manufacturing side, we have forged a partnership with global electronics and automation leader ABB that will allow ECOtality to benefit from ABB’s global value chains, streamline sourcing and production capabilities and allow for Blink charging systems to be powered by ABB’s industry leading power electronics. Technology partnerships are also in place with Cisco for the integration of Blink Level 2 residential chargers with Cisco’s home energy management systems, with Qualcomm to support cellular connectivity, and with Sprint Nextel for wireless machine-to-machine communications.

|

|

|

·

|

Smart Charging Stations. We believe our Level 2 and DC Fast Charger EV charging solutions are at the forefront of smart-charging technologies and have set a new standard within the industry. Each of our chargers also incorporates web-based information delivery and smart phone charger station location, GPS navigation, charge status, and completion/interruption notification. Furthermore, our DC chargers are optimized to fast charge on-road batteries of all chemistries, while controlling battery temperature and avoiding the negative effects of overcharging. All chargers are outfitted with advanced data collection capabilities, which provide comprehensive performance evaluation of a battery’s state-of-health and state-of-charge and automatically adjust its charging rates to increase and maximize battery life. We have also incorporated touch screen color displays in all Blink chargers to enable easy data input, while allowing opportunities for advertising revenue or marketing. Our DC Fast Charger can also be equipped with a 42-inch LCD for advertising, marketing or other media content.

|

|

|

·

|

Advanced Transportation Research and Development, Engineering and Testing. We have various standing contractual relationships as a vehicle tester and consultant for the DOE, national research laboratories, national energy storage consortiums, and electric utilities. We currently hold the exclusive contract for the DOE’s Advanced Vehicle Testing Activity program. As of December 31, 2010, we have conducted more than 10 million miles of vehicle testing on more than 200 advanced fuel vehicles.

|

|

|

·

|

Broad Government Support. In addition to the $100.2 million DOE grant under The EV Project, we have been awarded several additional contracts that further the goals of The EV Project. We are working in six states and the District of Columbia and with 18 major metropolitan areas across the U.S.

|

Strategy

Our objective is to leverage our EV charging infrastructure to further establish our leadership position and drive revenues through equipment sales, subscription programs and usage fees, media advertising models and interfaces with utilities. Key elements of our growth strategy include:

2

|

|

·

|

Equipment Sales. We anticipate that a majority of our revenue will be derived from the sale of Blink chargers to residential and commercial customers. We plan to offer our Blink Level 2 residential charger through both brick-and-mortar and online retail outlets. We have also reached agreement with our partner ABB to use its sales distribution channels to offer our Blink charging stations as part of a complete EV solution to ABB’s network of North American commercial and utility customers. Over time, we expect to explore opportunities to sell our products through other dealers, distributors and utilities.

|

|

|

·

|

Network Subscription and Usage Fees. We plan to generate recurring revenue within the Blink Network through a variety of membership plans and usage fees. Blink members and non-members will be able to charge EVs and pay using radio frequency identification (“RFID”) cards or fobs, smartphone applications, and mobile phone and credit cards. Blink users can choose between paying by the hour (Level 2) or minute (DC Fast Charger) at prices that are often substantially less than the per-mile cost of using gasoline.

|

|

|

·

|

Media and Advertising. Our Level 2 commercial and DC Fast Chargers are being installed in a variety of retail, parking, and fueling station locations. All chargers are equipped with color, touch screen monitors, with our DC Fast Chargers capable of holding a flat-panel color monitor up to 42 inches. We plan to offer a variety of media and advertising opportunities to charger hosts and third party advertisers through our Blink commercial chargers as well as explore other advertising opportunities within the Blink Network.

|

|

|

·

|

Utility Interface. Our smart chargers are equipped with an embedded micro-processor, an internal electric meter to monitor energy usage, and feature various communications capabilities. By utilizing our color touch screens and real time communications capabilities, our Blink chargers provide a platform for utilities to communicate with customers and are programmable for time of use activities, providing usage data to utilities for load management.

|

Corporate Information

Our principal executive offices are located at Four Embarcadero Center, Suite 3720, San Francisco, CA 94111, and our telephone number is (415) 992-3000. Our website address is www.ecotality.com. The information contained therein or connected thereto shall not be deemed to be incorporated into this prospectus or the registration statement of which this prospectus forms a part.

In November 2006, we changed our corporate name from Alchemy Enterprises, Ltd. to ECOtality, Inc. On May 19, 2010, our common stock commenced trading on the Nasdaq Capital Market.

Throughout this prospectus, we refer to various trademarks, service marks and trade names that we use in our business. Blink and Minit-Charger are some of our registered trademarks. EV Micro-Climate is one of our trademarks. We also have a number of other registered trademarks, service marks and pending applications relating to our products. Other trademarks and service marks appearing in this prospectus are the property of their respective holders.

In this prospectus, the terms “ECOtality,” “we,” “us,” “our” and “the company” refer to ECOtality, Inc. and its consolidated subsidiaries.

3

The Offering

|

Issuer

|

ECOtality, Inc.

|

|

|

Common stock offered by us

|

________ shares of common stock.

|

|

|

Common stock to be outstanding after the offering

|

________ shares of common stock.

|

|

|

Common stock offered by the selling stockholders pursuant to the over-allotment option

|

________ shares of common stock.

|

|

|

Offering price

|

$____ per share.

|

|

|

Use of proceeds

|

We estimate the net proceeds from this offering will be approximately $________, based on an assumed public offering price of $___ per share, after deducting underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds of this offering to provide the working capital for our DOE Contract, to develop and expand our Blink infrastructure and network, and for general working capital purposes. See “Use of Proceeds.” We will not receive any proceeds from the sale of shares of common stock offered by the selling stockholders pursuant to the exercise by the underwriters of their over-allotment option.

|

|

|

Risk factors

|

See “Risk Factors” beginning on page 6 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

|

Nasdaq Capital Market symbol

|

ECTY

|

The above information regarding the shares of common stock to be outstanding after the offering is based on 13,724,959 shares of common stock outstanding as of March 31, 2011 and excludes the following:

|

|

·

|

1,217,497 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2011, and an additional 8,829,677 shares of common stock reserved for future issuance under our 2007 Equity Incentive Plan (the “2007 Plan”) as of March 31, 2011;

|

|

|

·

|

5,781,300 shares of common stock issuable upon the exercise of all warrants outstanding as of March 31, 2011; and

|

|

|

·

|

6,329,650 shares of common stock issuable upon the conversion of all of the Company’s Series A Convertible Preferred Stock outstanding as of March 31, 2011.

|

Unless otherwise indicated, all information in this prospectus assumes:

|

|

·

|

no exercise of the underwriters’ over-allotment option to purchase up to an additional _______ shares of common stock from the selling stockholders;

|

|

|

·

|

no exercise of any of the Company’s outstanding options or warrants; and

|

|

|

·

|

no conversion of any shares of the Company’s Series A Convertible Preferred Stock into common stock.

|

4

Summary Consolidated Financial Data

The following tables set forth our summary consolidated financial data for the periods presented and should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Consolidated Financial Data” and our consolidated financial statements and related notes appearing elsewhere in this prospectus. The summary consolidated financial data for the years ended December 31, 2010 and 2009 was derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results presented below are not necessarily indicative of the financial results that may be achieved in any future period.

|

Years Ended

December 31,

|

||||||||

|

|

2010

|

2009

|

||||||

|

(in thousands,

except share and per share data)

|

||||||||

|

Consolidated Statement of Operations Data:

|

|

|

||||||

|

Revenues

|

$ | 13,737 | $ | 8,602 | ||||

|

Cost of goods sold

|

13,182 | 4,960 | ||||||

|

Gross profit

|

$ | 555 | $ | 3,642 | ||||

|

Operating expenses

|

17,206 | 17,290 | ||||||

|

Loss from operations

|

(16,651 | ) | (13,648 | ) | ||||

|

Other income (expense), net

|

209 | (15,860 | ) | |||||

|

Net loss

|

$ | (16,442 | ) | $ | (29,508 | ) | ||

|

|

||||||||

|

Net loss per common share – basic and diluted

|

$ | (1.78 | ) | $ | (8.16 | ) | ||

|

Weighted average common shares outstanding – basic and diluted

|

9,253,754 | 3,614,045 | ||||||

|

December 31, 2010

|

||||||||

|

|

Actual

|

As Adjusted(1)

|

||||||

|

(in thousands)

|

||||||||

|

Consolidated Balance Sheet Data:

|

||||||||

|

Cash and cash equivalents

|

$ | 3,845 | ||||||

|

Working capital

|

4,182 | |||||||

|

Total assets

|

16,792 | |||||||

|

Total liabilities

|

5,839 | |||||||

|

Accumulated deficit

|

(82,287 | ) | ||||||

|

Total stockholders’ equity

|

10,953 | |||||||

|

|

(1)

|

Reflects our sale of ________ shares of common stock offered by this prospectus at the assumed public offering price of $_____ per share, after deducting the underwriting discounts and commissions and the estimated offering expenses payable by us.

|

5

RISK FACTORS

Risks Relating to Our Business

A large percentage of our revenues will depend on our grants from the DOE, the loss of which would materially adversely affect our business, results of operations, and financial condition.

On September 30, 2009, our wholly owned subsidiary, Electric Transportation Engineering Corporation, d.b.a. ECOtality North America (“ECOtality North America”), signed a contract with the DOE for a cost-reimbursable contract worth at least $99.8 million, of which $13.4 million was sub-funded to federal research and development centers. On June 17, 2010, ECOtality North America was awarded a $15.0 million extension to the original cost-reimbursable contract, of which $1.2 million was sub-funded to federal research and development centers (such contract, as extended, the “DOE Contract”). The contract term ends on April 30, 2013. The DOE Contract will net approximately $100.2 million in revenue to us, which we expect to account for a substantial portion of our revenues in the immediate future. As a condition of the DOE Contract, we are required to meet certain obligations, including, but not limited to, producing and delivering products on a timely basis in accordance with required standards, and properly accounting for and billing our products. Conversely, if during the contract period, EV manufacturers do not deliver the desired number of EVs, we may not be able to achieve the desired revenue stream anticipated from the contract. In addition, we are subject to periodic compliance audits in connection with the DOE Contract. If we are unable to properly perform our obligations under the DOE Contract, or if any compliance audits result in material deficiencies, the DOE could terminate the DOE Contract, which would have a material adverse effect on our business, financial condition and results of operations.

ECOtality North America may not continue to receive DOE funding or any other government funding, which currently comprises a large portion of our consolidated revenue.

We expect to derive a substantial majority of our revenue during 2011 and 2012 from DOE-related activity, including pursuant to the DOE Contract. Government funding of projects related to renewable energy, energy, and transportation is subject to cuts or cancellation without notice. We cannot assure you that current levels of government funding for our products and services will continue. Therefore, the future of these revenue streams is uncertain and out of our control. If any of our current projects with the DOE are cut or cancelled, or future projects are reduced from those currently planned, our business, financial condition and results of operations could be materially and adversely affected.

To complete the DOE Contract, we will require additional working capital, which may not be available on terms favorable to us or at all.

The DOE Contract is cost-reimbursable, however it requires a significant amount of upfront expenditures that are not fully reimbursed until later in the contract term. As a result, profit margins related to the DOE Contract will be low and we do not expect the DOE Contract to provide significant profits. Additionally, we will require additional working capital to be able to complete the DOE Contract. Such additional capital may not be available on a timely basis, on acceptable terms or at all. If we are unable to obtain additional working capital to fulfill the DOE Contract on acceptable terms, we may be unable to fulfill our obligations pursuant to the DOE Contract, which could have a material adverse effect on our business, financial condition and results of operations.

We have a history of losses which may continue and may negatively impact our ability to achieve our business objectives.

We incurred net losses of approximately $16.4 million and $29.5 million for the years ended December 31, 2010 and 2009, respectively. We may not achieve or sustain profitability on a quarterly or annual basis in the future. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. Our future revenues and profits, if any, will depend upon various factors, including but not limited to, the following:

|

|

·

|

our ability to successfully perform and complete the DOE Contract and related contracts;

|

|

|

·

|

our ability to successfully develop, market, manufacture and distribute our charging stations and chargers;

|

|

|

·

|

our ability to resolve any technical issues in the development and production of our products and address any technological changes in the EV industry;

|

|

|

·

|

the rate of consumer adoption of EVs in general and the success of the automobile models that use our technologies;

|

6

|

|

·

|

our access to additional capital and our future capital requirements;

|

|

|

·

|

our ability to comply with evolving government standards related to the EV and automobile industry;

|

|

|

·

|

the timing of payments and reimbursements from the DOE, which directly impacts our cash flow requirements;

|

|

|

·

|

governmental agendas and changing funding priorities, budget issues and constraints;

|

|

|

·

|

delays in government funding or the approval thereof; and

|

|

|

·

|

general market and economic conditions.

|

We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our future growth is dependent upon consumers’ willingness to purchase and use electric vehicles.

Our growth is highly dependent upon the purchase and use by consumers of, and we are subject to an elevated risk of any reduced demand for, alternative fuel vehicles in general and EVs in particular. If the market for EVs does not gain broad market acceptance or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. The market for alternative fuel vehicles is relatively new, rapidly evolving, characterized by rapidly changing technologies, price competition, additional competitors, evolving government regulation and industry standards, frequent new vehicle announcements, long development cycles for EV original equipment manufacturers and changing consumer demands and behaviors. Factors that may influence the purchase and use of alternative fuel vehicles, and specifically EVs, include:

|

|

·

|

perceptions about EV quality, safety (in particular with respect to lithium-ion battery packs), design, performance and cost, especially if adverse events or accidents occur that are linked to the quality or safety of EVs;

|

|

|

·

|

perceptions about vehicle safety in general, in particular safety issues that may be attributed to the use of advanced technology, including vehicle electronics and regenerative braking systems, such as the possible perception that Toyota’s recent vehicle recalls may be attributable to these systems;

|

|

|

·

|

the limited range over which EVs may be driven on a single battery charge and concerns about running out of power while in use;

|

|

|

·

|

the decline of an EV’s range resulting from deterioration over time in the battery’s ability to hold a charge;

|

|

|

·

|

concerns about electric grid capacity and reliability, which could derail efforts to promote EVs as a practical solution to vehicles that require gasoline;

|

|

|

·

|

the availability of other alternative fuel vehicles, including PHEVs;

|

|

|

·

|

improvements in the fuel economy of the internal combustion engine;

|

|

|

·

|

the availability of service for EVs;

|

|

|

·

|

consumers’ desire and ability to purchase a luxury automobile or one that is perceived as exclusive;

|

|

|

·

|

the environmental consciousness of consumers;

|

|

|

·

|

volatility in the cost of oil and gasoline;

|

|

|

·

|

consumers’ perceptions of the dependency of the U.S. on oil from unstable or hostile countries and the impact of international conflicts;

|

|

|

·

|

government regulations and economic incentives promoting fuel efficiency and alternate forms of energy;

|

7

|

|

·

|

access to charging stations, standardization of EV charging systems and consumers’ perceptions about convenience and cost to charge an EV;

|

|

|

·

|

the availability of tax and other governmental incentives to purchase and operate EVs or future regulation requiring increased use of nonpolluting vehicles; and

|

|

|

·

|

perceptions about and the actual cost of alternative fuel.

|

The influence of any of the factors described above may cause current or potential customers not to purchase EVs and could impact the widespread consumer adoption of EVs, which would materially adversely affect our business, operating results, financial condition and prospects.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position.

We may be unable to keep up with changes in EV technology and evolving industry standards and, as a result, may suffer a decline in our competitive position. Any failure to keep up with advances in EV technology or to conform to new industry standards would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in EV technology and we may not have sufficient capital resources to address all such changes. As technologies change, we plan to upgrade or adapt our charging stations in order to continue to provide EVs with the latest technology, in particular battery cell technology. However, our charging stations may not compete effectively with other providers if we are not able to source and integrate the latest technology into our charging stations. For example, if a competitor was able to produce a charging station that fully charges EV batteries in less time, our products will be less desirable, which would materially adversely affect our business, operating results, financial condition and prospects.

We face competition from large established renewable and alternative energy development companies which are also seeking to develop alternative energy power sources. Such competition could reduce our revenue or force us to reduce our prices, which would reduce our potential profitability.

The industry in which we operate is highly competitive. Numerous companies, including many companies that have significantly greater financial, technical, marketing, sales, manufacturing, distribution and other resources than we do, are seeking to develop products and technologies that will compete with our products and technologies (including Minit-Charger and our Blink charging stations). Our primary competitors in the EV infrastructure market include Better Place, Coulomb Technologies, AeroVironment, Inc., Aker Wade Power Technologies, LLC, Car Charging Group, Delta-Q Technologies, Elektromotive (UK), Bosch, General Electric, Siemens and Schneider Electric. Our primary competitors in the industrial fast-charge market include AeroVironment, Inc., Aker Wade Power Technologies, LLC, Power Designers, LLC, C&D Technologies, Inc., and other suppliers of battery charging equipment and infrastructure, designers of battery charging rooms and battery manufacturers and dealers.

Our competitors may be able to provide customers with different or greater capabilities or benefits than we can provide in areas such as technical qualifications, past contract performance, geographic presence and price. Furthermore, many of our competitors may be able to utilize their substantially greater resources and economies of scale to develop competing products and technologies, divert sales away from us by winning broader contracts or hire away our employees by offering more lucrative compensation packages. In the event that the market for EV charging systems expands, we expect that competition will intensify as additional competitors enter the market and current competitors expand their product lines. In order to secure contracts successfully when competing with larger, well-financed companies, we may be forced to agree to contractual terms that provide for lower aggregate payments to us over the life of the contract, which could adversely affect our margins. Our failure to compete effectively with respect to any of these or other factors could have a material adverse effect on our business, prospects, financial condition or operating results.

We may not be able to protect our patents and intellectual property, and we could incur substantial costs defending against claims that our products infringe on the proprietary or other rights of third parties.

Some of our intellectual property may not be covered by any patent or patent application. Moreover, we do not know whether any of our pending patent applications will be issued or, if they are issued, whether they will be sufficiently broad to protect our technology and processes. Even if all of our patent applications are issued and are sufficiently broad, our patents may be challenged or invalidated. We could incur substantial costs in prosecuting or defending patent infringement suits or otherwise protecting our intellectual property rights, regardless of the merits of any such suits. While we have attempted to safeguard and maintain our proprietary rights, we do not know whether we have been or will be completely successful in doing so. Moreover, patent applications filed in foreign countries may be subject to laws, rules and procedures that are substantially different from those of the U.S., and any resulting foreign patents may be difficult and expensive to enforce.

8

Our competitors may independently develop or patent technologies or processes that are substantially equivalent or superior to ours. If we are found to be infringing on third party patents, we could be required to pay substantial royalties and/or damages, and we do not know whether we will be able to obtain licenses to use such patents on acceptable terms, or at all. Failure to obtain needed licenses could delay or prevent the development, manufacture or sale of our products, and could necessitate the expenditure of significant resources to develop or acquire non-infringing intellectual property.

Asserting, defending and maintaining our intellectual property rights could be difficult and costly and failure to do so may diminish our ability to compete effectively and may harm our operating results. We may need to pursue lawsuits or legal action in the future to enforce our intellectual property rights, to protect our trade secrets and domain names and to determine the validity and scope of the proprietary rights of others. If third parties prepare and file applications for trademarks used or registered by us, we may oppose those applications and be required to participate in proceedings to determine the priority of rights to the trademark. Similarly, competitors may have filed applications for patents, may have received patents and may obtain additional patents and proprietary rights relating to products or technology that block or compete with ours. We may have to participate in interference proceedings to determine the priority of invention and the right to a patent for the technology. In addition, we may be involved in other litigation matters, investigations and disputes from time to time, arising in the normal course of business. Litigation, investigations, disputes and interference proceedings, whether they are related to intellectual property or other aspects of our business, even if they are successful, are frequently expensive to pursue and time consuming, could result in a diversion of our management’s attention and could result in judgments or penalties that have a material adverse effect on our financial condition and results of operations.

The underlying technology of Minit-Charger or our Blink chargers may not remain commercially viable, and this could affect the revenue and potential profit of ECOtality North America.

Competitors may develop competing technology in fast charging, conditioning and monitoring batteries for transportation and industrial applications which could be a superior technology and/or be produced at a lower cost than our technology. If this occurs and we are unable to modify our technology to provide greater results or at a lower price, we could lose our technology advantage, which would adversely impact or eliminate our revenue and profitability in our transportation and industrial charging segments.

Material weaknesses in our internal controls could have a material adverse effect on our business, financial condition and operating results and stockholders could lose confidence in our financial reporting.

Management concluded that our internal controls over financial reporting were ineffective due to material weaknesses for the fiscal year ended December 31, 2010. The areas in which material weaknesses were identified include accounts payable cutoff, stock-based compensation and external use software capitalization. Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we are unable to correct these material weaknesses, we may not be able to provide reliable financial reports or prevent fraud, and our operating results could be harmed. Further, we may incur significant expenses in correcting these weaknesses and maintaining effective internal controls.

Pursuant to the recently passed Dodd-Frank Wall Street Reform and Consumer Protection Act, smaller reporting companies, like us, are exempt from the requirement that management’s report be subject to an audit by an independent registered public accounting firm, although we may be required to do so in the future. Failure to achieve and maintain an effective internal control environment, regardless of whether we are required to maintain such controls, could also cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price. We have not obtained an independent audit of our internal controls and, as a result, we may have other deficiencies or weaknesses in addition to the weaknesses described above. Further, at such time as we are required to comply with the internal controls requirements of the Sarbanes-Oxley Act, we may incur significant expenses in having our internal controls audited and in implementing any changes which are required.

The demand for hydrogen testing and educational materials, and small-scale applications for fuel cell products may not continue, and this could affect the prospects for the Fuel Cell Store.

We face competition in the provision of fuel cell products and educational materials from a number of companies. Additionally, the hydrogen industry is evolving; demand is unpredictable and follows outside forces such as school funding programs and government funding which are out of our control. If demand for these products and materials decreases, our business, financial condition and results of operations could be materially and adversely affected.

9

An increase in interest rates or a dramatic tightening of corporate credit markets could make it difficult for end-users to finance the cost of a conversion to renewable energy products and systems, and could reduce or eliminate the demand for our products.

Many of our end-users depend on debt financing to fund the initial capital expenditure required to purchase and install renewable energy products and systems. As a result, an increase in interest rates or further tightening in the credit markets could make it difficult for our end-users to secure the financing necessary to purchase and install renewable energy products and systems on favorable terms, or at all, and thus lower demand for our products and reduce our net sales. In addition, we believe that a significant percentage of our end-users install renewable energy products as an investment, funding the initial capital expenditure through a combination of equity and debt. An increase in interest rates could lower an investor’s return on investment in a renewable energy products and systems and make alternative investments more attractive relative to an investment in renewable energy products.

Problems with product quality or performance may cause us to incur warranty expenses, damage our market reputation and prevent us from maintaining or increasing our market share.

Our products are sold with various materials and workmanship warranties for technical defects and a 10-year and 25-year warranty against declines of more than 10% and 20% of their initial rated power, respectively. As a result, we bear the risk of extensive warranty claims long after we have sold our products and recognized net sales. As of December 31, 2010, our accrued warranty expense was approximately $0.3 million.

Because of the limited operating history of our products, we have been required to make assumptions regarding the durability and reliability of our products. Our assumptions could prove to be materially different from the actual performance of our products, causing us to incur substantial expense to repair or replace defective products in the future. Any widespread product failures may damage our market reputation and cause our sales to decline and require us to repair or replace the defective products, which could have a material adverse effect on our financial condition and results of operations.

We depend on a limited number of third-party suppliers for key raw materials and components and their failure to perform could cause manufacturing delays and impair our ability to deliver our products to customers in the required quality and quantities and at a price that is profitable to us.

Our failure to obtain raw materials and components that meet our quality, quantity and cost requirements in a timely manner could interrupt or impair our ability to manufacture our products or increase our manufacturing cost. Most of our key raw materials are either sole-sourced or sourced by a limited number of third-party suppliers. As a result, the failure of any of our suppliers to perform could disrupt our supply chain and impair our operations. In addition, many of our suppliers are small companies that may be unable to supply our increasing demand for raw materials as we implement our planned rapid expansion. We may be unable to identify new suppliers or qualify their products for use on our production lines in a timely manner and on commercially reasonable terms, if at all, which could have a material adverse impact on our financial condition and results of operations. In addition, the March 2011 earthquake and tsunami in Japan have disrupted the manufacturing of, and may delay the delivery of, the Nissan LEAF and Chevrolet Volt. If Nissan and General Motors, respectively, do not deliver the desired number of EVs, we may not be able to achieve full cost reimbursement under the DOE Contract, which could have a material adverse effect on our financial condition and results of operations.

Our international operations subject us to a number of risks, including unfavorable political, regulatory, labor and tax conditions in foreign countries.

We have operations outside the U.S. and expect to continue to have operations outside the U.S. in the near future. Currently, we have manufacturing operations in Mexico and established a subsidiary in Australia. In addition, we have signed agreements to establish joint ventures in the People’s Republic of China, although they have not yet been formed. As a result, we will be subject to the legal, political, social and regulatory requirements and economic conditions of many jurisdictions. Risks inherent to international operations, include, but are not limited to, the following:

|

|

·

|

difficulty in enforcing agreements in foreign legal systems;

|

|

|

·

|

foreign countries may impose additional withholding taxes or otherwise tax our foreign income, impose tariffs, or adopt other restrictions on foreign trade and investment, including currency exchange controls;

|

10

|

|

·

|

fluctuations in exchange rates may affect product demand and may adversely affect our profitability in U.S. dollars to the extent the price of our solar modules, cost of raw materials and labor and equipment is denominated in a foreign currency;

|

|

|

·

|

inability to obtain, maintain, or enforce intellectual property rights;

|

|

|

·

|

risk of nationalization of private enterprises;

|

|

|

·

|

changes in general economic and political conditions in the countries in which we operate;

|

|

|

·

|

unexpected adverse changes in foreign laws or regulatory requirements, including those with respect to environmental protection, export duties and quotas;

|

|

|

·

|

difficulty with staffing and managing widespread operations; and

|

|

|

·

|

trade barriers such as export requirements, tariffs, taxes and other restrictions and expenses, which could increase the prices of our solar modules and make us less competitive in some countries.

|

Our future success depends on our ability to retain our key employees.

We are dependent on the services of Jonathan Read, our Chief Executive Officer, H. Ravi Brar, our Chief Financial Officer, Barry Baer, our Secretary and Assistant Treasurer, Donald Karner, President of our ECOtality North America subsidiary and Kevin Morrow, Executive Vice President of our ECOtality North America subsidiary. The loss of Messrs. Read, Brar, Baer, Karner or Morrow could have a material adverse effect on us and our ability to achieve our business objectives. We may not be able to retain or replace these key employees. Several of our current key employees, including Messrs. Read, Brar, Baer, Karner and Morrow, are subject to employment conditions or arrangements that contain post-employment non-competition provisions. However, these arrangements permit the employees to terminate their employment with us upon little or no notice, and the enforceability of such non-competition provisions could be limited in certain circumstances. Failure to maintain our management team could prove disruptive to our daily operations, require a disproportionate amount of resources and management attention and could have a material adverse effect on our business, financial condition and results of operations.

We have limited insurance coverage and may incur losses resulting from product liability claims, business interruptions, or natural disasters.

We are exposed to risks associated with product liability claims in the event that the use of our products results in personal injury or property damage. Our recharging systems, batteries, solar modules are electricity-producing devices, and it is possible that users could be injured or killed by our products due to product malfunctions, defects, improper installation or other causes. Our commercial shipment of products began in 1999 and, due to our limited historical experience, we are unable to predict whether product liability claims will be brought against us in the future or the effect of any resulting adverse publicity on our business. Moreover, we may not have adequate resources and insurance to satisfy a judgment in the event of a successful claim against us. The successful assertion of product liability claims against us could result in potentially significant monetary damages and require us to make significant payments. Any business disruption could result in substantial costs and diversion of resources.

Risks Relating to Our Common Stock

Our common stock has historically been thinly traded, so the price of our common stock could be volatile and could decline following the offering at a time when you want to sell your holdings.

Our common stock is traded on the Nasdaq Capital Market under the symbol ECTY. Our common stock has historically been thinly traded and the price of our common stock may be volatile. Between April 1, 2010 and March 31, 2011, our stock has traded as low as $2.42 and as high as $6.55 per share. In addition, as of March 31, 2011, our average trading volume during the last three months has been approximately 51,544 shares per day. As a result, numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

|

|

·

|

expiration of lock-up agreements;

|

|

|

·

|

our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors;

|

11

|

|

·

|

changes in financial estimates by us or by any securities analysts who might cover our stock;

|

|

|

·

|

speculation about our business in the press or the investment community;

|

|

|

·

|

significant developments relating to our relationships with our customers, suppliers or the DOE;

|

|

|

·

|

stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in the electric transportation industry;

|

|

|

·

|

demand for our products;

|

|

|

·

|

investor perceptions of the electric transportation industry in general and the Company in particular;

|

|

|

·

|

the operating and stock performance of comparable companies;

|

|

|

·

|

general economic conditions and trends;

|

|

|

·

|

major catastrophic events;

|

|

|

·

|

announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures;

|

|

|

·

|

changes in accounting standards, policies, guidance, interpretation or principles;

|

|

|

·

|

failure to comply with Nasdaq rules;

|

|

|

·

|

sales of our common stock, including sales by our directors, officers or significant stockholders; and

|

|

|

·

|

additions or departures of key personnel.

|

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in the Company at a time when you want to sell your interest in us.

A sale or perceived sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

Sales of a substantial number of shares of our common stock or the perception that these sales could occur, may depress the trading price of our common stock. These sales could also impair our ability to raise additional capital through a sale of our equity securities on terms we deem favorable or at all. Our Articles of Incorporation authorize us to issue 1,300,000,000 shares of common stock. As of March 31, 2011, we had 13,724,959 shares of common stock issued and outstanding, shares of Series A Convertible Preferred Stock outstanding that may be converted into 6,329,650 shares of common stock and 5,781,300 shares of common stock issuable upon the exercise of outstanding warrants. All of the shares issuable upon conversion of the Series A Convertible Preferred Stock and exercise of the warrants may be sold without restriction assuming the continuing effectiveness of the registration statement that was deemed effective by the SEC on June 24, 2010.

Although certain holders of the Series A Convertible Preferred Stock and warrants may not convert their Series A Convertible Preferred Stock or exercise their warrants if such conversion or exercise would cause them to own more than 9.99% (or, in some cases, 19.99%) of our outstanding common stock, these restrictions do not prevent them from converting and/or exercising their holdings after they have sold shares.

The number of shares of common stock eligible for sale in the public market is limited by restrictions under federal securities law and may also be restricted under any agreements entered into with any underwriters who may participate in this offering.

12

We may continue to issue our stock and, subject to any restrictions in our debt instruments, if any, we may issue the stock of our subsidiaries to raise capital. Issuances of our stock or the stock of a subsidiary could dilute the interest of our existing stockholders and may reduce the trading price of our common stock. In addition, the shares issued upon conversion of the Series A Convertible Preferred Stock and/or exercise of the outstanding warrants could have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock, including investors in this offering.

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be used to fund our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as our Board of Directors may consider relevant. As a result, any return on your investment in our common stock may be limited to the amount of appreciation in the share price thereof, if any.

Our directors, executive officers and affiliates will continue to exert significant control over our future direction, which could reduce the price and likelihood of a change of control transaction.

As of March 31, 2011 members of our Board of Directors and our executive officers, together with our affiliates, owned approximately 66.54% of our outstanding common stock, determined in accordance with the SEC’s rules for calculating beneficial ownership. Accordingly, these stockholders, if they act together, may be able to control all matters requiring the approval of our stockholders, including the election of directors and approval of significant corporate transactions. In addition, these stockholders can exert significant influence over our business and operations and may have interests that are adverse to the interests of our other stockholders. This concentration of ownership, which could result in a continued concentration of representation on our Board of Directors, may also delay, prevent or deter a change in control and could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our business or assets.

There is a reduced probability of a change of control or acquisition of us due to the possible issuance of preferred stock. This reduced probability could deprive our investors of the opportunity to otherwise sell our stock in an acquisition of us by others.

Our Articles of Incorporation authorize our Board of Directors to issue up to 200,000,000 shares of preferred stock, of which 6,329,650 shares were outstanding as of March 31, 2011, in one or more series and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption, liquidation preferences and the number of shares constituting any series or designation of such series, without further vote or action by stockholders. As a result of the existence of “blank check” preferred stock, potential acquirers of the Company may find it more difficult to, or be discouraged from, attempting to effect an acquisition transaction with, or a change of control of, the Company, thereby possibly depriving holders of our securities of certain opportunities to sell or otherwise dispose of such securities at above-market prices pursuant to such transactions.

Certain provisions of our corporate governing documents and Nevada law could discourage, delay, or prevent a merger or acquisition at a premium price.

Certain provisions of our organizational documents and Nevada law could discourage potential acquisition proposals, delay or prevent a change in control of our Company, or limit the price that investors may be willing to pay in the future for shares of our common stock. For example, our Articles of Incorporation and Bylaws permit us to issue, without any further vote or action by the stockholders, up to 200,000,000 shares of preferred stock in one or more series and, with respect to each series, to fix the number of shares constituting the series and the designation of the series, the voting powers (if any) of the shares of the series, and the preferences and relative, participating, optional, and other special rights, if any, and any qualifications, limitations, or restrictions of the shares of the series. In addition, our Articles of Incorporation permit our Board of Directors to adopt amendments to our Bylaws.

Our failure to maintain the listing requirements of the Nasdaq Capital Market could result in a de-listing of our common stock.

If we fail to satisfy the continued listing requirements of the Nasdaq Capital Market, such as the corporate governance requirements, the minimum closing bid price requirement or remaining current in our reporting obligations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Nasdaq may take steps to de-list our common stock. Such a de-listing would likely have a negative effect on the price of our common stock and would impair your ability to sell or purchase our common stock when you wish to do so.

13

If securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or our business. We currently have research coverage by a single analyst. We may never obtain research coverage by other industry or financial analysts. If few analysts commence or provide coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage of the Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price and/or trading volume to decline, which could adversely affect your ability to sell our common stock at favorable prices or at all.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plans,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and are subject to inherent risks and uncertainties, such as those disclosed in this prospectus , including, without limitation, the risks and other factors discussed in the section captioned “Risk Factors” beginning on page 6 in this prospectus. Some of these risks include:

|

|

·

|

the potential loss of our grants from the U.S. Department of Energy (“DOE”);

|

|

|

·

|

the possibility that the additional capital that we will require to complete our DOE Contracts will not be available to us on favorable terms or at all;

|

|

|

·

|

our history of losses, which may continue and may negatively impact our ability to achieve our business objectives;

|

|

|

·

|

the possibility that the public demand for electric vehicles will not significantly increase in the future;

|

|

|

·

|

our dependency on car manufacturers’ timely delivery of EVs in sufficient quantities during the DOE Contract period;

|

|

|

·

|

the possibility that the decreasing range of EVs on a single charge will decrease consumers’ willingness to purchase EVs;

|

|

|

·

|

our potential inability to keep up with advances in EV technology;

|

|

|

·

|

increasing competition in our industry from large established companies;

|

|

|

·

|

our inability to defend our intellectual property or the potential that we will incur substantial costs in defending our intellectual property;

|

|

|

·

|

the possibility that we will cease to receive funding from the DOE or any other government funding;

|

|

|

·

|

the possibility that the technology underlying our Super-Charge and Minit-Charger products will cease to remain commercially viable;

|

|

|

·

|

the possibility that the demand for hydrogen testing will not continue;

|

14

|

|

·

|

the effect of local and national economic, credit and capital market conditions on the economy in general, and on the particular industries in which we operate;

|

|

|

·

|

potential problems with the quality or performance of our products;

|

|

|

·

|

our dependence on third party suppliers and the possibility that such suppliers will be unable to timely deliver the products we need on terms favorable to us or at all;

|

|

|

·

|

unfavorable political, regulatory, labor and tax conditions in foreign countries, which could adversely impact our international operations;

|

|

|

·

|

our potential inability to retain key employees;

|

|

|

·

|

our limited access to insurance coverage and the possibility that we may incur losses resulting from product liability claims, business interruptions, or natural disasters;

|

|

|

·

|

the interests of our directors, executive officers and affiliates, which exert significant control over our future direction and could reduce the sale value of the Company;

|

|

|

·

|

the fact that we have not and do not anticipate paying cash dividends on our common stock;

|

|

|

·

|

our ability to issue preferred stock, which may reduce the probability that we are acquired;

|

|

|

·

|

our high levels of outstanding preferred stock and warrants, which could depress the market price of our common stock;

|

|

|

·

|

the potential that the issuance of shares upon conversion of our preferred stock and exercise of our warrants could cause significant dilution to our common stockholders;

|

|

|

·

|

the limited market and volatility of our common stock;

|

|

|

·

|

the possibility that we could fail to remain current in our reporting obligations, which could result in the de-listing of our shares from the Nasdaq Capital Market;

|

|

|

·

|

the possibility that the sale or perceived sale of a substantial number of shares could cause the price of our common stock to decline;

|

|

|

·

|

the fact that we have material weaknesses in our internal controls in accordance with Section 404 of the Sarbanes-Oxley Act; and

|

|

|

·

|

the possibility that analysts could publish reports that adversely affect the price and volume of our common stock.

|

In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

Each forward-looking statement contained in this prospectus reflects management’s view only as of the date on which it is made, and, except to the extent required by federal securities laws, we undertake no obligation to publicly update any forward-looking statements, whether as the result of new information, future events, or otherwise.

15

USE OF PROCEEDS

We estimate the net proceeds to us from the sale of the common stock in this public offering will be approximately $________, based on an assumed public offering price of $____ per share and after deducting the underwriting discount and our estimated offering expenses. If the underwriters’ over-allotment option is exercised in full, it is estimated that the selling stockholders’ net proceeds will be approximately $______. We will not receive any of the proceeds from the sale of shares of our common stock offered by the selling stockholders pursuant to the exercise, if any, of the over-allotment option.

We intend to use the net proceeds from this public offering primarily for working capital related to the DOE Contract, which we anticipate will require $20-25 million for the remainder of 2011. We intend to use any remaining proceeds from this offering to expand our Blink infrastructure and for general corporate purposes.

The amounts and timing of our actual expenditures will depend on numerous factors. We may find it necessary or advisable to use portions of the net proceeds for other purposes, and we will have broad discretion in the application and allocation of the net proceeds from this offering. Additionally, we may use a portion of the net proceeds of this offering to finance acquisitions of, or investments in, competitive and complementary businesses or products as a part of our growth strategy. However, we currently have no plans or commitments with respect to any such acquisitions or investments. Any additional net proceeds received from the exercise of the over-allotment option will be used for working capital and general corporate purposes.

Pending use of the net proceeds from this offering, we intend to invest the net proceeds in short-term, investment-grade securities. We cannot predict whether the proceeds invested will yield a favorable return.

16

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information