Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 4-28-2011 - KADANT INC | kaiform8k4282011.htm |

First Quarter 2011 Business Review

Jonathan W. Painter, President & CEO

Thomas M. O’Brien, Executive Vice President & CFO

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Forward-Looking Statements

The following constitutes a “Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This presentation contains forward-looking statements that involve a

number of risks and uncertainties, including forward-looking statements about our expected

future financial and operating performance, demand for our products, and industry and

economic outlook. Important factors that could cause actual results to differ materially from

those indicated by such statements are set forth under the heading “Risk Factors” in

Kadant’s annual report on Form 10-K for the period ended January 1, 2011. These include

risks and uncertainties relating to our dependence on the pulp and paper industry;

significance of sales and operation of manufacturing facilities in China; our ability to expand

capacity in China to meet demand; commodity and component price increases or

shortages; international sales and operations; competition; soundness of suppliers and

customers; our effective tax rate; future restructurings; soundness of financial institutions;

our debt obligations; restrictions in our credit agreement; litigation and warranty costs

related to our discontinued operation; our acquisition strategy; protection of patents and

proprietary rights; fluctuations in our share price; and anti-takeover provisions. We

undertake no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

Reform Act of 1995: This presentation contains forward-looking statements that involve a

number of risks and uncertainties, including forward-looking statements about our expected

future financial and operating performance, demand for our products, and industry and

economic outlook. Important factors that could cause actual results to differ materially from

those indicated by such statements are set forth under the heading “Risk Factors” in

Kadant’s annual report on Form 10-K for the period ended January 1, 2011. These include

risks and uncertainties relating to our dependence on the pulp and paper industry;

significance of sales and operation of manufacturing facilities in China; our ability to expand

capacity in China to meet demand; commodity and component price increases or

shortages; international sales and operations; competition; soundness of suppliers and

customers; our effective tax rate; future restructurings; soundness of financial institutions;

our debt obligations; restrictions in our credit agreement; litigation and warranty costs

related to our discontinued operation; our acquisition strategy; protection of patents and

proprietary rights; fluctuations in our share price; and anti-takeover provisions. We

undertake no obligation to publicly update any forward-looking statement, whether as a

result of new information, future events, or otherwise.

2

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance with generally accepted

accounting principles (GAAP), we use certain non-GAAP financial measures, including

increases or decreases in revenues excluding the effect of foreign currency translation,

adjusted operating income, earnings before interest, taxes, depreciation, and amortization

(EBITDA), and adjusted EBITDA.

accounting principles (GAAP), we use certain non-GAAP financial measures, including

increases or decreases in revenues excluding the effect of foreign currency translation,

adjusted operating income, earnings before interest, taxes, depreciation, and amortization

(EBITDA), and adjusted EBITDA.

A reconciliation of those numbers to the most directly comparable U.S. GAAP financial

measures is shown in our 2011 first quarter earnings press release issued April 27, 2011,

which is available in the Investors section of our website at www.kadant.com under the

heading Investors News.

measures is shown in our 2011 first quarter earnings press release issued April 27, 2011,

which is available in the Investors section of our website at www.kadant.com under the

heading Investors News.

3

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Financial Classifications

All geographic revenues and bookings data are attributed to regions based on selling

locations. For North America and China, this also approximates revenues and bookings

based on where the equipment is shipped to and installed. Our European geographic data,

however, includes revenues and bookings that may be shipped to and installed outside

Europe, including South America, Africa, the Middle East, and certain countries in Asia

(excluding China).

locations. For North America and China, this also approximates revenues and bookings

based on where the equipment is shipped to and installed. Our European geographic data,

however, includes revenues and bookings that may be shipped to and installed outside

Europe, including South America, Africa, the Middle East, and certain countries in Asia

(excluding China).

Prior period amounts for Parts and Consumables revenues and bookings have been

reclassified to include amounts from our “other” category within the Papermaking Systems

segment and Fiber-based products.

reclassified to include amounts from our “other” category within the Papermaking Systems

segment and Fiber-based products.

Our Accessories product line is now being reported as Doctoring.

4

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Business Review

Jonathan W. Painter

President & CEO

5

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Q1 2011 Financial Highlights: Revenues

• $71.7 million, up 17% compared to Q1 2010

• All product lines saw increases compared to Q1 2010

– Stock-Preparation up 31%

– Fluid-Handling up 13%

– Doctoring up 13%

– Water-Management up 5%

– Fiber-based Products up 14%

• All product lines except Stock-Preparation were up

sequentially over Q4 2010

sequentially over Q4 2010

6

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Financial Highlights

Q1 2011 Q1 2010

Revenues $71.7 million $61.1 million

Gross margins 47.6% 44.0%

Diluted EPS $0.47 $0.29

Adjusted EBITDA $10.2 million $6.0 million

Adjusted EBITDA/Sales 14% 10%

7

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

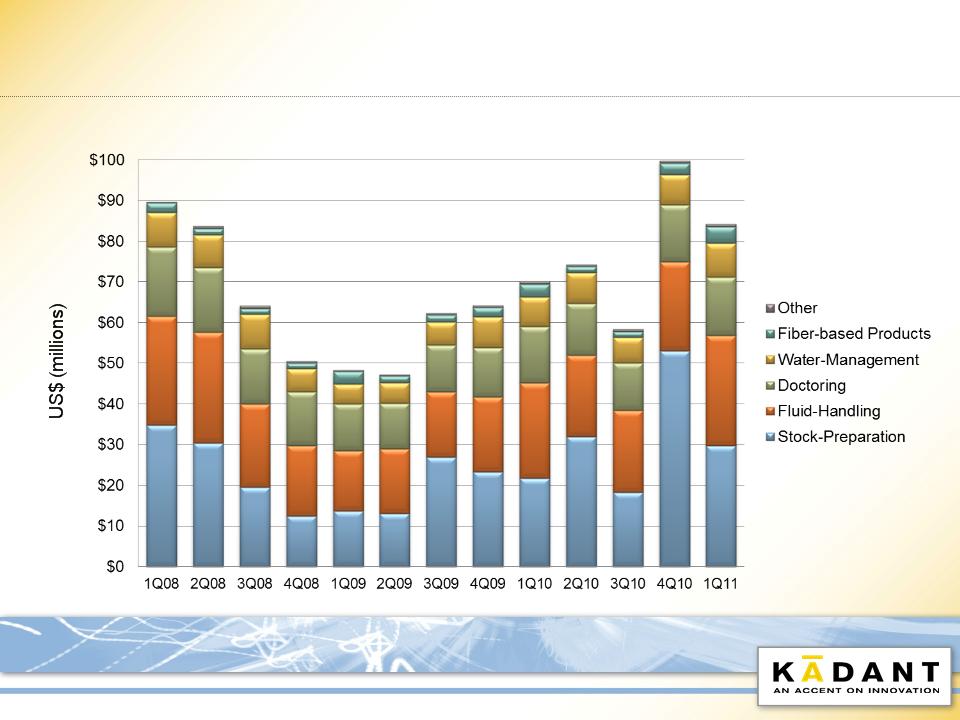

Q1 2011 Financial Highlights: Bookings

• $84.3 million, up 20% compared to Q1 2010

• Q1 booking performance

– Stock-Preparation up 37%

– Fluid-Handling up 15%

– Water-Management up 15%

– Doctoring up 4%

– Fiber-based Products up 25%

8

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

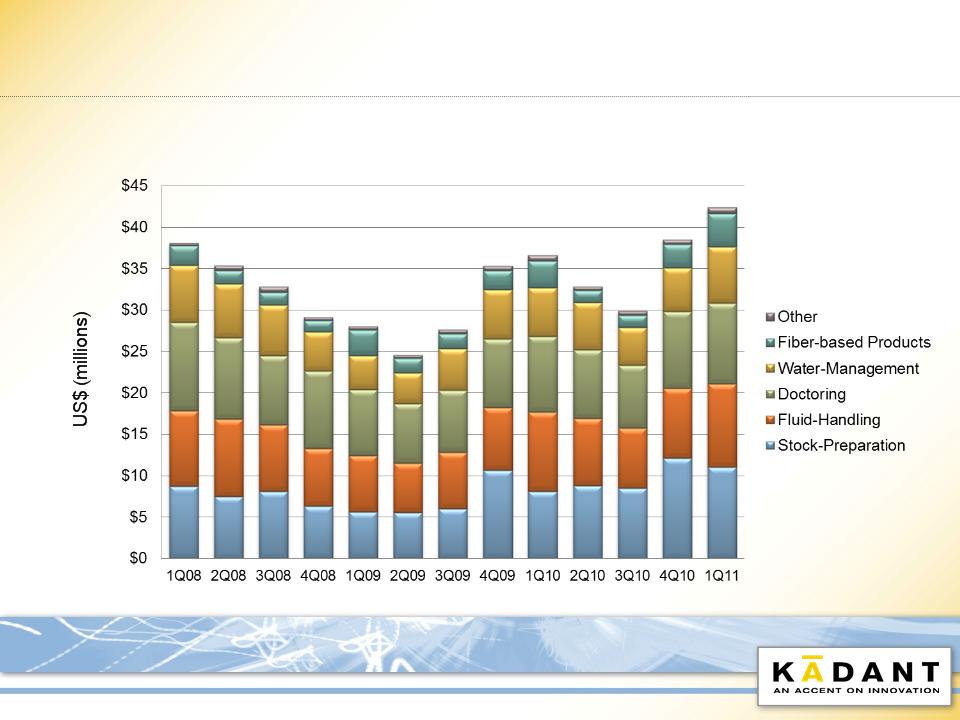

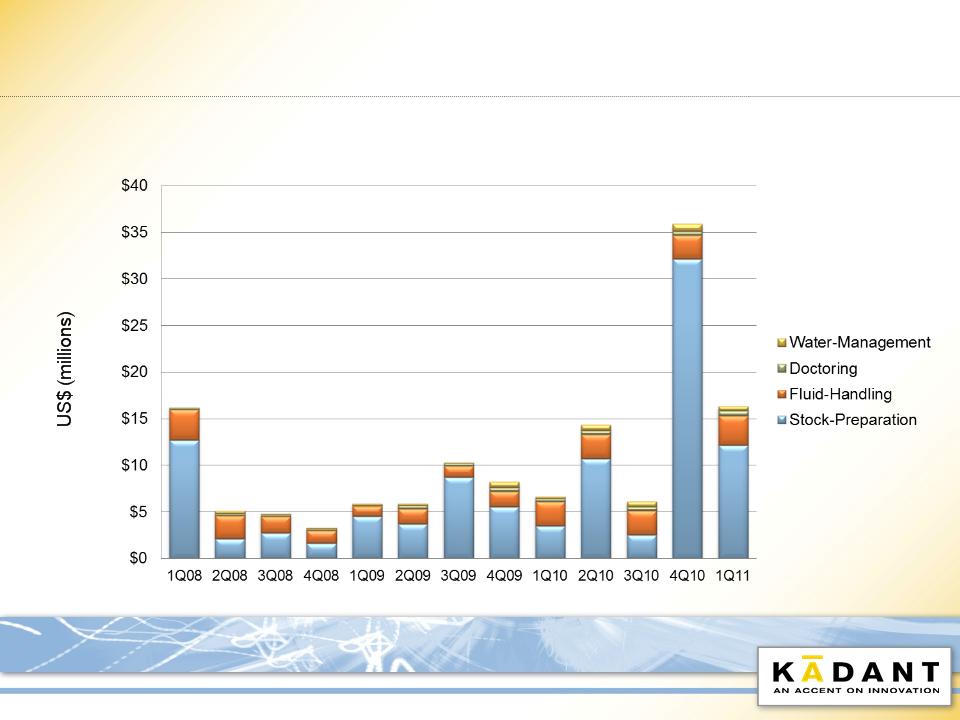

Quarterly Bookings Trend

9

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

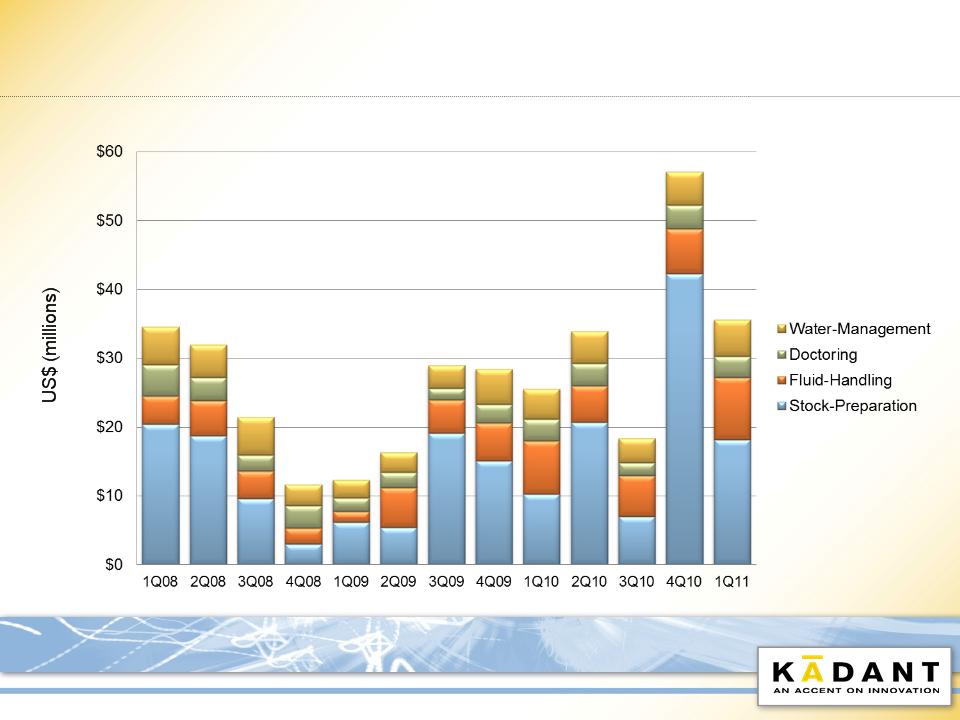

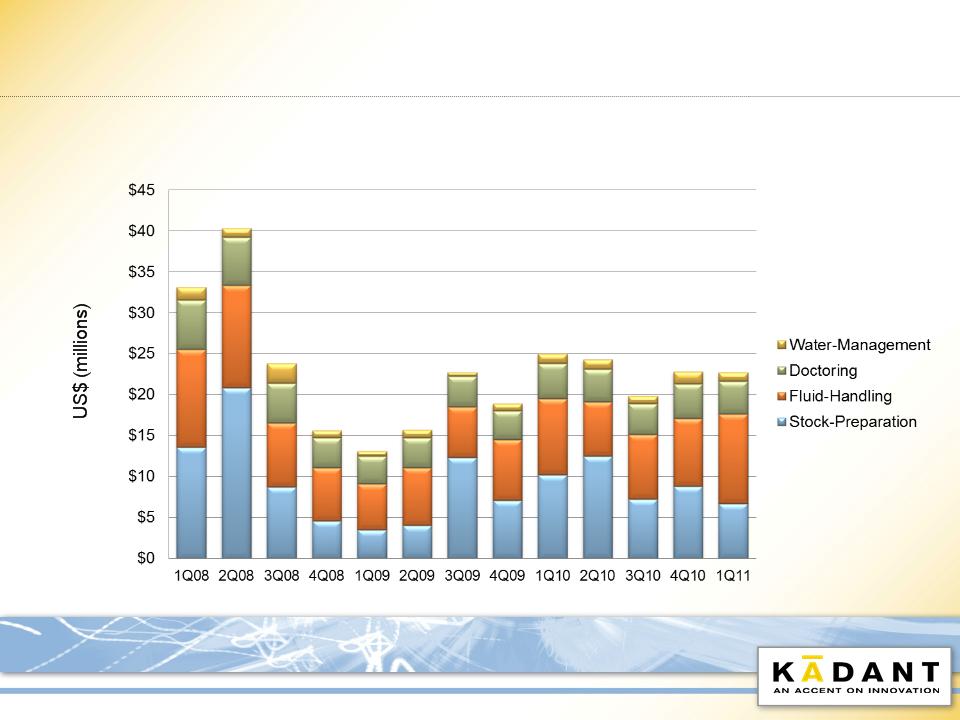

Capital Bookings

10

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

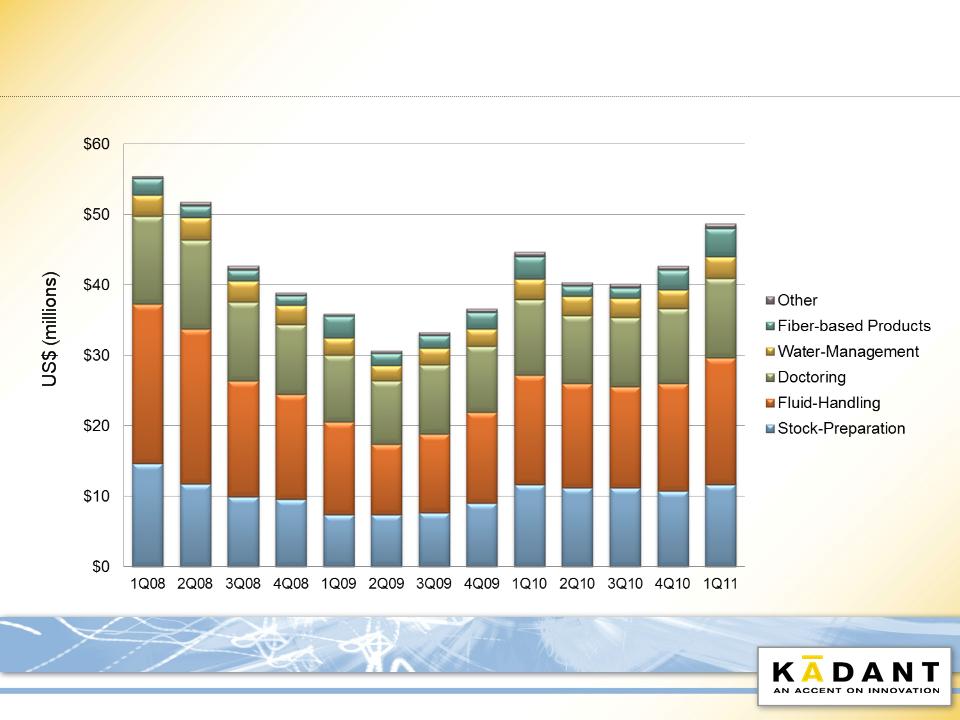

Parts and Consumables Bookings

11

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Market Review

12

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

North America Paper Industry Trends

• Q1 operating rates remained high in Containerboard

• Printing & Writing grades continue to be under pressure

• Rising energy, freight, and fiber cost

• Capital spending up from 2010, energy-driven projects

high on project list

high on project list

13

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

North America Bookings

$42.4 million, up 16% compared to Q1 2010

14

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Highlighted Q1 North America Bookings

• OCC system upgrade for

containerboard producer in the

Southeastern U.S.

containerboard producer in the

Southeastern U.S.

• Steam system rebuild for

packaging producer in Ontario,

Canada

packaging producer in Ontario,

Canada

• Multiple doctor systems sold to

a leading U.S. steel producer in

the Midwest

a leading U.S. steel producer in

the Midwest

15

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Europe Paper Industry Trends

• Containerboard inventories remained at historically low levels

• Pricing remains relatively high

• Demand for packaging grades still strong, but could weaken

if industrial production or exports soften

if industrial production or exports soften

• Operating rates expected to be negatively impacted by

proactive supply side management

proactive supply side management

16

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

European Bookings

$22.7 million, down 9% compared to Q1 2010

17

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Highlighted Q1 European Bookings

• Creping blade holders order for six

tissue machines from a Europe-

based OEM

tissue machines from a Europe-

based OEM

• Steam system and related drying

hardware for a corrugated board

machine in Finland

hardware for a corrugated board

machine in Finland

• Dryer system rebuild and drying

equipment for a corrugated board

mill in Ukraine

equipment for a corrugated board

mill in Ukraine

18

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

China Paper Industry Trends

• Price movements are mixed due to oversupply and input costs

• Demand has weakened, but outlook remains relatively strong

• Machine start-ups being “strategically” delayed by a few months

• Capacity additions continue to be announced

19

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

China Bookings

$16.3 million, up 146% compared to Q1 2010

20

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Highlighted Q1 China Bookings

• Eight stock prep systems orders from

China with a combined value of $11.5

million for OCC and approach flow

equipment

China with a combined value of $11.5

million for OCC and approach flow

equipment

• Drying and showering equipment for five

new paper machines from China-based

paper machine OEM

new paper machines from China-based

paper machine OEM

• 13 doctor systems for a boxboard

producer in Jiangsu Province in

eastern China

producer in Jiangsu Province in

eastern China

21

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Guidance for Continuing Operations

• FY 2011 revenues of $315 to $325 million

• FY 2011 GAAP diluted EPS of $2.15 to $2.25

• Q2 2011 revenues of $78 to $80 million

• Q2 2011 GAAP diluted EPS of $0.54 to $0.56

22

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Financial Review

Thomas M. O’Brien

Executive Vice President and

Chief Financial Officer

Chief Financial Officer

23

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

1Q11 Revenues Summary

• Consolidated Revenues = $71.7 million

– 17% increase vs. 1Q10

– Includes 2% favorable foreign currency translation

• Revenue Guidance = $71 to $73 million

– Higher Doctoring, Fiber-based Products and Fluid-Handling

revenues

revenues

– Lower Stock-Preparation and Water-Management revenues

24

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

1Q11 and 1Q10 Revenues by Product Line

* Percent change excluding the effect of currency translation

|

|

|

|

% Change

|

|

|

|

|

|

Qtr to

|

Excl.

|

|

($ Millions)

|

1Q11

|

1Q10

|

Qtr

|

FX*

|

|

Stock-Preparation

|

$ 23.3

|

$ 17.8

|

31%

|

30%

|

|

Doctoring

|

14.1

|

12.5

|

13%

|

11%

|

|

Water-Management

|

6.8

|

6.5

|

5%

|

3%

|

|

Other

|

0.7

|

0.6

|

8%

|

2%

|

|

Papermaking Systems Segment

|

67.5

|

57.5

|

18%

|

16%

|

|

Fiber-based Products

|

4.2

|

3.6

|

14%

|

14%

|

|

Total

|

$ 71.7

|

$ 61.1

|

17%

|

16%

|

25

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

1Q11 and 4Q10 Revenues by Product Line

* Percent change excluding the effect of currency translation

|

|

|

|

% Change

|

|

|

|

|

|

Qtr to

|

Excl.

|

|

($ Millions)

|

1Q11

|

4Q10

|

Qtr

|

FX*

|

|

Stock-Preparation

|

$ 23.3

|

$ 28.9

|

-19%

|

-19%

|

|

Doctoring

|

14.1

|

13.8

|

2%

|

1%

|

|

Water-Management

|

6.8

|

6.6

|

4%

|

3%

|

|

Other

|

0.7

|

0.6

|

16%

|

13%

|

|

Papermaking Systems Segment

|

67.5

|

71.5

|

-6%

|

-6%

|

|

Fiber-based Products

|

4.2

|

1.8

|

136%

|

136%

|

|

Total

|

$ 71.7

|

$ 73.3

|

-2%

|

-3%

|

26

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Revenues by Geography

(Papermaking Systems Segment Only)

(Papermaking Systems Segment Only)

* Percent change excluding the effect of currency translation

|

|

|

|

|

|

% Change

|

||

|

|

|

|

|

|

|

|

Excl.

|

|

|

|

|

|

|

|

|

FX*

|

|

($ Millions)

|

1Q11

|

4Q10

|

1Q10

|

|

4Q10

|

1Q10

|

1Q10

|

|

North America

|

$ 35.1

|

$ 33.4

|

$ 29.7

|

|

5%

|

18%

|

17%

|

|

Europe

|

21.2

|

23.0

|

21.0

|

|

-8%

|

1%

|

1%

|

|

China

|

8.8

|

12.3

|

5.4

|

|

-29%

|

64%

|

56%

|

|

|

|||||||

|

Australia

|

0.8

|

0.5

|

0.3

|

|

71%

|

122%

|

99%

|

|

Total

|

$ 67.5

|

$ 71.5

|

$ 57.5

|

|

-6%

|

18%

|

16%

|

27

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

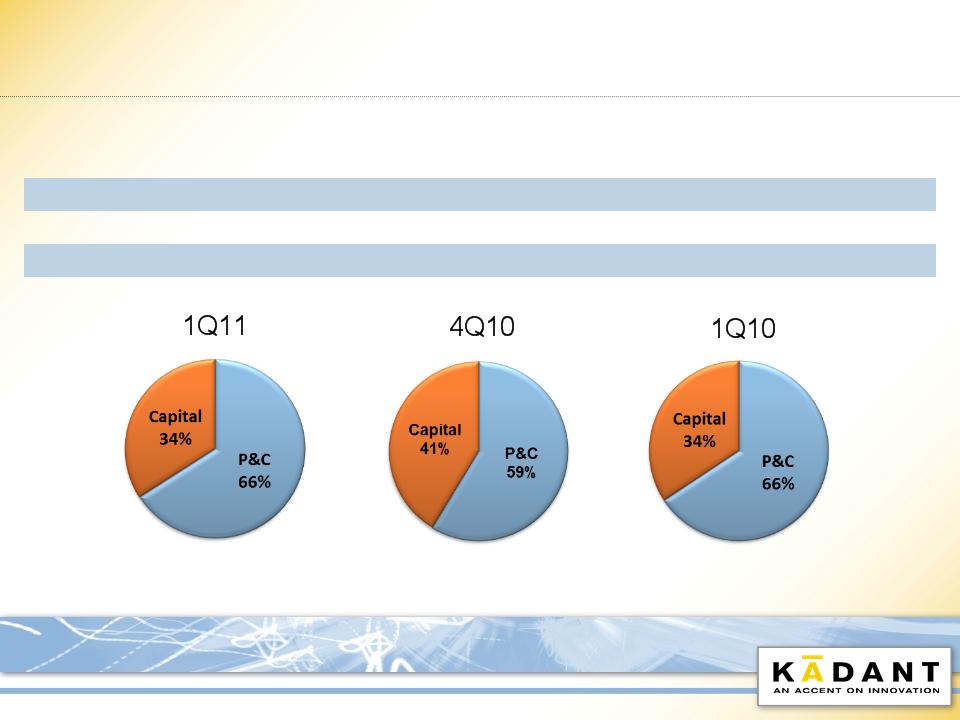

Revenue Detail

|

|

|

|

|

% Change

|

|

|

($ Millions)

|

1Q11

|

4Q10

|

1Q10

|

4Q10

|

1Q10

|

|

Parts & Consumables

|

$ 47.3

|

$ 43.0

|

$ 40.1

|

10%

|

18%

|

|

Capital

|

24.4

|

30.3

|

21.0

|

-19%

|

17%

|

|

Total

|

$ 71.7

|

$ 73.3

|

$ 61.1

|

-2%

|

17%

|

28

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

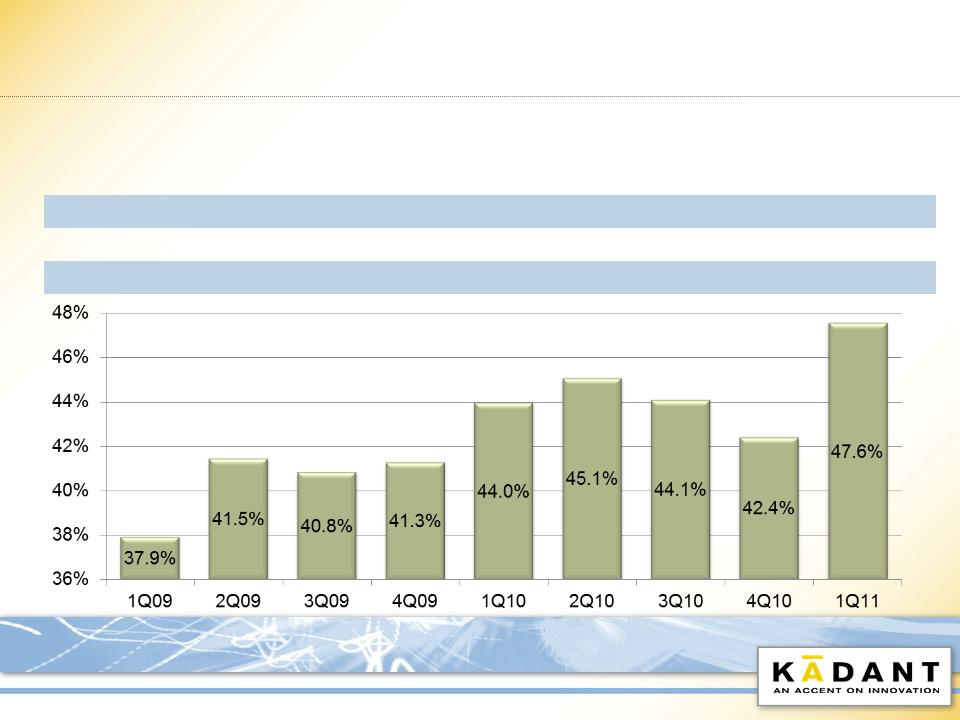

Gross Margin Percentages

|

|

|

|

|

|

% Point

|

|

|

|

|

|

|

|

Change

|

|

|

Quarter

|

1Q11

|

4Q10

|

1Q10

|

4Q10

|

1Q10

|

|

|

|

Papermaking Systems Segment

|

47.4

|

42.4

|

43.5

|

5.0%

|

3.9%

|

|

|

Fiber-based Products

|

50.8

|

41.8

|

50.7

|

9.0%

|

0.1%

|

|

|

Total

|

47.6

|

42.4

|

44.0

|

5.2%

|

3.6%

|

29

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

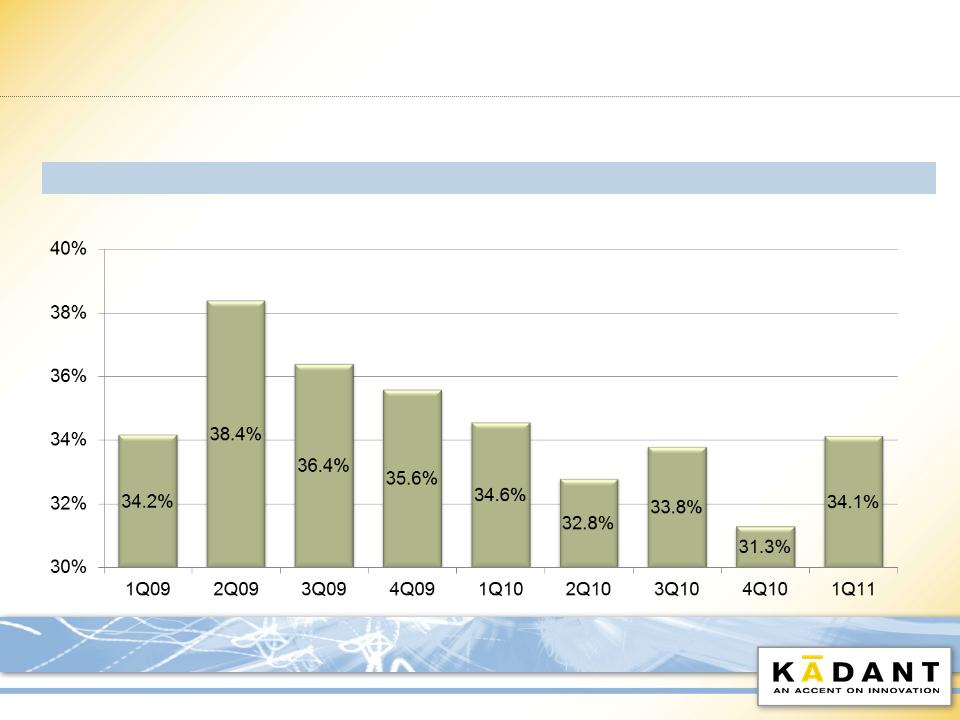

SG&A

|

Quarter

|

|

|

|

Change

|

||

|

|

($ Millions)

|

1Q11

|

4Q10

|

1Q10

|

4Q10

|

1Q10

|

|

|

SG&A

|

$ 24.5

|

$ 22.9

|

$ 21.1

|

$ 1.6

|

$ 3.4

|

|

|

% Revenues

|

34.1%

|

31.3%

|

34.6%

|

2.8%

|

-0.5%

|

30

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

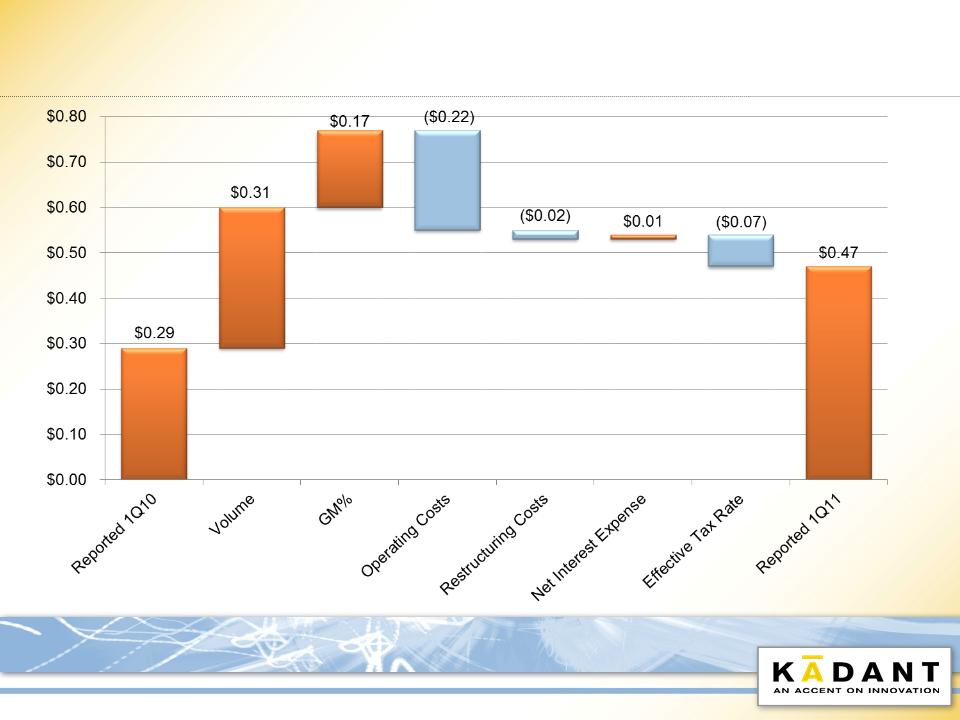

1Q11 to 1Q10 Diluted EPS

31

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Cash Flow

|

($ Millions)

|

1Q11

|

1Q10

|

|

Income from Continuing Operations

|

$ 5.9

|

$ 3.6

|

|

Depreciation and Amortization

|

1.9

|

1.6

|

|

Stock-Based Compensation

|

0.8

|

0.5

|

|

Other Items

|

0.5

|

(0.7)

|

|

Change in Current Assets &

|

|

|

|

Liabilities, Excluding Acquisitions

|

(8.7)

|

(5.6)

|

|

Cash from Continuing Operations

|

$ 0.4

|

$ (0.6)

|

32

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

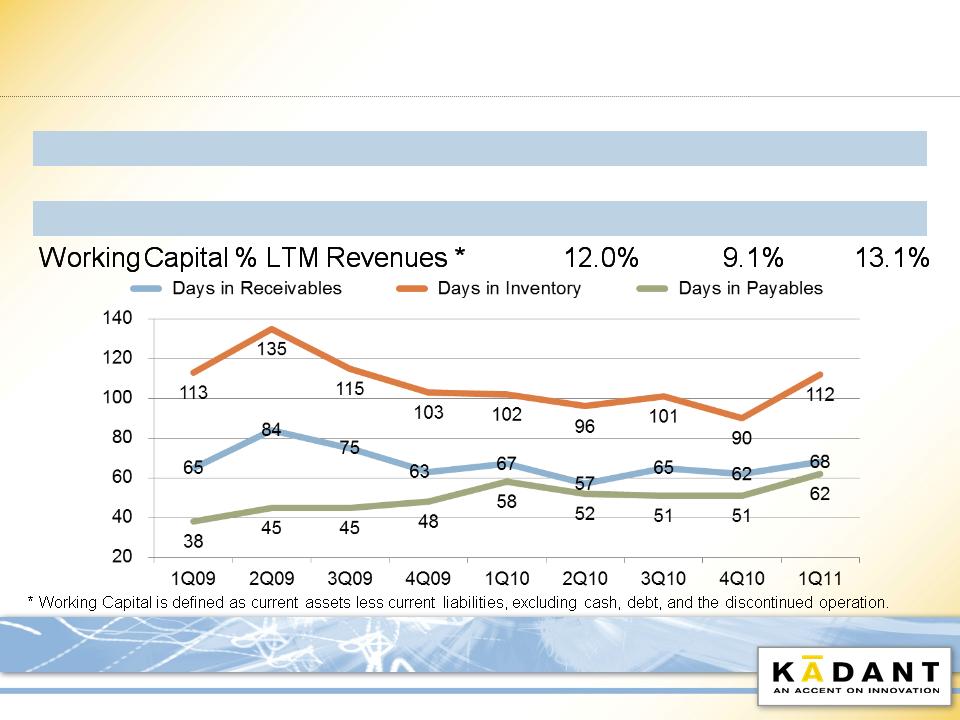

Key Working Capital Metrics

|

($ Millions)

|

1Q11

|

4Q10

|

1Q10

|

|

Days in Receivables

|

68

|

62

|

67

|

|

Days in Payables

|

62

|

51

|

58

|

|

Days in Inventory

|

112

|

90

|

102

|

33

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Cash and Debt

|

($ Millions)

|

1Q11

|

4Q10

|

1Q10

|

|

Cash *

|

$ 57.6

|

$ 61.8

|

$ 43.6

|

|

Debt

|

(17.6)

|

(22.7)

|

(23.1)

|

|

Net Cash

|

$ 40.0

|

$ 39.1

|

$ 20.5

|

34

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

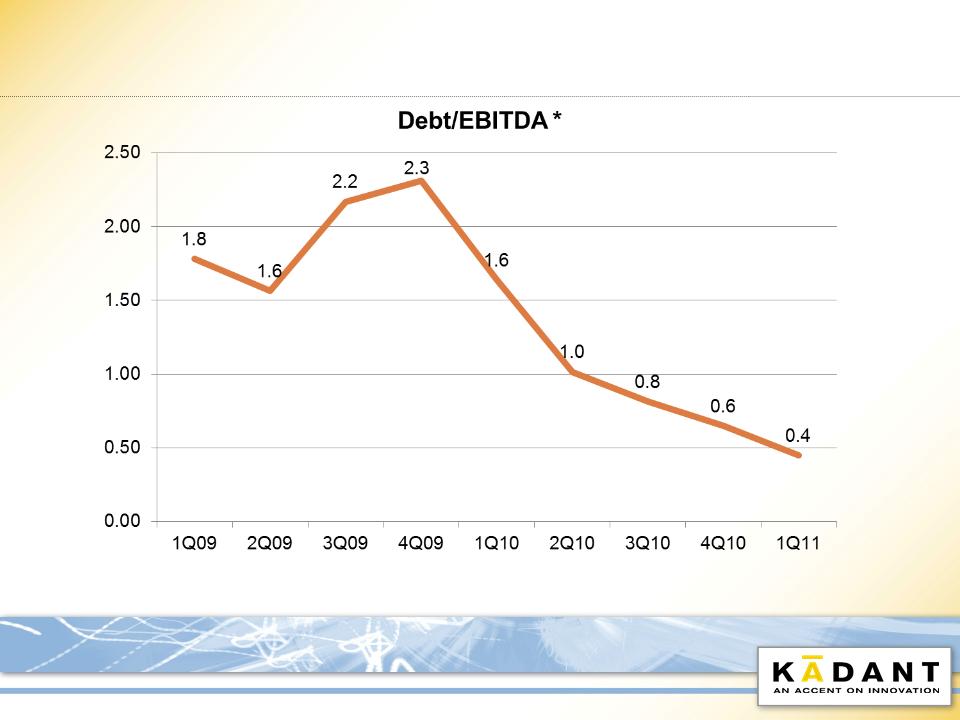

Leverage Ratio

* Calculated by adding or subtracting certain items, as defined in our Credit Facility, from Adjusted EBITDA reported externally.

35

© 2011 Kadant Inc. KAI 1Q11 Business Review - April 28, 2011

Questions & Answers

To ask a question, please call 866-804-6926 within the U.S. or

+1-857-350-1672 outside the U.S. and reference 83375884.

+1-857-350-1672 outside the U.S. and reference 83375884.

Please mute the audio on your computer.

36

First Quarter 2011 Business Review

Jonathan W. Painter, President & CEO

Thomas M. O’Brien, Executive Vice President & CFO

37