Attached files

| file | filename |

|---|---|

| 8-K - SUNOCO INC--FORM 8-K - SUNOCO INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - SUNOCO INC | dex991.htm |

1

1Q11 Earnings Conference Call

May 5, 2011

Exhibit 99.2 |

2

This slide presentation should be reviewed in conjunction with Sunoco’s First

Quarter 2011 earnings conference call held on May

5,

2011

at

5:30

p.m.

ET.

You

may

listen

to

the

audio

portion

of

the

conference

call

on

the

website

or

an

audio

recording

will be

available

after

the

call’s

completion

by

calling

1-888-566-0627

and

entering

conference

ID

#6570590.

Statements in this presentation that are not historical facts are

forward-looking statements intended to be covered by the safe

harbor

provisions

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

These

forward-looking statements are based upon assumptions by Sunoco concerning

future conditions, any or all of which ultimately may prove to be

inaccurate, and upon the current knowledge, beliefs and expectations of Sunoco management. These

forward-looking statements are not guarantees of future performance.

Forward-looking statements are inherently uncertain and involve significant

risks and uncertainties that could cause actual results

to

differ

materially

from

those

described

during

this

presentation.

Such

risks

and

uncertainties

include

economic,

business, competitive and/or regulatory factors affecting Sunoco's business, as

well as uncertainties related to the outcomes of pending

or

future

litigation.

In

accordance

with

the

safe

harbor

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995, Sunoco has included in its Annual Report on Form 10-K for the year ended

December 31, 2010, and in its subsequent Form 10-Q and Form 8-K

filings, cautionary language identifying important factors (though not necessarily all such factors) that

could

cause

future

outcomes

to

differ

materially

from

those

set

forth

in

the

forward-looking

statements.

For

more

information

concerning these factors, see Sunoco's Securities and Exchange Commission filings,

available on Sunoco's website at www.SunocoInc.com.

Sunoco

expressly

disclaims

any

obligation

to

update

or

alter

its

forward-looking

statements,

whether

as

a result of new information, future events or otherwise.

This presentation includes certain non-GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures. Reconciliations of

non-GAAP financial measures to GAAP financial measures are provided in the Appendix at the

end

of

the

presentation.

Investors

are

urged

to

consider

carefully

the

comparable

GAAP

measures

and

the

reconciliations

to

those measures provided in the Appendix, or on our website at

www.SunocoInc.com. Safe Harbor Statement |

3

1Q11 Results

After-tax loss before special items of $122MM* ($1.01/share diluted), pretax

loss of $141MM*

Retail contributed $12MM pretax in a period of rising crude prices

Logistics delivered strong results with pretax income of $31MM

SunCoke earned $9MM pretax

Refining & Supply (R&S) reported a pretax loss of $138MM as operational

issues hindered performance

* For reconciliation to Net Income (Loss), see Slide 13. Special Items in

1Q11 include a net gain of $21MM after-tax.

Summary |

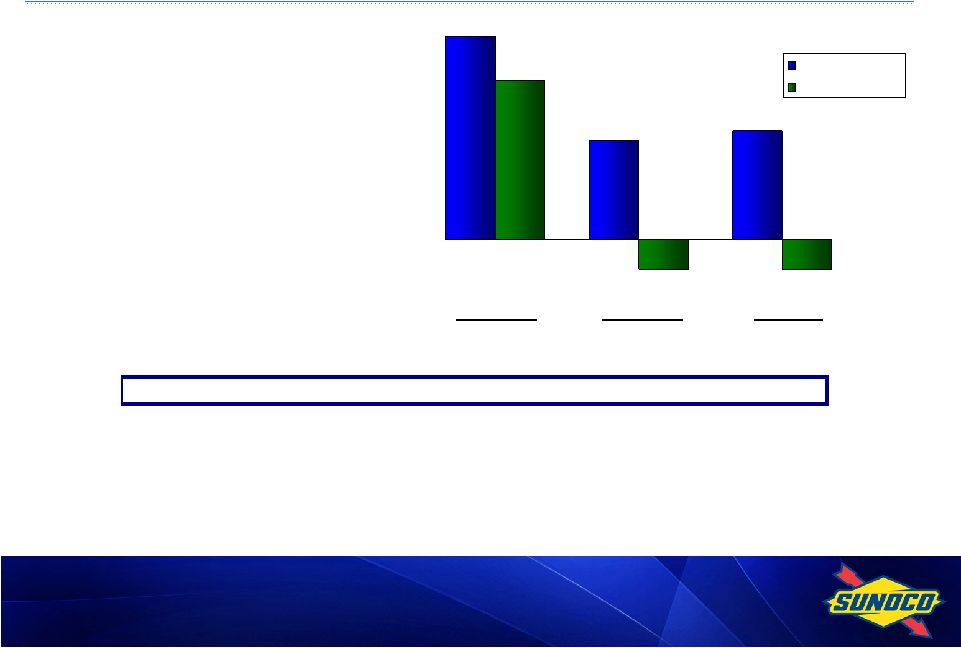

4

Retail Marketing –

Pretax Earnings of $12MM

Achieved 6.9 cpg average gasoline margins in face of sharply rising

wholesale prices throughout the quarter

Logistics –

Pretax Earnings of $31MM

Earnings helped by 2010 acquisitions (Texon butane blending acquisition

& additional equity interests in West Texas Gulf and Mid-Valley pipelines)

as well as crude lease acquisition results

Coke –

Pretax Earnings of $9MM

Impacted by costs of ~$25 million at Indiana Harbor vs. 1Q10, including

costs to cover projected 2011 coke production shortfall

R&S –

Pretax Loss of $138MM

Operational issues hindered performance –

74% utilization

Rising crude prices also impacted results by ~$40MM

* Pretax Business Unit Income Before Special Items, excluding income attributable

to noncontrolling interests. For reconciliation to Net Income (Loss), see

Slide 13. Segment Pretax Results* -

1Q11 |

5

1Q10

2Q10

3Q10

4Q10

1Q11

Refining & Supply

(70)

138

(70)

(17)

(138)

Retail Marketing

34

73

68

1

12

Logistics

27

30

40

35

31

Coke

51

56

44

25

9

Chemicals

Continuing Operations

5

7

5

6

(9)

Discontinued Polypropylene Operations

33

-

-

-

-

Corporate Expenses

(23)

(30)

(28)

(27)

(22)

Net Financing Expenses & Other

(28)

(27)

(28)

(27)

(24)

Pretax Income (Loss) Before Special Items

29

247

31

(4)

(141)

Pretax Income (Loss) Before Special Items*, MM$

(141)

(4)

31

247

29

($200)

($100)

$0

$100

$200

$300

* Pretax Income (Loss) Before Special Items. For reconciliation to Net Income

(Loss), see Slide 13. |

6

* R&S Weighted

Benchmark. For calculation, see Slide 22.

Realized R&S Margin vs. Benchmark, $/B |

7

0.65

1.52

0.92

(0.33)

0.92

-3.00

-1.00

1.00

3.00

1Q10

2Q10

3Q10

4Q10

1Q11

Crude Cost vs. Weighted Benchmark

(2.05)

(0.69)

(0.07)

0.50

(0.67)

-4.00

-2.00

0.00

2.00

1Q10

2Q10

3Q10

4Q10

1Q11

Products vs. Weighted Benchmark

Total Refining & Supply

* R&S Weighted

Benchmark. For calculation, see Slide 22.

1Q11 Comments:

Timing hit of ~$1.00/B due to rising crude

prices for third consecutive quarter

Transportation costs and quality differentials

also higher than benchmark

1Q11 Comments:

Realizations impacted by reliability issues-

because of lack of ratability, significant

purchases required, lower yield gains and

sub-optimal product slate

Non-crack product margins squeezed by

rising crude prices

Realized R&S Margin vs. Benchmark*, $/B |

8

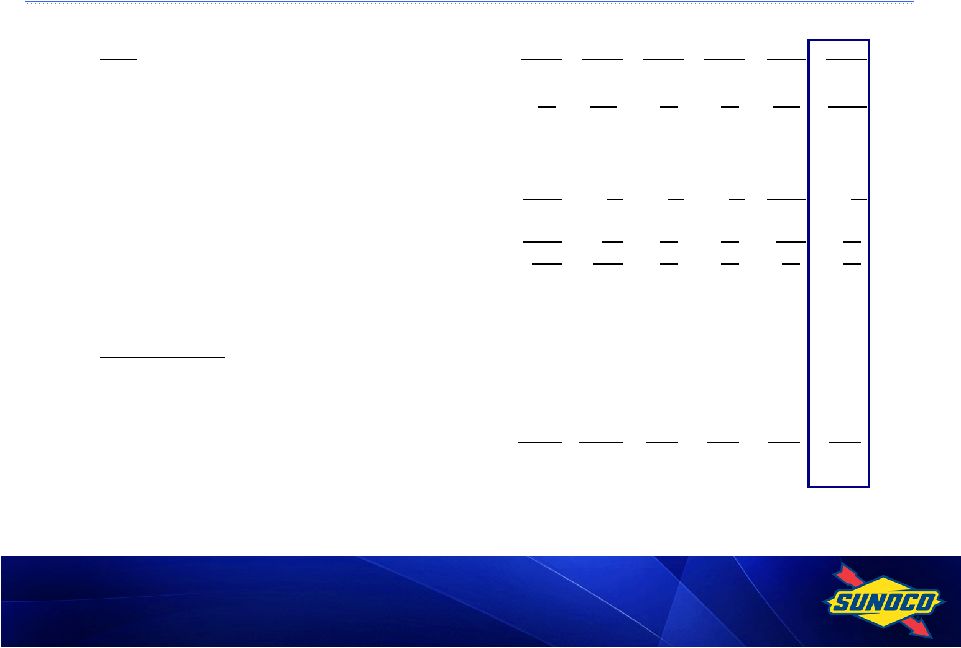

SUN

SXL

(ex SXL)

Sunoco

Cash from ops ex working capital

70

(203)

(133)

Working capital

(40)

(195)

(235)

Cash flow from operations

30

(398)

(368)

Capital expenditures

(28)

(158)

(186)

Cash flow from ops less capex

2

(556)

(554)

Divestments and other investing activities

-

546

546

Dividends to Sunoco shareholders

-

(18)

(18)

Distributions and other financing activities

(29)

3

(26)

SXL dividends to Sunoco

(24)

24

-

Net cash flow before net debt activity

(51)

(1)

(52)

Net debt activity

51

(4)

47

Net decrease in cash & cash equivalents

-

(5)

(5)

1Q11

Sunoco and SXL Cash Flow, MM$ |

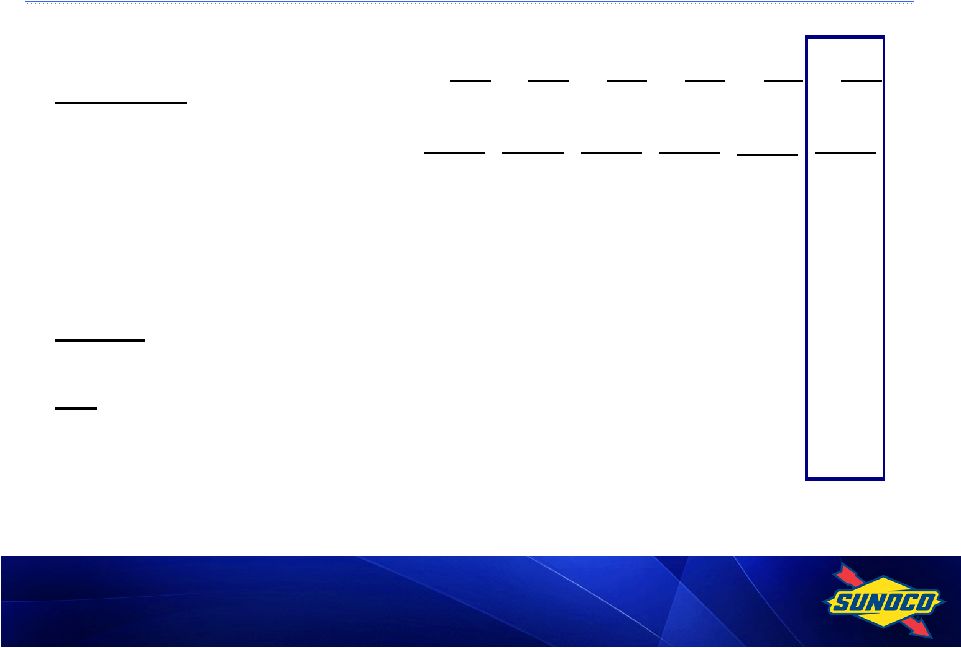

9

12/31/09

12/31/10

3/31/11

Sunoco (ex-SXL)*

32%

-6%

-6%

SXL

50%

54%

55%

Consolidated**

41%

20%

22%

Sunoco Net Debt/(Cash)

1,223

(182)

(165)

SXL Net Debt***

866

1,227

1,278

Consolidated Net Debt, MM$

2,089

945

1,013

Total Cash, MM$

377

1,485

1,480

20%

22%

41%

-6%

-6%

32%

Consolidated

Sunoco (ex-SXL)

* Proforma.

** Sunoco Revolver Covenant basis. For calculation, see Slide 18.

*** Includes intercompany loan due to Sunoco from SXL at 12/31/2010 and 3/31/2011

which is eliminated in consolidation.

Net Debt-to-Capital Ratio, % |

10

Refining

& Supply

1,100

Chemicals

690

Logistics

1,070

Will create two well-positioned businesses:

Leading high-quality metallurgical coke manufacturer with operations in the

U.S. and abroad

Streamlined fuels business that is better positioned to become the premier

provider of transportation fuels in its markets

Enhances both businesses and allows each to pursue more

focused strategic plan

Fritz Henderson hired to lead SunCoke; will be CEO after

separation

Relocation of corporate headquarters to Chicago area in mid-May

Filed registration statement with SEC in March for proposed IPO

of stock in SunCoke => 2 step separation planned

Unlocking Shareholder Value via SunCoke Separation |

11

Market remains challenging, but we continue to execute our strategy

Strong

results

in

logistics

and

good

execution

in

retail

in

face

of

challenging

market

Strong balance sheet provides flexibility

~$1.5 B cash at 3/31/11

Refining

remains

focused

on

improving

reliability/utilization,

margin

capture

and

cost

structure

Focused on fundamentals

Run safely and reliably at optimal capacity utilization; match product yield to

demand Improve margin capture

Lower our break-even cost per barrel

Balance sheet: High cash balance provides strategic flexibility

Positioning for future success

Become premier provider of transportation fuels in our markets

Grow through Retail and SXL

Achieve sustainably lower cost structure

Separation of SunCoke Energy on track

Key Takeaways |

12

Appendix |

13

Earnings Profile, MM$

*

Represents

a

loss

recognized

in

connection

with

the

divestment

of

the

polypropylene

chemicals

business.

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Refining & Supply

(70)

138

(70)

(17)

(19)

(138)

Retail Marketing

34

73

68

1

176

12

Logistics

27

30

40

35

132

31

Chemicals:

Continuing Operations

5

7

5

6

23

(9)

Discontinued Operations

33

-

-

-

33

-

Coke

51

56

44

25

176

9

Corporate and Other:

Corporate Expenses

(23)

(30)

(28)

(27)

(108)

(22)

Net Financing Expenses & Other

(28)

(27)

(28)

(27)

(110)

(24)

Pretax Income (Loss) attributable to Sunoco, Inc.

shareholders before special items

29

247

31

(4)

303

(141)

Income Tax Expense (Benefit) attributable to

Sunoco, Inc. shareholders

12

89

4

(17)

88

(19)

Income (Loss) attributable to Sunoco, Inc.

shareholders before special items

17

158

27

13

215

(122)

Special Items:

Continuing Operations

(45)

(22)

62

123

118

51

Discontinued Operations*

(169)

-

-

-

(169)

-

Pretax Income (Loss) from special items

(214)

(22)

62

123

(51)

51

Income Tax Expense (Benefit)

(134)

(9)

24

49

(70)

30

Income (Loss) from special items

(80)

(13)

38

74

19

21

Net Income (Loss) attributable to

Sunoco, Inc. shareholders

(63)

145

65

87

234

(101) |

14

Earnings Summary and EPS

MM$

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Income (Loss) attributable to Sunoco, Inc.

shareholders before special items

17

158

27

13

215

(122)

Special Items:

Continuing Operations

(45)

(22)

62

123

118

51

Discontinued Operations*

(169)

-

-

-

(169)

-

Pretax Income (Loss) from special items

(214)

(22)

62

123

(51)

51

Income Tax Expense (Benefit)

(134)

(9)

24

49

(70)

30

Income (Loss) from special items

(80)

(13)

38

74

19

21

Net Income (Loss) attributable to

Sunoco, Inc. shareholders

(63)

145

65

87

234

(101)

$/Share (diluted)

Earnings (Loss) per share of common stock (diluted):

Income (Loss) attributable to Sunoco, Inc.

shareholders before special items

0.14

1.31

0.22

0.11

1.79

(1.01)

Income (Loss) from special items

(0.67)

(0.11)

0.32

0.61

0.16

0.17

Net Income (Loss) attributable to

Sunoco, Inc. shareholders

(0.53)

1.20

0.54

0.72

1.95

(0.84)

* Represents a loss recognized in connection with the divestment

of the polypropylene chemicals business. |

15

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Total Refining & Supply

Crude Throughputs, MB/D

533

618

632

572

589

460

% Capacity

79

92

94

85

87

74

Net Prod. Available for Sale, MB/D

591

664

682

634

643

512

Net Prod. Available for Sale, MMB

53

61

62

58

234

46

Key Volume Indicators –

Refining & Supply |

16

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Realized Margin Indicators

Refining & Supply, $/B

4.08

7.34

3.88

4.77

5.04

3.14

Retail Marketing, cpg

Gasoline

8.9

11.5

10.5

6.6

9.4

6.9

Distillate

8.0

9.0

7.8

5.6

7.6

7.1

Chemicals, cpp*

9.9

8.9

7.6

9.1

8.8

7.4

Market Indicators

Dated Brent Crude Oil, $/B

76.24

78.30

76.86

86.53

79.48

104.90

Natural Gas, $/DT

5.04

4.34

4.23

3.97

4.40

4.20

* Excludes discontinued polypropylene operations.

Key Indicators |

17

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Retail Marketing

Gasoline Sales, MM Gal

1,026

1,130

1,171

1,171

4,498

1,086

Middle Distillate Sales, MM Gal

91

114

117

110

432

97

Total Sales, MM Gal

1,117

1,244

1,288

1,281

4,930

1,183

Gasoline and Diesel Throughput

147

159

148

161

156

150

(Company-Owned or Leased Outlets)

(M Gal/Site/Month)

Merchandise Sales (M$/Store/Month)

87

101

103

92

96

85

Chemicals*

Phenol and Related Sales, MM#

449

554

567

582

2,152

470

Coke

Production, M Tons:

United States

841

883

953

916

3,593

861

Brazil

413

422

431

370

1,636

331

* Excludes discontinued polypropylene operations.

Key Volume Indicators –

Retail, Chemicals, Coke |

18

* Represents intercompany loan due to Sunoco from SXL which is eliminated in

consolidation. ** Represents Partners’

Capital for SXL and Shareholders’

Equity for Sunoco.

*** The Net Debt / Capital ratio is used by Sunoco management in its internal

financial analysis and by investors and creditors

in

the

assessment

of

Sunoco’s

financial

position;

calculation

excludes

noncontrolling

interests

except

for

SXL

as prescribed by the revolver covenant.

Financial Ratios, MM$ except ratios

Proforma

Proforma

Proforma

SUN

SUN

SUN

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

SXL

(ex SXL)

Sunoco

Debt

868

1,596

2,464

1,129

1,300

2,429

1,180

1,292

2,472

Intercompany Debt*

-

-

-

100

-

-

100

-

Plus: Debt Guarantees

-

2

2

-

1

1

-

21

21

Less: Cash

(2)

(375)

(377)

(2)

(1,483)

(1,485)

(2)

(1,478)

(1,480)

Net Debt

866

1,223

2,089

1,227

(182)

945

1,278

(165)

1,013

Equity**

862

2,557

2,557

965

3,046

3,046

963

2,950

2,950

SXL Noncontrolling Interest

-

-

488

77

-

692

78

-

692

Other Noncontrolling Interest

-

74

74

-

61

61

-

52

52

Capital

1,728

3,854

5,208

2,269

2,925

4,744

2,319

2,837

4,707

Net Debt / Capital (Sunoco

Revolver Covenant

N/A

32%

41%

N/A

-6%

20%

N/A

-6%

22%

Basis)***

Debt / Capital

50%

38%

44%

54%

29%

39%

55%

30%

40%

(GAAP Basis)

12/31/2009

12/31/2010

3/31/2011 |

19

Liquidity*, B$

* Includes cash and cash equivalents of $0.4B, $1.5B and $1.5B at 12/31/09,

12/31/10, and 3/31/11 respectively.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

12/31/2009

12/31/2010

3/31/2011

SXL

Sunoco

1.7

3.4

3.4 |

20

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Total Refining & Supply

Net Production, MB/D

590.5

664.2

681.5

633.9

642.8

512.4

Gasoline

52%

52%

52%

54%

52%

52%

Middle Distillates

34%

37%

37%

35%

36%

36%

Residual Fuel

6%

6%

5%

4%

5%

5%

Petrochemicals

4%

3%

4%

4%

4%

3%

Other

9%

7%

7%

8%

8%

9%

Less Refinery Fuel

-5%

-5%

-5%

-5%

-5%

-5%

Refining & Supply –

Products Manufactured |

21

1Q10

2Q10

3Q10

4Q10

FY10

1Q11

Total Refining & Supply

Gasoline Production, MB/D

306.3

343.1

357.9

339.9

337.0

265.4

RFG

47%

48%

43%

45%

46%

49%

Conventional

53%

52%

57%

55%

54%

51%

Distillate Production, MB/D

202.4

244.5

250.1

225.1

230.6

183.6

On-Road Diesel Fuel

53%

66%

62%

52%

59%

52%

Heating Oil / Off-Road Diesel

28%

15%

18%

25%

21%

26%

Jet Fuel

17%

19%

19%

21%

19%

20%

Kerosene/Other

2%

0%

1%

2%

1%

2%

Refining & Supply –

Gasoline and Distillate Production |

22

Toledo 4-3-1 Benchmark

4 WTI Crude: NYMEX Futures Close + $2.00 for transportation

3 Unleaded Gasoline: Chicago Pipeline Platt’s Low

1 Distillate: 50% ULSD Chicago Pipeline Platt’s Low

50% Jet Gulf Coast Pipe Platt’s Low

Northeast 6-3-2-1 Value-Added Benchmark

6 Dated Brent Crude: Platt’s Mid + $2.25 for transportation

3 Gasoline: 50% Unleaded RBOB NY Harbor Barge Platt's Low

50% Unleaded Regular Gasoline NY Harbor Barge Platt's Low

2 Distillate: 55% ULSD NY Harbor Barge Platt's Low

20% Jet/Kero NY Harbor Barge Platt's Low

25% No.2 Fuel Oil NY Harbor Barge Platt's Low

1 No. 6 0.3% Sulfur High Pour Resid: NY Harbor Barge Platt’s Low

1Q10

2Q10

3Q10

4Q10

FY10

Jan 11

Feb 11

Mar 11

1Q11

Northeast 6-3-2-1

Value-Added Benchmark

6.09

5.91

4.22

6.05

5.57

5.86

4.70

6.60

5.72

Toledo 4-3-1

Benchmark

3.99

8.89

7.50

6.33

6.68

9.89

15.52

n/a

12.70

1Q10

2Q10

3Q10

4Q10

FY10

Jan 11

Feb 11

Mar 11

1Q11

Northeast 6-3-2-1

at 80% weight*

4.87

4.73

3.37

4.84

4.46

4.69

3.76

6.60

5.02

Toledo 4-3-1

at 20% weight*

0.80

1.78

1.50

1.27

1.33

1.98

3.10

n/a

1.69

R&S Weighted Benchmark*

5.67

6.51

4.87

6.11

5.79

6.67

6.86

6.60

6.71

Sunoco R&S Weighted Benchmark Margin, $/B

* Exception to weighted calculation for March 2011 due to the sale of Toledo

refinery on 3/1/11. -

Prior to Toledo sale on 3/1/11:

80% of NE 6-3-2-1 Value Added Margin and 20% of Toledo

4-3-1 Margin.

-

Post Toledo sale on 3/1/11:

100% of NE 6-3-2-1 Value Added Margin. |

23

Media releases and SEC filings are available

on our website at www.SunocoInc.com

Contact for more information:

Clare McGrory

(215) 977-6764

For More Information |