Attached files

| file | filename |

|---|---|

| 8-K - SI FINANCIAL GROUP 8-K 5-5-2011 - SI Financial Group, Inc. | form8k.htm |

Investor Presentation

May 5, 2011

Forward Looking Statements

2

This presentation contains forward-looking statements, which can be identified by the use of words such as “believes,” “expects,”

“anticipates,” “estimates” or similar expressions. These forward-looking statements include, but are not limited to:

“anticipates,” “estimates” or similar expressions. These forward-looking statements include, but are not limited to:

u statements of our goals, intentions and expectations;

u statements regarding our business plans, prospects, growth and operating strategies;

u statements regarding the asset quality of our loan and investment portfolios; and

u estimates of our risks and future costs and benefits.

These forward-looking statements are subject to significant risks and uncertainties. Actual results may differ materially from those

contemplated by the forward-looking statements due to, among others, the following factors:

contemplated by the forward-looking statements due to, among others, the following factors:

Ø general economic conditions, either nationally or in our market areas, that are worse than expected;

Ø changes in the interest rate environment that reduce our margins or reduce fair value of financial instruments;

Ø increased competitive pressures among financial services companies;

Ø changes in consumer spending, borrowing and savings habits;

Ø legislative or regulatory changes that adversely affect our business;

Ø adverse changes in the securities and credit markets; and

Ø changes in accounting policies and practices, as may be adopted by bank regulatory agencies or the Financial Accounting

Standards Board.

Standards Board.

Any of the forward-looking statements that we make in this presentation and in other public statements we make may later prove

incorrect because of inaccurate assumptions, the factors illustrated above or other factors that we cannot foresee. Consequently, no

forward-looking statement can be guaranteed.

incorrect because of inaccurate assumptions, the factors illustrated above or other factors that we cannot foresee. Consequently, no

forward-looking statement can be guaranteed.

Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these

forward-looking statements.

forward-looking statements.

3

4

|

Issuer:

|

SI Financial Group, Inc.

|

|

Listing / Ticker:

|

Nasdaq Global Market / “SIFI”

|

|

Market Price Per Share:

|

$9.95

|

|

Shares Outstanding:

|

10,576,302

|

|

Market Capitalization:

|

$105.2 million

|

|

Tangible Book Value Per Share:

|

$11.80

|

|

Price to Tangible Book Value:

|

84.3%

|

|

Dividend Yield:

|

1.2%

|

Market Summary as of 05/02/11

Company Overview

Company History

6

u Headquartered in Willimantic, CT

u Established in 1842

u Total assets in 1995: $252 million

u Total assets at 3/31/11: $929 million

Experienced Management Team

7

u Savings Institute’s management team is comprised of experienced individuals that

have operated through various credit cycles and have executed the Bank’s growth

strategy

have operated through various credit cycles and have executed the Bank’s growth

strategy

u 156 years of Banking Experience, 91 years at SIBT

u CEO, CFO and SCO with 88 years of commercial bank experience

u Chief Risk Officer with 10 years of compliance and operations experience

Company Profile

Headquartered in Willimantic, CT, SI

Financial reorganized to a two-tier

mutual holding company in 2000 and sold

a minority interest in 2004. In 2011, SI

Financial completed their 2nd step

conversion.

Financial completed their 2nd step

conversion.

As of December 31, 2010 / March 31, 2011:

u Total assets: $926.4 M / $929.4 M

u Total capital: $81.1 M / $128.9 M

u Number of banking offices: 21

u Number of full-time employees: 237

u Number of part-time employees: 38 / 37

Market Area Overview

9

u Savings Institute operates 21 full-service community banking locations in

Windham, New London, Tolland, Hartford and Middlesex counties in Connecticut

Windham, New London, Tolland, Hartford and Middlesex counties in Connecticut

u 30 miles east of Hartford, Connecticut

u Diverse economy primarily oriented to the educational, service, entertainment,

manufacturing and retail industries. Largest employers include:

manufacturing and retail industries. Largest employers include:

u The Mohegan Sun and Foxwoods casinos

u General Dynamics Defense Systems

u Pfizer, Inc.

u Several institutions of higher education (University of Connecticut, Eastern Connecticut

State University, Mitchell College, Connecticut College)

State University, Mitchell College, Connecticut College)

u Small to mid-sized businesses generally support the local economies

u During the current economic downturn Savings Institute’s primary market area has

remained a relatively stable banking market

remained a relatively stable banking market

u Since 2000, primary market’s population has grown by approximately 7.1% versus 3.8%

for Connecticut

for Connecticut

u In the 5 counties Savings Institute maintains branches median household income levels

ranged from $58,000 to $78,000 versus $70,000 for Connecticut and $54,000 for the

U.S.

ranged from $58,000 to $78,000 versus $70,000 for Connecticut and $54,000 for the

U.S.

Market Area Presence

10

u Savings Institute is among the top 10 banks by market share in 3 of the 5 counties

in which it does business

in which it does business

Source: FDIC. Data as of 6/30/10.

Business Strategy

11

u Continue community oriented focus by offering a full range of financial products

and services to its customers

and services to its customers

u Optimize future growth opportunities by executing a proven business model and by

seeking acquisition opportunities in areas in or adjacent to existing market area

seeking acquisition opportunities in areas in or adjacent to existing market area

u Actively manage the balance sheet and diversify the asset mix

u Prudently increase percentage of assets consisting of multi-family, commercial real

estate and commercial business loans

estate and commercial business loans

u Continue conservative underwriting practices and maintain a high quality loan

portfolio

portfolio

u Increase core deposits by emphasizing demand, savings and money market

accounts

accounts

u Supplement noninterest income through expanded mortgage banking operations

and existing wealth management operations

and existing wealth management operations

Acquisition Opportunities

12

u In Connecticut, Rhode Island and

Massachusetts there are

approximately 26 public and private

banks and thrifts with assets

between $100 million and $500

million

Massachusetts there are

approximately 26 public and private

banks and thrifts with assets

between $100 million and $500

million

u 11 are de novo

u 4 have TARP outstanding

u 2 have Texas ratios of greater than

50%*

50%*

u On a selective basis Savings

Institute would consider expanding

into contiguous or near-contiguous

markets via:

Institute would consider expanding

into contiguous or near-contiguous

markets via:

u Whole bank acquisitions

u Branch acquisitions

u FDIC assisted transactions

* Texas ratio defined as nonperforming assets, accruing restructured debt and accruing loans 90+ days past due divided by tangible common equity plus loan loss reserves.

Financial Highlights

Franchise Growth

u Savings Institute has grown organically and through acquisitions, resulting in an

asset CAGR from 2005 to 2010 of 6.0%

asset CAGR from 2005 to 2010 of 6.0%

u Since 2005 has acquired 2 branches, opened 4 branches and relocated or renovated 6

existing branches, expanding market presence in Tolland, New London, Hartford and

Middlesex counties

existing branches, expanding market presence in Tolland, New London, Hartford and

Middlesex counties

Diversified Loan Portfolio

15

u Savings Institute has diversified its portfolio mix by increasing commercial real

estate, multi-family and commercial business lending while maintaining prudent

underwriting practices

estate, multi-family and commercial business lending while maintaining prudent

underwriting practices

u Increased focus on SBA and USDA guaranteed commercial lending

At March 31, 2011

Total Loans: $611.4 million

At December 31, 2005

Total Loans: $516.4 million

Other loans consist of home equity and other consumer.

1-4 Family

Residential

52%

Other

Commercial

4%

Construction

9%

SBA and USDA

Guaranteed

Commercial

11%

Other

5%

Multi-family and

CRE

19%

Other

Commercial

4%

Construction

1%

SBA and USDA

Guaranteed

Commercial

21%

Other

5%

Multi-family and

CRE

26%

1-4 Family

Residential

43%

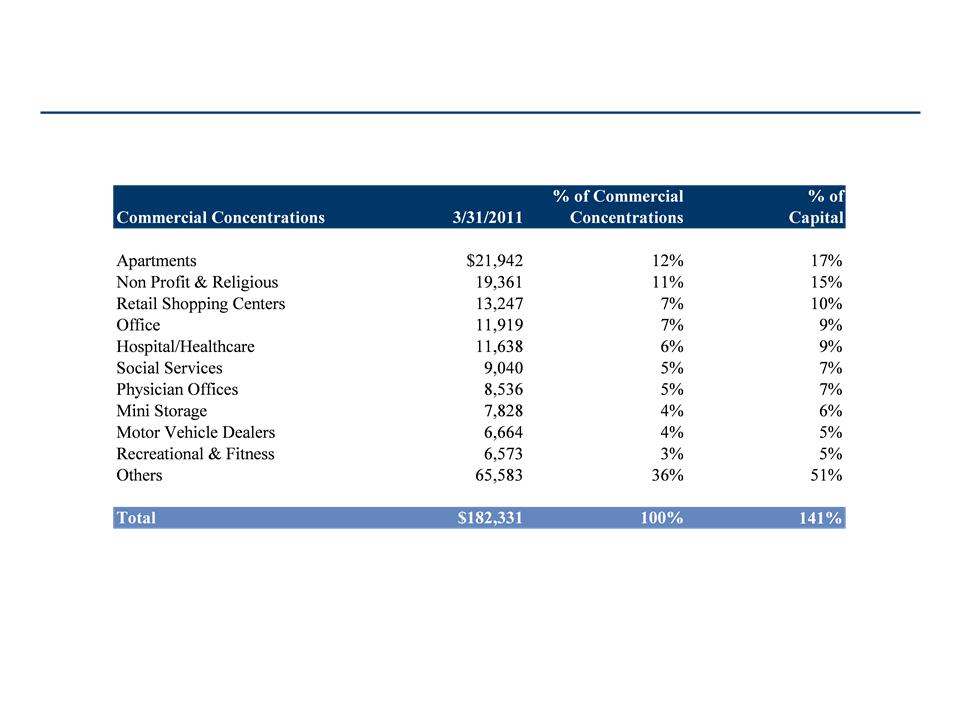

Commercial Loan Concentrations

16

Commercial loan concentration includes CRE, Multi-family and C&I loans

Dollars in thousands

Asset Quality Trends

u Savings Institute has maintained high asset quality with solid reserve coverage

u Aggressive early recognition of nonperforming loans

NPAs and TDRs/Assets

Peer group comprised of all publicly traded banks and thrifts in Connecticut.

2005

2006

2007

2008

2009

2010

3/31/2011

Total Nonperforming Loans

$240

$1,392

$7,632

$9,328

$3,007

$4,925

$6,173

Other Real Estate Owned

325

0

913

0

3,680

1,285

830

Total Nonperforming Assets

$565

$1,392

$8,545

$9,328

$6,687

$6,210

$7,003

Accruing Troubled Debt Restructurings

74

72

71

69

67

5,261

5,704

Total NPAs and TDRs

$639

$1,464

$8,616

$9,397

$6,754

$11,471

$12,707

NPLs/Loans

0.05%

0.24%

1.29%

1.50%

0.49%

0.80%

1.01%

NCOs/Avg Loans

(0.01)

0.03

0.03

0.09

0.64

0.16

0.29

NPAs and TDRs/Assets

0.09

0.19

1.09

1.10

0.77

1.24

1.37

Reserves/Loans

0.71

0.76

0.89

0.97

0.80

0.78

0.75

Reserves/NPLs

1,529.6

313.6

68.7

64.8

162.7

97.4

73.9

Non Performing Asset Breakdown

18

Dollars in thousands

30-59 days

60-89 days

Non

At 3/31/11

Accruing

Accruing

Accrual

OREO

1-4 Family Residential

$2,417

$11

$4,079

$190

CRE and Multi-family

595

0

1,992

640

Other Commercial

0

0

52

0

Home Equity

285

0

50

0

Other Consumer

9

2

0

0

Total

$3,306

$13

$6,173

$830

Excludes Purchased SBA/USDA Loans

Securities Portfolio

19

u Savings Institute maintains a diversified securities portfolio totaling $217 million as

of March 31, 2011

of March 31, 2011

u Savings Institute has previously taken $2.3 million in OTTI charges on 3 pooled trust

preferred securities and one non agency MBS

preferred securities and one non agency MBS

u Savings Institute performs impairment analyses on its securities portfolio quarterly

u As of March 31, 2011 investments below investment grade consisted of pooled trust

preferred securities with a book value of $6.7 million and a fair value of $3.7 million and

non-agency MBS with a book value of $7.3 million and a fair value of $6.9 million

preferred securities with a book value of $6.7 million and a fair value of $3.7 million and

non-agency MBS with a book value of $7.3 million and a fair value of $6.9 million

March 31, 2011

Equity

1%

USG and Agency

Obligations

17%

Corporate Debt

7%

Agency MBS -

Residential

47%

Non-Agency MBS

- Residential

6%

State and

Municipal Debt

3%

CDOs (TRuPs)

2%

GSE Debt

Obligations

17%

Deposit Mix

20

u Savings Institute has grown deposits and emphasized the growth of core deposits through

investments to its branch network, new product offerings and attracting commercial deposits

from small and medium size businesses

investments to its branch network, new product offerings and attracting commercial deposits

from small and medium size businesses

u From 2005 to 2010 total deposits and non-time deposits have grown at CAGRs of 5.3% and

7.0%, respectively

7.0%, respectively

Total deposits exclude mortgagors’ and investors’ escrow accounts.

Cost of

Interest

Bearing

Deposits

Interest

Bearing

Deposits

1.98%

2.74%

3.19%

2.85%

2.25%

1.55%

1.28%

Electronic Banking

21

Transactions at SIBT ATMs

195,229

190,790

Debit Signature Transactions

466,042

513,614

Debit POS/ATM Transactions

522,519

555,505

On Line Bill Pay Transactions

78,954

82,292

eStatement Accounts

7,796

9,524

Consumer Online Customers

10,989

13,021

Business Online Customers

471

848

Mortgage Banking

22

Dollars in thousands

u Savings Institute has recently started selling mortgage loans but has been retaining

the servicing portion and receives a fee for doing so.

the servicing portion and receives a fee for doing so.

Residential Mortgage Loans

Originated

$17,314,000

$25,094,000

Sold

7,624,000

19,844,000

Residential Loans Sold / Serviced

$125,543,757

$163,778,354

Core Profitability

23

u Core earnings have remained profitable, after excluding the following events:

u 2008 write down on securities of $7.1 million

u 2009 FDIC special assessment of $393,000

* Excludes events as noted above.

Strong Capital Profile

24

(1) Represents bank level data.

u Through internal capital generation Savings Institute has remained well capitalized

throughout the current economic crisis

throughout the current economic crisis

u As a result of our recent 2nd step offering, Savings Institute continues to have a

strong capital base for growth and execution of its business plan

strong capital base for growth and execution of its business plan

As of March 31, 2011

Minimum

Actual

Tangible Common Equity

NA

10.91%

Leverage (1)

5.00%

10.91

Tier 1 Risk Based (1)

6.00

20.80

Total Risk Based Capital (1)

10.00

21.77

Stock Buybacks and Dividends

25

u Since completing our MHC offering in December 2004, SI Financial has

repurchased approximately 786,000 shares

repurchased approximately 786,000 shares

u Approximately 15.6% of original offering

u Between March 2005 and March 2011 SI Financial has paid stockholders a total of

$0.72 in quarterly dividends

$0.72 in quarterly dividends

u Quarterly dividend was suspended in January 2009 in order to preserve capital

u With improving earnings outlook, quarterly dividend of $0.03 reinstated in May

2010 resulting in an annual dividend yield of 1.50% based on the $8.00 per share

offering price*

2010 resulting in an annual dividend yield of 1.50% based on the $8.00 per share

offering price*

* The rate of such dividends will be in the discretion of the board of directors and will depend upon a number of factors. No assurance can be given that SI Financial will continue

to pay dividends or that they will not be reduced in the future.

to pay dividends or that they will not be reduced in the future.

Investment Merits

u Community-oriented bank with experienced management team

u Managed company through different credit cycles

u Executed various bank and non-bank acquisitions

u Strong asset quality track record and reserve coverage levels

u Strong core deposit base

u Diversified loan portfolio

u Internal and external growth opportunities post-transaction

26

Trading Multiples

27

(1) Peer Group consists of Nationwide thrifts with assets between $500M and $1.5B and market caps between $75M and $125M.

Data as of May 2, 2011

Source: SNL Financial

SIFI

Average

Median

Average

Median

Price

$9.95

Price / Earnings

NM

19.80x

14.76x

26.78x

24.28x

Price / Book

81.62%

90.27%

87.31%

95.43%

91.99%

Price / Tang Book

84.32%

94.30%

88.40%

106.83%

98.62%

Peer Group

(1)

New England Thrifts

30