Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KEMPER Corp | d8k.htm |

1

Shareholder Meeting

May 4, 2011

EXHIBIT 99.1 |

CEO’s Remarks

Donald G. Southwell

Chairman, President & Chief Executive Officer |

| Explanatory Note:

This presentation may contain or incorporate by reference information that includes

or is based on forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934. Forward-looking statements give expectations or forecasts of future

events. These statements can be indentified by the

fact

that

they

do

not

relate

strictly

to

historical

or

current

facts.

They

use

words

such

as

“believe(s),”

“goal(s),”

“target(s),”

“estimate(s),”

“anticipate(s),”

“forecast(s),”

“project(s),”

“plan(s),”

“intend(s),”

“expect(s),”

“might,”

“may”

and other words and

terms of similar meaning in connection with a discussion of future operating

financial performance or financial condition. Forward-looking

statements, in particular, include statements relating to future actions, prospective services or products,

future performance or results of current and anticipated services or products,

sales efforts, expenses, the outcome of contingencies such as legal

proceedings, trends in operations and financial results. These statements are

based on current expectations and the current economic environment. They involve a number of risks

and uncertainties that are difficult to predict. These statements are not

guarantees of future performance; actual results could differ materially from

those expressed or implied in the forward-looking statements. Forward-looking statements can be

affected by inaccurate assumptions or by known or unknown risks and

uncertainties. No assurances can be given that the results

contemplated in any forward-looking statements will be achieved or will be achieved in any particular timetable. The

Company assumes no obligation to publicly correct or update any forward-looking

statements as a result of events or developments subsequent to the date of

this presentation. The reader is advised, however, to consult any further disclosures

Unitrin makes on related subjects in its filings with the SEC.

Non-GAAP Measures:

This presentation contains non-GAAP financial measures to analyze the

company’s operating performance for the periods presented in this

presentation. Because Unitrin’s calculation of these measures may differ from similar

measures used by other companies, investors should be careful when comparing

Unitrin’s non-GAAP financial measures to those of other

companies. For detailed disclosures on non-GAAP financial measures included in this

presentation and their GAAP reconciliations, where warranted, please refer to the

discussion at the end of this presentation, which is also posted on the

Unitrin website at www.unitrin.com. |

Unitrin Overview

2010 Performance

-

Financial Highlights

-

Investments

-

Capital

Segment Operating Results

Fireside Bank Update

1st Quarter Performance

Priorities

Today’s Agenda |

Unitrin Overview

A multi-line insurer with a national footprint

–

22

nd

largest

personal

lines

writer

and

20

th

largest

auto

insurer

in

the

United

States

(1)

–

Auto, home and basic protection products

–

Multi-channel distribution network

Conservative balance sheet with strong liquidity

–

$8.4billion

assets,

$2.1billion

shareholders’

equity,

22%

debt

to

capital

ratio

–

94% of fixed maturity portfolio rated investment grade

History of opportunistic acquisitions and successful integration

Experienced management team with long-term association with the Company

|

2010

Performance |

2010

Financial Highlights Net Income: $184

$95

$70

$19

Life &

Health

P&C

Other

Revenues:

Earned Premium:

Solid earnings performance in 2010

–

A focus on maintaining margins amidst soft P&C

pricing environment and slow, general recovery

–

Revenues declined modestly with tighter

underwriting and pricing actions

–

Unusual Q4 winter storms ~($15 million) impact

Fireside exceeded expectations

Reduced selective concentrations in

investment portfolio to lower risk and

volatility; yields maintained

Re-financed senior debt

($ Millions)

$2,289

$2,743 |

Investment Portfolio

Well diversified across asset classes

–

Low single-name exposure limits

–

Partnerships / LLC’s spread across multiple

funds and managers

–

~50 real estate properties, Essentially debt free

Solid liquidity and strong new cash flows

Equities (3)

$550

Real

Estate

$250

Other (2)

$245

LP

LLC

$328

Short

Term

$403

Fixed Maturities

$4,475

72%

34%

6%

9%

5%

4%

4%

$6,251

Pre-tax Equiv. Book

Yield

6.2%

Gross Unrealized G / (L)

$335

Average Duration (4)

~7 years

Corporate

Bonds

$2,145

States &

Political

Subdivisions

$1,344

US Gov’t

Bonds

$537

Pre-refunded -

backed by US

Gov’t Securities

$449

22%

9%

7%

Reported $328 million of Net Investment

Income

($ Millions) |

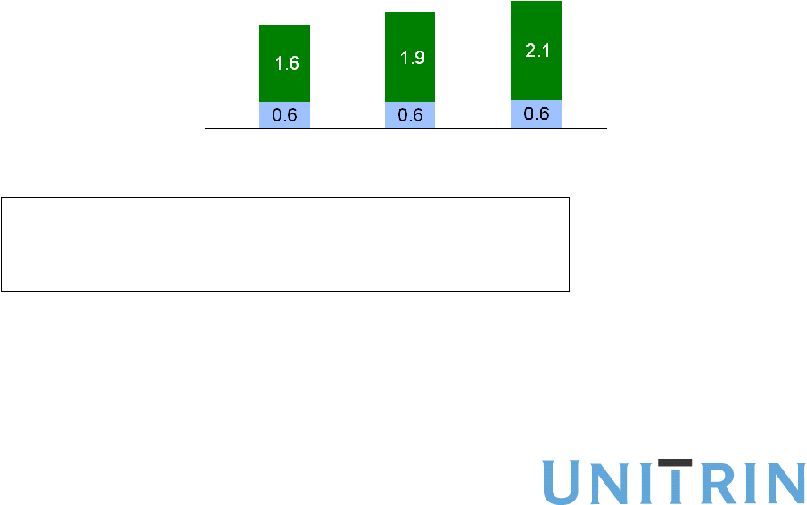

Capital & Liquidity

2008

2009

2010

$2.2

$2.5

$2.7

Total Capital

Senior Debt

Shareholders Equity

Debt to Total Capital

25%

23%

22%

Interest Coverage (5)

4x

7x

7x

Hold Co. Facility ($ Millions)

$312

$245

$245

Balance sheet flexibility continues to improve

–

Portfolio shifts since the economic crisis reduced overall sensitivity to market

fluctuations

–

Liquidity remains high and interest coverage ratios have improved

significantly –

Well positioned to fund growth AND manage risks

($ Billions) |

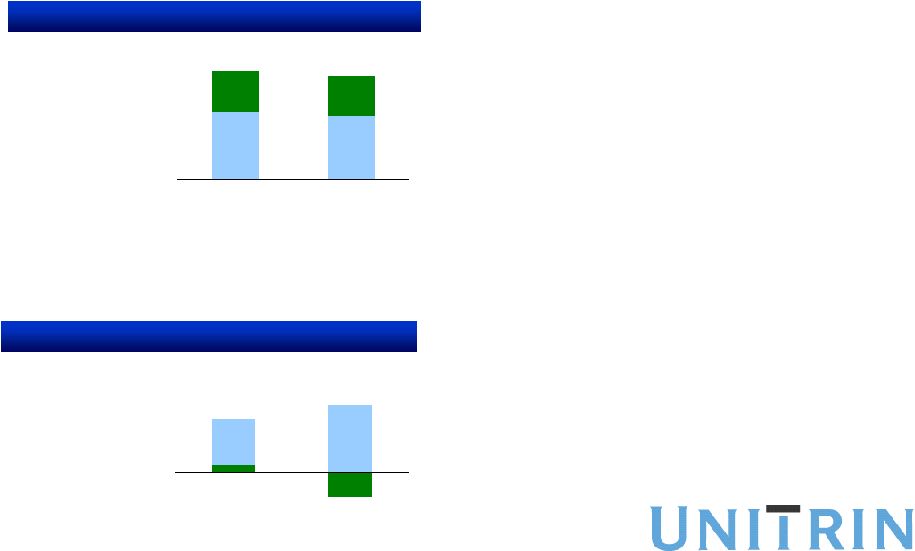

Focused on Shareholder Value

Book Value

Per Share

Dividends Paid

2009

2010

$30.75

$1.07

UTR Share Price

Earnings Per Share

$2.64

$2.98

$0.89

$34.61

$35.01

3/31/11

$0.88

$0.24

2009

2010

3/31/11

2009

2010

Q1 ‘11

$22.05

$24.54

$30.88

Price to Book

0.72x

0.71x

0.88x

Payout Ratio (6)

41%

30%

27%

Book value has recovered well since

crisis through both earnings and asset

valuations

Share price has increased closer to

book value

Adjusted dividend to $0.20 during the

economic crisis & subsequently

increased twice

Repurchased $22 million of common

stock in the first quarter of 2011 |

Capital Deployment Priorities

1.

Fund Organic Growth

Maintain or improve margins in all lines

Build growth capital while pricing environment recovers

2.

Acquisitions

Bolt-on Standard & Preferred opportunities

Geographic expansion in Non-standard

Leverage scale in Life operations

$300 million program approved February 2011

Maintain a flexible, measured approach

3.

Dividends

Remain competitive

4.

Share Repurchase |

Operating Results |

Kemper Segment

Auto

2009

2010

2009

2010

585

545

56

81

8

(30)

Catastrophes &

Reserve Development

Underlying Net Income

*

Earned Premiums

347

343

$932

$888

Homeowners

& Other

Underlying

Combined Ratio

*

96.7% 93.6%

Net Income

$64

$51

Focused on improving profit margins

–

Disciplined underwriting approach

–

Mix shift towards packaged offerings

–

Underlying combined ratio improved 300bps

Ongoing assessment of catastrophe risk;

no shift in strategy identified

–

Overall frequency increasing, particularly

tornados, hail and wind

Underlying Net Income up >40%

Net Income

as Reported

* Non-GAAP

measure discussed at the end of this presentation. ($ million)

|

* Non-GAAP measure discussed at the end of this presentation.

Unitrin Specialty Segment

Personal

2009

2010

2009

2010

472

431

21

25

3

(5)

Earned Premiums

56

44

$528

$475

Commercial

Underlying

Combined Ratio

*

98.9%

98.7% Net Income

$24

$20

Specialty non-standard market remains

highly competitive

–

Significant downward pricing pressure in

commercial lines

–

Business remains focused on maintaining

margins; top line declined ~10%

Selectively re-pricing as needed, while

launching auto product with improved risk

and pricing segmentation

Net Income

as Reported

Underlying Net Income

*

Catastrophes &

Reserve Development

($ million) |

Unitrin Direct Segment

2009

2010

6

3

(11)

(4)

Earned Premiums

Underlying

Combined Ratio

*

111.9%

111.9% Net Loss

($5)

($1)

All Lines

2009

2010

$346

$282

Transition continues on several fronts…

Product & distribution

–

New product launched late 2010; in 13 states

–

Offering both auto & home

–

Redesigned customer online experience

Platform integration

–

Consolidating acquisition infrastructure

–

Leveraging broader P&C shared services

Focused on Profitability Improvement

Net Loss

as Reported

Underlying Net Loss

*

Catastrophes &

Reserve Development

* Non-GAAP

measure discussed at the end of this presentation. ($ million)

|

Life & Health Insurance Segment

Life

2009

2010

2009

2010

400

110

(15)

$112

$95

Goodwill Write-off

Net Income

Ex-GW Write-off

*

Earned Premiums

159

92

$651

397

162

85

$644

Accident & Health

Property

Net Income

Life and Health continued to perform well

Top line steady amidst tough economic

cycle

Retention of Career Agents improved; well

positioned for 2011

Reserve National reported strong results

despite the uncertainties of national

healthcare reform

Earnings stable excluding unusual non-cash

goodwill charge

112

* Non-GAAP

measure discussed at the end of this presentation. ($ million)

|

Fireside Bank Update |

Wind-down plan ahead of schedule

Receivables down ~75% since 3/09

All deposits paid off in April 2011…have

initiated actions to turn in bank charter by

end of 2011

Begin returning $250+ million of capital

without FDIC restriction by year-end …

strong cash flows forecasted

Fireside Bank

Certificates of Deposits

$321

$1,054

$0

3/31/09

12/31/10

4/30/11

Net Automobile Loan Receivables

$381

$1,125

$290

3/31/09

12/31/10

4/30/11E

Tier One Capital Ratio (7)

16%

37%

53%

3/31/09

12/31/10

4/30/11E

Now in final phase of wind-down

($ million) |

1

Quarter

Performance

st |

1

st

Quarter 2011 Performance

Net Income: $54

$33

$12

$9

Life &

Health

P&C

Other

Revenues:

$657 Earned Premium: $546

Solid earnings growth of 12%

–

Life & Health performed ahead of expectations +

favorable unusual adjustment

–

Fireside contributed $8 million in Net Income

–

P&C earnings decreased; less favorable

development and higher auto losses

Evaluating impact of Q2 Catastrophes

Teams focused on meeting customer needs

($ million) |

| Priorities

Surrender bank charter and begin repatriation of Fireside capital

Position A&H product suite to adapt to healthcare reform evolution

Remain disciplined in a competitive P&C environment

Transition Direct business to sustainable profitability

Enhance risk management framework and tools

Deploy

excess

capital

to

opportunities

accretive

to

earnings

and

ROE

–

Organic top line growth where target margins can be achieved

–

Acquisitions with a special focus on standard and preferred personal lines

–

Flexible buy-back program |

22 |

Non-GAAP Measures

Underlying Combined Ratio

The Life & Health Net Income excluding a Goodwill Write-off

Underlying Net Income and Underlying Net Loss

is a non-GAAP measure, which is computed by adding the Current Year

Non-catastrophe Losses and LAE Ratio with the Incurred Expense Ratio.

The most directly comparable GAAP financial measure is the combined ratio,

which uses total incurred losses and LAE, including the impact of catastrophe losses, and loss

and LAE reserve development. We believe the Underlying Combined Ratio is useful to

investors and is used by management to reveal the trends in our Property

and Casualty businesses that may be obscured by catastrophe losses

and

prior

prior-year

reserve

development.

These

catastrophe

losses

may

cause

our

loss

trends

to

vary

significantly between periods as a result of their incidence of occurrence and

magnitude, and can have a significant impact on incurred losses and LAE and

the Combined Ratio. Prior Prior-year reserve developments are caused by

unexpected loss development on historical reserves. Because reserve development

relates to the re-estimation of losses from earlier periods, it has no

bearing on the performance of our insurance products in the current period.

We believe it is useful for investors to evaluate these components separately and

in the aggregate when reviewing our underwriting performance. The

Underlying Combined Ratio should not be considered a substitute for the

Combined Ratio and does not reflect the overall underwriting profitability of our

business. is a non-GAAP measure, which is computed as reported

Life and Health Insurance segment Net Income, excluding a 2010 Reserve National

Goodwill write-off. The most directly comparable GAAP measure is the

Total Life and Health Insurance segment Net Income. We believe the P&C

and Life net income excluding a Goodwill write-off is useful to investors and

is used by management to reveal the trends in business.

are non-GAAP measures, which are computed as net income or loss

reported by the segment, excluding the effect of catastrophes and reserve

development. The most directly comparable GAAP measure is the respective

segment’s net income or loss. We believe that underlying Net Income and

Underlying Net Loss are useful to investors and are used by management to

reveal the trends in our Property and Casualty business that may be

obscured by catastrophe losses and prior year reserve development. |

Reconciliation of Non-GAAP Measure

UNDERLYING COMBINED RATIOS:

Kemper:

2009

2010

Underlying Combined Ratio

96.7%

93.6%

Catastrophe Losses (excluding reserve development)

5.1%

7.9%

Loss Reserve Development (Favorable) Unfavorable

(6.5)%

(2.7)%

GAAP Reported Combined Ratios

95.3%

98.8%

Unitrin Specialty:

2009

2010

Underlying Combined Ratio

98.9%

98.7%

Catastrophe Losses (excluding reserve development)

0.8%

0.6%

Loss Reserve Development (Favorable) Unfavorable

(1.5)%

0.8%

GAAP Reported Combined Ratios

98.2%

100.1%

Unitrin Direct:

2009

2010

Underlying Combined Ratio

111.9%

111.9%

Catastrophe Losses (excluding reserve development)

0.9%

0.6%

Loss Reserve Development (Favorable) Unfavorable

(3.5)%

(2.4)%

GAAP Reported Combined Ratios

109.3%

110.1% |

Footnotes

(1)

Source: SNL Financial based on 2010 Direct Premium Written

(2)

Primarily loans to policyholders

(3)

Includes $125 million of Preferred Stock

(4)

Average Duration is the average option adjusted duration weighted by market value

at the measurement date for Unitrin’s Life Insurance and Property and

Casualty Insurance assets under management consisting of the following

asset classes: Cash and Short Term, Fixed Income Securities, and

Preferred Stocks treated as Equity securities on our GAAP financials.

(5)

Interest Coverage is calculated as (Unencumbered Parent Company Cash + Maximum

Ordinary Dividend) / Interest on Senior Debt.

(6)

Payout

Ratio

is

the

dividends

paid

by

Unitrin

as

a

percentage

of

Unitrin’s

Net

Income.

(7)

Ratio of Tier 1 Capital to total average assets |