Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d8k.htm |

2011 Annual

Shareholder’s 2011 Annual Shareholder’s

Meeting Presentation

Meeting Presentation

Exhibit 99.1 |

Safe Harbor

Statement Safe Harbor Statement

Statements contained in this presentation which are not historical facts and which pertain to

future operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements involve significant

risks and uncertainties. Actual results may differ materially from the results

discussed in these forward-looking statements. Factors that might cause such a

difference include, but are not limited to, those discussed in the Company’s

periodic filings with the SEC. In connection with the proposed mergers, IBERIABANK Corporation has filed Registration

Statements on Form S-4 that contain a proxy statement/prospectus. INVESTORS AND

SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/PROSPECTUS REGARDING

THE PROPOSED TRANSACTIONS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the

proxy statement/prospectus (when it is available) and other documents containing

information about IBERIABANK Corporation, Cameron Bancshares, Inc. and OMNI BANCSHARES

Inc., without charge, at the SEC's web site at http://www.sec.gov. Copies of the proxy

statement/prospectus and the SEC filings that will be incorporated by reference in the

proxy statement/prospectus may also be obtained for free from the IBERIABANK

Corporation website, www.iberiabank.com, under the heading “Investor Information”.

This communication is not an offer to purchase shares of Cameron Bancshares, Inc. common

stock or OMNI BANCSHARES, Inc. common stock, nor is it an offer to sell shares of

IBERIABANK Corporation common stock which may be issued in either proposed

merger. Any issuance of IBERIABANK Corporation common stock in either proposed

merger would have to be registered under the Securities Act of 1933, as amended, and

such IBERIABANK Corporation common stock would be offered only by means of a prospectus

complying with the Act. |

Annual Shareholder’s Meeting Presentation

Annual Shareholder’s Meeting Presentation

2010 Investments

•

Management Development Program

•

Introduction of New Businesses

•

Retail/Small Business Focus

Acquisition Update

•

OMNI BANK

•

Cameron State Bank

2010 Other Highlights |

Mission

Statement Mission Statement

Provide Exceptional Value-Based

Client Service

Great Place To Work

Growth That is Consistent With

High Performance

Shareholder Focused

Strong Sense Of Community |

Our Franchise

Our Franchise |

Marucci Sports

Baton Rouge, Louisiana

Management

Management

Development

Development

Program

Program |

Management

Development Program Management Development Program

Overview

Overview

We Developed The Program To:

Develop Future Bankers And Leaders

Build A Strong Sense Of Teamwork Within Our Future Bank

Leaders

Provide Associates With A Fundamental Understanding Of

Our Credit Culture Allowing Them To Bring That Knowledge

Into All Of Our Markets

Bring Career Opportunities For Our Children And Markets

Class Began in July 2010

15 Associates –

7 Internal, 8 External |

Garver

Little Rock, Arkansas

Capital Markets,

Capital Markets,

Brokerage,

Brokerage,

Wealth

Wealth

Management

Management

and Trust

and Trust |

IBKC Fee

Businesses IBKC Fee Businesses

Business Unit Structure

Business Unit Structure |

IBKC Fee

Businesses IBKC Fee Businesses

Enhancements to traditional banking business

Enhancements to traditional banking business |

IBERIA Capital

Partners IBERIA Capital Partners

Business Model Overview

Business Model Overview

Services

•

Research

•

Oilfield Services –

15

•

Exploration & Production –

12

•

Coal and Shipping –

10

•

Ultimate coverage list –

100

•

Sales

•

8 institutional salesmen

•

Trading

•

2 equity traders

•

Investment Banking

•

Focus on public equity offerings

•

Management advisory

•

Private Placements |

IBERIA Capital

Partners IBERIA Capital Partners

Website

Website

www.iberiacapitalpartners.com |

IBERIA Wealth

Advisors IBERIA Wealth Advisors

Who We Are

Who We Are

We are a team of Trust and Investment professionals:

•

Veterans in our respective markets

•

Holders of advanced degrees

•

Holders of professional designations

•

Focused on superior client service

*As of 3/31/2011

Wealth Advisor

Day-to-day administration of accounts

Advise client on estate planning matters

Consult with client's CPA and attorney as

needed

Interface with bankers to ensure

complementary services

Portfolio Manager

Develop investment plan for client

Implement and monitor investment strategy

Ensure that investment plan complements trust

and estate plan

*Approximate Assets Under Management: $228 million

|

IBERIA Wealth

Advisors IBERIA Wealth Advisors

Asset Allocation Models

Asset Allocation Models

Source: Federated Investors

The appropriate asset

allocation model is chosen

based on a client’s investment

needs and risk tolerance.

Conservative

•

Equities: 20%

•Fixed Income: 64%

•Alternatives: 16%

Conservative

Growth

•

Equities: 36%

•Fixed Income: 48%

•Alternatives: 16%

Balanced

•

Equities: 52%

•Fixed Income: 32%

•Alternatives: 16%

Growth

•

Equities: 65%

•Fixed Income: 20%

•Alternatives: 15%

Aggressive

Growth

•

Equities: 78%

•Fixed Income: 10%

•Alternatives: 12% |

Blessey Marine

Harahan, Louisiana

Retail/Small

Retail/Small

Business

Business |

Winning Banks

Will: Be Relationship-focused

Optimize Distribution Channels

Develop Products That Customers Want

Reinvent Underwriting Models

Exhibit Flawless Execution

Retail/Small Business

Retail/Small Business |

Small Business Opportunities:

293,000 Small Business Customers In Our

Footprint

Focused Bankers

Increased Lending

New Deposit And Treasury Management

Products

Enhanced Online And Mobile Solutions

Serve Businesses And Their Owners

Retail/Small Business

Retail/Small Business |

Retail

Opportunities: 3.6 Million Potential Consumer Clients In Our

Footprint

New Branch Locations Underway

Enhanced ATM, Phone, Online And Mobile

Solutions

Full And Integrated Product Set

Products That Reward Rather Than Penalize

Customers For Doing Business With Us

Retail/Small Business

Retail/Small Business |

Resort Management

Naples, Florida

Acquisition

Acquisition

Update

Update |

Acquisition of

OMNI BANCSHARES, Inc. Acquisition of OMNI BANCSHARES, Inc.

Headquartered In Metairie, LA

Bank Founded In 1988

14 Branches In New Orleans MSA (13) And

Baton Rouge (1)

Loans: $525 Million

Assets: $735 Million

Deposits: $646 Million |

Cultural Similarities

Enhancement To Existing New Orleans Franchise

Well Connected To Jefferson Parish

Strong Client Relationships

Significant Deposit Relationships In Public Funds

Arena

Involved In The Community

Exceptional Leadership: Jim Hudson, Chairman And

CEO -

Named ABA Community Banker Of The Year In

2005

Serving as 2010-2011 Chairman Of The Board -

GNO, Inc.

OMNI BANK

OMNI BANK |

OMNI BANK

OMNI BANK

Strengthens Greater New Orleans Franchise

Strengthens Greater New Orleans Franchise

New Orleans MSA

Rank

Company

Branches

Deposits

Mkt.

Share

1

Capital One

60

$ 8.6 27%

2

Hancock/

Whitney

59

4.5

18

3

JPMorgan

38

4.2

16

4

Regions

34

2.4

9

5

Pro Forma

Pro Forma

IBERIABANK

IBERIABANK

26

26

1.3

1.3

4

4

5

First NBC

15

1.1

3

6

Fidelity

Homestead

14

0.8

3

7

Gulf Coast

14

0.7

3

8

IBERIABANK

12

0.7

2

9

OMNI BANK

14

0.6

2

10

First Trust

8

0.5

2

Source: SNL Financial Deposit Data as of June 2010

IBERIABANK Branches

OMNI Branches

New Locations |

OMNI BANK

OMNI BANK

Branch Distribution

Branch Distribution

Main Office –

Metairie

Deposits: $175 million

Kenner Office

Deposits: $46 million

Mandeville Office (Northshore)

Deposits: $30 million

Carrollton Avenue

Deposits: $15 million

Baton Rouge Office

Deposits: $37 million

Gretna Office (West Bank)

Deposits: $59 million |

Investments In

New Orleans Investments In New Orleans |

Investments In

New Orleans Investments In New Orleans |

Cameron

Bancshares, Inc. Cameron Bancshares, Inc.

Headquartered In Lake Charles, LA

Bank founded In 1966

22 Branches And 48 ATMs In Lake Charles Area

Net Income (2010): $9 Million

Loans: $408 Million

Assets: $706 Million

Deposits: $575 Million |

Outstanding Opportunity To Serve SW LA

Well-Known And Respected Brand

Named “Best Bank”

in The Times of

Southwest Louisiana 12 straight years

Engaged Leadership

Creative Marketing Strategy

Cameron Bancshares, Inc.

Cameron Bancshares, Inc. |

Cameron State

Bank Cameron State Bank

Strengthens Our South Louisiana Franchise

Strengthens Our South Louisiana Franchise

Lake Charles MSA

Rank

Company

Branches

Deposits

Mkt.

Share

1

Capital One

15

$ 834 27%

2

JPMorgan

12

597

19

3

3

IBERIABANK/

IBERIABANK/

Cameron

Cameron

19

19

538

538

17

17

4

First Federal

7

349

11

5

Hancock/

Whitney

5

250

8

6

Jeff Davis

8

234

7

7

Business First

1

105

3

8

Louisiana

Community

4

55

2

9

Midsouth

3

55

2

10

Financial Corp.

2

43

1

Source: SNL Financial Deposit Data as of June 2010

Cameron Branches |

Cameron State

Bank Cameron State Bank

Lake Charles Branch Distribution

Lake Charles Branch Distribution

Main Office –

Lake Charles

Deposits: $163 million

Ryan St. Office

Deposits: $37 million

Westlake Office

Deposits: $25 million

Maplewood Office

Deposits: $39 million

Oak Park Office

Deposits: $25 million

De Quincy Office

Deposits: $23 million

Source: Company reports at December 31, 2010 |

Hundreds Of

Signs In Premium Locations LeGrange High School

Cameron State Bank

Cameron State Bank

Creative Marketing Program

Creative Marketing Program

Mascot: Mulla Mallard

Special School Focus: Investment = Relationships

Significant Signage Program

Quality Brand Reflected in Facility Management |

Partnership

With McNeese University

Includes A Branded

Branch and

Significant Signage

On Campus

Cameron State Bank

Cameron State Bank

Creative Marketing Program

Creative Marketing Program |

Cameron State Bank

Cameron State Bank

Creative Marketing Program

Creative Marketing Program |

CraneWorks

Birmingham, Alabama

Other

Other

Highlights in

Highlights in

2010

2010 |

Other Highlights

in 2010 Other Highlights in 2010

Excellent Organic Growth

Excellent Organic Growth

Taking Market Share From Competitors

Balance Sheet Expansion In 2010

•

Loans: $339 Million Growth

•

Deposits: $359 Million Growth

Mortgage Origination Business

•

$1.8

Billion

In

Production

(Up

12%)

And

Loan

Sales

(Up

11%)

•

$48 Million In Loan Sale Gains (Up 36%) Brokerage

Business •

$8 Million In Revenue (Up 64%)

Opportunities In Many Markets (New Orleans, Houston, etc.) |

Other Highlights

in 2010 Other Highlights in 2010

Distribution Improvements

Distribution Improvements

Acquired 6 Bank Offices From Sterling Bank

Opened 7 Bank Offices In 2010

•

Houston –

3 Offices

•

Mobile –

2 Offices

•

New Orleans

•

Sarasota

Opened 2 Mortgage Locations In 2010

Plan To Open 8 New Bank Offices In 2011

•

Birmingham –

4 Offices

•

Houston

•

Memphis

•

New Orleans

Plan To Relocate 7 Bank Offices In 2011 |

Other Highlights

in 2010 Other Highlights in 2010

Other Developments

Other Developments

Made Significant People Investments Over The Past 2

Years:

•

Added 432 Front-Office People

•

Added 314 Support People

Which Included…..

•

Sarasota/Bradenton

101

•

Naples

87

•

Birmingham

82

•

New Orleans

62

•

Lafayette

44

Maintained A Balanced Interest Risk Position

Deepwater Horizon Event In The Gulf Of Mexico

•

One Of The First Financial Institutions To Provide Guidance

•

No Material Impact On Our Company |

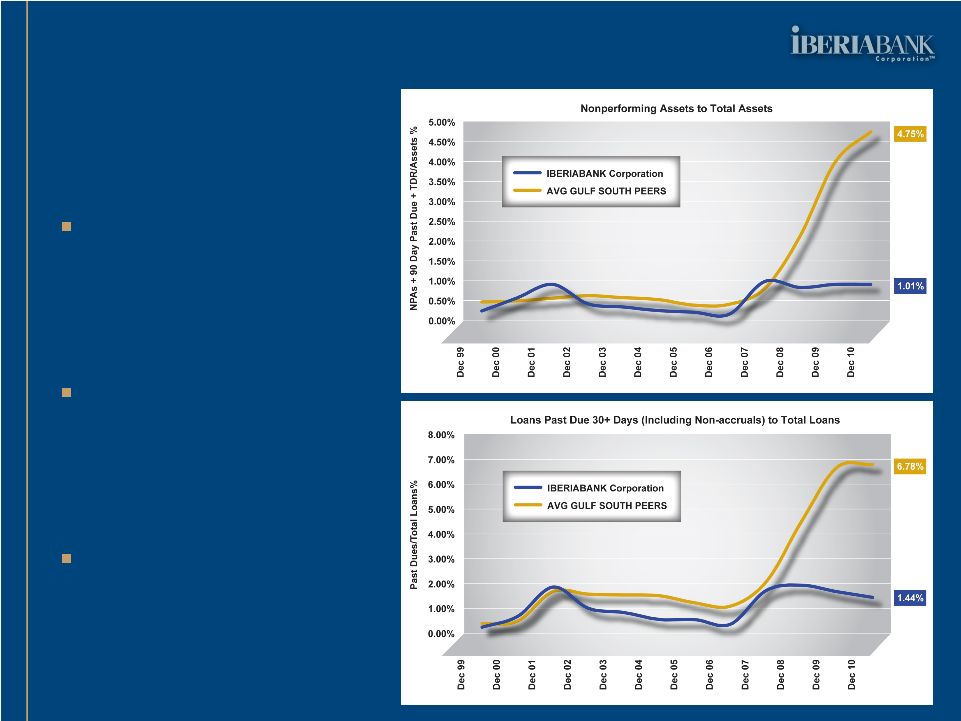

Other Highlights

in 2010 Other Highlights in 2010

Favorable Asset Quality

Favorable Asset Quality

Low and Stable Level

of Nonperforming

Assets

Low and Declining

Level of Loans Past

Due

Very Favorable

Compared to Peers |

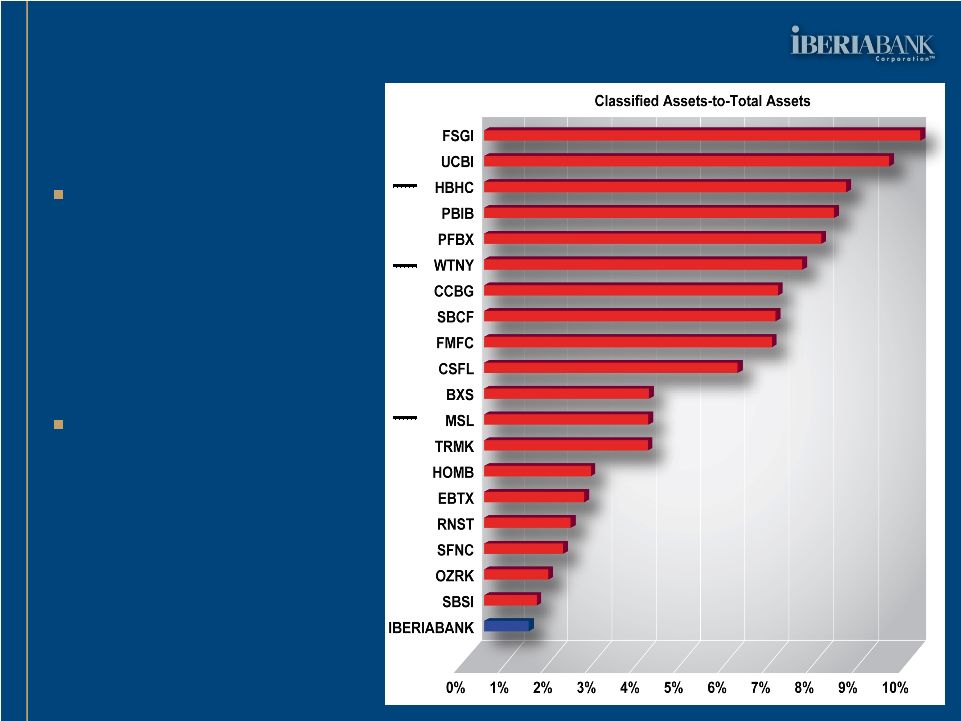

Other Highlights

in 2010 Other Highlights in 2010

Classified Assets

Classified Assets

“Classified Assets”

Are Loans That

Exhibit Stress And

Warrant Close

Watching

Our Classified Assets

As A Percentage Of

Total Assets Are Very

Low, Particularly

Compared To Our

Local Peers |

Other Highlights

in 2010 Other Highlights in 2010

Low Risk Balance Sheet

Low Risk Balance Sheet

Almost Half Of

Our Asset Base

Is Very Low

Risk:

•

Excess Cash

($800 Million)

•

Bond Portfolio

($1.8 Billion)

•

FDIC Receivable

($928 Million)

•

Loans Covered

Under FDIC Loss

Share ($1.5

Billion)

Excess

Cash, 8%

Bond

Portfolio,

18%

FDIC

Receivable,

9%

Loans -

FDIC

Covered,

15%

Loans -

Noncovered,

41%

Other Assets,

10%

Percent of Average Assets in 2010

Very Low Risk Components |

Other Highlights

in 2010 Other Highlights in 2010

Profitability And Capital Strength

Profitability And Capital Strength

In 2010, We Earned $48 Million In Net Income

Fully-Diluted Earnings Per Share Of $1.88

Highly Successful Common Stock Offering –

March 8, 2010

•

$329 Million In Net Proceeds

•

We Have Been Patient To Deploy This Capital

Capital Generation For Shareholders In 2010

•

Book Value Per Share Up $2.12, Or 5%, To $48.50

•

Tangible Book Value Per Share Up $2.80, Or 14%, To $36.68

We Are Well Positioned For Future Growth Opportunities |

Other Highlights

in 2010 Other Highlights in 2010

Over The Past Three Years….

Over The Past Three Years….

Total Revenues Of $1.2 Billion

Earned $243 Million; $13.26 EPS

Paid $76 Million In Dividends, Or

$4.08 Per Share (31% Payout)

Improved Asset Quality And

Capital Strength

Added:

•

+$5 Billion Assets (Doubled)

•

+76 New Locations

•

+803 Associates

•

+$19.62 In Tangible BVS

•

+$1 Billion Market Cap.

At The End Of 2010:

•

Total Assets Of $10 Billion

•

2,097 Associates

•

Operations In 12 States |

Our

Opportunities Our Opportunities

Successfully Integrate And Assimilate Our Pending

Acquisitions And Achieve Synergistic Benefits

Capitalize On Market Turmoil Opportunities

Deploy Our Equity Capital In An Effective Manner

Continue To Develop IBERIA Capital Partners, IBERIA

Wealth Advisors, And IBERIA Financial Services

Expand Small Business And Retail

Improve Earnings Through Revenue Growth And Expense

Management

Further Develop Florida Franchise |

Gulf Coast Asphalt Co.

Houston, Texas |