Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QCR HOLDINGS INC | f8k_050411.htm |

WELCOME

2011 Annual Meeting of Stockholders

May 4, 2011

James J. Brownson, Chairman

QCR Holdings, Inc.

Brief Financial Review

Key Industry Issues

QCR Holdings, Inc. Strategic Direction

SEC Disclosure

Some of the information we will be providing today falls

under the guidelines for forward-looking statements as

defined by the SEC.

under the guidelines for forward-looking statements as

defined by the SEC.

As part of these guidelines, we must point out that any

statements made during this meeting that discuss our

hopes, beliefs, expectations or predictions of the future

are forward-looking statements, and our actual results

could differ materially from those projected. Additional

information on these factors is included from time to time in

our 10-K and 10-Q filings which can be obtained

by contacting the Company or the SEC.

statements made during this meeting that discuss our

hopes, beliefs, expectations or predictions of the future

are forward-looking statements, and our actual results

could differ materially from those projected. Additional

information on these factors is included from time to time in

our 10-K and 10-Q filings which can be obtained

by contacting the Company or the SEC.

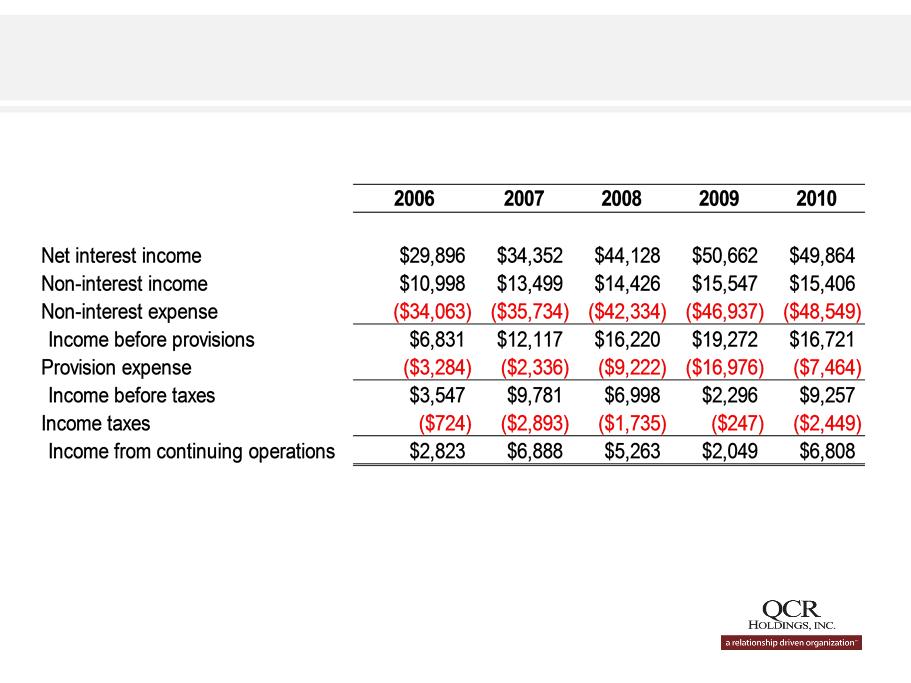

Summary of Financial Results 2006 - 2010

Source: SNL Financial

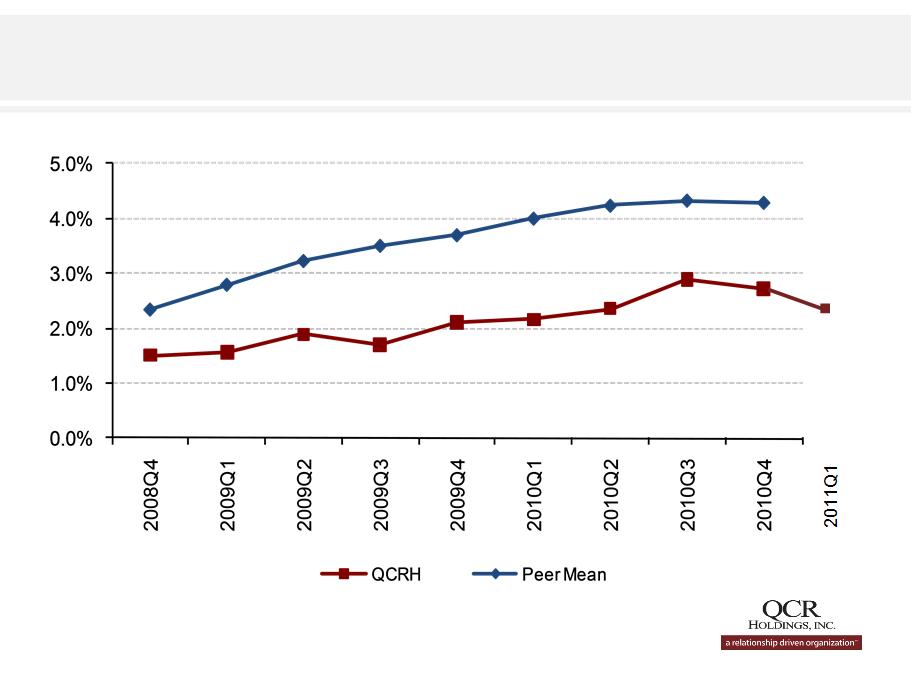

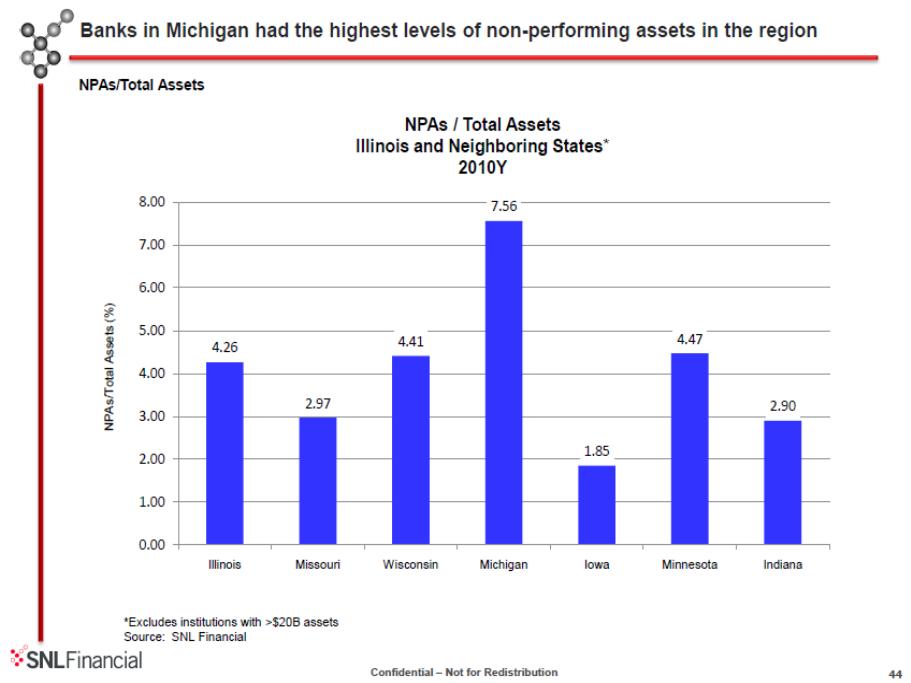

NPAs / Total Assets

4.34%

2.73%

2.36%

Source: SNL Financial

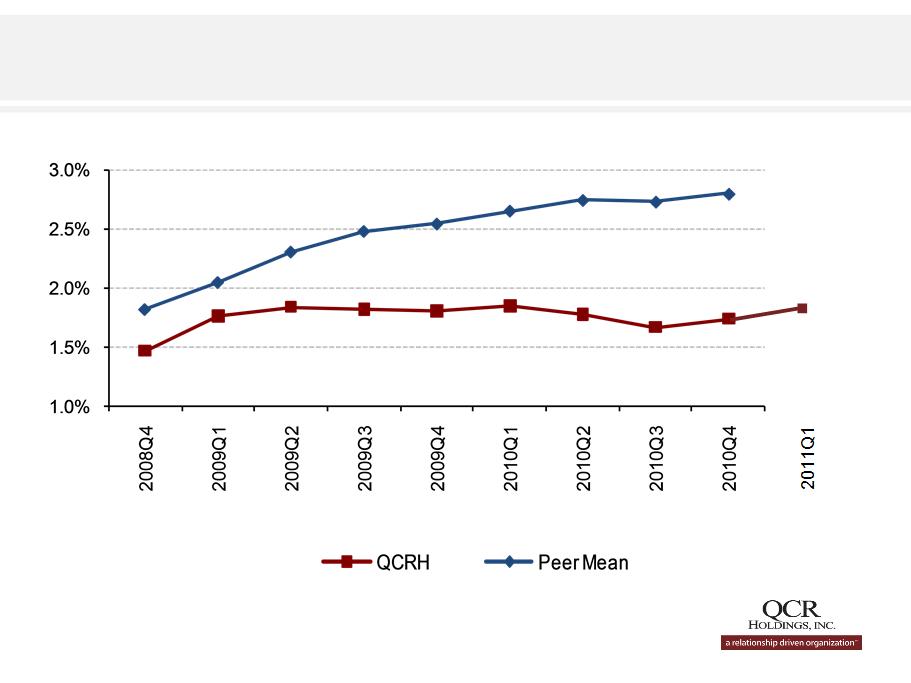

Reserves / Loans

2.79%

1.74%

1.79%

Source: SNL Financial

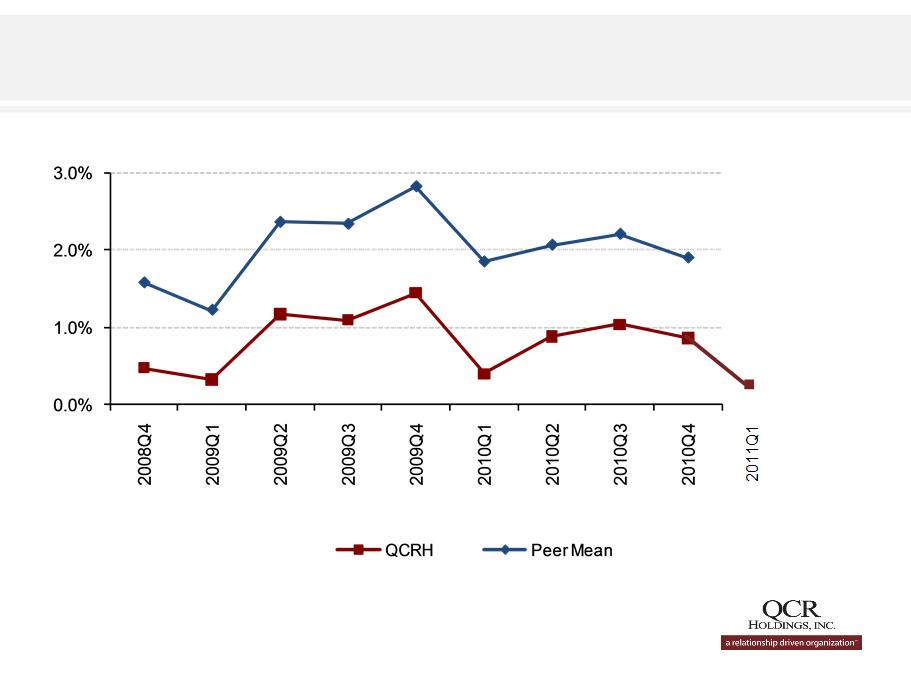

NCOs / Average Loans

.87%

1.90%

.24%

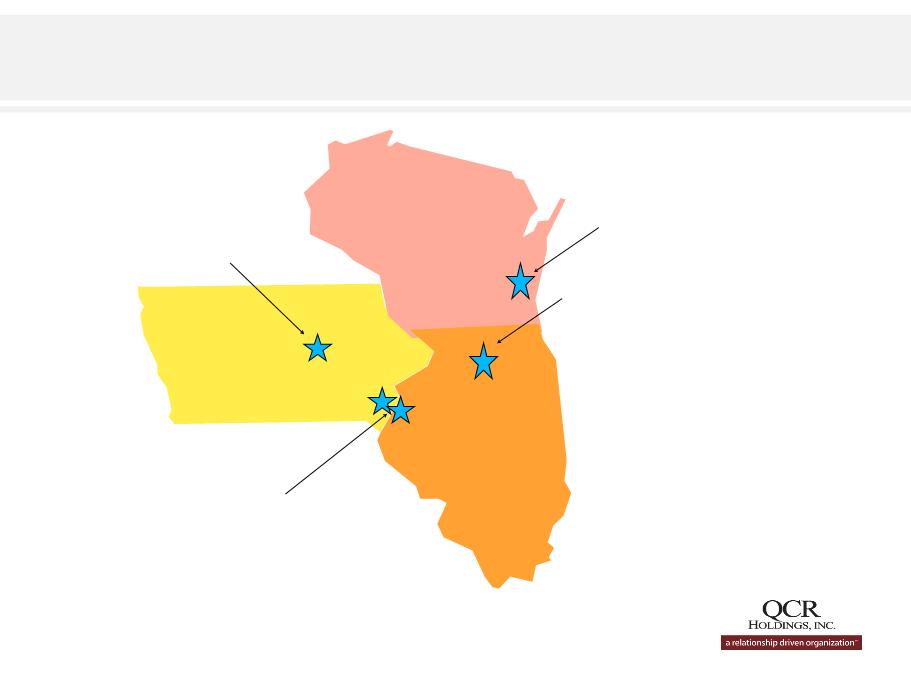

Rockford, IL

Quad Cities, IA & IL

Cedar Rapids, IA

Brookfield, WI

QCR Holdings, Inc. Subsidiary Locations

First Quarter 2011 Market Composites*

Total Return

Quarter One Year

Stocks

Dow Jones Industrial Average 7.07% 16.49%

Standard & Poor 500 5.92% 15.65%

Large-Cap Core 5.41% 13.47%

Multi-Cap Core 6.07% 16.69%

U.S. Diversified Equity Fund Average 6.04% 17.65%

Bonds

Short-Intermediate U.S. Government 0.10% 2.59%

Intermediate U.S. Government 0.03% 3.68%

Short-Intermediate Municipal Debt 0.39% 1.86%

Intermediate Municipal Debt 0.62% 2.08%

* Source: Barrons - Lipper Mutual Funds Quarterly - 4/9/11

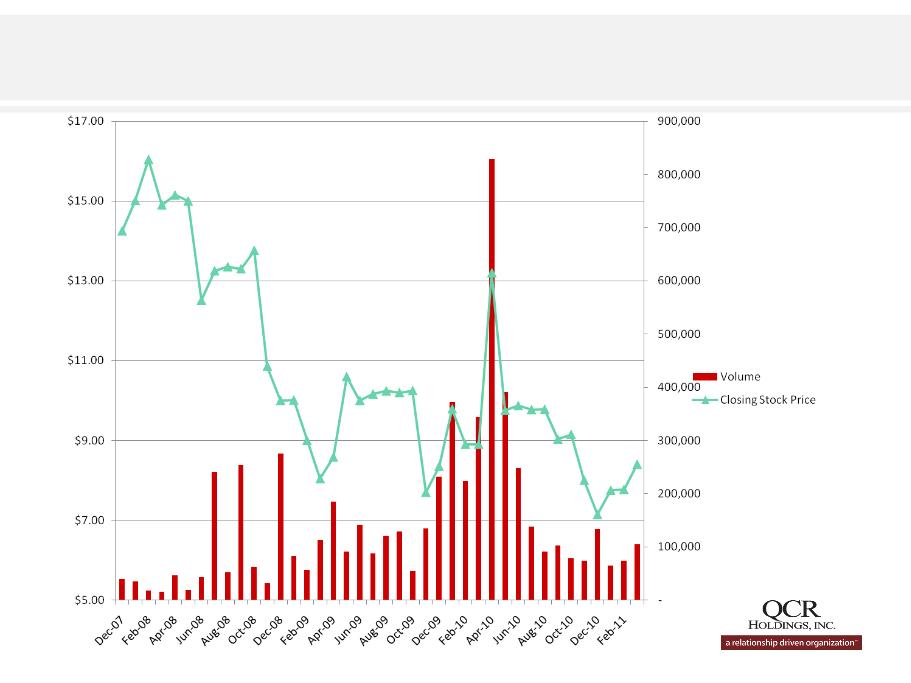

QCR Holdings, Inc. Closing Stock Price and Volume Last 3

years

years

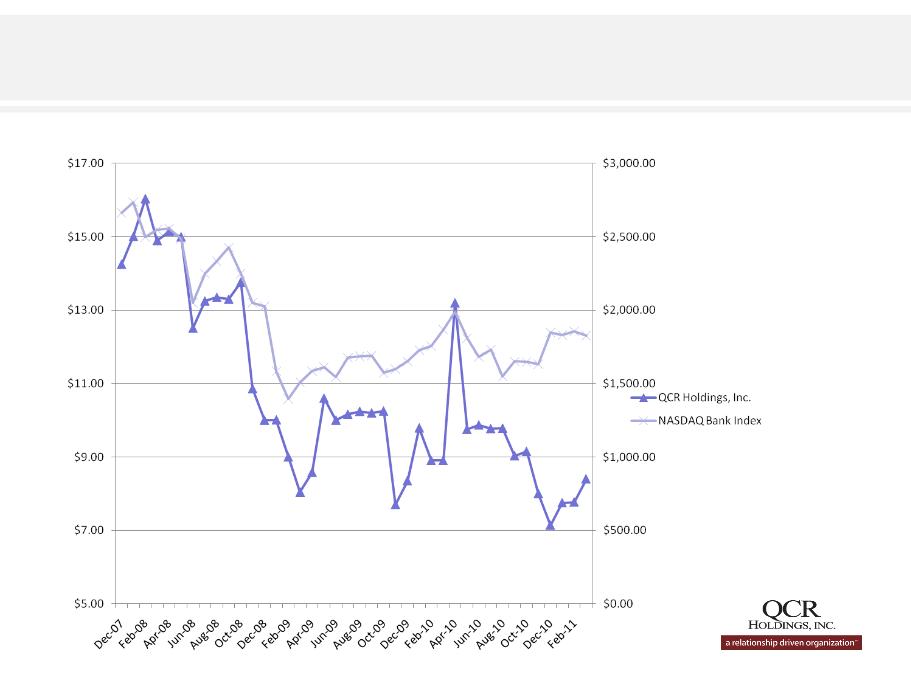

Closing Price - QCR Holdings, Inc. and NASDAQ Bank

Index Last 3 years

Index Last 3 years

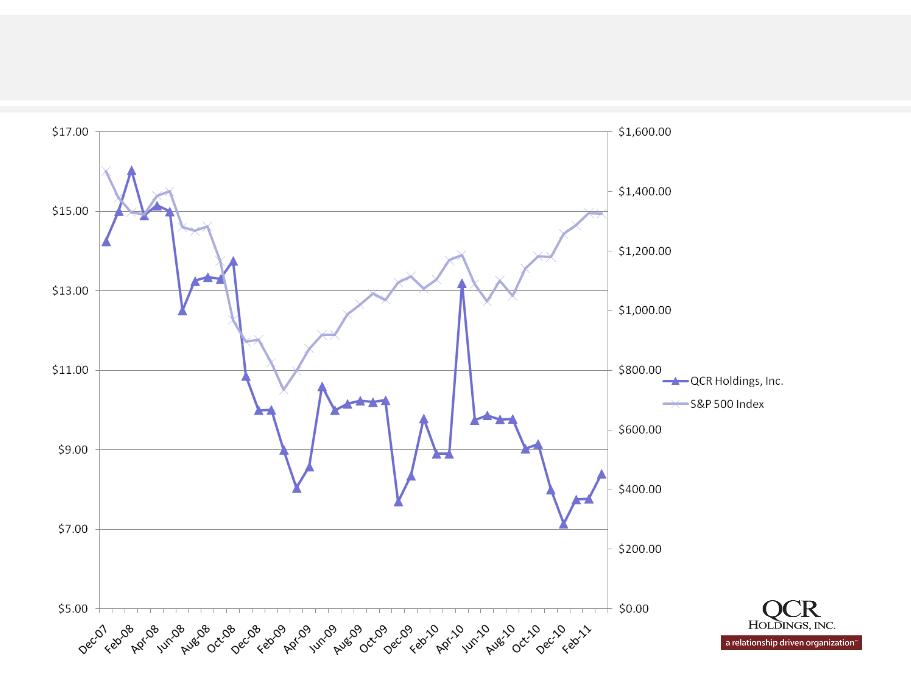

Closing Price - QCR Holdings, Inc. and S&P 500 Index

Last 3 years

Last 3 years

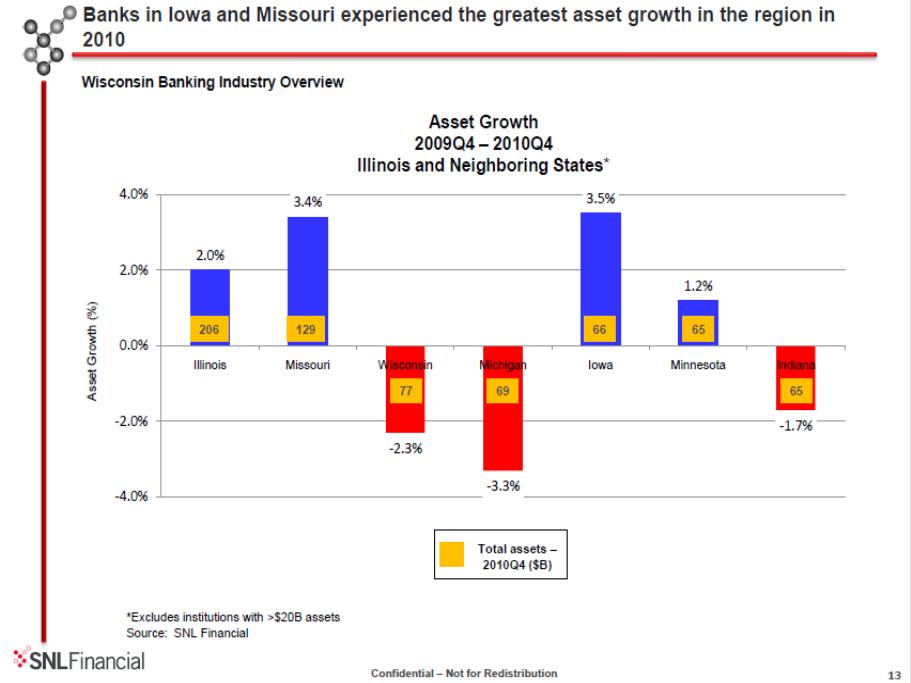

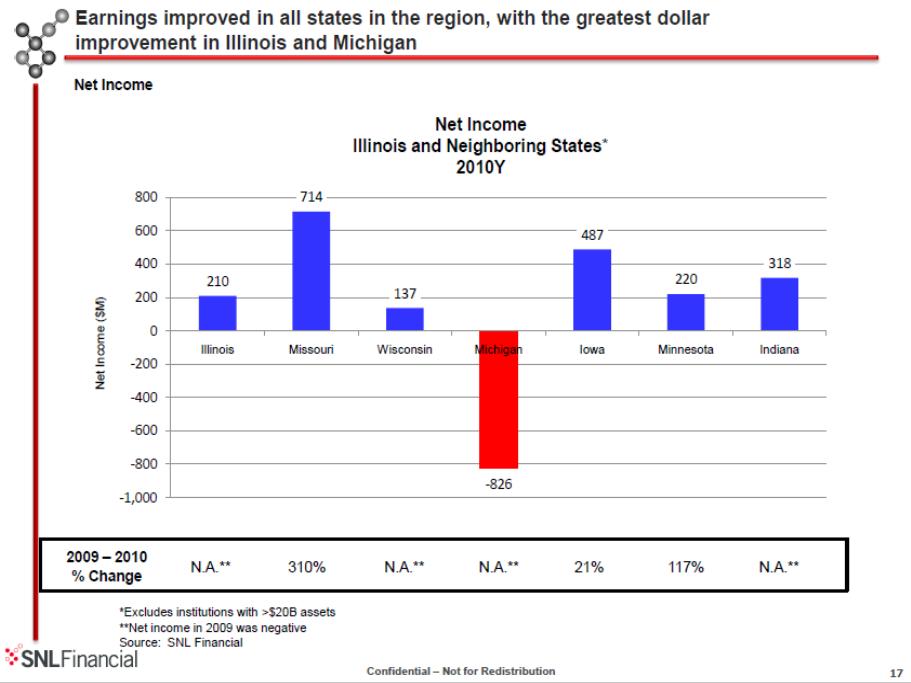

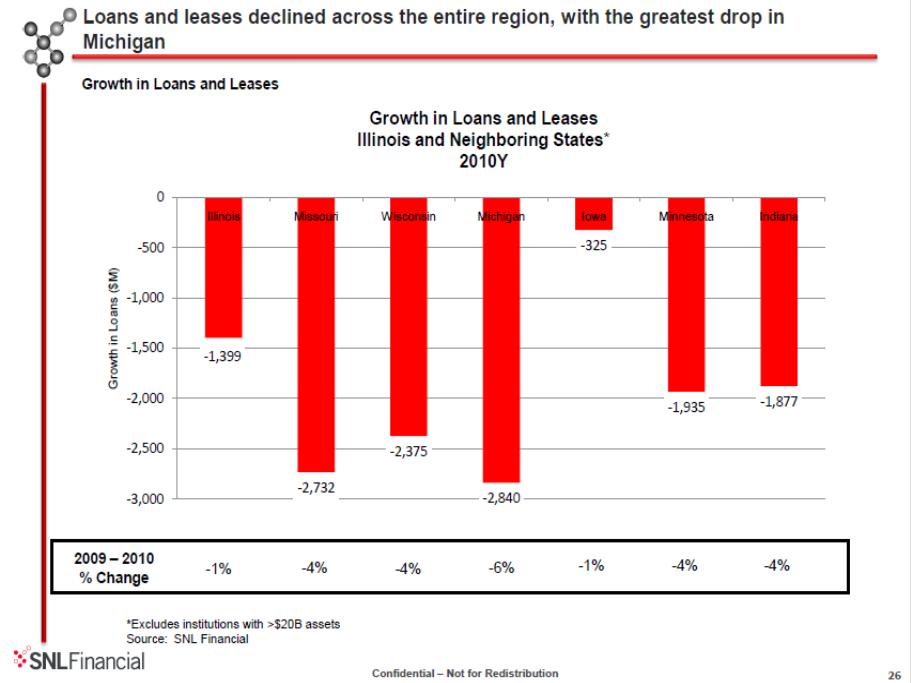

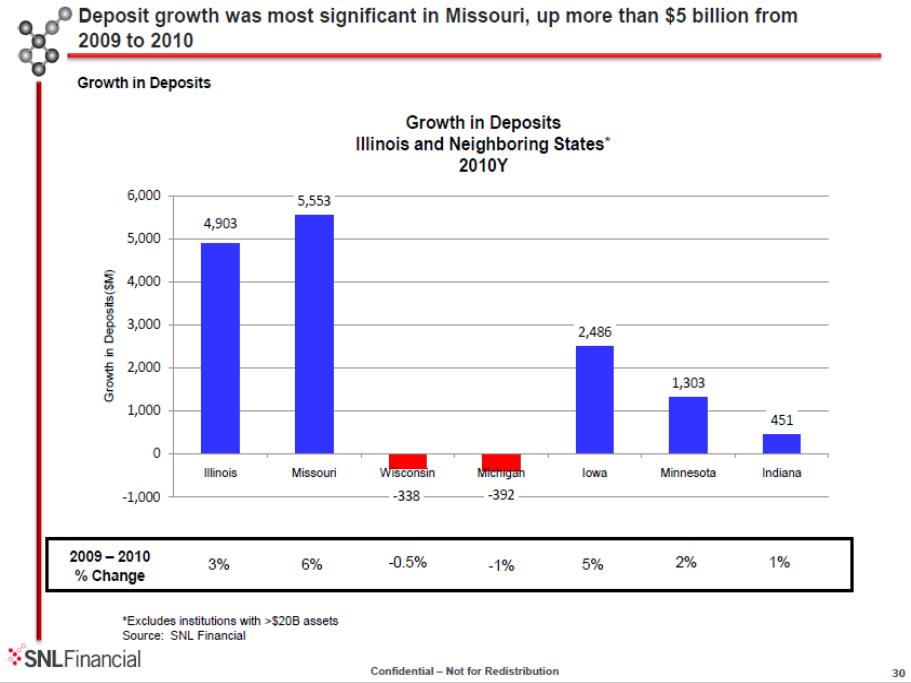

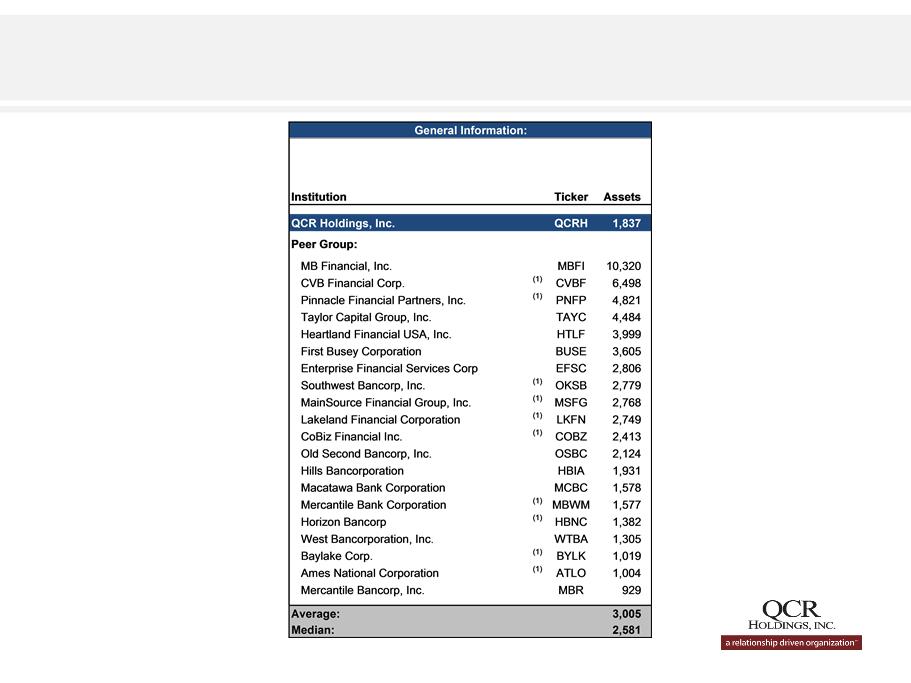

Source: SNL Financial. Data for the quarter ended 12/31/2010

(1) Data as of 3/31/2011

Proxy Peer Group

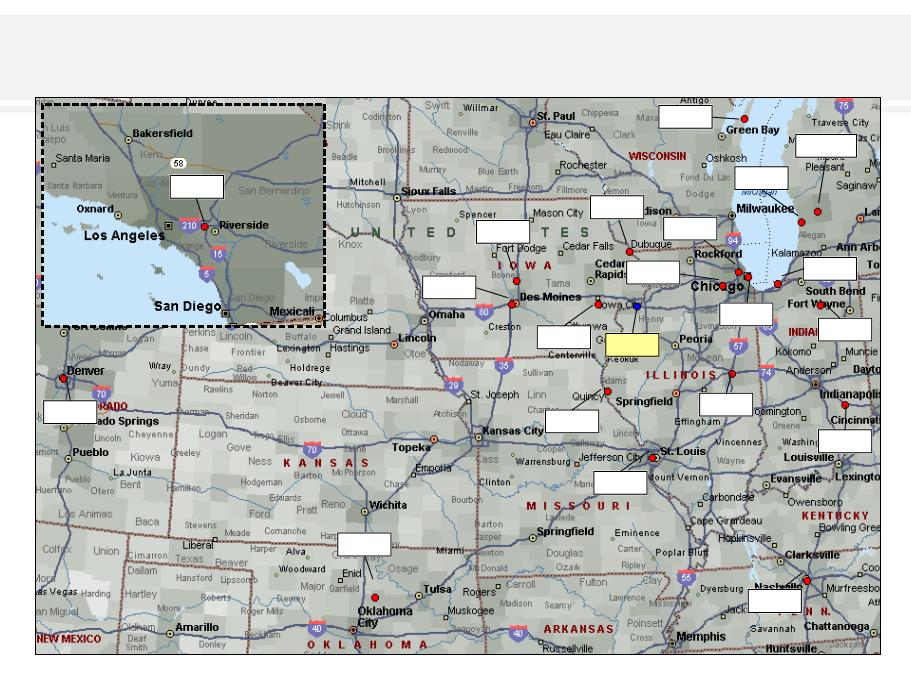

Source: SNL Financial, MapPoint

COBZ

CVBF

OKSB

ATLO

WTBA

HBIA

QCRH

MBR

EFSC

PNFP

HTLF

BUSE

BYLK

MSFG

LKFN

HBNC

OSBC

TAYC

MBFI

MCBC

MBWM

Proxy Peer Group - Headquarters Map

Peer Comparisons

|

|

QCRH

|

Average

|

Median

|

|

Assets

|

$1.8 Billion

|

$ 3 Billion

|

$2.6 Billion

|

|

Total Capital

|

13.7%

|

14.3%

|

15.2%

|

|

TCE

|

3.56

|

6.38

|

6.87

|

|

Texas Ratio

|

33.6

|

58.8

|

35.3

|

|

NPAs/Assets

|

2.7

|

4.3

|

3

|

|

ROE

|

5

|

(7)

|

6

|

|

Efficiency

|

68

|

64

|

64

|

|

Price/Tangible Book

|

0.6

|

1.4

|

1.4

|

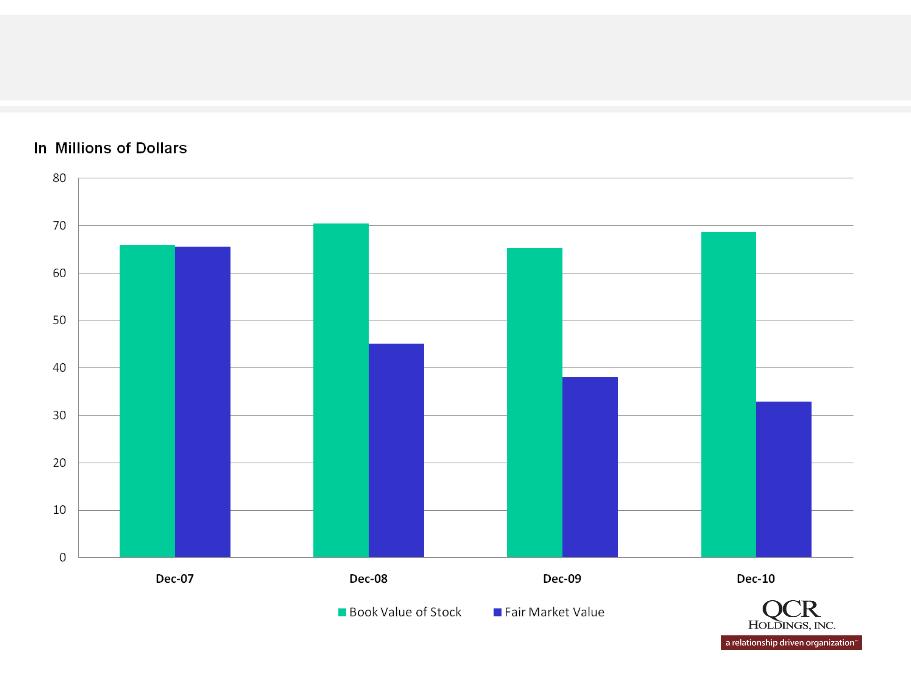

Book Value Per Share vs. Market Value Per Share

46.80%

Issues Impacting Market Value Per Share

• Low Tangible Common Equity Ratio - More Common

Shares?

Shares?

• Treasury Capital of $38.2 Million - How will it be

Redeemed?

Redeemed?

• Asset Quality Questions - Have NPA’s Peaked?

• “Normalized” Earnings - When and What?

• Low Trading Volume - Difficult for New Shareholders to

“Buy-In”.

“Buy-In”.

QCR Holdings’ Strategic Direction

• Tell the Story:

– Very Positive Asset Quality Results

– Grow TCE and Fund Treasury Capital without Common

Equity Raise.

Equity Raise.

– Focus on Growing EPS Faster than we Grow Assets

– Expanded Investor Relations Program to Attract New

Shareholders

Shareholders

• Execute on what is Possible in the Quad Cities, Cedar

Rapids, and Rockford Communities and with our Leasing

Subsidiary - m2 Lease Funds

Rapids, and Rockford Communities and with our Leasing

Subsidiary - m2 Lease Funds

• Repeat!

Thank You.

Thank you for your continued support.