Attached files

| file | filename |

|---|---|

| 10-Q - SNYDERS-LANCE, INC. 10-Q 4-2-2011 - SNYDER'S-LANCE, INC. | form10q.htm |

| EX-32 - EXHIBIT 32 - SNYDER'S-LANCE, INC. | ex32.htm |

| EX-10.3 - EXHIBIT 10.3 - SNYDER'S-LANCE, INC. | ex10_3.htm |

| EX-31.2 - EXHIBIT 31.2 - SNYDER'S-LANCE, INC. | ex31_2.htm |

| EX-10.1 - EXHIBIT 10.1 - SNYDER'S-LANCE, INC. | ex10_1.htm |

| EX-10.4 - EXHIBIT 10.4 - SNYDER'S-LANCE, INC. | ex10_4.htm |

| EX-31.1 - EXHIBIT 31.1 - SNYDER'S-LANCE, INC. | ex31_1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SNYDER'S-LANCE, INC. | Financial_Report.xls |

Exhibit 10.2

SNYDER’S-LANCE, INC.

2011 Three-Year Performance Incentive Plan for Officers and Key Managers

|

Purposes and

Introduction

|

The 2011 Three-Year Performance Incentive Plan for Officers and Key Managers provides for Stock Options, Restricted Stock and Performance Awards under the Snyder’s-Lance, Inc. 2007 Key Employee Incentive Plan (the “Incentive Plan”). Except as otherwise expressly defined herein, capitalized terms shall be as defined in the Incentive Plan.

|

|

|

The primary purposes of the 2011 Three-Year Performance Incentive Plan for Officers and Key Managers (the “2011 Plan”) are to:

|

||

|

•

|

Align officers’ and managers’ interests with those of stockholders by linking a substantial portion of compensation to the price of the Company’s Common Stock and to the Company’s financial performance based on the performance measures specified below.

|

|

|

•

|

Provide a way to attract and retain key executives and managers who are critical to Snyder’s-Lance, Inc. future success.

|

|

|

•

|

Provide competitive total compensation for executives and managers commensurate with Company performance.

|

|

|

To achieve the maximum motivational impact, the Plan and the awards opportunities will be communicated to participants as soon as practical after the 2011 Plan is approved by the Compensation Committee of the Board of Directors.

|

||

|

Each officer will be assigned a Target Incentive based on market and peer group data and each other participant will be assigned a Target Incentive, stated as a percent of base salary. The Chief Executive Officer is assigned a Target Incentive based on his Employment Agreement. Concurrently with the approval of the 2011 Plan, 25% of the Target Incentive will be awarded in the form of Nonqualified Stock Options and 25% will be awarded in the form of Restricted Stock. The final 50% of the Target Incentive will be in the form of a Performance Award payable in cash after the completion of the 2012 and 2013 fiscal years (the “Performance Period”), based on the attainment of predetermined goals.

|

||

1

|

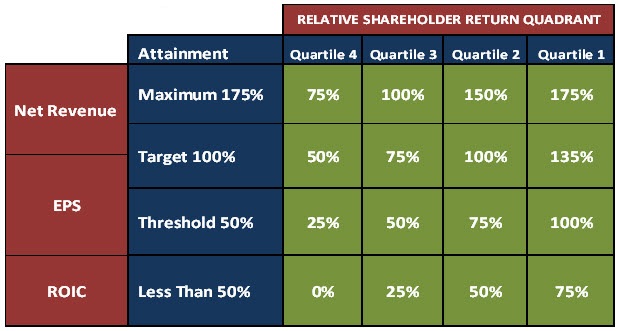

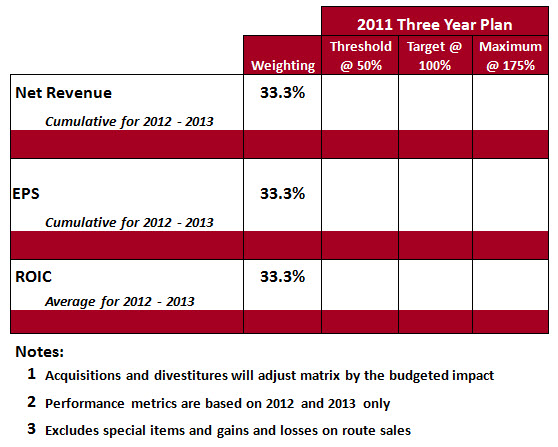

For the 2011 Plan, participants will be eligible to earn the Performance Award based on the matrix on Exhibit A-1 hereto which incorporates the financial performance measures on Exhibit A-2 hereto, excluding special items and adjusted for any acquisition or divestiture related activity, and relative total shareholder return of the peer companies listed on Exhibit A-3 hereto. The financial performance measures and relative total shareholder return are defined as follows:

|

||

| 1. |

Net Revenue (“Net Revenue”) is defined as the cumulative total of the revenue and other operating revenue, net of returns, allowances, discounts and other sales deduction items for the 2012 and 2013 fiscal years, as audited and reported in the Company’s Forms 10-K for the 2012 and 2013 fiscal years.

|

|

| 2. |

Corporate Earnings Per Share (“EPS”) is defined as the cumulative total of the fully diluted earnings per share of the Company for the 2012 and 2013 fiscal years, excluding special items, as audited and reported in the Company’s Forms 10-K for the 2012 and 2013 fiscal years.

|

|

| 3. |

Return on Invested Capital (“ROIC”) is defined as the average of the ROIC for the 2012 and 2013 fiscal years, excluding special items as audited and reported in the Company’s Forms 10-K for the 2012 and 2013 fiscal years, calculated as follows:

|

|

|

Operating Income x (1 - Tax Rate)

|

||

|

Average Equity + Average Net Debt

|

||

|

Operating Income shall be the Company’s actual earnings before interest and taxes, excluding special items, and excluding other income and expense.

|

||

|

Tax Rate for ROIC shall be the Company’s actual total effective income tax rate for each year.

|

||

|

Average Net Debt shall be the Company’s average debt less average cash for each year.

|

||

| 4. |

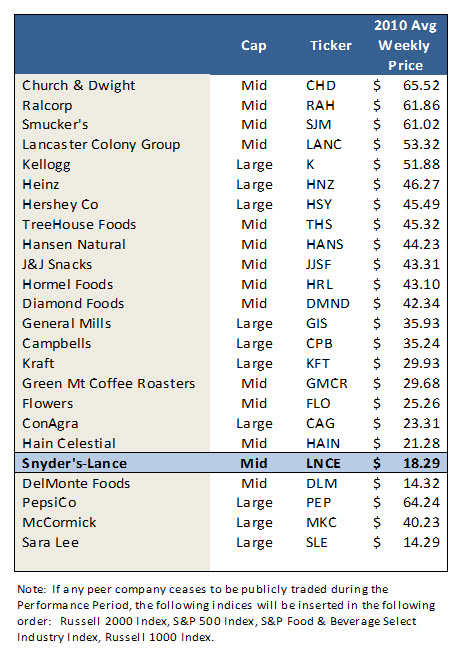

Relative Total Shareholder Return (“RTSR”) is defined as the total shareholder return for Snyder’s-Lance, Inc. relative to a peer group of 24 companies. Each peer company, including Snyder’s-Lance, Inc. will be compared to each other and put into four quadrants ranked from highest total shareholder return to lowest, with the highest in Quadrant One and the lowest in Quadrant Four.

|

|

2

|

Total Shareholder Return is defined as the return of $100 invested in each stock at the beginning of the Performance Period compared to the value of that $100, with dividends reinvested, at the end of the measurement period. The starting number of shares purchased for each peer company, including Snyder’s-Lance, Inc., with $100 will be based on the average weekly stock price for the preceding year 2010 as set forth on Exhibit A-3 hereto. The number of shares for each peer company will be adjusted for stock dividends, stock splits and other similar reorganizations and for special cash dividends. The value of Snyder’s-Lance, Inc. stock has been adjusted for the special cash dividend paid on December 10, 2010.

|

|

|

If any peer company ceases to be publicly traded during the Performance Period, the Russell 2000 Index will be inserted in its place; if a second peer company ceases to be publicly traded, the S&P 500 Index will be inserted in its place; if a third peer company ceases to be publicly traded, the S&P Food & Beverage Select Industry Index will be substituted in its place and if a fourth peer company ceases to be publicly traded, the Russell 1000 Index will be inserted in its place.

|

|

|

Certain executive officers have an additional performance condition based on total pre-tax operating profit, excluding special items, for 2012 and 2013, as described further below.

|

|

|

Base salary shall be the annual rate of base compensation for the 2011 fiscal year which is in effect on February 21, 2011; provided that for any award intended to satisfy the Performance-Based Exception, base salary shall be the annual rate of base compensation for the fiscal year which is set no later than March 31 of such fiscal year.

|

|

|

Notwithstanding the foregoing, for each of Messrs. Singer and Lee, the award to each such participant for the Performance Period shall be equal to % and %, respectively, of the cumulative pre-tax operating profit, excluding special items, for 2012 and 2013, subject to such discretionary reductions as may be made by the Compensation Committee. In considering such reductions, the Committee may take into account the results based on the matrix and performance measures set forth on Exhibits A-1 and A-2 hereto. For this purpose, “pre-tax operating profit” means the Company’s Net Revenue less total cost of goods and operating expenses for the 2012 and 2013 fiscal years.

|

3

|

Eligibility and

Participation

|

Eligibility in the Plan is limited to Executive Officers and Key Managers who are key to Snyder’s-Lance, Inc. success as reviewed and approved on an annual basis. The Compensation Committee will review and approve participants nominated by the Chief Executive Officer. An employee hired or promoted into an eligible position during the Performance Period will not participate in the 2011 Plan. Participation in the 2011 Plan does not guarantee participation in any subsequent long-term incentive plans but will be reevaluated and determined on an annual basis.

|

|

|

Exhibits A-4 and A-5 hereto include the list of 2011 Plan participants approved by the Compensation Committee on February 21, 2011.

|

||

|

Target Incentives and

Performance Measures

|

Each participant will be assigned a Target Incentive as specified above. Participants, other than officers, will be assigned to a Performance Tier by Salary Grade.

|

|

|

Performance Tier

|

Performance Tier Description

|

||

|

1

|

Officer

|

||

|

2

|

Non-Officer Vice President

|

||

|

3

|

Key Managers

|

|

For the Performance Awards, the 2012-2013 financial performance measures are on Exhibit A-2 hereto. Percent of payout will be determined according to the matrix on Exhibit A-1 hereto which encompasses RTSR and the financial performance measures.

|

|

|

The performance measures will be communicated to each participant as soon as practicable after they have been established. Final Performance Awards will be calculated after the Compensation Committee has reviewed the Company’s audited financial statements for 2012 and 2013 and determined the performance level achieved.

|

|

|

Exhibits A-4 and A-5 hereto list the Target Incentives for each participant for the 2011 Plan as determined by the Compensation Committee. Target Incentives will be communicated to each participant as close to the beginning of the year as practicable, in writing. Target Incentives, except for Officers, will be calculated by multiplying each participant’s base salary by the appropriate Performance Tiers and percentages, as described below.

|

4

|

Performance Tier

|

Percentage of Base Salary

for 2011 Target Incentives |

||

|

2

|

35 - 40%

|

||

|

3

|

15 - 30%

|

|

Awards

|

Final Performance Awards will be interpolated and calculated, paid and granted after the Compensation Committee has reviewed the Company’s audited financial statements for 2012 and 2013 and determined the performance levels achieved. Interpolation will be required relative to the financial performance measures but the relative shareholder return quadrant will determine the percentage to be applied. As further specified on Exhibits B-1 and B-2 hereto, the Awards under the 2011 Plan shall be as follows:

|

|

|

|

||

|

1. Stock Options. Each participant shall receive Stock Options equal to 25% in value of his or her Target Incentive. The number of Stock Options awarded to each participant will equal the dollar value of the participant’s Stock Option Incentive divided by the Black-Scholes value of the Stock Options, with the result rounded up to the nearest multiple of three shares.

|

||

|

The grant date for Stock Options will be the date specified by the Compensation Committee upon approval of the awards and the exercise price will be the Fair Market Value of the Common Stock, which is the closing price of the Common Stock, on the grant date. Each Stock Option will vest in three substantially equal annual installments beginning one year after the date of grant and the term of each Stock Option will be ten years.

|

||

|

2. Restricted Stock. Each participant shall receive Restricted Stock equal to 25% in value of his or her Target Incentive. The number of shares of Restricted Stock awarded to each participant will equal the dollar value of the participant’s Restricted Stock Incentive divided by the closing price of the Common Stock on the award date, with the results rounded up to the nearest multiple of three shares.

|

||

| The award date for Restricted Stock will be the date specified by the Compensation Committee upon approval of the awards and the value shall be the Fair Market Value of the Common Stock on the award date. Each award of Restricted Stock will vest in three substantially equal annual installments beginning one year after the award date. | ||

5

|

3. Performance Awards. Each participant shall receive a Performance Award equal to 50% in value of his or her Target Incentive.

|

||

|

For purposes of the 2011 Plan, the award date for cash as a Performance Award will be the date established by the Compensation Committee after completion of the Performance Period and the applicable performance level has been determined.

|

||

|

Form and Timing of

Awards

|

Awards will be made as soon as practicable after the performance level has been determined and approved by the Compensation Committee. All awards will be rounded to the nearest $100.

|

|

|

Change in Status

|

An employee hired or promoted into an eligible position during the Performance Period will not participate in the 2011 Plan.

|

|

|

Certain Terminations

of Employment

|

Performance Awards | |

|

In the event a participant voluntarily terminates employment (other than by Retirement) or is terminated involuntarily during or after the end of the Performance Period but before the applicable award date, the participant shall not receive any Performance Award hereunder.

|

||

|

In the event of a participant’s death or Disability before the end of the Performance Period, any Performance Award will be determined on and prorated to the date of such event based on target performance and paid out all in cash as soon as administratively practicable (but in no event more than 75 days) after the date of such event. In the event of a participant’s death or Disability on or after the end of the Performance Period but before the applicable award date, any Performance Award will be determined based on actual performance and paid out all in cash on or about the applicable award date.

|

||

|

If the event of a participant’s Retirement during or after the end of the Performance Period but before the applicable award date, any Performance Award will be determined based on actual performance and paid out all in cash on or about the applicable award date.

|

||

6

|

Stock Options

|

||

|

In the event a participant voluntarily terminates employment (other than by Retirement) or is terminated involuntarily or in the event of death, Disability or Retirement, vesting and the post-termination exercise period for Stock Options will be as follows:

|

||

|

Voluntary termination (other than Retirement): Vested Stock Options will remain exercisable for a period of 90 days following the date of termination (or, if earlier, the original expiration date of the option); unvested Stock Options will be forfeited as of the date of termination.

|

||

|

Involuntary termination: Vested Stock Options will remain exercisable for a period of 30 days following the date of termination (or, if earlier, the original expiration date of the option); unvested Stock Options will be forfeited as of the date of termination.

|

||

|

Death: Stock Options will remain exercisable for a period of one year following the date of death (or, if earlier, the original expiration date of the option); unvested Stock Options will become fully vested as of the date of termination.

|

||

|

Disability: Vested Stock Options will remain exercisable through the original expiration date of the option; unvested Stock Options will become fully vested as of the date of termination.

|

||

|

Retirement: Vested Stock Options will remain exercisable for a period of three years following retirement (or, if earlier, the original expiration date of the option); unvested Stock Options will continue to vest for a period of six months after Retirement and any remaining unvested Stock Options will be forfeited as of such date.

|

||

|

Restricted Shares

|

||

|

In the event a participant voluntarily terminates employment (other than by Retirement) or is terminated involuntarily or in the event of death, Disability or Retirement, vesting for Restricted Stock (including any Restricted Stock granted in connection with a Performance Award following completion of the Performance Period) will be as follows:

|

||

|

Voluntary termination (other than Retirement): Unvested Restricted Stock will be forfeited as of the date of termination.

|

||

|

Involuntary termination: Unvested Restricted Stock will be forfeited as of the date of termination.

|

||

7

|

Death: Unvested Restricted Stock will become fully vested on the date of such event.

|

||

|

Disability: Unvested Restricted Stock will become fully vested on the date of such event.

|

||

| Retirement: Unvested Restricted Stock will become vested pro rata based on the number of full months elapsed on the date of such event since the award date and any remaining unvested Restricted Stock will be forfeited as of such date. | ||

|

“Retirement” is defined under the Incentive Plan to mean the participant’s termination of employment with the Company either (i) after attainment of age 65 or (ii) after attainment of age 55 with the prior consent of the Compensation Committee.

|

||

|

Change in Control and

Withholding

|

In the event of a Change in Control (which will occur only upon the closing of the relevant transaction), (i) unvested Stock Options and unvested Restricted Stock will vest as provided in the Incentive Plan upon the closing of the Change in Control transaction and (ii) for outstanding Performance Awards pro rata payouts will be made all in cash at target through the closing date with such proration based on the number of days in the Performance Period preceding the closing of the Change in Control transaction. Payouts will be made within 30 days after the relevant transaction has been closed. The Company shall withhold from awards any Federal, foreign, state or local income or other taxes required to be withheld.

|

|

|

Progress reports should be made to participants annually, showing performance results.

|

||

|

Executive Officers

|

Notwithstanding any provisions to the contrary above, participation, awards and pro-rations for Executive Officers, including the Chief Executive Officer, shall be approved by the Compensation Committee.

|

|

|

Stockholder Approval

|

The 2011 Plan and the awards hereunder are made pursuant to the Incentive Plan, which was approved by the Company’s stockholders at the Annual Meeting of Stockholders held on April 26, 2007. | |

8

|

Governance

|

The Compensation Committee of the Board of Directors of Snyder’s-Lance, Inc. is ultimately responsible for the administration and governance of the Plan. Actions requiring Committee approval include final determination of plan eligibility and participation, identification of performance measures and goals, final award components and determination and amendments to the Plan. For purposes of the Plan, acquisition performance will be excluded for the first twelve months after the acquisition and included in the results thereafter. The Committee may adjust any award due to extraordinary events such as acquisitions, dispositions, required accounting adjustments or similar events, all as specified in Section 11(d) of the Incentive Plan; provided, however, that the Committee shall at all times be required to exercise this discretionary power in a manner, and subject to such limitations, as will permit all payments under the Plan to “covered employees,” as defined in Section 162(m) of the Internal Revenue Code, to continue to qualify as “performance-based compensation” for purposes of Section 162(m) of the Code. In addition, under the Incentive Plan, the Committee retains the discretion to reduce any award amount from the amount otherwise determined under the applicable formula. Subject to the foregoing, the decisions of the Committee shall be conclusive and binding on all participants.

|

|

9

Exhibit A-1

Matrix

10

Exhibit A-2

Performance Measures

11

Exhibit A-3

Peer Companies

12

Exhibit A-4

2011 Three-Year Performance Incentive Plan for Officers

|

Target

|

||

|

Name

|

Title |

Incentive

|

13

Exhibit B-1

2011 Three-Year Performance Incentive Plan for Officers

|

Name

|

Stock Option

Incentive

|

Nonqualified

Stock

Options

|

Restricted

Stock

Awards

|

Restricted

Stock

Shares

|

Performance

Award

Opportunity

|

14