Attached files

Table of Contents

As filed with the United States Securities and Exchange Commission on May 5, 2011

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SINOCOM PHARMACEUTICAL, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 5122 | 26-1188540 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Room 3, 21/F, Far East Consortium Building

121 Des Voeux Road

Central, Hong Kong

Telephone: +852 2191-3863

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Gary Joiner, Esq.

4750 Table Mesa Drive

Boulder, Colorado 80305-5575

United States of America

Telephone: (303) 494-3000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With Copies to:

| Calvin C. Lai, Esq. Freshfields Bruckhaus Deringer 11th Floor, Two Exchange Square Hong Kong Tel: (852) 2846 3400 | ||

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, or the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Proposed Maximum Offering |

Amount of Fee | ||

| Common stock, par value $0.001 per share(1) |

$15,000,000(2) | $1,741.50 | ||

| (1) | Represents the Registrant’s shares of common stock being registered for resale that have been issued to the selling stockholders named in this registration statement. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2011

Preliminary Prospectus

15,847,099 Shares

SINOCOM PHARMACEUTICAL, INC.

Common Stock

This prospectus relates to 15,847,099 shares of common stock that may be sold from time to time by the selling stockholders named in this prospectus.

The selling stockholders may sell shares of common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions. We will not receive any proceeds from the sales of outstanding shares of common stock by the selling stockholders.

We intend to apply to list our common stock on The NASDAQ Global Market under the symbol “ ”.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2011

Table of Contents

| Page | ||||

| 1 | ||||

| 9 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | |||

| 58 | ||||

| 66 | ||||

| 83 | ||||

| 90 | ||||

| 93 | ||||

| 96 | ||||

| 98 | ||||

| 102 | ||||

| 103 | ||||

| 105 | ||||

| 107 | ||||

| 110 | ||||

| 111 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| 113 | ||||

| F-1 | ||||

We have not authorized anyone to give any information or to make any representations other than those contained in this prospectus. Do not rely upon any information or representations made outside of this prospectus. This prospectus is not an offer to sell, and it is not soliciting an offer to buy securities in any circumstances in which our offer or solicitation is unlawful. The information contained in this prospectus may change after the date of this prospectus. Do not assume after the date of this prospectus that the information contained in this prospectus is still correct.

i

Table of Contents

Conventions Used in this Prospectus

Unless otherwise indicated, references in this prospectus to:

| • | “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| • | “China” and the “PRC” are to the People’s Republic of China, excluding, for the purpose of this prospectus only, Hong Kong, Macau and Taiwan; and |

| • | “RMB” and “Renminbi” are to the legal currency of the People’s Republic of China. |

Unless the context indicates otherwise, “we,” “us,” “our,” “our company,” and “Sinocom” refer to Sinocom Pharmaceutical, Inc and its subsidiaries.

Our business is conducted in China, and the financial records of our PRC subsidiaries are maintained in RMB, their functional currency. However, we use the U.S. dollar as our reporting currency. The assets and liabilities of our PRC subsidiaries are translated from RMB into U.S. dollars at the exchange rates on the balance sheet date, shareholders’ equity is translated at the historical rates and the revenues and expenses are translated at the weighted average exchange rate for the period. This prospectus contains translations of certain other RMB amounts into U.S. dollar amounts at the exchange rate certified for customs purposes by the Federal Reserve Bank of New York as set forth on December 30, 2010, the last business day of 2010, which was RMB6.6000 to $1.00. We make no representation that the RMB or U.S. dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. See “Risk Factors—Risks Related to Doing Business in the PRC—The fluctuation of the Renminbi may materially and adversely affect our cash flows, revenues and financial condition” for discussions of the effects of fluctuating exchange rates and currency control on the value of our common stock. On April 29, 2011, the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board was RMB6.4900 to $1.00.

Some numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that preceded them.

Market and Industry Data

This prospectus contains market data and industry forecasts that were obtained from industry publications, third-party market research and publicly available information. These publications generally state that the information contained therein has been obtained from sources believed to be reliable, but we have not independently verified the accuracy and completeness of such information. We have also paid for market research information provided by Frost & Sullivan which appears in this prospectus.

ii

Table of Contents

The items in the following summary are described in more detailed later in this prospectus. This summary provides an overview of selected information and does not contain all the information you should consider. Therefore, you should also read more detailed information set out in this prospectus and the financial statements included elsewhere in this prospectus.

OUR BUSINESS

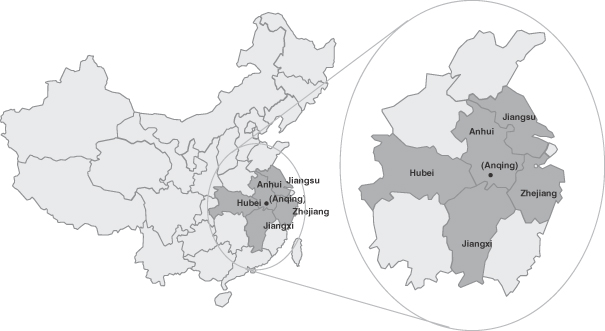

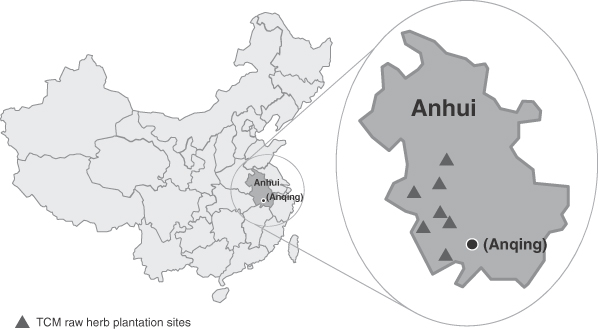

We are an established pharmaceutical wholesaler and distributor in Central-Eastern China. According to a report that we commissioned from Frost & Sullivan, we were the fourth largest wholesale pharmaceutical distribution company headquartered in Anhui province in 2009 in terms of revenue. Our core businesses are (i) selling and distributing traditional Chinese medicines, or TCM, and Western pharmaceuticals and medical supplies to third and fourth tier cities in Central-Eastern China and (ii) managing TCM raw herb plantations.

We sell and distribute approximately 6,800 products, including both TCM and Western pharmaceuticals and medical supplies, to more than 4,800 customers located in the provinces of Anhui, Jiangxi, Hubei, Zhejiang and Jiangsu. The wholesale pharmaceutical distribution market in these provinces was approximately RMB147 billion (US$22.3 billion) in 2009 and is expected to grow to RMB328 billion (US$49.7 billion) by 2014, representing a CAGR of 17.4%, according to Frost & Sullivan. These provinces are also expected to benefit from China’s RMB850 billion (US$128.8 billion) healthcare reform plan announced in March 2009, which seeks to, among others, extend insurance coverage, increase drug reimbursement, expand China’s medical infrastructure and promote the pharmaceutical industry.

Our pharmaceutical sales and distribution network covers the “last mile” of the pharmaceutical industry value chain to third and fourth tier cities in Central-Eastern China. Selling and distributing pharmaceuticals directly to the hospitals, pharmacies and medical clinics in the third and fourth tier cities that we primarily serve in a cost-effective manner is challenging, largely because the transportation infrastructure in these markets is less developed and the customer base is highly fragmented and often requires the delivery of small quantities of different products once every two to three days. Due to these logistical challenges, large wholesalers, distributors and manufacturers frequently rely on last mile wholesalers and distributors such as ourselves who possess the regional coverage and expertise, to sell and deliver their pharmaceutical products to customers located in these markets.

Over more than 20 years, we have developed a pharmaceutical sales and distribution model tailored to third and fourth tier cities in Central-Eastern China. In particular, our inventory management software system and our warehouse management processes enable small orders to be fulfilled efficiently while minimizing excess inventory. Our fleet of smaller trucks are able to better navigate the road conditions in the markets we serve and our local knowledge allows us to design optimized delivery routes that deliver our products to customers within 24 hours of receiving an order.

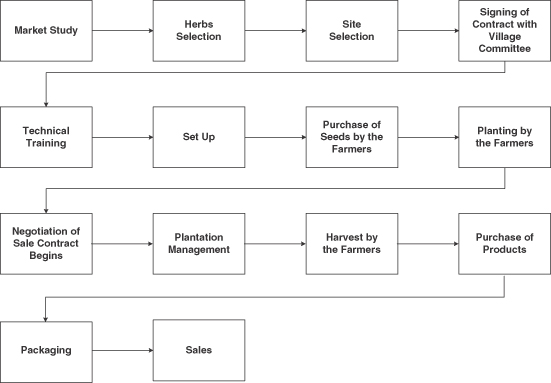

We are also engaged in managing TCM raw herb plantations, whereby we enter into exclusive long-term contractual arrangements with local villagers’ committees to purchase TCM raw herbs from local farmers. We have the rights to control the species of TCM raw herbs to be cultivated and the cultivation methodology to be used. We also provide on-site support by stationing one or two technical personnel at each plantation to provide technical assistance and training to the local farmers and closely supervise the cultivation process to ensure herb quality. The plantation sites encompass approximately 18.5 million square meters (4,500 acres) in Anhui province, a region widely recognized for its favorable herb growing climatic and soil conditions and its significant TCM trade including the Bozhou market, which accounts for more than 60% of China’s total herb trading volume.

1

Table of Contents

There are currently 12 different species of herbs grown at the seven contracted plantation sites. We select raw herbs that, according to the market intelligence we gain through our sales and distribution business, are in high demand and low supply. For each herb we consider factors such as the length of cultivation period, the suitability of growing the herb in Anhui and the technical skills required for cultivation. Furthermore, we have developed a crop rotation system that minimizes fallow periods and increases our revenue per square meter. The gross profit margin of our TCM raw herbs sales was 55.8% in 2010, which was the highest among all our product categories.

Our TCM raw herb plantation management business expands our TCM product portfolio to include high-margin TCM raw herbs and extend our sales and distribution base through the Bozhou market to TCM manufacturers across China. In addition, through these operations and our regular interactions with customers and suppliers we have developed a deep understanding of the TCM raw herb market. This knowledge allows us to detect changes in the supply and demand of specific TCM raw herbs and adjust our plantation plans to better serve our customers. Our ability to supply TCM raw herbs as raw materials also makes us an attractive business associate to TCM manufacturers.

We have achieved total net sales from our pharmaceutical sales and distribution and TCM raw herb plantation management business of US$64.8 million, US$86.1 million and US$108.6 million in 2008, 2009 and 2010 respectively, representing a compound annual growth rate, or CAGR, of 29.5%. During the same periods, our net income was US$12.8 million, US$16.9 million and US$22.0 million, respectively, representing a CAGR of 31.0%.

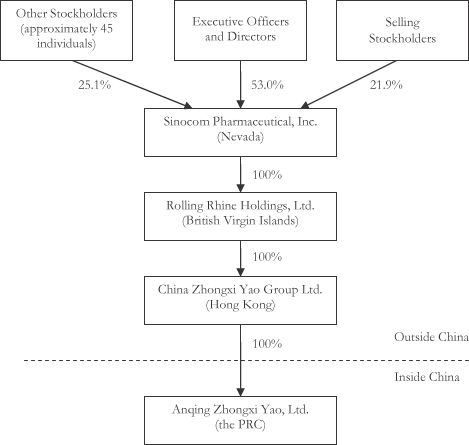

OUR INDUSTRY

China’s pharmaceutical market in terms of production revenue had grown from approximately US$18.7 billion in 2005 to approximately US$37.6 billion in 2009, representing a CAGR of 19.1%. Frost & Sullivan projects that the market will continue to grow at a similar growth rate and reach approximately US$76.5 billion by 2013. This rapid growth has been driven by rising domestic disposable income and living standards, increased awareness of and spending on healthcare products, government support for the healthcare industry including the Chinese health care reform and a growing aging population. According to the PRC National Statistics Bureau, the wholesale and retail market for western medicine, TCM and healthcare equipment grew from RMB391.2 billion (US$59.3 billion) in 2005 to RMB906.7 billion (US$137.4 billion) in 2009, representing a CAGR of 23.4%.

The size of the Chinese TCM market was RMB74.6 billion (US$11.3 billion) in 2009, representing approximately 30.0% of the overall pharmaceutical market. TCM is expected to grow rapidly over the next several years and become an increasingly important part of China’s overall pharmaceutical market, according to Frost & Sullivan. The size of the TCM market is expected to grow at a CAGR of 33.5% from 2009 to 2013 and reach RMB236.3 billion (US$35.8 billion) by 2013, representing 46.8% of the overall pharmaceutical market.

OUR COMPETITIVE STRENGTHS

We believe the following strengths differentiate us from our competitors:

| • | Leading pharmaceutical wholesaler and distributor in Anhui with an established presence in Central-Eastern China’s growing wholesale pharmaceutical distribution market |

| • | Our focus on providing access to a broad range of TCM products |

| • | Established TCM raw herb plantation management in strategic locations |

2

Table of Contents

| • | Our ability to leverage synergies from our two business lines |

| • | Sales and distribution network and expertise in serving the pharmaceutical needs of China’s third and fourth tier cities in Central-Eastern China |

| • | Experienced management team with skilled technical personnel |

OUR STRATEGY

Our goal is to become the leading pharmaceutical wholesaler and distributor to Central-Eastern China’s third and fourth tier cities and the leading TCM raw herb business plantation manager. We intend to achieve these goals through the following strategies:

| • | Expand our TCM raw herb plantation management business |

| • | Enter into the herb processing business to complement our other businesses |

| • | Expand our product portfolio and exclusive product offerings |

| • | Continue to invest in our distribution infrastructure and logistics capabilities |

| • | Further expand our sales and distribution coverage in Central-Eastern China through acquisitions |

RISKS AND UNCERTAINTIES

Our business is subject to many risks and uncertainties, including:

| • | Price control regulations potentially affecting our profitability |

| • | fragmented and competitive distribution market landscape in China |

| • | highly regulated nature of the PRC healthcare industry |

| • | Our sales concentration in Anhui province |

| • | Seasonal and climatic variations in weather conditions affecting our sourcing of raw herbs |

| • | Our ability to grow our business organically or through acquisitions |

See “Risk Factors” beginning on page 9 for a more detailed discussion of these and other risks and uncertainties that we face.

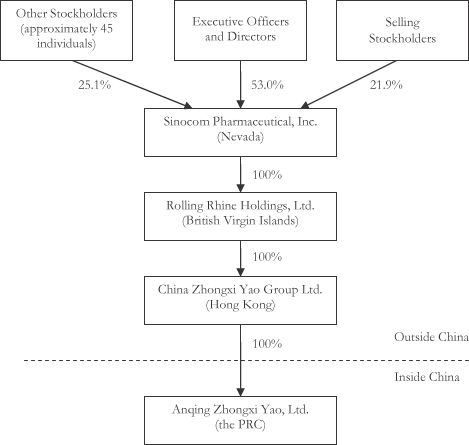

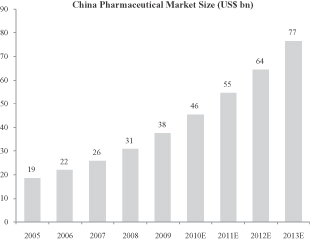

OUR HISTORY AND CORPORATE STRUCTURE

We were incorporated in the State of Nevada on September 13, 2007, under the name Tiger Acquisitions, Inc. It was organized as a vehicle to acquire a target company or business seeking the perceived advantages of being a publicly held corporation.

On February 20, 2009, we completed a share exchange transaction with Rolling Rhine Holdings, Ltd., a British Virgin Islands corporation (“Rolling Rhine”), pursuant to which the shareholders of Rolling Rhine transferred 300,000 shares of Rolling Rhine, representing all of the issued and outstanding shares of common stock in Rolling Rhine, to us in exchange for the issuance of an aggregate of 67,131,660 shares of our common stock. As a result of the share exchange transaction, Rolling Rhine, and its subsidiaries, China Zhongxi Yao Group Limited (“China Zhongxi”), and Anqing Zhongxi Yao Ltd (“Anqing Zhongxi”), became our wholly owned subsidiaries.

3

Table of Contents

Rolling Rhine was incorporated in December 2007, under the laws of the British Virgin Islands, and China Zhongxi was incorporated in July 2008, under the laws of Hong Kong. China Zhongxi was formed for the purpose of owning 100% of the capital stock of Anqing Zhongxi, and Rolling Rhine was formed as a holding company for the purposes of owning 100% of the capital stock of China Zhongxi.

Prior to the completion of the share exchange transaction with Rolling Rhine, we were a shell company with no or nominal business operations, employees, or assets. As a result of the share exchange transaction, we ceased to be a shell company and acquired the business operations of Anqing Zhongxi.

On February 26, 2009, we changed our name to Sinocom Pharmaceutical, Inc.

Anqing Zhongxi, our operating company, was incorporated in December 1997 under the laws of the PRC. It was owned by a number of individuals until December 13, 2005 when it was acquired by a company under the common control of Rolling Rhine and China Zhongxi.

The diagram below depicts our current corporate structure assuming the conversion of the Series A preferred stock into common stock.

4

Table of Contents

OUR COMPANY INFORMATION

Our principal executive offices are located at Room 3, 21/F, Far East Consortium Building, 121 Des Voeux Road Central, Hong Kong and our telephone number is (852) 2191-3863. Our website is located at www.sinocom-pharma.com. The information contained on our website is not part of this prospectus.

THE OFFERING

| Common stock offered by the selling stockholders |

15,847,099 shares | |||

| Common stock to be outstanding immediately after this offering |

87,263,759 shares | (1) |

Note:

| (1) | Excludes shares of common stock to be offered by us in a public offering contemplated under a registration statement filed concurrently herewith. |

Use of proceeds

We will not receive any proceeds from the sale of common stock by the selling stockholders.

NASDAQ Global Market listing

We intend to apply for the quotation of our common stock on the NASDAQ Global Market under the symbol “ .”

Unless otherwise indicated, all information in this prospectus gives effect to the automatic conversion of our Series A preferred stock into 15,847,099 shares of common stock upon the closing of the public offering contemplated under a registration statement filed concurrently herewith.

5

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following summary financial information should be read in conjunction with our financial statements and their related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus. Our consolidated statements of income data for each year ended December 31, 2008, 2009 and 2010 and the balance sheet data as of December 31, 2009 and 2010 are derived from the audited financial statements included in this prospectus. Our consolidated statements of income data for the year ended December 31, 2007 and the balance sheet data as of December 31, 2007 and 2008 are derived from our audited financial statements not included anywhere in this document. Our consolidated statement of income data for the year ended December 31, 2006 and the balance sheet data as of December 31, 2006 are derived from unaudited financial statements which are not included anywhere in this document. Our historical results do not necessarily indicate our future results.

On February 20, 2009, we completed a share exchange transaction with Rolling Rhine. See “Our History and Corporate Structure” for more details. This transaction was accounted for as a “reverse merger” with Rolling Rhine deemed to be the accounting acquirer and us as the legal acquirer. Consequently, the assets and liabilities and the historical operations that are reflected in the financial statements for periods prior to the share exchange are those of Rolling Rhine’s and its operating subsidiary, Anqing Zhongxi, recorded at the historical cost basis. After completion of the share exchange, our consolidated financial statements include the assets and liabilities of our company and Anqing Zhongxi, the historical operations of Anqing Zhongxi and the operations of our company and our subsidiaries from the closing date of the share exchange.

As part of the reorganization, we discontinued the distribution of certain TCM products produced by a related party, Anqing Cheng Feng Pharmaceutical Limited (“Cheng Feng”), in April 2008. These products contributed $13.4 million to our net sales in 2008, representing 20.7% of our total net sales in 2008. As a result of the discontinuation of these TCM products, our results of operations for 2008, 2009 and 2010 may not be directly comparable to each other. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting Our Comparability.”

6

Table of Contents

Consolidated Income Statement Data

| For the year ended December 31, | ||||||||||||

| 2008 | 2009 | 2010 | ||||||||||

| Sales, net |

$ | 64,772,822 | $ | 86,120,071 | $ | 108,654,024 | ||||||

| Cost of sales |

44,779,343 | 59,552,594 | 74,082,422 | |||||||||

| Gross profit |

19,993,479 | 26,567,477 | 34,571,602 | |||||||||

| Selling expenses |

1,877,771 | 2,480,854 | 3,695,936 | |||||||||

| General and administrative expenses |

1,087,852 | 1,415,014 | 1,632,781 | |||||||||

| Income from operations |

17,027,856 | 22,671,608 | 29,242,885 | |||||||||

| Total other income/ (expense) |

108,965 | 50,574 | 228,422 | |||||||||

| Income before income taxes |

17,136,821 | 22,722,182 | 29,471,307 | |||||||||

| Provisions for Income taxes |

4,327,610 | 5,809,640 | 7,478,584 | |||||||||

| Net income |

$ | 12,809,211 | $ | 16,912,542 | $ | 21,992,723 | ||||||

| Net income available to common stockholders |

$ | 12,809,211 | $ | 16,498,348 | $ | 21,185,189 | ||||||

| Net income per share of common stock |

||||||||||||

| Basic |

$ | 0.19 | $ | 0.23 | $ | 0.30 | ||||||

| Diluted |

$ | 0.19 | $ | 0.23 | $ | 0.25 | ||||||

| Weighted average shares of common stock outstanding(1) |

||||||||||||

| Basic |

67,131,660 | 70,817,934 | 71,416,660 | |||||||||

| Diluted |

67,131,660 | 70,817,934 | 87,263,759 | |||||||||

| Cash dividend per share |

$ | 0.71 | $ | — | $ | — | ||||||

Notes:

| (1) | To give effect to the automatic conversion of all of our outstanding Series A preferred stock into common stock upon completion of the public offering contemplated under a registration statement filed concurrently herewith. |

7

Table of Contents

Consolidated Balance Sheet Data:

| As of December 31, | ||||||||||||

| 2008 | 2009 | 2010 | ||||||||||

| Actual | Actual | Actual | ||||||||||

| Cash and cash equivalents |

$ | 5,302,591 | $ | 34,363,124 | $ | 24,783,238 | ||||||

| Total Assets |

20,783,951 | 61,132,961 | 84,178,841 | |||||||||

| Total Current Liabilities |

8,191,403 | 18,473,992 | 19,288,848 | |||||||||

| Stockholders’ Equity |

||||||||||||

| Common stock, par value $0.001; 150,000,000 shares authorized; 71,416,660 shares issued and outstanding |

67,132 | 71,417 | 71,417 | |||||||||

| Preferred stock, par value $0.001; 20,000,000 shares authorized; 15,847,099 issued and outstanding |

— | 15,847 | 15,847 | |||||||||

| Total Stockholders’ Equity |

$ | 12,592,548 | $ | 42,658,969 | $ | 64,889,994 | ||||||

8

Table of Contents

Our business, financial condition, operating results and prospects are subject to the risks listed below. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected and you may lose all or part of your original investment in our common stock.

Risks Relating to Our Business

Price control regulations may decrease our profitability.

The laws of the PRC provide for the government to fix and adjust prices in the pharmaceutical industry. In 2008, 2009 and 2010, approximately 21.8%, 32.7% and 36.8% of our total net sales was subject to price controls, respectively. Since May 1998, the PRC governmental authorities have ordered price reductions of thousands of pharmaceutical products at various times. The latest price reduction occurred in March 2011 and affected approximately 162 different pharmaceutical products.

The prices of some of the products that we sell and distribute, including those listed in the Chinese government’s catalog of medications that are reimbursable under the PRC’s social insurance program, or the Insurance Catalog, are subject to control by the relevant state or provincial price administration authorities. The PRC establishes price levels for products based on market conditions, average industry cost, supply and demand and keeping the price of medicine reasonable and encouraging the development of new medicine. In practice, price control with respect to these medicines sets a ceiling on their retail price. The actual price of such medicines set by manufacturers, wholesalers and retailers cannot historically exceed the price ceiling imposed by applicable government price control regulations. As a general matter, government price control regulations tend to cause drug prices to decline over time, but the impact of such regulations on any specific drug is difficult to predict.

It is possible that more of our products may be subject to price control in the future. To the extent that our products are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our sales will be limited and we may face no limitation on our costs. Further, if price controls affect both our revenue and costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

We may not be able to respond promptly and sufficiently to changes in government regulation.

The pharmaceutical industry in the PRC is subject to extensive governmental regulations and supervision, and the PRC government may change its policies and regulations governing pharmaceutical products. All of our sales are made in the PRC and we do not currently have any plans to sell our products outside of the PRC. As such, we are affected by changes in PRC governmental regulations regarding the pharmaceutical industry. In recent years, the PRC government has introduced and implemented regulatory measures and announced plans to implement additional rules and regulations with respect to the pharmaceutical industry, including:

| • | regulations governing the distribution, manufacturing and pricing of pharmaceutical products; |

| • | quality control, licensing and certification requirements; |

| • | regulations governing the pricing, procurement, prescription and dispensing of medicines by public hospitals or other healthcare institutions; and |

| • | government funding for individual healthcare and pharmaceutical services. |

These measures may lead to significant changes in the PRC pharmaceutical industry and result in increased costs and lower profit margins for pharmaceutical distributors. These measures may also lead to decreases in the

9

Table of Contents

amount of products we are able to sell to our customers or the price they are willing to pay for these products. The PRC government may not adopt policies benefiting the pharmaceutical industry, or may reduce support for healthcare services and benefits provided in the PRC, which may decrease demand for the products that we distribute. Failure to sufficiently and promptly respond to such changes may materially and adversely affect our business, financial condition and results of operations.

Our results of operations are affected by the volatility of prices for TCM raw herbs.

Our results of operations are significantly affected by prices for TCM raw herbs in Central-Eastern China. The TCM raw herbs we sell are priced with reference to market prices primarily determined by TCM pharmaceutical manufacturers and TCM herb trading companies located in Anhui’s Bozhou market, which conducts more than 60% of China’s TCM raw herbs trading. The size of the TCM distribution market in Central-Eastern China was approximately RMB20.7 billion (US$3.1 billion) in 2009 and is expected to grow at a CAGR of 35.6% from 2009 to 2014, according to Frost & Sullivan. Market prices for TCM raw herbs and products have increased significantly in recent years in response to changes in the supply of and demand for TCM raw herbs and products, market uncertainty and a variety of additional factors that are beyond our control, including changes of weather, outbreak of disease, inflation, domestic government regulation, market speculation and overall economic conditions. As a result, our revenue generated from the sales of TCM raw herbs increased significantly. However, we do not and will not have control over the factors affecting prices for TCM raw herbs in the areas in which we operate. There can be no assurance that the market price for TCM raw herbs, which historically have fluctuated widely, will continue to increase or remain stable and any future declines in prices will reduce our revenue.

Our business operations and primary markets are in Anhui province and our performance may be adversely affected by any significant slowdown in the economic development in the region.

Our operating assets and sales and distribution operations are primarily located in Anhui province, and we sell a significant amount of our TCM raw herbs in Anhui’s Bozhou market. Historically, the majority of our revenue has been generated from business operations in Anhui province, and approximately 90% of our total sales was generated in Anhui province in 2010. Economic development and growth in Anhui province may influence the demand for pharmaceutical products and TCM raw herbs. Future economic instability or disruptions to the infrastructure we will rely on to distribute pharmaceuticals and TCM raw herbs in Anhui province could materially and adversely affect our business and results of operations.

We may not be able to maintain the permits, licenses and certifications needed to carry on our business operations.

Pharmaceutical manufacturing and trading enterprises, medical device trading enterprises and health products trading enterprises are required to obtain certificates, permits and business licenses from the competent authorities to operate the relevant businesses in China. In addition, all pharmaceutical distribution companies in China are required to obtain Good Supply Practice, or GSP, certifications for wholesale and retail distribution operations. We have obtained the relevant permits, licenses and GSP certifications required for our pharmaceutical sales and distribution business. These permits, licenses and certifications are subject to periodic renewal and reassessment procedures by the relevant PRC government authorities. Standards for these renewal or reassessment procedures may change from time to time. Furthermore, if the interpretations or implementation of existing laws and regulations change or new laws and regulations come into effect, we may be required to obtain additional permits, licenses or certifications previously not required to run our existing businesses. We may not be able to obtain some of the new permits, licenses or certifications required or renew our existing ones when they expire. If we fail to meet the standards imposed by the State Food and Drug Administration or other governmental authorities during their inspections of our products and facilities, our permits, licenses and

10

Table of Contents

certifications may be suspended or revoked. Suspension, revocation or non-renewal of the permits, licenses and certifications required to operate our business will materially and adversely impact our business, financial condition and results of operations.

If the operation of our sales and distribution network is disrupted, we may be unable to meet customer demand.

We distribute most of our products through our distribution facility in Anqing, Anhui province. Our ability to meet customer demand may be significantly limited if we do not operate our distribution center and conduct our sales and distribution activities effectively, or if our distribution center is destroyed or shut down. Any disruption in the operation of our warehouse facility could result in our inability to meet our customers’ delivery requirements, higher costs or longer lead time associated with distributing our products. In addition, as it is difficult to accurately predict sales volume in our industry, we may be unable to optimize our sales and distribution activities, which may result in excess or insufficient inventory, warehousing, fulfillment of logistics or other value-added services, or distribution capacity and may have a material and adverse effect on our business, financial condition and results of operations.

We may not be able to maintain proper inventory levels for our pharmaceutical sales and distribution operations.

We consider a number of factors when we manage the inventory levels for our pharmaceutical sales and distribution operations, including inventory holding costs, our product portfolio, the preferences and purchasing trends of our customers and prompt delivery and sufficiency of our products in response to our customers’ requests. The structure of our business operations and customer demand require us to provide odd-lot deliveries. If we are unable to efficiently sell our products or fail to manage our odd-lot inventory, we may be subject to inventory write-downs, expiration of products or increase in inventory holding costs. In addition, if we underestimate consumer demand for our products or if our suppliers fail to provide products in a timely manner, we may experience inventory shortages. Such inventory shortages might result in unfilled customer orders and have a negative impact on customer relationships. We cannot assure you that we will be able to maintain proper inventory levels for our pharmaceutical sales and distribution operations and such failure may have an adverse effect on our business, financial condition and results of operations.

Unforeseen and severe weather can reduce cultivation activity and lead to a decrease in supply of our products.

The climatic and seasonal factors such as weather conditions, level of rainfall and temperature may, among other things, affect the quality, overall supply and availability of TCM raw herbs and TCM processed herbs that we source. Our operations and the supply of a number of our products, particularly the TCM raw herbs that we source from local plantations in the Da Bie Mountains in Anhui province, are affected by weather conditions in the markets where we operate. Sustained adverse weather conditions such as rain, extreme cold or snow could disrupt or curtail cultivation and harvesting activity which in turn could reduce supply, delay our procurement of products, particularly the TCM raw herbs, and negatively affect the quality of our products and have a material adverse effect on our business, financial condition and results of operations.

In addition, natural disasters such as fires, earthquakes, snowstorms, extreme climatic or weather conditions such as floods or droughts, or natural conditions such as crop disease, pests or soil erosion, may negatively impact the cultivation and harvest of the TCM raw herbs and TCM processed herbs. The occurrence of any of these may have a material adverse effect on our business, financial condition and results of operations.

Actual climate conditions may vary from historical patterns and may be affected by variations in weather patterns, including any potential impact of climate change. The effects of climate change may produce more variable or severe weather events that can adversely affect our ability to source the TCM raw herbs and TCM processed herbs that we sell. Each of these events could increase our cost of operations or affect our profitability.

11

Table of Contents

Our operating results are subject to seasonal fluctuation and other variations.

TCM raw herbs are typically harvested during the fourth quarter which results in additional revenue being generated in the fourth quarter. The TCM raw herb plantation management business is also affected by changes in weather conditions. Furthermore, the demand for certain of the products that we distribute, especially antibiotics and flu medicines, tend to be higher during the fourth quarter due to the beginning of the school year and the prevalence of coughs, colds and influenza during these months. As a result, our net sales and net income may fluctuate with net sales and net income generally being higher in the fourth quarter as compared to the other quarters. For example, our net sales in the fourth quarter of 2010 were $37.4 million, while our net sales in the first, second and third quarters of 2010 were $24.9 million, $19.4 million and $27.0 million, respectively. As a result, we expect climatic conditions and seasonality to continue to have an impact on our results of operations.

The harvest cycles of some of the TCM raw herbs that we sell and distribute may take two to four years and we are subject to risk of change in demand and price for TCM raw herbs.

We have entered into purchase and sales arrangement with the village committees to procure certain TCM raw herbs grown by local farmers. We specify the types of herbs to be grown by the farmers based on anticipated market demands. Some of the TCM raw herbs grown by the farmers cannot be harvested within one year. As it takes two to four years for some of our TCM raw herbs to sufficiently mature for harvesting, we are subject to the risk of change in demand and pricing during the time between planting and harvesting. We cannot assure you that we will be able to accurately predict the demand and pricing of TCM raw herbs in the future or we will be able to respond to a change in demand in a timely manner. Accordingly, our business, financial condition and results of operations may be materially and adversely affected.

We have short-term annual supply agreements and may not be able to maintain our supplier relationships in our pharmaceutical sales and distribution business.

We generally enter into annual supply agreements with the wholesale suppliers of the TCM pharmaceuticals, Western pharmaceuticals and medical products that we distribute. Manufacturers and other suppliers may not continue to sell products to us on commercially reasonable terms, or at all. We may not be able to establish relationships with new manufacturers and other suppliers, or extend existing relationships with suppliers when our agreements with them expire. Our annual supply agreements may be terminated from time to time due to reasons beyond our control. Moreover, the annual supply agreements for most of our products are not exclusive and our competitors may obtain the distribution rights for some of the products that we currently sell. We may not be able to extend the terms or geographical area of our existing exclusive distribution rights which are currently limited to Anhui province, or obtain distribution rights for new products that we desire on favorable terms, or at all. The occurrence of any of the above could have a material and adverse effect on our business, financial condition and results of operations.

We may not be able to adapt to changes in the PRC pharmaceutical industry.

The PRC pharmaceutical industry is characterized by rapid advances in science and technology and the emergence of new viruses or bacteria that lead pharmaceutical manufacturers to discover and develop new pharmaceuticals and other products and treatments. We must improve and diversify our product portfolio to respond to these changes and developments. We must also secure distribution agreements with pharmaceutical manufacturers or wholesalers for new and competitively priced pharmaceutical products. We may not be able to respond to these changes by improving our product portfolio or services or distributing new products in a timely fashion.

We may fail to grow our business organically or through acquisitions and any growth may expose us to significant business risks.

We plan to grow our business organically and through acquisitions. As part of our organic growth strategy, we plan to expand our distribution and warehouse facilities. We plan to construct new warehouse facilities for our

12

Table of Contents

sales and distribution business. Investment we make in our distribution and warehouse facilities may not produce anticipated results or economic benefits and the construction of these facilities may not progress smoothly or within budget. Furthermore, the integration of these new facilities into our existing operations may take more time than is anticipated or scheduled.

We also plan to construct a TCM raw herb processing plant, which will allow us to enter the TCM herb processing business to capture higher profit margins. Entering into the herb processing business involves significant investments in production facilities and related equipment. In addition, the TCM processed herbs that we will process may not meet our customers’ specifications.

When appropriate opportunities arise, we may acquire other pharmaceutical distributors. We currently do not have any specific acquisition plans or targets and we have not entered into any definitive agreements with potential targets. We may not be able to identify and secure suitable acquisition opportunities. Our ability to effectively consummate and integrate any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and our ability to obtain financing on satisfactory terms for acquisitions, if at all.

Moreover, if an acquisition target is identified, we may not be able to enter into arrangements on commercially reasonable terms with the target’s management and shareholders, if at all. Future acquisitions may also expose us to potential risks, including risks associated with:

| • | expected synergies from future acquisitions may not materialize; |

| • | the integration of new operations, services and personnel; |

| • | unforeseen or hidden liabilities such as additional indebtedness, costs, and contingent liabilities; |

| • | the diversion of financial or other resources from our existing businesses; |

| • | our inability to generate sufficient revenue to recover costs and expenses of the acquisitions; and |

| • | potential loss of, or harm to, relationships with our employees or customers. |

In addition, we intend to expand our sales and distribution network to additional third- and fourth-tier cities in China to further our geographical reach to our customers. However, we may not be successful in expanding our sales and distribution network. Our sales, distribution, logistic and value-added services and products may face competition from similar services and products offered by our competitors. As a result, the success of our expansion depends on many factors, including our ability to form relationships with, and manage an increasing number of, customers, suppliers and distributors nationwide and optimize our distribution channels. If we fail to expand our sales and distribution network in our targeted areas as planned or if we are unable to compete effectively with other distributors in geographical areas that we plan to enter into, our business, financial condition and results of operations may be materially and adversely affected.

We may be unable to obtain adequate financing to fund our capital requirements.

We may need to obtain financing to fund our future growth and expansion. In the past, we have relied on cash generated from our operations, short-term and long-term loans and investments from private equity funds to fund our capital requirements. We may need to raise additional capital by equity or debt issuances or loans. Financing may not be available on terms favorable to us, or at all. Future debt financings may require us to enter into covenants restricting the way we operate our business and other financial activities. Failure to obtain financing on acceptable terms may affect our expansion plans or ability to respond to competitive pressures or unanticipated requirements, which may materially and adversely affect our business, financial condition and results of operations.

13

Table of Contents

The TCM raw herbs or the products that we sell and distribute may become contaminated or deteriorate, and we may be exposed to negative publicity about product safety which could have a negative impact on our financial condition.

The contamination or deterioration of the TCM raw herbs or the products that we sell and distribute could harm our reputation and business. A risk of contamination or deterioration exists at each stage of our operations, including stocking and delivery of products to our customers, and the storage and shelving of products at our facilities. The cultivation and harvest of raw herbs are also subject to risks of contamination or deterioration. Any such contamination or deterioration could result in a recall of the TCM raw herbs that we source from local farmers or the products that we sell and distribute and criminal or civil liability and restrict our ability to sell our products, which would have a material and adverse effect on our business, financial condition and results of operations.

We may also be affected by factors such as negative publicity resulting from the publication of industry findings, research reports or health concerns concerning the safety of pharmaceutical and TCM products produced in China or our products in particular. Such complaints and negative publicity may lead to a loss of consumer confidence and a reduction in the demand for the TCM raw herbs or the products that we sell and distribute.

We may be subject to product liability claims and we do not have product liability insurance.

All of our products are sold in the PRC. In the event that the TCM raw herbs or the products that we sell and distribute are found to be unfit for human consumption or detrimental to health and cause illness or death as a result of our negligence, we may be subject to product liability claims. Negative effects to health may result from tampering by unauthorized third parties or product contamination or degeneration, including the presence of foreign contaminants, chemicals, substances or other agents or residues during various production and distribution processes.

We have not obtained any liability insurance for third party pharmaceutical products sold or distributed by us, as this is not a statutory requirement under current PRC laws and regulations and, to our knowledge, such product liability insurance is not typically available in the PRC. Under the Product Quality Law of the PRC, manufacturers and vendors are liable for property damage or personal injuries caused by their defective products. In addition, under the Law of the Protection of the Consumer’s Rights and Interests, the relevant administration for industry and commerce is authorized to impose penalties on manufacturers and vendors for such product liability. All business entities must observe and comply with the Law of the Protection of the Consumer’s Rights and Interests in providing goods and consumer services. We may face product liability claims, or criminal claims in some circumstances, arising from use of the products that we sell or distribute. Although our supplier agreements contain provisions that provide us with the right to seek compensations from our suppliers in relation to all losses arising or in connection with the sales of our suppliers’ products, any actions taken by consumers against us may jeopardize our reputation and adversely affect our sales. Even if we are able to successfully defend such claims, customers may lose confidence in our products, thereby adversely affecting our business and reputation. Further, we may incur significant expenses, time and effort in defending such claims.

We face increasing labor costs in the PRC, which could materially and adversely affect our profitability.

Our industry is labor intensive. While we believe we will have sufficient labor supply to support our operations, labor costs in the PRC have been increasing in recent years and could continue to increase in the future. In particular, recent reforms by regional provinces in the PRC have resulted in increases in the minimum wage of approximately 20 to 30%. This could increase the prices for our products and fees for our services and decrease demand for such products and services, which could adversely affect our sales, financial condition and results of operations. If we are unable to pass on these increased labor costs to our customers by increasing the prices for our products and fees for our services due to competitive pressures in the markets where we operate, our profit margins may decrease and our results of operations may be adversely affected.

14

Table of Contents

We have limited control over the availability and the quality of the local farmers with whom we cooperate because we do not employ them directly.

We source raw herbs that are cultivated by local farmers. Currently, an average of 700-800 such farmers per year work on the plantation sites where the TCM raw herbs we sell are grown. We do not employ these farmers directly. Instead, the farmers are recruited and employed by the local villagers’ committees that we have entered into agreements with. While we have not experienced any difficulties sourcing raw herbs from these farmers in the past, we have limited control over the availability and the quality of this labor. A shortage of suitable laborers or the inability to procure these raw herbs at commercially acceptable terms may adversely affect our business, financial condition and results of operations.

In the future, we may not be successful in competing with other pharmaceutical distributors in non-profit state-owned and state-controlled hospitals’ tender processes for medicine purchases.

Some of the hospitals that we sell and distribute products to have begun to implement centralized tender processes for the purchase of medicines listed in the State Basic Medical Insurance Catalogs and medicines commonly listed in these catalogs are prescribed for clinical uses and in high volumes. Pharmaceutical products listed on the State Basic Medical Insurance Catalogs are covered by national medical insurance program. See “Regulation—Reimbursement under the National Medical Insurance Program” for details. The centralized tender process is conducted once a year in various provinces or cities in China. Non-profit hospitals and healthcare institutions belonging to State-owned enterprises (including State-controlled enterprises) or to the people’s government at the county level or above can purchase only from winning bidders through the centralized tender processes. If the pharmaceutical manufacturing enterprises’ bids are successful, we can sell and distribute products, with the delegation by such pharmaceutical manufacturing enterprises, to the medical institution. Our failure to successfully compete with other pharmaceutical distributors in tender processes could have a material and adverse effect on our business, financial condition and results of operations.

Our success is dependent on retaining our senior management and key personnel who would be difficult to replace.

Our success depends largely on the continued services of our senior management and key personnel. In particular, our success depends on the continued services of Xuexiang Ai, our chief executive officer. Mr. Ai has been instrumental in developing our business model and is crucial for our business development. Although he is a party to an employment agreement, Mr. Ai may not continue in his present capacity for any particular period of time. We do not maintain key employee insurance on any of our personnel. The loss of the services of one or more members of our senior management team or key personnel could hinder our ability to effectively manage our business and implement our growth strategies, and we may not be able to appoint or integrate adequate replacement personnel into our operations in a timely manner, or at all. Our failure to do so could in turn disrupt our operations and the growth of our business.

Our ability to retain our senior management and key personnel is subject to numerous factors, including the compensation packages we offer, our ability to maintain a cohesive company culture and other factors. If any member of our senior management team or other key personnel joins a competitor or forms a competing company, we may lose customers and key employees and may not be able to promptly fill their positions with comparably qualified individuals without a significant increase in costs. Any of the foregoing adverse developments may materially and adversely affect our business, financial condition and results of operations.

15

Table of Contents

We rely on information systems to manage our operations and any system failure or deficiencies in our information systems may have a material and adverse effect on our business, financial condition and results of operations.

Our businesses rely on our information systems to process, analyze and manage our operational data. We rely on these systems to, among other things:

| • | facilitate the purchase and distribution of inventory items from our distribution center to our customers; |

| • | monitor the daily operations of our distribution network and supply chain; |

| • | receive, process and deliver orders in a timely manner; |

| • | manage the billing and collections for our customers; and |

| • | process payments to suppliers. |

Any damage, unforeseen events or system failure which cause interruptions to input, retrieval and transmission of data or increase in service time could disrupt our normal operations. We may not be able to effectively carry out our disaster recovery plan to handle the failure of our information systems or restore our operation capacity within a sufficiently adequate time frame to avoid disruptions to our business. In addition, if we cannot upgrade our information systems in a timely manner or on commercially acceptable terms to meet our expanding needs, our ability to expand may be constrained. The occurrence of these events may have a material and adverse effect on our business, financial condition and results of operations.

We may be exposed to potential risks relating to our internal controls over financial reporting.

If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of U.S. public companies’ internal control over financial reporting, and attestation of this assessment by their independent registered public accountants. While the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts non-accelerated filers with respect to the attestation by their independent registered public accountants as to financial controls, this exception does not affect the requirement that we include a report of management on our internal controls over financial reporting and will not affect the requirement to include the auditor’s attestation if we become an accelerated filer. Existing standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards.

Our internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the issuer are being made only in accordance with authorizations of our management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Subsequent to filing our annual report on Form 10-K on March 31, 2010 and our quarterly report on Form 10-Q filed on May 19, 2010, we identified concerns relating to our historical financial statements related to a change in the application of accounting for business combination from the pooling-of-interest method to the purchase method for the 2006 acquisition of Anqing Zhongxi and have restated those financial statements in these reports on Form 10-K/A and Form 10-Q/A, respectively. The restatement of our financial statements for the fiscal year ended December 31, 2009 was necessary to (i) amend and restate our stockholders’ equity for the fiscal years

16

Table of Contents

ended December 31, 2009 and 2008, and the related notes thereto, in light of a change in the application of accounting for business combination from the pooling-of-interest method to the purchase method for the 2006 acquisition of Anqing Zhongxi, (ii) to treat the shares issued to complete the share exchange transaction between us and Rolling Rhine as being outstanding in the earliest period for which financial statements were presented and to treat the outstanding shares of Rolling Rhine as if they were issued to acquire us, (iii) to correct the earnings per share calculation to reflect the fact that the share exchange shares are treated as being outstanding in the earliest period for which financial statements were presented, and (iv) in order to amend and restate our statement of cash flows in light of our use of an incorrect exchange rate in computing certain items. The restatement of our interim unaudited financial statements for the period ended March 31, 2010, was necessary to reflect the effects of the December 31, 2009 restatement on our March 31, 2010 financial statements, and in order to amend and restate our statement of cash flows in light of our use of an incorrect exchange rate in computing certain items for the period ended March 31, 2010. Because of the application of the pooling-of-interest accounting for the 2006 acquisition of Anqing Zhongxi, management determined that a material weakness existed with respect to our reporting of complex non-routine transactions. As a result, management has revised its assessment of the effectiveness of our internal control over financial reporting due to material weakness in our reporting of complex, non-routine transactions, and concluded that as of December 31, 2009, our internal control over financial reporting was not effective. We cannot guarantee the implementation of controls and procedures in future years to be without any significant deficiency or material weakness.

Any misstatements or adjustments due to errors or the failure to satisfy our reporting obligations on a timely basis could have a material adverse effect on our business, financial condition and results of operations. Our past restatements and our inability to have effective internal control over financial reporting may also create a public perception that our financial statements do not fairly present our results of operations and financial condition and adversely affect the trading price of our common stock.

We may be exposed to potential risks relating to our ongoing compliance with our reporting obligations.

We will be required to comply with all reporting and listing requirements on a timely manner and maintain our corporate governance and independent director standards. During 2010 and 2011, we were non-timely in the filing of some of our interim reports on Form 10-Q and our annual report on Form 10-K. In addition, some of the operational data in our previous public filings was not accurate. To ensure ongoing compliance with our reporting obligations, we may incur increased costs and management time. If we fail to meet our ongoing reporting obligations in a timely and accurate manner, we may face regulatory sanction and related penalties. The occurrence of any of these could have an adverse affect on our result of operations, financial condition and reputation.

We rely on limited storage facilities for our products that we sell and distribute and may not have sufficient insurance coverage. Any disruption to our current facilities could significantly disrupt our operations.

Our existing storage facilities are limited in storage capacity and are centralized at our headquarters in Anqing, Anhui province. As a result, our operations are subject to uncertainties and contingencies beyond our control that may materially and adversely affect our business and operations. These uncertainties and contingencies include industrial accidents, fires, floods, droughts, storms, earthquakes, snow storms, other natural disasters and catastrophes. We may also face equipment failures or other operational problems, strikes or other labor difficulties and disruptions to public infrastructure. Such events may occur from time to time and our facilities or operations may be materially damaged or disrupted as a result. As our existing storage facilities are limited, any such disruption or damage to our facilities could cause us to reduce or halt our operations, prevent us from meeting customer orders, negatively affect our business reputation, increase our costs of operation or require us to make unplanned capital expenditures, any of which may have a material and adverse effect on our business, financial condition and results of operations.

17

Table of Contents

Except for our inventory, we do not have any insurance coverage for our office and warehouse facilities. We also do not have any business interruptions insurance coverage. We may incur damages from fire, floods, storms, earthquakes, natural disasters and other catastrophes. If we were to incur substantial losses or liabilities that are not covered by our insurance policies, we may have to pay, out of our own funds, for financial and other losses, damages and liabilities, which may have a material and adverse effect on our business, financial condition and results of operations.

We are subject to anti-corruption laws in the jurisdictions in which we operate, including PRC anti-corruption laws and the United States Foreign Corrupt Practices Act. Our failure to comply with these laws could result in penalties which could harm our reputation and have a material and adverse effect on our business.

We are subject to the United States Foreign Corrupt Practices Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by United States persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. The PRC also strictly prohibits bribery of government officials. We have operations, agreements with third parties, and make all of our sales in China. Our activities in China create the risk of unauthorized payments or offers of payments by our employees, consultants, sales agents, or distributors, even though they are not always subject to our controls. We have implemented safeguards to discourage these practices by our employees and affiliated persons. However, our existing safeguards and any future improvements may not totally preclude our employees, consultants, sales agents, or distributors from engaging in conduct for which we might be held responsible. We are also in the process of implementing a detailed FCPA compliance program throughout our organization. This program has not been fully implemented and may not be effective and the failure to develop and maintain effective FCPA compliance programs could result in violations of FCPA or the applicable PRC anti-corruption laws. Violations of the FCPA or the PRC anti-corruption laws may result in severe criminal or civil sanctions and other liabilities, which could negatively affect our business, financial condition and results of operations. In addition, we may be liable for successor liability FCPA violations committed by companies that we invest in or acquire.

Negative publicity or media coverage of our company, our chief executive officer or any of their respective affiliates could materially and adversely affect our reputation, business, financial condition and the price of our Shares.

In the PRC, there has been negative publicity or media coverage concerning the corporate affairs of a company for which our chief executive officer acted as legal representative. For example, there have been articles posted on websites alleging improper business activities on the part of that company and our chief executive officer. Such media coverage, whether or not accurate and whether or not applicable to us, may have a material adverse effect on our reputation, business, financial condition and price of our common stock. We cannot assure you that there will not be similar or other negative publicity or other media coverage related to us, our management or our affiliates in the future.

We may be subject to potential disputes or challenges by regulatory authorities relating to the equity interests of Anqing Zhongxi.

Since the reorganization of Anqing Zhongxi, our PRC operating subsidiary was converted from a state-owned enterprise to a private company and was established as Anqing Zhongxi Pharmaceutical Company Limited in 1997. Since then, we have also undergone several capital increases and equity changes, eventually resulting in our current shareholding structure. Due to lapses in registration at the local administration of industry and commerce and management of Anqing Zhongxi’s internal documents, some important legal documents prepared after the establishment of Anqing Zhongxi are missing, or were not properly kept. As a result, there might be a lack of sufficient, conclusive and comprehensive evidence to prove the clearness and completeness of some

18

Table of Contents

historical equity interests relationships of Anqing Zhongxi. Therefore, Anqing Zhongxi has been and going forward may be subject to disputes concerning ownership of its equity interests.

If a dispute or challenge by regulatory authorities on the status of or previous transactions involving our equity interests, including transactions involving equity ownership transfer and its corresponding consideration arise, our reputation may be adversely affected and any finding or ruling that differs from our current equity ownership structure, could have a material adverse effect on our business, financial condition or results of operations as well as our shareholders.

Our business operations may be adversely affected or interrupted due to the lack of a valid building ownership certificate for a temporary warehouse. In addition, our expansion strategies may be adversely affected if we fail to obtain a valid land planning permit for the site where we intend to construct our new distribution and warehouse facilities.

Our chief executive officer has not obtained a valid building ownership certificate for the temporary warehouse that we lease from him and such warehouse facility accounts for approximately 40 percent of the total warehouse space and is used by us to support our distribution activities and warehouse operations. Based on the current PRC laws and regulations, our chief executive officer may be subject to government sanction if he does not obtain planning, construction or other permits in relation to the building ownership certificate. Our chief executive officer may be subject to fines which may be imposed by the PRC authorities, for occupying, utilizing or leasing such building, or he may be compelled to demolish this building and the lease arrangements in relation to the properties without valid building ownership certificate may be recognized as invalid. Although our chief executive officer has agreed to indemnify us for any relocation and other related costs and all other losses, our business operations may be adversely affected or interrupted.

In addition, we have not obtained a valid land planning permit for the site where we intend to construct our new distribution and warehouse facilities. Based on the current PRC laws and regulations, failure to obtain such permit could cause us to lose our land-use right. We have applied for the land planning permit. If we cannot obtain a valid land planning permit, our expansion strategies may be adversely affected.

Risks Relating to Our Industry

We face intense competition that may prevent us from maintaining or increasing our market share.

We sell and distribute pharmaceuticals and sell TCM raw and processed herbs and face competition from operators in each of our businesses. The pharmaceutical distribution business in the PRC is intensely competitive, rapidly evolving and highly fragmented. Our competitors include regional and local pharmaceutical distributors. Our existing or potential competitors may have substantially greater financial, technical, research and development, marketing, distribution and other resources than we do. We may not be able to remain competitive by distinguishing our distribution services, offering competitive price or maintaining our customers relationships, and we may not increase or maintain our existing market share. Furthermore, China’s entry into the World Trade Organization may foster increased competition from multinational pharmaceutical companies. Such competitors may also have greater brand recognition, established distribution networks, larger customer bases or more extensive knowledge of our target markets. Additionally, our competitors in the TCM raw herb plantation management business may develop products superior to or more affordable than ours or may more effectively market their products. Any significant increase in competition could materially and adversely affect our profitability. If we are unable to adapt to changing market conditions and compete effectively against our competitors, our business, financial condition and results of operations may be materially and adversely affected.

The PRC healthcare industry is highly regulated, and we may not be able to adapt to future changes in regulatory framework, requirements and enforcement trends.

The healthcare industry in China is highly regulated. We are governed by various local, provincial and national regulatory regimes in all aspects of our operations, including licensing and certification requirements and

19

Table of Contents

procedures for manufacturers and distributors of pharmaceutical and healthcare products, operating and security standards and environmental protection regulations. The legal framework, licensing and certification requirements and enforcement trends in the healthcare industry may change, and we may not successfully respond to such changes. Such changes may result in increased compliance costs, which may materially and adversely affect our business, financial condition and results of operations.

We are subject to regular inspections, examinations, inquiries or audits by relevant regulatory authorities for maintaining or renewing the various permits, licenses and certificates required for our distribution of pharmaceutical products and provision of related logistical services. If any of our products or facilities fails such inspections, our business, profitability and reputation in the industry may be adversely affected.

Counterfeit pharmaceuticals in China could materially and adversely impact our reputation, business, financial condition and results of operations.

Our products are subject to competition from counterfeit pharmaceuticals, or pharmaceuticals manufactured without proper licenses or approvals and are fraudulently mislabeled with respect to their content and manufacturer. Counterfeiters may illegally manufacture and market pharmaceuticals under the brand names of the products we distribute or those of our competitors. Counterfeit pharmaceuticals are generally sold at lower prices than authentic products due to their low production costs, and in some cases are very similar in appearance to the authentic products. Counterfeit pharmaceuticals may or may not have the same chemical content as their authentic counterparts. If counterfeit pharmaceuticals illegally sold under the brand names we distribute results in adverse side effects to consumers, we may be associated with any resulting negative publicity and legal proceedings. In addition, consumers may buy counterfeit pharmaceuticals that are in direct competition with pharmaceutical products we distribute, which could have a material and adverse impact on our revenues, business and results of operations. Although the PRC government has recently been active in policing counterfeit pharmaceuticals, China does not yet have an effective counterfeit pharmaceuticals regulation control and enforcement system. The proliferation of counterfeit pharmaceuticals has grown in recent years and may continue to grow in the future. Any such increase in the sales and production of counterfeit pharmaceuticals in China, or the technological capabilities of the counterfeiters, could have a material and adverse effect on our reputation, business, financial condition and results of operations.

Risks Relating to Doing Business in the PRC

The PRC’s economic, political and social conditions, as well as governmental policies, could affect the financial markets in the PRC, our liquidity and access to capital, and our ability to operate our business.