Attached files

| file | filename |

|---|---|

| 8-K - AMERICAS ENERGY COMPANY 8K, 04.27.11 - TREND TECHNOLOGY CORP | americasenergy8k042811.htm |

Exhibit 10.1

INVESTMENT AGREEMENT

This Investment Agreement (this “Agreement”) is made and entered into as of this 20th day of April, 2011, by and between Hanhong (Hong Kong) New Energy Holdings Limited (the “Investor”), and Americas Energy Company – AECo, a Nevada corporation (the “Company”).

The Investor and the Company desire to enter into this Agreement to evidence certain transactions between them, as provided for below.

Accordingly, for good and valuable consideration, the receipt and sufficiency of which are acknowledged, the parties agree as follows:

1. Loan to the Company.

1.1 Convertible Note, Security Agreement and Warrants.

On the date hereof, the Company shall issue, execute and deliver to the Investor (i) a 16.66% Convertible Line of Credit Note, in the form attached as Exhibit A, in the principal amount of up to $2,000,000 (the “Note”), (ii) a Security Agreement in the form attached hereto as Exhibit B, and (iii) Warrants for the purchase of up to 6,000,000 shares of Common Stock, $0.0001 par value, of the Company, in the forms attached as Exhibit C-1, C-2 and C-3 (each a “Warrant” and collectively, the “Warrants”).

1.2 Board Representation. On the date hereof, the Company shall cause John Gargis to resign as a member of the Company’s Board of Directors (the “Board”), and the Company shall cause a person designated by Investor to be appointed as a member of the Board to fill such vacancy. The Company shall reimburse the member of the Board designated by Investor for any out-of-pocket expenses incurred by such person in performing such person’s duties as a member of the Board. Thereafter, the Company shall cause a person designated by the Investor to be nominated as a candidate to the Board to the Company’s shareholders. The Company agrees to take any action reasonably requested by Investor to ensure that, until all amounts due to Investor under the Note have been paid in full, the Company will not issue additional shares of common stock or debt or equity instruments convertible to common stock, without the approval of the member or members of the Board designated by the Investor. On the date hereof, the Company represents and warrants that, before giving effect to the issuance of the Note and the Warrants, it has the following securities issued and outstanding (i) 81,212,617 shares of common stock, (ii) warrants to acquire 9,000,000 shares of common stock at an exercise price of $0.75, (iii) options to acquire 7,243,387 shares of common stock at an exercise price of $0.125. Except as set forth in this Agreement, the Company has no obligation to any person to issue securities.

1.3 Exclusive Sales Rights. Other than by or through Investor, the Company shall not, and shall not cause or allow any other third party to, and shall prohibit any third party to, directly or indirectly sell or distribute coal or coal products produced or distributed by the Company in or to China. In the event the Company desires to directly or indirectly sell or distribute coal or coal products produced or distributed by the Company in or to China, the Company shall offer to, and if acceptable to the Investor, enter into good faith negotiations with the Investor regarding an agreement whereby Investor would have the exclusive right to sell and distribute coal and coal products produced by the Company in or to China.

2. [REDACTED TEMPORARILY] Property.

2.1 Purchase Price. The Investor agrees that it will use its commercially reasonable efforts to explore the financing of an initial payment by the Company of up to [Redacted Temporarily] (the “Initial Payment”) to acquire the coal properties near [Redacted Temporarily] described on Schedule D (the “[Redacted Temporarily] Property”) from [Redacted Temporarily] in a sale anticipated to be conducted pursuant to Rule 363 under the federal Bankruptcy Code. The Investor would contribute the initial $2,000,000 of the Initial Payment to the Company in exchange for common stock of the Company, and would provide half of the remainder of the Initial Payment to the Company in exchange for common stock of the Company and half of the remainder of the Initial Payment to the Company as a loan bearing interest at the rate of 16.6% per annum, maturing on a date to be set by the Company and the Investor prior to the closing of [Redacted Temporarily] properties purchase. As part of the acquisition price, the Company would pay to [Redacted Temporarily] a $3.00 per ton royalty on coal produced from the [Redacted Temporarily] Property (the “Royalty”). The Investor does not expect the total purchase price to be paid for the [Redacted Temporarily] Property, including the Initial Payment and the Royalty, to exceed $23,600,000.

2.2 Additional Investment in [Redacted Temporarily] Property. The Investor agrees that it will use its commercially reasonable efforts to explore the potential investment in the Company be used by the Company to upgrade the existing processing plant (up to US$2,000,000), to acquire additional material mineral leases for the [Redacted Temporarily] property and to expand production and logistics capacities of the [Redacted Temporarily] Property, if and as may be mutually agreed upon by the Investor and the Company.

2.3 Participation of Investor. The Investor and the Company shall use their commercially reasonable efforts to minimize the amount of the purchase price of the [Redacted Temporarily] Property. Although the Investor may provide to the Company equity and debt financing for the purchase price and for related lease acquisitions and improvements, any such equity and debt financing shall be only upon the terms and conditions acceptable to the Investor in its sole and unfettered discretion, and Investor shall have no obligation or duty to provide any such equity or debt financing.

2.4 Issuance of Equity to Investor. If the Company acquires the [Redacted Temporarily] Property, then as part of the consideration for providing the Initial Payment and any other financial support that may be provided by the Investor to the Company in connection with the acquisition or as otherwise contemplated herein, the Company shall issue to the Investor a number of shares of the Company’s common stock such that, following such issuance, the Investor owns 51% of the Company’s common stock on a fully diluted basis. This stock issuance shall occur on completion of the acquisition of the [Redacted Temporarily] Property or as soon thereafter as possible. The Company and the Investor currently anticipate that approximately 113,195,149 shares of common stock would be issued to the Investor pursuant to this provision as indicated on Exhibit D.

2

Upon completion of the acquisition of the [Redacted Temporarily] Property, the Company shall cause the number of the members of the Company’s Board to be increased to five, and the Company shall cause two persons designated by Investor to be appointed as members of the Board to fill such new positions, so that the Investor’s nominees will be three of the five members of the Board. The Investor agrees that Ron Scott and Chris Headrick should remain as the other two members of the Board. The Company shall reimburse the members of the Board thus designated by Investor for any out-of-pocket expenses incurred by such person in performing such person’s duties as a member of the Board. Thereafter, the Company shall cause a total of three persons designated by the Investor to be nominated for election to the Board by the Company’s shareholders.

The Company shall use its best efforts to diligently pursue and take all actions necessary or desirable, or reasonably requested by Investor, (i) for approval of any transactions contemplated by this Agreement and related agreements, including obtaining any necessary shareholder approvals, and (ii) to increase the number of Company directors to be set at five (5), and (iii) to cause the appointment to the Board of three individuals designated by the Investor. In this connection, the Company shall obtain agreements (the “Required Lockup Agreements”) in a form satisfactory to the Investor from stockholders holding in excess of 51% of the outstanding common stock of the Company to vote in favor of the transactions contemplated by this Agreement, including without limitation the issuance of common stock to the Investor in the event the acquisition of the [Redacted Temporarily] Property is completed, as contemplated by this Section 2.4. Obtaining the Required Lockup Agreements is a condition precedent to any loan made by the Investor pursuant to the Note.

2.5 Exclusivity. Recognizing that the parties hereto will spend substantial time and incur substantial expense regarding a potential transaction involving the [Redacted Temporarily] Property (a “Potential Transaction”), each party hereto agrees that, from the date of this Agreement through July 31, 2011 (the “Exclusivity Period”), each party hereto (a) will work exclusively with the other party hereto respecting the Potential Transaction and (b) will not, directly or indirectly, through any affiliate, agent or otherwise (i) solicit, initiate, encourage or participate in any submission to the current owner of, or court controlling, the [Redacted Temporarily] Property, of any proposal or offer respecting a Potential Transaction, from any person, entity or group, or (ii) furnish any information with respect to the foregoing to any person, entity or group (each of (i) and (ii) being a “Prohibited Activity”). In addition, each party hereto agrees to promptly terminate any discussions or negotiations with any other party respecting a Potential Transaction which would constitute a Prohibited Activity that are in process on the date hereof. Each party agrees to promptly notify the other party hereto of any contact, request or offer regarding a Potential Transaction which could involve a Prohibited Activity, that the other party hereto receives from any other party or otherwise learns about during the Exclusivity Period.

3. Representations and Warranties of the Company. In order to induce the Investor to enter into the Agreement, the Company represents and warrants to the Investor that:

(a) The Company has been duly organized and is validly existing as a corporation and is in good standing under the laws of the State of Nevada. The Company is qualified to do business in each jurisdiction in which failure to be so qualified could have a

3

material adverse effect on the Company. The Company has all requisite organizational power and authority to conduct its business as currently conducted and to enter into, execute, deliver and perform all of its duties and obligations under this Agreement and all related instruments, documents and agreements executed in connection herewith and therewith (collectively the “Related Agreements”).

(b) This Agreement and the Related Agreements are the valid and binding obligations of the Company, enforceable in accordance with their terms, except as the enforcement may be limited by bankruptcy and other laws of general application relating to creditor’s rights or general principles of equity. The execution, delivery and performance of this Agreement and the Related Agreements and the issuance of any securities related thereto have been duly authorized by all necessary action on the part of the Company. No consent, approval or authorization of, or designation, declaration or filing with, any governmental authority or other person is required to be obtained in connection with the execution, delivery and performance of this Agreement, the Related Agreements or the issuance of any securities related thereto.

(c) The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby do not and will not: (i) conflict with or result in any default under any contract, obligation or commitment of the Company or any provision of the Company’s constitutive documents; (ii) result in the creation of any lien, charge or encumbrance of any nature upon any of the properties or assets of the Company; or (iii) violate any instrument, agreement, judgment, decree or order, or any statute, rule or regulation of any federal, state or local government or agency, applicable to the Company or to which the Company is a party.

(d) All of the filings made by the Company with the Securities and Exchange Commission are true and correct in all material respects.

4. General.

4.1 Amendments, Waivers and Consents. No covenant or other provision hereof or thereof may be waived otherwise than by a written instrument signed by the party so waiving such covenant or other provision. This Agreement may be amended only by written agreement executed by the Company and the Investor.

4.2 Governing Law; Jurisdiction; Venue. This agreement shall be deemed to be a contract made under, and shall be construed in accordance with, the laws of the State of Nevada. The Company and the Investor hereby agree that the state and federal courts of the State of Nevada shall have jurisdiction to hear and determine any claims or disputes between the Investor and the Company pertaining directly or indirectly to this Agreement.

4.3 Counterparts. This Agreement may be executed simultaneously in any number of counterparts, each of which when so executed and delivered shall be taken to be an original; but such counterparts shall together constitute but one and the same document.

4

4.4 Integration. This Agreement, including the exhibits, documents and instruments referred to herein or therein and any other instruments, documents or agreements executed or delivered herewith on the date hereof, constitutes the entire agreement, and supersedes all other prior agreements and understandings, both written and oral, among the parties with respect to the subject matter hereof.

4.5 Survival. The representations, warranties, covenants and agreements made herein shall survive the execution and delivery of this Agreement and the closing of the transactions contemplated hereby. All statements as to factual matters contained in any certificate or other instrument delivered by or on behalf of the Company pursuant hereto in connection with the transactions contemplated hereby shall be deemed to be representations and warranties by the Company hereunder solely as of the date of such certificate or instrument.

4.6 Successors and Assigns. Except as otherwise expressly provided herein, the provisions hereof shall inure to the benefit of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto. The Company hereby acknowledges and agrees that Investor may assign its rights hereunder to an Affiliate. For purposes of this Section 4.6, “Affiliate” shall mean any entity that now or in the future, directly or indirectly controls, is controlled with or by or is under common control with a party. The Company may not assign its rights or delegate its obligations under this Agreement without the written consent of Investor, which consent may be withheld at its discretion.

4.7 Severability. In case any provision of this Agreement shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby and such invalid, illegal or unenforceable provision shall be reformed to render valid and enforceable and so as to give effect to the intent manifested by such provision.

4.8 Delays or Omissions. It is agreed that no delay or omission to exercise any right, power or remedy accruing to any party, upon any breach, default or noncompliance by another party under this Agreement shall impair any such right, power or remedy, nor shall it be construed to be a waiver of any such breach, default or noncompliance, or any acquiescence therein, or of or in any similar breach, default or noncompliance thereafter occurring.

4.9 Notices. All notices required or permitted hereunder shall be in writing and shall be deemed effectively given: (i) upon personal delivery to the party to be notified, (ii) upon delivery by confirmed facsimile transmission if received by the recipient before 5:00 p.m. local time on a business day, and if not, then the next business day, (iii) upon receipt, if deposited with the United States Post Office, by registered or certified mail, postage prepaid or (iv) upon receipt, if delivered by a nationally recognized overnight courier service. All communications shall be sent to the party at the address as set forth on the signature page hereof or at such other address as the Company or the Investor may designate by ten (10) days advance written notice to the other party hereto.

4.10 Expenses. Each of the parties shall pay its own expenses and the fees and expenses of its counsel, accountants, and other experts or advisors in connection with this Agreement and the transactions contemplated hereby.

5

4.11 Attorneys’ Fees. In the event that any dispute among the parties to this Agreement should result in litigation, the prevailing party in such dispute shall be entitled to recover from the losing party all fees, costs and expenses of enforcing any right of such prevailing party under or with respect to this Agreement, including without limitation, such reasonable fees and expenses of attorneys and accountants, which shall include, without limitation, all fees, costs and expenses of appeals.

4.12 Titles and Subtitles. The titles of the sections and subsections of this Agreement are for convenience of reference only and are not to be considered in construing this Agreement.

4.13 Broker’s Fees. Each party hereto represents and warrants that no agent, broker, investment banker, person or firm acting on behalf of or under the authority of such party hereto is or will be entitled to any broker’s or finder’s fee or any other commission directly or indirectly in connection with the transactions contemplated herein. Each party hereto further agrees to indemnify each other party for any claims, losses or expenses incurred by such other party as a result of the representation in this Section 7.14 being untrue.

[Signature Page Follows]

6

The parties hereto have executed this Agreement as of the day and year first above written.

|

Investor

Hanhong (Hong Kong) New Energy Holdings Limited

By: /s/ Yang (Simon) Liu

Name: Yang (Simon) Liu

Title: President

Address:

Suite 1, 8th Floor, New Heny House,

10 Ice House Street, Central Hong Kong

Fax: (86) 10 8588 6577

Phone: (86) 10 8588 6567

Attention: James Liu

|

|

| Company | |

| Americas Energy Company-AECo | |

| By: /s/ Christopher L. Headrick | |

| Name: Christopher L. Headrick | |

| Title: President & CEO | |

| Address: | |

| 243 N. Peters Rd. | |

| Knoxville, TN 37923 | |

| Fax: (866) 655-6799 | |

| Phone: (865) 238-0668 | |

| Attention: John P. Hayes |

7

Exhibit A

to

Investment Agreement

Convertible Line of Credit Note

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THIS NOTE MAY NOT BE SOLD, OFFERED FOR SALE, ASSIGNED, TRANSFERRED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO THIS NOTE UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO AMERICAS ENERGY COMPANY – AECO THAT SUCH REGISTRATION IS NOT REQUIRED.

AMERICAS ENERGY COMPANY

249 N. Peters Rd.

Suite 300

Knoxville, TN 37923

Phone: (865) 238-0668 x 105

Web Site: www.americasenergycompany.com

(Incorporated under the laws of Nevada)

CONVERTIBLE LINE OF CREDIT NOTE

Loan # 1

| $2,000,000.00 | April 20, 2011 |

FOR VALUE RECEIVED, the undersigned AMERICAS ENERGY COMPANY – AECO, a Nevada corporation (the “Payor”) promises to pay to HANHONG (HONG KONG) NEW ENERGY HOLDINGS LIMITED, or such individual or entity designated by them in writing, located at Suite 1, 8th Floor, New Henry House, 10 Ice House Street, Central Hong Kong (together with its permitted successors and assigns, “Holder”) the principal sum of $2,000,000.00 (the “Principal Amount”) or so much thereof as may be advanced and outstanding (the “Outstanding Principal Amount”) with interest on the Outstanding Principal Amount of 16.66% (or if less, the maximum amount allowed under applicable law) per annum, compounded monthly, to be computed on each advance from the date of its disbursement as set forth below. Interest shall commence as of the date hereof and shall continue on the Outstanding Principal Amount and any accrued but unpaid interest until paid in full. Interest shall be computed on the basis of a 360-day year for the actual number of days elapsed.

1. Definitions. As used herein, the following terms shall have the meanings set forth after each, and any other term defined in this Note shall have the meaning set forth at the place defined:

(a) “Advance” means any disbursement by Holder of funds pursuant to the Note, to, or as directed by, the Payor.

(b) “Business Day” means any day except a Saturday, Sunday or any other day on which commercial banks in California are authorized or required by law to close.

A-1

(c) “Deposit Account” means the following account maintained by the Payor. Bank name and account number of this account will be provided by Holder at a later time.

(d) “Investment Agreement” means the Investment Agreement, dated April 25, 2011, by and between Holder and the Payor.

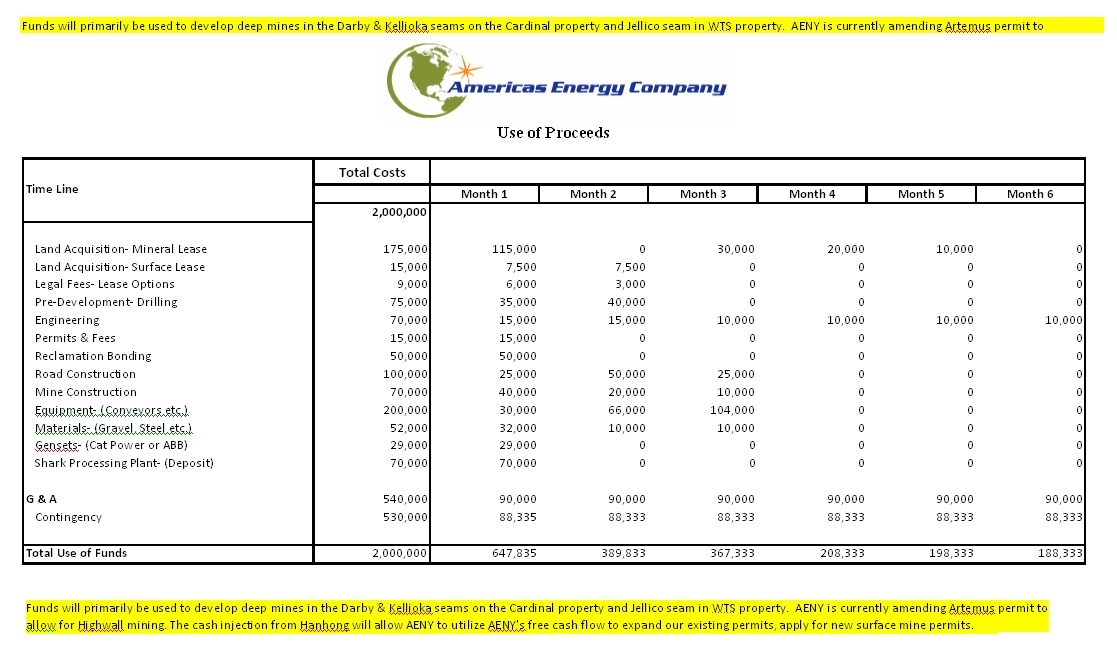

(e) “Permitted Purpose” means the purposes set forth herein on Exhibit A – Use of Proceeds.

2. Payments; Maturity Date. All payments of interest and the Outstanding Principal Amount on this note (the “Note”) shall be in lawful money of the United States of America. All payments shall be applied first to accrued interest and thereafter to the Outstanding Principal Amount. As partial repayment of the accrued interest and Outstanding Principal Amount under this Note, the Payor shall be required to make payments of $3.00 per ton on all coal produced by Payor and sold or transferred by Payor to any other person or entity, including any affiliate of Payor or Holder. Such payments shall be paid by Payor to Holder on or before the tenth (10th) day of the month following the month that title to such coal was transferred from Payor to the purchaser of such coal. Notwithstanding the foregoing, if Payor produces less than seventy percent (70%) of the amounts set forth on Exhibit B attached hereto in any period, Holder and Payor agree to engage in a good faith discussion regarding a revised payment schedule for such period. Unless earlier converted into Common Shares in accordance with Section 5 below, the Outstanding Principal Amount and all accrued but unpaid interest thereon shall be due and payable on the eighteenth (18th) month anniversary of the date hereof (the “Maturity Date”).

3. Borrowing and Repayment.

(a) The Payor may from time to time from the date of this Note up to and including October 31, 2011, borrow and partially or wholly repay its outstanding borrowings, subject to all of the limitations, terms and conditions of this Note and of any document executed in connection with or governing this Note; provided that the cumulative principal amount advanced hereunder from time to time shall not exceed the Principal Amount stated above.

(b) The Payor, acting by and through Chris Headrick, Ron Scott or John Gargis, (each an “Authorized Person”), may from time to time prior to October 31, 2011 request Holder to make advances under the Note, provided that such Advance will be used exclusively for a Permitted Purpose. To request an Advance, the Payor shall give Holder written notice (“Advance Notice”) (i) delivered to Holder (effective upon receipt) or sent by internet mail to Jian (James) Liu at jamesliujian@gmail.com, or (ii) by facsimile to Jian (James) Liu at (86)-10-8588-6577. Each Advance Notice shall be made to Holder at least seven (7) Business Days prior to the date such Advance is to be made, and must specify (1) the amount of such Advance, and (2) the proposed date of making such Advance. Holder may, in its sole discretion, but shall not be obligated to, not later than and upon fulfillment of the applicable conditions set forth in this Section 3, make such Advance available to the Payor, in immediately available funds, and will transmit such funds, by wire transfer or otherwise, (x) directly to the Deposit Account, or (y) as the Payor may otherwise direct in the Advance Notice.

A-2

4. Prepayment. The Payor may prepay this Note, in whole or in part, at any time without penalty. The Payor shall give Holder written notice at least five days prior to prepayment of any portion of the unpaid Outstanding Principal Amount or interest balance of the Note, during which period of time Holder may elect to convert the accrued and unpaid interest and Outstanding Principal Amount of the Note as provided in Section 5.

5. Conversion Option and Purchase Option.

(a) At the written election of Holder delivered to the Payor on or before the Maturity Date, the Holder can choose to convert, at any time and from time to time, up to, but not to exceed, $2,000,000 (the “Conversion Amount”) of any accrued but unpaid interest or principal amount of this Note into common shares of the Payor’s capital stock, par value $0.0001 per share (the “Common Shares”). The number of Common Shares convertible pursuant to this Section 5(a) shall be determined by dividing (i) the Conversion Amount to be so converted, by (ii) $0.136815. In the event that Holder as of any date has not converted the full Conversion Amount into Common Shares, Holder may purchase, upon demand to Payor, Common Shares at a price of $0.136815 in cash per Common Share, provided, however, that the total number of shares converted and/or purchased under this Section 5(a) may not exceed 14,618,401 Common Shares.

(b) In the event of a full conversion, Holder shall surrender the original of this Note for cancellation at the principal office of the Payor accompanied by a notice of conversion specifying the name or names in which the Common Shares are to be issued. Holder shall be treated as the record holder of Common Shares effective as of the date and time of conversion and shall have no remaining rights with respect to this Note so converted, and this Note shall be cancelled.

(c) In the event of a partial conversion, Holder shall retain this Note and shall deliver a notice of conversion specifying the name or names in which the Common Shares are to be issued. Holder shall be treated as the record holder of Common Shares effective as of the date and time of conversion.

6. Reservation of Shares. The Payor shall reserve and keep available out of its authorized but unissued Common Shares such number of Common Shares as shall from time to time be sufficient to effect such conversion and or purchase of at least 14,618,401 shares as provided for in Section 5(a) above. All Common Shares which may be issued upon conversion of this Note will, upon issuance, be validly issued, fully paid and non-assessable.

7. Delivery of Certificates. As promptly as practicable (but no more than fifteen (15) business days) after the surrender of this Note for full or partial conversion, the Payor shall, (subject to compliance with the applicable provisions of federal and state securities laws) deliver to Holder certificate(s) representing the number of Common Shares into which this Note is entitled to be converted or evidence of the issuance of such shares in book-entry form.

8. Collateral Security. As security for the due repayment of the Note and the payment of all other amounts due hereunder, the Payor shall execute and deliver to Holder a pledge agreement (the “Pledge Agreement”) granting to Holder a security interest in any and all, present and future property, including but not limited to, real property, inventory, receivables, vehicles, furniture and equipment. The Payor hereby authorizes Holder to file and

A-3

record such financing statements and other instruments, and to take such other actions, as it determines to be desirable to legalize, authenticate, protect, perfect and maintain the perfection of the security interest identified in the Pledge Agreement.

9. Events of Default. The occurrence of any of the following shall constitute a default by the Payor (an “Event of Default”) under this Note:

(a) the Payor’s failure to fully and timely perform its Obligations (as defined in the Investment Agreement);

(b) the Payor’s default in the payment of any installment of principal and interest on this Note when and as the same shall become due and payable, whether at the due date thereof or by acceleration thereof or otherwise or any other occurrence of any Event of Default or provided for in this Note;

(c) the insolvency of the Payor, the execution by the Payor of a general assignment for the benefit of creditors, the filing against the Payor of a petition in bankruptcy or any petition for relief under the federal bankruptcy act or the continuation of such petition without dismissal for a period of ninety (90) days or more, or the appointment of a receiver or trustee to take possession of the property or assets of the Payor or any execution or attachment shall be issued whereby any part of the Collateral (as defined in the Investment Agreement) shall be taken or attempted to be taken and the same shall not have been vacated or stayed within thirty (30) days after the issuance thereof; or

(d) the Payor’s default in the observance or performance by the Payor of any covenant, condition or agreement contained in the Investment Agreement or this Note.

10. Remedies, Default Interest. In the event that one or more Events of Default shall have occurred and be continuing, Holder may at its option by written notice to the Payor declare the entire Outstanding Principal Amount and accrued and unpaid interest immediately due and payable. Any overdue payment shall bear interest at the rate of 25% per annum, or if less, the maximum amount allowed under applicable law, compounded monthly, until the Outstanding Principal Amount and accrued and unpaid interest are fully paid.

11. Waiver. All parties to this Note, including any endorser or guarantors, if any, jointly and severally waive presentment, notice or dishonor and diligence in collecting and all agree to remain fully obligated under the terms of this Note even if, without notice, the time for payment is extended; or the Note is renewed or modified; or one of the parties is released or discharged; or the release or substitution of any collateral given as security for the payment of the Note. No course of dealing between the parties of this Note, and no delay on the part of Holder in exercising any rights hereunder, shall operate as a waiver of the rights of Holder. No covenant, provision or Event of Default hereunder may be waived except by written instrument signed by the waiving party, and no such waiver shall extend to or impair any obligation not expressly waived.

A-4

12. Representations of the Payor. The Payor makes the following representations and warranties to Holder, which representations and warranties shall survive the execution of this Note and shall continue in full force and effect until the final payment, and satisfaction and discharge, of all obligations of the Payor to Holder subject to this Note:

(a) Legal Status. The Payor is a corporation, duly organized and existing and in good standing under the laws of the State of Nevada, and is qualified or licensed to do business in all jurisdictions in which such qualification or licensing is required or in which the failure to so qualify or to be so licensed could have a material adverse effect on the Payor.

(b) Authorization and Validity. This Note and each other contract, instrument and document deemed necessary by Holder to evidence any extension of credit to the Payor pursuant to the terms and conditions hereof (collectively, the “Loan Documents”) have been duly authorized, and upon their execution and delivery in accordance with the provisions hereof will constitute legal, valid and binding agreements and obligations of the Payor, enforceable in accordance with their respective terms, subject to bankruptcy, reorganization, insolvency, fraudulent conveyance and other similar laws affecting the enforcement of creditors’ rights in general and to general principals of equity.

13. Adjustment of Number of Common Shares. In the event of changes in the capital stock of Payor by reason of stock dividends, splits, recapitalizations, reclassifications, combinations or exchanges of shares, separations, reorganizations, liquidations or the like, the number of Common Shares available under Section 5 of this Note in the aggregate and the purchase price thereof shall be correspondingly adjusted to give the Holder the total number, class, and kind of shares as the Holder would have owned had the conversion taken place and/or the Common Shares been purchased prior to the event and had the Holder continued to hold such shares until after the event requiring adjustment. No term of this Note need be changed because of any such adjustment.

14. Severability. If any provision herein is be determined to be unlawful, it is hereby agreed that this Note shall remain in full force and effect and shall be construed as if the provision determined to be unlawful was never contained herein and a reasonable provision shall be substituted therein.

15. Governing Law. This Note and all rights, obligations and liabilities hereunder shall be governed by and construed under the corporate laws of the State of Nevada and, as to matters of law other than corporate law, the laws of the State of Nevada as applied to agreements among Nevada residents, made and to be performed entirely within the State of Nevada without giving effect to conflict of laws principles that would cause the application of any other jurisdiction. THE COMPANY AND HOLDER AGREE THAT ANY ACTION BROUGHT BY EITHER PARTY UNDER OR IN RELATION TO THIS NOTE, INCLUDING WITHOUT LIMITATION ALL DISPUTES ARISING

A-5

OUT OF OR RELATING TO THIS NOTE, WILL BE BROUGHT EXCLUSIVELY IN A STATE OR FEDERAL COURT LOCATED IN THE DISTRICT ENCOMPASSING THE COMPANY’S PRINCIPAL PLACE OF BUSINESS. THE COMPANY AND HOLDER IRREVOCABLY AGREE TO AND SUBMIT TO THE JURISDICTION AND VENUE OF ANY SUCH COURT AND WAIVE ANY OBJECTION TO VENUE LAID THEREIN, INCLUDING ANY OBJECTION BASED ON AN ASSERTION OF INCONVENIENCE OF SUCH FORUM OR FORUM NON CONVENIENS.

16. Enforcement Costs. If this Note is not paid promptly in accordance with its terms, the undersigned agree to pay any and all costs of collection and enforcement, including, but not limited to, private costs, court costs and reasonable attorney fees. In the event that any judgment is obtained under this Note, the undersigned waive, to the extent permitted under the law, the benefit of any law exempting their property, or any part of it.

* * * * *

A-6

IN WITNESS WHEREOF, the Payor has executed and delivered this Note on the date first written above.

| AMERICAS ENERGY COMPANY - AECO | |||

|

|

By:

|

/s/ Chris Headrick | |

| Name: Chris Headrick | |||

| Title: President | |||

A-7

Exhibit A

A-8

Exhibit B

Coal Production Plan

|

Q2-2011

|

Q3-2011

|

Q4-2011

|

Q1-2012

|

Q2-2012

|

Q3-2012

|

Q4-2012

|

||

|

Coal Production (short ton)

|

45,000

|

195,000

|

320,000

|

345,000

|

345,000

|

345,000

|

345,000

|

Notes: Production numbers are internal production estimates tied to our fiscal quarters and are based on the following production assumptions:

Q2- 2011 – 22,500 tons per quarter from Artemus Surface mines in the Jellico Seam, and 22,500 per quarter from Artemus Surface Mines in the Lily Seam.

Q3-2011 – Q2 (45,000 tons) production plus 75,000 tons per quarter from the Artemus Jellico Deep Mine, 75,000 tons per quarter from the Hwy 72 (Cardinal) Darby Deep Mine.

Q4-2011 - Q3 production (195,000) plus 75,000 tons per quarter from the Artemus Lily Deep Mine, and 50,000 tons per quarter from the Hwy 92 Deane Seam Surface Mine.

Q1-2012 – Q4 production (320,000 tons) plus 25,000 tons per month from the Hwy 72 (Cardinal) Kellioka Deep Mine.

A-9

Exhibit B

to

Investment Agreement

Security Agreement

SECURITY AGREEMENT

This Security Agreement (the “Agreement”) is made as of 20th day of April, 2011 by and between Americas Energy Company-AECo, a Nevada Corporation (the “Borrower”) in favor of HANHONG (HONG KONG) NEW ENERGY HOLDINGS LIMITED (the “Secured Party”).

BACKGROUND

WHEREAS:

A. The Borrower is indebted to the Secured Party pursuant to a Secured Convertible Line of Credit Note of even date herewith (the “Note”).

B. The parties intend that the Borrower’s obligation to repay the Note shall be secured by all of the present and future assets of the Borrower, subject to the provisions hereof.

C. Terms used but not defined herein shall have such meaning as is ascribed to them by the Note.

AGREEMENT

THEREFORE, in consideration of the mutual promises, and each intending to be legally bound, the Borrower and the Secured Party hereby covenant and agree as follows:

Section 1. Incorporation of Background. The Background provisions of this Agreement are incorporated herein by reference thereto as if fully set forth in this Agreement.

Section 2. Grant of Security Interest.

2.1 To secure the Borrower’s full and timely performance of its Obligations, the Borrower hereby grants to the Secured Party a continuing Lien on and security interest, right of setoff against and an assignment to the Secured Party (the “Security Interest”) in all of the Borrower’s right, title and interest in and to all of its real properties, personal property and assets (both tangible and intangible), including, the following, but excluding Deposit Certificate of $1,580,508 pledged to the State of Kentucky by A. Y. Evans as bonds for reclamation reliability to be incurred, whether now owned or hereafter acquired and wherever located: (a) all Receivables; (b) all Equipment; (c) all Fixtures; (d) all Intangibles; (e) all Inventory; (f) all Investment Property; (g) all Deposit Accounts; (h) all Cash; (i) all Intellectual Property; (j) all leases; (k) all other Goods of the Borrower; and, all Proceeds of each of the foregoing and all accessions to, and replacements for, each of the foregoing (collectively, the “Collateral”).

Notwithstanding the granting by the Borrower to the Secured Party of the Security Interests in the assets listed in Section 2 (a) through (k) above, the Secured Party’s Security Interest shall be subordinate to the security interest held by the State of Kentucky on certificates of deposit and/or bonds pledged to the State of Kentucky to indemnify the State of Kentucky for any expenses or costs related to the reclamation of any surface and underground mines developed or exploited by the Borrower.

B-1

2.2 Anything herein to the contrary notwithstanding: (a) the Borrower shall remain liable under the contracts and agreements related to the Collateral to the extent set forth therein to perform all of its duties and obligations thereunder to the same extent as if this Agreement had not been executed; (b) the exercise by the Secured Party of any of the rights hereunder shall not release the Borrower from any of its duties or obligations under the contracts and agreements related to the Collateral; (c) no Secured Party shall have any obligation or liability under the contracts and agreements related to the Collateral by reason of this Agreement, nor shall the Secured Party be obligated to perform any of the obligations or duties of the Borrower thereunder or to take any action to collect or enforce any claim for payment assigned hereunder; and (d) no Secured Party shall have any liability in contract or tort for the Borrower’s acts or omissions.

Section 3. Defined Terms.

3.1 Definitions.

(a) “Account” means any “Account,” as such term is defined in the UCC now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest and, in any event, shall include, without limitation, all accounts receivable, book debts, rights to payment and other forms of obligations (other than forms of obligations evidenced by Chattel Paper, Documents or Instruments) now owned or hereafter received or acquired by or belonging or owing to the Borrower whether or not arising out of goods sold or services rendered by the Borrower or from any other transaction, whether or not the same involves the sale of goods or services by the Borrower and all of the Borrower’s rights in, to and under all purchase orders or receipts now owned or hereafter acquired by it for goods or services, and all of the Borrower’s rights to any goods represented by any of the foregoing, and all monies due or to become due to the Borrower under all purchase orders and contracts for the sale of goods or the performance of services or both by the Borrower or in connection with any other transaction (whether or not yet earned by performance on the part of the Borrower), now in existence or hereafter occurring, including, without limitation, the right to receive the proceeds of said purchase orders and contracts, and all collateral security and guarantees of any kind given by any Person with respect to any of the foregoing.

(b) “Cash” means all cash, money, currency, and liquid funds, wherever held, in which the Borrower now or hereafter acquires any right, title, or interest.

(c) “Chattel Paper” means any “Chattel paper,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(d) “Control” means the manner in which “control” is achieved under the UCC with respect to a particular item of Collateral.

(e) “Deposit Accounts” means any “Deposit accounts,” as such term is defined in the UCC, and includes any checking account, savings account, or certificate of deposit, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

B-2

(f) “Documents” means any “Documents,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(g) “Electronic Chattel Paper” means any “Electronic chattel paper,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(h) “Equipment” means any “Equipment,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest and any and all additions, upgrades, substitutions and replacements of any of the foregoing, together with all attachments, components, parts, equipment and accessories installed thereon or affixed thereto, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires interest.

(i) “Fixtures” means any “Fixtures,” as such term is defined in the UCC, together with all right, title and interest of the Borrower in and to all extensions, improvements, betterments, accessions, renewals, substitutes, and replacements of, and all additions and appurtenances to any of the foregoing property, and all conversions of the security constituted thereby, immediately upon any acquisition or release thereof or any such conversion, as the case may be, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(j) “Intangible” means any “Intangible,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest and, in any event, shall include, without limitation, all right, title and interest that the Borrower may now or hereafter have in or under any contracts, rights to payment, payment intangibles, confidential information, interests in partnerships, limited liability companies, corporations, joint ventures and other business associations, permits, goodwill, claims in or under insurance policies, including unearned premiums and premium adjustments, uncertificated securities, deposit, checking and other bank accounts, and any intellectual property (including the right to receive all proceeds and damages therefrom), rights to receive tax refunds and other payments and rights of indemnification.

(k) “Goods” means any “Goods,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(l) “Instruments” means any “Instrument,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(m) “Intellectual Property” means, collectively, all rights, priorities and privileges of the Borrower relating to intellectual property, whether arising under United States, multinational or foreign laws or otherwise, including copyrights, copyright licenses, inventions, patents, patent licenses, trademarks, trademark licenses and trade secrets (including customer lists), domain names, Web sites and know-how.

B-3

(n) “Inventory” means any “Inventory,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest, and, in any event, shall include, without limitation, all inventory, goods and other personal property that are held by or on behalf of the Borrower for sale or lease or are furnished or are to be furnished under a contract of service or that constitute raw materials, work in process or materials used or consumed or to be used or consumed in the Borrower’s business, or the processing, packaging, promotion, delivery or shipping of the same, and all finished goods, whether or not the same is in transit or in the constructive, actual or exclusive possession of the Borrower or is held by others for the Borrower’s account, including, without limitation, all goods covered by purchase orders and contracts with suppliers and all goods billed and held by suppliers and all such property that may be in the possession or custody of any carriers, forwarding agents, truckers, warehousemen, vendors, selling agents or other Persons.

(o) “Investment Property” means any “Investment property,” as such term is defined in the UCC, and includes certificated securities, uncertificated securities, money market funds and U.S. Treasury bills or notes, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

(p) “Letter of Credit Right” means any “Letter of credit right,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest, including any right to payment or performance under any letter of credit.

(q) “Lien” means any deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance, levy, lien or charge of any kind, whether voluntarily incurred or arising by operation of law or otherwise, against any property, any conditional sale or other title retention agreement, any lease in the nature of a security interest, and the filing of any financing statement (other than a precautionary financing statement with respect to a lease that is not in the nature of a security interest) under the UCC or comparable law of any jurisdiction.

(r) “Obligations” shall mean and include each and every debt, liability, and obligation of every type and description which the Borrower may now or at any time hereafter owe to the Secured Party, whether such debt, liability, or obligation now exists or is hereafter created or incurred, whether it arises in a transaction involving the Secured Party alone or in a transaction involving other creditors of the Borrower, and whether it is direct or indirect, due or to become due, absolute or contingent, primary or secondary, liquidated or unliquidated, or sole, joint, several, or joint and several, and including, specifically but not limited to all indebtedness, liability and other obligations of the Borrower arising under this Agreement or the Note and all indebtedness, liabilities and obligations of the Borrower now existing or hereafter created or arising under this Agreement and all renewals, extensions, restructurings and refinancings of any of the above including, without limitation, any additional indebtedness which may be extended to the Borrower pursuant to any restructuring or refinancing of the Borrower’s indebtedness under the Note, and also including any post-petition interest accruing during any bankruptcy, reorganization or other similar proceeding.

B-4

(s) “Permitted Liens” shall mean (i) Liens for taxes or other governmental charges not at the time delinquent or thereafter payable without penalty or being contested in good faith, provided that adequate reserves for the payment thereof have been established in accordance with generally accepted accounting principles, (ii) Liens of carriers, warehousemen, mechanics, materialmen, vendors, and landlords and other similar Liens imposed by law incurred in the ordinary course of business for sums not overdue more than forty-five (45) days or being contested in good faith, provided that adequate reserves for the payment thereof have been established in accordance with generally accepted accounting principles, (iii) deposits under workers’ compensation, unemployment insurance and social security laws or to secure the performance of bids, tenders, contracts (other than for the repayment of borrowed money) or leases, or to secure statutory obligations of surety or appeal bonds or to secure indemnity, performance or other similar bonds in the ordinary course of business, (iv) zoning restrictions, easements, rights-of-way, title irregularities and other similar encumbrances, which alone or in the aggregate are not substantial in amount and do not materially detract from the value of the property subject thereto or interfere with the ordinary conduct of the business of the Borrower, (v) banker’s Liens and similar Liens (including set-off rights) in respect of bank deposits, (vi) Liens in favor of customs and revenue authorities arising as a matter of law to secure payment of customs duties and in connection with the importation of goods in the ordinary course of the Borrower’s business, (vii) Liens on the property or assets of any subsidiary of the Borrower in favor of the Borrower, (viii) purchase money Liens that will be discharged upon the Borrower’s payment of the purchase price for the applicable property, to the extent such Liens relate solely to the property so purchased; and (ix) Liens in favor of banks or other institutional lenders granted by the Borrower prior to the date hereof.

(t) “Person” means any individual, sole proprietorship, partnership, joint venture, trust, unincorporated organization, association, corporation, limited liability company, institution, public benefit corporation, other entity or government (whether federal, state, county, city, municipal, local, foreign, or otherwise, including any instrumentality, division, agency, body or department thereof).

(u) “Proceeds” means “Proceeds,” as such term is defined in the UCC and, in any event, shall include, without limitation, (i) any and all Accounts, Chattel Paper, Instruments, cash or other forms of money or currency or other proceeds payable to the Borrower from time to time in respect of the Collateral, (ii) any and all proceeds of any insurance, indemnity, warranty or guaranty payable to the Borrower from time to time with respect to any of the Collateral, (iii) any and all payments (in any form whatsoever) made or due and payable to the Borrower from time to time in connection with any requisition, confiscation, condemnation, seizure or forfeiture of all or any part of the Collateral by any governmental authority (or any Person acting under color of governmental authority), and (iv) any and all other amounts from time to time paid or payable under or in connection with any of the Collateral.

(v) “Receivables” means all of the Borrower’s Accounts, Instruments, Documents, Chattel Paper, Supporting Obligations, and letters of credit and Letter of Credit Rights.

(w) “Supporting Obligation” means any “Supporting obligation,” as such term is defined in the UCC, now owned or hereafter acquired by the Borrower or in which the Borrower now holds or hereafter acquires any interest.

B-5

(x) “UCC” means the Uniform Commercial Code as the same may, from time to time, be in effect in the State of Nevada; provided, that in the event that, by reason of mandatory provisions of law, any or all of the attachment, perfection or priority of, or remedies with respect to, the Secured Party’s Lien on any Collateral is governed by the Uniform Commercial Code as enacted and in effect in a jurisdiction other than the State of Nevada, the term “UCC” shall mean the Uniform Commercial Code as enacted and in effect, from time to time, in such other jurisdiction solely for purposes of the provisions thereof relating to such attachment, perfection, priority or remedies and for purposes of definitions related to such provisions.

3.2 Terms of Use. In this Agreement, unless a clear contrary intention appears:

(a) reference to any Person includes such Person’s permitted executors, administrators, heirs, successors and assigns;

(b) reference to any agreement, document or instrument means such agreement, document or instrument as amended or modified and in effect from time to time in accordance with the terms thereof;

(c) “including” (and with correlative meaning “include”) means including without limiting the generality of any description preceding such term; and

(d) references to documents, instruments or agreements shall be deemed to refer as well to all addenda, exhibits, schedules or amendments thereto.

Section 4. Covenants, Representations and Warranties.

4.1 The Borrower covenants and agrees with the Secured Party that from and after the date of this Agreement until the Obligations are paid in full:

(a) Other Liens. Except for the Security Interest and Permitted Liens, the Borrower has rights in or the power to transfer the Collateral and its title and will be able to do so hereafter free from any adverse Lien, security interest or encumbrance, and the Borrower will defend the Collateral against the claims and demands of all persons at any time claiming the same or any interest therein.

(b) Indemnification. The Borrower agrees to defend, indemnify and hold harmless the Secured Party against any and all liabilities, costs and expenses (including, without limitation, legal fees and expenses) (“Liabilities”) in connection with any dispute between the Secured Party and other creditors of the Borrower regarding the Secured Party’s Security Interest in the Collateral.

4.2 In order to induce the Secured Party to enter into this Agreement, the Borrower represents and warrants to the Secured Party as follows:

(a) Binding Obligation. This Agreement is the legally valid and binding obligation of the Borrower, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or similar laws or equitable principles relating to or limiting the Secured Party’s rights generally.

B-6

(b) Ownership of Collateral. The Borrower exclusively owns the Collateral, and will exclusively own all after-acquired Collateral, free and clear of any Lien. No effective financing statement or other form of lien notice covering all or any part of the Collateral is on file in any recording office, except for those in favor of the Secured Party. No other Person has Control of any of the Collateral.

(c) Perfection. Each Secured Party has a valid, perfected security interest in the Collateral, securing the payment of the Secured Obligations, and such Security Interests are entitled to all of the rights, priorities and benefits afforded by the UCC or other applicable law as enacted in any relevant jurisdiction which relates to perfected security interests.

(d) Governmental Authorizations; Consents. No authorization, approval or other action by, and no notice to or filing with, any domestic or foreign governmental authority or regulatory body or consent of any other Person is required for: (i) the grant by the Borrower of the Security Interests granted hereby or for the execution, delivery or performance of this Agreement by the Borrower; (ii) the perfection of the Security Interests granted hereby (except for filing UCC financing statements with the appropriate jurisdiction); or (iii) the exercise by the Secured Party of its rights and remedies hereunder (except as may have been taken by or at the direction of the Borrower or any such Secured Party).

(e) Accurate Information. All information heretofore, herein or hereafter supplied to the Secured Party by or on behalf of the Borrower with respect to the Collateral is and will be accurate and complete.

Section 5. Event of Default; the Secured Party’s Appointment as Attorney-in-Fact.

5.1 Event of Default. For purposes of this Agreement, the occurrence of any one of the following events (each, an “Event of Default”) shall constitute a default hereunder:

(a) the Borrower’s failure to fully and timely perform its Obligations;

(b) the insolvency of the Borrower, the execution by the Borrower of a general assignment for the benefit of creditors, the filing against the Borrower of a petition in bankruptcy or any petition for relief under the federal bankruptcy act or the continuation of such petition without dismissal for a period of 90 days or more, or the appointment of a receiver or trustee to take possession of the property or assets of the Borrower or any execution or attachment shall be issued whereby any part of the Collateral shall be taken or attempted to be taken and the same shall not have been vacated or stayed within thirty (30) days after the issuance thereof;

(c) the Borrower’s default in the payment of any installment of principal and interest on the Note when and as the same shall become due and payable, whether at the due date thereof or by acceleration thereof or otherwise or any other occurrence of any event of default or provided for in the Note; or

(d) the Borrower’s default in the observance or performance by the Borrower of any covenant, condition or agreement contained in this Agreement or the Note.

B-7

5.2 Powers. The Borrower hereby appoints the Secured Party, with full power of substitution, as its attorney-in-fact with full irrevocable power and authority in the place of the Borrower and in the name of the Borrower or its own name, from time to time in the Secured Party’s discretion so long as an Event of Default has occurred and is continuing, for the purpose of carrying out the terms of this Agreement, to take any appropriate action and to authenticate any instrument which may be necessary or desirable to accomplish the purposes of this Agreement. So long as an Event of Default has occurred and is continuing, the Secured Party shall have the right, without notice to, or the consent of, the Borrower, to do any of the following on the Borrower’s behalf:

(a) to pay or discharge any taxes or Liens levied or placed on or threatened against the Collateral;

(b) to direct any party liable for any payment under any of the Collateral to make payment of any and all amounts due or to become due thereunder directly to the Secured Party;

(c) to ask for or demand, collect, and receive payment of and receipt for, any payments due or to become due at any time in respect of or arising out of any Collateral;

(d) to commence and prosecute any suits, actions or proceedings at law or in equity in any court of competent jurisdiction to enforce any right in respect of any Collateral;

(e) to defend any suit, action or proceeding brought against the Borrower with respect to any Collateral;

(f) to settle, compromise or adjust any suit, action or proceeding described in subsection (e) above and to give such discharges or releases in connection therewith as the Secured Party may deem appropriate;

(g) to assign any patent right included in the Collateral of the Borrower (along with the goodwill of the business to which any such patent right pertains), throughout the world for such term or terms, on such conditions, and in such manner, as the Secured Party shall in its sole discretion determine; and

(h) generally, to sell, transfer, pledge and make any agreement with respect to or otherwise deal with any of the Collateral and to take, at the Secured Party’s option and the Borrower’s expense, any actions which the Secured Party deems necessary to protect, preserve or realize upon the Collateral and the Secured Party’s Liens on the Collateral and to carry out the intent of this Agreement, in each case to the same extent as if the Secured Party were the absolute owner of the Collateral for all purposes.

The Borrower hereby ratifies whatever actions the Secured Party shall lawfully do or cause to be done in accordance with this Section 5. This power of attorney shall be a power coupled with an interest and shall be irrevocable.

5.3 No Duty on the Secured Party’s Part. The powers conferred on the Secured Party by this Section 5 are solely to protect the Secured Party’s interests in the Collateral and shall not impose any duty upon it to exercise any such powers. The Secured Party shall be accountable

B-8

only for amounts that it actually receives as a result of the exercise of such powers, and the Secured Party shall not be responsible to the Borrower for any act or failure to act pursuant to this Section 5.

Section 6. Remedies.

6.1 If an Event of Default has occurred and is continuing, the Secured Party may exercise, in addition to all other rights and remedies granted to it in this Agreement and in any other instrument or agreement relating to the Obligations, all rights and remedies of a Secured Party under the UCC (whether or not the UCC applies to the affected Collateral). Without limiting the foregoing, the Secured Party may: (a) require the Borrower to, and the Borrower hereby agrees that it will, at its expense and upon request of the Secured Party forthwith, assemble all or part of the Collateral as reasonably directed by such Secured Party and make it available to such Secured Party at any place or places designated by such Secured Party which is reasonably convenient to such Secured Party; and (b) without demand of performance or other demand, presentment, protest, advertisement or notice of any kind (except any notice required by law) to or upon the Borrower or any other person (all of which demands, defenses, advertisements and notices are hereby waived), may in such circumstances collect, receive, appropriate and realize upon any or all of the Collateral, and/or may sell, lease, assign, give an option or options to purchase, or otherwise dispose of and deliver any or all of the Collateral (or contract to do any of the foregoing), in one or more parcels at a public or private sale or sales, at any exchange, broker’s board or office of the Secured Party or elsewhere upon such terms and conditions as the Secured Party may deem advisable, for cash or on credit or for future delivery without assumption of any credit risk. The Secured Party shall have the right upon any such public sale or sales and, to the extent permitted by law, upon any such private sale or sales, to purchase all or any part of the Collateral so sold, free of any right or equity of redemption in the Borrower, which right or equity is hereby waived or released. The Secured Party shall apply the net proceeds of any such collection, recovery, receipt, appropriation, realization or sale, after deducting all reasonable expenses incurred therein or in connection with the care or safekeeping of any of the Collateral or in any way relating to the Collateral or the rights of the Secured Party under this Agreement (including, without limitation, reasonable attorneys’ fees and expenses) to the payment in whole or in part of the Obligations, in such order as the Secured Party may elect, and only after such application and after the payment by the Secured Party of any other amount required by any provision of law, need the Secured Party account for the surplus, if any, to the Borrower. To the extent permitted by applicable law, the Borrower waives all claims, damages and demands it may acquire against the Secured Party arising out of the exercise by the Secured Party of any of its rights hereunder. The Borrower shall remain liable for any deficiency if the proceeds of any sale or other disposition of the Collateral are insufficient to pay the Obligations and the fees and disbursements of any attorneys employed by the Secured Party to collect such deficiency.

6.2 The Borrower agrees that, to the extent notice of sale shall be required by law, a reasonable authenticated notification of disposition shall be a notification given at least ten (10) days prior to any such sale and such notice shall (a) describe the Secured Party and the Borrower, (b) describe the Collateral that is the subject of the intended disposition, (c) state the method of intended disposition, (d) state that the Borrower is entitled to an accounting of the Secured Obligations and stating the charge, if any, for an accounting, and (e) state the time and place of any public disposition or the time after which any private sale is to be made. At any sale of the Collateral, if

B-9

permitted by law, the Secured Party may bid (which bid may be, in whole or in part, in the form of cancellation of indebtedness) for the purchase, lease, license or other disposition of the Collateral or any portion thereof for the account of such Secured Party. No Secured Party shall be obligated to make any sale of Collateral regardless of notice of sale having been given. Each Secured Party may disclaim any warranties that might arise in connection with the sale, lease, license or other disposition of the Collateral and have no obligation to provide any warranties at such time. The Secured Party may adjourn any public or private sale from time to time by announcement at the time and place fixed therefor, and such sale may, without further notice, be made at the time and place to which it was so adjourned. To the extent permitted by law, the Borrower hereby specifically waives all rights of redemption, stay or appraisal which it has or may have under any law now existing or hereafter enacted.

6.3 Upon the occurrence and during the continuance of an Event of Default, the Secured Party or the Secured Party’s attorneys shall have the right without notice or demand or legal process (unless the same shall be required by applicable law), personally, or by the Secured Party or attorneys, (a) to enter upon, occupy and use any premises owned or leased by the Borrower or where the Collateral is located (or is believed to be located) until the Secured Obligations are paid in full without any obligation to pay rent to the Borrower, to render the Collateral useable or saleable and to remove the Collateral or any part thereof therefrom to the premises of the Secured Party or any agent of the Secured Party for such time as the Secured Party may desire in order to effectively collect or liquidate the Collateral and use in connection with such removal any and all services, supplies and other facilities of the Borrower; and (b) to take possession of the Borrower’s original books and records relating to the Collateral.

6.4 The Borrower acknowledges and agrees that a breach of any of the covenants contained in Sections 4, 5 and 6 hereof will cause irreparable injury to the Secured Party and that the Secured Party has no adequate remedy at law in respect of such breaches and therefore agrees, without limiting the right of the Secured Party to seek and obtain specific performance of other obligations of the Borrower contained in this Agreement, that the covenants of the Borrower contained in the Sections referred to in this Section shall be specifically enforceable against the Borrower.

6.5 The Borrower shall pay all reasonable costs, fees and expenses of each Secured Party incurred by such Secured Party in (a) protecting, storing, appraising, insuring, and maintaining the Collateral, (b) creating, perfecting, maintaining and enforcing the Security Interests, and (c) collecting, enforcing, retaking, holding, preparing for disposition, processing and disposing of the Collateral. The Borrower shall also pay any and all excise, property, income, sales and use taxes imposed by any federal, state, local or foreign authority on or related to any of the Collateral, or with respect to periodic appraisals and inspections of the Collateral, or with respect to the sale or other disposition thereof. If the Borrower fails to promptly pay any portion of the above costs, fees and expenses when due or to perform any other obligation of the Borrower under this Agreement, any Secured Party may, at its option, but shall not be required to, pay or perform the same and charge the Borrower’s account for all fees, costs and expenses incurred therefor, and the Borrower agrees to reimburse such Secured Party therefor on demand. All

B-10

sums so paid or incurred by any Secured Party for any of the foregoing, any and all other sums for which the Borrower may become liable hereunder and all fees, costs and expenses (including reasonable attorneys’ fees, legal expenses and court costs) incurred by such Secured Party in enforcing or protecting the Security Interests or any of their rights or remedies under this Agreement shall be payable on demand, shall constitute Secured Obligations, shall bear interest until paid at the highest rate provided in the Note and shall be secured by the Collateral.

Section 7. Limitation on Duties Regarding Preservation of Collateral. The Secured Party’s sole duty with respect to the custody, safekeeping and preservation of the Collateral, under Section 9-207 of the UCC or otherwise, shall be to deal with it in the same manner as the Secured Party deals with similar property for its own account. Neither the Secured Party nor any of its directors, officers, employees or agents shall be liable for failure to demand, collect or realize upon all or any part of the Collateral or for any delay in doing so or shall be under any obligation to sell or otherwise dispose of any Collateral upon the request of the Borrower or otherwise.

Section 8. Powers Coupled with an Interest. All authorizations and agencies contained in this Agreement with respect to the Collateral are irrevocable and are powers coupled with an interest.

Section 9. No Waiver; Cumulative Remedies. The Secured Party shall not by any act (except by a written instrument pursuant to Section 11.1 hereof), delay, indulgence, omission or otherwise be deemed to have waived any right or remedy hereunder or to have acquiesced in any Event of Default or in any breach of any of the terms and conditions of this Agreement. No failure to exercise, nor any delay in exercising, on the part of the Secured Party, any right, power or privilege hereunder shall operate as a waiver thereof. No single or partial exercise of any right, power or privilege hereunder shall preclude any other or further exercise thereof or the exercise of any other right, power or privilege. A waiver by the Secured Party of any right or remedy under this Agreement on any one occasion shall not be construed as a bar to any right or remedy which the Secured Party would otherwise have on any subsequent occasion. The rights and remedies provided in this Agreement are cumulative, may be exercised singly or concurrently and are not exclusive of any rights or remedies provided by law.

Section 10. Termination of Security Interest. Upon the Borrower’s satisfaction of the Obligations, the security interest granted herein shall terminate and all rights to the Collateral shall revert to the Borrower. Upon any such termination, the Secured Party shall authenticate and deliver to the Borrower such documents as the Borrower may reasonably request to evidence such termination.

Section 11. Miscellaneous.

11.1 Amendments and Waivers. Any term of this Agreement may be amended with the written consent of the Borrower and the Secured Party. Any amendment or waiver effected in accordance with this Section 11.1 shall be binding upon the parties and their respective successors and assigns.

11.2 Transfer; Successors and Assigns. The terms and conditions of this Agreement shall be binding upon the Borrower and its successors and assigns and inure to the benefit of the Secured Party and their executors, administrators, heirs, successors and assigns. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

B-11

11.3 Governing Law. This Agreement and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed and interpreted in accordance with the laws of the State of Nevada, without giving effect to principles of conflicts of law. The parties hereto consent to the exclusive jurisdiction and venue of the state and federal courts of the State of Alabama.

11.4 Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument.

11.5 Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

11.6 Notices. Any notice required or permitted by this Agreement shall be in writing and shall be deemed sufficient upon receipt, when delivered personally or by courier, overnight delivery service or confirmed facsimile, or forty-eight (48) hours after being deposited in the U.S. mail as certified or registered mail with postage prepaid, if such notice is addressed to the party to be notified at such party’s address or facsimile number as set forth below or as subsequently modified by written notice.

11.7 Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, the parties agree to renegotiate such provision in good faith, in order to maintain the economic position enjoyed by each party as close as possible to that under the provision rendered unenforceable. In the event that the parties cannot reach a mutually agreeable and enforceable replacement for such provision, then (a) such provision shall be excluded from this Agreement, (b) the balance of the Agreement shall be interpreted as if such provision were so excluded and (c) the balance of the Agreement shall be enforceable in accordance with its terms.

11.8 Entire Agreement. This Agreement, and the documents referred to herein constitute the entire agreement between the parties hereto pertaining to the subject matter hereof, and any and all other written or oral agreements existing between the parties hereto concerning such subject matter are expressly cancelled.

11.9 Advice of Legal Counsel. Each party acknowledges and represents that, in executing this Agreement, it has had the opportunity to seek advice as to its legal rights from legal counsel and that the person signing on its behalf has read and understood all of the terms and provisions of this Agreement. This Agreement shall not be construed against any party by reason of the drafting or preparation thereof.

The Borrower and the Secured Party have caused this Security Agreement to be duly executed and delivered as of the date set forth above.

B-12

BORROWER:

AMERICAS ENERGY COMPANY-AECO

/s/ Christopher L. Headrick

By: Christopher L. Headrick

By: Christopher L. Headrick

Title: President & CEO

SECURED PARTY:

HANHONG (HONG KONG) NEW ENERGY HOLDINGS LIMITED

/s/ Yang (Simon) Liu

By: Yang (Simon) Liu

Title: President

B-13

Exhibit C-1

to

Investment Agreement

Warrant

THIS WARRANT AND THE UNDERLYING SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THEY MAY NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO SUCH SECURITIES UNDER THE ACT OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED.

THE WARRANTS REPRESENTED HEREBY WILL BE VOID AND OF NO VALUE UNLESS EXERCISED BEFORE 5:00P.M. (EASTERN STANDARD TIME) ON _MAY, 10, 2013.

AMERICAS ENERGY COMPANY

249 N. Peters Rd.

Suite 300

Knoxville, TN 37923

Phone: (865) 238-0668 x 105

Web Site: www.americasenergycompany.com

(Incorporated under the laws of Nevada)

COMMON STOCK SHARE PURCHASE WARRANTS

| WARRANT

CERTIFICATE

NO. 0006

|

April 20, 2011 |

THIS IS TO CERTIFY THAT, for valuable consideration the receipt of which is hereby acknowledged, Hanhong (Hong Kong) New Energy Holdings Limited, and/or its permitted assigns (hereinafter called the “Holder”), is entitled to subscribe for and purchase 2,000,000 fully paid and non-assessable shares of capital stock, par value $0.0001 per share (the “Common Shares”) of Americas Energy Company - AECo, a Nevada corporation (hereinafter called the “Company”), during the Exercise Period (as defined below), as provided herein.

1. Definitions. As used in this Warrant (this “Warrant”), the following terms shall have the following respective meanings: