Attached files

Ally Financial Inc.

1Q Earnings Review

May 3, 2011

Contact Ally Investor Relations at (866) 710-4623 or

investor.relations@ally.com Exhibit 99.2 |

2

1Q 2011 Preliminary Results

Forward-Looking Statements and Additional Information

The following should be read in conjunction with the financial statements, notes and other information

contained in the Company’s 2010 Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and Current Reports on Form 8-K. This information is preliminary and based on

company data available at the time of the presentation In the presentation that follows and

related comments by Ally Financial Inc. (“Ally”) management, the use of the words “expect,” “anticipate,”

“estimate,” “forecast,” “initiative,” “objective,”

“plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “seek,” “may,”

“would,” “could,” “should,” “believe,” “potential,”

“continue,” or similar expressions is intended to identify forward-looking statements. All statements

herein and in related management comments, other than statements of historical fact, including without

limitation, statements about future events and financial performance, are forward-looking

statements that involve certain risks and uncertainties. While these statements represent our

current judgment on what the future may hold, and we believe these judgments are reasonable, these

statements are not guarantees of any events or financial results, and Ally’s actual

results may differ materially due to numerous important factors that are described in the most recent

reports on SEC Forms 10-K and 10-Q for Ally, each of which may be revised or supplemented in

subsequent reports on SEC Forms 10-Q and 8-K. Such factors

include, among others, the following: maintaining the mutually beneficial relationship between Ally and General Motors (“GM”),

and Ally and Chrysler; the profitability and financial condition of GM and Chrysler; securing low cost

funding for us and Residential Capital, LLC (“ResCap”); our ability to realize the

anticipated benefits associated with being a bank holding company, and the increased regulation and

restrictions that we are now subject to; any impact resulting from delayed foreclosure sales or

related matters; the potential for legal liability resulting from claims related to the sale of

private-label mortgage-backed securities; risks related to potential repurchase obligations due to

alleged breaches of representations and warranties in mortgage securitization transactions; changes in

U.S. government-sponsored mortgage programs or disruptions in the markets in which our

mortgage subsidiaries operate; continued challenges in the residential mortgage markets; the

continuing negative impact on ResCap and our mortgage business generally due to the recent decline in

the U.S. housing market; uncertainty of our ability to enter into transactions or execute

strategic alternatives to realize the value of our ResCap operations; the potential for deterioration in

the residual value of off-lease vehicles; disruptions in the market in which we fund our

operations, with resulting negative impact on our liquidity; changes in our accounting

assumptions that may require or that result from changes in the accounting rules or their application, which could result

in an impact on earnings; changes in the credit ratings of Ally, ResCap, Chrysler, or GM; changes in

economic conditions, currency exchange rates or political stability in the markets in which we

operate; and changes in the existing or the adoption of new laws, regulations, policies or other

activities of governments, agencies and similar organizations (including as a result of the

Dodd-Frank Act). Investors are cautioned not to place undue reliance on forward-looking

statements. Ally undertakes no obligation to update publicly or otherwise revise any

forward-looking statements except where expressly required by law. Reconciliation of non-GAAP financial measures included within

this presentation are provided in this presentation.

Use of the term “loans” describes products associated with direct and indirect lending

activities of Ally’s global operations. The specific products include retail

installment sales contracts, loans, lines of credit, leases or other financing products. The term “originate” refers to Ally’s purchase,

acquisition or direct origination of various “loan” products.

|

3

1Q 2011 Preliminary Results

•

Core

pretax

income

(1)

of

$428

million

and

net

income

of

$146

million

–

Fifth straight quarter of profitability

•

Began repayment of U.S. taxpayer investment

–

U.S.

Treasury

sold

$2.7

billion

of

Trust

Preferred

Securities

to

third

party

investors

–

Filed S-1 with the SEC for a proposed initial public offering

•

#1 overall U.S. auto lender

–

U.S. originations of $11.6 billion, up 25% from 4Q10

–

Strong growth in used and diversified channels

•

Further

improved liquidity position

–

Refinanced $15 billion of credit facilities on more favorable terms

–

Achieved multi-notch rating upgrades

•

Expanded Ally Bank and deposit base

–

Total deposits grew $1.6 billion in 1Q

–

Ally Bank now has over 425,000 deposit customers, up 8% from 4Q10

First Quarter Highlights

(1)

Core pre-tax income is a non-GAAP financial measure. Please refer to

slide 7 for further details |

4

1Q 2011 Preliminary Results

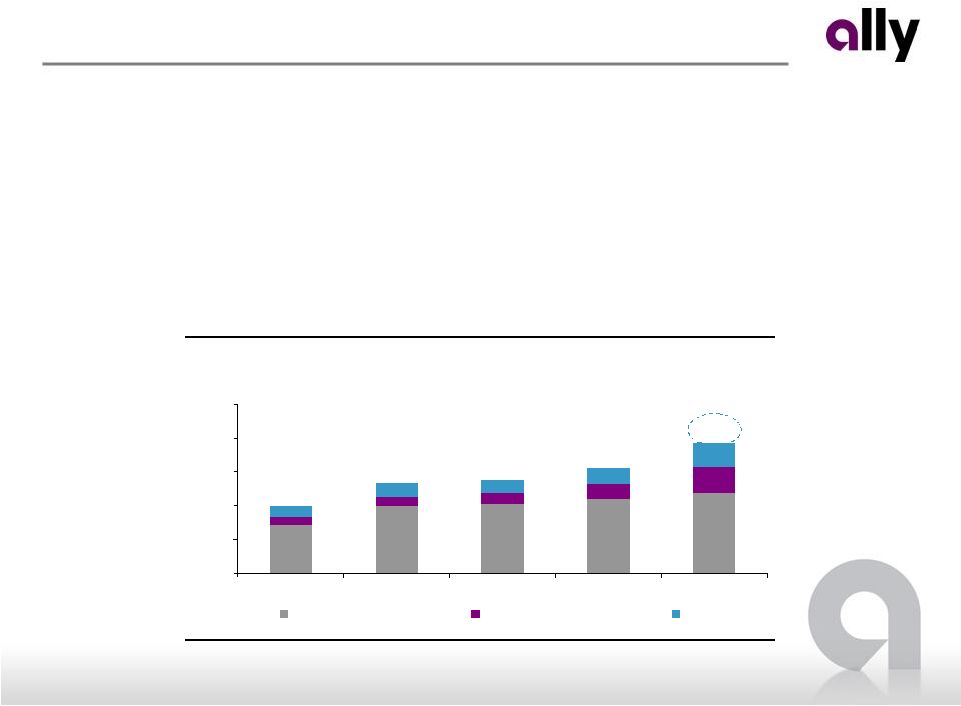

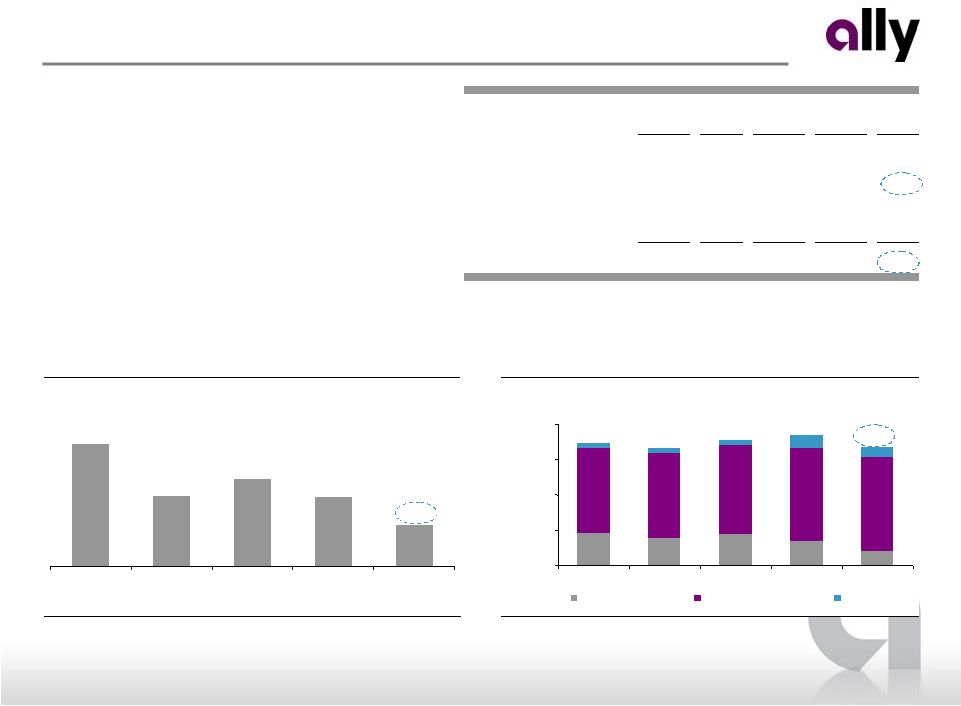

Demonstrating Auto Finance Franchise Strength

•

Evidence of competitively advantaged platform

–

Strong dealer relationships

–

Full product suite and scalable infrastructure

•

U.S. consumer originations up 25% quarter-over-quarter and 93%

year-over-year –

Used originations up 73% QoQ

–

Lease originations up 59% QoQ

–

Non GM/Chrysler new originations up 68% QoQ

U.S. Consumer Auto Originations

($ billions)

$6.0

$8.0

$8.3

$9.3

$11.6

$0.0

$3.0

$6.0

$9.0

$12.0

$15.0

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

New - Retail

New - Leases

Used |

5

1Q 2011 Preliminary Results

Used Vehicle Market Share

2.2%

1.9%

1.8%

1.0%

0.9%

0.9%

0.8%

0.8%

4.2%

2.6%

Wells

Fargo

ALLY

Toyota

Chase

Capital

One

Santander

Drive

5th Third

Bank of

America

GM

Financial

Honda

LEASE: Tripled Originations YoY

USED: 70% Growth in Market Share Since 4Q

TOTAL MARKET: #1 Auto Finance Provider

NEW: Wide Margin Over Nearest Competitor

Auto Finance Category Leader

Source: Experian Automotive

Market share information as of 1Q 2011

Total Market Share

4.9%

4.1%

3.5%

2.9%

2.0%

1.7%

1.3%

1.3%

2.9%

6.7%

ALLY

Toyota

Honda

Wells

Fargo

Chase

Ford

Nissan

Capital

One

Hyundai

BMW

New Vehicle Market Share

7.7%

6.7%

6.3%

4.6%

3.4%

3.1%

2.9%

2.3%

1.8%

13.5%

ALLY

Toyota

Honda

Ford

Chase

Nissan

Wells

Fargo

Hyundai

Bank of

America

Capital

One

Lease Market Share

14.4%

10.1%

7.6%

5.7%

5.4%

5.3%

4.5%

3.8%

11.4%

19.8%

Honda

Toyota

ALLY

Nissan

Ford

VW

BMW

Hyundai

Mercedes

Benz

Chase |

6

1Q 2011 Preliminary Results

2011 Strategic Priorities

Pre-eminent

Auto Franchise

Grow Deposit

Franchise

Mortgage

Franchise

Improve

Funding and

Costs

Manage Risk

Build a Winning

Culture

Build the pre-eminent global auto finance franchise by being an ally to the

dealer and strategic partner to the manufacturer

Continue to grow Ally Bank by building upon the strong consumer value

proposition

Operate a leading mortgage origination and servicing platform with lower risk

and higher operational efficiency

Continuously improve funding and operating costs

Effectively manage all our business risks

Build a winning culture that distinguishes Ally in the marketplace

Repay the U.S.

Treasury

Work toward repayment of the U.S. Treasury’s investment over time

|

7

1Q 2011 Preliminary Results

($ millions)

1Q 11

4Q 10

1Q 10

4Q 10

1Q 10

Total net revenue (ex. OID)

1,933

$

2,209

$

2,247

$

(276)

$

(314)

$

Provision for loan losses

113

71

144

42

(31)

Controllable expenses

(1)

874

923

906

(49)

(32)

Other noninterest expenses

518

682

613

(164)

(95)

Core pre-tax income (loss)

(2)

428

$

533

$

584

$

(105)

$

(156)

$

OID amortization expense

(3)

326

301

397

25

(71)

Income tax expense (benefit)

(68)

36

36

(104)

(104)

(Loss) income from discontinued operations

(24)

(117)

11

93

(35)

Net income (loss)

146

$

79

$

162

$

67

$

(16)

$

Total assets

173,704

$

172,008

$

179,427

$

1,696

$

(5,723)

$

Net interest margin

(4)

2.2%

2.3%

3.0%

Increase/(Decrease) vs.

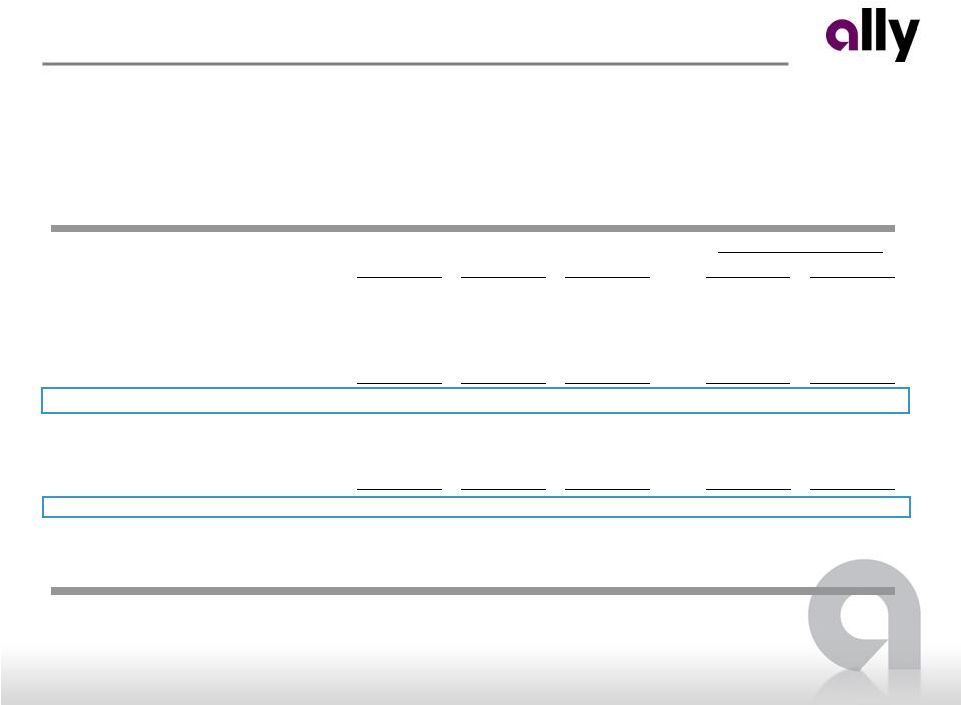

First Quarter 2011 Results

•

Five straight quarters of profitability

•

Certain

favorable

notable

items

from

2010

are

moderating

in

2011

(see

next

page)

•

Over time, profitability expected to improve

–

Cost of funds decline, more balanced credit mix, OID run off

•

Income tax benefit this quarter from $101 million release of valuation allowance in

Canadian operations (1) Includes employee related costs, consulting and legal fees, marketing,

information technology, facility, portfolio servicing and restructuring expenses

(2) Core pre-tax income is defined as income from continuing operations before taxes and primarily

bond exchange original issue discount ("OID") amortization expense

(3) Includes $30 million of accelerated OID amortization in 1Q11 and $101 million in 1Q10 from

extinguishment of debt

(4) Excludes OID amortization expense. The impact of historical financial statement restatements

for discontinued operations are not reflected in prior periods |

8

1Q 2011 Preliminary Results

Notable Items

•

Several notable items are impacting core pre-tax income

Notable Items - Pre-Tax

($ millions)

1Q 11

4Q 10

1Q 10

4Q 10

1Q 10

NAO lease remarketing gains

119

$

155

$

185

$

(36)

$

(66)

$

Auto forward flow sale gains

-

47

113

(47)

(113)

Insurance investment income and other

80

135

141

(55)

(61)

Origination and Servicing gain on sale of mortgage loans, net

74

214

86

(140)

(12)

Mortgage net servicing revenue

240

125

193

115

47

Legacy gain on sale of mortgage loans, net

18

136

65

(118)

(47)

Total net revenue impact of notable items

531

$

812

$

783

$

(281)

$

(252)

$

Mortgage repurchase reserve expense

26

180

49

154

23

Total core pre-tax income impact of notable items

505

$

632

$

734

$

(127)

$

(229)

$

Memo:

Total net revenue (ex. OID)

1,933

$

2,209

$

2,247

$

(276)

$

(314)

$

Core pre-tax income

428

$

533

$

584

$

(105)

$

(156)

$

Fav / (Unf.) vs. |

9

1Q 2011 Preliminary Results

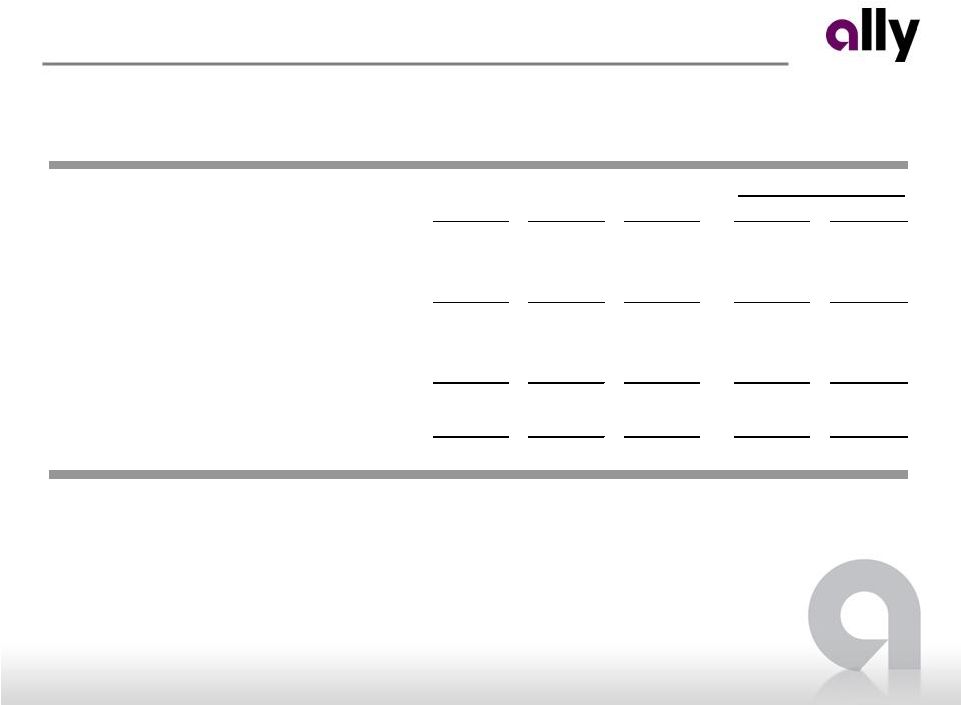

Results by Segment

(1)

Legacy Portfolio and Other segment primarily consists of loans originated prior to

Jan. 1, 2009, and includes non-core business activities including portfolios in run off

(2)

Corporate and Other as presented includes Commercial Finance Group

(“CFG”), certain equity investments and treasury activities including the residual impacts from the

corporate funds transfer pricing and asset liability management (“ALM”)

activities (3)

Core pre-tax income is a non-GAAP financial measure. Please refer to

slide 7 for further details •

Auto finance business continues positive credit and origination trends

•

Mortgage business impacted by lower volumes and higher expected servicing

costs Pre-Tax Income

($ millions)

1Q 11

4Q 10

1Q 10

4Q 10

1Q 10

North American Automotive Finance

518

$

589

$

612

$

(71)

$

(94)

$

International Automotive Finance

40

12

47

28

(7)

Insurance

134

164

183

(30)

(49)

Global Automotive Services

692

$

765

$

842

$

(73)

$

(150)

$

Mortgage Origination and Servicing

73

172

71

(99)

2

Legacy Portfolio and Other

(1)

(39)

(49)

85

10

(124)

Mortgage Operations

34

$

123

$

156

$

(89)

$

(122)

$

Corporate and Other (ex. OID)

(2)

(298)

(355)

(414)

57

116

Core pre-tax income (loss)

(3)

428

$

533

$

584

$

(105)

$

(156)

$

Increase/(Decrease) vs. |

10

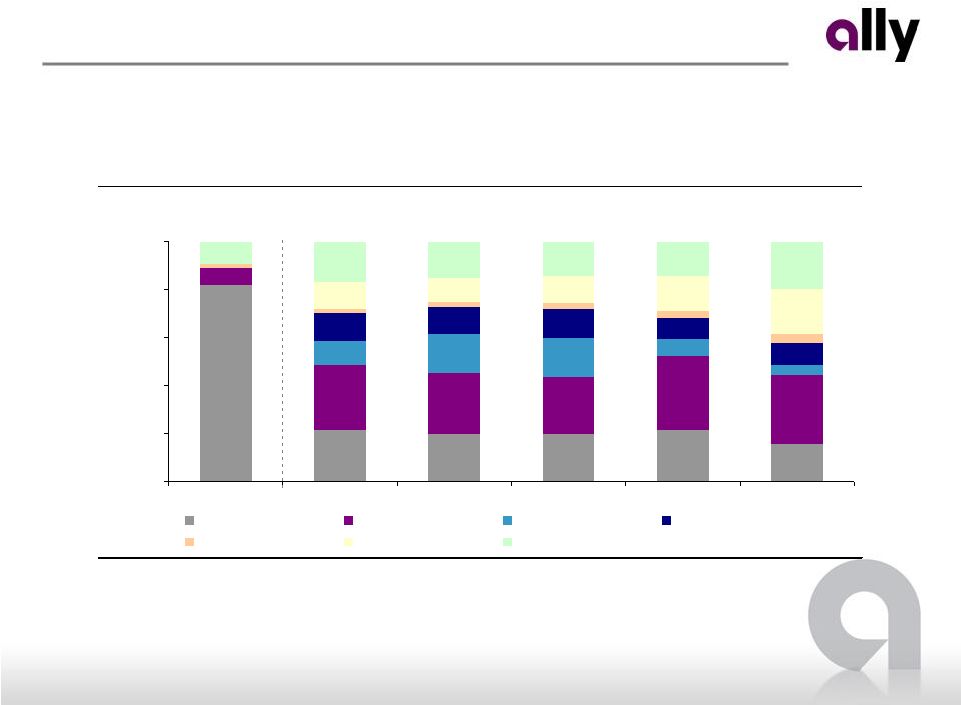

1Q 2011 Preliminary Results

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Net financing revenue

818

$

798

$

872

$

Total other revenue

109

157

203

Total net revenue

927

955

1,075

Provision for loan losses

46

19

101

Noninterest expense

363

347

362

Pre-tax income from continuing ops

518

$

589

$

612

$

Total assets

87,662

$

81,893

$

74,786

$

•

North American segment reported pre-tax income

of $518 million

•

Net financing revenue increase of $20 million

driven by higher consumer asset balances and

favorable net lease revenues

•

Total other revenue lower by $48 million

–

Expiration of whole loan forward flow

agreements in 4Q10 and resulting loss of

gain on sale revenue

•

Provision expense higher than 4Q10 by $27

million

due

to

higher

origination

volume

but

down

$55 million from 1Q10

•

Balance sheet growth driven by strong originations

and expiration of forward flow agreements

•

Auto balance sheet is repositioning

–

Run off of higher yielding, more volatile

legacy assets

–

More loans being held on-balance sheet

–

Originating more balanced credit mix

North American Automotive Finance

NAO Earning Asset Balances

($ billions)

$87.5

$81.9

$77.0

$73.8

$74.6

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Consumer

Commercial |

11

1Q 2011 Preliminary Results

Key Statistics

Inc/(Dec) vs.

($ billions)

1Q 11

4Q 10

1Q 10

1Q 10

GM Retail Subvented

$1.8

$2.0

$1.3

42%

GM Retail Standard

3.3

2.9

1.6

104%

Chrysler Retail Subvented

0.5

0.6

0.6

-14%

Chrysler Retail Standard

1.0

0.8

0.7

49%

Diversified New

0.5

0.3

0.1

358%

Lease

(1)

2.2

1.4

0.7

215%

Used

2.3

1.3

1.0

128%

Total

$11.6

$9.3

$6.0

93%

•

U.S. originations increased 25% QoQ and 93%

YoY

–

Strong consumer penetration at GM

–

Positive impact from OEM marketing

programs

–

Non GM/Chrysler new retail originations

grew 358% YoY

–

Lease originations up 215% YoY

Strong retention rate on GM pull

ahead programs

–

Used originations grew 128% YoY

U.S. Auto Originations

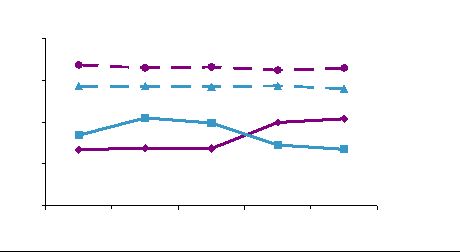

U.S. Penetration Rates

0%

25%

50%

75%

100%

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

GM Floorplan

Chrysler Floorplan

Chrysler Consumer

GM Consumer

(1) Includes GM and Chrysler lease originations |

12

1Q 2011 Preliminary Results

U.S. Consumer Auto Originations

(% of $ originations)

16%

82%

28%

7%

4%

9%

4%

1%

19%

20%

9%

0%

20%

40%

60%

80%

100%

2006

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

GM Subvented

GM Standard

Chrysler Subvented

Chrysler Standard

Diversified New

Lease

Used

(1)

•

Diversifying originations as an independent market driven competitor

•

Subvented loan originations, subject to partial exclusivity, down to 20% of total

originations from 32% in 1Q10 U.S. Auto Origination Mix

(2)

Note: Some standard rate loan originations contain manufacturer sponsored cash back rebate

incentives. Some lease originations contain rate subvention. While Ally may

jointly develop marketing programs for these originations, Ally does not have exclusive rights to such

originations under operating agreements with manufacturers.

(1) Includes subvented loan and lease originations to which Ally had exclusive rights prior to 2009

(2) Includes GM and Chrysler lease originations |

13

1Q 2011 Preliminary Results

•

International operations earned $40 million of

pre-tax income compared to $12 million in 4Q10

–

Net financing revenue higher by $13

million, primarily driven by higher asset

levels and improving margin in Brazil

–

Other revenue higher by $12 million due to

joint venture income in China

•

Originations up 28% year-over-year but down

24% quarter-over-quarter

–

Central bank tightening in China

–

Seasonality

•

Asset balances starting to grow after significant

streamlining over past two years

International Automotive Finance

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Net financing revenue

171

$

158

$

178

$

Total other revenue

75

63

92

Total net revenue

246

221

270

Provision for loan losses

37

29

21

Noninterest expense

169

180

202

Pre-tax income (loss) from continuing ops

40

$

12

$

47

$

Total assets

16,295

$

15,979

$

19,378

$

Note: Originations in China part of a joint-venture in which Ally owns a

minority interest International Consumer Auto Originations (Continuing Operations)

($ billions)

$1.5

$1.6

$2.0

$2.5

$1.9

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

China

Brazil

Germany

U.K.

Mexico

Other |

14

1Q 2011 Preliminary Results

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Insurance premiums, service revenue earned and other

440

$

464

$

480

$

Insurance losses and loss adjustment expenses

173

202

196

Acquisition and underwriting expenses

213

233

242

Total underwriting income

54

29

42

Investment income and other

80

135

141

Pre-tax income from continuing ops

134

$

164

$

183

$

Total assets

9,024

$

8,789

$

9,083

$

Key Statistics

1Q 11

4Q 10

1Q 10

Insurance Ratios

Loss ratio

40%

44%

41%

Underwriting expense ratio

48%

50%

50%

Combined ratio

88%

94%

91%

Insurance

•

Pre-tax income of $134 million, down $30 million

from 4Q10

–

Underwriting income increased $25 million

due to lower losses and lower operating

expenses

–

Investment income down due to lower

realized gains on investment portfolio

•

Written premiums increased from 4Q10 to $411

million

–

Higher written vehicle service contracts at

DP&S

–

Increase in fleet contract renewals in

international

Insurance Total Written Premiums

($ millions)

$411

$346

$404

$415

$423

$0

$100

$200

$300

$400

$500

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Dealer Products & Services

International |

15

1Q 2011 Preliminary Results

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Net financing revenue

(30)

$

(2)

$

(11)

$

Gain on sale of mortgage loans, net

74

214

86

Other revenue (excluding gain on sale)

277

206

260

Total net revenue

321

418

335

Provision for loan losses

2

-

1

Noninterest expense

246

246

263

Pre-tax income (loss) from continuing ops

73

$

172

$

71

$

Total assets

19,164

$

24,478

$

16,491

$

Primary servicing - EOP ($ billions)

360

$

361

$

379

$

($ millions)

1Q 11

4Q 10

1Q 10

Servicing fees

327

$

338

$

326

$

Servicing asset valuation, net of hedge

(87)

(213)

(133)

Net servicing revenue

240

$

125

$

193

$

Mortgage Operations –

Origination and Servicing

•

Continued solid performance with pre-tax income

of $73 million

–

Gain on sale revenue lower due to lower

production volumes

–

Servicing asset valuation impacted by

higher expected servicing costs

•

Loan production of $12.2 billion is down $11.6

billion from 4Q10 and $1.1 billion from 1Q10

–

Lower industry volume driven by higher

rates and seasonal trends

Residential Mortgage Loan Production

($ billions)

$13.3

$13.5

$20.5

$23.8

$12.2

$0

$5

$10

$15

$20

$25

$30

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Prime Conforming

Government

Prime Non-Conforming

Other |

16

1Q 2011 Preliminary Results

•

Highest HAMP conversion rate among 5 largest servicers

•

Completed

more

than

675,000

default

workouts

for

borrowers

since

2008

–

Comprises 25% of loans serviced during that time period

Leader in Loan

Modifications

Foreclosure

Process Update

Federal Consent

Order

•

Significantly bolstered foreclosure processes over the last six months

•

In

October,

began

assigning

single

point

of

contact

to

borrowers

in

need

of

assistance

•

Throughout foreclosure review process, Ally has found no instance where a

homeowner was foreclosed upon without being in significant default

Increased

Servicing Costs

•

Increased staffing levels, improved processes and foreclosure remediation have

impacted financial results:

–

Majority of foreclosure remediation costs (~$25 million) incurred in 4Q10

–

Changes reflected in the cost of servicing as part of our quarterly MSR valuation

process Increased

cost

of

servicing

since

Jan.

1,

2009

has

decreased

the

current

MSR

valuation by approximately $340 million

Impact

to

MSR

of

$79

million

in

1Q

due

to

higher

expected

future

servicing

and

foreclosure costs

•

Signed Consent Order issued by the Federal Reserve and FDIC on April 13

•

Ally

remains

committed

to

helping

borrowers

retain

homeownership

whenever

possible

•

Ally places the highest priority on meeting the requirements of the Order in a

timely manner –

Designated specific internal executive oversight team

–

Reassigned our General Auditor to lead the initiative

Mortgage Servicing Update |

17

1Q 2011 Preliminary Results

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Net financing revenue

78

$

98

$

193

$

Gain on sale of mortgage loans, net

18

136

65

Other revenue (excluding gain on sale)

(6)

(20)

(42)

Total net revenue

90

214

216

Provision for loan losses

45

23

6

Noninterest expense

84

240

125

Pre-tax income (loss) from continuing ops

(39)

$

(49)

$

85

$

Mortgage Operations –

Legacy Portfolio and Other

•

Pre-tax loss of $39 million

–

Lower gain on sale revenues offset by

lower repurchase expense

•

Assets continued to decline to $11.8 billion in 1Q

•

Legacy HFS portfolio of $1.7 billion carry value

–

Marked at 45% of UPB

–

Sold $35 million net UPB resulting in a net

gain of $7 million

•

Legacy Ally Bank HFI portfolio of $7.7 billion gross

carry value, down $323 million from 4Q10 and

down $1.4 billion from 1Q10

–

Performance has stabilized

–

Delinquencies remain in line with

expectations

–

Reserve of $508 million against portfolio

Note: Consumer loans HFI consists primarily of Ally Bank HFI (originated

pre-2009) and legacy securitizations

Legacy Portfolio & Other Balance Sheet

($ billions)

$11.8

$12.3

$15.6

$26.0

$28.0

$0

$10

$20

$30

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Loans HFI

Disc Ops

Loans HFS

Cash, trading & other assets |

18

1Q 2011 Preliminary Results

New Claims Trend

($ millions)

Trick

$133

$222

$281

$225

$392

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Mortgage Repurchase Reserves

•

Mortgage repurchase reserve expense of $26

million down $154 million from 4Q10

•

Reserve balance flat to 4Q10

–

Remaining reserves are primarily for

potential non-GSE claims

•

Outstanding claims predominantly from monolines

–

Vast majority reviewed and declined

•

New claims trends down 40% from 4Q10 and 66%

from 1Q10

–

Driven by settlements reached in 2010

(1) Includes claims that Ally has requested to be rescinded but not yet confirmed

by the counterparty

(2) Represents current UPB and requested make-whole amounts for claims and

does not represent expected losses

(1) Includes settlement amounts

Mortgage Repurchase Reserves

($ millions)

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Beginning reserve balance

1,263

$

890

$

855

$

1,128

$

830

$

Repurchase reserve expense

49

97

344

180

26

Other additions

1

25

8

37

6

Loss experience, net

(1)

(423)

(156)

(80)

(515)

(32)

Ending reserve balance

890

$

855

$

1,128

$

830

$

830

$

Outstanding

Claims

by

Counterparty

(1)(2)

($ millions)

Trick

$865

$827

$889

$918

$838

$-

$250

$500

$750

$1,000

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

GSEs

Monoline

Other |

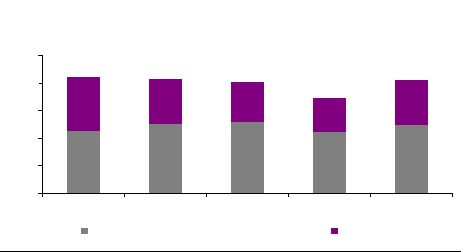

19

1Q 2011 Preliminary Results

Ally Bank Customer Satisfaction

89.0%

87.5%

88.3%

88.7%

0%

20%

40%

60%

80%

100%

Call Center Satisfaction

Web Satisfaction

Likelihood to Recommend

Ally Bank

Customer Satisfaction

Ranking

Ally Bank Customer Relationships

(# thousands)

220

427

1.7

1.9

0

50

100

150

200

250

300

350

400

450

1Q 09

2Q 09

3Q 09

4Q 09

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

1.5

1.6

1.7

1.8

1.9

2.0

# of Unique Ally Customers

Average Number of Accounts

Ally Bank Brand Awareness

10%

17%

27%

25%

32%

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Ally Bank Franchise Momentum

Steadily building Ally brand awareness

Strong customer satisfaction

Growing customer base

Note: Satisfaction scores represent top-two box satisfaction scores

•

Ally’s brand promise is resonating with customers

–

Added nearly 33,000 individual deposit customers

in 1Q

–

High CD retention rates

–

Accounts per customer increasing

•

Continued platform development

–

Introducing remote deposit capabilities

–

Integrating lending operations onto website

Note: Brand awareness figures based on monthly, third party consumer survey

|

20

1Q 2011 Preliminary Results

Average Retail CD Maturity and Retail Deposit Portfolio Rate

(months)

Trick

16.0

19.0

21.0

22.8

24.1

2.00%

1.82%

1.76%

1.71%

1.63%

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Avg. Retail CD Maturity

Avg. Retail Deposit Rate

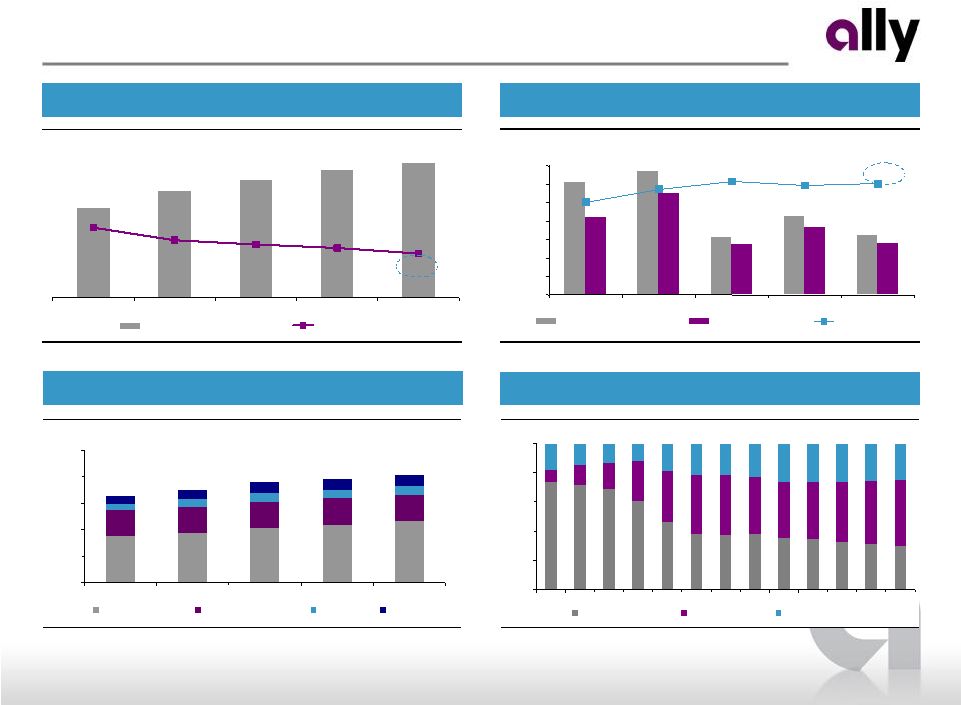

Deposits

Deposit rates declining as maturity extending

Diversified deposit product mix

High CD retention rates reflect franchise strength

Stable, consistent growth of retail deposits

Ally Financial Deposit Levels

($ billions)

$40.7

$39.0

$38.0

$35.2

$32.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Ally Bank Retail

Ally Bank Brokered

ResMor

Other

Ally Bank Deposit Composition

0%

20%

40%

60%

80%

100%

1Q 08

2Q 08

3Q 08

4Q 08

1Q 09

2Q 09

3Q 09

4Q 09

1Q10

2Q10

3Q10

4Q10

1Q 11

Brokered CD

Retail CD

MMA/OSA/Checking

Retail CD Balance Retention

(1)

($ billions)

(1) Retention includes balances retained in any Ally Bank product

82%

72%

85%

88%

86%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

CD Balances Up for Renewal

CD Balances Retained

Retention Rate |

21

1Q 2011 Preliminary Results

Liquidity

Unsecured

ABS

Credit Facilities

Issued $2.25 billion of U.S. unsecured debt in 1Q

Maintaining robust liquidity with minimal issuance required to address 2012

maturities Raised $4.6 billion in the securitization market in 1Q

–

$3.4 billion

of

U.S.

auto

transactions

including

retail,

lease

and

floorplan

assets

–

$748 million Canadian retail auto securitization

–

$450 million ResCap servicer advance securitization

Renewal of two large auto credit facilities totaling $15 billion

–

Capacity for both Ally Financial and Ally Bank

–

More favorable terms and lower funding costs

Additional $1.8 billion of renewals and new facilities in 1Q including mortgage

and auto facilities

•

Conservative liquidity

posture

with

total

parent

company

available

liquidity

of

$22

billion

and

consolidated

debt

maturities of $20 billion through 2012

(1)

–

Additional $11 billion of liquidity at Ally Bank to support asset generation

•

Diverse access to capital markets with over $7.2 billion of new funding in 1Q

(1) Refer to page 29 for more details |

22

1Q 2011 Preliminary Results

Capital

Note: Refer to page 22 of the financial supplement for additional details

•

Capital ratios lower due to increase in risk-weighted assets, driven by strong

growth in auto originations •

Ally is well positioned to achieve the enhanced Basel III capital requirements in

advance of the proposed timelines –

Estimated

1Q

2011

Basel

III

Tier

1

Common

Ratio

of

10.8%

on

a

fully

converted

basis

(1)

•

Comprehensive Capital Adequacy Review plan is still under review

–

Ally

is

well

capitalized

and

“stress

testing”

is

ongoing

part

of

our

operations

•

Series A Preferred remarketing saves approximately $15 million of dividends per

annum (1) Pro forma calculation assumes full conversion of remaining MCP

to common equity and is based on management’s current interpretation of Basel III capital proposals.

This pro forma calculation is subject to change depending on final Basel III

rulemaking and interpretations thereof by regulatory authorities. ($ billions)

3/31/2011

12/31/2010

3/31/2010

Tier 1 Capital

22.1

$

22.2

$

22.1

$

Tier 1 Common Capital

12.7

$

12.7

$

7.4

$

Total Risk-Based Capital

24.1

$

24.2

$

24.4

$

Tangible Common Equity

12.9

$

13.0

$

7.8

$

Tangible Assets

173.2

$

171.5

$

178.9

$

Risk-Weighted Assets

150.8

$

148.0

$

148.4

$

Tier 1 Capital Ratio

14.7%

15.0%

14.9%

Tier 1 Common Capital Ratio

8.4%

8.6%

5.0%

Total Risk-Based Capital Ratio

16.0%

16.4%

16.4%

Tangible Common Equity / Tangible Assets

7.5%

7.6%

4.4%

Tangible Common Equity / Risk-Weighted Assets

8.6%

8.8%

5.3% |

23

1Q 2011 Preliminary Results

Asset Quality: Summary

•

Continued positive trends in credit quality

•

Strong allowance coverage ratios relative to net charge-offs and

non-performing loans –

Almost 2.4x coverage of net charge-offs

•

Loan balance growth driven by strong auto originations

–

Global Automotive Services represents over 85% of loan balances

(1) Loans within this table are classified as held-for-investment recorded

at historical cost as these loans are included in our allowance for loan losses

(2) Net charge-off ratios are calculated as annualized net charge-offs

divided by average outstanding finance receivables and loans excluding loans measured

at fair value and loans held-for-sale

(3) ALLL coverage ratios are based on the allowance for loan losses related to

loans held-for-investment excluding those loans held at fair value as a

percentage of the unpaid principal balance, net of premiums and discounts

Ally Financial Consolidated

(1)

($ millions)

1Q 11

4Q 10

3Q 10

2Q 10

1Q 10

Ending Loan Balance

106,488

$

101,398

$

95,770

$

90,371

$

86,468

$

30+ Accruing DPD

963

1,114

1,173

1,380

1,366

30+ Accruing DPD %

0.9%

1.1%

1.2%

1.5%

1.6%

Non-Performing Loans (NPLs)

1,244

1,508

1,592

2,294

2,443

Net Charge-Offs (NCOs)

189

240

334

307

316

Net Charge-Off Rate

(2)

0.7%

1.0%

1.4%

1.4%

1.5%

Provision Expense

113

71

9

218

144

Allowance Balance (ALLL)

1,806

1,873

2,054

2,377

2,480

ALLL as % of Loans

(3)

1.7%

1.8%

2.1%

2.6%

2.9%

ALLL as % of NPLs

(3)

145.2%

124.3%

129.0%

103.6%

101.5%

ALLL as % of NCOs

(3)

239.1%

194.8%

153.8%

193.3%

196.1% |

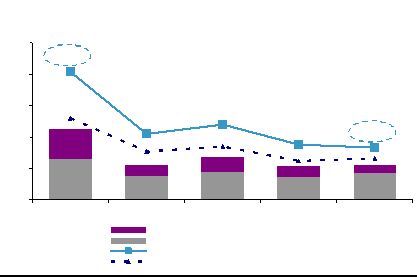

24

1Q 2011 Preliminary Results

Global Annualized Credit Losses - Managed Retail Contract Amount

($ millions)

2.04%

1.05%

1.20%

0.88%

0.83%

0.66%

0.62%

0.85%

0.77%

1.30%

$0

$100

$200

$300

$400

$500

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Nuvell Credit Losses

Credit Losses (excluding Nuvell)

% of Avg. Managed Assets

% of Avg. Managed Assets (excluding Nuvell)

Global Delinquencies - Managed Retail Contract Amount

$ Amount of Accruing Contracts Greater than 30 Days Past Due (millions)

2.22%

2.16%

1.81%

1.57%

1.21%

1.42%

1.94%

2.26%

2.93%

2.87%

$0

$500

$1,000

$1,500

$2,000

$2,500

1Q 10

2Q 10

3Q 10

4Q 10

1Q 11

Nuvell Delinquent Contract $

Delinquent Contract $ (excluding Nuvell)

% of Retail Contract $ Outstanding

% of Retail Contract $ Outstanding (excluding Nuvell)

Asset Quality: Global Auto Finance

•

Global auto credit quality trends continued to improve

in 1Q

–

Retail delinquencies down 52 bps from 4Q10

and 145 bps from 1Q10

–

Net credit loss ratio down 60% YoY

•

Nuvell portfolio continues to demonstrate strong

performance improvement

–

Significant decrease in delinquencies

–

Nuvell portfolio balance down to $2 billion |

25

1Q 2011 Preliminary Results

Summary

•

Fifth straight quarter of profitability

•

Demonstrated success as pre-eminent auto finance company with significant

origination growth •

Initiated process of repaying U.S. Treasury investments with Trust Preferred

transaction •

Further improved liquidity

•

Ally Bank continued positive momentum

First Quarter Highlights

Captive

Finance Company

Market Driven

Competitor

Bank Holding

Company

Transformation |

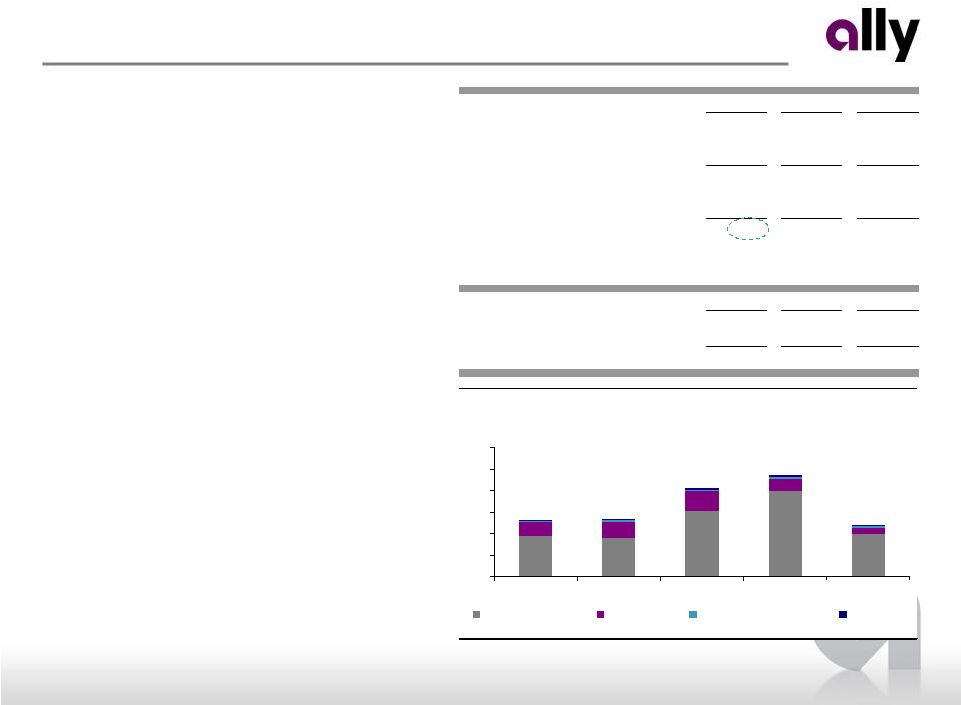

Supplemental Charts |

27

1Q 2011 Preliminary Results

Key Financials ($ millions)

1Q 11

4Q 10

1Q 10

Net financing loss

(226)

$

(243)

$

(214)

$

Total other revenue

55

45

(56)

Total net loss (ex. OID)

(171)

(198)

(270)

Provision for loan losses

(17)

-

15

Noninterest expense

144

157

129

Core pre-tax loss

(298)

$

(355)

$

(414)

$

OID Amortization

(1)

326

301

397

Pre-tax loss from continuing ops

(624)

$

(656)

$

(811)

$

Total assets

29,750

$

28,561

$

31,644

$

Corporate and Other

•

OID amortization expense of $326 million in 1Q

•

Commercial Finance pre-tax income of $51

million in 1Q up from $19 million in 4Q10

–

Favorable impact on provision due to

recoveries

Supplemental

OID Amortization Schedule

($ billions)

$0.6

$0.3

$0.2

$0.1

$0.2

Avg = $0.1 / yr

2011

2012

2013

2014

2015

2016 and thereafter

As of 3/31/2011

(1) Primarily bond exchange OID amortization expense used for calculating core

pre-tax income |

28

1Q 2011 Preliminary Results

Discontinued Operations

•

Closed the sale of Ecuador auto finance in 1Q

•

Signed agreement to sell U.K. Property and

Casualty insurance business in April 2011

•

No new operations classified as discontinued in

the quarter

•

Results driven by $26 million impairment of

Venezuela auto finance

Supplemental

(1) Definitive agreement signed in April 2011

Businesses classified as Discontinued Operations as of 3/31/2011

Auto Finance:

Australia

Russia

Venezuela

Insurance:

U.K. P&C

(1)

Impact of Discontinued Operations, net of tax

($ millions)

1Q 11

4Q 10

International Automotive Finance

(a)

(31)

$

(88)

$

Insurance

(a)

7

(20)

Global Automotive Services

(24)

(108)

Mortgage Operations

-

(9)

Consolidated net (loss) income

(24)

$

(117)

$

Total assets

523

$

690

$

(a) Includes certain income tax activity recognized by Corporate and Other |

29

1Q 2011 Preliminary Results

Ally Financial Inc. Consolidated Unsecured Long-Term Debt Maturity Profile

($ billions)

$21

$4

$4

$2

$13

$7

2011

2012

2013

2014

2015

2016 and

thereafter

Liquidity and Unsecured Debt Maturity Profile

Supplemental

As of 3/31/11

Available Liquidity

3/31/2011

12/31/2010

($ billions)

Parent

(1)

Ally Bank

Parent

(1)

Ally Bank

Cash and Cash Equivalents

7.6

$

3.7

$

6.7

$

3.1

$

Unencumbered Securities

(2)

1.2

5.0

2.3

4.4

Current Committed Unused Capacity

(3)

10.9

4.9

11.1

3.8

Subtotal

19.7

$

13.6

$

20.1

$

11.3

$

Ally Bank Intercompany Loan

(4)

2.3

(2.3)

3.7

(3.7)

Total Available Liquidity

22.0

$

11.3

$

23.8

$

7.6

$

(1)

Parent defined as Ally Consolidated less Ally Bank, ResCap (not shown) and Insurance (not

shown)

(2)

Includes UST, Agency debt and Agency MBS

(3)

Includes equal allocation of shared unused capacity totaling $3.93 billion in 1Q and $3.89 billion at

year end which can be used by Ally Bank or the Parent (including international

subsidiaries)

(4)

To optimize use of cash and secured facility capacity between entities, Ally Financial lends cash to

Ally Bank from time to time under an intercompany loan agreement. Amounts outstanding on

this loan are repayable to Ally Financial at any time, subject to 5 days notice. |