Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SUSQUEHANNA BANCSHARES INC | d8k.htm |

2011

Annual Meeting Hershey, PA

May 6, 2011

Exhibit 99.1 |

2

William J. Reuter

Chairman & CEO |

3

I pledge allegiance to the flag of the

United States of America

and to the republic for which it stands:

one nation under God, indivisible,

with liberty and justice for all. |

|

5

Nominations to Board of Directors

Nominations to Board of Directors

Anthony J. Agnone, Sr.

Wayne E. Alter, Jr.

Peter DeSoto

Eddie L. Dunklebarger

Henry R. Gibbel

Bruce A. Hepburn

Donald L. Hoffman

Sara G. Kirkland

Guy W. Miller, Jr.

Michael A. Morello

Scott J. Newkam

E. Susan Piersol

William J. Reuter

Christine Sears

James A. Ulsh

Roger V. Wiest, Sr. |

6

Additional Orders of Business

Additional Orders of Business

Increase Authorized Shares to 400 Million

2011 Employee Stock Purchase Plan

Short-Term Incentive Plan

Advisory Vote on Executive Compensation

Advisory Vote on Frequency of Future Votes on Executive

Compensation

Ratification of PricewaterhouseCoopers LLP as Independent

Registered Public Accountants |

7

Additional Orders of Business

Additional Orders of Business

Approval and Adoption of Agreement and Plan of Merger with

Abington Bancorp, Inc.

Approval of Adjournment, If Necessary, to Solicit Additional

Proxies in Favor of Merger Approval |

|

9

Voting Results

Voting Results

Directors Elected

Increase Authorized Shares to 400 Million

2011 Employee Stock Purchase Plan

Short-Term Incentive Plan

Advisory Vote on Executive Compensation

Advisory Vote on Frequency of Future Votes on Executive

Compensation

Ratification of PricewaterhouseCoopers LLP as Independent

Registered Public Accountants |

10

Voting Results

Voting Results

Approval and Adoption of Agreement and Plan of Merger with

Abington Bancorp, Inc.

Approval of Adjournment, If Necessary, to Solicit Additional

Proxies in Favor of Merger Approval |

|

12

Forward-Looking Statements

Forward-Looking Statements

During the course of this presentation, we may make projections and other

forward-looking statements regarding events or the future financial performance

of Susquehanna, including the impact of the announced acquisition of Abington

Bancorp. We wish to caution you that these forward-looking statements may

differ materially from actual results due to a number of risks and uncertainties.

For a more detailed description of the factors that may affect

Susquehanna’s operating results, we refer you to our

filings with the Securities & Exchange Commission, including our quarterly report on Form

10-Q for the quarter ended March 31, 2011, and our annual report on Form 10-K for the

year ended December 31, 2010. Susquehanna assumes no obligation to update the

forward-looking statements made during this presentation.

For more information, please visit our Web site at:

www.susquehanna.net

12 |

13

Susquehanna Profile

with Abington Bancorp

Susquehanna Profile

with Abington Bancorp

Company Statistics

242 branches in PA, NJ, MD, WV

$15 billion in assets

$10 billion in deposits

Approx. $6.5 billion in assets under management & administration

Shareholder Base

Approx. 157 million shares outstanding

Approx. 31,000 shareholders (record and street)

Approx. 64% institutional holders

13 |

14

2010 Accomplishments

2010 Accomplishments

Improved credit quality; diversified risk in portfolio |

15

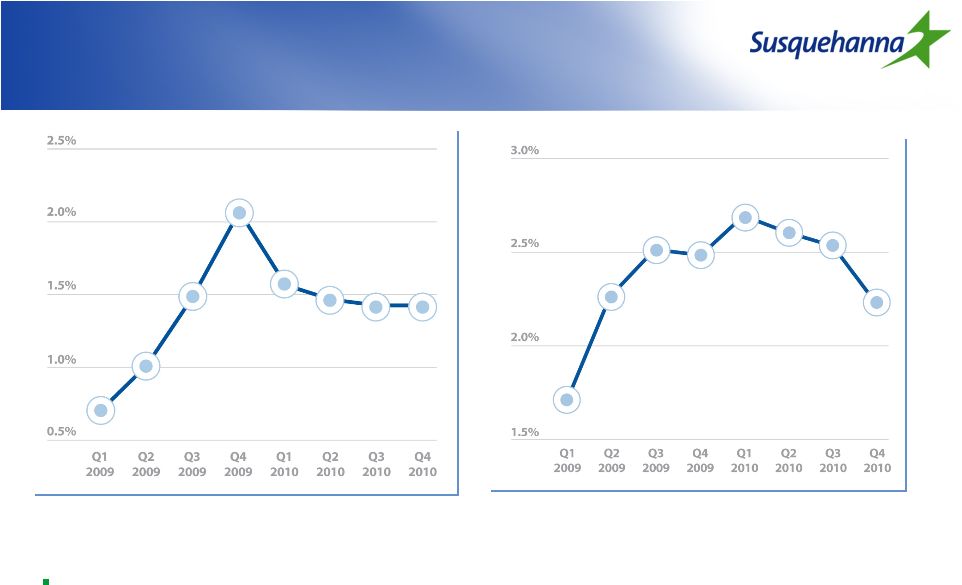

Credit Quality Trends

Credit Quality Trends

Net charge-offs and non-performing assets showed steady

improvement during 2010

Net charge-offs

Non-performing assets |

16

Loan Trends

Loan Trends

2009

2010

Target

Consumer

12.5%

13.3%

15%

Commercial

Real Estate

31.1

31.0

25

Residential

Real Estate

24.1

27.7

25

Construction

11.3

9.1

10

Commercial

21.0

18.9

25 |

17

2010 Accomplishments

2010 Accomplishments

Improved credit quality; diversified risk in portfolio

Grew core deposits |

18

Deposit Trends

Deposit Trends

2009

2010

Target

CDs

41.3%

37.0%

33%

Core

58.7

63.0

67 |

19

2010 Accomplishments

2010 Accomplishments

Improved credit quality; diversified risk in portfolio

Grew core deposits

Raised $395 million in capital and

repaid TARP Capital Purchase Program investment |

20

2010 Capital Raise

2010 Capital Raise

Raised total of $395 million in capital

$345 million in common

$50 million in trust preferred

TARP Capital Purchase Program

Repaid final installment of $300 million in December 2010

Repurchased warrant in January 2011

Total return to U.S. Treasury: $29 million |

21

Strong Capital Position

Strong Capital Position

SUSQ*

Peer Median**

Basel III

Requirement

Tier 1

Common

Total

Risk-Based

* Pro-forma for Abington acquisition

** Peers include FMER, FNB, FNFG, FULT, NPBC, VLY, WBS; 4Q2010

10.58%

10.16%

7.00%

15.42%

12.91%

10.5% |

22

2010 Accomplishments

2010 Accomplishments

Improved credit quality; diversified risk in portfolio

Grew core deposits

Raised $395 million in capital and

repaid TARP Capital Purchase Program investment

Expanded branch network and banking services |

23

Expanding Branch Presence

Expanding Branch Presence

Opened or relocated five

branches in 2010

Greater customer convenience

Better visibility

Marlton, NJ

Philadelphia, PA

Lancaster, PA

Hagerstown, MD

Towson, MD |

24

Strengthening Market Presence

Strengthening Market Presence

Market

Rank:

1-4

5-10

Other

Lancaster, PA

Baltimore, MD

Philadelphia, PA

Hagerstown, MD

Harrisburg, PA

Allentown, PA

York, PA

Reading, PA

Hazleton, PA

Vineland, NJ

Lewisburg, PA

Williamsport, PA

Hammonton, NJ

Chambersburg, PA

Ocean City, MD

Cumberland, MD

Sunbury, PA

Gettysburg, PA

Pottsville, PA

Selinsgrove, PA

In last 5 years, Susquehanna improved market rank in 15 of 20 MSAs

One of only two $10 billion+ banks with significant concentration of deposits

in Mid-Atlantic region*

*Susquehanna pro-forma for Abington acquisition; banks & thrifts with

PA/MD/NJ deposits=90%+ of total deposits |

25

Strong Demographic Markets

Strong Demographic Markets

Population in Susquehanna markets approaching 10 million

SUSQ*

U.S.

Median Household

Income

$58,100

$54,400

Projected Household

Income Growth

2010-2015

13.6%

12.4%

* Pro-forma for Abington acquisition |

26

Enhancing Services and

Brand Presence

Enhancing Services and

Brand Presence

Deposit Products

1-2-3 CD

Consumer Lending

Home Equity Loans

and Lines of Credit

Auto Loans |

27

Enhancing Services and

Brand Presence

Enhancing Services and

Brand Presence

Image Advertising Campaign

“Doing What Counts”

Social media tools to further build relationships

Connections Blog

Twitter |

28

2010 Accomplishments

2010 Accomplishments

Improved credit quality; diversified risk in portfolio

Grew core deposits

Raised $395 million in capital and

repaid TARP Capital Purchase Program investment

Expanded branch network and banking services

Enhanced corporate governance |

29

Enhanced Corporate Governance

Enhanced Corporate Governance

Appointed Lead Director

Established Risk Committee on Board of Directors

Enterprise risk management

Challenges and opportunities of Dodd-Frank Act |

30

Challenges to

Increasing Profitability

Challenges to

Increasing Profitability

Uneven pace of economic recovery

Increase in energy costs

Impacts three keys to increasing profitability:

Credit quality

Loan growth

Interest rate increase

Regulatory Changes

Dodd-Frank Wall Street Reform and Consumer Protection Act

Interchange fee cap

FDIC insurance costs

Likely to reduce revenue and increase costs |

31

2011 Initiatives

2011 Initiatives

Monitor and prepare for regulatory changes

Support industry government-relations efforts

Contingency planning

Grow revenue in competitive environment

Business banking

Consumer lending

Continue improvement in credit quality

Grow deposits, with focus on core deposits

Increase in earnings and dividends |

32

Strategic Acquisition of

Abington Bancorp

32 |

Abington Acquisition Summary

Abington Acquisition Summary

33

Low-risk, fill-in transaction expanding Susquehanna’s footprint

into highly attractive demographic markets

Significant opportunity for deposit, loan, and fee income

generation by delivering on Susquehanna’s full-service

platform to wealthy markets

Capital accretive transaction; potential to drive earnings

accretion through deployment of excess capital |

Susquehanna’s Strengths

Susquehanna’s Strengths

34

Diversified financial holding company

Strong fee income generating subsidiaries

Well positioned in attractive growth markets (Philadelphia, Baltimore)

Franchise that would be difficult to replicate

Fortress balance sheet with strong capital position

Current stock price not reflective of underlying franchise value

|

|

Questions and Answers

Questions and Answers

Microphones are available

at the front of the aisles. |

Quarterly Webcast

Quarterly Webcast

www.susquehanna.net |

|