Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF INTERNATIONAL PAPER COMPANY - INTERNATIONAL PAPER CO /NEW/ | dex991.htm |

| 8-K - FORM 8-K - INTERNATIONAL PAPER CO /NEW/ | d8k.htm |

First Quarter

2011 Review

April 28, 2011

First Quarter

2011 Review

April 28, 2011

John V. Faraci

Chairman &

Chief Executive Officer

Tim S. Nicholls

Senior Vice President &

Chief Financial Officer

Exhibit 99.2 |

2

Forward-Looking Statements

Forward-Looking Statements

These slides and statements made during this presentation contain

forward-looking statements. These statements reflect management's

current views and are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed or

implied

in

these

statements.

Factors

which

could

cause

actual

results

to

differ

relate

to:

(i) increases in interest rates; (ii) industry conditions, including but not

limited to changes in the cost or availability of raw materials, energy and

transportation costs, competition we face, cyclicality and changes in

consumer preferences, demand and pricing for our products; (iii) global

economic conditions and political changes, including but not limited to the

impairment of financial institutions, changes in currency exchange rates, credit ratings

issued by recognized credit rating organizations, the amount of our future pension

funding obligation, changes in tax laws and pension and health care costs;

(iv) unanticipated expenditures

related

to

the

cost

of

compliance

with

existing

and

new

environmental

and

other governmental regulations and to actual or potential litigation; and (v)

whether we experience a material disruption at one of our manufacturing

facilities and risks inherent in conducting business through a joint

venture. We undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information, future events or

otherwise. These and other factors that could cause or contribute to actual results

differing materially

from

such

forward

looking

statements

are

discussed

in

greater

detail

in

the

company's Securities and Exchange Commission filings.

|

3

Statements Relating to Non-GAAP

Financial Measures

Statements Relating to Non-GAAP

Financial Measures

During the course of this presentation, certain

non-U.S. GAAP financial information will be

presented.

A reconciliation of those numbers to U.S. GAAP

financial measures is available on the

company’s

website

at

internationalpaper.com

under Investors. |

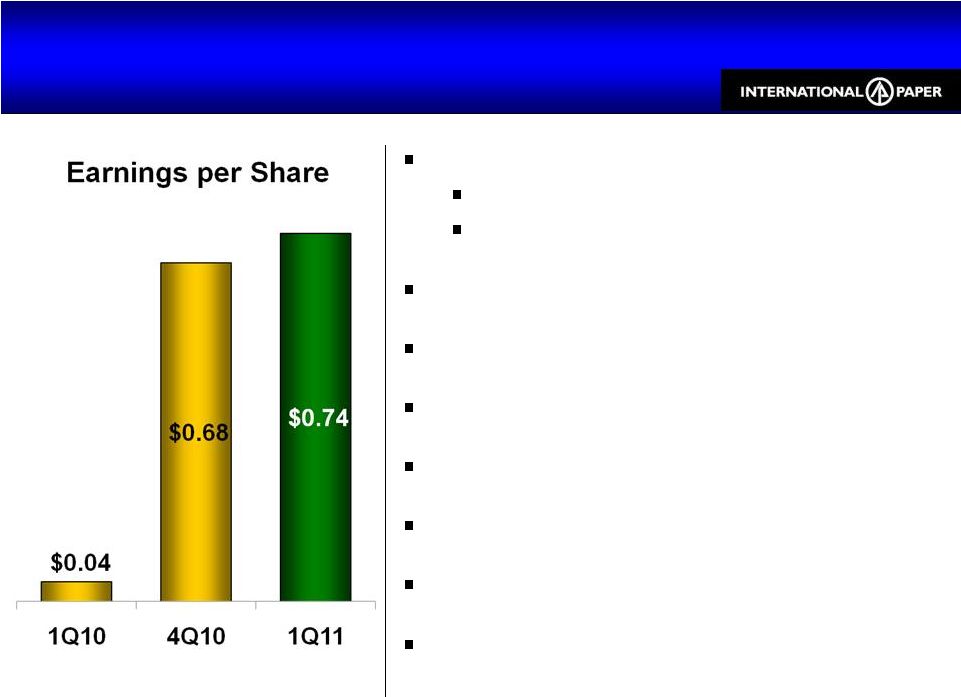

4

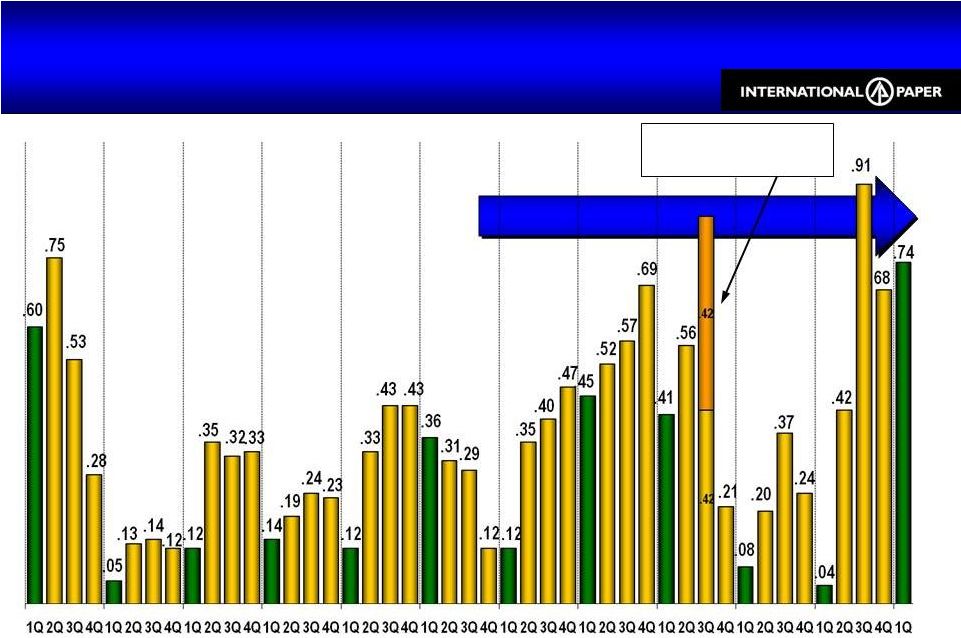

First Quarter 2011

Strong Global Operations & Free Cash Flow

First Quarter 2011

Strong Global Operations & Free Cash Flow

Robust Sales Growth

Continued Demand Recovery

Higher Exit Rates

Improving Margins

Strong Operations

Significant Input Cost Increases

Continued Solid Free Cash Flow

Increased Ilim JV Earnings

Announced 3

rd

Dividend Increase

Announced Strategic Entry into India

Earnings from continuing operations

before special items |

5

1Q11 Financial Snapshot

1Q11 Financial Snapshot

1Q10

4Q10

1Q11

Sales ($B)

$5.8

$6.5

$6.4

EBITDA

1

($MM)

$560

$872

$897

EBITDA Margin

10%

13%

14%

Free Cash Flow

2

($MM)

$39

$601

$419

Debt ($B)

$9.0

$8.7

$8.5

Cash Balance

3

($B)

$1.7

$2.1

$2.0

1

Earnings from continuing operations before special items

2

4Q10

excludes

cash

received

from

cellulosic

biofuel

credits

of

$17

MM;

See

slide

#27

for

a

reconciliation

of

4Q10

and

1Q11

free cash flows

3

1Q11

includes

impact

of

$0.1

B

cash

paid

into

escrow

arrangement

for

purchase

of

APPM

shares |

6

Earnings before special items

1Q11 vs. 4Q10 EPS

1Q11 vs. 4Q10 EPS

.68

.74

(.06)

(.08)

(.05)

.01

.13

.02

.04

.02

.03

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

4Q10

Volume

Price

Operations

& Costs

Maintenance

Outages

Input

Costs

Corporate

& Other

Interest

Tax

Ilim JV

1Q11 |

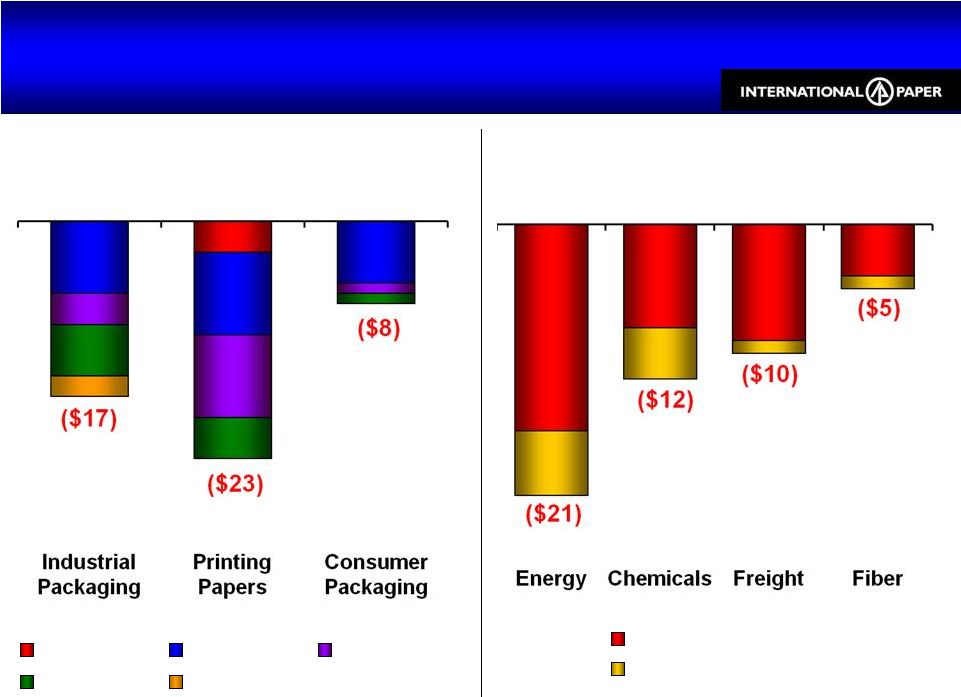

Global

Input Costs vs. 4Q10 $48 MM Unfavorable, or $0.08/Share

Global Input Costs vs. 4Q10

$48 MM Unfavorable, or $0.08/Share

By Business

By Input Type

7

Wood

Energy

Chemicals

Freight

OCC

Outside North America

North America |

8

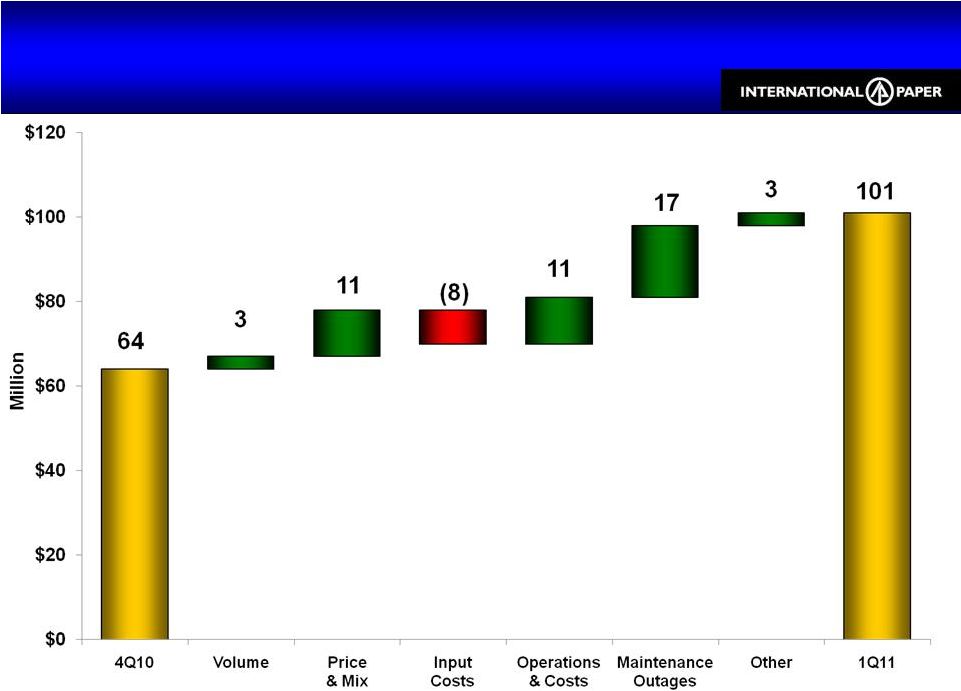

Industrial Packaging Earnings

1Q11 vs. 4Q10

Industrial Packaging Earnings

1Q11 vs. 4Q10

Earnings before special items

274

274

(14)

(17)

(9)

40

$0

$50

$100

$150

$200

$250

$300

$350

4Q10

Volume

Input

Costs

Operations

& Costs

Maintenance

Outages

1Q11 |

9

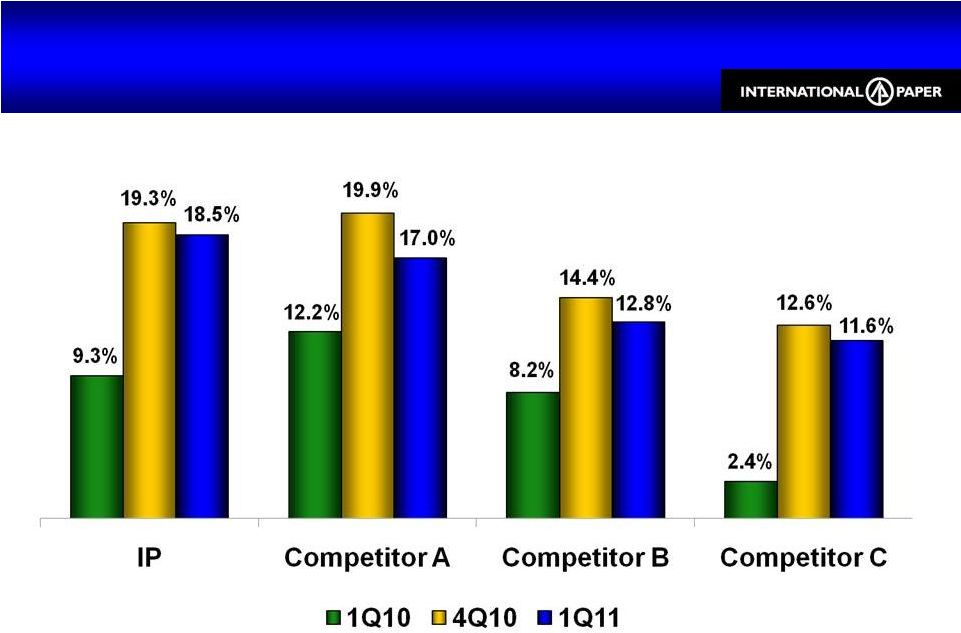

N.A. Industrial Packaging Relative EBITDA Margins

N.A. Industrial Packaging Relative EBITDA Margins

IP EBITDA margins based on North American Industrial Packaging operating profit

before special items. Competitor EBITDA margin estimates obtained from

public filings and IP analysis Excludes revenue from trade volumes

|

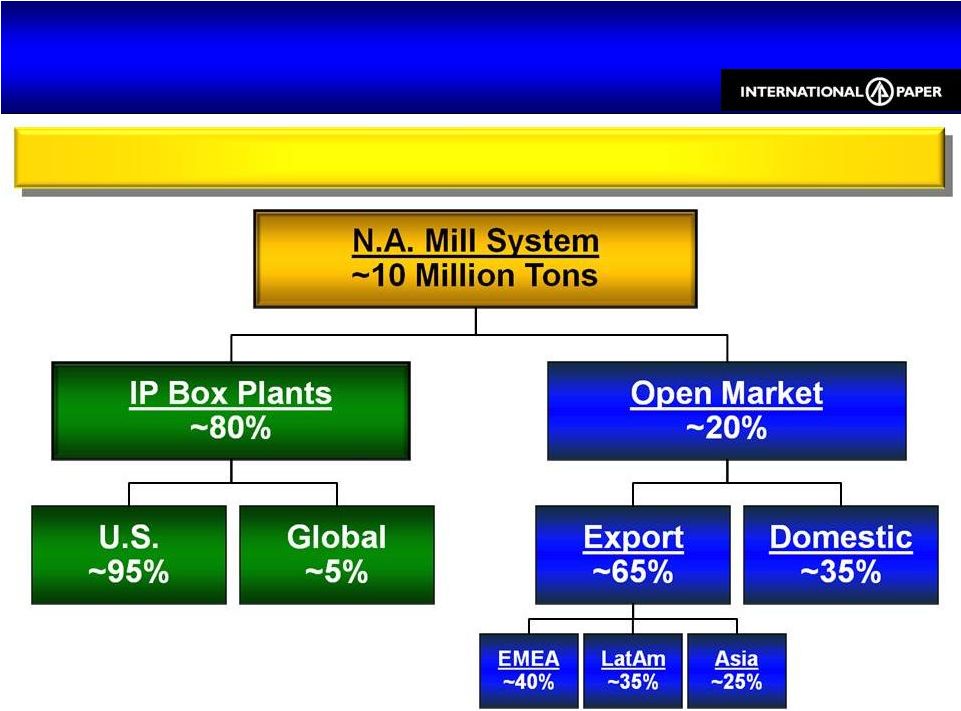

North

American Industrial Packaging Balanced Global Strategy

North American Industrial Packaging

Balanced Global Strategy

IP’s market access provides choices for maximizing value

Source: IP analysis, 1Q11 run rate

10 |

11

North American Industrial Packaging

1Q11

North American Industrial Packaging

1Q11

•

Continued year-over-year box demand growth

•

Industry shipments up 2%

•

IP up 1%

•

Industry-leading margins

•

Cost-of-capital ROI

Box demand on an FBA reporting basis

1Q11 Average Box Price vs.

$/Ton

1Q10

$91

4Q10

$6 |

12

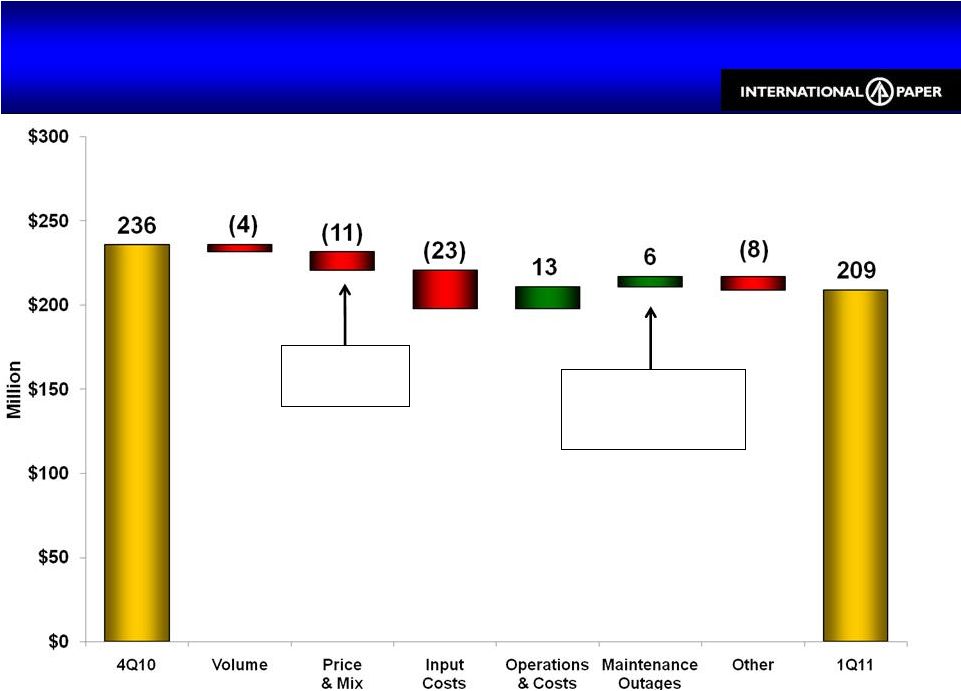

Printing Papers Earnings

1Q11 vs. 4Q10

Printing Papers Earnings

1Q11 vs. 4Q10

Earnings before special items

N.A. Papers 10

N.A. Pulp (20)

Europe 16

Price (5)

Mix (6) |

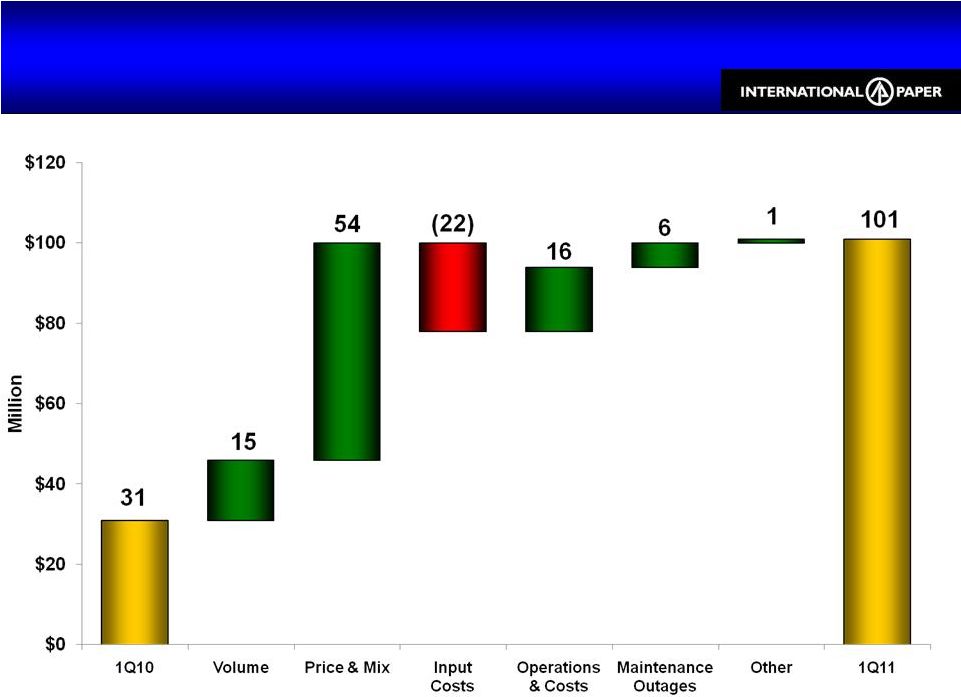

13

Consumer Packaging Earnings

1Q11 vs. 4Q10

Consumer Packaging Earnings

1Q11 vs. 4Q10

Earnings before special items |

14

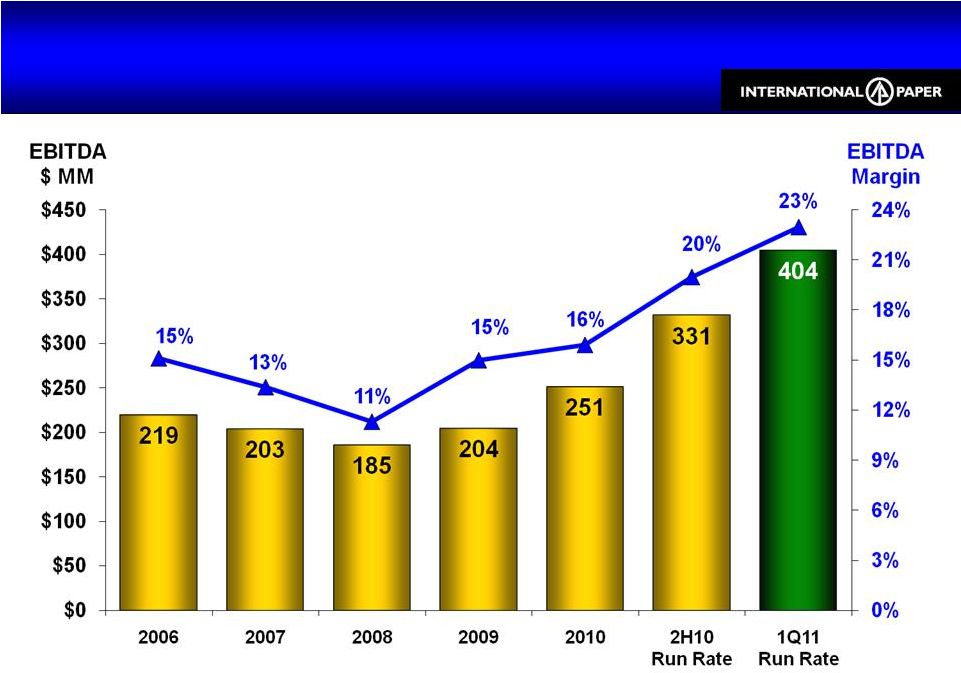

N.A. Coated Paperboard

Consistent Improvement

N.A. Coated Paperboard

Consistent Improvement |

15

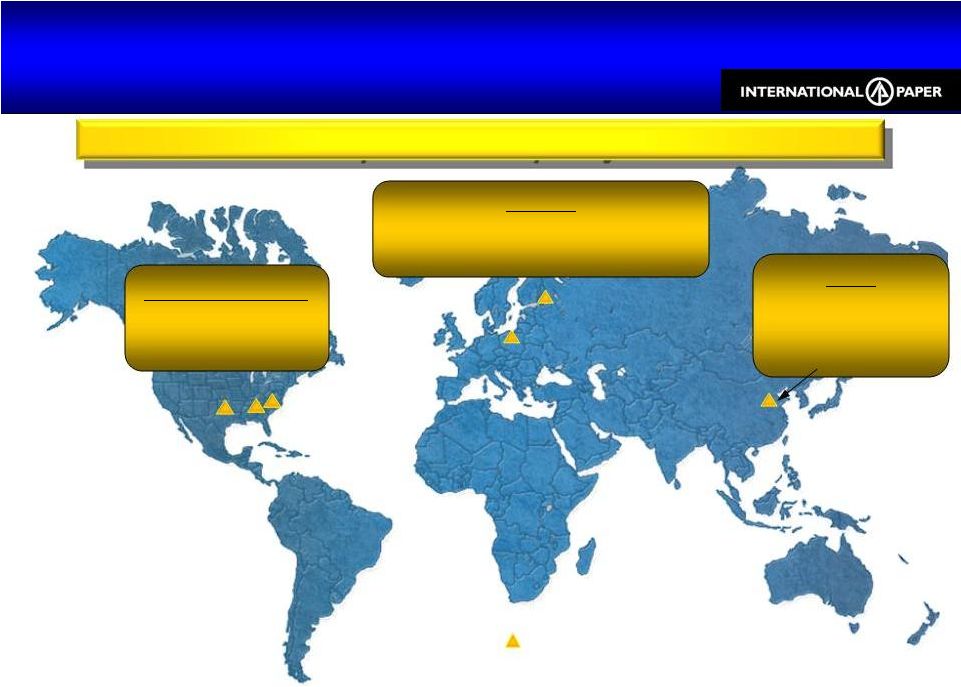

North America

1.7 Million Tons

23% Margin

Coated paperboard mill

EMEA

345,000 Tons

34% Margin

Asia

Sun Paper JV

915,000 Tons

11% Margin

Global Coated Paperboard

3 MM Tons at Cost-of-Capital Returns

Global Coated Paperboard

3 MM Tons at Cost-of-Capital Returns

Global Coated Paperboard Capacity of 3 Million Tons |

16

$ Million

1Q10

4Q10

1Q11

Sales

$1,580

$1,770

$1,640

Earnings

$21

$9

$12

xpedx

1Q11 vs. 4Q10

xpedx

1Q11 vs. 4Q10

Seasonal demand decline

Average daily sales rate up 2% vs. 1Q10

Higher transportation costs

Daily Sales Change

vs. 1Q10

vs. 4Q10

Printing

(5%)

(13%)

Packaging

6%

(7%)

Facility Supplies

(17%)

1

(9%)

Earnings before special items

1

Sales increased 5%, excluding the impact of the loss of one large national accounts

customer in 1H10. |

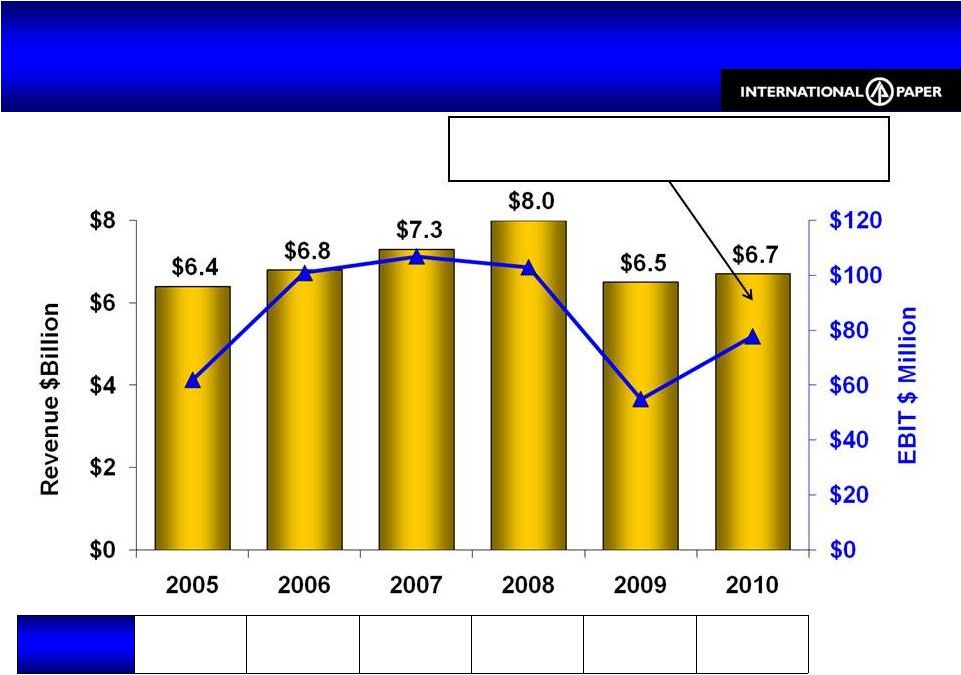

17

xpedx

Current Situation

xpedx

Current Situation

2005 EBIT

excludes

$20 MM of restructuring and other one-time charges

ROI

4%

6%

6%

5%

3%

4%

Recession drove 16% decline in revenue

and 24% decline in earnings |

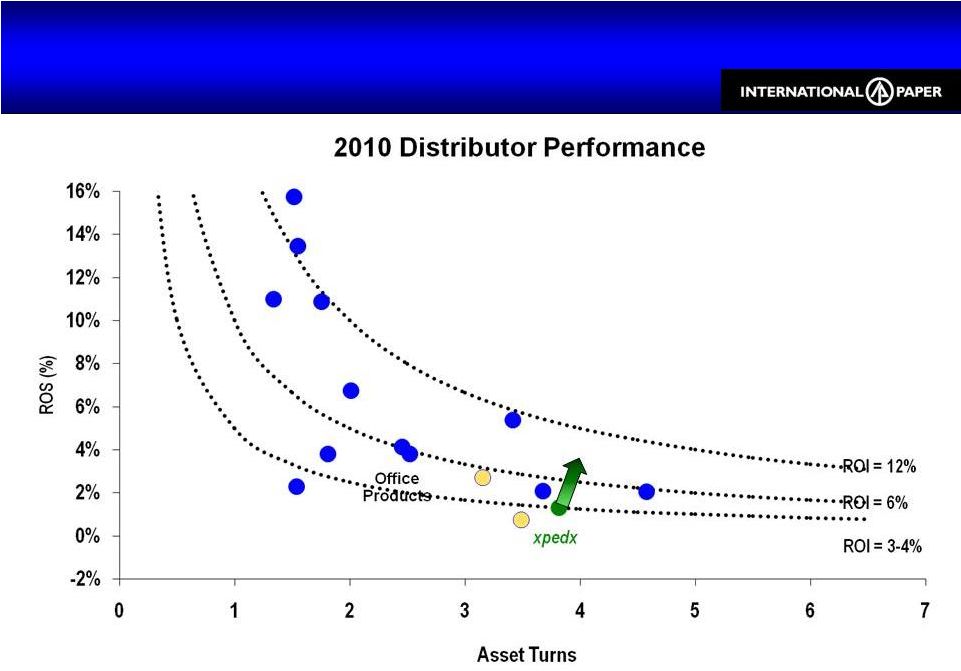

18

xpedx

Distribution Benchmarks

xpedx

Distribution Benchmarks

ROS = EBIT / Revenue

Asset Turns = Revenue / Assets

Industrial

Industrial

Industrial

Industrial

Industrial

Medical

Medical

Foodservice

Technology

Automotive

Technology

Paper

Paper

*Paper distributor data are xpedx estimates

|

19

xpedx

Projecting $140 MM Annual Benefit

xpedx

Projecting $140 MM Annual Benefit

Centralize processes and decision-making

Establish targeted / consistent product offering

Consolidate / rationalize suppliers & SKUs

Buy

Handle

Sell

Optimize warehouse network & inventory placement

around centers of demand

Streamline operations

Larger, lower-cost facilities

Increase productivity of print sales & marketing

Expand sales & marketing capabilities in growth

segments

Cash Costs of ~$100 MM over Three Years

Cash costs net of estimated proceeds of $60 million from asset recoveries

|

20

$ Million

1Q10

4Q10

1Q11

Sales (100%)

$395

$490

$515

Earnings (IP Share)

($3)

$31

1

$44

1

Ilim

recorded an asset impairment charge (IP share was $16 million after tax)

Ilim’s

results are reported on a one-quarter lag.

IP’s shares of Ilim’s

reported earnings for 1Q11 & 4Q10 include an after-tax foreign exchange

gain of $2MM and $10MM, respectively. 1Q10 earnings include an

after-tax foreign exchange loss of $2MM. Ilim

Joint Venture

1Q11 vs. 4Q10

Ilim

Joint Venture

1Q11 vs. 4Q10

1Q11 vs. 4Q10

1Q11 vs. 1Q10

Business

Volume

Price /

Ton

Volume

Price /

Ton

Pulp

4%

($8)

5%

$133

Containerboard

(3%)

$53

(2%)

$198

IP received a $42 MM dividend from Ilim

in 1Q11 |

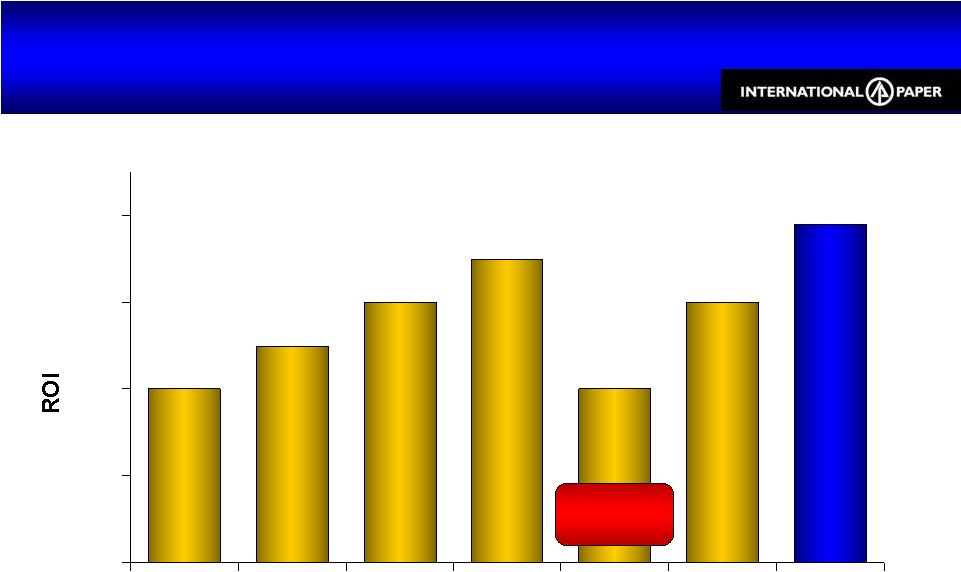

21

Improving Returns on Invested Capital

Transformation Driving ROI

Improving Returns on Invested Capital

Transformation Driving ROI

4%

5%

6%

7%

4%

6%

8%

0%

2%

4%

6%

8%

2000 -

2005 Avg

2006

2007

3Q08

Run Rate

2009

2010

1Q11

Global

Economic

Recession |

22

•

Increasing Demand

•

Stable-to-Improving Prices

•

Strong Operations

•

Strong Ilim

JV Earnings

•

$42 MM Ilim

JV Dividend

•

$140 MM Debt Reduction

•

Input Cost Escalation

1Q11 Summary

Momentum Continues

1Q11 Summary

Momentum Continues

Strong EPS, FCF & ROI |

23

Second Quarter Outlook

Changes from 1Q11

Second Quarter Outlook

Changes from 1Q11

North America

Europe

Brazil

Asia

Volume

Paper

Stable

Stable

Stable

Packaging

Seasonal

Increase

Stable

Stable

Pricing

Paper

Slight Increase

Increase

Slight Increase

Packaging

Stable

Increase

Slight Increase

Maintenance Outages

~$59 MM

Increase

~$9MM

Increase

~$6 MM

Increase

Input & Freight Costs

Higher Energy,

Transportation

& Chemicals

Increase

Stable

Stable

xpedx

Increase

Ilim

Increase |

24

Increasing U.S. Box Demand

Stable-to-Improving Prices

Strong Ilim JV Earnings

Input Cost Escalation

Significantly Higher Maintenance Outages

2Q11 Outlook

Momentum Continues

2Q11 Outlook

Momentum Continues

Strong EPS, FCF & ROI |

25

Appendix

Investor Relations Contacts

Thomas A. Cleves

901-419-7566

Emily Nix

901-419-4987

Media Contact

Tom Ryan

901-419-4333 |

26

$ Million

(Except as noted)

2009

2010

2011

Estimate

Capital Spending

$534

$775

$1.2 -

$1.3 B

Depreciation &

Amortization

$1,472

$1,456

$1.4 B

Net Interest Expense

$669

$608

$575 -

$600

Corporate Items

$181

$226

$175 -

$200

Effective Tax Rate

30%

30%

32 -

34%

Before special items and excluding Ilim

Key Financial Statistics

Key Financial Statistics |

27

Free Cash Flow

Free Cash Flow

$ Million

1Q10

4Q10

1Q11

Cash from Operations

$159

$919

1

$600

2

Cash Received from Cellulosic

Biofuel Tax Credits (CBTC)

$0

$17

$0

Cash Provided by Continuing

Operations

$159

$936

$600

Less Capital Investment

($120)

($318)

($181)

Free Cash Flow

$39

$618

$419

Free Cash Flow

Excluding CBTC

$39

$601

$419

1

Excludes

a

tax

receivable

of

$108

MM

collected

related

to

pension

contributions

2

Excludes a $209 MM increase in working capital related to the cessation of the

European A/R securitization program and a $123 MM tax receivable collected

related to pension contributions |

28

$ Million

1Q11

2Q11E

3Q11E

4Q11E

2011E

Industrial Packaging

$31

$82

$6

$24

$143

Printing Papers Total

$39

$45

$52

$49

$185

North America

$39

$30

$20

$49

$138

Europe

0

9

23

0

32

Brazil

0

6

9

0

15

Consumer Packaging

$0

$17

$0

$27

$44

Total Impact

$70

$144

$58

$100

$372

Dollar impact of planned maintenance outages are estimates and subject to

change Maintenance Outages Expenses

Maintenance Outages Expenses |

29

1Q11 vs. 4Q10

1Q11 vs. 1Q10

Business

Volume

Price /

Ton

Volume

Price /

Ton

N.A. Container

1

(1%)

$6

1%

$91

European Container

2

2%

€15

11%

€84

Industrial Packaging

Industrial Packaging

1

Volumes

reflect

FBA

reporting

basis,

which

excludes

Display

and

Bulk

products

and

shipments

from

facilities

in

Mexico

and

Latin

America; but includes domestic sheet plant shipments

2

European Container volumes reflect box shipments only, including the shipments by

the non-consolidated joint venture in Turkey •

Total box shipments for IP North America were

down seasonally 1% Q-o-Q and stable Y-o-Y

|

30

Average

IP

price

realization

(includes

the

impact

of

mix

across

all

grades)

1Q11 vs. 4Q10

1Q11 vs. 1Q10

Business

Volume

Price / Ton

Volume

Price / Ton

N.A. Paper

3%

($7)

(5%)

$60

N.A. Pulp

(8%)

$8

(8%)

$137

European Paper

2%

€7

1%

€97

Printing Papers

Printing Papers |

31

Average IP price realization (includes the impact of mix across all grades)

1Q11 vs. 4Q10

1Q11 vs. 1Q10

Volume

Price/Ton

Volume

Price/Ton

N.A. Coated Paperboard

9%

$12

8%

$92

Revenue

Price

Revenue

Price

Converting Businesses

(6%)

NA

7%

NA

Consumer Packaging

Consumer Packaging |

32

Special Items Pre-Tax

from Continuing Operations

Special Items Pre-Tax

from Continuing Operations

Special Items Pre-Tax ($Million)

1Q10

4Q10

1Q11

Industrial

Packaging

Facility & Machine Closure Costs

($5)

($10)

($2)

Other

($3)

$7

Printing

Papers

Facility Closure Costs

($204)

Other

($2)

($8)

Consumer

Packaging

Reorganization

($3)

($4)

($1)

xpedx

Reorganization

($7)

Corporate

Net Gain on Sale of Business

$25

Restructuring & Other Charges

($3)

($36)

($35)

Total Special Items Pre-Tax

($215)

($30)

($46) |

33

Special Items Net of Taxes

from Continuing Operations

Special Items Net of Taxes

from Continuing Operations

1Q11

$ Million

EPS

Earnings Before Special Items

$322

$0.74

Special Items Net of Taxes:

Mill & Machine Shutdowns

($2)

Debt Extinguishment Costs

($19)

Reorganization

($5)

Overhead Reduction Initiative

($2)

Other

($1)

Total Special Items Net of Taxes

($29)

($0.07)

Discontinued Operations Net of Taxes

$49

$0.11

Net Earnings

$342

$0.78 |

34

1Q11 EBITDA

1Q11 EBITDA

Operating

Profit

$ Million

D & A

$ Million

Tons

Thousand

EBITDA

per Ton

EBITDA

Margin

Industrial Packaging

North America

1

$255

$116

2,404

$154

18.9%

Europe

$17

$7

273

$88

8.6%

Printing Papers

North America

2

$88

$50

685

$201

20.0%

Eastern Europe & Russia

3

$57

$19

312

$244

22.8%

Brazil

$48

$37

273

$311

29.8%

U.S. Market Pulp

$16

$13

229

$127

16.6%

Consumer Packaging

N.A. Coated Paperboard

$64

$37

364

$277

23.2%

1

Excludes Recycling & Bag businesses; includes Saturating Kraft business

2

Includes Bleached Kraft business

3

Excludes Market Pulp |

35

Operating Profits by Industry Segment

Operating Profits by Industry Segment

$ Million

1Q10

4Q10

1Q11

Industrial Packaging

$46

$274

$274

Printing Papers

$126

$236

$209

Consumer Packaging

$31

$64

$101

Distribution

$21

$9

$12

Forest Products

$8

($3)

$0

Operating Profit

$232

$580

$596

Net Interest Expense

($149)

($150)

($136)

Noncontrolling Interest / Equity Earnings Adjustment

$8

($5)

$5

Corporate Items

($51)

($63)

($44)

Special Items

($215)

($30)

($53)

Earnings from continuing operations before income

taxes, equity earnings & noncontrolling interest

($175)

$332

$368

Equity Earnings, net of taxes -

Ilim

($3)

$31

$44 |

36

Geographic Business Segment Operating Results

Before Special Items

Geographic Business Segment Operating Results

Before Special Items

$ Million

Sales

Operating Profit

1Q10

4Q10

1Q11

1Q10

4Q10

1Q11

Industrial Packaging

North American

$1,890

$2,135

$2,115

$23

$261

$256

European

$245

$275

$280

$24

$16

$17

Asian

$85

$160

$160

($1)

($3)

$1

Printing Papers

North American

$685

$675

$690

$70

$92

$88

European

$315

$345

$360

$48

$38

$57

Brazilian

$225

$315

$285

$11

$63

$48

U.S. Market Pulp

$155

$190

$175

($3)

$43

$16

Consumer Packaging

North American

$550

$605

$620

($1)

$38

$65

European

$85

$95

$95

$20

$20

$27

Asian

$170

$180

$190

$12

$6

$9

xpedx

$1,580

$1,770

$1,640

$21

$9

$12

Does not reflect total company sales and operating profit

|

37

1

Assuming dilution

2

A reconciliation to GAAP EPS is available at www.internationalpaper.com under the

Investors tab at Webcasts and Presentations Pre-Tax

$MM

Tax

$MM

Non-

controlling

Interest

$MM

Equity

Earnings

Net

Income

$MM

Estimated

Tax Rate

Average

Shares

1

MM

Diluted

EPS

2

Before Special Items

1Q11

$421

($140)

($5)

$46

$322

33%

434

$0.74

Special Items

1Q11

($53)

$17

$0

$7

($29)

32%

434

($0.07)

Earnings

1Q11

$368

($123)

($5)

$53

$293

33%

434

$0.67

2011 Earnings from Continuing Operations

2011 Earnings from Continuing Operations |

38

1Q11 Operating Business EPS

1Q11 Operating Business EPS

2003

2004

2005

2006

2007

2010

2002

2000

2001

2008

Impact of Mineral

Rights Gain

2009

Earnings from continuing operations before special items as reported at the

time .84

Transformation

2011 |

39

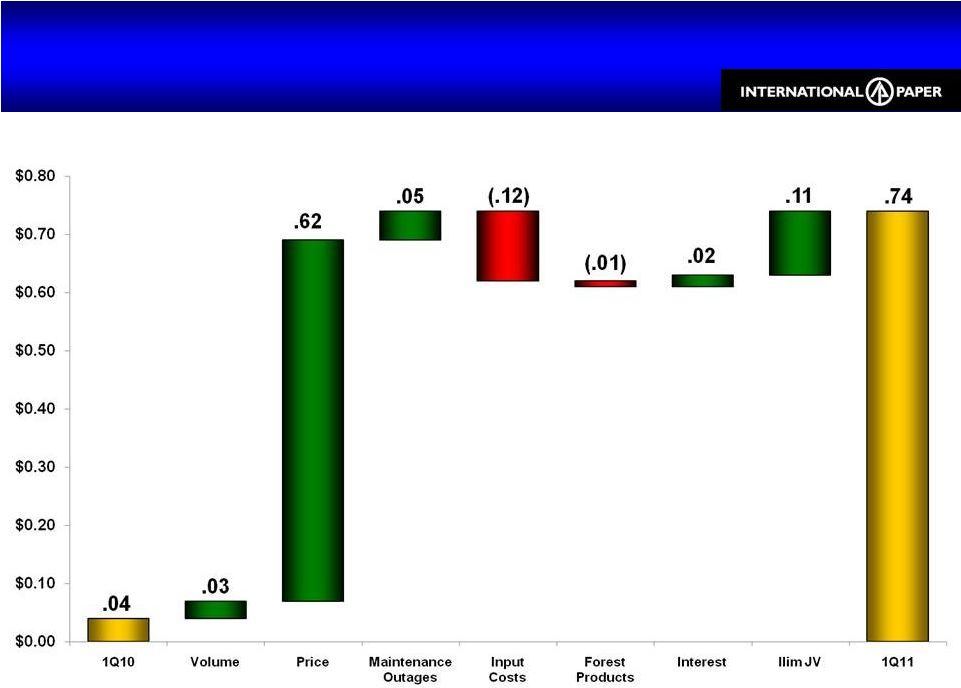

Earnings before special items

1Q11 vs. 1Q10 EPS

1Q11 vs. 1Q10 EPS |

40

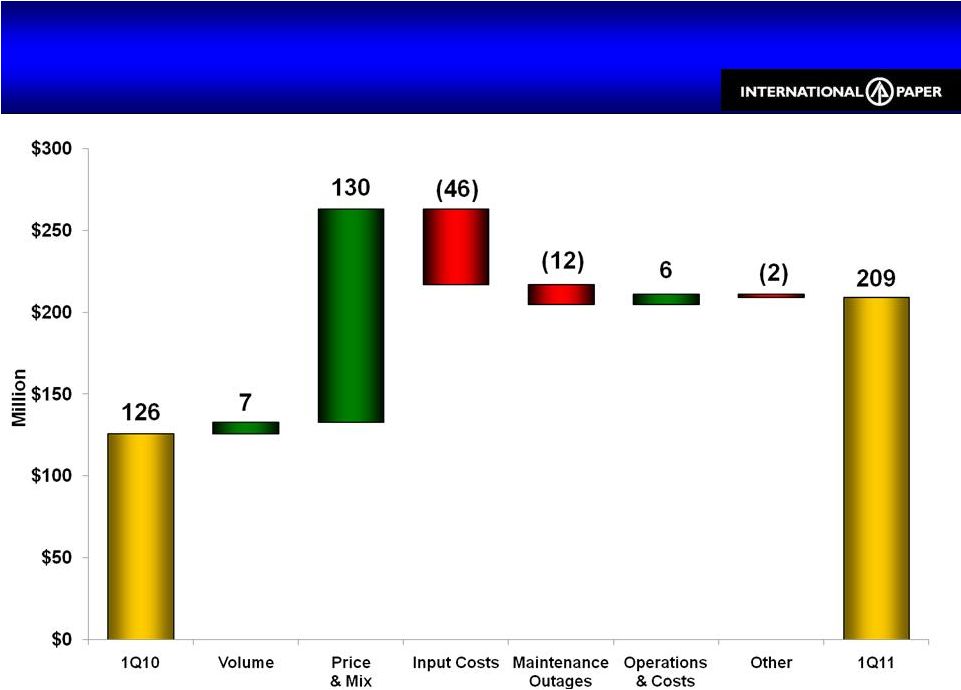

Industrial Packaging Earnings

1Q11 vs. 1Q10

Industrial Packaging Earnings

1Q11 vs. 1Q10

Earnings before special items

46

274

(2)

(13)

(3)

206

40

$0

$50

$100

$150

$200

$250

$300

1Q10

Volume

Price

& Mix

Input Costs

Operations

& Costs

Maintenance

Outages

1Q11 |

41

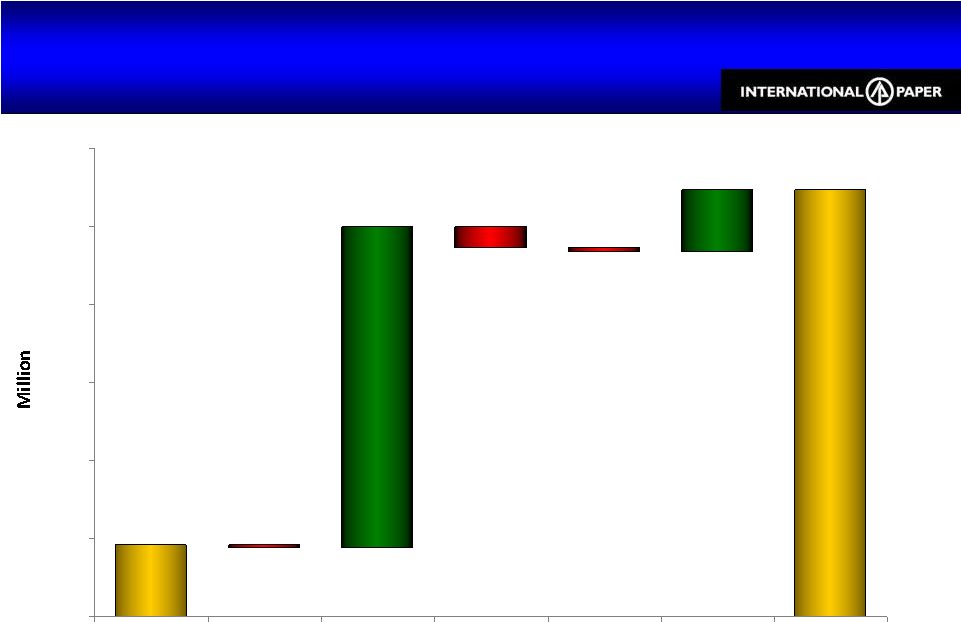

Printing Papers Earnings

1Q11 vs. 1Q10

Printing Papers Earnings

1Q11 vs. 1Q10

Earnings before special items |

42

$ Million

1Q10

4Q10

1Q11

Sales

$225

$315

$285

Earnings

$11

$63

$48

EBITDA Margin

20%

32%

30%

IP Brazil results are reported in the Printing Papers segment

IP Brazil

IP Brazil

1Q11 vs. 4Q10

1Q11 vs. 1Q10

Business

Volume

Price /

Ton

Volume

Price /

Ton

Uncoated Freesheet

(5%)

($8)

13%

$92

Domestic

(19%)

($27)

16%

$8

Export

6%

$4

11%

$148 |

43

Consumer Packaging Earnings

1Q11 vs. 1Q10

Consumer Packaging Earnings

1Q11 vs. 1Q10

Earnings before special items |

44

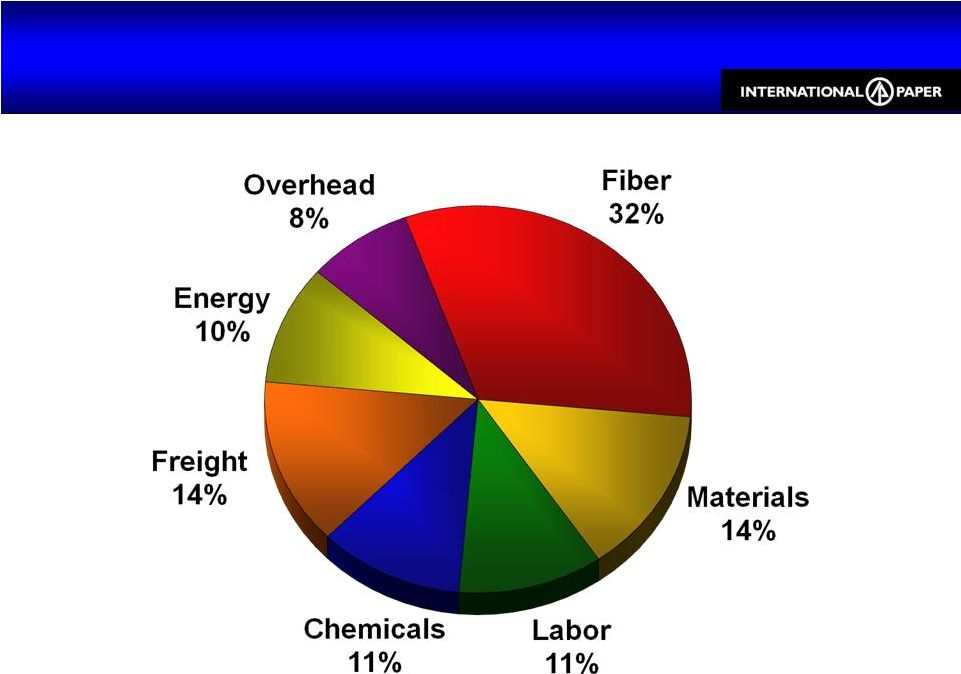

1Q11 Total North American Mills

Cash Cost Components

1Q11 Total North American Mills

Cash Cost Components |

45

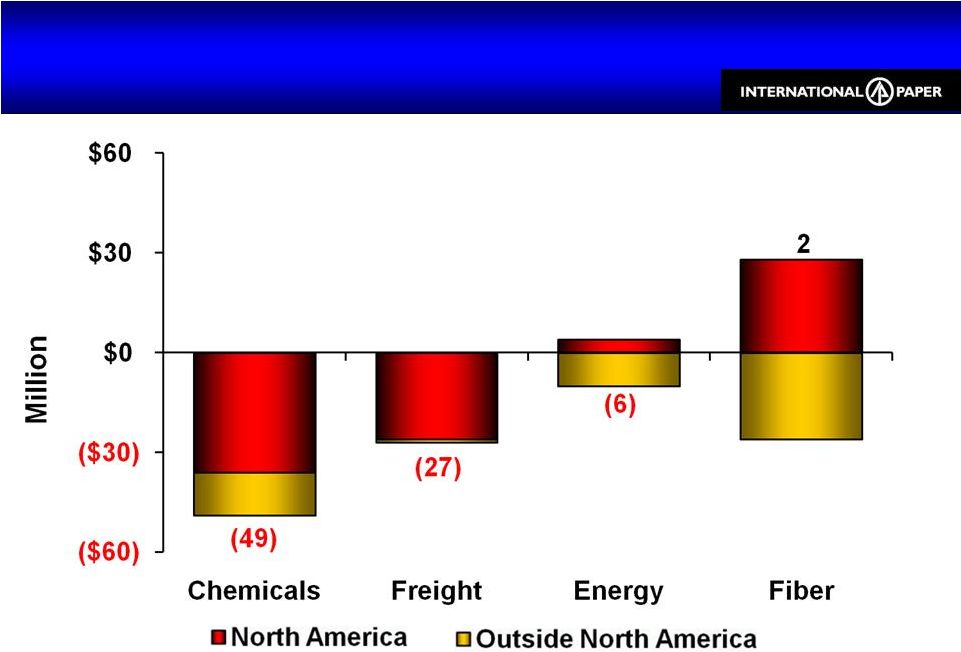

Global Input & Freight Costs vs. 1Q10

$80 MM Unfavorable, or $0.13/Share

Global Input & Freight Costs vs. 1Q10

$80 MM Unfavorable, or $0.13/Share

Input costs for continuing businesses |

46

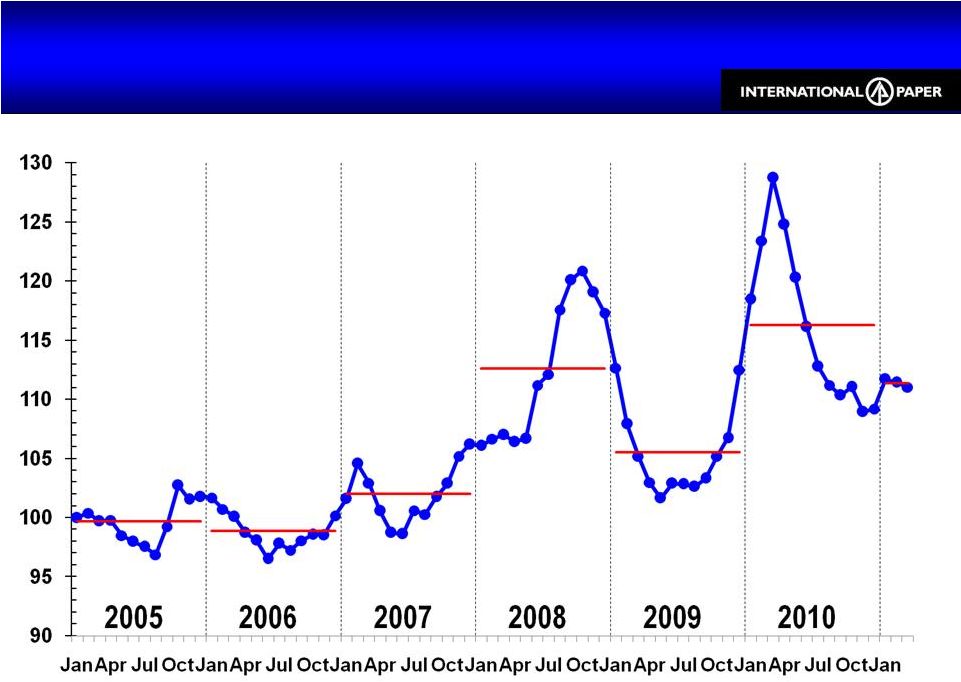

U.S. Mill Wood Delivered Cost Trends

2% Increase vs. 4Q10 Average Cost

U.S. Mill Wood Delivered Cost Trends

2% Increase vs. 4Q10 Average Cost

2011 |

47

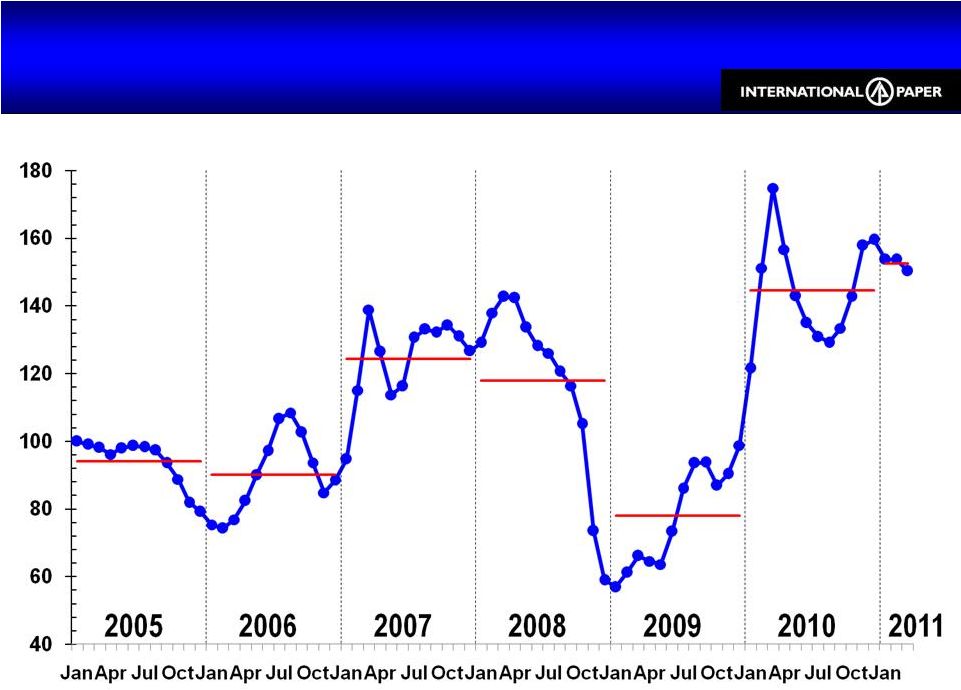

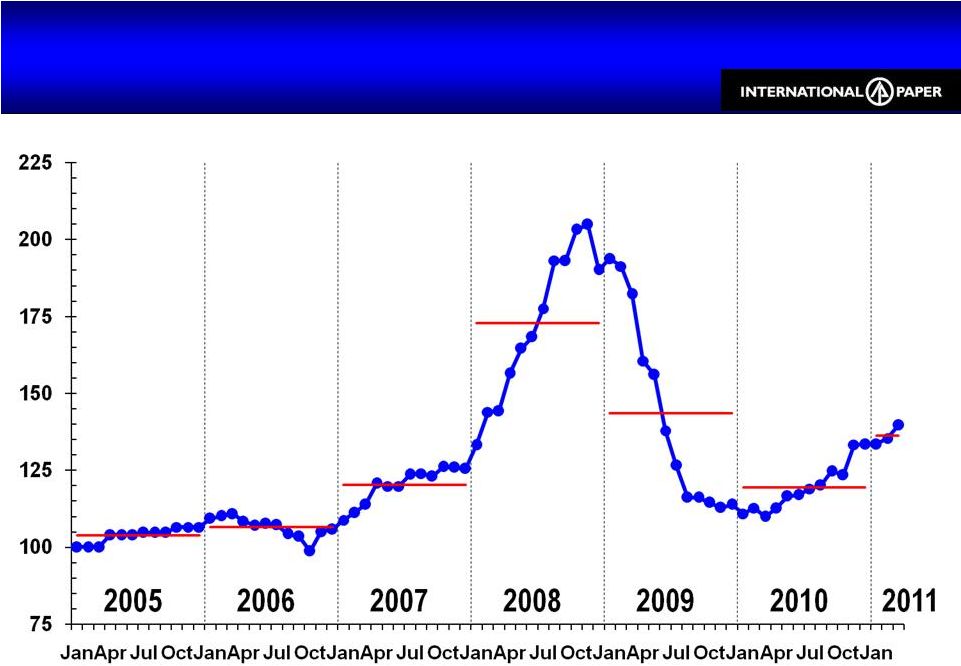

U.S. OCC Delivered Cost Trends

Flat vs. 4Q10 Average Cost

U.S. OCC Delivered Cost Trends

Flat vs. 4Q10 Average Cost

2005-2007 represents WY PKG delivered costs; 2008-2010 represents delivered

costs to the integrated system |

48

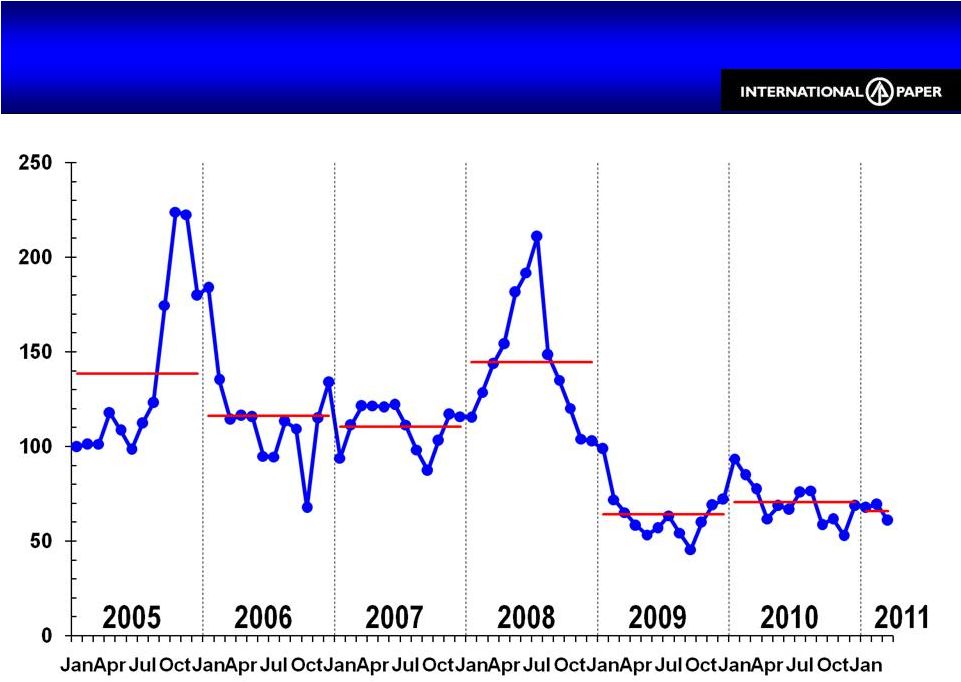

NYMEX Natural Gas closing prices

Natural Gas Costs

8% Increase vs. 4Q10 Average Cost

Natural Gas Costs

8% Increase vs. 4Q10 Average Cost |

49

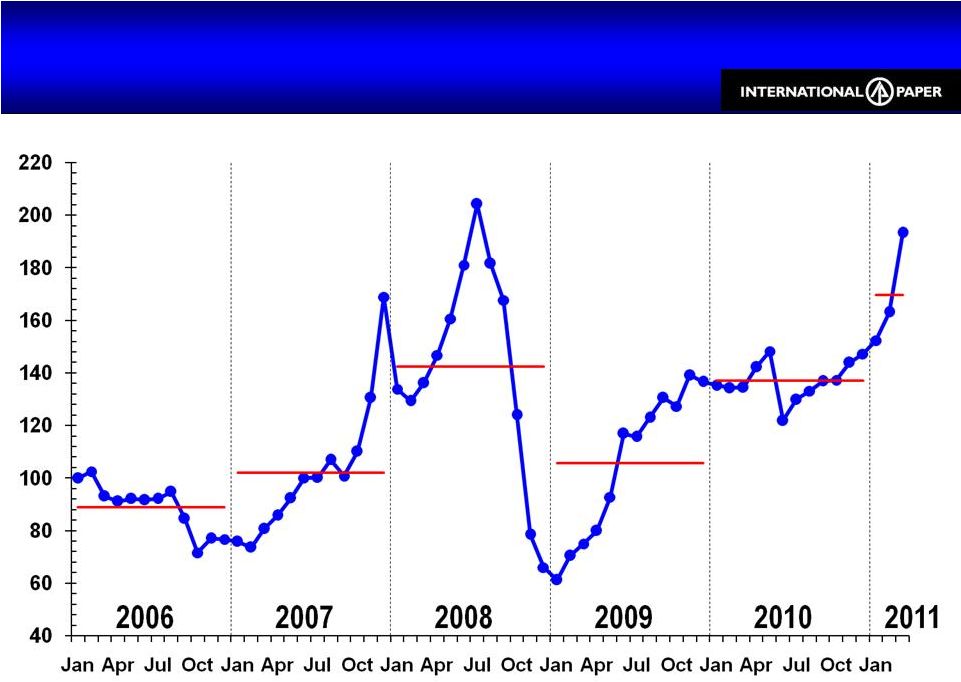

U.S. Fuel Oil

19% Increase vs. 4Q10 Average Cost

U.S. Fuel Oil

19% Increase vs. 4Q10 Average Cost

WTI Crude prices |

50

U.S. Chemical Composite Index

5% Increase vs. 4Q10 Average Cost

U.S. Chemical Composite Index

5% Increase vs. 4Q10 Average Cost

Delivered

cost

to

U.S.

facilities;

includes

Caustic

Soda,

Sodium

Chlorate,

Starch

and

Sulfuric

Acid

2005 -

2008 excludes WY PKG |

51

2011 Global Consumption

Annual Purchase Estimates for Key Inputs

2011 Global Consumption

Annual Purchase Estimates for Key Inputs

Does not include Asian or Ilim consumption

Estimates are based on normal operations and may be impacted by downtime

Commodity

U. S.

Non –

U. S.

Energy

Natural Gas (MM BTUs)

48,000,000

13,000,000

Fuel Oil (Barrels)

1,200,000

380,000

Coal (Tons)

840,000

410,000

Fiber

Wood (Tons)

44,200,000

9,300,000

Old Corrugated Containers (Tons)

3,400,000

142,000

Chemicals

Caustic Soda (Tons)

340,000

70,000

Starch (Tons)

385,000

100,000

Sodium Chlorate (Tons)

205,000

45,000

LD Polyethylene (Tons)

41,000

-

Latex (Tons)

21,000

7,000 |