Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 3D SYSTEMS CORP | f8k_050311.htm |

May 3 2011

Investor Presentation

May 2011

www.3dsystems.com NASDAQ:TDSC

Company Confidential

2

Forward Looking Statements

This presentation contains forward-looking statements, as defined by federal and state securities laws. Forward-looking statements include

statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance

or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can

identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,''

"contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of

these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-

looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements

described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking

statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood

of unanticipated events, and we disclaim any such obligation.

statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance

or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can

identify forward-looking statements by terminology such as ''may,'' ''will,'' ''should,'' “hope,'' "expects,'' ''intends,'' ''plans,'' ''anticipates,''

"contemplates," ''believes,'' ''estimates,'' ''predicts,'' ''projects,'' ''potential,'' ''continue,'' and other similar terminology or the negative of

these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-

looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements

described on this message including those set forth below. In addition, we undertake no obligation to update or revise any forward-looking

statements to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence or likelihood

of unanticipated events, and we disclaim any such obligation.

Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and

unknown risks, uncertainties, assumptions, and other factors, many of which are beyond our control, that may cause actual results,

outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes,

levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. As a

result, we cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no

assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished. These forward-

looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as

the beliefs and assumptions of management. 3D System’s actual results could differ materially from those stated or implied in forward-

looking statements. Past performance is not necessarily indicative of future results. We do not intend to update these forward looking

statements even though our situation may change in the future. Further, we encourage you to review the risks that we face and other

information about us in our filings with the SEC, including our Annual Report on Form 10-K which was filed on February 17, 2011. These are

available at www.SEC.gov.

Company Confidential

3

Profile

Company Confidential

4

Balanced Revenue Composition… 2010 FY

Company Confidential

5

Leading Provider of 3D Content-to-Print Solutions

Company Confidential

6

Global Reach with Local Presence

United States

- Rock Hill, SC

- Atlanta, GA

- Goodland, IN

- Lawrenceburg, TN

- Seattle, WA

- Syracuse, NY

- Valencia, CA

- Vernon Hills, IL

Europe

- England

- France

- Germany

- Italy

- Switzerland

Asia-Pacific

- China

- Hong Kong

- Japan

- Singapore

Company Confidential

7

Compelling Business Model

Printer Consumables

Company Confidential

8

Leadership Through Technology

Professional 3D Printers:

MJM, SLA®

MJM, SLA®

Price: $1,300 - $9,900

Personal 3D Printers:

FTI, PJP

Price: $49,000 - $199,000

Production 3D Printers:

SLA®, SLS®, SLM

SLA®, SLS®, SLM

Price: $250,000 - $950,000

Company Confidential

9

High-Performance Integrated Print Materials

q High-definition materials for

concept models and functional

prototypes

concept models and functional

prototypes

q Accurate durable materials for

rapid prototyping and

manufacturing of end-use

parts

rapid prototyping and

manufacturing of end-use

parts

q Engineered plastic materials

and composites that are tough

and stable for demanding end-

use environments

and composites that are tough

and stable for demanding end-

use environments

q Fully dense metals and alloys

for rapid tools and real parts

for rapid tools and real parts

Company Confidential

10

Expanding Range of End-Use Applications

Company Confidential

11

First Mover Advantage… Diverse Customer Base

Company Confidential

12

Clear Competitive Advantage

Company Confidential

13

Marketplace Convergence Drives Opportunities

Source: 3D Systems

Company Confidential

14

Company Confidential

15

Results From Growth Initiatives: Custom Parts Services

Access to end

users

users

Build scale and

presence

presence

Consolidate

channel

channel

Shape brand

experience

experience

Quickparts®

3Dproparts™

Exited 2010 with

$18.3 M of annual

customer parts services

revenue

$18.3 M of annual

customer parts services

revenue

Acquired Quickparts®

(Feb 2011) with 2010

revenue of $25.2 M

(Feb 2011) with 2010

revenue of $25.2 M

Generated $10.3 M

customer parts services

revenue in Q1 2011

customer parts services

revenue in Q1 2011

Improved gross profit

margin sequentially:

margin sequentially:

• 26% Q4, 2010

• 39% Q1, 2011

Company Confidential

16

Results From Growth Initiatives: 3D Printers

Record 2010 printer revenue of $54.7

million and 79% growth over prior year

million and 79% growth over prior year

Record Q1 2011 printer revenue of $13.5

million and 54% growth over Q1 2010

million and 54% growth over Q1 2010

Company Confidential

17

Results From Growth Initiatives: Healthcare Solutions

ITE hearing aids

Dental restorations

Orthodontic aligners

Orthopedic implants

Prosthetics

Trauma procedures

Company Confidential

18

Full Year 2010

2010

2010

79%

Across-The-Board Revenue Growth

$ in millions

38%

46%

16%

$ 30.5

$ 54.7

$ 32.0

$ 46.8

$ 50.3

$ 58.4

$ 15.7

$ 21.6

2010

Company Confidential

19

Shareholder Value

Acquisitions Track Record

2011

Quickparts

National RP Support

ATI

Sycode

Print3D

2010

Provel

Bits From Bytes

Express Pattern

CEP

Protometal

Design Prototyping Technologies

Moeller Design & Development

2009

AdvaTech Manufacturing

Acu-Cast Technologies

Desktop Factory

Company Confidential

20

Experienced Management Team

Bob Grace

GC&S

GC&S

Damon Gregoire

CFO

CFO

Abe Reichental

CEO

CEO

Chuck Hull

CTO

CTO

Kevin McAlea

Sales

Sales

Cathy Lewis

Marketing

Marketing

May 3 2011

Financial Overview

www.3dsystems.com NASDAQ:TDSC

Company Confidential

22

Revenue Categories

Geography

First Quarter Revenue by Category & Geography

Asia Pacific

2010

2010

2011

2011

Company Confidential

23

First Quarter 2011

2010

2010

54%

Across-The-Board Revenue Growth

$ in millions

52%

103%

15%

$ 8.8

$ 13.5

$ 9.2

$ 18.8

$ 13.6

$ 15.6

$ 4.1

$ 6.2

2010

Company Confidential

24

|

First Quarter

|

||||||

|

|

|

|

|

|

|

|

|

Drivers

|

|

2011

|

|

2010

|

|

% Change

Favorable/(Unfavorable)

|

|

Revenue

|

|

$ 47.9

|

|

$ 31.6

|

|

51%

|

|

Gross Profit

|

|

$ 23.2

|

|

$ 14.3

|

|

62%

|

|

% of Revenue

|

|

48%

|

|

45%

|

|

|

|

Operating Expenses

|

|

$15.8

|

|

$11.7

|

|

(35%)

|

|

% of Revenue

|

|

33%

|

|

37%

|

|

|

|

Net Income

|

|

$6.8

|

|

$2.0

|

|

238%

|

|

% of Revenue

|

|

14%

|

|

6%

|

|

|

|

Depreciation & Amortization

|

|

$2.4

|

|

$1.5

|

|

(60%)

|

|

% of Revenue

|

|

5%

|

|

5%

|

|

|

|

Diluted Earnings Per Share

|

|

$0.28

|

|

$0.09

|

|

211%

|

$ in millions, except earnings per share

-Percents are rounded to nearest whole number

First Quarter 2011 Operating Results

Company Confidential

25

Printer Razor and Blade Profile

(1) Model assumes net annual material revenue of $12,000 per printer from a mix of all printers. Model illustrates cumulative revenue growth of adding 100

new printers/year for five years. This target model is not intended to constitute financial global guidance related to the company’s expected performance. It is

based upon management’s current expectations concerning future events and trends and is necessarily subject to uncertainties.

new printers/year for five years. This target model is not intended to constitute financial global guidance related to the company’s expected performance. It is

based upon management’s current expectations concerning future events and trends and is necessarily subject to uncertainties.

Personal & Professional Printer Revenue Model (1)

Commentary

q Our “razor and blades” business model

centers on sustainable profitable growth

from consumables

centers on sustainable profitable growth

from consumables

q Recurring revenue drives sustainability and

profitability

profitability

q We expect higher margin integrated print

materials revenue to drive further margin

expansion and reduce seasonality as our

installed base grows over time

materials revenue to drive further margin

expansion and reduce seasonality as our

installed base grows over time

q Our personal and professional printers

consume an average of $12,000 of materials

annually (excluding BfB™ printers)

consume an average of $12,000 of materials

annually (excluding BfB™ printers)

Company Confidential

26

|

First Quarter

|

||||||

|

|

|

|

|

|

|

|

|

Category

|

2011

|

2010

|

Yr-Yr%

|

|||

|

$ Millions

|

Gross Profit

Margin |

$ Millions

|

Gross Profit

Margin |

$

|

Margin

|

|

|

Printers

|

$5.5

|

41%

|

$ 3.1

|

36%

|

75%

|

13%

|

|

Materials

|

$9.9

|

63%

|

$ 8.3

|

61%

|

20%

|

5%

|

|

Services(1)

|

$7.8

|

42%

|

$ 2.9

|

32%

|

167%

|

31%

|

|

Total

|

$23.2

|

48%

|

$ 14.3

|

45%

|

62%

|

7%

|

Gross Profit and Margin Trend

Company Confidential

27

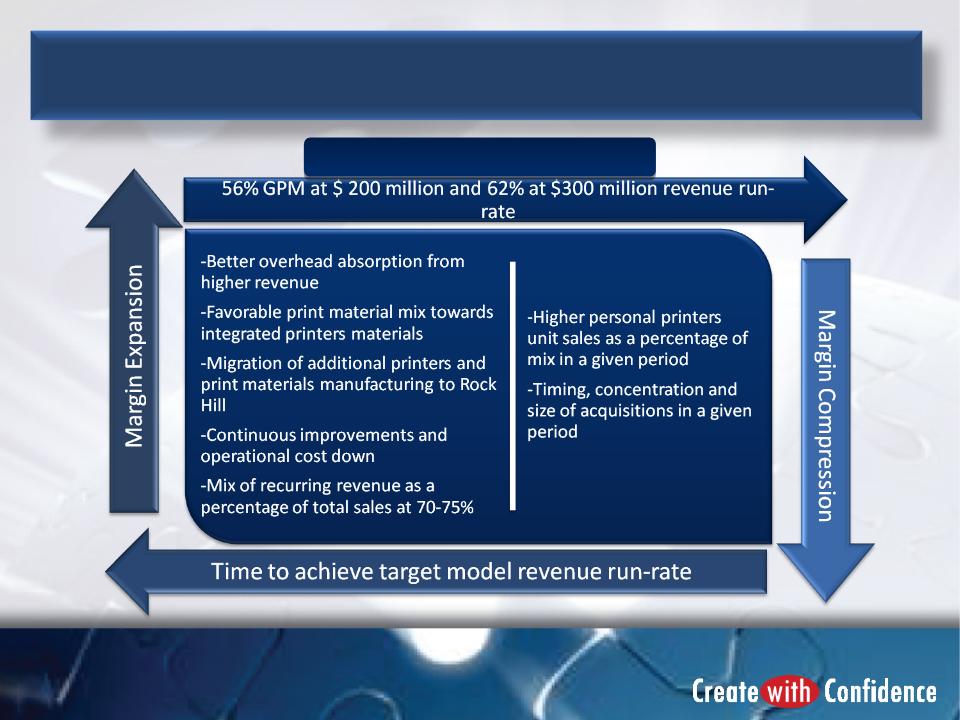

Expected Margin Expansion Path

Long-Term Target

Company Confidential

28

|

First Quarter

|

|||

|

|

|

|

|

|

Category

|

2011

|

2010

|

% Change Favorable

(Unfavorable) |

|

Selling, general & administrative

|

$13.0

|

$ 9.2

|

(42%)

|

|

Research and development

|

$2.8

|

$ 2.5

|

(13%)

|

|

Total Operating Expenses

|

$15.8

|

$ 11.7

|

(35%)

|

|

% of Revenue

|

33%

|

37%

|

11%

|

• Total operating expenses increased primarily due to:

• Higher commissions from increased revenue

• Cost from additional acquisitions made during the quarter

• Legal expenses of $1.7 million primarily due to litigation concentration and timing

• Selling, general & administrative expenses decreased to 27% of revenue for the quarter from 29% in the first quarter of 2010

• Research & development expenses decreased to 6% of revenue in 2011 from 8% of revenue in the 2010 quarter

($ in millions)

First Quarter Operating Expenses

Company Confidential

29

Operating Leverage Expected To Continue

$ in millions

Company Confidential

30

Factors Affecting Earnings Per Share

Company Confidential

31

Favorable EPS Trend

Revenue and margin expansion, coupled with operating cost containment and

optimization resulted in an improved bottom line and stronger balance sheet

optimization resulted in an improved bottom line and stronger balance sheet

|

EPS Improvement over Prior Year's Quarter

|

|

|

|

|

|

Q1 2009

|

$0.08

|

|

Q2 2009

|

$0.09

|

|

Q3 2009

|

$0.08

|

|

Q4 2009

|

$0.08

|

|

Q1 2010

|

$0.18

|

|

Q2 2010

|

$0.18

|

|

Q3 2010

|

$0.19

|

|

Q4 2010

|

$0.24

|

|

Q1 2011

|

$0.19

|

Company Confidential

32

|

|

|

|

|

|

|

March 31, 2011

|

December 31, 2010

|

% Change

Favorable (Unfavorable)

|

|

Cash

|

$70.8

|

$ 37.3

|

90%

|

|

Inventory

|

$ 26.6

|

$23.8

|

(12%)

|

|

Accounts Receivable

|

$ 39.3

|

$ 35.8

|

10%

|

|

Accounts Payable

|

$ 23.4

|

$ 26.6

|

12%

|

|

Working Capital

|

$ 76.5

|

$ 42.5

|

80%

|

• Cash increased $33.5 million from the fourth quarter of 2010, primarily reflecting $54.0 million

proceeds from our equity raise and $22.1 million paid in cash for acquisitions during the quarter.

proceeds from our equity raise and $22.1 million paid in cash for acquisitions during the quarter.

• Working capital increased $34.0 million compared to the end of 2010, including a $3.5 million

increase in accounts receivable and a $7.5 million decrease in trade accounts payable.

increase in accounts receivable and a $7.5 million decrease in trade accounts payable.

• Inventory increased $2.8 million primarily related to timing of inventory purchases and customer

deliveries.

deliveries.

($ in millions)

Working Capital

Company Confidential

33

Balance Sheet Management

Strong balance sheet coupled

with operating leverage allows us

to fund our strategic initiatives

with operating leverage allows us

to fund our strategic initiatives

No debt

Strong cash

balance

balance

Quality receivables

Balanced

inventories

inventories

Managed payables

Company Confidential

34

($ millions)

* Net income is inclusive of the estimated fully-burdened tax rate in a range of 31-38% depending on the period.

- The company’s current NOLs of $65 million reduce the cash taxes to the portion relating to the non-U.S. obligations.

This target model is not intended to constitute financial guidance related to the company’s expected performance. It is based upon management’s current

expectations concerning future events and trends and is necessarily subject to uncertainties.

expectations concerning future events and trends and is necessarily subject to uncertainties.

Long-Term Target Operating Model

Company Confidential

35

Well-Positioned For the Long Term

May 3 2011

www.3dsystems.com NASDAQ:TDSC

Thank You