Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NATIONAL FINANCIAL PARTNERS CORP | d8k.htm |

FIRST

QUARTER 2011 EARNINGS CALL PRESENTATION MAY 3, 2011

Exhibit 99.1 |

2

Related to Forward-Looking Statements |

3

Related to Non-GAAP Financial Information |

4

Reconciliation: Net Income to Cash Earnings

(1)

Cash earnings is a non-GAAP financial measure, which the Company defines as net

income excluding amortization of intangibles, depreciation, the after-tax impact of the impairment of

goodwill and intangible assets, the after-tax impact of non-cash interest

expense and the after-tax impact of certain non-recurring items. (2)

The

sum

of

the

per-share

components

of

cash

earnings

per

share

-

diluted

may

not

agree

to

cash

earnings

per

share

-

diluted

due

to

rounding.

Q1 2011

Q1 2010

GAAP net income

$ 6,876

$ 6,990

Amortization of intangibles

7,962

8,338

Depreciation

3,077

3,006

Impairment of goodwill and intangible assets

-

2,901

Tax benefit of impairment of goodwill and intangible assets

-

(1,118)

Non-cash interest, net of tax

631

1,866

Cash earnings

(1)

$ 18,546

$ 21,983

GAAP

net

income

per

share

-

diluted

$ 0.15

$ 0.16

Amortization of intangibles

0.18

0.19

Depreciation

0.07

0.07

Impairment of goodwill and intangible assets

-

0.07

Tax benefit of impairment of goodwill and intangible assets

-

(0.03)

Non-cash

interest,

net

of

tax

(1)

0.01

0.04

Cash

earnings

per

share

-

diluted

(2)

$ 0.41

$ 0.50

($ in thousands, except per share data) |

5

Reconciliation: Net Income to

Adjusted EBITDA

The reconciliation of Adjusted EBITDA per reportable segment does not include the

following items, which are not allocated to any of the Company’s reportable

segments:

income

tax

expense,

interest

income,

interest

expense,

gain

on

early

extinguishment

of

debt

and

other,

net.

These

items

are

included

in

the

reconciliation

of Adjusted EBITDA to net income on a consolidated basis.

For a reconciliation of Adjusted EBITDA per reportable segment for the three

months ended March 31, 2010, June 30, 2010, September 30, 2010, December 31, 2010

and March 31, 2011, please see the Company’s quarterly financial supplement

for the period ended March 31, 2011 which is available on the Investor Relations

section of

the

Company’s

Web

site

at

www.nfp.com.

Corporate

Individual

Advisor

(in thousands)

Client Group

Client Group

Services Group

Consolidated

For the three months ended March 31, 2011

GAAP net income (loss)

6,876

$

Income tax expense (benefit)

6,508

Interest income

(974)

Interest expense

3,771

Gain on early extinguishment of debt

-

Other, net

(3,187)

Income (loss) from operations

11,216

$

(685)

$

2,463

$

12,994

$

Amortization of intangibles

5,151

2,811

-

7,962

Depreciation

1,624

1,155

298

3,077

Impairment of goodwill and intangible assets

-

-

-

-

(Gain) loss on sale of businesses

-

-

-

-

Accelerated vesting of RSUs

-

-

-

-

Adjusted EBITDA

(1)

17,991

$

3,281

$

2,761

$

24,033

$

For the three months ended March 31, 2010

GAAP net income (loss)

6,990

$

Income tax expense (benefit)

5,563

Interest income

(888)

Interest expense

4,579

Other, net

(658)

Income (loss) from operations

11,949

$

1,926

$

1,711

$

15,586

$

Amortization of intangibles

5,348

2,990

-

8,338

Depreciation

1,559

1,125

322

3,006

Impairment of goodwill and intangible assets

1,931

970

-

2,901

(Gain) loss on sale of businesses

(1,321)

(910)

-

(2,231)

Adjusted EBITDA

(1)

19,466

$

6,101

$

2,033

$

27,600

$

Adjusted EBITDA is a non-GAAP financial measure, which the Company defines as net income

excluding income tax expense, interest income, interest expense, gain on early extinguishment

of debt, other, net, amortization of intangibles, depreciation, impairment of goodwill and intangible assets, (gain) loss on sale of businesses,

the pre-tax impact of the accelerated vesting of certain RSUs and any change in estimated

contingent consideration amounts recorded in accordance with purchase accounting that have

been subsequently adjusted and recorded in the consolidated statement of operations.

(1) |

JESSICA BIBLIOWICZ

Chairman, President & Chief Executive Officer |

7

1Q11 Highlights

Balanced capital allocation strategy

Strategic acquisitions

Reinvestment in existing businesses

$50 million stock repurchase plan

Revenue $233.3 million, grew 3.5%

Organic revenue grew 5.1%

Positive contributions from all three business

segments, especially Corporate

Client Group and Advisor Services Group Adjusted EBITDA $24.0 million

|

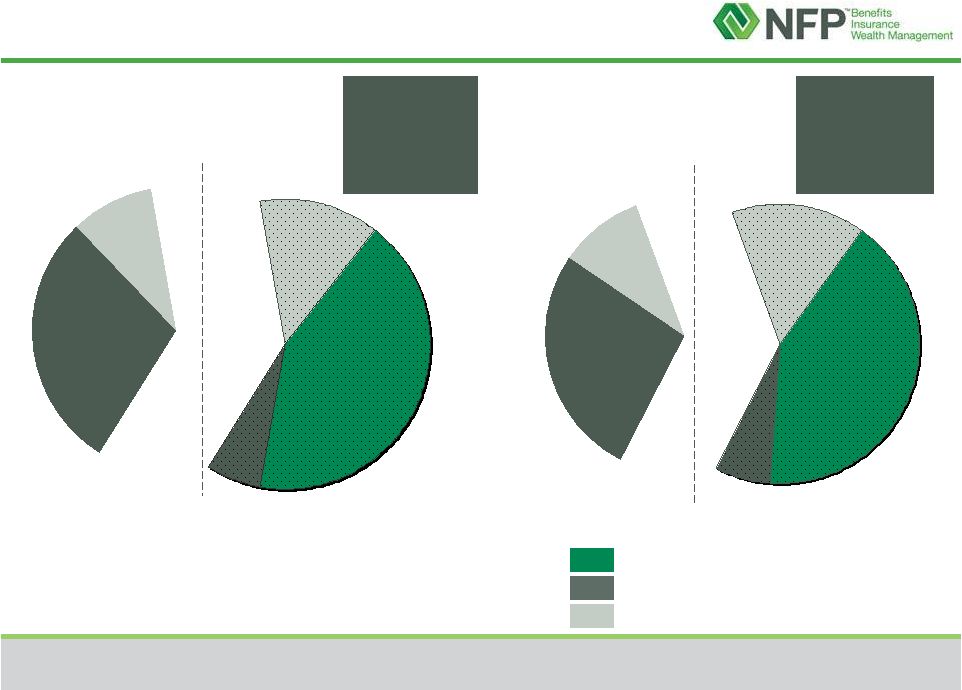

8

Business Segments

Advisor Services Group

Organic revenue growth +16.8%

Individual Client Group

Organic revenue growth +0.6%

Corporate Client Group

Organic revenue growth +2.4%

1Q11 Revenue $233.3 million

$95.5

41%

$77.8

33%

$60.0

26% |

9

Business Segment

1Q11 Overview & Components of Revenue

Steady performance

Expectations for CCG in 2011 (not

including acquisitions)

3% -

4% organic growth

Adjusted EBITDA margins

generally steady

Quarterly variability; 2Q

seasonally lowest margins

% of CCG

Revenue

Solid performance in wealth

management

Expectations for HNW life insurance in

2011

Increased activity; longer sales

cycle

Volatility and uncertainty remains

Continued strong growth

AUM $9.9 billion, up 16.3% YOY

Expectations for ASG in 2011

13% –

15% organic growth

Ongoing investments in

recruiting and marketing

Adjusted EBITDA margins

generally steady

% of ICG

Revenue

% of ASG

Revenue

11%

89%

41%

Corporate Benefits

Executive Benefits

19%

25%

56%

33%

Marketing Organization & Wholesale Life

Brokerage

Retail Life

Wealth Management

39%

61%

26%

Asset Based Fees & Trails

Commissions & Non-Recurring

Fees

Corporate Client Group

Individual Client Group

Advisor Services Group

|

10

$95.5

41%

$36.5

16%

$14.8

6%

$63.0

27%

$23.4

10%

Recurring Revenue

1

by Business Segment

1Q11

Recurring

revenue

63%

1Q10

Recurring

revenue

61%

1

Recurring revenue refers to revenue that is generally recurring in nature and

includes revenue from corporate and executive benefits, investment advisory

and asset based fees and trails. 2

The sum of the components may not agree to total due to rounding

1Q10 Revenue $225.3 million

Individual Client Group

Corporate Client Group

Advisor Services Group

$65.0

29%

$21.4

10%

$13.7

6%

$30.0

13%

$95.2

42%

($ in millions)

1Q11 Revenue $233.3 million

2 |

DOUG HAMMOND

Chief Operating Officer |

12

Steady and recurring business

Navigating challenging

economic and regulatory

environment

1Q11 pressure from specialty

business

Core Initiatives

Common brand and regional

focus

Diversification of products and

services

–

Health & Welfare

–

401(k)

–

P&C

–

Executive Benefits

–

Ancillary lines

High net worth life insurance

Challenges and

uncertainty remain

Large cases with longer

sale cycles in pipeline

Strong recruiting to

membership

organizations

Wealth management

Solid performance

continues

Growth drivers

New assets

Advisor recruitment

Asset-based fees (due to

broader financial market

performance)

Leading technology platform

Flexible offering serves multiple

advisor profiles

NFP B/D and NFP RIA

Hybrids –

NFP B/D and

independent RIA

Independent RIAs

Business Segment Performance

Corporate Client Group

Individual Client Group

Advisor Services Group

|

DONNA BLANK

Chief Financial Officer |

14

1Q11 Consolidated Financial Highlights

$19.5

$18.0

$6.1

$3.3

$2.0

$2.8

1Q10

1Q11

$27.6

$24.0

Individual Client Group

Corporate Client Group

Advisor Services Group

$51.4

$60.0

$95.2

$95.5

$78.7

$77.8

1Q10

1Q11

$225.3

$233.3

($ in millions)

Adjusted EBITDA Margin

1Q10

1Q11

Corporate Client Group

20.4%

18.8%

Individual Client Group

7.8%

4.2%

Advisor Services Group

4.0%

4.6%

Consolidated

12.3%

10.3%

61%

63%

Recurring

Revenue

1

The sum of the components may not agree to total due to rounding.

1

Revenue

Adjusted EBITDA & Margin

Revenue growth of 3.5% driven by CCG and ASG |

15

Management Fees (excl. accelerated vesting of RSUs)

as % of Adjusted Income Before Management Fees

Corporate Client Group

Individual Client Group

NFP’s priority interest in CCG was 60.6% as of 3/31/11

NFP’s priority interest in ICG was 46.3% as of 3/31/11

41.1%

48.0%

35.7%

42.6%

1.6%

0.9%

2.0%

1.7%

-1.2%

4.0%

43.7%

38.0%

58.7%

57.1%

57.9%

53.0%

56.3%

3.7%

0.2%

6.5%

5.3%

14.3%

56.6%

4Q09

Cumulative

47.7%

36.8%

42.8%

50.0%

36.6%

44.2%

70.9%

44.9%

63.6%

63.2%

53.2%

60.0%

1Q10

Includes Prior PIP

Includes Current PIP

4Q10

Cumulative

1Q11

Includes Prior PIP

Includes Current PIP

4Q09

Cumulative

1Q10

4Q10

Cumulative

1Q11

Principal Incentive Plan Management Fees (PIP)

All Other Management Fees

-13.8%

Higher targets and quarterly business seasonality reflected in

year-over-year PIP % |

16

-$44

$47

$36

$32

$71

-$2

$41

$124

$5

$37

$43

$119

-$6

$34

$34

In Q1, larger payments to Principals typically occur as management

fee bonuses for prior year performance are paid

Operating Cash Flow

(1)

Q1 2008 and 12/31/08 YTD acquisitions include $14.4 mm paid in connection with an

acquisition which was treated as prepaid management fees. (2)

Sum of the quarters may not agree to the full year total due to rounding.

(1)

(1)

(2)

$50

($ in millions)

Q1’08 Q2’08 Q3’08 Q4’08 FY’

08 Q1’09 Q2’09 Q3’09 Q4’09 FY’09

Q1’10 Q2’10 Q3’10 Q4’10 FY’10 Q1’11

Quarterly/Annual Operating Cash Flow |

17

Credit agreement amendment

Consolidated fixed charges to exclude up to $50 million in share

repurchases during any four consecutive fiscal quarters

Lowered consolidated fixed charge coverage ratio covenant level from

2.0x to 1.5x

Authorization to repurchase up to $50 million of NFP stock

Balanced approach to capital allocation; maintain financial flexibility

Strategic acquisitions

Reinvestment in existing businesses

Direct

capital

return

to

shareholders

–

stock

buyback

Balanced Capital Allocation Strategy |