Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - Digital Generation, Inc. | a2203427zex-31_2.htm |

| EX-32.1 - EX-32.1 - Digital Generation, Inc. | a2203427zex-32_1.htm |

| EX-31.1 - EX-31.1 - Digital Generation, Inc. | a2203427zex-31_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

Amendment No. 1

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 0-27644

DG FastChannel, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State of Incorporation) |

94-3140772 (I.R.S. Employer Identification Number) |

|

750 West John Carpenter Freeway, Suite 700 Irving, Texas (Address of principal executive offices) |

75039 (Zip Code) |

(972) 581-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $0.001 par value | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the common equity held by non-affiliates of the Registrant (assuming for these purposes, but without conceding, that all executive officers and Directors are "affiliates" of the Registrant) as of June 30, 2010, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $863 million (based on the closing sale price of the Registrant's Common Stock on that date as reported on the NASDAQ Global Select Market).

As of April 29, 2011 the Registrant had 27,411,625 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

The purpose of this Amendment No. 1 (the "Amendment") to the Annual Report on Form 10-K of DG FastChannel, Inc. (the "Registrant") for the year ended December 31, 2010 (the "Original Form 10-K") is to include the disclosure required in Part III, Items 10, 11, 12, 13 and 14. In connection with the filing of this Amendment and pursuant to the rules of the Securities and Exchange Commission, we are also including with this Amendment certain currently dated certifications and other exhibits. Accordingly, Item 15 of Part IV has also been amended to reflect the filing thereof. Except for Items 10, 11, 12, 13 and 14 of Part III and the inclusion of such exhibits in Item 15 of Part IV, no other information included in the Original Form 10-K is amended or changed by this Amendment.

DG FASTCHANNEL, INC.

FORM 10-K/A

INDEX

2

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Executive Officers and Directors

The following table sets forth certain information concerning our executive officers and directors as of March 31, 2011:

Name

|

Age | Title(s) | Expiration of Term as Director |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Scott K. Ginsburg(1) | 58 | Chief Executive Officer and Chairman of the Board | 2013 | ||||||

| Neil H. Nguyen(1) | 37 | President and Chief Operating Officer and Director | 2013 | ||||||

| Omar A. Choucair(1) | 49 | Chief Financial Officer and Director | 2012 | ||||||

| William Donner(3) | 58 | Director | 2011 | ||||||

| Lisa C. Gallagher(2) | 54 | Director | 2012 | ||||||

| Kevin C. Howe(4) | 62 | Director | 2011 | ||||||

| David M. Kantor(3),(4) | 54 | Director | 2012 | ||||||

| Anthony J. LeVecchio(2),(4) | 64 | Director | 2011 | ||||||

| John R. Harris (2),(3) | 62 | Director | 2011 | ||||||

| Jeffrey A. Rich(2),(4) | 50 | Director | 2011 | ||||||

- (1)

- Member

of the Executive Committee

- (2)

- Member

of the Audit Committee

- (3)

- Member

of the Compensation Committee

- (4)

- Member of the Nominating Committee

Scott K. Ginsburg joined the Company in December 1998 as Chairman of the Board and assumed the additional role of Chief Executive Officer in November 2003. From 1971 until 1975, Mr. Ginsburg worked in the U.S. Congress for two Iowa Congressmen. From 1975 until 1981, Mr. Ginsburg worked in a professional capacity of Staff Director and later as Staff Director and General Counsel of the U.S. Senate Labor's Subcommittee on Employment, Poverty and Migratory Labor. He also worked for the U.S. Senate Subcommittee on Social Security and Medicare. Then, in the early 1980's, Mr. Ginsburg turned to private industry and, in 1983, founded radio broadcasting concern Statewide Broadcasting. In 1987, Mr. Ginsburg co-founded H & G Communications. In 1988, Mr. Ginsburg established Evergreen Media Corporation, and took the company public in 1993. He served as Chairman of the Board and Chief Executive Officer at Evergreen. In 1997, Evergreen Media Corporation merged with Chancellor Broadcasting to form Chancellor Media Corporation, which became AMFM, Inc. Mr. Ginsburg served as Chancellor's Chief Executive Officer and a Director. From 1987 until 1998, the radio group headed by Mr. Ginsburg moved from the 25th ranked radio group to become the top billing radio group in the United States. Separately, Mr. Ginsburg founded the Boardwalk Auto Group in Dallas in 1998. Between 1998 and 2005, Porsche, Audi, Volkswagen, Ferrari, Maserati and Lamborghini were put into the dealership group. In 2009, the Boardwalk Auto Group acquired the Ferrari and Maserati dealership in San Francisco. Mr. Ginsburg earned a B.A. from George Washington University in 1974 and a J.D. from Georgetown University Law Center in 1978.

Mr. Ginsburg's qualifications to serve on our Board of Directors include:

- •

- service as the Chairman of the Board and Chief Executive Officer of Chancellor Media Corporation, AMFM, Inc. and Evergreen Media, which provides the Board a broad perspective

3

- •

- extensive knowledge and experience of the advertising and media industry and its participants, as well as a deep

understanding of operations in political and regulatory environments;

- •

- vast expertise in corporate strategy development, mergers and acquisitions proficiency, and organizational acumen;

- •

- valuable financial expertise, including extensive experience with capital market transactions and both equity and debt

capital raises;

- •

- experience leading and directing large media businesses, which informs his judgment and risk assessment as a board member;

and

- •

- background as a attorney, and his previous role in government and as founder and sole-proprietor of several auto dealerships, provides a unique perspective to the Board.

of someone with all facets of a global media enterprise, including direct responsibility for strategic planning and operations and corporate governance items;

Neil H. Nguyen joined the Company as Executive Vice President of Sales and Operations in March 2005. In 2009 he was promoted to President and Chief Operating Officer. In December 2009, he was appointed as a member of the Board of Directors. Prior to joining the Company, from 1998 to 2002, Mr. Nguyen served as President of Point.360's MultiMedia Group and also served in various senior management roles at FastChannel Network including Executive Vice President, Strategic Planning and Vice President Global Sales and Business Development from 2003 to 2005. Mr. Nguyen received a B.S. from California State University, Northridge.

Mr. Nguyen's qualifications to serve on our Board of Directors include:

- •

- broad sales and marketing experience with various media companies, as well as his executive leadership and management

experience;

- •

- extensive knowledge and experience of the advertising and media industry and its participants, as well as a deep

understanding of operations in the advertising industry; and

- •

- day to day leadership as current President and Chief Operating Officer of the Company provides him with intimate knowledge of our operations.

Omar A. Choucair joined the Company as Chief Financial Officer in July 1999 and has been a member of the Board of Directors of the Company since November 2000. Prior to joining the Company, Mr. Choucair served as Vice President of Finance for AMFM, Inc. (formerly Chancellor Media Corporation) and served as Vice President of Finance for Evergreen Media Corporation before it was acquired by Chancellor Media Corporation in 1997. Prior to entering the media industry, Mr. Choucair was a Senior Manager at KPMG LLP, where he specialized in media and telecommunications clients. Mr. Choucair received a B.B.A. from Baylor University.

Mr. Choucair's qualifications to serve on our Board of Directors include:

- •

- extensive experience with public and financial accounting matters for complex business organizations, including over ten

years of experience with KPMG LLP;

- •

- extensive knowledge and experience of the advertising and media industry and its participants;

- •

- valuable financial expertise, including extensive experience with capital market transactions and both equity and debt

capital raises; and

- •

- service in executive finance roles of Chancellor Media Corporation, AMFM, Inc. and Evergreen Media, which provides the Board a perspective of someone with all facets of a broad media enterprise, including direct responsibility for financial and accounting issues.

4

William Donner has been a member of the Board of Directors of the Company since May 2006 after having served as a director of FastChannel Network, Inc. Since 2004, Mr. Donner has served as CEO of MedCommons, a personal health record storage and transport company. In the early 1980s, Mr. Donner built and ran Precision Business Systems, a Wall Street based systems integrator. Precision Business Systems was sold to Bank of America in 1988 and subsequently, a division was sold to Reuters, PLC, where Mr. Donner ran the Reuters Dealing 2001 and 2002 Trading Services. In 1994, Mr. Donner was named Chief Architect of Reuters where he ran the central research group. Mr. Donner joined the Greenhouse Group, Reuters' corporate venture capital arm, in 1996. In 1999, Mr. Donner joined Fenway Partners, a private equity fund, where he led the technology investment group. Mr. Donner holds a B.S.E.E. from Massachusetts Institute of Technology.

Mr. Donner's qualifications to serve on our Board of Directors include:

- •

- experience as a Chief Executive of MedCommons and founder of a software systems integrator, provide him unique insights

into the Company's challenges, opportunities and operations;

- •

- previous experience serving on private company boards and membership of board committees, resulting in familiarity with

corporate and board functions; and

- •

- training as an engineer and former Chief Architect of Reuters, providing him with a deep technological and financial expertise about the Company's products and current technology, as well as about anticipated future technological needs of the Company and the industry.

Lisa C. Gallagher has been a member of the Board of Directors of the Company since May 2006 after having served first as a director, and most recently as Chairman of the Board of Directors, of FastChannel Network, Inc. since 2002. Since 2003, Ms. Gallagher has served as the Senior Vice President and Chief Operating Officer of Hawtan Leathers, a privately held international manufacturer of specialty leathers for the garment industry. She previously spent over 20 years as both a commercial as well as investment banker specializing in media transactions. She started her banking career in the early 1980s at the Bank of Boston and in 1997 moved to its investment bank, BancBoston Securities as Managing Director to run their Media & Communications Group. In 1998 she became Managing Director and Group head of the Internet/Media Convergence Group of Robertson Stephens, a leading high technology investment banking firm, upon the BancBoston Securities acquisition of Robertson Stephens. After leaving Robertson Stephens in 2001, she worked for Remy Capital Partners, a small investment banking boutique, before joining Hawtan Leathers. Ms. Gallagher holds a B.A. from Mount Holyoke College and an M.B.A. from the Simmons Graduate School of Management in Boston.

Ms. Gallagher's qualifications to serve on our Board of Directors include:

- •

- possesses valuable financial expertise, including extensive experience with capital markets transactions and investments

in both public and private companies;

- •

- strong investment banking background with extensive knowledge and experience of over 20 years working in the media

industry and its related participants;

- •

- previous experience serving on private company boards and membership of board committees, resulting in familiarity with

corporate and board functions; and

- •

- day to day leadership, as current Chief Operating Officer of Hawtan Leathers, provides her with valuable knowledge of operations and business challenges.

Kevin C. Howe has been a member of the Board of Directors of the Company since February 2001. Since 1999, he has been the Managing Partner of Mercury Ventures. Mercury Ventures manages seven different funds that invest in emerging technology companies that focus on Internet applications. Mr. Howe served on the board of The Sage Group, plc. which is traded on the London Stock Exchange from 1991 to 2005. Mr. Howe also sits on the boards of two privately held technology firms.

5

In 1985, he co-founded DacEasy, an early leader in packaged application software. In 1987, Mr. Howe led the sale of DacEasy to Insilco (a Fortune 500 company). In 1991, Mr. Howe led the carve-out of DacEasy from Insilco and subsequent sale to The Sage Group, plc. which had market capitalization of over $7 billion. He was Chief Executive Officer of the US operations of The Sage Group, plc. responsible for operations and acquisitions until 1999. In 1993, Mr. Howe also co-founded Martin Howe Associates, which was an early leader in the merchant credit card processing industry and a pioneer in wireless solutions. The company was sold in 1997 to PMT Services, Inc., a NASDAQ listed company. Mr. Howe received his M.B.A. from Southern Methodist University in 1976.

Mr. Howe's qualifications to serve on our Board of Directors include:

- •

- valuable financial expertise, including extensive experience with capital markets transactions and investments in both

public and private companies;

- •

- experience as a director of a UK-based, international technology company provides the board with a global

perspective; and

- •

- experience as a former Chief Executive Officer of a large software company and in depth management experience at premier global technology companies helps the Board address the challenges the Company faces due to constant changes in IT capabilities and communications.

David M. Kantor has been a member of the Board of Directors of the Company since August 1999. Since 2003, Mr. Kantor has been Vice Chairperson and Chief Executive Officer of Reach Media, a company that develops, acquires and partners in quality media and marketing opportunities targeting the African-American population. Formerly, he was Senior Vice President for Network Operations of AMFM, Inc. (formerly Chancellor Media Corporation) and President of ABC Radio Network, having previously served as Executive Vice President. Prior to joining ABC Radio Network, he held executive positions with Cox Cable and Satellite Music Network. Mr. Kantor holds a B.S. from the University of Massachusetts and an M.B.A. from Harvard Business School.

Mr. Kantor's qualifications to serve on our Board of Directors include:

- •

- service in the Senior Vice President for Network Operations role at Chancellor Media Corporation, AMFM, Inc. and

Evergreen Media, which provides the Board a broad perspective of someone with all facets of a large media enterprise, including direct responsibility for sales and marketing, corporate strategy

development and operating issues;

- •

- service as the President of ABC Radio Network, which provides the board a broad perspective of someone with all facets of

a large media enterprise, including direct responsibility for strategic operations and financial matters;

- •

- day to day leadership, as current Chief Executive Officer of Reach Media, provides him with intimate knowledge of

advertising and media operations and media industry challenges; and

- •

- extensive knowledge and experience of the advertising and media industry and its participants, as well as a deep understanding of operations in regulatory environments.

Anthony J. LeVecchio has been a member of the Board of Directors of the Company since August 2004. Since its formation in 1988, he has been the President of The James Group, a general business consulting firm that has advised clients across a range of high-tech industries. Prior to forming The James Group in 1988, Mr. LeVecchio was the Senior Vice President and Chief Financial Officer for VHA Southwest, Inc., a regional healthcare system. He currently serves on the Board of Directors of Ascendent Solutions, Inc., a company that is tracked on the OTC Bulletin Board and serves as the Chairman of its Audit Committee. He also serves on the Board of Directors of Viewpoint Financial Group, a Plano, Texas based bank holding group traded on the NASDAQ Global Select Market, serves as the Chairman of its Audit Committee, and serves on the Loan and Compensation Committees.

6

Mr. LeVecchio also serves as a Resident Director for the Institute for Excellence in Corporate Governance and is a lecturing professor in the M.B.A. program at the University of Texas, Dallas.

Mr. LeVecchio's qualifications to serve on our Board of Directors include:

- •

- extensive experience serving on public company boards and membership of board committees, resulting in familiarity with

corporate and board functions;

- •

- extensive experience with public and financial accounting matters for complex business organizations;

- •

- service in the Chief Financial Officer role for VHA Southwest, which provides the Board a perspective of someone with all

facets of a broad enterprise, including direct responsibility for financial and accounting issues; and

- •

- even temperament and ability to communicate and encourage discussion, together with his experience as senior independent director of other boards on which he serves, make him an effective chairman of the Board's Audit Committee.

John R. Harris has been a member of the Board of Directors of the Company since November 2010. Mr. Harris served as President and CEO of eTelecare Global Solutions, Inc., a business process outsourcing ("BPO") company listed on NASDAQ, from 2006 through its acquisition in 2009. Previously, Mr. Harris served as President and Chief Executive Officer of Seven Worldwide, a BPO services company, from 2003 to 2005, as President and Chief Executive Officer of Delinea Corporation, a BPO services company, from 2002 to 2003, and as President and Chief Executive Officer of Exolink Corporation, a technology company, from 2001 to 2002. From 1973 to 1999, Mr. Harris held a variety of positions, including group vice president and corporate officer, with Electronic Data Systems Corporation, or EDS, a provider of IT and BPO services (now a part of Hewlett-Packard, a New York Stock Exchange ("NYSE") listed company). Mr. Harris holds a B.B.A. and a M.B.A. from West Georgia University. Mr. Harris is currently a director of Premier Global Services, a NYSE listed company, The Hackett Group, a NYSE listed company, StarTek, a NYSE listed company, and Banctec (privately held). Mr. Harris also served as a director of inVentiv Health, a company that is listed on the NASDAQ from May 2000 to May 2008.

Mr. Harris's qualifications to serve on our Board of Directors include:

- •

- extensive experience serving on public company boards and membership of board committees, resulting in familiarity with

corporate and board functions;

- •

- extensive experience as a Chief Executive Officer of several BPO companies and in depth management experience that will

help the Board address the challenges the Company faces due to constant changes in IT capabilities and communications;

- •

- experience with companies operating internationally; and

- •

- even temperament and ability to communicate and encourage discussion, together with his experience as an independent director of other publicly-traded company boards on which he serves, make him an effective chairman of the Board's Compensation Committee.

Jeffrey A. Rich joined the Board of Directors in March 2011. Prior to forming PlumTree Partners in 2006, a private investment firm, Mr. Rich served as Chief Executive Officer of ACS, a Fortune 500 company and leading provider of BPO and information technology services, from 1999-2005. Mr. Rich also served ACS as President and Chief Operating Officer from 1995-1999 and Chief Financial Officer from 1989-1995. Prior to joining ACS in 1989, Mr. Rich was a Vice President in the Leverage Capital Group of Citibank New York. Mr. Rich currently serves on the Executive Board of the Dallas Symphony Orchestra, the Board of Directors of River Logic, Inc., and the Board of Directors of Telligent, Inc. He previously served as a Director of ACS, Inc. (NYSE "ACS") and Pegasus

7

Solutions, Inc. (NASDAQ "PEGS"). He has also served on the Visiting Committee of the Ross School of Business at the University of Michigan and as a Director of Education is Freedom and the United States Chamber of Commerce. Mr. Rich is a member of World President's Organization and a previous member of the Young President's Organization, serving in several officer positions in both organizations. Mr. Rich received a B.B.A. from the University of Michigan Business School in 1982.

The Company believes that Mr. Rich is qualified to serve on the Board of Directors because:

- •

- he has extensive experience with mergers and acquisitions which will brings valuable experience to the board and assist

the Company with its global expansion initiatives and operational improvement initiatives;

- •

- he is familiar with public company and financial accounting matters within complex business organizations;

- •

- Mr. Rich's leadership experience in senior management positions and on boards of directors brings valuable expertise to the board.

Corporate Governance

Independence

The Board of Directors has determined, after considering all of the relevant facts and circumstances, that each of Messrs. Howe, Kantor, LeVecchio, Harris, Donner, Rich, and Ms. Gallagher is independent from our management, and is an "independent director" as defined under the NASDAQ Marketplace Rules. This means that none of those directors (1) is an officer or employee of the Company or any of our subsidiaries or (2) has any direct or indirect relationship with us that would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director. As a result, the Company has a majority of independent directors as required by the NASDAQ Marketplace Rules.

Board Leadership Structure

The Board of Directors has the necessary flexibility to determine whether the positions of Chairman of the Board and Chief Executive Officer should be held by the same person or by separate persons based on the leadership needs of the Board of the Company at any particular time. The Board has given careful consideration to separating the roles of Chairman and Chief Executive Officer and has determined that the Company and its shareholders are best served by having Mr. Ginsburg serve as both the Chairman of the Board and Chief Executive Officer. Mr. Ginsburg's combined role as Chairman and Chief Executive Officer enhances the unified leadership and direction of the Board and executive management. Furthermore, given the size of the Company, this structure allows for a single, concise focus for management to execute the Company's strategic initiatives and business plans.

Mr. Ginsburg has served as both the Chairman of the Board and Chief Executive Officer of the Company since 2003 and Chairman of the Board since 1998. Mr. Ginsburg has been at the forefront of the media content distribution industry and his record of innovation, achievement, and leadership is an asset to the Board and the Company. Under Mr. Ginsburg's leadership, our Company has grown rapidly in terms of revenue, market capitalization, and customer base. The Board of Directors believes that our stockholders have been well served by having Mr. Ginsburg act as both Chairman of the Board and Chief Executive Officer.

The Board of Directors is comprised of independent, active and engaged directors. The Board of Directors and its committees tightly oversee the effectiveness of management policies and decisions. The Board's audit, compensation and nominating committees are comprised entirely of independent directors. As a result, independent directors directly oversee such critical matters as the integrity of the

8

Company's financial statements, the compensation of the executive management, including Mr. Ginsburg's compensation, the selection and evaluation of directors, and the development and implementation of corporate programs.

Additionally, the Board of Directors believes the Company's Corporate Governance Guidelines, which are available on the Company's website at www.DGIT.com, help ensure that strong and independent directors will continue to play the central oversight role necessary to maintain the Company's commitment to the highest quality corporate governance. We do not have a lead independent director. The Board of Directors believes the Company and its stockholders have been and continue to be well served by having Mr. Ginsburg serve as both Chairman of the Board and Chief Executive Officer.

Risk Oversight

Our Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the company. The involvement of the full Board of Directors in setting the Company's business strategy is a key part of its assessment of management's appetite for risk and also a determination of what constitutes an appropriate level of risk for the Company. Risk is assessed throughout the business, focusing on three primary areas of risk: financial risk, legal/compliance risk and operational/strategic risk.

While the Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives an annual risk assessment report from the Company's internal auditors. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with the Company's business strategy.

Corporate Governance and Code of Business Conduct and Ethics

The Company's Corporate Governance Guidelines, along with its Code of Business Conduct and Ethics, applies to its directors, officers and employees. A copy of the Company's Code of Business Conduct and Ethics is available on its website at www.DGIT.com by clicking first on "Our Company," then on "Investor Relations." The Company will also provide a copy of its Corporate Governance Guideliness or its Code of Business Conduct and Ethics, without charge, to any stockholder who so requests in writing.

Communications with the Board of Directors

Stockholders may communicate with the Board of Directors by writing to the Board in care of the Company's Secretary, DG FastChannel, Inc., 750 West John Carpenter Freeway, Suite 700, Irving, Texas 75039. The Board of Directors has delegated responsibility for initial review of stockholder communications to the Company's Secretary. In accordance with the Board's instructions, the Secretary will forward the communication to the director or directors to whom it is addressed, except for communications that are (1) advertisements or promotional communications, (2) solely related to complaints by users with respect to ordinary course of business customer service and satisfaction issues or (3) clearly unrelated to our business, industry, management or Board or committee matters. In addition, the Secretary will make all communications available to each member of the Board, at the Board's next regularly scheduled meeting.

9

Board Committees

The Board of Directors of the Company has three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee. None of the directors who serve as members of the Audit Committee, Nominating Committee or the Compensation Committee are employees of the Company or any of its subsidiaries.

Audit Committee

The Audit Committee operates under an Amended and Restated Charter of the Audit Committee adopted by our Board of Directors.

The Audit Committee's functions include:

- •

- engaging independent auditors and determining their compensation;

- •

- making recommendations to the Board of Directors for reviewing the completed audit and audit report with the independent

auditors, the conduct of the audit, significant accounting adjustments, recommendations for improving internal controls, and all other significant findings during the audit;

- •

- meeting at least quarterly with the Company's management and auditors to discuss internal accounting and financial

controls, as well as results of operations reviews performed by the auditors;

- •

- determining the scope of and authorizing or approving any permitted nonaudit services provided by the independent auditors

and the compensation for those services; and

- •

- initiating and supervising any special investigation it deems necessary regarding the Company's accounting and financial policies and controls.

The Audit Committee is composed solely of directors who are not officers or employees of the Company and who, the Company believes, have the requisite financial literacy to serve on the Audit Committee, have no relationship to the Company that might interfere with the exercise of their independent judgment, and meet the standards of independence for members of an audit committee under the rules of the Securities and Exchange Commission (the "SEC") and under the NASDAQ Marketplace Rules.

Messrs. LeVecchio (Chairman), Harris, Rich and Ms. Gallagher are the current members of the Audit Committee. The Board of Directors, after reviewing all of the relevant facts, circumstances and attributes, has determined that Mr. LeVecchio, the Chairman of the Audit Committee, is the sole "audit committee financial expert" on the Audit Committee.

Compensation Committee

The Compensation Committee's functions include:

- •

- establishing and administering the Company's compensation policies;

- •

- determining, or recommending to the Board, the compensation of the Company's executive officers;

- •

- administering the Company's equity compensation plans; and

- •

- overseeing the administration of other employee benefit plans and fringe benefits paid to or provided for the Company's officers.

10

See "Executive Compensation—Compensation Committee Report" below. Messrs. Harris (Chairman), Kantor and Donner are the current members of the Compensation Committee. All current members of the Compensation Committee are "independent directors" as defined under the NASDAQ Marketplace Rules.

Executive Committee

The Executive Committee was established in January 2001. The Executive Committee has the authority, between meetings of the Board of Directors, to take all actions with respect to the management of the Company's business that require action by the Board of Directors, except with respect to certain specified matters that by law must be approved by the entire Board of Directors. Messrs. Ginsburg, Nguyen, and Choucair are the current members of the Executive Committee.

Attendance at Meetings of the Board of Directors and Committees

During 2010, the Board of Directors held six meetings, the Audit Committee held six meetings, the Compensation Committee held three meetings and the Nominating Committee held no meetings. The Nominating Committee was established in late 2010. All persons who were directors during 2010 attended 100% of the Board meetings and the meetings of committees on which they served that were held while such person served as a director.

Nominating Committee

The Nominating Committee recommends qualified candidates to the Board for nomination or election as directors. The Nominating Committee is responsible for reviewing and interviewing qualified candidates to serve on the Board of Directors, for making recommendations to the full Board for nominations to fill vacancies on the Board, and for selecting the management nominees for the directors to be elected by the Company's stockholders at each annual meeting. The Nominating Committee has not established specific minimum age, education, experience or skill requirements for potential directors, however, does take into account all factors they consider appropriate in fulfilling their responsibilities to identify and recommend individuals to the Board as director nominees. Those factors may include, without limitation, the following:

- •

- an individual's business or professional experience, accomplishments, education, judgment, understanding of the business

and the industry in which the Company operates, specific skills and talents, independence, time commitments, reputation, general business acumen and personal and professional integrity or character;

- •

- the size and composition of the Board and the interaction of its members, in each case with respect to the needs of the

Company and its stockholders; and

- •

- regarding any individual who has served as a director of the Company, his or her past preparation for, attendance at, and participation in meetings and other activities of the Board or its committees and his or her overall contributions to the Board and the Company.

The Nominating Committee may use multiple sources for identifying and evaluating nominees for directors, including referrals from the Company's current directors and management as well as input from third parties, including executive search firms retained by the Nominating Committee. The Nominating Committee will obtain background information about candidates, which may include information from directors' and officers' questionnaires and background and reference checks, and will then interview qualified candidates. The Company's other directors will also have an opportunity to meet and interview qualified candidates. The Nominating Committee will then determine, based on the background information and the information obtained in the interviews, whether to recommend to the Board of Directors that a candidate be nominated to the Board.

11

Messrs. Howe (Chairman), Kantor, Rich, and LeVecchio are the current members of the Nominating Committee.

Section 16(a) Beneficial Ownership Reporting Compliance

The members of the Board of Directors, the executive officers of the Company and persons who hold more than 10% of the Company's outstanding common stock are subject to the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, as amended, which require them to file reports with respect to their ownership of the Company's common stock and their transactions in such common stock. Based upon (i) the copies of Section 16(a) reports that the Company received from such persons for their 2010 fiscal year transactions in the Company's common stock and their common stock holdings and (ii) the written representation received from one or more of such persons that no annual Form 5 reports were required to be filed by them for the 2010 fiscal year, the Company believes that all reporting requirements under Section 16(a) for such fiscal year were met in a timely manner by its officers, Board members and greater than 10% shareholders at all times during the 2010 fiscal year.

Other Information

In September 1999, a civil lawsuit was filed by the SEC in the United States District Court for the Southern District of Florida against Scott K. Ginsburg, the Chairman of the Board of the Company, his brother and his father. The lawsuit alleged that Mr. Ginsburg had violated the insider trading provisions of the federal securities laws by communicating material, non-public information to his brother in 1996 regarding the securities of EZ Communications, Inc. ("EZ") and in 1997 regarding the securities of Katz Media, Inc. ("Katz"). The lawsuit further alleged that Mr. Ginsburg's father and brother, relying upon the information allegedly furnished by Mr. Ginsburg, purchased securities in EZ and Katz, and subsequently profited from the sale of such securities.

In April 2002, a jury found that Mr. Ginsburg did make these communications, known as "tipping," and therefore concluded that he had violated Sections 10(b) and 14(e) of the Exchange Act and Rules 10b-5 and 14e-3 thereunder. In July 2002, the United States District Court imposed a $1,000,000 civil penalty against Mr. Ginsburg.

Mr. Ginsburg filed a motion asking the Court to set aside its ruling and the verdict of the jury. On December 19, 2002, the United States District Court granted Mr. Ginsburg's motion for judgment notwithstanding the verdict. The Court overturned the jury verdict in its entirety and set aside the civil penalty.

On February 13, 2003, the SEC filed a Notice of Appeal, seeking to reverse the Court's decision and challenging the Court's earlier refusal to impose an injunction against Mr. Ginsburg. In March 19, 2004 a decision of a three-judge panel of the Eleventh Circuit U.S. Court of Appeals reversed the decision by the U.S. District Court for the Southern District of Florida on December 19, 2002. The Court of Appeals (i) reinstated the jury verdict that Mr. Ginsburg had, in matters unrelated to the Company, violated Sections 10(b) and 14(e) of the Exchange Act and Rules 10b-5 and 14e-3 thereunder, (ii) reinstated a $1 million civil penalty against Mr. Ginsburg and (iii) remanded the case to the District Court with instructions to enjoin Mr. Ginsburg from violations of the federal securities laws and regulations. The Court of Appeals did not bar Mr. Ginsburg from serving as an officer or director of a public company and the Company's Board immediately and unanimously moved to affirm Mr. Ginsburg in his capacity as Chairman of the Board of Directors.

12

ITEM 11. EXECUTIVE COMPENSATION

Introduction

This Compensation Discussion and Analysis (CD&A) describes the principles of our executive compensation program, how we applied those principles in compensating our Named Executive Officers (NEOs) for 2010, and how our compensation program drives performance.

Our NEOs for 2010 are:

- •

- Scott K. Ginsburg, Chairman and Chief Executive Officer;

- •

- Neil H. Nguyen, President and Chief Operating Officer; and

- •

- Omar A. Choucair, Chief Financial Officer.

In this CD&A, we first provide an executive summary of our program for 2010. We then describe our compensation philosophy and the objectives of our executive compensation program and how the Compensation Committee of our Board of Directors oversees our compensation program. We discuss the compensation determination process and describe how we determine each element of compensation. We believe that our compensation program in 2010 and in prior years shows that we have closely linked pay to performance.

Executive Summary

Overview of Our Executive Compensation Program

The Compensation Committee has designed our executive compensation program to attract and retain superior employees in key positions to enable our Company to succeed in the highly competitive market for talent, while simultaneously maximizing shareholder returns. We believe that our executives are a primary factor in our strong performance over both the short- and long-term. Therefore, we intend to continue to provide a competitive compensation package to our executives, tie a significant portion of pay to performance and utilize components that best align the interests of our executives with those of our shareholders.

The following is a summary of important aspects of our executive compensation program discussed later in this CD&A:

- •

- Key Elements of Our Compensation Program. Our compensation

program is designed to achieve these objectives through a combination of the following types of compensation:

- •

- Base salary,

- •

- Annual cash incentive bonus awards, and

- •

- Long-term equity incentive awards.

- •

- We Intend to Pay for Performance. The majority of our

NEOs' total compensation as shown on page 24 in our Summary Compensation Table below ties compensation directly to the achievement of corporate and individual objectives. We emphasize pay for

performance in order to align executive compensation with our business strategy and the creation of long-term shareholder value.

- •

- Our Compensation Program Supports Our Corporate Objectives and Stockholder Interests. Our compensation program is designed to align executive officer compensation with our corporate strategies, business objectives and the long-term interests of our stockholders by rewarding successful execution of our business plan and tying a portion of total compensation opportunities to equity incentives.

Each element of our executive compensation program is discussed in greater detail below.

13

Overview of 2010 Performance

The Compensation Committee believes the executive compensation program is an important factor in driving our NEOs' performance to achieve long-term earnings per share growth and stock price appreciation. Our Company's fiscal 2010 accomplishments, guided by our NEOs, illustrate the success of this strategy, even in an uncertain economic environment, and included, among other things, the following:

- •

- Revenue and Net Income Growth: During 2010, we achieved

revenues of $247.5 million, representing an increase of 30% over 2009 revenues, and net income of $41.6 million, representing an increase of 103% over 2009 levels. We continued to

capture the market for online advertising while simultaneously growing our traditional advertising business. From 2009 to 2010, we increased our revenues from High Definition advertising by 72% to

$102.8 million.

- •

- Earnings Per Share: Our earnings per share for 2010 were

$1.52, representing an increase of 69% over 2009 earnings per share.

- •

- Retirement of Debt. We raised $108 million in a public equity offering and repaid all of our outstanding debt.

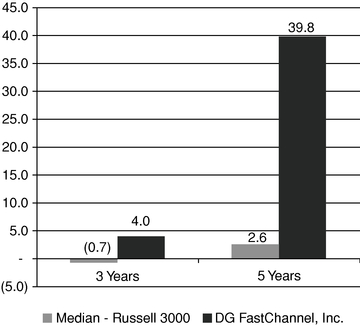

Total Shareholder Return

DG FastChannel, Inc. Compared to the Russell 3000 Industry Group

December 31, 2010

14

As shown above, our performance measured by total shareholder return well exceeds our industry group for each time period. A substantial reason for this superior performance is our track record of consistency in delivering strong, year-over-year growth in revenues, net income and earnings per share over the past five years, as shown below:

DG FastChannel, Inc.

Five-Year Trended Performance

December 31, 2010

| (Amounts shown in millions, except per share amounts) |

2006 | 2007 | 2008 | 2009 | 2010 | Compounded Annual Growth Rate |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Revenues |

$ | 68.7 | $ | 97.7 | $ | 157.1 | $ | 190.9 | $ | 247.5 | 38 | % | |||||||

Net income from continuing operations |

$ | 0.4 | $ | 10.9 | $ | 15.1 | $ | 20.5 | $ | 41.6 | 219 | % | |||||||

Basic EPS |

$ | 0.04 | $ | 0.65 | $ | 0.81 | $ | 0.90 | $ | 1.52 | 148 | % | |||||||

2010 Compensation Programs and Decisions

In line with our executive compensation program's emphasis on pay for performance, compensation awarded to our named executive officers for 2010 reflected our financial results and overall compensation philosophy:

- •

- Adjustments to Base Salary Solely In Line With Employment

Agreements: During 2010, our NEOs received only those increases to their base salaries that were provided pursuant to the terms of their

previously-negotiated employment agreements.

- •

- Pay-for-Performance Annual Incentive

Bonuses: For 2010, our company focused on increasing revenues and margin improvement. Our compensation program for 2010 was designed to

support the company's focus on these performance measures. For our annual bonus program for 2010, the Compensation Committee selected these two objectives as the key corporate objectives as the

Compensation Committee believes they encourage executives to achieve superior operating results using appropriate levels of capital. From 2009 to 2010, as discussed above, our revenues increased 30%,

and our net income grew by an impressive 103% and our operating margins improved by 60%. The annual bonuses awarded to our NEOs for 2010 are discussed beginning at page 19. Based on our strong

2010 performance, we paid bonuses for 2010 recognizing our strong revenue growth and operating margin improvement and for strong individual performance for fiscal 2010.

- •

- Equity-based Compensation: Our Compensation Committee did not grant any long-term equity incentive awards to our NEOs in 2010, as their existing equity awards were deemed sufficient to align their interests with our growth strategy and shareholder interests.

In light of the Company's strong performance during 2010, as well as its sustained performance over recent years, the Compensation Committee believes that the NEOs' 2010 compensation was appropriate.

Objectives of Our Executive Compensation Program

The primary objectives of our executive compensation program are:

- •

- Compensation Should Be Market Competitive: The

Compensation Committee intends to ensure that our executive compensation program is competitive with compensation paid by companies in the same market for executive talent while maintaining fiscal

responsibility for our stockholders.

- •

- Compensation Should Support Our Business Strategy: Our compensation program is designed to align executive officer compensation with our corporate strategies, business objectives and the

15

- •

- Compensation Should Reward Performance: While we utilize a

variety of compensation elements to achieve compensation targets, we intend that the majority of our NEOs' total compensation will be in the form of variable compensation, comprised of annual

incentive bonuses and long-term equity incentive awards dependent upon corporate or individual performance or the creation of long-term shareholder value.

- •

- Compensation Should Be Aligned With Stockholder Interests: Our executive compensation program also seeks to reward our executives for increasing our stock price over the long-term and maximizing stockholder value by providing a portion of total compensation opportunities for our executive officers in the form of long-term equity incentives.

long-term interests of our stockholders by rewarding successful execution of our business plan, with performance objectives tied to our key corporate objectives.

Key Elements of Our Executive Compensation Program

The following table lists the key elements that generally encompass our executive compensation program:

Element

|

Purpose | Form | ||

|---|---|---|---|---|

Base Salary |

Provide a basic level of compensation for performance of executive's primary responsibilities. | Cash | ||

Annual Cash Incentive Compensation |

Create a direct link between executive compensation and individual and business performance. |

Cash |

||

Long-Term Equity Incentive Compensation |

Focus executives on the enhancement of shareholder value over the long-term, to encourage equity ownership in the Company, and to retain key executive talent. |

Stock Options/Restricted Stock |

||

Employment Agreements |

Establish key compensation terms; severance and change in control provisions; provide stability for executives. |

Individual Agreements with NEOs |

||

Perquisites and Other Benefits |

To better enable the Company to attract and retain superior executives for key positions. |

401(k) Plan/Health and Welfare Benefits/Car Allowance |

All elements of compensation are taken into account when compensation decisions are made by the Compensation Committee.

Setting Executive Compensation

Our executive compensation program is reviewed annually by the Compensation Committee. Generally in the first quarter of each year, the Compensation Committee reviews the performance of each of our NEOs during the previous year. At this time the Compensation Committee also reviews our corporate performance for the prior year and makes the final bonus payment determinations based on such performance and the Compensation Committee's evaluation of each NEO's individual performance for the prior year. In connection with this review, the Compensation Committee also

16

reviews and adjusts, as appropriate, annual base salaries for our NEOs and grants, as appropriate, additional long-term equity incentive awards to our NEOs and certain other eligible employees for the coming fiscal year.

Role of Management

For NEOs other than our Chairman and Chief Executive Officer, our Compensation Committee has historically sought and considered input from our Chairman and Chief Executive Officer regarding such NEOs' responsibilities, performance and compensation. Specifically, our Chairman and Chief Executive Officer recommends base salary increases and equity award levels that are used throughout our compensation plans, and advises our Compensation Committee regarding the compensation program's ability to attract, retain and motivate executive talent. These recommendations reflect compensation levels that our Chairman and Chief Executive Officer believes are qualitatively commensurate with an executive officer's individual qualifications, experience, responsibility level, functional role, knowledge, skills and individual performance, as well as our company's performance. Our Compensation Committee considers our Chairman and Chief Executive Officer's recommendations, and approves the specific compensation for all the executive officers.

Our Compensation Committee meets in executive session, and our Chairman and Chief Executive Officer does not attend Compensation Committee discussions where recommendations are made regarding his compensation. Our Chairman and Chief Executive Officer does provide input and perspective regarding plan design and market factors related to his and other executive roles, but the Compensation Committee, acting under its independent authority, as established by the Board of Directors, determines his level of pay. He also abstains from voting in sessions of the Board of Directors where the Board of Directors acts on the Compensation Committee's recommendations regarding his compensation.

Compensation Determination Process

Our Compensation Committee has historically determined each element of an executive's initial compensation package within the framework of the objectives of our executive compensation program, which is then set forth in his or her employment agreement, based on numerous factors, including:

- •

- The individual's particular background, track record and circumstances, including training and prior relevant work

experience;

- •

- The individual's role with us and the compensation paid to similar persons in the companies represented in the

compensation data that we review;

- •

- The demand for individuals with the individual's specific expertise and experience;

- •

- Internal equity among our executive group;

- •

- Performance goals and other expectations for the position; and

- •

- Uniqueness of industry skills.

In general, the terms of our executive employment agreements are initially negotiated with the executive by our Chairman and Chief Executive Officer and Company legal counsel. The agreements for our executives over whose compensation the Compensation Committee has authority are presented to the Compensation Committee for consideration. When appropriate, such as in the case of the agreements for Messrs. Ginsburg, Nguyen and Choucair, the Compensation Committee takes an active role in the negotiation process.

During the review and approval process for the employment agreements for executives under its purview, and during its annual review of executive compensation, the Compensation Committee considers the appropriate amounts for each component of compensation and the compensation design

17

appropriate for the individual executive. Except for base salary, which has an established minimum amount set forth in the respective employment agreements, the Compensation Committee has discretion to increase or decrease cash bonus awards from the targets listed in the agreements.

We strive to achieve an appropriate mix between equity incentive awards and cash payments in order to meet our objectives. In determining each element of compensation for any given year, our Board of Directors and our Compensation Committee consider and determine each element individually and then review the resulting total compensation and determine whether it is reasonable and competitive. The Compensation Committee has not historically utilized formulas in establishing the amounts for each element of pay nor has it historically had any policies for allocating compensation between long-term and short-term compensation or cash and non-cash compensation. Instead, the appropriate mix among the various elements of compensation for each executive officer was established through negotiations directly with that officer, rather than by applying formulas. However, the Compensation Committee believes that all executive officers should have a significant amount of their total compensation package in the form of performance-based incentive compensation (annual cash bonus) and long-term equity incentive compensation. The amounts reflected in the Summary Compensation Table and their individual employment agreements reflect this process.

Role of Compensation Consultant and Comparable Company Information

Our Compensation Committee has not historically established compensation levels based on benchmarking. Our Compensation Committee has instead relied upon the judgment of its members in making compensation decisions and determining whether they are competitive in the marketplace in which we compete for executive talent, after reviewing our performance and carefully evaluating a named executive officer's performance during the year against established goals, leadership qualities, operational performance, business responsibilities, career with our company, current compensation arrangements and long-term potential to enhance stockholder value.

The Compensation Committee is authorized to retain the services of third-party compensation consultants and other outside advisors from time to time, as the committee sees fit, in connection with compensation matters. Compensation consultants and other advisors retained by the compensation committee will report directly to the compensation committee which has the authority to select, retain and terminate any such consultants or advisors.

In late 2010, the Compensation Committee retained James F. Reda & Associates (Reda) an independent compensation consultant to assist the Compensation Committee in connection with the implementation of various changes to our executive compensation program for 2011.

The compensation levels of the NEOs reflect to a significant degree their varying roles and responsibilities. Specifically, due to Mr. Ginsburg's extensive experience, responsibilities and significant market demand, the Company believes that it is appropriate that his total compensation is substantially higher than the Company's other executives.

2010 Executive Compensation Decisions

Base Salary

Base salaries for our executives are established based on individual factors such as the scope of their responsibilities, background, track record, training and experience, as well as competitive market compensation and the overall market demand for such executives at the time the respective employment agreements are negotiated. As with total executive compensation, we believe that executive base salaries should be competitive with the range of salaries for executives in similar positions and with similar responsibilities, although we have not historically benchmarked executive base salaries against a specific market comparison group. An executive's base salary is also evaluated together with

18

components of the executive's other compensation to ensure that the executive's total compensation is consistent with our overall compensation philosophy.

In connection with the execution of employment agreements with each of our NEOs in 2008, the base salary levels for each NEO during the initial term of those agreements was established through arms-length negotiations between each executive and the Company at that time. Although the Company considered the same factors in establishing the base salaries of each of the executives, due to the different levels of satisfaction of such factors by each executive, the base salaries are, in certain cases, substantially different. Specifically, due to his extensive experience, responsibilities and significant market demand, the Company believes that it is appropriate that Mr. Ginsburg's base salary is substantially higher than the Company's other executives.

The employment agreements provide for automatic increases in the base salaries of the NEOs through July 31, 2011, with respect to Mr. Ginsburg, through December 31, 2012, with respect to Mr. Nguyen, and through December 31, 2011, with respect to Mr. Choucair. These base salary levels are described below under Employment Agreements on page 25. Other than the automatic increases contemplated by the employment agreements, no additional base salary actions were taken during 2010 with respect to our NEOs.

Annual Bonus

Our executive compensation program includes eligibility for an annual performance-based cash bonus for all executives as set forth in their employment agreements. Our annual bonuses emphasize pay for performance by providing our executives with the opportunity to receive performance bonuses only in the event of strong corporate and individual performance, as determined in the discretion of the Compensation Committee.

Annual Target Bonuses. As provided in their employment agreements, for 2010, our Chief Executive Officer and President and Chief Operating Officer were eligible for a target bonus of up to 75% of their respective annual base salaries, while our Chief Financial Officer was eligible for an annual bonus of up to $140,000. Each NEO's target bonus represents the amount the Company would expect to pay the executive each year for satisfactory performance. This amount is then adjusted upward or downward on a discretionary basis by the Compensation Committee based on Company and individual performance.

Annual Performance Objectives. While our annual bonus program is a discretionary one, at the beginning of each year, the Compensation Committee establishes corporate and individual performance objectives to assist it in determining the annual bonuses for our executives. While these performance objectives are used as a guide by the Compensation Committee in determining the bonuses to be paid to the executives as they represent those areas in which the NEOs were expected to focus their efforts, the Compensation Committee retains discretion in making its bonus determinations and has used this discretion in 2010 as well as prior years. Our discretionary approach begins with the executive's targeted annual bonus which we then adjust upwards or downwards based on the executive's and the Company's performance during the year.

- •

- Company Performance Objectives. During 2010, the Compensation Committee determined to use revenue growth and margin improvement as the corporate objectives for purposes of NEO annual bonus decisions. The Compensation Committee determined to use these factors to measure corporate performance because they encourage executives to achieve superior operating results using appropriate levels of capital. The Compensation Committee did not establish specific quantitative targets for each company objective. Instead, the Compensation Committee believed that it was better to evaluate the Company's performance relative to these two categories of financial performance throughout the year, in light of the performance of the

19

- •

- Individual Performance Objectives. Each NEO's individual performance is determined by the Compensation Committee based on its subjective determination of the NEO's individual performance for the year. As described above, the Chairman and Chief Executive Officer provides the Compensation Committee with his evaluation of each of the other NEOs' performance and the Compensation Committee evaluates the Chairman and Chief Executive Officer's individual performance.

Company relative to the industry and the economy in general. As a result, the Compensation Committee considered the Company's achievements relative to these objectives in its discretion.

- •

- Achieving revenue and margin improvements;

- •

- Realization of operating cost synergies resulting from prior acquisitions; and

- •

- Successful negotiation and closing of an equity offering in order to retire our senior debt.

For 2010, the Compensation Committee established three areas of focus for the NEOs that included strategic and leadership goals and focused on the Company's strategic initiatives. The Compensation Committee did not establish specific quantitative targets for any of the individual performance objectives described below; instead, such objectives were intended to be qualitative, with the achievement of such objectives left solely to the discretion of the Compensation Committee after its consideration of each NEO's individual achievements as a whole.

The individual objectives established for the NEOs for 2010 included:

In determining the NEOs' 2010 annual bonuses, the Compensation Committee noted that the executive team had achieved all of the foregoing objectives to the satisfaction of the Compensation Committee. Their strong individual performance, in addition to the Company's financial performance as a whole, served as a basis for the Compensation Committee's determination of the 2010 bonuses for the NEOs.

For 2010, the Compensation Committee awarded annual bonuses to Messrs. Ginsburg and Nguyen in excess of target bonus levels to reward them for the outstanding corporate performance, and their respective individual performance, during 2010. Mr. Choucair was awarded the maximum annual bonus provided for in his employment agreement.

The 2010 annual bonuses paid to our NEOs are set forth on page 24 in the Summary Compensation Table below. We believe that given the NEOs' outstanding individual accomplishments and the Company's impressive performance during 2010, the awarded annual bonuses are consistent with our compensation philosophy.

Long-Term Equity Incentive Compensation

We believe that superior long-term performance is achieved through a culture that encourages our executives to hold a significant ownership stake in our Company. We provide this ownership stake to our executives through our equity-based incentive program.

Under our 2006 Long-Term Stock Incentive Plan (the 2006 Plan) our executive officers have historically been awarded long-term incentives in the form of stock options and restricted stock awards. We currently make equity awards as follows:

- •

- Upon an executive's execution of their initial employment agreement with the Company, based on the executive's prior work experience, the executive's position, and competitive market practices;

20

- •

- During our overall annual review process or upon an executive's execution of subsequent employment agreements with the Company, based on company and individual performance, internal pay equity considerations and competitive market practices. Annual grants of equity have not historically been a part of our total compensation program; however, we plan to begin making annual equity awards in 2011.

As is the case when the amounts of base salary and annual bonuses are determined, a review of all elements of compensation is conducted when determining equity awards to ensure that total compensation conforms to our overall compensation philosophy and objectives.

All stock option grants have an exercise price equal to the fair market value of our common stock on the date of grant (to ensure that our executive's interests are aligned with our shareholders) and they typically vest ratably over four years (to provide the executive with a long-term focus).

None of our NEOs received any long-term equity incentive awards during 2010.

Other Benefits

We provide our executives with the following types of benefits:

- •

- Perquisites;

- •

- Health, dental, life, and disability insurance; and

- •

- Retirement benefits.

We periodically review the levels of perquisites and other personal benefits provided to executive officers to ensure they fit within our overall compensation philosophy.

Perquisites

We provide a limited number of perquisites to our executives to better enable the Company to attract and retain superior employees for key positions. The main perquisite we provided our NEOs during 2010 was an automobile allowance. As set forth on page 24 in the Summary Compensation Table, the value of this benefit ranged from $6,231 to $12,000 depending on the NEO's particular position.

Health, Dental, Life and Disability Insurance

We offer all of our regular employees, including our NEOs, health, life, disability and dental insurance. The value of these benefits to our NEOs is set forth on page 24 in the Summary Compensation Table.

Retirement Benefits

All of our regular employees, including our NEOs, who meet certain defined requirements may participate in our 401(k) plan. We have the discretion to match employee contributions and we exercised that discretion in March 2010 to reinstate our previously suspended match. Under our current matching policy, we match 25% of the amount contributed by our employees, up to a maximum of employee contributions of 6% of gross earnings. The value of this match for our NEOs is set forth on page 24 in the Summary Compensation Table.

The Board of Directors has discretion to make additional contributions to our 401(k) plan. The Board of Directors did not exercise its discretion to do so during 2010.

21

Employment Agreements

We have entered into employment agreements that provide for certain severance benefits in the event that a NEO's employment is involuntarily or constructively terminated or in the event of a change in control. We recognize the challenges executives often face securing new employment following termination. To mitigate these challenges and to secure the focus of our management team on the Company's affairs, all executive officers are entitled to receive severance payments under their employment agreements upon certain types of termination. The terms of these employment agreements are described beginning on page 25. We believe that reasonable severance benefits for our executive officers are important because it may be difficult for our executive officers to find comparable employment within a short period of time following certain qualifying terminations. In addition to normal severance, we provide enhanced benefits in the event of a change in control as a means reinforcing and encouraging the continued attention and dedication of our executives to their duties of employment without personal distraction or conflict of interest in circumstances that could arise from the occurrence of a change in control. We believe that the interests of stockholders will be best served if the interests of our senior management are aligned with them, and providing change in control benefits should eliminate, or at least reduce, the reluctance of senior management to pursue potential change in control transactions that may be in the best interests of stockholders.

We also extend severance and change in control benefits because they are essential to help us fulfill our objectives of attracting and retaining key managerial talent. These agreements are intended to be competitive within our industry and company size and to attract highly qualified individuals and encourage them to be retained by us. While these arrangements form an integral part of the total compensation provided to these individuals and are considered by the Compensation Committee when determining NEO compensation, the decision to offer these benefits did not influence the Compensation Committee's determinations concerning other direct compensation or benefit levels.

In addition to cash severance benefits upon certain terminations, the employment agreements provide that any unvested shares of restricted stock granted to Mr. Ginsburg in 2008 and any unvested stock options granted to Messrs. Nguyen and Choucair vest upon a change in control. Other equity awards held by the NEOs will not be subject to these accelerated vesting provisions. In adopting the so-called "single" trigger treatment for these equity awards, the Company was guided by the following objectives:

- •

- keeping executives relatively whole for a reasonable period but avoiding creating a "windfall;"

- •

- ensuring that executives whose employment continues following a transaction are treated the same as terminated executives

with respect to outstanding equity awards;

- •

- providing the executives with the same opportunities as shareholders, who are free to sell their equity at the time of the

change in control event and thereby realize the value created at the time of the deal;

- •

- the company that made the original equity grant may no longer exist after a change in control and employees should not be

required to have the fate of their outstanding equity tied to the new company's future success;

- •

- supporting the compelling business need to retain executives during uncertain times;

- •

- providing a powerful retention device during change in control discussions, especially given that equity awards represents

a significant portion of the executives' total pay package; and

- •

- a double trigger on equity awards provides no certainty of what will happen when the transaction closes.

22

Deductibility of Executive Compensation

As part of its role, the Compensation Committee reviews and considers the deductibility of the Company's executive compensation under Section 162(m) of the Internal Revenue Code. Section 162(m) generally limits the tax deduction for compensation in excess of one million dollars paid to certain executive officers. However, performance-based compensation is excluded from the limit so long as it meets certain requirements.

In its review and establishment of compensation programs and awards for our NEOs, the Compensation Committee considers the anticipated deductibility or non-deductibility of the compensation as a factor in assessing whether a particular compensatory arrangement is appropriate; particularly in light of the goals of maintaining a competitive executive compensation system generally (i.e., paying for performance and maximizing shareholder return).

For 2010, a portion of the annual cash bonuses paid to our NEOs will not be tax deductible. However, beginning in 2011, we intend to take steps to ensure that a substantial majority of our annual cash bonuses and annual long-term incentive awards will be tax deductible commencing in 2012.

Compensation Committee Report

The Compensation Committee of the Board of Directors of the Company has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors of the Company that the Compensation Discussion and Analysis be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2010 and the Company's proxy statement for its 2011 annual meeting of stockholders.

| THE COMPENSATION COMMITTEE | ||

John R. Harris, Chairman David M. Kantor William Donner |

23

Summary Compensation Table

The following table shows the compensation for the three fiscal years ended December 31, 2010, 2009 and 2008 earned by our Chairman and Chief Executive Officer, our Chief Financial Officer who is our Principal Financial and Accounting Officer, and our President and Chief Operating Officer, who is our only other executive officer.

Name and Principal Position

|

Year | Salary ($) |

Bonus ($) |

Stock Option Awards ($)(1) |

Stock-based Awards ($)(1) |

All Other Compensation ($)(2) |

Total ($) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Scott K. Ginsburg |

2010 | 475,560 | 1,865,040 | — | — | 32,519 | 2,373,119 | |||||||||||||||

Chairman and Chief Executive |

2009 | 457,270 | 451,000 | — | — | 30,802 | 939,072 | |||||||||||||||

Officer |

2008 | 405,577 | 538,750 | — | 5,922,000 | (3) | 34,001 | 6,600,328 | ||||||||||||||

Neil H. Nguyen |

2010 |

394,077 |

1,311,250 |

— |

— |

29,076 |

1,734,403 |

|||||||||||||||

President and Chief Operating |

2009 | 350,570 | 190,000 | 1,990,450 | (4) | — | 29,766 | 2,560,786 | ||||||||||||||

Officer |

2008 | 233,846 | 250,000 | 1,618,620 | (5) | — | 106,515 | 2,208,981 | ||||||||||||||

Omar A. Choucair |

2010 |

344,847 |

140,000 |

— |

— |

25,991 |

510,838 |

|||||||||||||||

Chief Financial Officer |

2009 | 334,250 | 190,000 | — | — | 23,921 | 548,171 | |||||||||||||||

|

2008 | 265,769 | 300,500 | 2,023,275 | (6) | — | 26,705 | 2,616,249 | ||||||||||||||

- (1)

- Represents

the grant date fair value of equity awards granted to the NEO in the applicable fiscal year determined in accordance with ASC Topic 718,

Compensation—Stock Compensation (ASC Topic 718). See Note 13 to our Consolidated Financial Statements included in the Original Form 10-K for details as to the