Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SIGMA ALDRICH CORP | d8k.htm |

Sigma-Aldrich Corporation

2011 Shareholders Meeting

•May 3, 2011

sigma-aldrich.com

Exhibit 99.1 |

2

Cautionary Statements

Our presentation today will include forward looking statements relating to the

Company’s future performance, goals, strategic actions and initiatives

and similar intentions and beliefs, including expectations, goals, beliefs, intentions and the like regarding future sales,

earnings, free cash flow, share repurchases, acquisitions and other matters. These

statements are based on assumptions regarding Company operations, investments

and acquisitions and conditions in the markets the Company serves. We believe that these

expectations

are

reasonable

and

well-founded.

The

forward-looking

statements

in

this

presentation

are

subject

to

risks

and

uncertainties

including, among others, certain economic, political and technological factors.

Actual results could differ materially from those stated or implied during

this review or contained in other Company communications due to, but not limited to, such factors as (1) global economic

conditions, (2) changes in pricing and the competitive environment and the global

demand for our products, (3) fluctuations in foreign currency

exchange

rates,

(4)

changes

in

research

funding

and

the

success

of

research

and

development

activities,

(5)

failure

of

planned

sales initiatives in our Research and SAFC businesses, (6) dependence on

uninterrupted manufacturing operations, (7) failure to achieve planned cost

reductions in global supply chain initiatives and restructuring actions, (8) changes in the regulatory environment in

which the Company operates, (9) changes in worldwide tax rates or tax benefits from

domestic and international operations, including the

matters

described

in

Note

10–Income

Taxes–

to

the

Consolidated

Financial

Statements

in

the

Company’s

Form

10-K

report

for

the

year ended December 31, 2010, (10) exposure to litigation, including product

liability claims, (11) the ability to maintain adequate quality

standards,

(12)

reliance

on

third

party

package

delivery

services,

(13)

an

unanticipated

increase

in

interest

rates,

(14)

other

changes

in

the

business

environment

in

which

the

Company

operates,

and

(15)

the

outcome

of

the

outstanding

matters

described

in

Note

11-

Contingent Liabilities and Commitments to the Consolidated Financial

Statements-in the Company’s Form 10-K report for the year ended

December 31, 2010. A further discussion of risk factors can be found in Item 1A of Part 1 of the Company’s Form 10-K report for

the

year

ended

December

31,

2010.

The

Company

does

not

undertake

any

obligation

to

publicly

update

the

matters

covered

in

this

presentation.

With over 60% of sales denominated in currencies other than the U.S. dollar,

management uses currency-adjusted growth, and believes it

is

useful

to

investors,

to

judge

the

Company’s

controllable,

local

currency

performance.

Organic

sales

growth

data

presented

in

this

review

is

proforma

data

and

excludes

currency

and

acquisition

impacts.

The

Company

calculates

the

impact

of

changes

in

foreign

currency

exchange

rates

by

multiplying

current

period

activity

by

the

difference

between

current

period

exchange

rates

and

prior

period

exchange rates. The result is the defined impact of changes in foreign currency

exchange rates. While we are able to report historical currency impacts

after the fact, we are unable to estimate changes that may occur later in 2011 to applicable exchange rates. Any

significant

changes

in

currency

exchange

rates

would

likely

have

a

significant

impact

on

our

reported

growth

rates

due

to

the

volume

of

our sales denominated in foreign currencies.

Management also uses adjusted net income and EPS, adjusted operating income

and operating income margins (excluding restructuring

and

impairment

costs)

and

free

cash

flow,

non-GAAP

measures,

to

judge

its

performance

and

ability

to

pursue

opportunities that enhance shareholder value. Due to the uncertain timing of the

future restructuring and other extraordinary special changes, we are unable

to include a 2011 diluted GAAP EPS forecast or reconcile to our 2011 diluted adjusted EPS forecast or provide

a reconciliation to corresponding GAAP measures . Management believes this

non-GAAP information is useful to investors as well.

Reconciliations of GAAP to non-GAAP information are included in the

Company’s April 26, 2011 earnings release posted on its website,

www.sigma-aldrich.com, and in the Appendix –

Reconciliation of GAAP to Non-GAAP Financial Measures beginning on Slide

23. |

3

2010/2011 –

Important Transition Years

•

2010 and Q1 2011 performance

was outstanding

•

Company is financially strong

•

Management transition

We have a bright future ahead |

4

Sigma-Aldrich –

Unique Business Model

•

Leading Life Science and

Hitech

Company

•

Diversified and broad portfolio

–

Products

–

Customers

•

Expanding global footprint

•

Unrivalled customer service

•

World-class management team

•

Consistently strong financial performance

Delivering science with convenience |

5

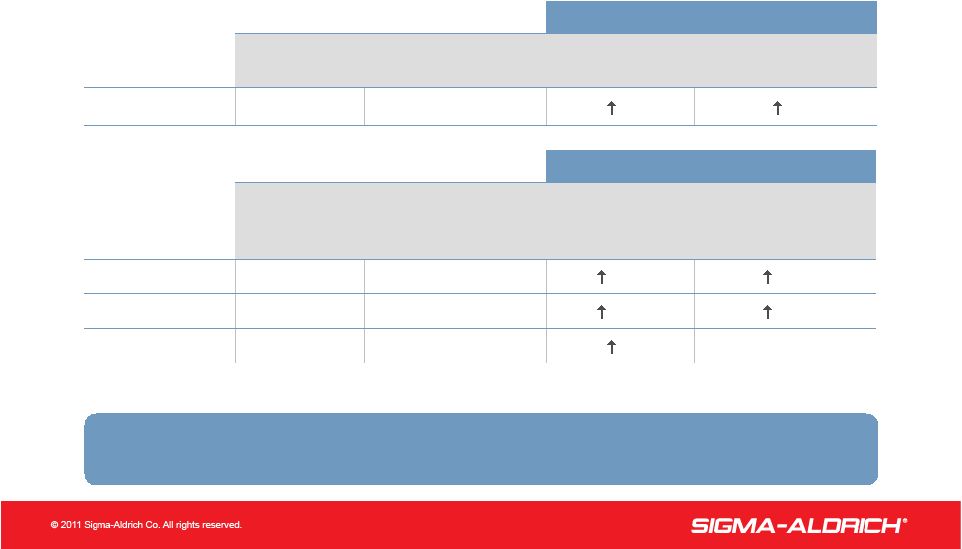

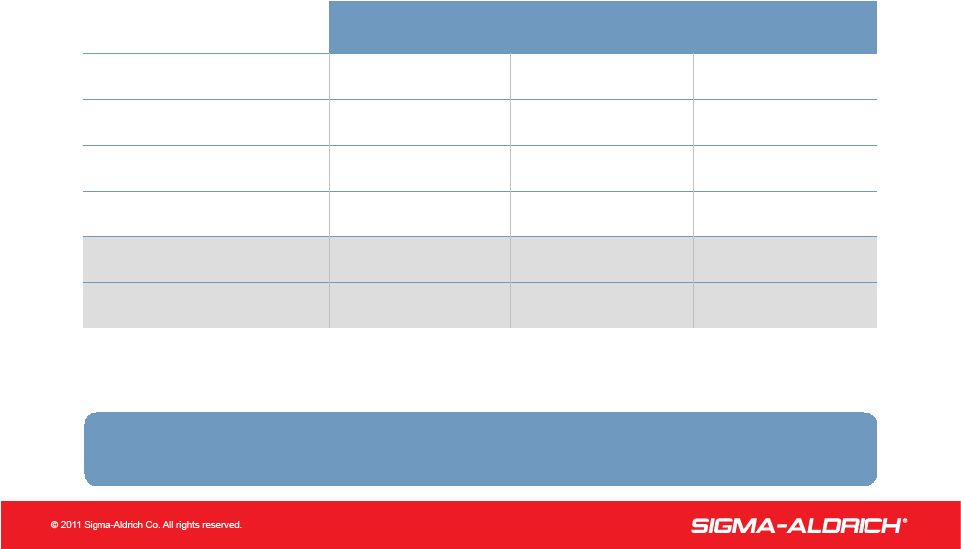

Full Year 2010 Financial Results

$ Millions, Except Per Share Amounts

Year-Over-Year

2010

As

Reported

Excluding

Currency Impact

Sales

$2,271

6%

5%

Year-Over-Year

As Reported

2010

Excluding

Restructuring and

Impairment Costs

As

Reported

Excluding

Restructuring and

Impairment Costs

Net Income

$384*

$408

11%

16%

Diluted EPS

$3.12*

$3.31

11%

16%

Free Cash Flow

$424

7%

Achieved new performance record in 2010

*Includes

currency

benefit:

Net

Income

–

$15;

Diluted

EPS

–

$0.12 |

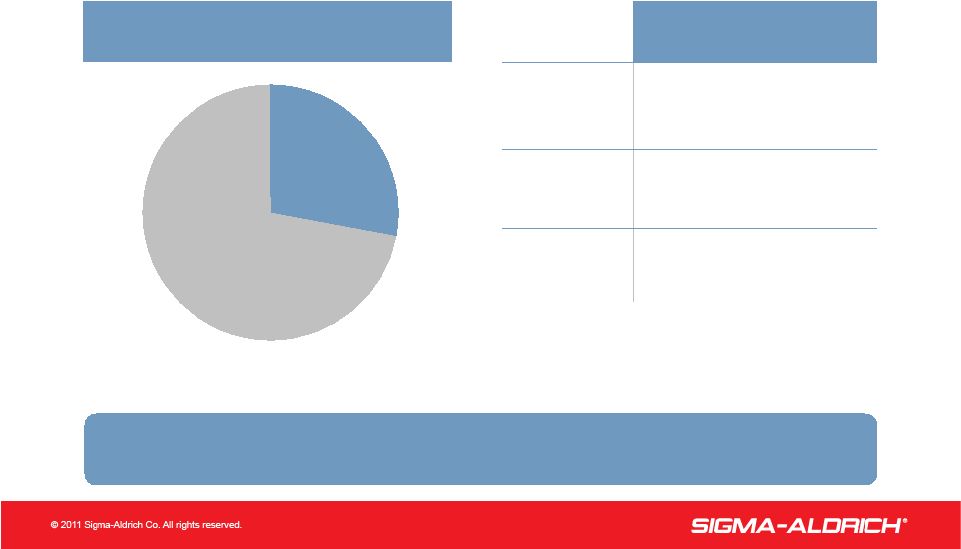

6

Sales Mix (YTD)

2010 Sales Growth

Adjusted for Currency

Demand for Research products continued to show growth.

SAFC sales set new annual high

28%

SAFC

72%

Research

Full Year 2010 /

Full Year 2009

5%

Total

Company

9%

SAFC

4%

Research |

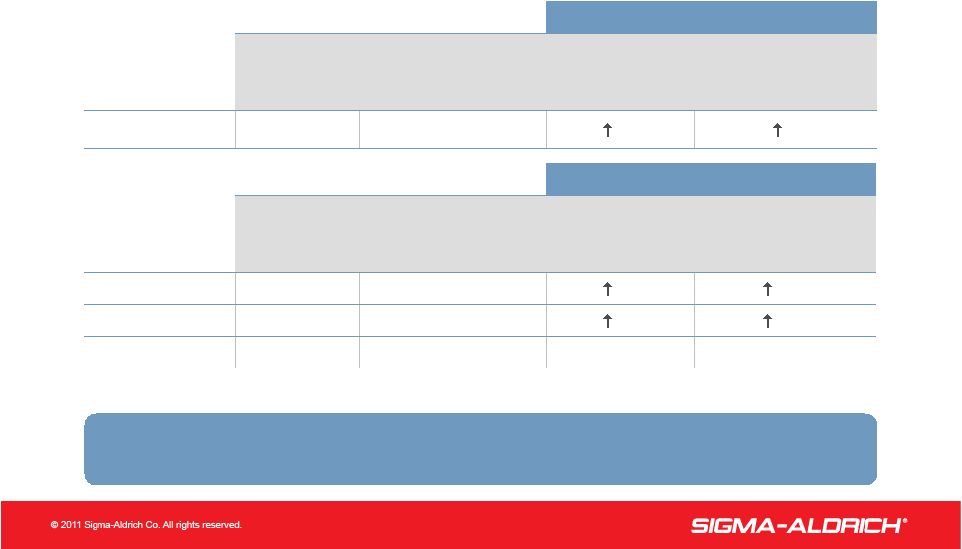

7

First Quarter 2011 Financial Results

$ Millions, Except Per Share Amounts

Year-Over-Year

Q1 2011

As

Reported

Excluding

Currency and

Acquisition Impacts

Sales

$632

10%

7%

Year-Over-Year

As Reported

Q1 2011

Excluding

Restructuring and

Tax Benefit

As

Reported

Excluding

Restructuring and

Tax Benefit

Net Income

$119*

$116

19%

12%

Diluted EPS

$0.97*

$0.94

20%

12%

Free Cash Flow

$133

–%

Q1 Sales and Net Income highest in Company history

*Includes

currency

benefit:

Net

Income

–

$1;

Diluted

EPS

–

$0.01 |

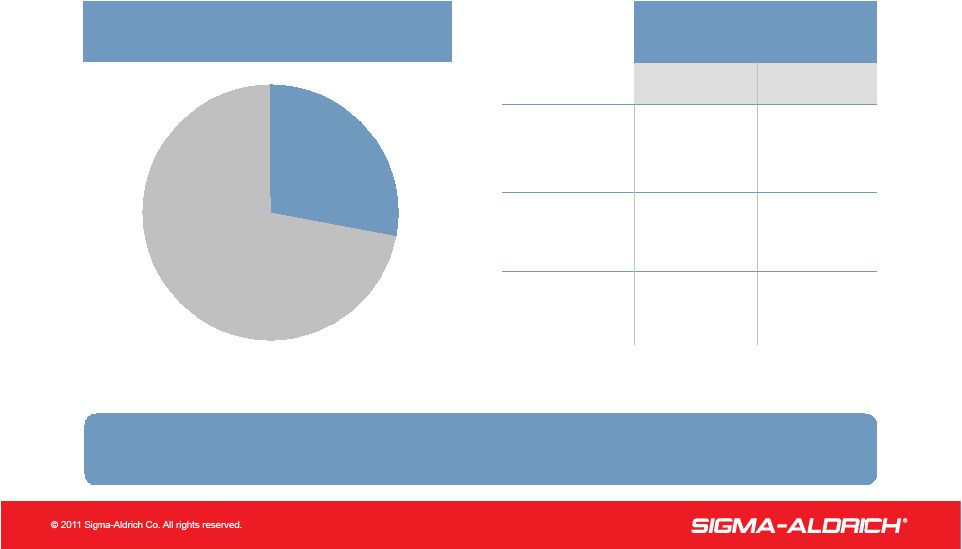

8

Sales Mix (YTD)

2011 Sales Growth

Demand for Research products met expectations.

SAFC sales set new quarterly high

28%

SAFC

72%

Research

Q1 2011 / Q1 2010

10%

18%

8%

Reported

Organic*

7%

Total

Company

16%

SAFC

4%

Research

*Adjusted for Currency and Acquisitions. |

9

Key Balance Sheet Metrics

21.5%

18.8%

6.5

47

489

$ 623

3/31/11

6.5

6.3

Inventory MOH

25.5%

21.4%

Debt to Capital

22.8%

21.5%

Return on Equity

47

577

$ 373

12/31/09

47

Receivable DSO

539

Total Debt ($M)

$ 569

Cash ($M)

12/31/10

Strong financial position |

10

Management Transition

Rakesh

Sachdev

Kirk Richter

Interim CFO

Dave Smoller

Chief Scientific Officer

Eric Green

Asia Pacific/Latin Amer.

Mike Harris

EMEA

Gerrit

van den Dool

North America

Regions

Gilles Cottier

SAFC

Frank Wicks

Research

Business Units

President and CEO

Strong leadership team –

Aligned with strategic plan initiatives

Loss of

Jai Nagarkatti

Management Team |

11

Recent Company Highlights and Achievements

•Technology Initiatives

•

Won

silver

award

in

The

Scientist

magazine

for top 10 innovations for 2010 for engineering

cell lines and knock-out rats using Zinc Finger

Nuclease (ZFN) technology

•

Expanded offering of Antibodies

•

Expanded manufacturing of large molecule

recombinant

proteins

and

small

molecule

APIs

•

Welcomed two new Analytical Standards

companies into Sigma-Aldrich

–

Cerilliant

–

RTC |

12

Recent Company Highlights and Achievements

•Customer Service

•

New warehouse management

system with Virtual Boxing at the

Milwaukee Distribution Center

•

Sigma-Aldrich China received

“Preferred

Supplier

Award”

from

GSK and Aleve China

•

Continued strong service levels in

North America and Europe;

improved service levels in

Asia-Pacific / Latin America |

13

Recent Company Highlights and Achievements

•Growth Accelerators

•

SAFC Biosciences

–

Biological drugs

•

SAFC Hitech

–

Chemicals for LEDs and

semiconductors

•

Emerging Markets

–

Strong growth in China, India & Brazil:

25% in Q1 2011 (31% in 2010)

•

eCommerce

–

Increased to 50% of global Research

sales in Q1 2011 (48% in 2010) |

14

Recent Company Highlights and Achievements

•Company / Employee

Recognition

•

Recognized as Top 100

Employers in UK, France,

Germany and Switzerland

•

Prestigious James B. Eads Award

for outstanding achievement in

Technology and Engineering

in St. Louis awarded to

Samy

Ponnusamy

for his work in

Polymers and Green Chemistry |

15

Recent Company Highlights and Achievements

•Corporate Citizenship

•

Team Sigma-Aldrich increased

volunteer participation and

contributions

•

Launched Global Citizenship Initiative

•

Sigma-Aldrich and Sigma-Aldrich

Foundation donated ~$1 million

•

Japan earthquake relief fund of $100K |

16

Sigma-Aldrich Strategic Priorities

•Enhance Growth in Core Research

and SAFC Business

•

Focus on higher growth markets

–

Analytical Chemistry

–

Biology

–

Chemistry/Materials Science

•

Capitalize

on

SAFC’s

unique

manufacturing capabilities and

cGMP facilities

•

Increased presence in faster-growth

economies

•

Expanded customer reach (eBusiness /

Sales Force effectiveness) |

17

Sigma-Aldrich Strategic Priorities

•Drive Operational Excellence

•

Continue to build upon the success

of our global supply chain initiatives

•

Streamline manufacturing and

distribution footprint

•

Expand global sourcing

•Leverage Strong Cash Flow

•

Actively pursue strategic acquisitions

Strategic actions build sustainable value |

18

2011 Guidance

*Excludes any restructuring and other extraordinary special charges.

Organic

Revenue Growth

Diluted

Adjusted EPS*

Free

Cash Flow

Mid-single digits

$3.60 –

$3.75

>$400 Million |

19

Objectives: 2011–2015

Deliver above-market top-line growth and profits

Incremental Impact

Five-Year Financial Targets

>$2 Billion

Cumulative free cash flow (five years)

26–27%

Expand cumulative operating margins by 2015

7–8%

Top line organic growth

(normal economic conditions) |

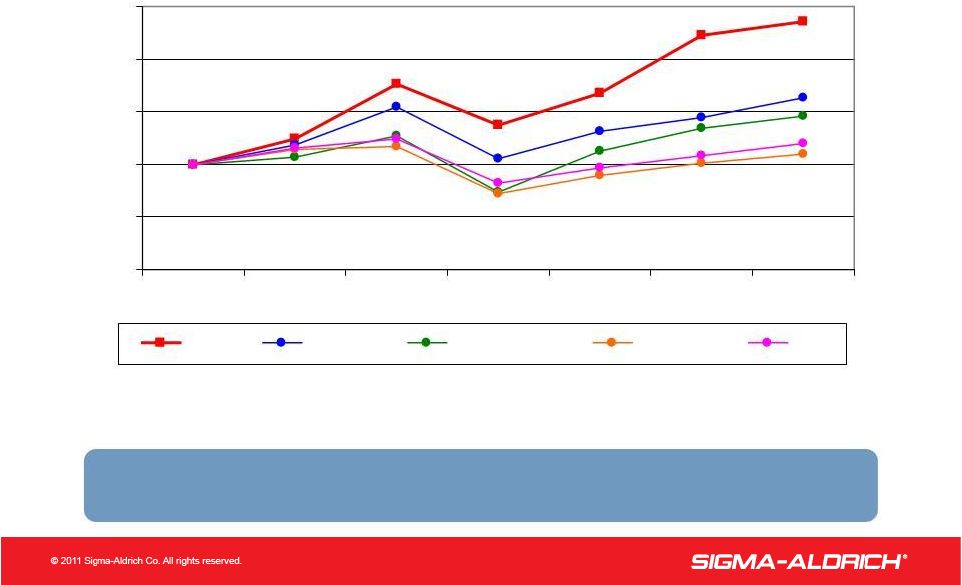

20

Shareholder Returns

SIAL Total Shareholder Return for 2010 exceeds 30%

Peers: Life Technologies, Qiagen, Techne, Thermo-Fisher, Waters, Agilent,

Becton Dickinson, Bio-Rad, PerkinElmer, Lonza $124.27

$176.39

$137.81

$222.56

$167.03

$100.00

$235.62

$0

$50

$100

$150

$200

$250

2005

2006

2007

2008

2009

2010

30-Apr

SIAL

PEERS

Nasdaq 100

S&P 500

DJIA |

21

Sigma-Aldrich: A Bright Future

Compelling investment opportunity

Unrivaled scientific knowledge and unsurpassed service

Diversified portfolio: products, customers

Expanding global footprint

History of profitable growth

Strong financial position and cash flow

Plans to enhance growth rates and improve profitability

|

22

Sigma-Aldrich Corporation

2011 Shareholders Meeting

Questions? |

Appendix

Reconciliation of GAAP to

Non-GAAP Financial Measures

23 |

24

Reconciliation of Reported Sales Growth to

Adjusted (Organic) Sales Growth

7%

1%

2%

10%

Total Customer Sales

16%

–

2%

18%

SAFC

4%

2%

2%

8%

Research Chemicals

4%

–

2%

6%

Research Biotech

4%

3%

2%

9%

Research Specialties

5%

–

2%

7%

Research Essentials

Adjusted

(Organic)

Acquisition

Benefit

Currency

Benefit

Reported

Three Months

Ended March 31, 2011

5%

1%

6%

9%

–

9%

4%

–

4%

2%

1%

3%

6%

–

6%

2%

–

2%

Adjusted

(Organic)

Currency

Impact

Reported

Twelve Months

Ended December 31, 2010 |

25

Reconciliation of Reported Net Income to

Adjusted Net Income

$2.85

$3.31

$0.84

$0.94

$353

408

$104

$116

Adjusted net income

–

–

–

(0.04)

–

–

–

(5)

Tax benefit

_

0.05

–

–

–

7

–

–

Impairment charge

0.05

0.14

0.03

0.01

6

17

4

2

Restructuring costs

$2.80

$3.12

$0.81

$0.97

$347

$384

$100

$119

Reported net income

2009

2010

2010

2011

2009

2010

2010

2011

Twelve Month ended

December 31

Three month ended

March 31

Twelve Month ended

December 31

Three month ended

March 31

Diluted Earnings Per Share

Net Income ($M) |

26

Reconciliation of Operating Cash Flow to

Free Cash Flow

$ Millions

Free cash flow

Less: Capital expenditures

Net cash provided by operating activities

$ 133

$ 133

(18)

(18)

$ 151

$ 151

2010

2011

Three Months Ended

March 31,

$ 396

$ 424

(120)

(99)

$ 516

$ 523

2009

2010

Twelve Months Ended

December 31, |