Attached files

Q3 and

9-Months Fiscal 2011 Investor/Analyst Call

May 5, 2011

Exhibit 99.2

©

2011 CareFusion

Corporation or one of its subsidiaries. All rights reserved. |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

2

Forward-Looking Statements, GAAP

Reconciliation and ISP Divestiture

“Safe

Harbor”

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

presentation

contains

forward-looking

statements

addressing

expectations,

prospects,

estimates

and

other

matters

that

are

dependent

upon

future events or developments. The matters discussed in these forward-looking

statements are subject to risks and uncertainties that could cause actual results to

differ materially from those projected, anticipated or implied. The most

significant of these uncertainties are described in CareFusion’s Form 10-K, Form

10-Q and Form 8-K reports (including all amendments to those reports) and

exhibits to those reports, and include (but are not limited to) the following: we may be

unable

to

effectively

enhance

our

existing

products

or

introduce

and

market

new

products

or

may

fail

to

keep

pace

with

advances in technology; we are subject to complex and costly regulation; cost containment

efforts of our customers, purchasing groups, third-party payers and governmental

organizations could adversely affect our sales and profitability; current economic

conditions have and may continue to adversely affect our results of operations and financial condition; we

may

be

unable

to

realize

any

benefit

from

our

cost

reduction

and

restructuring

efforts

and

our

profitability

may

be

hurt

or

our business otherwise might be adversely affected; we may be unable to protect our

intellectual property rights or may infringe on the intellectual property rights of

others; defects or failures associated with our products and/or our quality system

could lead to the filing of adverse event reports, recalls or safety alerts and negative publicity and could subject us

to regulatory actions; we are currently operating under an amended consent decree with the FDA

and our failure to comply with the requirements of the amended consent decree may have

an adverse effect on our business; and our success depends on our key personnel, and

the loss of key personnel or the transition of key personnel, including our chief executive

officer, could disrupt our business. This presentation reflects management’s views as of

May 5, 2011. Except to the extent required

by

applicable

law,

we

undertake

no

obligation

to

update

or

revise

any

forward-looking

statement.

Non-GAAP Financial Measures:

The financial information included in this presentation includes Non-GAAP financial

measures.

Reconciliations

can

be

found

on

slides

15

and

16

of

this

presentation.

In

addition,

definitions

and

reconciling

information

can

be

found

on

CareFusion’s

website

at

www.carefusion.com

under

the

Investors

tab.

ISP

Divestiture:

Results

from

the

company’s

International

Surgical

Products

(ISP)

business,

which

had

been

included

in

the Medical Technologies and Services segment and was divested in April 2011, have been

classified as discontinued operations

as

of

Q3

Fiscal

2011.

Reported

results

for

continuing

operations

and

comparisons

to

prior

periods

exclude

the

historical results of the ISP business. |

| ©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

3

Today’s Speakers

•

Kieran Gallahue, Chairman and Chief Executive

Officer

•

Jim Hinrichs, Chief Financial Officer |

Q3 and

9-Months Fiscal 2011 Results

©

2011 CareFusion

Corporation or one of its subsidiaries. All rights reserved. |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

5

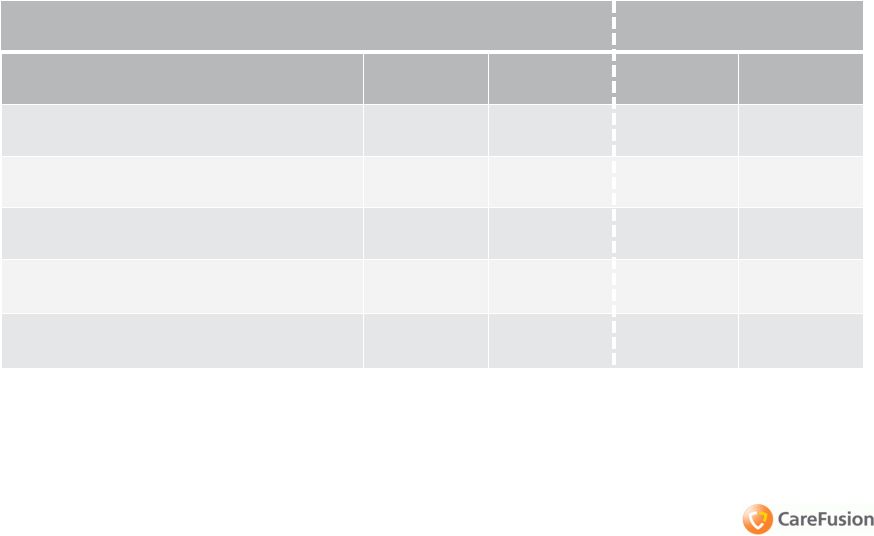

Q3 Fiscal 2011 Year-Over-Year

Quarterly Review

GAAP

Adjusted

$M

% Change

1

$M

% Change

1

Revenue

$867

4%

$867

4%

Operating Expenses

2

$301

(8)%

$292

(6)%

Operating Income

2

$146

70%

$155

49%

Income from Continuing

Operations

2

$86

762%

$94

77%

Diluted EPS from Continuing

Operations

$0.38

733%

$0.42

75%

1

% Change over prior year period.

2

Adjusted amounts are Non-GAAP financial measures that exclude nonrecurring

items primarily related to the spinoff, nonrecurring restructuring and

acquisition integration charges and nonrecurring gain on the sale of assets.

Additionally, in the case of adjusted income from continuing operations and

adjusted diluted earnings per share from continuing operations, nonrecurring tax

items are also excluded. 2 |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

6

Q3 Fiscal 2011 Year-Over-Year

Quarterly Segment Review

GAAP

Adjusted

Critical Care Technologies (CCT)

$M

% Change

1

$M

% Change

1

Revenues

$661

5%

$661

5%

Segment Profit

2

$115

49%

$129

43%

Medical Technologies and Services

(MTS)

$M

% Change

1

$M

% Change

1

Revenues

$206

(1)%

$206

(1)%

Segment Profit

2

$16

78%

$26

86%

1

% Change over prior year

period. 2 Adjusted segment profit is a Non-GAAP financial measure that

excludes nonrecurring items primarily related to the spinoff and nonrecurring restructuring and

acquisition integration charges. During the quarter ended March 31, 2011, the company recognized a $15 million gain on the sale of assets related to

the divestiture of its OnSite Services business, which was not allocated to the segments and is not

reflected in the above results. |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

7

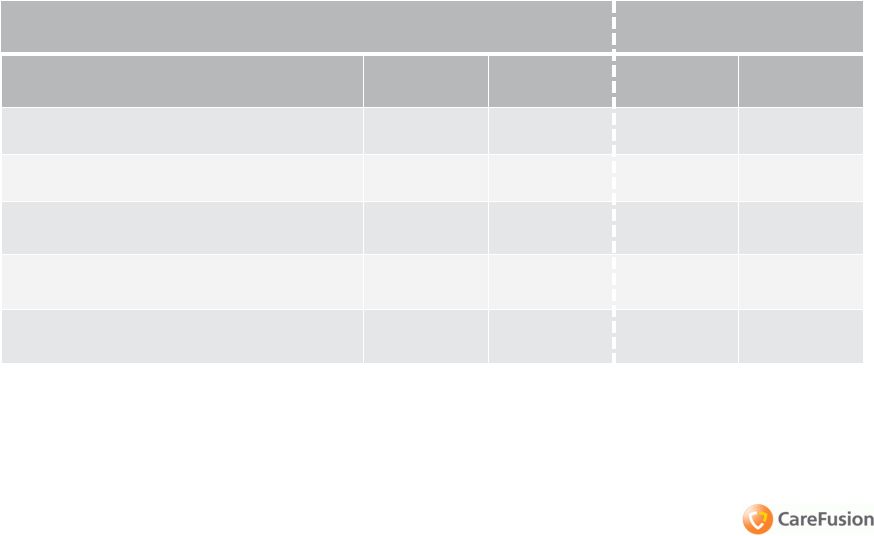

9-Months Fiscal 2011 Review

GAAP

Adjusted

$M

% Change

1

$M

% Change

1

Revenue

$2,564

1%

$2,564

1%

Operating Expenses

2

$958

--

$882

(2)%

Operating Income

2

$347

7%

$423

13%

Income from Continuing

Operations

$195

76%

$253

14%

Diluted EPS from Continuing

Operations

$0.87

74%

$1.13

14%

1

% Change over prior year period.

2

Adjusted amounts are Non-GAAP financial measures that exclude nonrecurring

items primarily related to the spinoff, nonrecurring restructuring and

acquisition integration charges and nonrecurring gain on the sale of assets.

Additionally, in the case of adjusted income from continuing operations and

adjusted diluted earnings per share from continuing operations, nonrecurring tax

items are also excluded. 2

2 |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

8

9-Months Fiscal 2011 Segment

Review

GAAP

Adjusted

Critical Care Technologies (CCT)

$M

% Change

1

$M

% Change

1

Revenues

$1,962

2%

$1,962

2%

Segment Profit

2

$298

3%

$357

9%

Medical Technologies and Services

(MTS)

$M

% Change

1

$M

% Change

1

Revenues

$602

(2)%

$602

(2)%

Segment Profit

2

$34

--

$66

35%

1

% Change over prior year period.

2

Adjusted segment profit is a Non-GAAP financial measure that excludes

nonrecurring items primarily related to the spinoff and nonrecurring restructuring and

acquisition integration charges. During the quarter ended March 31, 2011, the

company recognized a $15 million gain on the sale of assets related to the

divestiture of its OnSite Services business, which was not allocated to the segments and is not reflected in the above results. |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

Fiscal 2011

Guidance |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

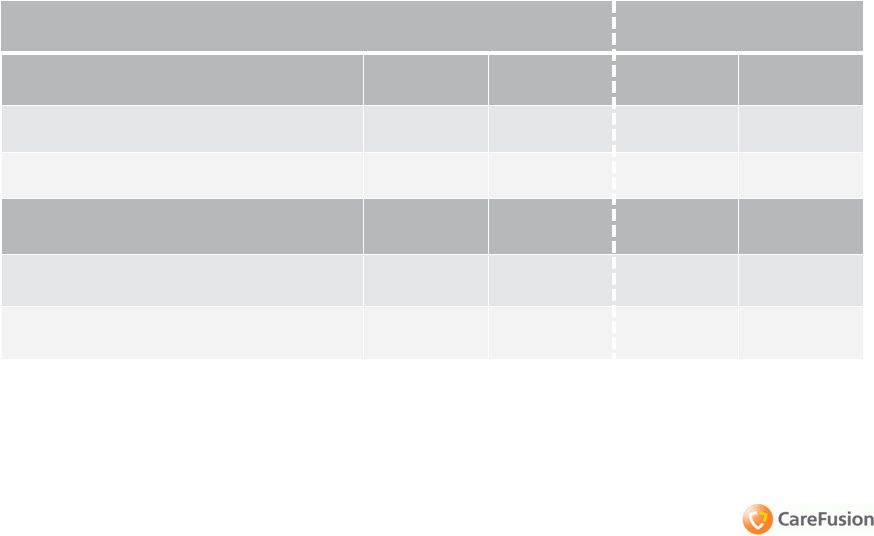

Fiscal 2011 Financial Guidance

May 5, 2011

1

Provided by CareFusion on February 3, 2011.

2

3

Assumes foreign exchange rates as of March 31, 2011.

4

Adjusted amounts are Non-GAAP financial measures that exclude nonrecurring

items primarily related to the spinoff, nonrecurring restructuring and acquisition

integration

charges

and

nonrecurring

gain

on

the

sale

of

assets. Additionally, in the case of adjusted effective tax rate

and adjusted diluted earnings per share

from continuing operations, nonrecurring tax items are also excluded.

5

Nonrecurring items are primarily related to the spinoff and to restructuring and

acquisition integration charges. 10

$ in millions

Previous

FY11

Outlook

1,2

Updated FY11 Outlook

Total Revenue

Low single digit growth over FY10

revenue of $3.5B on a reported and

constant currency basis

Low single digit growth over FY10

revenue of $3.5B on a reported and

constant

currency

basis

Adjusted

Operating

Expenses

4

34% of total revenue

34% of total revenue

Gross Margin

50 –

51%

50 –

51%

Adjusted

Operating

Margin

4

~17%

~17%

Adjusted

Effective

Tax

Rate

4

28 –

30%

28 –

30%

Adjusted

Diluted

EPS From Continuing

Operations

4

$1.58 –

$1.65

$1.60 –

$1.65

Nonrecurring

Items

5

$120

$120

Diluted Weighted Average Shares

Outstanding

~225M

~225M

Capital Expenditures

$150 –

$160

$150 –

$160

3

Reflects impact of the divestitures of OnSite Services and International Surgical Products (ISP)

businesses. Assumes the OnSite divestiture reduces revenues and adjusted diluted EPS by

approximately $13 million and $0.01, respectively, in Q4 FY11. Assumes the ISP divestiture reduces revenues and adjusted diluted

EPS by approximately $440 million and $0.06, respectively, for FY11.

|

| ©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

Updated Fiscal 2011 Revenue and

Adjusted EPS Guidance and Assumptions

Guidance

•

Revenue growth of low single digits

•

Adjusted diluted EPS from continuing operations of

$1.60 to $1.65

Assumptions

•

Hospital capital spending grows low to mid single digits;

customers continue prioritizing spending

•

Q4 revenues and adjusted earnings increase year-over-year

and sequentially from Q3 based on trends in capital

equipment

businesses

and

growth

in

our

ChloraPrep

®

business

•

Foreign exchange rates remain at March 31, 2011 levels

11 |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

12

Updated Fiscal 2011 CCT Segment-related

Assumptions vs. Fiscal 2010 Results

•

Segment revenue grows on a percentage basis by

low to mid single digits

Infusion:

Revenues grow on a percentage basis in the low

teens due to Medegen acquisition and from incremental

market share gains in 2H FY11 following FDA requirement

for Baxter to remove its Colleague pump base within two

years

Respiratory:

Revenues are down mid to high single digits

year-over-year as sales related to H1N1 have not

reoccurred this year

Dispensing:

Revenues grow on a percentage basis by low

to mid single digits |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

13

Updated Fiscal 2011 MTS Segment-related

Assumptions vs. Fiscal 2010 Results

•

Segment revenue essentially flat

ChloraPrep

®

business:

Grows double digits based on

successful execution of growth strategy both domestically

and internationally

International Surgical Products divested: Closed in April 2011

and included in discontinued operations as of Q3 FY11

OnSite Services divested:

Closed in March 2011 and was

not classified as discontinued operations; negatively

impacts top line by $13 million and adjusted diluted EPS

by $0.01 in Q4 FY11

Research Services divested:

Closed in May 2010 and was

not classified as discontinued operations; negatively

impacts top line by $59 million in FY11 |

Q&A

©

2011 CareFusion

Corporation or one of its subsidiaries. All rights reserved. |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

15

Q3 Fiscal 2011 Non-GAAP

Reconciliations

$ in millions

Q3 FY11

GAAP

Nonrecurring

Items

Q3 FY11

Adjusted

Operating Expenses

1

$301

$(9)

$292

Operating Income

1

$146

$9

$155

Income From Continuing

Operations

1

$86

$8

$94

Diluted EPS From Continuing

Operations

1

$0.38

$0.03

$0.42

Critical Care Technologies

Segment Profit

2

$115

$14

$129

Medical Technologies and Services

Segment

Profit

2

$16

$10

$26

1

2

The nonrecurring items in the table above include items primarily related to the spinoff,

restructuring and acquisition integration charges and gain on the sale of assets. Additionally,

in the case of income from continuing operations and diluted earnings per share from continuing operations, nonrecurring items also include

tax items.

The nonrecurring items in the table above include items primarily related to the spinoff

and restructuring and acquisition integration charges. During the quarter ended March 31, 2011,

the company recognized a $15 million gain on the sale of assets related to the divestiture of its OnSite Services business, which was not

allocated to the segments and is not reflected in the above results.

reasons why management believes that the presentation of non-GAAP financial measures provides

useful information to investors regarding the company’s financial condition and results of

operations is included in Exhibit 99.3 of Form 8-K filed by the company on May 5, 2011.

Note:

A

full

GAAP

to

non-GAAP

reconciliation

can

be

found

on

CareFusion’s

website

at

www.carefusion.com

under

the

Investors

tab.

A

discussion

of

the |

©

2011 CareFusion Corporation or one of its subsidiaries. All rights reserved.

16

9-Months Fiscal 2011 Non-GAAP

Reconciliations

$ in millions

9-Months FY11

GAAP

Nonrecurring

Items

9-Months FY11

Adjusted

Operating Expenses

1

$958

$(76)

$882

Operating Income

1

$347

$76

$423

Income From Continuing

Operations

1

$195

$58

$253

Diluted EPS From Continuing

Operations

1

$0.87

$0.26

$1.13

Critical Care Technologies

Segment Profit

2

$298

$59

$357

Medical Technologies and Services

Segment Profit

2

$34

$32

$66

reasons why management believes that the presentation of non-GAAP financial measures provides

useful information to investors regarding the company’s financial condition and results of

operations is included in Exhibit 99.3 of Form 8-K filed by the company on May 5, 2011.

Note:

A

full

GAAP

to

non-GAAP

reconciliation

can

be

found

on

CareFusion’s

website

at

www.carefusion.com

under

the

Investors

tab.

A

discussion

of

the

1

2

The nonrecurring items in the table above include items primarily related to the spinoff,

restructuring and acquisition integration charges and gain on the sale of assets. Additionally,

in the case of income from continuing operations and diluted earnings per share from continuing operations, nonrecurring items also include

tax items.

The nonrecurring items in the table above include items primarily related to the spinoff and

restructuring and acquisition integration charges. During the quarter ended March 31, 2011, the

company recognized a $15 million gain on the sale of assets related to the divestiture of its OnSite Services business, which was not

allocated to the segments and is not reflected in the above results.

|