Attached files

Exhibit 4.1

SECOND SUPPLEMENTAL INDENTURE

This Second Supplemental Indenture (this “Supplemental Indenture”), dated as of May 2, 2011, is entered into by and among AirTran Holdings, Inc., a Nevada corporation (the “Company”), Southwest Airlines Co., a Texas corporation (“Southwest”), and U.S. Bank National Association, a national banking association, as trustee hereunder (the “Trustee”). Capitalized terms used herein and not otherwise defined have the meanings set forth in the First Supplemental Indenture referred to below.

WHEREAS, the Company and the Trustee are parties to a Senior Indenture dated as of April 30, 2008 (the “Original Indenture”) and a First Supplemental Indenture dated as of April 30, 2008 relating to the issuance of the 5.50% Convertible Senior Notes due 2015 (the “First Supplemental Indenture,” and the Original Indenture as supplemented by the First Supplemental Indenture, the “Indenture”);

WHEREAS, the Company, Southwest, and Guadalupe Holdings Corp., a Nevada corporation and wholly owned subsidiary of Southwest (“Merger Sub”), are parties to that certain Agreement and Plan of Merger dated as of September 26, 2010 (the “Merger Agreement”), pursuant to which, at the effective time of the Merger contemplated thereby (the “Effective Time”), Merger Sub was merged with and into the Company such that the separate corporate existence of Merger Sub ceased and the Company continued as the surviving corporation (the “Merger”), and each share of Common Stock of the Company issued and outstanding immediately prior to the Effective Time was converted into the right to receive 0.321 of a share of Southwest’s common stock, par value $1.00 per share, and $3.75 in cash, in each case as set forth in the Merger Agreement;

WHEREAS, Section 4.09 of the First Supplemental Indenture provides that in the event of a sale or conveyance as an entirety or substantially as an entirety of the property and assets of the Company, directly or indirectly, to another Person as a result of which holders of outstanding shares of the Common Stock of the Company are entitled to receive stock (other than the Common Stock of the Company), other securities, other property, assets or Cash (or any combination thereof) for shares of such Common Stock of the Company, then the Company, or such successor, surviving or purchasing Person, as the case may be, shall, as a condition precedent to such sale or conveyance, execute and deliver to the Trustee a supplemental indenture providing (i) that, at the effective time of such sale or conveyance, the settlement of the Securities tendered for conversion will be based on, and the property deliverable in respect of any such settlement will consist of, the kind and amount of shares of stock, other securities or other property or assets (including Cash or any combination thereof) that holders of shares of the Common Stock of the Company are entitled to receive in respect of each share of Common Stock of the Company upon such sale or conveyance and (ii) for adjustments of the Conversion Rate which will be nearly as equivalent as may be practicable to the adjustments of the Conversion Rate provided for in Article 4 of the First Supplemental Indenture;

WHEREAS, Section 6.01 of the First Supplemental Indenture provides that the Company shall not consolidate with, or merge into, any other Person or convey, transfer or lease all or substantially all of the Company’s properties and assets to any other Person in a single transaction or series of transactions if, as a result of such transaction, the Securities become

1

convertible into common stock or other securities issued by a third party, unless such third party fully and unconditionally guarantees all obligations of the Company, or such other Person under the Securities and the Indenture;

WHEREAS, the Merger constitutes a Reorganization Event, Fundamental Change and Make-Whole Fundamental Change;

WHEREAS, in accordance with Section 8.01 of the Indenture, the Company and the Trustee may amend or supplement the Indenture or the Securities as provided in this Supplemental Indenture without notice to, or consent of, any Securityholder;

WHEREAS, each of the Company and Southwest have duly authorized the execution and delivery of this Supplemental Indenture;

WHEREAS, the Company has furnished the Trustee with an Opinion of Counsel and an Officer’s Certificate in accordance with the Indenture, stating that the execution of this Supplemental Indenture is authorized or permitted by the Indenture; and

WHEREAS, all things necessary to make this Supplemental Indenture a valid agreement of the Company, Southwest and the Trustee and a valid amendment of, and supplement to, the Indenture have been done, and the entry into this Supplemental Indenture by the parties hereto is in all respects authorized by the provisions of the Indenture.

NOW, THEREFORE, in consideration of the premises set forth herein and for other good and valuable consideration, the receipt of which is hereby acknowledged, the parties hereto covenant and agree for the equal and proportionate benefit of all Holders of the Securities, as follows:

ARTICLE I

DEFINITIONS

Section 1.01. Definitions. Section 1.02 of the First Supplemental Indenture is hereby amended as follows:

(a) The definition of “Common Stock” is hereby amended and restated in its entirety to read as follows:

“Common Stock” means, subject to Section 4.09, shares of common stock, $1.00 par value, of Southwest, at the Effective Time or shares of any class or classes resulting from any reclassification or reclassifications thereof and that have no preference in respect of dividends or of amounts payable in the event of any voluntary or involuntary liquidation, dissolution or winding up of Southwest and that are not subject to redemption by Southwest; provided that if at any time there shall be more than one such resulting class, the shares of each such class then so issuable shall be substantially in the proportion which the total number of shares of such class resulting from all such reclassifications bears to the total number of shares of all such classes resulting from all such reclassifications.

2

(b) The definition of “AirTran Consideration Unit” is hereby added and shall read as follows:

“AirTran Consideration Unit” means 0.321 shares of Common Stock plus the Cash Component.

(c) The definition of “Cash Component” is hereby added and shall read as follows:

“Cash Component” means the cash portion of the AirTran Consideration Unit, which is $3.75, without interest.

(d) The definition of “Effective Time” is hereby added and shall read as follows:

“Effective Time” means the time on May 2, 2011 when Guadalupe Holdings Corp., a Nevada corporation and wholly owned subsidiary of Southwest, merged with and into the Company pursuant that certain Agreement and Plan of Merger dated as of September 26, 2010 by and among the Company, Guadalupe Holdings Corp. and Southwest.

(e) The definition of “Southwest” is hereby added and shall read as follows:

“Southwest” means Southwest Airlines, Co., a Texas corporation, and subject to the provisions of Section 4.09 of the First Supplemental Indenture, shall include its successors and assigns.

ARTICLE II

EFFECT OF THE MERGER

Section 2.01. Conversion to AirTran Consideration Units. All references to “shares of Common Stock” and “Common Stock” in Sections 4.01, 4.02(b), 4.03(b), 4.03(c), 5.01, 7.01 and 8.02 of the First Supplemental Indenture are hereby amended and replaced with “AirTran Consideration Units.”

Section 2.02. Conversion Rate. In accordance with Section 4.09 of the First Supplemental Indenture, Section 4.02(a) of the First Supplemental Indenture is hereby amended and restated in its entirety to read as follows:

Section 4.02. Conversion Rate. (a) The Securities shall be convertible into a number of AirTran Consideration Units at an initial conversion rate (the “Initial Conversion Rate”) of 260.4167 AirTran Consideration Units (subject to adjustments as provided in Section 4.02(c), Section 4.06 and Section 4.11 of this First Supplemental Indenture, as so adjusted from time to time, the “Conversion Rate”) per $1,000 principal amount of Securities.

A Holder of a Security otherwise entitled to a fractional share will receive Cash in an amount equal to the value of such fractional share based on the Closing Price of the Common Stock on the related Conversion Date.

A Security for which a Holder has delivered a Fundamental Change Repurchase Notice requiring the Company to purchase the Securities may be surrendered for conversion only if such notice is withdrawn in accordance with this First Supplemental Indenture.

3

Section 2.03. Conversion Procedure. The last three sentences of Section 4.03(a) of the First Supplemental Indenture are hereby amended and restated in their entirety as follows:

The Company shall deliver the AirTran Consideration Units to the Holder through a Conversion Agent, and with respect to the shares of Common Stock included in the AirTran Consideration Units, such shares shall be delivered in the form of a certificate for the number of whole shares of Common Stock issuable upon the conversion or, in the case of holders of Securities in book-entry form with DTC, in accordance with DTC customary practices. In each case, the Company shall also deliver to such holder Cash in lieu of any fractional shares of Common Stock pursuant to Section 4.02(a) of this First Supplemental Indenture. The Company shall deliver such AirTran Consideration Units (including any Cash in lieu of fractional shares of Common Stock), except as set forth in Section 4.02(c) and subject to Section 4.04 of this First Supplemental Indenture, in any event no later than the third Trading Day immediately following the Conversion Date.

Section 2.04. Stock Price. In accordance with Section 4.09 of the First Supplemental Indenture, the first paragraph of Section 4.02(c) of the First Supplemental Indenture is hereby amended and restated in its entirety to read as follows:

(c) The increase in the Conversion Rate, expressed as a number of Additional Shares to be received per $1,000 principal amount of Securities, will be determined by the Company by reference to the table attached as Exhibit B hereto, based on the earliest of the date on which the Make-Whole Fundamental Change is publicly announced, occurs or becomes effective (the “Adjustment Date”) and the price paid or deemed to be paid per 0.321 of a share of Common Stock plus the Cash Component in the transaction constituting the Make-Whole Fundamental Change (the “Stock Price”) subject to adjustment as set forth in the next paragraph; provided that if a Holder of the Common Stock receives only Cash in connection with such transaction, the Stock Price shall be the Cash amount paid per 0.321 of a share of Common Stock plus the Cash Component. In all other cases, the Stock Price will be the average of the Closing Prices of 0.321 of a share of the Common Stock over the thirty consecutive Trading Days prior to, but not including, the date of effectiveness of the Make-Whole Fundamental Change plus the Cash Component. If the Stock Price is between two Stock Prices in the table or the Adjustment Date is between two Adjustment Dates in the table, the number of Additional Shares will be determined by a straight-line interpolation between the number of Additional Shares set forth for the higher and lower Stock Prices and the earlier and later Adjustment Dates based on a 365-day year, as applicable. If the Stock Price is in excess of $30.00 (subject to adjustment in the same manner as the Stock Price), no increase in the Conversion Rate will be made and if the Stock Price is less than $3.20 (subject to adjustment in the same manner as the Stock Price), no increase in the Conversion Rate will be made. Notwithstanding anything to the contrary, in no event will the number of Additional Shares to be added to the Conversion Rate pursuant to Section 4.02(b) above and this Section 4.02(c) exceed 52.0833 AirTran Consideration Units (subject to adjustment in the same manner in which the Conversion Rate is adjusted, as set forth in Section 4.06 hereof) per $1,000 principal amount of Securities.

For the avoidance of doubt, the amendments and supplements to the Indenture contained in this Supplemental Indenture shall not result in any additional adjustment to the Conversion Rate or result in Additional Shares in connection with or related to the Merger, other than as set forth in Section 2.05 of this Supplemental Indenture.

Section 2.05. Adjustment of Conversion Rate. In accordance with Section 4.09 of the First Supplemental Indenture, Section 4.06 of the First Supplemental Indenture is hereby amended and restated in its entirety to read as set forth on Annex A hereto.

Section 2.06. Temporary Adjustment to Conversion Rate. In accordance with Sections 4.02(b) and 4.09 of the First Supplemental Indenture, as a result of the Merger, which constitutes a Make-Whole Fundamental Change, the Conversion Rate for Securities surrendered for conversion on or after April 8, 2011 and before or on June 3, 2011 shall be increased by an additional number of AirTran Consideration Units equal to 17.8427 as determined by the Company by reference to the table attached as Exhibit B to the First Supplemental Indenture.

4

Section 2.07. References to Southwest. In accordance with Section 4.09 of the First Supplemental Indenture, all references to “the Company” in Sections 4.05, 4.06 and 4.08 of the First Supplemental Indenture are hereby amended and replaced with “Southwest.”

Section 2.08. Effect of Reclassification, Consolidation, Merger or Sale on Conversion Price. Section 4.09 of the First Supplemental Indenture is hereby amended and restated in its entirety to read as follows:

If (1) there shall occur (a) any reclassification of the Common Stock (other than a change only in par value, or from par value to no par value, or from no par value to par value, or a change as a result of a subdivision or combination of Common Stock); (b) a statutory share exchange, consolidation, merger or combination involving Southwest other than a merger in which Southwest is the continuing corporation and which does not result in any reclassification of, or change (other than in par value, or from par value to no par value, or from no par value to par value, or a change as a result of a subdivision or combination of Common Stock) in, outstanding shares of Common Stock; or (c) a sale or conveyance as an entirety or substantially as an entirety of the property and assets of Southwest, directly or indirectly, to another Person; and (2) pursuant to such reclassification, statutory share exchange, consolidation, merger, combination, sale or conveyance, holders of outstanding shares of Common Stock would be entitled to receive stock (other than Common Stock), other securities, other property, assets or Cash (or any combination thereof) for such shares of Common Stock (any such event a “Reorganization Event”), then the Company, or such successor or surviving, purchasing or transferee Person, as the case may be, shall, as a condition precedent to such Reorganization Event, execute and deliver to the Trustee a supplemental indenture signed by the principal executive officer, principal financial officer or principal accounting officer of the Company and at least one other Officer of the Company and providing that, at the effective time of the Reorganization Event, the settlement of the Securities tendered for conversion will be based on, and the property deliverable in respect of any such settlement will consist of, the kind and amount of shares of stock, other securities or other property or assets (including Cash or any combination thereof) that holders of shares of Common Stock are entitled to receive in respect of each share of Common Stock upon such Reorganization Event (the “Reference Property”). Such supplemental indenture shall provide for adjustments of the Conversion Rate and Cash Component, as applicable, which shall be as nearly equivalent as may be practicable to the adjustments of the Conversion Rate and Cash Component, as applicable, provided for in this Article 4. The provisions of this Section 4.09 shall similarly apply to successive Reorganization Events.

Section 2.09. Notice of Adjustment. Section 4.12 of the First Supplemental Indenture is hereby amended and restated in its entirety to read as follows:

Whenever the Conversion Rate or conversion privilege is adjusted, the Company shall promptly mail to Securityholders a notice of the adjustment in accordance with Section 1.8 of the Original Indenture, and file with the Trustee an Officers’ Certificate briefly stating the Conversion Rate (and any related change to the Cash Component), the facts giving rise to the adjustment and the manner of computing it. Unless and until the Trustee shall receive an Officers’ Certificate setting forth an adjustment of the

5

Conversion Rate (and any related change to the Cash Component), as applicable, the Trustee may assume without inquiry that the Conversion Rate and the Cash Component have not been adjusted and that the last Conversion Rate and Cash Component of which it has knowledge remains in effect.

Section 2.10. Other Remedies. The first sentence of Section 7.03 of the First Supplemental Indenture is hereby amended and restated in its entirety to read as follows:

If an Event of Default occurs and is continuing, the Trustee may, but shall not be obligated to, pursue any available remedy by proceeding at law or in equity to collect the payment of the principal of or accrued and unpaid interest on the Securities, the payment of AirTran Consideration Units upon conversion or to enforce the performance of any provision of the Securities or the Indenture.

Section 2.11. Waiver of Defaults and Events of Default. The references to “shares of Common Stock (and Cash in lieu of any fractional shares)” in the first sentence of Section 7.04 and the second sentence of Section 7.06 of the First Supplemental Indenture are hereby amended and replaced with “AirTran Consideration Units.”

Section 2.12. Form of Reverse Side of Security. The reference to “shares of Common Stock” in Section 6 on the Form of Reverse Side of Security is hereby amended and replaced with “AirTran Consideration Units.”

Section 2.13. Conversion Notice. The reference to “Common Stock of the Company” on the form of Conversion Notice for the Securities is hereby amended and replaced with “AirTran Consideration Units.”

Section 2.14. Exhibit B. The reference to “shares of Common Stock” in Exhibit B to the First Supplemental Indenture is hereby amended and replaced with “AirTran Consideration Units.”

ARTICLE III

GUARANTEES

Section 3.01. Southwest Guarantees. In accordance with Section 6.01 of the First Supplemental Indenture, Southwest hereby fully and unconditionally guarantees all obligations of the Company under the Securities and the Indenture.

ARTICLE IV

MISCELLANEOUS PROVISIONS

Section 4.01. Concerning the Trustee. The Trustee assumes no duties, responsibilities, or liabilities by reason of this Supplemental Indenture other than as set forth in the Indenture. The Trustee shall not be responsible in any manner whatsoever for or in respect of (i) the validity or sufficiency of this Supplemental Indenture, (ii) the correctness of any of the provisions contained herein, or (iii) the recitals contained herein, all of which recitals are made solely by the Company and Southwest. In addition, and without limiting the foregoing, the Trustee is not charged with knowledge of the Merger Agreement or any terms thereof.

Section 4.02. Supplemental Indenture Controls. In the event of a conflict or inconsistency between the Indenture and this Supplemental Indenture, the provisions of this Supplemental Indenture shall control.

6

Section 4.03. Representations and Warranties. The Company represents that (a) it has all necessary power and authority to execute and deliver this Supplemental Indenture and to perform the Indenture, (b) it is a corporation organized and validly existing under the laws of the State of Nevada, (c) both before and immediately after giving effect to this Supplemental Indenture, no Default or Event of Default has or will have occurred or be continuing, and (d) this Supplemental Indenture is executed and delivered pursuant to Section 8.01 of the First Supplemental Indenture and does not require the consent of Securityholders.

Section 4.04. Governing Law. This Supplemental Indenture shall be deemed to be a contract made under the laws of the State of New York, and for all purposes shall be construed in accordance with the laws of the State of New York, without regard to conflicts of laws principles thereof.

Section 4.05. Execution in Counterparts. This Supplemental Indenture may be executed in any number of counterparts, each of which shall be an original, but such counterparts shall together constitute but one and the same instrument.

Section 4.06. Confirmation of Indenture. Except as amended and supplemented hereby, the Indenture is hereby ratified, confirmed and reaffirmed in all respects. The Indenture and this Supplemental Indenture shall be read, taken and construed as one and the same instrument. For the avoidance of doubt, Southwest does not hereby assume any obligations of the Company under the Indenture, as supplemented and amended by this Supplemental Indenture, other than as expressly provided for in this Supplemental Indenture.

Section 4.07. Headings. The titles and headings of the articles and sections of this Supplemental Indenture have been inserted for convenience of reference only, are not to be considered a part hereof, and shall in no way modify or restrict any of the terms or provisions hereof.

Section 4.08. No Adverse Interpretation of Other Agreements. This Supplemental Indenture may not be used to interpret another indenture, loan, or debt agreement other than the Indenture for purposes of the Securities. Any such indenture, loan, or debt agreement may not be used to interpret this Supplemental Indenture.

Section 4.09. Successors and Assigns. All covenants and agreements made by the Company and Southwest in this Supplemental Indenture shall be binding upon their respective successors and assigns, whether expressed or not.

[Signature Page Follows]

7

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed.

| AIRTRAN HOLDINGS, INC. | ||

| By: | /s/ Ron Ricks | |

| Name: | Ron Ricks | |

| Title: | President, Secretary and Treasurer | |

Signature Page to Second Supplemental Indenture

| AIRTRAN HOLDINGS, INC. | ||

| By: | /s/ Laura Wright | |

| Name: | Laura Wright | |

| Title: | Senior Vice President Finance & Chief Financial Officer | |

Signature Page to Second Supplemental Indenture

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed.

| SOUTHWEST AIRLINES CO. | ||

| By: | /s/ Laura Wright | |

| Name: | Laura Wright | |

| Title: | Senior Vice President Finance & Chief Financial Officer | |

Signature Page to Second Supplemental Indenture

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed.

| U.S. BANK NATIONAL ASSOCIATION, as Trustee | ||

| By: | /s/ Susan Freedman | |

| Name: | Susan Freedman | |

| Title: | Vice President | |

Signature Page to 5.50% Second Supplemental Indenture

ANNEX A

Section 4.06. Adjustment of Conversion Rate. This Section 4.06 describes adjustments to the Conversion Rate to be made in connection with the events described below, as well as events that will not result in adjustment of the Conversion Rate, treatment of rights and treatment of Reference Property.

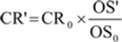

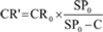

(a) If Southwest, at any time or from time to time while any of the Securities are outstanding, issues shares of Common Stock as a dividend or distribution on shares of Common Stock, or if Southwest effects a share split or share combination in respect of the Common Stock, then the Conversion Rate shall be adjusted based on the following formula:

where

| CR0 | = | the Conversion Rate in effect immediately prior to the Open of Business on the Record Date for such dividend or distribution, or the Open of Business on the effective date of such share split or combination, as applicable; | ||

| CR’ | = | the new Conversion Rate in effect immediately after the Open of Business on the Record Date for such dividend or distribution, or the Open of Business on the effective date of such share split or share combination, as applicable; | ||

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the Open of Business on the Record Date for such dividend or distribution, or the Open of Business on the effective date of such share split or share combination, as applicable; and | ||

| OS’ | = | the number of shares of Common Stock outstanding immediately after such dividend or distribution, or the Open of Business on the effective date of such share split or share combination, as applicable. | ||

Southwest will not pay any dividend or make any distribution on shares of Common Stock held in treasury by Southwest. If any dividend or distribution of the type described in this Section 4.06(a) is declared but not so paid or made, or the outstanding shares of Common Stock are not split or combined, as the case may be, the Conversion Rate shall again be adjusted to the Conversion Rate which would then be in effect if such dividend, distribution, share split or share combination had not been declared.

A-1

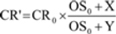

(b) Except as otherwise provided for by Section 4.06(d) below, if Southwest, at any time or from time to time while any of the Securities are outstanding, distributes to all or substantially all holders of its outstanding shares of Common Stock any rights or warrants entitling them for a period of not more than 45 calendar days from the Record Date of such distribution to subscribe for or purchase shares of Common Stock at a price per share less than the Closing Price of the Common Stock on the Trading Day immediately preceding the Record Date of such distribution, the Conversion Rate shall be adjusted based on the following formula:

| where | ||||

| CR0 | = | the Conversion Rate in effect immediately prior to the Open of Business on the Record Date for such distribution; | ||

| CR’ | = | the new Conversion Rate in effect immediately after the Open of Business on the Record Date for such distribution; | ||

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the Open of Business on the Record Date for such distribution; | ||

| X | = | the total number of shares of Common Stock issuable pursuant to such rights or warrants; and | ||

| Y | = | the number of shares of Common Stock equal to the aggregate price payable to exercise such rights or warrants divided by the average of the Closing Prices of the Common Stock over the ten consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Dividend Date for such distribution. | ||

To the extent that shares of Common Stock are not delivered pursuant to such rights or warrants upon the expiration or termination of such rights or warrants, the Conversion Rate shall be readjusted to the Conversion Rate which would then be in effect had the adjustments made upon the distribution of such rights or warrants been made on the basis of the delivery of only the number of shares of Common Stock actually delivered. In the event that such rights or warrants are not so distributed, the Conversion Rate shall again be adjusted to be the Conversion Rate which would then be in effect if the announcement with respect to such rights, warrants or convertible securities had not been made.

In determining the aggregate price payable to exercise such rights or warrants, there shall be taken into account any amount payable on exercise thereof, with the value of such consideration, if other than Cash, to be determined in good faith by the board of directors of Southwest.

(c) If Southwest, at any time or from time to time while any of the Securities are outstanding, shall, by dividend or otherwise, distribute to all or substantially all holders of its Common Stock shares of any class of Capital Stock of Southwest (other than Common Stock as covered by Section 4.06(a) above), evidences of its indebtedness, assets, property or rights or warrants to acquire the Southwest’s Capital Stock or other securities, but excluding (i) dividends or distributions as to which an adjustment under Section 4.06(a), Section 4.06(b) or Section 4.06(d) hereof shall apply, (ii) dividends or distributions paid exclusively in Cash and (iii) Spin-Offs to which the provision set forth below in this Section 4.06(c) shall apply (any of such shares of Capital Stock, indebtedness, assets, property or rights or warrants to acquire the Common Stock or other securities, hereinafter in this Section 4.06(c) called the “Distributed

A-2

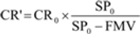

Property”), then, in each such case the Conversion Rate shall be adjusted based on the following formula:

| where | ||||

| CR0 | = | the Conversion Rate in effect immediately prior to the Open of Business on the Record Date for such distribution; | ||

| CR’ | = | the new Conversion Rate in effect immediately after the Open of Business on the Record Date for such distribution; | ||

| SP0 | = | the average of the Closing Prices of the Common Stock over the ten consecutive Trading Day period ending on the Trading Day immediately preceding the Ex-Dividend Date for such distribution; and | ||

| FMV | = | the fair market value (as determined in good faith by the Southwest’s board of directors) of the portion of Distributed Property with respect to each outstanding share of Common Stock on the Record Date for such distribution. | ||

Notwithstanding the foregoing, if the then fair market value (as so determined) of the portion of the Distributed Property so distributed applicable to one share of Common Stock is equal to or greater than SP 0 as set forth above, in lieu of the foregoing adjustment, Southwest shall distribute to each Holder on the date the Distributed Property is distributed to holders of Common Stock, but without requiring such Holder to convert its Securities, the amount of Distributed Property such Holder would have received had such Holder owned a number of shares of Common Stock equal to the Conversion Rate on the record date fixed for determination for stockholders entitled to receive such distribution. If such dividend or distribution is not so paid or made, the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such Record Date had not been fixed. If the board of directors of Southwest determines the fair market value of any distribution for purposes of this Section 4.06(c) by reference to the actual or when issued trading market for any securities, it shall in doing so consider the prices in such market over the same period used in computing the average of the Closing Prices of the Common Stock for purposes of calculating SP 0 in the formula in this Section 4.06(c).

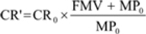

With respect to an adjustment pursuant to this Section 4.06(c) where there has been a payment of a dividend or other distribution on the Common Stock consisting of shares of Capital Stock of any class or series, or similar equity interest, of or relating to a Subsidiary or other business unit of Southwest (a “Spin-Off”), the Conversion Rate in effect immediately before the Close of Business on the tenth Trading Day immediately following, and including, the effective date of the Spin-Off shall be increased based on the following formula:

A-3

| where | ||||

| CR0 | = | the Conversion Rate in effect immediately prior to the Close of Business on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off; | ||

| CR’ | = | the new Conversion Rate in effect from and after the Close of Business on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off; | ||

| FMV | = | the average of the Closing Prices of the Capital Stock or similar equity interest distributed to holders of Common Stock applicable to one share of Common Stock over the 10 consecutive Trading Day period immediately following, and including, the effective date of the Spin-Off; and | ||

| MP0 | = | the average of the Closing Prices of Common Stock over the 10 consecutive Trading Day period immediately following, and including, the effective date of the Spin-Off. | ||

Such adjustment shall occur on the 10th Trading Day immediately following, and including, the effective date of the Spin-Off; provided that, for purposes of determining the Conversion Rate, in respect of any conversion during the 10 Trading Days following the effective date of any Spin-Off, references to 10 Trading Days within the portion of this Section 4.06(c) related to “Spin-Offs” shall be deemed replaced with such lesser number of Trading Days as have elapsed between the effective date of such Spin-Off and the relevant Conversion Date.

For purposes of this Section 4.06(c), Section 4.06(a) and Section 4.06(b) hereof, any dividend or distribution to which this Section 4.06(c) is applicable that also includes shares of Common Stock, or rights or warrants to subscribe for or purchase shares of Common Stock to which Section 4.06(a) or 4.06(b) hereof applies (or both), shall be deemed instead to be (1) a dividend or distribution of the evidences of indebtedness, assets or shares of Capital Stock other than such shares of Common Stock or rights or warrants to which Section 4.06(a) or 4.06(b) hereof applies (and any Conversion Rate adjustment required by this Section 4.06(c) with respect to such dividend or distribution shall then be made) immediately followed by (2) a dividend or distribution of such shares of Common Stock or such rights or warrants to which Section 4.06(a) or 4.06(b) hereof applies (and any further Conversion Rate adjustment required by Section 4.06(a) and 4.06(b) hereof with respect to such dividend or distribution shall then be made), except (A) the Open of Business on the Record Date of such dividend or distribution shall be substituted for “the Open of Business on the Record Date,” “the Open of Business on the Record Date or the Open of Business on the effective date,” “after the Open of Business on the Record Date for such dividend or distribution or the Open of Business on the effective date of such share split or share combination” and “the Open of Business on the Record Date for such distribution” within the meaning of Section 4.06(a) and Section 4.06(b) hereof and (B) any shares of Common Stock included in such dividend or distribution shall not be deemed “outstanding immediately prior to the Open of Business on the Record Date or the Open of Business on the effective date” within the meaning of Section 4.06(a) hereof.

A-4

(d) If Southwest, at any time or from time to time while any of the Securities are outstanding, distributes rights or warrants to all holders of Common Stock entitling the holders thereof to subscribe for, purchase or convert into shares of Southwest’s Capital Stock (either initially or under certain circumstances), which rights or warrants, until the occurrence of a specified event or events (“Trigger Event”): (x) are deemed to be transferred with such shares of Common Stock; (y) are not exercisable; and (z) are also issued in respect of future issuances of Common Stock, shall be deemed not to have been distributed for purposes of Section 4.06(c) above, (and no adjustment to the Conversion Rate under Section 4.06(c) above will be required) until the occurrence of the earliest Trigger Event and a distribution or deemed distribution under the terms of such rights or warrants and an appropriate adjustment (if any is required) to the Conversion Rate shall be made in the same manner as provided for under Section 4.06(c) above. If any such right or warrant are subject to events, upon the occurrence of which such rights or warrants become exercisable to purchase different securities, evidences of indebtedness or other assets, then the date of the occurrence of any and each such event shall be deemed to be the date of distribution and Record Date with respect to new rights or warrants with such rights (and a termination or expiration of the existing rights or warrants without exercise by any of the holders thereof). In addition, in the event of any distribution (or deemed distribution) of rights or warrants (of the type described in the preceding sentence) with respect thereto that was counted for purposes of calculating a distribution amount for which an adjustment to the Conversion Rate under this Section 4.06(d) was made, (1) in the case of any such rights or warrants that shall all have been redeemed or repurchased without exercise by any holders thereof, the Conversion Rate shall be readjusted upon such final redemption or repurchase to give effect to such distribution or Trigger Event, as the case may be, as though it were a Cash distribution, equal to the per share redemption or repurchase price received by a holder or holders of Common Stock with respect to such rights or warrants (assuming such holder had retained such rights or warrants), made to all holders of Common Stock as of the date of such redemption or repurchase, and (2) in the case of such rights or warrants that shall have expired or been terminated without exercise by any holders thereof, the Conversion Rate shall be readjusted as if such rights or warrants had not been issued.

(e) If Southwest, at any time or from time to time while any of the Securities are outstanding, makes a Cash dividend or distribution to all or substantially all holders of Common Stock, the Conversion Rate shall be adjusted based on the following formula:

| where | ||||

| CR0 | = | the Conversion Rate in effect immediately prior to the Open of Business on the Business Day immediately prior to the Record Date for such dividend or distribution; | ||

| CR’ | = | the new Conversion Rate in effect immediately after the Open of Business on the Record Date for such dividend or distribution; | ||

A-5

| SP0 | = | the average Closing Price of the Common Stock on the Trading Day immediately preceding the Ex-Dividend Date for such dividend or distribution; and | ||

| C | = | the amount in Cash per share Southwest distributes or dividends to holders of Common Stock. | ||

Notwithstanding the foregoing, if the portion of the Cash so distributed applicable to one share of Common Stock is equal to or greater than SP0 as set forth above, in lieu of the foregoing adjustment, Southwest shall distribute to each Holder on the date the Cash dividend or distribution is paid to holders of Common Stock, but without requiring such Holder to convert its Securities, for each $1,000 principal amount of Securities, the amount of Cash such Holder would have received had such Holder owned a number of shares of Common Stock equal to the product of 0.321 multiplied by the Conversion Rate on the Record Date for such dividend or distribution. If such dividend or distribution is not so paid or made, the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

For the avoidance of doubt, for purposes of this Section 4.06(e), in the event of any reclassification of the Common Stock, as a result of which the Securities become convertible into more than one class of Common Stock, if an adjustment to the Conversion Rate is required pursuant to this Section 4.06(e), references in this Section to one share of Common Stock or Closing Price of one share of Common Stock shall be deemed to refer to a unit or to the price of a unit consisting of the number of shares of each class of Common Stock into which the Securities are then convertible equal to the numbers of shares of such class issued in respect of one share of Common Stock in such reclassification. The above provisions of this paragraph shall similarly apply to successive reclassifications.

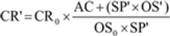

(f) If Southwest or any of its Subsidiaries makes a payment of Cash or other consideration in respect of a tender offer or exchange offer for all or any portion of the Common Stock, where such Cash and the value of any such other consideration included in the payment per share of Common Stock validly tendered or exchanged exceeds the Closing Price of the Common Stock on the Trading Day next succeeding the last date (the “expiration date”) on which tenders or exchanges may be made pursuant to such tender or exchange offer (as it may be amended), the Conversion Rate shall be increased based on the following formula:

| where | ||||

| CR0 | = | the Conversion Rate in effect immediately prior to the Close of Business on the Trading Day next succeeding the expiration date; | ||

| CR’ | = | the new Conversion Rate in effect immediately after the Close of Business on the Trading Day next succeeding the expiration date; | ||

A-6

| AC | = | the aggregate value of all Cash and any other consideration (as determined in good faith by Southwest’s board of directors) paid or payable for shares purchased in such tender or exchange offer; | ||

| OS0 | = | the number of shares of Common Stock outstanding immediately prior to the date such tender or exchange offer expires; | ||

| OS’ | = | the number of shares of Common Stock outstanding immediately after the date such tender or exchange offer expires (after giving effect to such tender offer or exchange offer); and | ||

| SP’ | = | the Closing Price of Common Stock on the Trading Day next succeeding the expiration date. | ||

If Southwest or a Subsidiary is obligated to purchase shares of Common Stock pursuant to any such tender or exchange offer, but Southwest or such Subsidiary is permanently prevented by applicable law from effecting any such purchases or all or any portion of such purchases are rescinded, then the Conversion Rate shall again be adjusted to be the Conversion Rate that would then be in effect if such tender or exchange offer had not been made or had only been made in respect of the purchases that had been effected. Except as set forth in the preceding sentence, if an adjustment to the Conversion Rate pursuant to this Section 4.06(f) with respect to any tender offer or exchange offer would result in a decrease in the Conversion Rate, no adjustment shall be made for such tender offer or exchange offer under this Section 4.06(f).

(g) For purposes of this Section 4.06 the term “Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any Cash, securities or other property or in which the Common Stock (or other applicable security) is exchanged for or converted into any combination of Cash, securities or other property, the date fixed for determination of shareholders entitled to receive such Cash, securities or other property (whether such date is fixed by the Board of Directors or by statute, contract or otherwise).

(h) If application of the formulas provided in Sections 4.06(a), 4.06(b), 4.06(c), 4.06(d), 4.06(e) or 4.06(f) above would result in a decrease in the Conversion Rate, no adjustment (other than a readjustment as described in such sections) to the Conversion Rate shall be made except in the case of a share split or combination of the Common Stock.

(i) If one or more events occur requiring an adjustment be made to the Conversion Rate for a particular period, adjustments to the Conversion Rate shall be determined by the Company’s Board of Directors to reflect the combined impact of such Conversion Rate adjustments, as set out in this Section 4.06, during such period.

A-7

(j) If any adjustment is made to the Conversion Rate pursuant to this Section 4.06 or 4.11, then concurrently therewith (but without any further adjustment to the Conversion Rate), the Cash Component shall be adjusted based on the following formula:

CC’ = (CC0 x CR0) / CR’

| where | ||||

| CC0 | = | the Cash Component in effect immediately prior to such adjustment to the Conversion Rate; and | ||

| CC’ | = | the new Cash Component in effect immediately after such adjustment to the Conversion Rate. | ||

| CR0 | = | the Conversion Rate in effect immediately prior to such adjustment to the Conversion Rate; | ||

| CR’ | = | the new Conversion Rate in effect immediately after such adjustment to the Conversion Rate; | ||

For the avoidance of doubt, (i) any adjustment of the Cash Component pursuant to this Section 4.06(j) shall not cause an additional adjustment to the Conversion Rate pursuant to this Section 4.06 as a result of the adjustment of the Cash Component and (ii) in no event shall the amount of cash payable on the conversion of all of the Securities immediately prior to any adjustment to the Conversion Rate pursuant to this Section 4.06 or 4.11 be different that the amount of cash payable on the conversion of all of the Securities immediately after such adjustment.

A-8