Attached files

1Q 2011

Presentation May 2011

Exhibit 99.2 |

Corporate Headquarters

Contacts

Plains Exploration & Production Company

700 Milam, Suite 3100

Houston, Texas 77002

Forward-Looking Statements

This presentation is not for reproduction or distribution to others without PXP’s

consent. Corporate Information

James C. Flores –

Chairman, President & CEO

Winston M. Talbert –

Exec. Vice President & CFO

Hance V. Myers –

Vice President Investor Relations

Joanna Pankey –

Manager, Investor

Relations

& Shareholder Services

Phone: 713-579-6000

Toll Free: 800-934-6083

Email:

investor@pxp.com

Web Site: www.pxp.com

Except for the historical information contained herein, the matters discussed in

this

presentation

are

“forward-looking

statements”

as

defined

by

the

Securities

and Exchange Commission. These statements involve certain assumptions PXP

made based on its experience and perception of historical trends, current

conditions, expected future developments and other factors it believes are

appropriate under the circumstances.

The forward-looking statements are subject to a number of known and

unknown risks, uncertainties and other factors that could cause our actual

results to differ materially. These risks and uncertainties include, among other

things, uncertainties inherent in the exploration for and development and

production

of

oil

and

gas

and

in

estimating

reserves,

the

timing

and

closing

of

acquisitions and divestments, unexpected future capital expenditures, general

economic conditions, oil and gas price volatility, the success of our risk

management

activities,

competition,

regulatory

changes

and

other

factors

discussed in PXP’s filings with the SEC.

References to quantities of oil or natural gas may include amounts that the

Company believes will ultimately be produced, but that are not yet classified as

"proved reserves" under SEC definitions.

2 |

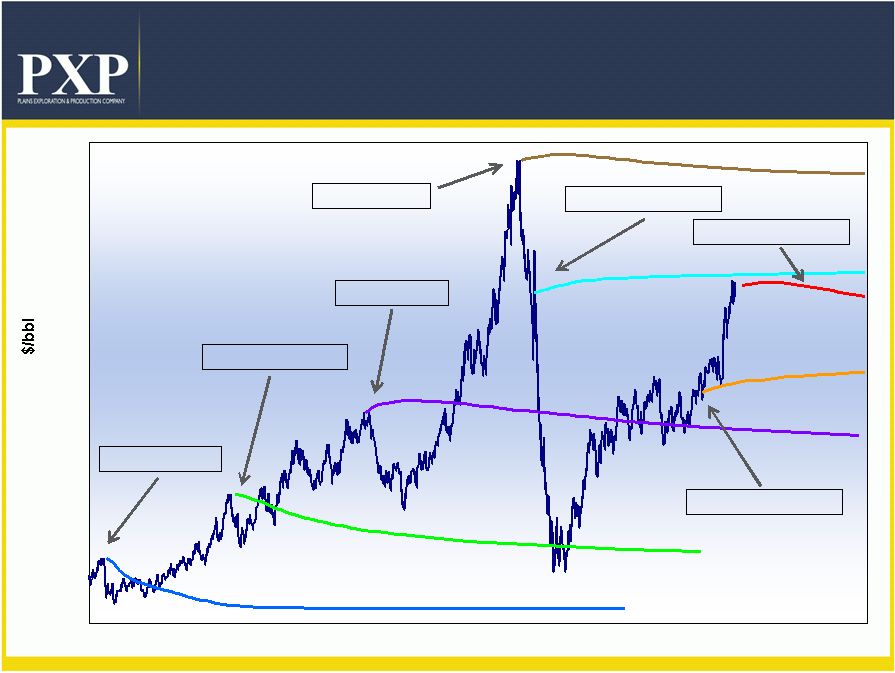

Source:

Goldman Sachs, NYMEX, ICE 3

WTI NYMEX Historical Prices and

Forward Curves

July 14, 2006

March 7, 2003

October 26, 2004

July 14, 2008

September 3, 2008

October 25, 2010

April 21, 2011

20

30

40

50

60

70

80

90

100

110

120

130

140

150

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012 |

4

PXP Today

•

$8.6

billion

enterprise

value

(1)

•

416 MMBOE proved reserves YE 2010

•

88.0 MBOE per day production for 1Q 2011

•

+1.6

billion

BOE

resource

potential

(2)

•

141.0 million shares outstanding

(3)

(1) Reflects stock price and total debt as of March 31, 2011.

(2) Excludes deepwater Gulf of Mexico assets.

(3) As of March 31, 2011. |

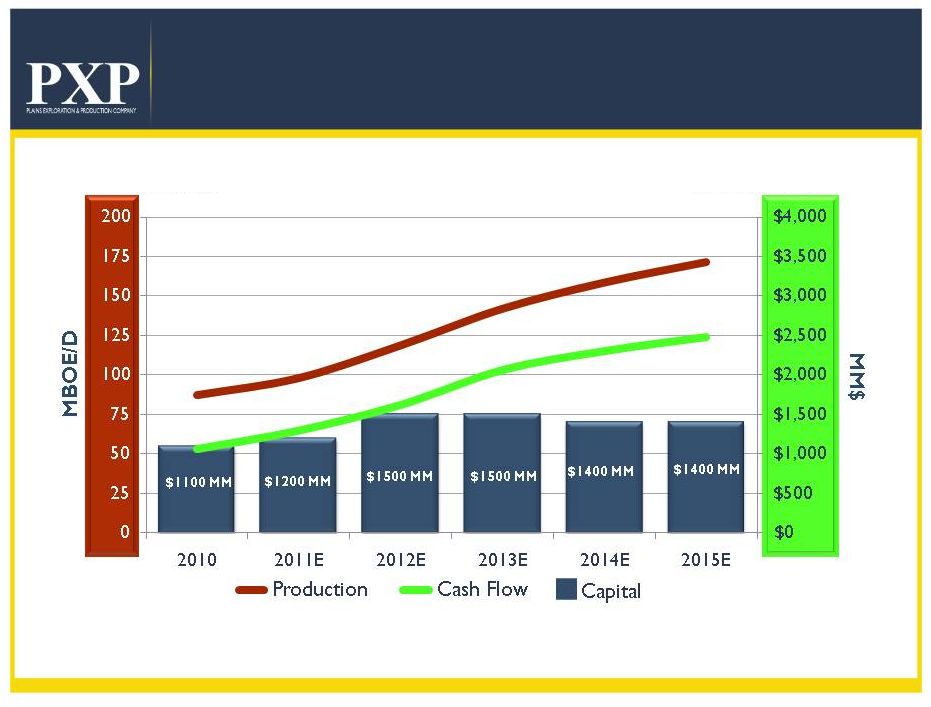

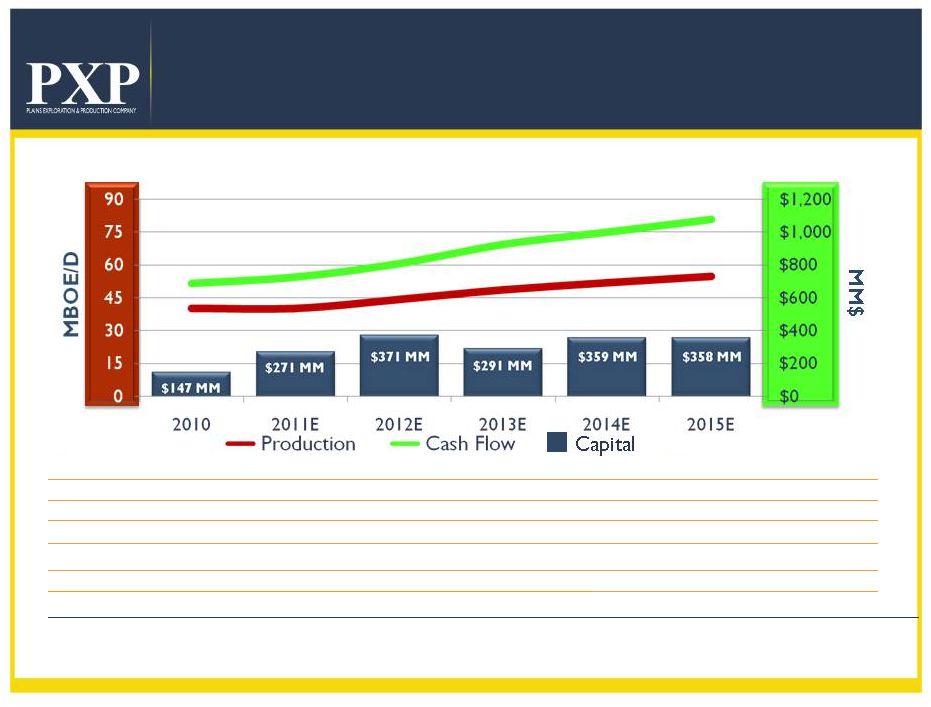

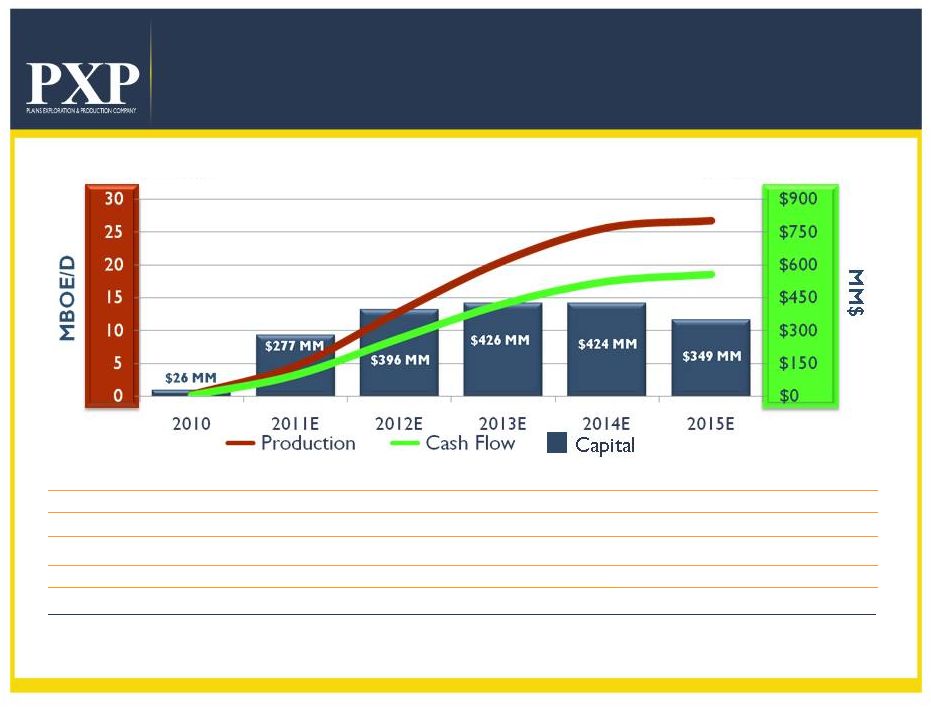

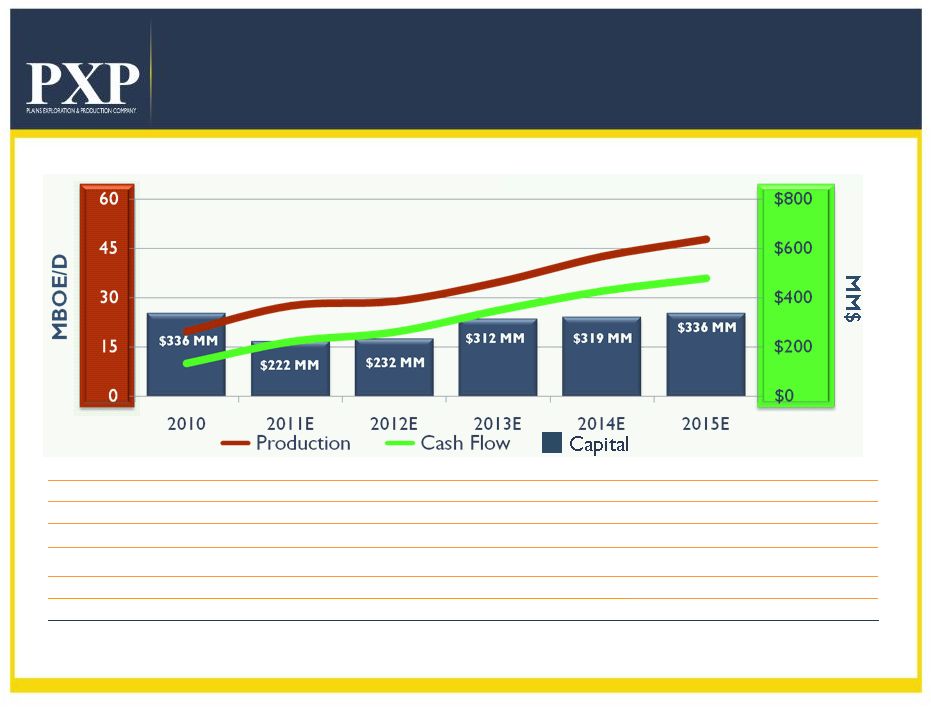

5

PXP

Operational Plan at $85 Oil

PXP Net Production

PXP Net Cash Flow

(1)(2)

(1) Net revenue minus net expenses.

(2) Assumes $85/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2011, $85/Bbl of

oil and natural gas pricing of $5.50/MMBtu in 2012, and $86/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

Excludes deepwater Gulf of Mexico. |

6

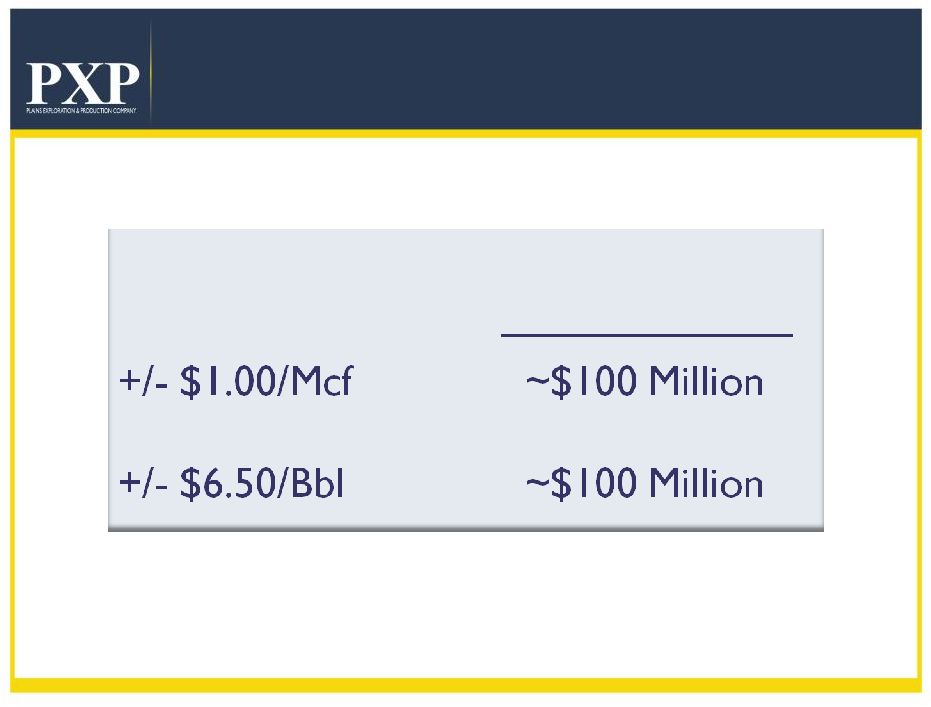

Cash Flow Sensitivities

(1)

Excludes impact of derivatives.

Impact on Est. 2011

Cash Flow From

Operating Activities

(1) |

7

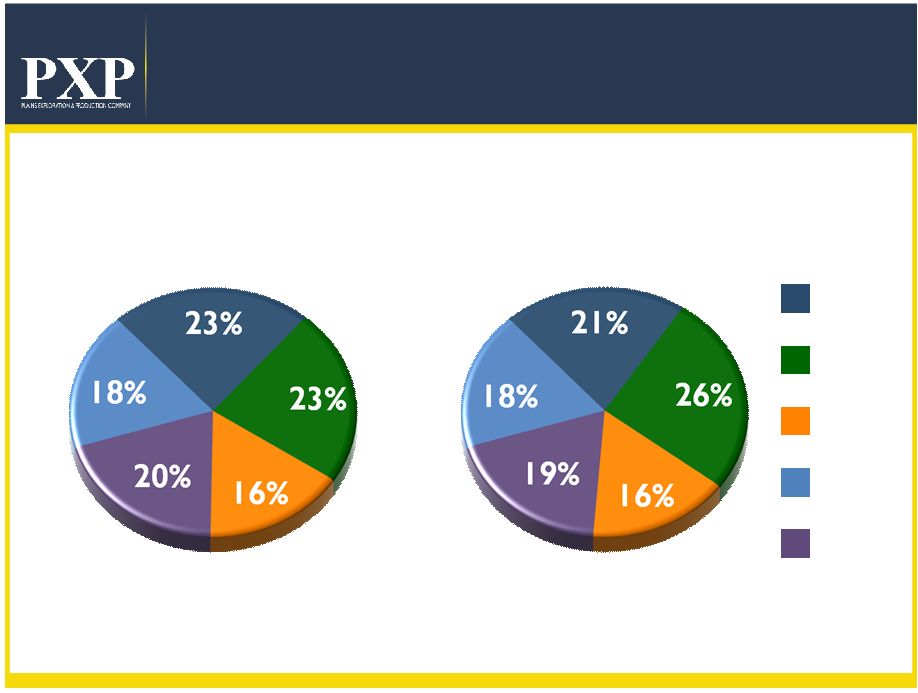

2011 Capital Allocation

Capital Program

Haynesville

California

Cap G&A, Interest

and Other

(1)

$1.5 Billion

Granite Wash

Eagle Ford

$1.2 Billion

Current Approved

Budget

$85 Oil Price

Expansion

Potential

$100+ Oil Price

(1)

Includes development, exploitation, real estate, capitalized interest and G&A costs

but does not include additional capital for exploratory successes.

Excludes deepwater Gulf of Mexico capital.

|

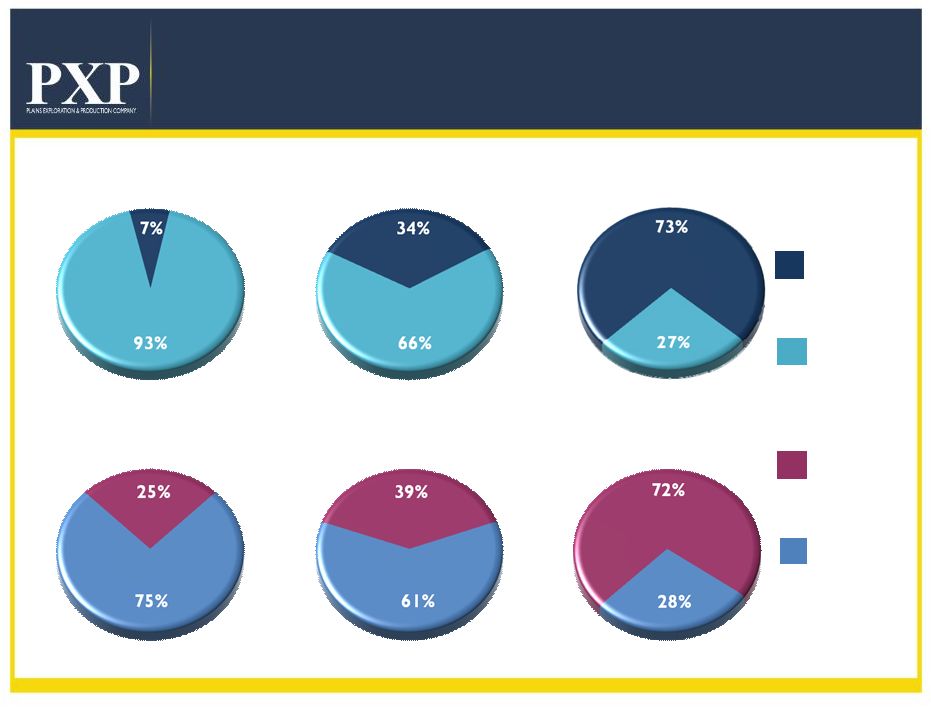

8

Capex Profile

Includes Eagle Ford acquisition and excludes Gulf of Mexico assets, shallow water as of

12/30/2010 and deepwater as of 1/1/2011. 2009

2011E

2010

Oil vs. Gas

Operated vs. Non-Operated

2009

2011E

2010

Oil + Liquids

Gas + Exploration

Operated

Non-operated |

9

Operational Strategy

Focused Oil Growth Strategy

•

Operate substantially all oil assets

•

Maintain total company liquids volumes between 50% and 60% of total

production

•

Hedging

strategy

protects

high

oil

margins

that

preserve

excellent

returns

Targeted High Liquids/Natural Gas Strategy

•

Granite Wash development focusing on high liquids and highest rate of

return wells

•

Haynesville Shale development drilling continues for our Held By

Production (HBP) program |

10

$% of

NYMEX Oil

Est. % of

2011 Capital

Operator

Oil Assets

Asset

California

PXP

23%

88%

Eagle Ford

PXP/EOG

23%

98%

Mowry Shale

PXP

1%

75%

Monterey Shale

PXP

1%

88% |

11

California

Onshore/Offshore

Los

Angeles

Basin

San Joaquin

Valley

Arroyo

Grande

Pt Pedernales

Pt Arguello

•

211 MMBOE Net Proved Reserves

•

272 MMBOE Net Development

Resource Potential

•

70% Proved Developed

•

2009 Capex $92 MM; 2010 Capex

$147 MM; 2011E Capex $271 MM

•

14 yr R/P

•

2,000+ future well locations

•

Price differentials protected by

contract

The shaded areas are for illustrative purposes only and do not reflect actual leasehold

acreage. |

12

California

Operational Plan

January 1, 2010 Project Cost Forward F&D:

$9.87/BOE

(2)

PXP

Interest:

98% WI / 86%

NRI Potential Net Locations:

2,000+

Proved Net

Reserves:

211 MMBOE

Net Development Resource

Potential:

272 MMBOE

Average Gross Well Cost:

$1.2 MM

Average Gross EUR per Well:

135 MBOE

PXP Net Production

PXP Net Cash Flow

(1)(2)

(1) Net revenue minus net operating expenses.

(2) Assumes $85/Bbl of oil and natural gas pricing of $5.00/MMBtu in

2011, $85/Bbl of oil and natural gas pricing of $5.50/MMBtu in 2012, and $86/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

|

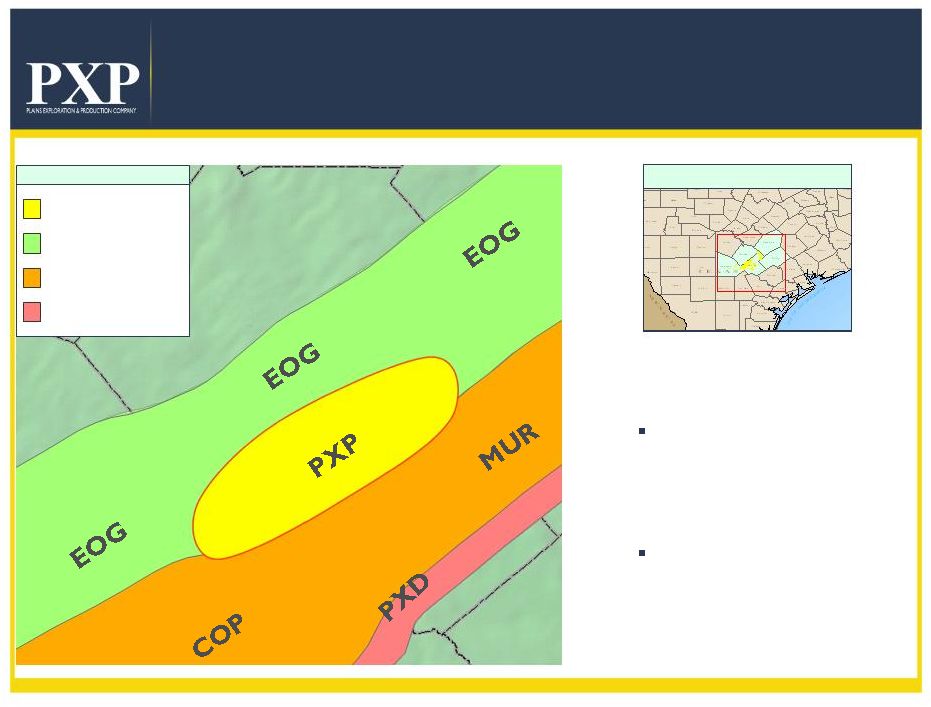

Eagle

Ford Horizontal Oil Play •

PXP acreage position

~58,400 net acres

•

4 to 6 rigs running in 2011

•

Depth to Eagle Ford Top

~9,500'

-

11,500'

TVD

Location Map

WILSON

ATASCOSA

Legend

PXP ACREAGE

OIL WINDOW

GAS CONDENSATE

WINDOW

DRY GAS WINDOW

The shaded area is for illustrative purposes only and does not reflect actual leasehold

acreage. 13 |

14

Eagle Ford

Operational Plan

September 1, 2010 Project Cost Forward F&D:

$18.81/BOE

(2)

PXP

Interest:

73% WI/ 56%

NRI Potential Net Locations:

487

Net Development Resource

Potential:

170 MMBOE

Average Gross Well Cost:

$7.0 MM

Average Gross Resource Potential per Well:

483 MBOE

PXP Net Production

PXP Net Cash Flow

(1)(2)

(1) Net revenue minus net expenses.

(2) Assumes $85/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2011, $85/Bbl of

oil and natural gas pricing of $5.50/MMBtu in 2012, and $86/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

|

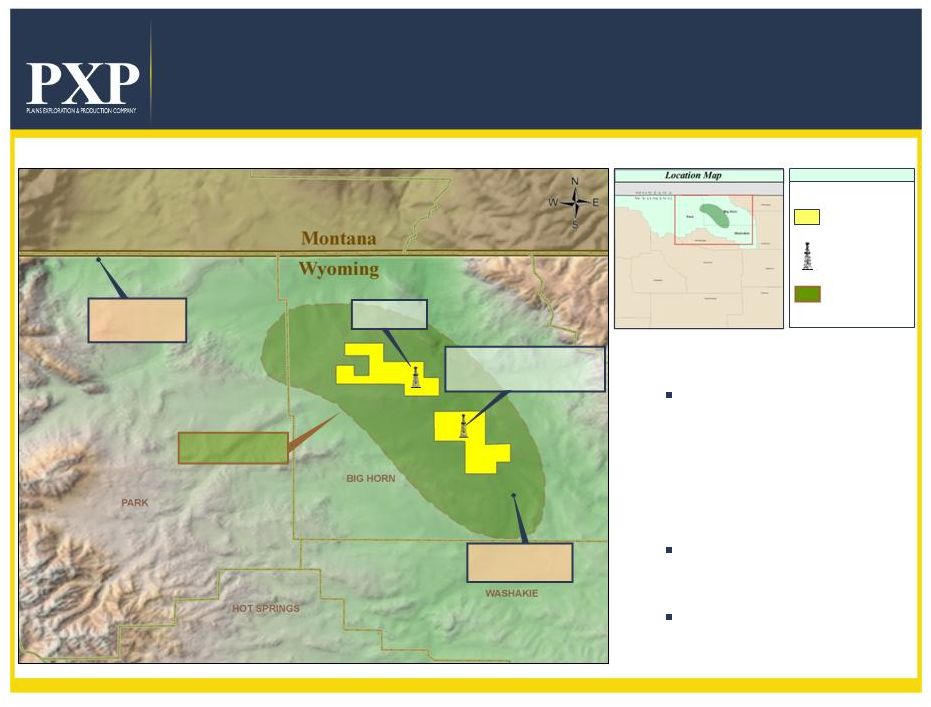

15

Mowry Shale Horizontal Oil Play

Big Horn Basin, Wyoming

•

PXP acreage position

93,600 net acres

•

Proven Source Rock

•

Petrophysical characteristics of

successful oil shale plays

•

Depth Range

~6,000' to 10,000'

•

Shale Thickness Range

~250' to 400'

•

Currently drilling second well

Legend

PXP LEASES

PXP DRILLING

OIL FAIRWAY

Oil Fairway

Mowry Oil

Production

Mowry Gas

Production

Drilled

but not completed

Drilling |

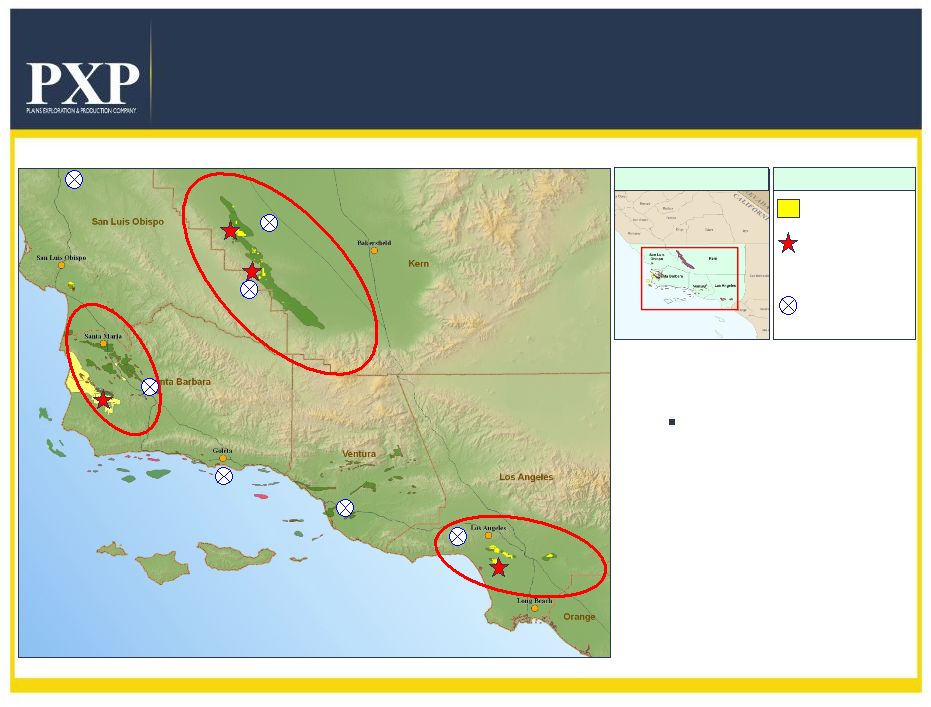

16

Legend

PXP ACREAGE

PXP

MONTEREY

PRODUCTION

OXY DISCOVERY

VENOCO ACTIVITY

*

•

PXP acreage position

86,000 net acres

•

Acquiring 3D seismic data

over key assets

•

Potential exploratory wells

planned in 2011

Monterey Shale Oil Play

Location Map

Los Angeles Basin

Los Angeles Basin

Point Pedernales

Point Arguello

Rocky Point

Arroyo Grande

Lompoc

Cymric

Belridge

McKittrick

Midway Sunset

Urban Area

Las Cienegas

Inglewood

Montebello

Pescado

Hondo

San Joaquin Basin

San Joaquin Basin

Santa Maria Basin

Santa Maria Basin

*

Jesus Maria |

17

Natural Gas Assets

Assets

Operator

Est. % of

2011 Capital

Production

Characteristics

Haynesville

CHK

18%

Dry Gas

Granite Wash

PXP

16%

High Liquids

South Texas

PXP

1%

Dry Gas

Madden

COP

1%

Dry Gas |

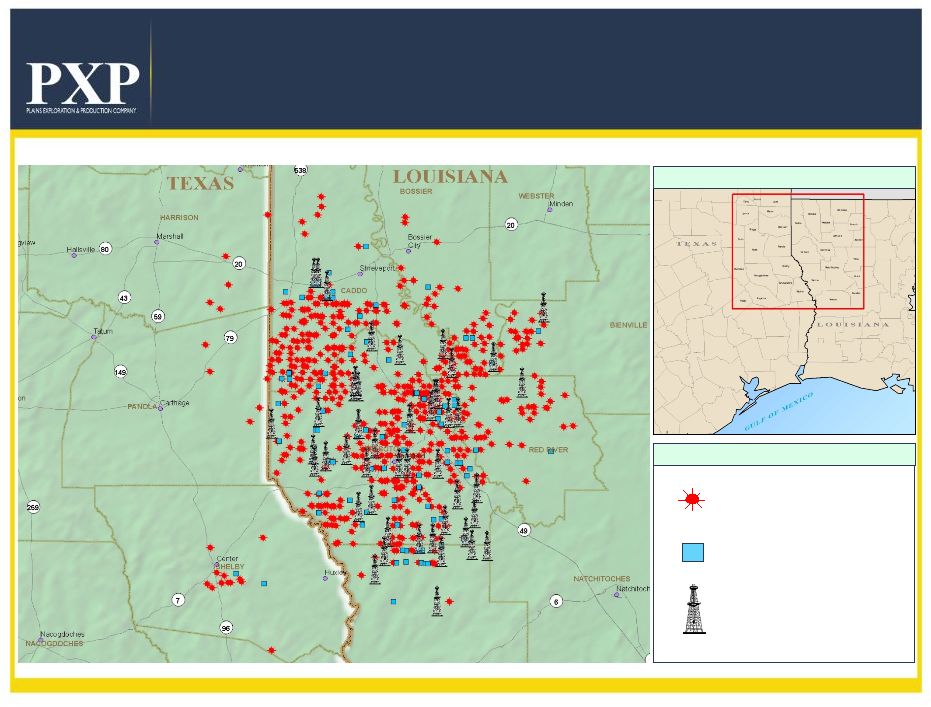

18

Producing

Waiting on Completion

Active Drilling

Haynesville Shale

Activity Map

Location Map

Legend |

19

Haynesville Shale

Operational Plan

January 1, 2010 Project Cost Forward F&D:

$8.24/BOE

or

$1.37/Mcfe

(3)

PXP

Interest:

20% WI / 15%

NRI Net Acreage:

97,000

Potential Net

Locations:

1,136

Net Resource

Potential:

5.5 Tcfe

Average Gross Well Cost:

$7.5 MM

(2)

Average Gross EUR per Well:

6.5 Bcfe

(1) Net revenue minus net expenses.

(2) Assumes D&C costs for first 4 years = $7.5 MM per well, after 4 years = $6 MM

per well. (3) Assumes $85/Bbl of oil and natural gas pricing of $5.00/MMBtu in

2011, $85/Bbl of oil and natural gas pricing of $5.50/MMBtu in 2012, and $86/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

PXP Net Production

PXP Net Cash Flow

(1)(2) |

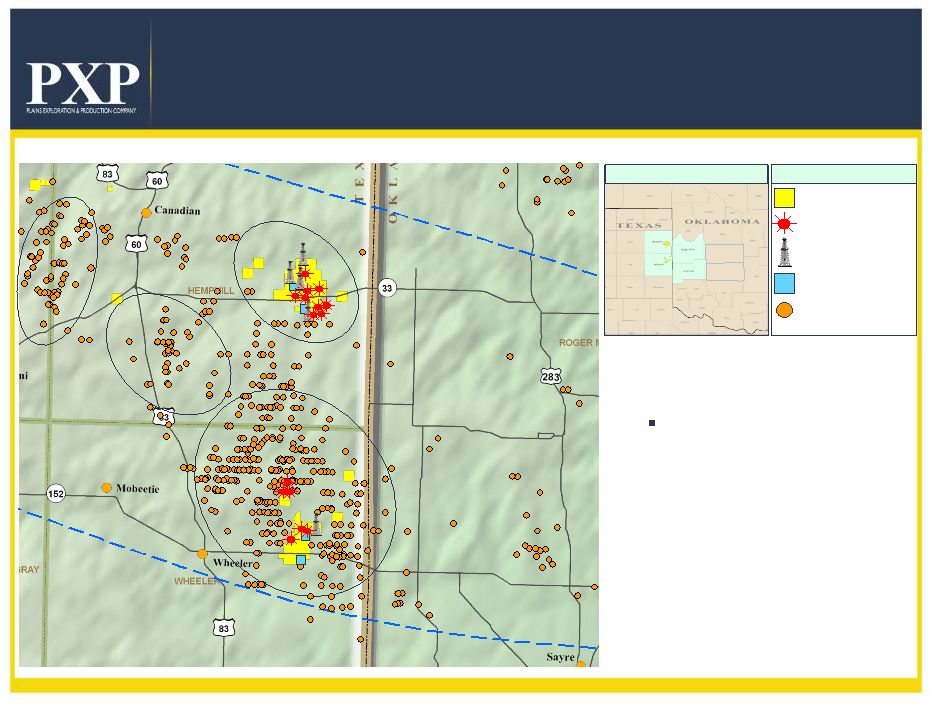

20

Granite Wash Horizontal Play

Activity Map

PXP Leases

PXP Producing Wells

Active Drilling

Waiting on Completion

Non PXP

Horizontal Wells

Custer

Washita

•

PXP acreage position

20,800 net acres

•

Five rigs currently operating

•

150 Granite Wash Locations

(PXP WI 93%)

•

Industry ROI 39% @

$5.00/MMBtu & $75/bbl

Legend

Location Map

Buffalo

Wallow Area

Marvin

Lake

Area

Wheeler

Area

NW. Mendota

Area |

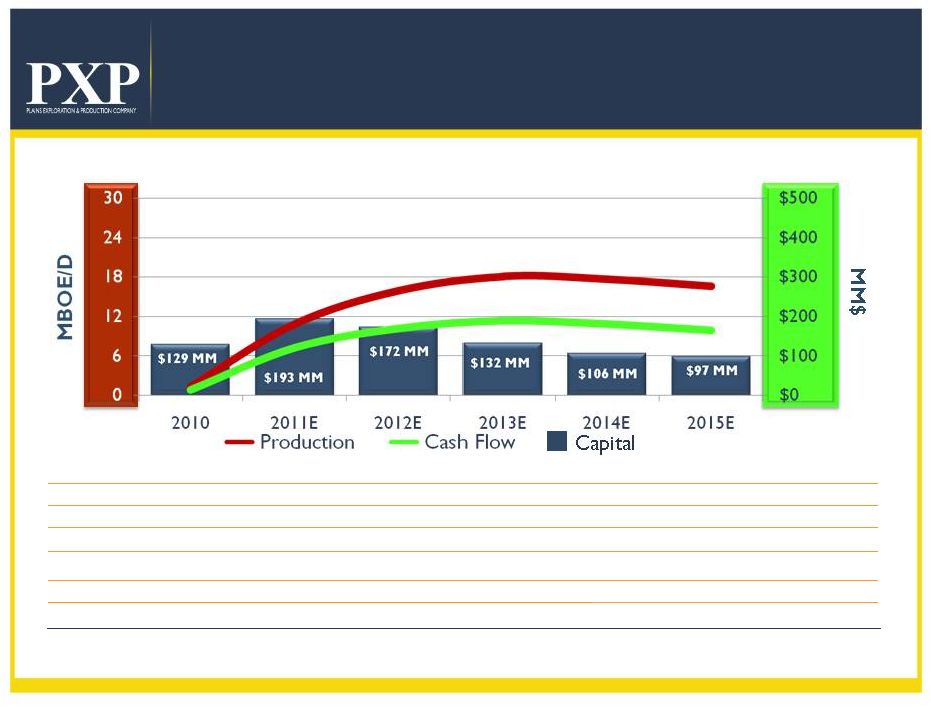

21

Granite Wash Horizontal Potential

Operational Plan

January 1, 2010 Project Cost Forward F&D:

$9.79/BOE or $1.62/Mcfe

(2)

PXP

Interest:

93% WI / 74%

NRI Net Acreage:

20,800

Potential

Locations:

152

Net Resource

Potential:

119.5 MMBOE

Average Gross Well Cost:

$8.2 MM

Average Gross EUR per Well:

1.1 MMBOE

PXP Net Production

PXP Net Cash Flow

(1)(2)

(1) Net revenue minus net expenses.

(2) Assumes $85/Bbl of oil and natural gas pricing of $5.00/MMBtu in 2011, $85/Bbl of

oil and natural gas pricing of $5.50/MMBtu in 2012, and $86/Bbl of oil

and natural gas pricing of $6.00/MMBtu 2013 and beyond.

|

22

+1.6 Billion BOE Resource Potential

Potential Reserves

924 MMBOE

272 MMBOE

170 MMBOE

120 MMBOE

10 MMBOE

Region

Haynesville/Bossier

California

Eagle Ford

Granite Wash

Rockies

Potential Reserves

156 MMBOE

30 MMBOE

Region

Mowry Shale

Monterey Shale

1.5 Billion BOE

Development Resource Potential

+100 Million BOE

Exploration Resource Potential |

23

Other Significant

Assets

1.

51MM

shares

of

MMR

representing

32.2%

(1)

of

their

common stock outstanding

As per MMR, “Unrisked potential for Ultra-Deep focus area: 30+ Tcfe

gross, 14+ Tcfe net

(2)

gross potential could exceed 100 Tcfe

.”

2. Deepwater GOM assets

As

per

APC,

“Gross

resource

potential

in

the

Lucius

field

is

approximately

300+

MMBOE”

+

1,000+

MMBOE

net

resource

potential

from

Phobos

and

additional

Pliocene,

Miocene

and

Tertiary

project

and

prospects.

(1)

As of March 31, 2011.

(2)

Assumes

MMR

has

rights

to

48%

NRI;

actual

WI

&

NRI

are

pending

unitization

and

parties’

participation

on

a

per

prospect

basis. |

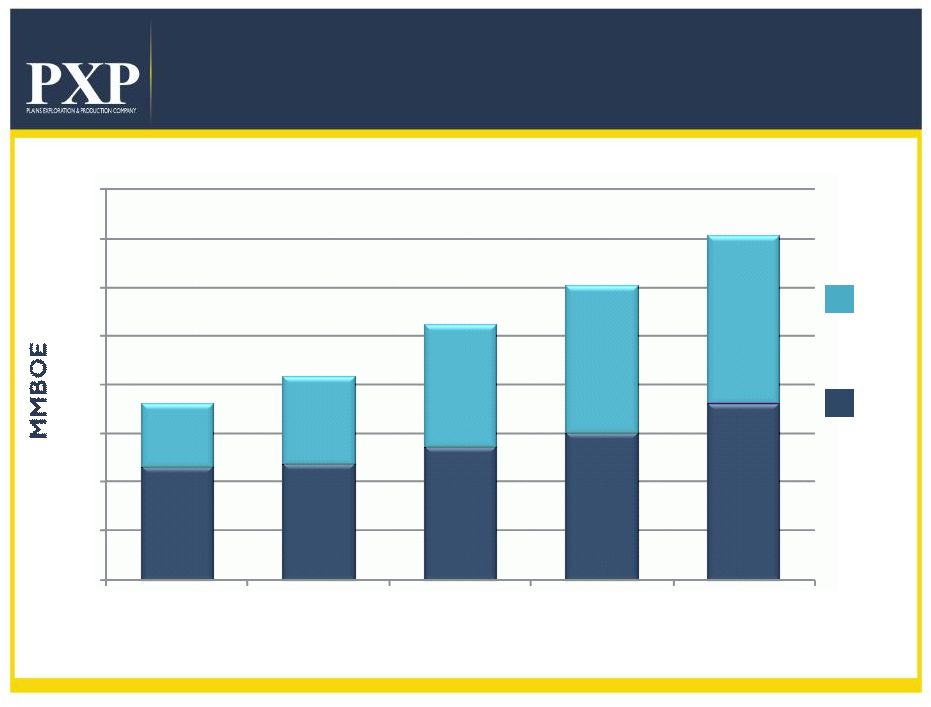

24

Proved

Reserves Target Growth

64%

64%

53%

53%

57%

57%

Proved

Developed

Proved

Undeveloped

50%

50%

51%

51%

(1)

Illustrates estimated reserves using NYMEX pricing.

Excludes deepwater Gulf of Mexico.

360

416

520

(1)

602

(1)

705

(1)

230

237

273

301

360

130

179

247

301

345

0

100

200

300

400

500

600

700

800

2009

2010

2011E

2012E

2013E |

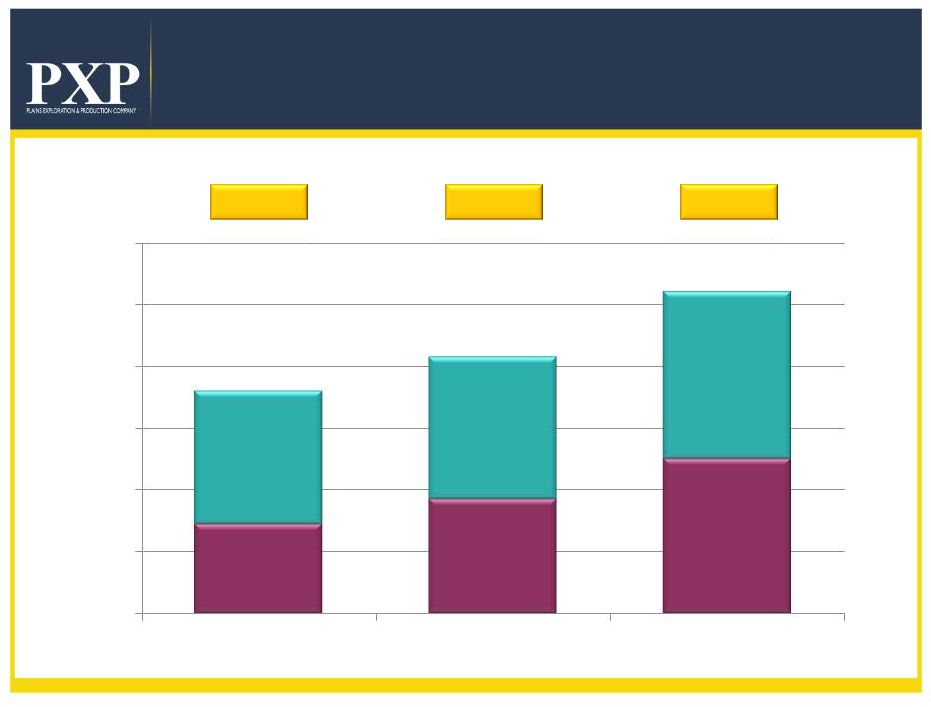

25

2009

2010

2011E

Proved Reserves Oil / Gas Split

360

416

520

(1)

60%

Oil

54%

Oil

53%

Oil

(1)

Illustrates estimated reserves using NYMEX pricing.

40%

Gas

46%

Gas

47%

Gas

0

100

200

300

400

500

600 |

26

Stronger Financial Position

12/31/2008

12/31/2009

12/31/2010

3/31/2011

BALANCE SHEET ($ millions)

Cash

Investment -

MMR Common Stock

(1)

Secured

Debt

-

Senior

Revolving

Credit

Facility

Unsecured

Debt

-

Senior

Notes

Total

Debt

Net

Debt

(2)

Net

Debt to Proved Reserves ($/BOE)

Debt to Capital

Net Debt to Capital

$ 312

$ 2

$ 6

$ 4

-

664

732

1,305

230

620

125

1,500

2,420

2,725

3,326

$ 2,805

$ 2,650

$ 3,345

$ 3,451

$ 2,493

$ 2,648

$ 2,675

$ 2,715

$ 8.53

$ 7.37

$ 6.43

$ 6.53

(3)

54%

51%

45%

45%

50%

50%

44%

44%

(1)

At December 31, 2010 and March 31, 2011 the McMoRan ("MMR") shares were valued at

approximately $664.3 million, and $731.6 million respectively based on MMR's closing stock

price of $17.14 on December 31, 2010 and $17.71 on March 31, 2011 discounted to reflect certain restrictions on the marketability of the MMR

shares. Under the terms of the stockholder agreement with MMR, we are generally prohibited from

transferring any of our shares of MMR until December 30, 2011. In addition, the market price

of MMR common stock may decline substantially before we sell them.

(2)

Net of Cash and Investment in MMR common stock.

(3)

Calculated utilizing December 31, 2010 proved reserves. |

27

PXP Targets Over Next 3 Years

•

Grow reserves 15% to 20% per year over the next 3

years

•

Grow production 10% to 15% per year over the next

3 years

•

Efficiently manage business focusing on cost reduction

and profitability

•

Maintain conservative balance sheet with active

hedging program

•

Focus drilling on high liquid development projects to

increase total percentage of oil production

•

Opportunistically monetize significant other assets |

28

Addendum |

29

(Millions, except for share data)

Quarter

Ended

3/31/2011

Quarter

Ended

3/31/2010

Revenues

$ 430.3

$ 384.1

Production Costs

(122.0)

(110.1)

General & Administrative

(36.0)

(37.4)

DD&A & Accretion Expense

(138.8)

(126.8)

Legal Recovery

–

8.4

Other Operating Income

0.3

0.6

Income From Operations

$ 133.8

$ 118.8

Income Before Income Taxes

$ 118.2

$ 106.2

Net Income

$ 71.0

$ 58.5

Earnings Per Share –

Diluted

$ 0.49

$ 0.41

Income Statement Summary |

“People

building

value

together

to

find

and

produce

energy resources safely, reliably and efficiently”

|