Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - WASHINGTON REAL ESTATE INVESTMENT TRUST | dex991.htm |

| 8-K - FORM 8-K - WASHINGTON REAL ESTATE INVESTMENT TRUST | d8k.htm |

Exhibit 99.2

First Quarter 2011

Supplemental Operating and Financial Data

for the Quarter Ended March 31, 2011

| Contact: | 6110 Executive Boulevard | |

| William T. Camp | Suite 800 | |

| Executive Vice President and | Rockville, MD 20852 | |

| Chief Financial Officer | (301) 984-9400 | |

| E-mail: bcamp@writ.com | (301) 984-9610 fax | |

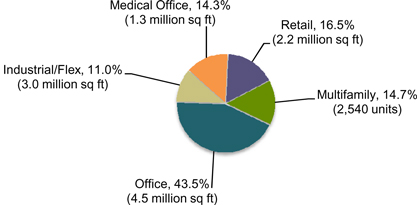

Washington Real Estate Investment Trust (“WRIT”) is a self-administered, self-managed, equity real estate investment trust investing in income-producing properties in the greater Washington metro region. WRIT is diversified, as it invests in office, medical office, industrial/flex, retail, and multifamily properties and land for development.

In the first quarter of 2011, WRIT acquired two downtown Washington, DC office assets. 1140 Connecticut Avenue is a twelve story, 184,000 square foot office building with a three level parking garage. The purchase price was $80.25 million. The property was 99% leased at the time of purchase to 25 office tenants and four retail tenants. It is located near the intersection of Connecticut Avenue and M Street in the heart of Washington’s “Golden Triangle” Central Business District, less than one block from the Farragut North Metro Station (Red Line) and two blocks from the Farragut West Metro Station (Blue and Orange Lines). WRIT funded this acquisition using available cash and its line of credit, and expects to achieve a first year unleveraged yield on 6.0% on a cash basis.

The second downtown office acquisition, 1227 25th Street, is an eight story, 130,000 square foot building with a two level parking garage. The purchase price was $47.0 million. The property was 72% leased at the time of purchase to the GSA and law firm tenants. It is located near the corner of 25th and M Streets in Washington’s West End submarket, immediately adjacent to WRIT’s 2445 M Street office building acquired in 2008. WRIT funded this acquisition using available cash and its line of credit, and projects a stabilized cash yield of 8.7%.

Subsequent to quarter end, WRIT completed the sale of Dulles Station West Phase I, a 180,000 square foot office building in Herndon, Virginia, for $58.8 million. WRIT acquired the land for Dulles Station West Phases I and II in 2005 and completed construction on Phase I in 2007. It is 100% leased to tenants including IBM and National Student Clearinghouse. Phase II, which was not included in the transaction, is zoned for future development of a 340,000 square foot office building.

WRIT signed commercial leases for 416,000 square feet with an average lease term of 4.9 years. The average rental rate increase on new and renewal leases was -0.6% on a GAAP basis and -7.5% on a cash basis. Commercial tenant improvement costs were $3.09 per square foot and leasing costs were $3.56 per square foot for the quarter.

As of March 31, 2011, WRIT owned a diversified portfolio of 87 properties totaling approximately 11 million square feet of commercial space and 2,540 residential units, and land held for development. These 87 properties consist of 27 office properties, 18 medical office properties, 16 industrial/flex properties, 15 retail centers and 11 multifamily properties. WRIT shares are publicly traded on the New York Stock Exchange (NYSE:WRE).

1

With investments in the office, medical office, industrial/flex, retail and multifamily segments, WRIT is uniquely diversified. This balanced portfolio provides stability during market fluctuations in specific property types.

| * | Excludes discontinued operations: |

Held for Sale Properties: Dulles Station Phase I.

Certain statements in the supplemental disclosures which follow are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to, the potential for federal government budget reductions, changes in general and local economic and real estate market conditions, the timing and pricing of lease transactions, the effect of the current credit and financial market conditions, the availability and cost of capital, fluctuations in interest rates, tenants’ financial conditions, levels of competition, the effect of government regulation, the impact of newly adopted accounting principles, and other risks and uncertainties detailed from time to time in our filings with the SEC, including our 2010 Form 10-K. We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

2

| Schedule |

Page | |||

| Key Financial Data |

||||

| Consolidated Statements of Operations |

4 | |||

| Consolidated Balance Sheets |

5 | |||

| Funds From Operations and Funds Available for Distribution |

6 | |||

| Adjusted Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) |

7 | |||

| Capital Analysis |

||||

| Long-Term Debt Analysis |

8-9 | |||

| Debt Covenant Compliance |

10 | |||

| Capital Analysis |

11 | |||

| Portfolio Analysis |

||||

| Same-Store Portfolio Net Operating Income (NOI) Growth & Rental Rate Growth |

12 | |||

| Same-Store Portfolio Net Operating Income (NOI) Summary |

13 | |||

| Same-Store Portfolio Net Operating Income (NOI) Detail for the Quarter |

14-15 | |||

| Net Operating Income (NOI) by Region |

16 | |||

| Same-Store Portfolio & Overall Physical Occupancy Levels by Sector |

17 | |||

| Same-Store Portfolio & Overall Economic Occupancy Levels by Sector |

18 | |||

| Tenant Analysis |

||||

| Commercial Leasing Summary |

19 | |||

| 10 Largest Tenants - Based on Annualized Base Rent |

20 | |||

| Industry Diversification |

21 | |||

| Lease Expirations as of March 31, 2011 |

22 | |||

| Growth and Strategy |

||||

| 2011 Acquisition Summary |

23 | |||

| Appendix |

||||

| Schedule of Properties |

24-25 | |||

| Supplemental Definitions |

26 | |||

3

| Three Months Ended | ||||||||||||||||||||

| OPERATING RESULTS |

03/31/11 | 12/31/10 | 09/30/10 | 06/30/10 | 03/31/10 | |||||||||||||||

| Real estate rental revenue |

$ | 78,155 | $ | 74,012 | $ | 73,585 | $ | 72,402 | $ | 73,551 | ||||||||||

| Real estate expenses |

(26,088 | ) | (23,456 | ) | (24,164 | ) | (23,172 | ) | (26,169 | ) | ||||||||||

| 52,067 | 50,556 | 49,421 | 49,230 | 47,382 | ||||||||||||||||

| Real estate depreciation and amortization |

(24,750 | ) | (23,384 | ) | (23,327 | ) | (22,720 | ) | (22,587 | ) | ||||||||||

| Income from real estate |

27,317 | 27,172 | 26,094 | 26,510 | 24,795 | |||||||||||||||

| Other income |

306 | 318 | 289 | 297 | 289 | |||||||||||||||

| Acquisition costs |

(1,649 | ) | (709 | ) | 12 | (409 | ) | (55 | ) | |||||||||||

| Gain from non-disposal activities |

— | 3 | 4 | — | — | |||||||||||||||

| Gain (loss) on extinguishment of debt |

— | (8,896 | ) | (238 | ) | — | (42 | ) | ||||||||||||

| Interest expense |

(17,126 | ) | (17,801 | ) | (16,965 | ) | (16,785 | ) | (16,838 | ) | ||||||||||

| General and administrative |

(3,702 | ) | (3,951 | ) | (3,153 | ) | (3,519 | ) | (3,783 | ) | ||||||||||

| Income (loss) from continuing operations |

5,146 | (3,864 | ) | 6,043 | 6,094 | 4,366 | ||||||||||||||

| Discontinued operations: |

||||||||||||||||||||

| Income (loss) from operations of properties sold or held for sale |

(458 | ) | 822 | 615 | 985 | 899 | ||||||||||||||

| Gain on sale of real estate |

— | 13,657 | — | 7,942 | — | |||||||||||||||

| Income from discontinued operations |

(458 | ) | 14,479 | 615 | 8,927 | 899 | ||||||||||||||

| Net income |

4,688 | 10,615 | 6,658 | 15,021 | 5,265 | |||||||||||||||

| Less: Net income from noncontrolling interests |

(23 | ) | (24 | ) | (33 | ) | (27 | ) | (49 | ) | ||||||||||

| Net income attributable to the controlling interests |

$ | 4,665 | $ | 10,591 | $ | 6,625 | $ | 14,994 | $ | 5,216 | ||||||||||

| Per Share Data |

||||||||||||||||||||

| Net income attributable to the controlling interests |

$ | 0.07 | $ | 0.16 | $ | 0.10 | $ | 0.24 | $ | 0.09 | ||||||||||

| Fully diluted weighted average shares outstanding |

65,907 | 64,536 | 63,055 | 61,287 | 60,001 | |||||||||||||||

| Percentage of Revenues: |

||||||||||||||||||||

| Real estate expenses |

33.4 | % | 31.7 | % | 32.8 | % | 32.0 | % | 35.6 | % | ||||||||||

| General and administrative |

4.7 | % | 5.3 | % | 4.3 | % | 4.9 | % | 5.1 | % | ||||||||||

| Ratios: |

||||||||||||||||||||

| Adjusted EBITDA / Interest expense |

2.8 x | 2.7 x | 2.8 x | 2.8 x | 2.7 x | |||||||||||||||

| Income from continuing operations attributable to the controlling interest/Total real estate revenue |

6.6 | % | -5.3 | % | 8.2 | % | 8.4 | % | 5.9 | % | ||||||||||

| Net income attributable to the controlling interest/Total real estate revenue |

6.0 | % | 14.3 | % | 9.0 | % | 20.7 | % | 7.1 | % | ||||||||||

Note: Certain prior quarter amounts have been reclassified to conform to the current quarter presentation.

4

| March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

||||||||||||||||

| Assets |

||||||||||||||||||||

| Land |

$ | 475,458 | $ | 432,149 | $ | 403,333 | $ | 403,315 | $ | 393,917 | ||||||||||

| Income producing property |

2,013,854 | 1,938,629 | 1,875,405 | 1,867,057 | 1,813,721 | |||||||||||||||

| 2,489,312 | 2,370,778 | 2,278,738 | 2,270,372 | 2,207,638 | ||||||||||||||||

| Accumulated depreciation and amortization |

(555,578 | ) | (534,570 | ) | (514,337 | ) | (494,127 | ) | (474,631 | ) | ||||||||||

| Net income producing property |

1,933,734 | 1,836,208 | 1,764,401 | 1,776,245 | 1,733,007 | |||||||||||||||

| Development in progress, including land held for development |

26,263 | 26,240 | 26,103 | 25,952 | 25,502 | |||||||||||||||

| Total real estate held for investment, net |

1,959,997 | 1,862,448 | 1,790,504 | 1,802,197 | 1,758,509 | |||||||||||||||

| Investment in real estate held for sale, net |

40,868 | 41,892 | 75,684 | 76,385 | 90,937 | |||||||||||||||

| Cash and cash equivalents |

12,480 | 78,767 | 262,413 | 13,338 | 10,758 | |||||||||||||||

| Restricted cash |

24,316 | 21,552 | 19,858 | 21,567 | 19,035 | |||||||||||||||

| Rents and other receivables, net of allowance for doubtful accounts |

53,278 | 49,227 | 49,171 | 46,072 | 45,766 | |||||||||||||||

| Prepaid expenses and other assets |

108,042 | 96,466 | 92,878 | 85,246 | 79,105 | |||||||||||||||

| Other assets related to properties sold or held for sale |

17,231 | 17,529 | 20,471 | 22,035 | 22,866 | |||||||||||||||

| Total assets |

$ | 2,216,212 | $ | 2,167,881 | $ | 2,310,979 | $ | 2,066,840 | $ | 2,026,976 | ||||||||||

| Liabilities and Equity |

||||||||||||||||||||

| Notes payable |

$ | 753,692 | $ | 753,587 | $ | 930,201 | $ | 689,007 | $ | 688,358 | ||||||||||

| Mortgage notes payable |

379,333 | 380,171 | 381,109 | 381,929 | 382,735 | |||||||||||||||

| Lines of credit/short-term note payable |

160,000 | 100,000 | 100,000 | 107,000 | 110,000 | |||||||||||||||

| Accounts payable and other liabilities |

60,129 | 51,036 | 53,854 | 54,169 | 52,903 | |||||||||||||||

| Advance rents |

12,722 | 12,589 | 10,586 | 10,196 | 9,489 | |||||||||||||||

| Tenant security deposits |

10,040 | 9,418 | 9,418 | 9,299 | 9,469 | |||||||||||||||

| Other liabilities related to properties sold or held for sale |

480 | 222 | 951 | 22,945 | 23,751 | |||||||||||||||

| Total Liabilities |

1,376,396 | 1,307,023 | 1,486,119 | 1,274,545 | 1,276,705 | |||||||||||||||

| Equity |

||||||||||||||||||||

| Shares of beneficial interest, $0.01 par value; 100,000 shares authorized |

660 | 659 | 642 | 625 | 607 | |||||||||||||||

| Additional paid-in capital |

1,130,297 | 1,127,825 | 1,074,308 | 1,020,768 | 966,952 | |||||||||||||||

| Distributions in excess of net income |

(293,860 | ) | (269,935 | ) | (251,964 | ) | (230,942 | ) | (219,094 | ) | ||||||||||

| Accumulated other comprehensive income (loss) |

(1,057 | ) | (1,469 | ) | (1,906 | ) | (1,949 | ) | (2,004 | ) | ||||||||||

| Total shareholders’ equity |

836,040 | 857,080 | 821,080 | 788,502 | 746,461 | |||||||||||||||

| Noncontrolling interests in subsidiaries |

3,776 | 3,778 | 3,780 | 3,793 | 3,810 | |||||||||||||||

| Total equity |

839,816 | 860,858 | 824,860 | 792,295 | 750,271 | |||||||||||||||

| Total liabilities and equity |

$ | 2,216,212 | $ | 2,167,881 | $ | 2,310,979 | $ | 2,066,840 | $ | 2,026,976 | ||||||||||

| Total Debt / Total Market Capitalization |

0.39:1 | 0.38:1 | 0.41:1 | 0.41:1 | 0.39:1 | |||||||||||||||

Note: Certain prior quarter amounts have been reclassified to conform to the current quarter presentation.

5

| Three Months Ended | ||||||||||||||||||||

| 3/31/2011 | 12/31/2010 | 9/30/2010 | 6/30/2010 | 3/31/2010 | ||||||||||||||||

| Funds from operations(1) |

||||||||||||||||||||

| Net income (loss) attributable to the controlling interests |

$ | 4,665 | $ | 10,591 | $ | 6,625 | $ | 14,994 | $ | 5,216 | ||||||||||

| Real estate depreciation and amortization |

24,750 | 23,384 | 23,327 | 22,720 | 22,587 | |||||||||||||||

| Gain from non-disposal activities |

— | (3 | ) | (4 | ) | — | — | |||||||||||||

| Discontinued operations: |

||||||||||||||||||||

| Gain on sale of real estate |

— | (13,657 | ) | — | (7,942 | ) | — | |||||||||||||

| Real estate depreciation and amortization |

499 | 807 | 951 | 949 | 1,021 | |||||||||||||||

| Funds From Operations (FFO) |

$ | 29,914 | $ | 21,122 | $ | 30,899 | $ | 30,721 | $ | 28,824 | ||||||||||

| Loss (gain) on extinguishment of debt |

— | 8,896 | 238 | — | 42 | |||||||||||||||

| Real estate impairment |

599 | — | — | — | — | |||||||||||||||

| Acquisition costs |

1,649 | 709 | (12 | ) | 409 | 55 | ||||||||||||||

| Core FFO (3) |

$ | 32,162 | $ | 30,727 | $ | 31,125 | $ | 31,130 | $ | 28,921 | ||||||||||

| FFO per share - basic |

$ | 0.45 | $ | 0.33 | $ | 0.49 | $ | 0.50 | $ | 0.48 | ||||||||||

| FFO per share - fully diluted |

$ | 0.45 | $ | 0.33 | $ | 0.49 | $ | 0.50 | $ | 0.48 | ||||||||||

| Core FFO per share - fully diluted |

$ | 0.49 | $ | 0.48 | $ | 0.49 | $ | 0.51 | $ | 0.48 | ||||||||||

| Funds available for distribution(2) |

||||||||||||||||||||

| FFO |

$ | 29,914 | $ | 21,122 | $ | 30,899 | $ | 30,721 | $ | 28,824 | ||||||||||

| Non-cash (gain)/loss on extinguishment of debt |

— | 2,922 | 238 | — | 42 | |||||||||||||||

| Tenant improvements |

(2,370 | ) | (6,373 | ) | (2,863 | ) | (2,331 | ) | (2,012 | ) | ||||||||||

| External and internal leasing commissions capitalized |

(2,232 | ) | (2,089 | ) | (3,387 | ) | (1,767 | ) | (2,268 | ) | ||||||||||

| Recurring capital improvements |

(691 | ) | (1,698 | ) | (1,377 | ) | (1,999 | ) | (864 | ) | ||||||||||

| Straight-line rent, net |

(657 | ) | (951 | ) | (1,099 | ) | (812 | ) | (608 | ) | ||||||||||

| Non-cash fair value interest expense |

179 | 345 | 760 | 783 | 776 | |||||||||||||||

| Non-real estate depreciation and amortization |

874 | 889 | 1,094 | 993 | 993 | |||||||||||||||

| Amortization of lease intangibles, net |

(278 | ) | (437 | ) | (413 | ) | (405 | ) | (562 | ) | ||||||||||

| Amortization and expensing of restricted share and unit compensation |

1,257 | 1,553 | 1,311 | 1,355 | 1,633 | |||||||||||||||

| Real estate impairment |

599 | — | — | — | — | |||||||||||||||

| Funds Available for Distribution (FAD) |

$ | 26,595 | $ | 15,283 | $ | 25,163 | $ | 26,538 | $ | 25,954 | ||||||||||

| Cash loss (gain) on extinguishment of debt |

— | 5,974 | — | — | — | |||||||||||||||

| Acquisition costs |

1,649 | 709 | (12 | ) | 409 | 55 | ||||||||||||||

| Core FAD (4) |

$ | 28,244 | $ | 21,966 | $ | 25,151 | $ | 26,947 | $ | 26,009 | ||||||||||

| FAD per share - basic |

$ | 0.40 | $ | 0.24 | $ | 0.40 | $ | 0.43 | $ | 0.43 | ||||||||||

| FAD per share - fully diluted |

$ | 0.40 | $ | 0.24 | $ | 0.40 | $ | 0.43 | $ | 0.43 | ||||||||||

| Core FAD per share - fully diluted |

$ | 0.43 | $ | 0.34 | $ | 0.40 | $ | 0.44 | $ | 0.43 | ||||||||||

| Common dividend per share |

$ | 0.4338 | $ | 0.4338 | $ | 0.4325 | $ | 0.4325 | $ | 0.4325 | ||||||||||

| Average shares - basic |

65,885 | 64,536 | 62,894 | 61,171 | 59,898 | |||||||||||||||

| Average shares - fully diluted |

65,907 | 64,536 | 63,055 | 61,287 | 60,001 | |||||||||||||||

| (1) | Funds From Operations (“FFO”) - The National Association of Real Estate Investment Trusts, Inc. (“NAREIT”) defines FFO (April, 2002 White Paper) as net income (computed in accordance with generally accepted accounting principles (“GAAP”)) excluding gains (or losses) from sales of property plus real estate depreciation and amortization. We consider FFO to be a standard supplemental measure for equity real estate investment trusts (“REITs”) because it facilitates an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which historically assumes that the value of real estate assets diminishes predictably over time. Since real estate values have instead historically risen or fallen with market conditions, we believe that FFO more accurately provides investors an indication of our ability to incur and service debt, make capital expenditures and fund other needs. FFO is a non-GAAP measure. |

| (2) | Funds Available for Distribution (“FAD”) is calculated by subtracting from FFO (1) recurring expenditures, tenant improvements and leasing costs, that are capitalized and amortized and are necessary to maintain our properties and revenue stream and (2) straight line rents, then adding (3) non-real estate depreciation and amortization, (4) non-cash fair value interest expense and (5) amortization of restricted share compensation, then adding or subtracting the (6) amortization of lease intangibles, (7) real estate impairment and (8) non-cash gain/loss on extinguishment of debt, as appropriate. FAD is included herein, because we consider it to be a measure of a REIT’s ability to incur and service debt and to distribute dividends to its shareholders. FAD is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

| (3) | Core Funds From Operations (“Core FFO”) is calculated by adjusting FFO for the following items (which we believe are not indicative of the performance of WRIT’s operating portfolio and affect the comparative measurement of WRIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties and (3) property impairments, as appropriate. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of WRIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FFO is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

| (4) | Core Funds Available for Distribution (“Core FAD”) is calculated by adjusting FAD for the following items (which we believe are not indicative of the performance of WRIT’s operating portfolio and affect the comparative measurement of WRIT’s operating performance over time): (1) gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties and (3) property impairments, as appropriate. These items can vary greatly from period to period, depending upon the volume of our acquisition activity and debt retirements, among other factors. We believe that by excluding these items, Core FFO serves as a useful, supplementary measure of WRIT’s ability to incur and service debt, and distribute dividends to its shareholders. Core FFO is a non-GAAP and non-standardized measure, and may be calculated differently by other REITs. |

6

| Three Months Ended | ||||||||||||||||||||

| 03/31/11 | 12/31/10 | 09/30/10 | 06/30/10 | 03/31/10 | ||||||||||||||||

| Adjusted EBITDA(1) |

||||||||||||||||||||

| Net income attributable to the controlling interests |

$ | 4,665 | $ | 10,591 | $ | 6,625 | $ | 14,994 | $ | 5,216 | ||||||||||

| Add: |

||||||||||||||||||||

| Interest expense, including discontinued operations |

17,126 | 17,801 | 17,100 | 17,013 | 17,065 | |||||||||||||||

| Real estate depreciation and amortization, including discontinued operations |

25,249 | 24,191 | 24,278 | 23,669 | 23,608 | |||||||||||||||

| Real estate impairment |

599 | — | — | — | — | |||||||||||||||

| Non-real estate depreciation |

268 | 279 | 277 | 274 | 272 | |||||||||||||||

| Less: |

||||||||||||||||||||

| Gain on sale of real estate |

— | (13,657 | ) | — | (7,942 | ) | — | |||||||||||||

| Loss (gain) on extinguishment of debt |

— | 8,896 | 238 | — | 42 | |||||||||||||||

| Gain from non-disposal activities |

— | (3 | ) | (4 | ) | — | — | |||||||||||||

| Adjusted EBITDA |

$ | 47,907 | $ | 48,098 | $ | 48,514 | $ | 48,008 | $ | 46,203 | ||||||||||

| (1) | Adjusted EBITDA is earnings before interest expense, taxes, depreciation, amortization, gain on sale of real estate, gain/loss on extinguishment of debt and gain from non-disposal activities. We consider Adjusted EBITDA to be an appropriate supplemental performance measure because it permits investors to view income from operations without the effect of depreciation, the cost of debt or non-operating gains and losses. Adjusted EBITDA is a non-GAAP measure. |

7

| March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

||||||||||||||||

| Balances Outstanding |

||||||||||||||||||||

| Secured |

||||||||||||||||||||

| Conventional fixed rate |

$ | 379,333 | $ | 380,171 | $ | 381,109 | $ | 403,612 | (1) | $ | 404,518 | (1) | ||||||||

| Secured total |

379,333 | 380,171 | 381,109 | 403,612 | 404,518 | |||||||||||||||

| Unsecured |

||||||||||||||||||||

| Fixed rate bonds and notes |

753,692 | 753,587 | 930,201 | 689,007 | 688,358 | |||||||||||||||

| Credit facility |

160,000 | 100,000 | 100,000 | 107,000 | 110,000 | |||||||||||||||

| Unsecured total |

913,692 | 853,587 | 1,030,201 | 796,007 | 798,358 | |||||||||||||||

| Total |

$ | 1,293,025 | $ | 1,233,758 | $ | 1,411,310 | $ | 1,199,619 | $ | 1,202,876 | ||||||||||

| Average Interest Rates |

||||||||||||||||||||

| Secured |

||||||||||||||||||||

| Conventional fixed rate |

5.9 | % | 5.9 | % | 5.9 | % | 5.9 | % | 5.9 | % | ||||||||||

| Secured total |

5.9 | % | 5.9 | % | 5.9 | % | 5.9 | % | 5.9 | % | ||||||||||

| Unsecured |

||||||||||||||||||||

| Fixed rate bonds |

5.4 | % | 5.4 | % | 5.5 | % | 5.7 | % | 5.7 | % | ||||||||||

| Credit facilities |

1.8 | %(2) | 2.5 | %(2) | 2.5 | %(2) | 2.4 | %(2) | 2.4 | %(2) | ||||||||||

| Unsecured total |

4.8 | % | 5.1 | % | 5.2 | % | 5.3 | % | 5.2 | % | ||||||||||

| Average |

5.1 | % | 5.4 | % | 5.4 | % | 5.5 | % | 5.5 | % | ||||||||||

Note: The current balances outstanding of the secured and unsecured fixed rate bonds and notes are shown net of discounts/premiums in the amount of $6.5 million and $2.8 million, respectively.

| (1) | Balance includes the mortgage note payable secured by The Ridges, a property we sold on December 21, 2010, which has been reclassified to “Other liabilities related to properties sold or held for sale.” We repaid this mortgage note payable without penalty on July 12, 2010. |

| (2) | On December 1, 2009, we borrowed $100.0 million on a line of credit in order to prepay the $100.0 million term loan. Through February 19, 2010, the interest rate on this $100.0 million borrowing on our lines of credit is effectively fixed by an interest rate swap at 3.375%. Beginning February 20, 2010 through November 1, 2011, an interest rate swap effectively fixes the interest rate at 2.525%. |

8

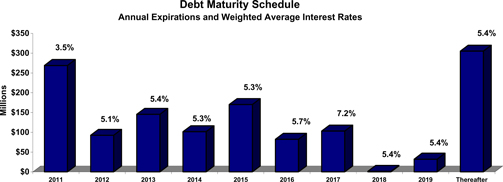

| Future Maturities of Debt | ||||||||||||||||||||

| Year | Secured Debt | Unsecured Debt | Credit Facilities | Total Debt | Average Interest Rate |

|||||||||||||||

| 2011 |

$ | 12,344 | $ | 96,521 | $ | 160,000 | $ | 268,865 | 3.5 | % | ||||||||||

| 2012 |

42,489 | 50,000 | — | 92,489 | 5.1 | % | ||||||||||||||

| 2013 |

85,504 | 60,000 | — | 145,504 | 5.4 | % | ||||||||||||||

| 2014 |

1,516 | 100,000 | — | 101,516 | 5.3 | % | ||||||||||||||

| 2015 |

20,040 | 150,000 | — | 170,040 | 5.3 | % | ||||||||||||||

| 2016 |

82,281 | — | — | 82,281 | 5.7 | % | ||||||||||||||

| 2017 |

103,193 | — | — | 103,193 | 7.2 | % | ||||||||||||||

| 2018 |

1,402 | — | — | 1,402 | 5.4 | % | ||||||||||||||

| 2019 |

32,061 | — | — | 32,061 | 5.4 | % | ||||||||||||||

| Thereafter |

5,041 | 300,000 | — | 305,041 | 5.4 | % | ||||||||||||||

| Total maturities |

$ | 385,871 | $ | 756,521 | $ | 160,000 | $ | 1,302,392 | 5.1 | % | ||||||||||

Weighted average maturity = 4.8 years

9

| Unsecured Notes Payable | Unsecured Line of Credit

#1 ($75.0 million) |

Unsecured Line of Credit

#2 ($262.0 million) |

||||||||||||||||||||||

| Quarter Ended March 31, 2011 |

Covenant | Quarter Ended March 31, 2011 |

Covenant | Quarter Ended March 31, 2011 |

Covenant | |||||||||||||||||||

| % of Total Indebtedness to Total Assets(1) |

43.6 | % | £ 65.0 | % | N/A | N/A | N/A | N/A | ||||||||||||||||

| Ratio of Income Available for Debt Service to Annual Debt Service |

3.0 | ³ 1.5 | N/A | N/A | N/A | N/A | ||||||||||||||||||

| % of Secured Indebtedness to Total Assets(1) |

12.8 | % | £ 40.0 | % | N/A | N/A | N/A | N/A | ||||||||||||||||

| Ratio of Total Unencumbered Assets(2) to Total Unsecured Indebtedness |

2.2 | ³ 1.5 | N/A | N/A | N/A | N/A | ||||||||||||||||||

| Tangible Net Worth |

N/A | N/A | $ | 1.1 billion | ³ | $808.6 million | $ | 1.1 billion | ³ | $808.6 million | ||||||||||||||

| % of Total Liabilities to Gross Asset Value(4) |

N/A | N/A | 53.1 | % | £ 60.0 | % | 51.5 | % | £ 60.0 | % | ||||||||||||||

| % of Secured Indebtedness to Gross Asset Value(4) |

N/A | N/A | 14.5 | % | £ 35.0 | % | 14.2 | % | £ 35.0 | % | ||||||||||||||

| Ratio of EBITDA(3) to Fixed Charges(5) |

N/A | N/A | 2.52 | ³ 1.75 | 2.52 | ³ 1.75 | ||||||||||||||||||

| Ratio of Unencumbered Pool Value(7) to Unsecured Indebtedness |

N/A | N/A | 2.36 | ³ 1.67 | N/A | N/A | ||||||||||||||||||

| Ratio of Unencumbered Net Operating Income to Unsecured Interest Expense |

N/A | N/A | N/A | N/A | 3.31 | ³ 2.00 | ||||||||||||||||||

| % of Development in Progress to Gross Asset Value(4) |

N/A | N/A | 1.0 | % | £ 30.0 | % | 1.0 | % | £ 20.0 | % | ||||||||||||||

| % of Non-Wholly Owned Assets(6) to Gross Asset Value(4) |

N/A | N/A | 1.3 | % | £ 15.0 | % | 1.3 | % | £ 15.0 | % | ||||||||||||||

| (1) | Total Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(3) from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. |

| (2) | Total Unencumbered Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(3) from unencumbered properties from the last four consecutive quarters, excluding EBITDA from acquired, disposed, and non-stabilized development properties. |

| (3) | EBITDA is defined in our debt covenants as earnings before interest income, interest expense, taxes, depreciation, amortization, gain on sale of real estate, real estate impairments, gain/loss on extinguishment of debt and gain from non-disposal activities. |

| (4) | Gross Asset Value is calculated by applying a capitalization rate to the annualized EBITDA(3) from the most recently ended quarter, excluding EBITDA from disposed properties and current quarter acquisitions. To this amount, the purchase price of current quarter acquisitions, cash and cash equivalents and development in progress is added. |

| (5) | Fixed Charges consist of interest expense, principal payments, ground lease payments and replacement reserve payments. |

| (6) | Non-Wholly Owned Assets is calculated by applying a capitalization rate of 7.50% to the EBITDA(3) from properties subject to a joint operating agreement (i.e. NVIP I&II). We add to this amount the development in progress subject to a joint operating agreement (i.e. 4661 Kenmore Avenue). |

| (7) | Unencumbered Pool Value is calculated by applying a capitalization rate of 7.75% to the net operating income from unencumbered properties owned for the entire quarter. To this we add the purchase price of unencumbered acquisitions during the current quarter and development in progress. |

10

| March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

||||||||||||||||

| Market Data |

||||||||||||||||||||

| Shares Outstanding |

65,941 | 65,870 | 64,093 | 62,380 | 60,545 | |||||||||||||||

| Market Price per Share |

$ | 31.09 | $ | 30.99 | $ | 31.73 | $ | 27.59 | $ | 30.55 | ||||||||||

| Equity Market Capitalization |

$ | 2,050,106 | $ | 2,041,311 | $ | 2,033,671 | $ | 1,721,064 | $ | 1,849,650 | ||||||||||

| Total Debt |

$ | 1,293,025 | $ | 1,233,758 | $ | 1,411,310 | $ | 1,199,619 | (3) | $ | 1,202,876 | (3) | ||||||||

| Total Market Capitalization |

$ | 3,343,131 | $ | 3,275,069 | $ | 3,444,981 | $ | 2,920,683 | $ | 3,052,526 | ||||||||||

| Total Debt to Market Capitalization |

0.39:1 | 0.38:1 | 0.41:1 | 0.41:1 | 0.39:1 | |||||||||||||||

| Earnings to Fixed Charges(1) |

1.3 x | 0.8 x | 1.3 x | 1.3 x | 1.2 x | |||||||||||||||

| Debt Service Coverage Ratio(2) |

2.7 x | 2.5 x | 2.7 x | 2.7 x | 2.5 x | |||||||||||||||

| Dividend Data |

||||||||||||||||||||

| Total Dividends Paid |

$ | 28,587 | $ | 28,438 | $ | 27,485 | $ | 26,677 | $ | 25,890 | ||||||||||

| Common Dividend per Share |

$ | 0.4338 | $ | 0.4338 | $ | 0.4325 | $ | 0.4325 | $ | 0.4325 | ||||||||||

| Payout Ratio (Core FFO per share basis) |

88.5 | % | 90.4 | % | 88.3 | % | 84.8 | % | 90.1 | % | ||||||||||

| Payout Ratio (Core FAD per share basis) |

100.9 | % | 127.6 | % | 108.1 | % | 98.3 | % | 100.6 | % | ||||||||||

| Payout Ratio (FAD per share basis) |

108.4 | % | 180.7 | % | 108.1 | % | 100.6 | % | 100.6 | % | ||||||||||

| (1) | The ratio of earnings to fixed charges is computed by dividing earnings by fixed charges. For this purpose, earnings consist of income from continuing operations attributable to the controlling interests plus fixed charges, less capitalized interest. Fixed charges consist of interest expense, including amortized costs of debt issuance, plus interest costs capitalized. |

| (2) | Debt service coverage ratio is computed by dividing Adjusted EBITDA (see page 7) by interest expense and principal amortization. |

| (3) | “Total Debt” balance includes a $22.5 million mortgage notes payable secured by The Ridges, a property we sold on December 21, 2010, that has been reclassified to “Other liabilities related to properties sold or held for sale.” We repaid this mortgage note payable without penalty on July 12, 2010. |

11

| First Quarter(1) | ||||||||

| NOI Growth |

Rental Rate Growth |

|||||||

| Cash Basis: |

||||||||

| Multifamily |

14.2 | % | 3.3 | % | ||||

| Office Buildings |

1.2 | % | 2.7 | % | ||||

| Medical Office Buildings |

-1.2 | % | 3.4 | % | ||||

| Retail Centers |

-1.8 | % | 0.5 | % | ||||

| Industrial/Flex |

0.5 | % | 3.7 | % | ||||

| Overall Same-Store Portfolio |

2.1 | % | 2.7 | % | ||||

| First Quarter(1) | ||||||||

| NOI Growth |

Rental Rate Growth |

|||||||

| GAAP Basis: |

||||||||

| Multifamily |

13.7 | % | 3.3 | % | ||||

| Office Buildings |

-1.5 | % | 1.9 | % | ||||

| Medical Office Buildings |

-1.3 | % | 3.7 | % | ||||

| Retail Centers |

0.5 | % | 0.9 | % | ||||

| Industrial/Flex |

-0.8 | % | 2.8 | % | ||||

| Overall Same-Store Portfolio |

1.1 | % | 2.4 | % | ||||

| 1 | Non same-store properties were: |

| Acquisitions: | Office - 1140 Connecticut Avenue, 1227 25th Street and Quantico Corporate Center; |

Retail - Gateway Overlook;

Medical Office - Lansdowne Medical Office Building.

Held for sale and sold properties: Office - Dulles Station, Phase I, Parklawn Plaza, Saratoga Building, Lexington Building and the Ridges;

Industrial - Crossroads Distribution Center, Charleston Business Center, Ammendale I&II and Amvax.

12

| Three Months Ended March 31, | ||||||||||||

| 2011 | 2010 | % Change | ||||||||||

| Cash Basis: |

||||||||||||

| Multifamily |

$ | 7,466 | $ | 6,540 | 14.2 | % | ||||||

| Office Buildings |

19,421 | 19,199 | 1.2 | % | ||||||||

| Medical Office Buildings |

7,309 | 7,398 | -1.2 | % | ||||||||

| Retail Centers |

7,132 | 7,263 | -1.8 | % | ||||||||

| Industrial/Flex |

5,848 | 5,818 | 0.5 | % | ||||||||

| $ | 47,176 | $ | 46,218 | 2.1 | % | |||||||

| GAAP Basis: |

||||||||||||

| Multifamily |

$ | 7,665 | $ | 6,739 | 13.7 | % | ||||||

| Office Buildings |

19,905 | 20,198 | -1.5 | % | ||||||||

| Medical Office Buildings |

7,505 | 7,603 | -1.3 | % | ||||||||

| Retail Centers |

7,255 | 7,217 | 0.5 | % | ||||||||

| Industrial/Flex |

5,720 | 5,764 | -0.8 | % | ||||||||

| $ | 48,050 | $ | 47,521 | 1.1 | % | |||||||

13

| Three Months Ended March 31, 2011 | ||||||||||||||||||||||||||||

| Multifamily | Office | Medical Office | Retail | Industrial/Flex | Corporate and Other |

Total | ||||||||||||||||||||||

| Real estate rental revenue |

||||||||||||||||||||||||||||

| Same-store portfolio |

$ | 12,493 | $ | 30,073 | $ | 11,023 | $ | 10,225 | $ | 8,281 | $ | — | $ | 72,095 | ||||||||||||||

| Non same-store - acquired and in development 1 |

— | 4,030 | 108 | 1,922 | — | — | 6,060 | |||||||||||||||||||||

| Total |

12,493 | 34,103 | 11,131 | 12,147 | 8,281 | — | 78,155 | |||||||||||||||||||||

| Real estate expenses |

||||||||||||||||||||||||||||

| Same-store portfolio |

4,828 | 10,168 | 3,518 | 2,970 | 2,561 | — | 24,045 | |||||||||||||||||||||

| Non same-store - acquired and in development 1 |

— | 1,320 | 151 | 572 | — | — | 2,043 | |||||||||||||||||||||

| Total |

4,828 | 11,488 | 3,669 | 3,542 | 2,561 | — | 26,088 | |||||||||||||||||||||

| Net Operating Income (NOI) |

||||||||||||||||||||||||||||

| Same-store portfolio |

7,665 | 19,905 | 7,505 | 7,255 | 5,720 | — | 48,050 | |||||||||||||||||||||

| Non same-store - acquired and in development 1 |

— | 2,710 | (43 | ) | 1,350 | — | — | 4,017 | ||||||||||||||||||||

| Total |

$ | 7,665 | $ | 22,615 | $ | 7,462 | $ | 8,605 | $ | 5,720 | $ | — | $ | 52,067 | ||||||||||||||

| Same-store portfolio NOI GAAP basis (from above) |

$ | 7,665 | $ | 19,905 | $ | 7,505 | $ | 7,255 | $ | 5,720 | $ | — | $ | 48,050 | ||||||||||||||

| Straight-line revenue, net for same-store properties |

(8 | ) | (258 | ) | (113 | ) | (59 | ) | 176 | — | (262 | ) | ||||||||||||||||

| FAS 141 Min Rent |

(191 | ) | (361 | ) | (93 | ) | (79 | ) | (54 | ) | — | (778 | ) | |||||||||||||||

| Amortization of lease intangibles for same-store properties |

— | 135 | 10 | 15 | 6 | — | 166 | |||||||||||||||||||||

| Same-store portfolio NOI, cash basis |

$ | 7,466 | $ | 19,421 | $ | 7,309 | $ | 7,132 | $ | 5,848 | $ | — | $ | 47,176 | ||||||||||||||

| Reconciliation of NOI to Net Income |

||||||||||||||||||||||||||||

| Total NOI |

$ | 7,665 | $ | 22,615 | $ | 7,462 | $ | 8,605 | $ | 5,720 | $ | — | $ | 52,067 | ||||||||||||||

| Other income |

— | — | — | — | — | 306 | 306 | |||||||||||||||||||||

| Acquisition costs |

— | — | — | — | — | (1,649 | ) | (1,649 | ) | |||||||||||||||||||

| Interest expense |

(1,686 | ) | (2,230 | ) | (1,313 | ) | (306 | ) | (234 | ) | (11,357 | ) | (17,126 | ) | ||||||||||||||

| Depreciation and amortization |

(3,134 | ) | (12,288 | ) | (3,827 | ) | (2,662 | ) | (2,528 | ) | (311 | ) | (24,750 | ) | ||||||||||||||

| General and administrative |

— | — | — | — | — | (3,702 | ) | (3,702 | ) | |||||||||||||||||||

| Discontinued operations2 |

— | (458 | ) | — | — | — | — | (458 | ) | |||||||||||||||||||

| Net Income |

2,845 | 7,639 | 2,322 | 5,637 | 2,958 | (16,713 | ) | 4,688 | ||||||||||||||||||||

| Net income attributable to noncontrolling interests |

— | — | — | — | — | (23 | ) | (23 | ) | |||||||||||||||||||

| Net income attributable to the controlling interests |

$ | 2,845 | $ | 7,639 | $ | 2,322 | $ | 5,637 | $ | 2,958 | $ | (16,736 | ) | $ | 4,665 | |||||||||||||

| 1 | Non same-store acquired and in development properties: |

| Acquisitions: | Office - 1140 Connecticut Avenue, 1227 25th Street and Quantico Corporate Center; | |

| Retail - Gateway Overlook; | ||

| Medical Office - Lansdowne Medical Office Building. |

| 2 | Discontinued operations include a held for sale property: Office - Dulles Station, Phase I. |

14

| Three Months Ended March 31, 2010 | ||||||||||||||||||||||||||||

| Multifamily | Office | Medical Office | Retail | Industrial/Flex | Corporate and Other |

Total | ||||||||||||||||||||||

| Real estate rental revenue |

||||||||||||||||||||||||||||

| Same-store portfolio |

$ | 11,842 | $ | 30,973 | $ | 11,415 | $ | 10,501 | $ | 8,820 | $ | — | $ | 73,551 | ||||||||||||||

| Non same-store - acquired and in development 1 |

— | — | — | — | — | — | — | |||||||||||||||||||||

| Total |

11,842 | 30,973 | 11,415 | 10,501 | 8,820 | — | 73,551 | |||||||||||||||||||||

| Real estate expenses |

||||||||||||||||||||||||||||

| Same-store portfolio |

5,103 | 10,775 | 3,812 | 3,284 | 3,056 | — | 26,030 | |||||||||||||||||||||

| Non same-store - acquired and in development 1 |

— | — | 139 | — | — | — | 139 | |||||||||||||||||||||

| Total |

5,103 | 10,775 | 3,951 | 3,284 | 3,056 | — | 26,169 | |||||||||||||||||||||

| Net operating income (NOI) |

||||||||||||||||||||||||||||

| Same-store portfolio |

6,739 | 20,198 | 7,603 | 7,217 | 5,764 | — | 47,521 | |||||||||||||||||||||

| Non same-store - acquired and in development 1 |

— | — | (139 | ) | — | — | — | (139 | ) | |||||||||||||||||||

| Total |

$ | 6,739 | $ | 20,198 | $ | 7,464 | $ | 7,217 | $ | 5,764 | $ | — | $ | 47,382 | ||||||||||||||

| Same-store portfolio NOI GAAP basis (from above) |

$ | 6,739 | $ | 20,198 | $ | 7,603 | $ | 7,217 | $ | 5,764 | $ | — | $ | 47,521 | ||||||||||||||

| Straight-line revenue, net for same-store properties |

(8 | ) | (529 | ) | (109 | ) | 122 | 90 | — | (434 | ) | |||||||||||||||||

| FAS 141 Min Rent |

(191 | ) | (528 | ) | (99 | ) | (84 | ) | (41 | ) | — | (943 | ) | |||||||||||||||

| Amortization of lease intangibles for same-store properties |

— | 58 | 3 | 8 | 5 | — | 74 | |||||||||||||||||||||

| Same-store portfolio NOI, cash basis |

$ | 6,540 | $ | 19,199 | $ | 7,398 | $ | 7,263 | $ | 5,818 | $ | — | $ | 46,218 | ||||||||||||||

| Reconciliation of NOI to net income |

||||||||||||||||||||||||||||

| Total NOI |

$ | 6,739 | $ | 20,198 | $ | 7,464 | $ | 7,217 | $ | 5,764 | $ | — | $ | 47,382 | ||||||||||||||

| Other income (expense) |

— | — | — | — | — | 289 | 289 | |||||||||||||||||||||

| Acquisition costs |

— | — | — | — | — | (55 | ) | (55 | ) | |||||||||||||||||||

| Interest expense |

(1,693 | ) | (2,337 | ) | (1,342 | ) | (320 | ) | (238 | ) | (10,908 | ) | (16,838 | ) | ||||||||||||||

| Depreciation and amortization |

(3,442 | ) | (10,568 | ) | (3,861 | ) | (1,795 | ) | (2,601 | ) | (320 | ) | (22,587 | ) | ||||||||||||||

| General and administrative |

— | — | — | — | — | (3,783 | ) | (3,783 | ) | |||||||||||||||||||

| Discontinued operations2 |

— | 364 | — | — | 535 | — | 899 | |||||||||||||||||||||

| Gain (loss) on extinguishment of debt |

— | — | — | — | — | (42 | ) | (42 | ) | |||||||||||||||||||

| Net income |

1,604 | 7,657 | 2,261 | 5,102 | 3,460 | (14,819 | ) | 5,265 | ||||||||||||||||||||

| Net income attributable to noncontrolling interests |

— | — | — | — | — | (49 | ) | (49 | ) | |||||||||||||||||||

| Net income attributable to the controlling interests |

$ | 1,604 | $ | 7,657 | $ | 2,261 | $ | 5,102 | $ | 3,460 | $ | (14,868 | ) | $ | 5,216 | |||||||||||||

| 1 | Non same-store acquired and in development properties: |

Acquisitions: Medical Office - Lansdowne Medical Office Building.

| 2 | Discontinued operations include held for sale and sold properties: Office - Parklawn Plaza, Saratoga Building, Lexington Building, the Ridges and Dulles Station, Phase I; |

Industrial - Charleston Business Center, Ammendale I&II and Amvax.

15

| 1 | Excludes discontinued operations: Dulles Station, Phase I. |

16

| Physical Occupancy - Same-Store Properties (1) | ||||||||||||||||||||

| Sector |

March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

|||||||||||||||

| Multifamily |

95.3 | % | 95.7 | % | 96.4 | % | 95.0 | % | 94.4 | % | ||||||||||

| Office Buildings |

88.3 | % | 88.4 | % | 88.4 | % | 89.9 | % | 90.2 | % | ||||||||||

| Medical Office Buildings |

93.5 | % | 93.8 | % | 93.3 | % | 94.1 | % | 93.8 | % | ||||||||||

| Retail Centers |

92.2 | % | 92.5 | % | 92.2 | % | 94.4 | % | 93.2 | % | ||||||||||

| Industrial / Flex |

80.2 | % | 78.6 | % | 79.7 | % | 79.3 | % | 83.0 | % | ||||||||||

| Overall Portfolio |

88.7 | % | 88.5 | % | 88.8 | % | 89.4 | % | 90.0 | % | ||||||||||

| Physical Occupancy - All Properties | ||||||||||||||||||||

| Sector |

March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

|||||||||||||||

| Multifamily |

95.3 | % | 95.7 | % | 96.4 | % | 95.0 | % | 94.4 | % | ||||||||||

| Office Buildings |

88.9 | % | 89.4 | % | 89.6 | % | 90.8 | % | 89.7 | % | ||||||||||

| Medical Office Buildings |

88.3 | % | 88.5 | % | 87.8 | % | 88.0 | % | 87.7 | % | ||||||||||

| Retail Centers |

92.0 | % | 92.1 | % | 92.2 | % | 94.4 | % | 93.2 | % | ||||||||||

| Industrial / Flex |

80.2 | % | 78.6 | % | 79.5 | % | 79.2 | % | 82.8 | % | ||||||||||

| Overall Portfolio |

88.4 | % | 88.3 | % | 88.4 | % | 88.9 | % | 89.0 | % | ||||||||||

| 1 | Non same-store properties were: |

| Acquisitions: | Office - 1140 Connecticut Avenue, 1227 25th Street and Quantico Corporate Center; | |

| Retail - Gateway Overlook; | ||

| Medical Office - Lansdowne Medical Office Building. |

| Sold and held for sale properties: | Office - Dulles Station, Phase I, Parklawn Plaza, Saratoga Building, Lexington Building and the Ridges; | |

| Industrial - Charleston Business Center, Ammendale I&II and Amvax. |

17

| Economic Occupancy - Same-Store Properties(1) | ||||||||||||||||||||

| Sector |

March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

|||||||||||||||

| Multifamily |

94.8 | % | 95.5 | % | 95.6 | % | 93.7 | % | 94.1 | % | ||||||||||

| Office Buildings |

89.4 | % | 88.8 | % | 88.9 | % | 91.3 | % | 92.0 | % | ||||||||||

| Medical Office Buildings |

94.2 | % | 94.5 | % | 94.8 | % | 95.7 | % | 95.9 | % | ||||||||||

| Retail Centers |

92.3 | % | 91.4 | % | 91.7 | % | 92.0 | % | 91.3 | % | ||||||||||

| Industrial / Flex |

81.4 | % | 81.6 | % | 83.1 | % | 82.4 | % | 85.9 | % | ||||||||||

| Overall Portfolio |

90.5 | % | 90.4 | % | 90.6 | % | 91.4 | % | 92.1 | % | ||||||||||

| Economic Occupancy - All Properties | ||||||||||||||||||||

| Sector |

March 31, 2011 |

December 31, 2010 |

September 30, 2010 |

June 30, 2010 |

March 31, 2010 |

|||||||||||||||

| Multifamily |

94.8 | % | 95.5 | % | 95.6 | % | 93.7 | % | 94.1 | % | ||||||||||

| Office Buildings |

90.7 | % | 90.0 | % | 90.1 | % | 91.3 | % | 91.6 | % | ||||||||||

| Medical Office Buildings |

90.5 | % | 90.3 | % | 90.3 | % | 91.0 | % | 91.1 | % | ||||||||||

| Retail Centers |

92.0 | % | 91.4 | % | 91.7 | % | 92.0 | % | 91.3 | % | ||||||||||

| Industrial / Flex |

81.4 | % | 81.9 | % | 83.0 | % | 82.8 | % | 85.7 | % | ||||||||||

| Overall Portfolio |

90.5 | % | 90.2 | % | 90.3 | % | 90.7 | % | 91.2 | % | ||||||||||

| 1 | Non same-store properties were: |

| Acquisitions: | Office - 1140 Connecticut Avenue, 1227 25th Street and Quantico Corporate Center; | |

| Retail - Gateway Overlook; | ||

| Medical Office - Lansdowne Medical Office Building. |

| Sold and held for sale properties: | Office - Dulles Station, Phase I, Parklawn Plaza, Saratoga Building, Lexington Building and the Ridges; | |

| Industrial - Charleston Business Center, Ammendale I&II and Amvax. |

18

| 1st Quarter 2011 | 4th Quarter 2010 | 3rd Quarter 2010 | 2nd Quarter 2010 | 1st Quarter 2010 | ||||||||||||||||||||||||||||||||||||

| Gross Leasing Square Footage |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

138,083 | 125,367 | 103,428 | 149,296 | 198,868 | |||||||||||||||||||||||||||||||||||

| Medical Office Buildings |

43,355 | 7,136 | 70,426 | 92,041 | 23,951 | |||||||||||||||||||||||||||||||||||

| Retail Centers |

78,669 | 97,055 | 52,501 | 113,878 | 5,805 | |||||||||||||||||||||||||||||||||||

| Industrial Centers |

156,134 | 152,563 | 103,800 | 285,628 | 45,616 | |||||||||||||||||||||||||||||||||||

| Total |

416,241 | 382,121 | 330,155 | 640,843 | 274,240 | |||||||||||||||||||||||||||||||||||

| Weighted Average Term (yrs) |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

3.6 | 5.4 | 3.8 | 6.7 | 5.6 | |||||||||||||||||||||||||||||||||||

| Medical Office Buildings |

6.0 | 3.9 | 5.3 | 5.4 | 9.0 | |||||||||||||||||||||||||||||||||||

| Retail Centers |

4.5 | 8.4 | 6.2 | 5.7 | 5.0 | |||||||||||||||||||||||||||||||||||

| Industrial Centers |

4.9 | 4.5 | 3.4 | 4.9 | 3.3 | |||||||||||||||||||||||||||||||||||

| Total |

4.5 | 5.8 | 4.4 | 5.5 | 5.5 | |||||||||||||||||||||||||||||||||||

| Rental Rate Increases: | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | GAAP | CASH | ||||||||||||||||||||||||||||||

| Rate on expiring leases |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

$ | 31.41 | $ | 32.26 | $ | 28.72 | $ | 30.30 | $ | 27.65 | $ | 28.50 | $ | 29.71 | $ | 30.35 | $ | 26.85 | $ | 27.91 | ||||||||||||||||||||

| Medical Office Buildings |

32.91 | 34.90 | 35.53 | 37.37 | 30.40 | 32.62 | 32.29 | 34.30 | 32.18 | 33.92 | ||||||||||||||||||||||||||||||

| Retail Centers |

15.64 | 15.91 | 15.50 | 16.13 | 26.01 | 26.71 | 16.10 | 16.38 | 25.83 | 27.42 | ||||||||||||||||||||||||||||||

| Industrial Centers |

10.28 | 10.54 | 10.82 | 11.45 | 10.36 | 10.73 | 10.05 | 10.46 | 9.29 | 9.93 | ||||||||||||||||||||||||||||||

| Total |

$ | 20.66 | $ | 21.30 | $ | 18.34 | $ | 19.31 | $ | 22.54 | $ | 23.51 | $ | 18.90 | $ | 19.57 | $ | 24.37 | $ | 25.43 | ||||||||||||||||||||

| Rate on new leases |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

$ | 30.97 | $ | 29.91 | $ | 31.39 | $ | 29.41 | $ | 28.29 | $ | 27.09 | $ | 31.49 | $ | 28.84 | $ | 30.97 | $ | 28.86 | ||||||||||||||||||||

| Medical Office Buildings |

37.24 | 34.76 | 37.41 | 36.05 | 34.94 | 32.78 | 39.30 | 36.44 | 40.38 | 35.27 | ||||||||||||||||||||||||||||||

| Retail Centers |

16.48 | 16.30 | 21.79 | 20.41 | 30.57 | 29.36 | 16.30 | 16.03 | 31.31 | 29.97 | ||||||||||||||||||||||||||||||

| Industrial Centers |

8.70 | 8.22 | 9.80 | 9.19 | 9.23 | 8.92 | 13.62 | 13.50 | 9.47 | 9.20 | ||||||||||||||||||||||||||||||

| Total |

$ | 20.53 | $ | 19.71 | $ | 20.44 | $ | 19.18 | $ | 24.08 | $ | 22.95 | $ | 21.95 | $ | 20.82 | $ | 28.22 | $ | 26.18 | ||||||||||||||||||||

| Percentage Increase |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

-1.40 | % | -7.30 | % | 9.31 | % | -2.93 | % | 2.34 | % | -4.93 | % | 6.00 | % | -5.00 | % | 15.34 | % | 3.43 | % | ||||||||||||||||||||

| Medical Office Buildings |

13.14 | % | -0.41 | % | 5.28 | % | -3.53 | % | 14.95 | % | 0.51 | % | 21.73 | % | 6.26 | % | 25.48 | % | 3.98 | % | ||||||||||||||||||||

| Retail Centers |

5.39 | % | 2.42 | % | 40.57 | % | 26.50 | % | 17.51 | % | 9.91 | % | 1.24 | % | -2.15 | % | 21.21 | % | 9.30 | % | ||||||||||||||||||||

| Industrial Centers |

-15.33 | % | -21.99 | % | -9.41 | % | -19.73 | % | -10.91 | % | -16.89 | % | 35.57 | % | 29.11 | % | 1.90 | % | -7.38 | % | ||||||||||||||||||||

| Total |

-0.62 | % | -7.48 | % | 11.47 | % | -0.69 | % | 6.84 | % | -2.36 | % | 16.15 | % | 6.39 | % | 15.79 | % | 2.92 | % | ||||||||||||||||||||

| Total Dollars | Dollars per Square Foot |

Total Dollars | Dollars per Square Foot |

Total Dollars | Dollars per Square Foot |

Total Dollars | Dollars per Square Foot |

Total Dollars | Dollars per Square Foot |

|||||||||||||||||||||||||||||||

| Tenant Improvements |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

$ | 535,267 | $ | 3.88 | $ | 2,461,273 | $ | 19.63 | $ | 1,296,481 | $ | 12.54 | $ | 4,512,498 | $ | 30.23 | $ | 3,473,255 | $ | 17.47 | ||||||||||||||||||||

| Medical Office Buildings |

384,336 | 8.86 | 86,938 | 12.18 | 859,930 | 12.21 | 1,610,073 | 17.49 | 595,969 | 24.88 | ||||||||||||||||||||||||||||||

| Retail Centers |

— | — | 288,110 | 2.97 | 22,500 | 0.43 | 587,775 | 5.16 | — | — | ||||||||||||||||||||||||||||||

| Industrial Centers |

367,313 | 2.35 | 166,689 | 1.09 | 102,112 | 0.98 | 513,745 | 1.80 | 64,327 | 1.41 | ||||||||||||||||||||||||||||||

| Subtotal |

$ | 1,286,916 | $ | 3.09 | $ | 3,003,010 | $ | 7.86 | $ | 2,281,023 | $ | 6.91 | $ | 7,224,091 | $ | 11.27 | $ | 4,133,551 | $ | 15.07 | ||||||||||||||||||||

| Leasing Costs |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

$ | 575,877 | $ | 4.17 | $ | 1,478,644 | $ | 11.79 | $ | 781,922 | $ | 7.56 | $ | 3,316,582 | $ | 22.21 | $ | 2,064,933 | $ | 10.38 | ||||||||||||||||||||

| Medical Office Buildings |

530,574 | 12.24 | 21,703 | 3.04 | 362,586 | 5.15 | 959,827 | 10.43 | 400,746 | 16.73 | ||||||||||||||||||||||||||||||

| Retail Centers |

84,464 | 1.07 | 423,791 | 4.37 | 120,850 | 2.30 | 195,025 | 1.71 | 7,808 | 1.35 | ||||||||||||||||||||||||||||||

| Industrial Centers |

289,927 | 1.86 | 371,620 | 2.44 | 222,983 | 2.15 | 921,870 | 3.23 | 97,391 | 2.14 | ||||||||||||||||||||||||||||||

| Subtotal |

$ | 1,480,842 | $ | 3.56 | $ | 2,295,758 | $ | 6.01 | $ | 1,488,341 | $ | 4.51 | $ | 5,393,304 | $ | 8.42 | $ | 2,570,878 | $ | 9.37 | ||||||||||||||||||||

| Tenant Improvements and Leasing Costs |

||||||||||||||||||||||||||||||||||||||||

| Office Buildings |

$ | 1,111,144 | $ | 8.05 | $ | 3,939,917 | $ | 31.43 | $ | 2,078,403 | $ | 20.10 | $ | 7,829,080 | $ | 52.44 | $ | 5,538,188 | $ | 27.85 | ||||||||||||||||||||

| Medical Office Buildings |

914,910 | 21.10 | 108,641 | 15.22 | 1,222,516 | 17.36 | 2,569,900 | 27.92 | 996,715 | 41.61 | ||||||||||||||||||||||||||||||

| Retail Centers |

84,464 | 1.07 | 711,901 | 7.34 | 143,350 | 2.73 | 782,800 | 6.87 | 7,808 | 1.35 | ||||||||||||||||||||||||||||||

| Industrial Centers |

657,240 | 4.21 | 538,309 | 3.53 | 325,095 | 3.13 | 1,435,615 | 5.03 | 161,718 | 3.55 | ||||||||||||||||||||||||||||||

| Total |

$ | 2,767,758 | $ | 6.65 | $ | 5,298,768 | $ | 13.87 | $ | 3,769,364 | $ | 11.42 | $ | 12,617,395 | $ | 19.69 | $ | 6,704,429 | $ | 24.45 | ||||||||||||||||||||

19

| Tenant |

Number of Buildings |

Weighted Average Remaining Lease Term in Months |

Percentage of Aggregate Portfolio Annualized Rent |

Aggregate Rentable Square Feet |

Percentage of Aggregate Occupied Square Feet |

|||||||||||||||

| World Bank |

1 | 51 | 4.76 | % | 210,354 | 2.30 | % | |||||||||||||

| Advisory Board Company |

1 | 98 | 2.71 | % | 180,925 | 1.98 | % | |||||||||||||

| General Services Administration |

10 | 41 | 2.55 | % | 304,866 | 3.33 | % | |||||||||||||

| INOVA Health System |

7 | 46 | 1.93 | % | 114,208 | 1.25 | % | |||||||||||||

| Patton Boggs LLP |

1 | 73 | 1.85 | % | 110,566 | 1.21 | % | |||||||||||||

| Sunrise Assisted Living, Inc. |

1 | 30 | 1.55 | % | 115,289 | 1.26 | % | |||||||||||||

| General Dynamics |

2 | 39 | 1.13 | % | 88,359 | 0.97 | % | |||||||||||||

| Children’s Hospital |

3 | 87 | 1.02 | % | 69,230 | 0.76 | % | |||||||||||||

| Epstein, Becker & Green, P.C. |

1 | 69 | 1.01 | % | 53,427 | 0.58 | % | |||||||||||||

| George Washington University |

2 | 57 | 1.01 | % | 69,775 | 0.76 | % | |||||||||||||

| Total/Weighted Average |

57 | 19.52 | % | 1,316,999 | 14.40 | % | ||||||||||||||

20

| Industry Classification (NAICS) |

Annualized Base Rental Revenue |

Percentage of Aggregate Annualized Rent |

Aggregate Rentable Square Feet |

Percentage of Aggregate Square Feet |

||||||||||||

| Professional, Scientific, and Technical Services |

$ | 64,634,564 | 28.64 | % | 2,334,664 | 25.31 | % | |||||||||

| Ambulatory Health Care Services |

39,598,256 | 17.55 | % | 1,177,947 | 12.77 | % | ||||||||||

| Credit Intermediation and Related Activities |

16,350,482 | 7.25 | % | 346,835 | 3.76 | % | ||||||||||

| Executive, Legislative, and Other General Government Support |

12,087,719 | 5.36 | % | 497,711 | 5.40 | % | ||||||||||

| Religious, Grantmaking, Civic, Professional, and Similar Organizations |

7,214,051 | 3.20 | % | 213,242 | 2.31 | % | ||||||||||

| Educational Services |

6,657,455 | 2.95 | % | 235,582 | 2.55 | % | ||||||||||

| Food Services and Drinking Places |

6,484,791 | 2.87 | % | 227,780 | 2.47 | % | ||||||||||

| Administrative and Support Services |

4,809,907 | 2.13 | % | 300,603 | 3.26 | % | ||||||||||

| Food and Beverage Stores |

4,715,705 | 2.09 | % | 270,049 | 2.93 | % | ||||||||||

| Nursing and Residential Care Facilities |

4,579,437 | 2.03 | % | 145,010 | 1.57 | % | ||||||||||

| Furniture and Home Furnishings Stores |

3,734,700 | 1.66 | % | 226,672 | 2.46 | % | ||||||||||

| Miscellaneous Store Retailers |

3,570,456 | 1.58 | % | 211,591 | 2.29 | % | ||||||||||

| Broadcasting (except Internet) |

3,087,610 | 1.37 | % | 89,238 | 0.97 | % | ||||||||||

| Sporting Goods, Hobby, Book, and Music Stores |

2,823,940 | 1.25 | % | 168,347 | 1.83 | % | ||||||||||

| Merchant Wholesalers, Durable Goods |

2,817,679 | 1.25 | % | 269,261 | 2.92 | % | ||||||||||

| Clothing and Clothing Accessories Stores |

2,721,962 | 1.21 | % | 139,874 | 1.52 | % | ||||||||||

| Personal and Laundry Services |

2,642,852 | 1.17 | % | 94,507 | 1.03 | % | ||||||||||

| Health and Personal Care Stores |

2,642,501 | 1.17 | % | 76,169 | 0.83 | % | ||||||||||

| Electronics and Appliance Stores |

2,200,192 | 0.98 | % | 145,807 | 1.58 | % | ||||||||||

| Hospitals |

2,091,876 | 0.93 | % | 70,909 | 0.77 | % | ||||||||||

| Merchant Wholesalers, Nondurable Goods |

1,845,854 | 0.82 | % | 195,893 | 2.12 | % | ||||||||||

| General Merchandise Stores |

1,672,527 | 0.74 | % | 209,452 | 2.27 | % | ||||||||||

| Real Estate |

1,651,096 | 0.73 | % | 58,225 | 0.63 | % | ||||||||||

| Construction of Buildings |

1,564,751 | 0.69 | % | 98,526 | 1.07 | % | ||||||||||

| Amusement, Gambling, and Recreation Industries |

1,525,390 | 0.68 | % | 106,464 | 1.15 | % | ||||||||||

| Miscellaneous Manufacturing |

1,479,761 | 0.66 | % | 149,604 | 1.62 | % | ||||||||||

| Transportation Equipment Manufacturing |

1,370,355 | 0.61 | % | 48,559 | 0.53 | % | ||||||||||

| Computer and Electronic Product Manufacturing |

1,188,679 | 0.53 | % | 47,770 | 0.52 | % | ||||||||||

| Printing and Related Support Activities |

1,115,972 | 0.50 | % | 48,775 | 0.53 | % | ||||||||||

| Insurance Carriers and Related Activities |

1,063,469 | 0.47 | % | 40,018 | 0.43 | % | ||||||||||

| Specialty Trade Contractors |

992,928 | 0.44 | % | 108,522 | 1.18 | % | ||||||||||

| Other |

14,708,201 | 6.49 | % | 869,771 | 9.42 | % | ||||||||||

| Total |

$ | 225,645,118 | 100.00 | % | 9,223,377 | 100.00 | % | |||||||||

21

| Year |

Number of Leases |

Rentable Square Feet |

Percent of Rentable Square Feet |

Annualized Rent * |

Average Rental Rate |

Percent of Annualized Rent * |

||||||||||||||||||

| Office: |

||||||||||||||||||||||||

| 2011 |

107 | 400,734 | 10.46 | % | $ | 13,020,527 | $ | 32.49 | 9.52 | % | ||||||||||||||

| 2012 |

92 | 454,621 | 11.87 | % | 13,981,747 | 30.75 | 10.22 | % | ||||||||||||||||

| 2013 |

91 | 499,336 | 13.04 | % | 16,100,551 | 32.24 | 11.77 | % | ||||||||||||||||

| 2014 |

79 | 800,672 | 20.90 | % | 26,488,446 | 33.08 | 19.36 | % | ||||||||||||||||

| 2015 |

66 | 457,971 | 11.96 | % | 19,240,517 | 42.01 | 14.06 | % | ||||||||||||||||

| 2016 and thereafter |

147 | 1,216,986 | 31.77 | % | 47,993,369 | 39.44 | 35.07 | % | ||||||||||||||||

| 582 | 3,830,320 | 100.00 | % | $ | 136,825,157 | $ | 35.72 | 100.00 | % | |||||||||||||||

| Medical Office: |

||||||||||||||||||||||||

| 2011 |

59 | 120,812 | 10.53 | % | $ | 3,999,943 | $ | 33.11 | 8.98 | % | ||||||||||||||

| 2012 |

47 | 170,163 | 14.83 | % | 6,235,374 | 36.64 | 14.01 | % | ||||||||||||||||

| 2013 |

57 | 165,436 | 14.42 | % | 5,873,842 | 35.51 | 13.19 | % | ||||||||||||||||

| 2014 |

37 | 115,148 | 10.04 | % | 4,483,834 | 38.94 | 10.07 | % | ||||||||||||||||

| 2015 |

29 | 103,741 | 9.04 | % | 3,983,696 | 38.40 | 8.95 | % | ||||||||||||||||

| 2016 and thereafter |

109 | 471,870 | 41.14 | % | 19,946,817 | 42.27 | 44.80 | % | ||||||||||||||||

| 338 | 1,147,170 | 100.00 | % | $ | 44,523,506 | $ | 38.81 | 100.00 | % | |||||||||||||||

| Retail: |

||||||||||||||||||||||||

| 2011 |

40 | 95,727 | 5.04 | % | $ | 2,092,227 | $ | 21.86 | 5.14 | % | ||||||||||||||

| 2012 |

43 | 143,468 | 7.55 | % | 3,369,854 | 23.49 | 8.28 | % | ||||||||||||||||

| 2013 |

38 | 293,901 | 15.47 | % | 4,414,170 | 15.02 | 10.85 | % | ||||||||||||||||

| 2014 |

23 | 98,527 | 5.19 | % | 2,328,885 | 23.64 | 5.72 | % | ||||||||||||||||

| 2015 |

33 | 303,296 | 15.97 | % | 5,863,164 | 19.33 | 14.41 | % | ||||||||||||||||

| 2016 and thereafter |

99 | 964,504 | 50.78 | % | 22,624,842 | 23.46 | 55.60 | % | ||||||||||||||||

| 276 | 1,899,423 | 100.00 | % | $ | 40,693,142 | $ | 21.42 | 100.00 | % | |||||||||||||||

| Industrial/Flex: |

||||||||||||||||||||||||

| 2011 |

33 | 258,953 | 10.91 | % | $ | 2,816,231 | $ | 10.88 | 9.79 | % | ||||||||||||||

| 2012 |

43 | 506,160 | 21.33 | % | 5,626,800 | 11.12 | 19.57 | % | ||||||||||||||||

| 2013 |

39 | 428,815 | 18.07 | % | 4,844,659 | 11.30 | 16.85 | % | ||||||||||||||||

| 2014 |

26 | 469,289 | 19.78 | % | 5,949,345 | 12.68 | 20.69 | % | ||||||||||||||||

| 2015 |

29 | 375,910 | 15.84 | % | 5,646,366 | 15.02 | 19.64 | % | ||||||||||||||||

| 2016 and thereafter |

27 | 333,686 | 14.07 | % | 3,872,438 | 11.61 | 13.46 | % | ||||||||||||||||

| 197 | 2,372,813 | 100.00 | % | $ | 28,755,839 | $ | 12.12 | 100.00 | % | |||||||||||||||

| Total: |

||||||||||||||||||||||||

| 2011 |

239 | 876,226 | 9.47 | % | $ | 21,928,928 | $ | 25.03 | 8.74 | % | ||||||||||||||

| 2012 |

225 | 1,274,412 | 13.78 | % | 29,213,775 | 22.92 | 11.65 | % | ||||||||||||||||

| 2013 |

225 | 1,387,488 | 15.00 | % | 31,233,222 | 22.51 | 12.45 | % | ||||||||||||||||

| 2014 |

165 | 1,483,636 | 16.04 | % | 39,250,510 | 26.46 | 15.65 | % | ||||||||||||||||

| 2015 |

157 | 1,240,918 | 13.42 | % | 34,733,743 | 27.99 | 13.85 | % | ||||||||||||||||

| 2016 and thereafter |

382 | 2,987,046 | 32.29 | % | 94,437,466 | 31.62 | 37.66 | % | ||||||||||||||||

| 1,393 | 9,249,726 | 100.00 | % | $ | 250,797,644 | $ | 27.11 | 100.00 | % | |||||||||||||||

| * | Annualized Rent is equal to the rental rate effective at lease expiration (cash basis) multiplied by 12. |

22

Acquisition Summary

| Acquisition Date |

Square Feet |

Leased Percentage at Acquisition |

March 31, 2011 Leased Percentage |

Investment | ||||||||||||||||

| 1140 Connecticut Avenue |

Washington, DC | January 11, 2011 | 184,000 | 99 | % | 99 | % | $ | 80,250 | |||||||||||

| 1227 25th Street |

Washington, DC | March 30, 2011 | 130,000 | 72 | % | 72 | % | 47,000 | ||||||||||||

| Total | 314,000 | $ | 127,250 | |||||||||||||||||

23

| PROPERTIES |

LOCATION |

YEAR ACQUIRED | YEAR CONSTRUCTED | NET RENTABLE SQUARE FEET* |

||||||||||

| Office Buildings | ||||||||||||||

| 1901 Pennsylvania Avenue |

Washington, DC | 1977 | 1960 | 97,000 | ||||||||||

| 51 Monroe Street |

Rockville, MD | 1979 | 1975 | 210,000 | ||||||||||

| 515 King Street |

Alexandria, VA | 1992 | 1966 | 76,000 | ||||||||||

| 6110 Executive Boulevard |

Rockville, MD | 1995 | 1971 | 198,000 | ||||||||||

| 1220 19th Street |

Washington, DC | 1995 | 1976 | 102,000 | ||||||||||

| 1600 Wilson Boulevard |

Arlington, VA | 1997 | 1973 | 166,000 | ||||||||||

| 7900 Westpark Drive |

McLean, VA | 1997 | 1972/1986/1999 | 523,000 | ||||||||||

| 600 Jefferson Plaza |

Rockville, MD | 1999 | 1985 | 112,000 | ||||||||||

| 1700 Research Boulevard |

Rockville, MD | 1999 | 1982 | 101,000 | ||||||||||

| Wayne Plaza |

Silver Spring, MD | 2000 | 1970 | 91,000 | ||||||||||

| Courthouse Square |

Alexandria, VA | 2000 | 1979 | 113,000 | ||||||||||

| One Central Plaza |

Rockville, MD | 2001 | 1974 | 267,000 | ||||||||||

| The Atrium Building |

Rockville, MD | 2002 | 1980 | 80,000 | ||||||||||

| 1776 G Street |

Washington, DC | 2003 | 1979 | 263,000 | ||||||||||

| Albemarle Point |

Chantilly, VA | 2005 | 2001 | 89,000 | ||||||||||

| 6565 Arlington Boulevard |

Falls Church, VA | 2006 | 1967/1998 | 140,000 | ||||||||||

| West Gude Drive |

Rockville, MD | 2006 | 1984/1986/1988 | 276,000 | ||||||||||

| The Crescent |

Gaithersburg, MD | 2006 | 1989 | 49,000 | ||||||||||

| Monument II |

Herndon, VA | 2007 | 2000 | 205,000 | ||||||||||

| Woodholme Center |

Pikesville, MD | 2007 | 1989 | 73,000 | ||||||||||

| 2000 M Street |

Washington, DC | 2007 | 1971 | 227,000 | ||||||||||

| Dulles Station |

Herndon, VA | 2005 | 2007 | 180,000 | ||||||||||

| 2445 M Street |

Washington, DC | 2008 | 1986 | 290,000 | ||||||||||

| 925 Corporate Drive |

Stafford, VA | 2010 | 2007 | 135,000 | ||||||||||

| 1000 Corporate Drive |

Stafford, VA | 2010 | 2009 | 136,000 | ||||||||||

| 1140 Connecticut Avenue |

Washington, DC | 2011 | 1966 | 184,000 | ||||||||||

| 1227 25th Street |

Washington, DC | 2011 | 1988 | 130,000 | ||||||||||

| Subtotal |

4,513,000 | |||||||||||||

| Medical Office Buildings |

||||||||||||||

| Woodburn Medical Park I |

Annandale, VA | 1998 | 1984 | 71,000 | ||||||||||

| Woodburn Medical Park II |

Annandale, VA | 1998 | 1988 | 96,000 | ||||||||||

| Prosperity Medical Center I |

Merrifield, VA | 2003 | 2000 | 92,000 | ||||||||||

| Prosperity Medical Center II |

Merrifield, VA | 2003 | 2001 | 88,000 | ||||||||||

| Prosperity Medical Center III |

Merrifield, VA | 2003 | 2002 | 75,000 | ||||||||||

| Shady Grove Medical Village II |

Rockville, MD | 2004 | 1999 | 66,000 | ||||||||||

| 8301 Arlington Boulevard |

Fairfax, VA | 2004 | 1965 | 49,000 | ||||||||||

| Alexandria Professional Center |

Alexandria, VA | 2006 | 1968 | 113,000 | ||||||||||

| 9707 Medical Center Drive |

Rockville, MD | 2006 | 1994 | 38,000 | ||||||||||

| 15001 Shady Grove Road |

Rockville, MD | 2006 | 1999 | 51,000 | ||||||||||

| Plumtree Medical Center |

Bel Air, MD | 2006 | 1991 | 33,000 | ||||||||||

| 15005 Shady Grove Road |

Rockville, MD | 2006 | 2002 | 52,000 | ||||||||||

| 2440 M Street |

Washington, DC | 2007 | 1986/2006 | 110,000 | ||||||||||

| Woodholme Medical Office Building |

Pikesville, MD | 2007 | 1996 | 125,000 | ||||||||||

| Ashburn Office Park |

Ashburn, VA | 2007 | 1998/2000/2002 | 75,000 | ||||||||||

| CentreMed I & II |

Centreville, VA | 2007 | 1998 | 52,000 | ||||||||||

| Sterling Medical Office Building |

Sterling, VA | 2008 | 1986/2000 | 36,000 | ||||||||||

| Lansdowne Medical Office Building |

Leesburg, VA | 2009 | 2009 | 87,000 | ||||||||||

| Subtotal |

1,309,000 | |||||||||||||

| Retail Centers |

||||||||||||||

| Takoma Park |

Takoma Park, MD | 1963 | 1962 | 51,000 | ||||||||||

| Westminster |

Westminster, MD | 1972 | 1969 | 151,000 | ||||||||||

| Concord Centre |

Springfield, VA | 1973 | 1960 | 76,000 | ||||||||||

| Wheaton Park |

Wheaton, MD | 1977 | 1967 | 72,000 | ||||||||||

| Bradlee |

Alexandria, VA | 1984 | 1955 | 168,000 | ||||||||||

| Chevy Chase Metro Plaza |

Washington, DC | 1985 | 1975 | 49,000 | ||||||||||

| Montgomery Village Center |

Gaithersburg, MD | 1992 | 1969 | 198,000 | ||||||||||

| Shoppes of Foxchase (1) |

Alexandria, VA | 1994 | 1960 | 134,000 | ||||||||||

| Frederick County Square |

Frederick, MD | 1995 | 1973 | 227,000 | ||||||||||

| 800 S. Washington Street |

Alexandria, VA | 1998/2003 | 1955/1959 | 44,000 | ||||||||||

| Centre at Hagerstown |

Hagerstown, MD | 2002 | 2000 | 332,000 | ||||||||||

| Frederick Crossing |

Frederick, MD | 2005 | 1999/2003 | 295,000 | ||||||||||

| Randolph Shopping Center |

Rockville, MD | 2006 | 1972 | 82,000 | ||||||||||

| Montrose Shopping Center |

Rockville, MD | 2006 | 1970 | 143,000 | ||||||||||

| Gateway Overlook |

Columbia, MD | 2010 | 2007 | 223,000 | ||||||||||

| Subtotal |

2,245,000 | |||||||||||||

| (1) | Development on approximately 60,000 square feet of the center was completed in December 2006. |

24

| PROPERTIES |

LOCATION |

YEAR ACQUIRED | YEAR CONSTRUCTED | NET RENTABLE SQUARE FEET* |

||||||||||

| Multifamily Buildings * / # units |

||||||||||||||

| 3801 Connecticut Avenue / 308 |

Washington, DC | 1963 | 1951 | 179,000 | ||||||||||

| Roosevelt Towers / 191 |

Falls Church, VA | 1965 | 1964 | 170,000 | ||||||||||

| Country Club Towers / 227 |

Arlington, VA | 1969 | 1965 | 163,000 | ||||||||||

| Park Adams / 200 |

Arlington, VA | 1969 | 1959 | 173,000 | ||||||||||

| Munson Hill Towers / 279 |

Falls Church, VA | 1970 | 1963 | 259,000 | ||||||||||

| The Ashby at McLean / 256 |

McLean, VA | 1996 | 1982 | 252,000 | ||||||||||

| Walker House Apartments / 212 |

Gaithersburg, MD | 1996 | 1971/2003(2) | 159,000 | ||||||||||

| Bethesda Hill Apartments / 195 |

Bethesda, MD | 1997 | 1986 | 226,000 | ||||||||||

| Bennett Park / 224 |

Arlington, VA | 2007 | 2007 | 214,000 | ||||||||||

| Clayborne / 74 |

Alexandria, VA | 2008 | 2008 | 60,000 | ||||||||||

| Kenmore Apartments / 374 |

Washington, DC | 2008 | 1948 | 270,000 | ||||||||||

| Subtotal (2,540 units) |

2,125,000 | |||||||||||||

| Industrial Distribution / Flex Properties |

||||||||||||||

| Fullerton Business Center |

Springfield, VA | 1985 | 1980 | 104,000 | ||||||||||

| The Alban Business Center |

Springfield, VA | 1996 | 1981/1982 | 87,000 | ||||||||||

| Pickett Industrial Park |

Alexandria, VA | 1997 | 1973 | 246,000 | ||||||||||

| Northern Virginia Industrial Park |

Lorton, VA | 1998 | 1968/1991 | 787,000 | ||||||||||

| 8900 Telegraph Road |

Lorton, VA | 1998 | 1985 | 32,000 | ||||||||||

| Dulles South IV |

Chantilly, VA | 1999 | 1988 | 83,000 | ||||||||||

| Sully Square |

Chantilly, VA | 1999 | 1986 | 95,000 | ||||||||||

| Fullerton Industrial Center |

Springfield, VA | 2003 | 1980 | 137,000 | ||||||||||

| 8880 Gorman Road |

Laurel, MD | 2004 | 2000 | 141,000 | ||||||||||

| Dulles Business Park Portfolio |

Chantilly, VA | 2004/2005 | 1999-2005 | 324,000 | ||||||||||

| Albemarle Point |

Chantilly, VA | 2005 | 2001/2003/2005 | 207,000 | ||||||||||

| Hampton Overlook |

Capital Heights, MD | 2006 | 1989 | 134,000 | ||||||||||

| Hampton South |

Capital Heights, MD | 2006 | 1989/2005 | 168,000 | ||||||||||

| 9950 Business Parkway |

Lanham, MD | 2006 | 2005 | 102,000 | ||||||||||

| 270 Technology Park |

Frederick, MD | 2007 | 1986-1987 | 157,000 | ||||||||||

| 6100 Columbia Park Road |

Landover, MD | 2008 | 1969 | 150,000 | ||||||||||

| Subtotal |

2,954,000 | |||||||||||||

| TOTAL |

13,146,000 | |||||||||||||

| * | Multifamily buildings are presented in gross square feet. |

| (2) | A 16 unit addition referred to as The Gardens at Walker House was completed in October 2003. |

25

Annualized base rent (ABR) is calculated as monthly base rent (cash basis) per the lease, as of the reporting period, multiplied by 12.

Debt to total market capitalization is total debt from the balance sheet divided by the sum of total debt from the balance sheet plus the market value of shares outstanding at the end of the period.

Adjusted EBITDA (a non-GAAP measure) is earnings attributable to the controlling interest before interest expense, taxes, depreciation, amortization, real estate impairment, gain on sale of real estate, gain/loss on extinguishment of debt and gain/loss from non-disposal activities.

Ratio of earnings to fixed charges is computed by dividing earnings attributable to the controlling interest by fixed charges. For this purpose, earnings consist of income from continuing operations (or net income if there are no discontinued operations) plus fixed charges, less capitalized interest. Fixed charges consist of interest expense (excluding interest expense from discontinued operations), including amortized costs of debt issuance, plus interest costs capitalized.

Debt service coverage ratio is computed by dividing earnings attributable to the controlling interest before interest expense, taxes, depreciation, amortization, real estate impairment, gain on sale of real estate, gain/loss on extinguishment of debt and gain/loss from non-disposal activities by interest expense (including interest expense from discontinued operations) and principal amortization.

Funds from operations (FFO) - The National Association of Real Estate Investment Trusts, Inc. (NAREIT) defines FFO (April, 2002 White Paper) as net income atributable to the controlling interest (computed in accordance with generally accepted accounting principles (GAAP)) excluding gains (or losses) from sales of property plus real estate depreciation and amortization. FFO is a non-GAAP measure.

Core Funds From Operations (Core FFO), a non-GAAP measure, is calculated by adjusting FFO for (1) gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties and (3) real estate impairments, as appropriate.

Funds Available for Distribution (FAD), a non-GAAP measure, is calculated by subtracting from FFO recurring expenditures, tenant improvements, leasing incentives and leasing costs, that are capitalized and amortized and are necessary to maintain our properties and revenue stream, non-cash gain/loss from extinguishment of debt and straight line rents, then adding non-real estate depreciation and amortization, real estate impairment, non-cash fair value interest expense, adding or subtracting amortization of lease intangibles and amortization of restricted share compensation, as appropriate.

Core Funds Available for Distribution (Core FAD), a non-GAAP measure, is calculated by adjusting FAD for (1) cash gains or losses on extinguishment of debt, (2) costs related to the acquisition of properties and (3) real estate impairments, as appropriate.

Recurring capital expenditures represents non-accretive building improvements and leasing costs required to maintain current revenues. Recurring capital expenditures do not include acquisition capital that was taken into consideration when underwriting the purchase of a building or which are incurred to bring a building up to “operating standard.”

Rent increases on renewals and rollovers are calculated as the difference, weighted by square feet, of the net ABR due the first month after a term commencement date and the net ABR due the last month prior to the termination date of the former tenant’s term.

Same-store portfolio properties include all properties that were owned for the entirety of the current and prior year reporting periods.

Same-store portfolio net operating income (NOI) growth is the change in the NOI of the same-store portfolio properties from the prior reporting period to the current reporting period.

Physical occupancy is calculated as occupied square footage as a percentage of total square footage as of the last day of that period.

Economic occupancy is calculated as actual real estate rental revenue recognized for the period indicated as a percentage of gross potential real estate rental revenue for that period. We determine gross potential real estate rental revenue by valuing occupied units or square footage at contract rates and vacant units or square footage at market rates for comparable properties. We do not consider percentage rents and expense reimbursements in computing economic occupancy percentages.

26