Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT231 - SOUTH AMERICAN GOLD CORP. | exhibit231.htm |

| EX-99.1 - EXHIBIT991 - SOUTH AMERICAN GOLD CORP. | exhibit991.htm |

| EX-10.2 - EXHIBIT102 - SOUTH AMERICAN GOLD CORP. | exhibit102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 25, 2011

South American Gold Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-52156

|

98-0486676

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

3645 E. Main Street, Suite 119, Richmond, IN

|

47374

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (765) 356-9726

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

If you are not familiar with the mineral exploration terms used in this Current Report on Form 8-K, please refer to the definitions of these terms under the caption “Glossary” at the end of Item 9.01 of this Current Report on Form 8-K.

Item 1.01 Entry into Material Definitive Agreement.

The information included under the caption “Amendment No. 1 to Stock Purchase Agreement” in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

Item 2.01 Completion of Acquisition or Disposition of Assets

Amendment No. 1 to Stock Purchase Agreement

On April 25, 2011 (the “Effective Date”), South American Gold Corp. (the “Company”) entered into an Amendment No.1 (the “Amendment”) to the Stock Purchase Agreement dated February 25, 2011 (the “Agreement”) with Minera Kata S.A., a corporation organized under the laws of the Republic of Panama (“Seller”), in order to acquire from Seller twenty-five percent (25%) of the outstanding capital stock (the “25% Stake”) of Kata Enterprises, Inc., a corporation organized under the laws of the Republic of Panama (“Kata”), and to revise the terms of the options under which the Company has the ability to acquire the remaining seventy-five percent (75%) of the outstanding capital stock of Kata.

In November 2010, Kata entered into an agreement to acquire, through its subsidiary, an eighty-five percent (85%) interest in certain mining concessions located in the Nariño province of Colombia (the “Mining Concessions”), but Kata has not successfully closed that transaction as of this time (the “Kata Transaction”). Kata is an entity that has nominal operations and was recently incorporated. The Company’s understanding is that closing of the Kata Transaction is conditioned upon the transferor of the Mining Concessions receiving acceptance of an application for a concession contract, executing a concession contract with Ingeominas (the entity authorized by the Colombian Ministry of Mines and Energy to grant mining concession contracts), registration of that contract at the National Mining Registry and securing the requisite approvals and governmental consents for the transfer of the Mining Concessions to Kata’s subsidiary. The Company can provide no assurance that Kata, through its subsidiary, will be able to successfully close the Kata Transaction. In the event that Kata, through its subsidiary, fails to close the Kata Transaction and thus fails by February 25, 2012 to have the Mining Concessions registered in the National Mining Registry of Colombia in favor of Kata, the Agreement provides that Seller will be obligated to deliver to the Company one-hundred percent (100%) of the outstanding capital stock of Kata (the “100% Stake”) without any additional consideration being paid. In such event, the Company will not have acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of its exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake, other than its entitlement, indirectly through its subsidiary, to the return of the $500,000 paid to Seller on closing of the Agreement.

- 2 -

Pursuant to the terms of the Amendment, the Company paid the Seller an additional $50,000 on the Effective Date, in addition to the $500,000 paid in cash at the closing of the Agreement, for the acquisition of the 25% Stake. In addition, the Amendment revises the terms pursuant to which the Company is entitled to also acquire from Seller the remaining seventy-five percent (75%) of the outstanding capital stock of Kata as follows:

|

●

|

The Company can exercise its option to acquire an additional 25% stake in Kata, resulting in the acquisition of fifty percent (50%) of the outstanding capital stock of Kata (the “50% Stake”), within six months of the Effective Date of the Agreement (August 25, 2011) or until five (5) business days following such time that the Company receives written notice that the Mining Concessions are registered in the National Mining Registry of Colombia in favor of Kata in accordance with the regulations set forth in the Colombian Mining Code (the "Registration"), whichever is later, up to a maximum of twelve (12) months, but in any event not later than March 2, 2012 by:

|

|

(i)

|

paying Seller $450,000 in cash on or before five (5) business days following the Company’s receipt of notice that the Registration was completed;

|

|

(ii)

|

paying Seller $1,000,000 in cash on or before sixty (60) days following the Company's receipt of notice that the Registration was completed or twelve (12) months following the Closing Date of the Agreement (February 25, 2012), whichever is earlier; and

|

|

(iii)

|

issuing to Seller 2,000,000 shares of the Company’s common stock.

|

|

●

|

Provided that the Company has acquired the 50% Stake, the Company can exercise its option to acquire an additional 25% stake in Kata, resulting in the acquisition of seventy-five percent (75%) of the outstanding capital stock of Kata (the “75% Stake”), within thirteen months of the Effective Date of the Agreement (March 25, 2012) by:

|

|

(i)

|

paying Seller $1,000,000 in cash; and

|

|

(ii)

|

issuing to Seller 1,000,000 shares of the Company’s common stock.

|

|

●

|

Provided that the Company has acquired the 75% Stake, the Company can exercise its option to acquire an additional 25% stake of Kata, resulting in the acquisition of the 100% Stake, by:

|

|

(i)

|

paying Seller $1,000,000 in cash; and

|

|

(ii)

|

issuing to Seller 1,000,000 shares of the Company’s common stock within eighteen months of the Effective Date of the Agreement (August 25, 2012).

|

Except for the changes set forth above to the amount of consideration required to acquire the 25% Stake and to acquire the remaining seventy-five percent (75%) of the outstanding capital stock of Kata, there were no other changes made by the Amendment to the Agreement.

- 3 -

The foregoing description of the Agreement is qualified in its entirety by reference to Exhibit 10.1 to the Form 8-K filed on March 2, 2011. A copy of Amendment is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Form 10 Requirements

In satisfaction of disclosure requirements of subpart(f) of this Item 2.01, the following reports previously filed with U.S. Securities and Exchange Commission (the “Commission”) on the dates indicated, are incorporated by reference into this Current Report:

|

·

|

The Company’s Annual Report on Form 10-K for the year ended June 30, 2010;

|

|

·

|

The Company’s Quarterly Reports on Form 10-Q for the quarters ended September 30, 2010 and December 31, 2010;

|

|

·

|

The Company’s Current Reports on Form 8-K filed with the Commission on: October 15, 2010, November 17, 2010, December 1, 2010, December 22, 2010, January 24, 2011, February 8, 2011, February 11, 2011, February 17, 2011, March 3, 2011, March 14, 2011 and April 8, 2011;

|

|

·

|

The description of the Company’s common stock contained in the Registration Statement on Form 8-A filed with the Commission on July 31, 2006 and any further amendment or report updating that description; and

|

|

·

|

The description of the Company’s indemnification of directors and officers contained in the Registration Statement on Form SB-2 filed with the Commission on March 24, 2006 and any further amendment or report updating that description.

|

Properties

In connection with the Company’s consideration of entering into the Agreement and Amendment, which resulted in its acquisition of the 25% Stake in Kata with an option to acquire the remaining 75% of the outstanding capital stock of Kata, it conducted a legal, financial and business review of the financial condition, assets, liabilities and business of Kata and its subsidiary entities. Kata’s acquisition, through its subsidiary, of an eighty-five percent (85%) interest in the Mining Concessions is conditioned on the successful closing of the Kata Transaction described above. The Company’s understanding is that the closing of the Kata Transaction is conditioned upon the transferor of the Mining Concessions receiving acceptance of an application for a concession contract, executing a concession contract with Ingeominas (the entity authorized by the Colombian Ministry of Mines and Energy to grant mining concession contracts), registration of that contract at the National Mining Registry and securing the requisite approvals and governmental consents for the transfer of the Mining Concessions to Kata’s subsidiary. The Company can provide no assurance that Kata, through its subsidiary, will be able to successfully close the Kata Transaction. In the event that Kata, through its subsidiary, fails to successfully close the Kata Transaction, the Company will not have acquired any direct or indirect interest in the Mining Concessions and not be entitled to recover any of its exploration expenditures of other expenses incurred in connection with acquiring the 25% Stake other than its entitlement, indirectly through its subsidiary, to return of the $500,000 paid to Seller on closing of the Agreement.

- 4 -

The description of property contained herein is the product of the Company’s due diligence of the property underlying the Mining Concessions.

Location and Access

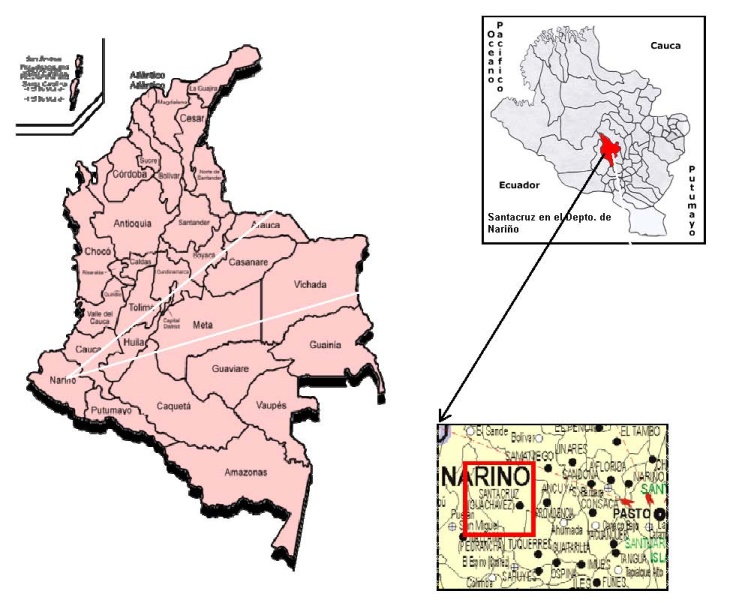

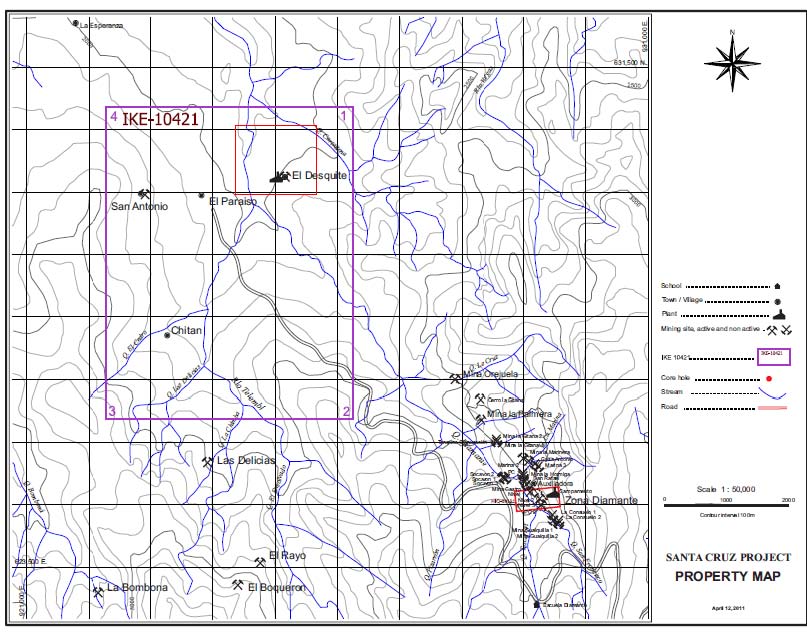

The Mining Concessions consist of one concession application IKE-10421 that covers an area of approximately covers an area of 1836 hectares. It is located in the south central part of the Nariño Department in southwestern Colombia. It is located in the municipality of Santa Cruz de Guachavez within the western drainage of the Western Cordillera (Cordillera Occidental).

The area of the property is accessible from Pasto via Highway 25 southwest to El Pedregal, 33 kilometers, and continuing west on highway 10 to Túquerres, 36 kilometers. At Túquerres a secondary road is followed north for 14 kilometers to Balalaika. A 13 kilometers improved road from Balalaika to the north reaches Guachaves. From Guachaves a 25 kilometer road partly to the southwest and turning to the northwest for the last 6 to 7 kilometers gives access to El Paraiso, a small settlement in the northern portion of the concession.

In the event that all conditions are satisfied enabling Kata, through its subsidiary, to successfully close the Kata Transaction and acquire the Mining Concessions, it will have acquired an 85% interest in the executed concession contract that is the subject of concession application IKE-10421. The Company’s ownership interest in the concession contract will occur indirectly through its ownership of an equity interest in Kata.

- 5 -

Set forth below is a map showing the general location of the area that is the subject of concession application IKE-10421.

- 6 -

Set forth below is a map showing more specifically the location of the area that is the subject of concession application IKE-10421. The IKE-10421 concession application covers an area that surrounds the concession FHRG-01, which is exclusive of and not part of the area covered by concession application IKE-10421. Maps were prepared based on data derived from the JICA maps and the Company’s initial field observations.

- 7 -

Land Status and Government Regulation

In connection with due diligence conducted prior to entering into the Agreement, the Company determined that the entire area encompassing concession application IKE-10421 overlaps with a forestry reserve. Under Colombia law, only prospecting activities which would not result in any significant surface disturbance can be undertaken in an area classified as a forestry reserve. In order to commence any exploration and mining activities that would result in any significant surface disturbance in the area that is the subject of a concession contract, it will be necessary to initiate a proceeding before the competent environmental authority to reclassify the entire area, or a portion thereof, that is the subject of concession application IKE-10421 so that it is no longer classified as a forestry reserve. The Company anticipates, but cannot provide any assurance, that efforts to declassify a portion or all of the subject area as a forestry reserve will be successful. In the unanticipated event that the Company is unable to succeed in reclassifying a portion or all of the area that is the subject of concession application IKE-10421 so that it is no longer classified as a forestry reserve, the Company will be unable to commence any exploration or mining activities causing any significant surface disturbance on the subject area resulting in its investment in Kata being without any value. In the event this were to occur, there is a substantial risk that the Company would not be entitled to any return of the Closing Payment paid to Seller, the Company's investment in Kata would be without any value, the Company may be forced to delay, scale back, or eliminate its planned activities and there is a substantial risk that the Company's business would fail. In addition, even if the effort to reclassify the entire area that is the subject of concession application IKE-10421 so that it is no longer classified as a forestry reserve is successful, there may be significant delay adversely impacting the Company’s prospects.

Mining in Colombia is governed by the Mining Law 685 of 2001. It was modified by Law 1382 of February 9, 2010. The mining authorities in Colombia are as follows:

|

·

|

Ministry of Mines and Energy (“MME”).

|

|

·

|

INGEOMINAS (Colombian Institute of Geology and Mining): The MME had delegated the administration of mineral resources to INGEOMINAS and some Department (Provincial) Mining Delegations. INGEOMINAS has two departments, the Geological Survey, and the Mines Department which is responsible for all mining contracts except where responsibility for the administration has been passed to the Departmental (Provincial) Mining Delegations.

|

|

·

|

Departmental Mining Delegations (Gobernaciones Delegadas): Administers mining contracts in the Departments with the most mining activity.

|

|

·

|

Mining Energy Planning Unit (UPME): Provides technical advice to the MME regarding planning for the development of the mining and energy sector and maintains the System of Colombian Mining Information (SIMCO).

|

All mineral resources belong to the state and can be explored and exploited by means of concession contracts granted by the state. Under the Mining Law of 2001, there is a single type of concession contract covering exploration, construction and mining which is valid for 30 years and can be extended for another 20 years.

- 8 -

Concession contract areas are defined on a map with reference to a starting point (punto arcifinio) and distances and bearings, or by map coordinates.

A surface tax (canon superficial) has to be paid annually in advance during the exploration and construction phases of the concession contract. This is defined as 1 minimum daily wage per hectare per year for years 1 to 5, 1.25 minimum daily wages per hectare per year for years 6 and 7, and 1.5 minimum daily wages per hectare per year for year 8. The 2010 Mining Law does not define the surface tax for years 9 to 11. A reasonable interpretation could be that the surface tax for year 9 should be 1.5 minimum daily wages per hectare and per year (the same as for year 8), and for years 10 and 11 should be 1.75 minimum daily wages per hectare and per year, on the basis that this provision appears to understand that the surface tax should be increased every two years by 0.25 minimum daily wages per hectare and per year. This issue requires clarification from the Ministry of Mines and Energy. Based on this calculation the fee per hectare currently is US$10.29, or a total of US$18,892 for the area covered by concession application IKE-10421.

The application process for a concession contract is as follows:

1. Application submitted.

2. Technical study by the mining authority to determine whether there is any overlap with other contracts or applications.

The applicant is notified.

3. Under the modifications to the Mining Law of 2010, the surface tax has to be paid within three days of the notification of the

technical study of free areas.

4. Once the surface tax is paid, the contract is prepared and signed.

5. The contract is inscribed in the National Mining Register.

Once the concession is approved, if at all, the Company will apply for permission to reclassify sections of the property that are currently classified as a forest reserve. The Company has already begun preparatory work for this process.

Once the concession is approved, if at all, the Company will apply for permission to reclassify sections of the property that are currently classified as a forest reserve. The Company has already begun preparatory work for this process.

The concession contract has three phases:

1. Exploration Phase.

· Starts once the contract is inscribed in the National Mining Registry.

· Valid for 3 years plus up to 4 extensions of 2 years each, for a maximum of 11 years.

· Annual surface tax payable.

· Requires an annual Environmental Mining Insurance Policy for 5% of the value of the planned exploration expenditure for the year.

· Present a mine plan (PTO) and an Environmental Impact Study (or EIA) for the next phase.

- 9 -

|

|

2.

|

Construction Phase.

|

|

·

|

Valid for 3 years plus a 1 year extension.

|

|

·

|

Annual surface tax payments continue as in Exploration Phase.

|

|

·

|

Requires an annual Environmental Mining Insurance Policy for 5% of the value of the planned investment as defined in the PTO for the year.

|

|

·

|

Environmental License issued on approval of Environmental Impact Study.

|

|

|

3.

|

Exploitation Phase.

|

|

·

|

Valid for 30 years minus the time taken in the exploration and construction phases, and is renewable for 30 years.

|

|

·

|

Annual Environmental Mining Insurance Policy required.

|

|

·

|

No annual surface tax.

|

|

·

|

Pay royalty based on regulations at time of granting of the Contract.

|

Royalties payable to the state are 4% of gross value at the mine mouth for gold and silver and 5% for copper (Law 141 of 1994, modified by Law 756 of 2002). For the purposes of royalties the gold and silver price is 80% of the average of the London afternoon fix price for the previous month.

The most important changes in the Mining Law of 2010 are:

|

·

|

The exploration phase can now be up to 11 years, rather than 5 years.

|

|

·

|

The contract length is reduced to 50 years (30 years + 20 year extension) from 60 years (30 + 30).

|

|

·

|

The surface tax is the same for all sizes of concession, and increases from year 6.

|

|

·

|

The surface tax for year 1 has to be paid within three days of notification of the free areas.

|

|

·

|

Once an application or contract is dropped or expires for whatever reason, the area does not become free for staking again for a period of 30 days.

|

Previous Exploration History

The larger district area where the concession application IKE-10421 is located was part of geological evaluation done by the Japan International Cooperation Agency (“JICA”) from 1981 to 1983. JICA did most of the geologic mapping with some adjustments that are currently shown in the Geologic map of Colombia.

The main objective of the work by the Japanese group, JICA, was to develop targets for mineral exploration that would potentially lead to the discovery of mineral deposits. As part of the program, extensive geochemical exploration was conducted in the area. The sampling involved soil and rock sampling. The reported results indicated zinc and arsenic anomalies in various locations in the area under study, with arsenic and zinc anomalies being considered indicators above buried veins. The area has extensive soil cover. Soil samples were collected from an average depth of 160 cm and ranged from 70 to 320 cm.

- 10 -

The only mine with recorded history of production in the district where IKE-10421 is located is El Diamante Mine. Detailed work by JICA to evaluate the vein mineralization in the district was done at El Diamante Mine which at the time was producing gold from ore at the surface and at one level. The Japanese mission mapped the area to locate the veins and drilled 15 diamond drill holes at that mine and adjacent areas.

The Company has not independently verified the results shown by the JICA study and such information is included for the limited purpose of understanding of the district area. The Company cautions that such information is not indicative in any way of results that may be obtained from the area covered by concession application IKE-10421.

Regional Geology of the District

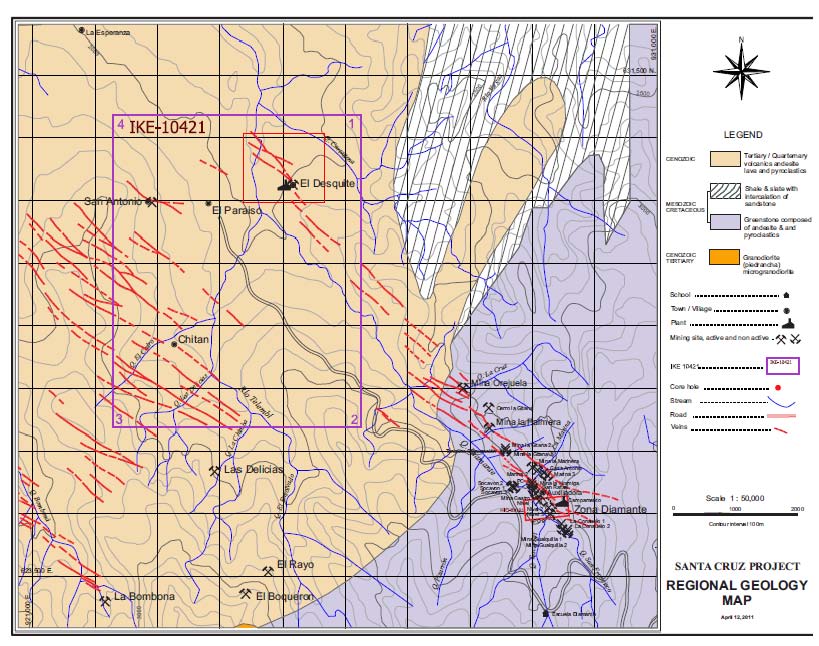

Southern Colombia, where Nariño Department is located, is dominated by uplifted rocks that form the Andes Mountains. In Colombia the Andes Mountains splits into three branches. Most of the area in Western Nariño Department is the Western Cordillera (Cordillera Occidental).

Rocks in the area are Cretaceous to Tertiary sandstones, shales, and andesitic and basaltic volcanics intruded by Eocene diorite and granodiorite plutons. Rocks intruded by the igneous rocks show the effects of contact metamorphism. The granodiorite intrusive is a complex that was active over a long period. Age determinations range from Eocene 40.5 million years ago to Miocene 6.5 million years ago.

The dominant structural trend is a series of major north-northeast trending faults which have left lateral slip that created northwest trending shear zones that became the host to gold bearing polymetallic veins.

The area has a young topography with steep sloped “V” shaped valleys and covered by dense vegetation where the land is not developed for agriculture.

- 11 -

Set forth below is a map showing the geology of portion of the Guachaves District at the location of the concession IKE-10421. The orange lines are the traces of veins as interpreted by JICA based on their geochemical work referenced above and for this reason the Company can provide no assurance as to the accuracy of the information or the manner in which it was compiled by JICA. The original map was prepared by JICA.

- 12 -

Geology

The mines in the area are located in a zone of northwest trending faults and shear zones that form clusters up to five (5) kilometers long and are hosted within volcanic rocks intruded by the Eocene Piedrancha granodiorite batholith and within the granodiorite itself. The volcanic rocks are basalts, basaltic andesite, andesite agglomerates and brecciated tuffs. Most of the volcanic rocks are metamorphosed as a result of contact metamorphism to a chlorite rich greenstone that may be classified as hornfels. The entire IKE-10421 concession application is located over the granodiorite pluton complex.

The structures containing the veins are NW-SE trending faults zones. These structures are cross faults to the general north-northeast fabric of the Western Cordillera.

The mineral deposits in the general area studied by JICA are epithermal and deposited by the action of the hydrothermal fluids in several depositional periods. The paragenesis (sequence of deposition) according to the JICA study is as follows. 1) Deposition of pyrite and arsenopyrite; 2) Deposition of gold and silver as electrum; 3) Deposition of the base metals minerals sphalerite, chalcopyrite and galena; and 4) Deposition of additional silver as pyrargyrite, argentite and polybasite. Silica deposition as quartz was continuous throughout most of the mineral deposition periods. Rock alteration is typical of hydrothermal epithermal deposits and varies from sericite-montmorillonite within and adjoining the gold/sulfide mineralization to kaolin-chlorite on the outer edges. The alteration does not extend far from the mineralized veins.

The JICA reports do not describe any of the mines or prospects located within the IKE-10421 concession application. Some of these mines are located in their maps but without a description of them. The JICA maps show NW-SE trending veins in the IKE-10421 concession application. This information is included for an understanding of the general area within which the concession is found, has not been independently verified, and the Company cautions that such information is not indicative of any identified deposits in the concession area of interest.

Reserves and Mineralized Material

At this time, the Company has no knowledge of mining activity within the boundaries of the IKE-10421 concession application.

The only drilling in the area was done by JICA in 1981 and 1982. There has been no drilling anywhere within IKE-10421 concession application.

There are no reserves or mineralized material identified on the IKE-10421 concession application.

Recent Exploration and Exploration Plan

After the first visit to the district where the concession application is located, it was determined to create the initial database as a baseline to evaluate the area of interest. Beginning in December 2010, the Company, as part of its due diligence process, began data compilation and review, and site visits began in 2011. Initial site visits included beginning work on geologic mapping and surveying, and sampling of nearby properties in the area to gain additional knowledge of the geological characteristics of the area. This reconnaissance work will be ongoing as much of the property position has had only limed historical exploration. In February 2011, samples were taken from nearby properties.

- 13 -

Reconnaissance work within concession application area was started in early April 2011. The work program included mapping and sampling the concession and nearby properties, including the El Desquite mine and other mines that are encountered during the our Phase I exploration program, with emphasis on locating the identified geochemical anomalies indicated by the JICA work. This is required because of the hummus accumulation over the 20 years since the JICA study. The areas within the IKE-10421 concession application and in proximity of El Desquite and Las Delicias mines are the principal exploration targets of the current program. The work is aimed at locating favorable areas for exploration drilling. This work will include taking stream sediment and soil samples, geochemical analyses, and interpretation of results. This work commenced in April 2011. To date, we have taken numerous assays from the nearby Diamante mine and assay results are under review; field work has also provided basis for updated maps and geological maps; expenditures on exploration in the first quarter of 2011 totaled $148,274.

Exploration work continues to advance knowledge of the area, conduct surveying and geologic mapping activities, determine prime areas for soil sediment sampling and re-sampling prospects pits that have been located. Our primary objective during Phase I exploration is identifying drill targets, preparing logistical arrangements for a drilling plan, continuing work for securing approval of the mining concession application which has been submitted and preparation for data to support our subsequent applications for regulatory approval of exploration activities, and review data of prior exploration in the area along with field work to verify historical data, particularly information on JICA maps indicating clusters of veins on the western portion within the concession. We plan in the second quarter to establish semi-permanent base camps in the concession. Our Phase II exploration phase, subject to results and timing of the completion Phase I exploration and regulatory approvals, includes a 6,000 meter planned drill program. We estimate drilling costs, including assays and review work, to be $200 a meter, thus the program before secondary charges would require $1.2 million in working capital to fund. We currently forecast ongoing exploration activities at $150,000 to $300,000 per quarter for the upcoming 18 months exclusive of our projected drilling program. We are forecasting subject to capital availability and timing of regulatory approvals required to explore in the area, a budget of approximately $2.1 to $3.0 million dollars for the Santacruz Gold project over the next 18 months.

Our current cash on hand is insufficient to complete any of the planned exploration activities and the full implementation of our planned exploration program is dependent on our ability to secure sufficient financing and to confirm that Kata has closed the Kata Transaction and completed the acquisition of an interest in 85% of the mining concession contract covering the area that is the subject of the IKE-10421 concession application. We can provide no assurance that we will secure sufficient financing or that a concession contract will be approved based on the IKE-10421 concession application.

- 14 -

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of April 8, 2011, the number and percentage of outstanding shares of common stock beneficially owned by (a) each person known by us to beneficially own more than five percent of such stock, (b) each director of the Company, (c) each named officer of the Company, and (d) all our directors and executive officers as a group. We have no other class of capital stock outstanding.

Security Ownership of Certain Beneficial Owners and Management

|

Amount and Nature of Beneficial Ownership

|

|||||||

|

Name and Address of Beneficial Owner (1)

|

Shares

|

Options Exercisable

|

Percent of

Class

|

||||

|

Directors and Executive Officers

|

|||||||

|

Raymond DeMotte

|

-

|

1,000,000

|

1.2%

|

||||

|

Camilo Velasquez

|

-

|

500,000

|

0.6%

|

||||

|

Beatriz Montoya Duque

|

-

|

200,000

|

0.3%

|

||||

|

Quinn Bastian

|

-

|

200,000

|

0.3%

|

||||

|

Francis Xavier Reinhold Delzer

|

-

|

200,000

|

0.3%

|

||||

|

Rene von Boeck

|

-

|

200,000

|

0.3%

|

||||

|

All current directors and executive officers as a group (six persons)

|

-

|

2,300,000

|

2.8%

|

||||

|

More Than 5% Beneficial Owners

|

|||||||

|

Felimon Lee

2431 M De La Cruz St.

Pasay, Philippines

|

5,000,000

|

-

|

6.3%

|

||||

|

Rizanina Raneses

2455 Legaspi Street

Pasay City, Philippines

|

5,000,000

|

-

|

6.3%

|

||||

|

None

|

|||||||

____________

|

(1)

|

Unless otherwise provided, the address of each person is c/o 3645 E. Main Street, Suite 119, Richmond, IN 47374.

|

|

(2)

|

Except as otherwise indicated, all shares shown in the table are owned with sole voting and investment power.

|

|

(3)

|

This column represents shares not included in “Shares Owned” that may be acquired by the exercise of options within 60 days of November 3, 2010.

|

The above beneficial ownership information is based on information furnished by the specified persons and is determined in accordance with Rule 13d-3 under the Exchange Act, as required for purposes of this annual report; accordingly, it includes shares of common stock that are issuable upon the exercise of stock options exercisable within 60 days of April 8, 2011. Such information is not necessarily to be construed as an admission of beneficial ownership for other purposes.

- 15 -

Item 5.06 Completion of Acquisition or Disposition of Assets

The information included under the caption “Amendment No. 1 to Stock Purchase Agreement” in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.06.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information.

In accordance with Item 9.01(b), our pro forma financial statements are filed in this Current Report on Form 8-K as Exhibit 99.1

(d) Exhibits.

|

Exhibit No.

|

Description

|

|

|

10.1

|

Stock Purchase Agreement by and among Minera Kata S.A. and South American Gold Corp. dated as of February 25, 2011 (incorporated by reference to Exhibit 10.1 to the Form 8-K filed on March 2, 2011).

|

|

|

10.2

|

||

|

23.1

|

||

|

99.1

|

- 16 -

Glossary of Certain Mining Terms

AGGLOMERATE: A chaotic assemblage of coarse angular volcaniclastic material extruded by a volcano.

ANDESITE: Dark, fine grained extrusive rock. Fine grained equivalent to diorite.

BASALT: Dark colored fine grained rock usually from volcanic origin.

BATHOLITH: A large, generally discordant igneous mass that penetrated the earth’s crust. It could be exposed over a large area or buried under overlaying rocks.

BRECIATED: Rock structure marked by an accumulation of angular fragments, or an ore texture showing mineral fragments without noticeable rounding.

CHLORITE: A platy mica mineral commonly associated with alteration of the rock minerals by hydrothermal activity.

CONCESSION (MINERAL CONCESSION): mineral rights given by the Government for mineral exploration or exploitation within a specific surface area regardless of surface ownership. In areas where the ground is covered under a Colombian “Reserva Forestal”, there has to be a “Sustraccion de Concesion” (removing the Reserva Forestal designation from the area covered by the concession) before any mining or mayor surface disturbance is made.

CRETACEOUS: The final period of the Mesozoic Era which covers the time span between 135 and 65 million years ago.

DEPARTMENT: A political administrative division of a country that has a central Unitarian government.

DEVELOPMENT: work carried out for the purpose of opening up a mineral deposit and making the actual extraction possible.

DIABASE: a dark colored basic intrusive rock. Sometimes is used in the field when the exact composition of the rock cannot be determined. The main minerals forming the rock are pyroxenes.

DIORITE: medium grained, gray colored igneous rock (intrusive rocks cool within the earth’s crust, as opposed to extrusive, or volcanic, rocks which cool at the earth’s surface).

ELECTRUM: A naturally occurring alloy of gold and silver (argentiferous gold) containing more than 20% silver.

EOCENE: an epoch of the Early Tertiary Period of the earth’s history from 55 to 38 Million years ago.

- 17 -

EPITHERMAL: term applied to hydrothermal deposition of mineral deposits within about one kilometer of the earth’s surface.

EXPLORATION: work involved in searching for ore by geological mapping, geochemistry, geophysics, drilling, and other methods.

GEOCHEMISTRY: study of relative and absolute abundances of chemical elements and atomic species (isotopes) in rocks, soils, water, or atmosphere.

GEOPHYSICS: study of the earth by quantitative physical methods.

GRANODIORITE: coarse grained, grey colored igneous rock containing more quartz than the finer grained diorite.

GREENSTONE: a field term applied to any dark-green altered or metamorphosed basic igneous rock such as basalt or diabase.

HECTARE: metric measure of area, equivalent to 2.47105 acres or 0.003861 square miles.

HORNFELS: a fine grained rock composed of a mosaic of equidimensional grains without preferred orientation and typically formed by contact metamorphism.

HYDROTHERMAL: pertaining to hot water, especially with respect to its action in dissolving, re-depositing, and otherwise producing mineral changes within the earth’s crust.

IGNEOUS: refers to a rock or mineral that solidified from molten or partly molten material. It also refers to the process leading to, related to, or resulting from the process of the formation of those rocks.

INTRUSION/INTRUSIVE: a volume of igneous rock that was injected, while still molten, into the earth’s crust or other rocks and solidified before reaching the surface as opposed to extrusive or volcanic.

KAOLIN: A name applied to a group of clay minerals. These may be formed from the alteration of alkali (calcium) feldspars and micas. The most common is kaolinite which is usually white and earthy. It is common alteration product on the outer fringes of a vein body.

LEFT LATERAL: displacement along a fault such that, in plan view, the side opposite the observer appears displaced to the left.

METAMORPHISM: the process by which consolidated rocks are altered in composition, texture, or structure as a result of the earth’s application of heat and/or pressure at depth over time.

METALLIFEROUS: bearing or producing metal.

- 18 -

METAMORPHOSED: term used when the original rock’s mineralogy, chemical and structural characteristic have been changed by the action of heat from an intrusive, or high pressure during tectonic events.

MINERALIZATION: as applied to mineral deposits, the process of adding concentrations of metals to rocks.

MIOCENE: an epoch of the Early Tertiary Period of the earth’s history from 25 Mya to 5 Mya

MONTMORILLONITE: a clay mineral of the smectite group.

ORE BODY: a continuous, well-defined mass of material of sufficient ore content to make extraction economically feasible; or a reserve.

OUTCROP: the exposure of bedrock or strata projecting through the overlying cover of soil.

PLUTON: . A body volume of igneous rock that was injected, while still molten, into the earth’s crust or other rocks and solidified before reaching the surface as opposed to extrusive or volcanic.

POLYBASITE: an iron black or steel gray metallic mineral of silver, copper and antimony.

PROSPECT: an area that is a potential site of mineral deposits.

PYRAGYRITE: a dark grey-red silver-antimony mineral which is an important ore mineral. It is also known as ruby silver.

RECLAMATION: the restoration of a site after exploration activity or mining is completed.

SANDSTONE: a medium grained clastic sedimentary rock composed of abundant rounded of angular fragments of sand set in fine grained matrix.

SEDIMENTARY ROCKS: rocks resulting from the consolidation of loose detritus of older rock.

SERICITE: a fine grained potassium mica occurring as small flakes or scales as an alteration product of aluminosilicate minerals. It is common alteration product along mineralized veins.

SHALE: A fine grained sedimentary rock formed by consolidation of clay, silt or mud.

SHEAR: a zone of deformation caused the by lateral movement along numerous parallel planes.

SULFIDE: a metallic mineral composed of sulfur combined with base metals.

STRIKE: the bearing of a vein or a layer of rock.

- 19 -

STRUCTURAL TREND: The trend of the general attitude, arrangement, or relative positions of the rock masses of a region or area.

TERTIARY: The first period of the Cenozoic era which covers the time span between 65 and 1.8 million years ago.

TUFF: A general term for all consolidated volcaniclastic rocks (extruded from a volcano)

UPLIFT: A structurally high area in the earth crust, produced by positive movements that raise the rocks.

VEIN: a deposit of foreign minerals within a rock fracture or joint.

- 20 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 29, 2011

|

South American Gold Corp.

|

||

|

By:

|

/s/ Raymond DeMotte

|

|

|

Name:

|

Raymond DeMotte

|

|

|

Title:

|

President and Chief Executive Officer

|

|

- 21 -